Attached files

| file | filename |

|---|---|

| EX-10.10 - EXHIBIT 10.10 - WireCo WorldGroup Inc. | exhibit1010_2015.htm |

| EX-32.1 - EXHIBIT 32.1 - WireCo WorldGroup Inc. | exhibit321_2015.htm |

| EX-31.2 - EXHIBIT 31.2 - WireCo WorldGroup Inc. | exhibit312_2015.htm |

| EX-21 - EXHIBIT 21 - WireCo WorldGroup Inc. | exhibit21_2015.htm |

| EX-32.2 - EXHIBIT 32.2 - WireCo WorldGroup Inc. | exhibit322_2015.htm |

| EX-31.1 - EXHIBIT 31.1 - WireCo WorldGroup Inc. | exhibit311_2015.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K | ||

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-174896

WireCo WorldGroup Inc.

(Exact name of registrant as specified in its charter)

Delaware | 27-0061302 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

2400 West 75th Street Prairie Village, Kansas | 66208 | |||

(Address of registrant's executive offices) | (Zip Code) | |||

(816) 270-4700 | ||||

(Registrant's telephone number, including area code) | ||||

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES x NO ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ¨ NO x

NOTE: While the Registrant is a voluntary filer not subject to the filing requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act"), the Registrant has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

Non-accelerated filer | x | Smaller reporting company | ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). YES ¨ NO x

There is no market for the Registrant’s equity, all of which is held by affiliates of WireCo WorldGroup (Cayman) Inc. (the “Company”). As of March 10, 2016, the Registrant had 100 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

WireCo WorldGroup Inc.

Annual Report

For the year ended December 31, 2015

TABLE OF CONTENTS

PART I | |

PART II | |

PART III | |

PART IV | |

1

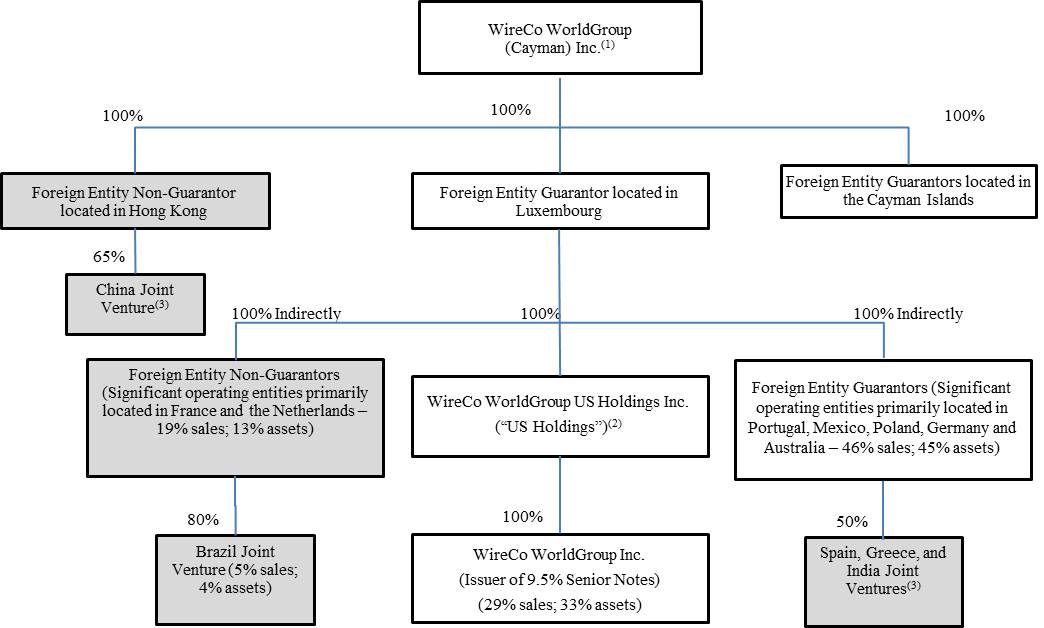

Our Organization

The diagram below illustrates our current corporate structure at December 31, 2015, including WireCo WorldGroup Inc. (the "Registrant"), the issuer of the 9.50% Senior Notes due 2017, the guarantors and non-guarantors designated by the shaded boxes. WireCo WorldGroup (Cayman) Inc. ("WireCo" or the "Company") indirectly owns 100% of the voting common stock of the Registrant and all of the subsidiaries guaranteeing the 9.50% Senior Notes. For a list of our subsidiaries, refer to Exhibit 21. Percentages of sales or assets represent the respective portion of consolidated WireCo net sales for the year ended December 31, 2015, or assets at December 31, 2015.

(1) | This entity is 82% beneficially owned by Paine & Partners Fund III, of which Paine & Partners, LLC ("Paine & Partners") is the manager. |

(2) | Certain current and former members of management beneficially own 3.3% of the non-voting common stock of U.S. Holdings, reflected as non-controlling interests. |

(3) | For subsidiaries in which the Company does not have a controlling interest, we account for our respective ownership interests as equity method investments. |

2

Cautionary Information Regarding Forward-Looking Statements

The Securities and Exchange Commission (“SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This report contains statements that relate to future events and expectations and, as such, constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “continues,” “estimates,” “expects,” “forecasts,” “outlook,” “plans,” “projects,” “should,” “targets,” “will,” or the negative of those words or other comparable terminology. All statements that reflect WireCo's expectations, assumptions or projections about the future other than statements of historical fact are forward-looking statements, including, without limitation, forecasts concerning end-market growth or other trend projections, anticipated financial results or operating performance, and statements about WireCo's business plans and strategies.

Forward-looking statements are subject to a number of known and unknown risks, uncertainties and other factors and are not guarantees of future performance. Actual results, performance or outcomes may differ materially from those expressed in or implied by those forward-looking statements. A number of factors or combination of factors including, but not limited to, the factors identified below and those discussed in Item 1A, Risk Factors, of this annual report may cause WireCo’s actual results to differ materially from those projected in any forward-looking statements.

Readers are strongly encouraged to consider these factors and the following factors when evaluating any forward-looking statements concerning the Company:

• | the general economic conditions in markets and countries where we have operations; |

• | fluctuations in end market demand; |

• | foreign currency exchange rate fluctuations; |

• | risks associated with our non-U.S. operations; |

• | our ability to meet quality standards; |

• | our ability to protect our trade names; |

• | the competitive environment in which we operate; |

• | changes in the availability or cost of raw materials and energy; |

• | risks associated with our manufacturing activities; |

• | violations of laws and regulations; |

• | the impact of environmental issues and changes in environmental laws and regulations; |

• | our ability to successfully execute and integrate acquisitions; |

• | comparability of our specified scaled disclosure requirements applicable to emerging growth companies; |

• | labor disturbances, including any resulting from suspension or termination of our collective bargaining agreements; |

• | our significant indebtedness; |

• | covenant restrictions; |

• | the interests of our principal equity holder may not be aligned with the holders of our 9.5% Senior Notes; and |

• | credit-rating downgrades. |

Any forward-looking statements that WireCo makes in this annual report speak only as of the date of such statement and we disclaim any intention or obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law.

3

PART I

Item 1.Business

INTRODUCTION

Unless otherwise indicated, the financial information included in this annual report on Form 10-K are those of WireCo WorldGroup (Cayman) Inc., its wholly-owned subsidiaries, including WireCo WorldGroup Inc., and subsidiaries in which it has a controlling interest. In this report, unless the context otherwise requires, “WireCo,” the “Company,” “we,” “our” or “us” means WireCo WorldGroup (Cayman) Inc. and all subsidiaries consolidated for the purposes of its financial statements. WireCo WorldGroup (Cayman) Inc. is an exempted company incorporated under the laws of the Cayman Islands in 2008. WireCo WorldGroup Inc. (the "Registrant") was originally founded in 1931 as Wire Rope Corporation of America, Inc.

