Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - General Motors Financial Company, Inc. | d133304d8k.htm |

Strategic and Operational Overview February 3, 2016 Exhibit 99.1

Safe Harbor Statement This presentation contains several “forward-looking statements”. Forward-looking statements are those that use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “may”, “likely”, “should”, “estimate”, “continue”, “future” or other comparable expressions. These words indicate future events and trends. Forward-looking statements are our current views with respect to future events and financial performance. These forward-looking statements are subject to many assumptions, risks and uncertainties that could cause actual results to differ significantly from historical results or from those anticipated. The most significant risks are detailed from time to time in our filings and reports with the Securities and Exchange Commission, including our report on Form 10-K for the year ended December 31, 2015. Such risks include - but are not limited to - changes in general economic and business conditions, GM’s ability to sell new vehicles that we finance in the markets we serve in North America, Europe, Latin America and China, interest rate and currency fluctuations, our financial condition and liquidity, as well as future cash flows and earnings, competition, the effect, interpretation or application of new or existing laws, regulations, court decisions and accounting pronouncements, the availability of sources of financing, the level of net charge-offs, delinquencies and prepayments on the loans and leases we originate, vehicle return rates and the residual value performance on vehicles we lease, the viability of GM-franchised dealers that are commercial loan customers, the prices at which used cars are sold in the wholesale markets, and changes in business strategy, including expansion of product lines, credit risk appetite, and acquisitions. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, actual events or results may differ materially. It is advisable not to place undue reliance on any forward-looking statements. We undertake no obligation to, and do not, publicly update or revise any forward-looking statements, except as required by federal securities laws, whether as a result of new information, future events or otherwise.

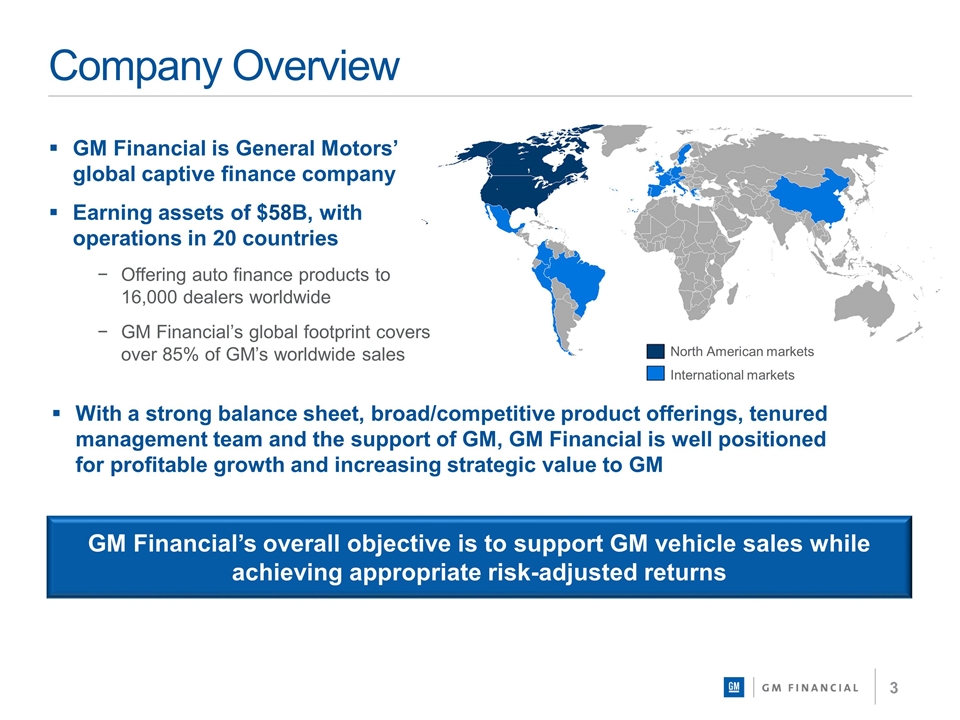

Company Overview GM Financial’s overall objective is to support GM vehicle sales while achieving appropriate risk-adjusted returns GM Financial is General Motors’ global captive finance company Earning assets of $58B, with operations in 20 countries Offering auto finance products to 16,000 dealers worldwide GM Financial’s global footprint covers over 85% of GM’s worldwide sales With a strong balance sheet, broad/competitive product offerings, tenured management team and the support of GM, GM Financial is well positioned for profitable growth and increasing strategic value to GM North American markets International markets

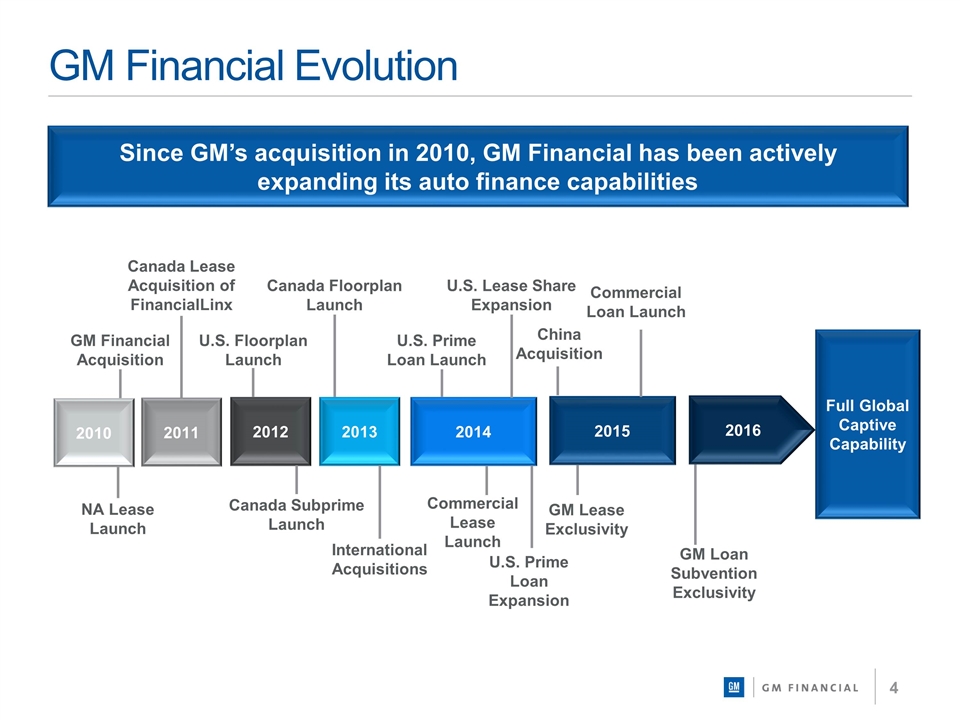

GM Financial Evolution Since GM’s acquisition in 2010, GM Financial has been actively expanding its auto finance capabilities China Acquisition GM Financial Acquisition 2010 2015 U.S. Floorplan Launch 2011 2012 2014 NA Lease Launch 2013 Canada Lease Acquisition of FinancialLinx Canada Subprime Launch Canada Floorplan Launch International Acquisitions U.S. Prime Loan Launch Commercial Lease Launch GM Lease Exclusivity U.S. Prime Loan Expansion Commercial Loan Launch Full Global Captive Capability GM Loan Subvention Exclusivity 2016 U.S. Lease Share Expansion

