Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - SILVER BULL RESOURCES, INC. | ex23x1.htm |

| EX-31.1 - EXHIBIT 31.1 - SILVER BULL RESOURCES, INC. | ex31x1.htm |

| EX-32.1 - EXHIBIT 32.1 - SILVER BULL RESOURCES, INC. | ex32x1.htm |

| EX-31.2 - EXHIBIT 31.2 - SILVER BULL RESOURCES, INC. | ex31x2.htm |

| EX-23.2 - EXHIBIT 23.2 - SILVER BULL RESOURCES, INC. | ex23x2.htm |

| EX-32.2 - EXHIBIT 32.2 - SILVER BULL RESOURCES, INC. | ex32x2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - SILVER BULL RESOURCES, INC. | Financial_Report.xls |

| EX-21.1 - EXHIBIT 21.1 - SILVER BULL RESOURCES, INC. | ex21x1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

R

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED October 31, 2014

|

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD OF _________ TO _________.

|

Commission File Number: 001-33125

SILVER BULL RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

91-1766677

|

|

State or other jurisdiction of incorporation or organization

|

(I.R.S. Employer Identification No.)

|

925 West Georgia Street, Suite 1908

Vancouver, B.C. V6C 3L2

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (604) 687-5800

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 Par Value

|

NYSE MKT

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes o No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes R No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes R No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company:

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company R

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No R

As of January 26, 2015, there were 159,072,657 shares of the registrant’s $0.01 par value Common Stock (“Common Stock”), the registrant’s only outstanding class of voting securities, outstanding. As of April 30, 2014, the aggregate market value of the registrant’s voting Common Stock held by non-affiliates of the registrant was approximately $38.8 million based upon the closing sale price of the Common Stock as reported by the NYSE MKT. For the purpose of this calculation, the registrant has assumed that its affiliates as of April 30, 2014 included two shareholders that held approximately 21.5% of its outstanding common stock and all directors and officers.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2015 annual meeting of shareholders are incorporated by reference in Part III of this annual report on Form 10-K.

SILVER BULL RESOURCES, INC.

ANNUAL REPORT ON FORM 10-K

|

|

|

|

|

|

|

|

|

|

Page

|

|

|

PART I

|

||||

|

|

|

|

|

|

|

Items 1 and 2.

|

Business and Properties

|

|

6

|

|

|

Item 1A.

|

Risk Factors

|

|

13

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

19

|

|

|

Item 3.

|

Legal Proceedings

|

|

19

|

|

|

Item 4.

|

Mine Safety Disclosure

|

|

19

|

|

|

|

|

|

|

|

|

|

||||

|

PART II

|

||||

|

Item 5.

|

Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

20

|

|

|

Item 6.

|

Selected Financial Data

|

|

22

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

22

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

|

29

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

29

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

29

|

|

|

Item 9A.

|

Controls and Procedures

|

|

29

|

|

|

|

|

|

|

|

|

|

||||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

31

|

|

|

Item 11.

|

Executive Compensation

|

|

31

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

31

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

31

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

31

|

|

|

|

||||

|

PART IV

|

||||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

|

32

|

|

|

|

Signatures

|

|

33

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

When we use the terms “Silver Bull,” “we,” “us,” or “our,” we are referring to Silver Bull Resources, Inc. and its subsidiaries, unless the context otherwise requires. We have included technical terms important to an understanding of our business under “Glossary of Common Terms” at the end of this section. Throughout this document we make statements that are classified as “forward-looking.” Please refer to the “Cautionary Statement Regarding Forward-Looking Statements” section of this document for an explanation of these types of assertions.

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K includes certain statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the United States Private Securities Litigation Reform Act of 1995, and “forward-looking information” within the meaning of applicable Canadian securities legislation. We use words such as “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “will,” “projection,” “should,” “believe,” “potential,” “could,” or similar words suggesting future outcomes (including negative and grammatical variations) to identify forward-looking statements. These statements include, among other things, our planned activities at the Sierra Mojada Project in 2015, continuing to progress in securing additional surface rights, internally remodeling the zinc resource and the potential for a standalone zinc project, internally studying a smaller silver open pit, the timing and scope of our exploration activities, the projections and estimates set forth in the PEA Technical Report and our proposed capital and operating budgets for the Sierra Mojada Project and general and administrative expenses.

These statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties and our actual results could differ from those express or implied in these forward-looking statements as a result of the factors described under “Risk Factors” in this Annual Report on Form 10-K, including:

|

·

|

Results of future exploration at our Sierra Mojada Project;

|

|

·

|

Our ability to raise necessary capital to conduct our exploration activities, and do so on acceptable terms;

|

|

·

|

Worldwide economic and political events affecting the market prices for silver, gold, zinc, lead, copper, manganese and other minerals that may be found on our exploration properties;

|

|

·

|

The amount and nature of future capital and exploration expenditures;

|

|

·

|

Competitive factors, including exploration-related competition;

|

|

·

|

Our inability to obtain required permits;

|

|

·

|

Timing of receipt and maintenance of government approvals;

|

|

·

|

Unanticipated title issues;

|

|

·

|

Changes in tax laws;

|

|

·

|

Changes in regulatory frameworks or regulations affecting our activities;

|

|

·

|

Our ability to retain key management and consultants and experts necessary to successfully operate and grow our business; and

|

|

·

|

Political and economic instability in Mexico and other countries in which we conduct our business, and future potential actions of the governments in such countries with respect to nationalization of natural resources or other changes in mining or taxation policies.

|

3

These factors are not intended to represent a complete list of the general or specific factors that could affect us.

All forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. You should not place undue reliance on these forward-looking statements.

Cautionary Note Regarding Exploration Stage Companies

We are an exploration stage company and do not currently have any known reserves and cannot be expected to have known reserves unless and until a feasibility study is completed for the Sierra Mojada concessions that shows proven and probable reserves. There can be no assurance that our concessions contain proven and probable reserves and investors may lose their entire investment. See “Risk Factors.”

Glossary of Common Terms

The following terms are used throughout this Annual Report on Form 10-K.

|

Concession

|

|

A grant of a tract of land made by a government or other controlling authority in return for stipulated services or a promise that the land will be used for a specific purpose.

|

|

|

|

|

|

Exploration Stage

|

|

A prospect that is not yet in either the development or production stage.

|

|

Feasibility Study

|

|

An engineering study designed to define the technical, economic, and legal viability of a mining project with a high degree of reliability.

|

|

|

|

|

|

Formation

|

|

A distinct layer of sedimentary rock of similar composition.

|

|

Mineralized Material

|

|

Mineral bearing material such as zinc, silver, gold, lead or copper that has been physically delineated by one or more of a number of methods including drilling, underground work, surface trenching and other types of sampling. This material has been found to contain a sufficient amount of mineralization of an average grade of metal or metals to have economic potential that warrants further exploration evaluation. While this material is not currently or may never be classified as reserves, it is reported as mineralized material only if the potential exists for reclassification into the reserves category. This material cannot be classified in the reserves category until final technical, economic and legal factors have been determined. Under the U.S. Securities and Exchange Commission’s standards, a mineral deposit does not qualify as a reserve unless the recoveries from the deposit are expected to be sufficient to recover total cash and non-cash costs for the mine and related facilities and make a profit.

|

|

|

|

|

|

Mining

|

|

The process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized.

|

|

|

|

|

|

Ore, Ore Reserve, or Mineable Ore Body

|

|

The part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

|

4

|

|

|

|

|

Reserves

|

|

Estimated remaining quantities of mineral deposit and related substances anticipated to be recoverable from known accumulations, from a given date forward, based on:

(a) analysis of drilling, geological, geophysical and engineering data;

(b) the use of established technology;

(c) specified economic conditions, which are generally accepted as being reasonable, and which are disclosed; and

(d) permitted and financed for development

|

|

|

|

|

|

Resources

|

|

Those quantities of mineral deposit estimated to exist originally in naturally occurring accumulations.

