Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - AVADEL PHARMACEUTICALS PLC | v441370_ex2-1.htm |

| 8-K - FORM 8-K - AVADEL PHARMACEUTICALS PLC | v441370_8k.htm |

Exhibit 99.1

Expert Report : Cross Border Merger of FTSA and Avadel 31 May 2016 Reliance Restricted Simon MacAllister Ian Venner Partner Partner Transaction Advisory Services Assurance T +353 (0)1 221 2611 T +353 (0)21 480 5715 M +353 (0)86 830 4580 M +353 (0)86 838 7496 F +353 (0)1 475 0599 F +353 (0)21 4272465 E simon.macallister@ie.ey.com E ian.venner@ie.ey.com Karl Byrne Assistant Director Transaction Advisory Services T +353 (0) 1 221 1596 M +353 (0)86 168 6425 F +353 (0)1 475 0599 E karl.byrne@ie.ey.com

Ernst & Young Tel: + 353 1 475 0555 Chartered Accountants Fax: + 353 1 475 0599 Harcourt Centre ey.com Harcourt Street Dublin 2 Ireland Reliance Restricted 31 May 2016 Flamel Technologies SA 33 Avenue du Dr. Georges Levy 69200 Vénissieux FRANCE Avadel Pharmaceuticals Limited Block 10-1 Blanchardstown Corporate Park Ballycoolin Dublin 15 Ireland Dear Sir/Madam ‘Expert’s report’ as specified in the Directive 2005/56/EC of the European Parliament and of the Council of 26 October 2005, on cross-border mergers of limited-liability companies (the “Directive”) as implemented in French law and Irish law. In accordance with your instructions, we have performed the work set out in our engagement agreement dated 25th April 2016 (the “Engagement Agreement”). Our work has been performed in accordance with the Directive and as implemented and specified by: The French law no 2008-649 dated 3 July 2008 and the French decree no 2009-11 dated 5 January 2009 which have implemented the Directive into French law under articles L.236-25 et seq. and R.236-13 et seq. of the French Commercial Code (“French Regulations”); and The European Communities (Cross-Border Mergers) Regulations 2008 as amended by the European Communities (Mergers and Divisions of Companies) (Amendment) Regulations 2011 (“Irish Regulations”). Collectively the “Regulations”. We are pleased to present the following report (the “Report”) in connection with the cross-border merger (the “Merger”) of Flamel Technologies SA (“FTSA”) into Avadel Pharmaceuticals Limited (“Avadel”) (collectively the “Client” or the “Group”) to be effected by way of acquisition (i.e. by way of absorption under French law) as set out in the common draft terms (the “Common Draft Terms”) of the merger entered into by FTSA and Avadel to be dated on or about the date of this Report. Purpose of our report and restrictions on its use The Report was prepared on the specific instructions of the directors of the Client solely for the purpose of the Merger and should not be used or relied upon for any other purpose. The Report and its contents may not be quoted, referred to or shown to any other parties except as provided in the Engagement Agreement, however the Report may be disclosed to the shareholders of FTSA solely for the purpose of Regulation 7 of the Regulations. V Bergin, L Charleton, D Daly, G Deegan, F de Freine, D FitzGerald, G Harman, J Higgins FCCA, N Hodgson, L Kealy, M Keane, K Kelly, H Kerr, T Lillywhite, B Maguire, E MacManus, L McCaul, J McCormack FCCA, F McNally, C Murphy, F O’Keeffe FCCA, A O’Leary FCCA, P O’Neill, M Purcell, D Quinn, G Reid, H Sidhu US CPA, A Tiernan, M Treacy, I Venner, R Wallace. The Irish firm Ernst & Young is a member practice of Ernst & Young Global Limited. It is authorised by the Institute of Chartered Accountants in Ireland to carry on investment business in the Republic of Ireland.

