Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Fifth Street Asset Management Inc. | fsam-ex322_2017033110xq.htm |

| EX-32.1 - EXHIBIT 32.1 - Fifth Street Asset Management Inc. | fsam-ex321_2017033110xq.htm |

| EX-31.2 - EXHIBIT 31.2 - Fifth Street Asset Management Inc. | fsam-ex312_2017033110xq.htm |

| EX-31.1 - EXHIBIT 31.1 - Fifth Street Asset Management Inc. | fsam-ex311_2017033110xq.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-Q

(Mark One)

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) | ||

OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

For the quarterly period ended March 31, 2017

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) | ||

OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

COMMISSION FILE NUMBER: 001-36701

Fifth Street Asset Management Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

DELAWARE | 46-5610118 | |

(State or jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

777 West Putnam Avenue, 3rd Floor Greenwich, CT | 06830 | |

(Address of principal executive office) | (Zip Code) | |

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

(203) 681-3600

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods as the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company þ | |||

(Do not check if a smaller reporting company) | ||||||

Emerging growth company þ | ||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act þ | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) YES ¨ NO þ

The number of shares of the registrant's Class A common stock, par value $0.01 per share, outstanding as of May 15, 2017 was 15,576,620. The number of shares of the registrant's Class B common stock, par value $0.01 per share, outstanding as of May 15, 2017 was 34,285,484.

TABLE OF CONTENTS

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934 as amended (the "Exchange Act"), that reflect our current views with respect to, among other things, future events and financial performance. Words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of those words or other comparable words indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements in this Quarterly Report on Form 10-Q are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. Our actual results may vary materially from those indicated in these forward-looking statements, including as a result of the factors described under "Risk Factors" in this Quarterly Report on Form 10-Q and in "Item 1A. Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2016, as such factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission (the "SEC"), which are accessible on the SEC's website at www.sec.gov. Other factors that could cause actual results to differ materially include: changes in the economy, financial markets and political environment; risks associated with possible disruption in our operations or the economy generally due to terrorism or natural disasters; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities) and conditions in our operating areas, particularly with respect to business development companies, small business investment companies, or SBICs, or regulated investment companies, or RICs; our ability to satisfy our debt obligations and pay dividends to our stockholders; potential wind-down or dispositions involving one or more of our non-core businesses and other considerations that may be disclosed from time to time in our publicly disseminated documents and filings. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. Although we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

Unless the context otherwise requires, references to "we," "us," "our" and "the Company" are intended to refer to the business and operations of Fifth Street Asset Management Inc. and its consolidated subsidiaries.

When used in this Quarterly Report on Form 10-Q, unless the context otherwise requires:

• | "Adjusted Net Income" is a non-GAAP measure that represents income before income tax benefit (provision) as adjusted for (i) certain compensation-related charges, (ii) unrealized gains (losses) on beneficial interests in CLOs, MMKT Notes and derivative liabilities, (iii) certain litigation costs and related insurance recoveries, (iv) the difference between cash dividends received from our investments in FSC and FSFR and the related income recognized under the equity method of accounting and (v) other non-recurring items; |

• | "AUM" refers to assets under management of the Fifth Street Funds and material control investments of these funds, and represents the sum of the net asset value of such funds and investments, the drawn debt and unfunded debt and equity commitments at the fund or investment-level (including amounts subject to restrictions) and uncalled committed debt and equity capital (including commitments to funds that have yet to commence their investment periods); |

• | "base management fees" refer to fees we earn for advisory services provided to our funds, which are generally based on a fixed percentage of fair value of assets, total commitments, invested capital, net asset value, total assets or principal amount of the investment portfolios managed by us; |

• | "catch-up" refers to a provision for a manager or adviser of a fund to receive the majority or all of the profits of such fund until the agreed upon profit allocation is reached; |

• | "CLO" refers to a collateralized loan obligation; |

• | “CLO I” refers to Fifth Street Senior Loan Fund I, LLC, a CLO in our senior loan fund strategy managed by CLO Management; |

• | "CLO II" refers to Fifth Street SLF II, Ltd. (formerly Fifth Street Senior Loan Fund II, LLC, prior to securitization), a CLO in our senior loan fund strategy managed by CLO Management; |

• | "CLO Management" refers to Fifth Street CLO Management LLC, the collateral manager for CLO I and CLO II; |

• | "fee-earning AUM" refers to the AUM on which we directly or indirectly earn management fees and represents the sum of the net asset value of the Fifth Street Funds and their material control investments, and the drawn debt and unfunded debt and equity commitments at the fund or investment-level (including amounts subject to restrictions); |

• | "Fifth Street BDCs" and "our BDCs" refer to FSC and FSFR together; |

• | "Fifth Street Funds" and "our funds" refer to the Fifth Street BDCs and the other funds advised or managed by Fifth Street Management or CLO Management; |

i

• | "Fifth Street Holdings" refers to Fifth Street Holdings L.P. |

• | "Fifth Street Management" or "FSM" refers to Fifth Street Management LLC and, unless the context otherwise requires, its subsidiaries; |

• | "FSC" refers to Fifth Street Finance Corp., a publicly-traded business development company managed by Fifth Street Management; |

• | "FSFR" refers to Fifth Street Senior Floating Rate Corp., a publicly-traded business development company managed by Fifth Street Management; |

• | "FSOF" refers to Fifth Street Opportunities Fund, L.P., a private fund managed by Fifth Street Management; |

• | "Holdings Limited Partners" refers to active, limited partners in Fifth Street Holdings (other than us), which include, among other persons, the Principals; |

• | "hurdle rate" or "hurdle" refers to a specified minimum rate of return that a fund must exceed in order for the investment adviser or manager of such a fund to receive Part I Fees and/or performance fees; |

• | "management fees" refer to base management fees and Part I Fees; |

• | "MMKT" refers to MMKT Exchange LLC, a financial technology company in which FSM owned 80% of the common membership interests prior to dissolution and “MMKT Notes” refers to the convertible promissory notes issued by MMKT to the Company and additional investors that were cancelled and settled pursuant to an agreement among MMKT and its noteholders entered into on August 8, 2016; |

• | "Part I Fees" refer to fees paid to us by our BDCs that are based on a fixed percentage of pre-incentive fee net investment income (subject, in the case of FSC, to certain limitations based on cumulative net increase in net assets resulting from operations), which are calculated and paid quarterly, and subject to certain specified performance hurdles. Part I Fees are classified as management fees as they are generally predictable and are recurring in nature, are not subject to repayment (or clawback) and are generally cash-settled each quarter; |

• | "Part II Fees" refer to fees paid to us by our BDCs that are based on net capital gains, which are paid annually; |

• | "performance fees" refer to fees we earn based on the performance of a fund, which are generally based on certain specific hurdle rates as defined in the fund's investment management or partnership agreements, may be either an incentive fee or carried interest, are paid annually and also include Part II Fees; |

• | "permanent capital" refers to capital of funds that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law, which funds currently consist of FSC and FSFR; such funds may be required to distribute all or a portion of capital gains and investment income or elect to distribute capital; |

• | "Principals" refers to Leonard M. Tannenbaum and Bernard D. Berman and, where applicable, any entities controlled directly or indirectly by them; |

• | "SLF I" refers to Fifth Street Senior Loan Fund I, LLC, a fund in our senior loan fund strategy, previously managed by Fifth Street Management prior to CLO I securitization; |

• | "SLF II" refers to Fifth Street Senior Loan Fund II, LLC, a fund in our senior loan fund strategy, previously managed by Fifth Street Management prior to CLO II securitization; |

• | "SMA" means a separately managed account; and |

• | "TRA recipients" refers to the Principals and Ivelin M. Dimitrov. |

Many of the terms used in this Quarterly Report on Form 10-Q, including AUM, fee-earning AUM and Adjusted Net Income, may not be comparable to similarly titled measures used by other companies. In addition, our definitions of AUM and fee-earning AUM are not based on any definition of AUM or fee-earning AUM that is set forth in the agreements governing the investment funds that we manage and may differ from definitions of AUM set forth in other agreements to which we are a party from time to time, including the agreements governing our revolving credit facility. Please see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures and Operating Metrics — Assets Under Management" and "— Fee-earning AUM" for more information on AUM and fee-earning AUM. Further, Adjusted Net Income is not a performance measure calculated in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"). We use Adjusted Net Income as a measure of operating performance, not as a measure of liquidity. We believe that Adjusted Net Income provides investors with a meaningful indication of our core operating performance and Adjusted Net Income is evaluated regularly by our management as a decision tool for deployment of resources. We believe that reporting Adjusted Net Income is helpful in understanding our business and that investors should review the same supplemental non-GAAP financial measures that our management uses to analyze our performance. Adjusted Net Income has limitations as an analytical tool and should not be considered in isolation or as a substitute for analyzing our results prepared in accordance with GAAP. The use of Adjusted Net Income without consideration of related GAAP measures is not adequate due to the adjustments described above. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures and Operating Metrics — Adjusted Net Income."