Resources are, therefore, those quantities estimated on a particular date to be remaining in known accumulations plus those quantities already produced from known accumulations plus those quantities in accumulations yet to be discovered.

Resources are divided into:

(a) discovered resources, which are limited to known accumulations; and

(b) undiscovered resources.

|

|

|

|

|

|

Tonne

|

|

A metric ton which is equivalent to 2,204.6 pounds.

|

|

|

|

|

|

|

|

|

5

PART I

Items 1 and 2. BUSINESS AND PROPERTIES

Overview and Corporate Structure

Silver Bull Resources, Inc. was incorporated in the State of Nevada on November 8, 1993 as the Cadgie Company for the purpose of acquiring and developing mineral properties. The Cadgie Company was a spin-off from its predecessor, Precious Metal Mines, Inc. On June 28, 1996, our name was changed to Metalline Mining Company (“Metalline”). On April 21, 2011, we changed our name to Silver Bull Resources, Inc. We have not realized any revenues from our planned operations and we are considered an Exploration Stage Company. We have not established any reserves with respect to our exploration projects, and may never enter into the development with respect to any of our projects.

We engage in the business of mineral exploration. We currently own or have the option to acquire a number of property concessions in Mexico within a mining district known as the Sierra Mojada District, located in the west-central part of the state of Coahuila, Mexico. We conduct our operations in Mexico through our wholly-owned subsidiary corporations, Minera Metalin S.A. de C.V. (“Minera Metalin”) and Contratistas de Sierra Mojada S.A. de C.V. (“Contratistas”) and through Minera Metalin’s wholly-owned subsidiary Minas de Coahuila SBR S.A. de C.V (“Minas”).

In April 2010, Metalline Mining Delaware, Inc., our wholly-owned subsidiary, was merged with and into Dome Ventures Corporation (“Dome”). As a result, Dome became a wholly-owned subsidiary of Silver Bull. Dome has a wholly-owned subsidiary, Dome Asia Inc. (“Dome Asia”), which is incorporated in the British Virgin Islands. Dome Asia has a wholly-owned subsidiary incorporated in Gabon, African Resources SARL Gabon (“African Resources”), as well as a 99.99%-owned subsidiary, Dome Minerals Nigeria Limited, incorporated in Nigeria. In January 2015 we completed the sale of our subsidiary Dome International Global Inc. (“Dome International”) including Dome International’s wholly-owned subsidiary Dome Ventures SARL Gabon (“Dome Gabon”) which held the Ndjole Prospect in Gabon.

Our efforts have been concentrated in expenditures related to exploration properties, principally in the Sierra Mojada Property located in Coahuila, Mexico. We have not determined whether the exploration properties contain ore reserves that are economically recoverable. The ultimate realization of our investment in exploration properties is dependent upon the success of future property sales, the existence of economically recoverable reserves, our ability to obtain financing or make other arrangements for exploration, development and future profitable production activities. The ultimate realization of our investment in exploration properties cannot be determined at this time. Accordingly, no provision for any asset impairment that may result, in the event we are not successful in developing or selling these properties, has been made in the accompanying consolidated financial statements, except as disclosed in Notes 3 and 6.

Sierra Mojada Project

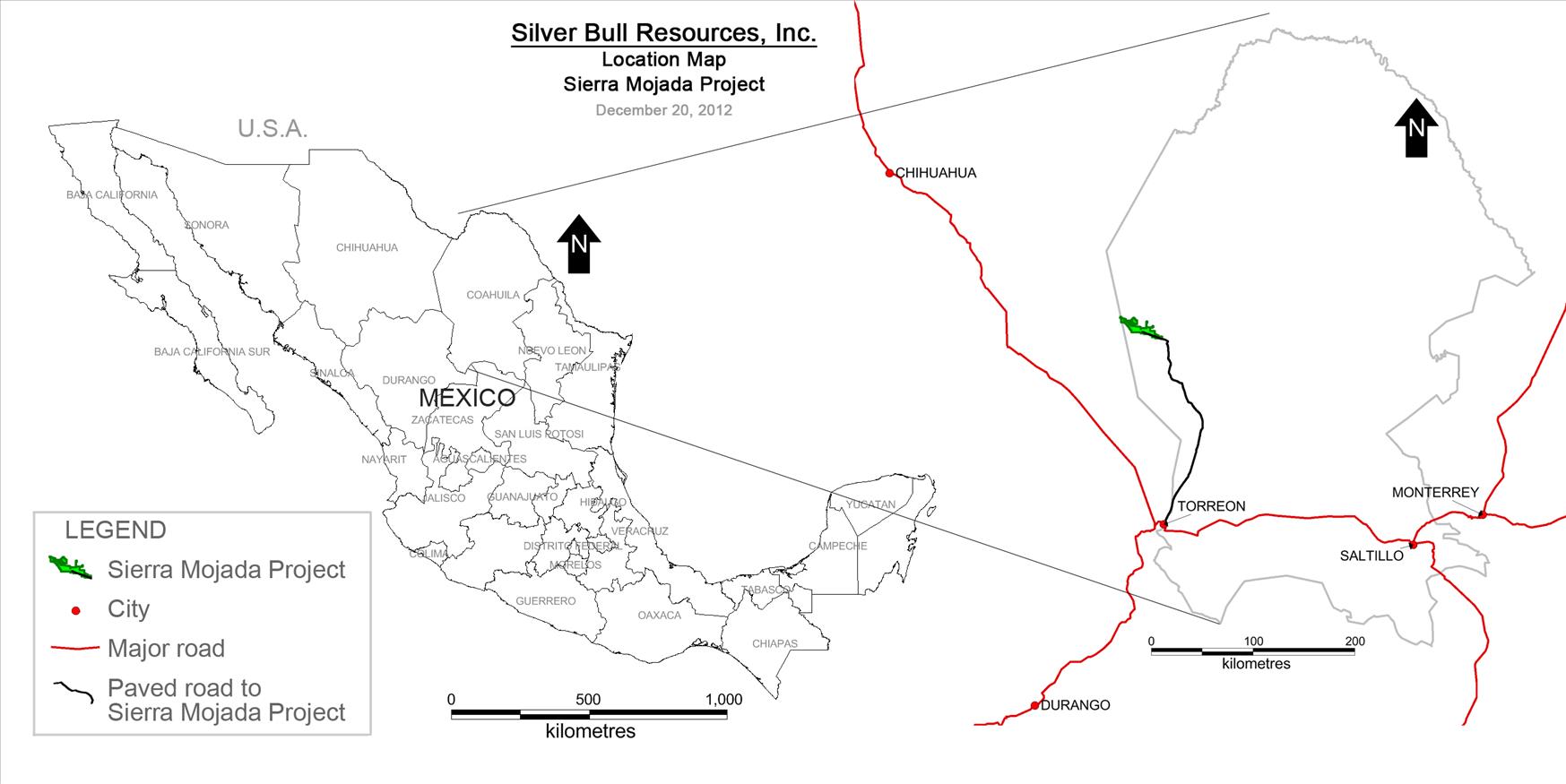

Location, Access and Infrastructure

The Sierra Mojada project is located within a mining district known as the Sierra Mojada District. The Sierra Mojada District is located in the west central part of the state of Coahuila, Mexico, near the Coahuila-Chihuahua state border approximately 200 kilometers south of the Big Bend of the Rio Grande River. The principal mining area extends for approximately 5 kilometers in an east-west direction along the base of the precipitous, 1,000 meter high, Sierra Mojada Range.

