Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Fifth Street Asset Management Inc. | v437525_8k.htm |

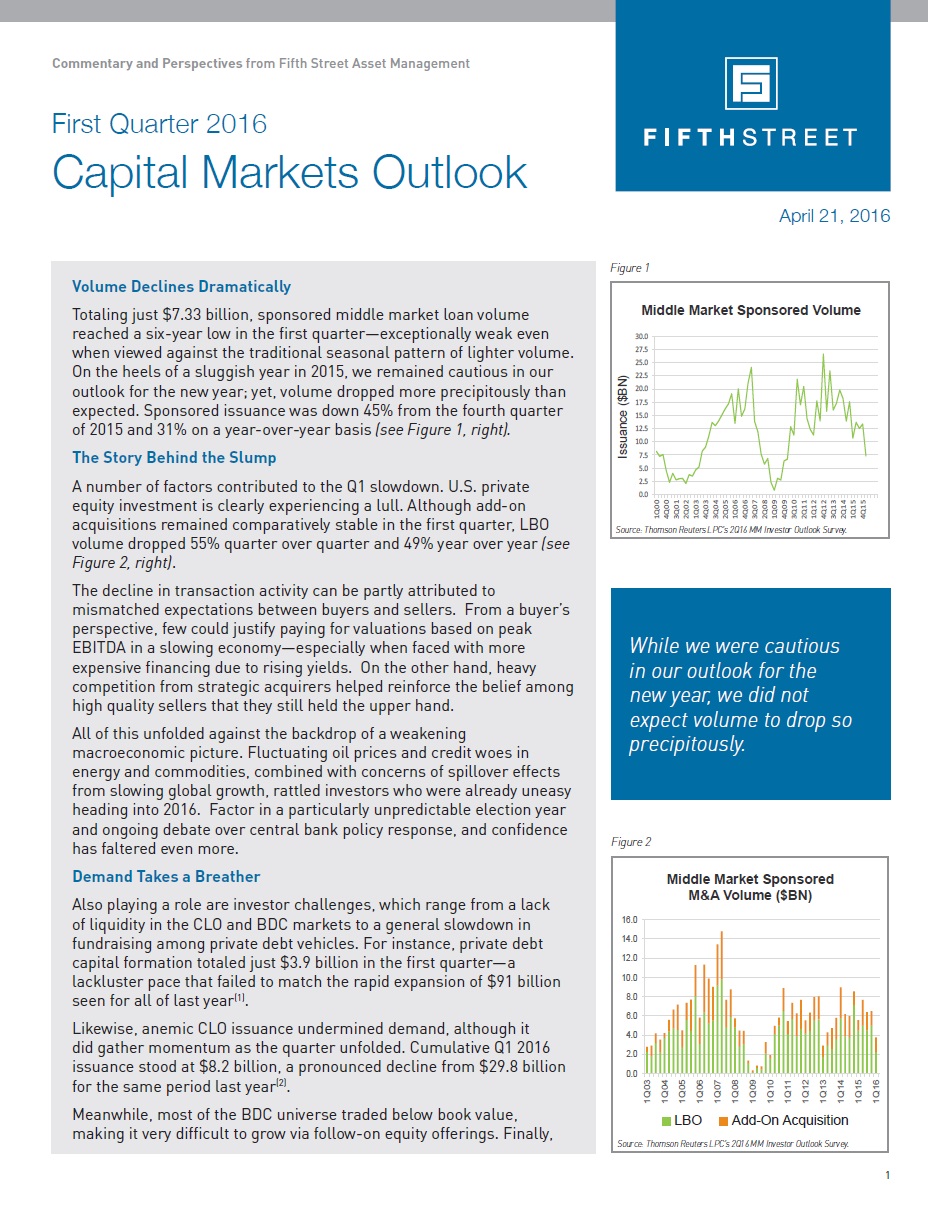

Figure 2 Volume Declines Dramatically Totaling just $7.33 billion, sponsored middle market loan volume reached a six-year low in the first quarter—exceptionally weak even when viewed against the traditional seasonal pattern of lighter volume. On the heels of a sluggish year in 2015, we remained cautious in our outlook for the new year; yet, volume dropped more precipitously than expected. Sponsored issuance was down 45% from the fourth quarter of 2015 and 31% on a year-over-year basis (see Figure 1, right). The Story Behind the Slump A number of factors contributed to the Q1 slowdown. U.S. private equity investment is clearly experiencing a lull. Although add-on acquisitions remained comparatively stable in the first quarter, LBO volume dropped 55% quarter over quarter and 49% year over year (see Figure 2, right). The decline in transaction activity can be partly attributed to mismatched expectations between buyers and sellers. From a buyer’s perspective, few could justify paying for valuations based on peak EBITDA in a slowing economy—especially when faced with more expensive financing due to rising yields. On the other hand, heavy competition from strategic acquirers helped reinforce the belief among high quality sellers that they still held the upper hand. All of this unfolded against the backdrop of a weakening macroeconomic picture. Fluctuating oil prices and credit woes in energy and commodities, combined with concerns of spillover effects from slowing global growth, rattled investors who were already uneasy heading into 2016. Factor in a particularly unpredictable election year and ongoing debate over central bank policy response, and confidence has faltered even more. Demand Takes a Breather Also playing a role are investor challenges, which range from a lack of liquidity in the CLO and BDC markets to a general slowdown in fundraising among private debt vehicles. For instance, private debt capital formation totaled just $3.9 billion in the first quarter—a lackluster pace that failed to match the rapid expansion of $91 billion seen for all of last year(1). Likewise, anemic CLO issuance undermined demand, although it did gather momentum as the quarter unfolded. Cumulative Q1 2016 issuance stood at $8.2 billion, a pronounced decline from $29.8 billion for the same period last year(2). Meanwhile, most of the BDC universe traded below book value, making it very difficult to grow via follow-on equity offerings. Finally, First Quarter 2016 Capital Markets Outlook Commentary and Perspectives from Fifth Street Asset Management While we were cautious in our outlook for the new year, we did not expect volume to drop so precipitously. April 21, 2016 Figure 1 Middle Market Sponsored Volume Issuance ($BN) Middle Market Sponsored M&A Volume ($BN) 1 0.0 2.5 5.0 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 27.5 30.0 1Q00 4Q00 3Q01 2Q02 1Q03 4Q03 3Q04 2Q05 1Q06 4Q06 3Q07 2Q08 1Q09 4Q09 3Q10 2Q11 1Q12 4Q12 3Q13 2Q14 1Q15 4Q15 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 1Q03 1Q04 1Q05 1Q06 1Q07 1Q08 1Q09 1Q10 1Q11 1Q12 1Q13 1Q14 1Q15 1Q16 LBO L B O AddAd-dO-onn a Acqcuiqsituionisition Source: Thomson Reuters LPC’s 2Q16 MM Investor Outlook Survey. Source: Thomson Reuters LPC’s 2Q16 MM Investor Outlook Survey.

