Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Voyager Therapeutics, Inc. | vygr-20160331ex312fd82ab.htm |

| EX-10.5 - EX-10.5 - Voyager Therapeutics, Inc. | vygr-20160331ex105244cd3.htm |

| EX-10.4 - EX-10.4 - Voyager Therapeutics, Inc. | vygr-20160331ex1040bb9ab.htm |

| EX-10.6 - EX-10.6 - Voyager Therapeutics, Inc. | vygr-20160331ex106f90c42.htm |

| EX-10.1 - EX-10.1 - Voyager Therapeutics, Inc. | vygr-20160331ex10125806b.htm |

| EX-32.1 - EX-32.1 - Voyager Therapeutics, Inc. | vygr-20160331ex3218502af.htm |

| EX-10.3 - EX-10.3 - Voyager Therapeutics, Inc. | vygr-20160331ex103adffc2.htm |

| EX-31.1 - EX-31.1 - Voyager Therapeutics, Inc. | vygr-20160331ex31126c810.htm |

| EX-10.2 - EX-10.2 - Voyager Therapeutics, Inc. | vygr-20160331ex102328bb8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the quarterly period ended March 31, 2016.

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from ______ to ______

Commission file number: 001-37625

Voyager Therapeutics, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

46-3003182 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

75 Sidney Street, |

|

02139 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(857) 259-5340

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

(Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of outstanding shares of the registrant’s common stock, par value $0.001 per share, as of May 6, 2016 was 26,749,740.

FORM 10-Q

TABLE OF CONTENTS

2

Voyager Therapeutics, Inc.

Condensed Consolidated Balance Sheets

(amounts in thousands, except share and per share data)

(unaudited)

|

|

|

March 31, |

|

December 31, |

|

||

|

|

|

2016 |

|

2015 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

33,895 |

|

$ |

31,309 |

|

|

Marketable investments, current |

|

|

170,097 |

|

|

163,028 |

|

|

Prepaid expenses and other current assets |

|

|

1,706 |

|

|

1,557 |

|

|

Total current assets |

|

|

205,698 |

|

|

195,894 |

|

|

Property and equipment, net |

|

|

3,558 |

|

|

3,234 |

|

|

Deposits and other non-current assets |

|

|

735 |

|

|

321 |

|

|

Marketable investments, non-current |

|

|

9,989 |

|

|

30,008 |

|

|

Total assets |

|

$ |

219,980 |

|

$ |

229,457 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,697 |

|

$ |

612 |

|

|

Accrued expenses |

|

|

2,661 |

|

|

3,430 |

|

|

Deferred rent, current portion |

|

|

— |

|

|

300 |

|

|

Deferred revenue, current portion |

|

|

18,719 |

|

|

19,589 |

|

|

Total current liabilities |

|

|

23,077 |

|

|

23,931 |

|

|

Deferred rent, net of current portion |

|

|

1,352 |

|

|

1,015 |

|

|

Deferred revenue, net of current portion |

|

|

31,914 |

|

|

35,393 |

|

|

Other non-current liabilities |

|

|

40 |

|

|

44 |

|

|

Total liabilities |

|

|

56,383 |

|

|

60,383 |

|

|

Commitments and contingencies (see note 6) |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock $0.001 par value: 5,000,000 shares authorized at March 31, 2016 and December 31, 2015; no shares issued and outstanding at March 31, 2016 and December 31, 2015 |

|

|

— |

|

|

— |

|

|

Common stock, $0.001 par value: 120,000,000 shares authorized at March 31, 2016 and December 31, 2015; 25,123,397 and 24,930,979 shares issued and outstanding at March 31, 2016 and December 31, 2015, respectively |

|

|

25 |

|

|

25 |

|

|

Additional paid-in capital |

|

|

220,552 |

|

|

219,122 |

|

|

Accumulated other comprehensive income (loss) |

|

|

30 |

|

|

(251) |

|

|

Accumulated deficit |

|

|

(57,010) |

|

|

(49,822) |

|

|

Total stockholders’ equity |

|

|

163,597 |

|

|

169,074 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

219,980 |

|

$ |

229,457 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Voyager Therapeutics, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(amounts in thousands, except per share and share data)

(Unaudited)

|

|

|

Three Months Ended |

|

||||

|

|

|

March 31, |

|

||||

|

|

|

2016 |

|

2015 |

|

||

|

Collaboration revenue |

|

$ |

4,830 |

|

$ |

2,576 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

|

8,732 |

|

|

5,523 |

|

|

General and administrative |

|

|

3,565 |

|

|

1,881 |

|

|

Total operating expenses |

|

|

12,297 |

|

|

7,404 |

|

|

Operating loss |

|

|

(7,467) |

|

|

(4,828) |

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

Interest income |

|

|

465 |

|

|

— |

|

|

Other expense |

|

|

(186) |

|

|

(9,749) |

|

|

Total other income (expense) |

|

|

279 |

|

|

(9,749) |

|

|

Net loss |

|

$ |

(7,188) |

|

$ |

(14,577) |

|

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

Net unrealized gain on available-for-sale-securities |

|

|

281 |

|

|

— |

|

|

Total other comprehensive gain |

|

|

281 |

|

|

— |

|

|

Comprehensive loss |

|

$ |

(6,907) |

|

$ |

(14,577) |

|

|

Reconciliation of net loss to net loss attributable to common stockholders: |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(7,188) |

|

$ |

(14,577) |

|

|

Accretion of redeemable convertible preferred stock to redemption value |

|

|

— |

|

|

(999) |

|

|

Accrued dividends on series A preferred stock |

|

|

— |

|

|

(237) |

|

|

Net loss attributable to common stockholders |

|

$ |

(7,188) |

|

$ |

(15,813) |

|

|

Net loss per share attributable to common stockholders, basic and diluted |

|

$ |

(0.29) |

|

$ |

(15.79) |

|

|

Weighted-average common shares outstanding, basic and diluted |

|

|

25,076,769 |

|

|

1,001,370 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Voyager Therapeutics, Inc.

Condensed Consolidated Statements of Cash Flows

(amounts in thousands)

(unaudited)

|

|

|

Three Months Ended |

|

||||

|

|

|

March 31, |

|

||||

|

|

|

2016 |

|

2015 |

|

||

|

Cash flow from operating activities |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(7,188) |

|

$ |

(14,577) |

|

|

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

1,422 |

|

|

302 |

|

|

Depreciation |

|

|

136 |

|

|

131 |

|

|

Amortization of premiums and discounts on marketable securities |

|

|

231 |

|

|

— |

|

|

Change in fair value of preferred stock tranche liability |

|

|

— |

|

|

9,750 |

|

|

In-kind research and development expenses |

|

|

— |

|

|

1,006 |

|

|

Deferred rent |

|

|

37 |

|

|

(67) |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

(149) |

|

|

494 |

|

|

Other non-current assets |

|

|

57 |

|

|

(51) |

|

|

Deferred revenue |

|

|

(4,349) |

|

|

67,425 |

|

|

Accounts payable |

|

|

1,085 |

|

|

25 |

|

|

Accrued expenses |

|

|

(769) |

|

|

182 |

|

|

Other non-current liabilities |

|

|

— |

|

|

(170) |

|

|

Lease incentive benefit |

|

|

— |

|

|

138 |

|

|

Net cash (used in) provided by operating activities |

|

|

(9,487) |

|

|

64,588 |

|

|

Cash flow from investing activities |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(460) |

