Attached files

| file | filename |

|---|---|

| EX-32.1 - Long Blockchain Corp. | ex32-1.htm |

| EX-31.1 - Long Blockchain Corp. | ex31-1.htm |

| EX-23.1 - Long Blockchain Corp. | ex23-1.htm |

| EX-21.1 - Long Blockchain Corp. | ex21-1.htm |

| EX-10.28 - Long Blockchain Corp. | ex10-28.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10–K

(Mark One)

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2017

OR

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to

Commission File Number 001-37808

LONG BLOCKCHAIN CORP.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 47-2624098 | |

| (State

or Other Jurisdiction of Incorporation or Organization) |

(I.R.S.

Employer Identification Number) |

| 12-1 Dubon Court, Farmingdale, NY | 11735 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(855) 542-2832

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $.0001 Per Share

Securities registered pursuant to Section 12(b) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of June 30, 2017 (the Registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of common stock held by non-affiliates was approximately $28,725,000 (based on a closing price of $5.40 per share).

As of April 10, 2018, there were 13,418,772 shares of common stock, $.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2018 annual meeting of stockholders are incorporated by reference into Part III of this Form 10-K where indicated. Such definitive proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the year ended December 31, 2017.

LONG BLOCKCHAIN CORP.

FORM 10-K

TABLE OF CONTENTS

| 2 |

Unless otherwise stated, as used herein, the terms the “Company” and “LBC” and references to “ we ,” ” us ” and “our” refer collectively to Long Blockchain Corp. and its wholly-owned subsidiaries, Long Island Brand Beverages LLC (“LIBB”), Long Island Iced Tea Corp.(“LIIT”), and Cullen Agricultural Holding Corp. (“Cullen”).

This Annual Report on Form 10-K (“Form 10-K”) contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Many of the forward-looking statements are located in Item 7 of Part II of this Form 10-K under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “will,” “would,” “could,” “can,” “may,” and similar terms. Forward-looking statements provide current expectations of future events based on certain assumptions and are not guarantees of future performance and the Company’s actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed in Item 1A of Part I of this Form 10-K under the heading “Risk Factors.” The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

Unless otherwise stated, references to particular years, quarters, months or periods refer to the Company’s fiscal years ended December 31st and the associated quarters, months and periods of those fiscal years.

General

We are a holding company. Until December 2017, we were focused exclusively on the ready-to-drink segment of the beverage industry. In December 2017, we announced that we were expanding our attention to include the exploration of, and investment in, opportunities that leverage the benefits of Blockchain technology. We changed our name from “Long Island Iced Tea Corp.” to “Long Blockchain Corp.” and reserved the web domain www.longblockchain.com. We also changed our trading symbol from “LTEA” to “LBCC” in connection with the name change.

Blockchain Business Overview

We are seeking to become a full service Blockchain technology company. The Blockchain is built by a chronological addition of transactions, which are grouped into blocks. Each new block requires a mathematical problem to be solved before it can be confirmed and added to the Blockchain. Our aim is to provide products and services to contribute and generate revenues from all aspects of the Blockchain eco-system, including digital trading (such as operating an exchange), facilitation of digital currency storage (Crypto wallets), capital raising activities (such as initial coin offerings, or “ICO’s”) or Distributed Ledger Technology (“DLT”)-based initiatives (Smart KYC). As a public company, we believe that we are in a prime position to build and acquire technology with global applications using Blockchain technology.

As our first step to becoming a full service Blockchain technology company, in March 2018 we entered into a sale and purchase agreement (the “Hashcove Agreement”), as amended on March 16, 2018, with the shareholders (“Hashcove Shareholders”) of Hashcove Limited (“Hashcove”). Pursuant to the Hashcove Agreement, we will acquire all of the outstanding shares of Hashcove from the Hashcove Shareholders and Hashcove will become our wholly owned subsidiary. The closing of the transaction, which is expected to occur by the third quarter of 2018, is subject to customary closing conditions, including, among others, that neither we nor Hashcove suffers a material adverse effect as described in the agreement.

Hashcove is an early stage UK-based technology company focused on developing and deploying globally scalable distributed ledger technology solutions. Among its planned product offerings, Hashcove is developing tokenized platforms, crypto-exchanges and wallets, smart contracts for ICOs, know-your-customer (“KYC”) and financial clearing technology on Blockchain, and other related Blockchain applications. Hashcove’s product team is comprised of 25 employees, including developers, with proven experience in enterprise financial trading algorithmic software.

| 3 |

Hashcove would provide us with in-house expertise in a number of Blockchain products and strategic leadership as to Blockchain/DLT product development and delivery. We believe moving in this direction will enable us to generate maximum revenue while maintaining full control over the intellectual property related to such technologies. Assuming consummation of the transaction with Hashcove, we intend to seek to build decentralized Blockchain applications for clients around the globe, across industries, for uses as varied as peer-to-peer lending, healthcare and education. The opportunities could include developing Blockchain applications on various Blockchain platforms including Ethereum and EOS. We would also look to leverage the core capability of Hashcove to build its other planned products including Crypto wallet, Crypto exchange, ICO Smart contracts and KYC / Clearing on Blockchain.

Following our acquisition of Hashcove, we intend to look to expand our business to allow for the generation of end-client acquisitions and formulate a solid distribution model. This will be driven by our recent minority investments in Stater Blockchain Limited (“SBL”) and TSLC PTE Ltd. (“TSLC”). SBL focuses on developing and deploying globally scalable blockchain technology solutions in the financial markets. SBL’s wholly-owned subsidiary, Stater Global Markets (“SGM”), is a Financial Conduct Authority (“FCA”) regulated brokerage that facilitates market access across multiple instruments including spot FX, exchange traded futures and contracts for difference (“CFDs”). TSLC is a major stakeholder of CASHe, a leading provider of digital money and short-term financial products to young millennials across India. TSLC owns all of the intellectual property developed by CASHe and has the worldwide rights outside of India to the application of its intellectual property for its lending and money transfer platform. We will seek to leverage our investment in SBL to help Hashcove cross market and diversify its products and offerings, and will seek to leverage our investment in TSLC to diversify our distribution base for Blockchain-based products. SBL and TSLC offer us entry ways to very different segments of the financial services market but that still have a need for Blockchain-based products. We believe this will allow Hashcove’s technology to service the full spectrum of customer segments and hopefully lead to additional avenues for its products.

Beverage Business Overview

Our wholly-owned subsidiary, LIBB, is focused on the ready-to-drink segment of the beverage industry. Through LIBB, we are engaged in the production and distribution of premium Non-Alcoholic Ready-to-Drink, or “NARTD,” beverages. LIBB’s mission is to provide consumers with “better-for-you” premium beverages offered at an affordable price.

Our beverage business is currently organized around our flagship iced tea product, under the brand Long Island Iced Tea®. The Long Island Iced Tea name for a cocktail originated in Long Island in the 1970’s, and its national recognition is such that it is ranked as the fourth most popular cocktail in restaurants and bars in the U.S. (Source: Nielsen CGA, On-Premise Consumer Survey, 2016). Our premium NARTD tea is made from a proprietary recipe and with quality components. Long Island Iced Tea® is sold in approximately 21 states across the U.S., primarily on the East Coast, through a network of national and regional retail chains and distributors.

We also sell The Original Long Island Brand™ Lemonade, which is a NARTD functional beverage made from a proprietary recipe with quality components. Since February 2016, we have also been engaged in the aloe juice business, under the brand ALO Juice. ALO Juice is a NARTD functional beverage made from juice derived from the aloe plant known as aloe vera. ALO Juice sources its aloe plants from harvests in Thailand. The plants are exported from there to South Korea where they are processed in a unique whole leaf manner to ensure the nutritional and health benefits are maintained from the plant all the way through to the bottling process.

In February 2018, our board of directors approved management’s intentions to spin off LIBB (the “Spinoff”). The Spinoff will allow us to focus exclusively on our move into the Blockchain technology industry. We aim to structure and complete the Spinoff by the third quarter of 2018.

Corporate History

We were incorporated on December 23, 2014 in the State of Delaware under the name “Long Island Iced Tea Corp.” as a wholly owned subsidiary of Cullen.