Amounts and percentages throughout this Quarterly Report on Form 10-Q may reflect rounding adjustments and consequently totals may not appear to sum.

ii

PART I - FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements

Fifth Street Asset Management Inc.

Consolidated Statements of Financial Condition

As of | ||||||||

March 31, 2017 | December 31, 2016 | |||||||

Assets | (unaudited) | |||||||

Cash | $ | 865,752 | $ | 6,727,085 | ||||

Management fees receivable (includes Part I Fees of $3,213,667 and $4,837,944 as of March 31, 2017 and December 31, 2016, respectively) | 13,107,090 | 15,346,566 | ||||||

Performance fees receivable | 34,587 | 123,300 | ||||||

Insurance recovery receivable | — | 9,250,000 | ||||||

Prepaid expenses (includes $418,300 and $620,794 related to income taxes as of March 31, 2017 and December 31, 2016, respectively) | 2,275,311 | 2,073,393 | ||||||

Investments in equity method investees | 67,574,280 | 66,176,884 | ||||||

Beneficial interests in CLOs at fair value: (cost March 31, 2017: $24,049,823; cost December 31, 2016: $24,138,496) | 23,260,659 | 23,155,062 | ||||||

Due from affiliates | 2,556,202 | 3,405,921 | ||||||

Fixed assets, net | 5,151,743 | 5,344,332 | ||||||

Deferred tax assets | 71,703,827 | 42,415,143 | ||||||

Deferred financing costs | 1,300,271 | 1,426,103 | ||||||

Other assets | 3,365,910 | 3,355,072 | ||||||

Total assets | $ | 191,195,632 | $ | 178,798,861 | ||||

Liabilities and Equity | ||||||||

Liabilities | ||||||||

Accounts payable and accrued expenses | $ | 5,253,690 | $ | 5,260,511 | ||||

Accrued compensation and benefits | 5,225,343 | 12,516,497 | ||||||

Income taxes payable | 223,694 | 223,694 | ||||||

Loans payable | 14,972,565 | 14,972,565 | ||||||

Legal settlement payable | — | 9,250,000 | ||||||

Credit facility payable | 100,000,000 | 102,000,000 | ||||||

Dividends payable | 3,022,611 | 1,961,863 | ||||||

Due to affiliates | 32,241 | 30,412 | ||||||

Deferred rent liability | 2,054,038 | 2,079,354 | ||||||

Payable to related parties pursuant to tax receivable agreements | 62,091,926 | 35,990,255 | ||||||

Total liabilities | 192,876,108 | 184,285,151 | ||||||

Commitments and contingencies | ||||||||

Equity (deficit) | ||||||||

Preferred stock, $0.01 par value; 5,000,000 shares authorized; none issued and outstanding as of March 31, 2017 and December 31, 2016 | — | — | ||||||

Class A common stock, $0.01 par value; 500,000,000 shares authorized; 15,576,620 and 6,602,374 shares issued and outstanding as of March 31, 2017 and December 31, 2016, respectively | 155,766 | 66,024 | ||||||

Class B common stock, $0.01 par value; 50,000,000 shares authorized; 34,285,484 and 42,856,854 shares issued and outstanding as of March 31, 2017 and December 31, 2016, respectively | 342,855 | 428,569 | ||||||

Additional paid-in capital | 5,348,702 | 6,354,291 | ||||||

Accumulated deficit | (130,932 | ) | (1,726,061 | ) | ||||

Total stockholders' equity, Fifth Street Asset Management Inc. | 5,716,391 | 5,122,823 | ||||||

Non-controlling interests | (7,396,867 | ) | (10,609,113 | ) | ||||

Total deficit | (1,680,476 | ) | (5,486,290 | ) | ||||

Total liabilities and equity (deficit) | $ | 191,195,632 | $ | 178,798,861 | ||||

Management fees receivable, performance fees receivable and investments are with related parties. See notes to consolidated financial statements.

1

Fifth Street Asset Management Inc.

Consolidated Statements of Operations

(unaudited)

For the Three Months Ended March 31, | |||||||||

2017 | 2016 | ||||||||

Revenues | |||||||||

Management fees (includes Part I Fees of $3,455,605 and $4,938,068 for the three months ended March 31, 2017 and 2016, respectively) | $ | 13,540,646 | $ | 17,087,545 | |||||

Performance fees | 34,587 | 25,764 | |||||||

Other fees | 2,063,277 | 1,934,422 | |||||||

Total revenues | 15,638,510 | 19,047,731 | |||||||

Expenses | |||||||||

Compensation and benefits | 6,523,085 | 8,768,625 | |||||||

General, administrative and other expenses | 5,115,418 | 7,301,492 | |||||||

Depreciation and amortization | 315,867 | 417,722 | |||||||

Total expenses | 11,954,370 | 16,487,839 | |||||||

Other income (expense) | |||||||||

Interest income | 329,852 | 339,602 | |||||||

Interest expense | (1,323,693 | ) | (1,114,999 | ) | |||||

Income from equity method investments | 2,958,759 | 868,109 | |||||||

Unrealized gain on MMKT Notes | — | 2,582,405 | |||||||

Unrealized gain (loss) on beneficial interests in CLOs | 194,270 | (848,264 | ) | ||||||

Adjustment of TRA liability due to tax rate change | (92,348 | ) | — | ||||||

Insurance recoveries | 4,332,024 | — | |||||||

Unrealized loss on derivatives | — | (4,676,019 | ) | ||||||

Loss on investor settlement | — | (10,419,274 | ) | ||||||

Other income (expense), net | — | (569,960 | ) | ||||||

Total other income (expense), net | 6,398,864 | (13,838,400 | ) | ||||||

Income (loss) before provision (benefit) for income taxes | 10,083,004 | (11,278,508 | ) | ||||||

Provision (benefit) for income taxes | 1,310,519 | (262,773 | ) | ||||||

Net income (loss) | 8,772,485 | (11,015,735 | ) | ||||||

Net (income) loss attributable to non-controlling interests | (7,177,356 | ) | 9,783,790 | ||||||

Net income (loss) attributable to Fifth Street Asset Management Inc. | $ | 1,595,129 | $ | (1,231,945 | ) | ||||

Net income (loss) per share attributable to Fifth Street Asset Management Inc. Class A common stock - Basic | $ | 0.10 | $ | (0.21 | ) | ||||

Net income (loss) per share attributable to Fifth Street Asset Management Inc. Class A common stock - Diluted | $ | 0.10 | $ | (0.23 | ) | ||||

Weighted average shares of Class A common stock outstanding - Basic | 15,224,235 | 5,798,614 | |||||||

Weighted average shares of Class A common stock outstanding - Diluted | 15,270,787 | 5,798,614 | |||||||

All revenues are earned from affiliates of the Company. All gains (losses) from investments are from related parties. See notes to consolidated financial statements.

2

Fifth Street Asset Management Inc.