|

|

(150) |

|

|

Change in restricted cash |

|

|

(471) |

|

|

— |

|

|

Proceeds from maturities of marketable securities |

|

|

13,000 |

|

|

— |

|

|

Net cash provided by (used) in investing activities |

|

|

12,069 |

|

|

(150) |

|

|

Cash flow from financing activities |

|

|

|

|

|

|

|

|

Proceeds from issuance of preferred stock |

|

|

— |

|

|

44,941 |

|

|

Proceeds from the exercise of stock options |

|

|

4 |

|

|

— |

|

|

Net cash provided by financing activities |

|

|

4 |

|

|

44,941 |

|

|

Net increase in cash and cash equivalents |

|

|

2,586 |

|

|

109,379 |

|

|

Cash and cash equivalents, beginning of period |

|

|

31,309 |

|

|

7,035 |

|

|

Cash and cash equivalents, end of period |

|

$ |

33,895 |

|

$ |

116,414 |

|

|

Supplemental disclosure of cash and non-cash activities |

|

|

|

|

|

|

|

|

Accretion of redeemable convertible preferred stock to redemption value |

|

$ |

— |

|

$ |

999 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

VOYAGER THERAPEUTICS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Nature of business

Voyager Therapeutics, Inc. (“the Company”) is a clinical‑stage gene therapy company focused on developing life‑changing treatments for patients suffering from severe diseases of the central nervous system (the “CNS”). The Company focuses on CNS diseases where it believes that an adeno‑associated virus (“AAV”) gene therapy approach can have a clinically meaningful impact by either increasing or decreasing the production of a specific protein. The Company has created a product engine that enables it to engineer, optimize, manufacture, and deliver its AAV‑based gene therapies that have the potential to provide durable efficacy following a single administration directly to the CNS. The Company’s product engine has rapidly generated programs for seven CNS indications, including advanced Parkinson’s disease, a form of monogenic amyotrophic lateral sclerosis, Friedreich’s ataxia, Huntington’s disease, spinal muscular atrophy, frontotemporal dementia / Alzheirmer’s disease, and severe, chronic pain. The Company’s most advanced clinical candidate, VY‑AADC01, is being evaluated for the treatment of advanced Parkinson’s disease in an open‑label, Phase 1b clinical trial with the goal of generating human proof‑of‑concept data in the fourth quarter of 2016.

The Company is subject to risks common to companies in the biotechnology and gene therapy industry, including but not limited to, risks of failure of pre‑clinical studies and clinical trials, the need to obtain marketing approval for its drug product candidates, the need to successfully commercialize and gain market acceptance of its drug product candidates, dependence on key personnel, protection of proprietary technology, compliance with government regulations, development by competitors of technological innovations, ability to transition from pilot‑scale manufacturing to large‑scale production of products, and reliance on external sources for financing.

2. Summary of significant accounting policies and basis of presentation

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial reporting and as required by Regulation S-X, Rule 10-01. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. For further information, refer to the financial statements and footnotes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 as filed with the Securities and Exchange Commission (“SEC”). Any reference in these notes to applicable guidance is meant to refer to the authoritative United States generally accepted accounting principles as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”).

The accompanying condensed consolidated financial statements include those of the Company and its subsidiary, Voyager Securities Corporation, after elimination of all intercompany accounts and transactions.

In November 2015, the Company completed the sale of 5,750,000 shares of its common stock in its initial public offering (the “IPO”), at a price to the public of $14.00 per share, resulting in net proceeds to the Company of $72.9 million after deducting underwriting discounts, commissions, and offering expenses paid by the Company. On October 29, 2015, in preparation for the Company's IPO, the Company's Board of Directors and stockholders approved a 1-for-4.25 reverse split of the Company's common stock, which became effective on October 29, 2015. All share and per share amounts in the financial statements and notes thereto have been retroactively adjusted for all periods presented to give effect to this reverse split, including reclassifying an amount equal to the reduction in par value of common stock to additional paid-in capital. In connection with the closing of the IPO, all of the Company’s outstanding redeemable convertible preferred stock automatically converted into shares of common stock as of November 16, 2015, resulting in the issuance by the Company of an additional 17,647,054 shares of common stock. The significant increase in shares outstanding in November 2015 is expected to impact the year-over-year comparability of the Company’s net loss per share calculations over the next year.

6

These condensed consolidated financial statements should be read in conjunction with the Company's audited financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2015 as filed with the SEC.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. On an ongoing basis, the Company’s management evaluates its estimates, which include, but are not limited to, estimates related to revenue recognition, accrued expenses, valuation of the tranche rights, stock‑based compensation expense, income taxes, and prior to the closing of the IPO, the fair value of common stock. The Company bases its estimates on historical experience and other market specific or other relevant assumptions that it believes to be reasonable under the circumstances. Actual results may differ from those estimates or assumptions.

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU No. 2014‑09, Revenue From Contracts With Customers. ASU 2014‑09 amends Accounting Standards Codification ASC 605, Revenue Recognition, by outlining a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers. ASU 2014‑09 will be effective for the Company for interim and annual periods beginning after December 15, 2017. The Company is evaluating the impact that this ASU may have on its financial statements, if any.

In August 2014, the FASB issued ASU No. 2014‑15, Presentations of Financial Statements, Going Concern, which requires management to assess an entity’s ability to continue as a going concern every reporting period, and provide certain disclosures if management has substantial doubt about the entity’s ability to operate as a going concern, or an express statement if not, by incorporating and expanding upon certain principles that are currently in U.S. auditing standards. This guidance is effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. The adoption of this accounting standard may affect our financial statement disclosures in future periods. The Company is evaluating the impact that this ASU may have on its financial statements, if any.

In February 2016, the FASB issued ASU 2016-02, Leases, which requires a lessee to recognize assets and liabilities on the balance sheet for operating leases and changes many key definitions, including the definition of a lease. The new standard includes a short-term lease exception for leases with a term of 12 months or less, as part of which a lessee can make an accounting policy election not to recognize lease assets and lease liabilities. Lessees will continue to differentiate between finance leases (previously referred to as capital leases) and operating leases using classification criteria that are substantially similar to the previous guidance. The new standard will be effective beginning January 1, 2019, and early adoption is permitted for public entities. The Company is currently evaluating the potential impact this ASU may have on its financial position.

