Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AVADEL PHARMACEUTICALS PLC | v432139_8k.htm |

Exhibit 99.1

February 2016 1

February 2016 2 Forward Looking Statements This document includes statements concerning our operating results (including product sales), financial condition and product development milestones, which are “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 . All statements herein that are not clearly historical in nature are forward - looking, and the words “anticipate,” “assume,” “believe,” “expect,” “estimate,” “plan,” “will,” “may,” and the negative of these and similar expressions generally identify forward - looking statements . All forward - looking statements involve risks, uncertainties and contingencies, many of which are beyond Flamel’s control and could cause actual results to differ materially from the results contemplated in such forward - looking statements . These risks, uncertainties and contingencies include the risks relating to : our dependence on a small number of products and customers for the majority of our revenues ; the possibility that our Bloxiverz® and Vazculep® products, which are not patent protected, could face substantial competition resulting in a loss of market share or forcing us to reduce the prices we charge for those products ; the possibility that we could fail to successfully complete the research and development for the two pipeline products we are evaluating for potential application to the FDA pursuant to our “unapproved - to - approved” strategy, or that competitors could complete the development of such products and apply for FDA approval of such products before us ; our dependence on the performance of third parties in partnerships or strategic alliances for the commercialization of some of our products ; the possibility that our products may not reach the commercial market or gain market acceptance ; our need to invest substantial sums in research and development in order to remain competitive ; our dependence on certain single providers for development of several of our drug delivery platforms and products ; our dependence on a limited number of suppliers to manufacture our products and to deliver certain raw materials used in our products ; the possibility that our competitors may develop and market technologies or products that are more effective or safer than ours, or obtain regulatory approval and market such technologies or products before we do ; the challenges in protecting the intellectual property underlying our drug delivery platforms and other products ; our dependence on key personnel to execute our business plan ; the possibility that we may cease to qualify as a foreign private issuer, which would increase the costs and expenses we incur to comply with U . S . securities laws ; and the other risks, uncertainties and contingencies described in the Company’s filings with the U . S . Securities and Exchange Commission, including our annual report on Form 20 - F for the year ended December 31 , 2014 , all of which filings are also available on the Company’s website . Flamel undertakes no obligation to update its forward - looking statements as a result of new information, future events or otherwise, except as required by law .

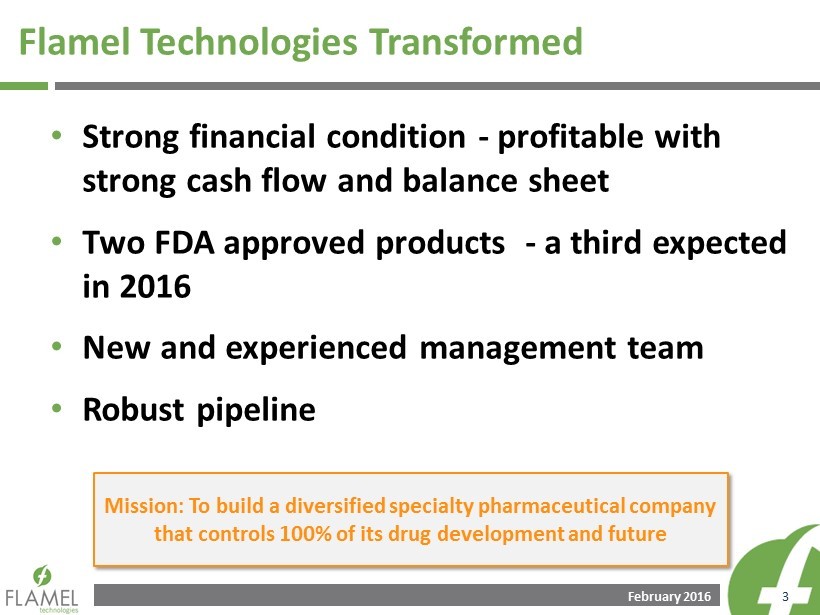

February 2016 3 Flamel Technologies Transformed • Strong financial condition - profitable with strong cash flow and balance sheet • Two FDA approved products - a third expected in 2016 • New and experienced management team • Robust pipeline Mission: To build a diversified specialty pharmaceutical company that controls 100% of its drug development and future

