Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CrossAmerica Partners LP | exhibit991capl2q2016earnin.htm |

| 8-K - 8-K - CrossAmerica Partners LP | capl20162qform8-kearningsr.htm |

2Q 2016

Earnings Call

August 2016

Safe Harbor Statement

Statements contained in this presentation that state the Partnership’s or management’s

expectations or predictions of the future are forward-looking statements. The words

“believe,” “expect,” “should,” “intends,” “estimates,” “target” and other similar expressions

identify forward-looking statements. It is important to note that actual results could differ

materially from those projected in such forward-looking statements. For more information

concerning factors that could cause actual results to differ from those expressed or

forecasted, see CrossAmerica’s Forms 10-Q or Form 10-K filed with the Securities and

Exchange Commission and available on CrossAmerica’s website at

www.crossamericapartners.com. If any of these factors materialize, or if our underlying

assumptions prove to be incorrect, actual results may vary significantly from what we

projected. Any forward-looking statement you see or hear during this presentation reflects

our current views as of the date of this presentation with respect to future events. We

assume no obligation to publicly update or revise these forward-looking statements for any

reason, whether as a result of new information, future events, or otherwise.

2

CrossAmerica Business Overview

Jeremy Bergeron, President

3

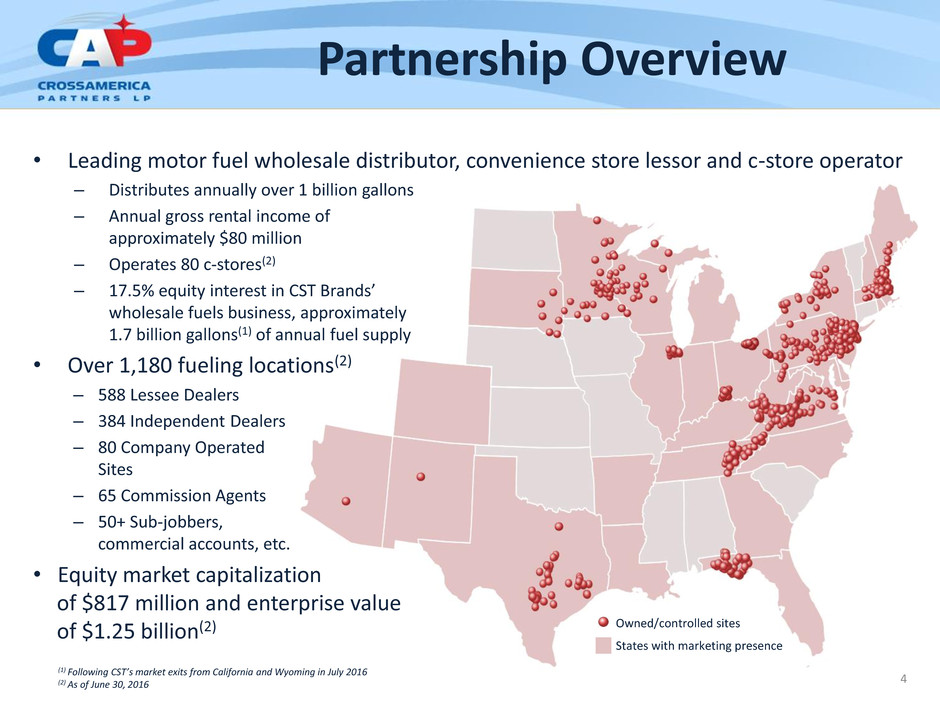

Partnership Overview

• Leading motor fuel wholesale distributor, convenience store lessor and c-store operator

– Distributes annually over 1 billion gallons

– Annual gross rental income of

approximately $80 million

– Operates 80 c-stores(2)

– 17.5% equity interest in CST Brands’

wholesale fuels business, approximately

1.7 billion gallons(1) of annual fuel supply

• Over 1,180 fueling locations(2)

– 588 Lessee Dealers

– 384 Independent Dealers

– 80 Company Operated

Sites

– 65 Commission Agents

– 50+ Sub-jobbers,

commercial accounts, etc.

