Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WireCo WorldGroup Inc. | q12016investorcallslides.htm |

WireCo WorldGroup Investor Call Q1 2016

2 Forward-Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements. It is important to note that the Company’s performance, and actual results, financial condition or business could differ materially from those expressed in such forward- looking statements. Forward-looking statements include those containing such words as “anticipates,” “believes”, “continues,” “estimates,” “expects,” “forecasts,” “intends,” “outlook,” “plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. Factors that could cause or contribute to such differences include, but are not limited to: the general economic conditions in markets and countries where we have operations; fluctuations in end market demand; risks associated with our non-U.S. operations; foreign currency exchange rate fluctuations; the competitive environment in which we operate; changes in the availability or cost of raw materials and energy; risks associated with our manufacturing activities; our ability to meet quality standards; our ability to protect our trade names; violations of laws and regulations; the impact of environmental issues and changes in environmental laws and regulations; our ability to successfully execute and integrate acquisitions; comparability of our specified scaled disclosure requirements applicable to emerging growth companies; labor disturbances, including any resulting from suspension or termination of our collective bargaining agreements; our significant indebtedness; covenant restrictions; the interests of our principal equity holder may not be aligned with the holders of our 9.5% Senior Notes; and credit-rating downgrades. More detailed information about factors that could affect future performance or results may be found in our filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2015 and subsequent reports. Forward-looking statements should not be relied upon as a guarantee of future performance or results, nor will they prove to be accurate indications of the times at or by which any such performance or results will be achieved. The Company undertakes no obligation to update forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial condition or business over time. Non-GAAP Financial Measures Some of the information included in this presentation is derived from our consolidated financial information but is not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Certain of these data are considered “Non-GAAP Financial Measures” under SEC rules. These Non-GAAP Financial Measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures can be found in the Appendix to this presentation. These Non-GAAP Financial Measures are provided as a means to enhance communications with security holders by providing additional information regarding our operating results and liquidity. Management uses these Non-GAAP Financial Measures in evaluating our performance and in determining debt covenant calculations. Any reference during the discussion today to EBITDA means Adjusted EBITDA for which we have provided a reconciliation in the Appendix. Cautionary Statements

WireCo Business Overview

4 WireCo Overview Steel (66%) (1) Large diameter, highly engineered rope and electrical signal transmission cable Engineered specialty wire products used in industrial end markets Highly engineered, made-to-order synthetic ropes and technical products that have strength characteristics of steel but weigh significantly less Synthetic (34%) (1) Highly engineered plastic molding from recycled materials used in a variety of industrial, structural and oil and gas applications Rope (71% of Sales) (1) Broad Product Offering Specialty Wire (19% of Sales) (1) Engineered Products (10% of Sales) (1) Rope: Diverse End Market Applications Oil & Gas Industrial and Infrastructure Fishing Maritime Mining (1) Percentages shown as % of Q1 2016 Sales.

WireCo Q1 2016 Performance

6 $27.3 $26.1 $23.5 Q1 '15 Q1 '15 CC Q1 '16 15.2% $180.4 $174.1 $149.0 Q1 '15 Q1 '15 CC Q1 '16 Management continues proactive cost and cash management in challenging market conditions, expanding Adjusted EBITDA(1) margins to 15.7% and generating $1.1 million of positive cash flow Revenue decline of $31.4 million from Q1’15 to Q1’16 – FX Impact: $6.3 million Adjusted EBITDA(1) decline of $3.8 million with increased Adjusted EBITDA margin of 50 bps – FX impact: $1.2 million Achieved positive cash generation of $1.1 million Q1 Performance Summary Sales Adjusted EBITDA (1) (1) Adjusted EBITDA, Credit Agreement EBITDA and Free Cash Flow are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions) (2) 2015 Constant Currency (CC) are 2015 actuals calculated at 2016 exchange rates for the same period. Free Cash Flow (1) (2) (2) FX EUR MXN PLN 2015A 1.13 14.94 3.72 2016A 1.10 18.03 3.96 15.0% 15.7% %: Adjusted EBITDA(1) Margin $(0.1) $1.1 Q1 '15 Q1 '16