On May 27, 2015, we closed the business combination (the “Business Combination”) contemplated by the Agreement and Plan of Reorganization (the “Merger Agreement”), dated as of December 31, 2014 and amended as of April 23, 2015, by and among Cullen, us, Cullen Merger Sub, Inc., LIBB Acquisition Sub, LLC, LIBB, Philip Thomas and Thomas Panza, who formerly owned a majority of the outstanding membership units of LIBB, and the other former members of LIBB executing a joinder thereto. Pursuant to the Merger Agreement, (i) Cullen Merger Sub, Inc. merged with and into Cullen, with Cullen surviving as a wholly owned subsidiary of ours and the stockholders of Cullen receiving one share of our common stock for every 15 shares of Cullen common stock held by them and (ii) LIBB Acquisition Sub, LLC merged with and into LIBB, with LIBB surviving as a wholly owned subsidiary of ours and the members of LIBB receiving an aggregate of 2,633,334 shares of our common stock.

| 4 |

Upon the closing of the Business Combination, we became the new public company, Cullen and LIBB became wholly-owned subsidiaries of ours and the stockholders of Cullen and the members of LIBB became our stockholders. In addition, the historical financial statements of LIBB became our financial statements. As a result of the Business Combination, the business of LIBB became our business. Cullen is currently inactive and no significant operations are being undertaken by it. LIBB was formed as a limited liability company under the laws of New York on February 18, 2011.

On December 21, 2017, we amended our certificate of incorporation to change our name from “Long Island Iced Tea Corp.” to “Long Blockchain Corp.”

Our principal executive offices are located at 12-1 Dubon Court, Farmingdale, New York 11735. Our telephone number is (855) 542-2832. Our website addresses are www.longblockchain.com and www.longislandicedtea.com. The information contained on, or accessible from, our corporate websites are not part of this annual report and you should not consider information contained on our websites to be a part of this annual report or in deciding whether to purchase our common stock.

Listing Developments

On October 9, 2017, we received a notice from the Listing Qualifications Department of The Nasdaq Stock Market (“NASDAQ”) stating that, for the last 30 consecutive business days, the market value of our listed securities had been below the minimum of $35 million required for continued listing on NASDAQ under Nasdaq Listing Rule 5550(b)(2) (the “MVLS Rule”). Pursuant to the notice, we had until April 9, 2018 to regain compliance with the MVLS Rule. In order to regain compliance, the market value of our listed securities was required to remain at $35 million or more for a minimum of ten consecutive business days. On January 23, 2018, we were notified by NASDAQ that we had regained compliance with the MVLS Rule. Then, on February 15, 2018, we received a notice from NASDAQ stating that NASDAQ had determined to delist our securities under the discretionary authority granted to NASDAQ pursuant to NASDAQ Rule 5101. The notification letter stated that NASDAQ believed that we made a series of public statements designed to mislead investors and to take advantage of public interest in bitcoin and Blockchain technology, thereby raising concerns about our suitability for exchange listing. The notification letter also stated that NASDAQ was revoking its January 23, 2018 notification to us that we had regained compliance with the MVLS Rule.

We appealed the foregoing delisting to a NASDAQ Hearings Panel, which appeal hearing was held on March 22, 2018. On April 10, 2018, we were notified that the NASDAQ Hearings Panel determined to affirm the delisting of our shares from NASDAQ, and suspended trading effective at the open of business on April 12, 2018. We intend to apply for our common stock to be quoted and traded on the OTCQB Market. Effective April 12, 2018, our common stock will be eligible for trading and quotation on the Pink Current Information tier operated by the OTC Markets Group Inc. (the “OTC”). Our trading symbol will remain LBCC.

Capital Raising Developments

January 2017 Offering

In January 2017, we consummated a public offering (the “January 2017 Offering”) of an aggregate of 376,340 shares of our common stock, through Alexander Capital, L.P., as placement agent, pursuant to the terms of a selling agent agreement, dated January 25, 2017, with the placement agent and subscription agreements with each of the investors in the offering. Of the aggregate number of shares sold, 300,000 shares were sold to the public at a price of $4.00 per share and 76,340 of the shares were sold to our officers and directors at a price of $4.10 per share, the most recent closing bid price of the common stock at the time the officers and directors executed their subscription agreements. The offering generated gross proceeds of $1,513,000 and net proceeds of $1,429,740, after payment of the placement agent fees and other offering expenses.

The offering was made pursuant to our existing shelf registration statement on Form S-3 (File No. 333-213874), which was filed with the Securities and Exchange Commission (“SEC”) on September 30, 2016 and declared effective by the SEC on October 14, 2016 (the “Shelf Registration”), and is described in more detail in a prospectus supplement dated January 27, 2017 and the accompanying base prospectus dated October 14, 2016 (the “Base Prospectus”).

| 5 |

June 2017 Offering

In June 2017, we consummated a public offering (the “June 2017 Offering”) of an aggregate of 256,848 shares of our common stock, through Alexander Capital, L.P., as placement agent, pursuant to subscription agreements with each of the investors in the offering. Of the aggregate number of shares sold, 231,850 shares were sold to the public at a price of $5.00 per share and 24,998 of the shares were sold to our officers and directors at a price of $5.60 per share, the most recent closing bid price of the common stock at the time the officers and directors executed their subscription agreements. The offering generated gross proceeds of $1,299,250 and net proceeds of $1,259,415, after payment of the placement agent fees and other offering expenses.

The offering was made pursuant to our Shelf Registration, and is described in more detail in a prospectus supplement dated June 14, 2017 and the accompanying Base Prospectus.

July 2017 Offering

In July 2017, we consummated a public offering (the “July 2017 Offering”) of an aggregate of 448,160 shares of our common stock, through Alexander Capital, L.P., as placement agent, pursuant to subscription agreements with each of the investors in the offering. The shares were sold at a price of $5.00 per share. Of the shares sold, 200,000 were sold to lead investors who, as a result of purchasing more than $500,000 in shares, each received (i) an additional number of shares of common stock equal to 7% of the total number of shares of common stock purchased by such lead investors in this offering (or an aggregate of 14,000 shares) and (ii) three-year warrants up to that number of shares of common stock equal to 20% of the total number of shares purchased by such lead investors in this offering (or warrants to purchase an aggregate of 40,000 shares). These warrants have an exercise price of $5.50 and were fully vested upon issuance. The sale of common stock generated gross proceeds of $2,240,800 and net proceeds of $2,134,487 after deducting commissions and other offering expenses.

The offering was made pursuant to our Shelf Registration, and is described in more detail in a prospectus supplement dated July 6, 2017 and the accompanying Base Prospectus.

October 2017 Offering

In October 2017, we consummated a public offering (the “October 2017 Offering”) of an aggregate of 607,500 shares of our common stock. The shares were sold at a price of $2.05 per share. The sale of common stock generated gross proceeds of $1,245,375 and net proceeds of $1,235,088 after deducting expenses. Each investor in the offering also received a warrant to purchase 50% of the number of shares for which such investor subscribed in the offering (or a total aggregate number of shares underlying such warrants equal to 303,750 shares). The warrants have an exercise price of $2.40 per share, subject to adjustment, and expire one year from the closing of the offering.

The offering was made pursuant to our Shelf Registration, and is described in more detail in a prospectus supplement dated September 27, 2017 and the accompanying Base Prospectus.

Radium2 Capital Inc.

On November 27, 2017, we completed a financing with Radium2 Capital Inc. (“Radium”). Pursuant to an Agreement for the Purchase and Sale of Future Receipts with Radium the (“Radium Agreement”), we received cash of $750,000, less $7,500 of fees and expenses. The Radium borrowing is repaid at a minimum amount per week, based upon 15% of our gross sales, until we have repaid a total of $986,250. The Radium Agreement further provides for a discount on the repayment amount, provided such prepay obligation of $838,313 is paid within 126 business days from the date of funding. The Radium Agreement was accounted for as a borrowing, with the difference between the repayment obligation and the net amount funded being recorded as an original issue discount, amortized using the interest method over the expected term of the arrangement. As of December 31, 2017, the balance of the obligation, net of the discount was $688,038, and was presented as note payable, current, within the consolidated financial statements. Since the repayment terms are based upon our actual future sales, which are not fixed, we classified the obligation as a current liability. During the year ended December 31, 2017, accreted discount amortization was $ 47,437, and was reflected as interest expense within the consolidated statements of operations and comprehensive loss.

