Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AVADEL PHARMACEUTICALS PLC | v434844_8k.htm |

Exhibit 99.1

Notice of meeting

Combined Shareholders’ Meeting

Friday June 26, 2015 At 11.00 A.M.

Flamel Technologies S.A. I Flamel.com

CONTENTS

| CONTENTS | 1 |

| NOTICE & AGENDA | 2 |

| HOW TO PARTICIPATE IN THE MEETING | 4 |

| Management Report By The Board Of Directors To The Shareholders’ Meeting To Be Held On June 26, 2015 | 5 |

| APPENDIX 1 TABLE OF EARNINGS FOR THE LAST FIVE FINANCIAL YEARS | 25 |

| APPENDIX 2 REPORT CONCERNING DELEGATIONS MADE TO THE BOARD | 26 |

| Presentation Of The Resolutions - Report By The Board Of Directors To The Combined Shareholders Meeting To Be Held On June 26, 2015 | 27 |

| Proposed Resolutions Presented At The Combined General Meeting To Be Held On June 26, 2015 | 34 |

| REQUEST FOR ADDITIONAL DOCUMENTS AND INFORMATION | 49 |

| Flamel Technologies S.A. I Flamel.com | 1 |

NOTICE & AGENDA

Dear Shareholders,

We are pleased to invite you to attend the Combined Ordinary and Extraordinary General Meeting of Flamel Technologies, SA that will be held on Friday, 26th June 2015 at 11:00 am (Paris time), at Company headquarters, located at 33, avenue du Dr Georges Lévy, 69693 Vénissieux, France, in order to deliberate on the following agenda:

Resolutions

Within The Competence Of The

Ordinary General Shareholders’ Meeting

| 1. | Approval of Statutory Accounts for year ended December 31, 2014 |

| 2. | Allocation of results |

| 3. | Renewal of Mr Anderson as Director |

| 4. | Renewal of Mr Cerutti as Director |

| 5. | Renewal of Mr Fildes as Director |

| 6. | Renewal of Mr Navarre as Director |

| 7. | Renewal of Ambassador Stapleton as Director |

| 8. | Renewal of Mr Van Assche as Director |

| 9. | Annual amount of Directors’ attendance fees (jetons de presence) |

| 10. | Approval of agreements referred to in article L.225-38 et seq. of the French Commercial Code |

Resolutions

Within The Competence Of The

Extraordinary General Shareholders’ Meeting

| 11. | Authorization to allocate a maximum number of 250,000 free shares for the benefit of the employees of the Group as well as to corporate officers of the Company, which implies waiving of preferential subscription rights of shareholders in favor of the beneficiaries of the said shares |

| 12. | Authorization to issue of a maximum number of 350,000 stock warrants reserved for a category of persons defined by the thirteenth resolution, which implies waiving of preferential subscription rights of shareholders on shares issued upon exercise of such warrants |

| 13. | Cancellation of the preferential right of subscription attributed to the shareholders with respect to the capital increase set forth in the twelfth resolution to the benefit of a category of persons consisting of the Company’s directors who are neither authorized agents nor employees of the Company, but including the Chairman of the Board of Directors |

| 14. | Authorization to be granted to the Board of Directors to increase the share capital by issuing of shares reserved for the members of a company savings plan established in application of Articles L.3332-18 et seq. of the French Labor Code |

| 15. | Cancellation of the preferential right of subscription attributed to the shareholders with respect to the capital increase set forth in the fourteenth resolution to the benefit of a category of persons consisting of employees of the Company |

| Flamel Technologies S.A. I Flamel.com | 2 |

| 16. | Authorization to be granted to the Board of Directors for issue of a maximum number of two million (2,000,000) ordinary shares of a nominal value of EUR 0.12196, in the form of American Depositary Shares (ADS), with removal of the shareholders’ preferential subscription rights and reserved for a category of persons defined by the seventeenth resolution; authorization to be granted to the Board of Directors for carrying out the resulting capital increases. |

| 17. | Cancellation of the preferential right of subscription attributed to the shareholders with respect to the capital increase set forth in the sixteenth resolution to the benefit of a category of persons consisting of any public or private French or foreign company engaged (i) in the manufacture, sale, marketing and/or distribution of pharmaceutical products or active pharmaceutical ingredients or (ii) in operational activities related to pharmaceutical industry. |

| 18. | Powers for formalities |

The present Notice of Meeting includes:

| · | the Management Report for Fiscal Year 2014, the presentation of the resolutions by the Board, the draft resolutions submitted to the General Meeting and, more generally, all documents and information referred to in article R. 225-81 of the French Commercial Code (Code de commerce); |

| · | a form to be used in order to obtain the documents and information referred to in article R. 225-83 of the French Commercial Code (Code de commerce). |

A voting form, to be used to vote by post is also attached.

Information about how to participate in the General Meeting is provided hereafter.

Yours sincerely,

| ON BEHALF OF THE BOARD OF DIRECTORS |

QUORUM REQUIRED UNDER FRENCH LAW |

The required quorum for ordinary resolutions is one fifth (20%) of the total outstanding shares. If such quorum is not met, the Board of Directors will give a second notice of Shareholders’ Meeting. At this second Meeting, no quorum is required for ordinary resolutions. |

The required quorum for extraordinary resolutions is one fourth (25%) of the total outstanding shares with voting rights, upon first call of the shareholders' meeting. If such quorum is not met, the Board of Directors will give a second notice of Shareholders’ Meeting. At this second Meeting, which shall take place within two months after the first meeting, the required quorum is one fifth (20%) of the total outstanding shares with voting rights.

IF THE QUORUM FOR THE ORDINARY MEETING IS NOT MET ON JUNE 26, 2015, SHAREHOLDERS WILL BE INVITED TO VOTE AT A MEETING WHICH WILL BE HELD ON JULY 3, 2015 ON THE SAME AGENDA, AS DESCRIBED IN THIS NOTICE.

| Flamel Technologies S.A. I Flamel.com | 3 |

HOW TO PARTICIPATE IN THE MEETING

All shareholders and bearers of voting right certificates may take part in the General Meeting by attending the Meeting in person, appointing a proxy of their choosing to represent them or voting by post.

Nevertheless, if you expect to be present at the meeting, please note that shareholders will be admitted to the General Meeting whatever the number of shares they hold provided they are owner of registered shares and their shares have been registered in a share account held by the Company at least one day prior to the date of the meeting.

You will need to provide evidence of share ownership

Holders of registered shares

Holders of registered shares need only register their shares in a registered share account, as specified above, to be able to take part in the General Meeting. Caceis Corporate Trust will therefore issue proof that they are shareholders.

Holders of American Depositary Shares (ADS)

Holders of ADS shall take part in the General Meeting by voting by post provided that their shares have been registered in a bearer share account held by an accredited banking or financial intermediary. The accredited banking or financial intermediary that holds the share account will therefore be responsible for issuing proof that they are shareholders and producing a certificate of share ownership, as specified above, to the General Meeting coordinator (centralisateur), i.e. The Bank of New-York – BNY Mellon.

The record date for ADS Owners entitled to vote at the Combined General Meeting is May 19, 2015.

If you wish to appear and vote at any meeting of the holders of Shares, you must surrender your receipts and become registered on the registry maintained by or on behalf of Flamel Technologies S.A. at least (i) one (1) Paris Business Day prior to the date of the relevant shareholders' meeting to appear and vote at such meeting.

You are requested to cast a postal vote

Your postal voting form or proxy form will be provided by your broker. You must complete and sign the voting form and return it to the General Meeting coordinator via the banking or financial intermediary that holds your share account, along with the certificate of share ownership referred to above.

Voting forms will only be taken into consideration if received by the General Meeting coordinator by June 18, 2015 at the latest.

Any questions related to voting by ADS holders should be addressed directly to your broker.

| Flamel Technologies S.A. I Flamel.com | 4 |

Management Report By The Board Of Directors To The Shareholders’ Meeting To Be Held On June 26, 2015

| 1. | The Company’s activities in 2014 | 6 |

| 2. | Financial Results for 2014 | 10 |

| 3. | Goals and Prospects for the Company for 2015 | 13 |

| 4. | Research and Development activities | 14 |

| 5. | Share Capital | 17 |

| 6. | Group Structure | 20 |

| 7. | Management and Directorship of the Company | 21 |

| 8. | Important events occurring between the end of the financial year and the date of the present report | 24 |

| APPENDIX 1 TABLE OF EARNINGS FOR THE LAST FIVE FINANCIAL YEARS | 25 | |

| APPENDIX 2 REPORT CONCERNING DELEGATIONS MADE TO THE BOARD | 26 | |

Nota: The auditor reports, the annual financial statements, as well as all documents relating thereto have been made available to you at the Company’s registered office according to legal and regulatory requirements.

