Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - CIFC LLC | cifc63016ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - CIFC LLC | cifc63016ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - CIFC LLC | cifc63016ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2016

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-37674

CIFC LLC

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 36-4814372 (I.R.S. Employer Identification No.) | |

250 Park Avenue, 4th Floor, New York, New York (Address of principal executive offices) | 10177 (Zip code) | |

Registrant’s telephone number, including area code: 212-624-1200

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | |

Non-accelerated filer o | Smaller reporting company x | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

There were 23,624,014 shares of the registrant's common shares outstanding as of August 9, 2016. Total outstanding common shares excludes 2,026,315 common shares which are no longer outstanding due to an appraisal petition that was filed with the Delaware Court of Chancery on April 28, 2016.

1

CIFC LLC

Index to Form 10-Q

Page | |

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this quarterly report on Form 10-Q (this "Quarterly Report"), and the information incorporated by reference into this Quarterly Report are forward-looking statements, as permitted by the Private Securities Litigation Reform Act of 1995. These include, but are not limited to, statements regarding future results or expectations. Forward-looking statements can be identified by forward-looking language, including words such as "believes," "anticipates," "expects," "estimates," "intends," "may," "plans," "projects," "will" and similar expressions, or the negative of these words. Such forward-looking statements are based on facts and conditions as they exist at the time such statements are made, various operating assumptions and predictions as to future facts and conditions, which may be difficult to accurately make and involve the assessment of events beyond our control. Caution must be exercised in relying on forward-looking statements. Our actual results may differ materially from the forward-looking statements contained in this Quarterly Report. We believe these factors include but are not limited to those described under the section entitled Item 1A —“Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015 (the "2015 Annual Report") as such factors may be updated from time to time in our periodic filings with the United States Securities and Exchange Commission ("SEC"), which are accessible on the SEC’s website at www.sec.gov.

The forward-looking statements contained in this Quarterly Report are made as of the date hereof, and we do not undertake any obligation to update any forward-looking statement to reflect subsequent events, new information or circumstances arising after the date of this Quarterly Report. All future written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referenced above. In addition, it is our policy generally not to make any specific projections as to future earnings, and we do not endorse any projections regarding future performance that may be made by third parties.

3

PART I. Financial Information

Item 1. Condensed Consolidated Financial Statements and Notes (Unaudited)

CIFC LLC AND ITS SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited)

June 30, 2016 | December 31, 2015 | ||||||

(In thousands, except share and per share amounts) | |||||||

ASSETS | |||||||

Cash and cash equivalents | $ | 39,720 | $ | 57,968 | |||

Restricted cash and cash equivalents | 1,694 | 1,694 | |||||

Investments | 94,483 | 70,696 | |||||

Receivables | 9,191 | 7,075 | |||||

Prepaid and other assets | 1,885 | 1,973 | |||||

Deferred tax asset, net | 41,585 | 44,425 | |||||

Equipment and improvements, net | 4,323 | 4,866 | |||||

Intangible assets, net | 4,682 | 6,857 | |||||

Goodwill | 76,000 | 76,000 | |||||

Subtotal | 273,563 | 271,554 | |||||

Assets of Consolidated Entities: | |||||||

Restricted cash and cash equivalents | 116,771 | 94,018 | |||||

Due from brokers | 37,599 | 25,910 | |||||

Investments | 1,850,562 | 1,351,403 | |||||

Receivables | 5,306 | 4,109 | |||||

Prepaid and other assets | 167 | 209 | |||||

Total assets of Consolidated Entities (1) | 2,010,405 | 1,475,649 | |||||

TOTAL ASSETS | $ | 2,283,968 | $ | 1,747,203 | |||

LIABILITIES | |||||||

Due to brokers | $ | 2,253 | $ | 61 | |||

Accrued and other liabilities | 27,912 | 18,397 | |||||

Contingent liabilities | 7,680 | 8,338 | |||||

Long-term debt | 156,313 | 156,161 | |||||

Subtotal | 194,158 | 182,957 | |||||

Non-Recourse Liabilities of Consolidated Entities: | |||||||

Due to brokers | 91,347 | 71,603 | |||||

Accrued and other liabilities | 139 | 193 | |||||

Interest payable | 4,689 | 5,090 | |||||

Long-term debt | 1,814,256 | 1,308,558 | |||||

Total Non-Recourse Liabilities of Consolidated Entities (1) | 1,910,431 | 1,385,444 | |||||

TOTAL LIABILITIES | 2,104,589 | 1,568,401 | |||||

EQUITY (Note 10) | |||||||

Common shares, par value $0.001: 500,000,000 shares authorized, 23,499,979 and 25,314,756 issued and outstanding as of June 30, 2016 and December 31, 2015, respectively. | 23 | 25 | |||||

Additional paid-in capital | 984,515 | 992,419 | |||||

Retained earnings (deficit) | (813,249 | ) | (821,491 | ) | |||

TOTAL CIFC LLC SHAREHOLDERS’ EQUITY | 171,289 | 170,953 | |||||

Noncontrolling interests in Consolidated Funds (Note 2) | 8,090 | 7,849 | |||||

TOTAL EQUITY | 179,379 | 178,802 | |||||

TOTAL LIABILITIES AND EQUITY | $ | 2,283,968 | $ | 1,747,203 | |||

4

CIFC LLC AND ITS SUBSIDIARIES

Condensed Consolidated Balance Sheets (continued)

(Unaudited)

Included in the Company's Condensed Consolidated Balance Sheets are balances from Consolidated Variable Interest Entities ("Consolidated VIEs") (1). See Notes 2 and 4.

June 30, 2016 | December 31, 2015 | ||||||

(In thousands) | |||||||

ASSETS | |||||||

Assets of Consolidated VIEs: | |||||||

Restricted cash and cash equivalents | $ | 116,771 | $ | 94,018 | |||

Due from brokers | 37,599 | 25,910 | |||||

Investments | 1,850,562 | 1,351,403 | |||||

Receivables | 5,306 | 4,109 | |||||

Prepaid and other assets | 167 | 209 | |||||

Total assets of Consolidated VIEs | $ | 2,010,405 | $ | 1,475,649 | |||

LIABILITIES | |||||||

Non-Recourse Liabilities of Consolidated VIEs: | |||||||

Due to brokers | $ | 91,347 | $ | 71,603 | |||

Accrued and other liabilities | 139 | 193 | |||||

Interest payable | 4,689 | 5,090 | |||||

Long-term debt | 1,814,256 | 1,308,558 | |||||

Total Non-Recourse Liabilities of Consolidated VIEs | $ | 1,910,431 | $ | 1,385,444 | |||

Explanatory Note:

________________________________

(1) | The assets of the Consolidated Entities would not be available to the Company's general creditors, and as a result, the Company does not consider them its assets. Additionally, the investors in the debt and residual interests of the Consolidated Entities have no recourse to the Company's general assets. Therefore, this debt is not the Company's obligation. |

See notes to Condensed Consolidated Financial Statements.

5

CIFC LLC AND ITS SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited)

For the Three Months Ended June 30, | For the Six Months Ended June 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(In thousands, except share and per share amounts) | |||||||||||||||

Revenues | |||||||||||||||

Management and incentive fees | $ | 21,277 | $ | 20,598 | $ | 41,092 | $ | 42,212 | |||||||

Interest income from investments | 1,162 | 2,227 | 2,095 | 4,834 | |||||||||||

Interest income - Consolidated Entities | 24,809 | 3,035 | 43,799 | 5,791 | |||||||||||

Total net revenues | 47,248 | 25,860 | 86,986 | 52,837 | |||||||||||

Expenses | |||||||||||||||

Employee compensation and benefits | 9,463 | 7,470 | 18,977 | 16,034 | |||||||||||

Share-based compensation | 1,744 | 988 | 4,125 | 2,668 | |||||||||||

Professional services | 1,685 | 1,795 | 3,757 | 3,722 | |||||||||||

General and administrative expenses | 2,543 | 2,517 | 5,060 | 4,813 | |||||||||||

Depreciation and amortization | 1,082 | 2,080 | 2,378 | 4,490 | |||||||||||

Impairment of intangible assets | — | 462 | 531 | 742 | |||||||||||

Corporate interest expense | 1,999 | 800 | 3,956 | 1,294 | |||||||||||

Expenses - Consolidated Entities | 609 | 435 | 997 | 1,703 | |||||||||||

Interest expense - Consolidated Entities | 11,601 | 923 | 20,022 | 1,667 | |||||||||||

Total expenses | 30,726 | 17,470 | 59,803 | 37,133 | |||||||||||

Other Gain (Loss) | |||||||||||||||

Net gain (loss) on investments | 3,863 | 1,466 | 4,134 | 2,659 | |||||||||||

Net gain (loss) on contingent liabilities | 150 | (577 | ) | (214 | ) | (1,290 | ) | ||||||||

Net gain (loss) on investments - Consolidated Entities | 24,103 | 1,317 | 26,703 | 4,113 | |||||||||||