Court Cavendish Ltd.

On December 20, 2017, we entered into the Option and Loan Agreement the (“Cavendish Loan Agreement”) with Court Cavendish Ltd (“Cavendish”). The Cavendish Loan Agreement provides for the availability of an initial $2,000,000 (“Initial Facility Amount”). Cavendish also agreed to allow for two extensions of $1,000,000 each (“Extended Facility Amount”, and together with the Initial Facility Amount, the “Facilities”), as long as we continued moving towards specific ventures related to the Blockchain technology and the Company remained compliant with its Nasdaq regulations, to increase the Facilities to $4,000,000 subject to Cavendish’s approval. Interest on the Facilities shall accrue monthly, at a rate of 12.5% per annum, on the unpaid principal balance commencing on the date of the first drawdown and shall be due and payable, without demand or notice, at our election quarterly in cash or in our shares valued at the lower of $3.00 or the closing price per share on the preceding date the interest payment is due. All principal and accrued interest under the Facilities is due and payable on December 21, 2018. On such date, at Cavendish’s election, we shall repay the outstanding amount together with accrued interest either in cash or in shares of our common stock at the lower of $3.00 or the closing price per share on such date, but not lower than $2.00 per share. In connection with the Cavendish Loan Agreement, a facility fee of 5% (“Original Issue Discount” or “OID”) of each of the Initial Facility Amount and the Extended Facility Amount is payable on the date of the first drawdown under each such facility and payable in either cash or stock. The facility fee on the Initial Facility Amount of $100,000 was withheld from the proceeds of the initial $750,000 funding under the Cavendish Loan Agreement.

| 6 |

In connection with the Initial Facility Amount, we issued to Cavendish a warrant to purchase 100,000 shares of the Company’s common stock with a three year life and an exercise price of $3.00 per share. This warrant had a gross fair value of $165,645, using the Black-Scholes option pricing model. Upon the first draw under the Extended Facility Amount, we shall issue a warrant to purchase an additional 50,000 shares of our common stock, with the same terms, for each of the $1,000,000 extensions that are made available under the Extended Facility Amount.

The $100,000 fee and the warrant to issue 100,000 shares of our common stock were considered costs of the Initial Facility Amount.

For the Initial Facility Amount, the $100,000 fee was charged in full as a cost of the facility and the warrant was charged on a relative fair value basis, or in the amount of $152,363. These costs were initially charged to deferred financing costs, since these costs were associated with the Initial Facility Amount and not to a single funding. Thereafter, these deferred costs shall be charged on a pro rata basis as a direct offset against the fundings as they occur, and such costs would be amortized using the interest method over the term of each funding loan.

On December 21, 2017, we requested a funding of $750,000 under the Initial Financing Facility, which was received by us on December 22, 2017. OID costs of $37,500 and warrant costs of $57,136, were from deferred financing costs were directly offset against this funding.

We then evaluated the funding transaction to determine whether or not there was a beneficial conversion feature. Accordingly, we determined that after the effect of the OID and the warrant, that the effective conversion price was $2.13 per share. With a market price of our common stock on December 20, 2017, of $2.44, we were determined to have a beneficial conversion feature with a value of $94,636. The beneficial conversion feature was accounted for as a credit to additional paid in capital and a direct offset to the funded loan amount, with such costs amortized using the interest method over the term of each funding loan.

On December 26, 2017, Cavendish elected to convert the initial drawdown amount, plus interest, of $750,700 into shares of our common stock. Pursuant to the Cavendish Loan Agreement, the conversion price was $3.00 per share. Accordingly, an aggregate of 250,233 shares of common stock were issued to Cavendish. Accordingly, in recording the conversion, we recognized $189,272 in interest expense for the unamortized debt discount and then the principal value of the note of $750,000 was credited to additional paid in capital and common stock.

On January 15, 2018, Cavendish funded an additional drawdown of $750,000. We received the final drawdown of $500,000 of the Initial Facility Amount on January 30, 2018. Since we are no longer listed on NASDAQ, the remaining amount under the Extended Facility Amount will not be available to us unless Cavendish were to waive this requirement.

Blockchain Developments

Agreement with Hashcove Limited

On March 15, 2018, the Company entered into the Hashcove Agreement with the Hashcove Shareholders.

Pursuant to the Hashcove Agreement, the Company is purchasing (the “Hashcove Purchase”) the entire issued share capital of Hashcove from the Hashcove Shareholders. In exchange, the Company will issue 531,250 shares of common stock of the Company to the Hashcove Shareholders. Additionally, the Shareholders may earn up to an aggregate of 1,533,750 of additional shares of common stock of the Company (the “Contingent Shares”) upon the achievement of the following milestones: (a) if (i) the Company’s net revenue (as defined in the Agreement) equals or exceeds $10,000,000 during any 12-calendar month period beginning six months after the closing (as defined below) and ending no later than 36 months after the closing; (ii) Hashcove’s net revenue equals or exceeds $5,000,000 during any 12-calendar month period beginning six months after the closing and ending no later than 36 months after the closing; or (iii) the closing sale price of the Company’s common stock equals or exceeds $8.00 for a minimum of 30 consecutive trading days during the 36 months following the closing, the Shareholders shall receive an aggregate of an additional 1,135,312 shares of common stock of the Company; and (b) if Hashcove completes the crypto exchange, ICO smart contract solution, “clearing on blockchain” and “KYC on blockchain” products in accordance with the Agreement during the 24 months following the closing, the Hashcove Shareholders shall receive an aggregate of an additional 398,438 shares of common stock of the Company. The Contingent Shares will be placed in escrow at the Closing and will be released to the Hashcove Shareholders upon achievement of the applicable milestones.

| 7 |

Upon closing of the Hashcove Purchase, Kunal Nandwani, Hashcove’s Chief Executive Officer, will become an executive officer and director of the Company.

The Hashcove Shareholders have agreed to certain restrictions on transfer of the shares they receive under the Hashcove Agreement. Hashcove Shareholders will also have no right to any economic benefit resulting from the Spinoff.

The Company has also agreed to file, as promptly as practicable in its reasonable discretion following the closing, a registration statement with the Securities and Exchange Commission (“SEC”) registering the resale of the shares of common stock of the Company to be issued to the Hashcove Shareholders pursuant to the Hashcove Agreement and agreed to seek to have such registration statement declared effective by the SEC as promptly as practicable thereafter.

Agreement with Stater Blockchain Limited

On March 19, 2018, the Company entered into a contribution and exchange agreement (the “Stater Agreement”) with SBL, and simultaneously closed the transactions contemplated thereby.

SBL is a New Zealand-based technology company focused on developing and deploying globally scalable blockchain technology solutions in the financial markets. SBL plans to develop multiple blockchain and digital currency technology solutions, such as its “Smart Settlements” and “Smart KYC” platforms, for the global financial markets where significant disintermediation opportunities exist. SBL owns SGM, a United Kingdom-based FCA-regulated prime-of-prime brokerage, which facilitates market access across multiple instruments including foreign exchange, exchange traded futures and CFDs.

Pursuant to the Stater Agreement, SBL issued to the Company 99 ordinary voting shares in SBL (“SBL Shares”) which, immediately following completion of the transaction contemplated by the Stater Agreement, constituted 9.9% of the total SBL Shares then issued and outstanding, in exchange for 1,135,435 shares of common stock of the Company, which constituted 9.9% of the total shares of common stock of the Company then issued and outstanding (the “Exchange”).

Upon closing, Shamyl Malik, the Company’s Chief Executive Officer, was appointed as a director of SBL and Ramy Soliman, SBL’s Chief Executive Officer, was appointed as a director of the Company.

Upon closing, the Company, SBL and the majority shareholder of SBL entered into a shareholders’ agreement (the “Stater Shareholders’ Agreement”), governing the management and ownership of SBL. The Stater Shareholders’ Agreement includes the Company’s right to appoint one director of SBL, so long as the Company holds at least 9.9% of the SBL Shares then on issue, certain restrictions on transfer and preemptive rights with respect to the issuance of new securities of SBL.

Upon Completion, the Company, SBL and LIIT entered into a voting agreement (the “Voting Agreement”), pursuant to which SBL agreed, if necessary, to vote its shares of common stock of the Company (i) in favor of the Company’s distributing the shares of common stock of LIIT held by it (the “LIIT Shares”) to the Company’s stockholders by way of a dividend (the “Spinoff”), and/or (ii) if requested by the Company against any agreement which would prevent the Spinoff. Additionally, until the earlier of (i) one year from the consummation of the Spinoff or (ii) the date on which LIIT Shares become listed on a national securities exchange, in the event any vote of LIIT’s stockholders is necessary to effectuate any corporate action, SBL agreed to vote the LIIT Shares it directly or indirectly receives upon consummation of the Spinoff (i) in favor of any corporate action recommended by the then existing board of directors of LIIT (a “LIIT Action”) and/or (ii) against any action or agreement which would impede, interfere with or prevent any LIIT Action from being consummated. Pursuant to the Voting Agreement, SBL also agreed to appoint the Company or LIIT as its proxy to vote SBL’s shares of common stock of the Company or LIIT Shares, as applicable, if so requested by the Company. The voting requirements set forth in the Voting Agreement shall expire if the Spinoff is not consummated by November 13, 2018 or if prior to such date, the Company’s board of directors unanimously decides not to proceed with the Spinoff.

| 8 |

Agreement with CASHe

On March 22, 2018, we entered into and closed on a contribution and exchange agreement (the “CASHe Agreement”) with TSLC.

TSLC is the parent company of CASHe. TSLC also owns all of the intellectual property developed by CASHe and has the worldwide rights outside of India to the application of its intellectual property for its lending and money transfer platform. CASHe provides short-term financial products using modern technology combined with intelligent big data analytics and proprietary algorithms to map young professionals across the country based on their mobile digital footprint and their social behaviour patterns to rate their credit worthiness. CASHe has also implemented distributed ledger enabled digital tokens using smart contracts on its lending platform. The distributed ledger technology allows the platform to record transactions in a secure and transparent manner by creating an audit trail.

Pursuant to the CASHe Agreement, TSLC issued us 1,145,960 shares of its voting capital stock (the “TSLC Capital Stock”), equal to 7.00% of the TSLC Capital Stock on a fully diluted basis, in exchange for (i) 1,949,736 shares of our common stock, equal to 17.00% of our total common stock issued and outstanding as of the date of the CASHe Agreement, and (ii) the right to receive, if a Material Adverse Effect (as defined in the CASHe Agreement) occurs with respect to the Company within ninety (90) days of the date of the CASHe Agreement, an additional 332,602 shares of our common stock, equal to 2.90% of our total issued and outstanding common stock as of the date of the CASHe Agreement. As of April 12, 2018, we were delisted from NASDAQ, which triggered the Material Adverse Effect under the CASHe Agreement, and therefore we owe to TSLC an additional 332,602 shares of our common stock.

Pursuant to the CASHe Agreement, one person from TSLC will be appointed to our board of directors. Such person has not been appointed to our board of directors as of the date of this Form 10-K.

Pursuant to the CASHe Agreement, TSLC agreed to vote its Company common stock received pursuant to the CASHe Agreement (i) in favor of the Spinoff, and/or (ii) if requested by us against any agreement which would prevent the Spinoff. Additionally, until the earlier of (i) one year from the consummation of the Spinoff or (ii) the date on which the LIIT Shares become listed on a national securities exchange, in the event any vote of the stockholders of LIIT is necessary to effectuate any LIIT Action, TSLC agreed to vote the LIIT Shares it directly or indirectly receives upon consummation of the Spinoff (i) in favor of any LIIT Action and/or (ii) against any action or agreement which would impede, interfere with or prevent any LIIT Action from being consummated.

Pursuant to the CASHe Agreement, TSLC granted us the rights to develop the business of CASHe in the Latin American market, subject to the parties entering into a mutually acceptable license agreement having terms customary for such agreements, including, without limitation, those relating to payment of license fees and royalties by us to TSLC (which terms have not yet been negotiated).

We agreed (a) to use our reasonable best efforts to file a registration statement to register the resale of the Company common stock issued pursuant to the CASHe Agreement as soon as practicable and have such registration statement declared effective as soon as possible thereafter and (b) file any necessary notices with the OTC Markets relating to the Company’s common stock as soon as reasonably possible to allow shares issued pursuant to the CASHe Agreement to be traded on the OTC.

| 9 |

Beverage Developments

Lemonade

On March 14, 2017, we announced the expansion of our brand to include lemonade. The Original Long Island Brand™ Lemonade range consists of nine real-fruit flavors, and is offered at retail in 18oz. bottles. This premium lemonade is intended to be differentiated from other lemonade beverages in the US market. It is made with 100% raw cane sugar and non-GMO ingredients that incorporate the “better-for-you” attributes that are prominent within our iced tea brand, and will complement Long Island Iced Tea®. This product became available in select markets during the second quarter of 2017. It is our objective to grow market share and offer this product alongside our iced tea products.

Big Geyser Strategic Distribution Partnership

On March 14, 2017, we entered into a long-term strategic distribution agreement, in certain regions, with Big Geyser, a large independent non-alcoholic beverage distributor in metro New York, pursuant to which Big Geyser became the exclusive distributor of our iced tea bottle products in the region. The agreement became effective on April 24, 2017 and covers retail locations in the New York City metro region, including the five boroughs of New York City, Long Island, Westchester and Putnam County. As part of the distribution agreement, we issued warrants to Big Geyser in the second and third quarter of 2017 which vest upon the achievement of certain performance targets.

ALO Juice

On September 18, 2017, we entered into an exclusive perpetual licensing agreement (“Licensing Agreement”) with The Wilnah International, LLC (“Wilnah”) ALO Juice brand owners, providing us with worldwide rights to produce, distribute and sell the ALO Juice brand. As compensation to Wilnah for these rights, we paid an initial fee of $150,000, which was applied against the Seba Distribution LLC (“Seba”) accounts receivable upon the closing and have agreed to pay to Wilnah a 7.0% royalty on our gross sales of ALO Juice sales delivered to our customers after the closing of this agreement. The majority owner of Wilnah is the former owner of Seba and the guarantor of its obligations. We believe that ALO Juice complements our “better for you” beverage strategy, and as such, we intend to further leverage and grow the ALO Juice brand and distribution. At December 31, 2017, we fully impaired the ALO Juice intellectual property because we have de-emphasized the sale of our ALO Juice in order to better manage our liquidity.

Blockchain Business

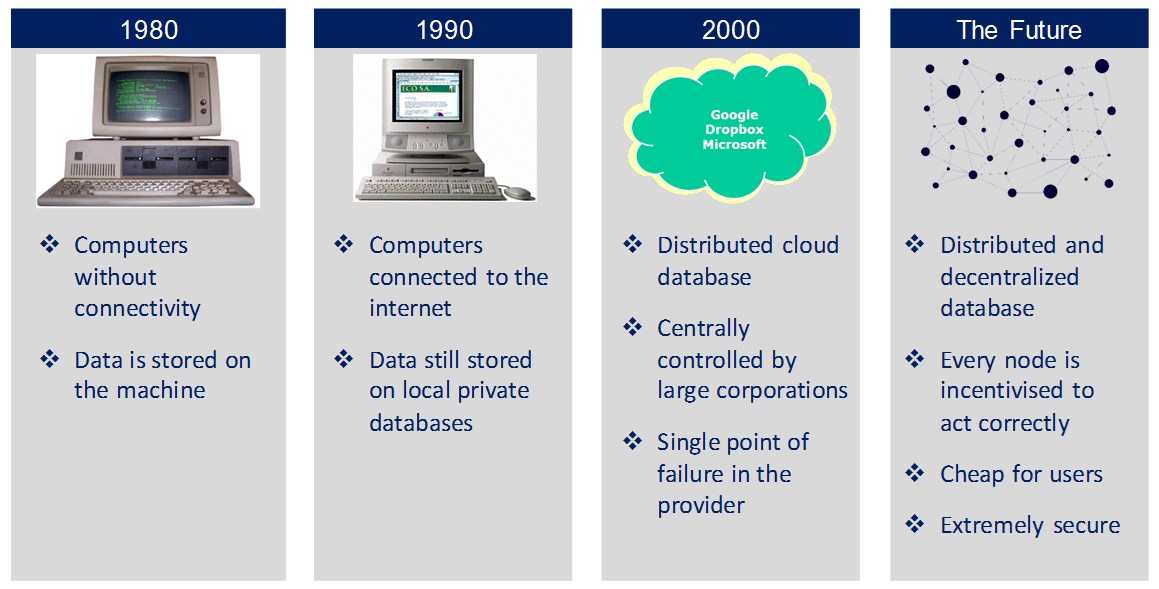

Background on Blockchain Technology

During September 2008, the global banking system was under tremendous strain, resulting in the financial services sector needing liquidity injections to avoid collapse. This situation lead to the birth of an idea for a peer-to-peer transactions system that would build trust in financial transactions using technology that was crowd-consensus driven and decentralized. The concept became what is now known as “Bitcoin,” a digital virtual global currency, and the underlying technology that enabled it was termed “Blockchain.”

