TERMS AND CONDITIONS

OF UNITS PRIVATE PLACEMENT

1. Subscription

As part of an offering (the “Offering”), the Purchaser hereby irrevocably subscribes for and agrees to purchase from the Company that number of units (the “Units” and each individually, a “Unit”) of the Company set forth on page 1 of this Subscription Agreement. Each Unit is comprised of one common share in the capital of the Company (a “Common Share”) and one Common Share purchase warrant (a “Warrant”). Each Warrant shall entitle the holder thereof to acquire one Common Share (a “Warrant Share”) at a price of CDN$0.16 per Warrant Share at any time on or before 4:00 p.m. (Vancouver time) on the first business day that is 36 months after the Closing Date (as defined below). If, commencing on the date that is four months after the Closing Date, the closing price of the common shares of the Company on the Toronto Stock Exchange is higher than CDN$0.30 for 20 consecutive trading days then on the 20th consecutive trading day (the “Acceleration Trigger Date”) the expiry date of the warrants may be accelerated to the 20th trading day after the Acceleration Trigger Date by the issuance, within three trading days of the Acceleration Trigger Date, of a news release announcing such acceleration. If, at the time of exercise of the Warrant, the Company is no longer an issuer subject to the reporting requirements of Section 13(a) or 15(d) of the United States Securities Exchange Act of 1934, as amended, then the Warrant may be exercised by means of a “cashless exercise” (the “Cashless Exercise Right”) whereby the holder thereof shall be entitled to receive that number of Warrant Shares resulting from the following formula:

Where:

|

A = |

the average closing price for the Company’s common shares as quoted on the Toronto Stock Exchange (the “Exchange”) for the five consecutive trading days immediately preceding the date on which the holder elects to exercise the Warrant by means of the Cashless Exercise Right. |

|

B = |

the then applicable exercise price of the Warrant. |

|

X = |

the number of Warrant Shares that would otherwise have been issuable had the holder elected to exercise the Warrant by means of a cash exercise. |

2. Conditions of Purchase

| 2.1 |

The Purchaser acknowledges that the Company’s obligation to sell the Units to the Purchaser is subject to, among other things, the conditions that: |

