Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2015 | ||

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

COMMISSION FILE NUMBER: 001-36701

Fifth Street Asset Management Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

DELAWARE | 46-5610118 | |

(State or jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

777 West Putnam Avenue, 3rd Floor Greenwich, CT | 06830 | |

(Address of principal executive office) | (Zip Code) | |

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

(203) 681-3600

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class | Name of Each Exchange on Which Registered | |

Class A Common Stock, par value $0.01 per share | The NASDAQ Global Select Market | |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods as the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ¨ No þ

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2015 was $58,860,011. The number of shares of the registrant's Class A common stock, par value $0.01 per share, outstanding as of March 15, 2016 was 5,798,614. The number of shares of the registrant's Class B common stock, par value $0.01 per share, outstanding as of March 15, 2016 was 42,856,854.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement relating to the registrant's 2016 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission within 120 days following the end of the registrant's fiscal year, are incorporated by reference in Part III of this Annual Report on Form 10-K as indicated herein.

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Exhibit Index | ||

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934 as amended, (the "Exchange Act"), that reflect our current views with respect to, among other things, future events and financial performance. You can identify these forward-looking statements by the use of forward-looking words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of those words or other comparable words. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. We believe these factors include, but are not limited to, those described under "Risk Factors" in this Annual Report on Form 10-K, as such factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission (the "SEC"), which are accessible on the SEC's website at www.sec.gov. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from those indicated in these forward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. We do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Unless the context otherwise requires, references to "we," "us," "our" and "the Company" are intended to mean the business and operations of Fifth Street Asset Management Inc. and its consolidated subsidiaries since the consummation of our initial public offering on November 4, 2014. When used in the historical context (i.e., prior to November 4, 2014), these terms are intended to mean the business and operations of Fifth Street Management Group.

When used in this Annual Report on Form 10-K, unless the context otherwise requires:

• | "Adjusted Net Income" represents income before income tax benefit (provision) as adjusted for (i) certain compensation-related charges, including the amortization of equity-based awards related to the Reorganization and initial public offering, (ii) non-recurring underwriting costs relating to public offerings of our funds, (iii) non-recurring professional fees and other expenses incurred in connection with our initial public offering, (iv) unrealized gains (losses) on beneficial interests in CLO, (v) certain litigation-related costs and (vi) other non-recurring items; |

• | "AUM" refers to assets under management of the Fifth Street Funds and material control investments of these funds, and represents the sum of the net asset value of such funds and investments, the drawn debt and unfunded debt and equity commitments at the fund or investment-level (including amounts subject to restrictions) and uncalled committed debt and equity capital (including commitments to funds that have yet to commence their investment periods); |

• | "base management fees" refer to fees we earn for advisory services provided to our funds, which are generally based on a fixed percentage of fair value of assets, total commitments, invested capital, net asset value, total assets or par value of the investment portfolios managed by us; |

• | "catch-up" refers to a provision for a manager or adviser of a fund to receive the majority or all of the profits of such fund until the agreed upon profit allocation is reached; |

• | "CLO" refers to a collateralized loan obligation; |

• | “CLO I” refers to Fifth Street Senior Loan Fund I, LLC, a CLO in our senior loan fund strategy managed by CLO Management; |

• | "CLO II" refers to Fifth Street SLF II, Ltd. (formerly Fifth Street Senior Loan Fund II, LLC, prior to securitization), a CLO in our senior loan fund strategy managed by CLO Management; |

• | "CLO Management" refers to Fifth Street CLO Management LLC, the collateral manager for CLO I and CLO II; |

• | "fee-earning AUM" refers to the AUM on which we directly or indirectly earn management fees, and represents the sum of the net asset value of the Fifth Street Funds and their material control investments, and the drawn debt and unfunded debt and equity commitments at the fund or investment-level (including amounts subject to restrictions); |

• | "Fifth Street BDCs" and "our BDCs" refer to FSC and FSFR together; |

• | "Fifth Street Funds" and "our funds" refer to the Fifth Street BDCs and the other funds advised or managed by Fifth Street Management or CLO Management; |

• | "Fifth Street Management" refers to Fifth Street Management LLC and, unless the context otherwise requires, its subsidiaries; |

• | "Fifth Street Management Group" and the "Predecessor" refers to Fifth Street Management LLC, FSC, Inc., FSC CT, Inc., FSC Midwest, Inc., Fifth Street Capital West, Inc. (and their wholly-owned subsidiaries) and certain combined funds; |

i

• | "FSC" refers to Fifth Street Finance Corp., a publicly-traded business development company managed by Fifth Street Management; |

• | "FSFR" refers to Fifth Street Senior Floating Rate Corp., a publicly-traded business development company managed by Fifth Street Management; |

• | "FSOF" refers to "Fifth Street Opportunities Fund, L.P.", a hedge fund managed by Fifth Street Management; |

• | "Fund II" refers to Fifth Street Mezzanine Partners II, L.P., a fund advised by an affiliate of Fifth Street Management; |

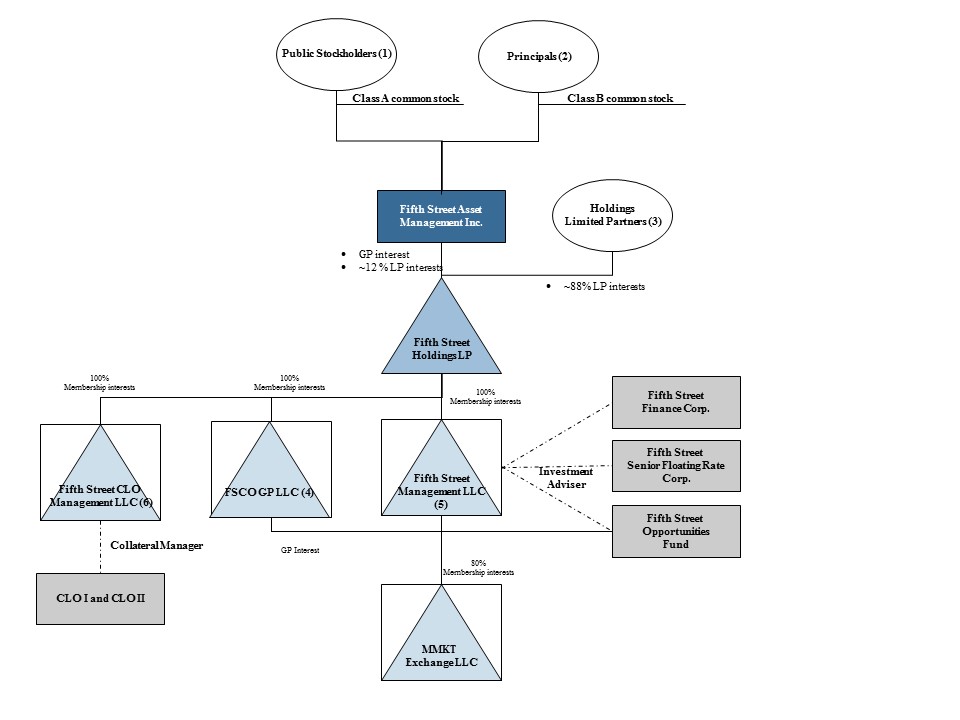

• | "Holdings Limited Partners" refers to active, limited partners in Fifth Street Holdings (other than us), which include, among other persons, the Principals; |