The annual financial statements presented to you have been established in accordance with French accounting laws, principles and methods.

Please note that the accounting methods used to prepare these annual financial statements are the same as the ones used for previous financial years.

| Flamel Technologies S.A. I Flamel.com | 5 |

| 1. | The Company’s activities in 2014 |

| 1.1. | Overview |

Flamel Technologies SA is a specialty pharmaceutical company utilizing core competencies in drug delivery and formulation to develop safer and more efficacious pharmaceutical products to address unmet medical needs and/or reduce overall healthcare costs. Flamel has a balanced business model consisting of a successful previously Unapproved Marketed Drugs (“UMDs”) business with two marketed products in the USA, Bloxiverz® and Vazculep™, and a branded business, focusing on the development of products utilizing Flamel’s proprietary drug delivery platforms. The branded products are based on proprietary drug delivery platforms and target high-value solid oral and alternative dosage forms using 505(b)(2) and Biosimilar pathways where the Company can develop strong intellectual property positions and deliver meaningful patient benefits. Flamel’s business model allows the Company to select, develop, seek approval for, and commercialize niche branded and generic products, initially targeted for the U.S. market. The Company is able to self-fund the development of most product development opportunities.

Flamel is headquartered in Lyon, France and has operations in St. Louis, Missouri, USA, and Dublin, Ireland.

| 1.2. | Employees |

As of December 31, 2014, Flamel had 109 full-time employees based in France and an average of 210 full-time employees over 2014. The divestiture of the Pessac Facility resulted in the transfer of 107 employees on December 1, 2014 to Recipharm Pessac SAS.

| 1.3. | Lead products |

Both products are commercialized in the USA by Flamel’s subsidiary Éclat:

Bloxiverz® (neostigmine methylsulfate injection), Flamel’s first NDA approval. Bloxiverz’s NDA was filed in August 2012 and approved by the FDA on May 2013. The launch of Bloxiverz™ (10mL multiple dose vial at 0.5 and 1.0 mg/mL strengths) commenced in July 2013. Bloxiverz™ is a drug used intravenously in the operating room for the reversal of the effects of non-depolarizing neuromuscular blocking agents after surgery. Bloxiverz™ is the first and only FDA-approved version of neostigmine methylsulfate, even though other versions of neostigmine have been on the market as unapproved, grandfathered products under the Food, Drug and Cosmetic Act of 1938. Compared with the remaining unapproved marketed products, Bloxiverz™ has proven and approved safety, efficacy and quality. Today, neostigmine is the most common agent used for the reversal of the effects of other agents used for neuromuscular blocks. There are approximately 5 million vials sold annually in the U.S. The volume of sales of Bloxiverz™ is dependent upon, as per FDA guidance the FDA removing all unapproved products from the market in a timely manner (typically one year post approval). All manufacturers of unapproved versions of neostigmine methylsulfate have been notified by the FDA to cease manufacturing of the unapproved product as of July 30, 2014. On January 8, 2015, the FDA approved Fresenius Kabi USA (“Fresenius”)’s NDA for neostigmine methylsulfate (for both 0.5 mg/1mL and 1 mg/1mL strengths). On January 15, 2015, Flamel’s increased the WAC for Bloxiverz® to $98.75 (from the previous WAC of $35.80) per vial for both the 0.5 and 1.0 mg/mL strengths. In the future, the volume of sales of Bloxiverz® is dependent upon the competitive landscape between Eclat, APP, and any subsequent ANDA approvals that may occur.

| Flamel Technologies S.A. I Flamel.com | 6 |

Vazculep™ (phenylephrine hydrochloride injection), Flamel’s second NDA approval. On June 28, 2013, the Company filed an NDA for a second product developed by Éclat and later identified as Vazculep™ (phenylephrine hydrochloride injection). The product was approved by the FDA on June 27, 2014. Flamel’s subsidiary Éclat Pharmaceuticals started shipping Vazculep™ (in 1mL single use vials, and 5mL and 10mL pharmacy bulk package vials) to wholesalers in October 2014. There are approximately 7 million vials sold annually in the U.S. Vazculep™ is the only FDA-approved version of phenylephrine hydrochloride to be available in all three vial sizes. West-Ward Pharmaceuticals Corp. (“West Ward”) commercializes the 1mL single-dose vial, as an approved product in the U.S. (NDA approved by the FDA on December 20, 2012); and, Sandoz, Inc. commercializes the 5mL and 10mL vials as unapproved products in the U.S.. The volume of sales of Vazculep™ is dependent upon the competitive landscape in the marketplace.

Coreg CR®, the Micropump®-based marketed product. Coreg CR® is an extended-release formulation (once-a-day) of Coreg (i.e. carvedilol phosphate). Coreg® and Coreg CR® are the only beta blockers indicated for the treatment of moderate to severe heart failure and left ventricular dysfunction following myocardial infarction. Coreg CR® has been developed in partnership with GlaxoSmithKline (“GSK”) and is approved, marketed and sold in the U.S since 2007. Up to December 1, 2014, we received royalty revenue of $6.3 million and a total amount of $6.7 million from product sales. In December 2014, as part of the divestiture of our development and manufacturing facility (“Pessac Facility”), the Company transferred the Supply Agreement for Coreg CR® and, transferred and assigned to Recipharm all rights, titles and interests in the royalties of the License Agreement by and between Flamel and GSK.

| 1.4. | Progress and difficulties encountered |

The acquisition of Éclat, which has focused on pursuing FDA approvals through the 505(b)(2) regulatory pathway, adds marketing and licensing knowledge of the commercial and regulatory process in the U.S. and EU to Flamel. We believe this enhances the ability of Flamel to identify product candidates for development, leverage new opportunities for the application of our drug delivery platforms, and to license and market products in the U.S and EU. By adopting this revised strategy, the Company makes itself less dependent on the, often changing, strategies of partners in the future.

While we are moving to a specialty pharma model, in 2014 about 30% of our revenues come, however, from partnerships.

In March 2014, the Company completed an underwritten public offering which generated €81.8 million in net proceeds. The remaining proceeds are used to pursue the development of our proprietary products, including clinical trials. We can now have proprietary products in late stage development that are not dependent on partnerships.

To complement the historical science-oriented strengths of Flamel as an innovator of drug delivery platforms, we have now enhanced our ability to identify new product candidates and to pursue commercial opportunities. The Company’s drug delivery platforms (Micropump®, LiquiTime®, Trigger Lock™, Medusa™) allow the creation of competitive and differentiated drug product profiles (e.g. with improved pharmacokinetics, efficacy and/or safety). These product development opportunities allow us to grow market share and to protect our products through patent protection and product differentiation. In 2014, we have focused our Research and Development (“R&D”) efforts on moving several products formulated using our proprietary drug delivery platforms more rapidly into clinical development stages. On completion of development and successful regulatory approval these products will be marketed either by Flamel or by partners via licensing/distribution agreements.

| Flamel Technologies S.A. I Flamel.com | 7 |

The Company has incurred substantial losses since its inception, and through December 31, 2014, with an accumulated deficit of approximately €122 million. Our investment in R&D has increased as we pursue development of products formulated using our proprietary drug delivery platforms which are being moved rapidly into clinical development stages. We continue to maintain an aggressive approach to cost controls and are committed to challenging our costs on non-core activities. Thus, there can be no assurance that the Company will not continue to incur losses.

Under the divestiture agreement of our Pessac Facility dated December 1, 2014, Recipharm paid the Company €10.6 million. This divestiture agreement allowed Flamel to retain access to the development and manufacturing capabilities of the acquired Pessac Facility and to use other Recipharm’s facilities for the development or manufacture of its proprietary pipeline if needed. Additionally, Recipharm made an investment of €10.5 million in Flamel’s stock at a purchase price equal to the trailing 20-day average price.

Following the rationalization of the Company’s products pipeline, the four partnerships that remained in effect in 2013 were either terminated in 2014 or transferred to Recipharm AB, as part the divestiture of our Pessac Facility. Consequently, the loss of this external, partner-based project portfolio resulted in a decrease in R&D revenues in 2014.

