Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ESSENDANT INC | esnd-8k_20160215.htm |

| EX-99.1 - EX-99.1 - ESSENDANT INC | esnd-ex991_7.htm |

Earnings Presentation Fourth Quarter & Full-Year 2015 February 16, 2016 Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements, including references to goals, plans, strategies, objectives, projected costs or savings, anticipated future performance, results or events and other statements that are not strictly historical in nature. These statements are based on management’s current expectations, forecasts and assumptions. This means they involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here. These risks and uncertainties include, but are not limited to the following: Essendant's reliance on key customers, and the risks inherent in continuing or increased customer concentration and consolidations; end-user demand for products in the office, technology, and furniture product categories may continue to decline; the impact of Essendant's repositioning activities on Essendant's customers, suppliers, and operations; Essendant's reliance on independent resellers for a significant percentage of its net sales and, therefore, the importance of the continued independence, viability and success of these resellers; prevailing economic conditions and changes affecting the business products industry and the general economy; Essendant's ability to maintain its existing information technology systems and to successfully procure, develop and implement new systems and services without business disruption or other unanticipated difficulties or costs; the impact of price transparency, customer consolidation, and changes in product sales mix on Essendant's margins; the impact on the company’s reputation and relationships of a breach of the company’s information technology systems; the risks and expense associated with Essendant's obligations to maintain the security of private information provided by Essendant's customers; Essendant's reliance on supplier allowances and promotional incentives; the creditworthiness of Essendant's customers; continuing or increasing competitive activity and pricing pressures within existing or expanded product categories, including competition from product manufacturers who sell directly to Essendant's customers; the impact of supply chain disruptions or changes in key suppliers’ distribution strategies; Essendant's ability to manage inventory in order to maximize sales and supplier allowances while minimizing excess and obsolete inventory; Essendant's success in effectively identifying, consummating and integrating acquisitions; the costs and risks related to compliance with laws, regulations and industry standards affecting Essendant's business; the availability of financing sources to meet Essendant's business needs; Essendant's reliance on key management personnel, both in day-to-day operations and in execution of new business initiatives; and the effects of hurricanes, acts of terrorism and other natural or man-made disruptions. Shareholders, potential investors and other readers are urged to consider these risks and uncertainties in evaluating forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. For additional information about risks and uncertainties that could materially affect Essendant's results, please see the company’s Securities and Exchange Commission filings. The forward-looking information in this presentation is made as of this date only, and the company does not undertake to update any forward-looking statement. Investors are advised to consult any further disclosure by Essendant regarding the matters discussed in this presentation in its filings with the Securities and Exchange Commission and in other written statements it makes from time to time. It is not possible to anticipate or foresee all risks and uncertainties, and investors should not consider any list of risks and uncertainties to be exhaustive or complete.

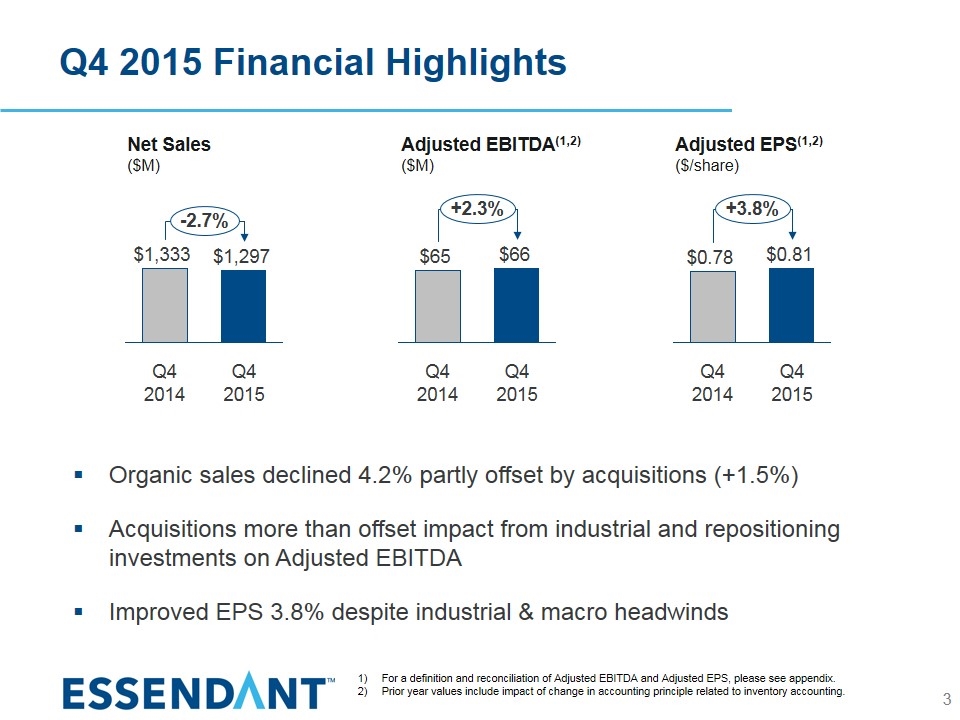

Q4 2015 Financial Highlights Organic sales declined 4.2% partly offset by acquisitions (+1.5%) Acquisitions more than offset impact from industrial and repositioning investments on Adjusted EBITDA Improved EPS 3.8% despite industrial & macro headwinds 3 Net Sales ($M) Adjusted EBITDA(1,2) ($M) Adjusted EPS(1,2) ($/share) For a definition and reconciliation of Adjusted EBITDA and Adjusted EPS, please see appendix. Prior year values include impact of change in accounting principle related to inventory accounting.