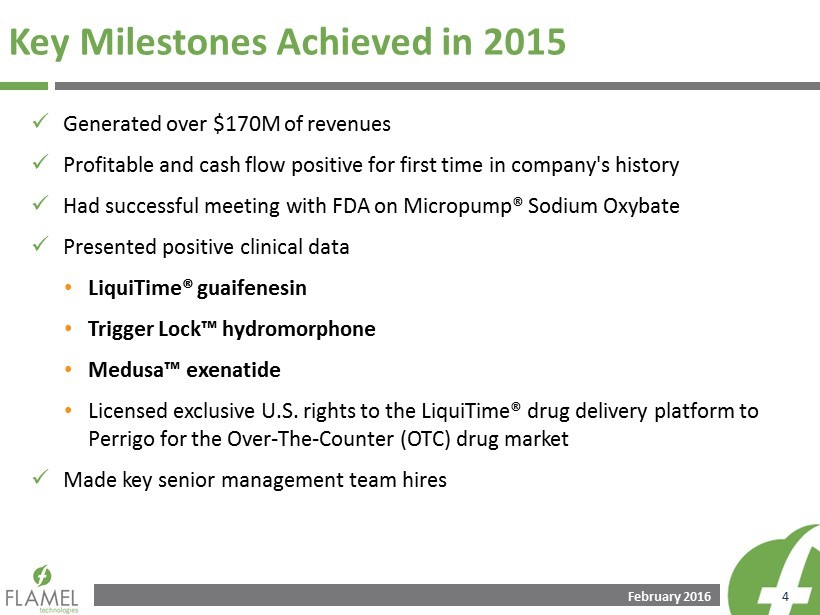

February 2016 4 Key Milestones Achieved in 2015 x Generated over $170M of revenues x Profitable and cash flow positive for first time in company's history x Had successful meeting with FDA on Micropump ® Sodium Oxybate x Presented positive clinical data • LiquiTime ® guaifenesin • Trigger Lock™ hydromorphone • Medusa™ exenatide • Licensed exclusive U.S. rights to the LiquiTime ® drug delivery platform to Perrigo for the Over - The - Counter (OTC) drug market x Made key senior management team hires

February 2016 5 2016 Expectations • Achieve total product sales of $110 - 130 million, inclusive of FSC Pediatrics • Launch UMD#3 • Integrate and market newly acquired FSC Pediatrics’ products • Start patient registration and dosing for pivotal study of Micropump® sodium oxybate • Begin licensing discussions for Trigger Lock™ platform • Complete and report data from Phase 1b study with Medusa™ exenatide in patients • Begin development of UMD #4* • Corporate restructuring to geographically align business with location of intellectual property *UMD is Flamel’s Unapproved Marketed Drugs Strategy

