Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROAN RESOURCES, INC. | d189000d8k.htm |

| EX-99.1 - EX-99.1 - ROAN RESOURCES, INC. | d189000dex991.htm |

| EX-99.4 - EX-99.4 - ROAN RESOURCES, INC. | d189000dex994.htm |

| EX-99.3 - EX-99.3 - ROAN RESOURCES, INC. | d189000dex993.htm |

| EX-10.1 - EX-10.1 - ROAN RESOURCES, INC. | d189000dex101.htm |

| Exhibit 99.2

|

APRI L 22 , 2016

R S A T E R M S H E E T

Project Lariat

LAZARD

|

|

C O N F I D E N T I A L

P R O J E C T L A R I A T

Disclaimer

The information herein has been prepared by Lazard based upon information supplied by the Company or publicly available information, and portions of the information hereinmay be based upon certain statements, estimates and forecasts provided by the Company with respect to the anticipated future performance of the Company. We have relied upon the accuracy and completeness of the foregoing information, and have not assumed any responsibility for any independent verification of such information or any independent valuation or appraisal of any of the assets or liabilities of the Company, or any other entity, or concerning solvency or fair value of the Company or any other entity. With respect to financial forecasts, we have assumed that they have been reasonably prepared in good faith on bases reflecting the best currently available estimates and judgments of management of the Company as to the future financial performance of the Company. We assume no responsibility for and express no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise. These materials and the information contained herein are confidential and may not be disclosed publicly or made available to third parties without the prior written consent of Lazard; provided, however, that you may disclose to any and all persons the U.S. federal income tax treatment and tax structure of the transaction described herein and the portions of these materials that relate to such tax treatment or structure. These materials are preliminary and summary in nature and do not include all of the information that the Company should evaluate in considering a possible transaction. Nothing herein shall constitute a commitment or undertaking on the part of Lazard or any related party to provide any service. These materials do not constitute tax, accounting, actuarial, legal or other specialist advice, and Lazard shall have no duties or obligations to you in respect of these materials or other advice provided to you, except to the extent specifically set forth in an engagement or other written agreement, if any, that is entered into by Lazard and you.

1 LAZARD

|

|

P R O J E C T L A R I A T

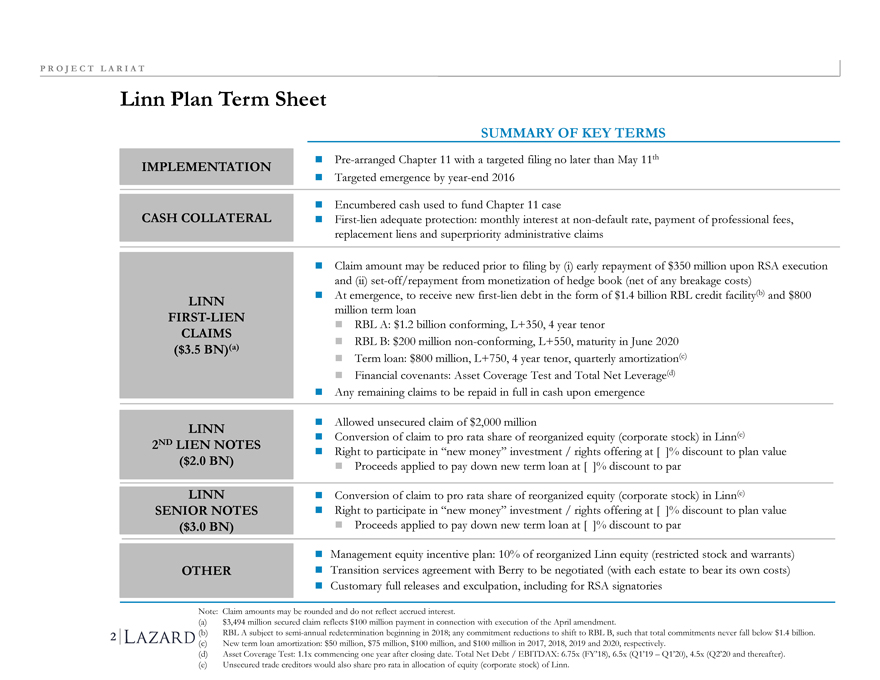

Linn Plan Term Sheet

IMPLEMENTATION

CASH COLLATERAL

LINN FIRST-LIEN

CLAIMS

($3.5 BN)(a)

LINN

2ND LIEN NOTES

($2.0 BN)

LINN SENIOR NOTES

($3.0 BN) OTHER

SUMMARY OF KEY TERMS

Pre-arranged Chapter 11 with a targeted filing no later than May 11th Targeted emergence by year-end 2016

Encumbered cash used to fund Chapter 11 case

First-lien adequate protection: monthly interest at non-default rate, payment of professional fees, replacement liens and superpriority administrative claims

Claim amount may be reduced prior to filing by (i) early repayment of $350 million upon RSA execution and (ii) set-off/repayment from monetization of hedge book (net of any breakage costs) At emergence, to receive new first-lien debt in the form of $1.4 billion RBL credit facility(b) and $800 million term loan RBL A: $1.2 billion conforming, L+350, 4 year tenor RBL B: $200 million non-conforming, L+550, maturity in June 2020 Term loan: $800 million, L+750, 4 year tenor, quarterly amortization(c) Financial covenants: Asset Coverage Test and Total Net Leverage(d) Any remaining claims to be repaid in full in cash upon emergence