COMPANY OVERVIEW

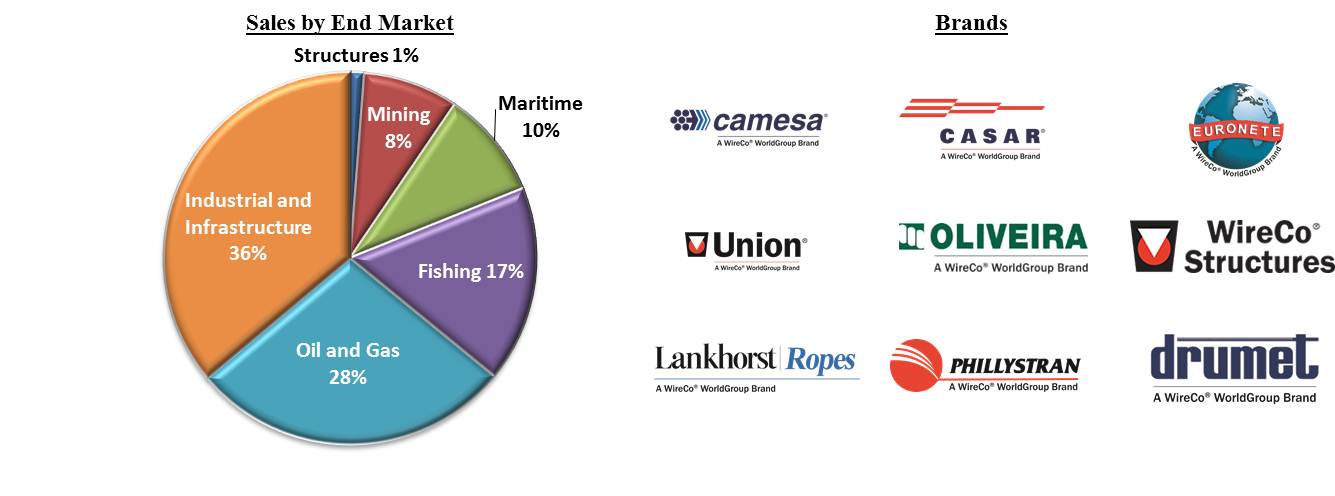

We are a leading global manufacturer of both steel and synthetic rope, specialty wire and engineered products serving a diverse range of end markets, geographies and customers. We maintain a broad portfolio of critical products across the end markets we serve, including, but not limited to, industrial and infrastructure, oil and gas (both offshore and onshore), fishing, mining, maritime, structures, poultry and storage systems. We market our products under well-known brands including: Union™, CASAR®, Lankhorst Ropes®, Camesa®, Euronete™, Oliveira®, Phillystran®, Drumet®, Lankhorst Engineered Products™ and Lankhorst Mouldings™.

Our highly engineered, specialized ropes are "mission-critical" equipment components used in applications, such as heavy lifting, pulling, mooring, supporting and suspension. Our products' performance, quality and safety are of the utmost importance to our customers to limit exposure to costly unplanned operational disruptions and downtime. The consumable nature of our products and rigid replacement cycles result in a recurring revenue base over time.

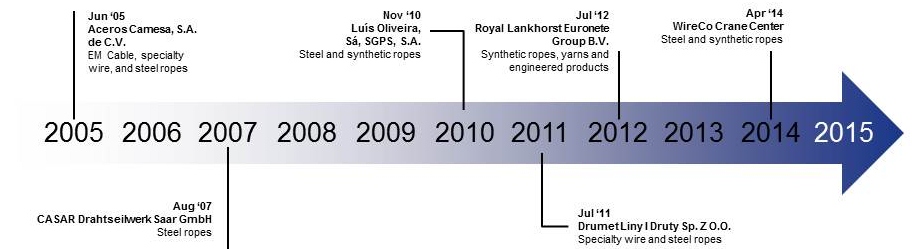

We operate 24 manufacturing facilities in 8 countries, which are supplemented by a global network of company-owned distribution facilities, consignment centers, distributor partnerships and sales offices. In addition, we have non-consolidated joint ventures with manufacturing activities in India, Spain, Norway, Greece and China. Our acquisitions have enhanced our leadership position by creating new growth opportunities, served to diversify and increase end market penetration and reduced our dependence on external wire suppliers. The timeline below highlights a few of the more significant acquisitions we have made over the past decade.

4

OUR STRENGTHS

• | Mission-Critical Products with Recurring Revenue. Due to the mission-critical nature of our products, customers choose our products based on quality, service and engineering support. Rigorous operating conditions require frequent replacement, generating a steady stream of recurring revenue. |

• | Highly Diversified Business Mix. Our revenue base is spread across a diverse mix of end-user markets, geographies, products and brands. We believe our overall business diversity helps to mitigate the impact of a downturn in any one product, end market or region. In 2015, no single end market represented more than 26% of our total sales. In addition, we are geographically diversified with approximately 71% of sales outside of the United States ("U.S.") during 2015. |

• | Leading Market Share. We believe we hold a top market position in each of the end markets in which we choose to participate. We attribute our leadership position to our engineering capabilities and technical expertise underpinned by a heritage of over 75 years of innovation, quality, industry experience and superior customer service. We are actively pursuing the high margin global marketplace, where quality and service is key for buying decisions. |

• | Track Record of Successful Acquisitions. We have been able to successfully execute several key acquisitions resulting in a market leading position and diversification among products, end markets and geographies. |

• | Consistent Margins Despite Volatile Raw Material Prices. We have pass-through pricing mechanisms for all products at the time of sale to reflect current commodity prices, which allows for stabilized margins during volatile commodity markets. |

• | Organic Innovation. We introduced, enhanced or improved 20 products during 2015. Driving this organic innovation is a team of over 70 research, design and development engineers involved in product conception, research, design, development, testing and full technical customer support. We employ some of the end markets' most creditable subject matter experts, currently serving or having served on committees such as the Wire Rope Technical Board, American Society of Mechanical Engineers B30.30 Committee, and in Europe, The Drahtseil-Vereinigung for the wire rope industry. In addition, our experienced manufacturing team of plant managers and engineers has extensive industry experience, allowing us to leverage a talented and knowledgeable workforce to deliver high-performance products to our customers. |

REPORTABLE SEGMENT

Our operations consist of one operating segment and one reportable segment. Refer to Note 14—“Segment and Geographic Area Information” to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data, of this annual report for additional information.

PRODUCTS

The table below summarizes each product's contribution as a percentage of our total consolidated sales during 2015, 2014 and 2013.

Product Sales as a Percentage of Total Consolidated Sales

2015 | 2014 | 2013 | ||||||

Rope | 73 | % | 73 | % | 74 | % | ||

Specialty Wire | 17 | % | 16 | % | 16 | % | ||

Engineered Products | 10 | % | 11 | % | 10 | % | ||

100 | % | 100 | % | 100 | % | |||

ROPE

Product Portfolio

We are a leading global producer with a broad product offering of steel rope, electromechanical cable ("EM Cable"), synthetic rope and synthetic yarns. These customized products are capable of withstanding extremely heavy loads and harsh operating environments with specific quality, durability, weight, functionality and performance capabilities. Given the intensity of rope usage in certain applications and their consumable nature, they are subject to strict inspection and removal criteria, necessitating frequent replacement. As a result, the aftermarket represents a significant portion of highly engineered rope sales.

5

Our products are mainly used for lifting equipment within the oil and gas, fishing, mining, maritime and industrial and infrastructure end markets.

We sell our products through a global sales force consisting of regional sales managers and application or end market specialists. To enhance our overall level of service to our customers, we have an extensive engineering and research and development organization that is actively involved in developing innovative products for our customers, leading technical training seminars surrounding our products and fieldwork with our customers to maximize product performance. We service our customers through a global network of owned distribution centers, consignment centers and distributor partnerships in order to provide fast delivery, short lead-times, consistent product supply and high quality customer service.

The below table summarizes each product's contribution as a percentage of our total consolidated sales during 2015, 2014 and 2013.

