Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - ION GEOPHYSICAL CORP | ioq216segmentslidesmlm.htm |

| EX-99.1 - EXHIBIT 99.1 - ION GEOPHYSICAL CORP | ex991earningsrelease2016-q2.htm |

| 8-K - 8-K - ION GEOPHYSICAL CORP | a8k-2016xq2xearnings.htm |

ION Earnings Call – Q2 2016

Earnings Call Presentation

August 4, 2016

Corporate Participants and Contact Information

CONTACT INFORMATION

If you have technical problems during the call, please contact DENNARD–LASCAR Associates

at 713 529 6600.

If you would like to view a replay of today's call, it will be available via webcast in the Investor Relations

section of the Company's website at www.iongeo.com for approximately 12 months.

BRIAN HANSON

President and

Chief Executive Officer

STEVE BATE

Executive Vice President

and Chief Financial Officer

2

Forward-Looking Statements

The information included herein contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934.

Actual results may vary fundamentally from those described in these

forward-looking statements.

All forward-looking statements reflect numerous assumptions and involve a

number of risks and uncertainties.

These risks and uncertainties include risk factors that are disclosed by ION

from time to time in its filings with the Securities and Exchange Commission.

3

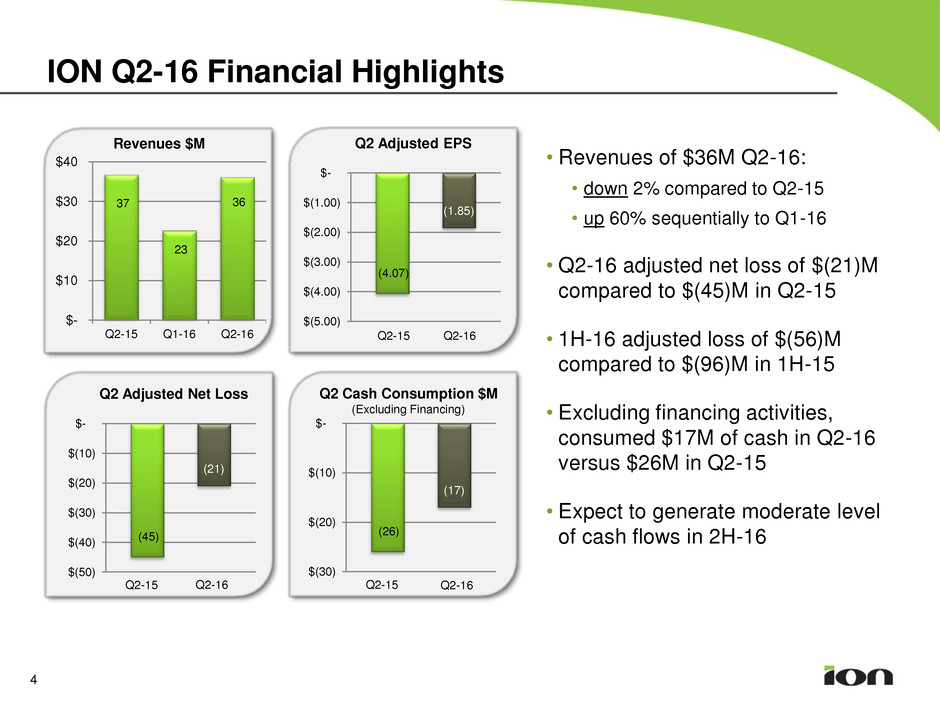

Revenues $M

4

• Revenues of $36M Q2-16:

• down 2% compared to Q2-15

• up 60% sequentially to Q1-16

• Q2-16 adjusted net loss of $(21)M

compared to $(45)M in Q2-15

• 1H-16 adjusted loss of $(56)M

compared to $(96)M in 1H-15

• Excluding financing activities,

consumed $17M of cash in Q2-16

versus $26M in Q2-15

• Expect to generate moderate level

of cash flows in 2H-16

ION Q2-16 Financial Highlights

(4.07)

(1.85)

$(5.00)

$(4.00)

$(3.00)

$(2.00)

$(1.00)

$-

Q2 Adjusted EPS

Q2-15 Q2-16

(45)

(21)

$(50)

$(40)

$(30)

$(20)

$(10)

$-

Q2 Adjusted Net Loss

Q2-15 Q2-16

(26)