• | "hurdle rate" or "hurdle" refers to a specified minimum rate of return that a fund must exceed in order for the investment adviser or manager of such a fund to receive performance fees; |

• | "management fees" refer to base management fees and Part I Fees; |

• | "MMKT" refers to MMKT Exchange LLC, a financial technology company in which FSM owns 80% of the common membership interests; |

• | "Part I Fees" refer to fees paid to us by our BDCs that are based on a fixed percentage of pre-incentive fee net investment income, which are calculated and paid quarterly, and subject to certain specified performance hurdles. Part I Fees are classified as management fees as they are predictable and are recurring in nature, are not subject to repayment (or clawback) and are generally cash-settled each quarter; |

• | "Part II Fees" refer to fees paid to us by our BDCs that are based on net capital gains, which are paid annually; |

• | "performance fees" refer to fees we earn based on the performance of a fund, which are generally based on certain specific hurdle rates as defined in the fund's investment management or partnership agreements, may be either an incentive fee or carried interest, are paid annually and also include Part II Fees; |

• | "permanent capital" refers to capital of funds that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law, which funds currently consist of FSC and FSFR; such funds may be required to distribute all or a portion of capital gains and investment income or elect to distribute capital; |

• | "Principals" refers to Leonard M. Tannenbaum and Bernard D. Berman and, where applicable, any entities controlled directly or indirectly by them; |

• | "SLF I" refers to Fifth Street Senior Loan Fund I, LLC, a fund in our senior loan fund strategy, previously managed by Fifth Street Management prior to CLO I securitization; |

• | "SLF II" refers to Fifth Street Senior Loan Fund II, LLC, a fund in our senior loan fund strategy, previously managed by Fifth Street Management prior to CLO II securitization; and |

• | "TRA recipients" refers to the Principals and Ivelin M. Dimitrov. |

Many of the terms used in this Annual Report on Form 10-K, including AUM, fee-earning AUM and Adjusted Net Income, may not be comparable to similarly titled measures used by other companies. In addition, our definitions of AUM and fee-earning AUM are not based on any definition of AUM or fee-earning AUM that is set forth in the agreements governing the investment funds that we manage and may differ from definitions of AUM set forth in other agreements to which we are a party from time to time, including the agreements governing our revolving credit facility. Please see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures and Operating Metrics — Assets Under Management" and "— Fee-earning AUM" for more information on AUM and fee-earning AUM. Further, Adjusted Net Income is not a performance measure calculated in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"). We use Adjusted Net Income as a measure of operating performance, not as a measure of liquidity. We believe that Adjusted Net Income provides investors with a meaningful indication of our core operating performance and Adjusted Net Income is evaluated regularly by our management as a decision tool for deployment of resources. We believe that reporting Adjusted Net Income is helpful in understanding our business and that investors should review the same supplemental non-GAAP financial measures that our management uses to analyze our performance. Adjusted Net Income has limitations as an analytical tool and should not be considered in isolation or as a substitute for analyzing our results prepared in accordance with GAAP. The use of Adjusted Net Income without consideration of related GAAP measures is not adequate due to the adjustments described above. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures and Operating Metrics — Adjusted Net Income."

Amounts and percentages throughout this Annual Report on Form 10-K may reflect rounding adjustments and consequently totals may not appear to sum.

ii

PART I

Item 1. Business

Our Business

Fifth Street is a leading alternative asset manager with more than $5.0 billion of assets under management. The funds we manage provide innovative and flexible financing solutions to small and mid-sized companies across their capital structures, primarily in connection with investments by private equity sponsors. We define small and mid-sized companies as those with annual revenues between $25 million and $250 million. As of December 31, 2015, 85.1% of our assets under management reside in publicly-traded permanent capital vehicles, consisting of Fifth Street Finance Corp. and Fifth Street Senior Floating Rate Corp.

Our direct origination platform is sustained by strong relationships with over 250 private equity sponsors. We believe we are differentiated from other alternative asset managers by our structuring flexibility, financial strength and a reputation for delivering on commitments. We provide innovative and customized credit solutions across the capital structure, including one-stop financing, unitranche debt, senior secured debt, mezzanine debt, equity co-investments and venture debt financing. Our platform targets loans for investment of up to $250 million and will structure and syndicate loans of up to $500 million.

Since our founding in 1998, we have grown into a diversified asset manager with approximately 70 employees, approximately half of whom are investment professionals. Our management team has a proven 17-year track record across market cycles using a disciplined investment process. Our historical growth has been facilitated through a scalable operating platform.

We provide our investment management services to the following fund strategies:

Fund Strategy(1) | Strategy and Focus | Launch | AUM (As of December 31, 2015) (in thousands) | ||||||

Permanent Capital Vehicles: | |||||||||

Fifth Street Finance Corp. (NASDAQ: FSC) | - Publicly-traded business development company, or BDC, focused on investing and lending to sponsor-backed small and mid-sized companies across their capital structure - Permanent capital vehicle | June 2008 | $ | 3,518,119 | |||||

Fifth Street Senior Floating Rate Corp. (NASDAQ: FSFR) | - Publicly-traded BDC focused on floating rate, senior secured loans to sponsor-backed mid- sized companies - Permanent capital vehicle | July 2013 | 989,702 | ||||||

Institutional Vehicles: | |||||||||

Senior Loan Funds | - Securitized private vehicles focused on senior secured loans to middle market companies. Consists of CLO I and CLO II | February 2014 | 697,701 | ||||||

Fifth Street Opportunities Fund | - A long/short hedge fund targeting uncorrelated returns by primarily focusing on yield-oriented corporate credit assets and equities, including leveraged loans and BDCs | March 2013 | 90,090 | ||||||

Total AUM | $ | 5,295,612 | |||||||

____________________

(1) FSC, FSFR, our Senior Loan Funds and FSOF may utilize leverage as part of their respective investment programs. See "Risk Factors — Risks Related to Our Business Development Companies and Other Funds — Dependence on leverage by certain of our funds and by our funds' portfolio companies subjects us to volatility and contractions in the debt financing markets and could adversely affect our funds' ability to achieve attractive rates of return on those investments."

Our Mission

Our mission is to build a leading alternative asset management firm with a core focus on credit solutions and to be admired in the marketplace for our ideas, talent and integrity.

We foster a culture of dedicated and innovative professionals who strive to deliver impeccable service and create value for both our investors and clients.

Our Investment Vehicles

We receive management fees in connection with the advisory services that we provide to the Fifth Street BDCs and

1

private funds. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Overview of Results of Operations." We also provide administrative services to the Fifth Street BDCs and have granted the Fifth Street BDCs non-exclusive, royalty-free license to use the name "Fifth Street."

Historical Performance of our Funds

The following table sets forth historical performance for certain of our funds as of December 31, 2015. When considering the data presented below, you should note that the historical results of our funds are not indicative of the future results that you should expect from such funds, from any future funds we may raise, our future results or from your investment in our Class A common stock. An investment in our Class A common stock is not an investment in any of our funds, and the assets and revenues of our funds are not directly available to us. See "Risk Factors — Risks Related to Our Business — The historical returns attributable to our funds should not be considered as indicative of the future results of our funds, our new investment strategies, our operations or of any returns expected on an investment in our Class A common stock."