The Sierra Mojada project site is situated to the south of the village of Esmeralda, on the northern side of a major escarpment that forms the northern margin of the Sierra Mojada range. In general, the site is approximately 1,500 meters above sea level. The project is accessible by paved road from the city of Torreon, Coahuila, which lies approximately 250 kilometers to the southwest. Esmerelda is served by a rail spur of the Coahuila Durango railroad. There is an airstrip east of Esmeralda, although its availability is limited, and another airstrip at the nearby Penoles plant, which we can use occasionally. The Sierra Mojada District has high voltage electric power supplied by the national power company, Comision Federal de Electricidad, C.F.E., and is supplied water by the municipality of Sierra Mojada. Although power levels are sufficient for current operations and exploration, future development of the project, if any, may require additional power supplies to be sourced.

6

Our facilities in Mexico include offices, residences, shops, warehouse buildings and exploration equipment located at Calle Mina #1, La Esmeralda, Coahuila, Mexico.

The map below shows the location of the Sierra Mojada project:

Property History

Silver and lead were first discovered by a foraging party in 1879, and mining to 1886 consisted of native silver, silver chloride, and lead carbonate ores. After 1886, silver-lead-zinc-copper sulphate ores within limestone and sandstone units were produced. No accurate production history has been found for historical mining during this period.

Approximately 90 years ago, zinc silicate and zinc carbonate minerals (“Zinc Manto Zone”) were discovered underlying the silver-lead mineralized horizon. The Zinc Manto Zone is predominantly zinc dominated, but with subordinate lead – rich manto and is principally situated in the footwall rocks of the Sierra Mojada Fault System. Since discovery and up to 1990, zinc, silver, and lead ores were mined from various mines along the strike of the deposit including from the Sierra Mojada Property. Ores mined from within these areas were hand-sorted, and the concentrate shipped mostly to smelters in the United States.

Activity during the period of 1956 to 1990 consisted of operations by the Mineros Norteños Cooperativa and operations by individual owners and operators of pre-existing mines. The Mineros Norteños operated the San Salvador, Encantada, Fronteriza, Esmeralda, and Parrena mines, and shipped oxide zinc ore to Zinc National’s smelter in Monterrey, while copper and silver ore were shipped to smelters in Mexico and the United States.

We estimate that over 45 mines have produced ore from underground workings throughout the approximately five kilometers by two kilometer area that comprises the Sierra Mojada District. We estimate that since its discovery in 1879, the Sierra Mojada District has produced approximately 10 million tons of silver, zinc, lead and copper ore. The District does not have a mill to concentrate ore and all mining conducted thus far has been limited to selectively mined ore of sufficient grade to direct ship to smelters. We believe that mill-grade mineralization that was not mined remains available for extraction. No mining operations are currently active within the area of the Sierra Mojada District, except for a dolomite quarry by Peñoles near Esmeralda.

In the 1990’s, Kennecott Copper Corporation (“Kennecott”) had a joint venture agreement involving USMX’s Sierra Mojada concessions. Kennecott terminated the joint venture in approximately 1995. We entered into a Joint Exploration and Development Agreement with USMX in July 1996 involving USMX’s Sierra Mojada concessions. In 1998, we purchased the Sierra Mojada and the USMX concessions and the Joint Exploration and Development Agreement was terminated. We also purchased certain other concessions during this time and conducted exploration for copper and silver mineralization from 1997 through 1999.

7

Title and Ownership Rights

The Sierra Mojada Project is comprised of 31 concessions consisting of 20,946 hectares (about 51,758 acres). We periodically obtain additional concessions in the Sierra Mojada Project area and whether we will continue to hold these additional concessions will depend on future exploration work and exploration results and our ability to obtain financing. As we have done in prior years, we continually assess our concession ownership and in 2014 we terminated our rights to certain concessions holdings not in the core area of the Sierra Mojada Project and three concessions in the core area of the Sierra Mojada Project which we did not consider to be material to the PEA Technical Report described in the Preliminary Economic Assessment Technical Report section.

Two of the concessions in the Sierra Mojada project are subject to options to purchase from existing third party concession owners. During 2014 we terminated an option agreement covering three concessions. We also modified the terms of the remaining option agreement to defer certain option payments. If exploration results warrant, we intend to make the payments described below. Pursuant to the option purchase agreement, we are required to make certain payments over the terms of this contract to obtain full ownership of these concessions as set forth in the table below:

|

Nuevo Dulces Nombres (Centenario) and Yolanda III (2 concessions)

|

|

|

|

|

|

Payment Date

|

Payment Amount(1)(2)

|

|

May 2015

|

$30,000

|

|

Monthly payment beginning August 2016 and ending July 2018

|

$20,000 per month

|

(1) Until July 2018, we have the option of acquiring Nuevo Dulces Nombres (100% interest) for $4 million and Yolanda III (100% interest) for $2 million plus a lump sum payment equal to any remaining monthly payments.

(2) If a change of control of Silver Bull occurs prior to May 30, 2016 we are required to make a payment of $200,000 within 20 days of the change of control.

Each mining concession enables us to explore the underlying concession in consideration for the payment of a semi-annual fee to the Mexican government and completion of certain annual assessment work. Annual assessment work in excess of statutory annual requirements can be carried forward and applied to future periods.

Ownership of a concession provides the owner with exclusive exploration and exploitation rights to all minerals located on the concessions, but does not include the surface rights to the real property. Therefore, we will need to negotiate any necessary agreements with the appropriate surface landowners if we determine that a mining operation is feasible for the concessions. We own surface rights to five lots in the Sierra Mojada Property (Sierra Mojada lot #1, #3, #4, #6 and #7), but anticipate that we will be required to obtain additional surface rights if we determine that a mining operation is feasible.

Geology and Mineralization

The Sierra Mojada concessions contain a mineral system which can be separated into two distinct zones: The “Silver Zone” and the “Zinc Zone.” These two zones lie along the Sierra Mojada Fault which trends east-west along the base of the Sierra Mojada range. All of the mineralization identified to date is seen as oxide, which has been derived from primary “sulphide” bodies which have been oxidized and remained in situ or remobilized into porous and fractured rock along the Sierra Mojada Fault. The formation of a silver rich zone (the Silver Zone) and a zinc rich zone (the Zinc Zone) is a reflection of the mobility’s of the metals in the ground water conditions at Sierra Mojada.

