Attached files

| file | filename |

|---|---|

| 8-K - GIGPEAK, INC. 8-K 6-3-2016 - GigPeak, Inc. | form8k.htm |

Exhibit 99.1

June 3, 2016NYSE MKT: GIG

Forward-Looking Statements: This presentation contains forward-looking statements regarding operating trends; expected future results and guidance; GigPeak’s and its subsidiaries’ expansion and business strategies into new markets and projects; further acquisitions; anticipated growth opportunities; the amount of capital-raising necessary to achieve those strategies; integrating recently acquired businesses into GigPeak effectively; changes in business or other market conditions and product trends that are forward-looking. We undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Additional factors that could cause actual results to differ are discussed under the heading "Risk Factors" and in other sections of GigPeak’s filings with the SEC, including in GigPeak’s current and periodic reports filed or furnished from time to time with the SEC. Use of Non-GAAP Financial Measures:These materials include references to non-GAAP net income, non-GAAP gross margin, non-GAAP earnings per share and Adjusted EBITDA. GigPeak believes that these non-GAAP financial measures are important indicators of the ongoing operations of its business and provide better comparability between reporting periods and provide a better baseline for analyzing trends in GigPeak’s operations. GigPeak does not, nor does it suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. GigPeak believes the disclosure of the effects of these items increases the reader’s understanding of the underlying performance of the business and that such non-GAAP financial measures provide investors with an additional tool to evaluate our financial results and assess our prospects for future performance.All trademarks, service marks and trade names of GigPeak, Inc. used herein are trademarks or registered trademarks of GigPeak, Inc. Any other product, company names, or logos mentioned herein are the trademarks and/or property of their respective owners. Disclaimer 2

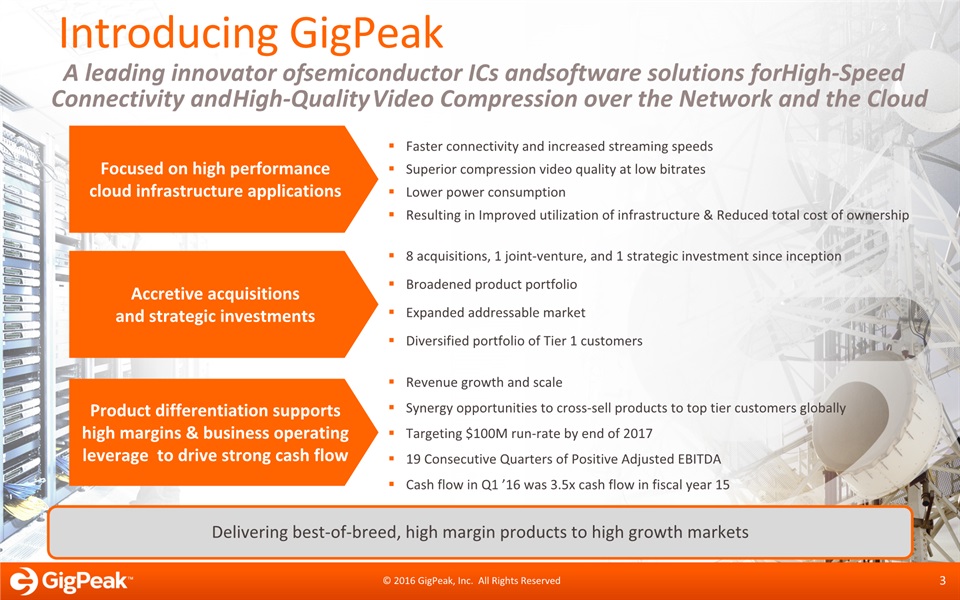

Introducing GigPeak 3 A leading innovator of semiconductor ICs and software solutions for High-Speed Connectivity and High-Quality Video Compression over the Network and the Cloud Faster connectivity and increased streaming speeds Superior compression video quality at low bitrates Lower power consumptionResulting in Improved utilization of infrastructure & Reduced total cost of ownership Delivering best-of-breed, high margin products to high growth markets Focused on high performance cloud infrastructure applications Accretive acquisitions and strategic investments Product differentiation supports high margins & business operating leverage to drive strong cash flow 8 acquisitions, 1 joint-venture, and 1 strategic investment since inceptionBroadened product portfolioExpanded addressable marketDiversified portfolio of Tier 1 customers Revenue growth and scaleSynergy opportunities to cross-sell products to top tier customers globallyTargeting $100M run-rate by end of 201719 Consecutive Quarters of Positive Adjusted EBITDACash flow in Q1 ’16 was 3.5x cash flow in fiscal year 15