We accept no responsibility or liability to any person other than to our Client, or to such party to whom we have agreed in writing to accept a duty of care in respect of the Report, and accordingly if such other persons choose to rely upon any of the contents of the Report they do so at their own risk Nature and scope of the services The nature and scope of the services, including the basis and limitations, are detailed in the Engagement Agreement. We performed our work based on the Regulations. When we were performing our work, we acted as an independent expert (the “Expert”). This analysis should not be construed as investment advice and should not be used as a basis to set a transaction price or ratio. We assume no responsibility to any potential party or the Client to negotiate a purchase or sale at the recommended values. The contents of the Report have been reviewed by our Client’s management team, who has confirmed to us its factual accuracy. Whilst each part of the Report addresses different aspects of our work, the entire Report should be read for full understanding of our findings and advice. Our Report does not take account of events or circumstances arising after the Report date and we have no responsibility to update the Report for such events or circumstances. We appreciate the opportunity to provide our services to FTSA and Avadel. Please do not hesitate to contact us if you have any questions about this engagement or if we may be of any further assistance. Yours faithfully, Ian Venner Partner

Abbreviations AGM Annual General Meeting Avadel Avadel Pharmaceuticals Limited Directive Directive 2005/56/EC of the European Parliament and of the Council of 26 October 2005 Eclat Éclat Pharmaceuticals Effective Date 31st December 2016 Ernst & Young EY Expert Ernst & Young or we The French law no 2008-649 dated 3 July 2008 and the French decree no 2009-11 dated 5 January 2009 which French Regulations have implemented the Directive into French law under articles L.236-25 et seq. and R.236-13 et seq. of the French Commercial Code FTSA Flamel Technologies SA FTSA and Avadel Collectively referred to as ‘the Client’ or ‘the Group’ Fx Foreign exchange rate IP Intellectual Property The European Communities (Cross-Border Mergers) Regulations 2008 as amended by the European Irish Regulations Communities (Mergers and Divisions of Companies) (Amendment) Regulations 2011 NASDAQ National Association of Securities Dealers Automated Quotations PP&E Property, plant and equipment R&D Research and Development Regulations Collectively the French Regulations and the Irish Regulations Report This Report dated 31 May 2016 SEC Securities and Exchange Commission $US dollar € Euro 4 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Contents Background 6 1. Background 7 Overview of FTSA 9 Balance Sheet analysis 12 2. Balance Sheet analysis 13 Merger rationale 14 Merger analysis 17 3. Merger overview 18 Final conclusions 24 4. Conclusion of value 25 Appendices 27 5. Appendix A: Signed Engagement Letter 28 6. Appendix B: Sources of information 29 5 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Background 1. Background 6 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Background Background Our Report has been prepared in accordance with Article 8 of the Directive and Article 10(2) of Council Directive 78/855/EEC of 9 October 1978 concerning mergers of public limited liability companies, and the related provisions of the Regulations. We were appointed by the High Court in Ireland, on the application of FTSA and Avadel, to prepare the Report as required by the Regulations. Council Directive No 2005/56/EC of 26 October 2005 on cross-border mergers of limited liability companies (the “CBM Directive”) provides a set of procedures for the merger of private companies from different states within the European Economic Area (“EEA”). While a directive is binding in respect of the ends it must achieve, each EEA state has limited degree of autonomy regarding the means with which it can implement certain aspects of the CBM Directive. Some differences therefore arise between the measures implementing the CBM Directive across EEA jurisdictions. Our report is based on information provided to us by or on behalf of FTSA and Avadel, including information from their respective advisors and from public sources. The scope of our report, as required by the Regulations, is to: 1 State the method or methods used to arrive at the proposed exchange ratio; 2 Give the opinion of the Expert whether the proposed exchange ratio is fair and reasonable; 3 Give the opinion of the Expert as to the adequacy of the method or methods used in the case in question; 4 Indicate the values arrived at using each such method; 5 Give the opinion of the Expert as to the relative importance attributed to such methods in arriving at the values decided on; and 6 Specify any special valuation difficulties which have arisen. The Report has been prepared on the instruction of the Client to comply with the requirement of Article 8 of the Directive, Regulation 7 of the Irish Regulations and Article L. 236-10 of the French commercial code. The Report should not be relied upon by other persons, should not be used for any other purpose and should not be considered as investment advice of any kind whatsoever. If persons choose to rely in any way on the Report, they do so entirely at their own risk. Typically in the case of a merger of unrelated parties a detailed valuation would be performed to determine the relative values of each of the merging entities, this valuation would in turn be used to determine the exchange ratio. In this case the Merger is between two companies within the same group. Management of FTSA have determined that for this reason a detailed valuation is not required. Save for any responsibility under Regulation 7 of the Regulations, to the fullest extent permitted by law we do not assume any responsibility and will not accept any liability to any person for any loss suffered by any person as a result of, arising out of, or in connection with the Report. 