7

3. Fair Value Measurements

Assets and liabilities measured at fair value on a recurring basis as of March 31, 2016 and December 31, 2015 are as follows:

|

|

|

|

|

|

Quoted Prices |

|

Significant |

|

|

|

|

||

|

|

|

|

|

|

in Active |

|

Other |

|

Significant |

|

|||

|

|

|

|

|

|

Markets for |

|

Observable |

|

Unobservable |

|

|||

|

|

|

|

|

|

Identical Assets |

|

Inputs |

|

Inputs |

|

|||

|

Assets |

|

Total |

|

(Level 1) |

|

(Level 2) |

|

(Level 3) |

|

||||

|

March 31, 2016 |

|

(in thousands) |

|

||||||||||

|

Money market funds included in cash and cash equivalents |

|

$ |

33,035 |

|

$ |

33,035 |

|

$ |

— |

|

$ |

— |

|

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury notes |

|

|

153,060 |

|

|

153,060 |

|

|

— |

|

|

— |

|

|

U.S. Government agency securities |

|

|

27,026 |

|

|

— |

|

|

27,026 |

|

|

— |

|

|

Total |

|

$ |

213,121 |

|

$ |

186,095 |

|

$ |

27,026 |

|

$ |

— |

|

|

December 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds included in cash and cash equivalents |

|

$ |

29,601 |

|

$ |

29,601 |

|

$ |

— |

|

$ |

— |

|

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury notes |

|

|

157,981 |

|

|

157,981 |

|

|

— |

|

|

— |

|

|

U.S. Government agency securities |

|

|

35,055 |

|

|

— |

|

|

35,055 |

|

|

— |

|

|

Total |

|

$ |

222,637 |

|

$ |

187,582 |

|

$ |

35,055 |

|

$ |

— |

|

The Company measures the fair value of money market funds and U.S. Treasuries based on quoted prices in active markets for identical securities. The Level 2 marketable securities include U.S. government and agency securities that are valued either based on recent trades of securities in inactive markets or based on quoted market prices of similar instruments and other significant inputs derived from or corroborated by observable market data.

4. Cash, Cash Equivalents, and Available for Sale Marketable Investments

Cash equivalents include all highly liquid investments maturing within 90 days from the date of purchase. Investments consist of securities with original maturities greater than 90 days when purchased. The Company classifies these investments as available-for-sale and records them at fair value in the accompanying condensed consolidated balance sheets. Unrealized gains or losses are included in accumulated other comprehensive income (loss). Premiums or discounts from par value are amortized to investment income over the life of the underlying investment.

The Company classifies marketable securities with a remaining maturity when purchased of greater than three months as available‑for‑sale. Marketable securities with a remaining maturity date greater than one year are classified as non‑current where the Company has the intent and ability to hold these securities for at least the next 12 months. Available‑for‑sale securities are maintained by an investment manager and may consist of U.S. Treasury securities and U.S. Government agency securities. Available‑for‑sale securities are carried at fair value with the unrealized gains and losses included in other comprehensive income/(loss) as a component of stockholders’ deficit until realized. Any premium or discount arising at purchase is amortized and/or accreted to interest income and/or expense. Realized gains and losses are determined using the specific identification method and are included in other income (expense). If any adjustment to fair value reflects a decline in value of the investment, the Company considers all available evidence to evaluate the extent to which the decline is “other‑than‑temporary” and, if so, recognizes the unrealized loss through a charge to the Company’s statement of operations and comprehensive loss. No other temporary losses are recognized.

8

Cash, cash equivalents and investments, available for sale included the following at March 31, 2016 and December 31, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortized |

|

Unrealized |

|

Unrealized |

|

Fair |

||||

|

|

|

Cost |

|

Gains |

|

Losses |

|

Value |

||||

|

|

|

(in thousands) |

||||||||||

|

As of March 31, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds included in cash and cash equivalents |

|

$ |

33,035 |

|

$ |

— |

|

$ |

— |

|

$ |

33,035 |

|

Total money market funds included in cash and cash equivalents |

|

$ |

33,035 |

|

$ |

— |

|

$ |

— |

|

$ |

33,035 |

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury notes |

|

|

153,027 |

|

|

33 |

|

|

— |

|

|

153,060 |

|

U.S. Government agency bonds |

|

|

27,029 |

|

|

— |

|

|

3 |

|

|

27,026 |

|

Total marketable securities |

|

$ |

180,056 |

|

$ |

33 |

|

$ |

3 |

|

$ |

180,086 |

|

Total money market funds and marketable securities |

|

$ |

213,091 |

|

$ |

33 |

|

$ |

3 |

|

$ |

213,121 |

|

As of December 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds included in cash and cash equivalents |

|

$ |

29,601 |

|

$ |

— |

|

$ |

— |

|

$ |

29,601 |

|

Total money market funds included in cash and cash equivalents |

|

$ |

29,601 |

|

$ |

— |

|

$ |

— |

|

$ |

29,601 |

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury notes |

|

|

158,166 |

|

|

— |

|

|

185 |

|

|

157,981 |

|

U.S. Government agency bonds |

|

|

35,121 |

|

|

— |

|

|

66 |

|

|

35,055 |

|

Total marketable securities |

|

$ |

193,287 |

|

$ |

— |

|

$ |

251 |

|

$ |

193,036 |

|

Total money market funds and marketable securities |

|

$ |

222,888 |

|

$ |

— |

|

$ |

251 |

|

$ |

222,637 |

The estimated fair value of the Company’s marketable securities balance at March 31, 2016, by contractual maturity, is as follows

|

Due in one year or less |

|

$ |

170,097 |

|

|

Due after one year through two years |

|

|

9,989 |

|

|

Total marketable securities |

|

$ |

180,086 |

|

5. Accrued Expenses

Accrued expenses as of March 31, 2016 and December 31, 2015 consist of the following:

|

|

|

|

|

|

|

|

|

|

|

As of March 31, |

|

As of December 31, |

||

|

|

|

2016 |

|

2015 |

||

|

|

|

(in thousands) |

||||

|

Research and development costs |

|

$ |

1,393 |

|

$ |

1,329 |

|

Employee compensation costs |

|

|

639 |

|

|

1,338 |

|

Professional services |

|

|

374 |

|

|

350 |

|

Other |

|

|

215 |

|

|

178 |

|

Patent costs |

|

|

40 |

|

|

235 |

|

Total |

|

$ |

2,661 |

|

$ |

3,430 |

6. Commitments and Contingencies

Operating Leases

During March 2014, the Company entered into an agreement to lease its facility under a non‑cancelable operating lease that expires December 15, 2019. The lease contains escalating rent clauses which require higher rent payments in future years. The Company expenses rent on a straight‑line basis over the term of the lease, including any rent‑free periods.

9

The Company received a leasehold improvement incentive from the landlord totaling $1,250,000. The Company recorded these incentives as a component of deferred rent and will amortize these incentives as a reduction of rent expense over the life of the lease. These leasehold improvements have been recorded as fixed assets.

In January 2016, the Company executed an amendment to extend the lease to December 2024 to coincide with an agreement to lease an additional facility of approximately 26,000 square feet in Cambridge, Massachusetts. Estimated payments related to the lease amendment and additional facility are approximately $25.0 million. The leases also include two renewal options, each for five year terms and at fair market value upon exercise. The Company will expense rent on a straight‑line basis over the term of the new lease, including any rent‑free periods once the landlord delivery date has commenced. The delivery date is currently set for the third quarter of 2016 and is projected to be ready for occupancy in early 2017.

The Company received a leasehold improvement incentive for the new lease from the landlord totaling $3,530,000. The Company will record these incentives as a component of deferred rent and will amortize these incentives as a reduction of rent expense over the life of the lease.