Rope Product Portfolio Sales as a Percentage of Total Consolidated Sales

2015 | 2014 | 2013 | ||||||

Steel Rope | 50 | % | 53 | % | 49 | % | ||

Steel EM Cable | 3 | % | 5 | % | 5 | % | ||

Total Steel | 53 | % | 58 | % | 54 | % | ||

Synthetic Rope | 17 | % | 12 | % | 16 | % | ||

Synthetic Yarns | 3 | % | 3 | % | 4 | % | ||

Total Synthetic | 20 | % | 15 | % | 20 | % | ||

Rope Total Sales | 73 | % | 73 | % | 74 | % | ||

Steel Rope consists of a group of high-carbon steel wire strands helically and symmetrically twisted and “closed” together around a central core. Steel rope can range from small specialty rope of 1/16th of an inch to large mining ropes of up to five inches in diameter. We produce both highly engineered specialty products and steel rope suitable for a variety of uses, such as drill lines, mining ropes, cranes, mooring lines, bridges and logging. Major applications of these highly engineered products involve mineral mining, oil and gas exploration, fishing, maritime, construction and heavy industry (e.g., cranes).

EM Cable is a highly engineered, customized electrical power and electrical signal transmission cable that is armored with high-carbon steel wire or special metal alloys, providing protection for the electrical conductors inside and various mechanical performance properties. Our EM Cable product is used in the oil and gas exploration industry and provides a link to the surface from underground instrumentation. The cable not only transmits data, but also acts as a strength member for the insertion and removal of the geophysical tools used for data-logging and perforating oil and gas wells. Over the past several years, advancements in drilling technology have opened up large shale gas reserves, creating a significant EM Cable opportunity in the shale oil and gas market.

Synthetic Ropes include high tenacity fiber ropes, strands, braids and strength members made from fibers such as Kevlar®, Dyneema®, Twaron®, Technora® (all registered trademarks are owned by their respective owners) and our own proprietary formulations. These products are unique in that they have the strength characteristics of steel rope but weigh significantly less. Synthetic ropes are primarily used in maritime, offshore oil and gas, fishing and other industries that require specific operating strength, buoyancy (when in high-modulus polyethylene), corrosion resistance or weight tolerance characteristics beyond wire rope. These include mooring lines, fishing ropes, fishing nets, life and winch lines, structural and support lines, boat rigging, power cables and broadcast tower guy cables. For certain applications, fiber ropes offer attractive physical characteristics compared to steel. Although fiber has comparative strength features, it is known to have greater flexibility and lighter weight, which allows submersion to approximately 10,000 meters, allowing far greater depth reach with virtually no increase in weight. Synthetic products have become crucial in the offshore oil and gas markets as greater drilling depths have made steel ropes impractical and obsolete due to the weight of the steel rope. We have pioneered the development of new products, which combine the use of steel wire ropes with high-strength synthetic components that improve the strength to weight ratio in the finished product.

Synthetic Yarn products, such as tapes, yarns and monofilaments, are used in a variety of end market applications including flexible intermediate bulk containers, horticulture, agriculture, cables, concrete reinforcement, synthetic grass, geotextiles, electrical fencing, antiballistics, luggage, sports products, industrial and infrastructure usage and synthetic ropes. We also manufacture synthetic yarns for use in the production of our own synthetic ropes.

6

End Markets

Our rope products provide solutions in a variety of end markets with attractive growth opportunities, focusing on premium high-margin business. A breakdown of our net sales for the year ended December 31, 2015 by end market, as well as our rope brands were as follows:

The following provides a detailed description regarding some uses of our products by end market:

Industrial and Infrastructure - This end market encompasses industrial and infrastructure applications that use steel rope in various industries, including construction, transportation, defense, automotive, agriculture and logging. Crane ropes sold within this end market consist of both Original Equipment Manufacturers ("OEMs") tied to new crane build annually and a much larger global market of end users of cranes in the aftermarket. Crane ropes are a consumable working component of cranes that require replacement every one to four years depending on cycle counts, working conditions and operator experience.

Oil and Gas - Steel and synthetic ropes are used throughout the oil and gas industry, providing solutions, from exploration all the way to production. We have a full suite of product offerings for onshore oil and gas (well servicing, tubing and sandlines, drill lines and mast raising lines), offshore above platform (drill lines, buoy pendants, tensioner ropes, riser ropes, cranes and cable lays) and solutions for offshore mooring systems below platform (deep water mooring, anchor lines, mooring systems, modulines and synthetic tethers). Onshore and offshore above platform ropes are mission critical and typically need to be replaced every 6 to 12 months depending on the application and operating environment.

Fishing - The fishing industry encompasses applications that use steel ropes, synthetic ropes and netting for fishing and other related uses. We are a leading global supplier of these products to the fishing industry, with worldwide distribution of our recognized Oliveira and Euronete brands. We believe we are the only company with a complete fishing gear range and the unique ability to produce netting, wire and synthetic ropes. Our products are consumable wire ropes and nets for fishing vessels and fish farms, which need to be replaced based on level of activity. Our research and development department is constantly working to build on our history of providing innovative and unique products to the markets that are at the front line of the industry.

Maritime - Steel and synthetic ropes are used for various maritime operating applications including mooring, tugging, lifting and anchoring. The maritime business is managed with ship owners directly or with affiliated companies, like ship yards and ship management companies with regular activity in vessels designed for bulk cargo, containers and tankers for shipping product globally, as well as working boats built for towing, dredging, drilling, offshore installations, holiday cruises and defense purposes. These types of ropes typically need to be replaced every 12 to 18 months depending on the application and operating environment.

Mining - Our steel rope products are primarily consumable working ropes for mining operations. We participate both in the underground and surface mining market for the extraction of coal, copper, iron ore and other minerals and ores. Due to the severe wear-and-tear that steel ropes endure in surface mining operations, they typically need to be replaced every two to four months depending on the application and operating environment.

Structures - Our steel and synthetic rope products are used in bridges, stadiums, towers and other cable supported structures.

7

SPECIALTY WIRE

Product Portfolio

Our specialty wire provides a competitive edge, fulfilling substantially all of our internal supply chain needs. The majority of our volume in wire is high-carbon steel wire for use in the production of our own steel ropes and EM Cable products. For our external customers, we offer a variety of selective products such as prestressed concrete ("PC") strand, PC wire, roping and automotive wire, tire bead, spring and duct, guy strand and staple band, which are manufactured for a wide variety of uses in a broad range of industries. Of our specialty wire production for the year ended December 31, 2015, we produced 43% for internal use and the remaining for our external customers. Our brands for specialty wire are as follows:

End Markets

Besides serving our internal needs, we serve niche markets in the infrastructure and industrial industries. Our primary infrastructure products are PC strand and PC wire. PC strand is used in highways, dams, silos, long extension bridges and industrial structures and is a reinforcing component for concrete. PC wire is used in residential construction in areas of Mexico as well as railroad ties in the U.S. and Mexico. Our specialty wire products are also commonly used as concrete reinforcement for infrastructure projects. For the industrial market, we serve a variety of applications including air conditioning, automotive, furniture and fencing applications. Guy strand is used in telecommunications and utilities and staple band is used to manufacture staples for various industries.

ENGINEERED PRODUCTS

Product Portfolio

Engineered products are highly engineered, plastic injected molded products and sheets including strakes for vibration suppression, piggyback blocks, coil and pipe storage and railway sleepers. Our products have a very low maintenance cost, long useful life, high impact resistance and perform in extreme temperature conditions. In many cases, these products are used as a substitute for steel, concrete or wood alternatives due to their unique engineered design, performance characteristics and price. Most products are custom designed by our dedicated team of research and development engineers to meet specific customer requirements. Since these applications are complementary with some of our wire and synthetic rope products, we can offer our customers a "complete solution." An example is our oil-platform mooring systems where we offer both the high strength synthetic ropes and the related buoyancy modules. Our sales and distribution of engineered products are done primarily in Europe. Together with our global network of dedicated distributors and agents, we are able to serve customers around the world.

