Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROAN RESOURCES, INC. | d189000d8k.htm |

| EX-99.1 - EX-99.1 - ROAN RESOURCES, INC. | d189000dex991.htm |

| EX-99.4 - EX-99.4 - ROAN RESOURCES, INC. | d189000dex994.htm |

| EX-99.2 - EX-99.2 - ROAN RESOURCES, INC. | d189000dex992.htm |

| EX-10.1 - EX-10.1 - ROAN RESOURCES, INC. | d189000dex101.htm |

| Exhibit 99.3

|

Ad Hoc Group of Unsecured Noteholders Counterproposal

April 20, 2016

|

|

CONTAINS MATERIAL NON-PUBLIC INFORMATION

PROVIDED SUBJECT TO CONFIDENTIALITY AGREEMENTS

FOR ILLUSTRATIVE PURPOSES ONLY

SUBJECT TO SUBSTANTIAL REVISIONS

SUBJECT TO FRE 408

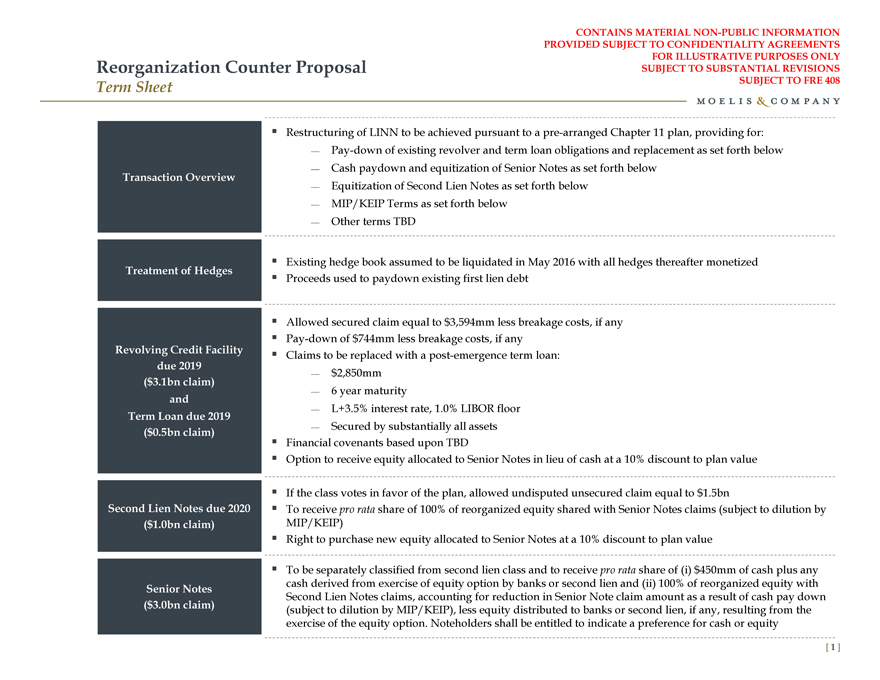

Reorganization Counter Proposal

Term Sheet

Transaction Overview

Treatment of Hedges

Revolving Credit Facility

due 2019

($3.1bn claim)

and

Term Loan due 2019

($0.5bn claim)

Second Lien Notes due 2020

($1.0bn claim)

Senior Notes

($3.0bn claim)

Restructuring of LINN to be achieved pursuant to a pre-arranged Chapter 11 plan, providing for: Pay-down of existing revolver and term loan obligations and replacement as set forth below Cash paydown and equitization of Senior Notes as set forth below Equitization of Second Lien Notes as set forth below MIP/KEIP Terms as set forth below Other terms TBD

Existing hedge book assumed to be liquidated in May 2016 with all hedges thereafter monetized Proceeds used to paydown existing first lien debt

Allowed secured claim equal to $3,594mm less breakage costs, if any Pay-down of $744mm less breakage costs, if any Claims to be replaced with a post-emergence term loan: $2,850mm 6 year maturity L+3.5% interest rate, 1.0% LIBOR floor Secured by substantially all assets Financial covenants based upon TBD

Option to receive equity allocated to Senior Notes in lieu of cash at a 10% discount to plan value

If the class votes in favor of the plan, allowed undisputed unsecured claim equal to $1.5bn

To receive pro rata share of 100% of reorganized equity shared with Senior Notes claims (subject to dilution by MIP/KEIP) Right to purchase new equity allocated to Senior Notes at a 10% discount to plan value

To be separately classified from second lien class and to receive pro rata share of (i) $450mm of cash plus any cash derived from exercise of equity option by banks or second lien and (ii) 100% of reorganized equity with Second Lien Notes claims, accounting for reduction in Senior Note claim amount as a result of cash pay down (subject to dilution by MIP/KEIP), less equity distributed to banks or second lien, if any, resulting from the exercise of the equity option. Noteholders shall be entitled to indicate a preference for cash or equity