The Blockchain architecture gives participants the ability to share a ledger that is updated, through peer-to-peer replication, every time a transaction occurs. The Blockchain network is economical and efficient because it eliminates duplication of effort and reduces the need for intermediaries. The Blockchain is less vulnerable because it uses consensus models to validate information; transactions are secure, authenticated and verifiable.

The Blockchain satisfies the global need of transaction networks that are fast and that provide a mechanism that establishes trust while requiring no specialized equipment. The Blockchain network has no chargebacks or monthly fees and provides a collective bookkeeping solution ensuring transparency and trust.

| 10 |

Blockchain has the ability to bring greater efficiencies in how information is created, shared, accessed, and secured, and relies upon crowd efforts for validating the correctness of the information. Decentralization is the core theme of Blockchain. After Blockchain’s apparent successful support of Bitcoin for years, it is ready for implementation and experimentation in various other industries and use cases, including, digitization of assets, ownership of assets and various other financial market applications.

Blockchain Technology

In a Blockchain, copies of a ledger are “distributed” and validated by a consensus process, with multiple users independently verifying ledger changes. Blockchain is a sequential transaction database, which contains a continuously growing list of all the transactions which have occurred in the system. All the recent valid transactions are bunched into a block (hence the name blockchain), which are then time-stamped and stored using strong cryptography. Blockchain relies on cryptography driven mining, to stamp all transactions uniquely, which builds the trust in collaborative transparent technology process.

Every new block added to the Blockchain database contains a hash (cryptographic hash) of the previous block, which makes it tamper-resistant. This is because changing any particular transaction in the Blockchain database would change the hash of the block being tampered with, which would cascade to all the subsequent blocks added in the Blockchain. The Blockchain database may be stored fully or partially by a set of nodes, which can verify any transaction being done on the Blockchain and these act in “consensus”.

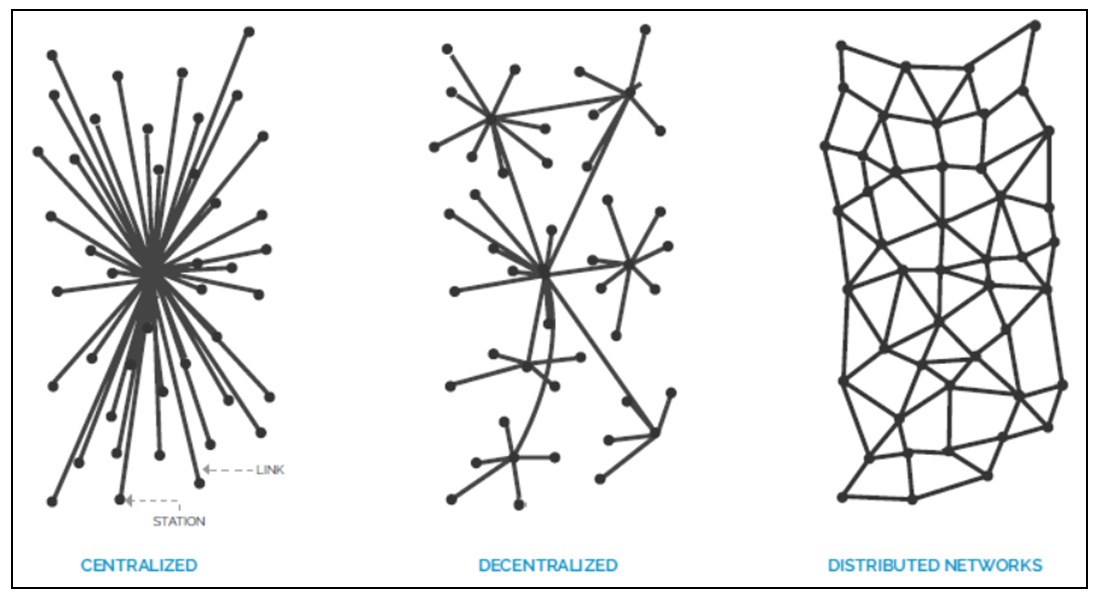

In traditional businesses and networks, the authority to make decisions is still centralized though the actual processing is distributed across several nodes globally. Although businesses previously employed a centralized data location, companies today use distributed networks to store and access data in order to avoid latency and connectivity problems. AWS, BitTorrent and Akamai are a few examples of centralized but distributed networks.

| 11 |

Differences between Centralized, Decentralized and Distributed Networks

Source: SharesPost Research, https://medium.com/@VitalikButerin/the-meaning-of-decentralization-a0c92b76a274

Blockchain can be programmed to record many items of value in our lives, such as: birth and death certificates, marriage licenses, deeds and titles of ownership, educational degrees, financial accounts, medical procedures, insurance claims, votes and anything else that can be expressed in code. Using Blockchain, we can build businesses and conduct transactions directly among participants with less friction from outside intermediaries like banks, brokers and governments. Institutions like banks or governments can embrace this technology to revamp their operations, cut costs, boost trust, increase commerce and create new value for their stakeholders.

Types of Blockchain

The following are some of the more commonly used Blockchains:

| ● | Bitcoin Blockchain –The original native Blockchain, which is the most used one in the market. | |

| ● | Ethereum –Invented to write trigger conditions based outcomes, called “smart contracts” within a software code, on top of the Blockchain. It is most widely used for Blockchain development of new tokens within ICOs. 1 | |

| ● | Multichain – A faster and flexible version of Bitcoin Blockchain, that lets you easily define assets, alter mining and consensus process that make the platforms more efficient. | |

| ● | Hyperledger – An open source collaborative effort created to advance cross-industry Blockchain technologies. It is a global collaboration, hosted by The Linux Foundation, including leaders in finance, banking, Internet of Things, supply chains, manufacturing and technology. |

There are many more Blockchain platforms available.

Key

Factors To Be Considered in Evaluating Blockchain Use

The following are some of the key factors that are considered when evaluating Blockchain use:

| ● | Shared beneficial ownership – Bitcoin Blockchain is owned by the public, striving to build a decentralized financial system where trust is built in a democratic fashion. While Bitcoin was initially a fringe technology, it was scaled by the tech community and eventually became mainstream, because it seemed to help the whole world and everyone had an equal opportunity to leverage the benefits of a secured decentralized ledger towards their business (like miners, bitcoin exchanges, developers of e. wallets, etc.). Wikipedia, Linux and several other open and crowd-sourced platforms have scaled in a similar fashion. | |

| ● | Independent mining achieves trust – Blockchain does not create trust inherently. Several nodes independently validating all transactions, for some incentive, build trust in a Blockchain. If the Blockchain application did not have enough independent participants, the Blockchain transactions would not be so trustworthy. |

| ● | True decentralization – To be truly decentralized, there must be no central point of failure. There is no dependence on one person, one node, one company, one nation or one leader. | |

| ● | No contract among transacting parties – In a transaction, payee and payer do not need to know each other. They do not need to have a legal agreement between them defining terms and conditions of their transaction. | |

| ● | Other factors – There are other factors that need consideration, including, multiple parties executing the transactions, transparency of transactions acceptable to all parties, public or private Blockchain, among others. |

All the above factors are very critical in evaluating whether or not one needs Blockchain in their business.

