Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENTELLUS MEDICAL INC | d175844d8k.htm |

1 Investor Presentation Investor Presentation May 2016 Exhibit 99.1 |

2 Entellus Medical May 2016 Forward Looking Statements Forward Looking Statements This presentation may contain forward-looking statements concerning the company’s business, operations and financial

performance and condition, as well as its plans, objectives and expectations for its

business operations and financial performance and condition. These

forward-looking statements include, but are not limited to, statements about the company’s total addressable market, financial guidance and future financial performance, product performance and

benefits, ability to implement its business model and strategic plan, ability to manage

and grow its business, ability to establish and maintain intellectual

property protection for its products or avoid claims of infringement, ability to hire and retain key personnel, and expectations about market trends, along with third-party payor reimbursement and coverage

decisions. Forward-looking statements are based on management’s current

expectations, estimates, forecasts and projections about the

company’s business and the industry in which it operates, and management’s beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks,

uncertainties and other factors that are in some cases beyond the company’s

control. As a result, any or all of the forward- looking statements in

this presentation may turn out to be inaccurate. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a representation or warranty by

the company or any other person that the company will achieve its

objectives and plans in any specified timeframe, or at all. Factors that may cause actual results to differ materially from current expectations include, among other things, those described in the section entitled

“Risk Factors” and elsewhere in greater detail in our Annual Report on Form

10-K filed with the Securities and Exchange Commission on February

25, 2016 and other filings with the Securities and Exchange Commission. The company undertakes no obligation to update or revise any forward-looking statements, even if subsequent events cause its views to

change. This presentation contains statistical data that we obtained from industry

publications and reports generated by third parties. Although we believe

that the publications and reports are reliable, we have not independently verified this statistical data. |

3 Entellus Medical May 2016 Well Positioned in Chronic Sinusitis Well Positioned in Chronic Sinusitis LARGE Potential Market Over 29 Million Adults and 6 Million Children with Chronic Sinusitis CLINICAL Efficacy Randomized trial showing Entellus products as effective as surgery REDUCES Costs Benefitting healthcare system & patient RAPID Revenue Growth 2015 26% y/y growth 2016 Guidance 19% – 25% y/y growth* *Guidance communicated on 5/4/16. The fact that the company includes these projections in this

presentation should not be taken to mean that these comments continue to be the company’s projections as of any subsequent date.

Minimally Invasive Treatment for Chronic & Recurrent Sinusitis |

4 Entellus Medical May 2016 Strong Financial Performance & Outlook Strong Financial Performance & Outlook $17.6M $32.5M $48.8M $0 $10 $20 $30 $40 $50 $60 $70 2012 2013 2014 2015 Gross Margin: 73% 76% 77% 78% 76% 78% $61.6M Annual Revenue Q1 Y/Y Revenue $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 Q1 '15 Q1 '16 $16.9M $13.5M |

5 Entellus Medical May 2016 Overview of Chronic Sinusitis Overview of Chronic Sinusitis Heavy Purulent Drainage Facial Pressure & Fullness Nasal Congestion Fatigue Facial or Dental Pain Headache Common Symptoms U.S. Adult CS Statistics Approximately 29 Million afflicted 1 12.3M annual patient visits to MD 2 23% of patient visits are to ENTs 2 1.23M patients seen by ENTs annually $8.6 Billion in healthcare costs Est. 552K sinus surgeries in 2015 1 12% of US adults per 2013 U.S. census data 2 CDC 2009-2010 NAMCS/NHAMCS survey |

6 Entellus Medical May 2016 0` Annual Patients to ENT Entellus Market Opportunity in U.S. Symptoms Relieved by Medical Management (Rx) Fail Rx & Elect Not to have Surgery Surgery (FESS) 85% Well Suited for BSD in Office 30% Well Suited for Hybrid BSD in OR Addressable Market for BSD in 2015 ~630,000 ~630,000 ~1,233,000 Treatment of Chronic Sinusitis Patients Treatment of Chronic Sinusitis Patients 600,000 400,000 200,000 55% Well Suited for BSD in Office All numbers are approximate and company estimates for 2015 304,000 (48%) Office Market 464,000 (73%) 168,000 (27%) 160,000 (25%) OR Market 168,000 (27%) 552,000 (45%) 188,000 (15%) 493,000 (40%) 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 Chronic Sinusitis Patients |