End Markets

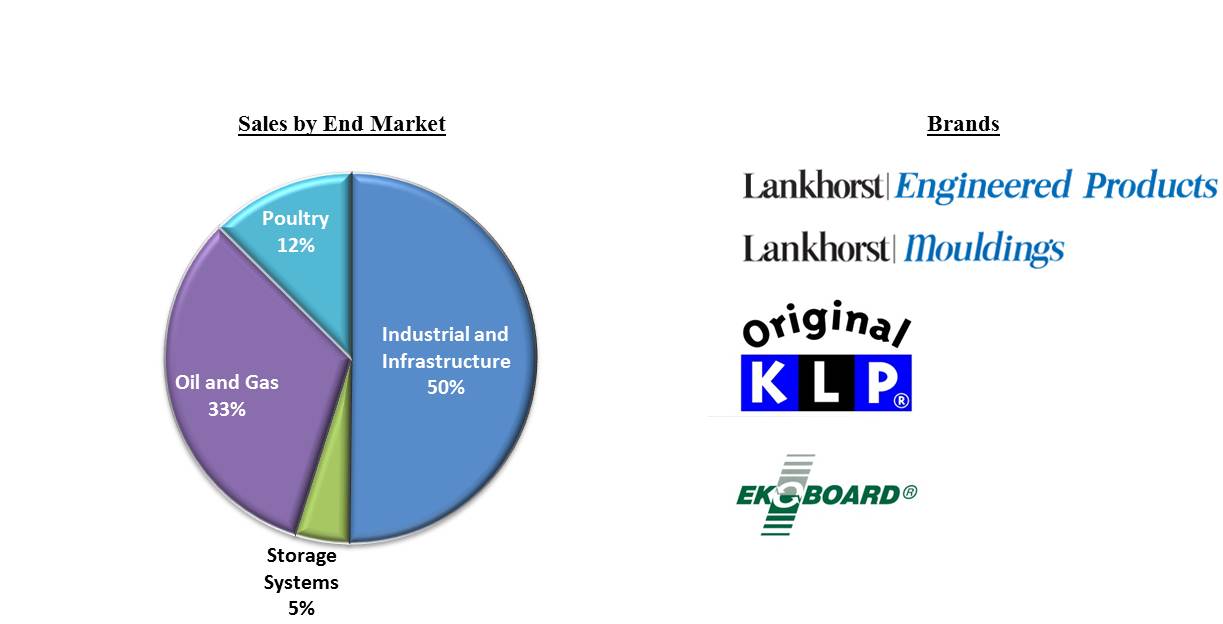

Engineered products are used in the following end markets: oil and gas, poultry, industrial and infrastructure and storage systems. Within oil and gas, we produce applications ranging from impact protection to buoyancy to anti-oscillation. Our poultry end market includes poultry manufacturing conveyor belts for eggs and manure that are tailored for the end application. The industrial and infrastructure end market produces manholes, poles, planks, decking sheet, furniture, bridges and railroad cross ties. Engineered products are used in pipe storage systems for worksite mobility and coil storage solutions, such as steel plants, service centers, automotive plants and transportation. A breakdown of our net sales for the year ended December 31, 2015 by end market, as well as our engineered products brands were as follows:

8

RAW MATERIALS

The main raw materials that we use to manufacture our rope products are high-carbon steel wire, polymers, such as polypropylene and polyethylene, and synthetic fibers, such as polyester and polyamide (nylon) and high tenacity synthetic fibers, such as Ultra High Molecular Weight Polyethylene. The main raw material that we use to manufacture wire is high-carbon steel rod. Our steel rope and wire products are made from steel rod that is primarily made from recycled steel scrap and iron ore and our synthetic ropes are primarily composed of new raw materials. Engineered products are made from new plastic materials (36%) and recycled plastic materials (64%). The recycled plastics are sourced from agricultural foils, bottle caps and industrial waste. All of our products have a variety of different coatings or ancillary materials required to complete finished products. Examples include zinc, grease, lubrication, master batch for coloring, polyurethane, fittings and hardware.

Due to the wide geographic dispersion of our production facilities, we use numerous suppliers for the raw materials needed in our operations. We are not significantly dependent on any one or a limited number of suppliers, especially considering we are vertically integrated and manufacture the majority of the wire, fibers and cores we use in our ropes. These raw materials are purchased at regular intervals, usually on a monthly or quarterly basis, depending on pricing and market conditions.

MANUFACTURING FOOTPRINT

We have a comprehensive global footprint, with both highly engineered value-added manufacturing and low cost production serving diverse end markets. Our rope products are produced on a diverse set of manufacturing assets and our engineered products have unique production capabilities, such as low and high pressure injection molding, flat-die extrusion and high production flexibility. Refer to Item 2, Properties, of this annual report for more information on our manufacturing footprint.

CUSTOMERS

We serve a broad customer base, both in terms of industries and geographic regions. Our rope and specialty wire customers include distributors, OEMs and end users of our products in the various industries we serve. Engineered products' customers include: engineering firms, contractors, multinational oil and gas energy companies, offshore pipelayers, steel manufacturers and railroads. Due to our diversified customer base, our top 10 customers only accounted for approximately 10% of our net sales in 2015, and our largest customer accounted for less than 2% of net sales in 2015.

BACKLOG

Our policy is to include only firm unfilled orders shippable within twelve months in backlog. The backlog of orders for the principal products manufactured and marketed was $73.3 million at December 31, 2015, relating primarily to offshore oil and gas contracts. The backlog of orders at December 31, 2014 was $156.6 million. We anticipate that most of the 2015 backlog of orders will be filled during fiscal year 2016.

9

COMPETITIVE CONDITIONS

We are subject to competitive conditions in most end markets. Our competitors include other global well-capitalized wire rope manufacturers, local and specialized wire manufacturers and niche markets with a wide variety of specialized producers of plastic solutions and large producers of steel, concrete and wood alternatives. In spite of this moderately competitive environment, we have established market leading positions in our various end markets under our distinguished brands and design capabilities. We generally compete on the basis of product performance, sales and technical service support and price.

INTELLECTUAL PROPERTY

We believe that our patents, brands, trademarks and other intellectual property provide us with a significant competitive advantage. We own numerous patents and patent applications worldwide. We regularly file patent applications and obtain issued patents resulting from our research and development activities. Although we use patented inventions throughout our product portfolio, our business is not substantially dependent on any single patent or group of patents. We have a significant number of trademarks registered around the world covering our company names and material brands. These trademarks include WireCo WorldGroup®, WireCo®, Union™, CASAR®, Lankhorst Ropes®, Camesa®, Euronete™, Oliveira®, WireCo® Structures, Phillystran®, Drumet®, Lankhorst Engineered Products™ and Lankhorst Mouldings™. In addition, we have trademarks registered in the U.S. and some foreign countries to protect our specific “marker strand” designs, which, consistent with market practice, designate our steel rope products as well as various brands. We have also trademarked our orange-colored plastic coating used to enhance the performance of our steel rope product lines.

RESEARCH AND DEVELOPMENT

We believe our focused agenda of research and development initiatives has enhanced our reputation as one of the leading product innovators in the industries that we serve. Demand for our products developed in previous years continues to increase as our customers recognize the added value to their respective business. In 2015, we introduced, enhanced or improved over 20 products to the diverse global industries that we serve. These new products have been included in our already extensive and highly engineered product portfolio. Our strategy is to continue to build on our history of innovation and technological expertise while bringing new, highly engineered products to market. Our investment in research and development was $4.8 million, $5.3 million and $4.0 million for the years ended December 31, 2015, 2014 and 2013, respectively.

REGULATION - Environmental Matters

Our business operations and facilities are subject to a number of laws and regulations, which govern the discharge of pollutants and hazardous substances into the air and water; the handling, storage, use and disposal of such materials; and remediation of contaminated sites. Operations at our facilities include transforming steel rods and wire into steel rope or cable, which can produce wastewater, spent acid and petroleum waste; and transforming polymers and synthetic fibers into fiber strand and fiber rope, which may be recycled or may produce polymer or synthetic fiber waste; and transforming lumber into wooden reels, which may produce waste that may be recycled or incinerated. We also store certain petroleum products and hazardous substances that we use in our operations. Due to the nature of these activities, our facilities are subject to routine inspection by regulators. Our regulators have not identified any material findings or situations that could have a material impact on our operations. Although we continually incur expenses and make capital expenditures related to environmental protection, we do not anticipate that future expenditures should materially impact our financial condition, results of operations or liquidity.