The following table summarizes our significant contractual obligations as of payment due date by period at March 31, 2016 (in thousands):

|

|

|

Total Minimum |

|

|

|

|

|

Lease Payments |

|

|

|

|

|

(in thousands) |

|

|

|

2016 |

|

|

886 |

|

|

2017 |

|

|

3,211 |

|

|

2018 |

|

|

3,290 |

|

|

2019 |

|

|

3,382 |

|

|

2020 |

|

|

3,762 |

|

|

2021+ |

|

|

16,141 |

|

|

|

|

$ |

30,672 |

|

Significant Agreements

Genzyme Collaboration Agreement

Summary of Agreement

In February 2015, the Company entered into an agreement with Genzyme (“Collaboration Agreement”), which included a non‑refundable upfront payment of $65.0 million. In addition, contemporaneous with entering into the Collaboration Agreement, Genzyme entered into a Series B Stock Purchase Agreement, under which Genzyme purchased 10,000,000 shares of Series B Preferred Stock for $30.0 million. The fair value of the Series B Preferred Stock at the time of issuance was approximately $25.0 million. The $5.0 million premium over the fair value is accounted for as additional consideration under the Collaboration Agreement.

Under the Collaboration Agreement, the Company granted Genzyme an exclusive option to license, develop and commercialize (i) ex‑U.S. rights to the following programs, which are referred to as Split Territory Programs; VY‑AADC01 (“Parkinson’s Program”), VY‑FXN01 (“Friedreich’s Ataxia Program”), a future program to be designated by Genzyme (“Future Program”) and VY‑HTT01 (“Huntington’s Program”) with an incremental option to co‑commercialize VY‑HTT01 in the United States and (ii) worldwide rights to VY‑SMN101 (“Spinal Muscular Atrophy Program”). Genzyme’s option for the Split Territory Programs and the Spinal Muscular Atrophy Program is triggered following the completion of the first proof‑of‑principle human clinical study (“POP Study”), on a program by program basis.

10

Prior to any option exercise by Genzyme, the Company will collaborate with Genzyme in the development of products under each Split Territory Program and VY‑SMN101 pursuant to a written development plan and under the guidance of an Alliance Joint Steering Committee (“AJSC”), comprised of an equal number of employees from the Company and Genzyme.

The Company is required to use commercially reasonable efforts to develop products under each Split Territory Program and the Spinal Muscular Atrophy Program through the completion of the applicable POP Study. During the development of these joint programs, the activities are guided by a Development Advisory Committee (“DAC”). The DAC may elect to utilize certain Genzyme technology relating to the Parkinson’s Program, the Huntington’s Program, or generally with the manufacture of Split Territory Program products.

The Company is solely responsible for all costs incurred in connection with the development of the Split Territory Programs and the Spinal Muscular Atrophy Program products prior to the exercise of an option by Genzyme with the exception of the following: (i) at the Company’s request and upon mutual agreement, Genzyme will provide “in‑kind” services valued at up to $5.0 million and (ii) Genzyme shall be responsible for the costs and expenses of activities under the Huntington’s Program development plan to the extent such activities are covered by financial support Genzyme is entitled to receive from a patient advocacy group, collectively Genzyme “in‑kind” and other funding.

Other than the Parkinson’s Program (for which a POP Study has already been commenced), if the Company does not initiate a POP Study for a given Split Territory Program by December 31, 2026 (or for the Future Program by the tenth anniversary of the date the Future Program is nominated by Genzyme), and Genzyme has not terminated the Collaboration Agreement with respect to the collaboration program, then Genzyme shall be entitled, as its sole and exclusive remedy, to a credit of $10.0 million for each such program against other milestone or royalty payments payable by Genzyme under the Collaboration Agreement. However, if the POP Study is not initiated due to a regulatory delay or a force majeure event, such time period shall be extended for so long as such delay continues.

With the exception of the Parkinson’s Program, Genzyme is required to pay an option exercise payment of $20.0 million or $30.0 million for each Split Territory Program, as well as the Spinal Muscular Atrophy Program.

Upon Genzyme’s exercise of its option to license a given product in a Split Territory Program (“Split Territory Licensed Product”), the Company will have sole responsibility for the development of such Split Territory Licensed Product in the United States and Genzyme shall have sole responsibility for development of such Split Territory Licensed Product in the rest of the world. The Company and Genzyme will have shared responsibility for execution of ongoing development of such Split Territory Licensed Product that is not specific to either territory, including costs associated therewith. The Company is responsible for all commercialization activities relating to Split Territory Licensed Products in the United States, including all of the associated costs. Genzyme is responsible for all commercialization activities relating to the Split Territory Licensed Products in the rest of the world, including all of the associated costs. If Genzyme exercised its co‑commercialization rights, Genzyme will be the lead party responsible for all commercialization activities related to Huntington’s licensed product in the United States.

Upon exercise of the option, Genzyme shall have the sole right to develop the licensed product from the Spinal Muscular Atrophy Program (the “Spinal Muscular Atrophy Licensed Product”) worldwide. Genzyme shall be responsible for all of the development costs that occur after the option exercise date for the Spinal Muscular Atrophy Program. Genzyme is also responsible for commercialization activities relating to the Spinal Muscular Atrophy Licensed Product worldwide.

Genzyme is required to pay the Company for specified regulatory and commercial milestones, if achieved, up to $645 million across all programs. The regulatory approval milestones are payable upon either regulatory approval in the United States or regulatory and reimbursement approval in the European Union and range from $40.0 million to $50.0 million per milestone, with an aggregate total of $265 million. The commercial milestones are payable upon achievement of specified annual net sales in each program and range from $50.0 million to $100 million per milestone, with an aggregate total of $380 million.

11

In addition, to the extent any Split Territory Licensed Products or the Spinal Muscular Atrophy Licensed Product are commercialized, the Company is entitled to tiered royalty payments ranging from the mid‑single digits to mid‑teens based on a percentage of net sales by Genzyme. Genzyme is entitled to receive tiered royalty payments related to sales of Split Territory Licensed Product ranging from the low‑single digits to mid‑single digits based on a percentage of net sales by the Company depending on whether the Company uses Genzyme technology in the Split Territory Licensed Product. If Genzyme elects to co‑commercialize VY‑HTT01 in the United States, the Company and Genzyme will share in any profits or losses from VY‑HTT01 product sales.

The Collaboration Agreement will continue in effect until the later of (i) the expiration of the last to expire of the option rights and (ii) the expiration of all payment obligations unless sooner terminated by the Company or Genzyme. The Company and Genzyme have customary termination rights including the right to terminate for an uncured material breach of the agreement committed by the other party and Genzyme has the right to terminate for convenience.