The geology of the District is composed of a Cretaceous limestone and dolomite sequence sitting on top of the Jurassic “San Marcos” red sediments. This sedimentary sequence has then later been intruded by Tertiary volcanics, which are considered to be responsible for the mineralization seen at Sierra Mojada. Historical mines are dry and the rocks are competent for the most part. The thickness and attitude of the mineralized material could potentially be amenable to high volume mechanized mining methods and low cost production.

8

Preliminary Economic Assessment Technical Report

On December 19, 2013, JDS Energy & Mining Inc. (“JDS”) delivered Silver Bull’s amended initial Preliminary Economic Assessment (the “PEA Technical Report”) on the silver and zinc mineralization for the Sierra Mojada Project in accordance with Canadian National Instrument 43-101 (“NI 43-101”). The PEA Technical Report includes an update on the silver and zinc mineralization, which was estimated from 1,372 diamond drill holes, 25 reverse circulation drill holes, 9,025 channel samples and 2,345 long holes. At a cutoff grade of 25 grams/tonne of silver for mineralized material, the PEA Technical Report indicates mineralized material of 71.1 million tonnes at an average silver grade of 71.5 grams/tonne silver and an average zinc percentage of 1.34%. Mineralized material estimates do not include any amounts categorized as inferred resources. The PEA Technical Report included a preliminary assessment of capital costs, mine plan, processing and projected operating costs of a possible future mine at the Sierra Mojada Project. We believe the results of the PEA Technical Report, although preliminary in nature, were encouraging and show that the Sierra Mojada Project has the potential to continue to advance.

“Mineralized material” as used in this Annual Report on Form 10-K, although permissible under the Securities and Exchange Commission’s (“SEC’s”) Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any part of the Sierra Mojada Project will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves.” Investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

Sampling, Analysis, Quality Control and Security

Our activities conform to mining industry standard practices and follow the Best Practices Guidelines of the Canadian Institute of Mining, Metallurgy, and Petroleum (CIM). Sampling is directed and supervised by trained and experienced geologists. Drill core and other samples are processed and logged using industry standard methods. Standard samples, duplicates and blanks are periodically entered into the stream of samples submitted for assays, and campaigns of re-sampling and duplicate analyses and round-robin inter-laboratory validations are conducted periodically. We use ALS Chemex - Vancouver (“ALS Chemex”) laboratory as our independent primary laboratory. ALS Chemex is ISO 9001:2000 certified. All analytical results that are used in resource models are exclusively from the independent primary laboratory.

Our consultants perform technical audits of our operations, including our formal QA/QC program, and recommend improvements as needed. A systematic program of duplicate sampling and assaying of representative samples from previous exploration activities was completed in 2010 under the direction and control of our consultants. Results of this study acceptably confirm the values in the project database used for resource modeling.

We formerly operated a sample preparation and an analytical laboratory at the project that prepared samples for shipment, performed QA/QC analyses to ensure against cross contamination of samples during preparation and removed most low-value samples from the flow to the primary laboratory. For both cost and perception reasons, the internal laboratory has been shut down, and all drill samples are submitted directly to ALS Chemex for sample preparation and analyses.

Prior Exploration Activities

We have focused our exploration efforts on two primary locations: the Silver Zone and the Zinc Zone. As further described below, we have conducted various exploration activities at the Sierra Mojada Project, however, to date, we have not established any reserves, and the project remains in the exploration state and may never enter the development stage.

Prior to 2008, exploration efforts largely focused on the Zinc Zone with surface and underground drilling. In 2008 Pincock, Allen, & Holt (“PAH”) published a resource report on the Zinc Zone. In fiscal year 2009, we scaled back our exploration activities and administrative costs to conserve capital while we tried to secure additional sources of capital.

After closing the transaction with Dome in April 2010, we focused our exploration activities at Sierra Mojada on the Silver Zone which lies largely at surface. By the end of calendar 2013, approximately 100,000 meters of diamond drilling from surface and 10,000 meters of underground drilling had been completed.

The silver contained within the Silver Zone is seen primarily as silver halide minerals. The zinc contained within the Zinc Zone is contained mostly in the mineral hemimorphite and, to a lesser amount, in the mineral smithsonite.

2014 Exploration Activities

Our focus for 2014 was the completion of the PEA Technical Report, continued metallurgical work and geological mapping. In December 2013, the PEA Technical Report was completed, together with an updated estimate on the silver and zinc mineralization. We also continued to progress our metallurgical program, as described below.

9

2015 Exploration Program

As discussed in the “Material Changes in Financial Condition, Liquidity and Capital Resources” section below we have approved a calendar year 2015 budget of $0.7 million for the Sierra Mojada Property. The focus of the 2015 calendar year program is continuing to progress in securing additional surface rights, maintenance of our property concessions, internally remodeling the zinc resource and the potential for a standalone zinc project and internally studying a smaller silver open pit as discussed below.

During 2015 we intend to internally investigate the potential for a high grade underground zinc oxide mine. To this purpose we are completing an internal remodeling of the zinc resource, much of which was not included in the resource outlined in the PEA Technical Report.

We also intend to do an internal examination on the potential for a smaller silver open pit than the one proposed in the PEA Technical Report. The focus will be to target the "at-surface" silver mineralization with a smaller project. Although a smaller project would produce fewer ounces than proposed in the PEA Technical Report, the low strip and smaller plant would be expected to significantly reduce the overall capital costs needed to put the project into production.

During 2015, and subject to market favorable conditions, we intend to examine the potential for fuming high grade zinc. Previous test work completed by Hazen Research Inc. at the request of us in 2012 focused on roasting the zinc ore in a rotary kiln to fume off the zinc and collect it as a zinc oxide concentrate. Recoveries of up to 98% of the zinc were recorded.

The roasting of the zinc samples aims to simulate a "Waelz Kiln", a kiln which is used extensively to recycle zinc from steel dust and which regularly achieves recoveries in excess of 90%. In considering this process, the zinc mineralization at Sierra Mojada has a number of possible advantages: It lies in the state of Coahuila which is the largest coal producing state in Mexico, and it has an existing gas pipeline nearby which may be able to be extended to the project (as contemplated in the PEA Technical Report). Either option could provide the fuel to run the kiln. The project also has a functioning railway right to site to potentially allow for transport of coal to the site and of the zinc concentrate from the site.

Metallurgical Studies

In addition we previously conducted a metallurgical program to test the recovery of the silver mineralization using the agitation cyanide leach method and recovery of the zinc mineralization using the SART process (sulfidization, acidification, recycling, and thickening). The test work on the silver zone focused on cyanide leach recovery of the silver using “Bottle Roll” tests to simulate an agitation leach system and to determine the recovery of low grade zinc that occurs in the silver zone and high grade zinc from the zinc zone that had been blended with mineralization from the silver zone to the leach solution. The silver was recovered from the cyanide leach solution using the Merrill Crowe technique and the zinc was recovered from the leach solution using the SART process. The SART Process is a metallurgical process that regenerates and recycles the cyanide used in the leaching process of the silver and zinc and allows for the recovery of zinc that has been leached by the cyanide solution. The results showed an overall average silver recovery of 73.2% with peak values of 89.0% and an overall average zinc recovery of 44% in the silver zone.