7 Entellus Medical May 2016 Balloon Sinus Dilation Market Opportunity Balloon Sinus Dilation Market Opportunity $680M 464,000 Procedures $275M 168,000 Procedures Total Market: Office Market: OR Market: + = $955M 630,000 Procedures Growth Drivers in the Trend Toward Office Sinus Procedures Strong clinical data from Entellus balloon sinus dilation Favorable economics for ENTs, patients and the healthcare system Ease-of-use for ENT physicians and very good patient comfort Physician convenience and time savings Increasing peer-to-peer discussions amongst ENTs |

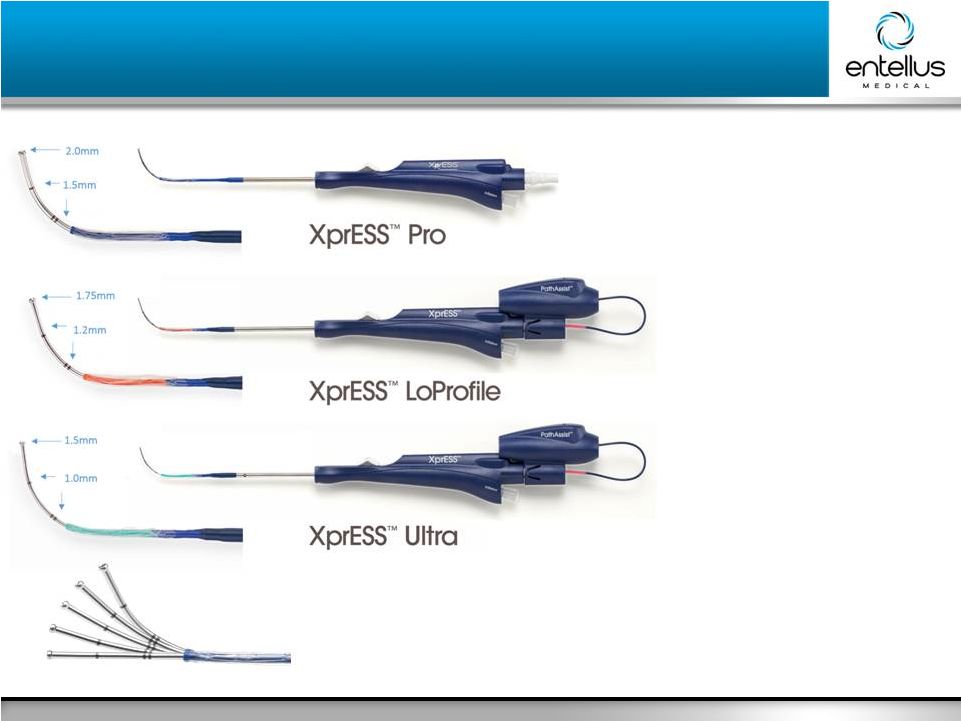

8 Entellus Medical May 2016 Full Line of Sinus Dilation Solutions Full Line of Sinus Dilation Solutions |

9 Entellus Medical May 2016 • Introduced 2011 • Introduced 2012 • Always sold with LED Light Fiber • Introduced 2015 • Always sold with LED Light Fiber XprESS Multi-Sinus Dilation System Product Family Shapeable Tip |

