Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WireCo WorldGroup Inc. | q22016investorsummaryprese.htm |

WireCo WorldGroup

Investor Summary Presentation

Q2 2016

2

Forward-Looking Statements

This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements. It is important to

note that the Company’s performance, and actual results, financial condition or business could differ materially from those expressed in such forward-

looking statements. Forward-looking statements include those containing such words as “anticipates,” “believes”, “continues,” “estimates,” “expects,”

“forecasts,” “intends,” “outlook,” “plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. Factors that could cause or contribute to

such differences include, but are not limited to: the general economic conditions in markets and countries where we have operations; fluctuations in end

market demand; risks associated with our non-U.S. operations; foreign currency exchange rate fluctuations; the competitive environment in which we

operate; changes in the availability or cost of raw materials and energy; risks associated with our manufacturing activities; our ability to meet quality

standards; our ability to protect our trade names; violations of laws and regulations; the impact of environmental issues and changes in environmental

laws and regulations; our ability to successfully execute and integrate acquisitions; comparability of our specified scaled disclosure requirements

applicable to emerging growth companies; labor disturbances, including any resulting from suspension or termination of our collective bargaining

agreements; our significant indebtedness; covenant restrictions; the interests of our principal equity holder may not be aligned with the holders of our

9.5% Senior Notes; and credit-rating downgrades. More detailed information about factors that could affect future performance or results may be found

in our filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2015

and subsequent reports. Forward-looking statements should not be relied upon as a guarantee of future performance or results, nor will they prove to be

accurate indications of the times at or by which any such performance or results will be achieved. The Company undertakes no obligation to update

forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial

condition or business over time.

Non-GAAP Financial Measures

Some of the information included in this presentation is derived from our consolidated financial information but is not presented in our financial

statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Certain of these data are considered “Non-GAAP

Financial Measures” under SEC rules. These Non-GAAP Financial Measures supplement our GAAP disclosures and should not be considered an

alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures can be found in the Appendix to this

presentation. These Non-GAAP Financial Measures are provided as a means to enhance communications with security holders by providing additional

information regarding our operating results and liquidity. Management uses these Non-GAAP Financial Measures in evaluating our performance and in

determining debt covenant calculations. Any reference during the discussion today to EBITDA means Adjusted EBITDA for which we have provided a

reconciliation in the Appendix.

Cautionary Statements

WireCo Business Overview

4

WireCo Overview

Steel (66%) (1)

Large diameter,

highly engineered

rope and electrical

signal transmission

cable

Engineered specialty wire

products used in industrial

end markets

Highly engineered,

made-to-order

synthetic ropes and

technical products

that have strength

characteristics of

steel but weigh

significantly less

Synthetic (34%) (1)

Highly engineered plastic

molding from recycled materials

used in a variety of industrial,

structural and oil and gas

applications

Rope (70% of Sales) (1)

Broad Product Offering

Specialty Wire (19% of Sales) (1) Engineered Products (11% of Sales) (1)

Rope: Diverse End Market Applications

Oil & Gas

Industrial and

Infrastructure

Fishing Maritime Mining

(1) Percentages shown as % of Q2 2016 Sales.

WireCo Q2 2016 Performance

6

Although experiencing difficult market conditions through the first half of the year,

management has organized operating costs and working capital to realign with

current revenue trends

Market stability on Oil and Gas on a sequential basis provided tangible realization of

cost savings initiatives implemented in 2015 and Q1 2016

– Adjusted EBITDA increase of $2.1 million versus Q1 2016 (first time since downturn, but

note, Q3 2016 includes August European holiday months)

– Adjusted EBITDA versus Q2 2015 modest decline - $1.0 million (constant currency basis)

Cash flow for Q2 of $17.9 million, but still working capital opportunity to generate cash

with working capital off ~800bps from its target of 30%

– $28.9 million in swap proceeds during Q2 2016 to help facilitate cash generation

Completing refinancing process allowing enhanced flexibility to invest in strategic

priorities

– Reduced interest expense: current level of ~$72 million annually to ~$45 million

– Ratings agencies upgrades to B3/B (corporate parent rating)

Q2 Summary

(1) Adjusted EBITDA, Credit Agreement EBITDA and Free Cash Flow are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

(2) 2015 Constant Currency (CC) are 2015 actuals calculated at 2016 exchange rates for the same period.