On December 16, 2014, we announced the transfer of all of our intangible property from our French entity to our Irish-based entity as a part of a global reorganization. The intangible property included patents on drug delivery platforms, clinical data sets and other intangible assets related to the pipeline of our proprietary products in development. Flamel’s proprietary drug delivery platforms include Micropump® (and its applications to the development of liquid formulations LiquiTime® and of abuse-resistant formulations Trigger Lock™) and Medusa™ platforms.

| 1.5. | Litigation |

No material litigation occurred in France in 2014.

| 1.6. | Major risks and uncertainty |

Flamel’s business is subject to substantial risks, including the uncertainties associated with the R&D of new products or technologies, the length and uncertainty linked to the results of clinical trials and regulatory procedures, difficulties in the scale-up and manufacturing of its products, the uncertainty relating to the market acceptance of new products based on its technologies and uncertainties arising from the development and commercialization of its portfolio of products. The time required for the Company to achieve sustained profitability, remains uncertain. Operating income and losses may also fluctuate from quarter to quarter as a result of differences in timing of revenues recognized or expenses incurred.

| Flamel Technologies S.A. I Flamel.com | 8 |

The risks facing the Company are described more fully under “Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended December 31, 2014 that has been filed with the U.S. Securities and Exchange Commission (SEC) and is publicly available.

| Flamel Technologies S.A. I Flamel.com | 9 |

| 2. | Financial Results for 2014 |

The following results have been prepared in accordance with French accounting standards relative to the individual statutory accounts of Flamel Technologies S.A., which have been applied consistently with prior year.

As expected, earnings for 2014, together with external financing and transfer of intangible assets to our Irish subsidiary, enabled the Company to finance its activity and its development for the year ended December 31, 2014. Despite continued global economic uncertainties and upheaval in the pharmaceutical industry, the Company has pursued a change in its strategy to adapt to this environment.

| 2.1. | Income Statement |

Revenues for fiscal year 2014 amount to €80.7 million, compared with €22.1 million in 2013. The 2014 revenues include €5.0 million in product sales, €0.2 million of license revenue, €6.9 million of research revenue and €4.9 million in royalties. In addition, in December 2014, the Company recharged its historical development costs and transferred its intangible property to its Irish-based entity as a part of a global reorganization for a total price of €63.8 million.

Financial net income, standing at €6.8 million in 2014, is generated from foreign exchange gains - €4.7 million - earned from investing available cash, and funding to affiliates - €2,4 million - from Flamel US Holdings financing, offset by realized and unrealized gain and loss on funds managed by our investment portfolio manager, Morgan Stanley of (€0.5 million).

Payroll, including social charges, representing 45% of total operating expenses, was €15.4 million, comparable to the €15.8 million in 2013.

As in previous years, in 2014 the majority of costs were incurred on research and development.

Operating expenses amounted to €34.3 million in 2014 and increased by €3.8 million (12.5%) largely as a result of investment in R&D notably due to transition into clinical development stages for several products.

Net gain before taxes and extraordinary income in 2014 amounted to 55.5 million €, compared with a loss of €(5.5) million in 2013.

The extraordinary result amounted to €3.8 million, generated essentially by the gain on sale of the Pessac facility for €4.6 million.

After accounting for a research tax credit amounting to €4.6 million, income taxes of €7.0 million and employee profit share of €0.9 million, the net gain for the financial year was €51,264,590 compared to a net loss of € (117,739) in the previous financial year.

| 2.2. | Balance sheet |

| 2.2.1 | Assets |

Total assets as of December 2014 amounted to €195.1 million, including €65.3 million in tangible and intangible assets and equity investments (in subsidiaries) and €128.7 million in current assets.

| Flamel Technologies S.A. I Flamel.com | 10 |

Accounts receivable as of December 31, 2014 stood at €12.7 million plus €40.9 million relating to Flamel US Holdings financing.

At the end of 2014, financial availabilities stood at €31.1 million and treasury placements totaled €43.7 million, including €33.4 million in short term investments with Morgan Stanley, €0.26 million in funds invested on the money market and €10 million in fixed term deposits, to be compared with €0.3 million at the end of 2013.

| 2.2.2 | Liabilities |

In 2014, shareholders equity, including current year results, amounts to €166.4 million.

Remaining liabilities amount to €28.7 million, including €3.6 million in accounts payable, €3.1 million in conditional advances from the “French government” for R&D projects, €2.3 million in accrual including €1.9 million in retirement accrual, €9.8 million in social and tax liabilities, €4.4 million regarding advances received in 2013 from OSEO, a French government agency, secured against Research and Development tax credits from 2011 and €4.8 million generated by foreign exchange rate on Eclat’s debt.

| 2.3. | Capital Investments |

In 2014, our investment in property and equipment amounted to €1.4 million including €0.6 million for purchase of scientific equipment and €0.6 for maintenance of our property and equipment, notably to comply with law requirements in view of the Pessac divestiture.

| 2.4. | Financing |

In March 2014, the Company completed an underwritten public offering which generated €81.8 million in net proceeds. 10,800,000 ordinary shares in the form of ADSs were issued as a primary offering at an issue price by share of $9.75 (issuance premium included) and an underwritter’s fee of $0.585 for each ADS issued. As part of the underwritten agreement, 1,600,000 ordinary shares in the form of ADSs were issued as a secondary offering (“Greenshoe”) under the same conditions.

Subsequently, Flamel Technologies loaned $32 million to our subsidiary Flamel US Holdings to repay outstanding long-term debt.

In December 2014, the Company completed a private offering to the benefit of Recipharm AB and issued 1,026,364 new shares at a purchase price equal to the trailing 20-day average price. This operation increased the capital by €125,175.35 and generated €10,374,814.73 in net proceeds.

| 2.5. | Non-deductible charges |

During the financial year 2014 the company recorded 12.2 k€ in excess depreciation that is not tax-deductible.

In the 2014 financial year the company also incurred 125.585 k€ in Directors attendance fees that are not tax deductible.

| Flamel Technologies S.A. I Flamel.com | 11 |

| 2.6. | Payment Terms |

The payment terms applied by the Company were for the most part in compliance with the law. Payment terms of accounts payable in each of the last two financial years were as follows:

| Accounts Payable in each of the last two financial years (in K€) | ||||||||

| 31/12/2014 | 31/12/2013 | |||||||

| Total Accounts Payable in k€ : | 1225 | 680 | ||||||

| Non past due Accounts | ||||||||

| Payment Date | ||||||||

| < 30 days: | 910 | 78 | ||||||

| Between 31 & 60 days: | 26 | 359 | ||||||

| Between 61 days & 90 days: | 0 | 53 | ||||||

| > 91 days: | 0 | - | ||||||

| Past Due Accounts | ||||||||

| Date past due | ||||||||

| < 30 days: | 147 | 90 | ||||||

| Between 31 & 60 days: | 0 | 12 | ||||||

| Between 61 days & 90 days: | 51 | 1 | ||||||

| > 91 days: | 91 | 87 | ||||||

| 2.7. | Dividends paid for the last three financial years and the corresponding Tax Credit |

We inform you, pursuant to Article 243 bis of the General Taxation Code, that no dividends were distributed during the last three financial years.

| 2.8. | Table of earnings for the last five financial years |

Pursuant to Article R 225-102 al 2 of the French Commercial Code, you will find attached the table summarizing the company’s earnings in each of the last five financial years.

(Cf. Appendix 1)

| Flamel Technologies S.A. I Flamel.com | 12 |

| 3. | Goals and Prospects for the Company for 2015 |

As a result of this shift to a specialty pharma model, the Company’s business is now less dependent on the development activities performed by partners, and relying more on the development of its own, self-funded, products. The difference in the current model and that of the past is that Flamel is no longer solely dependent on partnerships to create revenue and profit. Nevertheless, the Company continues to explore development and licensing opportunities with carefully selected third parties for either its drug delivery platforms or its proprietary products in areas where Flamel and/or its US operations, may choose not to market itself, such as the LiquiTime®-based OTC products.

Altogether, the key elements of our strategy that enable us to build upon our strengths are:

| · | Maximizing the commercial potential of our “Unapproved to Approved” products acquired from Éclat; |

| · | Continuing to build commercially successful products utilizing Micropump®; |

| · | Identifying and optimizing time-to-market for our (not yet approved) drug delivery platforms, i.e. LiquiTime®, Trigger Lock™ and Medusa™. |

| · | Maximizing the technical potential of our existing drug delivery platform for developing new and proprietary products with the appropriated development pathway; |

| · | Developing and validating additional drug delivery platforms for unmet applications utilizing our current platforms; and, |

| · | Leveraging the capabilities of our existing (and future) proprietary products and/or drug delivery platforms with pharmaceutical and biotechnology partners. |

We expect to see an increase in R&D expenditure in the future as we pursue clinical development, which will include costs of clinical trials, regulatory costs, sub-contracted development and manufacturing costs. Flamel expects to maintain its investment in its R&D activities in line with the development of its product portfolio, while being vigilant to ensure that investments in non-core activities are limited.

