Attached files

| file | filename |

|---|---|

| S-1/A - S-1/A - Great Basin Scientific, Inc. | d12581ds1a.htm |

| EX-5.1 - EX-5.1 - Great Basin Scientific, Inc. | d12581dex51.htm |

| EX-23.1 - EX-23.1 - Great Basin Scientific, Inc. | d12581dex231.htm |

| EX-10.40 - EX-10.40 - Great Basin Scientific, Inc. | d12581dex1040.htm |

| EX-10.38 - EX-10.38 - Great Basin Scientific, Inc. | d12581dex1038.htm |

| EX-10.39 - EX-10.39 - Great Basin Scientific, Inc. | d12581dex1039.htm |

| EX-10.41 - EX-10.41 - Great Basin Scientific, Inc. | d12581dex1041.htm |

Exhibit 3.1

SEVENTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION OF

GREAT BASIN SCIENTIFIC, INC.

The undersigned, Ryan Ashton, hereby certifies that:

FIRST: He is the duly elected and acting President of Great Basin Scientific, Inc., a Delaware corporation (the “Corporation”).

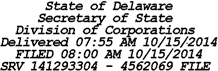

SECOND: That the Corporation was originally incorporated pursuant to the General

Corporation Law of the State of Delaware on August 12, 2008, the Amended and Restated

Certificate of Incorporation was filed on August 29, 2008, the Second Amended and Restated

Certificate of Incorporation was filed on February 11, 2010, the Third Amended and Restated

Certificate of Incorporation was filed on December 31, 2012, the Fourth Amended and Restated

Certificate of Incorporation was filed on November 26, 2013, the Fifth Amended and Restated

Certificate of Incorporation was filed on April 21, 2014, and the Sixth Amended and Restated

Certificate of Incorporation was filed on July 25,2014.

THIRD: The Sixth Amended and Restated Certificate of Incorporation of the Corporation is hereby amended and restated to read in its entirety as follows:

ARTICLE I

The name of the Corporation is Great Basin Scientific, Inc.

ARTICLE II

The address of the Corporation’s registered office in the State of Delaware is 1209 Orange Street, City of Wilmington, County of New Castle, Delaware 19801. The name of the Corporation’s registered agent at that address is The Corporation Trust Company.

ARTICLE III

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may now or hereafter be organized under the General Corporation Law of the State of Delaware, as amended from time to time (the “DGCL”).

ARTICLE IV

A. The total number of shares of capital stock the Corporation is authorized to issue is Fifty-Five Million (55,000,000) shares, consisting of Fifty Million (50,000,000) shares of common stock, par value $0.001 per share (the “Common Stock”), and Five Million (5,000,000) shares of preferred stock, par value $0.001 per share (“Preferred Stock”).

B. The holders of shares of the Common Stock shall be entitled to vote on all matters to be voted on by the stockholders of the Corporation and shall be entitled to one vote for each share thereof held of record.

C. The Preferred Stock may be issued from time to time by the board of directors as shares of one or more classes or series, without further stockholder approval. Subject to the provisions hereof and the limitations prescribed by law, the board of directors is expressly authorized, by adopting resolutions providing for the issuance of shares of any particular class or series and, if and to the extent from time to time required by law, by filing with the Delaware Secretary of State a certificate setting forth the resolutions so adopted pursuant to the DGCL, to establish the number of shares to be included in each such class or series and to fix the designation and relative powers, including voting powers (which may be full, limited or non-voting powers), preferences, rights, qualifications and limitations and restrictions thereof, relating to the shares of each such class or series. The rights, privileges, preferences and restrictions of any such additional class or series may be subordinated to, pari passu with (including, without limitation, inclusion in provisions with respect to liquidation and acquisition preferences, redemption and/or approval of matters by vote), or senior to any of those of any present or future class or series of Preferred Stock or Common Stock. The board of directors is also authorized to increase or decrease the number of authorized shares of any class or series of Preferred Stock prior or subsequent to the issue of that class or series, but not below the number of shares of such class or series then outstanding. In case the number of shares of any class or series shall be so decreased, the shares constituting such decrease shall resume the status which they had prior to the adoption of the resolution originally fixing the number of shares of such class or series.