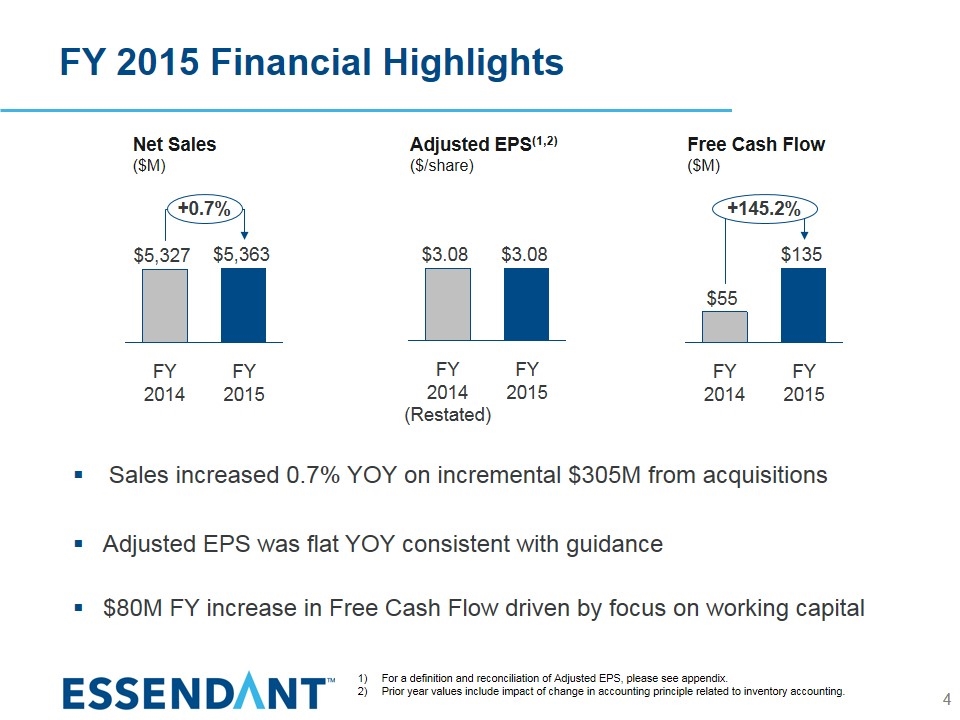

FY 2015 Financial Highlights Sales increased 0.7% YOY on incremental $305M from acquisitions Adjusted EPS was flat YOY consistent with guidance $80M FY increase in Free Cash Flow driven by focus on working capital 4 Net Sales ($M) Free Cash Flow ($M) Adjusted EPS(1,2) ($/share) For a definition and reconciliation of Adjusted EPS, please see appendix. Prior year values include impact of change in accounting principle related to inventory accounting.

2015 Review Executed strategic objectives Reduced cost structure Renewed focus on core Office Products and JanSan categories Re-branded to Essendant Exited low-margin business in Mexico Transitioned 14 facilities to common platform—Office Products and JanSan expected to be complete beginning Q2 2016 Focused on sales growth Built sales pipeline that has added four new large customers in last 3 months alone Online sales grew 16.1% YOY in Q4 Bolt-on Automotive acquisition (Nestor) performing well in growing category Contingent deal in place to acquire $550M+ wholesale business from Staples subject to merger approval Generated cash and returned value to shareholders Free cash flow up $79.7 million to $134.6 million $67.4 million in share repurchase in 2015 $21.1M dividends paid in 2015—20 quarters of consecutive payout 5 û û û û û û û û û û û û

2016 Outlook & Priorities Deliver sales growth and improve financial performance Significant opportunity to drive organic growth from share gain through customer conversions and product penetration across channels Further optimization of inventories Grow sales & margin more than costs Move additional business onto common platform Office Products and JanSan expected completion start of Q2 Future phases underway Stabilize industrial business Repositioning due to significant headwinds in energy and industrial space Plan to reduce SKU count and diversify customer base Revised business value proposition to diversify beyond oilfield and energy sectors 6