Consolidated Statement of Changes in Equity

For the Three Months Ended March 31, 2017 and 2016

(unaudited)

Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Accumulated deficit | Treasury Stock | Non-Controlling Interests | Total Deficit | ||||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||||||

Balance, December 31, 2015 | 5,822,672 | $ | 58,227 | 42,856,854 | $ | 428,569 | $ | 2,661,253 | $ | (30,904 | ) | $ | (180,064 | ) | $ | (5,392,371 | ) | $ | (2,455,290 | ) | ||||||||||||||

Cumulative effect of ASU 2016-09 adoption | — | — | — | — | 145,127 | (164,081 | ) | — | (160,023 | ) | (178,977 | ) | ||||||||||||||||||||||

Accrued dividends - $0.10 per Class A common share | — | — | — | — | (579,861 | ) | — | — | — | (579,861 | ) | |||||||||||||||||||||||

Accrual of dividends on restricted stock units | — | — | — | — | (15,615 | ) | — | — | (118,489 | ) | (134,104 | ) | ||||||||||||||||||||||

Deemed capital contribution (see Note 1) | — | — | — | — | 676,616 | — | — | 5,134,178 | 5,810,794 | |||||||||||||||||||||||||

Amortization of equity-based compensation | — | — | — | — | 163,324 | — | — | 1,495,994 | 1,659,318 | |||||||||||||||||||||||||

Net loss | — | — | — | — | — | (1,231,945 | ) | — | (9,783,790 | ) | (11,015,735 | ) | ||||||||||||||||||||||

Balance, March 31, 2016 | 5,822,672 | $ | 58,227 | 42,856,854 | $ | 428,569 | $ | 3,050,844 | $ | (1,426,930 | ) | $ | (180,064 | ) | $ | (8,824,501 | ) | $ | (6,893,855 | ) | ||||||||||||||

Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Accumulated Deficit | Non-Controlling Interests | Total Deficit | |||||||||||||||||||||||||

Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||

Balance, December 31, 2016 | 6,602,374 | $ | 66,024 | 42,856,854 | $ | 428,569 | $ | 6,354,291 | $ | (1,726,061 | ) | $ | (10,609,113 | ) | $ | (5,486,290 | ) | |||||||||||||

Accrued dividends - $0.125 per Class A common share | — | — | — | — | (1,947,078 | ) | — | — | (1,947,078 | ) | ||||||||||||||||||||

Accrued dividends on restricted stock units | — | — | — | — | (56,456 | ) | — | (131,730 | ) | (188,186 | ) | |||||||||||||||||||

Issuance of shares in connection with previously vested RSUs | 201,796 | 2,018 | — | — | (2,018 | ) | — | — | — | |||||||||||||||||||||

Issuance of Class A common stock and cancellation of Class B common stock in connection with exchange of Holdings LP Interests | 8,772,450 | 87,724 | (8,571,370 | ) | (85,714 | ) | (2,010 | ) | — | — | — | |||||||||||||||||||

Distributions to Holdings Limited Partners | — | — | — | — | — | — | (8,511,090 | ) | (8,511,090 | ) | ||||||||||||||||||||

Reallocation of equity for changes in ownership interest | — | — | — | — | (3,891,719 | ) | — | 3,891,719 | — | |||||||||||||||||||||

Amortization of equity-based compensation | — | — | — | — | 303,812 | — | 785,991 | 1,089,803 | ||||||||||||||||||||||

Net tax benefit in connection with TRA | — | — | — | — | 4,589,880 | — | — | 4,589,880 | ||||||||||||||||||||||

Net income | — | — | — | — | — | 1,595,129 | 7,177,356 | 8,772,485 | ||||||||||||||||||||||

Balance, March 31, 2017 | 15,576,620 | $ | 155,766 | 34,285,484 | $ | 342,855 | $ | 5,348,702 | $ | (130,932 | ) | $ | (7,396,867 | ) | $ | (1,680,476 | ) | |||||||||||||

See notes to consolidated financial statements.

3

Fifth Street Asset Management Inc.

Consolidated Statements of Cash Flows

(unaudited)

For the Three Months Ended March 31, | |||||||||

2017 | 2016 | ||||||||

Cash flows from operating activities | |||||||||

Net income (loss) | $ | 8,772,485 | $ | (11,015,735 | ) | ||||

Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |||||||||

Depreciation and amortization | 245,094 | 346,949 | |||||||

Amortization of fractional interests in aircrafts | 70,773 | 70,773 | |||||||

Amortization of deferred financing costs | 125,832 | 122,707 | |||||||

Amortization of equity-based compensation | 1,089,803 | 1,661,357 | |||||||

Write-off of MMKT capitalized software costs | — | 624,512 | |||||||

Unrealized (gain) loss on beneficial interests in CLOs | (194,270 | ) | 848,264 | ||||||

Distributions of earnings from equity method investments | 508,730 | 600,549 | |||||||

Interest income accreted on beneficial interest in CLOs | (329,843 | ) | (339,594 | ) | |||||

Interest expense on MMKT Notes | — | 92,119 | |||||||

Deferred taxes | 1,310,519 | (243,757 | ) | ||||||

Deferred rent | (25,316 | ) | (47,060 | ) | |||||

Unrealized gain on MMKT Notes | — | (2,582,405 | ) | ||||||

Loss on investor settlement | — | 10,419,274 | |||||||

Unrealized loss on derivatives | — | 4,676,019 | |||||||

Adjustment of TRA liability due to tax rate change | 92,348 | — | |||||||

Income from equity method investments | (2,958,759 | ) | (868,661 | ) | |||||

Changes in operating assets and liabilities: | |||||||||

Management fees receivable | 2,239,476 | (12,490,159 | ) | ||||||

Performance fees receivable | (34,587 | ) | 120,134 | ||||||

Insurance recovery receivable | 9,250,000 | — | |||||||

Prepaid expenses | (201,919 | ) | (1,201,837 | ) | |||||

Due from affiliates | 849,719 | 1,267,727 | |||||||

Other assets | (81,611 | ) | 15,695 | ||||||

Accounts payable and accrued expenses | (6,821 | ) | 109,590 | ||||||

Accrued compensation and benefits | (7,291,154 | ) | (7,400,660 | ) | |||||

Legal settlement payable | (9,250,000 | ) | — | ||||||

Due to affiliates | 1,829 | — | |||||||

Net cash provided by (used in) operating activities | 4,182,328 | (15,214,199 | ) | ||||||

Cash flows from investing activities | |||||||||

Purchases of fixed assets | (52,505 | ) | (13,980 | ) | |||||

Purchases of equity method investments | — | (26,925,757 | ) | ||||||

Redemptions of equity method investments | — | 6,000,000 | |||||||

Distributions from equity method investments | 1,175,933 | 180,998 | |||||||

Distributions received from beneficial interest in CLO | 418,516 | 186,902 | |||||||

Net cash provided by (used in) investing activities | 1,541,944 | (20,571,837 | ) | ||||||

Cash flows from financing activities | |||||||||

Proceeds from borrowings under credit facility | — | 25,000,000 | |||||||

Repayments under credit facility | (2,000,000 | ) | — | ||||||

Distributions to members | (8,511,090 | ) | — | ||||||

Dividends to Class A shareholders | (1,074,515 | ) | (989,854 | ) | |||||

Net cash provided by (used in) financing activities | (11,585,605 | ) | 24,010,146 | ||||||

Net decrease in cash | (5,861,333 | ) | (11,775,890 | ) | |||||

Cash, beginning of period | 6,727,085 | 17,185,204 | |||||||

Cash, end of period | $ | 865,752 | $ | 5,409,314 | |||||

4

Fifth Street Asset Management Inc.

Consolidated Statements of Cash Flows

(unaudited)

Supplemental disclosures of cash flow information: | |||||||||

Cash paid during the period for interest | $ | 1,221,559 | $ | 678,575 | |||||

Cash paid during the period for income taxes | $ | — | $ | 250 | |||||

Non-cash investing activities: | |||||||||

Non-cash contribution to FSOF | $ | (123,300 | ) | $ | — | ||||

Non-cash distribution from FSOF | $ | 123,300 | $ | — | |||||

Non-cash financing activities: | |||||||||

Accrued dividends | $ | 2,135,263 | $ | — | |||||

Deemed capital contribution | $ | — | $ | 5,810,794 | |||||

Increase in deferred tax assets as a result of exchange of Holdings LP Interests | $ | 30,599,203 | $ | — | |||||

Increase in amounts payable to related parties pursuant to tax receivable agreement | $ | 26,009,323 | $ | — | |||||

All revenues are earned from affiliates of the Company. All gains (losses) from investments are from related parties. See notes to consolidated financial statements.

5

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Note 1. Organization

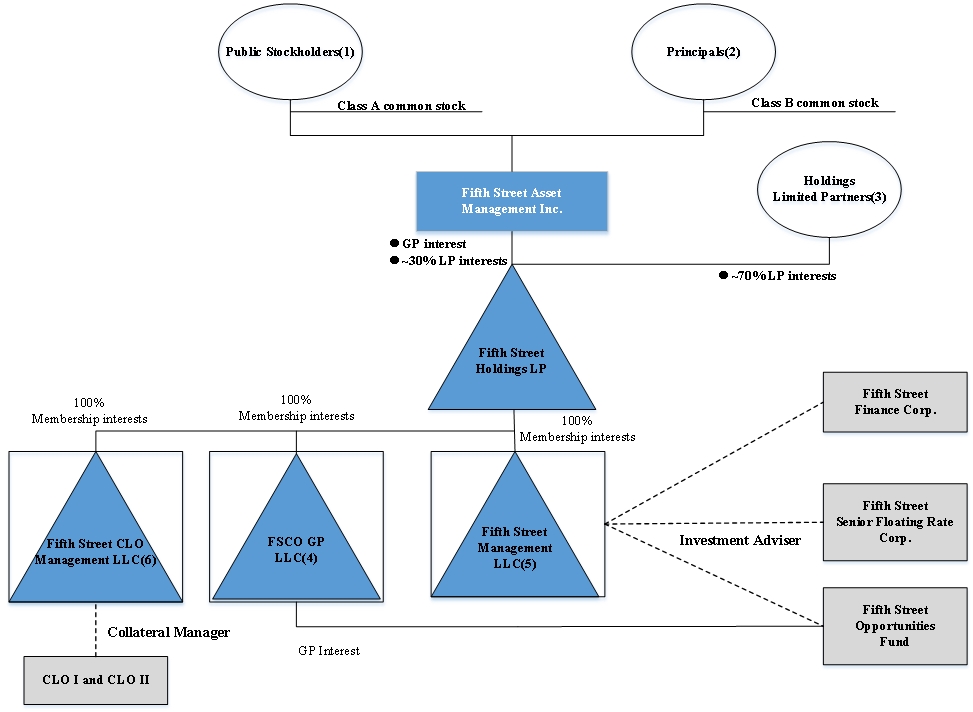

Fifth Street Asset Management Inc. ("FSAM"), together with its consolidated subsidiaries (collectively, the "Company"), is an alternative asset management firm headquartered in Greenwich, CT that provides asset management services to its investment funds (referred to as the "Fifth Street Funds" or the "funds"), which, as of March 31, 2017, consist primarily of Fifth Street Finance Corp. (formed on January 2, 2008, "FSC") and Fifth Street Senior Floating Rate Corp. (formed on May 22, 2013, "FSFR"), both publicly-traded business development companies regulated under the Investment Company Act of 1940 (together, the "BDCs"). The Company conducts all of its operations through its consolidated subsidiaries, Fifth Street Management LLC ("FSM"), Fifth Street CLO Management LLC ("CLO Management") and FSCO GP LLC ("FSCO GP").

The Company's primary sources of revenues are management fees, primarily from the BDCs, which are driven by the amount of the assets under management and quarterly investment performance of the Fifth Street Funds. The Company conducts substantially all of its operations through one reportable segment that provides asset management services to the Fifth Street Funds. The Company generates all of its revenues in the United States.

Reorganization

In anticipation of its initial public offering (the "IPO") that closed November 4, 2014, FSAM was incorporated in Delaware on May 8, 2014 as a holding company with its primary asset expected to be a limited partnership interest in Fifth Street Holdings L.P. ("Fifth Street Holdings"). Fifth Street Holdings was formed on June 27, 2014 by Leonard M. Tannenbaum and Bernard D. Berman (the "Principals") as a Delaware limited partnership. Prior to the transactions described below, the Principals were the general partners and limited partners of Fifth Street Holdings. Fifth Street Holdings has a single class of limited partnership interests (the "Holdings LP Interests"). Immediately prior to the IPO:

• | The Principals contributed their general partnership interests in Fifth Street Holdings to FSAM in exchange for 100% of FSAM's Class B common stock; |

• | The members of FSM contributed 100% of their membership interests in FSM to Fifth Street Holdings in exchange for Holdings LP Interests; and |

• | The members of FSCO GP, a Delaware limited liability company, formed on January 6, 2014 to serve as the general partner of Fifth Street Opportunities Fund, L.P. (''FSOF,'' formerly Fifth Street Credit Opportunities Fund, L.P.) contributed 100% of their membership interests in FSCO GP to Fifth Street Holdings in exchange for Holdings LP Interests. |

These collective actions are referred to herein as the "Reorganization."

Initial Public Offering

On November 4, 2014, FSAM issued 6,000,000 shares of Class A common stock in the IPO at a price of $17.00 per common share. The proceeds totaled $95.9 million, net of underwriting commissions of $6.1 million. The proceeds were used to purchase a 12.0% limited partnership interest in Fifth Street Holdings.

Immediately following the Reorganization and the closing of the IPO on November 4, 2014:

• | The Principals held 42,856,854 shares of FSAM Class B common stock and 42,856,854 Holdings LP Interests. |

• | FSAM held 6,000,000 Holdings LP Interests and the former members of FSM and FSCO GP, including the Principals, held 44,000,000 Holdings LP Interests. |

• | The Principals, through their holdings of FSAM Class B common stock in the aggregate, had approximately 97.3% of the voting power of FSAM's common stock. |

Upon the completion of the Reorganization and the IPO, FSAM also became the general partner of Fifth Street Holdings. Fifth Street Holdings and its wholly-owned subsidiaries (including FSM, CLO Management and FSCO GP) are consolidated by FSAM in the consolidated financial statements. The portion of net income attributable to the limited partners of Fifth Street Holdings, excluding FSAM, is recorded as "Net (income) loss attributable to non-controlling interests" on the Consolidated Statements of Operations.

6

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Exchange Agreement

In connection with the Reorganization, FSAM entered into an exchange agreement with the limited partners of Fifth Street Holdings that granted each limited partner of Fifth Street Holdings, and certain permitted transferees, the right, beginning two years after the closing of the IPO and subject to vesting and minimum retained ownership requirements, on a quarterly basis, to exchange such person's Holdings LP Interests for shares of Class A common stock of FSAM, on a one-for-one basis, subject to customary conversion rate adjustments for splits, unit distributions and reclassifications (collectively referred to as the "Exchange Agreement"). As a result, each limited partner of Fifth Street Holdings, over time, has the ability to convert his or her illiquid ownership interests in Fifth Street Holdings into Class A common stock of FSAM, which can more readily be sold in the public markets.

On January 4, 2017, pursuant to the terms of the above exchange agreement, a director of the Company and certain other Holdings Limited Partners exchanged an aggregate of 8,772,450 Holdings LP Interests of Fifth Street Holdings for shares of the Company’s Class A common stock on a one-for-one basis and, in the case of the Principals, submitted to the Company 8,571,370 shares of the Company’s Class B common stock for cancellation. The acquisition of additional Holdings LP Interests are treated as reorganizations of entities under common control as required by the Financial Accounting Standards Board (the "FASB") Accounting Standards Codification ("ASC") Topic 805.

As of March 31, 2017 and December 31, 2016, FSAM held approximately 30.7% and 13.0% of Fifth Street Holdings, respectively. FSAM’s percentage ownership in Fifth Street Holdings will continue to change as Holdings LP Interests are exchanged for Class A common stock of FSAM or when FSAM otherwise issues or repurchases FSAM common stock.