|

(a) |

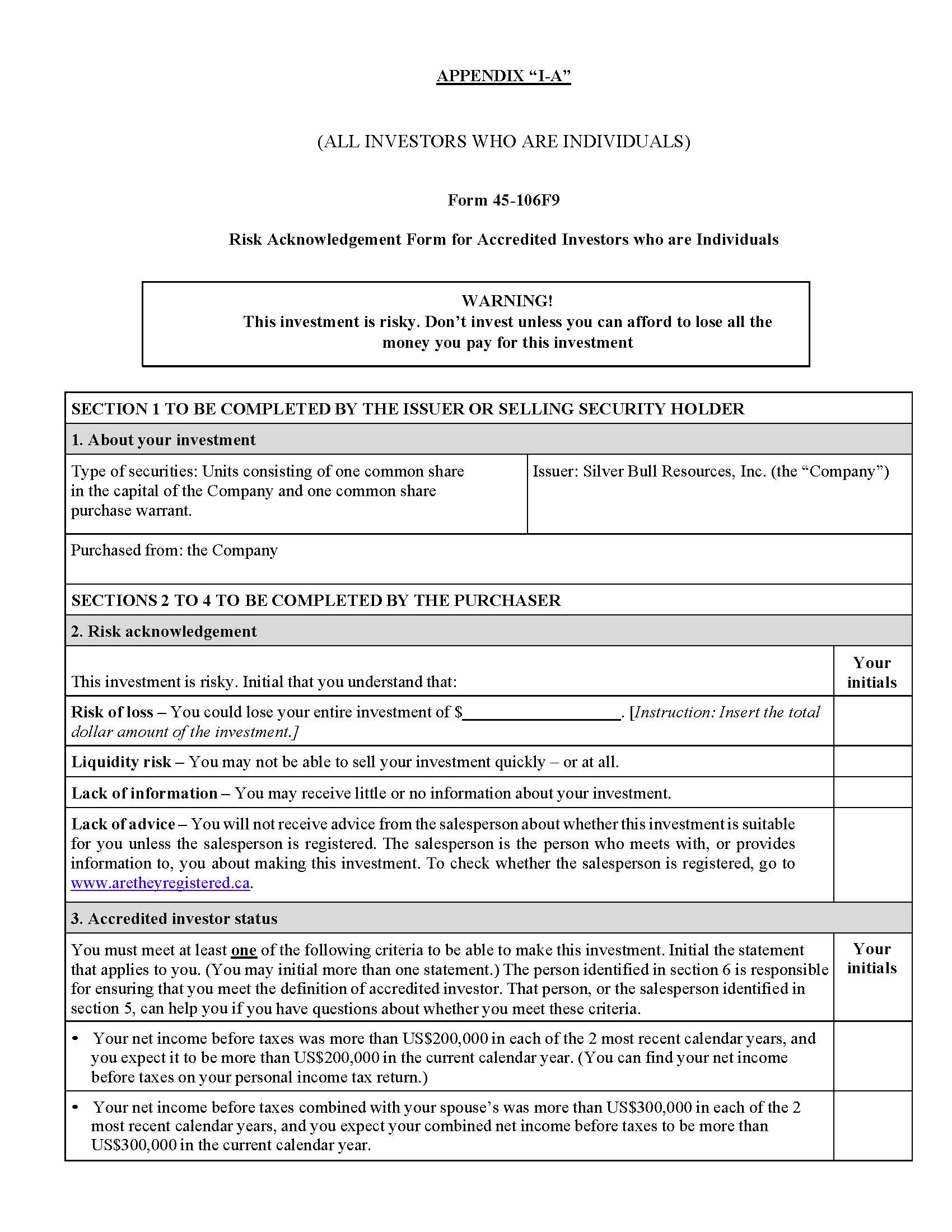

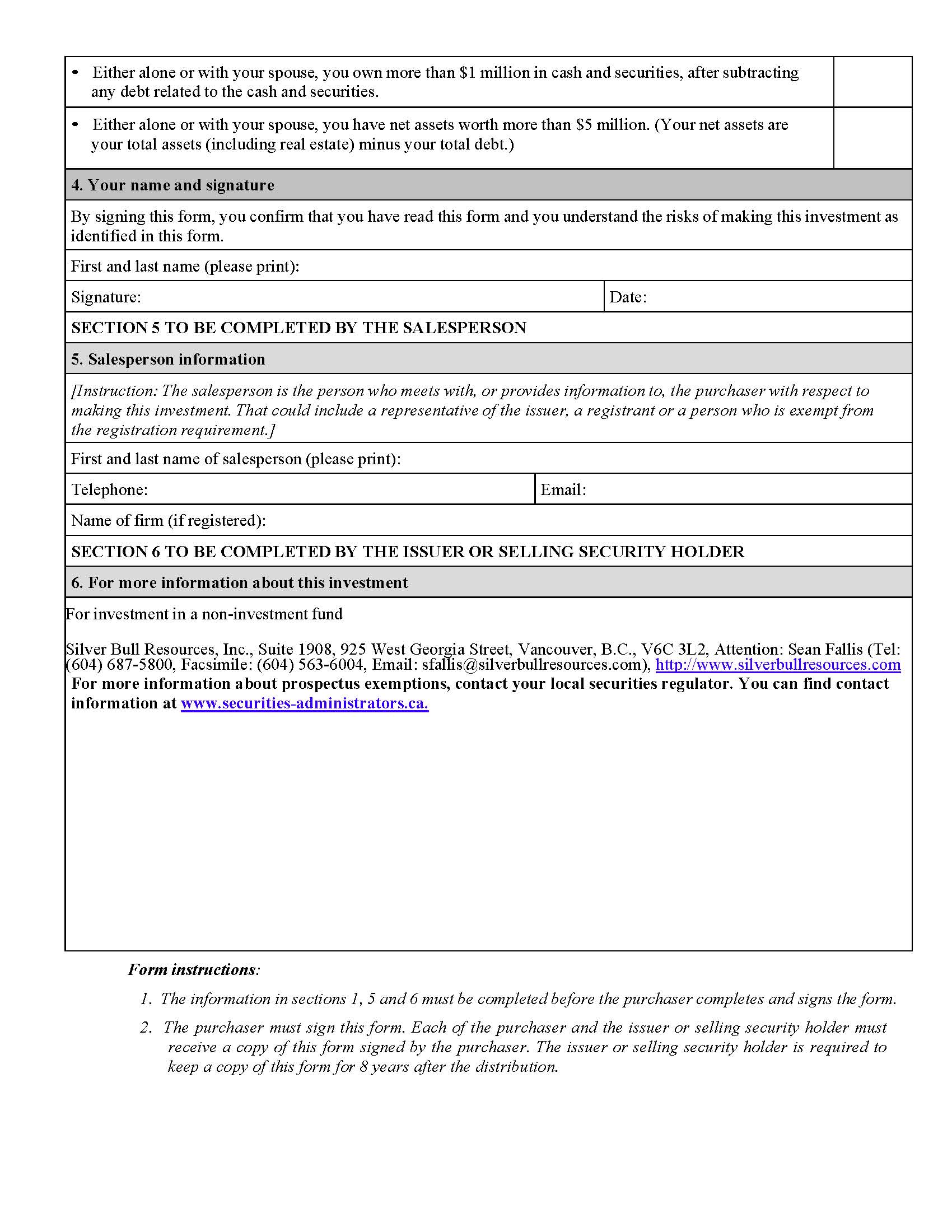

the Purchaser duly completes, executes and returns to the Company this subscription, together with all documents required by applicable securities laws, the Exchange and the OTCQB for delivery to the offices of the lawyers for the Company on behalf of the Purchaser, by no later than 4:00 p.m. (Vancouver time) on July 11, 2016 to Silver Bull Resources, Inc., Suite 1610, 777 Dunsmuir Street, Vancouver, B.C. V7Y 1K4, Canada, Attention: Sean Fallis, Facsimile: 604-563-6004, Email: sfallis@silverbullresources.com, including a duly completed and executed Appendix I – Investor Certificate (if the Purchaser is resident in Canada) and, if the Purchaser is an individual accredited investor, Appendix I-A – Risk Acknowledgment Form for Accredited Investors who are Individuals or Appendix II – U.S. Investors (if the Purchaser is a U.S. Person or does not otherwise satisfy the conditions set out in Section 4.2(a)); |

|

(b) |

payment has been made by the Purchaser of the Subscription Price as set out in Section 9 hereof; |

|

(c) |

the Company has accepted, in whole or in part, this Subscription Agreement, subject to Section 2.2; |

|

(d) |

all necessary regulatory, Exchange and OTCQB approvals have been obtained by the Company prior to the Closing (as defined below); |

|

(e) |

the sale of the Units is exempt from the requirement to file a prospectus or registration statement and the requirement to prepare and deliver an offering memorandum or similar document under any applicable statute relating to the sale of the Units or upon the issuance of such orders, consents or approvals as may be required to permit such sale without the requirement of filing a prospectus or registration statement or delivering an offering memorandum or similar document; |

|

(f) |

all covenants, agreements and conditions contained in this Agreement to be performed by the Purchaser have been performed or complied with in all material respects on or prior to the Closing; and |

|

(g) |

the representations, warranties and certifications of the Purchaser in this Agreement, including in any appendices hereto or other document delivered to the Company in connection with the Purchaser’s subscription, are true and correct when made and being true and correct at the Closing with the same force and effect as if they had been made on and as of the Closing. |

| 2.2 |

The Purchaser acknowledges and agrees that the Company reserves the right, in its absolute discretion, to reject this subscription for Units, in whole or in part, at any time prior to the time of Closing. If this subscription is rejected in whole, any cheques or other forms of payment delivered to the Company representing the subscription amount will be promptly returned to the Purchaser without interest or deduction. If this subscription is accepted only in part, a cheque representing any refund of the subscription amount for that portion of the subscription for the Units which is not accepted will be promptly delivered to the Purchaser without interest or deduction. |

3. Delivery

Delivery of the certificates representing the Common Shares and Warrants comprising the Units (the “Closing”) shall be completed at the offices of the Company’s legal counsel, Blake, Cassels & Graydon LLP, located at Suite 2600, 595 Burrard Street, Vancouver, British Columbia, V7X 1L3 at 4 p.m. (Vancouver time) on July 13, 2016 (the “Closing Date”), or at such other places, times or dates as may be determined by the Company not later than July 29, 2016.

The Purchaser appoints [Sprott Global Resource Investments, Ltd. (the “Placement Agent”) / the Company], with full power of substitution, as its true and lawful attorney and agent with full power and authority in its place and stead to:

|

(a) |

act as the Purchaser’s representative at the Closing and to swear, execute, file and record in the Purchaser’s name and on the Purchaser’s behalf any document necessary to accept delivery of the Units on the Closing Date; |

|

(b) |

approve any opinions, certificates or other documents addressed to the Purchaser; |

|

(c) |

waive, in whole or in part, any representations, warranties, covenants or conditions for the benefit of the Purchaser; |

|

(d) |

complete or correct any errors or omissions in this Subscription Agreement on behalf of the Purchaser; and |

|

(e) |

receive on the Purchaser’s behalf any certificates representing the Common Shares and Warrants comprising the Units subscribed for hereunder. |

4. Purchaser’s Representations, Warranties and Covenants

The Purchaser (on its own behalf and, if applicable, on behalf of each beneficial purchaser for whom the Purchaser is contracting hereunder) represents and warrants to, and covenants with, the Company (and acknowledges that the Company is relying on such representations, warranties and covenants), which representations, warranties and covenants shall survive the Closing, that as at the execution date of this Subscription Agreement and the Closing Date:

| 4.1 |

The Purchaser confirms that it: |

|

(a) |

has such knowledge in financial and business affairs as to be capable of evaluating the merits and risks of its investment in the Units; |

|

(b) |

is capable of assessing the merits and risks (including the potential loss of its entire investment) of the proposed investment in the Units; |

|

(c) |

is aware of the characteristics of the Units and understands the risks relating to an investment therein; and |

|

(d) |

is able to bear the economic risk of loss of its investment in the Units. |

| 4.2 |

The Purchaser is resident in the jurisdiction set forth in the “Address of Residence” set out on page 1 of this Agreement and either: |

(a) All of the following are met:

|

(i) |

the Purchaser is not a “U.S. Person” (as that term is defined in Rule 902(k) of Regulation S under the United States Securities Act of 1933, as amended (the “1933 Act”)) or a person in the United States of America, its territories or possessions, any State of the United States or District of Columbia (the “United States”), and is not purchasing the Units for the account of or benefit of a U.S. Person or a person in the United States; |

|

(ii) |

the Purchaser was not offered the Units in the United States; |

|

(iii) |

the buy order for the Purchaser’s Units was not originated, and the Purchaser did not execute or deliver this Subscription Agreement, in the United States; |

|

(iv) |

the Purchaser has no intention to distribute either directly or indirectly any of the Units in the United States and will not offer, sell or otherwise transfer, directly or indirectly, any of the Units (or any securities underlying the Units or that may be issued in connection with the Units) or to, or for the account or benefit of, a U.S. Person or person in the United States except pursuant to registration under the 1933 Act and the securities laws of all applicable states or available exemptions therefrom; and |

|

(v) |

the Purchaser did not receive the offer to purchase the Units as a result of, nor will it engage in, any “directed selling efforts” (as defined in Regulation S under the 1933 Act); or |

|

(b) |

The conditions set forth in clause (a) above are not met, but all of the conditions set forth on Appendix II are met. |

| 4.3 |

The Purchaser is aware that no prospectus or registration statement has been prepared or filed by the Company with any securities commission or similar authority in connection with the Offering of the Units contemplated hereby, and that: |

|

(a) |

the Purchaser may be restricted from using most of the civil remedies available under applicable securities laws in Canada; |

|

(b) |

the Purchaser may not receive information that would otherwise be required to be provided under applicable securities laws and the Company is relieved from certain obligations that would otherwise be required to be given if a prospectus were provided under applicable securities laws in connection with the Offering; and |

|

(c) |

the issuance and sale of the Units to the Purchaser is subject to such sale being exempt from the requirements of applicable securities laws as to the filing of a prospectus or registration statement. |

| 4.4 |

The Purchaser, if resident in Canada, is purchasing the Units as principal and is: |

|

(a) |

an “accredited investor” as defined in National Instrument 45-106 Prospectus Exemptions (“NI 45-106”) and is not a person created or used solely to purchase or hold securities as an “accredited investor” as defined in paragraph (m) of the aforesaid definition of “accredited investor”; or |

|

(b) |

purchasing the Units at an acquisition cost to the Purchaser of not less than CDN$150,000 paid in cash, the Purchaser is not an individual and the Purchaser was not created or used solely to purchase or hold securities in reliance on the exemption from the prospectus requirement available under section 2.10 of NI 45-106; |

and (i) the Purchaser has duly completed Section I, II, III or IV of, and executed and delivered to the Company, an Appendix I – Investor Certificate, and (ii) if the Purchaser is an accredited investor who is an individual, other than an individual who beneficially owns financial assets having an aggregate realizable value that, before taxes but net of any related liabilities, exceeds CDN$5,000,000, has completed and executed, in duplicate, and delivered one copy to the Company of, an Appendix I-A – Risk Acknowledgement Form for Accredited Investors who are Individuals.

