Attached files

Exhibit 99.3

Pro Forma Financial Information

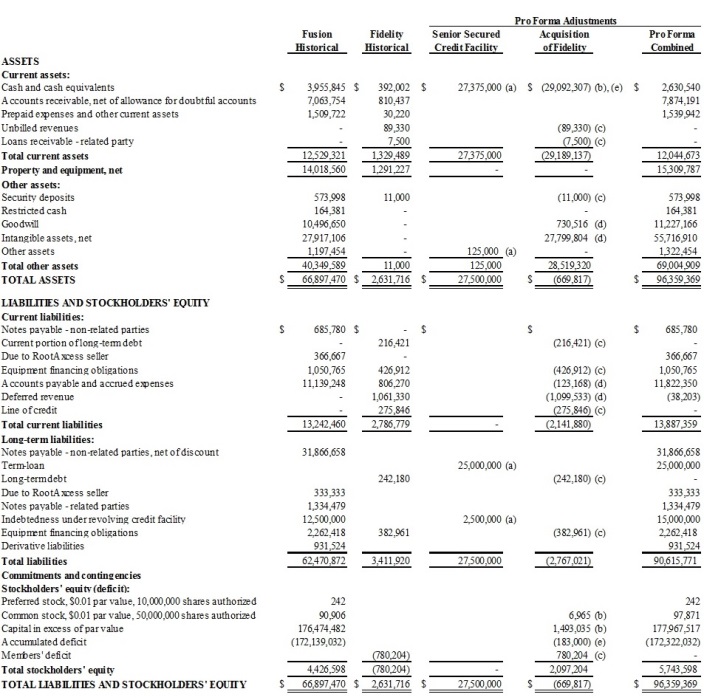

The following unaudited pro forma condensed balance sheet as of September 30, 2015 and the unaudited pro forma condensed statements of operations for the nine months ended September 30, 2015 and for the year ended December 31, 2014 are derived from the historical financial statements of Fusion Telecommunications International, Inc. (“Fusion”) and its subsidiaries (collectively with Fusion, the “Company”) after giving effect to the acquisition of assets and liabilities under the terms of the Stock Purchase and Sale Agreement dated as of December 8, 2015 (the “Purchase Agreement”) by and among Fusion NBS Acquisition Corp. (“FNAC”), Mitch Marks, Ron Kohn and Robert Marks (the “Acquired Business”).

The unaudited pro forma condensed statements of operations for the nine months ended September 30, 2015 and for the year ended December 31, 2014 give pro forma effect to the business combination as if it had occurred on January 1, 2015. The unaudited pro forma condensed combined balance sheet as of September 30, 2015 assumes that the business combination was effective on September 30, 2015.

The unaudited pro forma condensed statement of operations for the year ended December 31, 2014 was derived from Fusion's audited consolidated statement of operations, and the audited statement of operations of the Acquired Business, in each case for the year ended December 31, 2014.

The unaudited pro forma condensed balance sheet and statement of operations as of and for the nine months ended September 30, 2015 were derived from Fusion's unaudited condensed consolidated financial statements, and the unaudited financial statements of the Acquired Business, in each case as of and for the nine months ended September 30, 2015.

The unaudited pro forma condensed financial information has been prepared by the Company using the acquisition method of accounting in accordance with U.S. GAAP. The Company has been treated as the acquirer in the business combination for accounting purposes. The acquisition accounting is dependent upon certain valuation and other studies that have yet to progress to a stage where there is sufficient information to provide a definitive measurement. The assets and liabilities of the Acquired Business have been measured based on various preliminary estimates using assumptions that the Company believes are reasonable based on information that is currently available. Differences between these preliminary estimates and the final acquisition accounting will occur, and those differences could have a material impact on the accompanying unaudited pro forma condensed financial statements and the combined company’s future results of operations and financial position. The pro forma adjustments are preliminary and have been made solely for the purpose of providing unaudited pro forma condensed financial statements prepared in accordance with the rules and regulations of the Securities and Exchange Commission.

The Company has commenced the necessary valuation and other studies required to complete the acquisition accounting and intends to finalize the acquisition accounting as soon as practicable within the required measurement period in accordance with Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 805, Business Combinations, but in no event later than one year following completion of the transaction.

The following unaudited pro forma financial information is based on, and should be read in conjunction with:

|

●

|

The Company’s audited financial statements and the related notes thereto for the year ended December 31, 2014 included in the Company’s Annual Report on Form 10-K filed on March 30, 2015.

|

|

●

|

The Company’s unaudited financial statements and the related notes thereto as of and for the nine months ended September 30, 2015 included in the Company’s Quarterly Report on Form 10-Q filed on November 16, 2015.

|

|

●

|

The combined financial statements of Fidelity Access Networks, Inc. and Fidelity Telecom, LLC as of and for the years ended December 31, 2014 and 2013 (audited) appearing elsewhere in this current report.

|

|

●

|

The condensed combined financial statements of Fidelity Access Networks, Inc. and Fidelity Telecom, LLC as of and for the nine months ended September 30, 2015 and 2014 (unaudited) appearing elsewhere in this current report.

|

The pro forma financial information gives effect to the following transactions:

|

●

|

The acquisition of the Acquired Business as described in Item 2.01 of this current report.

|

|

●

|

The issuance of common stock described in item 3.02 of this current report.

|

|

●

|

The drawdown of credit under the Amended and Restated Credit Agreement, dated as of December 8, 2015, by and between Fusion NBS Acquisition Corp., as borrower, Opus Bank, as administrative agent and a lender, and each other lender from time to time a party thereto (the “Opus Facility”), as described in Item 2.03 of this report.

|

The unaudited pro forma financial information is for informational purposes only, is not indicative of future performance, and should not be considered indicative of actual results that would have been achieved had the forgoing transactions actually been consummated on the dates or at the beginning of the periods presented.