1 Source : https://techcrunch.com/2017/06/08/how-ethereum-became-the-platform-of-choice-for-icod-digital-assets/

| 12 |

Business Strategy

We are seeking to become a full service Blockchain technology company. Our aim is to provide products and services to contribute and generate revenues from all aspects of the Blockchain eco-system, including digital trading (such as operating an exchange), facilitation of digital currency storage (Crypto wallets), capital raising activities (ICO’s) or DLT-based initiatives (Smart KYC). As a public company, we believe that we are in a prime position to build and acquire technology with global applications using Blockchain technology.

As our first step to becoming a full service Blockchain technology company, we entered into the Hashcove Agreement in March 2018. Pursuant to the Hashcove Agreement, we will acquire all of the outstanding shares of Hashcove from the Hashcove Shareholders and Hashcove will become our wholly owned subsidiary. The closing of the transaction, which is expected to occur by the third quarter of 2018, is subject to customary closing conditions, including among others that neither we nor Hashcove suffers a material adverse effect as described in the agreement. Accordingly, there is no assurance that the transaction will be consummated.

Hashcove is an early stage UK-based technology company focused on developing and deploying globally scalable distributed ledger technology solutions. Among its planned product offerings, Hashcove is developing tokenized platforms, crypto-exchanges and wallets, smart contracts for ICO’s, KYC and financial clearing technology on Blockchain, and other related Blockchain applications. Hashcove’s product team includes 25 employees, including developers, with proven experience in enterprise financial trading algorithmic software.

Hashcove would provide us with in-house expertise in a number of Blockchain products and strategic leadership as to Blockchain/DLT product development and delivery. We believe moving in this direction will enable us to generate maximum revenue while maintaining full control over the intellectual property related to such technologies. Assuming consummation of the transaction with Hashcove, we intend to seek to build decentralized Blockchain applications for clients around the globe, across industries, for uses as varied as peer-to-peer lending, healthcare and education. The opportunities could include developing Blockchain applications on various Blockchain platforms including Ethereum and EOS. We would also look to leverage the core capability of Hashcove to build its other planned products including Crypto wallet, Crypto exchange, ICO Smart contracts and KYC / Clearing on Blockchain.

Assuming our acquisition of Hashcove is consummated, we will look to expand our business to allow for the generation of end-client acquisitions and formulate a solid distribution model. This will be driven by our recent minority investments in SBL and TSLC. SBL focuses on developing and deploying globally scalable blockchain technology solutions in the financial markets. SBL’s wholly-owned subsidiary, SGM, is a FCA-regulated brokerage that facilitates market access across multiple instruments including spot FX, exchange traded futures and CFDs. TSLC is the parent company of CASHe, a leading provider of digital money and short-term financial products to young millennials across India. TSLC also owns all of the intellectual property developed by CASHe and has the worldwide rights outside of India to the application of its intellectual property for its lending and money transfer platform. We will seek to leverage our investment in SBL to help Hashcove cross market and diversify its products and offerings and will seek to leverage our investment in TSLC to diversity our distribution base for Blockchain-based products. SBL and TSLC offer us entry ways to very different segments of the financial services market but that still have a need for Blockchain-based products. We believe this will allow Hashcove’s technology to service the full spectrum of customer segments and hopefully lead to additional avenues for its products.

Competitive Strengths

We believe that we have a competitive advantage over other companies by being an early public company in the Blockchain industry. We are looking to take advantage of this opportunity by assembling a team of professionals qualified to identify opportunities in the Blockchain industry. We currently utilize the experience and knowledge base of our management and independent and non-independent directors to analyze potential opportunities. We are currently headed by Shamyl Malik, our Chief Executive Officer. Mr. Malik brings over 13 years of experience at top tier investment banks and trading institutions. Prior to joining our company, Mr. Malik was Global Head of Trading at Voltaire Capital, a leading liquidity provider in the foreign exchange market. Prior to joining Voltaire Capital, he served as Head of FX Electronic Trading at Morgan Stanley and Head of Electronic Market Making for Emerging Markets and Precious Metals in the Capital Markets Division at Citibank. Mr. Malik began his investment banking career at Lehman Brothers, working in both New York and London across various derivative trading roles in fixed income, commodities and currencies. For nearly all his career he has been extremely focused on building and enhancing technology solutions in the financial markets space.

| 13 |

Loretta Joseph, one of our independent directors, has a significant background and experience in evaluating Blockchain opportunities. Ms. Joseph has over 25 years of experience in the global financial services industry, and is a Blockchain and technology advisor to companies, organizations and governments. She has held senior positions at investment banks across Asia and India where she was responsible for managing multiple asset classes and emerging markets environments, including RBS, Macquarie Group, Deutsche Bank, Credit Suisse and Elara Capital. Ms. Joseph has advised international banks, and global hedge and pension funds in the areas of portfolio management and exposure to derivatives and related products in emerging markets. Ms. Joseph serves as the Chair of the Advisory Board of ADCCA (Australian Digital Currency and Commerce Association), an advocacy group dedicated to ensuring the responsible adoption of Blockchain regulation. She also sits on the advisory boards of University of Western Sydney Business School and Blume Ventures, one of India’s leading tech-focused early stage VCs, and is an adjunct fellow at UWS Australia. She received Fintech Australia’s “FinTech Leader of 2017” and “Female Leader of 2016” awards, and the “Alumni Award for Social Impact” in 2016 from Sancta Sophia College.

Additionally, Kunal Nandwani, Hashcove’s Chief Executive Officer, recently joined our Blockchain Strategy Committee and upon consummation of the transaction with Hashcove, will become an executive officer and director of our company. Mr. Nandwani has been working on Blockchain since early 2016. He is a consultant to the Indian Finance Ministry for policy making on various Fintech subjects including algorithmic trading and Blockchain. Mr. Nandwani also cofounded uTrade Solutions, a product firm which offers trading, algorithmic and risk platforms in more than 10 countries. Previously, Mr. Nandwani worked at Lehman Brothers, Nomura & BNP Paribas in London. Mr. Nandwani also runs an angel network in India and is an advisor to the Indian commerce ministry on Artificial Intelligence.

We plan to include additional members on the Blockchain Strategy Committee in the future.

We also will seek to leverage the resources and experience of the management teams of our existing minority investments, as they are already collaborating and participating in the Blockchain industry. These minority investments in early stage assets provide first-hand experience and knowledge to enable future technological developments, as well as create exposure to a number of diversified touchpoints into potential revenue streams derived from Blockchain sources.

Business Opportunities

Blockchain provides a digital ledger that can be programmed to record many items of value in our lives, such as: birth and death certificates, marriage licenses, deeds and titles of ownership, educational degrees, financial accounts, medical procedures, insurance claims, votes and anything else that can be expressed in code. Using Blockchain, we can build businesses and conduct transactions directly among participants with less friction from outside intermediaries like banks, brokers and governments. Institutions like banks or governments can embrace this technology to revamp their operations, cut costs, boost trust, increase commerce and create new value for their stakeholders.

Assuming completion of the Hashcove acquisition, our product offerings would include the following:

Crypto Exchange – this would be a digital asset exchange utilizing Blockchain technology. There are currently over 170 exchanges in various countries with limited regulatory oversight, weak technology (when compared to exchanges for other asset classes) and opaque KYC practices. By being a public company operating a robust digital exchange in a regulated environment, we believe there is a large amount of institutional trading volume in digital trading that can generate significant revenues for us.

Smart Contracts for ICO’s – we believe the ICO market will be the primary capital raising method for companies utilizing Blockchain technology in the very near future replacing typical public offerings. Based on public information, approximately $5.6 billion was raised by startup’s in 2017 using ICO’s. We believe providing the technology and legal framework behind the ICO process is a sensible way to capitalize on the shift to ICO usage.

Crypto Wallets – as more and more digital trading is executed by more traditional investors (retail and institutional), the demand for Crypto wallets will increase. As part of a turnkey solution strategy in conjunction with the Crypto Exchange, we would seek to offer Crypto Wallets to customers that interact with us on our exchanges but also build technology that can be resold/white-labelled for other exchanges or industries that require Crypto Wallet facilities.

| 14 |

Competition

We may encounter intense competition from other entities having a business objective similar to ours. Some of these entities are well established and have management with significant experience in the Blockchain technology industry. Furthermore, many of these competitors possess greater technical, human and other resources than us and our financial resources will be relatively limited when contrasted with those of many of these competitors. Competitors may include start up companies that are just seeking to enter the Blockchain technology industry as well as companies who are seeking to expand their existing businesses into the Blockchain technology industry such as:

| ● | large companies like Chain, IBM and Accenture; | |

| ● | blockchain platforms like Multichain, Ripple and OmiseGo; and | |

| ● | several midsize Blockchain services firms like Opencrowd and Chainwork. |

As our market grows and rapidly changes, we expect it will continue to attract new companies, including smaller emerging companies, which could introduce new products and services. In addition, we may expand into new markets and encounter additional competitors in such markets. There is no assurance that we will be able to compete effectively with these or other companies in our industry.

Intellectual Property

We expect that our success will depend in part upon our ability to protect and use our core technology and intellectual property rights. We intend to rely on a combination of patents, copyrights, trademarks, trade secret laws, contractual provisions and confidentiality procedures to protect our intellectual property rights. We will also seek to leverage the intellectual property rights that Hashcove has with its existing products if we consummate our transaction with Hashcove.

Regulations

Currently the regulatory framework for Blockchain applications and technology is in its early stages. Certain Blockchain technologies that deal with cryptocurrencies will likely be regulated in the near term. Many U.S. regulators, including the SEC, the Financial Crimes Enforcement Network of the U.S. Department of the Treasury, the Commodity Futures Trading Commission, the U.S. Internal Revenue Service, and state regulators, including the New York Department of Financial Services, have made official pronouncements or issued guidance or rules regarding the treatment of Blockchain technology and digital currencies. However, other U.S. and state agencies have not made official pronouncements or issued guidance or rules regarding the treatment of Blockchain technology or digital currencies. Similarly, the treatment of this industry is often uncertain or contradictory in other countries. The regulatory uncertainty surrounding Blockchain technology could create risks for our business going forward.

Beverage Business

Industry Opportunity

Iced Tea

Globally, NARTD tea products are ranked as the 4th largest beverage category, behind carbonated soft drinks, water and dairy. The non-alcohol iced tea global category size is estimated at $55 billion and growing at a 6.6% compound annual growth rate (“CAGR”). (Source: Euromonitor International, “Versatility of RTD Tea Generates Bright Spot in Global Soft Drinks”, May 2014).

We have executed a select number of international distribution opportunities – recruiting an international beverage consultant - with a mandate to initially effect distribution and co-pack agreements in Australia and New Zealand. We have also established a footprint in South America with distribution agreements in Costa Rica, Columbia, Honduras and Ecuador, with other relationships pending.

The U.S. non-alcoholic liquid refreshment beverage market consists of a number of different products, and carbonated soft drinks (“CSDs”) are the top selling beverage category. However, consumers are increasingly coming to view CSDs (typically caffeinated as well as high in sugar and preservatives) with disfavor. In volume, the CSD category declined 0.6% in 2016, 1.5% in 2015, 1.6% in 2014, 2.3% in 2013 and 1.5% in 2012. (Sources: Euromonitor International, “Carbonates in the US”, February 2017).

| 15 |

CSDs have historically dominated the non-alcoholic liquid refreshment beverage market and been primarily controlled by two industry giants, Coca-Cola and PepsiCo. However, a number of beverages began to emerge in the 1990s as alternatives to CSDs as part of a societal shift towards beverages that are perceived to be healthier. The alternative beverage category of the market has resulted in the birth of multiple new product segments that include sports drinks, energy drinks and NARTD teas.

According to a 2017 Euromonitor International industry report, the U.S. NARTD tea segment was expected to have $7.1 billion of revenue in 2016, a 7.9% increase from the prior year and an 8.3% annualized growth rate over the last 5 years (2011 – 2016) (Source: Euromonitor International , “RTD Tea in the US”, February 2017). The industry report also forecasted an annual revenue growth rate of 5.3% over the coming five years, with revenues reaching $9.2 billion in 2021.

As shown below, consumers showed special interest in healthier versions of NARTD teas, preferring unsweetened teas.

RTD Tea Industry Revenue by Type (2017)

| Black Tea | 58.9 | % | ||

| Green and White Tea | 24.7 | % | ||

| Herbal Tea | 16.4 | % |

(Source: IBISWorld Industry Report OD4297, “RTD Tea Production in the US”, October 2017).

Lemonade

According to IBISWorld, lemonade comprises 8.2% of the $12.0 billion U.S. juice market in 2016. About 6.7 billion liters of juice were consumed in 2015, of which Lemonade sales totaled 451 million liters. (Source: IBISWorld Industry Report 31211c, “Juice Production in the US”, January 2017) According to a Technavio report, the Global lemonade drinks market is expected to grow at a CAGR of over 6% from 2017-2021. (Source: Technavio Market Research Report, “Global Lemonade Drinks Market 2017-2021”, July 2017).

ALO Juice

The global aloe vera-based drinks market is an expanding category, expected to grow at a CAGR of close to 10% during the forecast period for 2016 through 2020, according to a Technavio report dated November 2016. The Americas is expected to grow at an 11.24% CAGR over the same period. (Source: Technavio Market Research Report, “Aloe Vera-Based Drinks Market”, November 2016).

Other Brands

With the growing and sustainable distribution base, we now have the opportunity to develop domestic US and international brand portfolios via merger and acquisition opportunities, together with distribution and licensing opportunities. The building blocks we put in place over the last twelve months across the East Coast, including our partnership with Big Geyser, provides us with the infrastructure and management capabilities to pursue these extended goals.

Our Products and Services

Long Island Iced Tea® was first launched in the New York metro market by LIBB in July 2011, positioning itself as a premium iced tea beverage offered at an affordable price. We help differentiate ourselves from competitors with a proprietary recipe and quality components. Long Island Iced Tea® is a 100% brewed tea, using black tea leaves and purified water via reverse osmosis. It is gluten-free, free of genetically modified organisms, or “GMOs,” and certified Kosher with no artificial colors or preservatives.

Long Island Iced Tea® is primarily produced and bottled in the U.S. Northeast. This production in the Northeast, combined with its “Made in America” tag-line and brand name, all improve its credentials as a part of the local community from which we take our name.

| 16 |

We have developed ten flavors of Long Island Iced Tea® in an effort to ensure that our products meet the desired taste preferences of consumers. Regular flavors, which use natural cane sugar as a sweetener, include lemon, peach, raspberry, green tea & honey, half tea & half lemonade, guava, mango, and sweet tea. Diet flavors, which use sucralose (generic Splenda) instead of natural cane sugar as a sweetener, include diet lemon and diet peach. These flavors are currently available in twelve packs of 18oz polyethylene terephthalate bottles.

During 2017, we unveiled a new 18oz bottle and label design for our flagship Long Island Iced Tea® Brand, which replaced our 20oz size. The sleeker and slimmer 18oz design accentuates an authentic and fresh spirit of Long Island Iced Tea® products, which we believe will have a positive impact on our product gross margins. The bold and cleanly designed label aligns with our core brand image, clearly emphasizing the brand’s premium ingredients and better-for-you positioning. Both the label and customized bottle cap include informative health cues that include “non-GMO,” “100% raw cane sugar,” “no additives,” and “low calories” for diet flavors.

We have also developed The Original Long Island Brand™ Lemonade, which comes in nine real-fruit flavors, that are sold in the same locations as our iced tea.

ALO Juice has been distributed in New York City since 2008 and in Florida since 2012. We commenced distribution of ALO Juice in February 2016. It is packed in 0.5 liter and 1.5 liter bottles, with a wide variety of flavors including Original, Mango, Pomegranate, Pineapple and Raspberry. Aloe vera juice contains nutrients which include vitamins A, C, E, and B12, as well as minerals like potassium, zinc, and magnesium. It also provides antioxidants, helps to balance metabolism, and supports normal circulation and blood pressure.

Our Competitive Strengths

We believe that a differentiated brand will be a key competitive strength in the NARTD tea segment. Key points of differentiation for Long Island Iced Tea® and Long Island Brand™ Lemonade include:

| ● | A better and bolder tasting bottled iced tea as a result of premium ingredients that include natural cane sugar (sucralose for diet flavors), hot-filled using black and green tea leaves, that is offered at an affordable price; | |

| ● | Immediate global recognition of the “Long Island Iced Tea” phrase associated with the cocktail; | |

| ● | Made in America; | |

| ● | Strong Northeast roots where it is locally produced; | |

| ● | The use of non-GMO ingredients; and | |

| ● | Our product being corn free, hormone/antibiotic free, gluten free, natural and having no artificial color/flavor. |

The NARTD tea market is a crowded space and, as a result, we believe in pricing our products competitively. We highlight to consumers our use of premium ingredients and our affordable price. The suggested retail price for a 18oz. bottle of Long Island Iced Tea® is $1.00 to $1.50, and the suggested retail price for a 12oz. bottle is $1.00 to $1.25. The suggested retail price for our gallon containers is $2.99 to $3.49. The suggested retail price of The Original Long Island Brand™ Lemonade is $1.25 to $1.79 per 18oz bottle. ALO Juice® has a suggested retail price of $1.49 to $1.79 for the 500 ml bottle and $2.39 to $2.79 for the 1.5 liter bottle. Management has set pricing levels to reflect current pricing dynamics in the industry. There has been downward pressure on prices, which management believes is caused by the entrance of major multinational beverage corporations into the alternative beverage category. This is starting to lead towards industry consolidation, in what is currently considered a somewhat fragmented marketplace.

Our Business Strategies

We are seeking to organically grow our NARTD tea and related product sales by capitalizing on an iconic name with unique brand awareness to create familiar and easily recognizable beverages.

| 17 |

We intend to increase our market share in our existing geographic markets and expand into additional geographic markets in the U.S. We have established distribution in a number of small international markets and are exploring distribution in additional international markets on a highly selective and limited basis, which may include royalty and licensing agreements. As discussed below in “Our Customers,” we generally focus our sales efforts on approaching beverage distributors and taking advantage of their unique positioning in the retail industry. However, a portion of our sales efforts are also dedicated to direct sales to retailers, because some wholesale chains request direct shipments from the product supplier. In addition, we are exploring several new sales channels. We currently are conducting a small scale business trial in which we sell our beverage product alongside other snacks in vending machines. We also sell our twelve-ounce lower calorie products in schools, in some cases through sales to purchasing cooperatives that represent multiple school districts, but also via the vending machine business trial.

In March 2017, we entered into a long-term strategic distribution agreement with Big Geyser, a large independent non-alcoholic beverage distributor in metro New York, pursuant to which Big Geyser became the exclusive distributor of our iced tea bottle products. The agreement covers retail locations in the New York City metro region, including the five boroughs of New York City, Long Island, Westchester and Putnam County. This distribution coverage has the potential to significantly increase our distribution footprint and allow us to streamline our business and brings additional focus to building our brand. We are committed to building this relationship, including the recruitment of Robert Stefanizzi and a team of experienced industry professionals focused on expanding our products into Big Geyser’s distribution network.

We continually seek to better develop emerging markets, as well as expand our overall geographic footprint. We have entered into new business arrangements involving international specialists contracted to (i) identify new market opportunities and (ii) assist in the overall management of our international expansion efforts. During 2017, we announced the appointment of a New Zealand based distributor and an Australian based distributor, as well as an Australian based co-packer with capability to produce products for Australasia and Asia. We have also focused on the development of markets in South America, and have announced expansion into Costa Rica, Columbia, Honduras, Ecuador and other Latin American countries. We have worked alongside existing distributor partnerships in Puerto Rico, Canada and South Korea to further expand distribution points throughout their respective markets.

Our strategy for ALO Juice includes increasing brand support through our existing sales and marketing team, ultimately accelerating points of distribution throughout current (and future) distributor and retail partnerships alongside our flagship iced tea and lemonade products.

We are currently securing ownership of the “Long Island Iced Tea” trademark in selective international jurisdictions via the Madrid protocol. Domestically, we are building our brand primarily by establishing comprehensive marketing plans that include but are not limited to trade marketing, customer appreciation programs, social media, pricing promotions and demos via brand ambassadors.

In the past twelve months, we have secured two material brand building, awareness and trial mechanics through the sponsorships of 1) Nassau Veterans Memorial Coliseum and 2) Barclays Center. These properties reinforce brand ownership in our key New York markets and promote trial and adoption across key demographics.

We also use co-op advertising (advertisements by retailers that include the specific mention of manufacturers, who, in turn, repay the retailers for all or part of the cost of the advertisement) and special promotions, together with its retail partners, so as to complement other marketing efforts towards brand awareness.

We also seek to expand our product line. From time to time, we explore and test market potential of new NARTD products that may, in the future, contribute to our operating performance. We expect that the introduction of The Original Long Island Brand™ Lemonade and growth of ALO Juice will be able to attract a new market segment of beverage drinkers.

Manufacturing and Raw Materials

Long Island Iced Tea® and Long Island Brand™ Lemonade are currently produced by Brooklyn Bottling Group, Polar Corp., and LiDestri Spirits, all of which are established co-packing companies with reputable quality control. We intend to identify additional co-packers in the U.S. and other countries to support the continued growth of the brand. ALO Juice is purchased as a finished product from a third party supplier in South Korea.

The principal raw materials we use in our iced tea and lemonade business are bottles, caps, labels, packaging materials, tea essence and tea base, lemonade base, sugar, natural flavors and other sweeteners, juice, electricity, fuel and water. Our principal iced tea suppliers for the year ended December 31, 2017 were Zuckerman-Honickman, Inc. (bottles), US Sweeteners Corp. (sugar) and Allen Flavors, Inc. (natural flavors) who, together with Brooklyn Bottling Corp. (copacker), accounted for 70% of our purchases of raw materials inventory and copacking fees. Our principal suppliers for the year ended December 31, 2016, were Zuckerman-Honickman, Inc. (bottles) and Allen Flavors, Inc. (natural flavors) who, together with Lidestri Spirits (copacker), accounted for 46% of our purchases of inventory and copacking fees. In addition, 23% of our purchases were related to the purchase of finished bottled ALO Juice, which is purchased from suppliers located in South Korea.

| 18 |

Our relationships with our suppliers and co-packers are typically governed by short-term purchase orders or similar arrangements. We do not have any material contracts or other material arrangements with these parties and presently do not mitigate our exposure to volatility in the prices of raw materials or co-packing services through the use of forward contracts, pricing agreements or other hedging arrangements. Accordingly, we are subject to fluctuations in the costs of our raw materials and co-packing services.

Furthermore, some of our raw materials, such as bottles, caps, labels, tea essence and tea base, sugar, natural flavors and other sweeteners, and juice, are available from only a few suppliers. As a result, we may be subject to substantial increases in prices or shortages of raw materials, if the suppliers are unable or unwilling to meet our requirements.

Our Customers

We sell our products to a mix of independent mid-to-large size beverage distributors who in turn sell to retail outlets, such as big chain supermarkets, mass merchants, convenience stores, restaurants and hotels principally in the New York, New Jersey, Connecticut and Pennsylvania markets. We have also begun expansion into other geographic markets, such as Florida, Virginia, Massachusetts, New Hampshire, Maryland, North Carolina, South Carolina and parts of the Midwest. Our products are currently available in twenty one states that have a cumulative population of 100 million. While we primarily sell our products indirectly through distributors, at times we sell directly to the retail outlets and we may sell to certain retail outlets both directly and indirectly through distributors. We also sell our products directly to the distribution facilities of some of our retailers.

For the year ended December 31, 2017, two customers, Garden Foods and Big Geyser, accounted for 25% and 14% of our net sales, respectively. For the year ended December 31, 2016, our top customers, Seba Distribution LLC and Garden Foods, accounted for 20% and 11% of our net sales, respectively.

Our sales are typically governed by short-term purchase orders. We do not have any material contracts or other material arrangements with our customers or distributors and do not obtain commitments from them to purchase or sell a minimum amount of our products or to purchase or sell such products at a minimum price. Because our sales may be concentrated with a few customers, our results of operations may be materially adversely affected if one of these customers significantly reduces the volume of its purchases or demands a reduction in price, which may occur at any time due to the absence of such purchase commitments.

Management