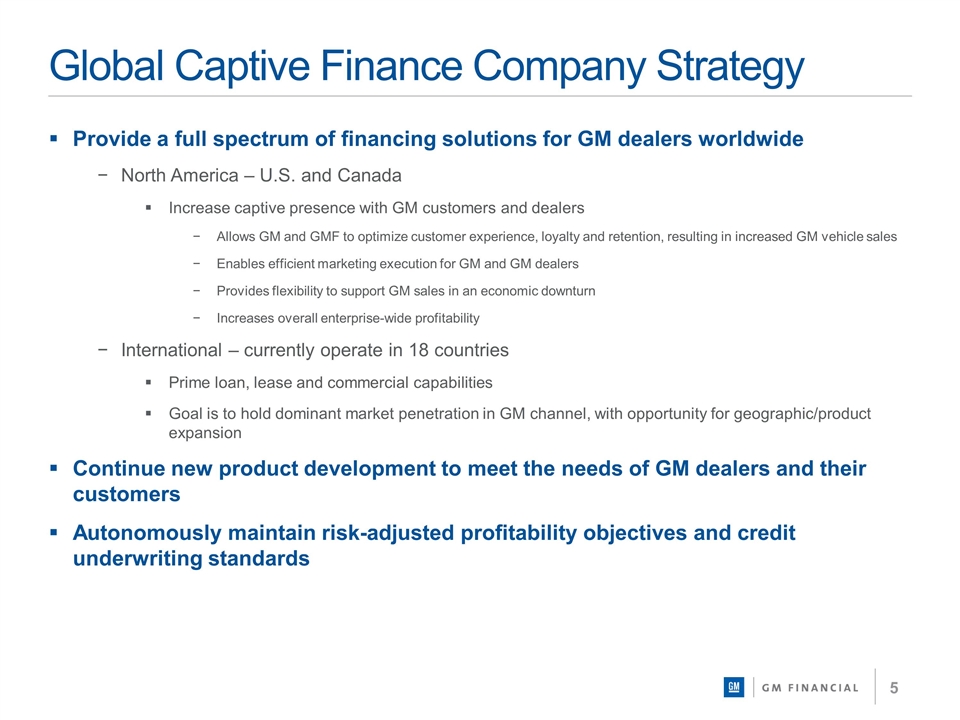

Global Captive Finance Company Strategy Provide a full spectrum of financing solutions for GM dealers worldwide North America – U.S. and Canada Increase captive presence with GM customers and dealers Allows GM and GMF to optimize customer experience, loyalty and retention, resulting in increased GM vehicle sales Enables efficient marketing execution for GM and GM dealers Provides flexibility to support GM sales in an economic downturn Increases overall enterprise-wide profitability International – currently operate in 18 countries Prime loan, lease and commercial capabilities Goal is to hold dominant market penetration in GM channel, with opportunity for geographic/product expansion Continue new product development to meet the needs of GM dealers and their customers Autonomously maintain risk-adjusted profitability objectives and credit underwriting standards

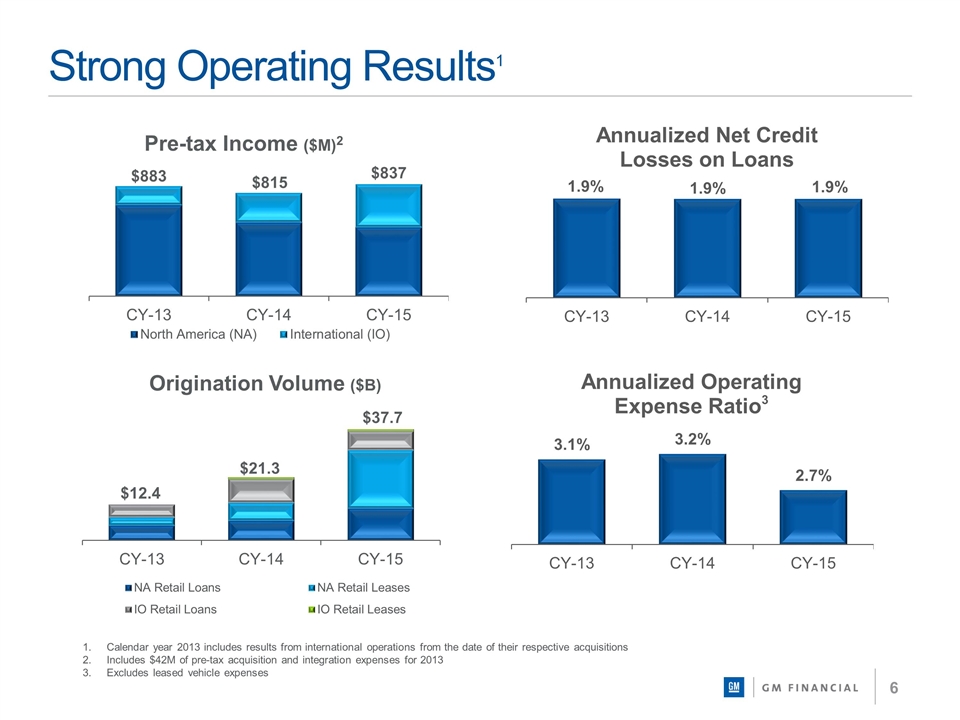

Strong Operating Results1 Calendar year 2013 includes results from international operations from the date of their respective acquisitions Includes $42M of pre-tax acquisition and integration expenses for 2013 Excludes leased vehicle expenses

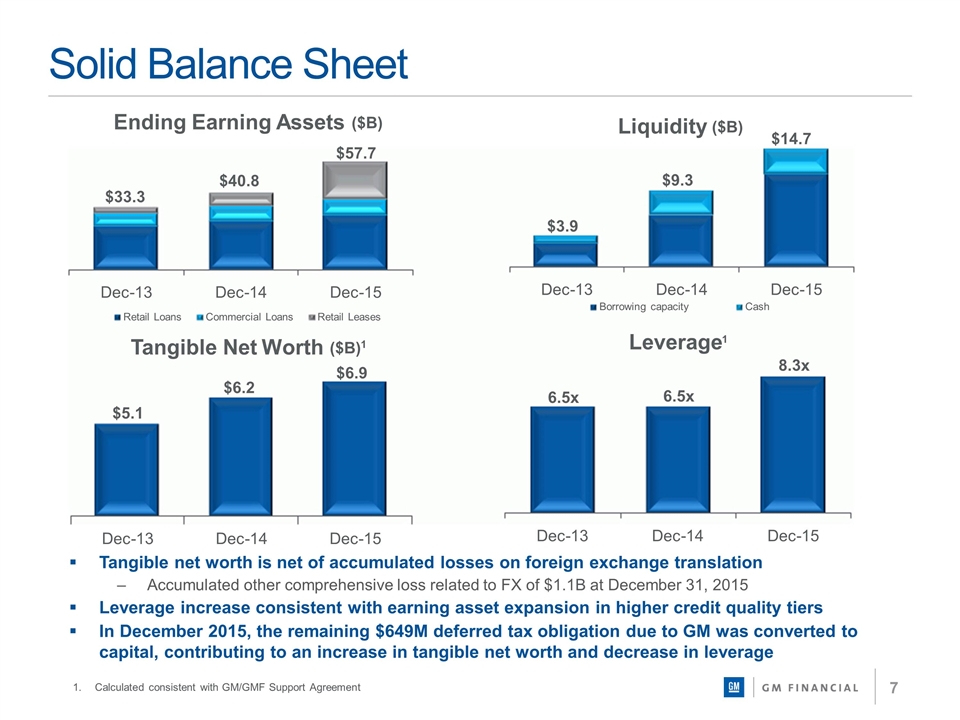

Solid Balance Sheet Calculated consistent with GM/GMF Support Agreement Tangible net worth is net of accumulated losses on foreign exchange translation Accumulated other comprehensive loss related to FX of $1.1B at December 31, 2015 Leverage increase consistent with earning asset expansion in higher credit quality tiers In December 2015, the remaining $649M deferred tax obligation due to GM was converted to capital, contributing to an increase in tangible net worth and decrease in leverage $33.3 $40.8 $57.7 Dec - 13 Dec - 14 Dec - 15 Ending Earning Assets ($B) Retail Loans Commercial Loans Retail Leases $5.1 $6.2 $6.9 Dec - 13 Dec - 14 Dec - 15 Tangible Net Worth ($B) 1 Dec - 13 Dec - 14 Dec - 15 Liquidity ($B) Borrowing capacity Cash $3.9 $9.3 6.5x 6.5x 8.3x Dec - 13 Dec - 14 Dec - 15 Leverage 1 $14.7