Gabon, Africa Licenses and Interests

On December 13, 2013, we entered into a binding letter of agreement, and on May 21, 2014 we executed a share purchase agreement (the “Transaction”) with BHK Mining Corp. (formerly BHK Resources, Inc.) (“BHK”) to sell all of the issued and outstanding securities of our former subsidiary, Dome International, which holds, indirectly, a 100% interest in and to the Ndjole manganese and gold license through its wholly-owned subsidiary, Dome Gabon, for cash consideration of $1,500,000 and reimbursement of our expenses of $75,000. In addition, we hold the Mitzic exploration license in Gabon whose recoverability is highly uncertain.

10

Executive Officers of Silver Bull Resources

We have three executive officers: (1) a Chairman, (2) a President and Chief Executive Officer and (3) a Chief Financial Officer. Set forth below is information regarding our executive officers.

|

Name and Residence

|

|

Age

|

Position

|

||

|

Brian Edgar

Vancouver, BC

|

65

|

Chairman

|

|||

|

Tim Barry

Vancouver, BC

|

39

|

President, Chief Executive Officer and Director

|

|||

|

Sean Fallis

Vancouver, BC

|

35

|

Chief Financial Officer

|

Brian Edgar. Mr. Edgar was appointed Chairman of the Board of Directors in April 2010. Mr. Edgar has broad experience working in junior and mid-size natural resource companies. He previously served as Dome's President and Chief Executive Officer from February 2005 until it was acquired by Silver Bull in April 2010. Further, Mr. Edgar served on Dome's Board of Directors from 1998 to 2010. Mr. Edgar currently serves as a director of BlackPearl Resources Inc., Denison Mines Corp., Lucara Diamond Corp., Lundin Mining Corporation, and ShaMaran Petroleum Corp. Mr. Edgar practiced corporate/securities law in Vancouver, British Columbia, Canada for sixteen years.

Tim Barry. Mr. Barry has served as a director, President and Chief Executive Officer of Silver Bull since March 2011. From August 2010 to March 2011, he served as our Vice President - Exploration. Between 2006 and August 2010, Mr. Barry spent 5 years working as Chief Geologist in West and Central Africa for Dome. During this time, he managed all aspects of Dome’s exploration programs, as well as oversaw corporate compliance for Dome’s various subsidiaries. Mr. Barry also served on Dome’s board of directors. In 2005, he worked as a project geologist in Mongolia for Entree Gold, a company that has a significant stake in the Oyu Tolgoi mine in Mongolia. Between 1998 and 2005, Mr. Barry worked as an exploration geologist for Ross River Minerals on its El Pulpo copper/gold project in Sinaloa, Mexico, for Canabrava Diamonds on its exploration programs in the James Bay lowlands in Ontario, Canada, and for Homestake on its Plutonic Gold Mine in Western Australia. He has also worked as a mapping geologist for the Geological Survey of Canada in the Coast Mountains, and as a research assistant at the University of British Columbia, where he examined the potential of CO2 sequestration in Canada using ultramafic rocks. Mr. Barry received a bachelor of science from the University of Otago in Dundein, New Zealand and is a registered geologist (CPAusIMM). He also serves on the board of directors of Acme Resources, a junior exploration company listed on the Toronto Stock Exchange.

Sean Fallis. Mr. Fallis was appointed Chief Financial Officer in April 2011. From February 2011 to April 2011, he served as our Vice President - Finance. From July 2008 to February 2011, Mr. Fallis served as the Corporate Controller for Rusoro Mining Ltd. Prior to working at Rusoro Mining Ltd, he worked at PricewaterhouseCoopers as an Audit Senior Associate from January 2007 to June 2008, where he worked with both Canadian and U.S. publicly-listed companies in the audit and assurance practice. At PricewaterhouseCoopers, Mr. Fallis focused on clients in the mining industry. Further, he worked at SmytheRatcliffe Chartered Accountants as a staff accountant from September 2004 to December 2006. Mr. Fallis received a bachelor of science from Simon Fraser University in 2002 and is a Chartered Accountant.

Competition and Mineral Prices

Mineral Prices

Silver and zinc are commodities, and their prices are volatile. From January 1, 2014 to December 31, 2014 the price of silver ranged from a low of $15.28 per troy ounce to a high of $22.05 per troy ounce, and from January 1, 2014 to December 31, 2014 the price of zinc ranged from a low of $2,008 per tonne to a high of $2,327 per tonne. Silver and zinc prices are affected by many factors beyond our control, including prevailing interest rates and returns on other asset classes, expectations regarding inflation, speculation, currency values, governmental decisions regarding the disposal of precious metals stockpiles, global and regional demand and production, political and economic conditions and other factors. The competitive nature of the business and the risks with which we are therefore faced are discussed further in the item entitled “Risk Factors,” below.

The following tables set forth, for the periods indicated, on the London Metal Exchange, high and low silver and zinc prices in U.S. dollars per troy ounce and per tonne, respectively. On October 31, 2014, the closing price of silver was $16.20 per troy ounce. On October 31, 2014, the closing price of zinc was $2,277 per tonne.

|

Silver

(per troy ounce)

|

||||||||

|

Year

|

High

|

Low

|

||||||

|

2007

|

$15.82 | $11.67 | ||||||

|

2008

|

$20.92 | $8.88 | ||||||

|

2009

|

$19.18 | $10.51 | ||||||

|

2010

|

$30.70 | $15.14 | ||||||

|

2011

|

$48.70 | $26.16 | ||||||

|

2012

|

$37.23 | $26.67 | ||||||

|

2013

|

$32.23 | $18.61 | ||||||

| 2014 | $22.05 | $15.28 | ||||||

|

Zinc

(per tonne)

|

||||||||

|

Year

|

High

|

Low

|

||||||

|

2007

|

$3,848 | $2,379 | ||||||

|

2008

|

$2,511 | $1,113 | ||||||

|

2009

|

$2,374 | $1,118 | ||||||

|

2010

|

$2,414 | $1,746 | ||||||

|

2011

|

$2,473 | $1,871 | ||||||

|

2012

|

$2,040 | $1,816 | ||||||

|

2013

|

$2,129 | $1,831 | ||||||

| 2014 | $2,327 | $2,008 | ||||||

11

Competition

Our industry is highly competitive. We compete with other mining and exploration companies in connection with the acquisition and exploration of mineral properties. There is competition for a limited number of mineral property acquisition opportunities, some of which is with other companies having substantially greater financial resources, staff and facilities than we do. As a result, we may have difficulty acquiring attractive exploration properties, staking claims related to our properties and exploring properties. Our competitive position depends upon our ability to successfully and economically acquire and explore new and existing mineral properties.

Government Regulation

Mineral exploration activities are subject to various national, state/provincial, and local laws and regulations, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. Similarly, if any of our properties are developed and/or mined, those activities are also subject to significant governmental regulation and oversight. We will obtain the licenses, permits or other authorizations currently required to conduct our exploration program. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations applicable to the mineral interests we now hold in Mexico and Gabon.

Environment Regulations

Our activities are subject to various national and local laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. We intend to conduct business in a way that safeguards public health and the environment. We will conduct our operational compliance with applicable laws and regulations.

Changes to current state or federal laws and regulations in Mexico and Gabon could, in the future, require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

During fiscal year 2014, we had no material environmental incidents or non-compliance with any applicable environmental regulations.