7 $27.3 $26.1 $23.5 $1.2 $7.2 $3.1 $1.5 Q1'15 Adjusted EBITDA FX Q1'15 Constant Currency Oil & Gas Operations SG&A Q1'16 Adjusted EBITDA(1) Consistent with previous quarters, managed operating costs to help mitigate Oil and Gas market change – FX impact to Adjusted EBITDA(1): $1.2 million – Sales Impact to Adjusted EBITDA(1): $6.1 million on Constant Currency(2) basis Sales declined by $25M (on a Constant Currency basis(2)); O&G accounted for $17M of the decline (US rig count average in Q1’15 of 1,403 decreased to 551 average in Q1’16) with remaining decline driven primarily by industrial markets on weak OEM backlogs – Operational cost savings of $3.1 million driven by procurement savings and freight efficiencies – SG&A savings of $1.5 million by headcount reductions Q1 Adjusted EBITDA(1) Bridge Adjusted EBITDA(1) Bridge (1) Adjusted EBITDA is a Non-GAAP Financial Measure. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions) (2) 2015 Constant Currency (CC) are 2015 actuals calculated at 2016 exchange rates for the same period. (1) (2)

8 Cash generation of $1.1 million in Q1’16 including $5.3 million interest payment and $1.6 million of FX and advisory fees Ending Net Debt(1) of $807.7 million (down from $808.8 million in Q4’15) Working Capital & Cash Management Key Working Capital Statistics Free Cash Flow (1) (1) Adjusted EBITDA, Free Cash Flow and Net Debt are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; $ in millions Metrics in Days Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 A/R 63 68 64 66 68 Inventory 134 137 132 140 156 A/P 51 52 46 54 51 WC % of Sales 34.8% 35.7% 36.2% 36.4% 40.8% FY 2015 Q1 '16 Adjusted EBITDA (1) $106.4 $23.5 Interest (67.8) (5.3) Tax (7.0) (2.1) A/R 16.7 6.9 Inventory 21.6 (2.6) Payable & Other (17.2) (10.2) Change in NWC $21.1 ($5.9) Capex (29.8) (5.1) Other (6.9) (2.5) Cash Flow (Pre FX / Advisory Fees) $16.0 $2.6 FX / Advisory Fees ($7.9) ($1.6) Free Cash Flow (1) 8.0$ 1.1$

9 $817 $826 $808 $809 $808 $762 $788 $768 $763 $780 6.0x 6.5x 5.3x 5.8x 6.0x 6.3x 6.8x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x $750 $770 $790 $810 $830 $850 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Net Debt Swap Adj. Net Debt Net Debt(1) ended at $807.7 million – Swap Adjusted Net Debt assumes unrealized gain from swap Total debt of $838.5 million; total cash of $30.7 million – Approximately $28.9 million of cash is unrestricted and can be repatriated on tax free basis; however, given inability of foreign entities to draw directly on revolver, those entities keep cash on balance sheet for working capital purposes Net Debt(1) Levels Net Debt (1) and Swap Adjusted Net Debt Trend (2) (1) Net Debt is a Non-GAAP Financial Measure. See appendix for reconciliation to most directly comparable GAAP Financial Measure; ($ in millions) (2) Calculated per Credit Agreement definition

Business Outlook

11 Short-Term WireCo Sales Outlook Sales Results LTM Rope Sales: $473.1 Industrial and Infrastructure Mining Fishing Maritime Rope Update Majority of analyst estimates anticipating rig count commencing increase in Q3 Continued strong penetration in Middle Eastern market Portugal offshore project commenced production as communicated Europe and US construction segments expected to improve on better macro results (Euro with higher than expected GDP; US improvement in manufacturing) China manufacturing sector continues to be slow but stimulus program expected to help Growth expected from fully operational Crane Center Continued slowdown of tons mined in NA with global mining companies under financial stress Continuing traction in new markets (Africa / South America) and scheduled new product releases on track Continued population growth driving increased demand for seafood Overall end market stability Delayed tuna net orders to be delivered in Q2 Global demand slowdown for commodities shipped via vessel Oversupply of vessels from previous years means less new builds Several initiatives in execution phase including further penetration of US market with Lankhorst synthetics products ($ in millions) Oil & Gas $126.5 $124.0 $116.2 $106.4 Q2 '15 Q3 '15 Q4 '15 Q1 '16