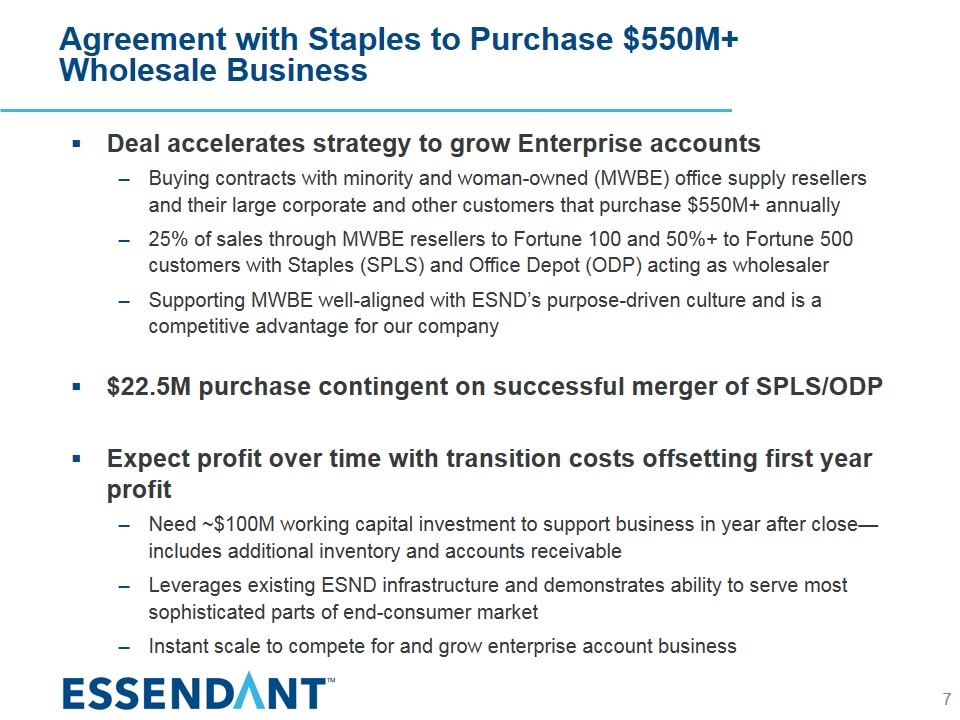

Agreement with Staples to Purchase $550M+ Wholesale Business Deal accelerates strategy to grow Enterprise accounts Buying contracts with minority and woman-owned (MWBE) office supply resellers and their large corporate and other customers that purchase $550M+ annually 25% of sales through MWBE resellers to Fortune 100 and 50%+ to Fortune 500 customers with Staples (SPLS) and Office Depot (ODP) acting as wholesaler Supporting MWBE well-aligned with ESND’s purpose-driven culture and is a competitive advantage for our company $22.5M purchase contingent on successful merger of SPLS/ODP Expect profit over time with transition costs offsetting first year profit Need ~$100M working capital investment to support business in year after close—includes additional inventory and accounts receivable Leverages existing ESND infrastructure and demonstrates ability to serve most sophisticated parts of end-consumer market Instant scale to compete for and grow enterprise account business 7

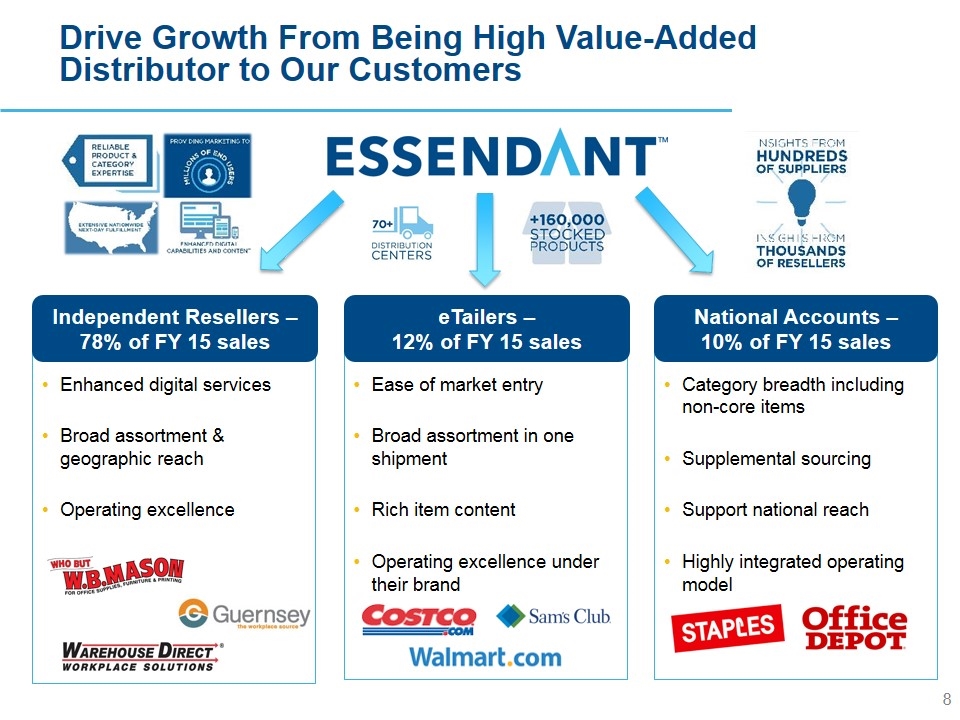

Enhanced digital services Broad assortment & geographic reach Operating excellence Drive Growth From Being High Value-Added Distributor to Our Customers Independent Resellers – 78% of FY 15 sales Ease of market entry Broad assortment in one shipment Rich item content Operating excellence under their brand eTailers – 12% of FY 15 sales Category breadth including non-core items Supplemental sourcing Support national reach Highly integrated operating model National Accounts – 10% of FY 15 sales 8

ESND Shares Have Key Long-Term Investor Attributes Stable business Office products remains large and profitable category Consistent profitability Business generates strong cash flow Expect free cash flow to be equal to or better than net income in 2016 Operating model generates strong operating cash flows with modest capex Opportunity to grow business faster than GDP Recent sales momentum: four large new customers in last two months alone Remain interested in inorganic growth opportunities that leverage platform New management team executing sensible plan Expect to begin realizing benefits of common platform project this year Goal to gain operating leverage by fully integrating recently acquired businesses Reducing costs to remain price competitive and drive free cash to re-invest in business Returning value to shareholders Reduced share count 42% in last 10 years Share repurchase and dividend viewed as key part of our capital allocation 9

Near-Term Objectives Generate profitable sales growth Aligning with customers who are taking share in each channel we serve Move businesses onto common platform Beginning with Office Products, JanSan and Breakroom CPO and Automotive to follow Simplify business and continue to control costs Gain operating leverage and reduce overhead by fully integrating recently acquired businesses Pursue merchandising excellence Optimize assortment and create additional value for business and customers Stabilize Industrial business Revised business value proposition to diversify beyond oilfield and energy sectors 10

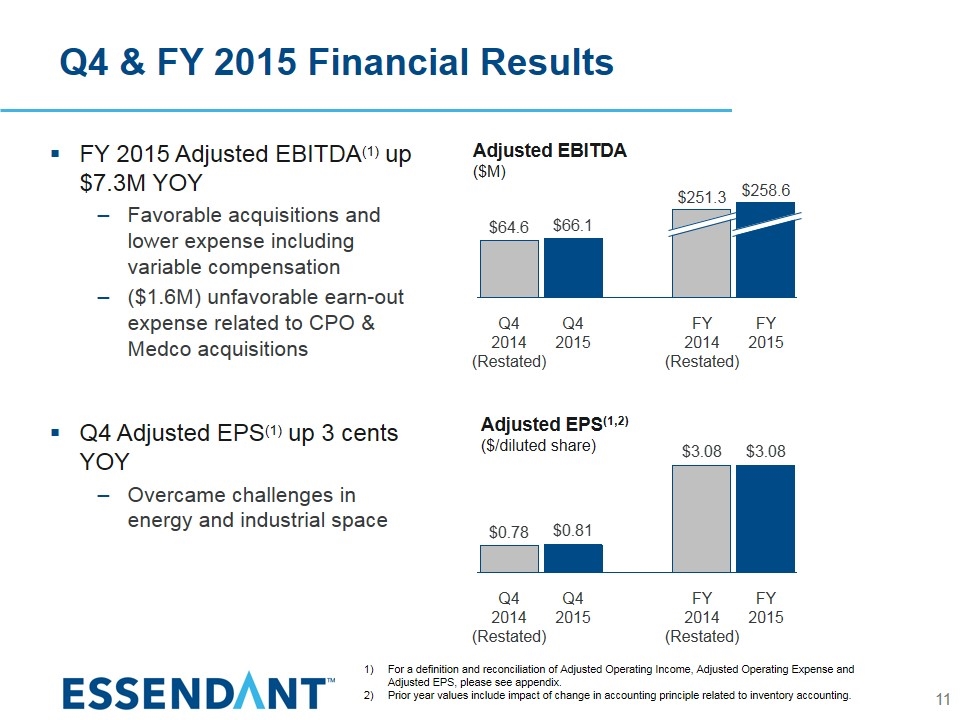

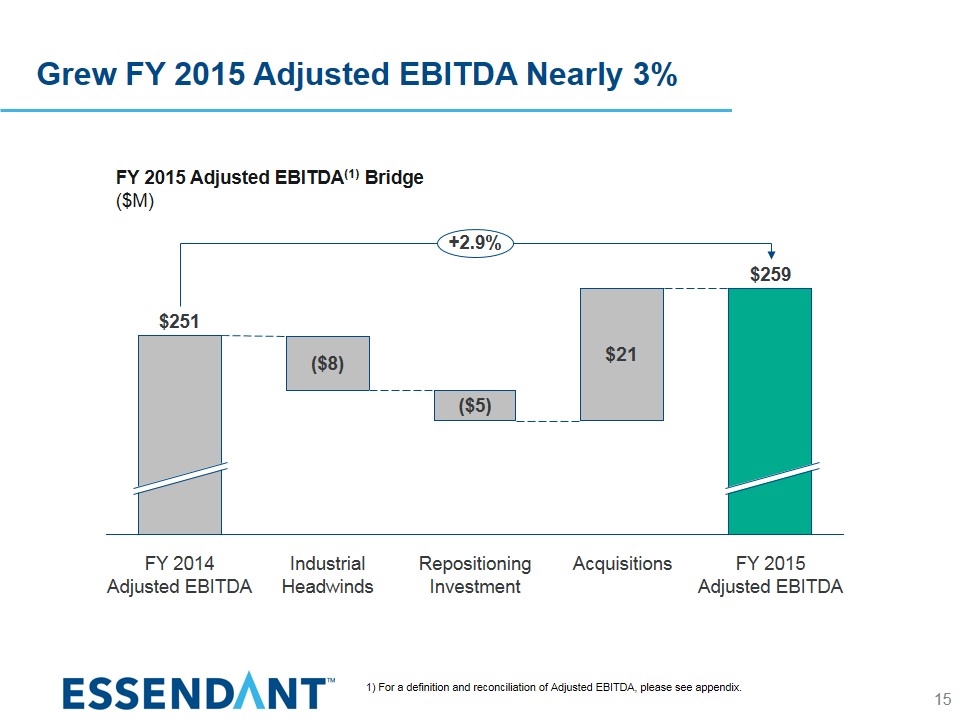

Q4 & FY 2015 Financial Results For a definition and reconciliation of Adjusted Operating Income, Adjusted Operating Expense and Adjusted EPS, please see appendix. Prior year values include impact of change in accounting principle related to inventory accounting. Adjusted EPS(1,2) ($/diluted share) Adjusted EBITDA ($M) FY 2015 Adjusted EBITDA(1) up $7.3M YOY Favorable acquisitions and lower expense including variable compensation ($1.6M) unfavorable earn-out expense related to CPO & Medco acquisitions Q4 Adjusted EPS(1) up 3 cents YOY Overcame challenges in energy and industrial space 11

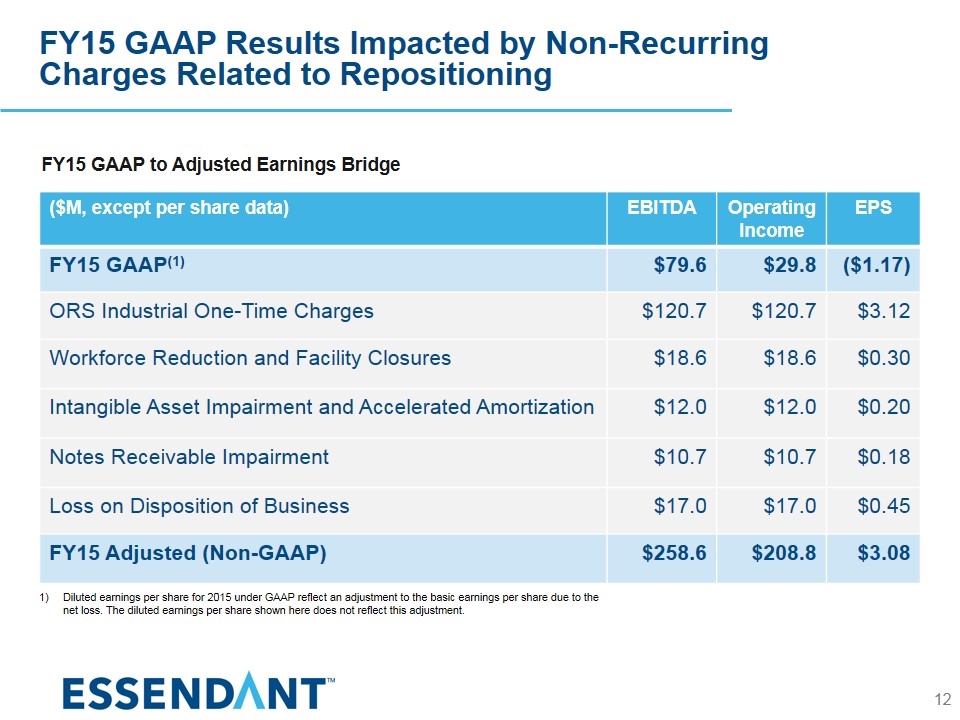

FY15 GAAP Results Impacted by Non-Recurring Charges Related to Repositioning 12 FY15 GAAP to Adjusted Earnings Bridge ($M, except per share data) EBITDA Operating Income EPS FY15 GAAP(1) $79.6 $29.8 ($1.17) ORS Industrial One-Time Charges $120.7 $120.7 $3.12 Workforce Reduction and Facility Closures $18.6 $18.6 $0.30 Intangible Asset Impairment and Accelerated Amortization $12.0 $12.0 $0.20 Notes Receivable Impairment $10.7 $10.7 $0.18 Loss on Disposition of Business $17.0 $17.0 $0.45 FY15 Adjusted (Non-GAAP) $258.6 $208.8 $3.08 Diluted earnings per share for 2015 under GAAP reflect an adjustment to the basic earnings per share due to the net loss. The diluted earnings per share shown here does not reflect this adjustment.