Allowed unsecured claim of $2,000 million

Conversion of claim to pro rata share of reorganized equity (corporate stock) in Linn(e)

Right to participate in “new money” investment / rights offering at [ ]% discount to plan value Proceeds applied to pay down new term loan at [ ]% discount to par

Conversion of claim to pro rata share of reorganized equity (corporate stock) in Linn(e)

Right to participate in “new money” investment / rights offering at [ ]% discount to plan value Proceeds applied to pay down new term loan at [ ]% discount to par

Management equity incentive plan: 10% of reorganized Linn equity (restricted stock and warrants) Transition services agreement with Berry to be negotiated (with each estate to bear its own costs) Customary full releases and exculpation, including for RSA signatories

Note: Claim amounts may be rounded and do not reflect accrued interest.

(a) $3,494 million secured claim reflects $100 million payment in connection with execution of the April amendment.

(b) RBL A subject to semi-annual redetermination beginning in 2018; any commitment reductions to shift to RBL B, such that total commitments never fall below $1.4 billion. (c) New term loan amortization: $50 million, $75 million, $100 million, and $100 million in 2017, 2018, 2019 and 2020, respectively.

(d) Asset Coverage Test: 1.1x commencing one year after closing date. Total Net Debt / EBITDAX: 6.75x (FY’18), 6.5x (Q1’19 – Q1’20), 4.5x (Q2’20 and thereafter). (e) Unsecured trade creditors would also share pro rata in allocation of equity (corporate stock) of Linn.

2

|

|

PROJECT L A R I A T

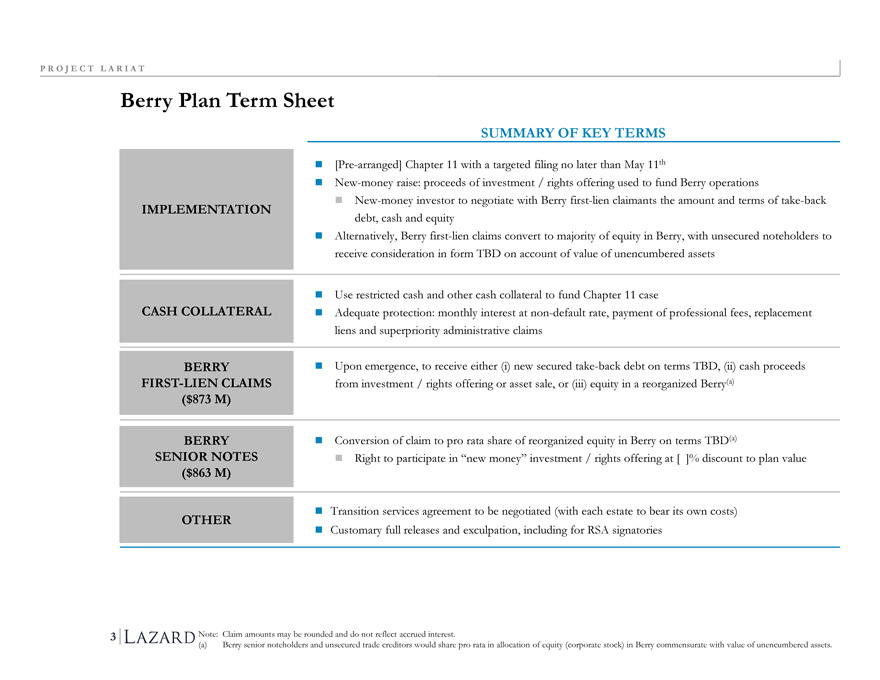

Berry Plan Term Sheet

IMPLEMENTATION

CASH COLLATERAL

BERRY FIRST-LIEN CLAIMS

($873 M)

BERRY SENIOR NOTES

($863 M) OTHER

SUMMARY OF KEY TERMS

[Pre-arranged] Chapter 11 with a targeted filing no later than May 11th

New-money raise: proceeds of investment / rights offering used to fund Berry operations

New-money investor to negotiate with Berry first-lien claimants the amount and terms of take-back debt, cash and equity Alternatively, Berry first-lien claims convert to majority of equity in Berry, with unsecured noteholders to receive consideration in form TBD on account of value of unencumbered assets

Use restricted cash and other cash collateral to fund Chapter 11 case

Adequate protection: monthly interest at non-default rate, payment of professional fees, replacement liens and superpriority administrative claims

Upon emergence, to receive either (i) new secured take-back debt on terms TBD, (ii) cash proceeds from investment / rights offering or asset sale, or (iii) equity in a reorganized Berry(a)

Conversion of claim to pro rata share of reorganized equity in Berry on terms TBD(a)

Right to participate in “new money” investment / rights offering at [ ]% discount to plan value

Transition services agreement to be negotiated (with each estate to bear its own costs) Customary full releases and exculpation, including for RSA signatories

Note: Claim amounts may be rounded and do not reflect accrued interest.

(a) Berry senior noteholders and unsecured trade creditors would share pro rata in allocation of equity (corporate stock) in Berry commensurate with value of unencumbered assets.

3