EMPLOYEES AND LABOR RELATIONS

At December 31, 2015, we employed approximately 3,800 employees worldwide, not including our non-consolidated joint ventures in India, Spain, Norway, Greece and China, of which approximately 700 were employed by the Registrant in the U.S. Approximately 34% of our employees were covered by collective bargaining agreements, of which none are subject to agreements that expire within one year of December 31, 2015. We believe we will be able to successfully negotiate all such contracts as they come due.

FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

We conduct a significant amount of our business and have a number of operating facilities in countries outside the United States. Refer to Note 14—“Segment and Geographic Area Information” to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data, of this annual report for financial information about our domestic and foreign operations.

10

AVAILABLE INFORMATION

We make available free of charge on our website, www.wirecoworldgroup.com, our current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the Securities and Exchange Commission ("SEC"). The SEC maintains an Internet website, www.sec.gov, which contains reports and other information issuers file electronically with the SEC. Interested parties may also read and copy any of our filings at the SEC’s Public Reference Room at 100 F Street N.E., Room 1580, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Item 1A.Risk Factors

Our business is subject to various risks, many of which are not exclusively within our control and may cause actual performance to differ materially from historical or projected future performance. The risks described below could materially and adversely affect our business, financial condition, results of operations or cash flows. These risks are not the only risks that we face and our business operations could also be affected by additional factors that are not presently known to us or that we currently consider to be immaterial to our operations. See “Cautionary Information Regarding Forward-Looking Statements” on page 3 of this annual report for cautionary statements regarding forward-looking statements.

Risks Relating to our Business

Worldwide economic conditions could negatively impact our business.

The general worldwide economic conditions continue to affect many industries, including industries in which we or our customers operate. These conditions have and could continue to negatively impact our business by adversely affecting, among other things, our: net sales; operating income; margins; cash flows; suppliers' and distributors' ability to perform and the availability and costs of materials; customers' orders; customers' ability to access credit; and customers' ability to pay amounts due to us. As a result of the weakening oil and gas end market during 2015, we reduced our factory work force in the United States, Mexico and Poland and implemented work force reductions in several administrative departments. We have been reducing our inventory in order to better match current demand. In addition, we are strategically supporting certain customers in the short-term with longer payment terms, which has resulted in an increase in days sales outstanding. If economic conditions continue to be unfavorable or worsen, the negative impact on our business could increase or continue for longer than we expect.

Some of our end markets are cyclical, which may cause us to experience fluctuations in net sales or operating results.

We have experienced, and expect to continue to experience, fluctuations in net sales and operating results due to business cycles. We sell our products principally to oil and gas (both offshore and onshore), industrial and infrastructure, fishing, mining, maritime, structures, poultry and storage systems markets. Although we serve a variety of markets to avoid a dependency on any one, a significant downturn in any one of these markets could cause a material reduction in our net sales that could be difficult to offset. In addition, decreased market demand typically results in excess manufacturing capacity among our competitors which, in turn, results in pricing pressure. As a consequence, a significant downturn in our markets can result in lower profit margins.

Our reported financial condition and results of operations are subject to exchange rate fluctuations, which will make it more difficult to predict our financial results.

Our reported financial condition and results of operations are reported in multiple currencies, which primarily include the euro, the Mexican peso and the Polish złoty and are then translated into U.S. dollars at the applicable exchange rate for inclusion in our consolidated financial statements. Appreciation of the U.S. dollar against the euro, the Mexican peso and the Polish złoty will have a negative impact on our reported net sales and operating income while depreciation of the U.S. dollar against such currencies will have a positive effect on reported net sales and operating income. Additionally, foreign currency exchange rate fluctuations related to intercompany loans denominated in U.S. dollars with subsidiaries whose functional currency is the euro, the Mexico peso and the Polish złoty impact the Foreign currency exchange gains (losses), net line item included in our consolidated statements of operations.

We may be subject to risks relating to our non-U.S. operations.

Many of our manufacturing operations and suppliers are located outside the United States. Our non-U.S. operations are subject to risks in addition to those facing our domestic operations, including: fluctuations in currency exchange rates; limitations on ownership and on repatriation of earnings; transportation delays and interruptions; political, social and economic instability and disruptions; government embargoes or trade restrictions; the imposition of duties and tariffs and other trade barriers; import and export controls; labor unrest and current and changing regulatory environments; the potential for nationalization of enterprises; difficulties in staffing and managing multi-national operations; limitations on our ability to enforce legal rights and remedies;

11

potentially adverse tax consequences; and difficulties in implementing restructuring actions on a timely basis. Given our global operations, the strengthening of the U.S. dollar has had a significant negative impact on our 2015 results, and we expect the changes in foreign currency exchange rates to continue to add volatility going forward. If we are unable to successfully manage the risks associated with expanding our global business or adequately manage operational fluctuations internationally, the risks could have a material adverse effect on our business, results of operations or financial condition.

If we do not maintain the quality of our products, our sales would be harmed and product liability claims could increase our costs.

Our products are used in applications by our customers where quality and performance are critical. If we are unable to maintain the high standards, including various quality certifications, expected by our customers, or our competitors are able to produce higher quality products, our sales may be harmed by the loss of existing customers and our ability to attract new customers. Also, we have potential exposure to product liability claims in the event that the use of any of our products results in personal injury or property damage, or a failure of our products causes a work stoppage, including situations resulting from misuse of our products. Any such claims may be significant. Therefore, product liability claims against us could have a negative reputational impact, particularly if the failure of a product is highly publicized. Furthermore, manufacturing defects may not be discovered for some time after new products are introduced. In the event that any of our products prove to be defective, among other things, we may be responsible for any related damages, and we may be required to recall or redesign such products. Any insurance we maintain may not continue to be available on terms acceptable to us or such coverage may not be adequate for liabilities actually incurred. Should this occur, we may also need to increase our investments in manufacturing processes, which could increase our expenses, reduce our margins and adversely affect our cash flows.

Our reputation and competitive position are dependent on our ability to protect our intellectual property rights.

We believe that our trade names are important to our success and competitive position. We cannot, however, guarantee that we will be able to secure protection for our intellectual property in the future or that such protection will be adequate for future operations. Furthermore, we face the risk of ineffective protection of intellectual property rights in jurisdictions where we source and distribute our products, some of which do not protect intellectual property rights to the same extent as the United States. If we are unsuccessful in challenging a party’s products on the basis of infringement of our intellectual property rights, continued sales of these products could adversely affect our sales, devalue our brands and result in a shift in consumer preference away from our products. We may face significant expenses and liability in connection with the protection of our intellectual property rights, and if we are unable to successfully protect our rights or resolve intellectual property conflicts with others, our business or financial condition could be adversely affected.

We face competition and competitive pressures, which could adversely affect our results of operations and financial condition.

We face competition on multiple fronts in our industry, including from large global firms and local specialized rope manufacturers. Other global firms may have more capital at their disposal, and may be able to produce their products at a lower cost due to their size and economies of scale. Our competitors who are based in other jurisdictions may have lower production costs because of lower labor costs, fewer regulatory standards, local access to raw materials, lower shipping costs or other factors. Local specialized firms may have an advantage due to their knowledge of the markets in which they operate. In addition, our competitors may be able to offer substitute products that customers could use as a replacement to our products.

We face volatility in the prices for, and availability of, raw materials and energy used in our business, which could adversely impact our competitive position and results of operations.