Accounting Analysis

The Collaboration Agreement includes the following deliverables: (i) research and development services for each of the Split Territory License Programs and the Spinal Muscular Atrophy Program, (ii) participation in the AJSC, (iii) participation in the DAC and (iv) the option to obtain a development and commercial license in the Parkinson’s Program and related deliverables. The Company has determined that the option to obtain a development and commercial license in the Parkinson’s Program is not a substantive option for accounting purposes, primarily because there is no additional option exercise payment payable by Genzyme at the time the option is exercised. Therefore, the option to obtain a license and other obligations of the Company that are contingent upon exercise of the option are considered deliverables at the inception of the arrangement. The options in the other Split Territory Programs and the Spinal Muscular Atrophy Program are considered substantive as there is substantial option exercise payments payable by Genzyme upon exercise. In addition, as a result of the uncertainties related to the discovery, research, development and commercialization activities, the Company is at risk with regard to whether Genzyme will exercise the options. Moreover, the substantive options are not priced at a significant incremental discount. Accordingly, the substantive options are not considered deliverables at the inception of the arrangement and the associated option exercise payments are not included in allocable arrangement consideration. The Company has also determined that any obligations which are contingent upon the exercise of a substantive option are not considered deliverables at the outset of the arrangement, as these deliverables are contingent upon the exercise of the options. In addition, any option exercise payments associated with the substantive options are not included in the allocable arrangement consideration.

The Company has concluded that each of the deliverables identified at the inception of the arrangement has standalone value from the other undelivered elements. Additionally, the Collaboration Agreement does not include return rights related to the initial collaboration term. Accordingly, each deliverable qualifies as a separate unit of accounting.

The Company has identified $79.3 million of allocable arrangement consideration consisting of the $65 million upfront fee, the $5.0 million premium paid in excess of fair value of the Series B Preferred Stock and $9.3 million of Genzyme “in‑kind” and other funding.

The Company has allocated the allocable arrangement consideration based on the relative selling price of each unit of accounting. For all units of accounting, the Company determined the selling price using the best estimate of selling price (“BESP”). The Company determined the BESP for the service related deliverable for the research and development activities based on internal estimates of the costs to perform the services, including expected internal expenses and expenses with third parties for services and supplies, marked up to include a reasonable profit margin and adjusted for the scope of the potential license. Significant inputs used to determine the total expense of the research and development activities include, the length of time required and the number and costs of various studies that will be performed to complete the applicable POP Study. The BESP for the AJSC and DAC have been estimated based on the costs incurred to participate in the committees, marked up to include a reasonable profit margin. The BESP for the license option was determined based on the estimated value of the license and related deliverables adjusted for the estimated probability that the option would be exercised by Genzyme.

12

Based on the relative selling price allocation, the allocable arrangement consideration was allocated as follows:

|

|

|

|

|

|

|

Unit of Accounting |

|

Amount |

|

|

|

|

|

(in thousands) |

|

|

|

Research and Development Services for: |

|

|

|

|

|

Huntington’s Program |

|

$ |

15,662 |

|

|

Parkinson’s Program |

|

|

6,648 |

|

|

Friedreich’s Ataxia Program |

|

|

16,315 |

|

|

Spinal Muscular Atrophy Program |

|

|

32,050 |

|

|

Future Program |

|

|

2,464 |

|

|

Committee Obligations: |

|

|

|

|

|

AJSC |

|

|

147 |

|

|

DAC |

|

|

227 |

|

|

License Option and related deliverables |

|

|

5,743 |

|

|

Total |

|

$ |

79,256 |

|

The Company recognizes the amounts associated with research and development services on a straight line basis over the period of service as there is no discernable pattern or objective measure of performance for the services. Similarly, the Company recognizes the amount associated with the committee obligations on a straight line basis over the period of service consistent with the expected pattern of performance. The amounts allocated to the license option will be deferred until the option is exercised. The revenue recognition upon option exercise will be determined based on whether the license has standalone value from the remaining deliverables at the time of exercise.

The Company has evaluated all of the milestones that may be received in connection with each Split Territory Licensed Product and the Spinal Muscular Atrophy Licensed Product. In evaluating if a milestone is substantive, the Company assesses whether: (i) the consideration is commensurate with either the Company’s performance to achieve the milestone or the enhancement of the value of the delivered item(s) as a result of a specific outcome resulting from the Company performance to achieve the milestone, (ii) the consideration relates solely to past performance and (iii) the consideration is reasonable relative to all of the deliverables and payment terms within the arrangement. All regulatory milestones are considered substantive on the basis of the contingent nature of the milestone, specifically reviewing factors such as the scientific, clinical, regulatory, and other risks that must be overcome to achieve the milestone as well as the level of effort and investment required. Accordingly, such amounts will be recognized as revenue in full in the period in which the associated milestone is achieved, assuming all other revenue recognition criteria are met. All commercial milestones will be accounted for in the same manner as royalties and recorded as revenue upon achievement of the milestone, assuming all other revenue recognition criteria are met.

During the three month period ended March 31, 2016, the Company recognized $4,830,000 of revenue associated with its collaboration with Genzyme related to research and development services performed during the period. As of March 31, 2016, there is $50,633,000 of deferred revenue related to the Collaboration Agreement, which is classified as either current or noncurrent in the accompanying balance sheet based on the period the services are expected to be delivered.

Costs incurred relating to the programs that Genzyme has the option to license under the Collaboration Agreement consist of internal and external research and development costs, which primarily include: salaries and benefits, lab supplies and preclinical research studies. The Company does not separately track or segregate the amount of costs incurred under the Collaboration Agreement. All of these costs are included in research and development expenses in the Company’s statement of operations during the three months ended March 31, 2016. The Company estimates that the majority of research and development expense during the period relate to programs for which Genzyme has an option right.

Litigation

The Company is not a party to any litigation and does not have contingency reserves established for any litigation liabilities as of March 31, 2016 or December 31, 2015.

13

7. Redeemable Convertible Preferred Stock

In November 2015, upon the closing of the Company’s IPO, all issued and outstanding redeemable convertible preferred stock was automatically converted into 17,647,054 shares of common stock.

The Company has newly authorized preferred stock amounting to 5,000,000 shares as of March 31, 2016 and December 31, 2015. The newly authorized preferred stock was classified under stockholders’ equity (deficit) at March 31, 2016 and December 31, 2015.

8. Stock‑Based Compensation

2015 Stock Option Plan

In October 2015, the Company’s board of directors and stockholders approved the 2015 Stock Option and Incentive Plan, or 2015 Stock Option Plan, which became effective upon the completion of the IPO. The 2015 Stock Option Plan provides the Company with the flexibility to use various equity-based incentive and other awards as compensation tools to motivate its workforce. These tools include stock options, stock appreciation rights, restricted stock, restricted stock units, unrestricted stock, performance share awards and cash-based awards. The 2015 Stock Option Plan replaced the Voyager Therapeutics, Inc. 2014 Stock Option and Grant Plan, or the 2014 Plan. Any options or awards outstanding under the 2014 Plan remained outstanding and effective. The number of shares initially reserved for issuance under the 2015 Stock Option Plan is the sum of (i) 1,311,812 shares of common stock and (ii) the number of shares under the 2014 Plan that are not needed to fulfill the Company’s obligations for awards issued under the 2014 Plan as a result of forfeiture, expiration, cancellation, termination or net issuances of awards thereunder. The number of shares of common stock that may be issued under the 2015 Stock Option Plan is also subject to increase on the first day of each fiscal year by up to 4% of the Company’s issued and outstanding shares of common stock on the immediately preceding December 31.