Fund | Period Presented(1) | Net IRR | Total Return | Benchmark Index(2) | Benchmark Index Performance | |||||

Fund II (3) | 01/28/2005 - 12/31/2014 | 6.7%(4) | N/A | LPX Mezzanine | (0.03)% | |||||

FSC | 06/12/2008 - 12/31/2015 | N/A | 2.5% (5) | CS Leveraged Loan Index | 4.4% | |||||

FSOF | 03/01/2013 - 12/31/2015 | N/A | 23.7% (6) | BAML HY Index | 3.1% | |||||

FSFR | 07/12/2013 - 12/31/2015 | N/A | (10.9%)(5) | CS Leveraged Loan Index | 1.8% | |||||

____________________

(1) Periods presented are shown from each included fund's date of inception or initial public offering through December 31, 2015, unless otherwise indicated. We have included in this table each of our funds for which we can calculate over one year of operating performance data. Our CLOs have been excluded from the table above since there has not been one year of operating performance since securitization.

(2) The LPX Mezzanine Index covers all listed private equity companies that pursue a mezzanine capital investment strategy and fulfill certain liquidity constraints. The index is diversified across regions, investment styles and vintage years. The Credit Suisse Leveraged Loan Index, or the CS Leveraged Loan Index, is an index designed to mirror the investable universe of the $US-denominated leveraged loan market. Securities in the index must meet the following criteria: loans must be rated "5B" or lower; only fully-funded term loans are included; the tenor must be at least one year; and the issuers of loans must be domiciled in developed countries. The BofA Merrill Lynch US High Yield Master II Index, or the BAML HY Index, tracks the performance of US dollar denominated below investment grade rated corporate debt publicly issued in the U.S. domestic market. Securities in the BAML HY Index must have a below investment grade rating and an investment grade rated country of risk. Each security must have more than one year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million.

(3) The partnership term of Fund II has expired and all remaining assets were transferred into a liquidating trust on December 31, 2014, for the period until such time that all underlying assets are liquidated.

(4) Percentage represents annualized Net IRR for the period indicated on invested capital based on contributions, distributions and unrealized value after giving effect to management fees, the general partner's carried interest, where applicable, and other expenses.

(5) Percentage represents the annualized total return provided to shareholders on our BDCs' common stock from the closing price on the date of their respective initial public offerings and equals the increase (or decrease) of ending market value over beginning market value, plus distributions, divided by the beginning market value, assuming dividend reinvestment under their respective dividend reinvestment plans.

(6) Percentage represents the annualized total return for the period indicated which is calculated based on the change in net asset value per share since inception after giving effect to management fees, performance fees and other expenses. Includes returns of predecessor fund of FSOF that operated with a substantially similar investment objective and strategy as FSOF.

Business Development Companies

Overview

Our BDCs are publicly-traded permanent capital vehicles that maintain a portfolio of a diverse range of companies in a tax-favored structure. These permanent capital vehicles are externally managed, closed-end, non-diversified investment companies that have elected to be regulated as BDCs under the 1940 Act. BDCs are required to comply with regulatory requirements, including limitations on the use of debt. Our BDCs are permitted to, and expect to continue to, finance investments through borrowings. However, such entities are only generally allowed to borrow amounts such that their asset coverage, as defined in the 1940 Act, equals at least 200% after such borrowing (subject, in the case of FSC, to certain exemptive relief granted with respect to its small business investment company, or SBIC, subsidiaries). Also under the 1940 Act, a BDC may not acquire any asset other than qualifying assets, as defined in Section 55(a) of the 1940 Act, unless, at the time the acquisition is made, qualifying assets represent at least 70% of the company's total assets. In order to count portfolio securities as qualifying assets for purposes of the 70% test, the portfolio company must (i) have its principal operations in the United States, (ii) generally be a private or thinly-traded public operating company and (iii) not be an investment company (other than a small business investment company wholly owned by the business development company) or a company that would be an investment company but for certain exclusions under the 1940 Act, and the BDC must either control the issuer of the securities in which it is investing or offer to make available significant managerial assistance to such issuer. Generally,

2

BDCs are not able to issue or sell common stock at a price below the net asset value per share.

Our BDCs have each elected to be treated for federal income tax purposes as a regulated investment company, or RIC, under Subchapter M of the Code. A BDC treated as a RIC generally will not have to pay corporate-level federal income taxes on any net ordinary income or realized net capital gains that is distributed to its stockholders if it meets certain source-of-income, income distribution, asset diversification and other requirements imposed under the Code.

Fifth Street Finance Corp.

FSC is a specialty finance company that lends to and invests in small and mid-sized companies, primarily in connection with investments by private equity sponsors. FSC's investment objective is to maximize its portfolio's total return by generating current income from its debt investments and capital appreciation from its equity investments. FSC is advised by Fifth Street Management pursuant to an investment advisory agreement.

FSC's investments generally range in size from $10 million to $100 million and are principally in the form of first lien, second lien and subordinated debt investments, which may also include an equity component. As of December 31, 2015, 80.5% of FSC's portfolio at fair value consisted of debt investments that were secured by first or second priority liens on the assets of its portfolio companies. Moreover, FSC held equity investments consisting of common stock, preferred stock or other equity interests in approximately half of its portfolio companies as of December 31, 2015.

From inception through December 31, 2015, FSC has originated over $6.0 billion of funded debt and equity investments. FSC's portfolio totaled $2.3 billion at fair value at December 31, 2015 and was comprised of 131 investments, 113 of which were in operating companies, one of which was in a senior loan fund vehicle and 17 of which were in private equity funds. The 17 investments in private equity funds represented approximately 1% of the fair value of FSC's assets as of December 31, 2015.

In addition, FSC maintains wholly-owned subsidiaries that are licensed as SBICs and regulated by the United States Small Business Administration, or SBA. The SBIC licenses allow FSC, through its wholly-owned subsidiaries, to issue SBA-guaranteed debentures. FSC received exemptive relief from the SEC to permit it to exclude the debt of its SBIC subsidiaries guaranteed by the SBA from the definition of senior securities in the 200% asset coverage ratio it is required to maintain under the 1940 Act. Pursuant to the 200% asset coverage ratio limitation, FSC is permitted to borrow one dollar for every dollar it has in assets less all liabilities and indebtedness not represented by debt securities issued by it or loans obtained by it. As a result of the receipt of exemptive relief from the SEC for its SBA debt, FSC has increased capacity to fund up to $225 million (the maximum amount of SBA-guaranteed debentures FSC's SBICs may currently have outstanding once certain conditions have been met) of investments with SBA-guaranteed debentures in addition to being able to fund investments with borrowings up to the maximum amount of debt that the 200% asset coverage ratio limitation would allow FSC to incur.

Fifth Street Senior Floating Rate Corp.

FSFR is a specialty finance company whose investment objective is to maximize the total return on its portfolio by generating current income from debt investments while seeking to preserve capital. FSFR invests primarily in senior secured loans, including first lien, unitranche and second lien debt instruments, that pay interest at rates which are determined periodically on the basis of a floating base lending rate, made to private middle market companies whose debt is rated below investment grade, which we refer to collectively as "senior loans." FSFR may also invest in senior unsecured loans issued by private middle market companies and, to a lesser extent, subordinated loans issued by private middle market companies and senior and subordinated loans issued by public companies. Under normal market conditions, at least 80% of the value of FSFR's net assets plus borrowings for investment purposes is invested in floating rate senior loans. FSFR is advised by Fifth Street Management pursuant to an investment advisory agreement.

FSFR invests in senior loans made primarily to private leveraged middle market companies with approximately $20 million to $100 million of EBITDA. Its business model is focused primarily on the direct origination of investments through portfolio companies or their financial sponsors. FSFR's investments generally range between $3 million and $30 million, although FSFR expects that this investment size will vary proportionately with the size of its capital base. In addition, FSFR may invest a portion of its portfolio in other types of investments, which it refers to as opportunistic investments, which are not its primary focus, but are intended to enhance overall returns. These opportunistic investments may include, but are not limited to, direct investments in public companies that are not thinly traded and securities of leveraged companies located in select countries outside of the United States. FSFR may invest up to 30% of its total assets in such opportunistic investments, including senior loans issued by non-U.S. issuers, subject to compliance with its regulatory obligations as a BDC under the 1940 Act.

From the time FSFR commenced operations on June 29, 2013 through December 31, 2015, it has originated over $1.5 billion of funded debt investments. As of December 31, 2015, its portfolio totaled $604.0 million at fair value and was comprised of 68 investments, 67 of which were in operating companies and one of which was in a senior loan fund vehicle.

3

Senior Loan Funds

The investment objective of our senior loan funds strategy is to generate leveraged returns by focusing on investing, directly or indirectly, through subsidiaries, in senior secured term loan debt (including broadly syndicated loans, first lien term loans, second lien loans and to a lesser extent, delayed draw term loans and revolving loans) of middle market companies. The portfolios of loan debt currently provide eligible collateral for securitization financing that are employed by the senior loan funds' strategy to enhance the size of investment portfolios and magnify the returns generated from such portfolios. Portfolio investments in loans are subject to certain criteria and restrictions with respect to the loans and the underlying obligors. In particular, we may not invest in a loan of which Fifth Street or an affiliate is the obligor.

We launched Fifth Street Senior Loan Fund I, LLC in February 2014 and Fifth Street Senior Loan Fund II, LLC in August 2014, each a warehouse financing vehicle. In February 2015, we securitized the senior secured loan portfolio warehoused in Fifth Street Senior Loan Fund I, LLC. In September 2015, we securitized the senior secured loan portfolio warehoused in Fifth Street Senior Loan II, LLC into CLO II.

Fifth Street Opportunities Fund

The investment objective of FSOF is to generate income and long-term capital appreciation. Fifth Street intends to achieve the investment objective by primarily investing opportunistically in various credit-related instruments, including, without limitation, debt securities, instruments and obligations of U.S. and non-U.S. government, corporate and other non-governmental entities and issuers and preferred and convertible preferred securities that include fixed-income features, and in publicly-traded equity and equity-linked securities, including, without limitation, the equity securities of BDCs managed by unaffiliated investment managers. FSOF may invest in instruments and obligations directly or indirectly by investing in derivative or synthetic instruments, including, without limitation, credit default swaps and loan credit default swaps, and may engage in currency trading. FSOF's investment program may include opportunistic investments in corporate structured credit, cash and synthetic collateralized loan obligations and collateralized debt obligations, or CDOs (e.g., bank and insurance trust preferred CDOs), cash and synthetic high-yield debt and leveraged loans, and non-mortgage asset-backed securities. FSOF may utilize other strategies or financial instruments as determined by Fifth Street, subject to the oversight of the general partner of FSOF. FSOF's general partner is FSCO GP and its investment adviser is Fifth Street Management.

Our Investment Team and Institutionalized Operating Platform

Fifth Street Management has carefully assembled a highly regarded team with significant experience in sponsor-led investing in private growing companies. As of December 31, 2015, we had over 30 professionals focused on originating, structuring and managing our investment portfolio, as well as other professionals focused on corporate operations.

Investment Process

We maintain a disciplined investment process approach across our funds that utilizes policies and procedures and leverages the strengths of our operating platform.

•Sourcing - Our relationships with private equity sponsors are our principal source of originations. Potential investments are screened on company, industry, capital structure and transaction considerations.

•Due diligence - We maintain a rigorous underwriting process that includes one-on-one meetings with management, review of third-party reports, utilization of industry consultations and in-depth financial analysis. We utilize our sponsor and portfolio company networks to form real-time industry sector views. Deal teams present their findings and recommendations to the investment committee or portfolio manager of the fund for further review and approval.

•Portfolio construction - We carefully consider asset and industry concentrations in the context of potential macroeconomic, cyclical, technological and regulatory headwinds. We evaluate price and risk alongside our ability to obtain optimal levels of leverage.

•Legal documentation and closing - We view legal documentation as a key risk mitigant. We work closely with external legal counsel to negotiate credit documentation with an emphasis placed on financial covenants that may be adverse to lenders.

Moreover, each fund is subject to certain investment criteria set forth in its governing documents that generally contain requirements and limitations for investments, such as limitations relating to types of assets in which the fund can invest, the amount that will be invested in any one company, the geographic regions in which the fund will invest and potential conflicts of interest that may arise from investing alongside funds within the same or a different investment group. Certain of our affiliates have received an exemptive order from the SEC that permits certain negotiated co-investments among our affiliates that would otherwise be prohibited under the 1940 Act. See "— Regulatory and Compliance Matters — SEC Regulation."

4

Deal Origination

The Fifth Street Funds' deal origination efforts center on building relationships with private equity sponsors that are focused on investing in the small and mid-sized companies that these funds target. The Fifth Street Funds emphasize active, consistent sponsor coverage across the United States. The investment professionals of Fifth Street Management have developed an extensive network of relationships with these private equity sponsors. We estimate that there are over 3,500 of such private equity sponsors and Fifth Street Management has active relationships with over 250 of them. An active relationship is one through which Fifth Street Management has received at least one potential investment opportunity from the private equity sponsor within the last year.

A significant portion of the investment transactions that the Fifth Street Funds have completed to date were originated through Fifth Street Management's relationships with private equity sponsors. We believe we are differentiated from other alternative asset managers by our structuring flexibility, financial strength and a reputation for delivering on commitments. We believe that this reputation and the relationships that Fifth Street Management has built with sponsors will continue to provide our funds with significant investment opportunities.

We have the capacity to be flexible in structuring transactions for private equity sponsors because of our ability in and experience with originating financings at every level of the capital structure, from senior debt to equity, across multiple industries and utilizing a variety of structures. For example, our broad product offerings include an innovative unitranche product that provides sponsors with a one-stop solution to their financing needs. Unitranche products provide private equity sponsors with ease of execution and post-closing management, higher certainty of closing because of the involvement of fewer stakeholders and a single class of debt thereby removing intercreditor complexity. In addition, our product offerings are bolstered by our permanent capital vehicles that allow us to support private equity sponsors' financing needs through economic cycles.