Net gain (loss) on liabilities - Consolidated Entities | (23,863 | ) | (406 | ) | (31,247 | ) | (2,665 | ) | |||||||

Net gain (loss) on other investments and derivatives - Consolidated Entities | — | 1,304 | — | 1,742 | |||||||||||

Net other gain (loss) | 4,253 | 3,104 | (624 | ) | 4,559 | ||||||||||

Income (loss) before income taxes | 20,775 | 11,494 | 26,559 | 20,263 | |||||||||||

Income tax (expense) benefit | (2,868 | ) | (9,828 | ) | (4,146 | ) | (12,915 | ) | |||||||

Net income (loss) | 17,907 | 1,666 | 22,413 | 7,348 | |||||||||||

Net (income) loss attributable to noncontrolling interests in Consolidated Entities | (322 | ) | (563 | ) | (324 | ) | (817 | ) | |||||||

Net income (loss) attributable to CIFC LLC | $ | 17,585 | $ | 1,103 | $ | 22,089 | $ | 6,531 | |||||||

Earnings (loss) per share (Note 11) — | |||||||||||||||

Basic | $ | 0.73 | $ | 0.04 | $ | 0.89 | $ | 0.26 | |||||||

Diluted | $ | 0.68 | $ | 0.04 | $ | 0.85 | $ | 0.25 | |||||||

Weighted-average number of shares outstanding (Note 11)— | |||||||||||||||

Basic | 24,095,932 | 25,302,358 | 24,725,498 | 25,290,856 | |||||||||||

Diluted | 25,760,974 | 26,431,680 | 25,963,108 | 26,504,030 | |||||||||||

Distributions declared per share | $ | 0.25 | $ | 0.10 | $ | 0.59 | $ | 0.20 | |||||||

See notes to Condensed Consolidated Financial Statements.

6

CIFC LLC AND ITS SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive Income (Loss)

(Unaudited)

For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||

2016 | 2015 | 2016 | 2015 | |||||||||||||

(In thousands) | ||||||||||||||||

Net income (loss) | $ | 17,907 | $ | 1,666 | $ | 22,413 | $ | 7,348 | ||||||||

Other comprehensive income (loss) | — | — | — | — | ||||||||||||

Comprehensive income (loss) | 17,907 | 1,666 | 22,413 | 7,348 | ||||||||||||

Comprehensive (income) loss attributable to noncontrolling interests in Consolidated Entities | (322 | ) | (563 | ) | (324 | ) | (817 | ) | ||||||||

Comprehensive income (loss) attributable to CIFC LLC | $ | 17,585 | $ | 1,103 | $ | 22,089 | $ | 6,531 | ||||||||

See notes to Condensed Consolidated Financial Statements.

7

CIFC LLC AND ITS SUBSIDIARIES

Condensed Consolidated Statements of Equity

(Unaudited)

CIFC LLC Shareholders' Equity | Consolidated Entities (Note 2) | ||||||||||||||||||||||||||||||||||||

Common Shares | Treasury Shares | ||||||||||||||||||||||||||||||||||||

Shares Outstanding | Par Value | Shares | Amount | Additional paid-in capital | Retained earnings (deficit) | Total CIFC LLC Shareholders' Equity | Noncontrolling Interests in Consolidated Funds | Appropriated retained earnings (deficit) of Consolidated VIEs | Total Shareholders' Equity | ||||||||||||||||||||||||||||

(In thousands) | |||||||||||||||||||||||||||||||||||||

Balance—December 31, 2014 | 25,193 | $ | 25 | (130 | ) | $ | (914 | ) | $ | 988,904 | $ | (811,695 | ) | $ | 176,320 | $ | 210,818 | $ | 134,764 | $ | 521,902 | ||||||||||||||||

Deconsolidation of CLOs and funds on adoption of ASU 2015-02 | — | — | — | — | — | — | (204,393 | ) | (127,877 | ) | (332,270 | ) | |||||||||||||||||||||||||

Valuation of financial assets and liabilities of Consolidated CLOs on adoption of ASU 2014-13 | — | — | — | — | — | — | — | — | (6,887 | ) | (6,887 | ) | |||||||||||||||||||||||||

Net income (loss) | — | — | — | — | — | 6,531 | 6,531 | 817 | — | 7,348 | |||||||||||||||||||||||||||

Share-based compensation, net | 157 | — | — | — | 2,404 | — | 2,404 | — | — | 2,404 | |||||||||||||||||||||||||||

Exercise of options | 25 | — | — | — | 128 | — | 128 | — | — | 128 | |||||||||||||||||||||||||||

Repurchases of common shares | (3 | ) | — | (3 | ) | (21 | ) | — | — | (21 | ) | — | — | (21 | ) | ||||||||||||||||||||||

Contribution from noncontrolling interests | — | — | — | — | — | — | — | 16,100 | — | 16,100 | |||||||||||||||||||||||||||

Distributions to noncontrolling interests | — | — | — | — | — | — | — | (970 | ) | — | (970 | ) | |||||||||||||||||||||||||

Distributions declared | — | — | — | — | — | (5,060 | ) | (5,060 | ) | — | — | (5,060 | ) | ||||||||||||||||||||||||

Balance—June 30, 2015 | 25,372 | $ | 25 | (133 | ) | $ | (935 | ) | $ | 991,436 | $ | (810,224 | ) | $ | 180,302 | $ | 22,372 | $ | — | $ | 202,674 | ||||||||||||||||

Balance—December 31, 2015 | 25,315 | $ | 25 | — | $ | — | $ | 992,419 | $ | (821,491 | ) | $ | 170,953 | $ | 7,849 | $ | — | $ | 178,802 | ||||||||||||||||||

Net income (loss) | — | — | — | — | — | 22,089 | 22,089 | 324 | — | 22,413 | |||||||||||||||||||||||||||

Repurchases of common shares | — | — | (75 | ) | (435 | ) | — | — | (435 | ) | — | — | (435 | ) | |||||||||||||||||||||||

Retirement of treasury stock | (75 | ) | — | 75 | 435 | (435 | ) | — | — | — | — | — | |||||||||||||||||||||||||

Share-based compensation, net | 236 | — | — | — | 3,624 | — | 3,624 | — | — | 3,624 | |||||||||||||||||||||||||||

Exercise of options | 50 | — | — | — | 212 | — | 212 | — | — | 212 | |||||||||||||||||||||||||||

Dissenting Shareholders (Note 10) | (2,026 | ) | (2 | ) | — | — | (11,305 | ) | — | (11,307 | ) | — | — | (11,307 | ) | ||||||||||||||||||||||

Contribution from noncontrolling interests | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Distributions to noncontrolling interests | — | — | — | — | — | — | — | (83 | ) | — | (83 | ) | |||||||||||||||||||||||||

Distributions declared | — | — | — | — | — | (13,847 | ) | (13,847 | ) | — | — | (13,847 | ) | ||||||||||||||||||||||||

Balance—June 30, 2016 | 23,500 | $ | 23 | — | $ | — | $ | 984,515 | $ | (813,249 | ) | $ | 171,289 | $ | 8,090 | $ | — | $ | 179,379 | ||||||||||||||||||

See notes to Condensed Consolidated Financial Statements.

8

CIFC LLC AND ITS SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited)

For the Six Months Ended June 30, | |||||||

2016 | 2015 | ||||||

(In thousands) | |||||||

CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||

Net income (loss) | $ | 22,413 | $ | 7,348 | |||

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||

Amortization of debt issuance costs and other | 152 | 45 | |||||

Share-based compensation | 4,125 | 2,668 | |||||

Net (gain) loss on investments and contingent liabilities / other (gain) loss | (3,920 | ) | (1,369 | ) | |||

Depreciation and amortization | 2,378 | 4,490 | |||||

Impairment of intangible assets | 531 | 742 | |||||

Deferred income tax expense (benefit) | 2,840 | 7,425 | |||||

Excess tax benefits from share-based payment arrangements | 263 | (7 | ) | ||||

Consolidated Entities: | |||||||

Net (gain) loss on investments | (26,703 | ) | (4,113 | ) | |||

Net (gain) loss on liabilities | 31,247 | 2,665 | |||||

Net other (gain) loss | — | (1,742 | ) | ||||

Changes in operating assets and liabilities: | |||||||

Due from brokers | — | (62 | ) | ||||

Receivables | (2,260 | ) | (3,616 | ) | |||

Prepaid and other assets | 88 | (6 | ) | ||||

Due to brokers | 2,192 | 13,308 | |||||

Accrued and other liabilities | (1,611 | ) | (5,041 | ) | |||

Consolidated Entities: | |||||||

Due from brokers | (667 | ) | (1,182 | ) | |||

Purchase of investments | (406,538 | ) | (244,892 | ) | |||

Sales of investments | 375,057 | 142,864 | |||||

Receivables | (42 | ) | (595 | ) | |||

Due to brokers | 11,280 | 37,569 | |||||

Accrued and other liabilities | (153 | ) | 196 | ||||

Interest payable | (2,639 | ) | 412 | ||||

Net cash provided by (used in) operating activities | 8,033 | (42,893 | ) | ||||

CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||

Purchases of investments | (71,610 | ) | (48,592 | ) | |||

Sales of investments | 46,722 | 58,705 | |||||

Purchases of equipment and improvements | (192 | ) | (619 | ) | |||

Consolidated Entities: | |||||||

Change in restricted cash and cash equivalents | 24,514 | (51,109 | ) | ||||

Net cash provided by (used in) investing activities | (566 | ) | (41,615 | ) | |||

CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||

Repurchases of common shares | (435 | ) | (21 | ) | |||

Distributions paid | (13,847 | ) | (5,060 | ) | |||

Proceeds from the exercise of options | 241 | 121 | |||||

Payments for tax from the net delivery of restricted share units | (267 | ) | (265 | ) | |||

Payments on contingent liabilities | (1,311 | ) | (2,904 | ) | |||

Excess tax benefits from share-based payment arrangements | (263 | ) | 7 | ||||

Consolidated Entities: | |||||||

Contributions from noncontrolling interests | — | 16,100 | |||||

Distributions to noncontrolling interests | (83 | ) | (970 | ) | |||

Proceeds from issuance of long-term debt | 3,846 | 125,400 | |||||

Payments made on long-term debt | (13,596 | ) | (78,821 | ) | |||

Net cash provided by (used in) financing activities | (25,715 | ) | 53,587 | ||||

Net increase (decrease) in cash and cash equivalents | (18,248 | ) | (30,921 | ) | |||

Cash and cash equivalents at beginning of period | 57,968 | 59,290 | |||||

Cash and cash equivalents at end of period | $ | 39,720 | $ | 28,369 | |||

9

CIFC LLC AND ITS SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (continued)

(Unaudited)

For the Six Months Ended June 30, | |||||||

2016 | 2015 | ||||||

(In thousands) | |||||||

SUPPLEMENTAL DISCLOSURE: | |||||||

Cash paid for interest | $ | 3,699 | $ | 953 | |||

Net cash paid for income taxes | $ | 4,620 | $ | 8,000 | |||

Consolidated Entities: | |||||||

Cash paid for interest | $ | 42,601 | $ | 2,656 | |||

Non-cash disclosures: | |||||||

Dissenting Shareholders (Note 10) | $ | 11,305 | $ | — | |||

Exercise of share options and RSUs | $ | 259 | $ | 311 | |||

Consolidated Entities: | |||||||

Consolidation of net assets | $ | 13,696 | $ | — | |||

Deconsolidation of net assets | $ | (8,236 | ) | $ | (22,578 | ) | |

Non-cash settlement of interest receivables with increases in principal | $ | 31 | $ | 89 | |||

See notes to Condensed Consolidated Financial Statements.

10

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 1—Organization and Business

Organization— CIFC LLC (together with its subsidiaries, "CIFC" or the "Company") is a Delaware limited liability company headquartered in New York City. The Company is a private debt manager specializing in secured U.S. corporate loan strategies. The Company's primary business is to provide investment management services for institutional investors, including pension funds, hedge funds, asset management firms, banks, insurance companies and other types of institutional investors around the world.

On December 31, 2015, CIFC Corp., the Company's former publicly traded entity, completed a series of transactions (the "Reorganization Transaction") to become a subsidiary of CIFC LLC, the current publicly traded entity. The series of transactions changed the Company's top-level form of organization from a corporation to a limited liability company. As of January 1, 2016, the Company is taxed as a partnership.

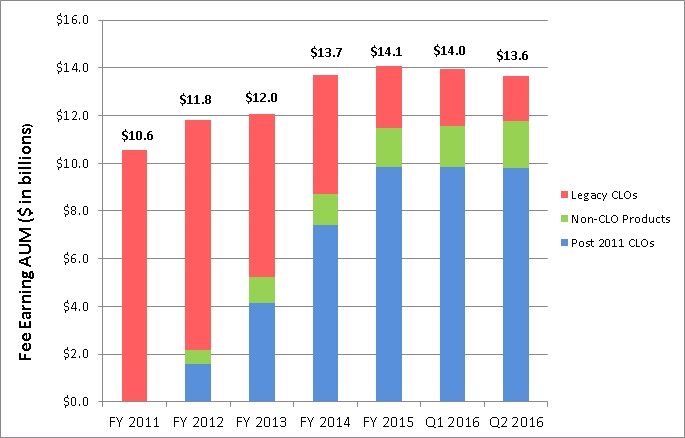

Fee Earning Assets Under Management (“Fee Earning AUM” or “AUM”) refers to the principal balance, net asset value or value of assets managed by the Company on which the Company earns management and/or incentive fees. The Company's AUM is primarily comprised of Collateralized Loan Obligations ("CLOs"). In addition, the Company manages credit funds and other loan-based products (together, "Non-CLO products" and together with CLOs, "Funds"). The Company manages these credit products through opportunistic investment strategies where the Company seeks to generate current income and/or capital appreciation, primarily through senior secured corporate loan investments (“SSCLs”) and, to a lesser extent, other investments. The Company also manages Collateralized Debt Obligations (“CDOs”), which it does not expect to issue in the future.

The Company has three primary sources of revenue: management fees, incentive fees and investment income. Management fees are generally earned based on a percentage of AUM of the Funds. Incentive fees are earned based on the performance of the Funds. Investment income represents interest income and realized/unrealized gains and losses on investments in the products sponsored by the Company and third parties.

Note 2—Basis of Presentation and Principles of Consolidation

Basis of Presentation—The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in conformity with the instructions to Form 10-Q and Article 10-01 of Regulation S-X for interim financial statements. Accordingly, they do not include all information and footnotes required by generally accepted accounting principles in the United States of America ("GAAP") for complete financial statements. The preparation of financial statements requires management to make estimates and assumptions that affect the amounts reported in the Condensed Consolidated Financial Statements and accompanying notes. Management believes that estimates utilized in the preparation of the Condensed Consolidated Financial Statements are prudent and reasonable. Actual results could differ from those estimates and such differences could be material. These accompanying unaudited Condensed Consolidated Financial Statements and related Notes should be read in conjunction with the Consolidated Financial Statements and related Notes included in the 2015 Annual Report.

In the opinion of management, the accompanying Condensed Consolidated Financial Statements contain all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of the results for the interim periods presented. Such operating results may not be indicative of the expected results for any other interim periods or the entire year.

The Reorganization Transaction was a transaction between entities under common control; therefore, the prior year comparative Condensed Consolidated Financial Statements include the Consolidated Balance Sheet, Statement of Operations, Comprehensive Income (Loss), Equity and Cash Flows as of December 31, 2015 and for the three and six months ended June 30, 2015 of CIFC Corp. Further, certain prior year amounts in the Condensed Consolidated Financial Statements and the related notes have been reclassified to conform to current period presentation. During late 2015, we adopted certain Accounting Standard Updates ("ASU") issued by the Financial Accounting Standards Board (FASB) such as the deconsolidation of certain CLOs and Funds (or ASU 2015-02) and the valuation of financial assets and liabilities of Consolidated CLOs (or ASU 2014-13) which were applied on a modified retroactive basis. As such, the Condensed Consolidated Financial Statements and the related notes for the three and six months ended June 30, 2015 have been re-presented to reflect the impact of these adoptions (see the 2015 Annual Report). In addition, other reclassified items include a detailed break-out of line items previously included within Net results of Consolidated Entities on the Condensed Consolidated Statements of Operations as well as Contributions from and Distributions to noncontrolling interests on the Condensed Consolidated Statements of Cash Flows and Condensed Consolidated Statements of Equity.

11

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Principles of Consolidation—The Condensed Consolidated Financial Statements include the financial statements of CIFC and its wholly owned subsidiaries, the entities in which the Company has a controlling interest ("Consolidated Funds") and VIEs for which the Company is deemed to be the primary beneficiary (together with Consolidated Funds and VIEs, the "Consolidated Entities").

All intercompany balances and transactions have been eliminated upon consolidation. This consolidation, particularly with respect to the Consolidated Entities, significantly impacts the Company's Condensed Consolidated Financial Statements.

Consolidated Entities—Consolidated Entities includes the operating results of the Consolidated Funds and the Consolidated VIEs. As of June 30, 2016 and December 31, 2015, the Company held $91.5 million and $81.8 million of investments in its Consolidated Entities, respectively.

Consolidated VIEs—The Company consolidates variable interest entities in which it is deemed the primary beneficiary. These Consolidated VIEs generally include certain CLOs (collectively, the "Consolidated CLOs"), warehouses, loan investment products, and other similar legal entities.

The Company holds interests in and manages an open-end credit fund that invests primarily in second-lien loans. The Company consolidated the fund as it was deemed the primary beneficiary. As the investment manager, the Company cannot be removed and held a significant financial interest in the fund. As of June 30, 2016 and December 31, 2015, the Company held an investment of $35.0 million and $33.2 million, respectively, and the limited partners held $8.1 million and $7.8 million, respectively, which is reported in "Noncontrolling interests in Consolidated Funds" on the Condensed Consolidated Balance Sheet.