7 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Background Background Our Report has been prepared in accordance with Article 8 of the Directive and Article 10(2) of Council Directive 78/855/EEC of 9 October 1978 concerning mergers of public limited liability companies, and the related provisions of the Regulations. We provided a draft of the Report to the Client and their respective advisers to obtain their comments as to factual accuracy of the information relating to the Group contained herein, as opposed to our opinions expressed herein, the latter of which are the responsibility of EY alone. Any amendments made to the Report as a result of this review did not change the methodology, opinions or conclusions reached by us. The Report must not be used for any other purpose and, save to the extent required by the Regulations, must not be recited or referred to in any document, copied or made available (in whole or in part) to any person without our prior written express consent (which we will not unreasonably withhold or delay) and you acknowledge that were you to do so (and without limitation) this could expose us to a risk that a third party who otherwise would not have access to the Report, might claim to have relied upon the Report and any other advice we provide to you to its detriment and might bring or threaten to bring an action, claim or proceedings against us. We are not obliged to update the Report to reflect any events which may arise subsequent to the date of the Report. Shareholders who are in any doubt as to the action they should take in relation to the Merger should consult their own independent financial advisor. 8 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Overview of FTSA 9 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Overview of FTSA FTSA is a NASDAQ listed speciality pharmaceutical business which was founded in Lyon, France FTSA is a French public company limited by shares (société anonyme) having more than ninety percent (90%) of its issued share capital listed on the NASDAQ in the form of American Depositary Shares (ADSs), through the Bank of New York Mellon, FTSA’s depositary agent. FTSA is a specialty pharmaceutical business. The initial focus of FTSA was the development of innovative drug delivery technologies, mainly in collaboration with global pharmaceutical players. FTSA’s original objective was to develop a complementary portfolio of drug delivery technologies, facilitating the development of safer and more efficacious drug formulations, and to address identified unmet medical needs. In recent years, FTSA has diversified away from pure play drug delivery technology and placed a new emphasis on direct development/registration and marketing of existing pharmaceutical products, mainly through new regulatory pathways for selected older, unapproved drugs in the US market. FTSA acquired Éclat Pharmaceuticals (Éclat) on March 13, 2012 to assist with its diversification strategy to access value from near-term product launches. FTSA’s current business model is to select, develop, seek approval for, and to commercialise niche branded and generic products in the USA. As a result of the shift to a broader specialty pharmaceutical company model, FTSA’s business is now less dependent on its ability to work with pharmaceutical partners in collaborative relationships where it would have limited control (and economic reward) on commercialisation activities. In part, the new business focus can support further investment and efforts in development of FTSA’s legacy drug delivery platforms, depending on evolving market opportunities. FTSA remains active in development of its technology and is actively seeking new licensing/collaboration opportunities for its drug delivery platforms with carefully selected third parties. However, there are considerable risks and uncertainties pertaining to the evolving risk/reward dynamics and sustainability of this business activity. FTSA’s corporate headquarters and research centres are based in Lyon, France. FTSA also owns, through wholly owned subsidiaries further commercial and administrative operations, located in St. Louis, Missouri, USA and Charlotte, North Carolina, USA. Business development, clinical and procurement operations are conducted through FTSA’s Irish subsidiary. 10 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Overview of FTSA FTSA is a NASDAQ listed speciality pharmaceutical business which was founded in Lyon, France Business function by location Flamel (U.S. Entity FTSA Avadel Holdings) Location Lyon Dublin Missouri /North Carolina Activity Global Clinical operations Commercial operations Headquarters Preclinical and Procurement 3rd party distributor clinical research operations relationships Location of IP for FTSA Location of executive management team Source: FTSA Business Function Overview FTSA (France) – Performs research and development on behalf of Flamel Ireland, Limited (“FIL”); and – Location of head office functions such as HR, payroll etc. FIL (Ireland) – IP owner; – Provides oversight and direction in respect of R&D performed by FTSA – Provides oversight over clinical trials and regulatory approval; – Commercially exploits the IP held by out licensing to third parties and or by granting distribution rights to related parties e.g. Flamel US; and – VP of Irish and European Operations is based here. Flamel (U.S. Holdings) – Distributes FTSA’s three main products (Bloxiverz, Vazculep and Ephedrine) in North America; and – Responsible for maintaining 3rd party distributor relationships to the US only. 11 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Balance Sheet analysis 1. Balance Sheet analysis 12 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

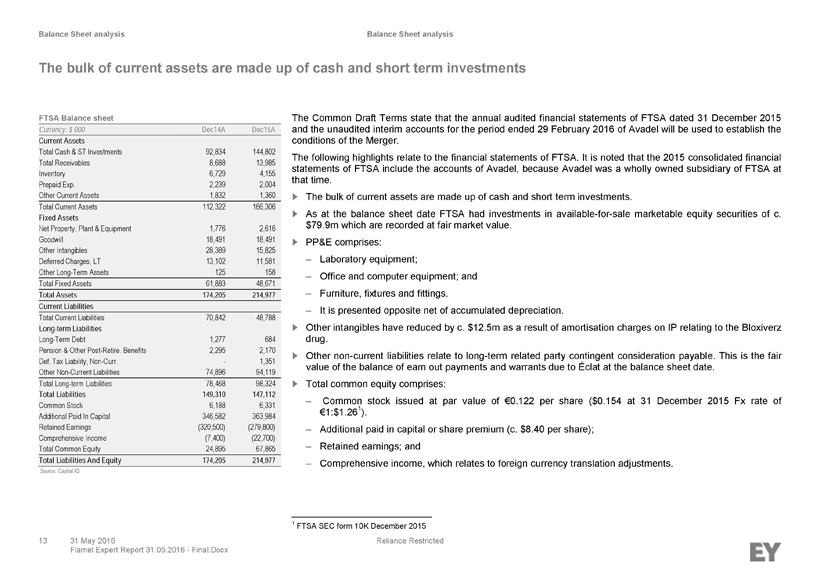

Balance Sheet analysis Balance Sheet analysis The bulk of current assets are made up of cash and short term investments FTSA Balance sheet Currency: $000 Dec14A Dec15A Current Assets Total Cash & ST Investments 92,834 144,802 Total Receivables 8,688 13,985 Inventory 6,729 4,155 Prepaid Exp. 2,239 2,004 Other Current Assets 1,832 1,360 Total Current Assets 112,322 166,306 Fixed Assets Net Property, Plant & Equipment 1,776 2,616 Goodwill 18,491 18,491 Other Intangibles 28,389 15,825 Deferred Charges, LT 13,102 11,581 Other Long-Term Assets 125 158 Total Fixed Assets 61,883 48,671 Total Assets 174,205 214,977 Current Liabilities Total Current Liabilities 70,842 48,788 Long-term Liabilities Long-Term Debt 1,277 684 Pension & Other Post-Retire. Benefits 2,295 2,170 Def. Tax Liability, Non-Curr. - 1,351 Other Non-Current Liabilities 74,896 94,119 Total Long-term Liabilities 78,468 98,324 Total Liabilities 149,310 147,112 Common Stock 6,188 6,331 Additional Paid In Capital 346,582 363,984 Retained Earnings (320,500) (279,800) Comprehensive Income (7,400) (22,700) Total Common Equity 24,895 67,865 Total Liabilities And Equity 174,205 214,977 Source: Capital IQ The Common Draft Terms state that the annual audited financial statements of FTSA dated 31 December 2015 and the unaudited interim accounts for the period ended 29 February 2016 of Avadel will be used to establish the conditions of the Merger. The following highlights relate to the financial statements of FTSA. It is noted that the 2015 consolidated financial statements of FTSA include the accounts of Avadel, because Avadel was a wholly owned subsidiary of FTSA at that time. The bulk of current assets are made up of cash and short term investments. As at the balance sheet date FTSA had investments in available-for-sale marketable equity securities of c. $79.9m which are recorded at fair market value. PP&E comprises: – Laboratory equipment; – Office and computer equipment; and – Furniture, fixtures and fittings. – It is presented opposite net of accumulated depreciation. Other intangibles have reduced by c. $12.5m as a result of amortisation charges on IP relating to the Bloxiverz drug. Other non-current liabilities relate to long-term related party contingent consideration payable. This is the fair value of the balance of earn out payments and warrants due to Éclat at the balance sheet date. Total common equity comprises: – Common stock issued at par value of €0.122 per share ($0.154 at 31 December 2015 Fx rate of €1:$1.261). – Additional paid in capital or share premium (c. $8.40 per share); – Retained earnings; and – Comprehensive income, which relates to foreign currency translation adjustments. 1 FTSA SEC form 10K December 2015 13 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger rationale 14 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger rationale Merger rationale We understand the benefits of the Merger to be as follow: 1 To ensure compliance with SEC and NASDAQ listing requirements In certain cases, SEC rules and NASDAQ listing requirements are not fully consistent with principles of French law and limit the ability of the board of directors to delegate certain authority to committees and other persons. To avoid any possible concerns about the continued and long-term compliance with these NASDAQ and SEC requirements, FTSA has determined that it is desirable to change its nationality from being a French company to an Irish company. 2 Operational effectiveness In 2014, the Directors of FTSA approved the sale of all of the Group’s intellectual property to Flamel Ireland Limited (“FTSA Ireland”), which is currently a 100% subsidiary of Avadel. Given the attractive nature of the business environment in Ireland and given that the Group’s IP and related functions are located in Ireland, Management believes the Merger will continue to leverage the operational benefits of this earlier transaction, driving synergies within the Group and improving the efficiency of its management and supporting services. These centralised functions will help to unify the Group wide decision-making process, thereby helping to ensure its customers receive safe and effective products. 3 Increased flexibility in completing certain transactions Prior to giving effect to certain transactions, FTSA is required to present to its Workers Council a written report summarising the transaction and wait a specified period of time during which the Workers Council may approve or reject the transaction. Although rejection by the Workers Council would not prohibit FTSA from completing a proposed transaction, the Workers Council notice procedure could cause a delay completing a transaction, and add to the expense and management time necessary to complete such transaction. 4 Become a more attractive acquisition target Certain U.S. public companies have acquired Irish companies in the pharmaceutical industry, as well as in other industries; and in a number of these business combinations the resulting parent company is domiciled in Ireland. The Board of FTSA believes that, in addition to the intrinsic values of the Irish target companies in these business combinations, the acquiring U.S. public companies may also perceive certain ancillary benefits associated with establishing Ireland as the domicile of the resulting parent company, including membership in the European Union and the Organisation for Economic Co-operation and Development; a skilled and highly educated work force with pharmaceutical company experience; modern infrastructure systems including roads, rail and utilities; and a relatively low corporate income tax rate. The FTSA Board is not presently seeking to engage in a transaction where control of FTSA would change. Nevertheless, the Board believes that, for the reasons cited above, shares may be more attractive to persons or entities who may be interested in acquiring FTSA in the future if it is domiciled in Ireland. 15 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

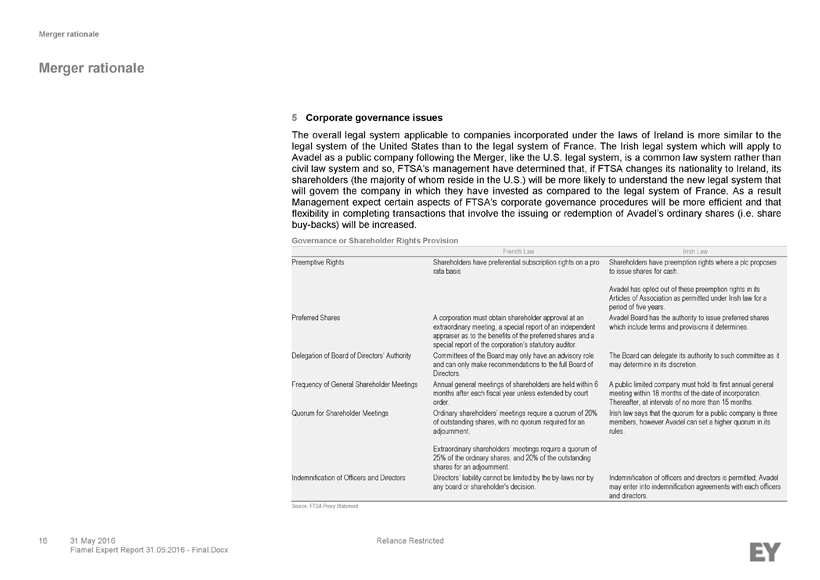

Merger rationale Merger rationale 5 Corporate governance issues The overall legal system applicable to companies incorporated under the laws of Ireland is more similar to the legal system of the United States than to the legal system of France. The Irish legal system which will apply to Avadel as a public company following the Merger, like the U.S. legal system, is a common law system rather than civil law system and so, FTSA’s management have determined that, if FTSA changes its nationality to Ireland, its shareholders (the majority of whom reside in the U.S.) will be more likely to understand the new legal system that will govern the company in which they have invested as compared to the legal system of France. As a result Management expect certain aspects of FTSA’s corporate governance procedures will be more efficient and that flexibility in completing transactions that involve the issuing or redemption of Avadel’s ordinary shares (i.e. share buy-backs) will be increased. Governance or Shareholder Rights Provision French Law Irish Law Preemptive Rights Shareholders have preferential subscription rights on a pro rata basis Shareholders have preemption rights where a plc proposes to issue shares for cash. Avadel has opted out of these preemption rights in its Articles of Association as permitted under Irish law for a period of five years. Preferred Shares A corporation must obtain shareholder approval at an extraordinary meeting, a special report of an independent appraiser as to the benefits of the preferred shares and a special report of the corporation’s statutory auditor. Avadel Board has the authority to issue preferred shares which include terms and provisions it determines. Delegation of Board of Directors’ Authority Committees of the Board may only have an advisory role and can only make recommendations to the full Board of Directors. The Board can delegate its authority to such committee as it may determine in its discretion. Frequency of General Shareholder Meetings Annual general meetings of shareholders are held within 6 months after each fiscal year unless extended by court order. A public limited company must hold its first annual general meeting within 18 months of the date of incorporation. Thereafter, at intervals of no more than 15 months. Quorum for Shareholder Meetings Ordinary shareholders’ meetings require a quorum of 20% of outstanding shares, with no quorum required for an adjournment. Irish law says that the quorum for a public company is three members, however Avadel can set a higher quorum in its rules. Extraordinary shareholders’ meetings require a quorum of 25% of the ordinary shares, and 20% of the outstanding shares for an adjournment. Indemnification of Officers and Directors Directors’ liability cannot be limited by the by-laws nor by any board or shareholder's decision. Indemnification of officers and directors is permitted; Avadel may enter into indemnification agreements with each officers and directors. Source: FTSA Proxy Statement 16 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger analysis 1. Merger overview 17 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger analysis Merger overview FTSA and Avadel are the parties to the Merger Identification of the merging companies FTSA FTSA is a French incorporated public company limited by shares (société anonyme) listed on the NASDAQ. FTSA is registered with the Lyon Trade and Companies Register (RCS) under no. 379 001 530 and registered office located at Parc Club du Moulin à Vent, 33, avenue du Dr Georges Levy, 69200 Vénissieux, France. FTSA is governed by French laws. Avadel Avadel is a private limited liability company incorporated in Ireland. Before the Merger Avadel will be a wholly owned subsidiary of FTSA and as such all of the assets and liabilities of Avadel will, indirectly be the assets and liabilities of FTSA. Avadel will re-register as a public company limited by shares immediately prior to the Merger. Avadel is registered with the Irish Companies Registration Office with registered number 572535 and its registered address is at Block 10-1, Blanchardstown Corporate Park, Ballycoolin Dublin 15. Avadel is governed by Irish laws. 18 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger analysis Merger overview FTSA and Avadel are the parties to the Merger Pre-Merger structure Reorganisation as result of the Merger Post-Merger structure Source: Management information Source: Management information Source: Management information Notes 1. All entities are 100% owned. Pre-Merger structure Reorganisation as result of the Merger Post-Merger structure The Group is currently organised with a French parent, FTSA owning 100% of each of FTSA US Holdings Inc and Avadel. FTSA, on being dissolved without going into liquidation, will transfer all of its assets and liabilities to Avadel. Avadel will remain domiciled and tax resident in the Republic of Ireland, with its registered and corporate head office at Blanchardstown. The ordinary shares that FTSA holds in Avadel immediately prior to the Merger will vest in Avadel and be cancelled subsequently. Shares or ADSs of Avadel will be admitted to trading on the NASDAQ. All French employment contracts held by FTSA are transferred to the newly established French branch of Avadel. 19 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger analysis Merger overview Shareholders are issued with the same number of shares in Avadel as they previously held in FTSA Summary of the Common Draft Terms The Merger of FTSA and Avadel will be carried out as a merger as defined under Article 2 of the Directive, paragraph 2. (b): i.e. “an operation whereby (…) (b) two or more companies, on being dissolved without going into liquidation, transfer all their assets and liabilities to a company that they form, the new company, in exchange for the issue to their members of securities or shares representing the capital of that new company and, if applicable, a cash payment not exceeding 10% of the nominal value, or in the absence of a nominal value, of the accounting par value of those securities or shares.” This corresponds to a “merger by acquisition” under the Irish Regulations, and to a “merger by absorption” under French law. On the 31st of December 2016 (the “Effective Date”) FTSA, will be dissolved without going into liquidation, and transfer all of its assets and liabilities to Avadel pursuant to regulation 19(1) of the Irish Regulations article L 236-3 of the French commercial code. Share Exchange Ratio 1 The objective of the share exchange ratio (“Share Exchange Ratio”) is to place shareholders of FTSA in the same economic position, and shareholding position relative to other shareholders, post-Merger as they were in pre-Merger. 2 The boards of directors of FTSA and Avadel have determined the most equitable way to achieve this is to exchange one new share in Avadel for an old share in FTSA. 3 The Share Exchange Ratio is calculated based on the number of FTSA shares in issue at the date of the Common Draft Terms. 4 At the Effective Date a shareholder in FTSA will receive one new share in Avadel for each FTSA share they held. Fair Market Value No cash payment will be made by Avadel to the shareholders of FTSA in respect of their shares or the transfer of FTSA’s assets and liabilities to Avadel. Shareholders are issued with the same number of shares in Avadel as they previously held in FTSA, as such the value impact is nil as an individual shareholder will have the same economic interest in the same assets and liabilities in Avadel as they had in FTSA and the same voting rights. 20 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger analysis Merger overview The new shares in Avadel will be issued at a premium to their nominal value Worked example As at As at the 31/12/2015 Effective Date Currency: $US Notes FTSA Avadel Number of ordinary shares 1 41,241,000 41,241,000 Par value of 1 share 0.10 0.01 Ordinary share capital 4,124,100 412,410 Deferred share capital ($) 31,457 Share price as at 31/12/2015 1 10.21 - Market cap. of the company 2 421,070,610 421,070,610 Share premium 420,626,743 Notes 1. Sourced from Capital IQ 2. Actual figures may vary to the figures presented in the table above as the FTSA share price is likely to change between the date of this Report and the Effective Date. Increase in Avadel’s issued share capital Prior to the Effective Date, Avadel will re-register as an Irish public limited company and: 1 Subdivide its share capital so that each ordinary share of €1.00 is represented by 100 ordinary shares of €0.01 each; 2 Adopt an authorised share capital of $5,500,000 comprising 500,000,000 ordinary shares of $0.01 each and 50,000,000 preferred shares of $0.01 each; and 3 Issue 25,000 deferred ordinary shares of €1.00 each The new shares in Avadel will be issued at a premium to their nominal value, equal to the difference between the value of the transferred assets and liabilities and the nominal value of the Avadel new shares at the Effective Date. FTSA has not yet determined if these assets will be valued at fair market value or net book value, in any event this will not impact the Share Exchange Ratio. As of 31 December 2015, Avadel had no retained profits or losses. In addition, as of the date of the Common Draft Terms and as of the date of the closing of the Merger, all of Avadel’s assets, liabilities and retained profits or losses will be indirectly the assets, liabilities and retained profits or losses of FTSA, because Avadel is and will be a wholly owned subsidiary of FTSA until completion of the Merger. The deferred ordinary shares will be held by Flamel US Holdings Inc. a wholly owned subsidiary of FTSA. As required by Irish law, the deferred ordinary shares will remain outstanding following the completion of the Merger, but they: Will not have any voting rights; Will not entitle the holders thereof to any dividends or other distributions of Avadel, and Will not entitle the holders thereof to participate in the surplus assets of Avadel on a winding-up. Worked example The exchange ratio is 1:1 so the number of new shares in Avadel (other than the deferred ordinary shares) equals the number of shares in FTSA. The nominal value of an ordinary share in Avadel is less than the nominal value of the share in FTSA. Share premium increases in proportion to the reduction in nominal share value to reflect the underlying assets and liabilities which have transferred from FTSA to Avadel. 21 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger analysis Merger overview The new shares in Avadel will be issued at a premium to their nominal value The total enterprise value remains unchanged as: – Shares in Avadel are admitted to trading on the NASDAQ as from the Effective Date meaning there is no reduction in the liquidity of the shares in Avadel when compared to the shares in FTSA that they are replacing; and – Transaction costs related to the Merger are not assumed to be material. In view of this economic reality, the beneficial interest of shareholders in the assets and liabilities of FTSA and Avadel will not change as a result of the Merger, and therefore no assets or liabilities will, in effect, be transferred. Therefore, we expect that all of the difference between the new share capital of Avadel after the Effective Date and its market capitalisation will be reflected as share premium as illustrated in the table on the previous page. Special rights No measures are proposed under the Merger by which any FTSA share or shareholder would be subject to any special rights or restrictions. All of the ordinary shares in Avadel rank pari passu with each other, as such no Avadel shareholder is subject to special rights or restrictions. Avadel will be substituted for FTSA with regard to its obligations toward the beneficiaries of existing stock option plans, free share rights and warrants. As such, a shareholder in Avadel would not suffer any additional dilution in their holding as a result of the Merger because: The stock option plans, free share rights and warrants were issued by FTSA before the Effective Date; and They are not being varied in any way as a result of the Merger. Tax implications In principle the Merger triggers the immediate taxation of any deferred profits and built-in gains in FTSA under standard French corporate income tax rules. However, FTSA has submitted a request to the French tax authorities seeking to benefit from the special regime for mergers and demergers, which the French Code makes conditional upon a formal consent of the French tax authorities. If granted, such regime would allow a rollover of some of the gains mentioned above. However, to date, there is no certainty that FTSA will receive consent from the French tax authorities. Other considerations We are required by the Regulations to comment on the Share Exchange Ratio and whether or not it is fair and reasonable. Tax costs resulting from the transaction should not have any impact on the share exchange ratio as Avadel Limited is ‘stepping into the shoes’ of FTSA and each shareholder of FTSA receives the same proportion 22 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Merger analysis Merger overview The new shares in Avadel will be issued at a premium to their nominal value of shares in Avadel Limited that it held in FTSA. Thus our report does not include an estimation or assessment of the tax implications of the transaction. 23 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Final conclusions 1. Conclusion of value 24 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Final conclusions Conclusion of value Conclusion of value In accordance with the Directive and the Regulations a merging company must engage an Expert to report on the Common Draft Terms. The report should: 1 State the method or methods used to arrive at the proposed exchange ratio; 2 Give the opinion of the Expert whether the proposed exchange ratio is fair and reasonable; 3 Give the opinion of the Expert as to the adequacy of the method or methods used in the case in question; 4 Indicate the values arrived at using each such method; 5 Give the opinion of the Expert as to the relative importance attributed to such methods in arriving at the values decided on; and 6 Specify any special valuation difficulties which have arisen. As part of the above process, we have prepared our report in compliance with the Regulations. Our conclusions are as follow: 1 State the method or methods used to arrive at the proposed exchange ratio. The Share Exchange Ratio of one new Avadel share for each existing FTSA share i.e. a 1:1 ratio has been agreed by each of the boards of directors of FTSA and Avadel. The method is to issue a number of new shares equal to the number of old shares based on the facts and circumstances of the Merger and the mechanisms proposed to effect it. The principle underpinning the Share Exchange Ratio is that the net assets of FTSA will have the same value when they are merged into Avadel. 