February 2016 6 Acquisition of FSC

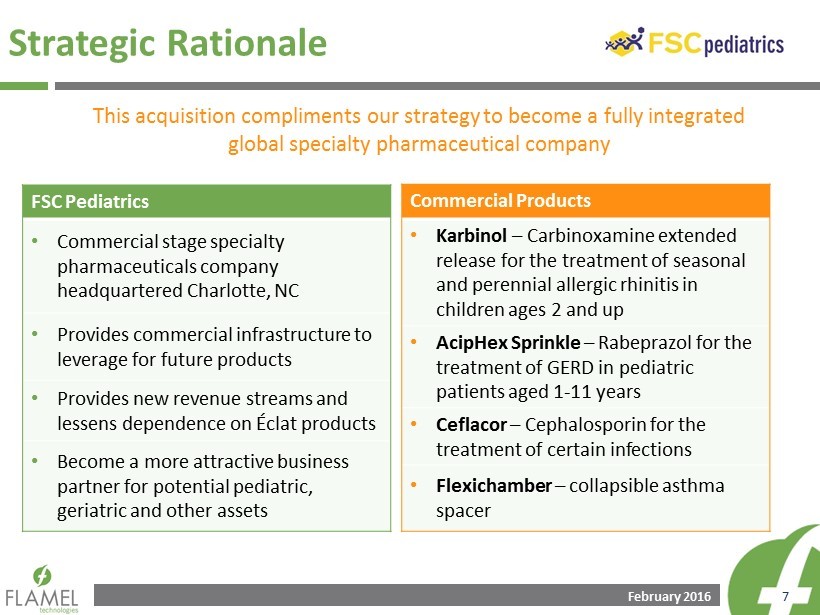

February 2016 7 Strategic Rationale FSC Pediatrics • Commercial stage specialty pharmaceuticals company headquartered Charlotte, NC • Provides commercial infrastructure to leverage for future products • Provides new revenue streams and lessens dependence on Éclat products • Become a more attractive business partner for potential pediatric, geriatric and other assets This acquisition compliments our strategy to become a fully integrated global specialty pharmaceutical company Commercial Products • Karbinol – Carbinoxamine extended release for the treatment of seasonal and perennial allergic rhinitis in children ages 2 and up • AcipHex Sprinkle – Rabeprazol for the treatment of GERD in pediatric patients aged 1 - 11 years • Ceflacor – Cephalosporin for the treatment of certain infections • Flexichamber – collapsible asthma spacer

February 2016 8 Terms of the Transaction • Fixed acquisition price totals $20.25 million paid over a five year period • $1 million annually for five years • And a final payment in January 2021 of $15.0 million • Variable consideration: • Royalties of 15 % per annum on net sales of the current FSC products, up to $12.5 million for a period not exceeding ten years • Expected 2015 revenues to approximate $10 - $15 million • Adjusted operating profit and cash flow neutral Terms of the Transaction are Very Cash Friendly

February 2016 9 FSC Sales Force Coverage

February 2016 10 Marketed Products Portfolio • Flamel’s Products • Acquired FSC Products

February 2016 11 BLOXIVERZ® & VAZCULEP ® Overview * IMS Bloxiverz ® • Indication: Reverses neuromuscular blockades used in surgical procedures • 1 of 3 approved versions of neostigmine methylsulfate injection • Approximately 4 million vials sold annually in the United States* • More details can be found at www.bloxiverz.com Vazculep ® • Indication: Treatment of hypotension resulting primarily from vasodilation in the setting of anesthesia • Form: 1 mL single use vials, 5 mL and 10 mL • Market potential at end 2015* • 1mL vial – 5.7 million 5mL vial – 1.2 million 10mL vial – 0.2 million • More details can be found at www.vazculep.com

February 2016 12 Karbinol ER & Cefaclor Overview • Licensed from Tris Pharma in August 2013 • Used for the treatment of seasonal and perennial allergic rhinitis in children 2 years of age and older • Orange book patent protection through March 2029 • Market size for liquids in US estimated at $110 million • Licensed from Yung Shin in March 2015 • 2nd generation Cephalosporin • Market size approximates $300 million • FDA - approved as therapeutically equivalent to Ceclor (significant brand recognition) • Broad indication for children as young as 1 month of age; covers common pathogens

February 2016 13 AcipHex Sprinkle Overview • Licensed from Eisai in June 2014 • FDA approved AcipHex Sprinkle in March, 2013 for the treatment of GERD in pediatric patients aged 1 - 11 years • Launched promotional efforts in August 2014 • Market size for liquids in US estimated at $110 million • Proton Pump Inhibitor (PPI) market is large and stable >1.1MM annual prescriptions for patients aged 0 - 9 years Market opportunity for this age group exceeds $400MM > 2.0MM annual prescriptions for patients aged 10 - 19 years Market opportunity in this age group in excess of $ 750MM