As of June 30, 2016 and December 31, 2015, the Company consolidated 3 CLOs and 2 credit funds and 2 CLOs and 2 credit funds, respectively. During the three and six months ended June 30, 2016, the Company purchased and sold residual interests in certain of its managed CLOs. As a result of these transactions, the Company deemed the expected potential returns on 2 CLOs potentially significant while 1 CLO was no longer potentially significant. As such, during the three and six months ended June 30, 2016, we consolidated 2 additional managed CLOs and deconsolidated 1 managed CLO. During the three and six months ended June 30, 2016, the Company consolidated 4 CLOs (of which 1 was deconsolidated as of June 30, 2016). During the three and six months ended June 30, 2015, the Company consolidated 1 CLO, 2 credit funds and 1 warehouse.

Warehouses—From time to time, the Company will create special purpose vehicles ("SPVs") to warehouse SSCLs in advance of sponsoring new CLOs or other funds. The Company may contribute equity to the new SPVs which are typically levered three to five times depending on the terms agreed to with the warehousing counterparties. When the related CLO or Fund is sponsored, typically around three to nine months later, the warehouse is “terminated,” with it concurrently repaying the related financing and returning to the Company its equity contribution, net of gains and losses, if any.

As of June 30, 2016 and December 31, 2015, the Company did not consolidate any warehouses. As of June 30, 2016, the Company held variable interests in 2 warehouses for which it was not deemed to be the primary beneficiary.

Unconsolidated VOEs—The Company holds interests in and manages two closed-end structured credit funds that invest primarily in CLOs and warehouses. As of June 30, 2016 and December 31, 2015, the aggregate carrying value of the Company's investments, as the general partner of these funds, was $17.6 million and $26.0 million, respectively. The limited partners of the Funds may remove the general partner's presumption of control, and as such, the Company did not consolidate these Funds. The Company's investments in these Funds is recorded in "Investments" on the Company's Condensed Consolidated Balance Sheets.

Unconsolidated VIEs—The Company holds interests in and manages an open-end credit fund that invests in performing U.S. SSCLs to provide capital appreciation and risk-adjusted returns to its investors. The Company does not consolidate this fund as it does not have a significant financial interest in the fund and was not deemed the primary beneficiary of the fund. As of June 30, 2016 and December 31, 2015, the carrying value of the Company's investment, as the general partner of this fund, was $5.6 million and $5.4 million, respectively.

As of June 30, 2016, the Company had variable interests in 25 CLOs, 8 CDOs, and 2 Non-CLO products, which the Company managed, that were not consolidated (collectively the "Unconsolidated VIEs") as the Company was not deemed to be the primary beneficiary. As of December 31, 2015, the Company's unconsolidated VIEs included 28 CLOs, 8 CDOs and 2 Non-CLO products.

12

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

The Company's maximum exposure to loss on Unconsolidated VIEs includes its investment, management fee receivables and future management fees collectible by the Company. As of June 30, 2016 and December 31, 2015 the Company invested $70.3 million and $29.0 million, respectively, in Unconsolidated VIEs and the Company's management fee receivables were $3.9 million and $4.1 million, respectively.

Note 3—Summary of Significant Accounting Policies and Recent Accounting Updates

As of June 30, 2016, the Company's significant accounting policies, which are detailed in the 2015 Annual Report have not changed materially.

Recent Accounting Updates

In March 2016, the FASB issued ASU 2016-09, Compensation—Stock Compensation (Topic 718) ("ASU 2016-09"), which is intended to simplify several aspects of the accounting for share-based payment award transactions. Specifically, ASU 2016-09 aims to simplify the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities and classification on the statement of cash flows. The guidance will be effective for fiscal years beginning after December 15, 2016, including interim periods within that year. The Company is currently evaluating the impact of this ASU on its Consolidated Financial Statements.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) ("ASU 2016-02"), to increase transparency and comparability among organizations by recognizing all lease transactions (with terms in excess of 12 months) on the balance sheet as a lease liability and a right-of-use asset (as defined). ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, with earlier application permitted. Upon adoption, the lessee will apply the new standard retrospectively to all periods presented or retrospectively using a cumulative effect adjustment in the year of adoption. The Company is currently evaluating the impact of this ASU on its Consolidated Financial Statements.

In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers (Topic 606), Deferral of the Effective Date ("ASU 2015-14"). The ASU amends the effective date of ASU 2014-09 for all entities by one year. In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606) ("ASU 2014-09"), which outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. The standard clarifies the required factors that an entity must consider when recognizing revenue and also requires additional disclosures. With the issuance of ASU 2015-14 the new effective date for the Company is January 1, 2018. The new revenue standard may be applied retrospectively to each prior period presented or retrospectively with the cumulative effect recognized as of the date of adoption. The Company is currently evaluating the impact of this ASU on its Consolidated Financial Statements.

Note 4—Consolidated VIEs

Although the Company consolidates all the assets and liabilities of the Consolidated VIEs (including the Consolidated CLOs, warehouses and other investment products), its maximum exposure to loss is limited to its investments and beneficial interests in the Consolidated VIEs and the receivables of management fees from the Consolidated VIEs. All of these items are eliminated upon consolidation. The assets of each of the Consolidated VIEs are administered by the trustee of each fund solely as collateral to satisfy the obligations of the Consolidated VIEs. If the Company were to liquidate, the assets of the Consolidated VIEs would not be available to the Company's general creditors, and, as a result, the Company does not consider them its assets. Additionally, the investors in the debt and residual interests of the Consolidated VIEs have no recourse to the Company's general assets. Therefore, this debt is not the Company's obligation.

13

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

The following table summarizes the Company's total maximum exposure to loss on these Consolidated VIEs, as follows (1):

June 30, 2016 | December 31, 2015 | |||||||

(In thousands) | ||||||||

Maximum exposure to loss: | ||||||||

Investments and beneficial interests (2) | $ | 91,474 | $ | 81,752 | ||||

Receivables | 410 | 605 | ||||||

Total maximum exposure to loss | $ | 91,884 | $ | 82,357 | ||||

Explanatory Notes:

________________________________

(1) | In addition, exposure to loss includes future management fees on the Consolidated VIEs, which are not included in the table. |

(2) | Investments made in our Consolidated VIEs are eliminated in consolidation. |

Note 5—Fair Value

Assets and Liabilities Measured at Fair Value on a Recurring Basis

Fair Value Hierarchy—The following table summarizes the assets and liabilities carried at fair value on a recurring basis, by class and level:

June 30, 2016 | December 31, 2015 | ||||||||||||||||||||||||||||||||||||||

Level 1 | Level 2 | Level 3 | NAV | Estimated Fair Value | Level 1 | Level 2 | Level 3 | NAV | Estimated Fair Value | ||||||||||||||||||||||||||||||

(In thousands) | (In thousands) | ||||||||||||||||||||||||||||||||||||||

Assets | |||||||||||||||||||||||||||||||||||||||

Investments: | |||||||||||||||||||||||||||||||||||||||

Credit Funds | $ | — | $ | — | $ | — | $ | 23,174 | $ | 23,174 | $ | — | $ | — | $ | — | $ | 31,411 | $ | 31,411 | |||||||||||||||||||

Warehouses | — | — | 44,990 | — | 44,990 | — | — | — | — | — | |||||||||||||||||||||||||||||

Structured products & other | — | 1,857 | 24,462 | — | 26,319 | — | 1,768 | 37,517 | — | 39,285 | |||||||||||||||||||||||||||||

Subtotal | — | 1,857 | 69,452 | 23,174 | 94,483 | — | 1,768 | 37,517 | 31,411 | 70,696 | |||||||||||||||||||||||||||||

Consolidated Entities: | |||||||||||||||||||||||||||||||||||||||

Loans (1) | — | 1,422,493 | 426,967 | — | 1,849,460 | — | 1,067,539 | 281,868 | — | 1,349,407 | |||||||||||||||||||||||||||||

Structured products & other | — | 781 | 321 | — | 1,102 | — | 840 | 1,156 | — | 1,996 | |||||||||||||||||||||||||||||

Total Consolidated Entities | — | 1,423,274 | 427,288 | — | 1,850,562 | — | 1,068,379 | 283,024 | — | 1,351,403 | |||||||||||||||||||||||||||||

Total Assets | $ | — | $ | 1,425,131 | $ | 496,740 | $ | 23,174 | $ | 1,945,045 | $ | — | $ | 1,070,147 | $ | 320,541 | $ | 31,411 | $ | 1,422,099 | |||||||||||||||||||

Liabilities | |||||||||||||||||||||||||||||||||||||||

Contingent liabilities | $ | — | $ | — | $ | 7,680 | $ | — | $ | 7,680 | $ | — | $ | — | $ | 8,338 | $ | — | $ | 8,338 | |||||||||||||||||||

Total Liabilities | $ | — | $ | — | $ | 7,680 | $ | — | $ | 7,680 | $ | — | $ | — | $ | 8,338 | $ | — | $ | 8,338 | |||||||||||||||||||

Explanatory Note:

______________________________

(1) | As of June 30, 2016 and December 31, 2015, the total aggregate unpaid principal balance of loans was $1.9 billion and $1.4 billion, respectively. See Note 9 for total contractual principal amounts. |

14

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Changes in Level 3 Recurring Fair Value Measurements—The following tables summarize by class the changes in financial assets and liabilities measured at fair value classified within Level 3 of the valuation hierarchy. Net realized and unrealized gains (losses) for Level 3 financial assets and liabilities measured at fair value are included in the Consolidated Statements of Operations.

