Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BROADWIND, INC. | exh_991.htm |

| 8-K - FORM 8-K - BROADWIND, INC. | f8k_042816.htm |

EXHIBIT 99.2

Q1 2016 Earnings Conference Call April 28, 2016

Industry Data and Forward-Looking Statements Disclaimer ▪ Broadwindobtained the industry and market data used throughout this presentation from our own research, internal surveys and studies conducted by third parties, independent industry associations or general publications and other publicly available information. Independent industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy or completeness of such information. Forecasts are particularly likely to be inaccurate, especially over long periods of time. We are not aware of any misstatements in the industry data we have presented herein, but estimates involve risks and uncertainties and are subject to change based on various factors beyond our control. ▪ This presentation contains “forward-looking statements”—that is, statements related to future, not past, events—as defined in Section21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities, as well as assumptions made by, and information currently available to, our management. Forward-looking statements include any statement that does not directly relate to a current or historical fact. We have tried toidentify forward-looking statements by using words such as “anticipate,” “believe,” “expect,” “intend,” “will,” “should,” “may,” “plan” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. Our forward-looking statements may include or relate to the following: (i)our expectations relating to state, local and federal regulatory frameworks affecting the industries in which we compete, including the wind energy industry, and the related extension, continuation or renewal of federal tax incentives and grants and state renewable portfolio standards; (ii) our expectations with respect to our customer relationships and efforts to diversify our customer base and sector focus and leverage customer relationships acrossbusiness units; (iii)our plans to continue to grow our business organically; (iv)our beliefs with respect to the sufficiency of our liquidity and our plans toevaluate alternate sources of funding if necessary; (v)our plans and assumptions, including estimated costs and saving opportunities, regarding our restructuring efforts; (vi)our beliefs regarding our ability to realize revenue from customer orders and backlog; (vii)our beliefs regarding our ability to operate our business efficiently, manage capital expenditures and costs effectively, and generate cash flow; (viii)our beliefs and expectations relating to the economy and the potential impact it may have on our business, including our customers; (ix)our beliefs regarding the state of the wind energy market and other energy and industrial markets generally and the impact of competition and economic volatility in those markets; (x)our beliefs and expectations relating to the effects of market disruptions and regular market volatility, including fluctuations in the price of oil, gas and other commodities; and (xi) our beliefs regarding the potential loss of tax benefits if we experience an “ownership change” under Section382 of the Internal Revenue Code of 1986, as amended. Thesestatements are based on information currently available to us and are subject to various risks, uncertainties and other factors that could cause our actual growth, results of operations, financial condition, cash flows, performance, business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. We are under no duty to update any of these forward-looking statements after the date of this release to conform such statements to actual results. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. ▪ This presentation contains non-GAAP financial information. Webelieve that certain non-GAAP financial measures may provide users of this financial information with meaningful comparisons between current results and results in prior operating periods. We believe that thesenon-GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a comparison of historical information that excludes certain infrequently occurring or non-operational items that impact the overall comparability. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to, our reported results prepared in accordance with GAAP. Please see our earnings release dated April 28, 2016 for a reconciliation of certain non-GAAP measures presented in this presentation. 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 2

Q1 2016 Highlights ▪Booked $39M net new orders in Q1 2016, nearly double Q1 2015 ▪Tower units sold increased 15% compared to Q1 2015 ▪Gross Profit of $4M in Q1 2016, increased 290 basis points from Q1 2015 ▪Operating Loss narrowed to $.2M in Q1 2016, adj. EBITDA $1.7M ▪Cash and short-term investments increased to $15M; credit line remains undrawn 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 3

Progress on Priorities 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 4 ▪Double Order Intake xQ1 2016 orders totaled $39M vs. $22M in Q1 2015 ▪Maintain Consistent Tower Production xBoth plants operating at plant design rate ▪Aggressively Manage Costs xFOH reduced $1.1M compared to Q1 2015 xOperating expenses reduced $.9M compared to Q1 2015

Market Update ▪Wind Energy – Industry outlook unchanged –strong installations through 2019 ▪Gearing – Weak demand expected through at least mid-2016, especially oil & gas, field equipment – After market wind gearing remains a bright spot –wind turbine lives are extending out ▪CNG – New station installations dropped sharply with oil price collapse (from 224 stations in 2014 to 47 in 2015) – Current diesel : CNG fuel spread very low –conversion economics tied to incentives and longer-term oil outlook 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 5