Provided, that if the conditions set forth in 4.2(a) are not met, the Purchaser shall also complete an Investor Certificate in the form attached as Appendix II.

| 4.5 |

If the Purchaser is resident in an international jurisdiction other than the United States then: |

|

(a) |

the Purchaser currently has knowledge and experience or has consulted the Purchaser’s own counsel, accountant or investment advisor, with respect to the investment contemplated hereby and applicable securities laws in the international jurisdiction in which the Purchaser resides which would apply to this subscription; |

|

(b) |

the Purchaser is purchasing the Units in compliance with or pursuant to exemptions from any prospectus, registration or similar requirements under the applicable securities laws of the international jurisdiction in which the Purchaser resides (and the Purchaser shall deliver to the Company such further particulars of such applicable securities laws or exemptions and the Purchaser’s qualifications thereunder as the Company may request), and the purchase and sale of the Units does not trigger any obligation to prepare and file a prospectus, registration statement or similar document, or any other report with respect to such purchase and/or any registration on the part of the Company; |

|

(c) |

no applicable securities laws of the international jurisdiction in which the Purchaser resides require the Company to make any filings or seek any approvals of any kind whatsoever from any securities commission or regulatory authority of any kind whatsoever in the jurisdiction of residence of the Purchaser; and |

|

(d) |

the Purchaser will not sell or otherwise dispose of any of Units (or any securities underlying the Units or that may be issued in connection with the Units) except in accordance with all applicable securities laws, including, without limitation, the rules, regulations and policies of the Exchange and the OTCQB. If the Purchaser sells or otherwise disposes of any of the Units (or any securities underlying the Units or that may be issued in connection with the Units), the Purchaser will obtain from the person acquiring them a covenant in the same form as provided for in this Subscription Agreement, and the Company shall not have any obligation to register any purported sale or disposition of the Units (or any securities underlying the Units or that may be issued in connection with the Units) which may be in violation of such laws and any such sale, transfer or other disposition shall be null and void and of no force or effect. |

| 4.6 |

The Purchaser acknowledges that: |

|

(a) |

no securities commission or similar regulatory authority has reviewed or passed on the merits of the Units; |

|

(b) |

there is no government or other insurance covering the Units; |

|

(c) |

there are risks associated with the purchase of the Units; |

|

(d) |

there are restrictions on the Purchaser’s ability to resell the Units (or any securities underlying the Units or that may be issued in connection with the Units) and it is the responsibility of the Purchaser to find out what those restrictions are and to comply with them before selling any of the Units (or any securities underlying the Units or that may be issued in connection with the Units); and |

|

(e) |

the Company has advised the Purchaser that the Company is relying on an exemption from the requirements to provide the Purchaser with a prospectus or registration statement and to sell the Units through a person or company registered to sell securities under applicable securities laws and, as a consequence of acquiring the Units pursuant to this exemption, certain protections, rights and remedies provided by the applicable securities laws, including statutory rights of rescission or damages, will not be available to the Purchaser. |

| 4.7 |

If the Purchaser is not resident in British Columbia, the Purchaser certifies that the Purchaser is not resident in British Columbia and acknowledges that: |

|

(a) |

the Purchaser is knowledgeable of, or has been independently advised as to, the Other Applicable Securities Laws (as defined below); |

|

(b) |

the Purchaser is purchasing the Units pursuant to exemptions from any prospectus, registration or similar requirements under the Other Applicable Securities Laws, or, if such is not applicable, the Purchaser is permitted to purchase the Units under the Other Applicable Securities Laws without the need to rely on exemptions; and |

|

(c) |

the distribution of the Units to the Purchaser by the Company complies with all of the Other Applicable Securities Laws. |

For purposes hereof, “Other Applicable Securities Laws” means, in respect of each and every offer and sale of the Units, the securities legislation having application and the regulations, rules, orders, instruments, notices, directions, rulings and published policy statements of the securities regulatory authorities having jurisdiction over the Purchaser and the Offering, other than the laws of British Columbia which would apply to this subscription, if any.

| 4.8 |

The Purchaser will comply with all applicable securities laws and with the policies of the Exchange and the OTCQB concerning the purchase of, the holding of and the resale restrictions on the Units (or any securities underlying the Units or that may be issued in connection with the Units). |

| 4.9 |

The Purchaser is aware that the offer made by this subscription is irrevocable and requires acceptance by the Company and the acceptance for filing thereof by the Exchange and will not become an agreement between the Purchaser and the Company until accepted by the Company signing in the space above. |

| 4.10 |

If an individual, the Purchaser has attained the age of majority and is legally competent to execute and deliver this subscription and to take all actions required pursuant hereto and if a corporation, partnership or other entity, the Purchaser has been duly incorporated, created or organized and validly exists under the laws of its jurisdiction of incorporation, creation or organization and all necessary approvals by its directors and shareholders have been obtained for the execution and delivery of this subscription. |

| 4.11 |

The execution and delivery of this Subscription Agreement and the performance and compliance with the terms hereof will not result in any breach of, or be in conflict with, or constitute a default under, or create a state of facts which after notice or lapse of time or both would constitute a default under, any term or provision of any constating documents, by-laws or resolutions of the Purchaser or any indenture, contract, agreement (whether written or oral), instrument or other document to which the Purchaser is a party or subject, or any judgment, decree, order, statute, rule or regulation applicable to the Purchaser; |

| 4.12 |

Upon acceptance of this subscription by the Company, this Subscription Agreement, including all exhibits and appendices, will constitute a legal, valid and binding contract of purchase enforceable against the Purchaser in accordance with its terms and will not violate or conflict with the terms of any restriction, agreement or undertaking respecting purchases of securities by the Purchaser. |

| 4.13 |

The Purchaser’s purchase of the Units has not been made through or as a result of, the distribution of the securities comprising the Units is not being accompanied by and the Purchaser is not aware of, any advertisement of the securities in printed media of general and regular paid circulation, radio, television or electronically. |

| 4.14 |

No prospectus or offering memorandum within the meaning of applicable securities laws or any other document purporting to describe the business and affairs of the Company has been delivered to the Purchaser in connection with the Offering. |

| 4.15 |

No person has made to the Purchaser any written or oral representation; |

|

(a) |

that any person will resell or repurchase any of the Units (or any securities underlying the Units or that may be issued in connection with the Units); |

|

(b) |

that any person will refund all or any part of purchase price of the Units; |

|

(c) |

as to the future price or value of any of the Units; or |

|

(d) |

that any of the Units (or any securities underlying the Units or that may be issued in connection with the Units) will be listed and posted for trading on a stock exchange or marketplace or that application has been made to list and post any of the Units (or any securities underlying the Units or that may be issued in connection with the Units) for trading on a stock exchange or marketplace. |

| 4.16 |

None of the Units are being purchased by the Purchaser with knowledge of any material fact about the Company that has not been generally disclosed to the public. |

| 4.17 |

In the case of a person signing this subscription as agent for a disclosed principal, each beneficial Purchaser for whom the agent is purchasing, or is deemed under NI 45-106 to be purchasing, as principal, for its own account and not for the benefit of any other person, and such person is duly authorized to enter into this Subscription Agreement and to execute all documentation in connection with the purchase on behalf of each such beneficial Purchaser. |

| 4.18 |

The funds representing the aggregate Subscription Price in respect of the Units which will be advanced by or on behalf of the Purchaser to the Company hereunder do not represent proceeds of crime for the purposes of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada) (for the purposes of this section 4.19 the “PCMLTFA”) and the Purchaser acknowledges and agrees that the Company may be required by law to provide the securities regulators with a list setting forth the identities of the beneficial purchasers of the Units, or disclosure pursuant to the PCMLTFA. Notwithstanding that the Purchaser may be purchasing Units as agent on behalf of an undisclosed principal, the Purchaser agrees to provide, on request, particulars as to the identity of such undisclosed principal as may be required by the Company in order to comply with the foregoing. To the best of the Purchaser’s knowledge (a) none of the subscription funds provided by or on behalf of the Purchaser (i) have been or will be derived directly or indirectly from or related to any activity that is deemed criminal under the laws of Canada, the United States, or any other jurisdiction, or (ii) are being tendered on behalf of a person or entity who has not been identified to the Purchaser and, (b) the Purchaser will promptly notify the Company if the Purchaser discovers that any of such representations cease to be true, and shall provide the Company with appropriate information in connection therewith. |

| 4.19 |

The Purchaser is at arm’s-length within the meaning of Securities Laws (as defined herein) of the Company. |

| 4.20 |

The Purchaser is not, with respect to the Company or any of its affiliates, a “control person”, as defined under applicable securities laws, and the acquisition of the Units hereunder by the Purchaser will not result in the Purchaser becoming a “control person”. |

| 4.21 |

The Purchaser has been advised to seek tax, investment and independent legal advice and any other professional advice the Purchaser considers appropriate in connection with the Purchaser’s purchase of the Units and the Purchaser confirms that the Purchaser has not relied on the Company or its legal counsel in any manner in connection with the Purchaser’s purchase of the Units. |

