Attached files

Exhibit 99.2

FIDELITY ACCESS NETWORKS, INC.

AND FIDELITY TELECOM, LLC

CONDENSED COMBINED FINANCIAL STATEMENTS

Nine Months Ended September 30, 2015

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

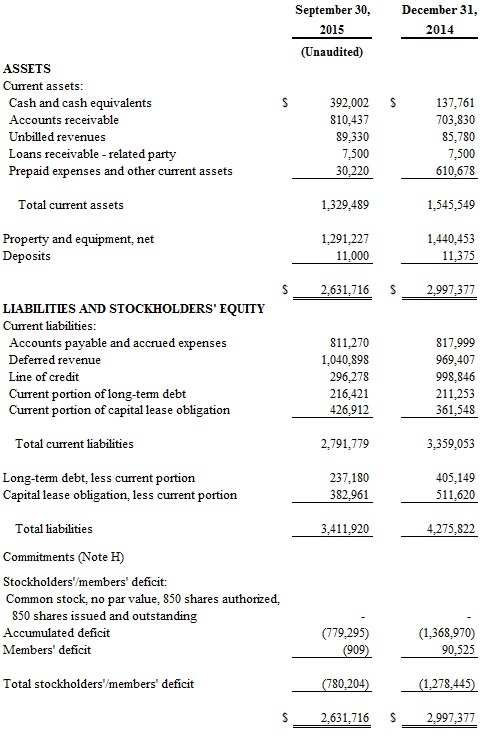

Condensed Combined Balance Sheet

See notes to the condensed combined financial statements

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

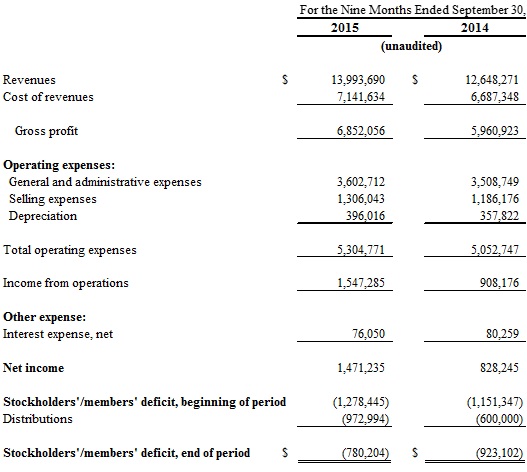

Condensed Combined Statement of Operations and Stockholders’/Members’ (Deficit)

See notes to the condensed combined financial statements

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

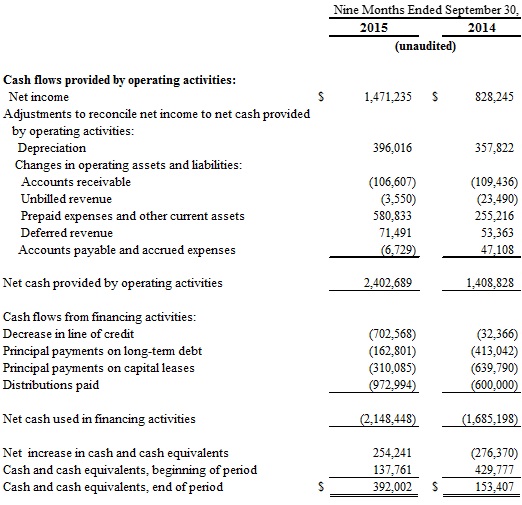

Condensed Combined Statements of Cash Flows

See notes to the condensed combined financial statements

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

Notes to Condensed Combined Financial Statements (unaudited)

Note A - Description of Business And Summary of Significant Accounting Policies

[1] Description of businesses and basis of combination:

Fidelity Access Networks, Inc. ("FAN") and Fidelity Telecom, LLC ("Telecom"), located in Solon, Ohio, are providers of voice and data IP telephony services, cloud storage, network security and colocation services to small and medium size businesses and enterprises. FAN is owned equally by Robert Marks and his brother, Mitch Marks. Telecom is owned by Robert Marks (33.3%), Mitch Marks (33.3%) and Ron Kohn (33.3%). FAN has a 92.5% owned subsidiary, Fidelity Access Networks, LLC ("FAN LLC") which in turn has a 66.6% owned subsidiary Fidelity Voice Services, LLC ("Fidelity Voice") (with the remaining 33.3% owned by Ron Kohn). Additionally, FAN has a 100% owned subsidiary Fidelity Connect, LLC. All of the aforementioned entities are collectively referred to herein as the "Company".