February 2016 14 Flexichamber Overview • Collapsible asthma spacer • Internally developed with a 510 (K) approval • Market size estimated at $50 million • Patents through 2028 • Patient benefits: x Dynamic Portability x Optimal Performance x Simple Assembly x Enhanced Patient Care TRANSFORMING THE TRADITIONAL CHAMBER TO MOVE WITH THE LIFE OF A CHILD

February 2016 15 Flamel’s R&D Pipeline • Micropump® sodium oxybate • LiquiTime® • Trigger Lock™ hydromorphone • Medusa™ e xenatide

February 2016 16 Drug/ Technology Indication Proof of Concept Pilot Pivotal Under Review Approved Sales Force UD/UMD 1 # 3 Undisclosed Flamel UD/UMD 1 # 4 Undisclosed Flamel Sodium oxybate/ Micropump® Narcolepsy Flamel Ibuprofen / LiquiTime ® Pain / Fever Perrigo Guaifenesin / LiquiTime ® Respiratory Perrigo Hydromorphone / Trigger Lock™ Pain TBD Exenatide/Medusa™ Diabetes TBD Current Pipeline 1 UMD is Flamel’s Unapproved Marketed Drugs Strategy that does not involve patented technology UD = undisclosed

February 2016 17 FT218 Overview • Extended release oral solid formulation of sodium oxybate using Micropump ® • Studied in 40 healthy volunteers across 2 studies • Profile is consistent with the target of single dose before bedtime • Met with FDA mid 2015 and will submit IND and SPA during 1H 2016 • Next step: Phase III clinical trial application submission and initiation of pivotal study Market Opportunity • Jazz’s Xyrem ® FY 2015 sales could exceed $ 900 million * • >~ 178 , 000 narcoleptic patients in the U . S . * • Jazz reports < 13 , 000 patients on treatment * • Limited competition to date • Micropump ® sodium oxybate could benefit from improved formulation Micropump ® Sodium Oxybate (F T218) * GlobalData & JAZZ’s 3Q’15 e a rnings call

February 2016 18 Overview • Extended release liquid oral suspension for treatment of pain and fever • Ibuprofen & Guaifenesin oral suspension twice - daily dosing confirmed Next Step : • Ibuprofen – IND/CTA filing and pivotal trial initiation in 2 H 2016 • Guaifenesin – Confirmatory PK study in 1 H 2016 Market Opportunity • Cough and cold U . S . market is estimated at $ 6 . 5 b annually 1 • OTC ibuprofen - containing products recorded over $ 490 million 2 of sales • OTC guaifenesin - containing products recorded over $ 440 million 2 of sales • LiquiTime ® allows for combination of active ingredients • Exclusive U . S . rights licensed to Perrigo for the OTC drug market LiquiTime ® OTC 1 Deutsche Bank 2 IMS – U.S. sales