5. Purchaser’s Acknowledgments

| 5.1 |

The Purchaser acknowledges and agrees (on its own behalf and, if applicable, on behalf of each beneficial purchaser for whom the Purchaser is contracting hereunder) with the Company (which acknowledgements and agreements shall survive the Closing) that: |

|

(a) |

This subscription forms part of the Offering. |

|

(b) |

The Units are subject to resale restrictions under applicable Securities Laws (defined below) and the Purchaser covenants that it will not resell the Units (or any securities underlying the Units or that may be issued in connection with the Units), except in compliance with such laws and the Purchaser acknowledges that it is solely responsible (and the Company is not in any way responsible) for such compliance. The Purchaser is advised to consult the Purchaser’s own legal advisors in this regard. For purposes hereof, “Securities Laws” means the Securities Act (British Columbia) (the “B.C. Act”), the 1933 Act, and the rules and regulations promulgated thereunder and all orders, rulings, published policy statements, notices, interpretation notes, directions and instruments thereunder and, if the Purchaser is not resident in British Columbia, also means the Other Applicable Securities Laws. |

|

(c) |

The Units are being offered for sale only on a “private placement” basis. |

|

(d) |

In purchasing the Units, the Purchaser has relied solely upon publicly available information relating to the Company and not upon any oral or written representation as to any fact or otherwise made by or on behalf of the Company or any other person associated therewith, the decision to purchase the Units was made on the basis of publicly available information. |

|

(e) |

The Purchaser’s ability to transfer the Units (or any securities underlying the Units or that may be issued in connection with the Units) is limited by, among other things, the Securities Laws and the policies of the Exchange. In particular the Purchaser acknowledges having been informed that the Units (or any securities underlying the Units or that may be issued in connection with the Units), are subject to resale restrictions under National Instrument 45-102 – Resale of Securities (“NI 45-102”) and may not be sold or otherwise disposed of in Canada for a period of four months from the date of distribution of the Units, unless a statutory exemption is available or a discretionary order is obtained from the applicable Securities Commission allowing the earlier resale thereof, and may be subject to additional resale restrictions if such sale or other disposition would be a “control distribution”, as that term is defined in NI 45-102. If the Purchaser is not resident in Canada, additional resale restrictions may apply under the Other Applicable Securities Laws. |

In addition to the foregoing, the Purchaser acknowledges that (i) the Company is a “domestic issuer” for purposes of United States securities laws, (ii) the Units (or any securities underlying the Units or that may be issued in connection with the Units) will constitute “restricted securities” under the 1933 Act and (iii) certificates representing the Common Shares and the Warrants comprising the Units will bear a legend in the form set forth in Section 6.2. Because the Company is a “domestic issuer” the Units (or any securities underlying the Units or that may be issued in connection with the Units) will continue to be “restricted securities” notwithstanding any resale pursuant to Regulation S under the 1933 Act. The U.S. restrictive legend set forth on any certificate representing the Units (or any securities underlying the Units or that may be issued in connection with the Units) will not be removed except in connection with (A) a resale of the Units (or any securities underlying the Units or that may be issued in connection with the Units) pursuant to an effective registration statement under the 1933 Act, or (B) a resale of the Units (or any securities underlying the Units or that may be issued in connection with the Units) pursuant to Rule 144 under the 1933 Act, in each case, irrespective of the holding period set forth above under NI 45-102.

|

(f) |

The representations, warranties, covenants and acknowledgements of the Purchaser contained in this Subscription Agreement, and in any appendices or other documents or materials executed and delivered by the Purchaser hereunder, are made by the Purchaser with the intent that they may be relied upon by the Company and its professional advisors in determining the Purchaser’s eligibility to purchase the Units. The Purchaser further agrees that by accepting the Units the Purchaser shall be representing and warranting that the foregoing representations and warranties are true as at the Closing with the same force and effect as if they had been made by the Purchaser at the Closing and that they shall survive the purchase by the Purchaser of the Units and shall continue in full force and effect notwithstanding any subsequent disposition by the Purchaser of the Units (or any securities underlying the Units or that may be issued in connection with the Units). The Purchaser hereby agrees to indemnify and save harmless the Company and its directors, officers, employees, advisors, affiliates, shareholders and agents, and their respective counsel, against all losses, claims, costs, expenses and damages or liabilities which any of them may suffer or incur and which are caused by or arise from any inaccuracy in, breach or misrepresentation by the Purchaser of, any such representations, warranties and covenants. The Purchaser undertakes to immediately notify the Company of any change in any statement or other information relating to the Purchaser set forth herein or in an Investor Certificate, as the case may be, that takes place prior to the Closing Date. |

|

(g) |

The sale and delivery of the Units to the Purchaser is conditional upon such sale being exempt from the requirement to file a prospectus or registration statement or to prepare and deliver an offering memorandum or similar document under any applicable statute relating to the sale of the Units or upon the issuance of such orders, consents or approvals as may be required to permit such sale without the requirement of filing a prospectus or registration statement or preparing and delivering an offering memorandum or similar document. The Purchaser further acknowledges and agrees that the Company may be required to provide applicable securities regulatory authorities with a list setting forth the identities of the beneficial purchasers of the Units and that the Purchaser will provide, on request, particulars as to the identity of such beneficial purchasers as may be required by the Company in order to comply with the foregoing. |

|

(h) |

The Purchaser and, if the person signing this subscription is acting as agent for a disclosed principal, such agent acknowledge and consent to the fact that the Company is collecting the Purchaser’s, and, if applicable, such agent’s personal information (as that term is defined under applicable privacy legislation, including, without limitation, the Personal Information Protection and Electronic Documents Act (Canada) and any other applicable similar, replacement or supplemental provincial or federal legislation or laws in effect from time to time), for the purpose of completing this Subscription Agreement. The Purchaser and, if the person signing this subscription is acting as agent for a disclosed principal, such agent acknowledge and consent to the Company retaining such personal information for as long as permitted or required by law or business practices. The Purchaser and, if the person signing this subscription is acting as agent for a disclosed principal, such agent further acknowledges and consents to the fact that the Company may be required by the Securities Laws, the rules and policies of any stock exchange or the rules of the Investment Industry Regulatory Organization of Canada to provide regulatory authorities, stock exchanges or marketplaces with any personal information provided by the Purchaser or, if applicable, such agent in this Subscription Agreement. The Purchaser and, if the person signing this subscription is acting as agent for a disclosed principal, such agent represent and warrant that it has the authority to provide the consents and acknowledgements set out in this Subsection 5.1(h). In addition to the foregoing, the Purchaser and, if the person signing this subscription is acting as agent for a disclosed principal, such agent acknowledge and agree that the Company may use and disclose the Purchaser’s and, if applicable, such agent’s personal information, and consents thereto, as follows: |

|

(i) |

for internal use with respect to managing the relationships between and contractual obligations of the Company and the Purchaser; |

|

(ii) |

for use and disclosure for income tax related purposes, including without limitation, where required by law, disclosure to the Canada Revenue Agency; |

|

(iii) |

disclosure to stock exchanges, marketplaces and securities regulatory authorities and other regulatory bodies having jurisdiction with respect to approval or acceptance for filing of the Offering, reports of trades and similar stock exchange, marketplace or regulatory filings; |

|

(iv) |

disclosure to a governmental or other authority to which the disclosure is required by court order or subpoena compelling such disclosure and where there is no reasonable alternative to such disclosure; |

|

(v) |

disclosure to professional advisers of the Company in connection with the performance of their professional services; |