Effective January 1, 2016, an additional 1,069,971 shares were added to the Company’s 2015 Stock Option Plan, for future issuance pursuant to the terms of the 2015 Stock Option and Grant Plan, or the 2014 Plan. As of March 31, 2016, there were 2,098,221 shares of common stock available for future award grants under the 2015 Plan. During the three months ended March 31, 2016, the Company issued a total of 603,310 stock options to employees and directors and 2,500 stock options to non-employees under the 2015 Stock Option Plan.

2014 Stock Option and Grant Plan

In January 2014 the Company adopted the 2014 Plan, under which it may grant incentive stock options, non‑qualified stock options, restricted stock awards, unrestricted stock awards, or restricted stock units to purchase up to 823,529 shares of Common Stock to employees, officers, directors and consultants of the Company.

In April 2014 the Company amended the 2014 Plan to allow for the issuance of up to 1,411,764 shares of common stock. In August 2014, April 2015, August 2015, and October 2015, the Company further amended the 2014 Plan to allow for the issuance of up to 2,000,000, 2,047,058, 2,669,411, and 2,998,823 shares of Common Stock, respectively. During 2014 the Company issued only restricted stock awards under the 2014 Plan and during 2015 the Company only granted stock options.

The terms of stock awards agreements, including vesting requirements, are determined by the Board of Directors and are subject to the provisions of the 2014 Plan. Restricted Stock awards granted by the Company generally vest based on each grantee’s continued service with the Company during a specified period following grant. Awards granted to employees generally vest over four years, with 25% vesting on the one year anniversary and 75% vesting ratably, on a monthly basis, over the remaining three years. Awards granted to non‑employee consultants generally vest monthly over a period of one to four years.

During the year ended December 31, 2014, the Company granted a total of 1,597,988 shares of restricted stock to employees and 110,960 shares of restricted stock to non‑employee consultants at an original issuance price of $0.04 per share.

14

Founder Awards

In January 2014 the Company issued 1,188,233 shares of restricted stock to its Founders at an original issuance price of $0.0425 per share. Of the total restricted shares awarded to the Founders, 835,292 shares generally vest over one to four years, based on each Founder’s continued service to the Company in varying capacity as a Scientific Advisory Board member, consultant, director, officer or employee, as set forth in each grantee’s individual restricted stock purchase agreement. The remaining 352,941 of the shares issued will begin vesting upon the achievement of certain performance objectives as well as continued service to the Company, as set forth in the agreements.

These performance conditions are tied to certain milestone events specific to the Company’s corporate goals, including but not limited to preclinical and clinical development milestones related to the Company’s product candidates. Stock‑based compensation expense associated with these performance‑based awards will be recognized when the achievement of the performance condition is considered probable, using management’s best estimates. During the three months ended March 31, 2016, management has determined that the achievement of one of the three performance‑based milestones was probable. Accordingly, stock-based compensation expense in the amount of $578,000 was recorded related to this award during the three months ended March 31, 2016. No stock‑based compensation expense was recorded for the remaining two Founders’ awards with performance-based vesting as of March 31, 2016 and December 31, 2015 as the performance-based milestones related to these awards were not probable.

2015 Employee Stock Purchase Plan

In October 2015, the Company’s board of directors and stockholders approved the 2015 Employee Stock Purchase Plan. A total of 262,362 shares of common stock were initially authorized for issuance under this plan. The 2015 Employee Stock Purchase Plan became effective upon the completion of the IPO. A total of 267,492 shares of common stock were subsequently added during the three months ended March 31, 2016.

Stock‑Based Compensation Expense

Total compensation cost recognized for all stock‑based compensation awards in the statements of operations and comprehensive loss is as follows:

|

|

|

Three Months Ended |

|

||||

|

|

|

March 31, |

|

||||

|

|

|

2016 |

|

2015 |

|

||

|

|

|

(in thousands) |

|

||||

|

Research and development |

|

$ |

1,117 |

|

$ |

225 |

|

|

General and administrative |

|

|

305 |

|

|

77 |

|

|

Total stock-compensation expense |

|

$ |

1,422 |

|

$ |

302 |

|

Restricted Stock

A summary of the status of and changes in unvested restricted stock unit activity under the Company’s equity award plan was as follows:

|

|

|

|

|

Weighted |

|

|

|

|

|

|

|

Average |

|

|

|

|

|

|

|

Grant Date |

|

|

|

|

|

|

|

Fair Value |

|

|

|

|

|

Shares |

|

Per Share |

|

|

|

Unvested restricted common stock as of December 31, 2015 |

|

1,818,261 |

|

$ |

0.76 |

|

|

Issued |

|

— |

|

|

— |

|

|

Vested |

|

(191,918) |

|

$ |

0.73 |

|

|

Repurchased |

|

— |

|

|

— |

|

|

Unvested restricted common stock as of March 31, 2016 |

|

1,626,343 |

|

$ |

0.76 |

|

15

The expense related to awards granted to employees and non-employees was $132,000 and $727,000, respectively, for the period ended March 31, 2016.

As of March 31, 2016, the Company had unrecognized stock-based compensation expense related to its unvested restricted stock awards of $12,105,000, which is expected to be recognized over the remaining average vesting period of 2.1 years.

Stock Options

The following is a summary of stock option activity for the three months ended March 31, 2016:

|

|

|

|

|

Weighted |

|

Remaining |

|

Aggregate |

|

||

|

|

|

|

|

Average |

|

Contractual |

|

Intrinsic |

|

||

|

|

|

|

|

Exercise |

|

Life |

|

Value |

|

||

|

|

|

Shares |

|

Price |

|

(in years) |

|

(in thousands) |

|

||

|

Outstanding at December 31, 2015 |

|

1,022,617 |

|

$ |

8.35 |

|

|

|

|

|

|

|

Granted |

|

605,810 |

|

$ |

11.18 |

|

|

|

|

|

|

|

Exercised |

|

(500) |

|

$ |

7.27 |

|

|

|

|

|

|

|

Cancelled or forfeited |

|

(13,581) |

|

$ |

9.53 |

|

|

|

|

|

|

|

Outstanding at March 31, 2016 |

|

1,614,346 |

|

$ |

9.41 |

|

9.5 |

|

$ |

691 |

|

|

Exercisable at March 31, 2016 |

|

155,477 |

|

$ |

7.82 |

|

9.1 |

|

$ |

170 |

|

|

Vested and expected to vest at March 31, 2016 |

|

1,614,346 |

|

$ |

9.41 |

|

9.5 |

|

$ |

691 |

|

Using the Black‑Scholes option pricing model, the weighted average fair value of options granted to employees and directors during the three months ended March 31, 2016 was $7.22. The expense related to awards granted to employees and directors was $551,000 for the three months ended March 31, 2016. There were no stock options awarded during the three months ended March 31, 2015.

The fair value of each option issued to employees and directors was estimated at the date of grant using the Black‑Scholes option pricing model with the following weighted‑average assumptions:

|

|

|

Three Months Ended |

|

|

|

|

March 31, 2016 |

|

|

Risk-free interest rate |

|

1.5 |

% |

|

Expected dividend yield |

|

— |

% |

|

Expected term (in years) |

|

6.0 |

|

|

Expected volatility |

|

73.0 |

% |

Using the Black‑Scholes option pricing model, the weighted average grant date fair value of options granted to non‑employees during the three months ended March 31, 2016 was $7.10. Unvested options granted to non‑employees are revalued at each measurement period until they vest. The expense related to awards granted to non‑employees was $12,000 for the three months ended March 31, 2016. There were no stock options awarded during the three months ended March 31, 2015.