7

$27.1 $26.6

$23.5

$25.6

Q2 '15 Q2 '15 CC Q1 '16 Q2 '16

$173.8 $171.8

$149.0

$156.4

Q2 '15 Q2 '15 CC Q1 '16 Q2 '16

Revenue and EBITDA up vs Q1’16, 1st sequential quarter over quarter growth since downturn

Revenue:

– Increase of $7.4 million in Q2’16 over Q1’16

– Q2’15 relative Q2’16, revenue decline of $17.4 million (FX Impact: $2.0 million)

Adjusted EBITDA(1):

– Increase of $2.1 million in Q2’16 over Q1’16 inclusive of Adjusted EBITDA(1) margin

increase of 70 bps

– Q2 ‘15 relative Q2 ’16, EBITDA decline of $1.5 million (FX impact: $0.5 million), margin up

80 bps

Achieved positive cash generation of $17.9 million, including $28.7 million from Swap

Q2 Performance Summary

Sales Adjusted EBITDA (1)

(1) Adjusted EBITDA, Credit Agreement EBITDA and Free Cash Flow are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

(2) 2015 Constant Currency (CC) are 2015 actuals calculated at 2016 exchange rates for the same period.

Free Cash Flow (1)

FX EUR MXN PLN

2015A 1.11 15.32 3.70

2016A 1.13 18.08 3.87

16.4%

%: Adjusted EBITDA(1) Margin

15.7%

(2)

15.5% 15.6%

(2)

$(9.2)

$1.1

$17.9

Q2 '15 Q1 '16 Q2 '16

8

$27.1 $26.6 $25.6

$0.5

$3.8

$0.9

$1.6 $2.2

Q2'15 Adjusted

EBITDA

FX Q2'15 Constant

Currency

Onshore O&G Maritime Operations SG&A Q2'16 Adjusted

EBITDA(1)

Manage costs to mitigate Oil and Gas market and FX decline relative to Q2’15 ($1.5 million EBITDA

decline); expanding Adjusted EBITDA(1) margins to 16.4%

– FX impact to Adjusted EBITDA(1): $0.5 million

– Sales Impact to Adjusted EBITDA(1): $4.7 million on Constant Currency(2) basis

Onshore Oil and Gas accounting for 81% of EBITDA decline (US rig count average Q2’15 of 896 down to 422 Q2’16)

Maritime weak due to commodity shipping demand (Oil and Gas specifically) accounting for 19% of decline

Stability across remaining markets

– Cost containment measure benefiting EBITDA by $3.8 million; plant operations and SG&A spending reductions

Operations savings: $1.6 million driven by initiatives in procurement, plants and distribution centers

SG&A savings of $2.2 million driven by cost reductions announced in Q1’16

Q2 Adjusted EBITDA(1) Bridge

Adjusted EBITDA(1) Bridge

(1) Adjusted EBITDA is a Non-GAAP Financial Measure. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

(2) 2015 Constant Currency (CC) are 2015 actuals calculated at 2016 exchange rates for the same period.