Our subsidiary has two approved UMD products on the market, and, as a result of these two products, we anticipate the repayment of the loan granted to Flamel US holdings would occur in 2015 and beyond. Eclat’s portfolio will be supplemented by further products in subsequent years which could favorably impact its progression to profitability. We may continue to seek partnership opportunities, in particular for certain of our proprietary products that we are not in a position to market ourselves. These partnerships will equally contribute to our future revenue generation.

| Flamel Technologies S.A. I Flamel.com | 13 |

| 4. | Research and Development activities |

Flamel’s Drug Delivery Platforms

Flamel owns and develops drug delivery platforms that address key formulation challenges, leading to the development of differentiated drug products for administration in various forms (e.g. capsules, tablets, sachets or liquid suspensions for oral use; or injectables for subcutaneous administration) and can be applied to a broad range of drugs (novel, already-marketed, or off-patent):

| · | Micropump® is a microparticulate system that allows the development and marketing of modified and/or controlled release of solid, oral dosage formulations of drugs (Micropump®-carvedilol and Micropump®-aspirin formulations have been approved in the U.S. and in the E.U., respectively. |

| · | LiquiTime® allows development of modified/controlled release oral products in a liquid suspension formulation particularly suited to children or for patients having issues swallowing tablets or capsules. |

| · | Trigger Lock™ allows development of abuse-resistant modified/controlled release formulations of narcotic/opioid analgesics and other drugs susceptible to abuse. |

We believe in the competitive advantages represented by the versatility of Micropump® which permits us to develop differentiated product profiles (modified/controlled release formulations) under various dosage forms including capsules, tablets, sachets and liquid suspensions (LiquiTime®) for oral use. With Trigger Lock™ potentially addressing the issue of narcotic/opioid analgesics abuse, we have broad and versatile presentations to serve most markets from pediatric to geriatric.

| · | Medusa™ allows the development of extended/modified release of injectable dosage formulations of drugs (e.g. peptides, polypeptides, proteins, and small molecules). |

We believe also that the Medusa™ platform provides a competitive advantage for developing differentiated injectable product profiles. Medusa™-based formulations permit drugs’ full activity to be preserved in an extended release format with other potential advantages being, improved solubility, stability, and resistance to aggregation. Overall, Medusa™ can improve the patient experience though a change in the route of administration (e.g. switching from intravenous to subcutaneous injection) and may improve compliance through reduction of administration frequency (e.g. from once-a-day to once-a-week).

Proprietary pipeline to deliver several regulatory filings (US and/or EU) through 2017.

Using the acquired marketing and commercial capability of Éclat, six new products development opportunities (i.e. four using Micropump® or LiquiTime® or Trigger Lock™, and two using Medusa™) have been selected for internal development. After setting differentiated targeted product profiles and establishing development plans, pharmaceutical development activities have been initiated.

| Flamel Technologies S.A. I Flamel.com | 14 |

| · | Sodium Oxybate, a Micropump®-based formulation for one single dose before bedtime for patients suffering from narcolepsy, eliminating the need for a second dose. The results of Flamel’s FIM clinical study in healthy volunteers, published in April 2014, demonstrated elimination of the need for a second, middle of the night dose. This was further confirmed by a second clinical study performed at higher doses, published in December 2014. The elimination of the second dose for narcolepsy patients not only provides more convenience, but could also benefit patients by eliminating or reducing the current disruption in nighttime sleep. The potential for additional benefits of Micropump® Sodium Oxybate, including improved safety, will be examined in future clinical studies. The Company plans to meet with the FDA during the first half of 2015 and begin a pivotal clinical study by the end of 2015. |

| · | Ibuprofen, LiquiTime®-based formulation for twice-daily dosing for the treatment of pain. Flamel’s pharmacokinetics results, published in September 2014, demonstrated equivalent exposure (or “AUC”) to immediate-release ibuprofen, similar onset and similar blood levels at 12 hours, with no safety or tolerability issues. Flamel anticipates a US regulatory filing during the first half of 2016 which will be followed by a later filing in the European Union. LiquiTime® ibuprofen opens the door to the Over-The-Counter (“OTC”) cough, cold and allergy markets, where LiquiTime delivery platform can provide significant benefit through combination products containing frequently used together active ingredients with tailored and extended release profiles. |

| · | Guaifenesin, LiquiTime®-based formulation for twice-daily dosing for the treatment of chest congestion associated with various indications (common cold, infections, or allergies). Flamel’s pharmacokinetics results, published in March 2015, clearly met the intention of the study, i.e. to allow selecting the best formulation prototype, which satisfied most of the criteria necessary for proving bioequivalence of AUC to the immediate release guaifenesin tablets, for further optimization and scale up with the aim to performing a pivotal study in 2016. This second product will expand our twice-daily oral suspension offerings for the OTC market in the near future. Additionally, we believe that LiquiTime®, designed to provide a controlled, extended release of oral liquids principally for pediatric and geriatric patients will be also effective for certain prescription products. |

| · | Exenatide, a once-a week Medusa™-based injectable formulation of exenatide, a glucagon-like peptide-1 (“GLP-1”) agonist for the treatment of type 2 diabetes. Flamel’s preclinical results in minipigs, published in June 2014, demonstrated an improved bioavailability versus commercially available once-a-week exenatide, similar release profiles for two successive injections, no adverse clinical signs and an excellent local tolerability. The pharmacokinetics profile of Medusa-exenatide was compatible with a release over one week in human. The Company expects to have Phase 1 data during the second half of 2015. |

Flamel has several other products based on its proprietary drug delivery platforms at various stages of development, e.g. hGH XL (a once-a week Medusa™-based injectable formulation of recombinant human growth hormone (“rhGH”) for the treatment of growth disorder; pre-clinical data were published in October 2013). The company also has a Trigger Lock™-based opioid (for pain indication) in development. For competitive reasons, the Company has decided not to identify that particular opioid for the time being, but intends to provide additional information upon the achievement of pre-clinical, clinical and regulatory milestones.

| Flamel Technologies S.A. I Flamel.com | 15 |

These proprietary pipeline products will be marketed either by Flamel (and/or its subsidiary Éclat) or by partners via licensing/distribution agreements.

Patents

Patents and other proprietary rights are essential to our business. Our proprietary product pipeline and our strategic alliances are dependent on our drug delivery platforms and related products (formulation, process, etc.) being patent protected. As a matter of policy, we seek patent protection of our inventions and trademarks and also rely upon trade secrets, know-how, continuing technological innovations and licensing opportunities to maintain and develop our competitive position.

On a case-by-case basis, an invention developed jointly by Flamel and a partner may be assigned to and prosecuted by the partner. The information provided in this section herein, does not refer to such patent applications.

In 2014, Flamel engaged in a rationalization process of its patent portfolio to focus on key patent families that protect our core drug delivery platforms. As a result of this process, the total number of patents is significantly lower than in previous years. Specifically, during 2014, we were granted 58 new patents and we filed 3 new patent applications.

As of December 31, 2014, we owned the following patent and patent applications:

| US | EUROPE | RoW* | TOTAL | |||||||||||||

| Granted patents | 16 | 135 | 94 | 245 | ||||||||||||

| Pending patent applications | 11 | 17 | 46 | 74 | ||||||||||||

| Patents granted in 2014 | 6 | 31 | 21 | 58 | ||||||||||||

| Patent applications filed in 2014 | 1 | 2 | 0 | 3 | ||||||||||||

* RoW: Rest of the Word;

The Company’s patents protecting its drug delivery platforms have the following dates of expiration:

| Drug Delivery | Date of expiration of granted patents | |||

| Platforms | U.S. | Europe | ||

| Micropump® | November 2025 | July 2023 | ||

| LiquiTime® | September 2025 | April 2023 | ||

| Trigger Lock™ | April 2027 | May 2026 (pending) | ||

| Medusa™ | June 2031 | June 2027 (pending) | ||

| Flamel Technologies S.A. I Flamel.com | 16 |

| 5. | Share Capital |

| 5.1. | Evolution in 2014 |

With respects to the Shareholders’ delegations granted to the Board of directors by the Extraordinary General Meeting held on February 11, 2014, Flamel issued 12.4 million new ordinary shares, on the form of American Depositary Shares (ADSs) and completed an underwritten public offering which generated € 81.8 million in net proceeds.

With respects to the Shareholders’ delegations granted to the Board of directors by the Extraordinary General Meeting held on February 11, 2014, Flamel issued 1,026,364 new ordinary shares, on the form of American Depositary Shares (ADSs) to the benefit of Recipharm AB which increased the capital by €125,175.35 and generated €10,374,814.73 in net proceeds.

In addition, Flamel completed capital increases as a result of the definitive grant of free shares to employees and/or exercise of stock options and/or warrants during the year just ended as follows:

| · | The definitive grant of 156,600 shares to 105 beneficiaries as a result of, on one hand, the definitive grant of 150,600 shares subsequent to the grant made by the Board on December 10, 2012 and on the other hand, the 4-year acquisition period of 6,000 shares granted in December 6, 2010 to a non-French tax resident employee. Through such issuance of 156,600 new shares, the capital has been increased by 19,098.94€. |

| · | The exercise of 445,000 stock warrants and 550,750 stock options during the fiscal year 2014. Through the subsequent issuance of 995,750 new shares, the capital has been increased by €121,441.67, with a total share premium of €4,379,537. |

As of December 31, 2014, the Company’s capital stood at €4,901,727 consisting of 40,191,264 shares.

| 5.2. | Employee shareholding |

As of December 31, 2014, employees directly held 450.160 shares in the Company, representing 1.1 % of the capital.

On December 11, 2014, the Board of Directors decided, to grant

| o | 188,300 free shares to employees of Group on the basis of your authorizations granted to the Board on June 24, 2014. |

| o | 669,500 stock options to employees of Group on the basis of your authorization granted to the Board on June 24, 2014. |

You will find details concerning these allocations in the special reports issued in that connection.

We propose to you to authorize the Board to implement a new plan for allocation of free shares. You will find details concerning the plan in presentation of the resolutions.

| Flamel Technologies S.A. I Flamel.com | 17 |

| 5.3. | Capital distribution as of December 31, 2014 |

| 5.3.1 | Share capital fully paid-off |

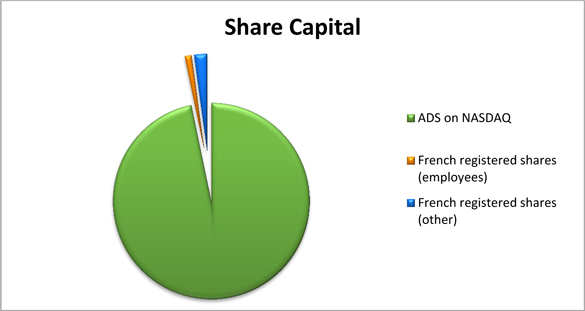

A total of 38,881,732 shares, i.e. 97% of share capital is listed on Nasdaq in the form of American Depositary Shares (ADSs), through the Bank of New York Mellon, our depositary agent.

The remaining amount (1,309,532 shares i.e. 3% of share capital) is owned by 252 physical persons, registered (“nominative pur”) in France.

| 5.3.2 | Securities conferring access to the share capital |

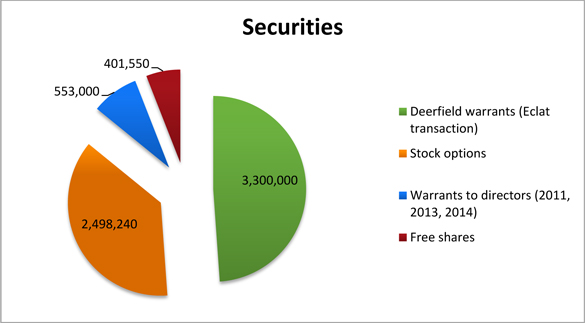

A total of 6,752,790 securities conferring access to the share capital (corresponding to 16.9% of the share capital) has been granted to different categories of beneficiaries by the Board but remain, as of today, not exercised (or definitely acquired in the case of free shares) and so are not recorded in share capital.

| Flamel Technologies S.A. I Flamel.com | 18 |

| 5.3.3 | Authorized but unissued share capital |

The shareholders authorized the Board to issue a total of 4,667,836 shares (representing 11.6% of the share capital) for different purposes, described in the chart below.

Pursuant to article L.225-100 of the French Commercial Code (Code de commerce), the appendix 2 to this report contains a table summarizing the authorizations given to the Board of Directors by shareholders to increase the capital in force at December 31, 2014 and details of their use at the same date.

| Flamel Technologies S.A. I Flamel.com | 19 |

| 6. | Group Structure |

| 6.1. | Affiliates |

The Company currently has two direct wholly owned operating subsidiaries: Flamel US Holdings, Inc., and Flamel Irish Holdings, Ltd. Our US wholly owned subsidiary, Flamel Technologies Inc. was liquidated in 2014.

Flamel US Holdings, Inc. is a Delaware corporation, created for the acquisition of Éclat in March 2012. Éclat Pharmaceuticals, LLC, a Delaware limited liability company, is a wholly owned subsidiary of Flamel US Holdings, Inc. Talec Pharma, LLC, a Delaware limited liability company, is a wholly owned subsidiary of Éclat Pharmaceuticals, LLC.

Flamel Irish Holdings, Ltd is a corporation duly organized under the laws of Ireland. Flamel Ireland, Ltd., is a wholly owned subsidiary of Flamel Irish Holdings.

The Company meets the requirements as a small company for exemption of consolidated accounts in accordance with the French commercial code. Accordingly, the company’s did not establish consolidated account for the year ended December 31, 2014.

6.2. Acquisition of significant holdings in companies having their registered offices in France and acquisitions of control

No acquisition in 2014

| Flamel Technologies S.A. I Flamel.com | 20 |

| 7. | Management and Directorship of the Company |

During 2014 the Board of Directors met twelve times.

7.1. Mandates and functions exercised in any company, during the past financial year, by each of the company’s authorized agents

The Company’s Board of Directors currently consists of six members, five of whom are outside directors and whom we believe bring broad experience to Flamel:

| · | Michael S. Anderson, CEO of Flamel Technologies SA since March 2012 and CEO of Éclat Pharmaceuticals LLC since its creation in November 2010, former CEO of its generic business, former President and CEO of ETHEX Corporation and Ther-Rx Corporation, subsidiaries of KV Pharmaceuticals. |

| · | Guillaume Cerutti is the Chairman and Chief Executive Officer of Sotheby’s France, former CEO of the French Directorate General for Competition, Consumer Affairs and Repression of Fraud, (Ministry of Finance and Economy) and currently serves as Chairman of the Board of the ‘Institut de Financement du Cinéma et des Industries Culturelles’; |

| · | Francis JT Fildes is the former Senior Vice President: Head of Global Development for AstraZeneca, PLC, former Director of ProStrakan Pharmaceuticals PLC and a current Director of Fildes Partners Ltd and a Fellow of the Royal Society of Medicine and the Royal Society of Chemistry; |

| · | Christophe Navarre is Board Member of the Comité Colbert, Member of the Heineken Supervisory Board and Chairman of the FEVS (Fédération des Exportateurs de Vins et Spiritueux). |

| · | The Honorable Craig Stapleton, former United States Ambassador to France and Director of Carlisle Bank and Lead Director of Abercrombie and Fitch; |

| · | Ben Van Assche is a member of the international jury that assists the government of the Walloon Region in its policy towards clusters of competitiveness, in particular the BioWin health cluster. |

7.2. Related-party agreements governed by articles L.225-38 and next of the French Commercial Code

These agreements include agreements – other than those executed with a wholly-owned subsidiary or falling within the scope of routine operations – that are entered into between the Company and (i) any companies with which it has a member of management in common, or (ii) a shareholder owning more than 10% of the Company’s voting rights.

Please note that the auditor has drawn up a special report, submitted to you, indicating that certain conventions mentioned in Articles L.225-38 et seq. of the Code of Commerce were concluded or renewed during the last financial year.

| Flamel Technologies S.A. I Flamel.com | 21 |

We ask you to approve and/or ratify, as the case may be, any convention mentioned in Articles L.225-38 et seq. of the Code of Commerce that have been concluded or renewed during the financial year, and which might appear in the auditor’s report. (Tenth resolution)

| 7.3. | Agreement executed with a wholly-owned subsidiary |

The Ordonnance dated on July 31, 2014 has changed the regime of conventions which, while no longer covered by the scope of the procedure for related-parties agreements, may be significant for the parent company, the concerned subsidiary and their shareholders.

Thus, are brought to your attention in the present report, agreements made, directly or through an intermediary, between:

| · | -Firstly, the Chief Executive Officer, delegated Executive Officer, one of the directors or a shareholder owning more than 10% voting rights, of a limited company, |

| · | - and, on the other hand, a company whose Flamel owns, directly or indirectly, more than half of the capital. |

Agreements that relate to current operations and concluded under normal conditions (article L. 225-102-1 of the French Commercial Code) are not mentioned.

| 7.3.1 | Transactions renewed during financial year ended December 31, 2014 |

On October 29, 2013, the Board of Directors unanimously approved a current account agreement between Flamel Technologies SA and Eclat Pharmaceuticals LLC whereby Flamel Technologies grants to Eclat Pharmaceuticals advance of funds up to a maximum of 15MUSD with an annual interest rate of 23%. Any interest accumulated over this period will be credited to the current account and will be due within 30 days of external funding. Late payment will be subject to late payment penalties, from the due date to the actual date of payment, with effective interest rate of 10 %. Agreement expires on December 31, 2014 and has been renewed for an additional year. The whole amount has been reimbursed on April 2015.

| 7.3.2 | Transactions concluded during financial year ended on December 31, 2014 |

On March 20, 2014, following the raising funds performed by Flamel Technologies in March 2014 and in order to allow its subsidiary to repay outstanding long-term debt Flamel Technologies SA, has granted a loan (Facility Agreement) to its wholly-owned subsidiary Flamel US Holding Inc, in an aggregate amount not to exceed $40.0 million. A Loan may be drawn down in varying amounts at any time between prior to December 31, 2015. Interest will accrue on the loans at a rate of 10.265% per annum. The proceeds of the Loans will be used for working capital without limitation as to its use. The Loan may be prepaid at any time, without any prepayment penalty and on December 31, 2016 the latest. The loan is governed by the laws of the Ireland.

On December 11, 2014, the Board authorized a transaction relating to the transfer of all of the intangible property from the French entity to the Irish-based entity as a part of a global reorganization of the Flamel group. The intangible property included patents on drug delivery platforms, clinical data sets and other intangible assets related to the pipeline of our proprietary products in development. Flamel’s proprietary drug delivery platforms include Micropump® (and its applications to the development of liquid formulations LiquiTime® and of abuse-resistant formulations Trigger Lock™) and Medusa™ platforms. The transaction, amounting to €63.8 million deals with a chargeback from the R & D expenditure incurred by Flamel, plus a 20% mark-up and the transfer price of the intangible asset.

| Flamel Technologies S.A. I Flamel.com | 22 |

| 7.4. | Renewal of Directors |

The term of the mandate as a company director of Messrs Michael S. Anderson, Guillaume Cerutti, Francis J.T. Fildes, Mr. Christophe Navarre, Craig Stapleton and Ben C. Van Assche expires at the end of the Ordinary shareholders meeting to which you are invited.

Accordingly, we propose to you to renew the term for a further year, for Messrs Michael S. Anderson, Guillaume Cerutti, Francis J.T. Fildes, Mr. Christophe Navarre, Craig Stapleton and Ben C. Van Assche.

The directors’ office will be renewed for a duration of one (1) year, namely until the Ordinary shareholders meeting to be held to approve the financial statements for the financial year ending on December 31, 2015. (Third to eighth resolution)

| 7.5. | Directors’ attendance fees |

In the 2014 financial year, the global amount paid by the Company to the Directors as annual attendance fees is 243.7 k€ (behind €325.000 authorized by the General shareholder meeting on June 24, 2014).

In view of the Directors’ participation and the level of their responsibilities, we propose to you that the amount of €325,000) be assigned to the Board of Directors as annual attendance fees, equivalent to the previous fiscal year and for which the distribution and breakdown thereof will be decided by the Board of Directors. (Ninth resolution)

We also propose to you to authorize the Board to implement a new plan for allocation of stock warrants to Directors. You will find details concerning the plan in the report issued in that connection.

| Flamel Technologies S.A. I Flamel.com | 23 |

8. Important events occurring between the end of the financial year and the date of the present report

On January 15, 2015, we announced that the Wholesale Acquisition Cost (“WAC”) for Bloxiverz® has been increased to $98.75 per vial for both the 0.5 and 1.0 mg/mL strengths, subsequent to the approval by the FDA of APP’s NDA for neostigmine methylsulfate product.

On March 27, 2015, we announced positive results of FIM clinical trial with LiquiTime® guaifenesin. Three different twice-daily formulations of LiquiTime® guaifenesin against immediate release guaifenesin tablets dosed every four hours were evaluated in a 16-healthy volunteers four-way crossover pharmacokinetic study. The trial was intended to provide sufficient data for us to choose the best formulation to move forward into a pivotal study. While none of the formulations in this relatively small pilot study exactly satisfied all of the criteria necessary for proving bioequivalence of Area Under the Curve (“AUC”) to the immediate release guaifenesin tablets under FDA requirements, the results clearly met the intention of the study. The chosen formulation will be optimized and scaled up with the aim to perform a pivotal study in 2016. In addition, there were no safety issues raised during the study.

On April 7, 2015, we announced the departure of Mr. Steve Lisi, Senior Vice President of Business and Corporate Development at Flamel.

The Board invites you after reading the reports by the auditor, to discuss these matters and vote on the resolutions submitted to you.

| Flamel Technologies S.A. I Flamel.com | 24 |

APPENDIX

1

TABLE OF EARNINGS FOR THE LAST FIVE FINANCIAL YEARS

| FLAMEL TECHNOLOGIES - | December 31, 2014 |

| FINANCIAL RESULTS OF LAST FIVE YEARS | ||||||||||||||||||||||

| In euros | ||||||||||||||||||||||

| 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | 12/31/2014 | ||||||||||||||||||

| a) | Share Capital | 3 005 783 | 3 044 396 | 3 099 662 | 3 123 707 | 4 901 727 | ||||||||||||||||

| b) | Number of Ordinary Shares | 24 645 650 | 24 962 250 | 25 415 400 | 25 612 550 | 40 191 264 | ||||||||||||||||

| c) | Number of Preference Shares | |||||||||||||||||||||

| d) | Maximum number of shares to be issued by : | |||||||||||||||||||||

| - Bond Issue | ||||||||||||||||||||||

| - Exercise of Stock Options and Warrants and issue of Free Shares | 4 370 990 | 4 481 640 | 7 723 140 | 7 384 990 | 6 396 240 | |||||||||||||||||

SHARE CAPITAL

| a) | Revenues | 25 324 364,68 | 22 503 580,78 | 17 183 940,00 | 22 145 947,00 | 80 731 185,00 | ||||||||||||||||

| b) | Income before taxes, depreciation and provisions | -9 477 166,03 | -7 856 268,36 | -14 124 502,34 | -3 804 496,47 | 60 091 076,00 | ||||||||||||||||

| c) | Income Tax (Tax Credit) | -5 720 673,00 | -4 931 445,00 | -5 067 856,00 | -4 303 328,00 | 7 045 175,00 | ||||||||||||||||

| d) | Employee's Profit-Sharing | 940 459,00 | ||||||||||||||||||||

| e) | Income after taxes, profit sharing, depreciation and provisions | -7 158 443,00 | -6 647 651,00 | -12 315 766,04 | -117 738,65 | 51 264 590,00 | ||||||||||||||||

| f) | Profit Distribution |

ANNUAL OPERATIONS AND EARNINGS

| a) | Income after tax and profit sharing and before depreciation and provisions | -0,15 | -0,12 | -0,36 | 0,02 | 1,30 | ||||||||||||||||

| b) | Income after tax, profit-sharing, depreciation and provisions | -0,29 | -0,27 | -0,48 | 0,00 | 1,28 | ||||||||||||||||

| c) | Dividend per share |

EARNINGS PER SHARE

| a) | Average number of employees | 301 | 278 | 243 | 242 | 226 | ||||||||||||||||

| b) | Payroll Costs | 12 888 143,45 | 11 817 905,34 | 12 037 122,88 | 10 796 957,78 | 10 107 395,00 | ||||||||||||||||

| c) | Social tax costs | 5 991 371,53 | 5 398 852,98 | 5 400 517,43 | 4 983 511,01 | 5 140 115,00 |