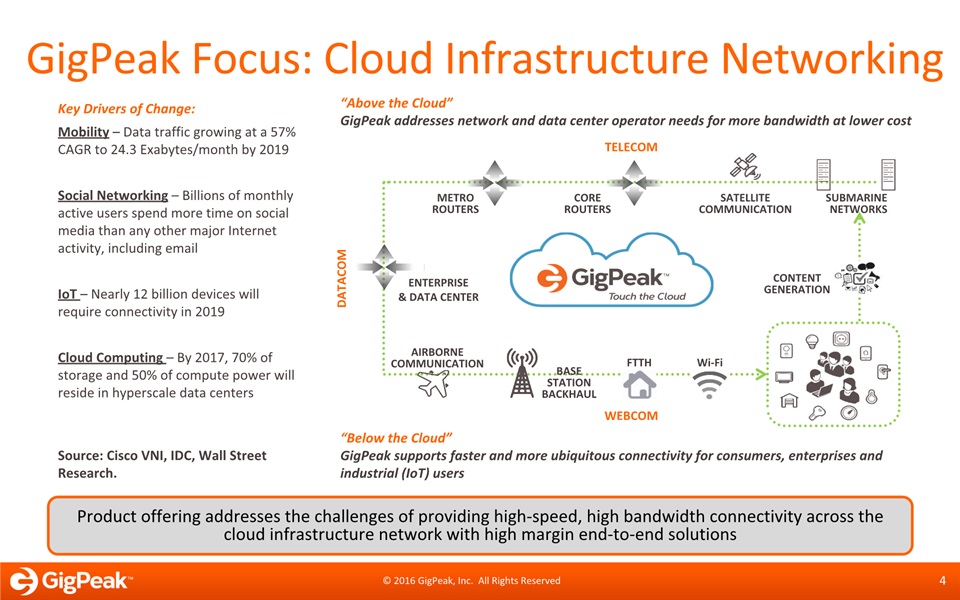

“Above the Cloud” GigPeak addresses network and data center operator needs for more bandwidth at lower cost GigPeak Focus: Cloud Infrastructure Networking 4 Product offering addresses the challenges of providing high-speed, high bandwidth connectivity across the cloud infrastructure network with high margin end-to-end solutions “Below the Cloud” GigPeak supports faster and more ubiquitous connectivity for consumers, enterprises and industrial (IoT) users METRO ROUTERS BASE STATIONBACKHAUL AIRBORNE COMMUNICATION SATELLITE COMMUNICATION SUBMARINE NETWORKS ENTERPRISE& DATA CENTER CORE ROUTERS Wi-Fi FTTH TELECOM WEBCOM DATACOM CONTENTGENERATION Mobility – Data traffic growing at a 57% CAGR to 24.3 Exabytes/month by 2019Social Networking – Billions of monthly active users spend more time on social media than any other major Internet activity, including emailIoT – Nearly 12 billion devices will require connectivity in 2019Cloud Computing – By 2017, 70% of storage and 50% of compute power will reside in hyperscale data centers Key Drivers of Change: Source: Cisco VNI, IDC, Wall Street Research.

GigPeak Growth History 5 Proven consolidation model, monetizing best-of-breed technologiesand delivering profitable growth 20%+Revenue CAGRfrom 2009 – 2015 ($ in millions) Telecom PMD Video compression and analytics Datacom PMD High speed ASIC IoT RF devices Wireless devices Datacom PMD (a) (a) Based upon purchase accounting adjustment for Magnum acquisition as reflected in Current Report on Form 8-K/A filed May 27, 2016.