The authority of the board of directors with respect to each class or series shall include, but not be limited to, determination of the following:

(i) the distinctive class or serial designation of such class or series and the number of shares constituting such class or series;

(ii) the annual dividend rate on shares of such class or series, if any, whether dividends shall be cumulative and, if so, from which date or dates;

(iii) whether the shares of such class or series shall be redeemable and, if so, the terms and conditions of such redemption, including the date or dates upon and after which such shares shall be redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates;

(iv) the obligation, if any, of the Corporation to retire shares of such class or series pursuant to a sinking fund;

(v) whether shares of such class or series shall be convertible into, or exchangeable for, shares of stock of any other class or classes and, if so, the terms and conditions of such conversion or exchange, including the price or prices or the rate or rates of conversion or exchange and the terms of adjustment, if any;

(vi) whether the shares of such class or series shall have voting rights, in addition to any voting rights provided by law, and, if so, the terms of such voting rights;

(vii) the rights of the shares of such class or series in the event of voluntary or involuntary liquidation, dissolution or winding-up of the Corporation; and

2

(viii) any other relative rights, powers, preferences, qualifications, limitations or restrictions thereof relating to such class or series.

ARTICLE V

The number of directors to constitute the whole board of directors shall be such number (not less than three nor more than twelve) as shall be fixed from time to time by resolution of the board of directors adopted by such vote as may be required in the bylaws. The board of directors shall be divided into three classes as nearly equal in number as may be feasible, hereby designated as Class I, Class II and Class III, with the term of office of one class expiring each year. For the purposes hereof, the initial Class I, Class II and Class III directors shall be so designated by a resolution of the board of directors. Each director shall serve for a term ending on the third annual meeting of stockholders following the annual meeting of stockholders at which such director was elected, or until his or her earlier death, resignation or removal; provided, however, that the directors first elected to Class I shall serve for a term ending on the Corporation’s first annual meeting of stockholders following the effectiveness of this Seventh Amended and Restated Certificate of Incorporation, the directors first elected to Class II shall serve for a term ending on the Corporation’s second annual meeting of stockholders following the effectiveness of this Seventh Amended and Restated Certificate of Incorporation, and the directors first elected to Class III shall serve for a term ending on the Corporation’s third annual meeting of stockholders following the effectiveness of this Seventh Amended and Restated Certificate of Incorporation. As long as Hitachi Chemical Co., Ltd. (“Hitachi”) owns at least 5% of the issued and outstanding shares of capital stock of the Corporation Hitachi shall be entitled to -elect one (1) director of the Corporation (the “Hitachi Director”), who shall be a Class III director. Subject to the rights of Hitachi with respect to the Hitachi Director and the rights, if any, of the holders of any Preferred Stock then outstanding, any vacancy in the board of directors, whether because of death, resignation, disqualification, an increase in the authorized number of directors, removal, or any other cause, may be filled by a vote of the majority of the remaining directors, although less than a quorum, or by a sole remaining director. When the board of directors fills a vacancy, the director chosen to fill that vacancy shall complete the term of the director he or she succeeds (or shall complete the term of the class of directors in which the new directorship was created) and shall hold office until such director’s successor shall have been elected and qualified or until such director’s earlier death, resignation or removal. No reduction of the authorized number of directors shall have the effect of removing any director prior to the expiration of such director’s term of office. Directors shall continue in office until others are elected and qualified in their stead, or until their earlier death, resignation or removal. When the number of directors is changed, each director then serving as such shall nevertheless continue as a director of the class of which he or she is a member until the expiration of his or her current term, and any newly created directorships or any decrease in directorships shall be so assigned among the classes by a majority of the directors then in office, though less than a quorum, as to make all classes as nearly equal in number as may be feasible. Any director (other than the Hitachi Director) or the entire board of directors may be removed at any time by the affirmative vote of the holders of at least a majority of the shares then entitled to vote at an election of directors, but only for cause.

Advance notice of stockholder nominations for the election of members of the board of directors and of business to be brought by stockholders before any meeting of the stockholders of the Corporation shall be given in the manner provided in the bylaws of the Corporation.