• Equity market capitalization

of $817 million and enterprise value

of $1.25 billion(2)

(1) Following CST’s market exits from California and Wyoming in July 2016

(2) As of June 30, 2016

Owned/controlled sites

States with marketing presence

4

Continuing Accretive Growth

5

55 Lessee Dealers, 25 Indep.

Dealers, 3 Company Ops

$45 Million Purchase

60 Million Gallons

Chicago Market

Marathon, Citgo, Phillips 66,

Mobil, BP, Shell

Est. 3Q16 close date

Asset Purchase

Rationale

154 current locations

85 pending locations (State Oil)

CrossAmerica Upper Midwest Region

Owned, Leased or Supplied Locations

• 59 valuable fee sites in

Greater Chicago

• Located in proximity of

existing markets

• Expands branding

relationship with several

suppliers

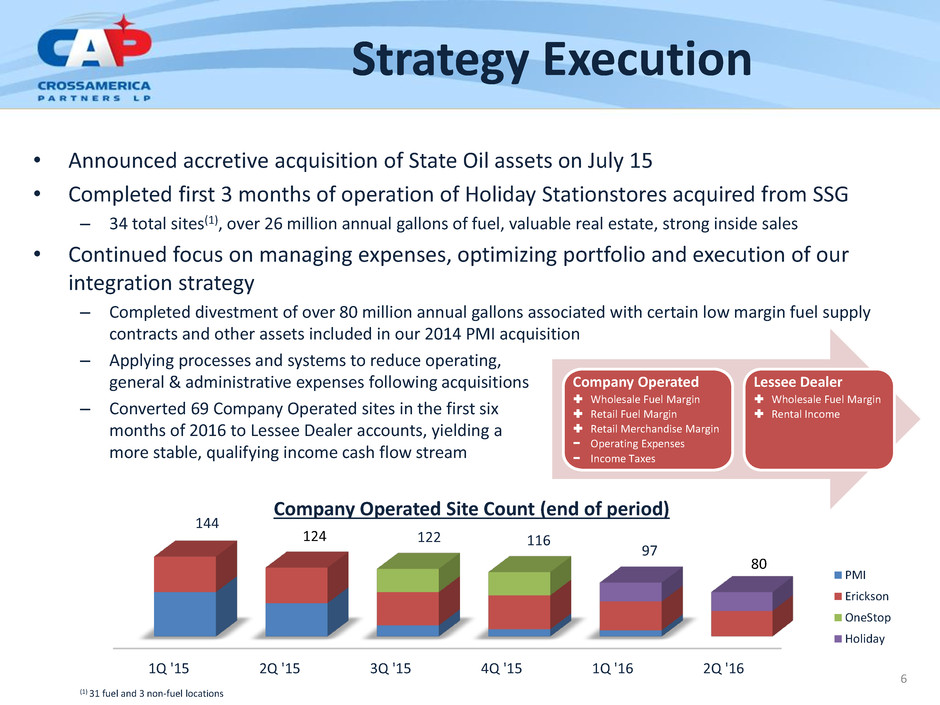

Strategy Execution

• Announced accretive acquisition of State Oil assets on July 15

• Completed first 3 months of operation of Holiday Stationstores acquired from SSG

– 34 total sites(1), over 26 million annual gallons of fuel, valuable real estate, strong inside sales

• Continued focus on managing expenses, optimizing portfolio and execution of our

integration strategy

– Completed divestment of over 80 million annual gallons associated with certain low margin fuel supply

contracts and other assets included in our 2014 PMI acquisition

– Applying processes and systems to reduce operating,

general & administrative expenses following acquisitions

– Converted 69 Company Operated sites in the first six

months of 2016 to Lessee Dealer accounts, yielding a

more stable, qualifying income cash flow stream

1Q '15 2Q '15 3Q '15 4Q '15 1Q '16 2Q '16

144

122 116

97

124

80

Company Operated Site Count (end of period)