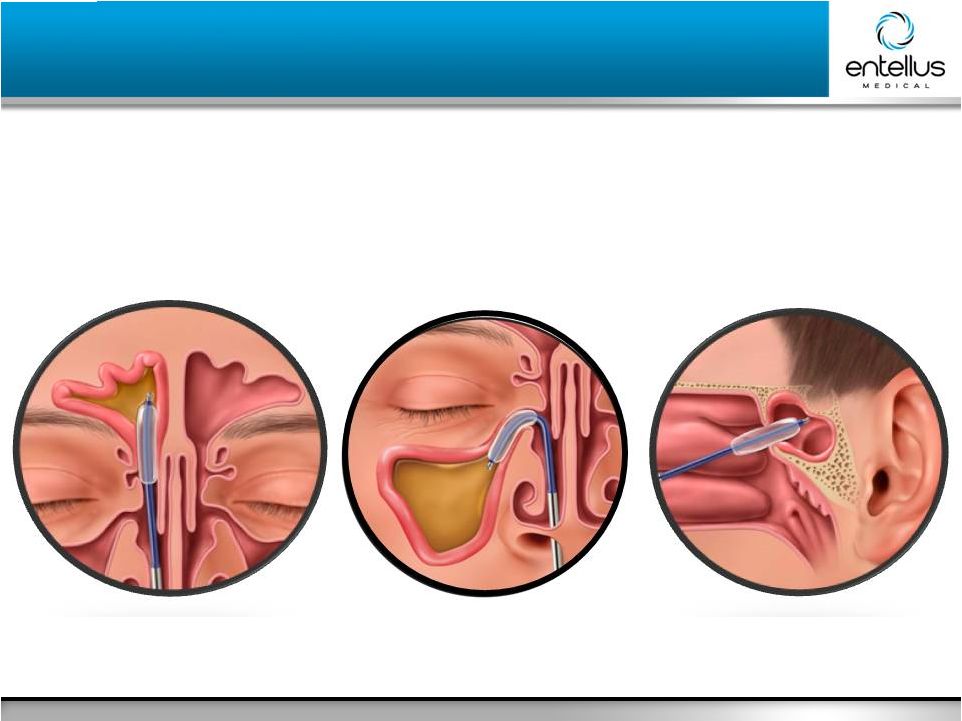

10 Entellus Medical May 2016 XprESS Multi-Sinus Indications XprESS Multi-Sinus Indications Indications for Use To access and treat the maxillary ostia/ethmoid infundibula in patients 2 years and

older, and frontal ostia/recesses and sphenoid sinus ostia in patients 12 years and

