Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROAN RESOURCES, INC. | d189000d8k.htm |

| EX-99.4 - EX-99.4 - ROAN RESOURCES, INC. | d189000dex994.htm |

| EX-99.3 - EX-99.3 - ROAN RESOURCES, INC. | d189000dex993.htm |

| EX-99.2 - EX-99.2 - ROAN RESOURCES, INC. | d189000dex992.htm |

| EX-10.1 - EX-10.1 - ROAN RESOURCES, INC. | d189000dex101.htm |

Creditor Diligence Presentation April 16, 2016 Exhibit 99.1

Confidentiality The following slide presentation may contain confidential information of LINN Energy, LLC and its subsidiaries, including Berry Petroleum Company, LLC (collectively, “LINN” or the “Company”). By accepting and reviewing this presentation, you expressly acknowledge and agree that: (i) you will not copy, fax, reproduce, divulge, or distribute any information contained herein, in whole or in part, without the express written consent of the Company and (ii) the information herein will be treated as confidential information except to the extent such information is or becomes publicly available other than as a result of a disclosure by you or your representatives.

Forward-Looking Statements and Risk Factors Statements made in these presentation slides and by representatives of LINN Energy, LLC and LinnCo, LLC (collectively, the “Companies”) during the course of this presentation that are not historical facts are “forward-looking statements.” These statements are based on certain assumptions and expectations made by the Companies which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments, potential for reserves and drilling, completion of current and future acquisitions, future distributions, future growth, benefits of acquisitions, future competitive position and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Companies, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to financial performance and results, the integration of Berry Petroleum Company’s business and operations and the Devon Assets with those of LINN Energy, indebtedness under LINN Energy’s credit facilities and senior notes, access to capital markets, availability of sufficient cash flow to pay distributions and execute our business plan, prices and demand for oil, natural gas and natural gas liquids, the ability to replace reserves and efficiently develop current reserves, the ability to make acquisitions on economically acceptable terms, the regulatory environment, availability of connections and equipment and other important factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Please read “Risk Factors” in the Companies’ Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other public filings. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. These slides include certain non-GAAP financial measures such as Adjusted EBITDA and unlevered free cash flow. These non-GAAP financial measures should not be considered as alternatives to GAAP measures such as net income, operating income, net cash flows provided by operating activities or any other GAAP measure of liquidity or financial performance.

Reserve Estimates The SEC permits oil and natural gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms. The Company may use terms in this presentation that the SEC’s guidelines strictly prohibit in SEC filings, such as “estimated ultimate recovery” or “EUR,” “resources,” “net resources,” “total resource potential” and similar terms to estimate oil and natural gas that may ultimately be recovered. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves as used in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. These estimates have not been fully risked by management. Actual quantities that may be ultimately recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery include the scope of LINN Energy’s actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual recoveries of oil and natural gas in place, length of horizontal laterals, actual drilling results, including geological and mechanical factors affecting recovery rates and other factors. These estimates may change significantly as the development of properties provides additional data.