On May 28, 2015, the Company signed a letter of intent whereby Fusion Telecommunications International, Inc. would acquire all of the outstanding capital stock or membership units of the Company including the 7.5% minority stake in Fidelity Access Networks, LLC. The accompanying financial statements have been prepared combining the financial results of the Company in accordance with the pending transaction.

On December 8, 2015, the Company was acquired by Fusion NBS Acquisition Corp., a subsidiary of Fusion Telecommunications International, Inc. for a total consideration of $30.0 million consisting of approximately $28.5 million in cash and $1.5 million in Fusion common stock.

[2] Basis of presentation:

The accompanying condensed combined interim financial statements and information have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). The combined financial statements include the accounts of the Company, its wholly owned subsidiaries and other entities, which as described above, have been operated as a unified business and are collectively subject to a contingent sale. All intra-entity accounts and transactions have been eliminated. Because certain information and footnote disclosures have been condensed or omitted, these combined financial statements should be read in conjunction with the audited combined financial statements and related notes for the fiscal year ended December 31, 2014. In the opinion of management, these combined financial statements contain all normal and recurring adjustments considered necessary to present fairly the financial position, results of operations, and cash flows for the period presented.

[3] Use of estimates

The preparation of condensed combined financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the combined financial statements and the reported amounts of revenues and expenses during the reporting period. The significant estimates made by management affect revenues, accounts receivable, the allowance for doubtful accounts, deferred revenue, uncertain tax positions, loss contingencies and accrued liabilities. Management periodically evaluates such estimates and they are adjusted prospectively based upon such periodic evaluation. Actual results could differ from those estimates.

[4] Cash and cash equivalents

The Company considers highly liquid instruments with a maturity of three months or less when purchased to be cash equivalents.

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

Notes to Condensed Combined Financial Statements (unaudited)

Note A - Description of Business And Summary of Significant Accounting Policies (CONTINUED)

[5] Revenue recognition

The Company recognizes revenues when persuasive evidence of an arrangement exists, services have been rendered, the price to the buyer is fixed or determinable and collectability is reasonably assured. The Company's services revenue include all fees billed in connection with subscriptions to the Company's IP voice and data solutions and cloud services. The Company records provisions against revenue for billing adjustments, which are based upon

estimates derived from factors that include, but are not limited to, historical results and an analysis of credits issued. The provisions for revenue adjustments are recorded as a reduction of revenue when the revenue is recognized.

Revenue includes fixed revenue earned from monthly recurring services provided to customers, for which charges are contracted for over a specified period of time, and from variable usage fees charged to customers that purchase the Company's Business Services products and services. Revenue recognition commences after the provisioning, testing and acceptance of the service by the customer. The recurring customer charges continue until the expiration of the contract, or until cancellation of the service by the customer. To the extent that payments received from a customer are related to a future period, the payment is recorded as deferred revenue until the service is provided or the usage occurs.

Revenue is also derived from usage fees charged to other telecommunications carriers that terminate voice traffic over the Company's network, and from the monthly recurring and usage fees charged to customers that purchase the Company's business products and services. Variable revenue is earned based on the length of a call, as measured by the number of minutes of duration. It is recognized upon completion of the call and is adjusted to reflect the Company's allowance for billing adjustments. Revenue for each customer is calculated from information received through the Company's network switches. The Company's customized software tracks the information from the switches and analyzes the call detail records against stored detailed information about revenue rates. This software provides the Company with the ability to complete a timely and accurate analysis of revenue earned in a period. The Company believes that the nature of this process is such that recorded revenues are unlikely to be revised in future periods.

[6] Accounts receivable

Accounts receivable are recorded net of an allowance for doubtful accounts. On a periodic basis, the Company evaluates accounts receivable and records an allowance for doubtful accounts based on the Company's history of past write-offs, collections experience and current credit conditions. Specific customer accounts are written off as uncollectible when collection efforts have been exhausted and payments are not expected to be received.

[7] Property and equipment

Property and equipment is stated at cost, less accumulated depreciation and amortization. Depreciation is recorded under the straight-line method over the estimated useful lives of the assets, commencing when the assets are placed in service. The estimated useful lives are five to seven years for furniture and fixtures, two to five years for software and three to five years for computer servers and Internet and telecommunications equipment. The cost of installation of equipment is capitalized, as applicable. Depreciation of assets recorded under capital leases is included in depreciation. Assets recorded under capital leases and leasehold improvements are depreciated over the shorter of their useful lives or the terms of the related leases. Maintenance and repairs are charged to expense as incurred.