older using a trans-nasal approach. The bony sinus outflow

tracts are remodeled by balloon displacement of adjacent bone and

paranasal sinus structures. Frontal

Sphenoid Maxillary |

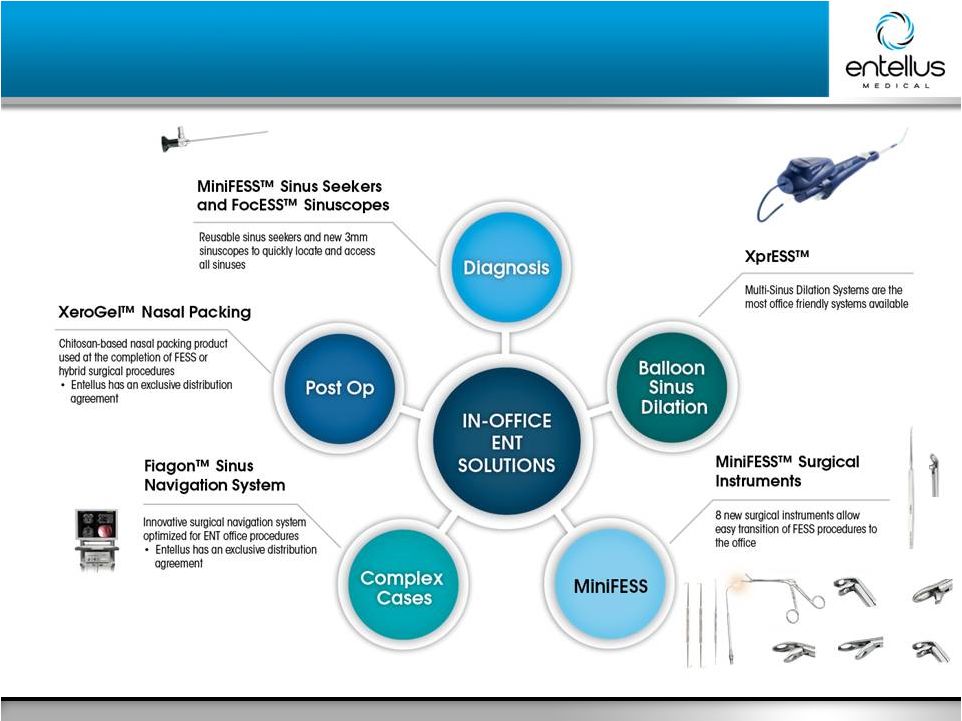

11 Entellus Medical May 2016 Leading the Way to the Office Leading the Way to the Office Xoran™ MiniCAT, |

12 Entellus Medical May 2016 Open Platform Minimal space ideally suited for the office Simple set-up process Compatible with XprESS Pro Tracks both rigid and malleable instruments Compatible with debriders and shavers from multiple manufacturers Accurate to 2mm Over 8 times larger than Fiagon Requires separate cart making office use logistically challenging Multiple complex steps Each instrument requires set-up Only tracks rigid instruments Only compatible with Medtronic devices Requires initial purchase of Medtronic tools to enable procedures Accurate to 2mm Fiagon IGS Well Suited for Office Setting Fiagon IGS Well Suited for Office Setting Medtronic Fusion IGS Over 8X Larger Entellus Fiagon IGS |

13 Entellus Medical May 2016 Competitive Advantages Competitive Advantages Entellus XprESS offers ENT physicians and staff: 1. Single integrated device 2. Sinus seeker-based design, familiar to sinus surgeons 3. Smaller device enables easier sinus access and procedure 4. Slideable balloon to enhance endoscopic visualization 5. Malleable, controllable tip customizable to unique anatomy 6. Multiple methods of confirming device placement 7. No capital equipment necessary such as CT image guidance 8. Multitier product family provides feature / price flexibility |

14 Entellus Medical May 2016 Competitive Advantages in Treating Maxillary & Frontal Sinuses Competitive Advantages in Treating Maxillary & Frontal Sinuses Frontal Advantage: 5 Confirmation Methods 1. Palpation and tactile feel 2. Direct visualization 3. Depth of insertion with shaft markings 4. Transillumination 5. Controlled light excursion on forehead Maxillary Advantage: • Controllable, angled device tip plus transillumination enables accurate cannulation of the maxillary sinus ostium • Proven efficacious in a randomized trial |

15 Entellus Medical May 2016 Comprehensive Intellectual Property Comprehensive Intellectual Property Entellus & Acclarent license agreement - Feb 2011 – Entellus licensed entire portfolio of current and future Acclarent balloon sinus dilation patents – Entellus XprESS, FinESS, and PathAssist product lines are Covered Products under the non-exclusive license – Paying a royalty on net sales of Covered Products Entellus has at least 29 issued & 14 pending U.S. patents relating to sinusitis treatment – At least 13 patents are directed towards the XprESS products line |

16 Entellus Medical May 2016 Substantial Body of Clinical Evidence Substantial Body of Clinical Evidence Subjects Treated REMODEL Randomized Trial of Entellus Office Balloon Sinus Dilation vs. FESS 135 81 XprESS Multi-Sinus Office Treatment 5 Other Clinical Studies of Entellus Products 473 2 Cadaver Studies: Accuracy of Maxillary Sinus Cannulation & Effectiveness of Transillumination 36 Studies Safety & Efficacy Demonstrated in 8 Clinical Studies Involving nearly 700 Patients 50 XprESS Pediatric Study |

17 Entellus Medical May 2016 Just Published! Just Published! REMODEL Larger Cohort With Long-term Outcomes and Meta-Analysis of Standalone Balloon Dilation Studies Rakesh K. Chandra, MD; Robert C. Kern, MD; Jeffrey L. Cutler, MD; Kevin C. Welch, MD; Paul T. Russell, MD The Laryngoscope. January, 2016. [printed version]