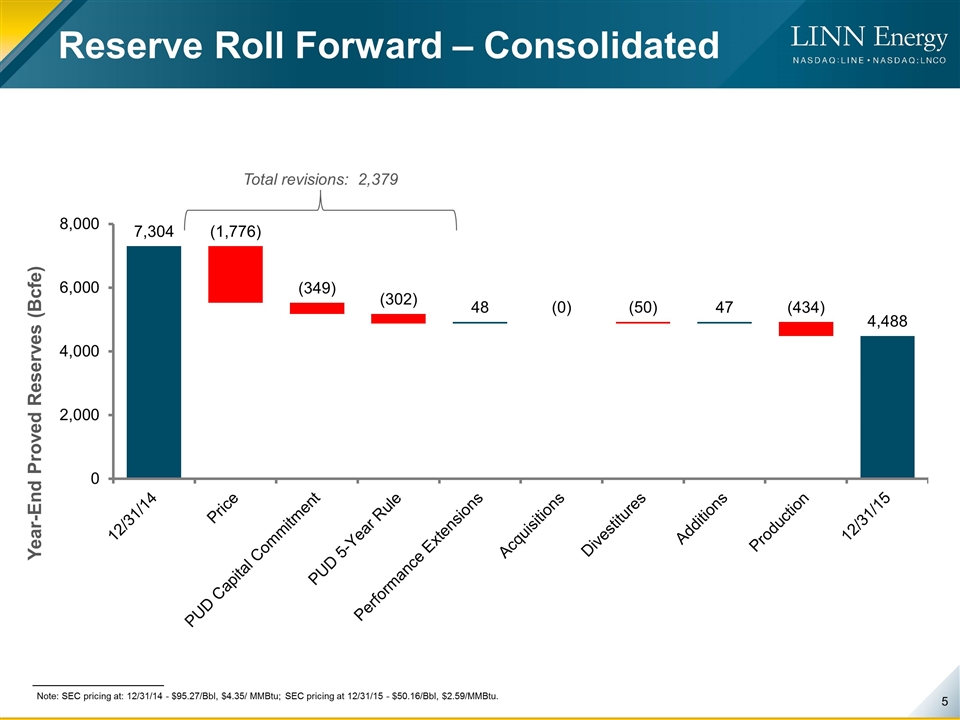

Reserve Roll Forward – Consolidated Year-End Proved Reserves (Bcfe) Total revisions: 2,379 Note: SEC pricing at: 12/31/14 - $95.27/Bbl, $4.35/ MMBtu; SEC pricing at 12/31/15 - $50.16/Bbl, $2.59/MMBtu.

Linn Standalone

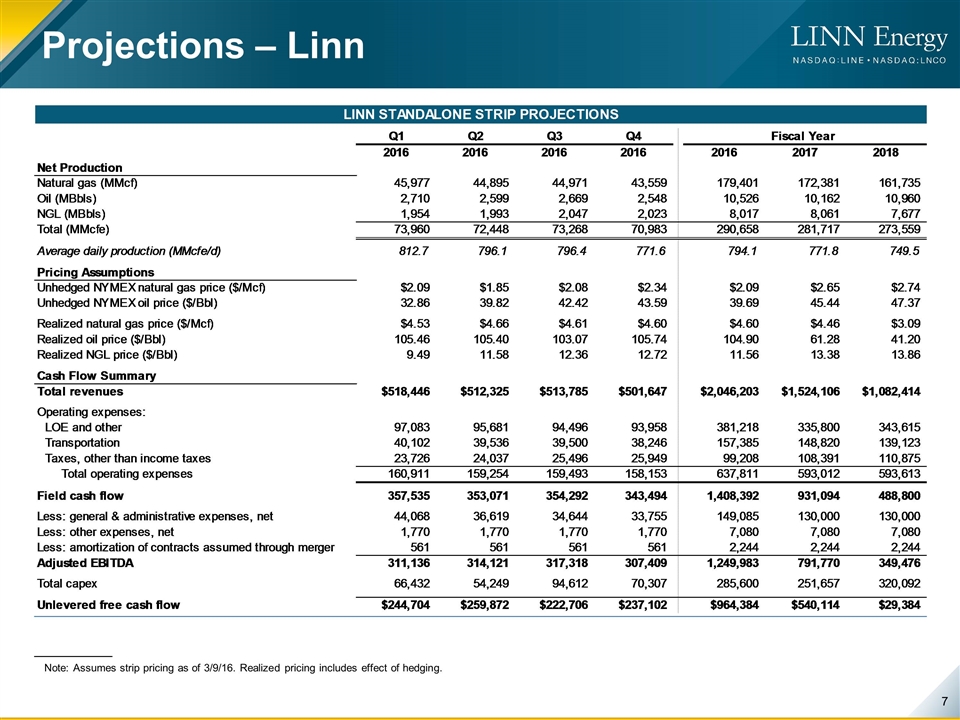

Projections – Linn Note: Assumes strip pricing as of 3/9/16. Realized pricing includes effect of hedging.