PERSONNEL COSTS

| Flamel Technologies S.A. I Flamel.com | 25 |

APPENDIX

2

REPORT CONCERNING DELEGATIONS MADE TO THE BOARD

| Date

of the shareholder's meeting |

Securities concerned / type of emission | Duration

of the autorisation |

Authorisation expiry date |

Maximum nominal amount |

Utilisation of autorisation by the Board of Directors | |||||

| Jun 20, 2013 | Delegation to issue 200 000 new shares, with no preferential subscription right for shareholders | 18 months | Dec 20, 2014 | € 24 392,00 | none | |||||

| Feb 11, 2014 | Delegation to issue 3 000 000 new shares, maintaining the shareholders' preferential subscription right | 26 months | Apr 11, 2016 | € 365 880,00 | none | |||||

| Feb 11, 2014 | Delegation to issue 15 000 000 new shares, with no preferential subscription right for shareholders | 18 months | Aug 11, 2015 | € 1 829 400,00 | Mar 6, 2014: 10,800,000 (primary offering) + 1,600,000 (greenshoe). 2,600,000 remaining shares to be issued. | |||||

| Feb 11, 2014 | Delegation to issue 2 000 000 new shares, with no preferential subscription right for shareholders | 18 months | Aug 11, 2015 | € 243 920,00 | Nov 26, 2014: 1,026,364 new shares subscribed by Recipharm AB. 973,236 remaining shares to be issued. May be superseded and replaced by the authorization of June 26, 2015. | |||||

| Jun 24, 2014 | Delegation to issue 300 000 stock warrants | 18 months | Dec 24, 2015 | € 36 588,00 | Jun 24, 2014: issuance of 298,000 warrants to directors; subscription price is 0,89 € i.e. 10% of the average market price of the share, in the form of ADS, on the NASDAQ, on the closing of the trades on the 20 days preceding the Board decision. 2,000 remaining warrants to be issued. May be superseded and replaced by the authorization of June 26, 2015. | |||||

| Jun 24, 2014 | Authorization to allocate 250 000 free shares | 38 months | Aug 24, 2017 | € 30 490,00 | Dec 11, 2014: initial allocation of 188 300 free shares. 61,700 remaining free-shares to be issued. May be superseded and replaced by the authorization of June 26, 2015. | |||||

| Jun 24, 2014 | Authorization to allocate 1700 000 stock options | 38 months | Aug 24, 2017 | € 207 332,00 | Dec 11, 2014: allocation of 669,500 stock options; exercise price is $16,30 (being 13,15€ at the rate of 0,81), i.e. the market price of the share, in the form of ADS, on the NASDAQ on the day prior to the Board of Directors meeting. 1,030,500 remaining stock optionsto be issued. |

| Flamel Technologies S.A. I Flamel.com | 26 |

Presentation Of The Resolutions - Report By The Board Of Directors To The Combined Shareholders Meeting To Be Held On June 26, 2015

Eighteen resolutions have been submitted for your approval. The first ten resolutions will be submitted to the Ordinary General Meeting, while Resolutions 11 to 18 will be submitted to the Extraordinary General Meeting.

Resolutions

Within The Competence Of The

Ordinary General Shareholders’ Meeting

Approval of the annual financial statements for the fiscal year ended December 31, 2014 (Resolutions 1 and 2)

The General Meeting is requested to approve the Company’s annual financial statements for the fiscal year ended December 31, 2014, as well as the operations reflected in those statements (First resolution)

In addition, since financial statements show a net earning for the financial year of €51,264,590, we propose to you to allocate this entire gain to the retained earnings account, which, following that allocation, will amount to €(70,929,961) (Second resolution).

Renewal of a part of directorships and appointment of two new directors (Resolutions 3 to 8)

The General Meeting is requested, under Resolutions 3 to 8, to renew the directorships of Messrs Michael S. Anderson, Guillaume Cerutti, Francis J.T. Fildes, Christophe Navarre, Craig Stapleton and Ben C. Van Assche, which expire at the close of this meeting, for a one-year term.

Determination of the annual amount of Directors’ attendance fees (“jetons de presence”) (Resolution 9)

The General Meeting is requested to allocate to the Board of Directors, under condition of adoption of resolution 3 to 8, a maximum aggregate amount EUR 325,000 as annual attendance fees for the fiscal year ending December 31, 2014.

Approval of related-party agreements (Resolution 10)

The General Meeting is requested to approve the statutory auditors’ Special Report on the related-party agreements and commitments set out in Articles L. 225-38 et seq. of the French Commercial Code.

| Flamel Technologies S.A. I Flamel.com | 27 |

Resolutions

Within The Competence Of The

Extraordinary General Shareholders’ Meeting

Employee and directorship shareholding

Over the past, as a matter of partnership governance, and in order to take into account the interests of all stakeholders, we regularly proposed to you to authorize the Board of directors to issue securities to employees and corporate officers (free shares and/or stock options) as well as to directors (stock warrants). As reported in the table summarizing the current authorizations given to the Board of directors, you may note that we almost totally used the authorizations you gave to the Board of directors (i) to issue free shares to the benefit of Company’s employees and corporate officers, and (ii) to issue stock warrants to the benefit of Company’s directors.

The Company believes the profit-sharing in the form of shares is the most effective way of aligning the interests of the shareholders and employees and to attract and to retain key staff. Hence, and in the light of the important contribution of the Board of Directors to Company management, we propose that the authorizations given in 2014 relating to free shares and stock warrants be renewed in their entirety. Considering the remaining amount to be used to issue stock options, we estimate that it is not necessary to renew the authorization relating to stock options.

The Board of directors shall have full powers to implement them, to set terms and conditions pursuant to legal and regulatory provisions and those set by your General Meetings, to record the resulting increases in share capital and amend the Company’s bylaws accordingly. It shall, together with the Statutory Auditors, prepare a supplemental report at the time the Board will use any of these authorizations. These reports shall be made available to you pursuant to legal provisions. The issue of securities giving access to the share capital shall require the elimination of shareholders’ preferential subscription rights or the automatic waiver by shareholders of their preferential right to subscribe for the shares to which the issued securities give access.

As provided by law, any new authorization giving by the shareholders to the Board of directors to increase the share capital will supersede and replace the previous authorization on the same purpose. Such authorizations are tracked in the report issued pursuant to article L.225-100 of the French Commercial Code (Code de commerce).

In order to allow you to take a position on the proposal for allocation of new securities of the Company which is submitted to you, and according to the conditions set forth in article R225-113 of the French Commercial Code, the important events occurring between the end of the financial year and the date of the present report are listed p 24 of this report.

A proposal for free allocation of 250,000 shares to the benefit of the members of the salaried staff and/or of certain authorized agents (Article L.225-197-1 of the French Commercial Code) (Resolution 11)

The purpose of the eleventh resolution is to authorize the Board of directors to award a maximum of two hundred fifty thousand (250,000) free shares of the Company to employees and to corporate officers (“mandataires sociaux”) of the Company and its subsidiaries, pursuant to the conditions set forth in Articles L.225-197-1, II and L.225-197-2, 1° of the French Commercial Code. The objectives in this matter are to make employees full partners of the Company and to retain key staff. The corresponding plan is also aimed at bolstering existing procedures and processes in relation to employee compensation.

| Flamel Technologies S.A. I Flamel.com | 28 |

This is a collective plan to the benefit of all employees of the Company and of all its subsidiaries. The beneficiaries of the said allocations could be:

| · | the employees of the Company or the companies and the economic interest groupings which are linked to it pursuant to the conditions stipulated in Article L.225-197-2, 1° of the French Commercial Code; |

| · | the company officers (“mandataires sociaux”) referred to in Article L.225-197-1, II of the French Commercial Code. |

The shares awarded would be those issued as part of a share capital increase through the creation of new shares by the capitalization of reserves, profits, or premiums, or existing shares. The shares awarded to the employees would only vest at the end of a vesting period of no less than two years and would then be subject to a holding period of no less than two years, except for beneficiaries who are not French tax residents for whom the vesting period may be extended to up to four years and the holding period reduced accordingly.

Hence we propose that you authorize the Board of Directors and entrust it with full powers to implement this authorization within the limits fixed in the detailed resolution and thus notably set the terms and conditions and determine the identity of the beneficiaries of the free allocations from among the persons complying with the conditions set above, as well as the number of shares due to each of them and, where applicable, the criteria for awarding shares to employees, as well as the length of the vesting period and the holding period for the shares.

The number of free shares that can be allocated by the Board under the present delegation may not exceed 10% of the share capital existing on the day of the first grant.

Free shares cannot be granted to an employee or corporate officer who holds more than 10% of the Company’s share capital.

This authorization would be given for a period of thirty-eight months from the date of this meeting. Nevertheless, we anticipate using an important part of this authorization within the next year, as compensation and incentive to employees and officers, and so asking for a renewal of this authorization each year.

We remind you that, in the event that the Board should make use of this authorization, it shall inform the ordinary general meeting each year of the operations performed by virtue of the provisions stipulated in articles L.225-197-1 to L.225-197-3 of the French commercial code pursuant to the conditions stipulated by article L.225-197-4 of said code.