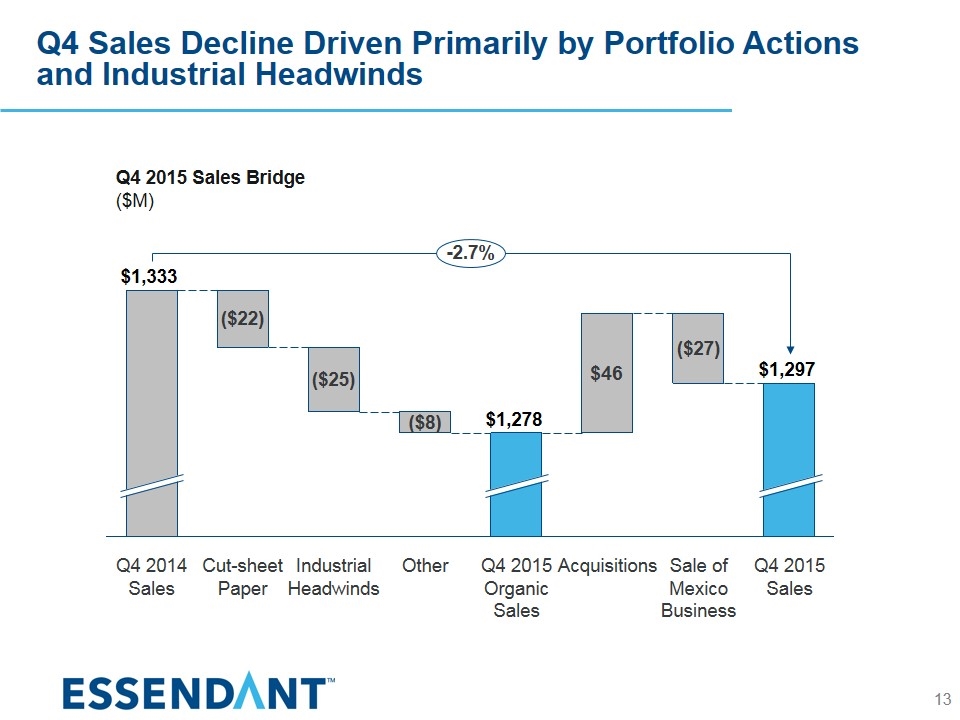

Q4 Sales Decline Driven Primarily by Portfolio Actions and Industrial Headwinds ($8) Q4 2015 Sales Bridge ($M) 13

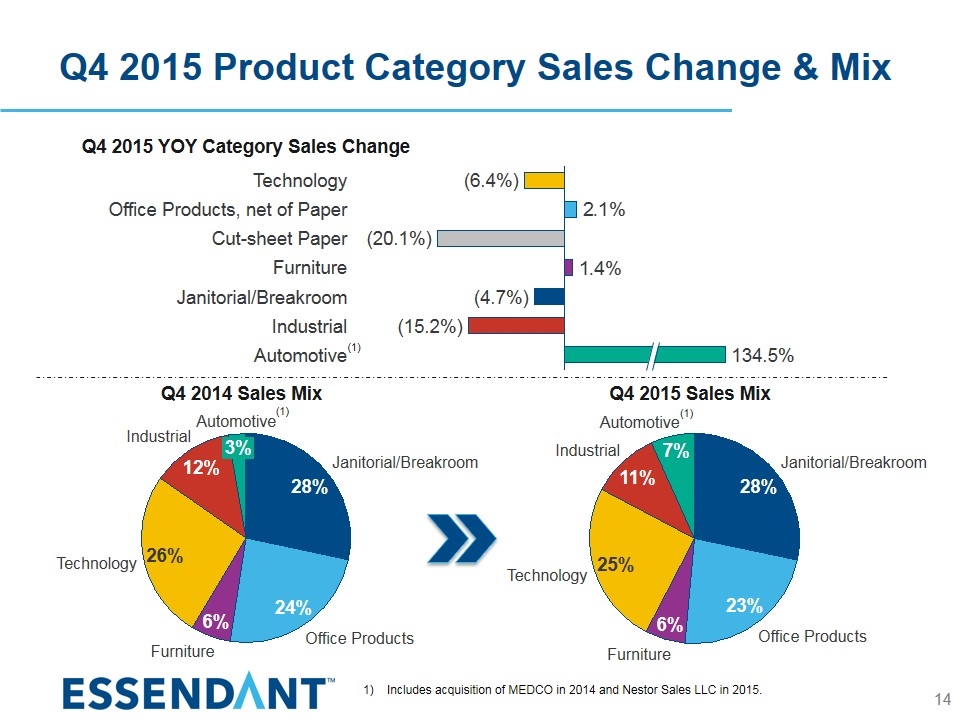

Q4 2015 Product Category Sales Change & Mix Q4 2015 Sales Mix Q4 2014 Sales Mix Q4 2015 YOY Category Sales Change (4.7%) (20.1%) (15.2%) (6.4%) Includes acquisition of MEDCO in 2014 and Nestor Sales LLC in 2015. (1) (1) 14 (1)

Grew FY 2015 Adjusted EBITDA Nearly 3% FY 2015 Adjusted EBITDA(1) Bridge ($M) 15 1) For a definition and reconciliation of Adjusted EBITDA, please see appendix.