3

Elections of directors need not be by written ballot unless the bylaws of the Corporation shall so provide.

ARTICLE VI

To the extent permitted by law, any action required to be taken at any annual or special meeting of stockholders of the Corporation, or any action which may be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote, if: (i) a consent in writing, setting forth the action so taken shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present, and (ii) such action has been earlier approved by the board of directors. Prompt notice of the taking of the corporate action without a meeting by less than unanimous written consent shall be given to those stockholders who have not consented in writing. Special meetings of stockholders may be called only by the Chairman of the board of directors or the Chief Executive Officer or by the board of directors acting pursuant to a resolution adopted by a majority of the board of directors.

ARTICLE VII

In furtherance and not in limitation of the power conferred upon the board of directors by law, the board of directors shall have power to adopt, amend, alter and repeal from time to time the bylaws of the Corporation by majority vote of all directors except that any provision of the bylaws requiring, for board action, a vote of greater than a majority of the board shall not be amended, altered or repealed except by such supermajority vote. The stockholders of the Corporation may only adopt, amend or repeal bylaws with the affirmative vote of the holders of at least a majority of the voting power of all of the shares of the Common Stock outstanding and entitled to vote thereon.

ARTICLE VIII

The Corporation reserves the right to amend this Seventh Amended and Restated Certificate of Incorporation in any manner provided herein or permitted by the DGCL, and all rights and powers, if any, conferred herein on stockholders, directors and officers are subject to the reserved power. Notwithstanding the foregoing, without the affirmative vote of the holders of sixty percent of the voting power of all of the shares of the stock outstanding entitled to vote thereon, voting as a single class, the Corporation shall not alter, amend or repeal Article V, Article VI, Article VIII, or Article IX of this Seventh Amended and Restated Certificate of Incorporation or the provisions of Article IV providing for undesignated Preferred Stock.

ARTICLE IX

A. To the fullest extent permitted by the DGCL, as the same exists or as may hereafter be amended, a director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director.

B. The Corporation shall indemnify to the fullest extent permitted by law any person made or threatened to be made a party to an action or proceeding, whether criminal, civil, administrative or investigative, by reason of the fact that he or she, his or her testator or intestate is

4

or was a director or officer of the Corporation or any predecessor of the Corporation, or serves or served at any other enterprise as a director or officer at the request of the Corporation, or any predecessor to the Corporation.

C. Neither any amendment nor repeal of this Article IX, nor the adoption of any provision of the Corporation’s Certificate of Incorporation inconsistent with this Article IX, shall eliminate or reduce the effect of this Article IX in respect of any matter occurring, or any action or proceeding accruing or arising or that, but for this Article IX, would accrue or arise, prior to such amendment, repeal or adoption of an inconsistent provision.

FOURTH: This Seventh Amended and Restated Certificate of Incorporation has been duly approved by the board of directors of the Corporation in accordance with the provisions of Sections 242 and 245 of the General Corporation Law of the State of Delaware.

FIFTH: This Seventh Amended and Restated Certificate of Incorporation has been duly approved, in accordance with Sections 228, 242 and 245 of the General Corporation Law of the State of Delaware, by the written consent of the holders of the requisite number of the shares of outstanding stock of entitled to vote thereon, and written notice of such action will be given to the holders of such shares who did not so consent, in accordance with Section 228 of the General Corporation Law of the State of Delaware.

5

IN WITNESS WHEREOF, Great Basin Scientific, Inc. has caused this Seventh Amended and Restated Certificate of Incorporation to be signed by its President on this 14th day of October, 2014.

| GREAT BASIN SCIENTIFIC, INC. | ||

| By: |

| |

| Ryan Ashton, | ||

| President | ||

| 4815-7745-6669\3 | 6 |

CERTIFICATE OF DESIGNATION OF SERIES E CONVERTIBLE

PREFERRED STOCK OF GREAT BASIN SCIENTIFIC, INC.