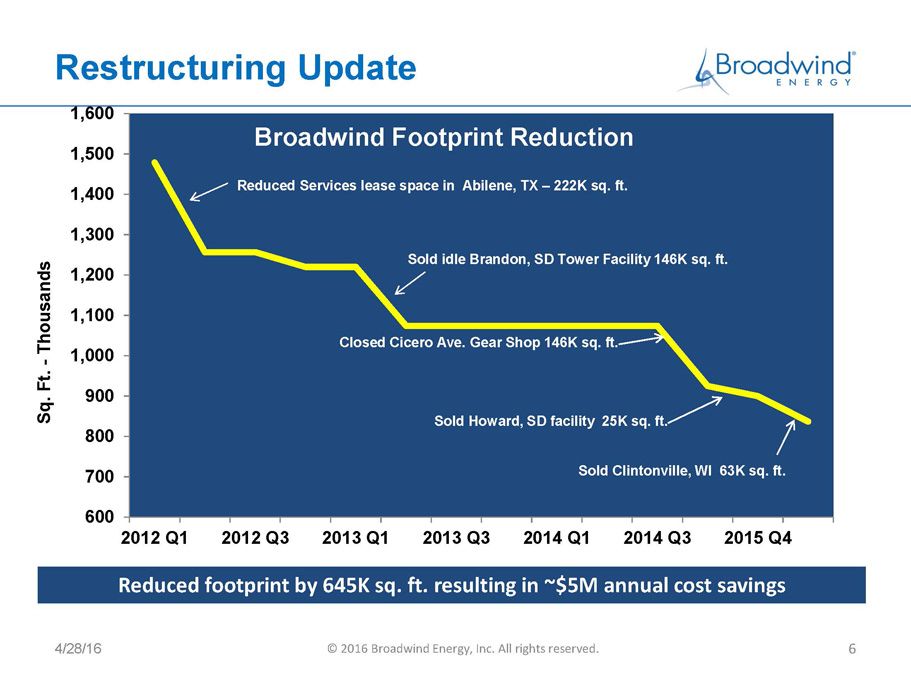

Restructuring Update 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 6 600 700 800 900 1,000 1,100 1,200 1,300 1,400 1,500 1,600 2012 Q1 2012 Q3 2013 Q1 2013 Q3 2014 Q1 2014 Q3 2015 Q4 S q . F t . - T h o u s a n d s BroadwindFootprint Reduction Sold idle Brandon, SD Tower Facility 146K sq. ft. Closed Cicero Ave.Gear Shop 146K sq. ft. Sold Howard, SD facility 25K sq. ft. Sold Clintonville, WI 63K sq. ft. Reduced Services lease space in Abilene, TX –222K sq. ft. Reduced footprint by 645K sq. ft. resulting in ~$5M annual cost savings

Orders and Backlog Orders –$M ▪$35M of new tower orders in Q1 2016, up significantly from Q1 2015 ▪Gearing orders down vs. PY –lower oil & gas orders and timing of large wind gearing order Order Backlog –$M ▪Ending backlog $86.0M ▪~ 6 months of projected 2016 shipments included in backlog ▪General reduction in order lead times and lower steel pricing contributing to lower backlog Q1 2015 Q1 2016 % Change Book : Bill Towers & Weldments 11.8 35.4 201% .84 Gearing 9.9 3.5 (64%) .74 Total 21.7 39.0 80% .83 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 7 - 50 100 150 200 250 300 350 M i l l i o n s Record-high backlog; Tower orders placed ahead of PTC expiration

- 2 4 6 8 10 12 14 16 Liquidity 4/28/16 © 2016 BroadwindEnergy, Inc. All rights reserved. 8 ▪Inventory declined $5M in Q1 2016 ▪Operating working capital declined $2M, to 4% of annualized sales, in Q1 2016 driven primarily by decrease in raw materials ▪Outstanding debt at 3/31/16 totaled $5.2M, including $2.6M New Markets Tax Credit financing ▪Cash and short-term investments >$15M and LOC undrawn Inventory Operating Working Capital* ¢/$ Sales *Operating Working Capital = Trade A/R + Inventories –Trade Payables –Customer Deposits - 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 Raw Materials WIP Finished Goods

Consolidated Financial Results 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 9 ▪Sales down 5%; Towers and Weldments +2%, Gearing -45% ▪Gross margin, profit and EPS increases all due primarily to significantly improved operating efficiencies at Abilene, TX tower plant, reduced depreciation and $2M reduction in fixed overhead and operating expenses * Reconciliation to non-GAAP measure included in Appendix 2015 2016 Revenue-$M 49.2$ 46.8$ Gross Profit-$M 2.7 4.0 -% (ex. Restructuring) 5.6% 8.5% Operating Expense-$M 5.1 4.2 -% (ex. Restructuring) 10.4% 9.0% Operating Income(Loss)-$M (2.4) (0.2) Adj. EBITDA-$M 0.2 1.7 EPS, Continuing Operations (0.17) (0.02) Memo: NI including Disc. Operations (5.0) (0.4) Q1