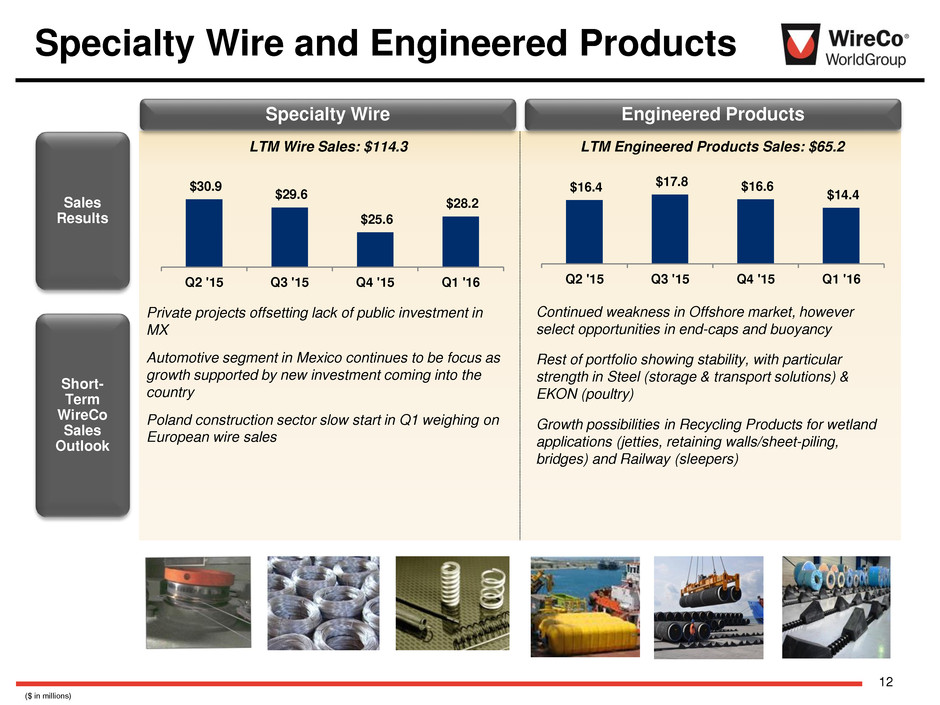

12 LTM Wire Sales: $114.3 Sales Results Specialty Wire Short- Term WireCo Sales Outlook Engineered Products LTM Engineered Products Sales: $65.2 Specialty Wire and Engineered Products Continued weakness in Offshore market, however select opportunities in end-caps and buoyancy Rest of portfolio showing stability, with particular strength in Steel (storage & transport solutions) & EKON (poultry) Growth possibilities in Recycling Products for wetland applications (jetties, retaining walls/sheet-piling, bridges) and Railway (sleepers) Private projects offsetting lack of public investment in MX Automotive segment in Mexico continues to be focus as growth supported by new investment coming into the country Poland construction sector slow start in Q1 weighing on European wire sales ($ in millions) $30.9 $29.6 $25.6 $28.2 Q2 '15 Q3 '15 Q4 '15 Q1 '16 $16.4 $17.8 $16.6 $14.4 Q2 '15 Q3 '15 Q4 '15 Q1 '16

13 Achieved Adjusted EBITDA(1) margins of 15.7% in Q1, 50 bps in excess of Q1’15 – Continued expense management with cost savings in line with 2015 quarterly achievements Continue to monitor the market environment and to react appropriately in operations and SG&A to preserve EBITDA margin – Achieved cost savings of $4.6 million in Q1’16 compared to Q1’15 Generated positive cash flow through disciplined management of working capital Disciplined cost and cash management allowing for investment in strategic commercial initiatives during current commodity market decline – Management investments in new products, new geographies and new equipment generating sales in Q1’16 in excess of Management’s expectations Remain focused on extending the duration of our capital structure – In active dialogue with various sources of financing and expect to complete a refinancing well- ahead of our 2017 maturities Conclusion (1) Adjusted EBITDA is a Non-GAAP Financial Measure. See appendix for reconciliations to most directly comparable GAAP Financial Measures.