PMI

Erickson

OneStop

Holiday

(1) 31 fuel and 3 non-fuel locations

Company Operated

Wholesale Fuel Margin

Retail Fuel Margin

Retail Merchandise Margin

− Operating Expenses

− Income Taxes

Lessee Dealer

Wholesale Fuel Margin

Rental Income

6

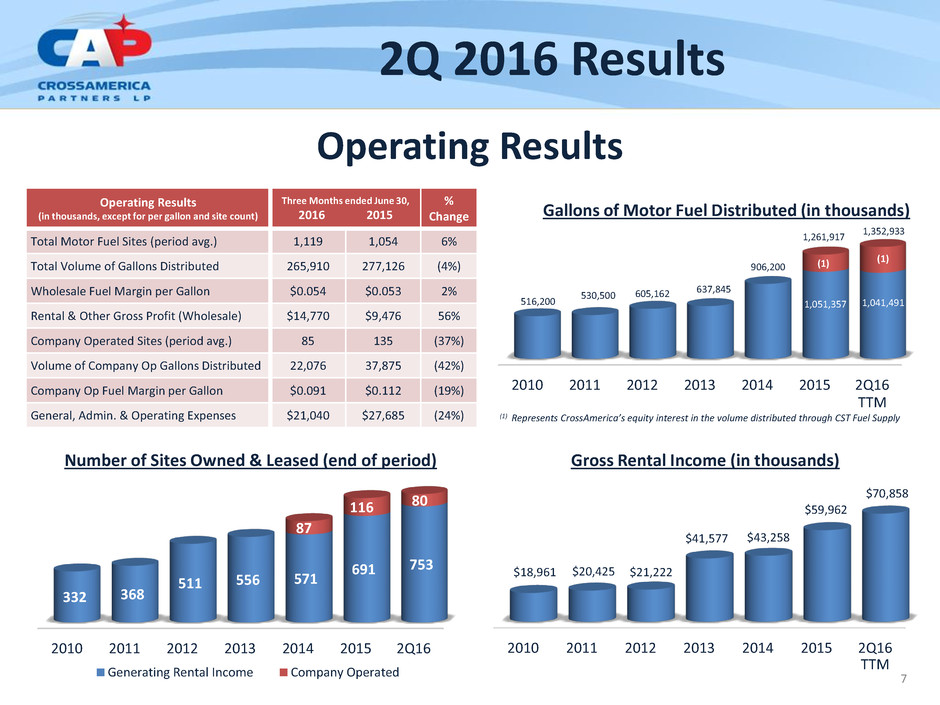

Operating Results

Operating Results

(in thousands, except for per gallon and site count)

Three Months ended June 30,

2016 2015

%

Change

Total Motor Fuel Sites (period avg.) 1,119 1,054 6%

Total Volume of Gallons Distributed 265,910 277,126 (4%)

Wholesale Fuel Margin per Gallon $0.054 $0.053 2%

Rental & Other Gross Profit (Wholesale) $14,770 $9,476 56%

Company Operated Sites (period avg.) 85 135 (37%)

Volume of Company Op Gallons Distributed 22,076 37,875 (42%)

Company Op Fuel Margin per Gallon $0.091 $0.112 (19%)

General, Admin. & Operating Expenses $21,040 $27,685 (24%)

Gallons of Motor Fuel Distributed (in thousands)

1,261,917

(1) Represents CrossAmerica’s equity interest in the volume distributed through CST Fuel Supply

2010 2011 2012 2013 2014 2015 2Q16

332 368

511 556 571

691 753

87

116 80

Number of Sites Owned & Leased (end of period)

Generating Rental Income Company Operated

2010 2011 2012 2013 2014 2015 2Q16

516,200

530,500 605,162

637,845

906,200

1,051,357 1,041,491

(1) (1)

TTM

2010 2011 2012 2013 2014 2015 2Q16

$18,961 $20,425 $21,222

$41,577 $43,258

$59,962

$70,858

Gross Rental Income (in thousands)