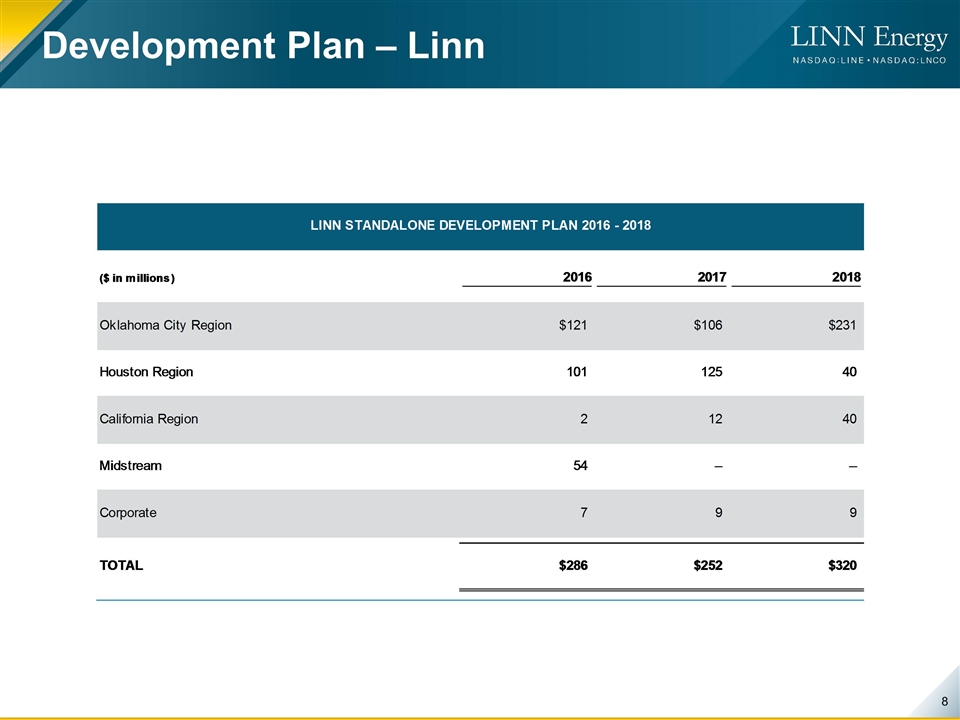

Development Plan – Linn

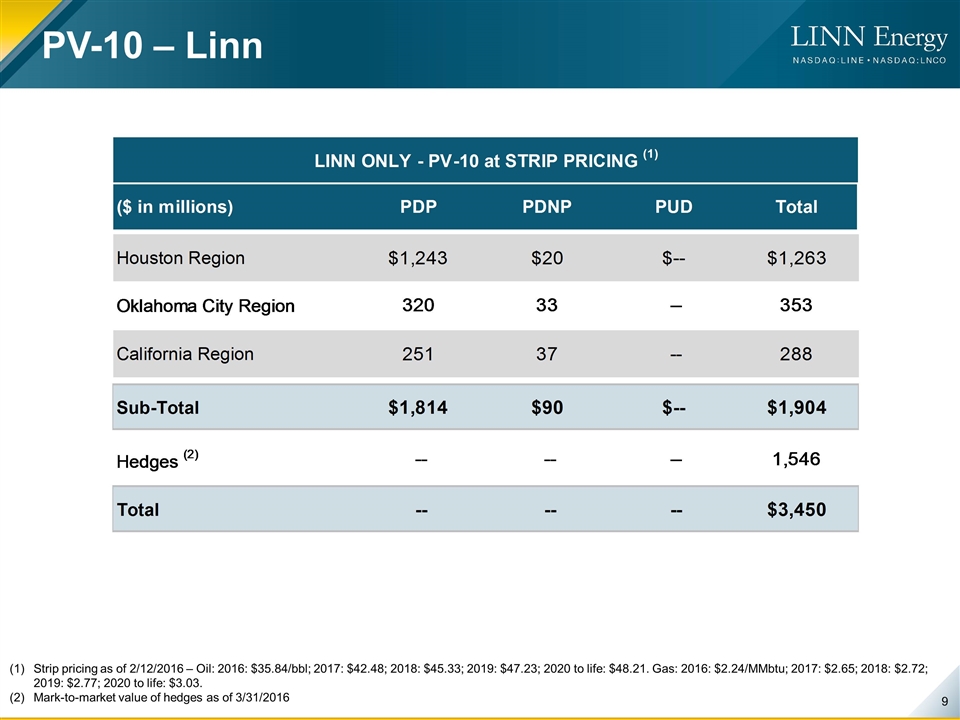

Strip pricing as of 2/12/2016 – Oil: 2016: $35.84/bbl; 2017: $42.48; 2018: $45.33; 2019: $47.23; 2020 to life: $48.21. Gas: 2016: $2.24/MMbtu; 2017: $2.65; 2018: $2.72; 2019: $2.77; 2020 to life: $3.03. Mark-to-market value of hedges as of 3/31/2016 PV-10 – Linn

Berry Standalone

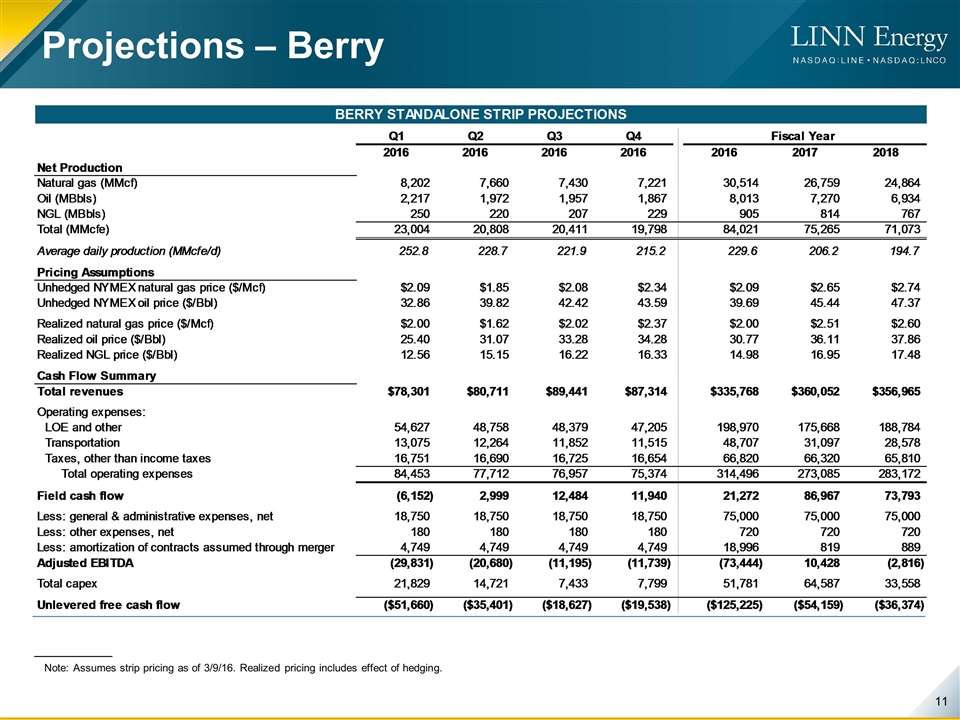

Projections – Berry Note: Assumes strip pricing as of 3/9/16. Realized pricing includes effect of hedging.

