Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Citizens Independent Bancorp, Inc. | v439057_8k.htm |

Exhibit 99.1

CITIZENS INDEPENDENT BANCORP

AND

THE CITIZENS BANK OF LOGAN

SHAREHOLDERS’ ANNUAL MEETING

MAY 5, 2016

Forward Looking Statements

When used in this presentation, the words or phrases “believes,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project”, “will have”, “plan to” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties, including changes in economic conditions in the Company’s market area, changes in policies by regulatory agencies, fluctuations in interest rates, demand for loans in the Company’s market area, and competition that could cause actual results to differ materially from historical earnings and those presently anticipated or projected. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company advises readers that the factors listed above could affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake, and specifically disclaims any obligation, to release publicly the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

CITIZENS INDEPENDENT BANCORP

Year Over Year Pretax Net

Income

($000's)

| 2015 | 2014 | |||||||

| Net Interest Income | $ | 6,947 | $ | 6,819 | ||||

| Net Income Before Tax | $ | 886 | $ | 979 | ||||

THE CITIZENS BANK OF LOGAN

CITIZENS LOGAN vs OHIO PEERS

Selected Performance Ratios

| NAME | CITY | Assets | Earning Asset Yield | Cost of Funds | Net Interest Margin | Noncurr Assets +ORE to Assets | Noncurr. Loans to Loans | Loan to Deposit | Core Leverage Capital |

| Ohio Peers | |||||||||

| $100 million - $300 million | |||||||||

| December 31, 2015 * | Average | 170,016 | 4.12 | 0.48 | 3.64 | 1.08 | 1.46 | 82.00 | 12.46 |

| Median | 152,976 | 4.10 | 0.46 | 3.55 | 0.73 | 0.88 | 81.90 | 10.58 |

| Citizens Bank of Logan | 12/31/13 | 201,191 | 4.75 | 0.79 | 3.96 | 4.95 | 5.30 | 76.80 | 6.04 |

| 12/31/14 | 199,725 | 4.54 | 0.64 | 3.91 | 4.41 | 5.29 | 79.70 | 8.11 | |

| 12/31/15 | 181,615 | 4.69 | 0.51 | 4.18 | 0.87 | 0.91 | 90.50 | 8.23 | |

| 03/31/16 | 177,411 | 4.96 | 0.44 | 4.53 | 0.51 | 0.62 | 92.60 | 8.67 |

| 3 |

THE CITIZENS BANK OF LOGAN

SEVERAL WAYS TO LOOK AT OUR LOAN HISTORY

| 4 |

THE CITIZENS BANK OF LOGAN

A HISTORY OF OUR LOAN QUALITY

| 12/31/13 | 06/30/14 | 12/31/14 | 06/30/15 | 12/31/15 | 03/31/16 | |||||

| Nonperforming Loans | $ | 7,788,344 | $ | 7,864,446 | $ | 7,729,408 | $ | 1,765,783 | $ 1,349,954 | $ 908,276 |

| Classified Loans | $ | 8,600,169 | $ | 8,717,321 | $ | 9,725,106 | $ | 6,130,992 | $ 7,606,092 | $ 6,653,400 |

| Criticized Loans | $ | 23,627,542 | $ | 18,119,064 | $ | 15,154,407 | $ | 9,828,158 | $ 9,248,078 | $ 7,799,990 |

Nonperforming Loan - a loan that is in default or close to being in default.

Classified Loan - a loan that is in danger of default, but not yet at the nonperforming level. Classified loans have unpaid interest and principal outstanding, and it is unclear whether the bank will be able to recoup the loan proceeds from the borrower.

Criticized Loan - a loan with payments in arrears and for which payment is considered uncertain. Criticized loans include classified loans.