FSAM's purchase of Holdings LP Interests concurrent with its IPO and the subsequent and future exchanges by holders of Holdings LP Interests for shares of FSAM's Class A common stock pursuant to the Exchange Agreement are expected to result in increases in its share of the tax basis of the tangible and intangible assets of Fifth Street Holdings, which will increase the tax depreciation and amortization deductions that otherwise would not have been available to FSAM. These increases in tax basis and tax depreciation and amortization deductions are expected to reduce the amount of cash taxes that FSAM would otherwise be required to pay in the future. FSAM entered into a tax receivable agreement ("TRA") with certain limited partners of Fifth Street Holdings (the "TRA Recipients") that requires FSAM to pay the TRA Recipients 85% of the amount of cash savings, if any, in U.S. federal, state, local and foreign income tax that FSAM actually realizes (or, under certain circumstances, is deemed to realize) as a result of the increases in tax basis in connection with exchanges by the TRA Recipients described above and certain other tax benefits attributable to payments under the tax receivable agreement. In connection with the exchange of Holdings LP Interests on January 4, 2017, the Company recorded a deferred tax asset in the amount of $30,599,203 and an additional payable to the TRA Recipients of $26,009,323 with a corresponding increase in additional paid-in capital of $4,589,880.

RiverNorth Settlement

On February 18, 2016, the Company entered into a purchase and settlement agreement ("PSA") with RiverNorth Capital Management, LLC ("RiverNorth") pursuant to which RiverNorth would withdraw its competing FSC proxy solicitation. In connection with the execution and delivery of the PSA, on March 24, 2016, the Company purchased 4,078,304 shares of common stock of FSC for $25.0 million of cash at a purchase price of $6.13 per share, net of certain dividends payable to the Company pursuant to the PSA, resulting in a loss of $4,608,480, which represents the premium paid by the Company in excess of the FSC closing share price on the date of the transaction. Pursuant to a letter agreement with the Company, Leonard M. Tannenbaum purchased 5,142,296 shares of common stock of FSC from RiverNorth at a net purchase price of $6.13 per share, resulting in a loss of $5,810,794 which represents the premium paid by Mr. Tannenbaum in excess of the FSC closing share price on the date of the transaction. Such amount was recorded as a loss in the Consolidated Statement of Operations and as a deemed contribution/distribution in the Consolidated Statement of Changes in Stockholder's Equity since Mr. Tannenbaum holds a controlling interest in FSAM and the Company directly benefited from this payment. The total premium paid by the Company and Mr. Tannenbaum in the amount of $10,419,274 was recorded as a loss during the three months ended March 31, 2016.

In addition, the Company issued RiverNorth a warrant to purchase 3,086,420 shares of FSAM's Class A common stock that, upon exercise, the Company was obligated to pay RiverNorth an amount equal to the lesser of: (i) $5 million and (ii) the spread value of the warrant based on a $3.24 strike price. The warrant was exercised by RiverNorth on June 23, 2016. Refer to Note 3 for further information.

The Company also entered into a swap agreement with RiverNorth whereas on each settlement date, if the settlement date share price of FSC common stock was less than $6.25, the Company was obligated to pay RiverNorth an amount equal to the

7

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

excess of $6.25 over the settlement date share price multiplied by the 3,878,542 notional shares of common stock underlying the swap. Alternatively, if the settlement date share price of FSC common stock was greater than $6.25, RiverNorth was obligated to pay the Company for the excess of the settlement date share price over $6.25 in cash. The Company was also entitled to a portion of dividends on FSC shares underlying the total return swap which were earned by RiverNorth prior to the settlement date. On September 7, 2016, the Company settled the swap agreement with RiverNorth. Refer to Note 3 for further information.

Ironsides Settlement

On September 30, 2016, the Company entered into a PSA with Ironsides Partners LLC, Ironsides Partners Special Situations Master Fund II L.P. and Ironsides P Fund L.P. (collectively, "Ironsides"). Upon execution of the PSA, Ironsides agreed that it would not, and would not permit any of its controlled Affiliates or Associates (as defined in the PSA) to, during a standstill period: (1) nominate or recommend for nomination any person for election at any annual or special meeting of stockholders of FSAM, FSC and FSFR (the "Fifth Street Parties"), directly or indirectly, (2) submit any proposal for consideration at, or bring any other business before, any annual or special meeting of any of the Fifth Street Parties' stockholders, directly or indirectly, or (3) initiate, encourage or participate in any “withhold” or similar campaign with respect to any annual or special meeting of any of the Fifth Street Parties' stockholders, directly or indirectly. During the standstill period, Ironsides shall not publicly or privately encourage or support any other stockholder to take any of the actions described above. On November 30, 2016, in connection with the execution and delivery of the PSA, the Company purchased 1,295,767 shares of common stock of FSFR for a per-share purchase price of $9.00. Pursuant to a letter agreement with the Company, Mr. Tannenbaum purchased 646,863 shares of common stock of FSFR from Ironsides for a per-share purchase price of $9.00. These purchases were not made at a premium to the market price of the FSFR shares on the date of purchase.

Note 2. Significant Accounting Policies

Revision of Previously Issued Financial Statements for Correction of Immaterial Errors

During the three months ended September 30, 2016, the Company identified an error related to the accounting treatment of its investments in common shares of the BDCs. In September 2015, the Company began purchasing common stock in the BDCs and treated such shares as available-for-sale securities under ASC Topic 320, Investments - Debt and Equity Securities. In 2016, the Company made substantial additional purchases of the common stock of the BDCs. As a result, the Company revisited its accounting method for the shares held. The Company determined that it does exert significant influence over the BDCs and accordingly, its investments in the BDCs should have been accounted for as equity method investments under ASC Topic 323, Investments - Equity Method and Joint Ventures, since inception. The Company assessed the materiality of these errors on its prior quarterly and annual financial statements, assessing materiality both quantitatively and qualitatively, in accordance with the SEC’s Staff Accounting Bulletin (“SAB”) No. 99 and SAB No. 108 and concluded that the errors were not material to any of its previously issued financial statements. However, in order to correctly present the shares as an equity method investment in the appropriate period, management revised previously issued financial statements. The Company also corrected immaterial out-of-period adjustments that had been previously reported.

Set forth below is a summary of the amounts and financial statement line items impacted by these revisions for the periods presented in this Form 10-Q.

8

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Three Months Ended March 31, 2016 | ||||||||||||

Consolidated Statement of Operations: | As previously reported | Adjustments | As revised | |||||||||

Income from equity method investments | $ | — | $ | 868,109 | $ | 868,109 | ||||||

Other income (expense), net | 211,587 | (781,547 | ) | (569,960 | ) | |||||||

Total other expense, net | (13,924,962 | ) | 86,562 | (13,838,400 | ) | |||||||

Loss before income tax benefit | (11,365,070 | ) | 86,562 | (11,278,508 | ) | |||||||

Income tax benefit | (265,412 | ) | 2,639 | (262,773 | ) | |||||||

Net loss | (11,099,658 | ) | 83,923 | (11,015,735 | ) | |||||||

Net loss attributable to non-controlling interests | 9,860,273 | (76,483 | ) | 9,783,790 | ||||||||

Net loss attributable to Fifth Street Asset Management Inc. | $ | (1,239,385 | ) | $ | 7,440 | $ | (1,231,945 | ) | ||||

Net loss per share attributable to Fifth Street Asset Management Inc. - Basic | $ | (0.21 | ) | $ | — | $ | (0.21 | ) | ||||

Net loss per share attributable to Fifth Street Asset Management Inc. - Diluted | $ | (0.24 | ) | $ | 0.01 | $ | (0.23 | ) | ||||

Three Months Ended March 31, 2016 | ||||||||||||

Consolidated Statement of Comprehensive Income: | As previously reported | Adjustments | As revised | |||||||||

Net loss | $ | (11,099,658 | ) | $ | 83,923 | $ | (11,015,735 | ) | ||||

Adjustment for change in fair value of available-for-sale securities | (5,695,952 | ) | 5,695,952 | — | ||||||||