TTM

1,352,933

7

2Q 2016 Results

CrossAmerica Financial Overview

Steven Stellato, Chief Accounting Officer

8

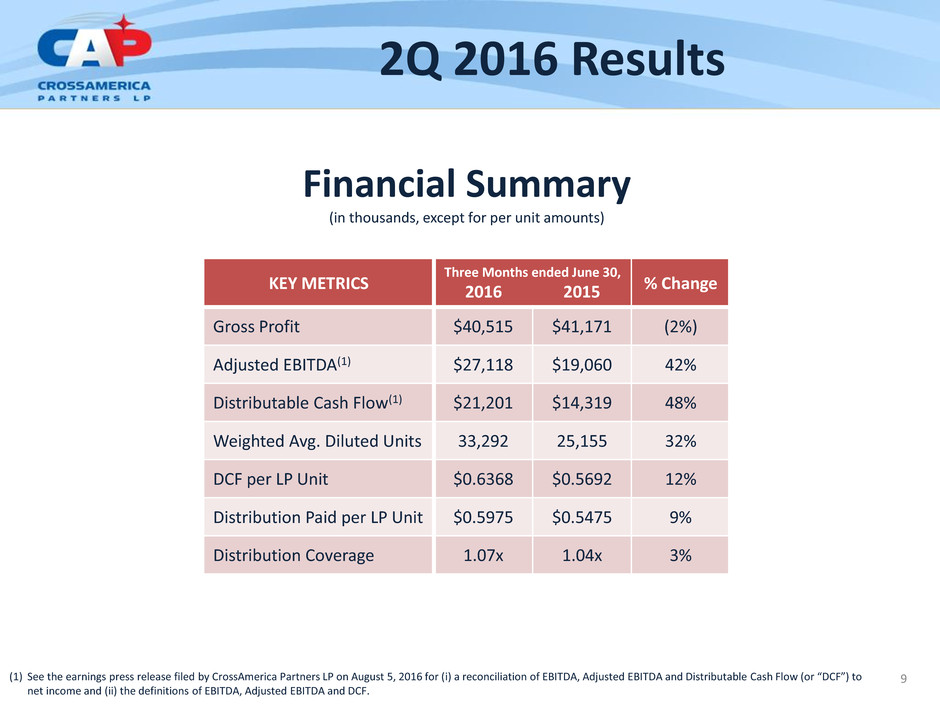

2Q 2016 Results

9 (1) See the earnings press release filed by CrossAmerica Partners LP on August 5, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to

net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF.

KEY METRICS

Three Months ended June 30,

2016 2015 % Change

Gross Profit $40,515 $41,171 (2%)

Adjusted EBITDA(1) $27,118 $19,060 42%

Distributable Cash Flow(1) $21,201 $14,319 48%

Weighted Avg. Diluted Units 33,292 25,155 32%

DCF per LP Unit $0.6368 $0.5692 12%

Distribution Paid per LP Unit $0.5975 $0.5475 9%

Distribution Coverage 1.07x 1.04x 3%

Financial Summary

(in thousands, except for per unit amounts)

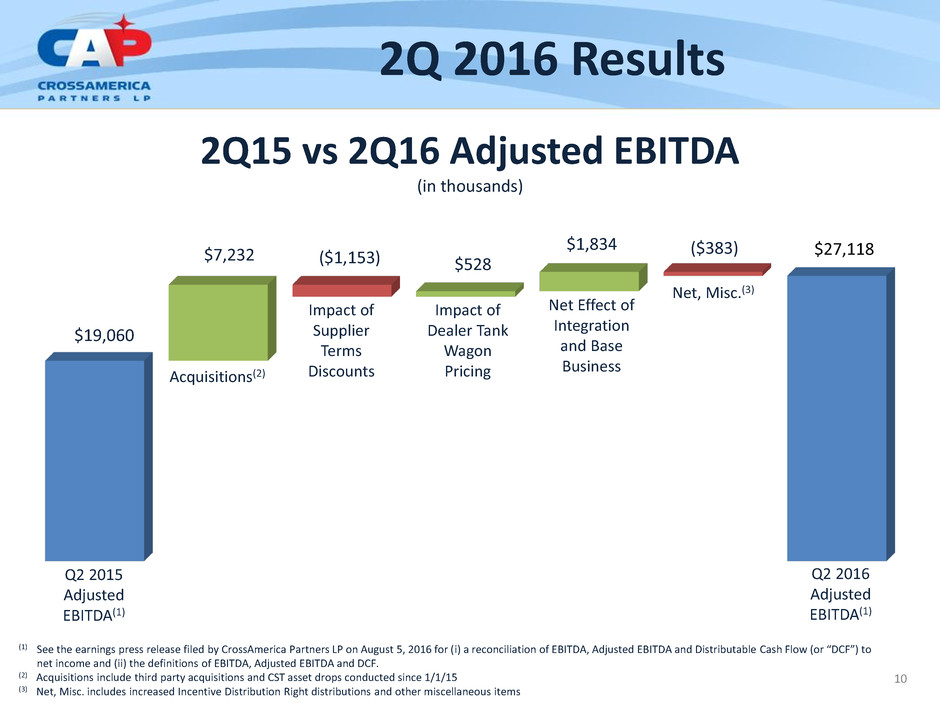

2Q15 vs 2Q16 Adjusted EBITDA

(in thousands)

$27,118

$19,060

$7,232 ($1,153) $528

$1,834 ($383)

Acquisitions(2)

Impact of

Supplier

Terms

Discounts

Q2 2015

Adjusted

EBITDA(1)

Q2 2016

Adjusted

EBITDA(1)

Net, Misc.(3)

Net Effect of

Integration

and Base

Business

(1) See the earnings press release filed by CrossAmerica Partners LP on August 5, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to

net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF.