|

(vi) |

disclosure to any person where such disclosure is necessary for legitimate business reasons; |

|

(vii) |

disclosure to a court determining the rights of the parties under this Subscription Agreement; or |

|

(viii) |

for use and disclosure as otherwise required or permitted by law. |

|

(i) |

The Purchaser is aware of the characteristics of the Units and the risks relating to an investment therein and agrees that the Purchaser must bear the economic risk of his, her or its investment in the Units. |

|

(j) |

The Purchaser has such knowledge in financial and business affairs as to be capable of evaluating the merits and risks of the Purchaser’s proposed investment in the Units. |

|

(k) |

This subscription is conditional upon its acceptance by the Company and the Subscription Agreement is conditional upon the acceptance of the Offering for filing by the Exchange. |

|

(l) |

The Purchaser is aware that (i) the Company may complete additional financings in the future in order to develop the Company’s business and to fund its ongoing development, (ii) there is no assurance that such financings will be available and, if available, on reasonable terms, (iii) any such future financings may have a dilutive effect on the Company’s securityholders, including the Purchaser, and (iv) if such future financings are not available, the Company may be unable to fund its on-going development and the lack of capital resources may result in the failure of the Company’s business. |

|

(m) |

A placement agent’s fee or finder’s fee may be payable by the Company to [the Placement Agent / Sprott Global Resource Investments, Ltd. (the “Placement Agent”)] or any finder, as applicable, who introduces a purchaser to the Company and such person’s Subscription Agreement is accepted by the Company. |

|

(n) |

The Purchaser is aware that the Offering is not subject to a minimum aggregate subscription amount, and the Company may close the Offering for less than the maximum aggregate amount indicated or may increase the size of the Offering. |

6. Resale Restrictions and Legending of Securities

| 6.1 |

In addition to the acknowledgements given in Article 5 hereof, the Purchaser acknowledges that the Units (or any securities underlying the Units or that may be issued in connection with the Units) will be subject to statutory resale restrictions. |

| 6.2 |

The Purchaser acknowledges that the Common Shares and Warrants and, if any Warrants are exercised prior to the expiry of the statutory resale restrictions, any Warrant Shares, will have attached to them whether through the electronic deposit of CDS, an ownership statement issued under a direct registration system or other electronic book-entry system, or on certificates that may be issued, as applicable, legends setting out the resale restrictions under applicable Securities Laws and required by the Exchange substantially in the following form and with the information completed: |

|

(a) |

Canadian restrictive legends: |

“UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY IN CANADA BEFORE [INSERT THE DATE THAT IS FOUR MONTHS AND ONE DAY AFTER THE CLOSING DATE.]”

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE LISTED ON THE TORONTO STOCK EXCHANGE (THE “TSX”); HOWEVER, THE SAID SECURITIES CANNOT BE TRADED THROUGH THE FACILITIES OF THE TSX SINCE THEY ARE NOT FREELY TRANSFERABLE, AND CONSEQUENTLY ANY CERTIFICATE REPRESENTING SUCH SECURITIES IS NOT “GOOD DELIVERY” IN SETTLEMENT OF TRANSACTIONS ON THE TSX.”

|

(b) |

U.S. restrictive legend (the “U.S. Legend”): |

“THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”), OR ANY STATE SECURITIES LAW. THE HOLDER HEREOF, BY PURCHASING SUCH SECURITIES, AGREES FOR THE BENEFIT OF SILVER BULL RESOURCES, INC. (THE “COMPANY”) THAT SUCH SECURITIES MAY BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY, (B) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT AND IN COMPLIANCE WITH ANY APPLICABLE STATE SECURITIES LAWS, (C) PURSUANT TO RULE 904 OF REGULATION S OF THE 1933 ACT, IF AVAILABLE, AND PURSUANT TO LOCAL LAWS AND REGULATIONS, (D) IN COMPLIANCE WITH THE EXEMPTION FROM REGISTRATION UNDER THE 1933 ACT PROVIDED BY RULE 144 THEREUNDER, IF AVAILABLE, AND IN COMPLIANCE WITH ANY APPLICABLE STATE SECURITIES LAWS OR (E) IN A TRANSACTION THAT DOES NOT REQUIRE REGISTRATION UNDER THE 1933 ACT AND IN COMPLIANCE WITH ANY APPLICABLE STATE SECURITIES LAWS, PROVIDED THAT, IN THE CASE OF (C), (D) OR (E), THE HOLDER HAS DELIVERED TO THE COMPANY AND THE REGISTRAR AND TRANSFER AGENT AN OPINION OF COUNSEL OF RECOGNIZED STANDING IN FORM AND SUBSTANCE REASONABLY SATISFACTORY TO THE COMPANY AND THE REGISTRAR AND TRANSFER AGENT TO SUCH EFFECT.”

| 6.3 |

The Purchaser acknowledges that the Units are being offered pursuant to an exemption from the registration requirements of the 1933 Act pursuant to Regulation S or Regulation D under the 1933 Act. The Purchaser further acknowledges that the Units (or any securities underlying the Units or that may be issued in connection with the Units) have not been registered under the 1933 Act or the securities laws of any State of the United States and that the Company does not intend to register any of the Units (or any securities underlying the Units or that may be issued in connection with the Units) under the 1933 Act or the securities laws of any state of the United States and has no obligation to do so. The Units may not be offered or sold to a U.S. Person or a person in the United States unless registered in accordance with United States federal securities laws and all applicable state securities laws or exemptions from such requirements are available. |

| 6.4 |

In the case of a sale of the Common Shares or the Warrant Shares by the Purchaser made pursuant to either (A) the provisions of Rule 144 of the 1933 Act; or (B) an effective registration statement under the 1933 Act, the Company shall, at the Company’s own cost, use commercially reasonable efforts to cause the transfer agent to remove the U.S. Legend and deliver unlegended share certificates to the Purchaser within three trading days following the delivery by the Purchaser to the Company or the Company’s transfer agent of a share certificate endorsed with the U.S. Legend. If the Company’s transfer agent fails to deliver an unlegended share certificate within such three trading day period, the Company will indemnify the Purchaser [(other than U.S. investors that are (i) brokers employed by the Placement Agent or its affiliates or (ii) one of the Exploration Capital Limited Partnerships managed by the Placement Agent or its affiliates)] for any damages and costs incurred as a result thereof, provided that: (i) such indemnity shall not extend to any lost profits of the Purchaser; and (ii) the aggregate amount of such indemnity in respect of any one legend removal shall not exceed US$5,000. For greater clarity, if, in the case of a sale pursuant to, and subject to satisfaction of the conditions required by, (A) or (B) above, the Company or the Company’s transfer agent requires a legal opinion to remove the U.S. Legend from any certificates representing the Common Shares or the Warrant Shares as contemplated in this Section, the Company shall use commercially reasonable efforts to cause its legal counsel to deliver such legal opinion at the Company’s expense. |

| 6.5 |

If, at any time before the first anniversary of the expiry of the Warrants, the Company determines to prepare and file with the United States Securities and Exchange Commission (the “SEC”) a registration statement relating to an offering for the Company’s own account or the account of others under the 1933 Act of any of its equity securities, other than a registration statement on Form S-4 or Form S-8 (each as promulgated under the 1933 Act) or their then equivalents relating to equity securities to be issued solely in connection with any acquisition of any entity or business or equity securities issuable in connection with the Company’s stock option or other employee benefit plans, then the Company shall deliver to the Purchaser a written notice of such determination and, if within 15 days after the date of the delivery of such notice, the Purchaser shall so request in writing, the Company shall include in such registration statement all or any part of the Common Shares or the Warrant Shares issued or issuable to the Purchaser (and any securities issued or then issuable upon any stock split, dividend or other distribution, capitalization or similar event with respect to the foregoing) (collectively, the “Registrable Securities”) that the Purchaser requests to be registered, but the Company shall not be required to register any Registrable Securities that (i) are eligible for resale pursuant to Rule 144 of the 1933 Act, and (ii) would continue to be eligible for resale pursuant to Rule 144 of the 1933 Act if the Company ceased to comply with the current information requirements of Rule 144(c). |

7. Company’s Representations and Warranties

| 7.1 |

The Company hereby represents and warrants to, and covenants with, the Purchaser, which representations, warranties and covenants shall survive the Closing, that as at the execution date of this Subscription Agreement and the Closing Date: |

|

(a) |

the Company is a valid and subsisting corporation duly incorporated and in good standing under the Nevada Revised Statutes and each subsidiary representing 10% or more of the Company’s consolidated assets or revenues (a “Material Subsidiary”) is a valid and subsisting corporation duly created and in good standing under the laws of the jurisdictions in which it exists with respect to all acts necessary to maintain its corporate existence; |

|

(b) |

all of the issued and outstanding shares in the capital of each Material Subsidiary have been duly authorized and validly issued, are fully paid and are directly or indirectly beneficially owned by the Company, free and clear of any liens, none of the outstanding securities of any Material Subsidiary was issued in violation of the pre-emptive or similar rights of any security holder of such subsidiary and there are no options, warrants, purchase rights, or other contracts or commitments that could require the Company to sell, transfer or otherwise dispose of any securities of any Material Subsidiary; |

|

(c) |

prior to the Closing, neither the Company nor any Material Subsidiary will have taken any steps to terminate its existence, to amalgamate or merge into another corporation, to continue into any other jurisdiction or to otherwise change its corporate existence and will not have received any notice or other communication from any person or governmental authority indicating that there exists any situation which could result in the termination of its existence; |

|

(d) |

the Company and each Material Subsidiary is not insolvent, and no acts or proceedings have been taken by or against it in connection therewith, the Company has not received any notice in respect of, and the Company and each Material Subsidiary is not in the course of, liquidation, winding-up, dissolution, bankruptcy or reorganization; |

|

(e) |

the Company and each Material Subsidiary has all requisite corporate power and capacity to possess its assets and to conduct its business as now carried on by it or proposed to be carried on by it; |

|

(f) |

the Company and each Material Subsidiary is duly qualified and registered or licensed to carry on business in the jurisdictions in which it is required to be so registered or licensed to carry on business or own property or assets and, to the Company’s knowledge, is carrying on its business and owns its property and assets, in all material aspects, in accordance with all applicable laws, regulations and other requirements and has not received any notice of a breach thereof which would have a material adverse effect on the Company, except where it is in good faith attempting to remedy such breach or contesting such notice; |

|

(g) |

neither the Company nor any Material Subsidiary is a party to any actions, suits or proceedings which could materially affect its business or financial condition, and no such actions, suits or proceedings have been threatened or, to the Company’s knowledge, are pending, except as disclosed in the Public Record (for the purposes hereof, “Public Record” means all documents containing information regarding the Company, including the Company’s audited annual and unaudited interim financial statements for the last two financial years (collectively the “Financial Statements”) filed by the Company with various Canadian securities commissions and are available on the System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedar.com and the United States Securities and Exchange Commission is available on the Electronic Data Gathering and Retrieval (EDGAR) website at www.sec.gov); |

|

(h) |

the Company is the beneficial owner of the properties, business and assets or the interests in the properties, business and assets disclosed in the Public Record, all agreements by which the Company holds an interest in a property, business or asset are in good standing according to their terms except as disclosed in the Public Record or where any such default would not have a material adverse effect on the Company;

|

|

(i) |

the Public Record and the representations contained in this Agreement are accurate in all material respects and omit no fact, the omission of which would make the filings comprising the Public Record or such representations misleading in light of the circumstances in which such statements or representations were made; |

|

(j) |

there is no “material fact” or “material change” (as those terms are defined in applicable Securities Laws) affecting the Company that has not been generally disclosed to the public (without restricting the statutory definition of such terms, a “material fact” is a fact that would reasonably be expected to have a significant effect on the market price or value of the Company’s securities and “material change” is a change (or a decision to implement a change) in the business, operations or capital of the Company that would reasonably be expected to have a significant effect on the market price or value of its securities); |

|

(k) |

the Financial Statements accurately reflect the financial position of the Company as at the date thereof and have been properly prepared in accordance with accounting principles generally accepted in the United States of America; |

|

(l) |

no material adverse change in the Company’s financial position has taken place since the date of the latest balance sheet contained in the Financial Statements, except as disclosed in the Public Record; |

|

(m) |

all tax returns, reports, elections, remittances and payments of the Company and its Material Subsidiaries required by applicable laws have been filed or made, except where the Company is contesting in good faith any re-assessments of its taxes payable thereunder, and are true, complete and correct except where the failure to make such filing, election, or remittance and payment shall not have a material adverse effect on the Company or its business; |

|

(n) |

the Company has all requisite corporate power and authority to issue and sell the Units and to execute, deliver and perform its obligations under this Agreement; |

|

(o) |

the Company has complied, and will comply, with all applicable corporate and securities laws and regulations in connection with the offer, sale and issuance of the Units; |

|

(p) |

the execution and delivery of this Agreement, the offer, sale and issuance of the Units, and the delivery of the certificates representing them, by the Company do not and will not conflict with and do not and will not result in a breach of any of the terms, conditions or provisions of its constating documents or any agreement or instrument to which the Company is a party; |

|

(q) |

this Agreement and the consummation of the transactions contemplated herein have been duly authorized by all necessary corporate action on the part of the Company and, subject to acceptance by the Company, this Agreement constitutes a valid obligation of the Company legally binding upon it and enforceable in accordance with its terms subject to such limitations and prohibitions in applicable laws relating to bankruptcy, insolvency, liquidation, moratorium, reorganization, arrangement or winding-up and other laws, rules and regulations of general application affecting the rights, powers, privileges, remedies and interests of creditors generally; |

|

(r) |

upon issue and delivery at the Closing, the Common Shares comprising the Units will be validly issued as fully paid and non-assessable and the Warrants will be validly issued and the certificates representing such Common Shares and Warrants will be validly delivered; |

|

(s) |

at the Closing, the Warrant Shares will have been duly allotted and reserved for issuance and, when issued upon the due exercise of the Warrants, will be duly issued as fully paid and non-assessable Common Shares; |

|

(t) |

to the Company’ knowledge, neither the Company nor its subsidiaries, nor to the knowledge of the Company, any director, officer, employee, consultant, representative or agent of the foregoing, has (i) violated any anti-bribery or anti-corruption laws applicable to the Company and its subsidiaries, including but not limited to Canada’s Corruption of Foreign Public Officials Act and the United States Foreign Corrupt Practices Act, or (ii) offered, paid, promised to pay, or authorized the payment of any money, or offered, given, promised to give, or authorized the giving of anything of value, that goes beyond what is reasonable and customary: (A) to any government official, whether directly or through any other person, for the purpose of influencing any act or decision of a government official in his or her official capacity, inducing a government official to do or omit to do any act in violation of his or her lawful duties, securing any improper advantage, inducing a government official to influence or affect any act or decision of any governmental authority, or assisting any representative of the Company or its subsidiaries in obtaining or retaining business for or with, or directing business to, any person; or (B) to any person in a manner which would constitute or have the purpose or effect of public or commercial bribery, or the acceptance of or acquiescence in extortion, kickbacks, or other unlawful or improper means of obtaining business or any improper advantage, and neither the Company nor its subsidiaries nor to the knowledge of the Company, any director, officer, employee, consultant, representative or agent of foregoing, has (i) conducted or initiated any review, audit, or internal investigation that concluded the Company, a subsidiary or any director, officer, employee, consultant, representative or agent of the foregoing violated such laws or committed any material wrongdoing, or (ii) made a voluntary, directed, or involuntary disclosure to any governmental authority responsible for enforcing anti-bribery or anti-corruption laws, in each case with respect to any alleged act or omission arising under or relating to non-compliance with any such laws, or received any notice, request, or citation from any person alleging non-compliance with any such laws; |

|

(u) |

none of the Company, its affiliates, or , to the Company’s knowledge, any person acting on their behalf (other than the Placement Agent or any finder, as to whose activities no representations or warranties are made) has engaged or will engage in any form of “general solicitation” or “general advertising” (as those terms are used in Regulation D), including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media or broadcast over radio or television, or other form of telecommunications, including electronic display, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising in the United States in connection with the Offering; |

|

(v) |

none of the Company, its affiliates or, to the Company’s knowledge, any person acting on its or their behalf (other than the Placement Agent or any finder, as to whose activities no representations or warranties are made) has made or will make any “directed selling efforts” (as such term is defined in Regulation S under the 1933 Act) in the United States with respect to the Offering and, without limiting such definition, “directed selling efforts” generally means any activity undertaken for the purpose of, or that could reasonably be expected to have the effect of, conditioning the market in the United States for any of the securities being offered and includes placing an advertisement in a publication “with a general circulation in the United States” that refers to the offering of securities being made in reliance upon Regulation S under the 1933 Act; |

|

(w) |

no order ceasing or suspending trading in the Units nor prohibiting sale of the Units has been issued to, and is outstanding against, the Company or its directors, officers or promoters and, to the Company’s knowledge, no investigations or proceedings for such purposes are pending or threatened; |

|

(x) |

the Company will apply to, and use commercially reasonable efforts to obtain the listing of the Common Shares issuable under the Offering on, the Exchange; |

|

(y) |

the Company is a reporting issuer under Securities Laws in British Columbia, Alberta and Ontario, and the Company is not in default in any material respect of any requirement of such Securities Laws; |

|

(z) |

the Common Shares are listed for trading on the Exchange and the Company is not in default in any material respect of any requirement of the Exchange; |

|

(aa) |

the Company’s registrar and transfer agent for its Common Shares has been duly appointed; and |

|

(bb) |

there shall not be any consents, approvals, authorizations, orders or agreements of any stock exchanges, securities commissions or similar authorities, governmental agencies or regulators, courts or any other persons which may be required for the issuance of the Units and the delivery of certificates representing the Units to the Purchaser, not obtained and not in effect on the date of delivery of such certificates; |

|

(cc) |

it will reserve or set aside sufficient shares in its treasury to issue the Common Shares and Warrant Shares; and |

|

(dd) |

no general solicitation or general advertising with respect to the sale of the Units offered hereby or of any of the securities of the Company has been made or is being made in relation to or in conjunction with the distribution pursuant to the Offering. |

| 7.2 |

The Company shall perform and carry out all of the acts and things to be completed by it as provided in this Subscription Agreement. |

8. General

| 8.1 |

Time shall, in all respects, be of the essence hereof. |

| 8.2 |

All references herein to monetary amounts are to lawful money of the Canada, unless indicated otherwise. |

| 8.3 |

The headings contained herein are for convenience only and shall not affect the meaning or interpretation hereof. |

| 8.4 |

Except as expressly provided for in this Subscription Agreement and in the agreements, instruments and other documents provided for, contemplated or incorporated herein, this Subscription Agreement constitutes the only agreement between the parties with respect to the subject matter hereof and shall supersede any and all prior negotiations and understandings. This Subscription Agreement may be amended or modified in any respect by written instrument only. |

| 8.5 |

The terms and provisions of this Subscription Agreement shall be binding upon and enure to the benefit of the Purchaser, the Company and their respective successors and assigns; provided that, except as herein provided, this Subscription Agreement shall not be transferable or assignable by any party without the written consent of the other. |

| 8.6 |

This Subscription Agreement shall be governed by and construed in accordance with the laws of the Province of British Columbia and the laws of Canada applicable therein and the parties hereto hereby irrevocably attorn to the exclusive jurisdiction of the courts of the Province of British Columbia. |

| 8.7 |

This Subscription Agreement is intended to and shall take effect on the date of acceptance of the subscription by the Company, notwithstanding its actual date of execution or delivery by any of the parties hereto, and shall be dated for reference as of the date of such acceptance by the Company. |

| 8.8 |

The Company shall be entitled to rely on delivery of a facsimile or electronic copy of an executed subscription and acceptance by the Company of such subscription shall be legally effective to create a valid and binding Agreement between the Purchaser and the Company in accordance with the terms hereof. |

| 8.9 |

The Purchaser acknowledges and agrees that all costs incurred by the Purchaser (including any fees and disbursements of counsel retained by the Purchaser) relating to the sale of the Units to the Purchaser shall be borne by the Purchaser. |

| 8.10 |

The Purchaser acknowledges that the Purchaser has consented to and requested that all documents evidencing or relating in any way to the issuance of the Units be drawn up in the English language only. Le soussigne reconnait par les presentes avoir consenti et exige que tous les documents faisant foi ou se rapportant de quelque maniere a la vente des titres offerts soient rediges en anglais seulement. |

| 8.11 |

Each of the parties hereto upon the request of the other parties hereto, whether before or after the Closing, shall do, execute, acknowledge and deliver or cause to be done, executed, acknowledged and delivered all such further acts, deeds, documents, assignments, transfers, conveyances, powers of attorney and assurances as reasonably may be necessary or desirable to complete, better evidence, or perfect the transactions contemplated herein. |

9. Method of Payment

Payment for the Units subscribed for (the “Subscription Amount”) must accompany this subscription and shall be paid by wire transfer (which subscription amount shall include any wire transfer fees payable) to:

|

Canadian Dollars

Beneficiary bank:

Beneficiary bank address:

Transit #:

Institution #:

SWIFT:

Beneficiary name:

Beneficiary account:

Intermediary bank

Bank name:

SWIFT:

ABA:

Canadian Clearing Code

|

|

10. Execution

This Subscription Agreement may be executed in any number of counterparts and may be executed and delivered by facsimile or other electronic means, all of which when taken together and so delivered shall be deemed to be one and the same original document.

APPENDIX I

INVESTOR CERTIFICATE

(CANADIAN INVESTORS)

Reference is made to the subscription agreement between Silver Bull Resources, Inc. (the “Company”) and the undersigned (the “Purchaser”) of which this Appendix I – Investor Certificate, once executed, forms a part (the “Subscription Agreement”). Upon execution of this Investor Certificate by the Purchaser, this Investor Certificate shall be incorporated into and form a part of the Subscription Agreement. For purposes hereof, certain definitions are included below for convenience.

In addition to the covenants, representations and warranties contained in the Subscription Agreement, the undersigned Purchaser represents, warrants and certifies to the Company that the Purchaser is purchasing as principal and qualifies to purchase under National Instrument 45-106 Prospectus Exemptions (“NI 45-106”), or otherwise, by reason of the fact that the Purchaser falls into one or more of the subparagraphs set out below, the Purchaser having initialled the applicable subparagraph or subparagraphs, and is:

|

I. |

If the Purchaser is not an individual, is subscribing for CDN$150,000 or more and is an entity not created or used solely to purchase or hold securities, please complete Section I – Minimum CDN$150,000 Investment below. |

|

II. |

If the Purchaser does not meet the requirements of Section I but is a non-individual Accredited Investor, please make the appropriate selection under Section II – Non-Individual Accredited Investor below. |

|

III. |

If the Purchaser does not meet the requirements of Section I but is an individual Accredited Investor, please make the appropriate selection under Section III – Individual Accredited Investor below. |

|

IV. |

If none of the above applies, please make the appropriate selection under Section IV – Employees, Officers, Directors and Consultants below. |

I. MINIMUM CDN$150,000 INVESTMENT

| ______ |

(a) |

A non-individual purchaser purchasing securities having an acquisition cost of not less than CDN$150,000 paid in cash and was not created or used solely to purchase or hold securities in reliance on the exemption from the dealer registration requirement or prospectus requirement available under section 2.10 of NI 45-106; |

II. NON-INDIVIDUAL ACCREDITED INVESTOR

| ______ |

(a) |

except in Ontario, a Canadian financial institution, or a Schedule III bank; |

| ______ |

(b) |

except in Ontario, the Business Development Bank of Canada incorporated under the Business Development Bank of Canada Act (Canada); |

| ______ |

(c) |

except in Ontario, a subsidiary of any person referred to in paragraphs (a) or (b), if the person owns all of the voting securities of the subsidiary, except the voting securities required by law to be owned by directors of that subsidiary; |

| ______ |

(d) |

except in Ontario, a person registered under the securities legislation of a jurisdiction of Canada as an adviser or dealer; |

| ______ |

(e) |

an individual registered under the securities legislation of a jurisdiction of Canada as a representative of a person referred to in paragraph (d); |

| ______ |

(e.1) |

an individual formerly registered under the securities legislation of a jurisdiction of Canada, other than an individual formerly registered solely as a representative of a limited market dealer under one or both of the Securities Act (Ontario) or the Securities Act (Newfoundland and Labrador); |

| ______ |

(f) |

except in Ontario, the Government of Canada or a jurisdiction of Canada, or any crown corporation, agency or wholly owned entity of the Government of Canada or a jurisdiction of Canada; |

| ______ |

(g) |

except in Ontario, a municipality, public board or commission in Canada or a metropolitan community, school board, the Comité de gestion de la taxe scolaire de l’île de Montréal or an intermunicipal management board in Québec; |

| ______ |

(h) |

except in Ontario, a national, federal, state, provincial, territorial or municipal government of or in any foreign jurisdiction, or an agency of that government; |

| ______ |

(i) |

except in Ontario, a pension fund that is regulated by either the Office of the Superintendent of Financial Institutions (Canada) or a pension commission or similar regulatory authority of a jurisdiction of Canada; |

| ______ |

(j) |

an investment fund that distributes or has distributed its securities only to; |

|

(i) |

a person that is or was an accredited investor at the time of the distribution; |

|

(ii) |

a person that acquires or acquired securities in the circumstances referred to in sections 2.10 of NI 45-106 [Minimum amount investment], and 2.19 of NI 45-106 [Additional investment in investment funds], or |

|

(iii) |

a person described in paragraph (i) or (ii) that acquires or acquired securities under section 2.18 of NI 45-106 [Investment fund reinvestment]; |

| ______ |

(k) |

an investment fund that distributes or has distributed securities under a prospectus in a jurisdiction of Canada for which the regulator, or, in Québec, the securities regulatory authority has issued a receipt; |

| ______ |

(l) |

a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or foreign jurisdiction, acting on behalf of a fully managed account managed by the trust company or trust corporation, as the case may be; |

| ______ |

(m) |

a person acting on behalf of a fully managed account1 managed by that person, if that person is registered or authorized to carry on business as an adviser or the equivalent under the securities legislation of a jurisdiction of Canada or a foreign jurisdiction; |

_____________________

1 A “fully managed account” means an account of a client for which a person makes the investment decisions if that person has full discretion to trade in securities for the account without requiring the client’s express consent to a transaction.

| ______ |

(n) |

a registered charity under the Income Tax Act (Canada) that, in regard to the trade, has obtained advice from an eligibility adviser or an adviser registered under the securities legislation of the jurisdiction of the registered charity to give advice on the securities being traded; |

| ______ |

(o) |

a person in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law to be owned by directors, are persons that are accredited investors; |

Note: if the Purchaser chooses to select this category, please complete the following:

I, ___________________________________, am an authorized signatory of above the Purchaser and confirm that all owners of interest of the Purchaser are Accredited Investors and the Purchaser has done the necessary investigations to verify that fact.

| ______ |

(p) |

an investment fund that is advised by a person registered as an adviser or a person that is exempt from registration as an adviser; |

| ______ |

(q) |

a trust established by an accredited investor for the benefit of the accredited investor’s family members of which a majority of the trustees are accredited investors and all of the beneficiaries are the accredited investor’s spouse, a former spouse of the accredited investor or a parent, grandparent, brother, sister, child or grandchild of that accredited investor, of that accredited investor’s spouse or of that accreted investor’s former spouse. |

| III. |

INDIVIDUAL ACCREDITED INVESTOR |

| ______ |

(a) |

an individual who, either alone or with a spouse,2 beneficially owns, directly or indirectly, financial assets3 having an aggregate realizable value that before taxes, but net of any related liabilities3 (“Net Financial Assets”), exceeds CDN$1,000,000; |

Note: if the Purchaser chooses to select this category, please complete the Risk Acknowledgement Form for Accredited Investors who are Individuals at Appendix I-A hereto

| ______ |

(a.1) |

an individual who beneficially owns financial assets3 having an aggregate realizable value that, before taxes but net of any related liabilities3 (“Net Financial Assets”), exceeds CDN$5,000,000; |

| ______ |

(b) |

an individual whose net income before taxes (“Net Income”) exceeded CDN$200,000 in each of the two most recent calendar years or whose net income before taxes combined with that of a spouse2 exceeded CDN$300,000 in each of the two most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year; |

2 For the purposes of this certificate, the term “spouse” means an individual who (i) is married to another individual and is not living separate and apart within the meaning of the Divorce Act (Canada) from the other individual, (ii) is living with another individual in a marriage-like relationship, including a marriage-like relationship between individuals of the same gender, or (iii) in Alberta, is an individual referred to in clause (i) or (ii) above, or is an adult interdependent partner within the meaning of the Adult Interdependent Relationships Act (Alberta).

3 For the purposes of this certificate, “Financial Assets” means cash, securities, or any contract of insurance or deposit or evidence thereof that is not a security for the purposes of securities legislation, and (ii) “Related Liabilities” means liabilities incurred or assumed for the purpose of financing the acquisition or ownership of financial assets and liabilities that are secured by financial assets.

Note: if the Purchaser chooses to select this category, please complete the Risk Acknowledgement Form for Accredited Investors who are Individuals at Appendix I-A hereto

| ______ |

(c) |

an individual who, either alone or with a spouse2, has net assets4 of at least CDN$5,000,000; |

Note: if the Purchaser chooses to select this category, please complete the Risk Acknowledgement Form for Accredited Investors who are Individuals at Appendix I-A hereto

| ______ |

(d) |

a person, other than an individual or investment fund, that has net assets4 of at least CDN$5,000,000 as shown on its most recently prepared financial statements; |

IV. EMPLOYEES, OFFICERS, DIRECTORS AND CONSULTANTS

| ______ |

(a) |

an employee, executive officer, director or consultant of the Company; |

| ______ |

(b) |

an employee, executive officer, director or consultant of a related entity of the Company; or |

| ______ |

(c) |

a permitted assign of a person referred to in paragraphs (a) or (b). |

___________________

4 For the purposes of this question, “net assets” means the value of the total assets of the purchaser less the value of the total liabilities.

The representations, warranties, statements and certifications made in this Certificate are true and accurate as of the date of this Certificate and will be true and accurate as of the Closing and the Purchaser acknowledges that this certificate is incorporated into and forms part of the subscription agreement to which it is attached. If any such representation, warranty, statement or certification becomes untrue or inaccurate prior to the Closing, the undersigned Purchaser shall give the Company immediate written notice thereof.

|

|

|

|

|

|

|

Name of Purchaser [Please Print]

|

|

|

|

|

|

Witness (If Purchaser is an individual)

|

|

Signature of Purchaser or Authorized Signatory of Purchaser

|

|

|

|

|

|

Name of Witness [Please Print]

|

|

Name and Office of Authorized Signatory of Purchaser [Please Print]

|

|

|

|

|

| |

|

Address of Purchaser |

Definitions

In this Investor Certificate, the following definitions are included for convenience:

“affiliate” means an issuer connected with another issuer because

(a) one of them is the subsidiary of the other, or

(b) each of them is controlled by the same person;

“director” means

|

(a) |

a member of the board of directors of a company or an individual who performs similar functions for a company; and |

|

(b) |

with respect to a person that is not a company, an individual who performs functions similar to those of a director of a company; |

“executive officer” means, for an issuer, an individual who is

|

(a) |

a chair, vice-chair or president, |

|

(b) |

a vice-president in charge of a principal business unit, division or function including sales, finance or production, or |

|

(c) |

performing a policy-making function in respect of the issuer; |

“financial assets” means

|

(c) |

a contract of insurance, a deposit or an evidence of a deposit that is not a security for the purposes of securities legislation |

“foreign jurisdiction” means a country other than Canada or a political subdivision of a country other than Canada;

“jurisdiction” means a province or territory of Canada except when used in the term foreign jurisdiction;

“permitted assign” means, for a person that is an employee, executive officer, director or consultant of an issuer or of a related entity of the issuer,

|

(a) |

a trustee, custodian, or administrator acting on behalf of, or for the benefit of the person, |

|

(b) |

a holding entity of the person, |

|

(c) |

a registered retirement savings plan or registered retirement income fund of the person, |

|

(d) |

a spouse of the person, |

|

(e) |

a trustee, custodian, or administrator acting on behalf of, or for the benefit of the spouse of the person, |

|

(f) |

a holding entity of the spouse of the person, or |

|

(g) |

a registered retirement savings plan or registered retirement income fund of the spouse of the person; |

“person” includes

|

(c) |

a partnership, trust, fund and an association, syndicate, organization or other organized group of persons, whether incorporated or not, and |

|

(d) |

an individual or other person in that person’s capacity as a trustee, executor, administrator or personal or other legal representative; |

“related entity” means, for an issuer, a person that controls or is controlled by the issuer or that is controlled by the same person that controls the issuer;

“Schedule III bank” means an authorized foreign bank named in Schedule III of the Bank Act (Canada);

“spouse” means, an individual who,

|

(a) |

is married to another individual and is not living separate and apart within the meaning of the Divorce Act (Canada), from the other individual; |

|

(b) |

is living with another individual in a marriage-like relationship, including a marriage-like relationship between individuals of the same gender; or |

|

(c) |

in Alberta, is an individual referred to in paragraph (a) or (b), or is an adult interdependent partner within the meaning of the Adult Interdependent Relationships Act (Alberta); |

“subsidiary” means an issuer that is controlled directly or indirectly by another issuer and includes a subsidiary of that subsidiary; and

“voting security” means any security which:

|

(a) |

is not a debt security; and |

|

(b) |

carries a voting right either under all circumstances or under some circumstances that have occurred and are continuing. |