Tax effect of adjustment for change in fair value of available-for-sale securities | 263,706 | (263,706 | ) | — | ||||||||

Total comprehensive loss | (16,531,904 | ) | 5,516,169 | (11,015,735 | ) | |||||||

Less: Comprehensive loss attributable to non-controlling interests | 14,892,981 | (5,109,191 | ) | 9,783,790 | ||||||||

Comprehensive loss attributable to Fifth Street Asset Management Inc. | $ | (1,638,923 | ) | $ | 406,978 | $ | (1,231,945 | ) | ||||

Three Months Ended March 31, 2016 | ||||||||||||

Consolidated Statement of Cash Flows: | As previously reported | Adjustments | As revised | |||||||||

Cash flows from operating activities | ||||||||||||

Net loss | $ | (11,099,658 | ) | $ | 83,923 | $ | (11,015,735 | ) | ||||

Distributions of earnings from equity method investments | — | 600,549 | 600,549 | |||||||||

Deferred taxes | (246,396 | ) | 2,639 | (243,757 | ) | |||||||

Income from equity method investments | (552 | ) | (868,109 | ) | (868,661 | ) | ||||||

Net cash used in operating activities | (15,033,201 | ) | (180,998 | ) | (15,214,199 | ) | ||||||

Purchases of equity method investments | — | (26,925,757 | ) | (26,925,757 | ) | |||||||

Purchases of available-for-sale securities | (26,925,757 | ) | 26,925,757 | — | ||||||||

Distributions from equity method investments | — | 180,998 | 180,998 | |||||||||

Net cash used in investing activities | (20,752,835 | ) | 180,998 | (20,571,837 | ) | |||||||

Net decrease in cash and cash equivalents | (11,775,890 | ) | — | (11,775,890 | ) | |||||||

Cash and cash equivalents, beginning of period | 17,185,204 | — | 17,185,204 | |||||||||

Cash and cash equivalents, end of period | $ | 5,409,314 | $ | — | $ | 5,409,314 | ||||||

9

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Basis of Presentation

The consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") and pursuant to the rules and regulations of the Securities and Exchange Commission (the "SEC") and the requirements for reporting on Form 10-K and Regulation S-X. In the opinion of management, all adjustments of a normal recurring nature considered necessary for the fair presentation of the consolidated financial statements have been made. All significant intercompany transactions and balances have been eliminated in consolidation. For the periods presented herein, total comprehensive income (loss) is equivalent to net income (loss), and accordingly, no statements of comprehensive income (loss) are presented.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and entities in which it, directly or indirectly, is determined to have a controlling financial interest under ASC Topic 810, as amended by ASU No. 2015-02. Under the variable interest model, the Company determines whether, if by design, an entity has equity investors who lack substantive participating or kick-out rights. If equity investors do not have such rights, the entity is considered a variable interest entity ("VIE") and must be consolidated by its primary beneficiary. An enterprise is determined to be the primary beneficiary if it holds a controlling financial interest. A controlling financial interest is defined as (a) the power to direct the activities of a VIE that most significantly impact the entity's economic performance and (b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the VIE. The consolidation guidance requires an analysis to determine (a) whether an entity in which the Company holds a variable interest is a VIE and (b) whether the Company's involvement, through holding interests directly or indirectly in the entity, would give it a controlling financial interest. Performance of that analysis requires the exercise of judgment.

Under the consolidation guidance, the Company determines whether it is the primary beneficiary of a VIE at the time it becomes involved with a variable interest entity and reconsiders that conclusion continually. In evaluating whether the Company is the primary beneficiary, the Company evaluates its economic interests in the entity held either directly or indirectly by the Company. The consolidation analysis can generally be performed qualitatively; however, if it is not readily apparent that the Company is not the primary beneficiary, a quantitative analysis may also be performed. Investments and redemptions (either by the Company, affiliates of the Company or third parties) or amendments to the governing documents of the respective investment funds could affect an entity's status as a VIE or the determination of the primary beneficiary. At each reporting date, the Company assesses whether it is the primary beneficiary and will consolidate or deconsolidate accordingly.

For equity investments where the Company does not control the investee, and where it is not the primary beneficiary of a VIE, but can exert significant influence over the financial and operating policies of the investee, the Company follows the equity method of accounting. The evaluation of whether the Company exerts control or significant influence over the financial and operational policies of its investees requires significant judgment based on the facts and circumstances surrounding each individual investment. Factors considered in these evaluations may include the type of investment, the legal structure of the investee, the terms and structure of the investment agreement, including investor voting or other rights, the terms of the Company's investment advisory agreement or other agreements with the investee, any influence the Company may have on the governing board of the investee, the legal rights of other investors in the entity pursuant to the fund’s operating documents and the relationship between the Company and other investors in the entity.

Consolidated Variable Interest Entities

Fifth Street Holdings

FSAM is the sole general partner of Fifth Street Holdings and, as such, it operates and controls all of the business and affairs of Fifth Street Holdings and its wholly-owned subsidiaries. Under ASC 810, Fifth Street Holdings meets the definition of a VIE because the limited partners do not hold substantive kick-out or participating rights. Since FSAM has the obligation to absorb expected losses and the right to receive benefits that could be significant to Fifth Street Holdings and is the sole general partner, FSAM is considered to be the primary beneficiary of Fifth Street Holdings. The assets of Fifth Street Holdings can be used to settle the obligations of FSAM based on the discretion of FSAM in its capacity as the general partner of Fifth Street Holdings.

As a result, the Company consolidates the financial results of Fifth Street Holdings and its wholly-owned subsidiaries and records the economic interests in Fifth Street Holdings held by the limited partners other than FSAM as "Non-controlling interests" on the Consolidated Statements of Financial Condition and "Net (income) loss attributable to non-controlling interests" on the Consolidated Statements of Operations.

10

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Voting Interest Entities

Entities that are not VIEs are generally evaluated under the voting interest model. The Company consolidates voting interest entities that it controls through a majority voting interest or through other means.

Unconsolidated Variable Interest Entities

The Company holds interests in certain VIEs that are not consolidated because the Company is not deemed the primary beneficiary. The Company's interest in such entities generally is in the form of direct interests and fixed fee arrangements. The maximum exposure to loss represents the potential loss of assets by the Company relating to these non-consolidated entities. The Company's interests in these non-consolidated VIEs and their respective maximum exposure to loss relating to non-consolidated VIEs as of March 31, 2017 is $24,515,965, which represents the fair value of the Company's investments and related fee receivables for unconsolidated VIEs at such date.

CLOs

In February 2015, the Company closed a securitization of the senior secured loans warehoused in Fifth Street Senior Loan Fund I, LLC ("CLO I"). In September 2015, Fifth Street Senior Loan II, LLC merged into Fifth Street SLF II Ltd. ("CLO II"), and the Company closed a securitization of the senior secured loans previously warehoused in Fifth Street Senior Loan Fund II, LLC. CLO Management, a wholly owned-consolidated subsidiary of Fifth Street Holdings, is the collateral manager of CLO I and CLO II (collectively referred to as the "CLOs"), and as such, it operates and controls all of the business and affairs of the CLOs. Under ASC 810, the CLOs meet the definition of a VIE because the total equity at risk is not sufficient to finance their activities.

The Company determined that it did not have an obligation to absorb expected losses that could be significant to the CLOs. Therefore, the Company is not considered to be the primary beneficiary of the CLOs and, accordingly, does not consolidate their financial results. As of March 31, 2017, investments held by the Company in the senior secured and subordinated notes of the CLOs are included within "Beneficial interests in CLOs at fair value" on the Consolidated Statements of Financial Condition.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions affecting amounts reported in the consolidated financial statements and accompanying notes. The most significant of these estimates are related to: (i) the valuation of equity-based compensation, (ii) the estimate of future taxable income, which impacts the carrying amount of the Company’s deferred income tax assets, (iii) the determination of net tax benefits in connection with the Company's tax receivable agreements, (iv) the valuation of the Company's investments, (v) the measurement of asset and liabilities associated with exit and disposal activities related to the abandonment of office space, (vi) the calculation of interest income accreted on beneficial interests in CLOs and (vii) the accretion of the residual excess of the Company's share of FSC and FSFR's net assets over its cost basis. These estimates are based on the information that is currently available to the Company and on various other assumptions that the Company believes to be reasonable under the circumstances. Actual results could differ materially from those estimates under different assumptions and conditions.