Level 3 Financial Assets | |||||||||||||||||||||||

For the Three Months Ended June 30, 2016 | |||||||||||||||||||||||

Investments | Investment Assets of Consolidated Entities | ||||||||||||||||||||||

Structured Products & Other | Warehouses | Total | Loans | Structured Products & Other | Total | ||||||||||||||||||

(In thousands) | |||||||||||||||||||||||

Estimated fair value, beginning of period | $ | 43,812 | $ | — | $ | 43,812 | $ | 292,559 | $ | 1,118 | $ | 293,677 | |||||||||||

Transfers into Level 3 (1) | — | — | — | 107,361 | — | 107,361 | |||||||||||||||||

Transfers out of Level 3 (2) | — | — | — | (109,269 | ) | — | (109,269 | ) | |||||||||||||||

Transfers in(out) due to consolidation or acquisition | (23,443 | ) | — | (23,443 | ) | 205,361 | — | 205,361 | |||||||||||||||

Transfers out due to deconsolidation | — | — | — | (75,327 | ) | — | (75,327 | ) | |||||||||||||||

Net realized/unrealized gains (losses) | 2,263 | 868 | 3,131 | 3,018 | 14 | 3,032 | |||||||||||||||||

Purchases | 19,398 | 44,122 | 63,520 | 28,515 | — | 28,515 | |||||||||||||||||

Sales | (15,973 | ) | — | (15,973 | ) | (12,083 | ) | (811 | ) | (12,894 | ) | ||||||||||||

Settlements | (1,595 | ) | — | (1,595 | ) | (13,168 | ) | — | (13,168 | ) | |||||||||||||

Estimated fair value, end of period | $ | 24,462 | $ | 44,990 | $ | 69,452 | $ | 426,967 | $ | 321 | $ | 427,288 | |||||||||||

Change in unrealized gains (losses) for the period for the assets held as of the end of the period | $ | 275 | $ | 868 | $ | 1,143 | $ | 5,383 | $ | (5 | ) | $ | 5,378 | ||||||||||

For the Six Months Ended June 30, 2016 | |||||||||||||||||||||||

Investments | Investment Assets of Consolidated Entities | ||||||||||||||||||||||

Structured Products & Other | Warehouses | Total | Loans | Structured Products & Other | Total | ||||||||||||||||||

(In thousands) | |||||||||||||||||||||||

Estimated fair value, beginning of period | $ | 37,517 | $ | — | $ | 37,517 | $ | 281,868 | $ | 1,156 | $ | 283,024 | |||||||||||

Transfers into Level 3 (1) | — | — | — | 202,783 | — | 202,783 | |||||||||||||||||

Transfers out of Level 3 (2) | — | — | — | (193,820 | ) | — | (193,820 | ) | |||||||||||||||

Transfers in(out) due to consolidation or acquisition | (23,443 | ) | — | (23,443 | ) | 205,361 | — | 205,361 | |||||||||||||||

Transfers out due to deconsolidation | — | — | — | (75,327 | ) | — | (75,327 | ) | |||||||||||||||

Net realized/unrealized gains (losses) | 954 | 868 | 1,822 | 2,085 | (25 | ) | 2,060 | ||||||||||||||||

Purchases | 35,120 | 44,122 | 79,242 | 52,991 | — | 52,991 | |||||||||||||||||

Sales | (23,973 | ) | — | (23,973 | ) | (21,982 | ) | (810 | ) | (22,792 | ) | ||||||||||||

Settlements | (1,713 | ) | — | (1,713 | ) | (26,992 | ) | — | (26,992 | ) | |||||||||||||

Estimated fair value, end of period | $ | 24,462 | $ | 44,990 | $ | 69,452 | $ | 426,967 | $ | 321 | $ | 427,288 | |||||||||||

Change in unrealized gains (losses) for the period for the assets held as of the end of the period | $ | 1,142 | $ | 868 | $ | 2,010 | $ | 5,383 | $ | (5 | ) | $ | 5,378 | ||||||||||

15

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

For the Three Months Ended June 30, 2015 | |||||||||||||||||||||||

Investments | Investment Assets of Consolidated Entities | ||||||||||||||||||||||

Loans | Structured Products & Other | Total | Loans | Structured Products & Other | Total | ||||||||||||||||||

(In thousands) | |||||||||||||||||||||||

Estimated fair value, beginning of period | $ | 967 | $ | 32,863 | $ | 33,830 | $ | 44,983 | $ | 4,677 | $ | 49,660 | |||||||||||

Transfers into Level 3 (1) | — | — | — | 8,193 | — | 8,193 | |||||||||||||||||

Transfers out of Level 3 (2) (3) | — | — | — | (1,351 | ) | (1,803 | ) | (3,154 | ) | ||||||||||||||

Net realized/unrealized gains (losses) (3) | 27 | 444 | 471 | (1,121 | ) | 308 | (813 | ) | |||||||||||||||

Purchases (3) | 2,971 | 33,570 | 36,541 | 90,070 | 1,554 | 91,624 | |||||||||||||||||

Sales (3) | (1,971 | ) | (23,438 | ) | (25,409 | ) | (59,504 | ) | (1,242 | ) | (60,746 | ) | |||||||||||

Settlements (3) | — | — | — | (8,118 | ) | — | (8,118 | ) | |||||||||||||||

Estimated fair value, end of period | $ | 1,994 | $ | 43,439 | $ | 45,433 | $ | 73,152 | $ | 3,494 | $ | 76,646 | |||||||||||

Change in unrealized gains (losses) for the period for the assets held as of the end of the period | $ | 27 | $ | 372 | $ | 399 | $ | (194 | ) | $ | (10 | ) | $ | (204 | ) | ||||||||

For the Six Months Ended June 30, 2015 | |||||||||||||||||||||||||||

Investments | Investment Assets of Consolidated Entities | ||||||||||||||||||||||||||

Loans | Structured Products & Other | Total | Loans | Corporate Bonds | Structured Products & Other | Total | |||||||||||||||||||||

(In thousands) | |||||||||||||||||||||||||||

Estimated fair value, beginning of period | $ | 967 | $ | 7,604 | $ | 8,571 | $ | 2,517,887 | $ | 478 | $ | 69,973 | $ | 2,588,338 | |||||||||||||

Transfers into Level 3 (1) | — | — | — | 10,520 | — | — | 10,520 | ||||||||||||||||||||

Transfers out of Level 3 (2) (3) | — | — | — | (9,828 | ) | — | (1,803 | ) | (11,631 | ) | |||||||||||||||||

Transfers in (out) due to deconsolidation (3) | — | 23,614 | 23,614 | (2,476,625 | ) | (478 | ) | (67,383 | ) | (2,544,486 | ) | ||||||||||||||||

Net realized/unrealized gains (losses) (3) | 27 | 247 | 274 | (624 | ) | — | 207 | (417 | ) | ||||||||||||||||||

Purchases (3) | 2,971 | 40,708 | 43,679 | 116,713 | — | 3,742 | 120,455 | ||||||||||||||||||||

Sales (3) | (1,971 | ) | (28,734 | ) | (30,705 | ) | (70,841 | ) | — | (1,242 | ) | (72,083 | ) | ||||||||||||||

Settlements (3) | — | — | — | (14,050 | ) | — | — | (14,050 | ) | ||||||||||||||||||

Estimated fair value, end of period | $ | 1,994 | $ | 43,439 | $ | 45,433 | $ | 73,152 | $ | — | $ | 3,494 | $ | 76,646 | |||||||||||||

Change in unrealized gains (losses) for the period for the assets held as of the end of the period | $ | 1 | $ | 3 | $ | 4 | $ | (194 | ) | $ | — | $ | (10 | ) | $ | (204 | ) | ||||||||||

Explanatory Notes:

______________________________

(1) | Transfers in represent investments currently valued by a third-party pricing service using composite prices determined using less than two quotes, an internally developed pricing model or broker quotes and that were previously marked by a third-party pricing service using composite prices determined from two or more quotes. |

(2) | Transfers out represent investments previously valued by an internally developed pricing model, broker quotes, or a third-party pricing service using composite prices determined using less than two quotes and are now being marked by a third-party pricing service using composite prices determined from two or more quotes. |

(3) | The adoption of ASU 2015-02 was applied on a modified retrospective basis. Transfers out, net realized/unrealized gains (losses), purchases, sales and settlements for the three and six months ended June 30, 2015 reflect the deconsolidation of CLOs as of January 1, 2015. |