Pursuant to Section 151 of the General Corporation Law of the State of Delaware, Great Basin Scientific, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), in accordance with the provisions of Section 103 thereof, does hereby submit the following:

WHEREAS, the Certificate of lncorporation of the Corporation (the “Certificate of Incorporation”) authorizes the issuance of up to 5,000,000 shares of preferred stock, par value $0.001 per share, of the Corporation (“Preferred Stock”) in one or more series, and expressly authorizes the Board of Directors of the Corporation (the “Board”), subject to limitations prescribed by law, to provide, out of the unissued shares of Preferred Stock, for series of Preferred Stock, and, with respect to each such series, to establish and fix the number of shares to be included in any series of Preferred Stock and the designation, rights, preferences, powers, restrictions and limitations of the shares of such series; and

WHEREAS, it is the desire of the Board to establish and fix the number of shares to be included in a new series of Preferred Stock and the designation, rights, preferences and limitations of the shares of such new series.

NOW, THEREFORE, BE IT RESOLVED, that the Board does hereby provide for the issue of a series of Preferred Stock and does hereby in this Certificate of Designation (the “Certificate of Designation”) establish and fix and herein state and express the designation, rights, preferences, powers, restrictions and limitations of such series of Preferred Stock as follows:

1. Designation. There shall be a series of Preferred Stock that shall be designated as “Series E Convertible Preferred Stock” (the “Series E Preferred Stock”) and the number of shares constituting such series shall be 2,860,200. The rights, preferences, powers, restrictions and limitations of the Series E Preferred Stock shall be as set forth herein.

2. Defined Terms. For purposes hereof, the following terms shall have the following meanings:

“Affiliate” has the meaning provided for the same term in the Exchange Act.

“Board” has the meaning set forth in the Recitals.

“Certificate of Designation” has the meaning set forth in the Recitals.

“Certificate of Incorporation” has the meaning set forth in the Recitals.

“Common Stock” means the common stock, par value $0.001 per share, of the Corporation.

“Corporation” has the meaning set forth in the Preamble.

“Date of Issuance” means, for any share of Series E Preferred Stock, the date on the prospectus included in the registration statement pursuant to which the units were issued of which the Series E Preferred Stock was a component.

“Early Conversion Trigger Date” has the meaning set forth in Section 5.1(b).

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Fundamental Transaction” means that (i) the Corporation or any of its subsidiaries shall, directly or indirectly, in one or more related transactions, (1) consolidate or merge with or into (whether or not the Corporation or any of its subsidiaries is the surviving corporation) any other Person unless the shareholders of the Corporation immediately prior to such consolidation or merger continue to hold more than 50% of the outstanding shares of Voting Stock after such consolidation or merger, or (2) sell, lease, license, assign, transfer, convey or otherwise dispose of all or substantially all of its respective properties or assets to any other Person, or (3) allow any other Person to make a purchase, tender or exchange offer that is accepted by the holders of more than 50% of the outstanding shares of Voting Stock of the Corporation (not including any shares of Voting Stock of the Corporation held by the Person or Persons making or party to, or associated or affiliated with the Persons making or party to, such purchase, tender or exchange offer), or (4) consummate a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with any other Person whereby such other Person acquires more than 50% of the outstanding shares of Voting Stock of the Corporation (not including any shares of Voting Stock of the Corporation held by the other Person or other Persons making or party to, or associated or affiliated with the other Persons making or party to, such stock or share purchase agreement or other business combination), or (ii) any “person” or “group” (as these terms are used for purposes of Sections 13(d) and 14(d) of the Exchange Act and the rules and regulations promulgated thereunder) is or shall become the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of 50% of the aggregate ordinary voting power represented by issued and outstanding Voting Stock of the Corporation.

“Maximum Percentage” has the meaning set forth in Section 5.5.

“Person” means an individual, corporation, partnership, joint venture, limited liability company, governmental authority, unincorporated organization, trust, association or other entity.

“Preferred Stock” has the meaning set forth in the Recitals.

“Series E Preferred Stock” has the meaning set forth in Section 1.

“Transfer Agent” has the meaning set forth in Section 5.1(b).