The Company evaluates the recoverability of property and equipment for possible impairment whenever events or circumstances indicate that the carrying amount of such assets or asset groups may not be recoverable. Recoverability of these assets is measured by a comparison of the carrying amounts to the future undiscounted cash flows of the assets or asset groups are expected to generate. If such evaluation indicates that the carrying amount of the assets or asset groups is not recoverable, the carrying amount of such assets or asset groups is reduced to its

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

Notes to Condensed Combined Financial Statements (unaudited)

Note A - Description of Business And Summary of Significant Accounting Policies (CONTINUED)

estimated fair value. No impairment losses have been recognized during the nine months ended September 30, 2015 and 2014.

[8] Income taxes

FAN, with the approval of its shareholders, has elected to be taxed as an S Corporation as defined in the Internal Revenue Code for Federal and state income tax purposes. Certain subsidiaries and affiliates are limited liability companies. In lieu of Federal and state income taxes, the shareholders and members of the respective entities are taxed on their proportionate share of the Company's taxable income. Therefore, there is no provision or liability for Federal and state income taxes included in the combined financial statements.

Telecom is a limited liability company for Federal and state purposes. As a limited liability company, Telecom's taxable income or loss is allocated to members in accordance with their respective percentage ownership. Therefore, no provision or liability for income taxes has been included in the combined financial statements.

The Company follows the accounting guidance for uncertainty in income taxes according to the Accounting Standards Codification (ASC), Income Taxes. Using this guidance, tax positions initially need to be recognized in the combined financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities.

As of September 30, 2015, the Company had no uncertain tax positions that qualify for either recognition or disclosure in the combined financial statements. It is the Company's policy to include any penalties and interest related to income taxes in its income tax provision; however, the Company currently has no penalties or interest related to income taxes. The earliest year that the Company is subject to examination is the year ended December 31, 2011.

[9] Universal service fees charges

In accordance with Federal Communications Commission rules, we are required to contribute to the Federal Universal Service Fees ("USF') for some of our solutions, which we recover from our applicable customers and remit to the Universal Service Administrative Company. We present the USF charges that we collect and remit on a net basis, with both collections from our customers and the amounts we remit, recorded net in Revenues.

[10] Cost of revenues

Cost of revenues primarily consists of costs of network capacity purchased from third-party telecommunications providers, network operations, costs to maintain data centers, including colocation fees for servers in third-party data centers, depreciation of equipment, along with related utilities and maintenance costs. Cost of revenues also includes personnel costs associated with non-administrative customer care and support of the functionality of the Company's platform and data center operations, including share-based compensation expenses and allocated costs of facilities and information technology. Cost of revenues is expensed as incurred.

Cost of revenues is also comprised primarily of the cost associated with purchased phones, shipping costs, as well as personnel costs for contractors and allocated costs of facilities and information technology related to the procurement, management and shipment of phones. Cost of revenues is expensed in the period the product is delivered to the customer.

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

Notes to Condensed Combined Financial Statements (unaudited)

Note A - Description of Business And Summary of Significant Accounting Policies (CONTINUED)

[11] Advertising and marketing costs

Advertising and marketing costs are expensed as incurred and includes cost for promotional materials and trade show expenses for the marketing of the Company's business products and services. Advertising and marketing expenses were approximately $11,000 and $13,000 for the nine months ended September 30, 2015 and 2014, respectively.

[12] Fair value of financial instruments

At September 30, 2015, the carrying value of the Company’s accounts receivable, accounts payable and accrued expenses approximates its fair value due to the short term nature of these financial instruments.

[13] Fair value measurements

The Company determines the fair value of its assets and liabilities using valuation techniques, such as the market approach (comparable market prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement cost), each of which is based upon observable and unobservable inputs. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company's market assumptions.