– REMODEL data on larger cohort of 135 patients with 1 to 2 years of follow-up – Meta-analysis of 7 standalone balloon dilation studies including 358 patients with follow-up from 6 months to 2 years |

18 Entellus Medical May 2016 Prospective, multicenter randomized controlled trial at 14 centers – 135 Adult patients treated with Entellus balloon sinus dilation performed in an

ENT physician office or traditional sinus surgery (FESS)

– All patients exhibited maxillary sinusitis with or without ethmoid inflammation Primary Endpoints: – Non-inferiority at reducing sinusitis symptoms as assessed by change in

Sino-Nasal Outcomes Test (SNOT-20) QOL survey scores

– Superiority of BSD regarding the mean number of debridements per patient after treatment Additional Endpoints: – Complication rate, recovery time, surgical revision rate, change in number of sinusitis episodes, and changes in activity impairment and work productivity Post-procedure follow up conducted at 1 week, months 1, 3, 6, 12, and every 6 months until study closure REMODEL Randomized Trial of Office Balloon Sinus Dilation vs. FESS

REMODEL Randomized Trial of Office Balloon

Sinus Dilation vs. FESS |

19 Entellus Medical May 2016 Significant Reduction of Sinusitis Episodes 3 Times Faster Recovery Similar Symptom Reduction REMODEL Randomized Trial of Office Balloon Sinus Dilation vs. FESS

REMODEL Randomized Trial of Office Balloon

Sinus Dilation vs. FESS Debridement

Rate Superior to FESS Entellus Balloon FESS Both Primary Endpoints Achieved Recovery Time (days) 1.7 5.0 0 1 2 3 4 5 6 0.2 1.0 0 0.4 0.8 1.2 0 1 2 3 Pre-Tx 6M 12M 18M 24M SNOT-20 Symptom Score # Episodes 12Mo. Before & After Tx Avg. Debridements per Patient p < 0.0001 p < 0.0001 Balloon dilation non-inferior to FESS, p <0.001 5.1 4.5 0.9 0.8 0 1 2 3 4 5 6 p < 0.0001 p < 0.0001 |

20 Entellus Medical May 2016 Entellus balloon products used in the ENT physician office as a standalone therapy demonstrated the following: REMODEL Trial – Additional Key Findings REMODEL Trial – Additional Key Findings Entellus products are the only devices proven in a sufficiently powered prospective, multicenter, randomized, controlled trial to be as effective as FESS

2.7% 6.9% 0% 3% 6% 9% 18-Month Revision Rate Balloon FESS 32% 56% 0% 25% 50% 75% 100% Bleeding after Discharge Balloon FESS 1.0 2.8 0 1 2 3 4 Duration (days) of Prescription Pain Rx Balloon FESS p = 0.009 p < 0.0001 p = NS |

21 Entellus Medical May 2016 Clinical Studies to Broaden Indications Clinical Studies to Broaden Indications Pediatric IDE Study – Multicenter study to support 510(k) clearance – Treatment of 50 sinuses in 25 to 50 patients; 3-month follow-up – Study completed; FDA 510(k) clearance received Patient Age 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Acclarent Entellus Maxillary Only Maxillary Only Frontal, Sphenoid, Maxillary All 3 Sinuses Caution: Investigational device. Limited by U.S. Law to investigational use

Eustachian Tube IDE Study

– Completed Phase I of study (10 patients) – Currently enrolling for Phase 2 – Study limited to 70 patients and 7 investigators Entellus has Broadest Indication in Adolescents |

22 Entellus Medical May 2016 BSD Significantly Reduces Health Care Utilization and Activity Impairment BSD Significantly Reduces Health Care Utilization and Activity Impairment Rhinosinusitis Symptom Inventory (RSI) Healthcare Use

(Meta-analysis) 5.4 4.5 6.8 1.5 1.6 2.3 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 Acute infections Antibiotic courses Physician/nurse visits 12 Months before Tx 12 Months after Tx p <0.0001 p <0.0001 p <0.0001 N = 167 N =