“Voting Stock” of a Person means capital stock of such Person of the class or classes pursuant to which the holders thereof have the general voting power to elect, or the general power to appoint, at least a majority of the board of directors, managers or

2

trustees of such Person (irrespective of whether or not at the time capital stock of any other class or classes shall have or might have voting power by reason of the happening of any contingency).

3. Rank. With respect to payment of dividends and distribution of assets upon liquidation or dissolution or winding up of the Corporation, whether voluntary or involuntary, the Series E Preferred Stock shall rank equal to the Common Stock on an as converted basis.

4. Voting.

4.1 The Series E Convertible Preferred Stock shall have no voting rights, except as expressly set forth in this Section 4.

4.2 So long as any shares of Series E Preferred Stock are outstanding, the affirmative vote of the holders of at least a majority of the Series E Preferred Stock at the time outstanding, given in person or by proxy, either in writing without a meeting or by vote at any meeting called for the purpose, shall be necessary for effecting or validating any amendment, alteration or repeal of any of the provisions of this Certificate of Designation that materially and adversely affects the powers, preferences or special rights of the Series E Preferred Stock, whether by merger or consolidation or otherwise; provided, however, that in the event of an amendment to terms of the Series E Preferred Stock, including by merger or consolidation, so long as the Series E Preferred Stock remains outstanding with the terms thereof materially unchanged, or the Series E Preferred Stock is converted into, preference securities of the surviving entity, or its ultimate parent, with such powers, preferences or special rights, taken as a whole, not materially less favorable to the holders of the Series E Preferred Stock than the powers, preferences or special rights of the Series E Preferred Stock, taken as a whole, the occurrence of such event shall not be deemed to materially and adversely affect such powers, preferences or special rights of the Series E Preferred Stock, and in such case such holders shall not have any voting rights with respect to the occurrence of such events.

4.3 For purposes of Section 4.2, each share of Series E Preferred Stock shall have one vote per share. Except as set forth herein, the Series E Preferred Stock shall not have any relative, participating, optional or other special voting rights and powers other than as set forth herein, and the consent of the holders thereof shall not be required for the taking of any corporate action.

4.4 No amendment to these terms of the Series E Preferred Stock shall require the vote of the holders of Common Stock (except as required by law) or any series of Preferred Stock other than the Series E Preferred Stock.

4.5 Without the consent of the holders of the Series E Preferred Stock, so long as such action does not materially and adversely affect the powers, preferences or special rights of the Series E Preferred Stock, taken as a whole, and to the extent permitted by

3

law, the Corporation may amend, alter, supplement, or repeal any terms of this Certificate of Designation for the following purposes:

(a) to cure any ambiguity, or to cure, correct, or supplement any provision that may be ambiguous, defective, or inconsistent; or

(b) to make any provision with respect to matters or questions relating to the Series E Preferred Stock that is not inconsistent with the provisions of this Certificate of Designation.

5. Conversion.

5.1 Right to Convert

(a) Right to Convert. Subject to the provisions of this Section 5, at any time and from time to time on or after the date that is six months after the Date of Issuance, any holder of Series E Preferred Stock shall have the right by written election to the Corporation to convert each share of Series E Preferred Stock held by such holder into four (4) shares of Common Stock (including any fraction of a share).

(b) Early Conversion. Subject to the provisions of this Section 5, if at any time after 30 days from the Date of Issuance, the closing trading price of the Common Stock of the Corporation is above $4.00 per share (subject to adjustment for stock splits, stock dividends or similar events) for 20 consecutive trading days (such twentieth day, the “Early Conversion Trigger Date”), then, at any time and from time to time after the 15th day after the Early Conversion Trigger Date, any holder of Series E Preferred Stock shall have the right by written election to the Corporation and the Corporation’s transfer agent American Stock Transfer & Trust Company (the “Transfer Agent”), to convert all or any portion of each outstanding share of Series E Preferred Stock (including any fraction of a share) held by such holder into four (4) shares of Common Stock (including any fraction of a share) at any time after 15 days from the Early Conversion Trigger Date.