Latest Acquisition: Magnum Semiconductor 6 Key Customers Magnum acquisition further enhances our vision of enabling high-speed and high-quality information streaming end-to-end over the network from the network's core to the end user Lighthouse Customer Similar to GigPeak, Magnum focused on highest performance, high-speed information transmission, but within broadcast infrastructure rather than telecom or datacom networksMagnum’s industry leading compression technology reduces the size of video data without losing quality, complementing GigPeak’s solutions that increase the speed of data transmission~100 video compression and processing patents granted/pending2015 - $17M in revenue will increase GigPeak’s total revenue and improve gross margin

Focus on High Value, High Margin Markets 7 Solutions for the Internet of Things Access,Backhaul & 5G Applications Professional Broadcast and IP Video Streaming Data Center Communication Drivers, TIAs, & CDRs for AOCs & Pluggables Core & Metro Networks Drivers & TIAsCustom ASICs SoC & ASIC Chips RF MMICs for Access & 5G Applications Software & SoC GigPeak addresses a multi-billion dollar TAM opportunity “Above the Cloud” “Below the Cloud” TIAs & Drivers–all Speeds, all FormatsLeadership in Limiting and Linear Coherent 100Gbps To 400Gbps Drivers Sole Merchant Supplier for 40Gbps Parallel ICs Complete 100Gbps ICs Product Portfolio with Best-in-class Performance Highest Video Quality at Lowest Bitrate Solutions Leading Market Share in Broadcast Video Market mmWave Power AmplifiersBiCMOS TransceiversSystem In Package Wearables, Consumer Devices and SatelliteHigh Frequency RF DevicesHigh-Speed / Low-PowerBroadband EverywhereConnected Smart Vehicles

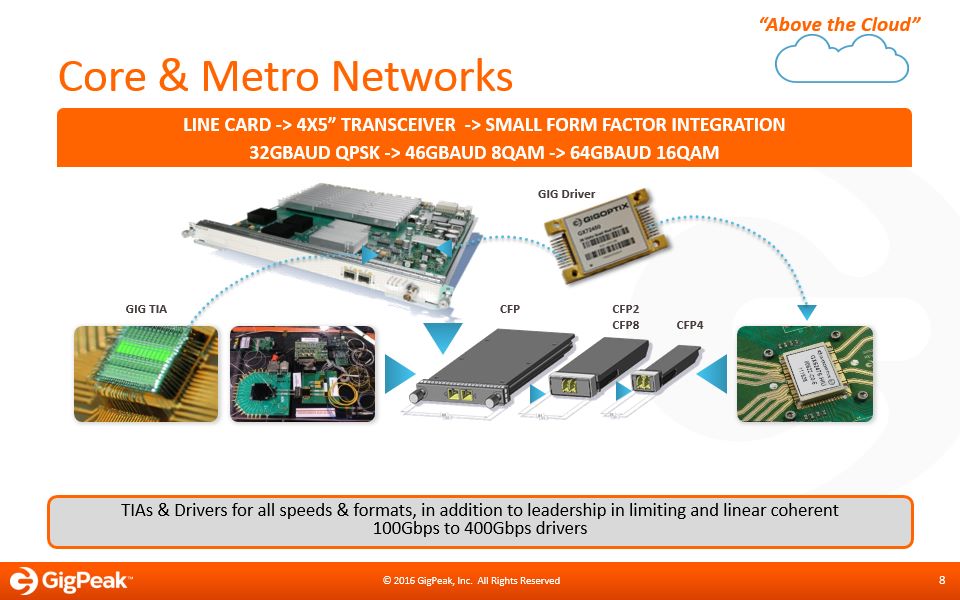

Core & Metro Networks 8 GIG Driver GIG TIA Line Card -> 4x5” Transceiver -> Small Form Factor integration32Gbaud QPSK -> 46Gbaud 8QAM -> 64Gbaud 16QAM CFP CFP2CFP8 CFP4 TIAs & Drivers for all speeds & formats, in addition to leadership in limiting and linear coherent 100Gbps to 400Gbps drivers “Above the Cloud”

9 Data Center Communication Devices for Parallel Optics Links1x/4x/12x channels for 10, 14 And 28 Gbps/channel – 40GBPS and 100GBPS NRZNext Generation solutions for 56Gbps – PAM4 TIA IC PD ARRAY VD IC VD IC TIA IC VCSEL ARRAY VCSEL ARRAY PD ARRAY LENS ARRAY LENS ARRAY LENS ARRAY LENS ARRAY CDR ARRAY CDR ARRAY CDR ARRAY CDR ARRAY Sole merchant supplier for 40Gbps Parallel ICs and complete 100Gbps ICs product portfolio with best-in-class performance “Above the Cloud” TIA IC PD ARRAY VD IC VD IC TIA IC VCSEL ARRAY VCSEL ARRAY PD ARRAY LENS ARRAY LENS ARRAY LENS ARRAY LENS ARRAY CDR ARRAY CDR ARRAY CDR ARRAY CDR ARRAY