(1) (2)

9

Cash generation of $17.9 million in Q2’16 including $25.5 million interest payment and $28.7M from Swap

proceeds

Ending Net Debt(1) of $789.9 million (down from $807.7 million in Q1’16)

Working Capital & Cash Management

Key Working Capital Statistics Free Cash Flow (1)

(1) Adjusted EBITDA, Free Cash Flow and Net Debt are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; $ in millions

Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

A/R 68 64 66 68 69

Inventory 137 132 140 156 143

A/P 52 46 54 51 51

WC % of Sales 35.7% 36.2% 36.4% 40.8% 38.3%

FY 2015 Q1 '16 Q2 '16

Adjusted EBITDA (1) $106.4 $23.5 $25.6

Interest (67.8) (5.3) (25.5)

Swap Proceeds 28.7

Tax (7.0) (2.1) (2.0)

A/R 16.7 6.9 (7.9)

Inventory 21.6 (2.6) 1.3

Payable & Other (17.2) (10.2) 4.8

Change in NWC $21.1 ($5.9) ($1.8)

Capex (29.8) (5.1) (4.0)

Other (6.9) (2.5) (1.2)

Cash Flow (Pre FX / Advisory Fees) $16.0 $2.6 $19.9

FX / Advisory Fees (7.9) (1.6) (2.0)

Free Cash Flow (1) 8.0$ 1.1$ $17.9

10

$817

$826

$808 $809 $808

$790

$762

$788

$768

$763

$780

6.0x

6.5x

6.8x

5.3x

5.8x

6.0x

6.3x

6.8x 6.8x

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

7.0x

$750

$770

$790

$810

$830

$850

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Net Debt Swap Adj. Net Debt

Net Debt(1) ended at $789.9 million

– Swap executed in Q2’16 delivering $28.7 million in cash proceeds, Swap Adj. Net Debt excludes restricted cash

Total debt of $834.8 million; total cash of $44.9 million

– Approximately $43.1 million of cash is unrestricted and can be repatriated on tax free basis

Net Debt(1) Levels

Net Debt (1) and Swap Adjusted Net Debt Trend

(2)

(1) Net Debt is a Non-GAAP Financial Measure. See appendix for reconciliation to most directly comparable GAAP Financial Measure; ($ in millions)

(2) Calculated per Credit Agreement definition

Business Outlook

12

Short-Term WireCo Sales Outlook

Sales Results

LTM Rope Sales: $455.6

Industrial and

Infrastructure

Mining Fishing Maritime

Rope Update

Rig count stabilization at

end of Q2, Goldman

Sachs estimates 501 rigs

by year end 2016(1)

Continued penetration in

Middle Eastern market

Portugal offshore project

continuing as scheduled

Slow growth in core

industrial segments

during Q2 expected to

continue

China manufacturing

sector continues to be

slow

Crane sector impacted by

declining OEM backlog

Continued slowdown of

tons mined in NA with

global mining companies

under financial stress

(Coal production down

25.8 percent from YTD

Jul’15 to YTD Jul’16)(2)

Continuing traction in new

markets (Africa / Russia)

and scheduled new

product releases on track

Commodity prices

showing signs of

improvement

Continued population

growth driving increased

demand for seafood

Overall end market

stability

Continued market

penetration in targeted

new areas

Global demand

slowdown for

commodities shipped

via vessel

Oversupply of vessels

from previous years

means less new builds

Several initiatives in

execution phase

including further

penetration of US

market with Lankhorst

synthetics products

($ in millions)

(1): Source – GS Research Model as of 11-Apr-16 (2): Source – U.S. Energy Information Agency Weekly Coal Production Estimates as of July 30, 2016