Proposal to issue a total of 350,000 autonomous stock warrants reserved for the category of persons consisting of the Company’s directors who are neither legal representatives nor employees of the Company, but including the Chairman of the Board of Directors. (Resolutions 12 and 13)

During the present meeting, we proposed that you renew the mandates of Messrs. Guillaume Cerutti, Francis J.T. Fildes, Christophe Navarre, Craig Stapleton and Ben C. Van Assche (Directors who are not employees).

| Flamel Technologies S.A. I Flamel.com | 29 |

The twelfth resolution seeks to authorize the Board of Directors to issue of a maximum of three hundred fifty thousand (350,000) stock warrants, which may be converted into ordinary shares already existing or to be issued, in the form of ADS.

With respect to the said three hundred fifty thousand (350,000) stock warrants, the General Meeting is requested to withdraw the shareholders’ preferential application right appearing in Article L.225-132 of the French Commercial Code, and reserve applications, for the reasons mentioned below, for a category of persons as follows:

| · | the Company’s directors who are neither legal representatives nor Company employees, but including the Chairman of the Board of Directors. |

In addition, the present authorization would entail, for the benefit of warrants’ beneficiaries, express waiver, by the shareholders, of the preferential right to subscribe for the shares that will be issued subsequently to the exercise of stock warrants.

We propose that you decide that the subscription price of a stock warrant shall be one tenth (10%) of the average market price of the share, in the form of ADS, on the NASDAQ, on the closing of the trades on the twenty days preceding the decision of the Board to issue such stock warrants.

We propose that you decide that each stock warrant shall be exercised by its holder within four (4) years from the issuance date, subject to the conditions set forth in your resolution and by the Board’s decision to issue the warrants.

We propose that you decide that a stock warrant shall give its holder, subject to the terms and conditions defined below and by the decision of the Board of Directors relative to the issuance of the stock warrants, the right to subscribe to one (1) Company ordinary share, in the form of ADS, at an exercise price to be determined by the Board of Directors based on the Company’s share price. This exercise price shall be equal to the trading price of a share, on the NASDAQ Global Market, at the close of that market on the trading days preceding the date of the Board of Directors’ decision relating to the issue of stock warrants, subject to such price is no less than 80% of the average trading prices of the share on the NASDAQ, in the form of ADS, during the last twenty trading days preceding the date of such Board of Directors’ decision; in that case, the price of the share shall be equal to 80% of the average trading prices of the share on the NASDAQ, in the form of ADS, during the last twenty trading days preceding the date of such Board of Directors’ decision.

The General Meeting is requested to decide that the Board of Directors shall hold full powers to implement the present authorization within the limits fixed by the detailed resolution and thus notably set the terms and conditions of the issuance and determine the beneficiaries of the stock warrants among the category described herein.

This authorization would be given for a period of eighteen months starting from the date of this General Shareholders’ Meeting.

We remind you that when the Board of Directors uses this authorization, it will provide a special report to the next General Meeting which indicates the final terms and conditions of the operation; such report will be put at the shareholders' disposal at the company's head office within fifteen (15) days following the meeting of the Board of Directors at the latest; a special report will be also issued by the Statutory Auditors.

| Flamel Technologies S.A. I Flamel.com | 30 |

Proposal to authorize the Board to increase the share capital through issuance of shares reserved for the employees (Resolutions 14 and 15)

Pursuant to the provisions of Article L.225-129-6 of the French Commercial Code and of Article L.3332-18 of the Labour Code, we remind you that the shareholders must make a decision on a draft resolution aimed at carrying out a capital increase under the conditions laid down in Article L.3332-18 of the Labour Code (reserved, directly or through the intermediary of a company investment fund, for the members of a company savings plan, even in the absence of such a plan within the Company), on the occasion of each capital increase by cash conveyance that is proposed to them.

As a result of the proposals regarding a capital increase listed above, we therefore invite you to make a decision on the proposed capital increase reserved for the Company’s employees.

Such a resolution implies the suppression of the preferential application right granted to the shareholders pursuant to the applicable legal and regulatory provisions (Fifteenth Resolution).

In order to comply with this legal requirement, we are submitting for your approval a draft resolution authorizing the Board of Directors and delegating to it, for a period of twenty-six (26) months, the powers required to increase the share capital, in a nominal amount equal at most to 1% of the share capital on the date of the present meeting, to set the issue price under the conditions laid down in the provisions of Article L.3332-20 of the Labour Code, subject to supervision by the Auditor, and to determine the number of shares allocated to each beneficiary pursuant to the provisions of Article L.225-138 of the French Commercial Code.

We draw your attention to the fact that the Company shares are not eligible to the current company savings plan.

Furthermore, the Board of Directors considers that the present authorization is unnecessary in view of the Company’s situation and other existing compensation tools. Hence we invite you to vote against these resolutions.

Delegation to be granted to the Board of Directors for issue of a maximum number of two million (2,000,000) ordinary shares, reserved for a category of persons consisting of any public or private French or foreign company engaged (i) in the manufacture, sale, marketing and/or distribution of pharmaceutical products or active pharmaceutical ingredients or (ii) in operational activities related to pharmaceutical industry. (Sixteenth and Seventeenth Resolutions)

On February 2014, you authorized the Board to issue a maximum number of two million (2,000,000) ordinary shares, reserved for a category of persons consisting of any public or private company engaged in the manufacture, sale, marketing and/or distribution of pharmaceutical products or active pharmaceutical ingredients. As reported in the table summarizing the current authorizations given to the Board of directors, you may note that we partially used this authorization you gave to the Board of directors to 1,026,364 new shares to the benefit of Recipharm AB. Since this authorization was granted for 18 months, the delegation to issue the remaining amount (i.e. 973,636 new shares) shall be used before August 2015. Hence, we propose that the authorization given in 2014 relating to this volume of shares, reserved for a limited category of persons, be renewed in their entirety

| Flamel Technologies S.A. I Flamel.com | 31 |

The purpose of this delegation is to provide to the Company flexibility in dealing with potential partners. It is not uncommon in the pharmaceutical industry for potential partners to take minority interests in companies with whom they work and we would like to be able to have shares available for such transactions, should one arise. Agreeing to this proposal will allow the Company to act in a timely manner should such an opportunity arise.

As provided by law, any new authorization giving by the shareholders to the Board of directors to increase the share capital will supersede and replace the previous authorization on the same purpose. Such authorizations are tracked in the report issued pursuant to article L.225-100 of the French Commercial Code (Code de commerce).

We propose that you authorize the issuance of a maximum of two million (2,000,000) ordinary shares in the form of American Depositary Shares (ADS), which shall have to be fully paid up on the date of their subscription through the payment of cash consideration or by offset against debt owed by the Company (“paiement par compensation de créance”) as authorized by applicable law and regulations.

We request that you decide to cancel the shareholders’ preferential subscription rights in relation to the capital increase(s) realized under this resolution for the benefit of the category of persons consisting of any public or private French or foreign company engaged (i) in the manufacture, sale, marketing and/or distribution of pharmaceutical products or active pharmaceutical ingredients or (ii) in operational activities related to pharmaceutical industry (Seventeenth Resolution).

We propose that the subscription price of one (1) ordinary share of the Company shall be determined by the Board based on the Company’s share price, it being specified that:

| · | this issue price shall be equal to the closing trading price for the shares, in the form of ADS, on the NASDAQ Global Market, on the last trading day preceding the date of the Board of Directors’ decision setting the opening date for the period of subscription to a share capital increase performed on the basis of this sixteenth resolution, more or less a premium or a discount, as decided by the Board, in its sole discretion. The amount of the discount or premium, as the case may be, shall be determined by the Board of Directors, in its sole discretion, subject to compliance with the following terms and conditions; |

| · | the issue price of the shares shall be at least equal to the minimum amount provided under applicable laws and regulations at the time this delegation is used and in any case no less than 80% of the average of the market price for the share on the NASDAQ, in the form of ADS, during the last twenty trading days preceding such Board’s decision. |

We propose that you limit this delegation to a maximum number of two million (2,000,000) new Company ordinary shares with a nominal value of EUR 0.12196, which represent approximately 5% of the Company’s share capital as at December 31, 2014. Accordingly, the maximum nominal amount of the Company’s share capital which may be realized, immediately or overtime, under the present resolution is EUR 243,920. This global cap does not include the nominal amount of the ordinary shares to be issued in order to maintain the rights of the holders of securities conferring access to the share capital of the Company, in accordance with the law and with any applicable contractual provisions providing for other cases of adjustment.

| Flamel Technologies S.A. I Flamel.com | 32 |