Employees

We have three employees, of which, all are full time. Contratistas, our wholly-owned operating subsidiary in Mexico currently has nine employees who are all full time. Minera, our mineral holding company in Mexico, does not have any employees.

Corporate Offices

Our corporate offices are located at 925 West Georgia Street, Suite 1908, Vancouver, British Columbia, Canada V6C 3L2. Our telephone number is (604) 687-5800, and our fax number is (604) 563-6004.

Available Information

We maintain an internet website at http://www.silverbullresources.com. The information on our website is not incorporated by reference in this Annual Report on Form 10-K. We make available on or through our website certain reports and amendments to those reports that we file with or furnish to the SEC in accordance with the Exchange Act. Alternatively, you may read and copy any information we file with the SEC at its public reference room at 100 “F” Street NE, Washington, D.C. 20549. You may obtain information about the operation of the public reference room by calling 1-800-SEC-0330. You may also obtain this information from the SEC’s website, http://www.sec.gov.

12

Item 1A. RISK FACTORS

A purchase of our securities involves a high degree of risk. Our business, operating or financial condition could be harmed due to any of the following risks. Accordingly, investors should carefully consider these risks in making a decision as to whether to purchase, sell or hold our securities. In addition, investors should note that the risks described below are not the only risks facing us. Additional risks not presently known to us, or risks that do not seem significant today, may also impair our business operations in the future. You should carefully consider the risks described below, as well as the other information contained in this Annual Report on Form 10-K and the documents incorporated by reference herein, before making a decision to invest in our securities.

RISKS RELATED TO OUR BUSINESS:

We may have difficulty meeting our current and future capital requirements.

Our management and our board of directors monitor our overall costs and expenses and, if necessary, adjust our programs and planned expenditures in an attempt to ensure we have sufficient operating capital. We continue to evaluate our costs and planned expenditures for our on-going exploration efforts at our Sierra Mojada Project. As of October 31, 2014, we had working capital of $2.9 million including $1.3 million of assets of discontinued operations held for sale and cash and cash equivalents of $1.9 million. The continued exploration and possible development of the Sierra Mojada Project will require significant amounts of additional capital. If we are unable to fund future operations by way of financing, including public or private offerings of equity or debt securities, we will need to significantly reduce operations, which will result in an adverse impact on our business, financial condition and exploration activities. See Note 1 to our Consolidated Financial Statements included in this Annual Report on Form 10-K. We do not have a credit, off-take or other commercial financing arrangement in place that would finance continued evaluation or development of the Sierra Mojada Project and we believe that securing credit for these projects may be difficult due to continuing volatility in global credit markets. Moreover, equity financing may not be available on attractive terms and if available, will likely result in significant dilution to existing shareholders.

We are an exploration stage mining company with no history of operations.

We are an exploration stage enterprise engaged in mineral exploration, primarily in Mexico. We have a very limited operating history and are subject to all the risks inherent in a new business enterprise. As an exploration stage company, we may never enter the development and production stages. To date we have had no revenues and have relied upon equity financing to fund our operations. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with an exploration stage business, and the competitive and regulatory environment in which we operate and will operate, such as under-capitalization, personnel limitations, and limited financing sources.

We have no commercially mineable ore body.

No commercially mineable ore body has been delineated on our Sierra Mojada Project or on our exploration license in Gabon, Africa, nor have our properties been shown to contain proven or probable mineral reserves. The PEA Technical Report on our Sierra Mojada Project was preliminary in nature and investors should not assume that the projections contained therein will ever be realized. We cannot assure you that any mineral deposits we identify on the Sierra Mojada Project, in Gabon or on another property will qualify as an ore body that can be legally and economically exploited or that any particular level of recovery of silver or other minerals from discovered mineralization will in fact be realized. Most exploration projects do not result in the discovery of commercially mineable ore deposits. Even if the presence of reserves is established at a project, the legal and economic viability of the project may not justify exploitation.

Mineral resource estimates may not be reliable.

There are numerous uncertainties inherent in estimating quantities of mineralized material such as silver, zinc, lead, and gold, including many factors beyond our control, and no assurance can be given that the recovery of mineralized material will be realized. In general, estimates of mineralized material are based upon a number of factors and assumptions made as of the date on which the estimates were determined, including:

| · | geological and engineering estimates that have inherent uncertainties and the assumed effects of regulation by governmental agencies; |

| · | the judgment of the engineers preparing the estimate; |

| · | estimates of future metals prices and operating costs; |

13

| · | the quality and quantity of available data; |

| · | the interpretation of that data; and |

| · | the accuracy of various mandated economic assumptions, all of which may vary considerably from actual results. |

All estimates are, to some degree, uncertain. For these reasons, estimates of the recoverable mineral resources prepared by different engineers or by the same engineers at different times, may vary substantially. As such, there is significant uncertainty in any mineralized material estimate and actual deposits encountered and the economic viability of a deposit may differ materially from our estimates.

Our business plan is highly speculative, and its success largely depends on the successful exploration of our Sierra Mojada concessions.

Although we hold an exploration license in Gabon, our business plan is focused on exploring the Sierra Mojada concessions to identify reserves, and if appropriate, to ultimately develop this property. Further, although we have reported mineralized material on our Sierra Mojada Project, we have not established any reserves and remain in the exploration stage. We may never enter the development or production stage. Exploration of mineralization and determination of whether the mineralization might be extracted profitably is highly speculative, and it may take a number of years until production is possible, during which time the economic viability of the project may change. Substantial expenditures are required to establish reserves, extract metals from ore and to construct mining and processing facilities.

The Sierra Mojada Project is subject to all of the risks inherent in mineral exploration and development. The economic feasibility of any mineral exploration and/or development project is based upon, among other things, estimates of the size and grade of mineral reserves, proximity to infrastructures and other resources (such as water and power), anticipated production rates, capital and operating costs, and metals prices. To advance from an exploration project to a development project, we will need to overcome various hurdles, including the completion of favorable feasibility studies, issuance of necessary permits, and the ability to raise significant further capital to fund activities. There can be no assurance that we will be successful in overcoming these risks. Because of our focus on the Sierra Mojada Project, the success of our operations and our profitability may be disproportionately exposed to the impact of adverse conditions unique to the Torreon, Mexico region, as the Sierra Mojada Project is located 250 kilometers north of this area.

Due to our history of operating losses, we are uncertain that we will be able to maintain sufficient cash to accomplish our business objectives.

During the years ended October 31, 2014 and October 31, 2013, we suffered net losses of $4,914,251 and $7,466,580 respectively. At October 31, 2014, we had stockholders’ equity of $27,368,957 and working capital of $2,947,144 including $1,281,518 of assets of discontinued operations held for sale and $8,894 of liabilities of discontinued operations held for sale. Significant amounts of capital will be required to continue to explore and potentially develop the Sierra Mojada concessions. We are not engaged in any revenue producing activities, and we do not expect to be in the near future. Currently, our sources of funding consist of the sale of additional equity securities, entering into joint venture agreements or selling a portion of our interests in our assets. There is no assurance that any additional capital that we will require will be obtainable on terms acceptable to us, if at all. Failure to obtain such additional financing could result in delays or indefinite postponement of further exploration of our projects. Additional financing, if available, will likely result in substantial dilution to existing stockholders.

Our exploration activities require significant amounts of capital that may not be recovered.