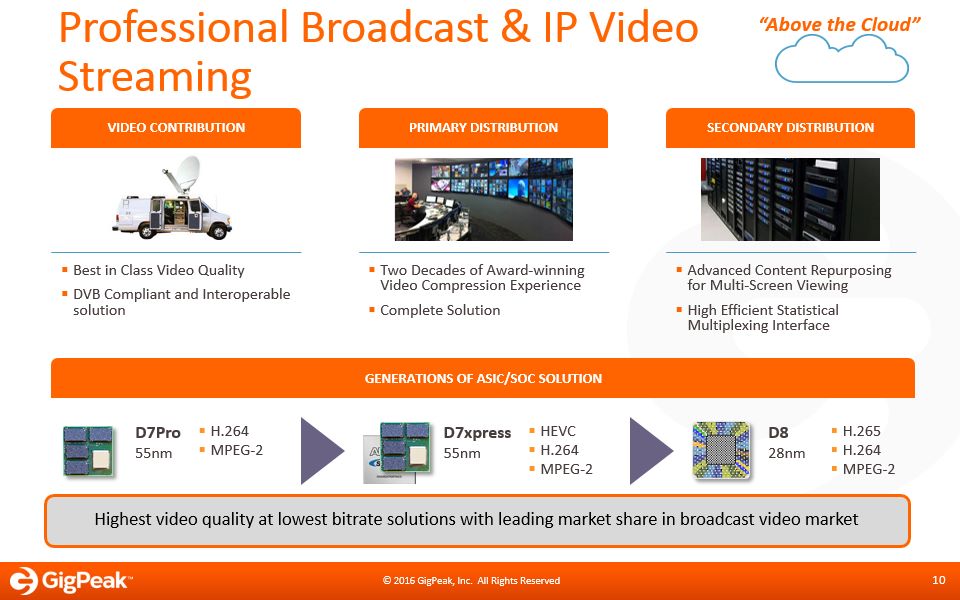

Professional Broadcast & IP Video Streaming 10 Generations of ASIC/SOC Solution Highest video quality at lowest bitrate solutions with leading market share in broadcast video market D828nm H.265H.264MPEG-2 D7Pro55nm H.264MPEG-2 D7xpress55nm HEVCH.264MPEG-2 Video Contribution Primary distribution Secondary distribution Best in Class Video QualityDVB Compliant and Interoperable solution Two Decades of Award-winning Video Compression ExperienceComplete Solution Advanced Content Repurposing for Multi-Screen ViewingHigh Efficient Statistical Multiplexing Interface “Above the Cloud”

Backhaul, Access & 5G Applications 11 Broadband Everywhere AnytimeConnected Smart VehiclesMassive Internet of Things Internet EverywhereV/Q/E Band PA, LNAGPS Receivers mmWave Power AmplifiersBiCMOS TransceiversSystem In Package 5G network satellite Small Cells E-band backhaulpoint-to-point Strong technology platform for 5G applications and best output power performance through 2 chip solution for E-band Point-to-Point backhaul “Below the Cloud”