Concentration of Credit Risk and Other Risks and Uncertainties

Financial instruments which potentially subject the Company to concentrations of credit risk consist primarily of cash.

For the three months ended March 31, 2017 and 2016, substantially all revenues and receivables were earned or derived from advisory or administrative services provided to the BDCs and other affiliated entities.

The Company is dependent on its chief executive officer, Leonard M. Tannenbaum, who holds approximately 86% of the combined voting power of the Company through his ownership of shares of common stock. If for any reason the services of the Company's chief executive officer were to become unavailable, there could be a material adverse effect on the Company's operations, liquidity and profitability.

Fair Value Measurements

The carrying amounts of cash, management fees receivable, performance fees receivable, prepaid expenses, insurance recovery receivable, due from/to affiliates, accounts payable and accrued expenses, accrued compensation and benefits, income taxes payable, legal settlement payable and dividends payable approximate fair value due to the immediate or short-term maturity of these financial instruments.

11

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Cash and Cash Equivalents

Cash equivalents include short-term, highly liquid investments that are readily convertible to known amounts of cash and have original maturities of three months or less. The Company places its cash and cash equivalents with U.S. financial institutions and, at times, amounts may exceed federally insured limits. The Company monitors the credit standing of these financial institutions.

Equity Method Investments

Investments over which the Company exercises significant influence, but which do not meet the requirements for consolidation, are accounted for using the equity method of accounting, whereby the Company records its share of the underlying income or losses of equity method investees. The Company did not elect the fair value option on its equity method investments.

Investments in equity method investees consists of the Company's general partner interests in an unconsolidated fund and investments in FSC and FSFR common stock. The Company exercises significant influence with respect to this fund and the BDCs as a result of its management contracts with them, and specifically with respect to the BDCs, its representation on the board of directors.

Beneficial Interest in CLOs

Beneficial interests in CLOs meet the definition of a debt security under ASC Topic 325-40, Beneficial Interest in Securitized Financial Assets. Income from the beneficial interest in CLOs is recorded using the effective interest method based upon an estimation of an effective yield to maturity utilizing assumed cash flows. The Company monitors the expected residual payments, and effective yield is determined and updated periodically, as needed. Any distributions received from the beneficial interests in CLOs in excess of the calculated income using the effective yield are treated as a reduction of the cost.

The Company earned interest income of $329,843 and $339,594, respectively, from beneficial interests in CLOs, for the three months ended March 31, 2017 and March 31, 2016.

Fair Value Option

The Company has elected the fair value option, upon initial recognition, for all beneficial interests in CLOs, which had a cost of $24,049,823 as of March 31, 2017. There were $194,270 of unrealized gains recorded on beneficial interests in CLOs for the three months ended March 31, 2017. There were $848,264 of unrealized losses recorded on beneficial interests in CLOs for the three months ended March 31, 2016.

The fair value option permits the irrevocable election of fair value on an instrument-by-instrument basis at initial recognition of an asset or liability or upon an event that gives rise to a new basis of accounting for that instrument. The Company believes that by electing the fair value option for these financial instruments, it provides consistent measurement with its peers in the asset management industry. Changes in the fair value of these assets and liabilities and related interest income/expense are recorded within "Other income (expense)" in the Consolidated Statements of Operations. Refer to Note 4 for a description of valuation methodologies for the beneficial interests in CLOs.

Derivative Instruments

Derivative instruments include warrant and swap contracts issued in connection with the RiverNorth settlement. The derivative instruments are not designated as hedging instruments and are carried at fair value. Changes in fair value are recorded within "Unrealized gain (loss) on derivatives" and upon settlement of a derivative instrument, the Company records a "Realized gain (loss) on derivatives" in the Consolidated Statements of Operations.

See Note 3 for quantitative disclosures regarding derivative instruments.

12

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Fixed Assets

Fixed assets consist of furniture, fixtures and equipment (including automobiles, computer hardware and purchased software), software developed for internal use and leasehold improvements, and are recorded at cost, less accumulated depreciation and amortization. Depreciation of furniture, fixtures and equipment is computed using the straight-line method over the estimated useful lives of the respective assets (three to eight years). Software developed for internal use, which is amortized over three years, consists of costs incurred during the application development stage of software developed for the Company's proprietary use and includes costs of Company personnel who are directly associated with the development. Amortization of improvements to leased properties is computed using the straight-line method based upon the initial term of the applicable lease or the estimated useful life of the improvements, whichever is shorter, and ranges from five to 10 years. Routine expenditures for repairs and maintenance are charged to expense when incurred. Major betterments and improvements are capitalized. Upon retirement or disposition of fixed assets, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in the Consolidated Statements of Operations. The Company evaluates fixed assets for impairment whenever events or changes in circumstances indicate that an asset's carrying value may not be fully recovered.

Deferred Financing Costs

Deferred financing costs, which consist of fees and expenses paid in connection with the closing of Fifth Street Holdings' credit facility, are capitalized at the time of payment. Deferred financing costs are amortized using the straight line method over the term of the credit facility and are included in interest expense on the Consolidated Statements of Operations.

Deferred Rent

The Company recognizes rent expense on a straight-line basis over the expected lease term. Within the provisions of certain leases, there are free rent periods and escalations in payments over the base lease term. The effects of these items have been reflected in rent expense on a straight-line basis over the expected lease term. Landlord contributions and tenant allowances are included in the straight-line calculations and are being deferred over the lease term and are reflected as a reduction in rent expense.

Revenue Recognition

The Company has three principal sources of revenues: management fees, performance fees and other fees. These revenues are derived from the Company's agreements with the funds it manages, primarily the BDCs. The investment advisory agreements on which revenues are based are generally renewable on an annual basis by the general partner or the board of directors of the respective funds.

Management Fees

Management fees are generally based on a defined percentage of fair value of assets, total commitments, invested capital, net asset value, net investment income, total assets or principal amount of the investment portfolios managed by the Company. All management fees are earned from affiliated funds of the Company. The contractual terms of management fees vary by fund structure and investment strategy and range from 0.40% to 1.75% for base management fees, which are asset or capital-based.

Management fees from affiliates also include quarterly incentive fees on the net investment income from the BDCs ("Part I Fees"). Part I Fees are generally equal to 20.0% of the BDCs' net investment income (before Part I Fees and performance fees payable based on capital gains), subject to fixed "hurdle rates" or preferred returns, as defined in the respective investment advisory agreement. No fees are recognized until the BDCs' net investment income exceeds the respective hurdle rate, with a "catch-up" provision that serves to ensure the Company receives 20.0% of the BDCs' net investment income from the first dollar earned. Such fees are classified as management fees as they are paid quarterly, predictable and recurring in nature, not subject to repayment (or clawback) and cash settled each quarter. Management fees from affiliates are recognized as revenue in the period investment advisory services are rendered, subject to the Company's assessment of collectability. On March 20, 2017, Fifth Street Management entered into a new investment advisory agreement with FSC, which, effective as of January 1, 2017, (i) decreased the quarterly preferred return to 1.75% on the income portion of the incentive fee and (ii) implemented a total return requirement that may decrease the incentive fee payable to Fifth Street Management by 25% per quarter to the extent that FSC’s cumulative incentive fees over a lookback period of up to 12 quarters exceed 20.0% of FSC's cumulative net increase in net assets resulting from operations.

13

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Performance Fees

Performance fees are earned from the funds managed by the Company based on the performance of the respective funds. The contractual terms of performance fees vary by fund structure and investment strategy and are generally 15.0% to 20.0% of investment performance.