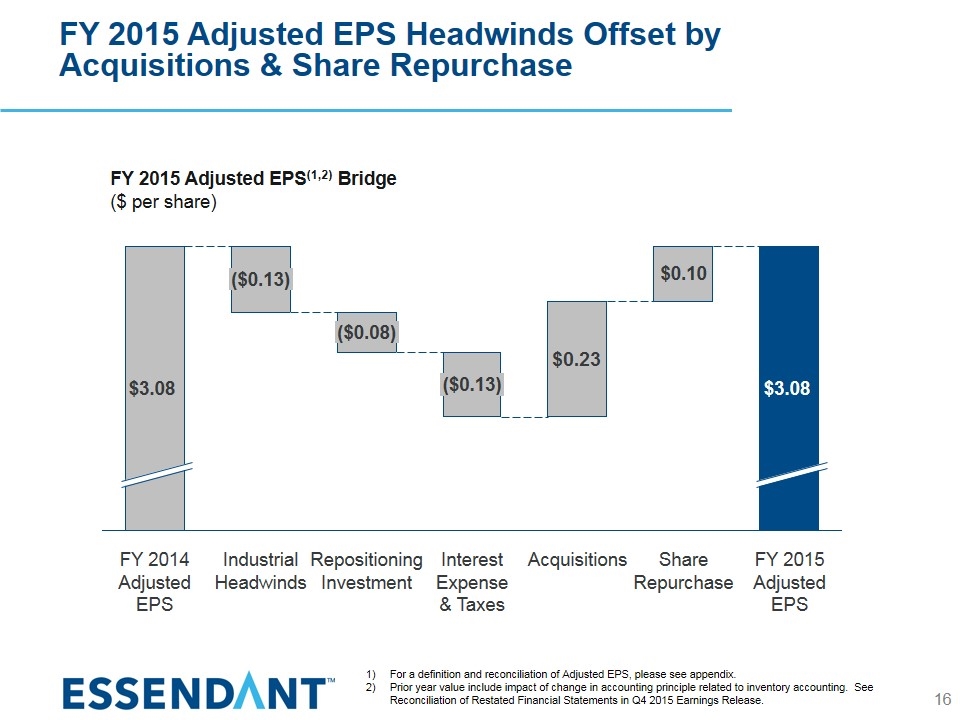

FY 2015 Adjusted EPS Headwinds Offset by Acquisitions & Share Repurchase $0.10 FY 2015 Adjusted EPS(1,2) Bridge ($ per share) 16 For a definition and reconciliation of Adjusted EPS, please see appendix. Prior year value include impact of change in accounting principle related to inventory accounting. See Reconciliation of Restated Financial Statements in Q4 2015 Earnings Release.

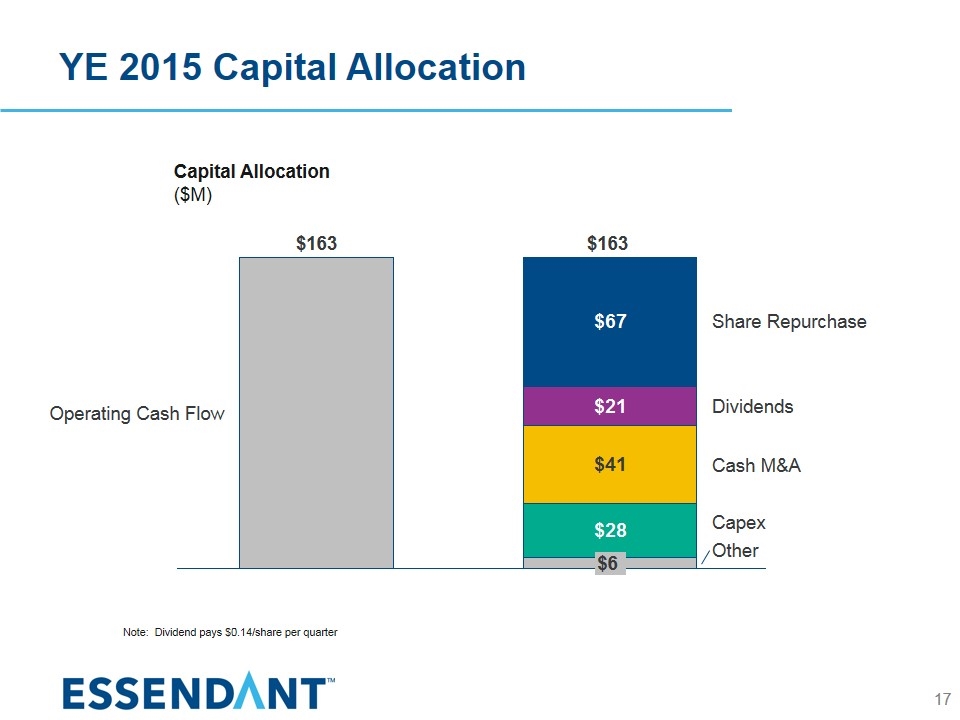

YE 2015 Capital Allocation Capital Allocation ($M) $ Note: Dividend pays $0.14/share per quarter 17