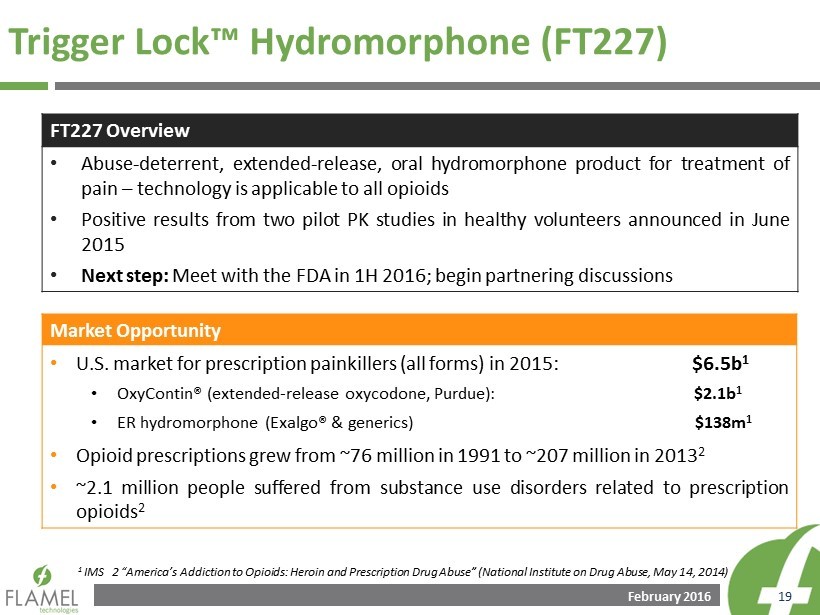

February 2016 19 FT227 Overview • Abuse - deterrent, extended - release, oral hydromorphone product for treatment of pain – technology is applicable to all opioids • Positive results from two pilot PK studies in healthy volunteers announced in June 2015 • Next step : M eet with the FDA in 1 H 2016 ; begin partnering discussions Market Opportunity • U.S. market for prescription painkillers (all forms) in 2015: $6.5b 1 • OxyContin® (extended - release oxycodone, Purdue) : $ 2 . 1 b 1 • ER hydromorphone ( Exalgo ® & generics) $ 138 m 1 • Opioid prescriptions grew from ~ 76 million in 1991 to ~ 207 million in 2013 2 • ~ 2 . 1 million people suffered from substance use disorders related to prescription opioids 2 Trigger Lock ™ Hydromorphone ( FT227 ) 1 IMS 2 “America’s Addiction to Opioids: Heroin and Prescription Drug Abuse” (National Institute on Drug Abuse, May 14, 2014)

February 2016 20 FT228 Overview • Subcutaneous injection formulation of exenatide , a GLP - 1 (glucagon - like peptide – 1 ) for treatment of Type 2 diabetes • Interim phase I human clinical data reported in December 2015 • PK profile compatible with a release over one week in humans • Next step : Complete Phase 1 b study in 1 H 2016 Market Opportunity • Market opportunity: GLP - 1 products recorded over $3.2 billion*: • $2.1b for Victoza ® (once a day liraglutide , Novo Nordisk) • $600m for Bydureon ® (once - a - week exenatide , AstraZeneca) • $266m for Byetta ® (twice - a - day exenatide , AstraZeneca) Medusa™ Exenatide ( FT228) * IMS – U.S. sales in 2015 (Jan. – Nov.)

February 2016 21 Flamel’s Strengths • Strong intellectual property • Seasoned senior management • Healthy financial situation

February 2016 22 Strong Intellectual Property • New patents may be issued targeting each individual product in development where a Flamel drug delivery platform is applied to a specific molecule Platform US Europe Micropump® July 2027 July 2023 LiquiTime® September 2025 April 2023 Trigger Lock™ April 2027 May 2026 (pending) Medusa™ June 2031 June 2027 (pending) * 2014 ’ Annual Report on form 20 - F published on April 31st, 2015

February 2016 23 Seasoned Senior Management Name Title Appointed Experience Michael S. Anderson Chief Executive Officer 2012 40+ years Pharma Sandy Hatten Senior Vice President, Quality and Regulatory Affairs 2015 30+ years Pharma Phillandas T. Thompson, J.D., M.B.A. Senior Vice President, General Counsel 2013 16+ years Legal Mike Kanan Senior Vice President and Chief Financial Officer 2015 30+ years Financial Gregory J. Davis Vice President, Corporate and Business Development 2015 20+ years Pharma David Monteith, Ph.D. Vice President, Research and Development 2014 25+ years Pharma Dhiren D’Silva Vice President of Irish and European Operations 2015 19+ years Business

February 2016 24 Condensed Consolidated Statement of Operations (Unaudited) In USD million, except EPS and shares data (million) Nine months ended September 30, 2015 September 30, 2014 Revenue $ 130 $12 COGS (8) (2) R&D (20) (12) SG&A (15) (12) Acquisition Royalty Payments (24) (1) Adj Op. Profit (Loss) (non - GAAP) 62 (15) Adj. Net Income (Loss) (non - GAAP) 29 (16) Adjusted Diluted EPS 0.72 (0.44) See Reconciliation of Non GAAP to GAAP in Appendix