Appendix

15 ($0.1) ($9.2) $18.1 ($0.7) $1.1 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Adjusted Working Capital (1) $251.3 $248.2 $247.8 $230.4 $243.0 34.8% 35.7% 36.2% 36.4% 40.8% Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Adjusted Working Capital % of Sales $27.3 $27.1 $27.5 $24.5 $23.5 15.2% 15.6% 16.1% 15.5% 15.7% Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Adjusted EBITDA EBITDA Margin Quarterly Performance Trends Sales Adjusted EBITDA (1) Free Cash Flow (1) (1) Adjusted EBITDA, Adjusted Working Capital and Free Cash Flow are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions) (1) (1) $180.4 $173.8 $171.4 $158.4 $149.0 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16

16 Adjusted Working Capital(1) Metrics A/P Working capital management is the largest opportunity for cash generation Q1’16 Adjusted Working Capital(1) 40.8% of sales Adjusted Working Capital (1) A/R & Customer Advances Inventory (1) Adjusted Working Capital is a Non-GAAP Financial Measure. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions) AWC % of L3M Sales Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 34.6% 3 .0% 32.5% 34.8% 35.7% 36.2% 36.4% 40.8% 248 228 225 206 203 192 187 194 135 128 134 134 137 132 140 156 100 110 120 130 140 150 160 $- $50 $100 $150 $200 $250 $300 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 D S I Inventory, net Days sales in inventory (DSI) Linear (Inventory, net) 160 139 137 123 122 122 116 113 53 58 61 63 68 64 66 68 2 22 42 62 82 102 $50 $70 $90 $110 $130 $150 $170 $190 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 D S O AR Days sales outstanding (DSO) Linear (AR) 95 80 99 78 76 67 72 64 51 45 56 51 52 46 54 51 2 12 22 32 42 52 62 $35 $45 $55 $65 $75 $85 $95 $105 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 D P O AP Days payables outstanding (DPO) Linear (AP) 313 287 264 251 248 248 230 243 137 141 139 146 153 150 152 173 115 125 135 145 155 165 175 $0 $50 $100 $150 $200 $250 $300 $350 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 C a s h C onv e rs io n Adjusted Working Capital Cash conversion cycle (in days)

17 Income Statement Results 2015 2016 Q1 Q2 Q3 Q4 FY Q1 Sales $180.4 $173.8 $171.4 $158.4 $684.0 $149.0 Adj. EBITDA (1) $27.3 $27.1 $27.5 $24.5 $106.4 $23.5 Adj. EBITDA Margin 15.2% 15.6% 16.1% 15.5% 15.6% 15.7% Credit Agreement EBITDA (1) $35.4 $31.9 $31.9 $28.5 $127.7 $27.7 Sales Var. QoQ (11.0%) (3.6%) (1.4%) (7.5%) (5.9%) Adj. EBITDA Var. QoQ (20.2%) (0.7%) 1.7% (11.0%) (4.2%) Sales Var. YoY (14.3%) (23.3%) (21.1%) (21.8%) (17.4%) Adj. EBITDA Var. YoY (25.2%) (34.4%) (29.4%) (28.5%) (14.2%) (1) Adjusted EBITDA and Credit Agreement EBITDA are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

18 2015 2016 Q1 Q2 Q3 Q4 Q1 Free Cash Flow (1) $0 ($9) $18 ($1) $1 Interest Paid $6 $28 $6 $25 $5 CapEx $9 $8 $5 $7 $5 Adjusted Work Capital (AWC)(1) $251 $248 $248 $230 $243 AWC % of Sales 34.8% 35.7% 36.2% 36.4% 40.8% Net Debt (1) $817 $826 $808 $809 $808 Net Leverage 5.3x 5.8x 6.0x 6.3x 6.8x Cash Flow Balance Sheet Cash Flow and Balance Sheet Results (1) Free Cash Flow, Adjusted Working Capital and Net Debt are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures; ($ in millions)