Oil & Gas

$124.0

$116.2

$106.4

$108.9

Q3 '15 Q4 '15 Q1 '16 Q2 '16

13

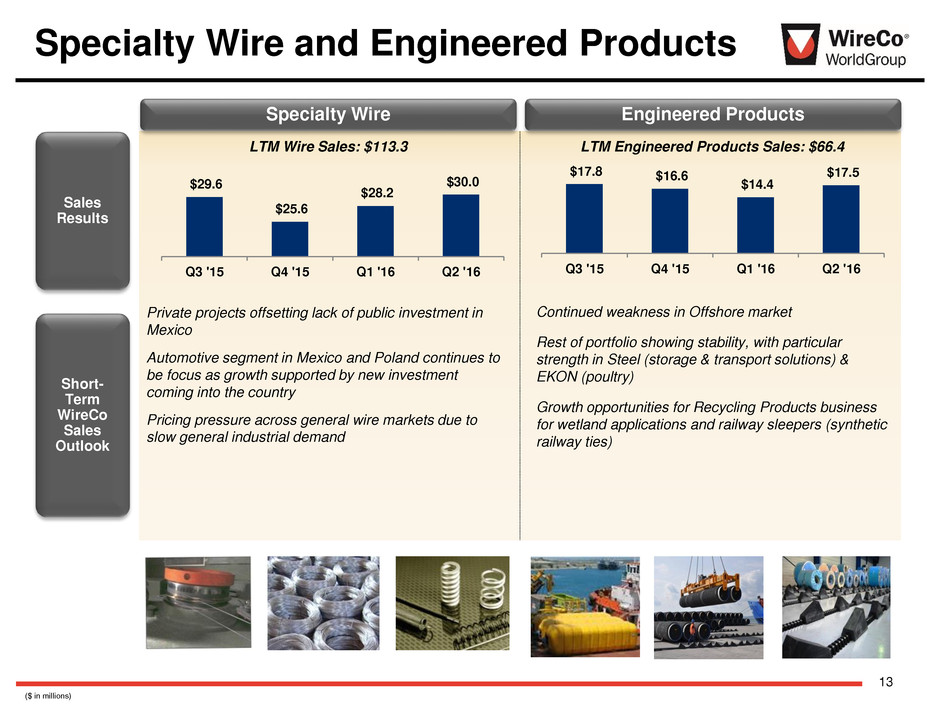

LTM Wire Sales: $113.3

Sales

Results

Specialty Wire

Short-

Term

WireCo

Sales

Outlook

Engineered Products

LTM Engineered Products Sales: $66.4

Specialty Wire and Engineered Products

Continued weakness in Offshore market

Rest of portfolio showing stability, with particular

strength in Steel (storage & transport solutions) &

EKON (poultry)

Growth opportunities for Recycling Products business

for wetland applications and railway sleepers (synthetic

railway ties)

Private projects offsetting lack of public investment in

Mexico

Automotive segment in Mexico and Poland continues to

be focus as growth supported by new investment

coming into the country

Pricing pressure across general wire markets due to

slow general industrial demand

($ in millions)

$29.6

$25.6

$28.2

$30.0

Q3 '15 Q4 '15 Q1 '16 Q2 '16

$17.8 $16.6

$14.4

$17.5

Q3 '15 Q4 '15 Q1 '16 Q2 '16

14

Achieved sales of $156.4M and Adjusted EBITDA of $25.6M in Q2’16, demonstrating first

sequential quarter over quarter increase in sales and EBITDA since commencement of

downturn

Continued expense management with cost savings in line with 2015 quarterly achievements,

achieving Adjusted EBITDA(1) margins of 16.4% in Q2, 80 bps in excess of Q2’15

Disciplined cost and cash management allowing for investment in strategic commercial initiatives

during current commodity market decline

As disclosed publicly, on June 25, 2016, an affiliate of Onex Corporation entered into an

agreement to acquire a majority interest in the Company

– At closing, Leverage Ratio will decrease from 6.8x (see slide 9) to 5.2x based on Q2 LTM EBITDA

– Ratings agency upgrade to B3/B (corporate parent rating)

Completion of the recapitalization will provide substantial operating flexibility, reducing

interest expense from $72 million to $45 million.

Consistent with previous guidance, anti-trust and other closing processes are continuing as

scheduled

Conclusion

(1) Adjusted EBITDA is a Non-GAAP Financial Measure. See appendix for reconciliations to most directly comparable GAAP Financial Measures.