February 2016 25 Flamel Technologies Transformed • Strong financial condition - Profitable with strong cash flow and balance sheet • Two FDA approved products - a third expected in 2016 • New and experienced management team • Robust pipeline Mission: To build a diversified specialty pharmaceutical company that controls 100% of its drug development and future

February 2016 26 Appendix

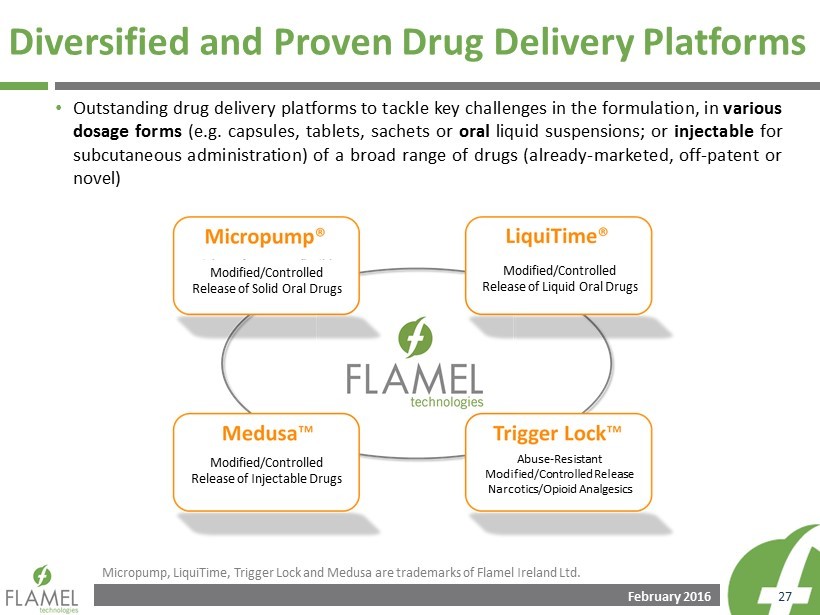

February 2016 27 Diversified and Proven Drug Delivery Platforms • Outstanding drug delivery platforms to tackle key challenges in the formulation, in various dosage forms (e . g . capsules, tablets, sachets or oral liquid suspensions ; or injectable for subcutaneous administration) of a broad range of drugs (already - marketed , off - patent or novel) Micropump, LiquiTime, Trigger Lock and Medusa are trademarks of Flamel Ireland Ltd. Modified/Controlled Release of Solid Oral Drugs Modified/Controlled Release of Liquid Oral Drugs Abuse - Resistant Modified/Controlled Release Narcotics/Opioid Analgesics Modified/Controlled Release of Injectable Drugs