16

The fair value of each option issued to non‑employees was estimated at each vesting and reporting date using the Black‑Scholes option pricing model. The reporting date fair value was determined using the following weighted‑average assumptions:

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, 2016 |

|

|

Risk-free interest rate |

|

1.5 |

% |

|

Expected dividend yield |

|

— |

% |

|

Expected term (in years) |

|

10.0 |

|

|

Expected volatility |

|

84.1 |

% |

As of March 31, 2016, the Company had unrecognized stock-based compensation expense related to its unvested stock options of $8,556,000 which is expected to be recognized over the remaining weighted average vesting period of 3.35 years.

For the three months ended March 31, 2016 and March 31, 2015, expected volatility was estimated using the historical volatility of the common stock of a group of similar companies that are publicly traded. The Company will continue to apply this process until a sufficient amount of historical information regarding the volatility of its own stock price becomes available.

9. Net Loss Per Share

The following table sets forth the outstanding potentially dilutive securities that have been excluded in the calculation of diluted net loss per share because to do so would be anti-dilutive (in common stock equivalent shares):

|

|

|

As of March 31, |

||

|

|

|

2016 |

|

2015 |

|

Redeemable convertible preferred stock |

|

— |

|

12,941,176 |

|

Unvested restricted common stock |

|

1,626,343 |

|

2,325,510 |

|

Outstanding stock options |

|

1,614,346 |

|

— |

|

Total |

|

3,240,689 |

|

15,266,686 |

10. Related‑Party Transactions

Since inception, the Company received consulting and management services from one of its investors. In January 2014, the Company issued 470,589 shares of common stock as partial compensation for these services. The fair value of the shares was approximately $238,000.

The total amount of consulting and management services provided by this investor was approximately $3,000 and $69,000 during the three months ended March 31, 2016 and March 31, 2015, respectively. As of March 31, 2016, the Company included approximately $3,000, in accounts payable related to service fees charged by this investor.

During the three month period ended March 31, 2016 the Company recognized $4,830,000 of revenue associated with the Genzyme Collaboration related to research and development services provided during this period. The Company also recognized $481,000 of expense during the three months ended March 31, 2016 related to in‑kind services provided by Genzyme associated with the collaboration arrangement.

17

ITEM 2.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes appearing elsewhere in this Quarterly Report on Form 10-Q and the audited financial information and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the Securities and Exchange Commission, or the SEC, on March 17, 2016.

Our actual results and timing of certain events may differ materially from the results discussed, projected, anticipated, or indicated in any forward-looking statements. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this Quarterly Report on Form 10-Q. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this Quarterly Report on Form 10-Q, they may not be predictive of results or developments in future periods.

The following information and any forward-looking statements should be considered in light of factors discussed elsewhere in the Quarterly Report on Form 10-Q, including those risks identified under Part II, Item 1A. Risk Factors.

We caution readers not to place undue reliance on any forward-looking statements made by us, which speak only as of the date they are made. We disclaim any obligation, except as specifically required by law and the rules of the SEC, to publicly update or revise any such statements to reflect any change in our expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

Overview

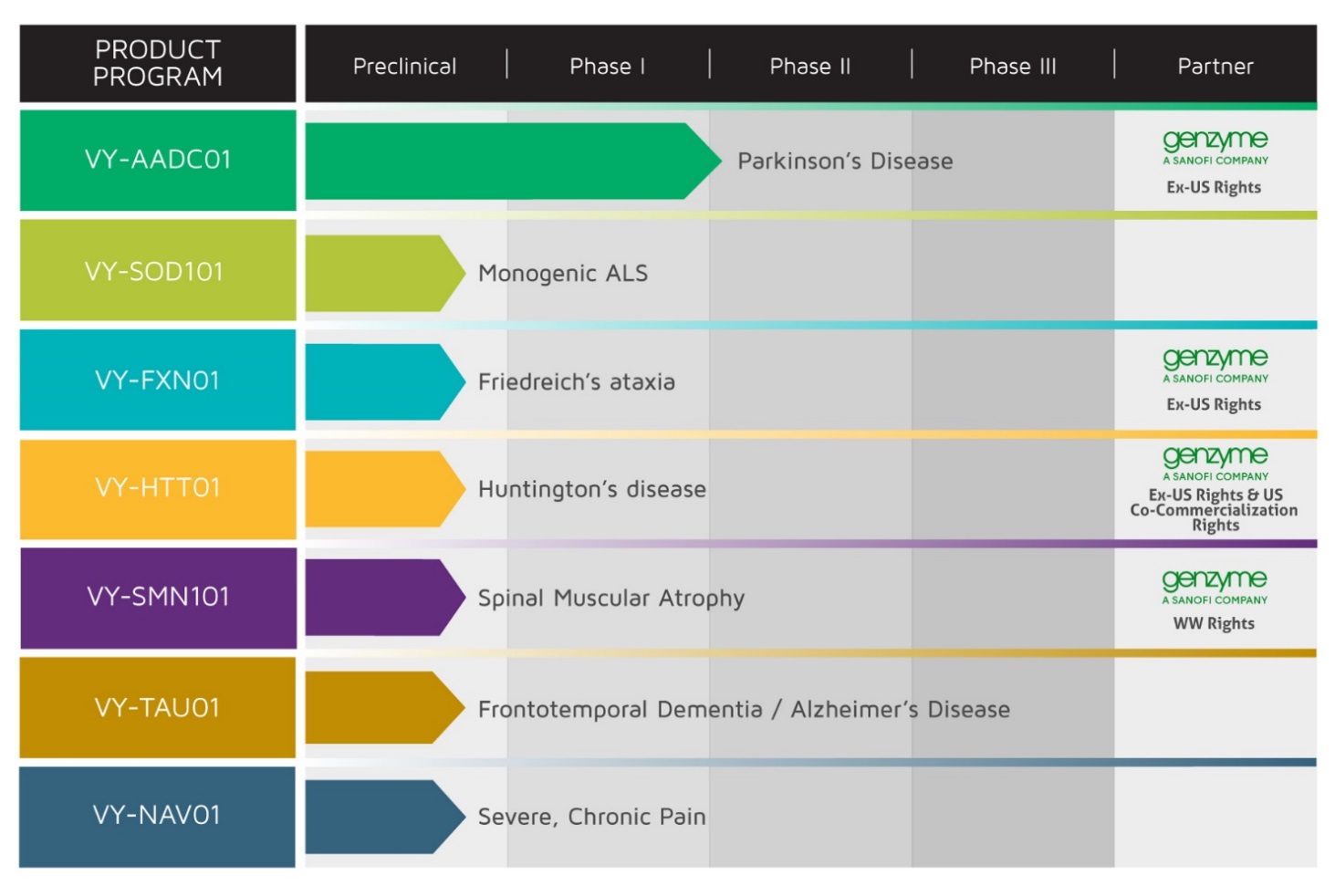

We are a clinical‑stage gene therapy company focused on developing life‑changing treatments for patients suffering from severe diseases of the central nervous system, or CNS. We focus on CNS diseases where we believe an adeno‑associated virus, or AAV, gene therapy approach that either increases or decreases the production of a specific protein can slow or reduce the symptoms experienced by patients, and therefore have a clinically meaningful impact. We have created a product engine, which enables us to engineer, optimize, manufacture, and deliver our AAV‑based gene therapies that have the potential to provide durable efficacy following a single administration directly to the CNS. Our product engine has rapidly generated programs for seven CNS indications, including advanced Parkinson’s disease; a monogenic form of ALS; Friedreich’s ataxia; Huntington’s disease; spinal muscular atrophy, frontotemporal dementia / Alzheimer’s disease, and severe, chronic pain. Our most advanced clinical candidate, VY‑AADC01, is being evaluated for the treatment of advanced Parkinson’s disease in an open‑label, Phase 1b clinical trial with the goal of generating human proof‑of‑concept data in the fourth quarter of 2016. We expect to submit an IND for our ALS program, VY-SOD101, in late 2017.

