Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Long Blockchain Corp. | v430472_8k.htm |

| EX-99.3 - EXHIBIT 99.3 - Long Blockchain Corp. | v430472_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - Long Blockchain Corp. | v430472_ex99-1.htm |

Exhibit 99.2

February 2016

Disclaimer THIS PRESENTATION CONTAINS “FORWARD - LOOKING STATEMENTS.” THESE FORWARD - LOOKING STATEMENTS INVOLVE SIGNIFICANT RISKS AND UNCERTAINTIES THAT COULD CAUSE THE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE EXPECTED RESULTS. ACTUAL RESULTS MAY DIFFER FROM EXPECTATIONS, ESTIMATES AND PROJECTIONS AND, CONSEQUENTLY, YOU SHOULD NOT RELY ON THESE FORWARD LOOKING STATEMENTS AS PREDICTIONS OF FUTURE EVENTS. WORDS SUCH AS “EXPECT,” “ESTIMATE,” “PROJECT,” “BUDGET,” “FORECAST,” “ANTICIPATE,” “INTEND,” “PLAN,” “MAY,” “WILL,” “COULD,” “SHOULD,” “BELIEVES,” “PREDICTS,” “POTENTIAL,” “CONTINUE,” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY SUCH FORWARD - LOOKING STATEMENTS . LIIT UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD - LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. IMPORTANT FACTORS, AMONG OTHERS, THAT MAY AFFECT ACTUAL RESULTS INCLUDE: LIIT’S ABILITY TO IMPLEMENT ITS BUSINESS PLAN; LIIT OBTAINING THE NECESSARY FINANCING TO OPERATE ITS BUSINESS; LOSS OF KEY PERSONNEL; CHANGES IN ECONOMIC CONDITIONS GENERALLY; LEGISLATIVE AND REGULATORY CHANGES; AND THE DEGREE AND NATURE OF LIIT’S COMPETITION. THIS PRESENTATION ALSO INCLUDES ESTIMATED 2015 RESULTS. SUCH ESTIMATED RESULTS MAY DIFFER FROM ACTUAL RESULTS THAT LIIT REPORTS FOLLOWING COMPLETION OF ITS AUDIT AND OTHER FINANCIAL AND ACCOUNTING PROCEDURES. LIIT MAKES NO REPRESENTATION OR WARRANTY AS TO THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED IN THIS PRESENTATION. THIS PRESENTATION IS NOT INTENDED TO BE ALL - INCLUSIVE OR TO CONTAIN ALL THE INFORMATION THAT A PERSON MAY DESIRE IN CONSIDERING AN INVESTMENT IN LIIT AND IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION IN LIIT . THIS PRESENTATION SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES, NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTIONS IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION.

The Path to Success 3 Who a re we… ▪ Unique beverage company with significant brand equity and early distribution success ▪ Strong and experienced management team preparing the company to capitalize on the significant growth in the RTD tea and alcohol markets How we intend to grow… ▪ Attack distribution, share, scale and pricing opportunities available in the $5.3bn RTD tea market ▪ Transform to a multi - beverage alcohol and non - alcohol company - large opportunity for a strong brand position in highly fragmented market ▪ Expand internationally Source : IBISWorld Industry Report “RTD Tea Production in the US” December 2014 INVESTMENT THESIS TAKE ADVANTAGE OF MARKET SHIFT AWAY FROM CARBONATED SOFT DRINKS ▪ $5.3bn non - alcohol RTD tea growing at 10% annually over the next five years TAKE ADVANTAGE OF MARKET SHIFT AWAY FROM BEER ▪ Alcohol growth from consumers switching from beer to premixed drinks