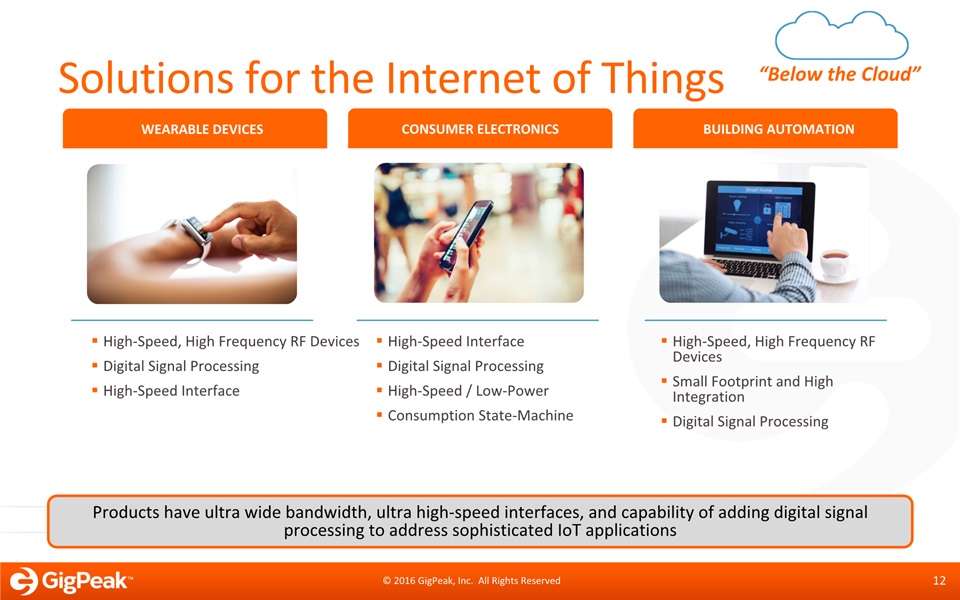

Solutions for the Internet of Things 12 CONSUMER ELECTRONICS High-Speed, High Frequency RF DevicesDigital Signal ProcessingHigh-Speed Interface High-Speed InterfaceDigital Signal ProcessingHigh-Speed / Low-PowerConsumption State-Machine High-Speed, High Frequency RF DevicesSmall Footprint and High IntegrationDigital Signal Processing Wearable devices Building automation Products have ultra wide bandwidth, ultra high-speed interfaces, and capability of adding digital signal processing to address sophisticated IoT applications “Below the Cloud”

Top Tier, Diversified Global Customer Base 13 GigPeak’s current sales and marketing infrastructure is globally aligned with customers and poised to continue capitalizing on cross-sell opportunities APAC NORTH AMERICA EMEA

Strong Financial Momentum 14 19 Consecutive Quarters of Positive Adjusted EBITDA Note: Guidance for the Quarter Ending June 26, 2016 Record GAAP and non-GAAP Gross Margin in Q1’16 2015 results illustrate the benefits of GigPeak’s organic and inorganic strategic initiatives, with strong sequential quarterly improvement in revenue and profits Revenue Growth ($M) Non-gaap gross margin ADJUSTED EBITDA ($M)

Consistent and Accelerating Revenue Growth 15 14% 23% Record revenue in Q1’16; up 25% from Q1’15 2015 revenue grew 23% Y/Y, reflecting double-digit growth across all product linesAcquisition of Magnum accelerates revenue growth, provides for incremental cross-selling opportunities and positions the Company for sustainable growth in high-margin business Annual Revenue ($M) Commentary GigPeak is rapidly approaching its goal of $100M in annualized run-rate revenue by the end of 2017 (a) (a) Based upon purchase accounting adjustment for Magnum acquisition as reflected in Current Report on Form 8-K/A filed May 27, 2016.

Increasing Profitability 16 Proven operating model with industry leading marginsRecord 68% GAAP and 69% non-GAAP gross margin in Q1’16Q1’16 marked the 19th straight quarter of positive Adjusted EBITDAEnhanced high margin product lines, and Magnum’s solutions will further improve marginsFurther cost synergies and continued operating efficiencies expected to support continuously improving profitability Annual ADJUSTED EBITDA Margins Annual Non-GAAP Gross Margins Commentary Note: 2011-2012 included lower margin revenue from ChipX and Endwave acquisitions that were discontinued in 2013. Improving profitability a direct result of strategic initiatives focused on high margin opportunities