165 N = 172 Reduces – Sinusitis episodes – Sinus infections – Antibiotic use – Physician visits – Homebound days – Daily activity impairment – Impairment while working |

23 Entellus Medical March 2016 Broad Reimbursement Broad Reimbursement Acceptance by many insurers has led to broad insurance coverage for balloon sinus dilation Major payors for standalone balloon sinus dilation include Medicare, Medicaid in 30 states, United Healthcare, Aetna, Cigna, Humana, Kaiser, TRICARE, Health Net, BCBS in 17 states Non-covering insurers include Anthem/WellPoint and other BCBS plans 79% 21% Stand-alone Balloon Dilation Covered Investigational 5/8/16 88% 12% Balloon Dilation During FESS Covered Investigational 5/816 |

24 Entellus Medical May 2016 Cost of FESS vs. Office Balloon Sinus Dilation Cost of FESS vs. Office Balloon Sinus Dilation Sinus Disease 2016 National Average Cost to Medicare BSD in Office FESS in Hospital FESS in ASC % FESS costs more than BSD: Hospital & ASC Maxillary + Ethmoid $3,356 $7,980 $5,075 138% & 51% Max + Frontal + Ethmoid $4,987 $11,830 $7,574 137% & 52% Max+Frontal+Sphen+Ethmoid $6,590 $15,323 $9,715 133% & 47% Office BSD is less costly to patients and the healthcare system than FESS in the OR, irrespective of the number of sinuses treated Costs include payments to physicians and facilities, plus cost of post-FESS debridement or post-BSD nasal

endoscopy. Ethmoidectomy

is performed with all FESS procedures. Costs are based on 2016

Medicare average reimbursement rates. |

25 Entellus Medical May 2016 Focused on Market Development Focused on Market Development 400+ * Peer training events 15,000+ * Views of Live Case Videos 140 Direct U.S. sales organization as of March 31, 2016 REMODEL Results up to 2 years show BSD is as effective as FESS while providing a superior patient experience *Based on 2015 internal company estimates Market Development Sales Rep Training Physician Training Physician Education Patient Education 20,000+ * Average visits per month to SinusSurgeryOptions.com 8,000+ * Patients using “Find-a- Doctor” tool each month on average Meta Analysis Highlights combined analysis of all 6 Entellus sponsored BSD studies. Shows positive results are consistent and clinically meaningful |

26 Entellus Medical May 2016 International Commercialization Underway International Commercialization Underway Worldwide regulatory approvals received Recently established direct sales team in the UK Indirect distribution efforts underway in Europe and Canada Initial cases commenced in June 2015 |

27 Entellus Medical May 2016 Revenue and Cash Snapshot Revenue and Cash Snapshot Quarterly Revenue YOY & Guidance Growth: 22% Growing Revenue Base – 2015: 26% growth – 2016E: 19 – 25% growth Expanding Account Base Cash position of $62M as of March 31, 2016 25% 27% 25% 17 - 24% 2015 vs 2014 2016 vs 2015 * * Guidance communicated on 5/4/16. The fact that the company includes these projections in this presentation should not be taken to mean that these comments continue to be the company’s projections as of any subsequent date.

$12.5M $15.2M $11.7M $13.5M $16.9M $15.2M $17.8M – $18.8M $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 Q2'14 Q2'15 Q3'14 Q3'15 Q4'14 Q4'15 Q1'15 Q1'16 Q2'15 Q2'16 E $14.8M $18.1M $14.6M |

28 Entellus Medical May 2016 Penetrate U.S. Market Grow Direct Sales Force Educate ENTs on clinical and economic value of office BSD Increase Payor Coverage Peer-to-peer initiatives Broaden Indications and Acceptance Pediatric indication Eustachian tube indication Mini-FESS Increase Patient Awareness Positioned For Growth Positioned For Growth Expand Internationally Complete product registrations Commercialize internationally Launched in Europe and Canada New Products Tailored to Office XprESS Ultra MiniFESS™ and FocESS™ Tools Fiagon Image Guidance System |