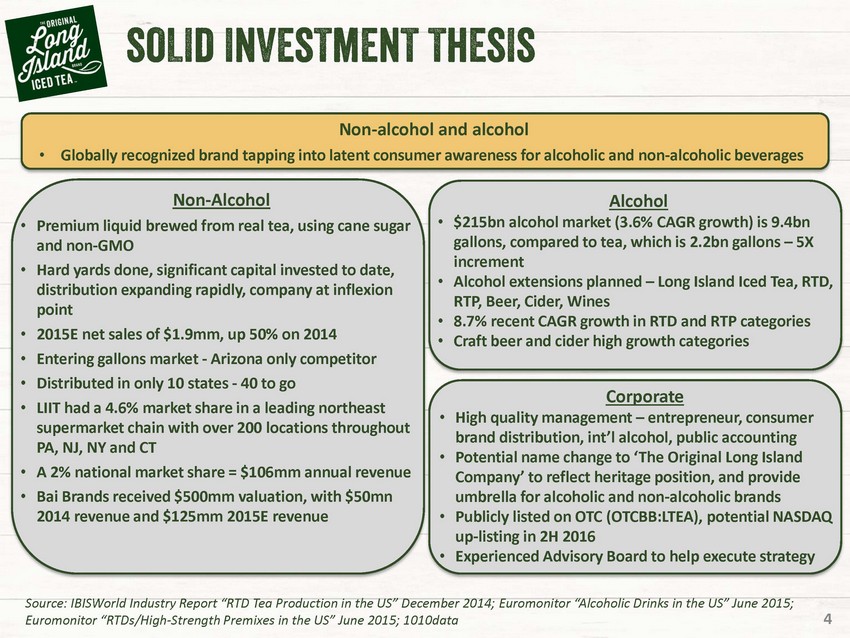

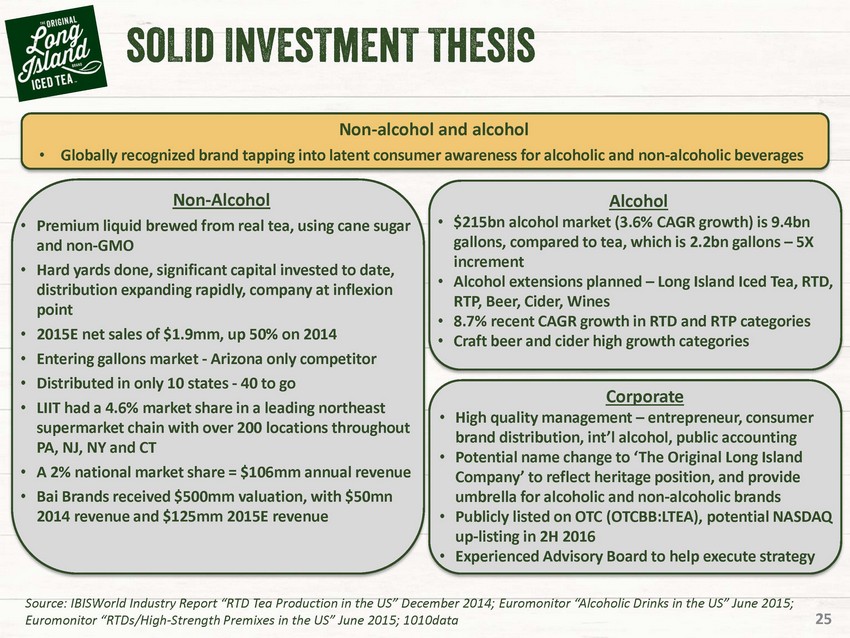

SOLID INVESTMENT THESIS 4 Source : IBISWorld Industry Report “RTD Tea Production in the US” December 2014; Euromonitor “Alcoholic Drinks in the US” June 2015 ; Euromonitor “RTDs/High - Strength Premixes in the US” June 2015; 1010data Non - alcohol and alcohol • Globally recognized brand tapping into latent consumer awareness for alcoholic and non - alcoholic beverages Non - Alcohol • Premium liquid brewed from real tea, using cane sugar and non - GMO • Hard yards done , significant capital invested to date, distribution expanding rapidly, company at inflexion point • 2015E net sales of $1.9mm, up 50% on 2014 • Entering gallons market - Arizona only competitor • Distributed in only 10 states - 40 to go • LIIT had a 4.6% market share in a leading northeast supermarket chain with over 200 locations throughout PA, NJ, NY and CT • A 2% national market share = $106mm annual revenue • Bai Brands received $500mm valuation, with $50mn 2014 revenue and $125mm 2015E revenue Alcohol • $ 215bn alcohol market ( 3.6% CAGR growth) is 9.4bn gallons, compared to tea, which is 2.2bn gallons – 5X increment • Alcohol extensions planned – Long Island Iced Tea, RTD, RTP, Beer, Cider, Wines • 8.7% recent CAGR growth in RTD and RTP categories • Craft beer and cider high growth categories Corporate • High quality management – entrepreneur, consumer brand distribution, int’l alcohol, public accounting • Potential name change to ‘The Original Long Island Company’ to reflect heritage position, and provide umbrella for alcoholic and non - alcoholic brands • Publicly listed on OTC ( OTCBB:LTEA), potential NASDAQ up - listing in 2H 2016 • Experienced Advisory Board to help execute strategy