19 Adjusted EBITDA Reconciliation Non-GAAP Reconciliations (1) Reflects correction of an error of $3,051 in unrealized foreign currency gains which were previously excluded from net loss; ($ in 000’s) Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Q1 2016 Net Loss (GAAP) (4,068)$ (15,045)$ (5,192)$ (11,203)$ (35,508)$ (20,475)$ Plus: Interest expense, net 18,988 16,637 19,597 15,364 70,586 18,971 Income tax expense (benefit) (7,561) 6,709 1,446 (472) 122 4,412 Depreciation and amortization 11,375 11,138 11,232 10,527 44,272 10,747 Foreign currency exchange losses (gains), net 4,278 2,689 (5,626) 598 1,939 3,544 Share-based compensation 1,926 1,926 1,926 1,718 7,496 1,736 Other expense (income), net 309 (80) 169 447 845 (59) Loss on extinguishment of debt - - - - - - Acquisition costs - - - - - - Purchase accounting (inventory step-up and other) - - - - - - Advisory fees 984 991 953 979 3,907 767 Reorganization and restructuring charges 759 1,498 2,956 3,463 8,676 3,769 Effect of inventory optimization program - - - - - - Non-cash impairment of fixed assets - - - 3,238 3,238 - Other adjustments 352 587 58 (159) 838 47 Adjusted EBITDA (Non-GAAP) 27,342$ 27,050$ 27,519$ 24,500$ 106,411$ 23,459$ Plus: Additional reorganization and restructuring charges 89 172 - - 261 - Additional effect of Inventory Optimization Program - - 143 327 470 330 Production curtailment 633 491 737 1,000 2,861 - Impact of nonrecurring resin procurement costs - - 920 - 920 - Impact of nonrecurring and unusual items in Brazil 2,609 1,136 - - 3,745 - Impact of nonrecurring and unusual items in Portugal - - - - - 1,113 Pro forma selling and administrative expense savings 3,397 1,850 1,375 1,375 7,997 917 Pro forma manufacturing facility consolidation 1,173 1,173 1,173 1,173 4,693 1,173 Pro forma manufacturing facility labor savings - - - - - 659 Additional other adjustments 202 - - 157 359 - Credit Agreement EBITDA (Non-GAAP) 35,445$ 31,872$ 31,868$ 28,532$ 127,717$ 27,651$ (1) (1)

20 Adjusted Working Capital Non-GAAP Reconciliations ($ in 000’s) Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Accounts receivable, net 126,549$ 131,707$ 134,297$ 124,463$ 122,582$ Inventories, net 205,567 202,889 192,211 186,964 194,251 Accounts payable (77,656) (76,182) (66,738) (72,153) (64,005) Customer advances (3,128) (10,204) (11,964) (8,918) (9,853) Adjusted Working Capital (Non-GAAP) 251,332 248,210 247,806 230,356 242,975 Plus: All other current assets 67,177 57,483 49,852 33,494 77,156 Less: All other current liabilities (65,251) (41,820) (56,393) (47,672) (411,192) Working capital (GAAP) 253,258$ 263,873$ 241,265$ 216,178$ (91,061)$

21 Free Cash Flow Reconciliation Non-GAAP Reconciliations ($ in 000’s) Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Net cash provided by (used in) operating activities (GAAP) 12,600$ (896)$ 24,299$ 7,043$ 5,672$ Less: capital expenditures (9,212) (8,250) (5,367) (6,973) (5,055) Effect of exchange rates on cash and cash equivalents (4,460) 608 (547) (560) 461 Other items 940 (700) (263) (221) (12) Free Cash Flow (Non-GAAP) (132)$ (9,238)$ 18,122$ (711)$ 1,066$

22 Net Debt Reconciliation Non-GAAP Reconciliations ($ in 000’s) Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Borrowings under Revolving Loan Facility 57,650$ 75,600$ 54,570$ 42,305$ 49,900$ Term Loan due 2017 323,532 308,038 307,246 306,454 305,662 9.00% Senior Notes due 2017 56,000 56,000 56,000 56,000 56,000 9.50% Senior Notes due 2017 425,000 425,000 425,000 425,000 425,000 Capital lease obligations 1,050 1,246 1,460 1,619 1,900 Total debt at face value plus capital lease obligations (GAAP) 863,232 865,884 844,276 831,378 838,462 Less: Cash and cash equivalents (45,193) (38,044) (34,607) (21,060) (28,941) Less: Restricted cash (1,070) (1,633) (1,584) (1,522) (1,791) Net Debt (Non-GAAP) 816,969$ 826,207$ 808,085$ 808,796$ 807,730$