Mineral exploration activities are subject to many risks, including the risk that no commercially productive or extractable resources will be encountered. There can be no assurance that our activities will ultimately lead to an economically feasible project or that we will recover all or any portion of our investment. Mineral exploration often involves unprofitable efforts, including drilling operations that ultimately do not further our exploration efforts. The cost of minerals exploration is often uncertain and cost overruns are common. Our drilling and exploration operations may be curtailed, delayed or canceled as a result of numerous factors, many of which are beyond our control, including title problems, weather conditions, compliance with governmental requirements, including permitting issues, and shortages or delays in the delivery of equipment and services.

14

Our financial condition could be adversely affected by changes in currency exchange rates, especially between the U.S. dollar and the Mexican peso given our focus on the Sierra, Mojada Project.

Our financial condition is affected in part by currency exchange rates, as portions of our exploration costs in Mexico and Gabon are denominated in the local currency. A weakening U.S. dollar relative to the Mexican peso will have the effect of increasing exploration costs while a strengthening U.S. dollar will have the effect of reducing exploration costs. The Gabon local currency is tied to the Euro. Some of our exploration activities in Mexico are tied to the peso. The exchange rates between the Euro and the U.S. dollar and between the peso and U.S. dollar have fluctuated widely in response to international political conditions, general economic conditions and other factors beyond our control. We seek to mitigate exposure to foreign currency fluctuations by holding a majority of our cash balances in U.S. dollars.

THE BUSINESS OF MINERAL EXPLORATION IS SUBJECT TO MANY RISKS:

There are inherent risks in the mineral exploration industry

We are subject to all of the risks inherent in the minerals exploration industry including, without limitation, the following:

| · | we are subject to competition from a large number of companies, many of which are significantly larger than we are, in the acquisition, exploration, and development of mining properties; |

| · | we might not be able raise enough money to pay the fees and taxes and perform the labor necessary to maintain our concessions in good force; |

| · | exploration for minerals is highly speculative and involves substantial risks and is frequently un-productive, even when conducted on properties known to contain significant quantities of mineralization, and our exploration projects may not result in the discovery of commercially mineable deposits of ore; |

| · | the probability of an individual prospect ever having reserves that meet the requirements for reporting under SEC Industry Guide 7 is remote and any funds spent on exploration may be lost; |

| · | our operations are subject to a variety of existing laws and regulations relating to exploration and development, permitting procedures, safety precautions, property reclamation, employee health and safety, air quality standards, pollution and other environmental protection controls and we may not be able to comply with these regulations and controls; and |

| · | a large number of factors beyond our control, including fluctuations in metal prices, inflation, and other economic conditions, will affect the economic feasibility of mining. |

Metals prices are subject to extreme fluctuation.

Our activities are influenced by the prices of commodities, including silver, zinc, lead, gold, manganese and other metals. These prices fluctuate widely and are affected by numerous factors beyond our control, including interest rates, expectations for inflation, speculation, currency values (in particular the strength of the U.S. dollar), global and regional demand, political and economic conditions and production costs in major metal producing regions of the world.

Our ability to establish reserves through our exploration activities, our future profitability and our long-term viability, depend, in large part, on the market prices of silver, zinc, lead, gold, manganese and other metals. The market prices for these metals are volatile and are affected by numerous factors beyond our control, including:

| · | global or regional consumption patterns; |

| · | supply of, and demand for, silver, zinc, lead, gold, manganese and other metals; |

| · | speculative activities and producer hedging activities; |

| · | expectations for inflation; |

| · | political and economic conditions; and |

| · | supply of, and demand for, consumables required for production. |

Future weakness in the global economy could increase volatility in metals prices or depress metals prices, which could in turn reduce the value of our properties, make it more difficult to raise additional capital, and make it uneconomical for us to continue our exploration activities.

15

There are inherent risks with foreign operations.

Our business activities are primarily conducted in Mexico, and we also hold interests in Gabon, and as such, our activities are exposed to various levels of foreign political, economic and other risks and uncertainties. These risks and uncertainties include, but are not limited to, terrorism, hostage taking, military repression, extreme fluctuations in currency exchange rates, high rates of inflation, labor unrest, the risks of war or civil unrest, expropriation and nationalization, renegotiation or nullification of existing concessions, licenses, permits, approvals and contracts, illegal mining, changes in taxation policies, restrictions on foreign exchange and repatriation, changing political conditions, currency controls and governmental regulations that favor or require the rewarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

Changes, if any, in mining or investment policies or shifts in political attitude in Mexico and/or Gabon may adversely affect our exploration and possible future development activities. We may also be affected in varying degrees by government regulations with respect to, but not limited to, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure, could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our operations. In addition, legislation in the U.S., Canada, Mexico and/or Gabon regulating foreign trade, investment and taxation could have a material adverse effect on our financial condition.

Our Sierra Mojada Project is located in Mexico and is subject to various levels of political, economic, legal and other risks.

The Sierra Mojada Project, our primary focus, is in Mexico. In the past, Mexico has been subject to political instability, changes and uncertainties, which have resulted in changes to existing governmental regulations affecting mineral exploration and mining activities. Mexico’s status as a developing country may make it more difficult for us to obtain any required financing for the Sierra Mojada Project or other projects in Mexico in the future. Our Sierra Mojada Project is also subject to a variety of governmental regulations governing health and worker safety, employment standards, waste disposal, protection of historic and archaeological sites, mine development, protection of endangered and protected species and other matters. Mexican regulators have broad authority to shut down and/or levy fines against facilities that do not comply with regulations or standards.

Our exploration activities in Mexico may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that increase the costs related to the Sierra Mojada Project. Changes, if any, in mining or investment policies or shifts in political attitude may adversely affect our financial condition. Expansion of our activities will be subject to the need to obtain sufficient access to adequate supplies of water, assure the availability of sufficient power, as well as sufficient surface rights which could be affected by government policy and competing operations in the area.

We also have litigation risk with respect to our operations. In particular, in July 2014 a local cooperative named Sociedad Cooperativa de Exploración Minera Mineros Norteños, S.C.L. (“Mineros Norteños”) filed an action (the “Action”) against our Mexican subsidiary, Minera Metalin, claiming that we breached an agreement regarding the development of the Sierra Mojada Project. Mineros Norteños is seeking payment of a royalty, including interest at a rate of 6% per annum from August 30, 2004, notwithstanding that no revenue has been produced from the applicable mining concessions, and it is also seeking payment of wages to the cooperative’s members from August 30, 2004, notwithstanding that none of the individuals were ever hired or performed work for us. Although we and our Mexican legal counsel believe this claim is without merit and have asserted all applicable defenses, we may incur costs associated with defending the claim. We have not accrued any amounts in our financial statements with respect to this claim.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our financial condition. Future changes in applicable laws and regulations or changes in their enforcement or regulatory interpretation could negatively impact current or planned exploration activities with the Sierra Mojada Project or in respect to any other projects in which we become involved in Mexico. Any failure to comply with applicable laws and regulations, even if inadvertent, could result in the interruption of exploration operations or material fines, penalties or other liabilities.

16

Title to our properties may be challenged or defective.