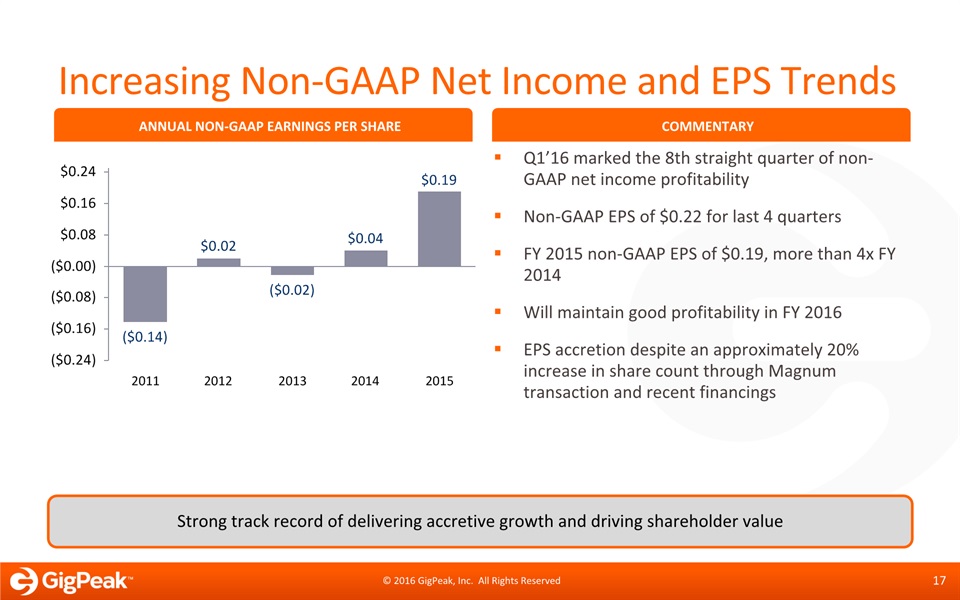

Increasing Non-GAAP Net Income and EPS Trends 17 Q1’16 marked the 8th straight quarter of non-GAAP net income profitability Non-GAAP EPS of $0.22 for last 4 quartersFY 2015 non-GAAP EPS of $0.19, more than 4x FY 2014Will maintain good profitability in FY 2016EPS accretion despite an approximately 20% increase in share count through Magnum transaction and recent financings Annual Non-GAAP EARNINGS PER SHARE Commentary Strong track record of delivering accretive growth and driving shareholder value

Year-Over-Year Financial Progress Q1 2015 Q1 2016 ~Increase Market Capitalization* $49M $156M 218% Stock Price* $1.47 $2.90 97% Average Trading Volume* ~128,000 ~475,000 271% Quarterly Total Revenue $9.1M $11.4M 25% Gross Margin (Non-GAAP) 62% 69% 7% Earnings Per Share (Non-GAAP) $0.02 $0.05 150% Adjusted EBITDA $1.4M $3.0M 114% Analyst Coverage 4 7 75% *as of May 22, 2015 and May 24, 2016 18

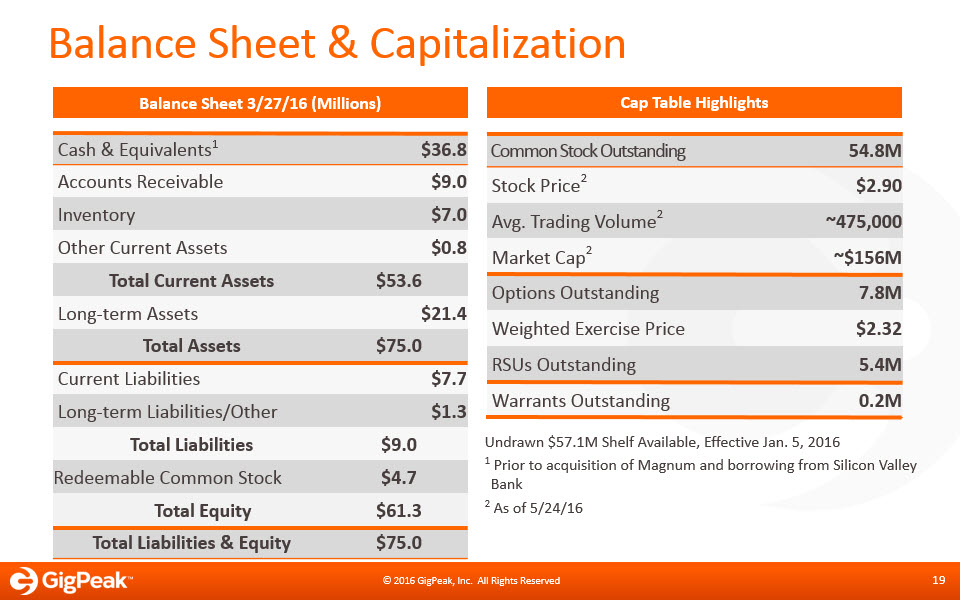

Balance Sheet & Capitalization Cash & Equivalents1 $36.8 Accounts Receivable $9.0 Inventory $7.0 Other Current Assets $0.8 Total Current Assets $53.6 Long-term Assets $21.4 Total Assets $75.0 Current Liabilities $7.7 Long-term Liabilities/Other $1.3 Total Liabilities $9.0 Redeemable Common Stock $4.7 Total Equity $61.3 Total Liabilities & Equity $75.0 Common Stock Outstanding 54.8M Stock Price2 $2.90 Avg. Trading Volume2 ~475,000 Market Cap2 ~$156M Options Outstanding 7.8M Weighted Exercise Price $2.32 RSUs Outstanding 5.4M Warrants Outstanding 0.2M Balance Sheet 3/27/16 (Millions) Cap Table Highlights Undrawn $57.1M Shelf Available, Effective Jan. 5, 20161 Prior to acquisition of Magnum and borrowing from Silicon Valley Bank2 As of 5/24/16 19

