Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EDGEWATER TECHNOLOGY INC/DE/ | d102696d8k.htm |

| EX-2.2 - EX-2.2 - EDGEWATER TECHNOLOGY INC/DE/ | d102696dex22.htm |

| EX-2.1 - EX-2.1 - EDGEWATER TECHNOLOGY INC/DE/ | d102696dex21.htm |

| EX-10.1 - EX-10.1 - EDGEWATER TECHNOLOGY INC/DE/ | d102696dex101.htm |

| EX-99.1 - EX-99.1 - EDGEWATER TECHNOLOGY INC/DE/ | d102696dex991.htm |

Asset Acquisition of M2 by Edgewater Ranzal Exhibit 99.2

Safe Harbor Language Some of the statements in this presentation constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, growth, performance, tax consequences or achievements to be materially different from any future results, levels of activity, growth, performance, tax consequences or achievements expressed or implied by such forward-looking statements. Such factors include, among other things, those listed below. The forward-looking statements included in this presentation are related to future events or the Company's strategies or future financial performance, including statements concerning the accretive nature of the M2 acquisition to 2016 GAAP and EBITDA earnings per share, future revenue growth for Ranzal and M2, geographic and client expansion, customer spending outlook, general economic trends, IT service demand, future revenue and revenue mix, utilization, new service offerings, significant customers, competitive and strategic initiatives, growth plans, potential stock repurchases, future results, tax consequences and liquidity needs. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "believe," "anticipate," "anticipated," "expectation," "continued," "future," "forward," "potential," "estimate," "estimated," "forecast," "project," "encourage," "opportunity," "goal," "objective," "could," "expect," "expected," "intend," "plan," "planned," "will," "predict," or the negative of such terms or comparable terminology. These forward-looking statements inherently involve certain risks and uncertainties, although they are based on the Company's current plans or assessments which are believed to be reasonable as of the date of this presentation. Factors that may cause actual results, goals, targets or objectives to differ materially from those contemplated, projected, forecasted, estimated, anticipated, planned or budgeted in such forward-looking statements include, among others, the following possibilities: (1) failure to obtain new customers or retain significant existing customers; (2) the loss of one or more key executives and/or employees; (3) changes in industry trends, such as a decline in the demand for Enterprise Resource Planning and Enterprise Performance Management solutions, custom development and system integration services and/or declines in industry-wide information technology spending, whether on a temporary or permanent basis and/or delays by customers in initiating new projects or existing project milestones; (4) inability to execute upon growth objectives, including new services and growth in entities acquired by the Company; (5) adverse developments and volatility involving geopolitical or technology market conditions; (6) unanticipated events or the occurrence of fluctuations or variability in the matters identified under "Critical Accounting Policies" in our 2014 Annual Report on Form 10-K; (7) delays in, or the failure of, the Company's sales pipeline being converted to billable work and recorded as revenue; (8) termination by clients of their contracts with the Company or inability or unwillingness of clients to pay for the Company's services, which may impact the Company's accounting assumptions; (9) inability to recruit and retain professionals with the high level of information technology skills and experience needed to provide the Company's services; (10) failure to expand outsourcing services to generate additional revenue; (11) any changes in ownership of the Company or otherwise that would result in a limitation of the net operating loss carry forward under applicable tax laws; (12) the possibility that activist stockholders may wage proxy contests or gain representation on or control of the Board of Directors and cause disruption and/or uncertainty to the Company's business, customer relationships and employee retention; (13) the failure of the marketplace to embrace advisory and product-based consulting services; and/or (14) changes in the Company's utilization levels. In evaluating these statements, you should specifically consider various factors described above as well as the risks outlined under Part I - Item IA "Risk Factors" in the Company's 2014 Annual Report on Form 10-K filed with the SEC on March 2, 2015.

Safe Harbor Language (Continued) These factors may cause the Company's actual results to differ materially from those contemplated, projected, anticipated, planned or budgeted in any such forward-looking statements. Although the Company believes that the expectations in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, growth, earnings per share or achievements. However, neither the Company nor any other person assumes responsibility for the accuracy and completeness of such statements. Except as otherwise required, the Company undertakes no obligation to update any of the forward-looking statements after the date of this presentation to conform such statements to actual results.