The Company has elected to adopt Method 2 of ASC 605-20, Revenue Recognition for Revenue Based on a Formula. Under this method, the Company recognizes revenue based on the respective fund's performance during the period, subject to certain hurdles or benchmarks. The performance fees for any period are based upon an assumed liquidation of the fund's net assets on the reporting date, and distribution of the net proceeds in accordance with the fund's income allocation provisions. The performance fees may be subject to reversal to the extent that the performance fees recorded exceed the amount due to the general partner or investment manager based on a fund's cumulative investment returns.

Performance fees related to the BDCs ("Part II Fees") are calculated and payable in arrears as of the end of each fiscal year of the BDCs and equal 20.0% of the BDCs' realized capital gains, if any, on a cumulative basis since inception, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid Part II fees.

Other Fees

The Company also provides administrative services to the Fifth Street Funds. These fees are reported within Revenues - Other fees in the Consolidated Statements of Operations. These fees generally represent reimbursable compensation, overhead and other expenses incurred by the Company on behalf of the funds. The Company is considered the principal under these arrangements and is required to record the expense and related reimbursement revenue on a gross basis.

Compensation and Benefits

Compensation generally includes salaries, bonuses, severance and equity-based compensation charges. Bonuses are accrued over the service period to which they relate.

Retention Bonus Agreements

During the year ended December 31, 2016, the Company entered into retention bonus agreements in the amount of $2,307,000 with certain key employees, all of which has been expensed as of March 31, 2017. Included in compensation expense for the three months ended March 31, 2017 is $674,314 of amortization related to these agreements. There were no retention bonuses forfeited during the three months ended March 31, 2017.

Severance Agreements

The Company has entered into various severance and change in control agreements with certain key employees, which provide for the payment of severance and other benefits to each participant in the event of a termination without cause or for good reason, and in certain cases, the payment of a cash bonus upon the occurrence of a change in control event. The amounts of such payments and benefits vary by employee. The Company records expenses related to such severance and change in control agreements by employee if, and when, a termination or change in control event occurs. Included in compensation expense for the three months ended March 31, 2017 and 2016 is $114,466 and $339,821, respectively, related to these severance arrangements.

Equity-Based Compensation

The Company accounts for stock-based compensation in accordance with ASC Topic 718, Compensation – Stock Compensation. Under the fair value recognition provision of this guidance, share-based compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense over the requisite service period.

The Company recognizes expense related to equity-based compensation transactions in which it receives employee services in exchange for: (a) equity instruments of the Company or (b) liabilities that are based on the fair value of the Company's equity instruments. Equity-based compensation expense represents expenses associated with the: (i) granting of Part I Fee-sharing arrangements prior to the Reorganization; (ii) conversion of and acceleration in vesting of interests in the Predecessor in connection with the Reorganization; and (iii) the granting of restricted stock units, options to purchase shares of FSAM Class A common stock and stock appreciation rights granted.

The value of the award is amortized on a straight-line basis over the requisite service period and is included within "Compensation and benefits" (except for grants to non-employees which are included in "General, administrative and other expenses") in the Company’s Consolidated Statements of Operations.

14

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

Effective January 1, 2016, the Company elected to early adopt ASU 2016-09. The primary impact of the Company's adoption was limited to the accounting for forfeitures of certain stock based awards, which is adopted on a modified retrospective basis. Upon adoption, the Company no longer estimates forfeitures. Rather, the Company has elected to account for forfeitures as they occur.

The Company records deferred tax assets or liabilities for equity compensation plan awards based on deductions for income tax purposes of stock-based compensation recognized at the statutory tax rate in the jurisdiction in which the Company is expected to receive a tax deduction. In addition, differences between the deferred tax assets recognized for financial reporting purposes and the actual tax deduction reported on the Company's income tax returns are recorded as an adjustment to the provision (benefit) for income taxes on the Consolidated Statements of Operations.

Income Taxes

Fifth Street Holdings complies with the requirements of the Internal Revenue Code that are applicable to limited partnerships, which allow for the complete pass-through of taxable income or losses to Fifth Street Holdings limited partners, including FSAM, who are individually responsible for any federal tax consequences. The tax provision includes the income tax obligation related to FSAM's allocated portion of Fifth Street Holdings' income, which is net of any tax incurred at Fifth Street Holdings' subsidiaries that are subject to income tax.

Also, as a result of the Reorganization, certain subsidiaries were converted from pass-through entities to taxable entities. Accordingly, the portion of the Company's subsidiaries' earnings attributable to non-controlling interests are subject to tax when reported as a component of the non-controlling interests' taxable income on their individual tax returns.

The Company accounts for income taxes under the asset and liability method prescribed by ASC Topic 740, Income Taxes. As a result of the Company's acquisition of limited partnership interests in Fifth Street Holdings, the Company expects to benefit from amortization and other tax deductions reflecting the step-up in tax basis in the acquired assets. Those deductions will be used by the Company and will be taken into account in determining the Company's taxable income. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Management periodically assesses the recoverability of its deferred tax assets based upon expected future earnings, future deductibility of the asset and changes in applicable tax laws and other factors. If management determines that it is not probable that the deferred tax asset will be fully recoverable in the future, a valuation allowance may be established for the difference between the asset balance and the amount expected to be recoverable in the future. The allowance will result in a charge to the Company’s Consolidated Statements of Operations. Further, the Company records its income taxes receivable and payable based upon its estimated income tax liability.

The Company recognizes the effect of income tax positions only if those positions are more likely than not of being sustained. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in the period in which the change in judgment occurs.

The Company recognizes interest and penalties associated with tax matters such as franchise tax liabilities, if applicable, as general and administrative and other expenses.

Class A Earnings per Share

The Company computes basic earnings per share attributable to FSAM’s Class A common stockholders by dividing income attributable to FSAM by the weighted average Class A common shares outstanding for the period. Diluted earnings per share reflects the potential dilution beyond shares for basic earnings per share that could occur if securities or other contracts to issue common stock were exercised, converted into common stock, or resulted in the issuance of common stock that would have shared in the Company's earnings. Potentially dilutive securities include outstanding options to acquire Class A common shares, unvested restricted stock units, warrants issued to RiverNorth, MMKT Notes and Fifth Street Holdings limited partnership interests which are exchangeable for shares of Class A common stock. The dilutive effect of stock options and restricted stock units is reflected in diluted earnings per share of Class A common stock by application of the treasury stock method.

Under the treasury stock method, if the average market price of a share of Class A common stock increases above the option's exercise price, the proceeds that would be assumed to be realized from the exercise of the option would be used to acquire outstanding shares of Class A common stock. The dilutive effect of awards is directly correlated with the fair value of the shares of Class A common stock. However, the awards may be anti-dilutive when the market price of the underlying shares exceeds the option's exercise price. This result is possible because the compensation expense attributed to future services but not yet recognized is included as a component of the assumed proceeds upon exercise.

Loss Contingencies and Insurance Recoveries

15

Fifth Street Asset Management Inc.

Notes to Consolidated Financial Statements

In accordance with ASC Topic 450, an estimated loss from a loss contingency is accrued if it is determined that it is probable that a liability has been incurred at the reporting date and the amount can be reasonably estimated. Insurance claims for loss recoveries generally are recognized when a loss event has occurred and recovery is considered probable.

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers ("ASU 2014-09"), which requires an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. ASU 2014-09 will replace most existing revenue recognition guidance in GAAP when it becomes effective. In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606) - Principal versus Agent Considerations. This ASU is intended to clarify revenue recognition accounting when a third party is involved in providing goods or services to a customer. In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606) - Identifying Performance Obligations and Licensing. This ASU is intended to clarify two aspects of ASC Topic 606: identifying performance obligations and licensing implementation guidance. In May 2016, the FASB issued ASU 2016-12, Revenue from Contracts with Customers (Topic 606) - Narrow-Scope Improvements and Practical Expedients. This ASU amends certain aspects of ASU 2014-09, addresses certain implementation issues identified and clarifies the new revenue standards’ core revenue recognition principles. The new standards will be effective for the Company on January 1, 2018 and early adoption is permitted on the original effective date of January 1, 2017. The standard permits the use of either the retrospective or cumulative effect transition method. The Company has not yet selected a transition method nor has it determined the effect of this standard on its consolidated financial statements and its ongoing financial reporting.