The Company uses a three-tier valuation hierarchy based upon observable and non-observable inputs, as described below:

|

●

|

Level 1 - Quoted market prices in active markets for identical assets or liabilities at the measurement date.

|

|

●

|

Level 2 - Observable market based inputs or other observable inputs corroborated by market data at the measurement date, other than quoted prices included in Level 1, either directly or indirectly.

|

|

●

|

Level 3 - Significant unobservable inputs that cannot be corroborated by observable market data and reflect the use of significant management judgment. These values are generally determined using valuation models for which the assumptions utilize management's estimates of market participant assumptions.

|

The Company determines the estimated fair value of assets, liabilities and equity instruments using available market information and commonly accepted valuation methodologies. However, considerable judgment is required in interpreting market and other data to develop the estimates of fair value. The use of different assumptions or estimation methodologies could have a material effect on the estimated fair values. The fair value estimates are based on information available as of the valuation dates.

Note B - Note Receivable – Related Party

At September 30, 2015, the Company had a note receivable from an officer. The amount outstanding is

$7,500 and payable upon demand. There was no interest charged on the outstanding balance during the nine months ended September 30, 2015 and 2014.

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

Notes to Condensed Combined Financial Statements (unaudited)

Note C - Line of Credit

On October 17, 2014, the Company obtained a $1,000,000 line of credit agreement with First Merit Bank. Interest is payable at the one month LIBOR rate +3%. (3.16950% at December 31, 2014). The line of credit with First Merit Bank is guaranteed by the members. At September 30, 2015, the Company had outstanding borrowings of $275,846. The line of credit has no expiration date adn is due on demand from the bank. There are no covenant restrictions under this line of credit.

Note D – Debt

On October 17, 2014, the Company signed a term loan in the amount of $651,288 with First Merit Bank. The principal is payable in 36 monthly installments of $19,011 including interest at 3.2% beginning in November 2014 through October 2017. The loan is due October 17, 2017. At September 30, 2015, the amount outstanding is $458,601. There are no covenant restrictions under the term loan.

Note E – Profit Sharing Plan

The Company maintains a profit-sharing plan which allows eligible employees meeting minimum age and service requirements to make contributions by salary reduction pursuant to Section 401(k) of the Internal Revenue Code.

However, total deferrals in any plan year may not exceed a dollar limit, which is determined by law. The Company makes a safe harbor nonelective and discretionary profit-sharing contribution to participants. During the nine months ended September 30, 2015 and 2014, the Company did not make any profit-sharing contributions to its 401(k) plan.

Note F. Supplemental Cash Flows Information

Interest paid during the nine months ended September 30, 2015 and 2014 was $76,050 and $80,259, respectively. During the nine months ended September 30, 2015 and 2014, the Company acquired certain property and equipment through capital leases in the amount of $246,790 and $241,390, respectively.

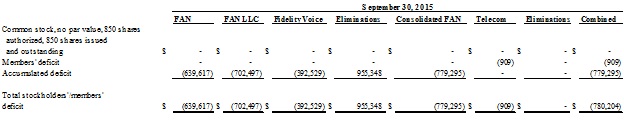

Note G – Stockholders’/Members’ Deficit

Stockholders’/members’ deficit consisted of the following:

FIDELITY ACCESS NETWORKS, INC. AND FIDELITY TELECOM, LLC

Notes to Condensed Combined Financial Statements (unaudited)

Note H – Contingencies

The Company may be, from time to time, a party to various disputes and claims arising from normal business activities. The Company continually assesses litigation to determine if an unfavorable outcome would lead to a probable loss or reasonably possible loss which could be estimated. In accordance with the guidance of the Financial Accounting Standards Board (FASB) on accounting for contingencies, the Company accrues for all contingencies at the earliest date at which the Company deems it probable that a liability has been incurred and the amount of such liability can be reasonably estimated. If the estimate of a probable loss is a range and no amount within the range is more likely than another, the Company accrues the minimum of the range. In the cases where the Company believes that a reasonably possible loss exists, the Company discloses the facts and circumstances of the litigation, including an estimable range, if possible. Management does not expect the outcome of any such claims, legal actions or regulatory inquiries to have a material impact on the Company's liquidity, financial condition or results of operations. As of September 30, 2015, the Company did not have any significant ongoing legal matters.

Note I – Subsequent Events

Management has considered events subsequent from September 30, 2015 through February 3, 2016, for recording or disclosure in the condensed combined financial statements.

As described in Note A[1], on May 28, 2015, the Company signed a letter of intent whereby Fusion Telecommunications International, Inc. would acquire all of the outstanding capital stock or membership units of the Company.

On December 8, 2015, the Company was acquired by Fusion NBS Acquisition Corp., a subsidiary of Fusion Telecommunications International, Inc. for a total purchase price of $30.0 million consisting of approximately $28.5 in cash and $1.5 million in Fusion common stock.