Non - alcohol Alcohol capital deployment & Up - listing Appendix

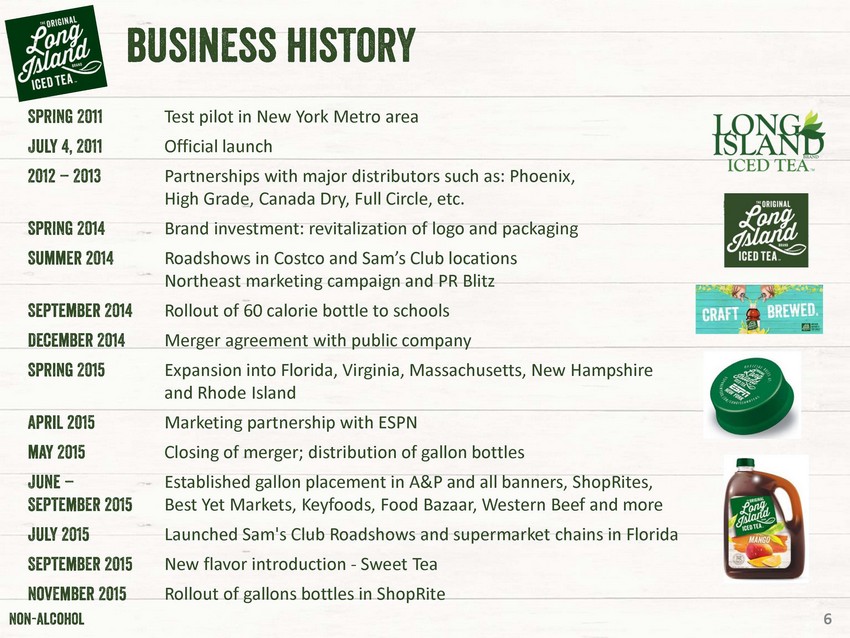

Business History Spring 2011 July 4, 2011 2012 – 2013 Spring 2014 Summer 2014 September 2014 December 2014 Spring 2015 April 2015 May 2015 June – September 2015 July 2015 September 2015 November 2015 Test pilot in New York Metro area O fficial launch Partnerships with major distributors such as: Phoenix, High Grade, Canada Dry, Full Circle, etc. Brand investment: revitalization of logo and packaging Roadshows in Costco and Sam’s Club locations Northeast marketing campaign and PR Blitz Rollout of 60 calorie bottle to schools Merger agreement with public company Expansion into Florida, Virginia, Massachusetts, New Hampshire and Rhode Island Marketing partnership with ESPN Closing of merger; distribution of gallon bottles Established gallon placement in A&P and all banners, ShopRites , Best Yet Markets, Keyfoods , Food Bazaar, Western Beef and more Launched Sam's Club Roadshows and supermarket chains in Florida New flavor introduction - Sweet Tea Rollout of gallons bottles in ShopRite Non - alcohol 6

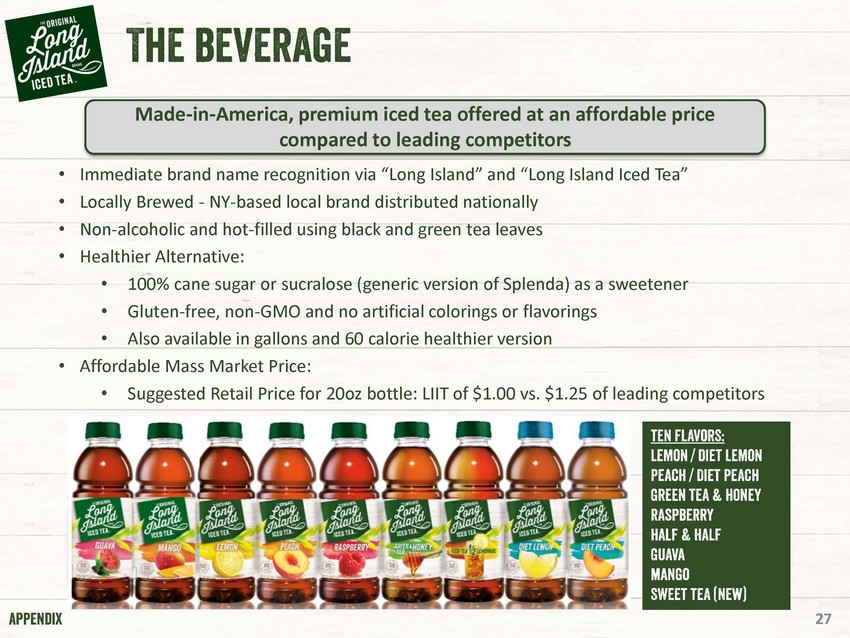

7 The brand Non - alcohol Lemon / Diet Lemon Peach / Diet Peach Green Tea & Honey Raspberry Half & Half Guava Mango Sweet Tea Beverage Made - in - America , premium iced tea offered at an affordable price; cane sugar and Non - GMO BRAND G lobally recognized name ‘Long Island’, potential to expand into other product offerings CONSUMER Inspires refreshment, sunny days and relaxation associated with summer and the beach MARKETING D rawing upon the equity of the legendary cocktail and geographic region

$1.0 $0.8 $1.2 $1.8 2012 2013 2014 2015E solid DISTRIBUTION PROGRESS 8 Current YE 2016 YE 2017 • 2015E net sales of $ 1.8mn¹ • 2015E case volume of 313,000¹ • YOY volume growth of 168% in Q4 15 and 4% in Q3 15¹ Net Sales ($ mn )¹ Distributed in approximately 30 Northeast regional chains that include leading supermarkets, grocery and convenience stores, as well as wholesalers Geographic Expansion Non - alcohol (1) Excludes all Costco sales; Financial data estimated for Q4 2015; case figures calculated from typical selling price using 12 pack 20 ounce bottle equivalents