(2) Acquisitions include third party acquisitions and CST asset drops conducted since 1/1/15

(3) Net, Misc. includes increased Incentive Distribution Right distributions and other miscellaneous items

10

2Q 2016 Results

Impact of

Dealer Tank

Wagon

Pricing

Strengthening Balance Sheet

• Renegotiation of Rocky Top Lease Obligation

– In September 2013, CrossAmerica acquired 33 sites for $36.9 million

– As part of financing the transaction, CrossAmerica entered into a master lease,

with a purchase obligation, for 29 sites at an interest rate of 7.7%, resulting in

approximately $2.1 million in annual interest expense

– In June 2016, we renegotiated the terms with the seller to transfer the lease to a 15-year term

operating lease, with four 5-year renewal options for a 6.5% cap rate, with 1.5% annual rent increases

– Results

• Reduces annual rent expense by approximately $300,000

• Elimination of purchase obligation frees up $26 million of borrowing capacity

• Refund of interest in CST Fuel Supply

– In July, as a result of CST’s sale of California and Wyoming retail sites to 7-eleven, CrossAmerica

received a refund of approximately $18.2 million on the approximately $1.67 million of annual cash

flow being generated at the Partnership

– Proceeds were used to pay down revolver

• Improving leverage ratio

– As of June 30, leverage ratio of 4.29x, with $80 million of additional borrowing capacity

– As of August 3, the Partnership has approximately $100 million of additional borrowing capacity

11

Executing with Measured Growth

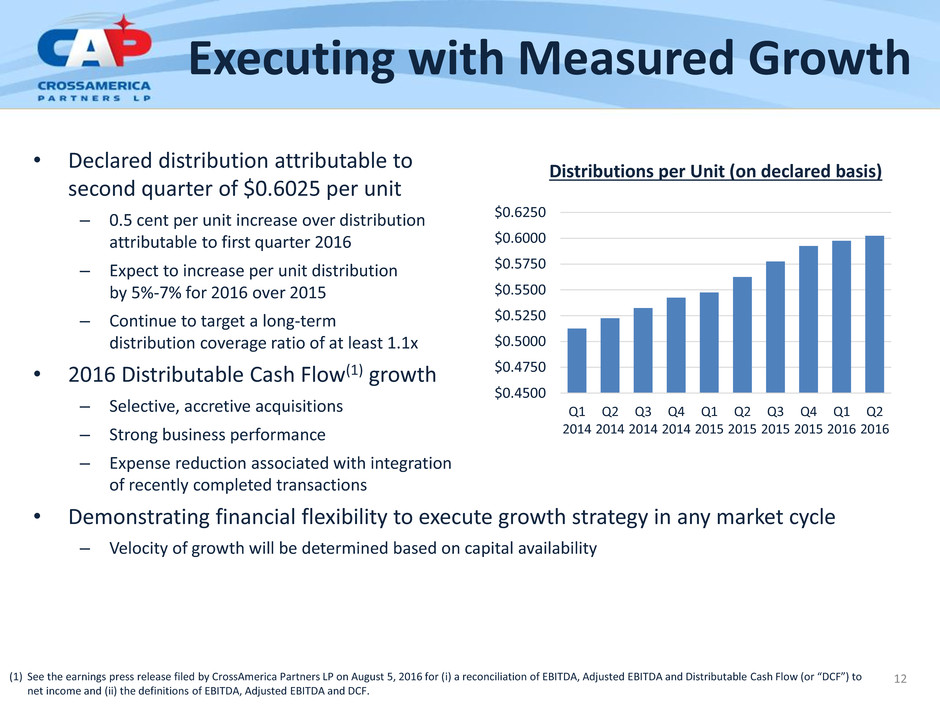

• Declared distribution attributable to

second quarter of $0.6025 per unit

– 0.5 cent per unit increase over distribution

attributable to first quarter 2016

– Expect to increase per unit distribution

by 5%-7% for 2016 over 2015

– Continue to target a long-term

distribution coverage ratio of at least 1.1x

• 2016 Distributable Cash Flow(1) growth

– Selective, accretive acquisitions

– Strong business performance

– Expense reduction associated with integration

of recently completed transactions

• Demonstrating financial flexibility to execute growth strategy in any market cycle

– Velocity of growth will be determined based on capital availability

12

$0.4500

$0.4750

$0.5000

$0.5250

$0.5500

$0.5750

$0.6000

$0.6250

Q1

2014

Q2

2014

Q3

2014

Q4

2014

Q1

2015

Q2

2015

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Distributions per Unit (on declared basis)

(1) See the earnings press release filed by CrossAmerica Partners LP on August 5, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to

net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF.