Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CrossAmerica Partners LP | capl2016juneform8-kinvesto.htm |

Investor Update June 2016

Investor Update June 2016 Safe Harbor Statements Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s Forms 10-Q or Form 10-K filed with the Securities and Exchange Commission and available on CrossAmerica’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise. 2

Investor Update June 2016 Partnership Overview • Leading motor fuel wholesale distributor, convenience store lessor and c-store operator – Distributes annually over 1 billion gallons – Annual gross rental income of approximately $80 million – Operates 90+ c-stores(1) – 17.5% equity interest in CST Brands’ wholesale fuels business, approximately 1.9 billion gallons of annual fuel supply • Over 1,180 fueling locations(1) – 577 Lessee Dealers – 390 Independent Dealers – 97 Company Operated Sites – 66 Commission Agents – 50+ Sub-jobbers, commercial accounts, etc. • Equity market capitalization of $806 million and enterprise value of $1.24 billion(1) (1) As of March 31, 2016 3 Owned/controlled sites States with marketing presence

Investor Update June 2016 Investment Highlights • Serial acquirer and integrator of convenience store and fuel distribution assets with a proven track record of executing on accretive transactions – $475.6 million of acquisitions in 2015 – Increased velocity of growth in 2015 with drop downs from CST – Exercising capital discipline in current environment by focusing on smaller, highly accretive acquisitions • Significant pipeline of fuel supply assets available from CST Brands – Look to return to higher trajectory of growth in future periods • Strong financial position, with potential to continue growth in 2016 without accessing equity markets 4 2012 2013 2014 2015 2016 $74,400 $42,500 $166,500 $163,700 $52,300 $311,900(1) Acquisitions Completed since IPO in 4Q12 (in thousands) (1) Represents CrossAmerica’s drop-down acquisitions from CST Brands

Investor Update June 2016 Investment Highlights • Solid business fundamentals and core competencies – Long term, substantial relationships with major fuel suppliers – Prime real estate in high traffic regions – Stable cash flow from Rental Income, Wholesale Distribution and Retail Operations – Business is more diversified than ever, both geographically and across operating segments • Strong and experienced management team – Years of industry knowledge and experience in wholesale, real estate and retail operations – Seasoned M&A team with strong track record of growth – Integration-focused organization with commitment to fast implementation, synergy capture and EBITDA growth Top 10 Distributor for: 5

Investor Update June 2016 Strategy Execution • Completed accretive SSG acquisition on March 29 – 34 total sites(1), over 26 million annual gallons of fuel, valuable real estate, strong inside sales • Continued focus on managing expenses and execution of our integration strategy – Applying processes and systems to reduce operating, general & administrative expenses following acquisitions – Converted 52 Company Operated sites in the first quarter to Lessee Dealer accounts, yielding a more stable, qualifying income cash flow stream 6 1Q '15 2Q '15 3Q '15 4Q '15 1Q '16 144 122 116 97 124 Company Operated Site Count (end of period) PMI Erickson OneStop SSG (1) 31 fuel and 3 non-fuel locations Company Operated Wholesale Fuel Margin Retail Fuel Margin Retail Merchandise Margin Operating Expenses Income Taxes Lessee Dealer Wholesale Fuel Margin Rental Income

Investor Update June 2016 1Q 2016 Results Summary (in thousands, except for per unit amounts) KEY METRICS Three Months ended Mar. 31, 2016 2015 % Change Gross Profit $37,190 $37,727 (1%) Adjusted EBITDA(1) $22,215 $15,583 43% Distributable Cash Flow(1) $17,289 $10,095 71% Weighted Avg. Diluted Units 33,177 24,583 35% DCF per LP Unit $0.5211 $0.4107 27% Distribution Paid per LP Unit $0.5925 $0.5425 9% Distribution Coverage 0.88x 0.76x 16% 7 (1) See the earnings press release filed by CrossAmerica Partners LP on May 6, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF.

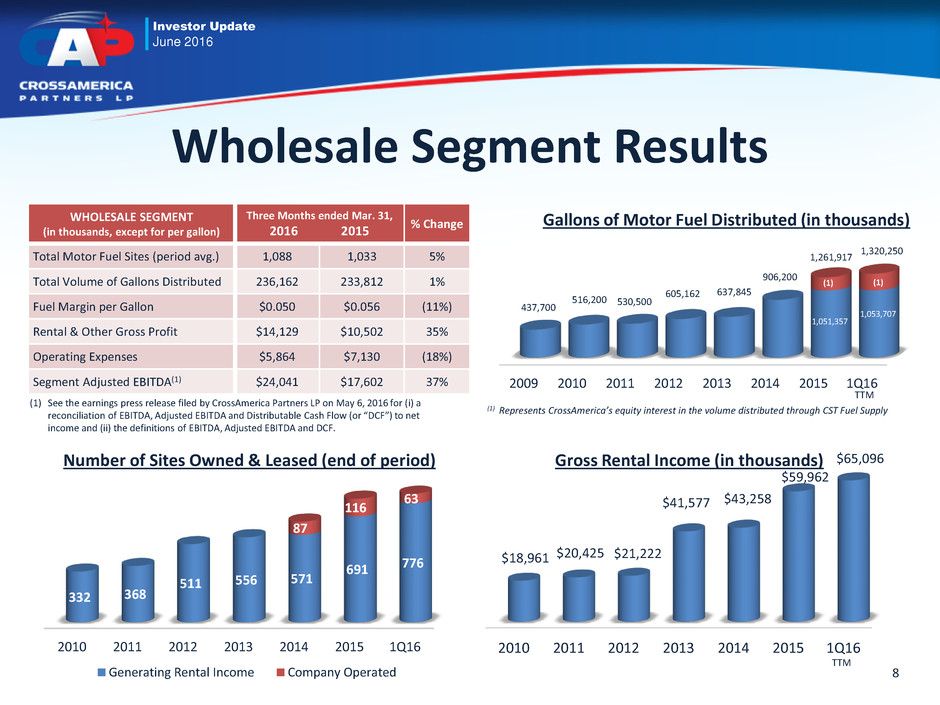

Investor Update June 2016 2010 2011 2012 2013 2014 2015 1Q16 $18,961 $20,425 $21,222 $41,577 $43,258 $59,962 $65,096 Gross Rental Income (in thousands) 2009 2010 2011 2012 2013 2014 2015 1Q16 437,700 516,200 530,500 605,162 637,845 906,200 1,051,357 1,053,707 (1) (1) Wholesale Segment Results WHOLESALE SEGMENT (in thousands, except for per gallon) Three Months ended Mar. 31, 2016 2015 % Change Total Motor Fuel Sites (period avg.) 1,088 1,033 5% Total Volume of Gallons Distributed 236,162 233,812 1% Fuel Margin per Gallon $0.050 $0.056 (11%) Rental & Other Gross Profit $14,129 $10,502 35% Operating Expenses $5,864 $7,130 (18%) Segment Adjusted EBITDA(1) $24,041 $17,602 37% (1) See the earnings press release filed by CrossAmerica Partners LP on May 6, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF. Gallons of Motor Fuel Distributed (in thousands) 1,261,917 (1) Represents CrossAmerica’s equity interest in the volume distributed through CST Fuel Supply 2010 2011 2012 2013 2014 2015 1Q16 332 368 511 556 571 691 776 87 116 63 Number of Sites Owned & Leased (end of period) Generating Rental Income Company Operated 8 TTM TTM 1,320,250

Investor Update June 2016 1Q15 vs 1Q16 Adjusted EBITDA Performance (in thousands) $22,215 $15,583 $7,616 ($1,467) $1,504 ($1,021) Acquisitions(2) Impact of Supplier Terms Discounts Q1 2015 Adjusted EBITDA(1) Q1 2016 Adjusted EBITDA(1) Net, Misc.(3) Net Effect of Integration and Base Business 9 (1) See the earnings press release filed by CrossAmerica Partners LP on May 6, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF. (2) Acquisitions include third party acquisitions and CST asset drops conducted since 1/1/15 (3) Net, Misc. includes increased Incentive Distribution Right distributions, Dealer-Tank-Wagon pricing and other miscellaneous items

Investor Update June 2016 - 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Coverage Ratio (on paid basis) Quarterly Coverage Ratio Targeted 12 Month Coverage Ratio, 1.1x Current Trailing 12 Month Coverage Ratio, 1.08x Strength Despite Crude Price Headwinds $- $20 $40 $60 $80 $100 $120 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Cash Flow Performance Distributable Cash Flow(1) (in thousands, left axis) Avg. WTI Crude Price (per barrel, right axis) 10 (1) See the earnings press release filed by CrossAmerica Partners LP on May 6, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF. is ri le Fl (1) (in thousands, left axis)

Investor Update June 2016 Executing with Measured Growth • Declared distribution attributable to first quarter of $0.5975 per unit – 0.5 cent per unit increase over fourth quarter 2015 – Expect to increase per unit distribution by 5%-7% for 2016 over 2015 – Continue to target a long-term distribution coverage ratio of at least 1.1x • 2016 Distributable Cash Flow(1) growth expected to come from selective, accretive acquisitions, strong business performance and expense reduction associated with integration of recently completed transactions – Maintaining a strong Balance Sheet with a leverage ratio well within our credit facility covenants – Real estate assets remain a viable source of capital to fund accretive growth – Assets are well positioned as we head into our seasonably stronger periods of operations 11 $0.4500 $0.4750 $0.5000 $0.5250 $0.5500 $0.5750 $0.6000 $0.6250 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Distributions per Unit (on declared basis) (1) See the earnings press release filed by CrossAmerica Partners LP on May 6, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF.

Investor Update June 2016 Investment Summary • Stable cash flow business with minimal exposure to commodity market fluctuations, even during historically volatile times • Visible path to continued DCF growth through acquisitions, integration and operational excellence • Unit price remains significantly below intrinsic value, based on demonstrated distribution growth Leader in wholesale fuel distribution and c-store lessor and operator Substantial relationship with the largest fuel suppliers in the industry Diverse geographic and operational footprint Significant real estate ownership provides stable cash flow contribution Serial acquirer with reputation to complete strategic, accretive transactions Acquisition pipeline from general partner sponsor Strong management team and board with experience in MLPs, operations, acquisitions and integration 12

Investor Update June 2016 Appendix 13

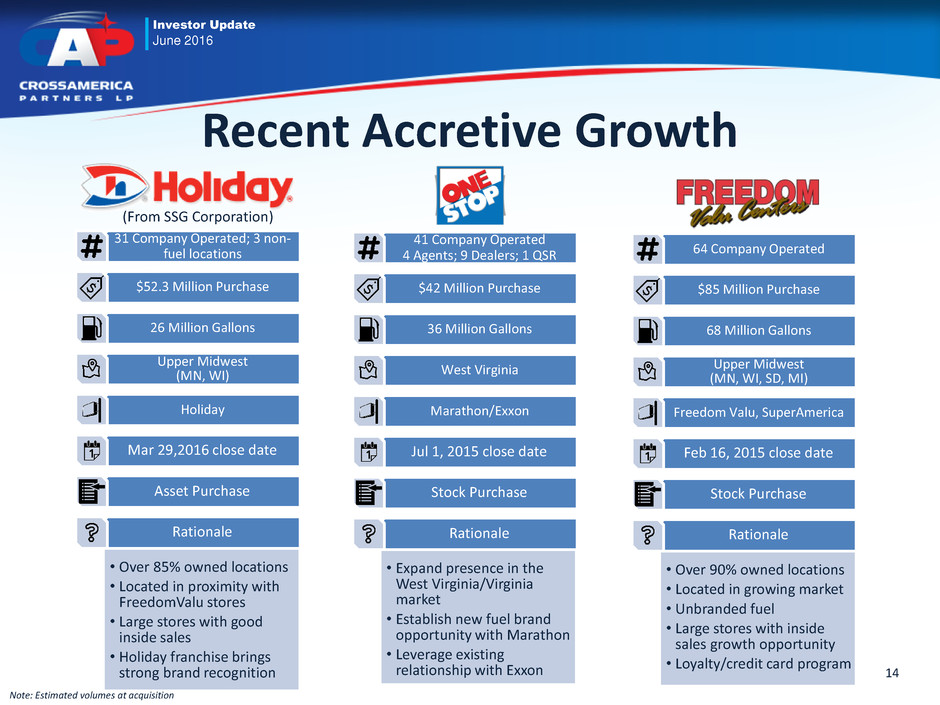

Investor Update June 2016 • Over 90% owned locations • Located in growing market • Unbranded fuel • Large stores with inside sales growth opportunity • Loyalty/credit card program 64 Company Operated $85 Million Purchase 68 Million Gallons Upper Midwest (MN, WI, SD, MI) Freedom Valu, SuperAmerica Feb 16, 2015 close date Stock Purchase Rationale • Expand presence in the West Virginia/Virginia market • Establish new fuel brand opportunity with Marathon • Leverage existing relationship with Exxon 41 Company Operated 4 Agents; 9 Dealers; 1 QSR $42 Million Purchase 36 Million Gallons West Virginia Marathon/Exxon Jul 1, 2015 close date Stock Purchase Rationale Note: Estimated volumes at acquisition Recent Accretive Growth 14 • Over 85% owned locations • Located in proximity with FreedomValu stores • Large stores with good inside sales • Holiday franchise brings strong brand recognition 31 Company Operated; 3 non- fuel locations $52.3 Million Purchase 26 Million Gallons Upper Midwest (MN, WI) Holiday Mar 29,2016 close date Asset Purchase Rationale (From SSG Corporation)

Investor Update June 2016 • Strong fuel margin (6 cpg) with long-term fuel supply • Good rental income •Minimal expense and CapEx impact • CST operated sites 25 CST Dealer Sites (Fuel Income) 23 CST Fee Sites (Rental Income) $53.6 Million Purchase 40 Million Gallons Central New York Nice N Easy Nov 1, 2014 close date Asset Purchase Rationale • Large volume network • Strong retail operator with embedded food options at several locations • Recognize synergies with other operations in the area 87 Company Operated Petroleum Products Division $61 Million Purchase 200+ Million Gallons Virginia, West Virginia, Tennessee, North Carolina Shell, Exxon, BP, Citgo May 1, 2014 close date Stock Purchase Rationale Recent Accretive Growth Note: Estimated volumes at acquisition 15 • Strong margin (5 cpg) with high volume and long-term supply • Leverage existing relationship with Shell • Good rental income • CST operated sites 22 CST Lessee Dealer Sites $41.2 Million Purchase 41 Million Gallons San Antonio & Austin Shell Jan 8, 2015 close date Asset Purchase Rationale (From Landmark Industries)

Investor Update June 2016 Additional Information: • $0.5031 on an annual basis = $2.01 • $0.5469 on an annual basis = $2.19 • $0.6563 on an annual basis = $2.63 • Q4 2014 Distribution = $0.5325, on an annual basis = $2.13 Incentive Distribution Rights 100% 85% 75% 50% 15% 25% 50% up to $0.5031 above $0.5031 up to $0.5469 above $0.5469 up to $0.6563 above $0.6563 M ar gi n al % In te re st in D is tri b u tio n Total Quarterly Distribution per Common and Subordinated Unit • If cash distributions to our unitholders exceed $0.5031 per unit in any quarter, CrossAmerica unitholders and the incentive distribution rights held by CST will receive distributions according to the percentage allocations shown in the chart to the right $0.5031 $0.5469 $0.6563 ↑ Unitholder Distribution IDR Distribution Lower Tier Unitholder Distribution Lower Tier IDR Distribution 16