Leading Metro NY Supermarket chain Sales for 2015 9 0 10,000 20,000 30,000 40,000 50,000 1/3/15 1/24/15 2/14/15 3/7/15 3/28/15 4/18/15 5/9/15 5/30/15 6/20/15 7/11/15 Metro NY Supermarket Chain (over 200 locations in PA, NY, NJ & NY) Unit Sales by week #3 - Arizona #4 - Long Island Iced Tea #7 - Sweet Leaf #5 - Honest Tea #6 - Gold Peak The 4th most popular iced tea brand (4.6% ppts market share ), only behind Snapple (# 1 ), Lipton Pure Leaf (#2) and Arizona (#3) Non - alcohol Source: 1010data

• U.S . Ready - to - Drink (“RTD”) tea market generated 2014 revenue of $5.3bn with expected growth of +10 % annually over the next five years • LIIT continues to expand distribution throughout the eastern seaboard, advancing shelf presence in stores such as ShopRite , Stop & Shop, Duane Reade (Walgreens), Rite Aid, Key Food and Western Beef • A 2% LIIT market share would equate to revenue of $106mn • Distributed in 10 states (pop. of 90mn); additional 40 states for growth (pop. of 231mn) • Market dominated by Arizona, Lipton, Snapple and Nestle (combined share of 47%) - after that massively fragmented 10 growth opportunities (1) Company market share of 2014 RTD tea market Source : uscensus.gov; IBISWorld Industry Report “RTD Tea Production in the US” December 2014 Distribution, share, scale and pricing opportunities available in a $5.3bn market Brand Market Share¹ Arizona 17.3% Lipton 15.6% Snapple 7.3% Nestle 6.7% Coca Cola Brands 3.8% Non - alcohol

Non - alcohol Alcohol capital deployment & Up - listing Appendix

THE ORIGINAL long island company Alcohol 12 N0n - alcohol alcohol M&A New Product Development 2011 - 2015 future Transformation to a multi - beverage alcohol and non - alcohol company, building from the history and storied reputation of Long Island liqueur cocktails beer wine Non - alcohol

CURRENT Alcohol MARKET 13 U.S. Beverage Market (billions of gallons) Source: Beverage Information Group 2013 Handbook; Euromonitor “Alcoholic Drinks in the US” June 2015 Existing reach of non - alcohol iced tea 2.2bn gallons Additional reach with alcohol 9.4bn gallons Combined potential reach 11.6bn gallons Wine , 0.7 , 1% Spirits , 0.5 , 1% Carbonated Soft Drinks , 13.5 , 27% Bottled water , 8.6 , 17% Coffee , 7.2 , 15% Milk , 5.9 , 12% Tea , 2.2 , 5% Juices , 1.6 , 3% Powdered Drinks , 1.2 , 2% Beer , 8.2 , 17% Alcohol $187 $191 $201 $208 $215 $170 $180 $190 $200 $210 $220 2010 2011 2012 2013 2014 • U.S. alcohol market growing at 3.6% CAGR over past 4 years • Market reached $ 215bn in 2014 Total u.s. Sales of Alcoholic Drinks ($ bn )

Millennials Trending away from beer 14 Alcohol Source: Morgan Stanley Research “Global Beverages: US Beer Alphawise Survey” May 17, 2015; Euromonitor “Beer in the US” June 2015 Millennials are increasingly moving away from beer in favor of wine and spirits Beer Cited as “Favorite Alcoholic Beverage” is Falling Among the General Population and With Millennials Beer Volume Loss Has Predominantly Benefited Wine and Spirits • RTD/RTP growing through innovation • Cider repositioning itself globally as an apple - based flavored RTD • Craft/premium beer is 22% of the beer category • Wine and spirits stable (1.2%) 35.4% 5.9% 2.4% 2.9% (1.5%) 13.3% 2.2% 3.8% (5%) 5% 15% 25% 35% 45% Beer Cider RTD/RTP Spirits Wine 2008/13 CAGR 2012/13 Total u.s. Alcoholic volume growth 2008 - 2013 (%) Results of Recent Morgan Stanley U.S. Beer Alphawise Survey: 64.2%