For the Three Months Ended June 30, | |||||||

2016 | 2015 | ||||||

Contingent Liabilities | |||||||

(In thousands) | |||||||

Estimated fair value, beginning of period | $ | 8,142 | $ | 11,823 | |||

Net realized/unrealized (gains) losses | (150 | ) | 577 | ||||

Settlements | (312 | ) | (1,346 | ) | |||

Estimated fair value, end of period | $ | 7,680 | $ | 11,054 | |||

Change in Net realized/unrealized (gains) losses for the period for the liabilities outstanding as of the end of the period | $ | 150 | $ | (577 | ) | ||

16

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

For the Six Months Ended June 30, 2016 | For the Six Months Ended June 30, 2015 | ||||||||||||||||||

Contingent Liabilities | Total | Contingent Liabilities | Long-term Debt of Consolidated Entities | Total | |||||||||||||||

(In thousands) | |||||||||||||||||||

Estimated fair value, beginning of period | $ | 8,338 | $ | 8,338 | $ | 12,668 | $ | 12,049,034 | $ | 12,061,702 | |||||||||

Transfer in (out) due to consolidation (2)(3) | — | — | — | (12,049,034 | ) | (12,049,034 | ) | ||||||||||||

Net realized/unrealized (gains) losses (2) | 214 | 214 | 1,290 | 1,290 | |||||||||||||||

Settlements (2)(4) | (872 | ) | (872 | ) | (2,904 | ) | (2,904 | ) | |||||||||||

Estimated fair value, end of period | $ | 7,680 | $ | 7,680 | $ | 11,054 | $ | — | $ | 11,054 | |||||||||

Change in unrealized (gains) losses for the period for the liabilities outstanding as of the end of the period | $ | (214 | ) | $ | (214 | ) | $ | (1,290 | ) | $ | — | $ | (1,290 | ) | |||||

Explanatory Notes:

__________________________

(1) | Represents the Company's sales of its residual interests in the Consolidated CLOs. The sale removes the requirement to consolidate the CLOs, therefore, debt and/or subordinated notes of the CLOs are no longer eliminated in consolidation. |

(2) | The adoption of ASU 2015-02 was applied on a modified retrospective basis. Transfers out, net realized/unrealized gains (losses), purchases, sales and settlements for the three and six months ended June 30, 2015 reflect the deconsolidation of CLOs as of January 1, 2015. |

(3) | Pursuant to the adoption of ASU 2014-13, the Long-term Debt of Consolidated Entities have been remeasured in accordance with the new guidance. |

(4) | For Contingent Liabilities, amount represents payments made and due related to the contingent liabilities from the merger with Legacy CIFC (Note 8). |

Fair Value Methodologies of Financial Instruments

The following is a description of the Company's valuation methodologies for financial instruments measured at fair value by class as required by ASC Topic 820, including the general classification of such instruments pursuant to the valuation hierarchy.

Credit Funds—Amounts include the Company's investment in unconsolidated credit funds where the Company co-invests with third-party investors. The fair value of investments in credit funds are generally determined based on the Company's proportionate share of the net asset value ("NAV") of the fund. Investors in the Company’s open-ended credit funds may redeem their interests, at any time, within 30 days after notice. Investors in the Company’s closed-end credit funds generally cannot redeem. The Company estimates that closed-end funds are expected to liquidate over 2.5 to 6.3 years. The Company has no unfunded commitments in its open-ended and closed-end credit funds. The Company's investments in credit funds have been excluded from the fair value hierarchy table.

Loans—Loans are generally valued via a third-party pricing service. The value represents a composite of the mid-point in the bid-ask spread of broker quotes or is based on the composite price of a different tranche of the same or similar security if broker quotes are unavailable for the specific tranche the Company owns. The third-party pricing service provides the number of quotes used in determining the composite price, a factor that the Company uses in determining the observability level of the inputs to the composite price. When the fair value of the loan investments is based on a composite price determined using two or more quotes the composite price is considered to be based on significant observable inputs and classified as Level 2 within the fair value hierarchy. When the fair value of certain loan investments is based on a composite price determined using less than two quotes, the composite price is considered to be based on significant unobservable inputs. In these instances, the Company performs certain procedures on a sample basis to determine that composite prices approximate fair market value. Alternative methodologies are used to value the loans such as a comparable company pricing model (an internally developed model using composite or other observable comparable market inputs) or an internally developed model using data including unobservable market inputs. Accordingly, loans valued using alternative methodologies are classified as Level 3 within the fair value hierarchy.

Warehouses—Warehouse investments consist of investments in loans using leverage from a third-party financial institution. Loans are generally valued via a third-party pricing service. The quoted value represents a composite of the mid-point in the bid-ask spread of broker quotes or, in circumstances where broker quotes are unavailable, the value is based on the composite price of a different tranche of the same or similar security. Calculation of fair value on warehouse investments is based on the quoted mid-price of the underlying securities less the associated warehouse debt and accrued expenses, including interest expense. However, market participants may use different assumptions to price the warehouse investments; accordingly, warehouse investments are classified as Level 3 within the fair value hierarchy.

17

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Structured Products & Other—Structured Products and Other primarily represents the fair value of investments in CIFC and third-party managed CLOs and warehouses. These assets are generally valued via a third-party pricing service. The inputs to the valuation include recent trade information, discount rates, forward yield curves, and loan level information (including loan loss, recovery and default rates, prepayment speeds and other security specific information obtained from the trustee and other service providers related to the product being valued). Although the inputs used in the third-party pricing service's valuation model are generally obtained from active markets, the third-party pricing service does not provide a detailed analysis for each security valued. The Company performs certain procedures on a sample basis to determine that prices approximate fair market value. When a value from a third-party pricing service is unavailable, the value may be based on an internally developed discounted cash flow model which includes unobservable market inputs or by broker quote. Inputs to the internally developed model include the structure of the product being valued, estimates related to loan default, recovery and discount rates. Accordingly these assets are classified as Level 3 within the fair value hierarchy.

In addition, included in Structured Products and Other are (i) equity securities not listed for trading on a national exchange ("Non-listed Equity Securities") received on certain loan restructurings within our portfolio and (ii) on occasion, warehouse total return swaps ("TRS," Note 6). Similar to the fair value of loans, Non-listed Equity Securities are valued using a third-party pricing service. When the fair value of a Non-listed Equity Security is determined using two or more quotes, it is classified as Level 2 within the fair value hierarchy, and when the fair value is determined using less than two quotes, it is classified as Level 3 within the fair value hierarchy. The fair value of a warehouse TRS is calculated as the sum of (i) the change in fair value of the reference obligations (SSCLs are valued at a composite of the mid-point in the bid-ask spread of broker quotes) since they became reference obligations, (ii) net realized gains (losses) on reference obligations sold during the period and (iii) interest income earned on the reference obligations, less an amount equal to LIBOR plus an agreed upon margin on the outstanding notional amount of the reference obligations. The warehouse TRS values are classified as Level 2 within the fair value hierarchy.

Contingent Liabilities—The fair value of contingent liabilities is based on a discounted cash flow model. The model is based on projections of the relevant future management fee cash flows and utilizes both observable and unobservable inputs in the determination of fair value. Significant inputs to the valuation model include the structure of the underlying CLO and estimates related to loan default, recovery and discount rates. Contingent liabilities are classified as Level 3 within the fair value hierarchy.

Long-Term Debt of the Consolidated CLOs & Warehouses—Long-term debt of the Consolidated CLOs and warehouses consists of debt and subordinated notes of the Consolidated CLOs and warehouses. Financial liabilities are measured as: (1) the sum of the fair value of the financial assets and the carrying value of any non-financial assets that are incidental to the operations of the CLOs less (2) the sum of the fair value of any beneficial interests retained by the reporting entity (other than those that represent compensation for services) and the Company’s carrying value of any beneficial interests that represent compensation for services.

Quantitative Information about Level 3 Assets & Liabilities

The disclosure provided below provides quantitative information about the significant unobservable inputs used in the valuation of the contingent liabilities of Legacy CLOs (see Note 8).