18

Our pipeline of gene therapy programs is summarized in the table below:

Since our inception on June 19, 2013, our operations have focused on organizing and staffing our company, business planning, raising capital, establishing our intellectual property portfolio, determining which CNS indications to pursue and conducting preclinical studies and clinical trials. We do not have any product candidates approved for sale and have not generated any revenue from product sales. Prior to the completion of our initial public offering, or IPO, we funded our operations primarily through private placements of redeemable convertible preferred stock and common stock and our collaboration with Genzyme, or the Genzyme Collaboration, which commenced in February 2015. In November 2015, we closed our IPO whereby we sold 5,750,000 shares of common stock, at a public offering price of $14.00 per share, including 750,000 shares of common stock issued upon the full exercise by the underwriters of their option to purchase additional shares, resulting in net proceeds to us of $72.9 million after deducting underwriting discounts, commissions, and offering expenses.

We have incurred significant operating losses since our inception. Our net losses were $7.2 million for the quarter ended March 31, 2016. As of March 31, 2016, we had an accumulated deficit of $57.0 million. We expect to continue to incur significant expenses and operating losses for the foreseeable future. We anticipate that our expenses will increase significantly in connection with our ongoing activities, as we:

|

· |

continue investing in our product engine to optimize vector engineering, manufacturing and dosing, and delivery techniques; |

|

· |

continue development of our clinical candidate, VY‑AADC01; |

|

· |

initiate additional preclinical studies and clinical trials for our other programs; |

19

|

· |

continue our process research and development activities, as well as establish our research‑grade and commercial manufacturing capabilities; |

|

· |

identify additional CNS diseases for treatment with our AAV gene therapies; |

|

· |

seek marketing approvals for VY‑AADC01 or other product candidates that arise from our programs that successfully complete clinical trials; |

|

· |

develop a sales, marketing, and distribution infrastructure to commercialize any product candidates for which we may obtain marketing approval; |

|

· |

maintain, expand, and protect our intellectual property portfolio; and |

|

· |

identify, acquire, or in‑license other product candidates and technologies. |

Financial Operations Overview

Collaboration Revenue

To date, we have not generated any revenue from product sales and do not expect to generate any revenue from product sales for the foreseeable future. For the three months ended March 31, 2016, we recognized $4.8 million of collaboration revenue from the Genzyme Collaboration.

For the foreseeable future, we expect substantially all of our revenue will be generated from the Genzyme Collaboration, and any other strategic relationships we may enter into. If our development efforts are successful, we may also generate revenue from product sales.

Expenses

Research and Development Expenses

Research and development expenses consist primarily of costs incurred for our research activities, including our program discovery efforts, and the development of our programs and product engine, which include:

|

· |

employee‑related expenses including salaries, benefits, and stock‑based compensation expense; |

|

· |

costs of funding research performed by third parties that conduct research and development, preclinical activities, manufacturing, and production design on our behalf; |

|

· |

the cost of purchasing lab supplies and non‑capital equipment used in designing, developing, and manufacturing preclinical study materials; |

|

· |

consultant fees; |

|

· |

facility costs including rent, depreciation, and maintenance expenses; and |

|

· |

fees for maintaining licenses under our third‑party licensing agreements. |

Research and development costs are expensed as incurred. Costs for certain activities such as manufacturing, preclinical studies, and clinical trials, are generally recognized based on an evaluation of the progress to completion of specific tasks using information and data provided to us by our vendors and collaborators.

20

At this time, we cannot reasonably estimate or know the nature, timing, and estimated costs of the efforts that will be necessary to complete the development of our product candidates. We are also unable to predict when, if ever, material net cash inflows will commence from sales of our product candidates. This is due to the numerous risks and uncertainties associated with developing such product candidates, including the uncertainty of:

|

· |

successful enrollment in and completion of clinical trials; |

|

· |

establishing an appropriate safety profile; |

|

· |

establishing commercial manufacturing capabilities or making arrangements with third‑party manufacturers; |

|

· |

receipt of marketing approvals from applicable regulatory authorities; |

|

· |

commercializing our product candidates, if and when approved, whether alone or in collaboration with others; |

|

· |

obtaining and maintaining patent and trade secret protection and regulatory exclusivity for our product candidates; |

|

· |

continued acceptable safety profiles of the products following approval; and |

|

· |

retention of key research and development personnel. |

A change in the outcome of any of these variables with respect to the development of any of our product candidates would significantly change the costs, timing, and viability associated with the development of that product candidate.

Research and development activities are central to our business model. We expect research and development costs to increase significantly for the foreseeable future as our development programs progress, including as we continue to support the Phase 1b clinical trial of VY‑AADC01 as a treatment for advanced Parkinson’s disease, and move such VY-AADC01 into additional clinical trials if the Phase 1b trial is successful. There are numerous factors associated with the successful commercialization of any of our product candidates, including future trial design and various regulatory requirements, many of which cannot be determined with accuracy at this time based on our stage of development. Additionally, future commercial and regulatory factors beyond our control will impact our clinical development programs and plans.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries and other related costs, including stock‑based compensation for personnel in executive, finance, accounting, business development, legal, and human resource functions. Other significant costs include corporate facility costs not otherwise included in research and development expenses, legal fees related to patent and corporate matters, and fees for accounting and consulting services.

We anticipate that our general and administrative expenses will increase in the future to support continued research and development activities, including the continuation of the Phase 1b clinical trial of VY‑AADC01, and the initiation of our clinical trials for our other product candidates. These increases will likely include increased costs related to the hiring of additional personnel and fees to outside consultants. We also anticipate increased expenses in comparison to general and administrative expenses of the prior year, associated with being a public company including costs for audit, legal, regulatory, and tax‑related services, director and officer insurance premiums, and investor relations costs.

21

Critical Accounting Policies and Estimates

We have prepared our financial statements in accordance with U.S. generally accepted accounting principles. Our preparation of these financial statements requires us to make estimates, assumptions, and judgments that affect the reported amounts of assets, liabilities, expenses, and related disclosures at the date of the financial statements, as well as revenue and expenses recorded during the reporting periods. We evaluate our estimates and judgments on an ongoing basis. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results could therefore differ materially from these estimates under different assumptions or conditions.