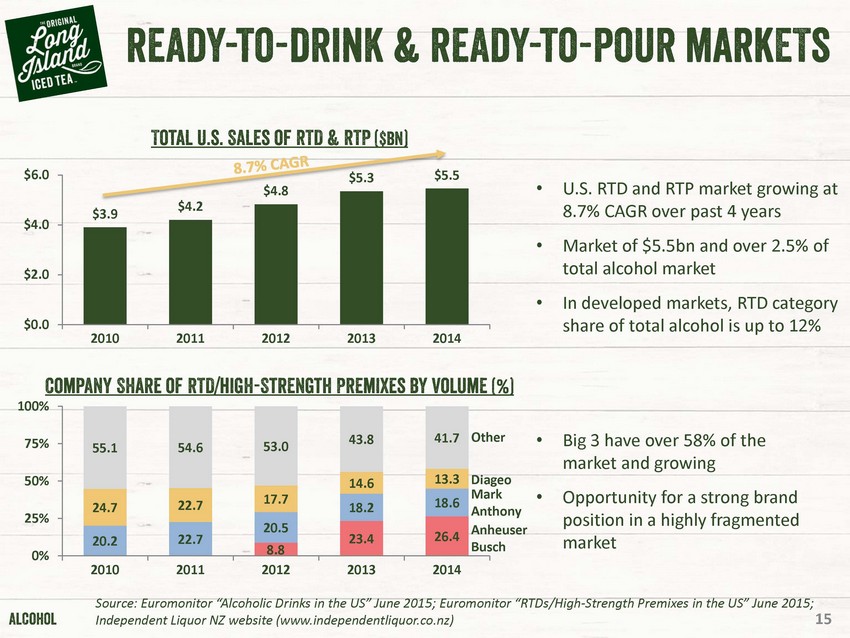

15 $3.9 $4.2 $4.8 $5.3 $5.5 $0.0 $2.0 $4.0 $6.0 2010 2011 2012 2013 2014 Total u.s. Sales of RTD & RTP ($ bn ) • U.S. RTD and RTP market growing at 8.7% CAGR over past 4 years • Market of $5.5bn and over 2.5% of total alcohol market • In developed markets, RTD category share of total alcohol is up to 12% • Big 3 have over 58% of the market and growing • Opportunity for a strong brand position in a highly fragmented market 8.8 23.4 26.4 20.2 22.7 20.5 18.2 18.6 24.7 22.7 17.7 14.6 13.3 55.1 54.6 53.0 43.8 41.7 0% 25% 50% 75% 100% 2010 2011 2012 2013 2014 Alcohol Company Share of RTD/High - Strength Premixes by volume (%) Other Diageo Mark Anthony Anheuser Busch Source : Euromonitor “Alcoholic Drinks in the US” June 2015 ; Euromonitor “RTDs/High - Strength Premixes in the US” June 2015; Independent Liquor NZ website (www.independentliquor.co.nz) Ready - to - Drink & ready - to - pour MARKETS

LONG ISLAND BRAND EXTENSIONs 16 Alcohol Robert “Rosebud” Butt claims to have invented ‘Long Island Iced Tea’ in 1972, while he worked at the Oak Beach Inn on Long Island • Gin • Tequila • Vodka • Rum • Triple Sec 40% ABV

LONG ISLAND BRAND EXTENSIONs 17 14 - 15% ABV Ready - to - Pour (RTP) cocktails served over ice; classic c ocktail blends such as Long Island Iced Tea, Cosmopolitans, Mojitos, etc. 5 - 6% Ready - to - Drink (RTD) beverages, made from malt or spirits Note: “ABV” stands for “alcohol by volume” Alcohol

LONG ISLAND BRAND EXTENSIONs 18 Alcohol Craft beer and cider – launched in multiple variants (IPA, Pilsner, etc.) capturing the heritage and essence of long Island – to enter the rapidly growing cider and craft beer market

LONG ISLAND BRAND EXTENSIONs 19 Alcohol Wines of the World by Long Island • NZ Sauvignon • Australia Pinot Grigio • California Chardonnay • South Africa Riesling • French Pinot Gris

Case study - Independent Liquor NZ 20 Start - up $ 1.2bn $ 1.5bn -$1 $0 $1 $2 1987 2006 2011 Private equity sells to Asahi Julian Davidson joined ILNZ with 2006 private equity acquirers 1. RTDs (NZ) (1) Improved brand equity, (2) Maintenance of dominant 50%+ share (3) Price realization (4) Premiumization (5) constant innovation 2. Beer (NZ) (1) Doubling of market share (2) On - premise / keg launch (3) Innovation/development of craft beers (4) broadening of portfolio via agency deals 3. Spirits (NZ) (1) Broadening of portfolio via agency deals (2) Innovation 4. Cider (NZ) (1) Launch of domestic competition to Rekorderlig 5. U.S. / Canada (1) Restructure of ‘Twisted Shotz ’ business from distributors to in - house (2) R oll out to all U.S. states (3) Regional and national chain penetration (4) Constant innovation Key success factors ILNZ Enterprise Value ($NZ) Alcohol Source: Unitas Capital Press Release, August 18, 2011