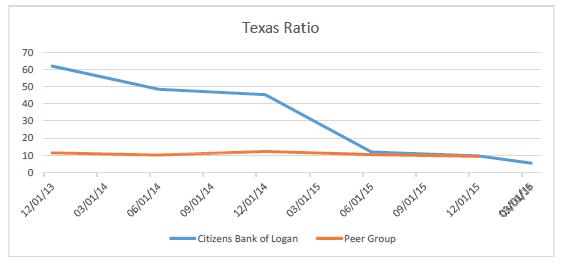

Texas Ratio

| 12/31/13 | 06/30/14 | 12/31/14 | 06/30/15 | 12/31/15 | 03/31/16 | |

| Citizens Bank of Logan | 61.9 | 48.4 | 45.3 | 11.9 | 9.7 | 5.4 |

| Peer Group | 11.4 | 10.2 | 12.2 | 10.4 | 9.3 |

Texas Ratio is Non-performing Assets + OREO divided by Loan Loss Reserve + Equity

Texas ratio is a measure of a bank's credit troubles. The higher the Texas ratio, the more severe the credit troubles.

| 5 |

CITIZENS INDEDPENDENT BANCORP

The Holding Company Has Debts to Pay

Where we were last year

December 31, 2014

| Principal | Rate | Maturity |

| $ 5,000,000 | 8.00% | 12/29/15 Note AB |

| 485,132 | 4.25% | 06/25/19 Note S |

| 662,370 | 4.75% | 11/21/19 Note M |

| $ 6,147,502 |

Annual Interest Expense: $ 455,548

Where we are now

December 31, 2015

| Principal | Rate | Maturity |

| 384,695 | 4.25% | 06/25/19 Note S |

| 539,844 | 4.75% | 11/21/19 Note M |

| $ 1,644,547 | 6.00% | 08/04/21 Note B |

| $ 2,569,086 |

Annual Interest Expense: $ 334,442

Where we plan to be

December 31, 2016

| Principal | Rate | Maturity |

| 280,242 | 4.25% | 06/25/19 Note S |

| 411,337 | 4.75% | 11/21/19 Note M |

| $ - | 6.00% | 08/04/21 Note B |

| $ 691,579 |

Estimated Annual Interest Expense: $ 59,811

| 6 |

COST SAVINGS INITIATIVES HELP DRIVE PROFITABILITY

ESTIMATED TWELVE MONTH SAVINGS OF CURRENT INITIATIVES

| $145,000 | Renegotiated the IMG contract under which Citizens Bank was "The Bank of the Bobcats". The Bank was never able to fully utilize the benefits of this arrangement. Current management renegotiated the terms of the contract, saving the bank over $12,000 per month through the life of the contract. |

| $150,000 | Balances of OREO properties, those properties securing loans which the bank has foreclosed and plans to sell in satisfaction of unpaid loans, have fallen from $2.8 million at the end of 2012 to a level of $0 at March 31, 2016. The drop in these OREO properties, accompanied by the improved asset quality, leads to an estimated savings in legal expenses of $150,000 per year. |

| $430,000 | Branch utilization and profitability studies have indicated the Bank could no longer afford to support the Walmart Athens and Nelsonville branches. The Walmart Athens branch was closed in September of last year and the Nelsonville branch is scheduled to close in July of this year. Additional analysis has shown that the Walmart Logan and Mall branches can be replaced by a new, high efficiency, branch at the Rt. 664 roundabout. Cost savings related to these initiatives are substantial. |

| $170,000 | We anticipate future savings in accounting and legal fees. The improved health of the Bank has resulted in lower insurance premiums. An extensive employee training and education program will allow Bank employees to perform several tasks currently done by outside consultants. |

| 7 |

CITIZENS INDEPENDENT BANCORP

| History of the Main Office | |

| 1969 | Main Office Building Constructed |

| 1992 | Expansion Added to Back of Building |

| 1992 – 2015 | Minimal Dollars Spent on Building Improvements |

| 2015 – 2016 | Main Office Refurbished and Upgraded |

| Our Offices Must Convey the Proper Image |

| $ 205,812 | Cost of Upgrades and Improvements to Date |

| Accounting Rules Lessen the Financial Impact of Upgrades and Improvements |

| $ 1,157.12 | Monthly Depreciation Expense |

| $ 750.00 | AEP Estimated Electric Savings Due to LED Lighting |

| $ 407.12 | Net Monthly Expense |

| 8 |