June 30, 2016 | June 30, 2016 | December 31, 2015 | Impact of Increase in Input on Fair Value Measurement (1) | ||||||||

Financial Liabilities | Fair Value (In thousands) | Valuation Technique | Significant Unobservable Input | Range | Range | ||||||

Contingent Liabilities | $ | 7,680 | Discounted cash flows | Discount rate (2) | 7.5%-13.0% | 6.7%-12.0% | Decrease | ||||

Default rate (3) | 2.0% | 2.0% | Decrease | ||||||||

Recovery rate (3) | 70% | 70% | Increase | ||||||||

Pre-payment rate (3) | 25% | 40% | Decrease | ||||||||

Reinvestment spread of assets above LIBOR | 3.3%-4.0% | 3.0-3.8% | Increase | ||||||||

Reinvestment price of assets | 100.0 | 100.0 | Increase | ||||||||

Explanatory Notes:

____________________________

(1) | The impact of a decrease in input would have the opposite impact to the fair value as that presented in the table. |

(2) | The discount rate varies by type of management fee (senior management fee, subordinated management fee, or incentive fee), the priority of that management fee in the waterfall of the CLO and the relative risk associated with the respective management fee cash flow projections. Amounts are presented as a spread over LIBOR. |

(3) | Generally an increase in the default rate would be accompanied by a directionally opposite change in assumption for the recovery and pre-payment rates. |

18

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Carrying Value and Estimated Fair Value of Financial Assets and Liabilities

The Company has not elected the fair value option for certain financial liabilities. A summary of the carrying value and estimated fair value of those liabilities are as follows:

As of June 30, 2016 | As of December 31, 2015 | ||||||||||||||

Carrying Value | Estimated Fair Value | Carrying Value | Estimated Fair Value | ||||||||||||

(In thousands) | |||||||||||||||

Financial liabilities: | |||||||||||||||

Long-term debt: | |||||||||||||||

Junior Subordinated Notes (1) | $ | 118,304 | $ | 52,199 | $ | 118,259 | $ | 57,371 | |||||||

Senior Notes (2) | $ | 38,009 | $ | 40,468 | $ | 37,902 | $ | 40,000 | |||||||

Explanatory Note:

________________________________

(1) | The Junior Subordinated Notes include both the March and October Junior Subordinated Notes (Note 9). The estimated fair values were determined using a discounted cash flow model which utilizes significant unobservable inputs, including discount rates, yield and forward LIBOR curve assumptions. This methodology is classified as Level 3 within the fair value hierarchy. |

(2) | On November 2, 2015, the Company issued $40.0 million par value of Senior Notes which are publicly registered. The estimated fair value was determined using a discounted cash flow valuation model, utilizing significant unobservable inputs such as a discount rate and credit spread over the BB High Yield Index. As the unobservable inputs in isolation can cause significant increases or decreases in fair value, this methodology is classified as Level 3 within the fair value hierarchy. |

The carrying value of all of the following approximate the fair value of the financial instruments and are considered Level 1 in the fair value hierarchy: cash and cash equivalents, restricted cash and cash equivalents, receivables and due to brokers. In addition, amounts in the Consolidated Entities related to restricted cash and cash equivalents, due from brokers, receivables and due to brokers also approximate the fair value of the instruments and are all considered Level 1 in the fair value hierarchy.

Investments of the Consolidated Entities are diversified over multiple industries. In addition, applicable agreements governing CLOs and warehouses outline industry concentration limits. Management does not believe the Company has any significant concentration risks.

Note 6—Derivative Instruments and Hedging Activities

Total Return Swap—During the six months ended June 30, 2015, the Company, through a warehouse SPV, entered into a TRS agreement with a third-party bank, in lieu of financing. Under the TRS agreement, the Company received the income on the reference obligations (including gains on terminated reference obligations) and paid the counterparty an amount equal to three month LIBOR plus a margin on the outstanding notional amount of the reference obligations and losses on terminated reference obligations. The Company also consolidated this warehouse SPV as it was a VIE in which the Company was deemed the primary beneficiary (Note 2). During the year ended December 31, 2015 the warehouse agreement was terminated in conjunction with the issuance of a CLO.

Net gain (loss) related to other derivative instruments for the three and six months ended June 30, 2016 was deminimus and, for the three and six months ended June 30, 2015, the Company recognized net gain (loss) of $1.3 million and $1.7 million, respectively, related to the TRS agreement.

19

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 7—Intangible Assets

Intangible assets are comprised of the following:

Weighted-Average Remaining Estimated Useful Life | Gross Carrying Amount (1) | Accumulated Amortization (2) | Net Carrying Amount | ||||||||||

(In years) | (In thousands) | ||||||||||||

June 30, 2016: | |||||||||||||

Investment management contracts | 1.8 | $ | 40,405 | $ | 37,972 | $ | 2,433 | ||||||

Referral arrangement | 3.3 | 3,810 | 2,476 | 1,334 | |||||||||

Non-compete agreements | 1.8 | 1,284 | 963 | 321 | |||||||||

Trade name | 4.8 | 1,250 | 656 | 594 | |||||||||

Total intangible assets | $ | 46,749 | $ | 42,067 | $ | 4,682 | |||||||

December 31, 2015: | |||||||||||||

Investment management contracts | 2.4 | $ | 71,113 | $ | 67,040 | $ | 4,073 | ||||||

Referral arrangement | 3.8 | 3,810 | 2,096 | 1,714 | |||||||||

Non-compete agreements | 2.2 | 1,535 | 1,122 | 413 | |||||||||

Trade name | 5.2 | 1,250 | 593 | 657 | |||||||||

Total intangible assets | $ | 77,708 | $ | 70,851 | $ | 6,857 | |||||||

Explanatory Notes:

_________________________________

(1) | Gross carrying amounts as of June 30, 2016 have been reduced to reflect fully impaired and amortized assets. |

(2) | The Company recorded amortization expense on its intangible assets of $0.7 million and $1.6 million for the three and six months ended June 30, 2016, respectively, and $1.7 million and $3.8 million for the three and six months ended June 30, 2015, respectively. |

The following table presents expected amortization expense of the existing intangible assets:

(In thousands) | |||

2016 (six months remaining) | $ | 940 | |

2017 | 1,726 | ||

2018 | 1,449 | ||

2019 | 411 | ||

2020 | 125 | ||

Thereafter | 31 | ||

$ | 4,682 | ||

The Company received notice from holders of certain CLOs exercising their right to call the CLOs for redemption. As a result of these calls, the Company recorded impairment charges of $0.5 million for the three and six months ended June 30, 2016 and $0.5 million and $0.7 million for the three and six and months ended June 30, 2015, respectively, to fully impair intangible assets associated with these management contracts.

20

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 8—Contingent Liabilities

Contingent Liabilities—In addition to the consideration paid in connection with the merger with Commercial Industrial Finance Corp. ("Legacy CIFC") (the "Merger"), the Company was required to pay CIFC Parent Holdings LLC ("CIFC Parent") a portion of incentive fees earned on six CLOs managed by CIFC Asset Management LLC (the "Legacy CIFC CLOs"). The terms of these payments were as follows: (i) the first $15.0 million of incentive fees received (which was fulfilled in 2013), (ii) 50% of any incentive fees in excess of $15.0 million in aggregate received from the Legacy CIFC CLOs by the combined company over ten years from April 13, 2011 (the "Merger Closing Date") and (iii) payments relating to the present value of any such incentive fees from the Legacy CIFC CLOs that remain payable to the combined company after the tenth anniversary of the Merger Closing Date. The Company made total payments of $0.3 million and $1.3 million for the three and six months ended June 30, 2016, respectively, and $0.8 million and $1.8 million for the three and six months ended June 30, 2015, respectively, related to these contingent liabilities. As of June 30, 2016, there are no remaining payments under item (i) and the Company made cumulative payments of $16.9 million under (ii) to date.

In addition, the Company also assumed contingent liabilities during the Merger that primarily represent contingent consideration related to Legacy CIFC’s acquisition of CypressTree Investment Management, LLC ("CypressTree") in December 2010. The assumed contingent liabilities are based on a fixed percentage of certain management fees from the CypressTree CLOs. These fixed percentages vary by CLO. The minimum fixed percentage was 39% since July 2013. As of June 30, 2016, there were no payments due. During the three and six months ended June 30, 2015, the Company made its final payments of $0.6 million and $1.1 million, respectively, satisfying its contingent obligation.

Note 9—Long-Term Debt

The following table summarizes the long-term debt:

June 30, 2016 | December 31, 2015 | |||||||||||||||||||||||||

Par | Carrying Value | Weighted Average Borrowing Rate | Weighted Average Remaining Maturity | Par | Carrying Value | Weighted Average Borrowing Rate | Weighted Average Remaining Maturity | |||||||||||||||||||

(In thousands) | (In years) | (In thousands) | (In years) | |||||||||||||||||||||||

Recourse Debt: | ||||||||||||||||||||||||||

March Junior Subordinated Notes (1) | $ | 95,000 | $ | 93,496 | 3.22 | % | 19.3 | $ | 95,000 | $ | 93,456 | 2.90 | % | 19.8 | ||||||||||||

October Junior Subordinated Notes (2) | 25,000 | 24,808 | 4.14 | % | 19.3 | 25,000 | 24,803 | 3.82 | % | 19.8 | ||||||||||||||||

Senior Notes (3) | 40,000 | 38,009 | 8.50 | % | 9.3 | 40,000 | 37,902 | 8.50 | % | 9.8 | ||||||||||||||||

Total Recourse Debt | $ | 160,000 | $ | 156,313 | 4.68 | % | 16.3 | $ | 160,000 | $ | 156,161 | 4.44 | % | 17.3 | ||||||||||||

Non-Recourse Consolidated Entities' debt: | ||||||||||||||||||||||||||

Consolidated CLOs and Other (4) | $ | 1,890,174 | $ | 1,814,256 | 0.03 | % | 8.3 | $ | 1,385,226 | $ | 1,308,558 | 0.02 | % | 9.1 | ||||||||||||