Fusion Telecommunications International, Inc.

Unaudited Pro Forma Condensed Combined Balance Sheet

As of September 30, 2015

|

(a)

|

Represents a $25 million-five year term loan net of financing costs of $125,000 and additional borrowings under the revolving credit facility of $2.5 million pursuant to an Amended and Restated Credit Agreement with Opus Bank used to finance the cash component of Fidelity's acquisition.

|

|

(b)

|

Represents cash consideration paid of $28.9 million and $1.5 million of Fusion stock issued in connection with the purchase price. In this regard, the Company delivered 696,508 shares of Fusion’s common stock based upon the volume weighted average price of the common stock over a ten trading day period ending four trading days prior to the Initial Closing date.

|

|

(c)

|

The Pro Forma Balance Sheet has been adjusted to reflect the elimination of the assets and liabilities not acquired by Fusion as per the stock purchase and sale agreement with Fidelity. Also, represents the elimination of Fidelity’s members’ equity.

|

|

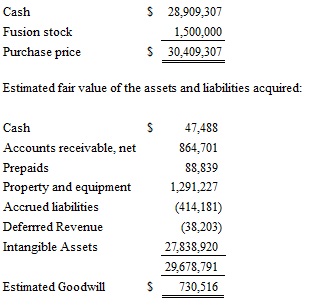

(d)

|

The excess of the purchase price over the estimated fair value of Fidelity’s assets and liabilities acquired is as follows:

|

In accordance with ASC 805 ‘Business Combination’, the Company expects to allocate a portion of the excess of the purchase price over the fair value of the net assets acquired to a number of separately identifiable assets, including but not limited to, customer contracts/lists, trade names and non-compete agreements. The Company expects that this allocation, as well as the final determination of fair value of the acquired net assets, will be completed within the required measurement period as set forth in ASC 805, but in no event later than one year following the date of transaction.

|

(e)

|

Represents transaction costs incurred in the acquisition of Fidelity.

|

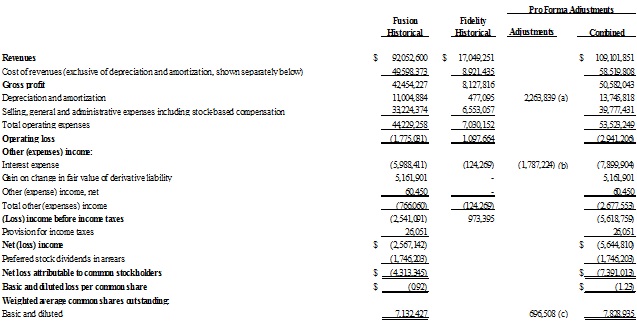

Fusion Telecommunications International, Inc.

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Year Ended December 31, 2014

|

(a)

|

Reflects the amortization expense of the acquired separately identifiable intangible assets of $2.3 million at an average aggregate estimated useful life of 12.3 years.

|

|

(b)

|

Reflects annual interest expenses on the term loan of $1.1 million and $0.6 million on the revolving credit facility with Opus Bank at an annual interest rate of 4.5% and amortization of debt issuance costs of approximately $65,000.

|

|

(c)

|

Reflects shares of Fusion common stock valued at $1.5 million issued to the Fidelity Sellers as part of the purchase price.

|

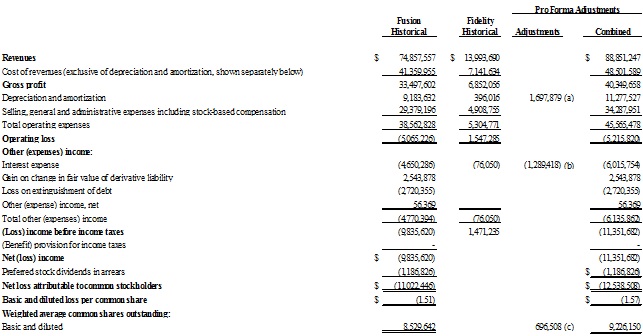

Fusion Telecommunications International, Inc.

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Nine Months Ended September 30, 2015

|

(a)

|

Reflects the amortization expense of the acquired separately identifiable intangible assets of $1.7 million at an average aggregate estimated useful life of 12.3 years.

|

|

(b)

|

Reflects interests on the term loan of $0.8 million and $0.4 million revolving credit facility with Opus Bank at an annual interest rate of 4.5%, and amortization of debt issuance costs of $49,000.

|

|

(c)

|

Represents shares of Fusion common stock valued at $1.5 million issued to the Fidelity Sellers as part of the purchase price.

|