(17)

$(30)

$(20)

$(10)

$-

Q2 Cash Consumption $M

(Excluding Financing)

Q2-15 Q2-16

37

23

36

$-

$10

$20

$30

$40

Q2-15 Q1-16 Q2-16

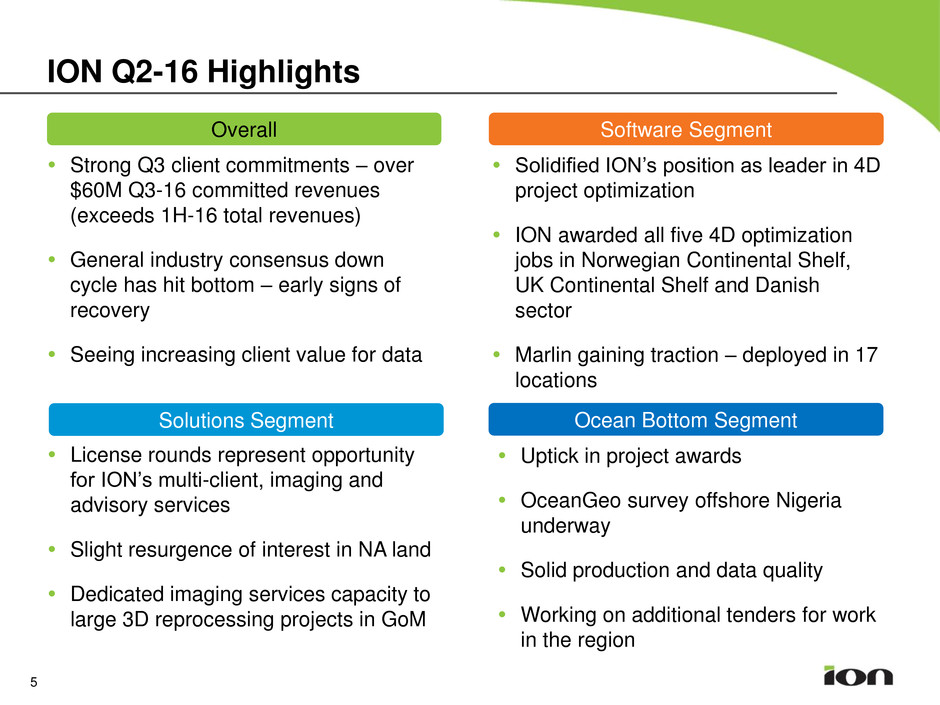

ION Q2-16 Highlights

Strong Q3 client commitments – over

$60M Q3-16 committed revenues

(exceeds 1H-16 total revenues)

General industry consensus down

cycle has hit bottom – early signs of

recovery

Seeing increasing client value for data

5

Overall Software Segment

Solutions Segment

License rounds represent opportunity

for ION’s multi-client, imaging and

advisory services

Slight resurgence of interest in NA land

Dedicated imaging services capacity to

large 3D reprocessing projects in GoM

Solidified ION’s position as leader in 4D

project optimization

ION awarded all five 4D optimization

jobs in Norwegian Continental Shelf,

UK Continental Shelf and Danish

sector

Marlin gaining traction – deployed in 17

locations

Ocean Bottom Segment

Uptick in project awards

OceanGeo survey offshore Nigeria

underway

Solid production and data quality

Working on additional tenders for work

in the region

(4.07)

(1.85)

$(5.00)

$(4.00)

$(3.00)

$(2.00)

$(1.00)

$-

Adjusted EPS

Q2-15

6

ION Financial Overview

Q2-16 Summary

$-

$10

$20

$30

$40

Q2-15 Q2-16

Software

Systems Solutions

Revenue $M • Revenues down 2% vs Q2-15

• Solutions down 17%

• Software down 34%

• Systems down 14%

• Ocean Bottom $6M in revenues

• Revenues up 60% vs Q1-16

• Loss from operations of $(15)M

compared to $(39)M in Q2-15

• Margin improvement driven by

positive impact of cost savings

initiatives

• Adjusted EPS of $(1.85) compared

to $(4.07) in Q2-15

• Adjusted EBITDA of $(3)M

compared to $(29)M in Q2-15

Ocean Bottom

Q2-16

$(39)

$(15)

$(50)

$(40)

$(30)