Total Non-recourse Debt | $ | 1,890,174 | $ | 1,814,256 | 0.03 | % | 8.3 | $ | 1,385,226 | $ | 1,308,558 | 0.02 | % | 9.1 | ||||||||||||

Explanatory Notes:

_______________________________

(1) | March Junior Subordinated Notes bear interest at an annual rate of three month LIBOR plus 2.58% until maturity on October 30, 2035. Prior to April 30, 2015, these notes bore interest at an annual rate of 1%. |

(2) | October Junior Subordinated Notes bear interest at an annual rate of three month LIBOR plus 3.50% and mature on October 30, 2035. |

(3) | The Senior Notes bear interest at 8.5% and mature on October 30, 2025. As of January 1, 2016, the Company temporarily did not meet certain registration requirements under the indenture (and associated agreements) and incurred additional interest of 25 and 50 basis points per annum for the three and six months ended June 30, 2016, respectively. On July 19, 2016, the Company cured these conditions and the additional interest will no longer apply. |

(4) | The subordinated notes of the Consolidated CLOs do not have a stated interest rate and have been excluded from the calculation of the weighted average borrowing rate. As of June 30, 2016 and December 31, 2015, long-term debt of the Consolidated CLOs and Other includes $151.7 million and $153.1 million of credit fund debt, respectively. |

Non-Recourse Consolidated Entities' Debt—The debt and equity holders only have recourse to the total assets of the respective Consolidated Entity's assets.

21

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Consolidated Entities— During the six months ended June 30, 2016, the Company consolidated 4 CLOs (of which one was deconsolidated as of June 30, 2016) and 2 credit funds (Note 2). The Consolidated Entities distributed $12.2 million to the holders of their subordinated notes.

During the three and six months ended June 30, 2015, the Company consolidated 1 CLO, 2 credit funds and 1 warehouse. The Consolidated Entities paid down $26.4 million of their outstanding debt, made net borrowings under revolving credit facilities of $74.4 million and distributed $1.4 million to the holders of their subordinated notes.

The carrying value of the assets of the Consolidated CLOs, which are the only assets to which the Consolidated CLO debt holders have recourse for repayment was $1.8 billion and $1.2 billion as of June 30, 2016 and December 31, 2015, respectively.

Note 10—Equity

Common Shares— The Company declared aggregate distributions of $0.25 and $0.59 per common share for the three and six months ended June 30, 2016, respectively, and $0.10 and $0.20 per common share for the three and six months ended June 30, 2015, respectively.

On April 28, 2016, in connection with the Reorganization Transaction, two holders of record (the “Dissenting Shareholders”) with a total of 2,026,315 shares of common stock of CIFC Corp. (“Dissenting Shares”) filed petitions for appraisal with the Delaware Court of Chancery ("Delaware Court"). The Dissenting Shareholders will be entitled to receive a cash amount from CIFC Corp. equal to the fair value of the Dissenting Shares as of December 31, 2015, as determined by the Delaware Court. The Company recorded a liability of $11.3 million based on the closing stock price as of December 31, 2015. The accrued expense is based on management's best estimate of the value of the Dissenting Shares, and there can be no assurance that the amounts accrued will be the same amount determined by the Delaware Court. Further, the Dissenting Shareholders were no longer entitled to dividends declared after December 31, 2015.

Treasury Share/Share Repurchases—During the six months ended June 30, 2016, the Company repurchased 75,296 common shares in open-market transactions for an aggregate cost (including transaction costs) of $0.4 million with an average price per share of $5.75. The Board authorized the constructive retirement of all of these shares and the cost of these shares was reclassified from Treasury shares to Additional paid-in capital on the Condensed Consolidated Balance Sheet. During both the three and six months ended June 30, 2015, the Company repurchased 2,847 common shares in open-market transactions for an aggregate cost (including transaction costs) of $20,555 with an average price per share of $7.22. As of June 30, 2016, the Company was authorized to repurchase up to $3.8 million of its common shares under the share repurchase program.

Share-based Compensation— As of June 30, 2016, there was $13.7 million of estimated unrecognized compensation expense related to unvested share options and Restricted Stock Unit ("RSU") awards, net of estimated forfeitures. The remaining weighted average vesting periods of share options and RSUs are 0.21 years and 2.53 years, respectively.

Share Options—The following table summarizes certain share options activity:

Number of Shares Underlying Share Options | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term | Aggregate Intrinsic Value | |||||||||

(In years) | (In thousands) | |||||||||||

Outstanding at December 31, 2015 | 3,285,313 | $ | 6.69 | 4.64 | $ | 788 | ||||||

Exercised (1) | (50,000 | ) | $ | 4.83 | ||||||||

Outstanding at June 30, 2016 | 3,235,313 | $ | 6.72 | 4.18 | $ | 2,619 | ||||||

Exercisable at June 30, 2016 | 3,020,793 | $ | 6.59 | 3.95 | $ | 2,618 | ||||||

Vested and Expected to vest at June 30, 2016 (2) | 3,223,368 | $ | 6.71 | 4.17 | $ | 2,619 | ||||||

Explanatory Notes:

________________________________

(1) | During the six months ended June 30, 2016 and 2015, the total intrinsic value of options exercised was $33.5 thousand and $78.3 thousand, respectively. |

(2) | Includes a reduction to outstanding options at period end for expected forfeiture rate over the life of the options. |

22

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

RSUs—For RSU awards that were not entitled to distribution equivalent rights, the fair value of the awards was determined using the Company's grant date common share price less the present value of the expected distributions forgone during the vesting period. For RSU awards that were entitled to distribution equivalent rights, the fair value of the awards was determined using the Company's grant date common share price.

During the six months ended June 30, 2016 the Company granted to executives, employees and directors 1,190,215 RSUs. These awards generally vest over 3 years, with 33% vesting at the end of the grant year and the remainder of the award vesting ratably on a quarterly basis for the remaining 2 years (until the last vesting date as stated in the award agreement). The awards include RSUs with performance conditions that affect the number of shares granted. As such, for the three and six months ended June 30, 2016, total shares granted and compensation expense recognized were based on a determination of the most probable outcome of the performance conditions.

The following table summarizes restricted share unit activity:

For the Six Months Ended June 30, 2016 | Weighted Average Grant Date Fair Value | |||||

Restricted share units outstanding, beginning of period | 2,033,510 | $ | 7.69 | |||

Granted (1)(2) | 1,190,215 | $ | 5.84 | |||

Vested | (268,723 | ) | $ | 8.06 | ||

Forfeited (3) | (8,193 | ) | $ | 7.63 | ||

Restricted share units outstanding, end of period | 2,946,809 | $ | 6.67 | |||

Explanatory Notes:

_________________________________

(1) | Weighted average grant date fair value excludes 360,000 of performance based RSUs for which performance hurdles will be determined in the future. |

(2) | Shareholder approval is required to increase the number of shares available under the Company’s 2011 Stock and Incentive Plan to accommodate these new grants. |

(3) | The forfeited share-based awards are returned to the grant pool for reissuance under the 2011 Stock Plan. |

Note 11 —Earnings (Loss) Per Share

The following table presents the calculation of basic and diluted earnings (loss) per share ("EPS"):

For the Three Months Ended June 30, | For the Six Months Ended June 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(In thousands, except per share data) | |||||||||||||||

Net income (loss) attributable to the Company - basic & diluted | $ | 17,585 | $ | 1,103 | $ | 22,089 | $ | 6,531 | |||||||

Weighted-average shares - basic (1) | 24,096 | 25,302 | 24,725 | 25,291 | |||||||||||

Share options (2) | 423 | 649 | 353 | 673 | |||||||||||

Warrants | 665 | 351 | 511 | 406 | |||||||||||

Unvested RSUs | 577 | 130 | 374 | 134 | |||||||||||

Weighted-average shares - diluted (1) | 25,761 | 26,432 | 25,963 | 26,504 | |||||||||||

Earnings (loss) per share | |||||||||||||||

Basic (1) | $ | 0.73 | $ | 0.04 | $ | 0.89 | $ | 0.26 | |||||||

Diluted (1) | $ | 0.68 | $ | 0.04 | $ | 0.85 | $ | 0.25 | |||||||

Explanatory Notes:

________________________________

(1) | Weighted-average number of shares outstanding basic and diluted excludes Dissenting Shares as of April 28, 2016 (Note 10). Excluding the Dissenting Shares as of January 1, 2016 (Reorganization Transaction), total weighted average shares basic and diluted for the three months ended June 30, 2016, would be 23,472,450 and 25,137,491, respectively, and earnings per share basic and diluted would be $0.75 and $0.70, respectively and for the six months ended June 30, 2016, would be 23,400,600 and 24,638,209, respectively, and earnings per share basic and diluted would be $0.94 and $0.90, respectively (Note 10). |

(2) | For both the three and six months ended June 30, 2016 and June 30, 2015, the Company excluded anti-dilutive share options from the calculation of diluted EPS of $1.9 million and $0.8 million, respectively. |

23

CIFC LLC AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 12—Income Taxes