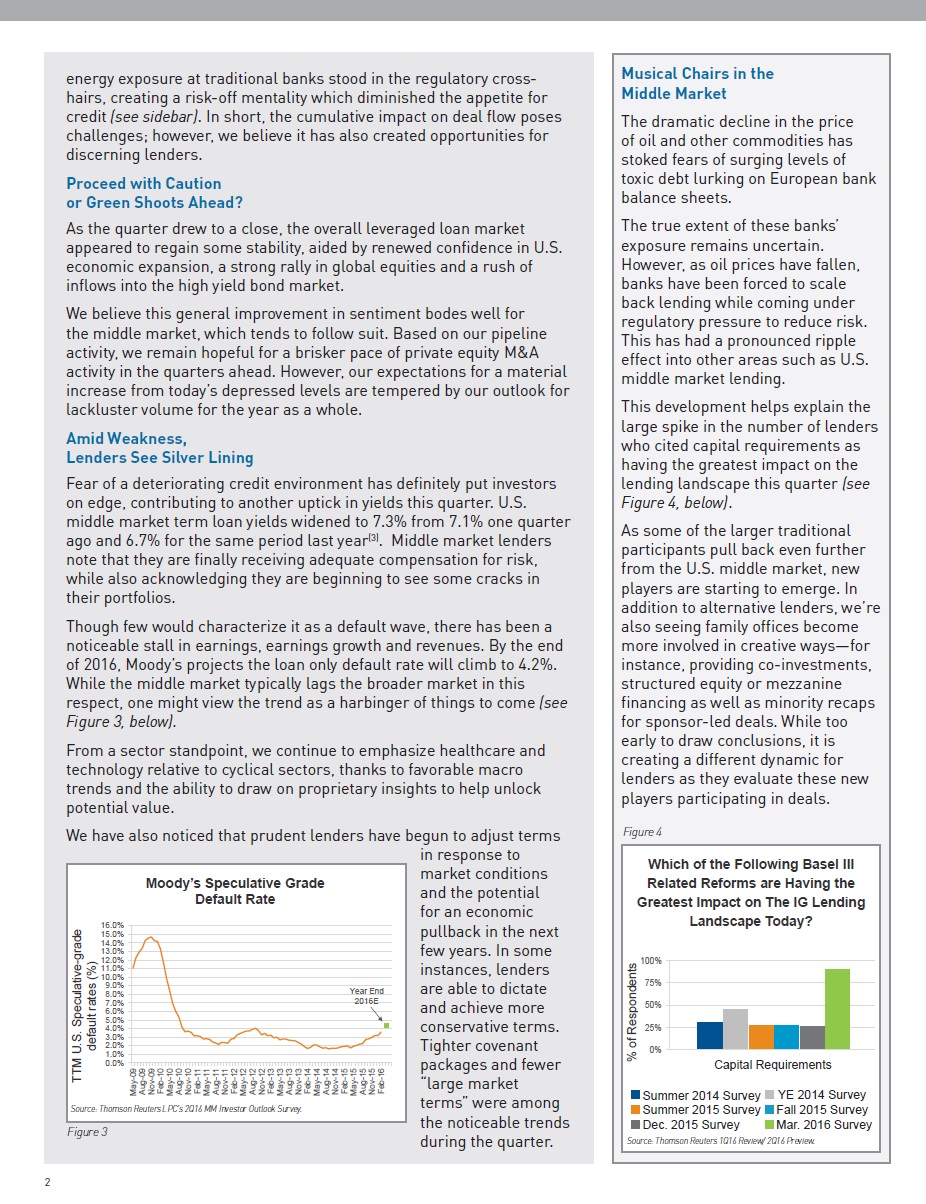

energy exposure at traditional banks stood in the regulatory crosshairs, creating a risk-off mentality which diminished the appetite for credit (see sidebar). In short, the cumulative impact on deal flow poses challenges; however, we believe it has also created opportunities for discerning lenders. Proceed with Caution or Green Shoots Ahead? As the quarter drew to a close, the overall leveraged loan market appeared to regain some stability, aided by renewed confidence in U.S. economic expansion, a strong rally in global equities and a rush of inflows into the high yield bond market. We believe this general improvement in sentiment bodes well for the middle market, which tends to follow suit. Based on our pipeline activity, we remain hopeful for a brisker pace of private equity M&A activity in the quarters ahead. However, our expectations for a material increase from today’s depressed levels are tempered by our outlook for lackluster volume for the year as a whole. Amid Weakness, Lenders See Silver Lining Fear of a deteriorating credit environment has definitely put investors on edge, contributing to another uptick in yields this quarter. U.S. middle market term loan yields widened to 7.3% from 7.1% one quarter ago and 6.7% for the same period last year(3). Middle market lenders note that they are finally receiving adequate compensation for risk, while also acknowledging they are beginning to see some cracks in their portfolios. Though few would characterize it as a default wave, there has been a noticeable stall in earnings, earnings growth and revenues. By the end of 2016, Moody’s projects the loan only default rate will climb to 4.2%. While the middle market typically lags the broader market in this respect, one might view the trend as a harbinger of things to come (see Figure 3, below). From a sector standpoint, we continue to emphasize healthcare and technology relative to cyclical sectors, thanks to favorable macro trends and the ability to draw on proprietary insights to help unlock potential value. We have also noticed that prudent lenders have begun to adjust terms in response to market conditions and the potential for an economic pullback in the next few years. In some instances, lenders are able to dictate and achieve more conservative terms. Tighter covenant packages and fewer “large market terms” were among the noticeable trends during the quarter. Musical Chairs in the Middle Market The dramatic decline in the price of oil and other commodities has stoked fears of surging levels of toxic debt lurking on European bank balance sheets. The true extent of these banks’ exposure remains uncertain. However, as oil prices have fallen, banks have been forced to scale back lending while coming under regulatory pressure to reduce risk. This has had a pronounced ripple effect into other areas such as U.S. middle market lending. This development helps explain the large spike in the number of lenders who cited capital requirements as having the greatest impact on the lending landscape this quarter (see Figure 4, below). As some of the larger traditional participants pull back even further from the U.S. middle market, new players are starting to emerge. In addition to alternative lenders, we’re also seeing family offices become more involved in creative ways—for instance, providing co-investments, structured equity or mezzanine