$(20)

$(10)

$-

Q2-16

Adjusted Operating Loss $M

Q2-15

$(29)

$(3)

$(30)

$(25)

$(20)

$(15)

$(10)

$(5)

$-

Q2-15 Q2-16

Adjusted EBITDA $M

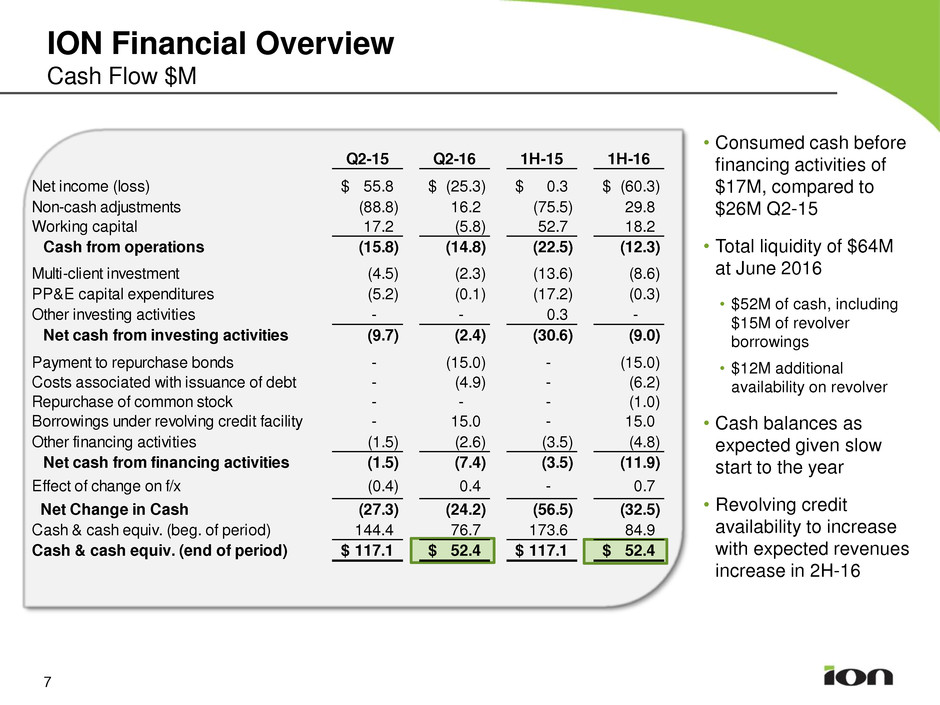

ION Financial Overview

Cash Flow $M

7

• Consumed cash before

financing activities of

$17M, compared to

$26M Q2-15

• Total liquidity of $64M

at June 2016

• $52M of cash, including

$15M of revolver

borrowings

• $12M additional

availability on revolver

• Cash balances as

expected given slow

start to the year

• Revolving credit

availability to increase

with expected revenues

increase in 2H-16

Q2-15 Q2-16 1H-15 1H-16

Net income (loss) 55.8$ (25.3)$ 0.3$ (60.3)$

Non-cash adjustments (88.8) 16.2 (75.5) 29.8

Working capital 17.2 (5.8) 52.7 18.2

Cash from operations (15.8) (14.8) (22.5) (12.3)

Multi-client investment (4.5) (2.3) (13.6) (8.6)

PP&E capital expenditures (5.2) (0.1) (17.2) (0.3)

Other investing activities - - 0.3 -

Net cash from investing activities (9.7) (2.4) (30.6) (9.0)

Payment to repurchase bonds - (15.0) - (15.0)

Costs associated with issuance of debt - (4.9) - (6.2)

Repurchase of common stock - - - (1.0)

Borrowings under revolving credit facility - 15.0 - 15.0

ther financing activities (1.5) (2.6) (3.5) (4.8)

Net cash fro financing activities (1.5) (7.4) (3.5) (11.9)

Effect of change n f/x (0.4) 0.4 - 0.7

Net Change i Cash (27.3) (24.2) (56.5) (32.5)