Name Title Biography Dr. Avi Katz Chairman & CEO Founded GigPeak in 200725+ years experience with technology, business development, and sales Darren Ma Vice President, Chief Financial Officer Joined GigPeak in 201412+ years experience in semiconductors Dr. Raluca Dinu COO Joined GigPeak through acquisition of Lumera in 200815+ years experience in the telecom industry Andrea Betti-Berutto Senior Vice President, Chief Technology Officer Joined GigPeak through acquisition of iTerra in 200720+ years experience with high-speed IC and multichip modules Management Team in Place to Execute Strategic Vision 20

Investment Highlights 21 Track Record of Growing Revenue and Improving Profit Margins Addressing High Margin Market Opportunities Global Diversified Customer Base Highly Differentiated Technology Portfolio Disciplined M&A Strategy Driving Scale and Growth ProvenExecutive Management Team

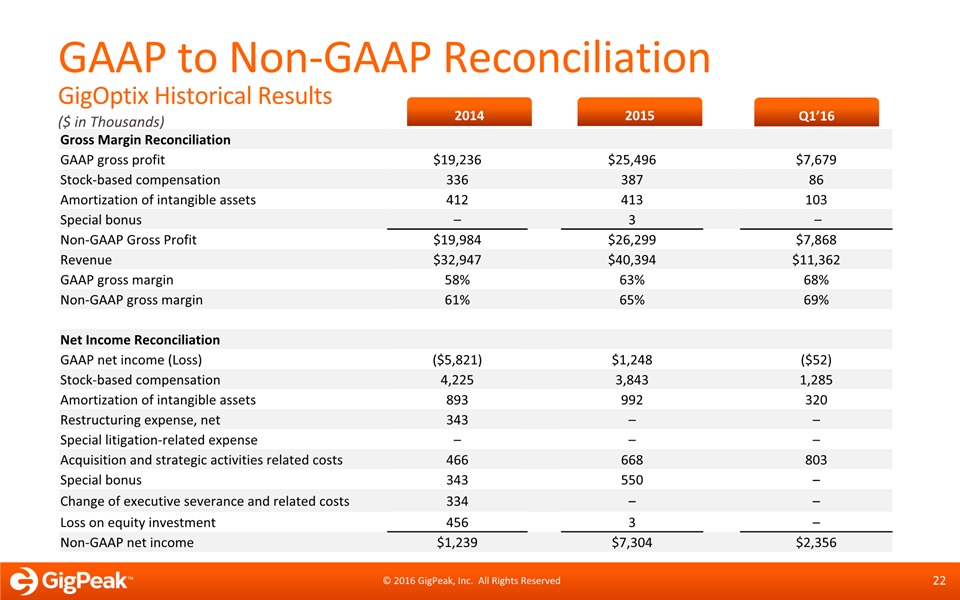

GAAP to Non-GAAP ReconciliationGigOptix Historical Results ($ in Thousands) 2013 2014 2015 Gross Margin Reconciliation GAAP gross profit $19,236 $25,496 $7,679 Stock-based compensation 336 387 86 Amortization of intangible assets 412 413 103 Special bonus – 3 – Non-GAAP Gross Profit $19,984 $26,299 $7,868 Revenue $32,947 $40,394 $11,362 GAAP gross margin 58% 63% 68% Non-GAAP gross margin 61% 65% 69% Net Income Reconciliation GAAP net income (Loss) ($5,821) $1,248 ($52) Stock-based compensation 4,225 3,843 1,285 Amortization of intangible assets 893 992 320 Restructuring expense, net 343 – – Special litigation-related expense – – – Acquisition and strategic activities related costs 466 668 803 Special bonus 343 550 – Change of executive severance and related costs 334 – – Loss on equity investment 456 3 – Non-GAAP net income $1,239 $7,304 $2,356 2014 2015 Q1’16 22