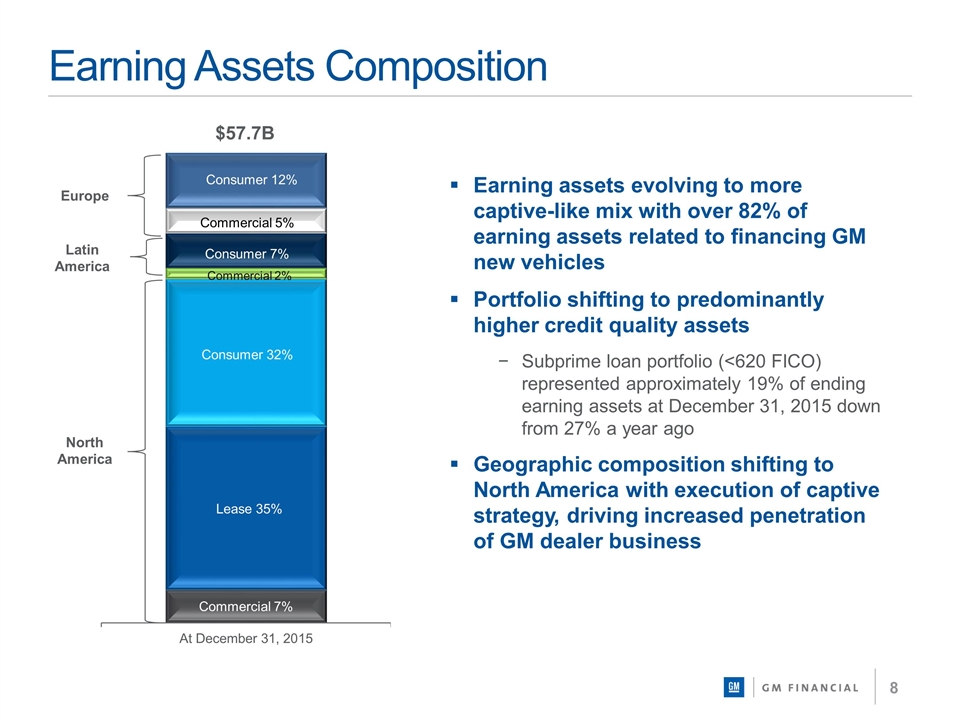

Earning Assets Composition Earning assets evolving to more captive-like mix with over 82% of earning assets related to financing GM new vehicles Portfolio shifting to predominantly higher credit quality assets Subprime loan portfolio (<620 FICO) represented approximately 19% of ending earning assets at December 31, 2015 down from 27% a year ago Geographic composition shifting to North America with execution of captive strategy, driving increased penetration of GM dealer business Lease 13% Consumer 32% Consumer 12% Consumer 7% North America Europe Latin America Lease 35% Commercial 7% Commercial 2% $57.7B Commercial 5%

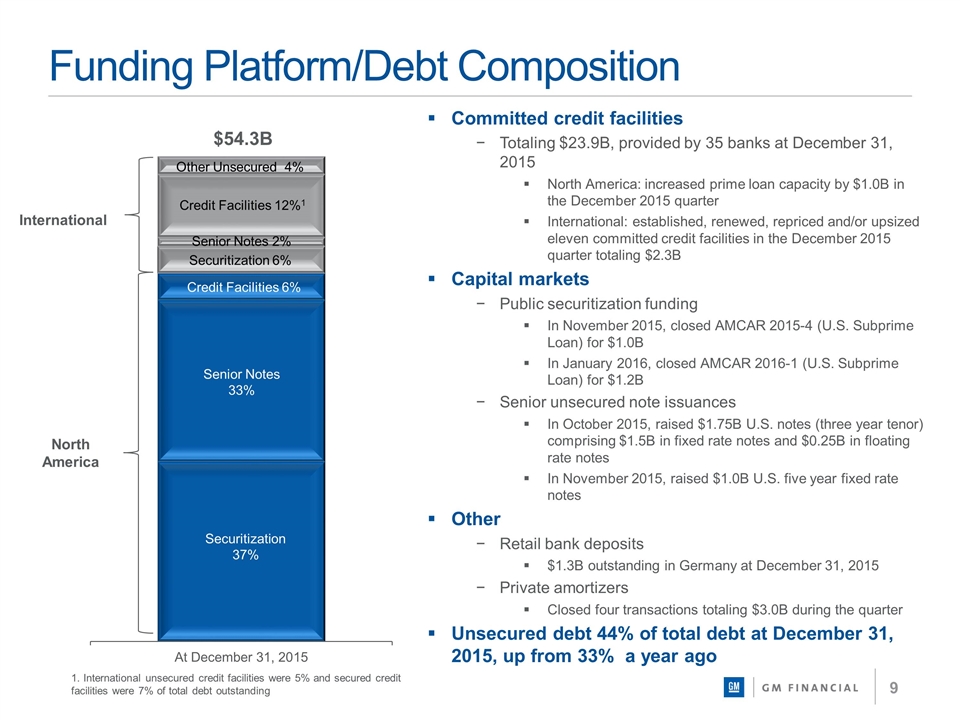

Funding Platform/Debt Composition Committed credit facilities Totaling $23.9B, provided by 35 banks at December 31, 2015 North America: increased prime loan capacity by $1.0B in the December 2015 quarter International: established, renewed, repriced and/or upsized eleven committed credit facilities in the December 2015 quarter totaling $2.3B Capital markets Public securitization funding In November 2015, closed AMCAR 2015-4 (U.S. Subprime Loan) for $1.0B In January 2016, closed AMCAR 2016-1 (U.S. Subprime Loan) for $1.2B Senior unsecured note issuances In October 2015, raised $1.75B U.S. notes (three year tenor) comprising $1.5B in fixed rate notes and $0.25B in floating rate notes In November 2015, raised $1.0B U.S. five year fixed rate notes Other Retail bank deposits $1.3B outstanding in Germany at December 31, 2015 Private amortizers Closed four transactions totaling $3.0B during the quarter Unsecured debt 44% of total debt at December 31, 2015, up from 33% a year ago North America International Senior Notes 33% Credit Facilities 6% Other Unsecured 4% Securitization 37% $54.3B Credit Facilities 12%1 Senior Notes 2% Securitization 6% 1. International unsecured credit facilities were 5% and secured credit facilities were 7% of total debt outstanding

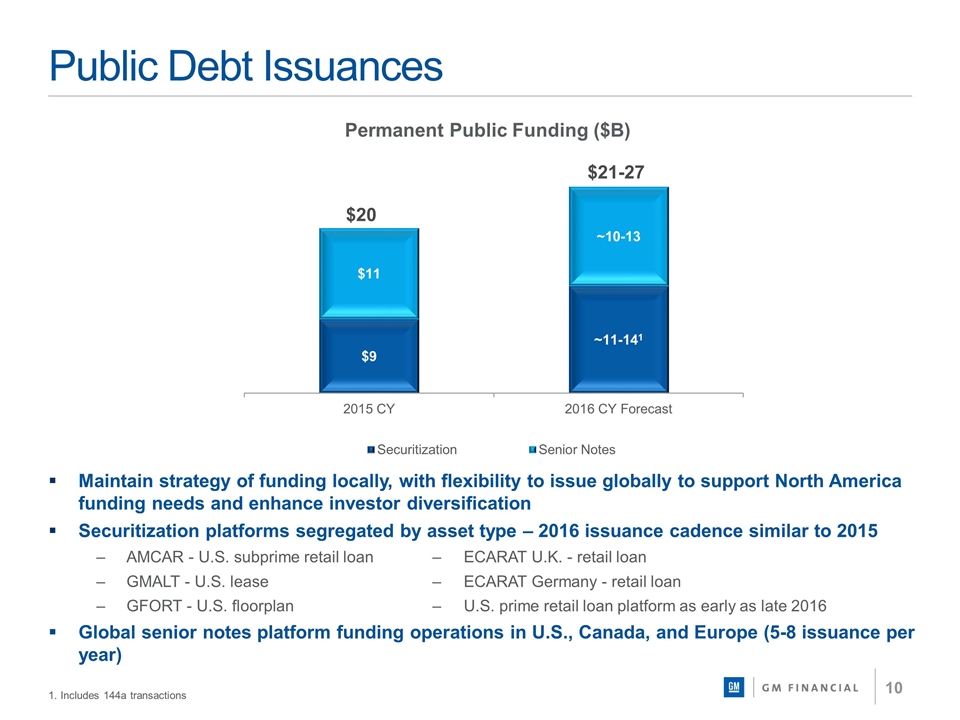

Public Debt Issuances Secured 22% Secured 11% Maintain strategy of funding locally, with flexibility to issue globally to support North America funding needs and enhance investor diversification Securitization platforms segregated by asset type – 2016 issuance cadence similar to 2015 AMCAR - U.S. subprime retail loan‒ ECARAT U.K. - retail loan GMALT - U.S. lease ‒ ECARAT Germany - retail loan GFORT - U.S. floorplan‒ U.S. prime retail loan platform as early as late 2016 Global senior notes platform funding operations in U.S., Canada, and Europe (5-8 issuance per year) 1. Includes 144a transactions

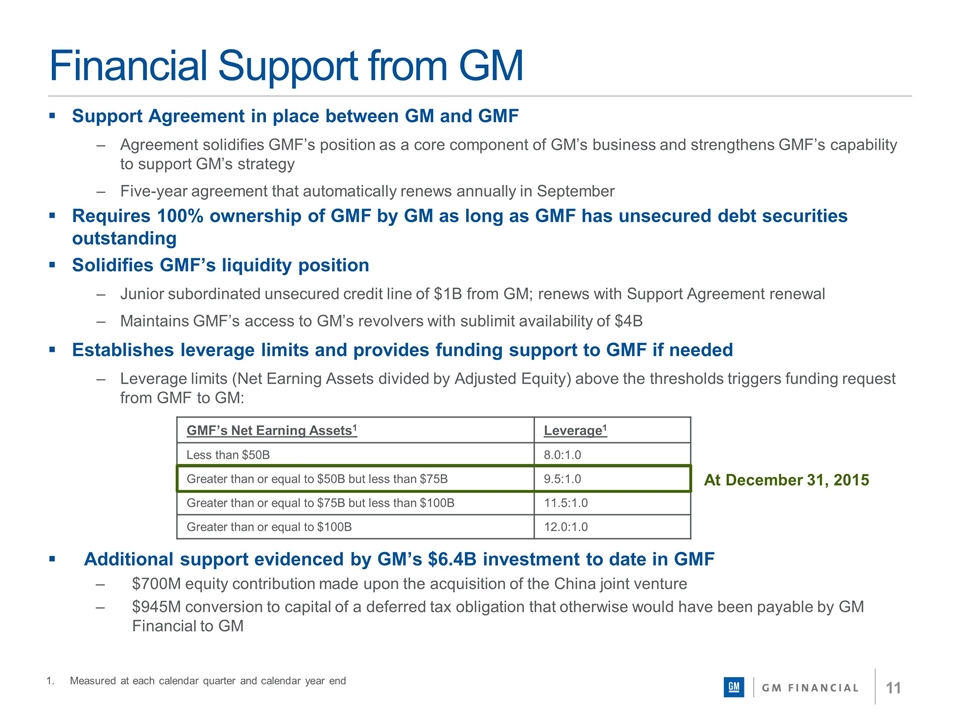

Measured at each calendar quarter and calendar year end Financial Support from GM Support Agreement in place between GM and GMF Agreement solidifies GMF’s position as a core component of GM’s business and strengthens GMF’s capability to support GM’s strategy Five-year agreement that automatically renews annually in September Requires 100% ownership of GMF by GM as long as GMF has unsecured debt securities outstanding Solidifies GMF’s liquidity position Junior subordinated unsecured credit line of $1B from GM; renews with Support Agreement renewal Maintains GMF’s access to GM’s revolvers with sublimit availability of $4B Establishes leverage limits and provides funding support to GMF if needed Leverage limits (Net Earning Assets divided by Adjusted Equity) above the thresholds triggers funding request from GMF to GM: Additional support evidenced by GM’s $6.4B investment to date in GMF $700M equity contribution made upon the acquisition of the China joint venture $945M conversion to capital of a deferred tax obligation that otherwise would have been payable by GM Financial to GM GMF’s Net Earning Assets1 Leverage1 Less than $50B 8.0:1.0 Greater than or equal to $50B but less than $75B 9.5:1.0 Greater than or equal to $75B but less than $100B 11.5:1.0 Greater than or equal to $100B 12.0:1.0 At December 31, 2015

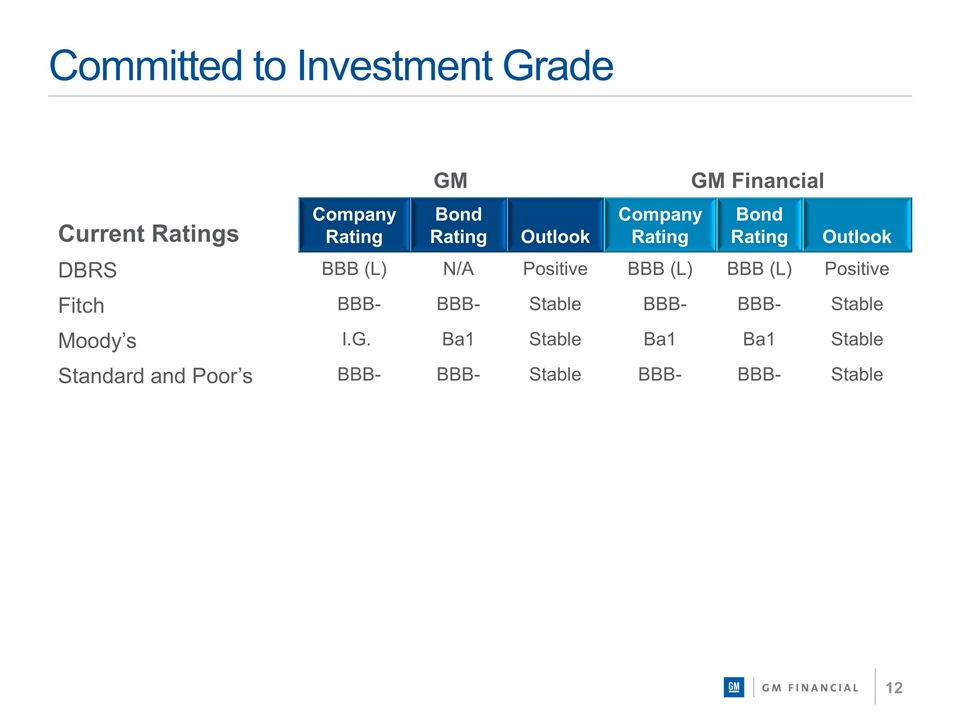

Current Ratings GM GM Financial Company Rating Bond Rating Outlook Company Rating Bond Rating Outlook DBRS BBB (L) N/A Positive BBB (L) BBB (L) Positive Fitch BBB- BBB- Stable BBB- BBB- Stable Moody’s I.G. Ba1 Stable Ba1 Ba1 Stable Standard and Poor’s BBB- BBB- Stable BBB- BBB- Stable Committed to Investment Grade