2 Give the opinion of the Expert whether the proposed exchange ratio is fair and reasonable. Shareholders are issued with the same number of shares in Avadel as they previously held in FTSA, as such the value impact is nil (irrespective of the difference in the nominal value between the ordinary shares of FTSA and Avadel) as an individual shareholder will have the same economic interest in the same assets and liabilities in Avadel as they had in FTSA and the same voting rights. On this basis, in our opinion the proposed exchange ratio is fair and reasonable. 25 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Final conclusions Conclusion of value Conclusion of value 3 Give the opinion of the Expert as to the adequacy of the method or methods used in the case in question. The Merger is in substance an internal re-organisation of FTSA and no external third party is a merging entity, as such the Client performed a basic valuation to determine the Share Exchange Ratio based on the book value of the net assets of FTSA. No cash payment will be made by Avadel to the shareholders of FTSA in respect of their shares or the transfer of FTSA’s assets and liabilities to Avadel. The Client deemed book value of the net assets of FTSA to have the same value when they are merged into Avadel. In our opinion the methodology set out at 1 above is adequate. 4 Indicate the values arrived at using each such method; As a formal valuation has not been undertaken this requirement is not applicable to the Merger. 5 Give the opinion of the Expert as to the relative importance attributed to such methods in arriving at the values decided on. Management of FTSA used one method to arrive at the Share Exchange Ratio, this method set out at 1 above. In our opinion attributing sole importance to this method is reasonable. 6 Specify any special valuation difficulties which have arisen. While FTSA has applied for a tax ruling in order to obtain relief from part of the taxes that the Merger may crystallise, a ruling has not yet been given and as such the outcome is uncertain. Notwithstanding this uncertainty, in our opinion the Share Exchange Ratio proposed remains appropriate as the decision to approve the proposed transaction is not linked directly to the Share Exchange Ratio. Shareholders will remain in the same relative (to other shareholders) position following the merger based on the proposed Share Exchange Ratio. Our opinion should only be interpreted in terms of the scope and procedures applied during the course of our work. No additional responsibility may be derived from our opinion. This Report has been prepared strictly to comply with the requirements for the preparation of such a Report in the context of the Merger as specified in the Regulations and should not be used for any other purpose. 26 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Appendices Appendix A: Signed Engagement Letter Appendix B: Sources of information 27 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Appendices Appendix A: Signed Engagement Letter Signed Engagement Letter Appendices Appendix A: Signed Engagement Letter Signed Engagement Letter Ernst & Young Tel:+3353 1475 0555 Business Advisory Services ey.com Harcourt Centre Harcourt Street Dublin 2 Ireland Private and confidential 25 April 2016 Flamel Technologies SA Mike Kanan 33 Avenue du Dr. Georges Levy 69200 Vénissieux FRANCE Dear Mike Cross Border Merger Valuation Support Thank you for choosing Ernst & Young (“we” or “EY”) to perform certain professional services (the “Services”) for Flamel Technologies SA(“you” or “Client” or “Flamel”), relating to the proposed merger of FCCML Limited and Flamel Technologies SA and the provision of valuation support to you and the members of Flamel (“the Valuation”). We appreciate the opportunity to assist you and look forward to working with you. This cover letter together with all of its appendices, exhibits, schedules and other attachments (collectively, this “Agreement”), describes and documents the arrangements between us, including our respective obligations. The scope of the Services is set out in the Statement of Work at Appendix A, together with details of our fees and billing arrangements. Any additional terms and conditions specific to the Services are set out in Appendix B, including restrictions on the disclosure and use of our advice and reports. Please sign and return the enclosed copy of this Agreement to confirm your acceptance of these terms. If you have any questions about these arrangements, please contact me. Yours sincerely Simon MacAllister Partner AGREED Flamel Technologies SA By (Authorised Representative): Signature: By: Mike Kanan Date: 4/25/16 Encl: Appendix A – Statement of work Appendix B – General terms and conditions Appendix C – Information request list 28 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

Appendices Appendix B: Sources of information Sources of information Capital IQ. Common Draft Terms Of Cross-Border Merger. CBM Proxy Statement. Flamel MS Cost Allocation Memo. Preliminary Draft Legal Step Plan. 29 31 May 2016 Reliance Restricted Flamel Expert Report 31.05.2016 - Final.Docx

EY | Assurance | Tax | Transactions | Advisory About EY EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com. © 2016 Ernst & Young. Published in Ireland. All Rights Reserved. The Irish firm Ernst & Young is a member practice of Ernst & Young Global Limited. It is authorised by the Institute of Chartered Accountants in Ireland to carry on investment business in the Republic of Ireland. Ernst & Young, Harcourt Centre, Harcourt Street, Dublin 2, Ireland. All Rights Reserved. EY.com