5.2 Fundamental Transaction Automatic Conversion. Subject to the provisions of this Section 5, if at any time and from time to time on or after the Date of Issuance, the Corporation enters into or is party to a Fundamental Transaction, each share of Series E Preferred Stock shall convert automatically into four (4) shares of Common Stock (including any fraction of a share) immediately prior to consummation of such Fundamental Transaction. To the extent such a conversion would be limited by Section 5.5, the holder shall be entitled to convert the Series E Preferred Stock that it could not initially convert at a later date or dates, provided that at such later date or dates the limitation in Section 5.5 would no longer apply to the holder because such holder would no longer own in excess of the Maximum Percentage (as defined in Section 5.5).

4

5.3 Procedures for Conversion; Effect of Conversion

(a) Procedures for holder Conversion. In order to effectuate a conversion of shares of Series E Preferred Stock pursuant to Section 5.1(a), a holder shall submit a written election to the Corporation and the Corporation’s Transfer Agent, and that such holder elects to convert such shares, the number of shares elected to be converted. The conversion of such shares hereunder shall be deemed effective as of the date of receipt of such written election by the Corporation’s Transfer Agent. All shares of capital stock issued hereunder by the Corporation shall be duly and validly issued, fully paid and nonassessable, free and clear of all taxes, liens, charges and encumbrances with respect to the issuance thereof.

(b) Effect of Conversion. All shares of Series E Preferred Stock converted as provided in this Section 5 shall no longer be deemed outstanding as of the effective time of the applicable conversion and all rights with respect to such shares shall immediately cease and terminate as of such time, other than the right of the holder to receive shares of Common Stock in exchange therefor.

5.4 Reservation of Stock. The Corporation shall at all times when any shares of Series E Preferred Stock are outstanding reserve and keep available out of its authorized but unissued shares of capital stock, solely for the purpose of issuance upon the conversion of the Series E Preferred Stock, such number of shares of Common Stock issuable upon the conversion of all outstanding Series E Preferred Stock pursuant to this Section 5. The Corporation shall take all such actions as may be necessary to assure that all such shares of Common Stock may be so issued without violation of any applicable law or governmental regulation or any requirements of any domestic securities exchange upon which shares of Common Stock may be listed (except for official notice of issuance which shall be immediately delivered by the Corporation upon each such issuance). The Corporation shall not close its books against the transfer of any of its capital stock in any manner which would prevent the timely conversion of the shares of Series E Preferred Stock.

5.5 Limitations on Conversion. Notwithstanding anything to the contrary contained in this Certificate, the Series E Preferred Stock shall not be convertible by a holder to the extent (but only to the extent) that the holder or any of its Affiliates would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the Common Stock. To the extent the above limitation applies, the determination of whether the holder’s shares shall be convertible (vis-à-vis other convertible securities owned by the holder or any of its Affiliates) and of which such securities shall be convertible (as among all such securities owned by the holder) shall, subject to such Maximum Percentage limitation, be determined on the basis of the first submission to the Corporation for conversion. No prior inability to convert the shares of Series E Preferred Stock pursuant to this paragraph shall have any effect on the applicability of the provisions of this paragraph with respect to any subsequent determination of convertibility. For the purposes of this paragraph, beneficial ownership and all determinations and calculations (including, without limitation, with respect to calculations of percentage ownership) shall be determined in accordance with Section 13(d) of the Exchange Act, and the rules and regulations

5

promulgated thereunder. The provisions of this paragraph shall be implemented in a manner otherwise than in strict conformity with the terms of this paragraph to correct this paragraph (or any portion hereof) which may be defective or inconsistent with the intended Maximum Percentage beneficial ownership limitation herein contained or to make changes or supplements necessary or desirable to properly give effect to such Maximum Percentage limitation. The limitations contained in this paragraph shall apply to a successor holder of the shares of Series E Preferred Stock. The holders of Common Stock shall be third party beneficiaries of this paragraph and the Corporation may not amend or waive this paragraph without the consent of holders of a majority of its Common Stock. For any reason at any time, upon the written or oral request of the holder, the Corporation shall within one (1) Business Day confirm orally and in writing to the holder the number of shares of Common Stock then outstanding, including by virtue of any prior conversion of convertible securities into Common Stock, including, without limitation, pursuant to this Certificate of Designation or securities issued pursuant to the Certificate of Designation.