North America

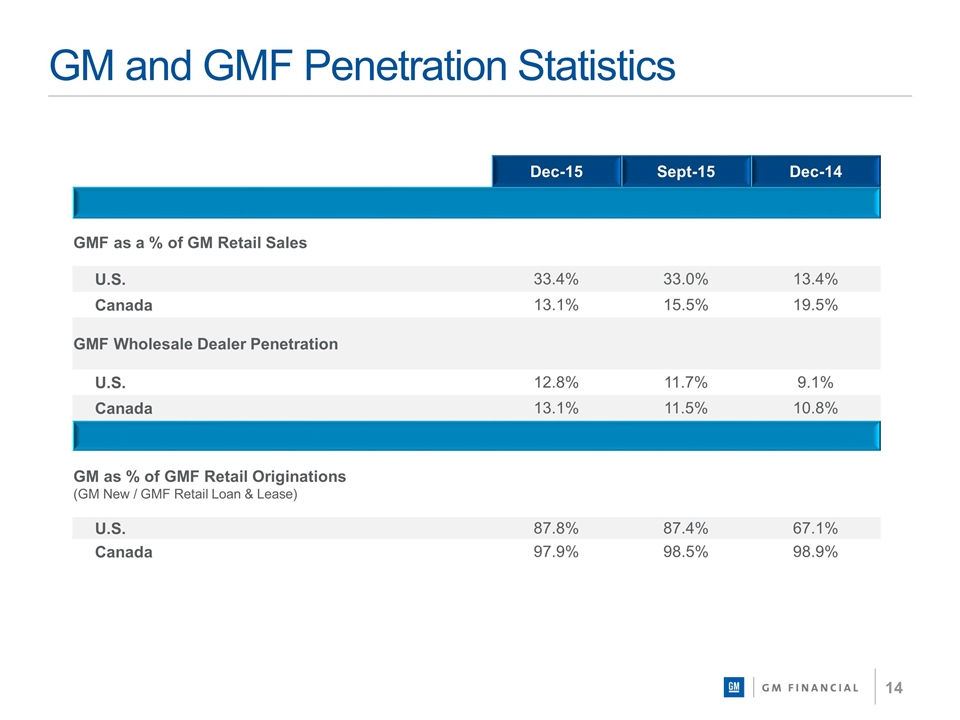

GM and GMF Penetration Statistics Dec-15 Sept-15 Dec-14 GMF as a % of GM Retail Sales U.S. 33.4% 33.0% 13.4% Canada 13.1% 15.5% 19.5% GMF Wholesale Dealer Penetration U.S. 12.8% 11.7% 9.1% Canada 13.1% 11.5% 10.8% GM as % of GMF Retail Originations (GM New / GMF Retail Loan & Lease) U.S. 87.8% 87.4% 67.1% Canada 97.9% 98.5% 98.9%

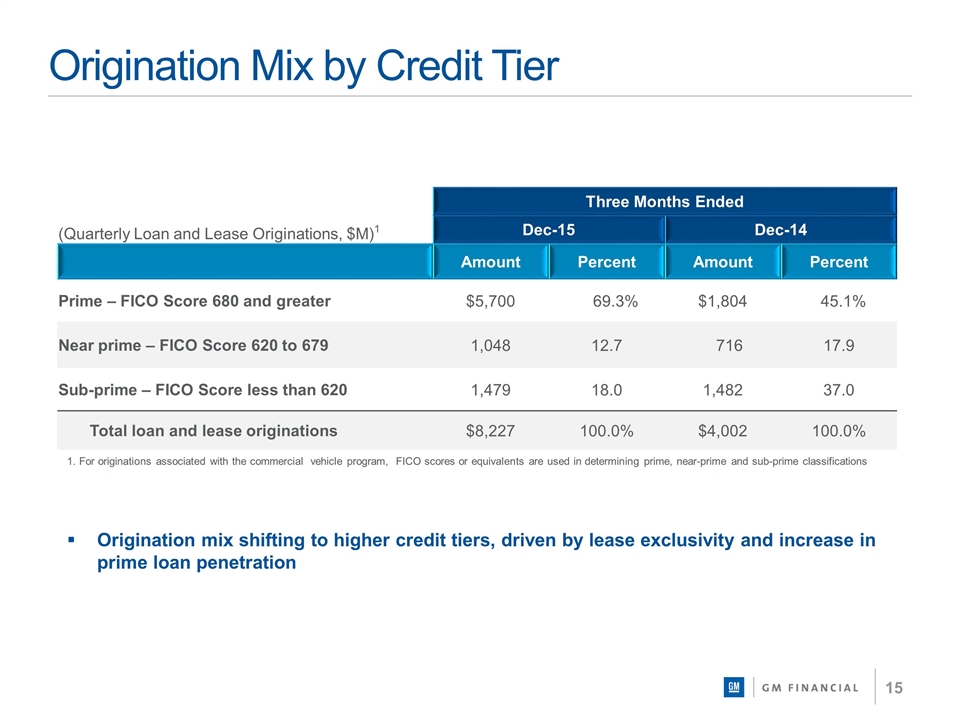

Origination Mix by Credit Tier Three Months Ended (Quarterly Loan and Lease Originations, $M)1 Dec-15 Dec-14 Amount Percent Amount Percent Prime – FICO Score 680 and greater $5,700 69.3% $1,804 45.1% Near prime – FICO Score 620 to 679 1,048 12.7 716 17.9 Sub-prime – FICO Score less than 620 1,479 18.0 1,482 37.0 Total loan and lease originations $8,227 100.0% $4,002 100.0% Origination mix shifting to higher credit tiers, driven by lease exclusivity and increase in prime loan penetration 1. For originations associated with the commercial vehicle program, FICO scores or equivalents are used in determining prime, near-prime and sub-prime classifications

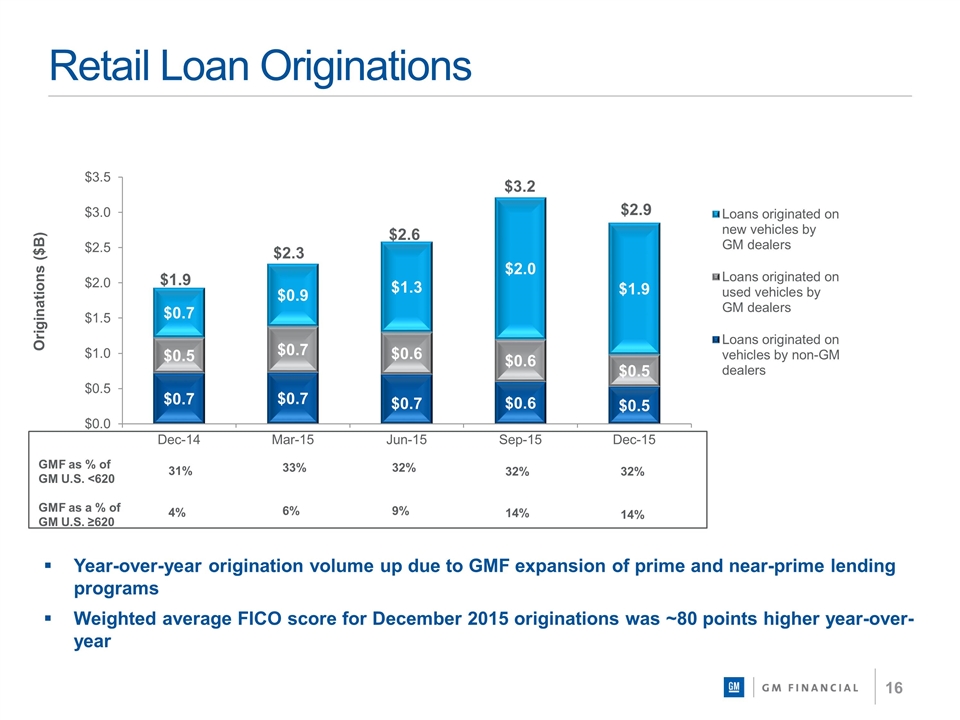

Retail Loan Originations GMF as % of GM U.S. <620 GMF as a % of GM U.S. ≥620 32% 9% 32% 14% 32% 14% 31% 4% 33% 6% Year-over-year origination volume up due to GMF expansion of prime and near-prime lending programs Weighted average FICO score for December 2015 originations was ~80 points higher year-over-year