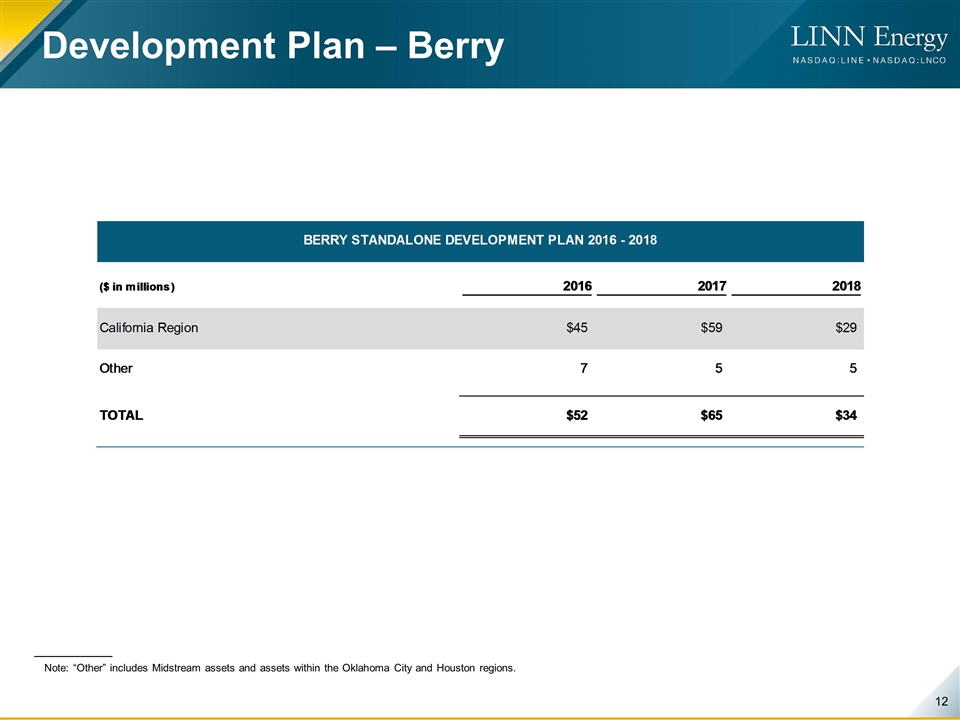

Development Plan – Berry Note: “Other” includes Midstream assets and assets within the Oklahoma City and Houston regions.

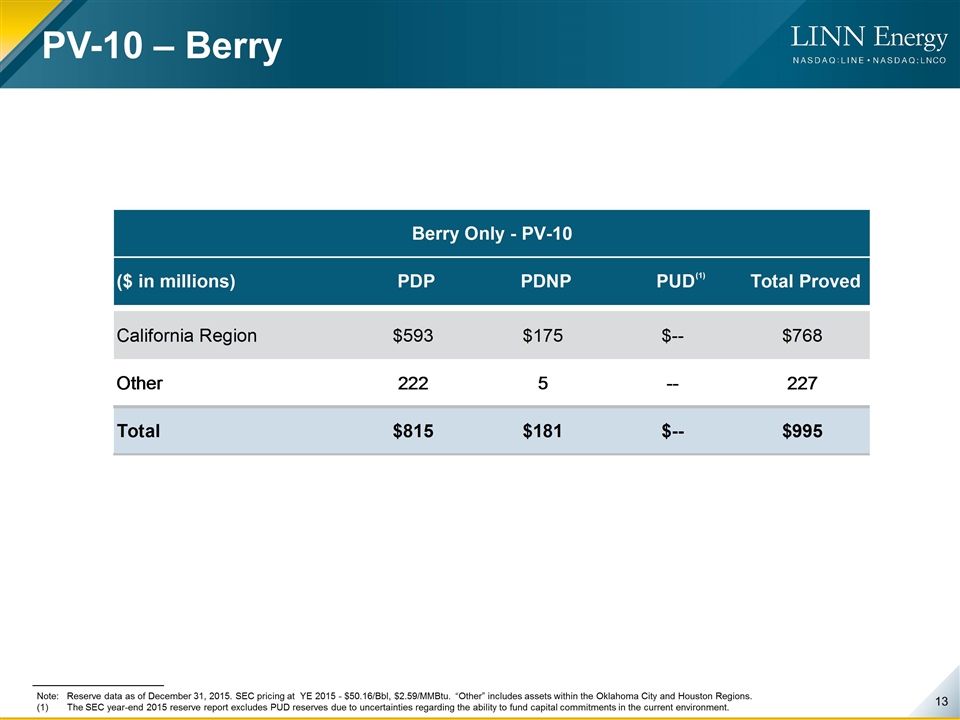

PV-10 – Berry Note:Reserve data as of December 31, 2015. SEC pricing at YE 2015 - $50.16/Bbl, $2.59/MMBtu. “Other” includes assets within the Oklahoma City and Houston Regions. (1)The SEC year-end 2015 reserve report excludes PUD reserves due to uncertainties regarding the ability to fund capital commitments in the current environment. (1)