Cash & cash equiv. (beg. of period) 144.4 76.7 173.6 84.9

Cash & cash equiv. (end of period) 117.1$ 52.4$ 117.1$ 52.4$

Summary

Expect continued sequential improvement in 2H-16

– Completion of OBS Nigeria survey in Q3

– Repair & replacement and software recurring revenue streams

– Industry-funded new venture programs in southern GoM

– Traditional year-end spending on data library programs

Strong Q3 commitments

Expect to generate net cash flows in second half of 2016

Expect positive working capital second half of 2016, providing

liquidity into 2017 and restoring borrowing base of revolver

8

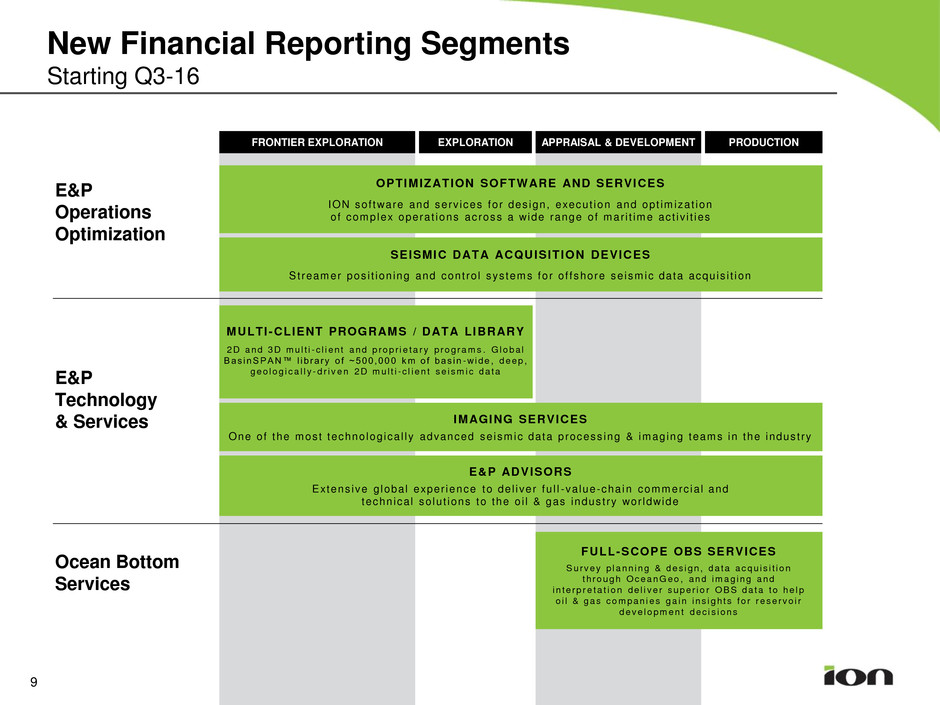

FRONTIER EXPLORATION EXPLORATION APPRAISAL & DEVELOPMENT PRODUCTION

E&P

Operations

Optimization

OPTIMIZATION SOFTWARE AND SERVICES

ION sof tware and serv ices for des ign, execut ion and opt im izat ion

o f complex operat ions ac ross a wide range o f mar i t ime ac t iv i t ies

SEISMIC DATA ACQUISITION DEVICES

St reamer pos i t ion ing and cont ro l sys tems for o f f shore se ism ic data acqu is i t ion

IMAGING SERVICES

One of the mos t technolog ica l l y advanced se ism ic data process ing & imaging teams in the indus t ry

FULL-SCOPE OBS SERVICES

S urvey p l ann ing & des i gn , da ta acqu i s i t i on

t h rough OceanG eo , and im ag ing and

i n te rp r e ta t i on de l i ve r supe r i o r OB S da ta t o he l p

o i l & gas com pan ies ga i n i ns i gh t s f o r rese rvo i r

deve lopm en t dec i s i ons

MULTI-CLIENT PROGRAMS / DATA LIBRARY

2D and 3D m u l t i - c l i en t and p rop r i e ta r y p rog ram s . G loba l

Bas inSPAN™ l i b ra ry o f ~500 ,000 km o f bas i n -w ide , deep ,

geo log i ca l l y - d r i v e n 2D m u l t i - c l i en t se i sm i c da ta

E&P ADVISORS

Extens ive g loba l exper ience to de l i ver fu l l -va lue-cha in commerc ia l and

techn ica l so lu t ions to the o i l & gas indus t ry wor ldwide

E&P

Technology

& Services

Ocean Bottom

Services

New Financial Reporting Segments

Starting Q3-16

9

10

Q&A