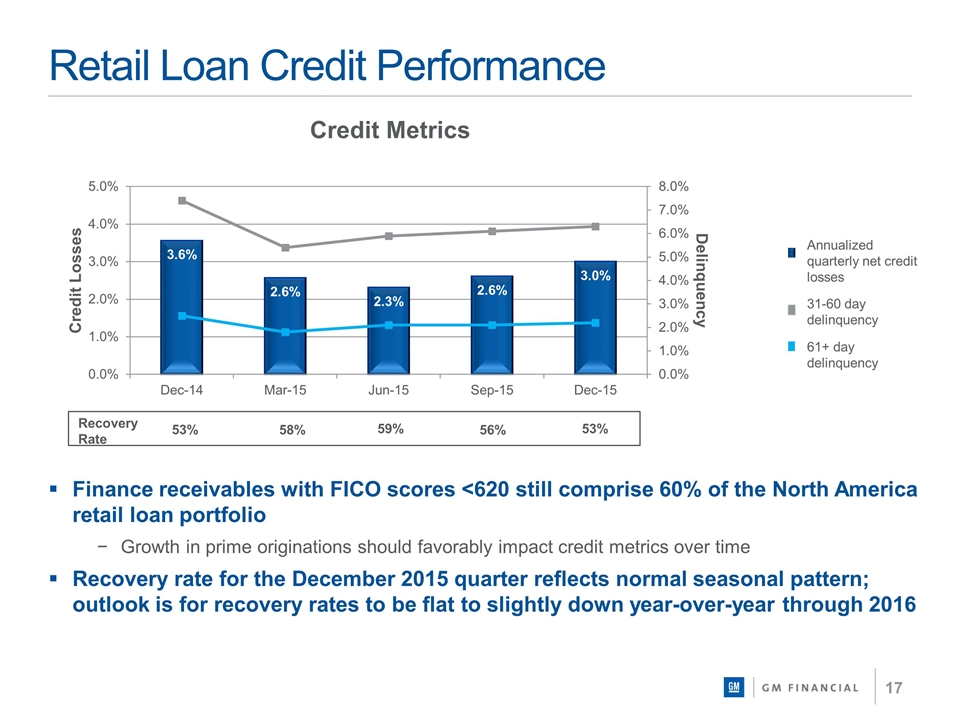

Retail Loan Credit Performance Finance receivables with FICO scores <620 still comprise 60% of the North America retail loan portfolio Growth in prime originations should favorably impact credit metrics over time Recovery rate for the December 2015 quarter reflects normal seasonal pattern; outlook is for recovery rates to be flat to slightly down year-over-year through 2016 Annualized quarterly net credit losses 31-60 day delinquency 61+ day delinquency Recovery Rate 56% 53% 53% 58% 59%

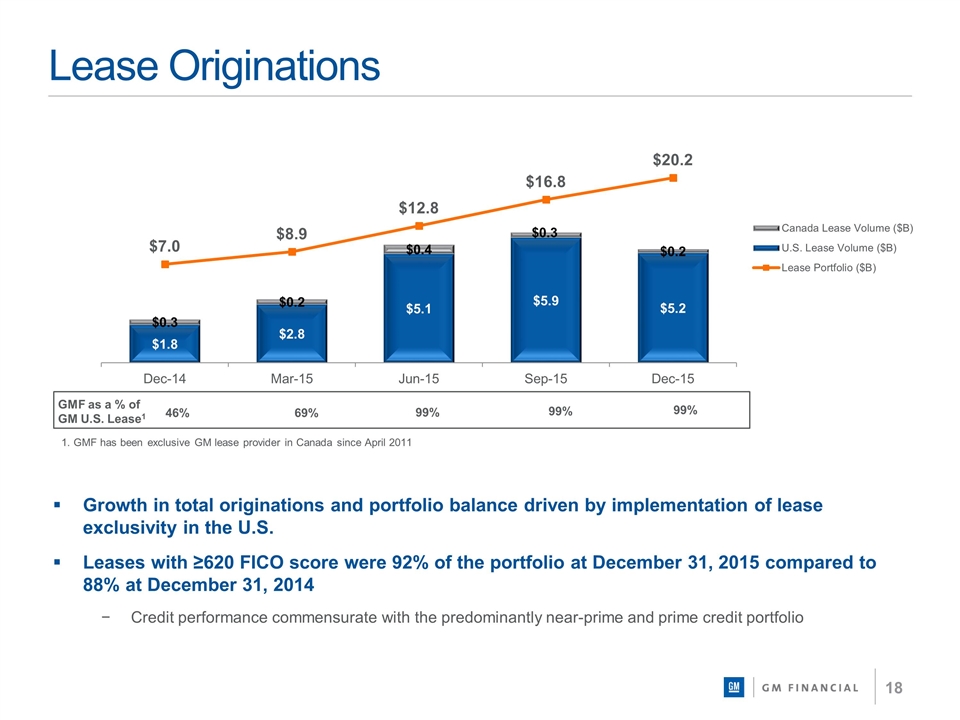

Lease Originations GMF as a % of GM U.S. Lease1 Growth in total originations and portfolio balance driven by implementation of lease exclusivity in the U.S. Leases with ≥620 FICO score were 92% of the portfolio at December 31, 2015 compared to 88% at December 31, 2014 Credit performance commensurate with the predominantly near-prime and prime credit portfolio 99% 99% 99% 46% 69% 1. GMF has been exclusive GM lease provider in Canada since April 2011

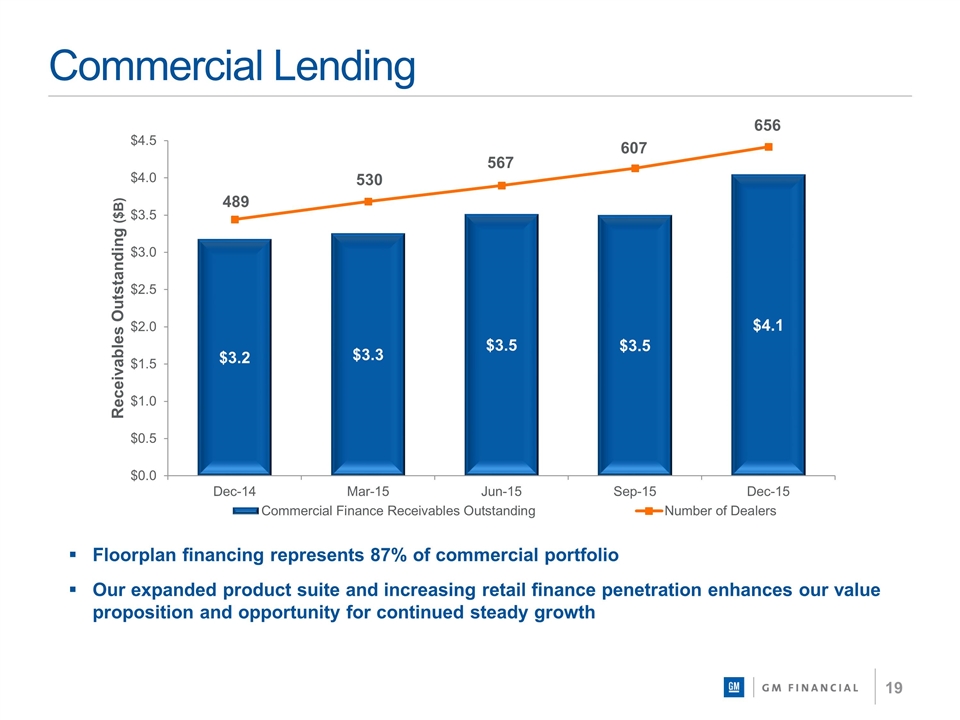

Commercial Lending Floorplan financing represents 87% of commercial portfolio Our expanded product suite and increasing retail finance penetration enhances our value proposition and opportunity for continued steady growth