We rely heavily on certain raw materials (principally rod, polymers and synthetic fibers), and energy sources (principally electricity, natural gas and propane) in our manufacturing processes. As a result, our earnings are affected by changes in the costs and availability of these raw materials and energy. Unanticipated increases in the prices of such commodities could increase our costs, negatively impacting our business, results of operations and financial condition if we are unable to fully offset the effects of higher raw material or energy costs through price increases, productivity improvements or cost-reduction programs. Although we are not significantly dependent on any one or a limited number of suppliers, the loss of some of our significant raw material suppliers could cause shortages, which could have a material adverse effect on operations. The imposition of tariffs pursuant to trade laws and regulations in the jurisdictions in which our operations and suppliers are located can have an adverse impact on our business by placing tariffs and tariff-rate quotas on the import of certain raw materials and raising the prices of raw materials we require for our production. In addition, under certain tax laws, customs and taxing authorities may, from time to time, review the tariff classifications we use to import our raw materials and export our products.

We experience risks associated with manufacturing, which could adversely affect our business and results of operations.

A manufacturing disruption, such as equipment downtime, facility shutdown or casualty loss, could lead to production curtailment and could substantially impair our business. Interruptions in production capabilities would increase production costs and reduce our sales and earnings. In addition to lost revenue, long-term business interruption could result in the loss of

12

some customers. To the extent these events are not covered by insurance, we are unable to recover insurance proceeds to reimburse for losses or business interruption, or if we are insured but there are delays in the receipt of such reimbursements, our cash flows may be adversely impacted by events of this type.

We are subject to extensive governmental laws and regulations that can adversely affect the cost, manner or feasibility of doing business and could result in restrictions on our operations or civil or criminal liability.

We are required to comply with various governmental laws and regulations, including but not limited to environmental, occupational health and safety, tax, trade, import and export, anti-dumping, anti-bribery, anti-trust and reporting obligations of the Exchange Act. Failure to comply could lead to manufacturing shutdowns, product shortages, delays in product manufacturing, operating restrictions, withdrawal of required licenses and prohibitions against exporting or importing of products. In addition, civil and criminal penalties could result from regulatory violations. Such laws and regulations may become more stringent and result in necessary modifications to our current practices and facilities that could force us to incur additional costs that could materially affect us.

We are subject to significant environmental compliance obligations and potential environmental liabilities, which could increase our costs or cause us to change our operations.

As activities in certain of our facilities involve the handling, storage, use and disposal of hazardous substances, we may be subject to material liabilities arising from conditions caused by the release of these substances. Such liability can include the costs of investigation and clean-up, fines and penalties sought by environmental authorities and damages arising out of personal injury and contaminated property and other toxic tort claims, as well as claims for lost or impaired natural resources. Certain environmental laws impose strict liability, and under certain circumstances, joint and several liability on current and prior owners and operators of sites without regard to comparative fault. In addition, environmental requirements change frequently, and have tended to become more stringent over time. We cannot predict what environmental laws or regulations will be enacted or amended in the future, how existing or future laws or regulations will be interpreted or enforced or the amount of future expenditures that may be required to comply with such laws or regulations. Failure to maintain or comply with environmental permits, governmental approvals or other environmental requirements necessary to operate our business, exposure to any one of the possible environmental obligations and liabilities listed above, and the uncertainty that our indemnification rights will result in the recovery of any environmental losses that may arise, may subject us to significant obligations and liabilities that could have a material adverse effect on our business, financial condition and results of operations.

We may pursue and execute acquisitions, which could adversely affect our business.

We have made, and may in the future make, acquisitions of or significant investments in businesses with complementary products, services and/or technologies. We cannot provide assurance that we will be able to consummate any such transactions or that any future acquisitions will be consummated at acceptable prices and terms. Acquisitions involve numerous risks, including: unforeseen difficulties in integrating operations, technologies, services, accounting and personnel; the diversion of financial and management resources from existing operations; unforeseen difficulties related to entering geographic regions or target markets where we do not have prior experience; and the assumption of known and unknown liabilities and exposure to litigation. If we finance an acquisition with debt, it could result in higher leverage and interest costs. As a result, if we fail to evaluate and execute acquisitions properly, we might not achieve the anticipated benefits of these acquisitions, and we may incur costs in excess of what we anticipate.

An information technology system failure or breach of security may adversely affect our business.

We rely on our information technology ("IT") systems and infrastructure in order to achieve our business objectives and manage our operations. An IT system failure due to computer viruses, internal or external security breaches, power interruptions, hardware failures, fire, natural disasters, human error or other causes could disrupt our operations and prevent us from being able to operate our manufacturing facilities, process transactions with our customers and properly report those transactions in a timely manner. In addition, our efforts to avoid or mitigate the impact of cyber-based attacks and security breaches may not be successful in avoiding a material breach, which could result in unauthorized disclosure of confidential information or damage to our IT networks and systems. Any such events could cause us to lose customers or revenue and could require us to incur significant expense to eliminate these problems and address related security concerns.

We are an emerging growth company and our election to delay compliance with new or revised accounting standards and utilize scaled disclosure and governance requirements applicable to reporting companies may result in our financial statements not being comparable to those of other reporting companies.

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we are utilizing certain exemptions from various reporting requirements that are applicable to other reporting companies that are not emerging growth companies. An emerging growth company may also take advantage of some or all of the scaled disclosure provisions that are applicable to emerging growth companies, such as delayed compliance with new or revised accounting

13

pronouncements applicable to reporting companies until such pronouncements are made applicable to private companies and reduced disclosure about executive compensation arrangements. We are electing to take advantage of the extended transition period for complying with new or revised accounting standards until we (i) no longer qualify as an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided by the JOBS Act. As a result of this election, our financial statements may not be comparable to the financial statements of other reporting companies. Also, we are taking advantage of scaled disclosure provisions within Item 11, Executive Compensation, of this annual report provided by the JOBS Act to emerging growth companies. We cannot predict if investors will find our debt securities less attractive because we are relying on these exemptions. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and our trading price may be more volatile. We may utilize these reporting exemptions until we are no longer an emerging growth company. We will continue to be an emerging growth company until the earliest of: (i) the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more or (ii) the date on which we have issued more than $1 billion in non-convertible debt securities during the previous three-year period.

Organized labor action could have a material adverse effect on our business.

Many of our operations are highly labor intensive. We have collective bargaining agreements with our employees at several plant locations and distribution centers. Approximately 34% of our work force is unionized. If our unionized employees were to engage in a strike, work stoppage or other slowdown at any of our plants, this could adversely affect our ability to produce our products. In addition, any significant increase in labor costs or the making of other significant concessions as a result of agreements with our unionized workforce could have a material adverse effect on our business, financial condition and results of operations.

Risks Relating to our Public Debt

Our substantial level of indebtedness could have a material adverse effect on our financial condition and prevent us from fulfilling our debt service obligations.

As of December 31, 2015, we had $829.8 million of total indebtedness at face value. Face value excludes adjustments for unamortized premium and discounts. In addition, subject to restrictions in the indenture governing the 9.50% Senior Notes (the “Indenture”) and restrictions in our current debt agreements, we may incur additional indebtedness. Our high level of indebtedness could have important consequences, including the following:

• | it may be more difficult for us to satisfy our obligations with respect to the 9.50% Senior Notes; |

• | our ability to obtain additional financing for working capital, capital expenditures, acquisitions or general corporate purposes may be impaired; |

• | we must use a substantial portion of our cash flow from operations to pay interest and principal on the 9.50% Senior Notes and other indebtedness, which will reduce the funds available to us for other purposes such as capital expenditures; |

• | we may be more vulnerable to economic downturns and adverse developments in our business; and |

• | there would be a material adverse effect on our business and financial condition if we were unable to service our indebtedness or obtain additional financing, as needed. |

Without a successful equity capital raise or refinance of our current long-term debt, or some combination thereof, we will not have sufficient liquidity to satisfy these obligations as they become due in 2017.

Covenants in our debt instruments may limit our ability to operate our business and any failure by us to comply with such covenants may accelerate our obligation to repay the underlying debt.