[ 1 ]

|

|

CONTAINS MATERIAL NON-PUBLIC INFORMATION

PROVIDED SUBJECT TO CONFIDENTIALITY AGREEMENTS

FOR ILLUSTRATIVE PURPOSES ONLY

SUBJECT TO SUBSTANTIAL REVISIONS

SUBJECT TO FRE 408

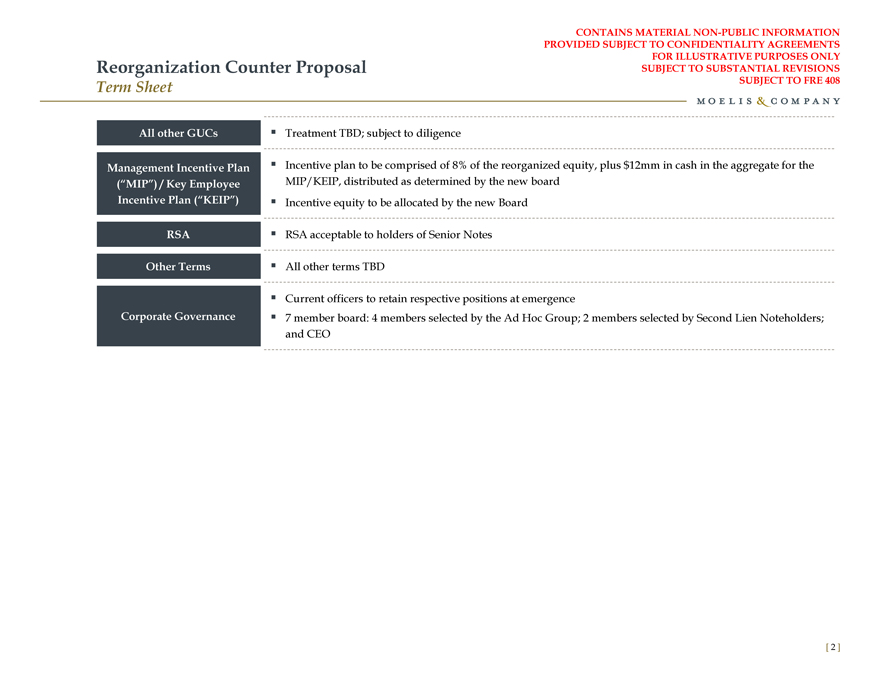

Reorganization Counter Proposal

Term Sheet

All other GUCs

Management Incentive Plan (“MIP”) / Key Employee Incentive Plan (“KEIP”)

RSA

Other Terms

Corporate Governance

Treatment TBD; subject to diligence

Incentive plan to be comprised of 8% of the reorganized equity, plus $12mm in cash in the aggregate for the MIP/KEIP, distributed as determined by the new board Incentive equity to be allocated by the new Board

RSA acceptable to holders of Senior Notes

All other terms TBD

Current officers to retain respective positions at emergence

7 member board: 4 members selected by the Ad Hoc Group; 2 members selected by Second Lien Noteholders; and CEO

[ 2 ]

|

|

CONTAINS MATERIAL NON-PUBLIC INFORMATION

PROVIDED SUBJECT TO CONFIDENTIALITY AGREEMENTS

FOR ILLUSTRATIVE PURPOSES ONLY

SUBJECT TO SUBSTANTIAL REVISIONS

SUBJECT TO FRE 408

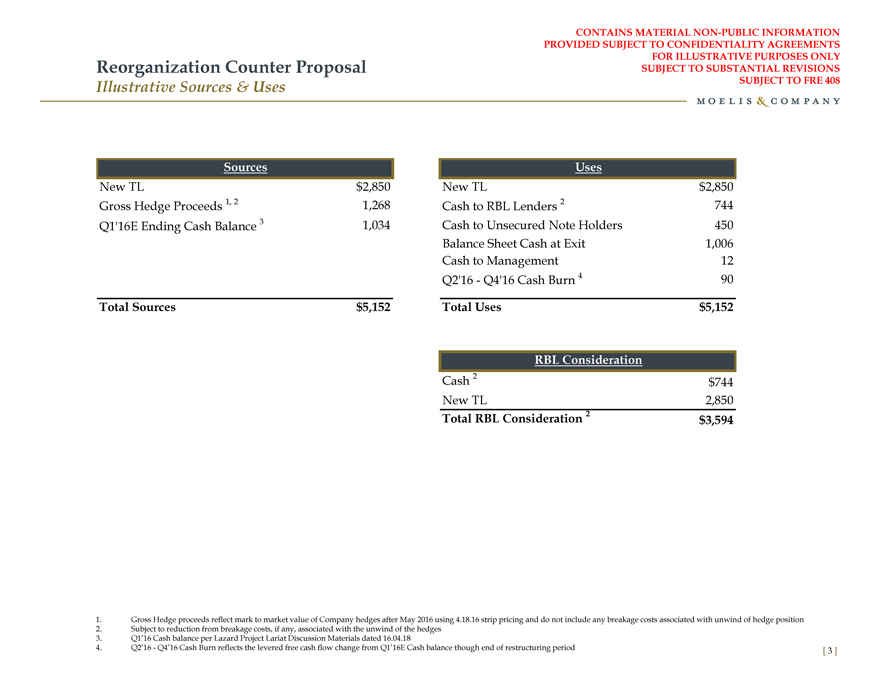

Reorganization Counter Proposal

Illustrative Sources & Uses

Sources

New TL $ 2,850

Gross Hedge Proceeds 1, 2 1,268

Q1’16E Ending Cash Balance 3 1,034

Total Sources $ 5,152

Uses

New TL $2,850

Cash to RBL Lenders 2 744

Cash to Unsecured Note Holders 450

Balance Sheet Cash at Exit 1,006

Cash to Management 12

Q2’16—Q4’16 Cash Burn 4 90

Total Uses $5,152

RBL Consideration

Cash 2 $744

New TL 2,850

Total RBL Consideration 2 $3,594

1. Gross Hedge proceeds reflect mark to market value of Company hedges after May 2016 using 4.18.16 strip pricing and do not include any breakage costs associated with unwind of hedge position

2. Subject to reduction from breakage costs, if any, associated with the unwind of the hedges

3. Q1’16 Cash balance per Lazard Project Lariat Discussion Materials dated 16.04.18

4. Q2’16—Q4’16 Cash Burn reflects the levered free cash flow change from Q1’16E Cash balance though end of restructuring period [ 3 ]