Our platform targets loans for investment of up to $250 million and will structure and syndicate transactions of up to $500 million. Our financing solutions include:

•One-Stop Financing

•First Lien Debt and Second Lien Debt

•Revolver

•Mezzanine Debt

•Delayed Draw Term Loan

•Equity Co-Investment

We provide financing solutions across industry sectors, including:

•Healthcare

•Food and Restaurants

•Manufacturing

•Software and Technology

•Business Services

•Energy

•Education

•Aerospace and Defense

•Consumer Products

•Marketing Services

Risk Management

We have established risk management policies and procedures that are integrated into all aspects of our business from deal origination to portfolio management. Our management team is attuned to the macro-environment and focuses our funds' investments on industry leaders with the scale to withstand market volatility. We also monitor investment concentration across portfolio companies and industry sectors to ensure our portfolios are sufficiently diversified. A credit committee or the portfolio manager must approve each investment that our funds make. We have sought to adhere to underwriting best practices by utilizing, among others, defined credit boxes, standardized write-ups and strict underwriting guidelines. Once our funds have made an investment, we take a proactive approach to portfolio management. We utilize our integrated portfolio management system to monitor financials, covenant compliance, financial performance trends and portfolio level concentration data. We keep an active watch list and utilize proprietary metrics to monitor the performance of our investments. We monitor the portfolio investments of our funds using a variety of tools and processes on a daily, weekly and monthly basis. We also believe that we are differentiated from our competitors by taking an active role in attending certain board meetings of our BDCs'

5

portfolio companies.

Information Technology

Information technology is important for us to conduct our investment, management and administrative activities for our funds. As part of our technology strategy and governance processes, we develop and routinely refine our technology architecture to leverage solutions that will best serve the needs of our investors. We have developed an enterprise management system that enables us to efficiently integrate our portfolio management and operations activities. Our systems provide us with the ability to generate reports on individual fund investments or entire portfolios. We also utilize subscription-based information services and databases to conduct research, track market movements and perform credit analysis. In addition, our systems, data, network and infrastructure are monitored and administered by formal controls and risk management processes that also help protect the data and privacy of our employees and investors. Our business continuity plan is designed to allow critical business functions to continue in the event of a significant business disruption.

Competition

We face competition both in the pursuit of outside investors for our funds and in acquiring investments in attractive portfolio companies and making other investments. We compete in all aspects of our business with other investment management companies, including BDCs, investment funds, private equity funds, traditional financial services companies, such as commercial banks and other sources of financing. We compete for outside investors based on a variety of factors, including:

• | investment performance; |

• | investor perception of investment managers' drive, focus and alignment of interest; |

• | terms of investment, including the level of fees and expenses charged for services; |

• | our actual or perceived financial condition, liquidity and stability; |

• | the quality and mix of services provided to, and the duration of relationships with, investors; and |

• | our business reputation. |

In order to grow our business, we must be able to compete effectively for investments based on a variety of factors, including:

• | the experience and contacts of our management team; |

• | our responsive and efficient investment analysis and decision-making processes; |

• | the investment terms we offer; and |

• | our willingness to make smaller investments. |

Many of our competitors are substantially larger and may possess greater financial and technical resources. Several of these competitors have raised, or are expected to raise, significant amounts of capital and many of them have similar investment objectives to us, which may create additional competition for investment opportunities. Some of these competitors may also have a lower cost of capital and access to funding sources that are not available to us, which may create competitive disadvantages for us with respect to investment opportunities. Some of these competitors may have higher risk tolerance, make different risk assessments or have lower return thresholds, which could allow them to consider a wider variety of investments, bid more aggressively for investments that we want to make or accept legal or regulatory limitations or risks we would be unable or unwilling to accept. We believe that some of our competitors make loans with interest rates and returns that are comparable to, or lower than, the rates and returns that we target.

Therefore, we do not seek to compete solely on the interest rates that are offered by our funds to potential portfolio companies. Corporate buyers may be able to achieve synergistic cost savings with regard to an investment that may provide them with a competitive advantage relative to us when bidding for an investment. Moreover, an increase in the allocation of capital to alternative investment strategies by institutional and individual investors could lead to a reduction in the size and duration of pricing inefficiencies that many of our investment funds seek to exploit. Alternatively, a decrease in the allocation of capital to alternative investments strategies could intensify competition for that capital and lead to fee reductions and redemptions, as well as difficulty in raising new capital.

Competition is also intense for the attraction and retention of qualified employees. Our ability to compete effectively in our businesses will depend upon our ability to continue to attract new employees and retain and motivate our existing employees.

For information on the competitive risks we face, see "Risk Factors — Risks Related to Our Business — The investment

6

management business is intensely competitive."

Employees

We employ approximately 70 employees, approximately half of whom are investment professionals. None of our employees are subject to collective bargaining agreements. We consider our relationship with our employees to be good and have not experienced interruptions of operations due to labor disagreements.

Regulatory and Compliance Matters

We are subject to extensive regulation. Each of the regulatory bodies with jurisdiction over us has regulatory powers dealing with many aspects of financial services, including the authority to grant, and in specific circumstances to limit, restrict or prohibit an investment adviser from carrying on particular activities in the event that it fails to comply with such laws and regulations. Any failure to comply with these rules and regulations could expose us to liability and/or reputational damage. In addition, additional legislation, increasing regulatory oversight of fundraising activities, changes in rules promulgated by self-regulatory organizations or exchanges or changes in the interpretation or enforcement of existing laws and rules may directly affect our mode of operation and profitability.

Rigorous legal and compliance analysis of our businesses and investments is important to our culture. We strive to maintain a culture of compliance through the use of policies and procedures, such as oversight compliance, codes of ethics, compliance systems, communication of compliance guidance and employee education and training. We have a compliance group that monitors our compliance with the regulatory requirements to which we are subject and manages our compliance policies and procedures. Our Chief Compliance Officer supervises our compliance group, which is responsible for monitoring all regulatory and compliance matters that affect our activities. Our compliance policies and procedures address a variety of regulatory and compliance risks, such as the handling of material, non-public information, personal securities trading, document retention, potential conflicts of interest and the allocation of investment opportunities. Senior management is involved at various levels in all of these functions, including through active participation on oversight and credit committees.

SEC Regulation

Fifth Street Management and CLO Management are registered as investment advisers and Fifth Street Capital LLC, the former adviser of Fund II, reports as an exempt reporting adviser with the SEC pursuant to the Advisers Act, and our BDCs are regulated under the 1940 Act. As compared to other, more disclosure-oriented U.S. federal securities laws, the Advisers Act and the 1940 Act, together with the SEC's regulations and interpretations thereunder, are highly restrictive regulatory statutes. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act and the 1940 Act, ranging from fines and censures to termination of an adviser's registration.

Under the Advisers Act, an investment adviser (whether or not registered under the Advisers Act) has fiduciary duties to its clients. The SEC has interpreted these duties to impose standards, requirements and limitations on, among other things, trading for proprietary, personal and client accounts; allocations of investment opportunities among clients; use of "soft dollars," a practice that involves using client brokerage commissions to purchase research or other services that help managers make investment decisions; execution of transactions; and recommendations to clients. On behalf of our investment advisory clients, we make decisions to buy and sell securities for each portfolio, select broker dealers to execute trades and negotiate brokerage commission rates.

Section 28(e) of the Exchange Act provides a "safe harbor" to investment managers who use commission dollars generated by their advised accounts to obtain investment research and brokerage services that provide lawful and appropriate assistance to the manager in the performance of investment decision-making responsibilities. Conduct outside of the safe harbor afforded by Section 28(e) is subject to the traditional standards of fiduciary duty under state and federal law. While neither we nor any of our funds currently use soft dollars, to the extent that we may use "soft dollars" in the future, we would intend for such use to fall within the safe harbor of Section 28(e).

The Advisers Act also imposes specific restrictions on an investment adviser's ability to engage in principal and agency cross transactions. As a registered adviser, we are subject to many additional requirements that cover, among other things, disclosure of information about our business to clients; maintenance of written policies and procedures; maintenance of extensive books and records; restrictions on the types of fees we may charge, including performance fees; solicitation arrangements; maintaining effective compliance program; custody of client assets; client privacy; advertising; and proxy voting. The SEC has authority to inspect any registered investment adviser and typically inspects a registered adviser periodically to determine whether the adviser is conducting its activities in compliance with (i) applicable laws, (ii) disclosures made to clients and (iii) adequate systems, policies and procedures to ensure compliance.

A majority of our revenues are derived from our advisory services to our BDCs, which are subject to regulation under the 1940 Act. The 1940 Act imposes significant requirements and limitations on BDCs, including with respect to their capital

7

structure, investments and transactions. While we exercise broad discretion over the day-to-day management of these funds, each BDC is also subject to oversight and management by a board of directors, a majority of whom are not "interested persons" as defined under the 1940 Act. The responsibilities of each board include, among other things, approving our advisory contract with the BDC; approving certain service providers; determining the valuation and the method for valuing assets; and monitoring transactions involving affiliates. Our advisory contracts with a Fifth Street BDC may be terminated by the stockholders or directors of such BDC on not more than 60 days' notice, and are subject to annual renewal by each respective BDC's board of directors after an initial two-year term.

Generally, BDCs are prohibited under the 1940 Act from knowingly participating in certain transactions with their affiliates without prior approval of their board of directors who are not interested persons and, in some cases, prior approval by the SEC. The SEC has interpreted the prohibition on transactions with affiliates to prohibit "joint transactions" among entities that share a common investment adviser.

On September 9, 2014, Fifth Street Management and certain of its affiliates received an exemptive order from the SEC that permits them to co-invest with each other and other funds managed by Fifth Street Management or its affiliates in negotiated transactions in a manner consistent with the Fifth Street BDCs' investment objectives, positions, policies, strategies and restrictions as well as regulatory requirements (including the terms and conditions of the exemptive order).

Under the terms of the exemptive order, a "required majority" (as defined in Section 57(o) of the 1940 Act) of BDC directors must make certain conclusions in connection with a co-investment transaction, including that (1) the terms of the proposed transaction, including the consideration to be paid, are reasonable and fair to the BDC and its stockholders and do not involve overreaching in respect of the BDC and its stockholders on the part of any person concerned and (2) the transaction is consistent with the interests of the BDC's stockholders and its investment objectives and strategies.

In certain situations where co-investment with one or more funds managed by Fifth Street Management or its affiliates is not covered by the Order, such as when there is an opportunity to invest in different securities of the same issuer, the personnel of Fifth Street Management or its affiliates will need to decide which fund will proceed with the investment. Such personnel will make these determinations based on policies and procedures, which are designed to reasonably ensure that investment opportunities are allocated fairly and equitably among affiliated funds over time and in a manner that is consistent with applicable laws, rules and regulations and our allocation policy. Moreover, except in certain circumstances, when relying on the Order, we are unable to invest in any issuer in which one or more funds managed by Fifth Street Management or its affiliates has previously invested.

Under the Advisers Act, our investment management agreements may not be assigned without the client's consent. Under the 1940 Act, advisory agreements with 1940 Act funds (such as the BDCs we manage) terminate automatically upon assignment. The term "assignment" is broadly defined and includes direct assignments as well as assignments that may be deemed to occur upon the transfer, directly or indirectly, of a controlling interest in us.

Other Federal and State Regulators; Self-Regulatory Organizations

In addition to the SEC regulatory oversight we are subject to under the 1940 Act and the Advisers Act, there are a number of other regulatory bodies that have or could potentially have jurisdiction to regulate our business activities. For example, certain of FSC's subsidiaries must comply with regulations adopted by the SBA, in order to maintain their status as SBICs. In addition, in connection with many of the activities of our BDCs or ourselves, we rely on a number of exemptions from regulatory oversight of various other Federal regulatory agencies (including the CFTC and DOL), various self-regulatory organizations (including FINRA and NFA) and various state regulatory authorities. These exemptions are in many cases complex rules in and of themselves, and complying with them can be difficult and time consuming. At times, they may also impose restrictions on our ability to engage in various types of investments or other activities that we would otherwise engage in for the benefit of our clients absent the need to comply with an applicable exemption. Failure to comply with these exemptions (or a change in the scope or conditions of these exemptions) could subject us or our BDCs to additional regulatory oversight.

For additional information about our regulatory environment, see "Risk Factors — Risks Related to Our Industry — The regulatory environment in which we operate is subject to continual change and regulatory developments designed to increase oversight may adversely affect our business."

Item 1A. Risk Factors

RISK FACTORS

We are subject to a number of significant risks inherent in our business. You should carefully consider the risks and uncertainties described below and other information included in this Annual Report on Form 10-K. If any of the events described below occur, our business and financial results could be seriously harmed. The trading price of our Class A Common Stock could decline as a result of any of these risks, and you could lose all or part of your investment.

8

Risks Relating to Economic Conditions

Economic recessions or downturns may have a material adverse effect on our business, financial condition and results of operations.

Economic recessions or downturns may result in a prolonged period of market illiquidity which could have a material adverse effect on our business, financial condition and results of operations. Unfavorable economic conditions also could increase the funding costs of our funds, limit access to the capital markets of our funds or result in a decision by lenders not to extend credit to us or our funds. An economic decline could also negatively impact the private equity sponsors with whom we partner, leading to decreased origination opportunities and potentially less favorable economic terms for our funds in connection with our direct originations. These events could limit investment originations by the Fifth Street Funds, limit our ability to grow the Fifth Street Funds and negatively impact our operating results.

In addition, to the extent that recessionary conditions return, the financial results of small and mid-sized companies, like those in which our funds invest, will likely experience deterioration, which could ultimately lead to difficulty in meeting debt service requirements and an increase in defaults. Additionally, the end markets for certain of the products and services of the portfolio companies of our funds would likely experience negative economic trends. The performance of certain of the portfolio companies of our funds have been, and may continue to be, negatively impacted by these economic or other conditions, which may ultimately result in our receipt of a reduced level of interest income from the portfolio companies of our funds and/or losses or charge offs related to such investments, and, in turn, may materially adversely affect the fees we receive from our funds. Further, adverse economic conditions may decrease the value of collateral securing some of the loans, including the first lien loans, and the value of equity investments held by our funds. As a result, the Fifth Street Funds may need to modify the payment terms of their investments, including changes in payment-in-kind interest provisions and/or cash interest rates. These factors may result in the receipt of a reduced level of interest income from our funds' portfolio companies and/or losses or charge offs related to their investments, and, in turn, may adversely affect the fees that we receive and have a material adverse effect on our results of operations.

Further downgrades of the U.S. credit rating, impending automatic spending cuts or another government shutdown could negatively impact our liquidity, financial condition and earnings.

Recent U.S. debt ceiling and budget deficit concerns have increased the possibility of additional credit rating downgrades and economic slowdowns, or a recession in the United States. Although U.S. lawmakers passed legislation to raise the federal debt ceiling on multiple occasions, ratings agencies have lowered or threatened to lower the long-term sovereign credit rating on the United States. The impact of this or any further downgrades to the U.S. government's sovereign credit rating or its perceived creditworthiness could adversely affect the United States and global financial markets and economic conditions. Absent further quantitative easing by the Federal Reserve, these developments could cause interest rates and borrowing costs to rise, which may negatively impact our ability to access the debt markets on favorable terms. In addition, disagreement over the federal budget has caused the U.S. federal government to shut down for periods of time. Continued adverse political and economic conditions could have a material adverse effect on our business, financial condition and results of operations.

Global economic, political and market conditions and economic uncertainty may adversely affect our business, results of operations and financial condition, including our revenue growth and profitability.

The current worldwide financial market situation, as well as various social and political tensions in the United States and around the world, may contribute to increased market volatility, may have long-term effects on the United States and worldwide financial markets, and may cause economic uncertainties or deterioration in the United States and worldwide. Economic uncertainty can have a negative impact on our business through changing spreads, structures and purchase multiples, as well as the overall supply of investment capital. Since 2010, several European Union, or EU, countries, including Greece, Ireland, Italy, Spain, and Portugal, have faced budget issues, some of which may have negative long-term effects for the economies of those countries and other EU countries. There is continued concern about national-level support for the Euro and the accompanying coordination of fiscal and wage policy among European Economic and Monetary Union member countries. In addition, the fiscal policy of foreign nations, such as Russia and China, may have a severe impact on the worldwide and United States financial markets. We cannot predict the effects of these or similar events in the future on the U.S. economy and securities markets or on our investments. As a result of these factors, there can be no assurance that we will be able to successfully monitor developments and manage the investments of our funds in a manner consistent with achieving their investment objectives.

9

Risks Relating to Our Business

The growth of our business depends in large part on our ability to raise capital from investors. If we are unable to raise capital from new or existing investors or existing investors decide to withdraw their investments from our funds, the Fifth Street Funds will be unable to deploy such capital into investments and we will be unable to collect additional management fees, which would have a negative effect on our growth prospects.

Our ability to raise capital from investors depends on a number of factors, including many that are outside our control. Investors may choose not to make investments with alternative asset managers, including BDCs, private funds and hedge funds, and may choose to invest in asset classes and fund strategies that we do not offer. Poor performance of our funds could also make it more difficult for us to raise new capital. Our investors and potential investors continually assess the performance of these funds independently and relative to market benchmarks and our competitors, and our ability to raise capital for existing and future funds depends on our performance. If economic and market conditions deteriorate, we may be unable to raise sufficient amounts of capital to support the investment activities of our new and future strategies and funds. In addition, one of our key growth strategies is the expansion of our product offerings through the development of new and future strategies and funds. If we are unable to successfully raise capital for our existing and future funds, we will be unable to collect additional management fees, which would have a negative effect on our growth prospects.

In addition, certain of our newer strategies permit investors to withdraw their investments from our funds and could be affected by portfolio rebalancing. This could have the effect of decreasing the capital available for investments in our funds and reduce our revenues and cash flows. As of December 31, 2015, these non-permanent capital strategies constituted 15% of our fee-earning AUM as compared to 10% at December 31, 2014. The AUM of our non-permanent capital vehicles may increase, in both absolute dollars and as a percentage of our total AUM over time.

The loss of our executive officers, key investment professionals or senior management team could have a material adverse effect on our business. Our ability to attract and retain qualified investment professionals is critical to our success.

We depend on the investment expertise, skill and network of business contacts of our executive officers, key investment professionals and senior management team. Our executive officers, key investment professionals and senior management team evaluate, negotiate, structure, execute, monitor and service our funds' investments. Our future success will depend to a significant extent on the continued service and coordination of our executive officers, key investment professionals and senior management team. The departure of any of these individuals could have a material adverse effect on our ability to achieve our funds' investment objectives.

The ability of the Fifth Street Funds to achieve their investment objectives depends on our ability to identify, analyze, invest in, finance and monitor companies that meet their investment criteria. Our capabilities in structuring the investment process, providing competent, attentive and efficient services to our funds, and facilitating access to financing on acceptable terms depend on the employment of investment professionals in adequate number and of adequate sophistication to match the corresponding flow of transactions. To achieve the investment and growth objectives of the Fifth Street Funds, we may, through our affiliates, need to hire, train, supervise and manage new investment professionals to participate in our investment selection and monitoring process. We may not be able to find investment professionals in a timely manner or at all. We also face competition from other industry participants for the services of qualified investment professionals, both with respect to hiring new and retaining current investment professionals. Failure to support our investment process could have a material adverse effect on our business, financial condition and/or results of operations. We do not carry any "key man" insurance that would provide us with proceeds in the event of the death or disability of our executive officers, key investment professionals or senior management team.

Our business model depends to a significant extent upon strong referral relationships with private equity sponsors, and the inability of our executive officers, key investment professionals and senior management team to maintain or develop these relationships, or the failure of these relationships to generate investment opportunities, could adversely affect our business.

We expect that certain of our executive officers, key investment professionals and senior management team will maintain and develop our relationships with private equity sponsors, and our funds will rely to a significant extent upon these relationships to provide them with potential investment opportunities. Certain key private equity sponsors regularly provide us with access to their transactions. If such persons fail to maintain their existing relationships or develop new relationships with other sponsors or sources of investment opportunities, we may not be able to grow the investment portfolios of the Fifth Street Funds. In addition, individuals with whom such persons have relationships are not obligated to provide us with investment opportunities, and, therefore, there is no assurance that such relationships will generate investment opportunities for the Fifth Street Funds.

10

The investment management business is intensely competitive.

The investment management business is intensely competitive, with competition based on a variety of factors, including investment performance, continuity of investment professionals and client relationships, the quality of services provided to clients, corporate positioning and business reputation and continuity of selling arrangements with intermediaries and differentiated products. A number of factors, including the following, serve to increase our competitive risks:

• | a number of our competitors have greater financial, technical, marketing and other resources, including a lower cost of capital and better access to funding sources, more established name recognition and more personnel than we do; |

• | there are relatively low barriers impeding entry to new investment funds, including a relatively low cost of entering these businesses; |

• | there are an increasing number of BDCs and the size of BDCs has also been increasing; |

• | the recent trend toward consolidation in the investment management industry, and the securities business in general, has served to increase the size and strength of our competitors; |

• | some investors may prefer to invest with an investment manager that is not publicly-traded based on the perception that publicly-traded companies focus on growth to the detriment of performance; |

• | some competitors may invest according to different investment styles or in alternative asset classes that the markets may perceive as more attractive than our investment approach; |

• | some competitors may have higher risk tolerances or different risk assessments than we or our funds have; and |

• | other industry participants, hedge funds and alternative asset managers may seek to recruit our qualified investment professionals. |

If we are unable to compete effectively, our earnings would be reduced and our business could be materially adversely affected.

The Fifth Street Funds face increasing competition for investment opportunities, which could reduce returns and result in losses at the Fifth Street Funds and reduce our revenues.