6. Status of Converted or Acquired Shares. All shares of Series E Preferred Stock (i) converted into shares of Common Stock in accordance with Section 5 herein or (ii) acquired by the Corporation shall be restored to the status of authorized but unissued shares of undesignated Preferred Stock of the Corporation.

7. Maturity. The Series E Preferred Stock has no maturity date, no sinking fund has been established for the retirement or redemption of Series E Preferred Stock, and the Series E Preferred Stock has no redemption provisions.

8. Notices. Except as otherwise provided herein, all notices, requests, consents, claims, demands, waivers and other communications hereunder shall be in writing and shall be deemed to have been given: (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by facsimile or e-mail of a PDF document (with confirmation of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after normal business hours of the recipient; or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid. Such communications must be sent (a) to the Corporation, at its principal executive offices and (b) to any stockholder, at such holder’s address at it appears in the stock records of the Corporation (or at such other address for a stockholder as shall be specified in a notice given in accordance with this Section 8).

9. Amendment and Waiver. No provision of this Certificate of Designation may be amended, modified or waived except by an instrument in writing executed by the Corporation, and any such written amendment, modification or waiver will be binding upon the Corporation and each holder of Series E Preferred Stock; provided, that no amendment, modification or waiver of the terms or relative priorities of the Series E Preferred Stock may be accomplished by the merger, consolidation or other transaction of the Corporation with another corporation or entity unless the Corporation has obtained the prior written consent of the holders in accordance with Section 4 and this Section 9.

6

[SIGNATURE PAGE FOLLOWS]

7

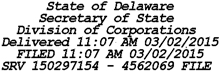

IN WITNESS WHEREOF, this Certificate of Designation is executed on behalf of the Corporation by its Chief Executive Officer this 2nd day of March, 2015.

| GREAT BASIN SCIENTIFIC, INC. | ||

| By: | /s/ Ryan Ashton | |

| Name: | Ryan Ashton | |

| Title: | Chief Executive Officer | |

8

CERTIFICATE OF AMENDMENT

TO THE SEVENTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION OF

GREAT BASIN SCIENTIFIC, INC.

The undersigned, Ryan Ashton, hereby certifies that:

FIRST: He is duly elected and acting President and Chief Executive Officer of Great Basin Scientific, Inc., a Delaware corporation (the “Corporation”).

SECOND: Article IV.A. of the Seventh Amended and Restated Certificate of Incorporation of Great Basin Scientific, Inc. is hereby amended and restated in its entirety:

“A. The total number of shares of capital stock the Corporation is authorized to issue is Two Hundred and Five Million (205,000,000) shares, consisting of Two Hundred Million (200,000,000) shares of common stock, par value $0.001 per share (the “Common Stock”), and Five Million (5,000,000) shares of preferred stock, par value $0.001 per share (“Preferred Stock”).”

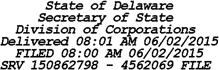

THIRD: This certificate of Amendment to the Seventh Amended and Restated Certificate of Incorporation has been duly adopted by the board of directors of the Corporation in accordance with the provisions of Section 242 of the Delaware General Corporation Law.

FOURTH: This Certificate of Amendment to the Seventh Amended and Restated Certificate of Incorporation has been duly approved, in accordance with Section 242 of the Delaware General Corporation Law, by the vote of the holders of the requisite number of the shares of outstanding common stock entitled to vote thereon at the annual meeting of the Corporation.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to the Seventh Amended and Restated Certificate of Incorporation to be signed by its President and Chief Executive Officer on this 2nd day of June, 2015.

| GREAT BASIN SCIENTIFIC, INC. | ||

| By: |

| |

| Ryan Ashton | ||

| President and Chief Executive Officer | ||

4838-5677-5204\1

CERTIFICATE OF AMENDMENT OF

CERTIFICATE OF DESIGNATION OF

SERIES E CONVERTIBLE PREFERRED STOCK OF

GREAT BASIN SCIENTIFIC, INC.