financing as well as minority recaps for sponsor-led deals. While too early to draw conclusions, it is creating a different dynamic for lenders as they evaluate these new players participating in deals. TTM U.S. Speculative-grade default rates (%) Moody’s Speculative Grade Default Rate Which of the Following Basel III Related Reforms are Having the Greatest Impact on The IG Lending Landscape Today? % of Respondents Figure 4 Figure 3 2 0% 25% 50% 75% 100% Capital requirements Summer 2014 Survey YE 2014 Survey Summer 2015 Survey Fall 2015 Survey Dec. 2015 Survey Mar. 2016 Survey Summer 2014 Survey Summer 2015 Survey Dec. 2015 Survey YE 2014 Survey Fall 2015 Survey Mar. 2016 Survey 0.0% Capital Requirements 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% May-09 Aug-09 Nov-09 Feb-10 May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11 Nov-11 Feb-12 May-12 Aug-12 Nov-12 Feb-13 May-13 Aug-13 Nov-13 Feb-14 May-14 Aug-14 Nov-14 Feb-15 May-15 Aug-15 Nov-15 Feb-16 Year End 2016E Source: Thomson Reuters LPC’s 2Q16 MM Investor Outlook Survey. Source: Thomson Reuters 1Q16 Review/ 2Q16 Preview.

Sponsors Gravitate to Unitranche A subdued environment and ongoing credit woes are also having an impact on structure. Prudent middle market lenders like Fifth Street are continuing to adopt defensive positions, moving up the capital stack into first lien, higher priority assets. From a sponsor standpoint, the unitranche structure seems to have become even more popular. The surge can likely be traced to heightened uncertainty combined with an uptick in senior pricing and a fall-off in second lien volume. With a risk-off mode prevailing for much of the quarter, second lien issuance was anemic, totaling only $47.5 million—a level not seen since Q1 2010 (see Figure 5, below). In some instances, the unitranche structure is favored by sponsors who want to circumvent the auction process entirely. In these cases, sponsors are approaching lenders to get a deal done expeditiously without attracting the kind of attention that could prompt a bidding war. Heightened uncertainty has also inured to the benefit of lenders with deep private equity relationships and the wherewithal to hold larger positions. These select lenders are gaining ground as sponsors are increasingly shifting away from “underwrite to syndicate” solutions and toward “buy and hold” solutions with their most trusted debt providers. This helps explain the increasing number of “pari passu” unitranches, and the decrease in first out/last out structures. Too Early For Energy With oil prices strengthening over the quarter, we see some lenders considering increasing their portfolio exposure. In fact, oil and gas loan bids regained a small piece of lost territory, closing the quarter just below 60, up 5 points from February’s low point(2). However, as we noted last quarter, we continue to believe that energy has further downside potential and has not yet reached a bottom. While rig count has declined in the U.S., we believe oil producers like Saudi Arabia and Iran have yet to reconcile their disparate views on supply. For instance, Iran has not yet agreed to take part in the current freeze under discussion. In our view, the oil issue has devolved into a case of each side waiting for the other to blink first. With oversupply being a key driver behind today’s depressed oil price levels, it’s difficult for us to foresee stabilization