International Operations

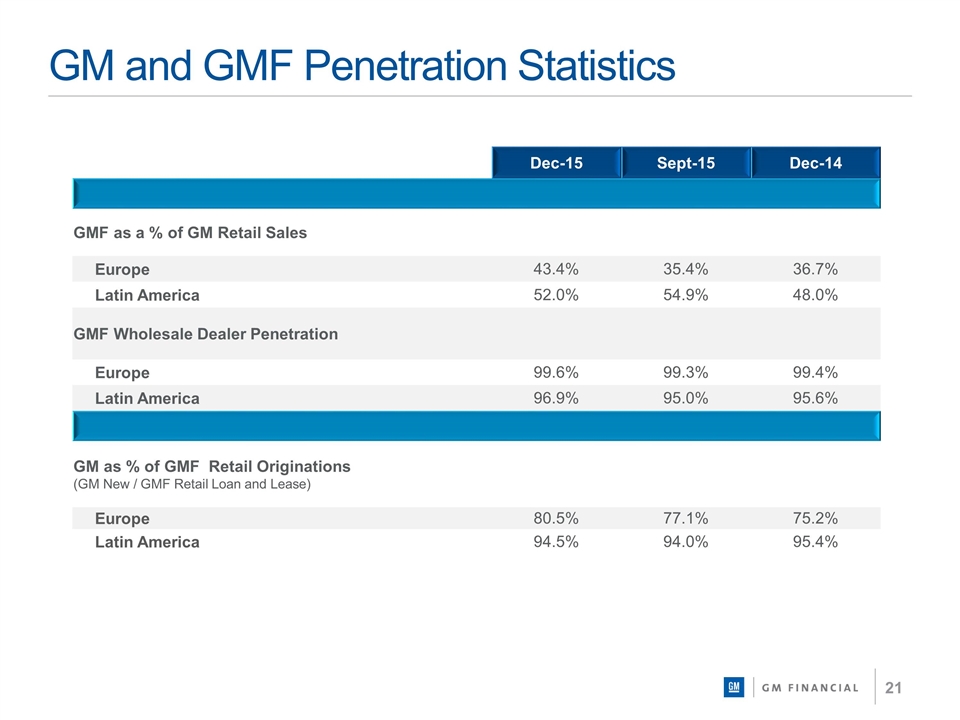

GM and GMF Penetration Statistics Dec-15 Sept-15 Dec-14 GMF as a % of GM Retail Sales Europe 43.4% 35.4% 36.7% Latin America 52.0% 54.9% 48.0% GMF Wholesale Dealer Penetration Europe 99.6% 99.3% 99.4% Latin America 96.9% 95.0% 95.6% GM as % of GMF Retail Originations (GM New / GMF Retail Loan and Lease) Europe 80.5% 77.1% 75.2% Latin America 94.5% 94.0% 95.4%

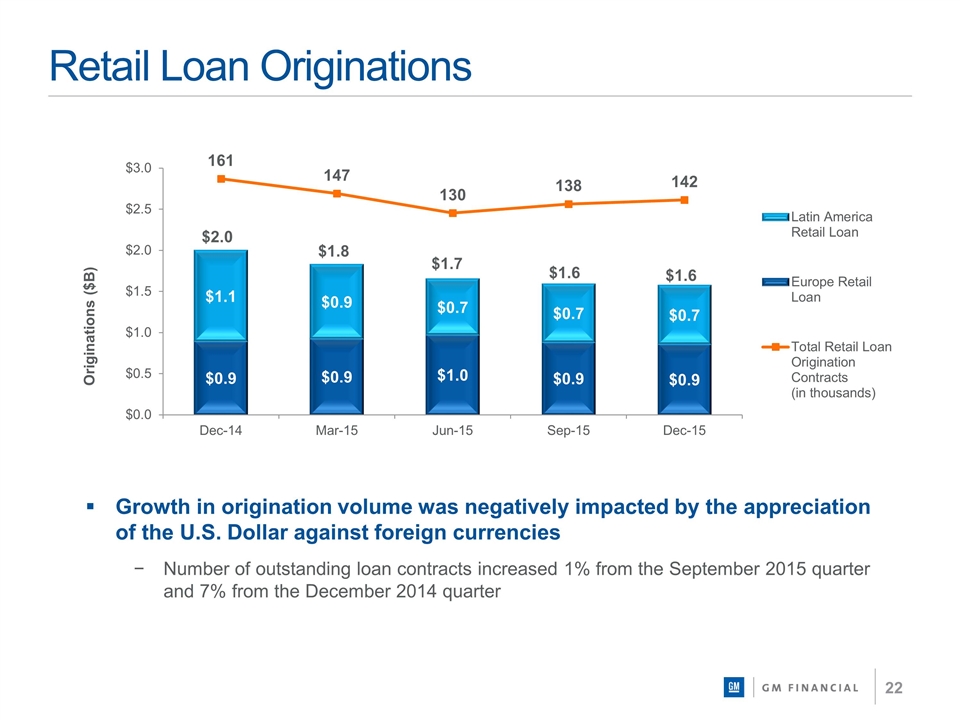

Retail Loan Originations Growth in origination volume was negatively impacted by the appreciation of the U.S. Dollar against foreign currencies Number of outstanding loan contracts increased 1% from the September 2015 quarter and 7% from the December 2014 quarter

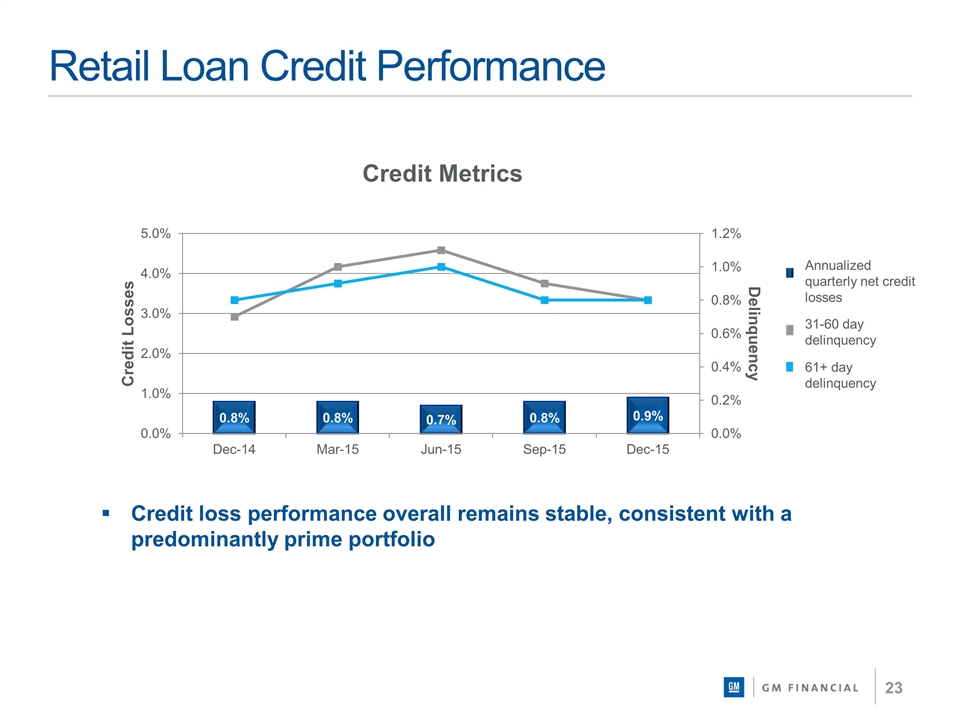

Retail Loan Credit Performance Credit loss performance overall remains stable, consistent with a predominantly prime portfolio Annualized quarterly net credit losses 31-60 day delinquency 61+ day delinquency