Appendix

16

$27.1 $27.5

$24.5

$23.5

$25.6

15.6%

16.1%

15.5%

15.7%

16.4%

Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

Adjusted EBITDA EBITDA Margin

Adjusted Working Capital (1)

Quarterly Performance Trends

Sales Adjusted EBITDA (1)

Free Cash Flow (1)

(1) Adjusted EBITDA, Adjusted Working Capital and Free Cash Flow are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

(1)

(1)

$173.8

$171.4

$158.4

$149.0

$156.4

Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

$248.2 $247.8

$230.4

$243.0 $239.8

35.7%

36.2% 36.4%

40.8%

38.3%

Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

Adjusted Working Capital % of Sales

($9.2)

$18.1

($0.7)

$1.1

$17.9

Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

17

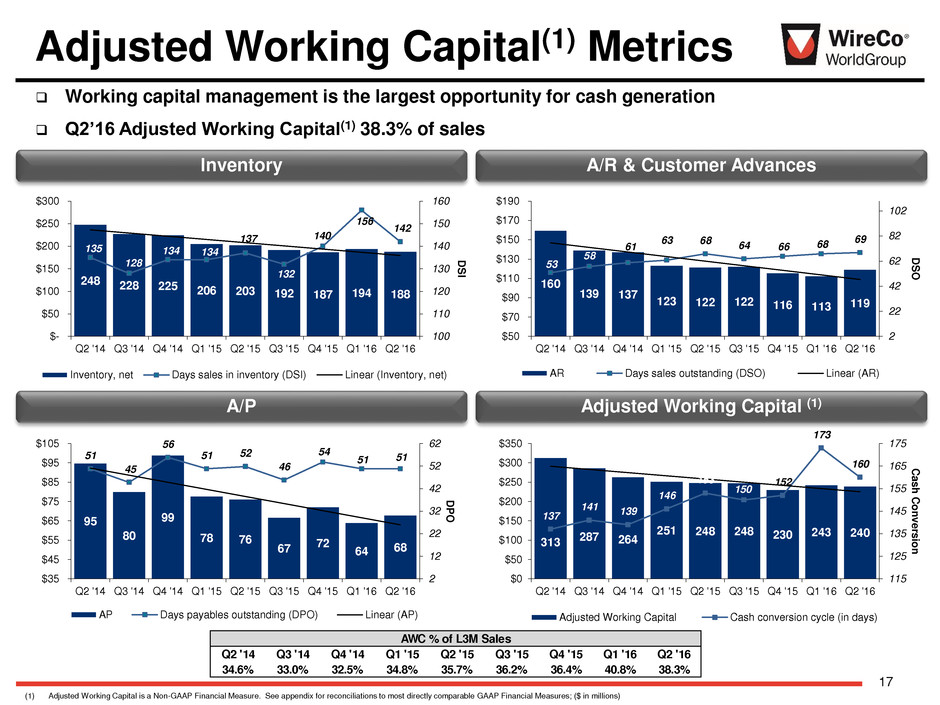

Adjusted Working Capital(1) Metrics

A/P

Working capital management is the largest opportunity for cash generation

Q2’16 Adjusted Working Capital(1) 38.3% of sales

Adjusted Working Capital (1)

A/R & Customer Advances Inventory

(1) Adjusted Working Capital is a Non-GAAP Financial Measure. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

248 228 225 206 203 192 187 194 188

135

128

134 134

137

132

140

156

142

100

110

120

130

140

150

160

$-

$50

$100

$150

$200

$250

$300

Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

D

S

I

Inventory, net Days sales in inventory (DSI) Linear (Inventory, net)

160

139 137

123 122 122 116 113 119

53

58

61

63 68 64 66 68

69

2

22

42

62

82

102

$50

$70

$90

$110

$130

$150

$170

$190

Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

D

S

O

AR Days sales outstanding (DSO) Linear (AR)