Certain debt instruments contain covenant restrictions that limit our ability to operate our business, including covenant restrictions that may prevent us from:

• | incurring additional debt or issuing guarantees; |

• | creating liens; |

• | entering into certain transactions with our affiliates; and |

• | consolidating, merging or transferring all or substantially all of our assets and the assets of our subsidiaries on a consolidated basis. |

The Revolving Loan Facility and the Term Loan due 2017 requires us to maintain specific leverage ratios, and the Indenture governing the 9.50% Senior Notes requires us to meet a specific fixed charge coverage ratio prior to incurring certain additional debt. Our ability to comply with these covenants is dependent on our future performance, which will be subject to many factors, some of which are beyond our control, including prevailing economic conditions. Our failure to comply with these obligations could prevent us from borrowing additional money and could result in our default. If a default occurs under any of

14

our senior indebtedness, the relevant lenders could elect to declare such indebtedness, together with accrued interest and other fees, to be immediately due and payable and to proceed against our assets that secure such senior indebtedness. Moreover, if the lenders under a facility or other agreement in default were to accelerate the indebtedness outstanding under that facility, it could result in a default under other indebtedness. If all or any part of our indebtedness were to be accelerated, we may not have or be able to obtain sufficient funds to repay it. In addition, we may incur other indebtedness in the future that may contain financial or other covenants that are more restrictive than those contained in the Indenture. As a result of these and certain other covenants, our ability to respond to changes in business and economic conditions and to obtain additional financing, if needed, may be significantly restricted, and we may be prevented from engaging in transactions that might otherwise be beneficial to us.

We are controlled by a principal equity holder who will be able to make important decisions about our business and capital structure.

A majority of our shares are held by Paine & Partners Fund III, an affiliate of Paine & Partners. As a result, Paine & Partners controls us and has the power to elect the members of our board of directors, appoint new management and approve any action requiring the approval of the holders of our stock, including approving acquisitions or sales of all or substantially all of our assets. Paine & Partners has the ability to control decisions affecting our capital structure, including the issuance of additional capital stock, the implementation of stock repurchase programs and the declaration of dividends. The interests of our principal equity holder may not be aligned with the holders of our 9.50% Senior Notes. Our principal equity holder may have an interest in pursuing acquisitions, divestitures, financings or other transactions that, in their judgment, could enhance their equity investment, even though such transactions might involve risks to the holders of our 9.50% Senior Notes.

Any lower-than-expected rating of our bank debt and debt securities could adversely affect our business.

Two rating agencies, Moody's and Standard & Poor's, rate our debt securities. If the rating agencies were to reduce their current ratings, then our ability to access certain financial markets may become limited, the perception of us in the view of our customers, suppliers and security holders may worsen and as a result, our business and financial condition may be adversely affected.

Item 1B.Unresolved Staff Comments

None.

Item 2.Properties

Our principal properties include our manufacturing facilities and our distribution centers. A depiction of our global manufacturing footprint, excluding our non-consolidated joint ventures in India, Spain, Norway, Greece and China, is below:

North America | South America | Europe | ||||||

|  |  |  |  | ||||

United States (8) | Brazil (1) | France (2) | Germany (2) | Portugal (6) | ||||

|  |  | ||||||

Mexico (2) | The Netherlands (2) | Poland (1) | ||||||

We have eight domestic manufacturing facilities in Missouri, Texas and Pennsylvania and sixteen international manufacturing facilities in Mexico, Germany, Portugal, Poland, the Netherlands, Brazil and France, excluding our five non-consolidated joint ventures. We have global capacity to annually produce approximately 307,000 metric tons of wire, 231,000 metric tons of rope, 35,000 metric tons of engineered products and 5,000 metric tons of recycled raw materials. Utilization of manufacturing capacity varies by manufacturing plant based upon the type of products assigned and the level of demand for those products.

The Company adequately uses its total production capacity. Utilization of manufacturing capacity varies by manufacturing plant based upon the type of products assigned and the level of demand for those products.

15

We have twenty stand-alone distribution facilities in the U.S., Portugal, the Netherlands, France, United Kingdom, Australia, Denmark, Slovakia and Czech Republic. In addition to these distribution facilities, we have warehouse space available at substantially all of our manufacturing facilities.

We own all but five of our manufacturing facilities and lease fourteen stand-alone distribution centers. Refer to Note 13—“Commitments and Contingencies” to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data, of this annual report for further information on the Company's lease commitments.

Most of our properties and other assets are subject to liens securing our various borrowings. Refer to Note 6—“Borrowings” to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data, of this annual report for further information on assets secured.

We believe our properties are in good condition, well maintained, adequately utilized and sufficient to support the anticipated operations of the business.

Item 3.Legal Proceedings

We are not a party to any material legal proceedings. From time to time, we are involved in routine litigation arising in the ordinary course of business, which is incidental to our operations. For further information required by this item, refer to Note 13—“Commitments and Contingencies” to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data, of this annual report.

Item 4.Mine Safety Disclosures

Not applicable.

PART II

Item 5.Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Registrant's common equity consists of common stock that is privately held and there is no established public trading market. As of March 10, 2016, there was one stockholder of record. There are currently no significant restrictions on the ability of the Registrant to pay dividends to WireCo WorldGroup US Holdings Inc., its sole stockholder.

Item 6.Selected Financial Data

The selected financial data below should be read in conjunction with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 8, Financial Statements and Supplementary Data, of this annual report. During the periods presented, we acquired businesses as set forth in the footnotes. The Company's consolidated financial statements include the results of operations of these acquired businesses from the date of acquisition and as such, period to period results of operations vary depending on these dates. Accordingly, this selected financial data is not necessarily comparable or indicative of our future financial results.

16

Years ended December 31, | ||||||||||||||||||||

2015 | 2014 | 2013 | 2012 (1) | 2011 (2) | ||||||||||||||||

(in thousands) | ||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Net sales | $ | 683,953 | $ | 856,760 | $ | 821,055 | $ | 742,689 | $ | 604,927 | ||||||||||

Gross profit | 161,439 | 208,245 | 198,749 | 163,755 | 158,573 | |||||||||||||||

Operating income | 37,984 | 70,954 | 51,418 | 45,195 | 57,009 | |||||||||||||||

Net loss | (35,508 | ) | (28,773 | ) | (27,004 | ) | (18,174 | ) | (50,707 | ) | ||||||||||

As of December 31, | ||||||||||||||||||||

2015 | 2014 | 2013 | 2012 (1) | 2011 (2) | ||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Working capital (3) | $ | 216,178 | $ | 279,545 | $ | 295,362 | $ | 320,888 | $ | 199,309 | ||||||||||

Total assets (3) | 980,447 | 1,121,274 | 1,185,669 | 1,245,011 | 882,696 | |||||||||||||||

Long-term debt, excluding current maturities | 820,208 | 854,042 | 862,492 | 893,217 | 565,044 | |||||||||||||||

Total stockholders’ equity (deficit) | (16,429 | ) | 44,263 | 96,233 | 112,012 | 129,536 | ||||||||||||||

Years ended December 31, | ||||||||||||||||||||

2015 | 2014 | 2013 | 2012 (1) | 2011 (2) | ||||||||||||||||

Statement of Cash Flows Data: | ||||||||||||||||||||

Cash flows provided by (used in): | ||||||||||||||||||||

Operating activities | $ | 43,046 | $ | 59,418 | $ | 55,151 | $ | 13,554 | $ | 10,653 | ||||||||||

Investing activities | (29,802 | ) | (27,494 | ) | (29,353 | ) | (210,232 | ) | (93,335 | ) | ||||||||||

Financing activities | (45,420 | ) | (4,865 | ) | (40,980 | ) | 214,599 | 56,956 | ||||||||||||

(1) | The 2012 financial information reflects the acquisition of Royal Lankhorst Euronete Group B.V. ("Lankhorst") on July 12, 2012. |

(2) | The 2011 financial information reflects the acquisition of Drumet Liny I Druty Sp Z O.O. ("Drumet") on July 18, 2011. |

(3) | During the fourth quarter of 2015, the Company adopted new accounting guidance regarding the presentation of deferred tax assets and liabilities as non-current in a classified balance sheet and applied it retrospectively. |

Item 7.Management's Discussion and Analysis of Financial Condition and Results of Operations

Unless the context otherwise requires, the use of the terms “WireCo,” the “Company,” “we,” “our” or “us” in the following refers to WireCo WorldGroup (Cayman) Inc., its wholly-owned subsidiaries, including WireCo WorldGroup Inc., and subsidiaries in which it has a controlling interest.