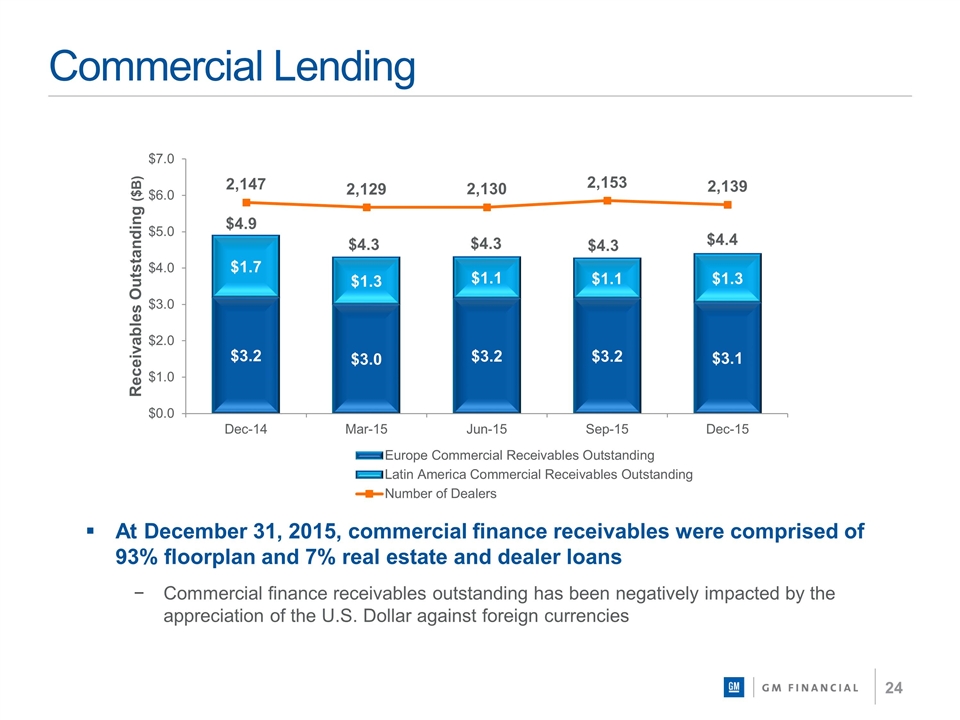

Commercial Lending At December 31, 2015, commercial finance receivables were comprised of 93% floorplan and 7% real estate and dealer loans Commercial finance receivables outstanding has been negatively impacted by the appreciation of the U.S. Dollar against foreign currencies

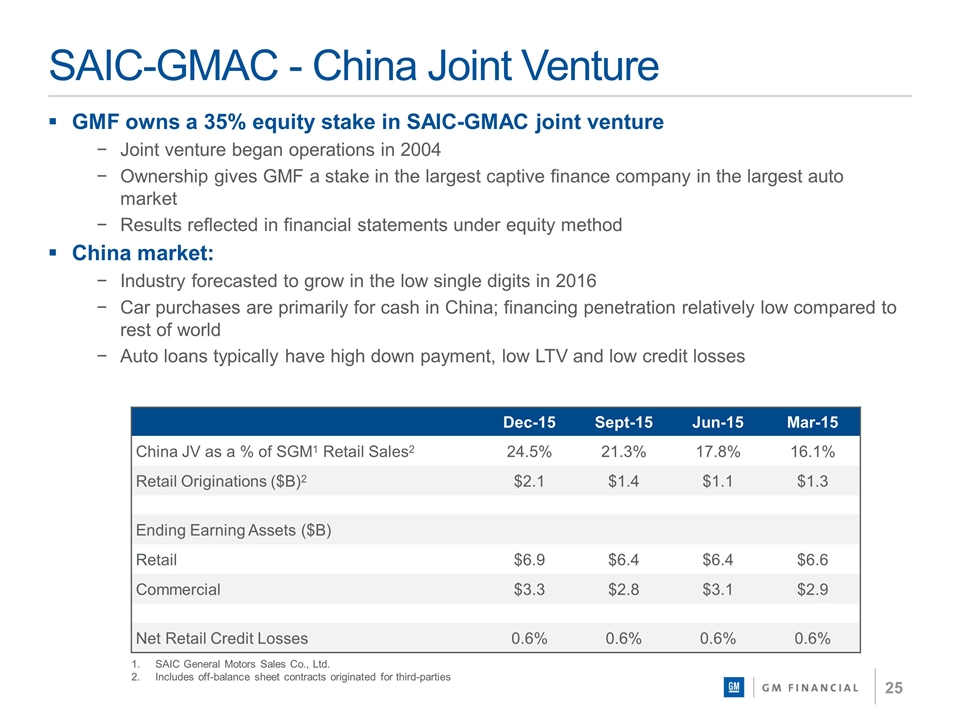

SAIC-GMAC - China Joint Venture GMF owns a 35% equity stake in SAIC-GMAC joint venture Joint venture began operations in 2004 Ownership gives GMF a stake in the largest captive finance company in the largest auto market Results reflected in financial statements under equity method China market: Industry forecasted to grow in the low single digits in 2016 Car purchases are primarily for cash in China; financing penetration relatively low compared to rest of world Auto loans typically have high down payment, low LTV and low credit losses Dec-15 Sept-15 Jun-15 Mar-15 China JV as a % of SGM1 Retail Sales2 24.5% 21.3% 17.8% 16.1% Retail Originations ($B)2 $2.1 $1.4 $1.1 $1.3 Ending Earning Assets ($B) Retail $6.9 $6.4 $6.4 $6.6 Commercial $3.3 $2.8 $3.1 $2.9 Net Retail Credit Losses 0.6% 0.6% 0.6% 0.6% SAIC General Motors Sales Co., Ltd. Includes off-balance sheet contracts originated for third-parties

GM Financial’s Key Credit Strengths Strategic interdependence with GM Operations covering over 85% of GM’s worldwide sales Expansion of captive presence in North America Captive penetration levels in International Operations Participation in China auto finance market through JV ownership Support Agreement between GM and GMF Established automobile finance franchise with an experienced and seasoned management team Experience operating across business and economic cycles through disciplined underwriting, credit risk management and servicing capability Incremental growth opportunities Additional product offerings and enhancements, improved penetration and geographic expansion, and customer retention Solid global funding platform Committed bank lines, well-established global ABS and unsecured debt issuance programs Along with GM, committed to maintaining and strengthening investment grade ratings Strong financial performance Solid balance sheet supporting originations growth Liquidity of $14.7B at 12/31/2015 2015 CY earnings before tax of $837M Full year 2016 earnings are anticipated to be slightly up compared to 2015 Inflection point for North America earnings expected in back half of 2016, at which time income from the increase in earning assets will begin generating year-over-year earnings growth in excess of investments made to implement the full captive strategy