95

80

99

78 76

67 72 64 68

51

45

56

51 52

46

54

51 51

2

12

22

32

42

52

62

$35

$45

$55

$65

$75

$85

$95

$105

Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

D

P

O

AP Days payables outstanding (DPO) Linear (AP)

313 287 264

251 248 248 230 243 240

137

141 139

146

153

150

152

173

160

115

125

135

145

155

165

175

$0

$50

$100

$150

$200

$250

$300

$350

Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

C

a

s

h

C

onv

e

rs

io

n

Adjusted Working Capital Cash conversion cycle (in days)

AWC % of L3M Sales

Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16

34.6% 33.0% 32.5% 34.8% 35.7% 36.2% 36.4% 40.8% 38.3%

18

Income Statement Results

2015 2016

Q1 Q2 Q3 Q4 FY Q1 Q2

Sales $180.4 $173.8 $171.4 $158.4 $684.0 $149.0 $156.4

Adj. EBITDA (1) $27.3 $27.1 $27.5 $24.5 $106.4 $23.5 $25.6

Adj. EBITDA Margin 15.2% 15.6% 16.1% 15.5% 15.6% 15.7% 16.4%

Credit Agreement

EBITDA (1) $35.4 $31.9 $31.9 $28.5 $127.7 $27.7 $28.3

Sales Var. QoQ (11.0%) (3.6%) (1.4%) (7.5%) (5.9%) 5.0%

Adj. EBITDA Var. QoQ (20.2%) (0.7%) 1.7% (11.0%) (4.2%) 9.2%

Sales Var. YoY (14.3%) (23.3%) (21.1%) (21.8%) (17.4%) (10.0%)

Adj. EBITDA Var. YoY (25.2%) (34.4%) (29.4%) (28.5%) (14.2%) (5.3%)

(1) Adjusted EBITDA and Credit Agreement EBITDA are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

19

2015 2016

Q1 Q2 Q3 Q4 Q1 Q2

Free Cash Flow (1) $0 ($9) $18 ($1) $1 $18

Interest Paid $6 $28 $6 $25 $5 $26

CapEx $9 $8 $5 $7 $5 $4

Adjusted Work Capital

(AWC)(1) $251 $248 $248 $230 $243 $239.8

AWC % of Sales 34.8% 35.7% 36.2% 36.4% 40.8% 38.3%

Net Debt (1) $817 $826 $808 $809 $808 $790

Net Leverage 5.3x 5.8x 6.0x 6.3x 6.8x 6.8x

Cash Flow

Balance Sheet

Cash Flow and Balance Sheet Results

(1) Free Cash Flow, Adjusted Working Capital and Net Debt are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

20

Adjusted EBITDA Reconciliation

Non-GAAP Reconciliations

(1) Reflects correction of an error of $3,051 in unrealized foreign currency gains which were previously excluded from net loss; ($ in 000’s)

Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Q1 2016 Q2 2016

Net Loss (GAAP) (4,068)$ (15,045)$ (5,192)$ (11,203)$ (35,508)$ (20,475)$ (21,875)$

Plus:

Interest expense, net 18,988 16,637 19,597 15,364 70,586 18,971 16,204

Income tax expense (benefit) (7,561) 6,709 1,446 (472) 122 4,412 (123)

Depreciation and amortization 11,375 11,138 11,232 10,527 44,272 10,747 10,783

Foreign currency exchange losses (gains), net 4,278 2,689 (5,626) 598 1,939 3,544 13,869

Share-based compensation 1,926 1,926 1,926 1,718 7,496 1,736 1,574

Other expense (income), net 309 (80) 169 447 845 (59) 1,910

Loss on extinguishment of debt - - - - - - -

Acquisition costs - - - - - - -

Purchase accounting (inventory step-up and other) - - - - - - -

Advisory fees 984 991 953 979 3,907 767 744

Reorganization and restructuring charges 759 1,498 2,956 3,463 8,676 3,769 2,505

Effect of inventory optimization program - - - - - - -

Non-cash impairment of fixed assets - - - 3,238 3,238 - -

Other adjustments 352 587 58 (159) 838 47 28

Adjusted EBITDA (Non-GAAP) 27,342$ 27,050$ 27,519$ 24,500$ 106,411$ 23,459$ 25,619$