Management’s Discussion and Analysis (“MD&A”) provides a reader of our financial statements with a narrative from the perspective of our management on our consolidated results of operations, financial condition, liquidity and capital resources on a historical basis and certain other factors that have affected recent earnings, as well as those factors that may affect future earnings. Please see “Cautionary Information Regarding Forward-Looking Statements” for a discussion of the risks, uncertainties and assumptions relating to these statements. This MD&A is provided as a supplement to, and should be read in conjunction with the consolidated financial statements and accompanying notes included in Item 8, Financial Statements and Supplementary Data, of this annual report.

Non-GAAP Financial Measures

Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). This MD&A includes various financial measures that have not been calculated in accordance with GAAP, commonly referred to as “Non-GAAP Financial Measures”. These Non-GAAP Financial Measures include:

• | Adjusted EBITDA |

• | Credit Agreement EBITDA |

• | Adjusted Working Capital |

• | Net Debt |

• | Free Cash Flow |

17

We provide Adjusted EBITDA and Credit Agreement EBITDA as a means to enhance communication with security holders by providing additional information regarding our operating results. We use these Non-GAAP Financial Measures internally to evaluate our performance, allocate resources, calculate debt covenant ratios and for incentive compensation purposes. We believe that our presentation of these measures provides investors with greater transparency with respect to our results of operations, are required for debt covenant calculation purposes and are useful for peer and period-to-period comparisons of results considering our history of acquisitions.

We provide Adjusted Working Capital, Net Debt and Free Cash Flow as additional information regarding our liquidity. We believe that Adjusted Working Capital provides a meaningful measure of our efforts to manage inventory, our customer collections and vendor payments. We believe Net Debt is meaningful to investors because management assesses our leverage position after factoring in available cash and restricted cash that eventually could be used to repay outstanding debt. We believe that the Free Cash Flow measure is meaningful to investors because it represents the cash flow we have available to pay down debt and/or invest for future growth. It is important to note that Free Cash Flow does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure.

These measures are not in accordance with, or an alternative to GAAP, and may be different from Non-GAAP Financial Measures used by other companies. These measures have important limitations as analytical tools and should not be considered in isolation, nor as a substitute for, or superior to, analysis of our results as reported under GAAP. We recommend that investors view these measures in conjunction with the GAAP measures included in this MD&A and have provided reconciliations of reported GAAP amounts to the Non-GAAP amounts.

BUSINESS OVERVIEW

We are a leading global manufacturer of both steel and synthetic rope, specialty wire and engineered products. Our products are used in a diverse range of industries including, but not limited to, industrial and infrastructure, oil and gas (both offshore and onshore), fishing, mining, maritime, structures, poultry and storage systems. Our global manufacturing footprint includes 24 manufacturing facilities in 8 countries.

EXECUTIVE SUMMARY

We provide steel and synthetic rope, specialty wire and engineered products across multiple customers and geographies which

results in a diversified revenue stream. The long-term sales growth and profitability of our product portfolio is dependent not

only on increased demand in the end markets which we serve and the overall economic environment, but also on our ability to

increase our existing market share and expand our presence geographically, continuously improve operational excellence,

identify, consummate and integrate strategic acquisitions and develop and market innovative new products.

For the year ended December 31, 2015, we reported sales of $684.0 million, a net loss of $35.5 million and Adjusted EBITDA of $106.4 million compared to sales of $856.8 million, a net loss of $28.8 million and Adjusted EBITDA of $151.0 million for the year ended December 31, 2014. Given our global operations, the strengthening of the U.S. dollar had a significant negative impact on our 2015 results. For the year ended December 31, 2015, approximately 68% of our sales were generated in currencies other than the U.S. dollar. During 2015, the euro, Polish złoty and Mexican peso all devalued between 19-20% compared to the year ended December 31, 2014. Given the translation of our international results into U.S. dollars, this devaluation unfavorably impacted our sales by $87.0 million and our Adjusted EBITDA by $15.5 million for the twelve months ended December 31, 2015. The foreign currency exchange impact on cash for the year ended December 31, 2015 is a decrease of $5.0 million. Conversely, while the appreciation of the U.S. dollar has an immediate negative impact on our earnings, there is potential for leveraging a weakening currency as a competitive sales advantage. Given our scale and ability to serve a global market, when our non-U.S. manufactured products are imported by customers in countries that have not experienced a currency devaluation, the prices of these produced goods have decreased.

As a result of the weakening oil and gas end market during 2015, we reduced our factory work force in the United States, Mexico and Poland and implemented workforce reductions in several administrative departments. In addition, we took other cost containment measures, such as certain procurement initiatives and other selling and administrative savings. The disciplined management of capital expenditures during 2015 has also contributed to our cost savings initiatives. During 2015, management achieved $18.3 million of savings resulting from operational initiatives.

During the year ended December 31, 2015, we reduced our inventory in order to better match current demand. As a result, we reduced inventory levels by $38.1 million at December 31, 2015 as compared to the December 31, 2014 balance. In addition, we are strategically supporting certain customers in the short-term with longer payment terms which has resulted in an increase in days sales outstanding. Despite short-term challenges in some of our end markets, we continue to believe that our targeted strategies, including acquisitions, geographic expansion, market share gains and new product development, will provide attractive long-term opportunities for sustainable growth. We remain focused on maintaining our financial strength by

18

adjusting our cost structure to reflect changes in demand levels and by proactively managing working capital and cash flow generation.

CONSOLIDATED RESULTS OF OPERATIONS

This section focuses on significant items that impacted our operating results during the years ended December 31, 2015, 2014 and 2013.

Our reported financial condition and results of operations have been translated to U.S. dollars from multiple currencies, which primarily include the euro, the Mexican peso and the Polish złoty. Our revenues and certain expenses are affected by fluctuations in the value of the U.S. dollar against these local currencies. When we refer to changes in foreign currency exchange rates, we are referring to the differences between the foreign currency exchange rates we use to translate our international operations’ results from local currencies into U.S. dollars for reporting purposes. The impacts of foreign currency exchange rate fluctuations are calculated as the difference between current period activity translated using the current period’s currency exchange rates and the comparable prior year period’s currency exchange rates. We use this method for all countries where the functional currency is not the U.S. dollar.

Year ended December 31, 2015 compared to the year ended December 31, 2014

The following table presents selected consolidated financial data for the years ended December 31, 2015 and 2014:

Years ended December 31, | Change | ||||||||||||||

2015 | 2014 | Dollars | Percent | ||||||||||||

(in thousands) | |||||||||||||||

Net sales | $ | 683,953 | $ | 856,760 | $ | (172,807 | ) | (20.2 | )% | ||||||

Gross profit | 161,439 | 208,245 | (46,806 | ) | (22.5 | )% | |||||||||

Other operating expenses | (123,455 | ) | (137,291 | ) | 13,836 | (10.1 | )% | ||||||||

Other expense, net | (73,370 | ) | (115,368 | ) | 41,998 | (36.4 | )% | ||||||||

Income tax benefit (expense) | (122 | ) | 15,641 | (15,763 | ) | NM | |||||||||

Net loss | $ | (35,508 | ) | $ | (28,773 | ) | $ | (6,735 | ) | NM | |||||

Gross profit as % of net sales | 23.6 | % | 24.3 | % | |||||||||||

Other operating expenses as % of net sales | 18.1 | % | 16.0 | % | |||||||||||

NM = Not Meaningful

Net sales

Our consolidated net sales decreased $172.8 million, or 20.2%, during the year ended December 31, 2015 compared to the same period in 2014. Contributing to the decrease was an $87.0 million decline due to foreign currency exchange rate fluctuations when comparing the average exchange rates for the twelve months ended December 31, 2015 to the average exchange rates for the twelve months ended December 31, 2014.