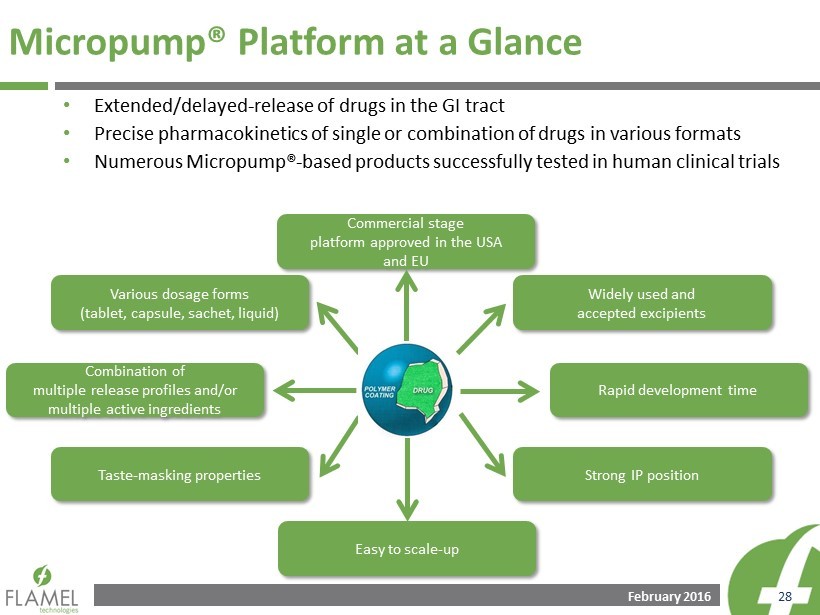

February 2016 28 Micropump® Platform a t a Glance • Extended/delayed - release of drugs in the GI tract • Precise pharmacokinetics of single or combination of drugs in various formats • Numerous Micropump® - based products successfully tested in human clinical trials Various dosage forms (tablet, capsule, sachet, liquid) Commercial stage platform approved in the USA and EU Widely used and accepted excipients Rapid development time Combination of multiple release profiles and/or multiple active ingredients Taste - masking properties Easy to scale - up Strong IP position

February 2016 29 • Microparticles are dispersed in the stomach and pass into the small intestine, after which each microparticle releases the drug at an adjustable rate and over an extended period of time (up to 24 hours) • Drug released at an adjustable rate controlled and/or delayed • Micropump® microparticles can be used separately or together to provide highly specialized delivery profiles Micropump Microparticles for Controlled/Modified Release Granules drug granulate or layered neutral core

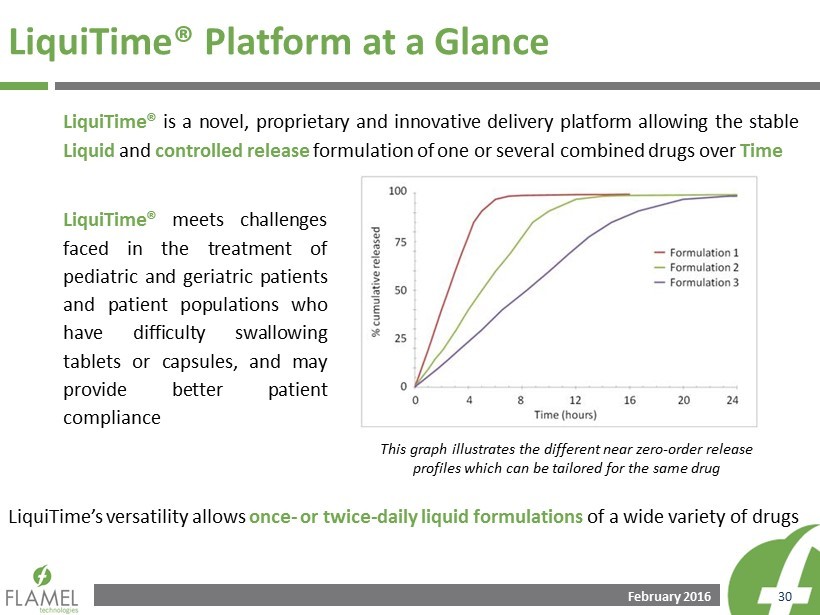

February 2016 30 LiquiTime® Platform at a Glance LiquiTime® is a novel, proprietary and innovative delivery platform allowing the stable L iquid and controlled release formulation of one or several combined drugs over Time LiquiTime® meets challenges faced in the treatment of pediatric and geriatric patients and patient populations who have difficulty swallowing tablets or capsules, and may provide better patient compliance LiquiTime’s versatility allows once - or twice - daily liquid formulations of a wide variety of drugs This graph illustrates the different near zero - order release profiles which can be tailored for the same drug

February 2016 31 Each microparticle is individually coated and behaves as an independent micro reservoir Coating • controls diffusion • keeps its integrity • offers good resistance to stress LiquiTime® f or Extended - Release Liquid Suspension L iquid suspension contains small coated drug microparticles A dose typically contains 5,000 to 50,000 particles ER microparticles are suspended in the liquid medium Granules drug granulate or layered neutral core 150 - 500 µm