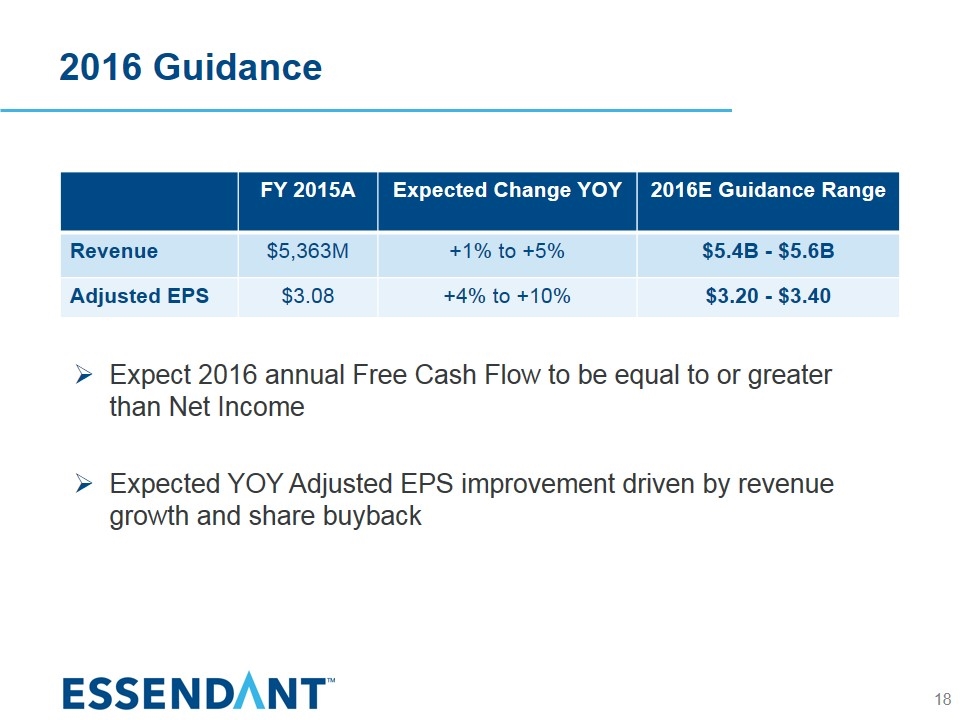

2016 Guidance 18 Expect 2016 annual Free Cash Flow to be equal to or greater than Net Income Expected YOY Adjusted EPS improvement driven by revenue growth and share buyback FY 2015A Expected Change YOY 2016E Guidance Range Revenue $5,363M +1% to +5% $5.4B - $5.6B Adjusted EPS $3.08 +4% to +10% $3.20 - $3.40

Appendix

Liquidity & Capitalization ($M, except ratios) QTD Q4 2014 QTD Q1 2015 QTD Q2 2015 QTD Q3 2015 QTD Q4 2015 Cash $21 $24 $30 $28 $30 Debt $714 $684 $661 $669 $716 Equity $840 $814 $825 $833 $724 Total Capitalization $1,554 $1,498 $1,486 $1,502 $1,440 20

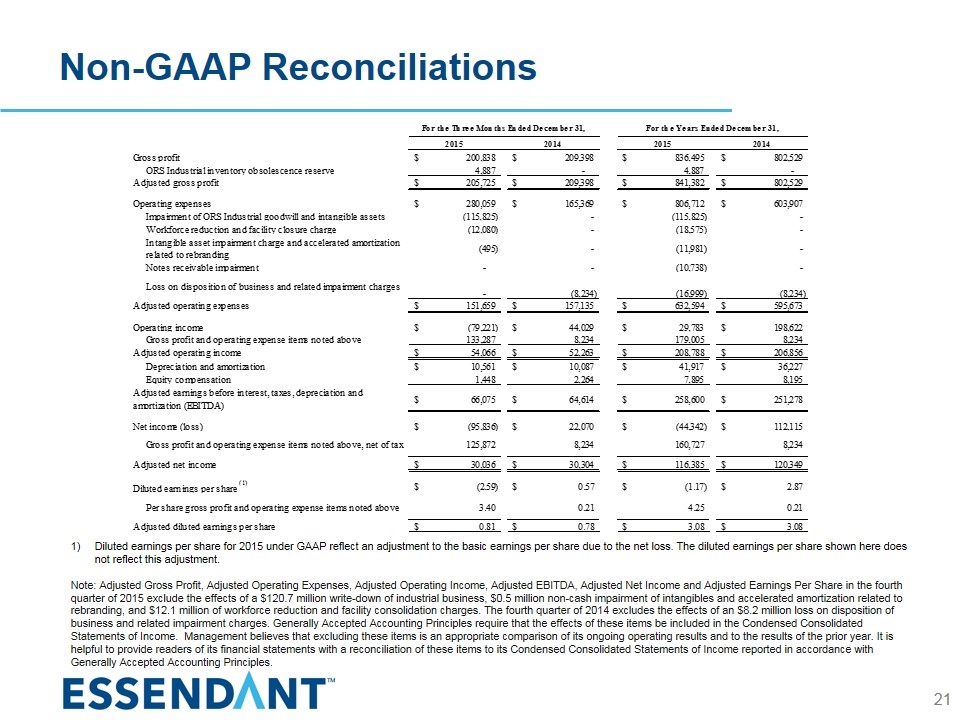

Non-GAAP Reconciliations 21 Diluted earnings per share for 2015 under GAAP reflect an adjustment to the basic earnings per share due to the net loss. The diluted earnings per share shown here does not reflect this adjustment. Note: Adjusted Gross Profit, Adjusted Operating Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings Per Share in the fourth quarter of 2015 exclude the effects of a $120.7 million write-down of industrial business, $0.5 million non-cash impairment of intangibles and accelerated amortization related to rebranding, and $12.1 million of workforce reduction and facility consolidation charges. The fourth quarter of 2014 excludes the effects of an $8.2 million loss on disposition of business and related impairment charges. Generally Accepted Accounting Principles require that the effects of these items be included in the Condensed Consolidated Statements of Income. Management believes that excluding these items is an appropriate comparison of its ongoing operating results and to the results of the prior year. It is helpful to provide readers of its financial statements with a reconciliation of these items to its Condensed Consolidated Statements of Income reported in accordance with Generally Accepted Accounting Principles.