Plus:

Additional reorganization and restructuring charges 89 172 - - 261 - -

Additional effect of Inventory Optimization Program - - 143 327 470 330 193

Production curtailment 633 491 737 1,000 2,861 - -

Impact of nonrecurring resin procurement costs - - 920 - 920 - -

Impact of nonrecurring and unusual items in Brazil 2,609 1,136 - - 3,745 - -

Impact of nonrecurring and unusual items in Portugal - - - - - 1,113 641

Pro forma selling and administrative expense savings 3,397 1,850 1,375 1,375 7,997 917 -

Pro forma manufacturing facility consolidation 1,173 1,173 1,173 1,173 4,693 1,173 1,173

Pro forma manufacturing facility labor savings - - - - - 659 659

Additional other adjustments 202 - - 157 359 - -

Credit Agreement EBITDA (Non-GAAP) 35,445$ 31,872$ 31,868$ 28,532$ 127,717$ 27,651$ 28,285$

(1)

(1)

21

Adjusted Working Capital

Non-GAAP Reconciliations

($ in 000’s)

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Accounts receivable, net 126,549$ 131,707$ 134,297$ 124,463$ 122,582$ 128,412$

Inventories, net 205,567 202,889 192,211 186,964 194,251 188,403

Accounts payable (77,656) (76,182) (66,738) (72,153) (64,005) (67,890)

Customer advances (3,128) (10,204) (11,964) (8,918) (9,853) (9,121)

Adjusted Working Capital (Non-GAAP) 251,332 248,210 247,806 230,356 242,975 239,804

Plus: All other current assets 67,177 57,483 49,852 33,494 77,156 56,065

Less: All other current liabilities (65,251) (41,820) (56,393) (47,672) (411,192) (866,828)

Working capital (GAAP) 253,258$ 263,873$ 241,265$ 216,178$ (91,061)$ (570,958)$

22

Free Cash Flow Reconciliation

Non-GAAP Reconciliations

($ in 000’s)

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Net cash provided by (used in) operating activities (GAAP) 12,600$ (896)$ 24,299$ 7,043$ 5,672$ 22,380$

Less: capital expenditures (9,212) (8,250) (5,367) (6,973) (5,055) (3,958)

Effect of exchange rates on cash and cash equivalents (4,460) 608 (547) (560) 461 (787)

Other items 940 (700) (263) (221) (12) 235

Free Cash Flow (Non-GAAP) (132)$ (9,238)$ 18,122$ (711)$ 1,066$ 17,870$

23

Net Debt Reconciliation

Non-GAAP Reconciliations

($ in 000’s)

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Borrowings under Revolving Loan Facility 57,650$ 75,600$ 54,570$ 42,305$ 49,900$ 53,005$

Term Loan due 2017 323,532 308,038 307,246 306,454 305,662 299,105

9.00% Senior Notes due 2017 56,000 56,000 56,000 56,000 56,000 56,000

9.50% Senior Notes due 2017 425,000 425,000 425,000 425,000 425,000 425,000

Capital lease obligations 1,050 1,246 1,460 1,619 1,900 1,693

Total debt at face value plus capital lease obligations (GAAP) 863,232 865,884 844,276 831,378 838,462 834,803

Less: Cash and cash equivalents (45,193) (38,044) (34,607) (21,060) (28,941) (43,124)

Less: Restricted cash (1,070) (1,633) (1,584) (1,522) (1,791) (1,819)

Net Debt (Non-GAAP) 816,969$ 826,207$ 808,085$ 808,796$ 807,730$ 789,860$