February 2016 32 Trigger Lock™ is a proprietary and innovative delivery platform that enables the controlled release of narcotic and opioid analgesics while deterring their abuse Trigger Lock™ successfully addresses the issues of narcotic/opioid analgesics tampering : x The sustained release Micropump® - based microparticles are resistant to crushing : each microparticle retains its polymer coating which is virtually impervious to further crushing x Trigger Lock™ resists extraction attempts (even in boiling liquids) with beverages (alcoholic or not ) preventing injection x Trigger Lock™ preserves the bioavailability of the narcotic/opioid analgesics x Trigger Lock™ is compatible with different dosage forms (capsules, tablets) Trigger Lock™ Platform at a Glance

February 2016 33 1. Drug loaded Micropump® microparticles Sustained Release (SR) microparticles which are resistant to crushing 2. Viscosifying ingredient(s) To prevent abuse by injection after extraction in a small volume of solvent 3. Quenching ingredient(s) To prevent extraction in large volumes of liquid » Each microparticle retains its polymer coating which is virtually impervious to further crushing Trigger Lock™ SR Microparticles for Abuse Resistance

February 2016 34 Medusa Depot Solubilization and stabilization of drugs Applicable to a wide range of small molecules, peptide and protein drugs Safe, non - immunogenic and fully biodegradable Sustained delivery from 1 to 7 days in human Combination of several different drugs in the same formulation Bio - friendly, water - based, solvent - free formulation process Strong IP position Medusa™ Platform at a Glance

February 2016 35 Medusa ™ Depot for Injection COO - Na + COO - Na + COO - Na + COO - Na + COO - Na + COO - Na + COO - Na + Vitamin E Polyglutamate chain Drug solution or powder Formulation by simple mixing in water Non - covalent association ( reversible hydrophobic and/or electrostatic interaction) of the drug with Medusa™ nanoparticles Injection In vivo depot formation 1 2 3 Sustained release of the unmodified drug over 1 to 7 days * * * Water clear liquid Solution Or Freeze - dried In Vitro In Vivo • Made of polyglutamic acid and Vitamin E • Amphiphilic and spontaneously forms stable nanoparticles in water • Complexes are stable over a wide range of pH

February 2016 36 Reconciliation of Non GAAP to GAAP Results Flamel Technologies Reconciliation of GAAP to Non GAAP Non GAAP Operating Profit (Loss) 62$ (15)$ Contingent Consideration - Cash Payments 24 2 Contingent Consideration - Fair Value Remeasurement (82) (35) Amortization of R&D Intangibles (9) (9) Acquisition Note Expenses - (3) Total Adjusmtnets to arrive at GAAP Operating Profit (67) (45) GAAP Operating Profit (5)$ (60)$ Net Diluted Net Diluted Income (loss) EPS Income (loss) EPS Non GAAP Net Income (Loss) 29$ 0.72 (16)$ (0.44)$ Non GAAP Adjustments above (67) (1.66) (45) (1.28) Other, net (1) (0.04) 1 0.03 Taxes 4 0.09 2 0.05 GAAP Net Income (35)$ (0.88)$ (58)$ (1.64)$ Nine months ended Sept 30, 2015 Nine months ended Sept 30, 2014

February 2016 37 Headquarters 33 avenue du Dr . Georges Levy 69200 Vénissieux (Lyon) France U . S . Commercial Operations 16640 Chesterfield Grove Road, Suite 200 Chesterfield, MO Corporate Contact Phone : + 33 472 783 434 Fax : + 33 472 783 435 E - mail : licensing@flamel . com Specialty Pharmaceutical Company with Proprietary Drug Delivery Platforms Focused on Improved or Cost - Effective Products Phone: 636 449 1830 Fax: 636 449 1850