Non - alcohol Alcohol capital deployment & Up - listing Appendix

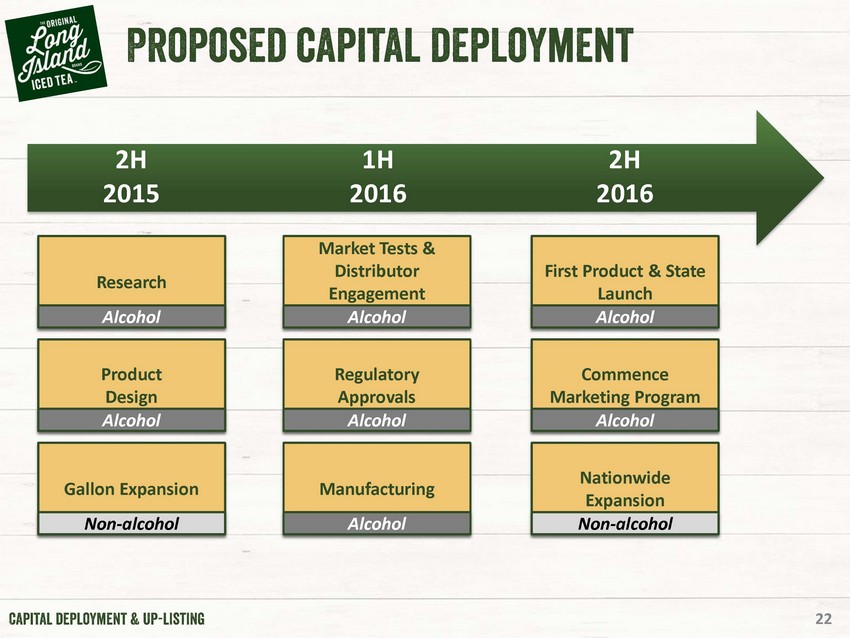

Proposed Capital deployment 22 2H 2015 1H 2016 2H 2016 capital deployment & Up - listing Research Product Design Gallon Expansion Market Tests & Distributor Engagement Regulatory Approvals Manufacturing First Product & State Launch Commence Marketing Program Nationwide Expansion Alcohol Alcohol Alcohol Alcohol Alcohol Alcohol Non - alcohol Alcohol Non - alcohol

Investor update - international business 23 future LIIT is taking preliminary steps forward to prepare itself for global expansion • LIIT is in discussion with distributor partners in Australia and New Zealand, with three objectives: ▪ To develop global brand management and distributor relationship capability ▪ To test the product and supply chain capability in non - US markets ▪ To network with global distributors to allow meaningful expansion beyond initial test markets capital deployment & Up - listing

Recent Beverage M&A Non - Alcohol Sunny Delight sale to Brynwood Partners BodyArmor investment from DPS American Beverage Corporation sale to Harvest Hill Beverage Muscle Milk sale to Hormel Foods ZICO sale to Coca - Cola Honest Tea sale to Coca - Cola Vitamin Water sale to Coca - Cola Ballast Point Brewing sale to Constellation Banks Rum sale to Bacardi Angel’s Envy sale to Bacardi Beam sale to Suntory Whyte & Mackay sale to Emperador Skinnygirl sale to Beam Jenn's Cocktail Company sale to Constellation Alcohol capital deployment & Up - listing • Received $15mn equity investment from DPS in April 2015 at a $500mn valuation • Revenues of $5mn in 2012, $17mn in 2013, $50mn in 2014E and $125mn in 2015E Bai brands case study • Sold 25% stake to Reignwood Group in July 2014 at a $665mn valuation • Global retail sales rose 31% to $ 421mn in 2014 Vita Coco case study Sources: Wall Street Journal (“Coconut Water Maker Vita Coco Broadens Overseas Footprint”); BevNet (“Bai - Popping Number: DPS Investment Based on $500M Valuation”); Foodnavigator - usa.com ( Dr Pepper invests $15m in minority stake in Bai Brands”) 24 • Received $20mn equity investment from Dr Pepper Snapple Group (“DPS”) in August 2015 at a $171mn valuation • Revenues of $ 3 0mn in 2014 and 180% YoY growth through August 2015 Body armor case study

SOLID INVESTMENT THESIS 25 Source : IBISWorld Industry Report “RTD Tea Production in the US” December 2014; Euromonitor “Alcoholic Drinks in the US” June 2015 ; Euromonitor “RTDs/High - Strength Premixes in the US” June 2015; 1010data Non - alcohol and alcohol • Globally recognized brand tapping into latent consumer awareness for alcoholic and non - alcoholic beverages Non - Alcohol • Premium liquid brewed from real tea, using cane sugar and non - GMO • Hard yards done , significant capital invested to date, distribution expanding rapidly, company at inflexion point • 2015E net sales of $1.9mm, up 50% on 2014 • Entering gallons market - Arizona only competitor • Distributed in only 10 states - 40 to go • LIIT had a 4.6% market share in a leading northeast supermarket chain with over 200 locations throughout PA, NJ, NY and CT • A 2% national market share = $106mm annual revenue • Bai Brands received $500mm valuation, with $50mn 2014 revenue and $125mm 2015E revenue Alcohol • $ 215bn alcohol market ( 3.6% CAGR growth) is 9.4bn gallons, compared to tea, which is 2.2bn gallons – 5X increment • Alcohol extensions planned – Long Island Iced Tea, RTD, RTP, Beer, Cider, Wines • 8.7% recent CAGR growth in RTD and RTP categories • Craft beer and cider high growth categories Corporate • High quality management – entrepreneur, consumer brand distribution, int’l alcohol, public accounting • Potential name change to ‘The Original Long Island Company’ to reflect heritage position, and provide umbrella for alcoholic and non - alcoholic brands • Publicly listed on OTC ( OTCBB:LTEA), potential NASDAQ up - listing in 2H 2016 • Experienced Advisory Board to help execute strategy

Non - alcohol Alcohol capital deployment & Up - listing Appendix

The Beverage • Immediate brand name recognition via “Long Island” and “Long Island Iced Tea” • Locally Brewed - NY - based local brand distributed nationally • Non - alcoholic and hot - filled using black and green tea leaves • Healthier Alternative: • 100 % cane sugar or sucralose (generic version of Splenda) as a sweetener • Gluten - free, non - GMO and n o artificial colorings or flavorings • Also available in gallons and 60 calorie healthier version • Affordable M ass Market Price: • Suggested Retail Price for 20oz bottle: LIIT of $1.00 vs. $1.25 of leading competitors Ten FLAVORS: Lemon / Diet Lemon Peach / Diet Peach Green Tea & Honey Raspberry Half & Half Guava Mango Sweet Tea (NEW ) 27 Made - in - America, premium iced tea offered at an affordable price compared to leading competitors appendix

The Brand Brand Goal Capitalize on globally recognized name “ Long Island”, while expanding into other product offerings 28 appendix

29 PHILIP THOMAS (FOUNDER & CEO) • Over 20 years of beverage experience • Revitalized a 45 year old family owned food and beverage distribution business, Magnum Enterprises , in 2003 by creating strategic partnerships with Coca-Cola and Vitamin Water • Founded Capital Link in 2005, involved in a nationally recognized ATM processing network that funds over 13,000 ATMs in all 50 states PETER DYDENSBORG (COO) • Over 30 years of experience in the distribution and building of brands within large corporations, including Kellogg's , Keebler , Coca Cola and Thomas English Muffins • Previously the Director of Sales for Phoenix Beverages , from 2004 until joining LIBB in 2014 • Senior Zone Manager at The Keebler Company (which was later acquired by the Kellogg Company) from 1994 to 2004 JULIAN DAVIDSON (senior consultant - alcohol) • Nearly 25 years in the alcoholic beverage industry, primarily Australia and New Zealand • CEO of Independent Liquor NZ (7 years - NZ/US/CAN) - sold to Asahi in 2011 for $ 1.5bn • Transitioned Independent Liquor NZ from a single focus RTD business to a multi - beverage business (RTD's / Beer / Cider / Spirits) • Previously spent 15 years at Lion Nathan , an Australasian brewery subsidiary of Kirin Holdings Joseph Caramele ( VP, national sales & Marketing - Non - alcohol) • Nearly ten years of iced tea experience with Arizona Beverages USA , most recently as Executive National Sales Director • Managed a team of 85 individuals and a portfolio of over 100 accounts totaling nearly $750 million in sales James Meehan (CAO) • Over ten years of public company accounting and auditing experience • Manager at Marcum, LLP , a nationally recognized public accounting firm, prior to joining LIBB in 2014 Experienced Management Team appendix

30 Industry Focused Advisory board Tom Cardella Mr . Cardella was president and CEO of Tenth and Blake Beer Company, an independent division of MillerCoors focused on craft and import beers. The company’s brands include Blue Moon , Pilsner Urquell , Leinenkugel’s , Peroni Nastro Azzurro , Batch 19 and Colorado Native. He also served as Chairman of the Board of Directors for the Jacob Leinenkugel Brewing Company . Mr. Cardella is a 30 - year veteran of the global beer industry. Previously he served as eastern division president for MillerCoors , where he was responsible for driving the business in the MillerCoors eastern division, including its sales volume, profit contribution and share growth. Prior to that, he was executive vice president of sales and distribution for Miller Brewing Company, a position he took in August 2006. Mr. Cardella serves on the Board of Directors for the Green Bay Packers , United Way of Greater Milwaukee and Metropolitan Milwaukee Association of Commerce. John Carson Mr. Carson is the former President, CEO and Chairman of several leading beverage companies including Marbo and Triarc Beverages , both private equity backed corporations. He led the expansion of the Tampico brand throughout new markets. Mr. Carson also led the acquisition and integration of Snapple Beverages as Chairman of Triarc Beverages (RC Cola). He expanded Triarc’s business internationally by leading negotiations in China, Japan, Mexico, South America, Russia and Poland. Mr. Carson sold the entire beverage portfolio of Triarc to Cadbury Schweppes. He is the former President of Cadbury Schweppes North America where he led the expansion of the Schweppes brand beyond mixers and into Adult Soft Drinks . appendix