Towers and Weldments Q1 2015 Q1 2016 FY 2015 Orders ($M) $11.8 $35.4 $69.1 Towers Sold (#) 103 119 450 Revenue ($M) 41.0 42.0 170.9 Operating Income($M) 1.1 3.2 4.7 -% of Sales 2.8% 7.7% 2.8% EBITDA* ($M) 2.2 4.3 9.5 -% of Sales 5.3% 10.1% 5.6% Q1 Results ▪Towers sold up 15% vs. Q1 2015 – Abilene operating efficiencies ▪Q1 Revenue up 2% vs. Q1 2015 – volume increase partly offset by $4M reduction in steel content ▪Operating Income more than doubled Q1 2015 ▪First CNG unit delivered 2016 Objectives ▪Sell remaining 2016-17 tower capacity; build and diversify Weldments backlog ▪Reduce tower production cost through improved welding and paint productivity ▪Improve management of tower model changeovers ▪Phase I of Paint Investment 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 10 0 100 200 300 400 500 2012 2013 2014 2015 # o f T o w e r s Annual Tower Sales * Reconciliation to non-GAAP measure included in Appendix

Gearing Q1 2015 Q1 2016 FY 2015 Orders ($M) $9.9 $3.5 $24.9 Revenue ($M) 8.6 4.8 29.6 Operating Loss ($M) -1.2 -1.2 -8.2 EBITDA* ($M) 0.1 -0.5 -2.1 Q1 Results ▪Orders down vs. Q1 2015 –wind down $3.2M (order timing), oil & gas orders down $1.2M ▪Revenue down significantly –oil & gas and mining down ▪Operating Loss flat on significantly lower revenue –cost management and lower depreciation both contributed 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 11 2016 Objectives ▪Continue cross-training to improve labor productivity ▪Continue aggressive cost management ▪Expand sales efforts to improve capacity utilization * Reconciliation to non-GAAP measure included in Appendix Source: AGMA Coarse Pitch Gearing

Summary 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 12 ▪Tower production stabilized ▪Gearing continues to manage well through oil & gas and mining downturn; savings from consolidation in effect, aggressive cost management continues ▪Cost reduction and continuous improvement remain primary focus areas ▪Q2 Outlook: $42-44M Revenue, small operating loss consistent with Q1 2016

Appendix –Non-GAAP Financial Measure Non-GAAP Financial Measure The Company provides non-GAAP adjusted EBITDA (earnings before interest, income taxes, depreciation, amortization, and stock compensation) as supplemental information regarding the Company’s business performance. The Company believes that this non-GAAP financial measureis useful to investors because it provides investors with a better understanding of the Company’s past financial performance and future results. The Company’s management uses adjusted EBITDA when it internally evaluates the performance of the Company’s business, reviews financial trendsand makes operating and strategic decisions. The Company believes that providing this non-GAAP financial measure to its investors is useful because it allows investors to evaluate the Company’s performance using the same methodology and information as the Company’s management. The Company's definition of adjusted EBITDA may be different from similar non-GAAP financial measures used by other companies and/or analysts. 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 13 Towers and Weldments Segment 2016 2015 Operating Profit……………………………………………….. 3,241$ 1,135$ Depreciation………………………………………………………. 966 915 Share-based Compensation and Other Stock Payments………………………………………………………………38 15 Other Income ………………..………………………………………….. 12 110 Restructuring Expense…………………………… (17) Adjusted EBITDA (Non-GAAP)…………………… 4,257$ 2,158$ Three Months Ended March 31, Gearing Segment 2016 2015 Operating (Loss)….………………………………………………………(1,202)$ (1,211)$ Depreciation………………………………………………………… 528 1,185 Amortization………………………………………………………….. 111 111 Share-based Compensation and Other Stock Payments………………………………………………………………48 62 Adjusted EBITDA (Non-GAAP)…………………. (515)$ 147$ Three Months Ended March 31, Consolidated 2016 2015 Operating (Loss) ………………………………………………………………(224)$ (2,364)$ Depreciation and Amortization………………………………………………………………1,657 2,256 Share-based Compensation and Other Stock Payments………………………………………………………………259 255 Other Income…………………………………………………... 12 110 Restructuring Expense…………………………………………………... - (17) Adjusted EBITDA……………………………………………………………… Adjusted EBITDA (Non-GAAP)………………… 1,704$ 240$ Three Months Ended March 31, Corporate and Other 2016 2015 Operating (Loss)….………………………………………………………(2,263)$ (2,288)$ Depreciation………………………………………………………. 52 46 Share-based Compensation and Other Stock Payments………………………………………………………………173 178 Adjusted EBITDA (Non-GAAP)………………… (2,038)$ (2,064)$ Three Months Ended March 31,

Click to edit Master title style ▪ Click to edit Master text styles –Second level • Third level – Fourth level » Fifth level Broadwind Energy is committed to helping customers maximize performance of their energy and infrastructure investments— quicker, easier and smarter. 4/28/16 © 2016 Broadwind Energy, Inc. All rights reserved. 14