until these two major players set aside their regional rivalry and agree to work together to reassert a balance. That said, an additional 1.2 million barrels of demand is expected to come on this year. When coupled with a potential reduction of 800,000 barrels of supply in the U.S., output may stabilize this fall. Fifth Street Asset Management 3 Issuance ($BN) Middle Market Second Lien Issuance Figure 5 “With a risk-off mode prevailing for much of the quarter, second lien issuance was anemic, totaling only $47.5 million—a level not seen since Q1 2010.” “Heightened uncertainty has also inured to the benefit of lenders with deep private equity relationships and the wherewithal to hold larger positions.” Source: Thomson Reuters LPC (4/8/16). 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 1Q03 3Q03 1Q04 3Q04 1Q05 3Q05 1Q06 3Q06 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 3Q14 1Q15 3Q15 1Q16

www.fifthstreetfinance.com Copyright © Fifth Street Management LLC. All Rights Reserved. Robyn Friedman, Executive Director, Head of Investor Relations rfriedman@fifthstreetfinance.com I (203) 681-3723 Fifth Street Asset Management Inc. (NASDAQ:FSAM) is a nationally recognized credit-focused asset manager. The firm has over $5 billion of assets under management across two publicly-traded business development companies, Fifth Street Finance Corp. (NASDAQ:FSC) and Fifth Street Senior Floating Rate Corp. (NASDAQ:FSFR), as well as multiple private investment vehicles. The Fifth Street platform provides innovative and customized financing solutions to small and mid-sized businesses across the capital structure through complementary investment vehicles and co-investment capabilities. With over an 18- year track record focused on disciplined credit investing across multiple economic cycles, Fifth Street is led by a seasoned management team that has issued billions of dollars in public equity, private capital and public debt securities. Fifth Street’s national origination strategy, proven track record and established platform are supported by approximately 65 professionals across locations in Greenwich and Chicago. (1) Preqin Q1 2016 Private Capital Fundraising Update. I (2) Thomson Reuters LPC’s Leveraged Loan Monthly - March 2016. I (3) Thomson Reuters LPC’s 2Q16 MM Investor Outlook Survey. DISCLAIMER: Statements included herein about the middle market lending environment are based on observations made by Fifth Street deal professionals and were corroborated by Thomson Reuters LPC survey data and Preqin. Some of the statements included herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events and/or Fifth Street Asset Management Inc.’s (“Fifth Street”) future performance or financial condition. Words such as “believes,” “expects,” “seeks,” “plans,” “should,” “estimates,” “project,” and “intend” indicate forwardlooking statements. These statements are based on certain assumptions about future events or conditions and involve a number of risks and uncertainties. These statements are not guarantees of future performance, condition or results. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in our filings with the SEC. The information contained in this article is summary information that is intended to be considered in the context of Fifth Street’s SEC filings and other public announcements that Fifth Street may make, by press release or otherwise, from time to time. Fifth Street undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this article, except as required by law. These materials contain information about Fifth Street, its affiliated funds (including Fifth Street Finance Corp. and Fifth Street Senior Floating Rate Corp.) and general information about the market. You should not view information related to the past performance of Fifth Street and its affiliated funds or information about the market as indicative of future results, the achievement of which cannot be assured. Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Fifth Street or its affiliates or as legal, accounting or tax advice. None of Fifth Street, its affiliated funds or any affiliate of Fifth Street or its affiliated funds makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates, projections and targets and involves significant elements of subjective judgment and analysis. No representations are made as to the accuracy of such estimates, projections or targets or that all assumptions relating to such estimates, projections or targets have been considered or stated or that such estimates, projections or targets will be realized. This article is not intended to be an offer to sell, or the solicitation of an offer to purchase, any security (including Fifth Street Asset Management or its affiliates, Fifth Street Finance Corp. or Fifth Street Senior Floating Rate Corp.), the offer and/or sale of which can only be made by definitive offering documentation. Any other solicitation with respect to any securities that may be issued by Fifth Street or its affiliates will be made only by means of definitive offering memoranda or prospectus (as applicable), which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment. 4 The Table is Set for Good Vintage Due to broader market volatility and uncertainty, we have noticed a widening of spreads in the middle market, creating opportunities for strong riskadjusted returns. As a result, we have been able to find attractive pricing at the higher end of the capital structure for select deals and look forward to continuing to invest in this more lender friendly environment. As previously mentioned, we believe that lenders with flexible, long term capital will look back favorably on the vintages of 2016 and 2017 similarly to those of 2009 and 2010. Relationships Mean More Than Ever Despite a slower quarter, Fifth Street remains well positioned on several fronts. In times of uncertainty, relationships come to the fore. We are proud to be one of the premier lending partners to sponsors in the middle market due to the quality and breadth of our platform, relationships and people. Fifth Street is also widely recognized for our unitranche specialty, with the ability to hold loans up to $250 million on our balance sheet. In these times, our top sponsors have been relying on us even more to delve deeply into each transaction and find creative ways to ensure their timely and effective completion. For sponsors, experience also counts. Lenders like Fifth Street—who have successfully navigated past economic cycles and demonstrated a steadfast willingness to support sponsors and their portfolio companies through growth phases as well as setbacks— top their shortlist. As always, our main priority remains supporting our sponsors and deepening those relationships by showing both flexibility and strength. Fifth Street Activity