The Fifth Street Funds compete for investments with other BDCs and investment funds (including private equity funds and mezzanine funds), as well as traditional financial services companies such as commercial banks and other sources of funding. Many of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we or our funds do. For example, some competitors may have a lower cost of capital and access to funding sources that are not available to us or the Fifth Street Funds. In addition, some of our competitors may have higher risk tolerances or different risk assessments than we or our funds have. These characteristics could allow our competitors to consider a wider variety of investments, establish more relationships and offer better pricing and more flexible structuring than we are able to do for our funds. We may lose investment opportunities for our funds if we do not match our competitors' pricing, terms and structure. If we are forced to match our competitors' pricing, terms and/or structure, we may not be able to achieve acceptable returns on investments for the Fifth Street Funds or such investments may bear substantial risk of capital loss, particularly relative to the returns to be achieved. A significant part of our competitive advantage stems from the fact that the market for investments in small and mid-sized companies is underserved by traditional commercial banks and other financial sources. A significant increase in the number and/or the size of our competitors in this target market could force us to accept less attractive investment terms for the Fifth Street Funds. Recently, there has been an increase in the number and size of BDCs as part of the competitive landscape in our industry. Furthermore, some of our competitors have greater experience operating under, or are not subject to, the regulatory restrictions that the 1940 Act imposes on our two largest funds as BDCs.

Poor performance of our funds would cause a decline in our revenues and results of operations and could materially adversely affect our ability to raise capital for future funds.

We derive revenues primarily from management fees from the BDCs and funds we manage. When any of our funds perform poorly, either by incurring losses or underperforming benchmarks, as compared to our competitors or otherwise, our investment record suffers. As a result, our revenues may be adversely affected and the value of our assets under management could decrease, which may, in turn, reduce our management fees. Moreover, we may experience losses on investments of our own capital as a result of poor investment performance, including investments in our own funds. If a fund performs poorly, we may receive little or no incentive fees with regard to the fund and little income or possibly losses from our own principal investment in such fund. Poor performance of our funds could also make it more difficult for us to raise new capital. Investors in our closed-end funds may decline to invest in future closed-end funds we raise as a result of poor performance. Investors and potential investors in our funds continually assess performance of our funds independently and relative to market benchmarks and our competitors, and our ability to raise capital for existing and future funds and avoid excessive redemption levels depends on our funds' performance. Accordingly, poor performance may deter future investment in our funds and thereby

11

decrease the capital invested in our funds and, ultimately, our revenues. Alternatively, in the face of poor fund performance, investors could demand lower fees or fee concessions for existing or future funds which would likewise decrease our revenues.

Management fees received from the Fifth Street BDCs comprise a significant portion of our revenues and a reduction in such fees, including from the termination of investment advisory agreements, could have an adverse effect on our revenues and results of operations.

For the year ended December 31, 2015, the management fees generated from FSC and FSFR were approximately 97% of our management fees (including 35% attributable to Part I Fees). The investment advisory agreements Fifth Street Management has with each of the Fifth Street BDCs categorizes the fees we receive, with respect to each BDC, as: (a) base management fees, which are paid quarterly and generally increase or decrease based on such BDC's total assets, (b) Part I Fees, which are paid quarterly, and (c) Part II Fees, which are paid annually. We classify the Part I Fees as management fees because they are paid quarterly, are predictable and recurring in nature, are not subject to repayment (or clawback) and are generally cash-settled each quarter. Part I Fees, however, are subject to certain specified performance hurdles and, if we do not meet the specified performance hurdles, the amount of fees paid to us would decrease. Due to underperformance versus these hurdles, we did not earn the full Part I Fees for FSC and FSFR for the quarter ended December 31, 2015. If the total assets or net investment income of FSC or FSFR were to decline significantly for any reason, including without limitation, due to short-term changes in market value, mark-to-market accounting requirements, the poor performance of its investments or the failure to successfully access or invest capital, the amount of the fees we receive from these BDCs, including management fees, would also decline significantly, which could have an adverse effect on our revenues and results of operations. In addition, because the Part II Fees are not paid unless such BDC achieves cumulative realized capital gains (net of realized capital losses and unrealized capital depreciation), Part II Fees payable to us are variable and not predictable.

Fees paid to us by the Fifth Street BDCs could vary quarter to quarter due to a number of factors, including such BDC's ability or inability to make investments in companies that meet its investment criteria, the interest rate payable on the debt securities it acquires, the level of its expenses, variations in and the timing of the recognition of realized and unrealized gains or losses, the degree to which it encounters competition in our market, its ability to fund investments and general economic conditions. Variability in revenues received from the Fifth Street BDCs could have an adverse effect on our revenues, results of operations and could cause volatility or a decline in the market price of our Class A common stock. We may also be required to reduce fees as a result of industry and competitive pressures. In January 2016, we and the FSC board of directors made a decision to permanently reduce the base management fee on FSC's total gross assets (excluding cash and cash equivalents) from 2.00% to 1.75%. See "Risks Relating to Our Industry—We may not be able to maintain our current fee structure as a result of industry pressure to reduce fees, or as a result of changes in our business mix, which could have an adverse effect on our profit margins and results of operations."

The investment advisory agreements with FSC and FSFR may be terminated by either party without penalty upon 60 days' written notice to the other.

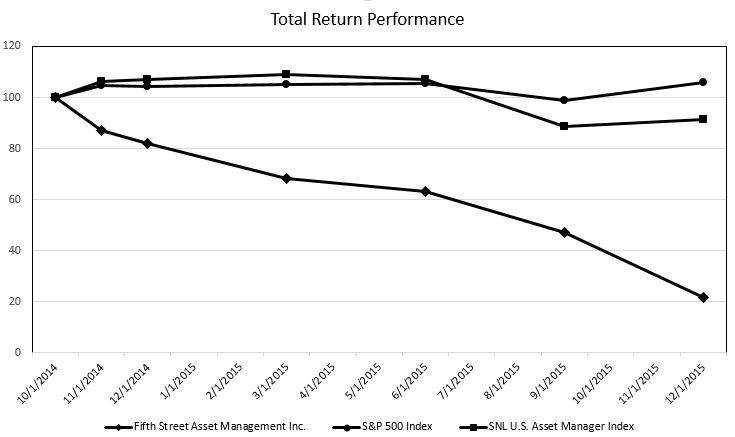

Certain stockholders of FSC and FSFR have recently put forth binding proposals to terminate our respective investment advisory agreements with these BDCs. These certain stockholders nominated director nominees who would seek to replace us as the investment manager of the BDCs. On February 18, 2016, we entered into a purchase and settlement agreement with these FSC stockholders and such stockholders irrevocably withdrew and rescinded their proposals and director nominees. We can give no assurance that the FSFR proposals will be unsuccessful or that the BDCs will not receive similar proposals in the future from other stockholders of FSC or FSFR. If either of these agreements were terminated, our business would be materially and adversely affected and we would suffer a significant decline in revenues and profitability. In addition, a proxy contest involving either of our BDCs would be disruptive, costly and time-consuming to such BDC and us and would divert the attention of our senior management team and employees from the operation of such BDC. In addition perceived uncertainties as to the strategic direction of either of our BDCs, or any abrupt changes in senior management or the board of directors of such BDC, may lead to concerns regarding the direction or stability of its business and operations, which may be exploited by competitors, resulting in the loss of business opportunities for us and our BDCs.