31 Industry Focused Advisory board (cont’d) Dan Holland Mr. Holland is the former CEO of XXIV Karat Wines , which was founded in 2012 and offers the first gold infused sparkling wine. He is the former President and CEO of The Rising Beverage Co (Los Angeles, CA) and prior to that served as an adviser for First Beverage Group (Los Angeles, CA). Mr. Holland began his career at Mission Beverage , also based in Los Angeles, where he served as president for 15 years. During his tenure as p resident of Mission Beverage, Mr. Holland served on many distributor/supplier councils for companies including Coors Brewing Co., Heineken , Guinness, Anheuser - Busch InBev and Glaceau . Bump Williams Mr. Williams is the President and CEO of The BWC Company, a consulting company that works across the entire 6 - tier network of beverages. Mr. Williams began his career at Procter & Gamble where he developed a National Sales Program (Publishers Clearing House) that incorporated all P&G brands being merchandised across the United State with key national retailers. In 1986 he left P&G to head up Analytics and National Accounts at the A.C. Nielsen Company where he developed the industry’s first Beverage Vertical servicing a multitude of manufacturers, retailers and distributors. In 1994 he joined Information Resources, Inc. as the President of Global Consulting where he was responsible for the use of store - level data and consumer segmentation analyses that allowed the beverage industry to develop specific advertising, point of sale and new product launches at targeted consumers and specific demographic audiences. In 2008, Mr. Williams resigned his post at IRI and retired but has continued to provide consulting to several retailers to conduct analyses on the health of their beverage business and determine business plans and strategies designed to capitalize on changing consumer purchase behavior. He works with brewers, distillers, vintners, retailers, importers, private equity, Wall St. and investment companies, large and small from around the globe on new product launches, pricing and promotion analytics, mergers and acquisitions, market expansion and strategic business planning. Mr. Williams serves on several boards of directors and advisors across the beverage alcohol and non - alcoholic beverage community. appendix

Mood & Target Consumers Key consumer communications include : Original Americana Quirky Fresh Simple Surprising Classic 32 LIIT's brand image inspires refreshment, sunny days and the relaxation associated with summer and the beach appendix

PR & Marketing Initiatives IN THE FIELD PR & OTHER Partnered with for an under the cap promotion with prizes in conjunction with radio and internet advertising beginning in April 2015 “Craft Brewed” “No ID Required” “Just Add Rocks ” “There’s No Such Thing As One Too Many” Billboards & Print 33 Legacy & Wit - Drawing upon the equity of a legendary cocktail and geographic region “Buy Your Family A Round” “Put It On Your (Grocery) Tab” appendix

Growing non - alcohol Sales Channels 34 7 - 11 acme Associated Supermarkets Best Yet C - Town Compare Foods Duane reade (Walgreens) Fairway Fine Fare Food Bazaar Food Dynasty Food Emporium Foodtown Grace’s Marketplace Gristedes H Mart Handy Pantry Key Food King Kullen North shore Farms Pioneer Supermarket Rite Aid ShopRite Stop & Shop Trade Fair walgreens Western Beef Wild by Nature Select Current Distribution Points appendix

35 appendix Financial Performance $376 $143 $181 $286 $200 $170 $174 $380 $394 $234 $265 $600 $414 $500 $0 $150 $300 $450 $600 $750 Q3 '12 Q1 '13 Q3 '13 Q1 '14 Q3 '14 Q1 '15 Q3 '15 12 - Pack Cases, Excluding Costco (000)¹ Net Sales, Excluding Costco ($000)¹ 56.8 21.4 31.7 41.5 28.5 25.6 26.3 86.1 74.0 37.6 41.4 94.4 76.8 100.7 0 25 50 75 100 125 Q3 '12 Q1 '13 Q3 '13 Q1 '14 Q3 '14 Q1 '15 Q3 '15 (1) Financial data estimated for Q4 2015; case figures calculated from typical selling price using 12 pack 20 ounce bottle equivalents 2012 2013 2014 • Launched using independent distributors • Major regional distributors secured • Sam’s Club showcases, Costco rollout and 1,200 retail doors • Northeast ad campaign 2015 • Developing Top 10 Markets • Southeast expansion 2016/2017 • Midwest expansion (2016) • Nationwide expansion • National ad campaign • Global expansion

Millennials Trend away from beer 36 Results of Recent Morgan Stanley U.S. Beer Alphawise Survey • “Overall beer consumption trends remain weak…and it appears millennials are increasingly turning to other alcoholic [beverages]” • Identified two encouraging trends: ▪ “As expected, Bud Light’s flavor extensions with high level of alcohol have limited cannibalization with only 35% of volume coming from the beer category specifically” ▪ “Brand awareness is still limited, but it is much higher with Millennials which shows that ABI digital marketing targeted at this age group is efficient” appendix Source: Morgan Stanley Research “Global Beverages: US Beer Alphawise Survey” May 17, 2015 Millennials are increasingly moving away from beer in favor of wine and spirits

Millennials Trend away from beer 37 Beer Cited as “Favorite Alcoholic Beverage” is Falling Among the General Population and With Millennials % Who Answered Beer as Their Favorite Alcoholic Beverage 29.0 33.0 26.8 27.4 0% 10% 20% 30% 40% Overall Millenials 2012 2015 Source: Morgan Stanley Research “Global Beverages: US Beer Alphawise Survey” May 17, 2015 appendix

Millennials Trend away from beer 38 0% 10% 20% 30% 40% 50% 60% Not drinking anything more in its place I am drinking less beer but with a higher ABV More non-alcoholic beverages More liquor/ spirits/mixed drinks More wine 2015 2014 Beer Volume Loss Has Predominantly Benefited Wine and Spirits Which of the following applies to you as a result of drinking less beer overall? I am drinking… appendix Source: Morgan Stanley Research “Global Beverages: US Beer Alphawise Survey” May 17, 2015

What does Long Island stand for? 39 appendix