Pursuant to Section 242 of the

General Corporation Law of the State of Delaware

Great Basin Scientific, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware, by its President and Chief Executive Officer, does hereby certify and set forth as follows:

1. The name of the corporation is Great Basin Scientific, Inc. (the “Corporation”).

2. The Corporation’s Certificate of Designation of Series E Convertible Preferred Stock was filed with the Secretary of State of the State of Delaware on March 2, 2015.

3. Effective upon the filing of this Certificate of Amendment, the Certificate of Designation of Series E Convertible Preferred Stock of the Corporation is hereby amended by adding a new Section 5.1(c), which shall read in its entirety as follows:

“5.1(c). Early Conversion Upon Cash Exercise of Series C Warrants. Subject to the provisions of this Section 5, if at any time the holder of Series E Preferred Stock tenders an exercise notice to exercise all eight (8) Series C Warrants contained in each Unit held by such holder for cash, such holder of Series E Preferred Stock shall have the right by written election to the Corporation and the Transfer Agent, to convert all or any portion of each outstanding Share of Series E Preferred Stock (including any fraction of a share) contained in each such Unit held by such holder into four (4) shares of Common Stock (including any fraction of a share) at any time.”

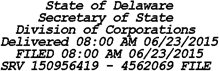

4. Such amendment was duly adopted in accordance with the provisions of Sections 228 and 242 of the General Corporation Law of the State of Delaware by the Board of Directors and the holders of the requisite number of shares of Series E Convertible Preferred Stock of the Corporation.

IN WITNESS WHEREOF, the Corporation has caused this Certificate to be executed as of June 22, 2015.

| GREAT BASIN SCIENTIFIC, INC. | ||

| By: |

| |

| Name: | Ryan Ashton | |

| Title: | President and Chief Executive Officer | |

4837-6454-1477\2

SECOND

CERTIFICATE OF AMENDMENT

TO

THE SEVENTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

GREAT BASIN SCIENTIFIC, INC.

Great Basin Scientific, Inc. (the “Corporation”), a corporation duly organized and existing under the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify:

FIRST: That at a meeting of the Board of Directors of the Corporation (the “Board”) resolutions were duly adopted authorizing the Corporation to execute and file with the Secretary of State of the State of Delaware amendments (the “Amendment”) to the Corporation’s seventh amended and restated certificate of incorporation (the “Certificate of Incorporation”) to reclassify, change, and convert every sixty (60) outstanding shares of the Corporation’s common stock, par value $0.001 per share (“Common Stock”), into one (1) share of Common Stock, par value $0.0001 per share.

SECOND:

| 1. | Article IV.A of the Corporation’s Certificate of Incorporation is hereby amended by adding the following: |

“Upon the effectiveness of this Certificate of Amendment to the Certificate of Incorporation of the Corporation, every sixty (60) shares of the Corporation’s issued and outstanding Common Stock, par value $0.001 per share, that are issued and outstanding immediately prior to 5:00 pm EST on December 11, 2015 shall, automatically and without any further action on the part of the Corporation or the holder thereof, be combined into one (1) validly issued, fully paid and non-assessable share of the Corporation’s Common Stock, par value $0.0001 per share, provided that in the event a stockholder would otherwise be entitled to a fraction of a share of Common Stock pursuant to the provisions of this Article, such stockholder shall receive one whole share of Common Stock in lieu of such fractional share and no fractional shares shall be issued.”

THIRD: That pursuant to a resolution of the Board, a special meeting of the stockholders of the Corporation was duly called and held upon notice in accordance with Section 222 of the DGCL at which meeting the necessary number of shares as required by statute were voted in favor of the Amendment.

FOURTH: That the aforesaid Amendment were duly adopted in accordance with the applicable provisions of Section 242 of the DGCL.

FIFTH: The foregoing amendment shall be effective on December 11, 2015 at 5:00 pm EST.

SIXTH: Except as herein amended, the Corporation’s Certificate of Incorporation shall remain in full force and effect.

1

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be executed by a duly authorized officer on this 10th day of December, 2015.

| GREAT BASIN SCIENTIFIC, INC. | ||

| By: |

| |

| Name: | Ryan Ashton | |

| Title: | President and Chief Executive Officer | |

2