Our future operations, including our activities at the Sierra Mojada Project and other exploration activities, will require additional permits from various governmental authorities. Our operations are and will continue to be governed by laws and regulations governing prospecting, mineral exploration, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, mining royalties and other matters. There can be no assurance that we will be able to acquire all required licenses, permits or property rights on reasonable terms or in a timely manner, or at all, and that such terms will not be adversely changed, that required extensions will be granted, or that the issuance of such licenses, permits or property rights will not be challenged by third parties.

We attempt to confirm the validity of our rights of title to, or contract rights with respect to, each mineral property in which we have a material interest. However, we cannot guarantee that title to our properties will not be challenged. The Sierra Mojada Property may be subject to prior unregistered agreements, interests or native land claims, and title may be affected by undetected defects. There may be valid challenges to the title of any of the claims comprising the Sierra Mojada Property that, if successful, could impair possible development and/or operations with respect to such properties in the future. Challenges to permits or property rights, whether successful or unsuccessful; changes to the terms of permits or property rights; or a failure to comply with the terms of any permits or property rights that have been obtained, could have a material adverse effect on our business by delaying or preventing or making continued operations economically unfeasible.

A title defect could result in Silver Bull losing all or a portion of its right, title, and interest to and in the properties to which the title defect relates. Title insurance generally is not available, and our ability to ensure that we have obtained secure title to individual mineral properties or mining concessions may be severely constrained. In addition, we may be unable to operate our properties as permitted or to enforce our rights with respect to our properties. We annually monitor the official land and mining records in Mexico City to determine if there are annotations indicating the existence of a legal challenge against the validity of any of our concessions. As of January, 2015 and to the best of our knowledge, there are no such annotations, nor are we aware of any challenges from the government or from third parties, except for a Court order to record the Action with the Public Registry of Mines. We do not have evidence or information as to the enforcement of this Court order to date. However based on a subsequent ruling it is unlikely that the Court order will be enforced.

In addition, in connection with the purchase of certain mining concessions, the prior management of Silver Bull agreed to pay a net royalty interest on revenue from future mineral sales on certain concessions at the Sierra Mojada Project, including concessions on which a significant portion of our mineralized material is located. The aggregate amount payable under this royalty is capped at $6.875 million, an amount that will only be reached if there is significant future production from the concessions. As noted above, this royalty is currently the subject of a dispute with a local cooperative. In addition, records from prior management indicate that additional royalty interests may have been created, although the continued applicability and scope of these interests are uncertain. The existence of these royalty interests may have a material effect on the economic feasibility of potential future development of the Sierra Mojada Project.

We are subject to complex environmental and other regulatory risks, which could expose us to significant liability and delay and, potentially, the suspension or termination of our exploration efforts.

Our mineral exploration activities are subject to federal, state and local environmental regulation in the jurisdictions where our mineral properties are located. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. No assurance can be given that environmental standards imposed by these governments will not be changed, thereby possibly materially adversely affecting our proposed activities. Compliance with these environmental requirements may also necessitate significant capital outlays or may materially affect our earning power.

Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. As a result of recent changes in environmental laws in Mexico, for example, more legal actions supported or sponsored by non-governmental groups interested in halting projects may be filed against companies operating in all industrial sectors, including the mining sector. Mexican projects are also subject to the environmental agreements entered into by Mexico, the United States and Canada in connection with the North American Free Trade Agreement.

Future changes in environmental regulation in the jurisdictions where our projects are located may adversely affect our exploration activities, make them prohibitively expensive, or prohibit them altogether. Environmental hazards may exist on the properties in which we currently hold interests, such as the Sierra Mojada Project, or may hold interests in the future, which are unknown to us at present and that have been caused by us or previous owners or operators, or that may have occurred naturally. We may be liable for remediating any damage that we may have caused. The liability could include costs for removing or remediating the release and damage to natural resources, including ground water, as well as the payment of fines and penalties.

17

We may face a shortage of water.

Water is essential in all phases of the exploration and development of mineral properties. It is used in such processes as exploration, drilling, leaching, placer mining, dredging, testing, and hydraulic mining. Both the lack of available water and the cost of acquisition may make an otherwise viable project economically impossible to complete. In November 2013 Silver Bull was granted the right to exploit up to 3.5 million cubic meters of water per year from six different well sites by the water regulatory body in Mexico, Comision Nacional de Agua, but it has yet to be determined if the six well sites can produce this much water over a sustained period of time.

We may face a shortage of supplies and materials.

The mineral industry has experienced from time to time shortages of certain supplies and materials necessary in the exploration for and evaluation of mineral deposits. The prices at which such supplies and materials are available have also greatly increased. Our planned operations could be subject to delays due to such shortages and further price escalations could increase our costs for such supplies and materials. Our experience and that of others in the industry is that suppliers are often unable to meet contractual obligations for supplies, equipment, materials, and services, and that alternate sources of supply do not exist.

Competition for outside engineers and consultants is fierce.

We are heavily dependent upon outside engineers and other professionals to complete work on our exploration projects. The mining industry has experienced significant growth over the last several years and as a result, many engineering and consulting firms have experienced a shortage of qualified engineering personnel. We closely monitor our outside consultants through regular meetings and review of resource allocations and project milestones. However, the lack of qualified personnel combined with increased mining projects could result in delays in completing work on our exploration projects or result in higher costs to keep personnel focused on our project.

Our non-operating properties are subject to various hazards.

We are subject to risks and hazards, including environmental hazards, the encountering of unusual or unexpected geological formations, cave-ins, flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. These occurrences could result in damage to, or destruction of, mineral properties or future production facilities, personal injury or death, environmental damage, delays in our exploration activities, asset write-downs, monetary losses and possible legal liability. We may not be insured against all losses or liabilities, either because such insurance is unavailable or because we have elected not to purchase such insurance due to high premium costs or other reasons. Although we maintain insurance in an amount that we consider to be adequate, liabilities might exceed policy limits, in which event we could incur significant costs that could adversely affect our activities. The realization of any significant liabilities in connection with our activities as described above could negatively affect our activities and the price of our common stock.

We need and rely upon key personnel.

Presently, we employ a limited number of full-time employees, utilize outside consultants, and in large part rely on the personal efforts of our officers and directors. Our success will depend, in part, upon the ability to attract and retain qualified employees. In particular, we have only three executive officers, Brian Edgar, Timothy Barry and Sean Fallis, and the loss of the services of any of these three would adversely affect our business.

18

RISKS RELATING TO OUR COMMON STOCK:

Further equity financings may lead to the dilution of our common stock.

In order to finance future operations, we may raise funds through the issuance of common stock or the issuance of debt instruments or other securities convertible into common stock. We cannot predict the size of future issuances of common stock or the size and terms of future issuances of debt instruments or other securities convertible into common stock or the effect, if any, that future issuances and sales of our securities will have on the market price of our common stock. Any transaction involving the issuance of previously authorized but unissued shares, or securities convertible into common stock, would result in dilution, possibly substantial, to present and prospective security holders. Demand for equity securities in the mining industry has been weak, therefore equity financing may not be available on attractive terms and if available, will likely result in significant dilution to existing shareholders.

No dividends are anticipated.

At the present time, we do not anticipate paying dividends, cash or otherwise, on our common stock in the foreseeable future. Future dividends will depend on our earnings, if any, our financial requirements and other factors. There can be no assurance that we will pay dividends.

Our stock price can be extremely volatile.