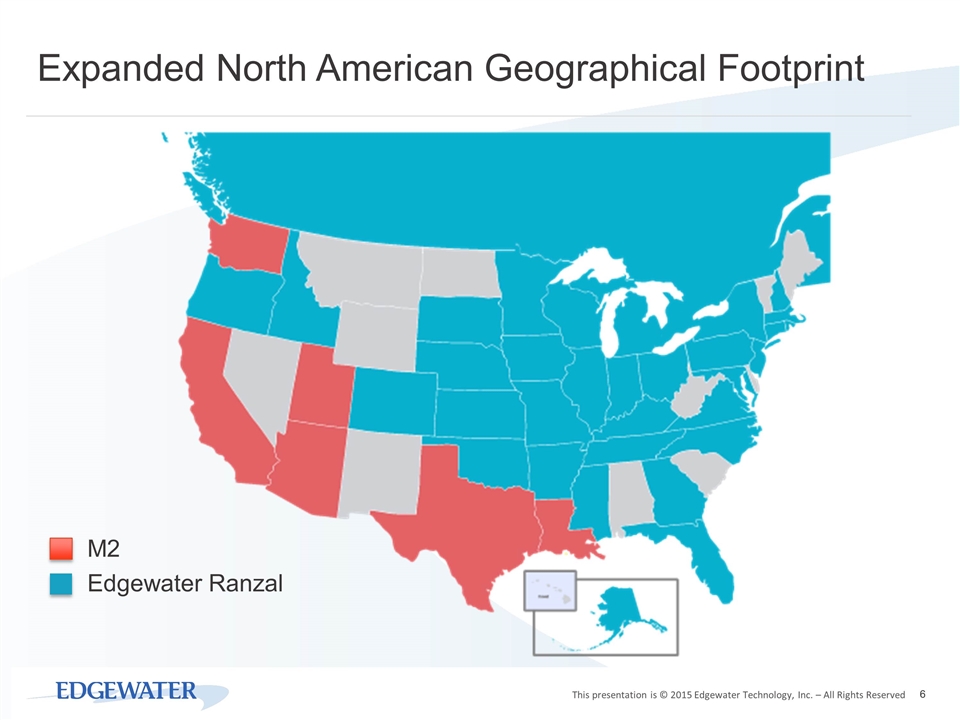

Company Overview M2 Dynamics Inc. (“M2”) is a global provider of Oracle / Hyperion based implementations and business consulting solutions Oracle Platinum Partner Five categories of core service offerings include: (1) budgeting and planning; (2) financial management and consolidation; (3) business intelligence and enterprise data warehousing; (4) infrastructure, integrations and master data; and (5) managed services Geographically focused on clients in west coast and TOLA (Texas, Oklahoma, Louisiana and Arkansas) markets Recently developed one of the largest and most complex cloud-based planning and budgeting projects 43 employees, consisting of partners, consultants, sales and administrative professionals Organically built verticals: aerospace, retail, entertainment, and financial services Brings large scale cloud-based EPM references

Acquisition Overview of M2 The acquisition of substantially all of the assets of M2 represents the continuation of Edgewater’s strategy to make disciplined tuck-in acquisitions that expand capabilities, geographies, and customers M2 enhances Ranzal’s capabilities in cloud, while extending its footprint in the western US and TOLA region Adds scale to the enterprise Expected to be accretive to 2016 EPS Acquisition process began in May 2015 Features Product: Oracle, Platinum Partner and leading Cloud-based Solutions Clients: Major Fortune 100 clients and industry diversification (aerospace, retail, entertainment, financial services) Combined Financial Profile: Platform for significant revenue growth, and expected to be accretive to 2016 EBITDA and GAAP EPS Cross-Sell: Opportunity to expand Ranzal products into M2’s markets Culture: Similar positive, employee-valued culture and pride in the work being performed Geography: Feet on the street / people in geographies where Ranzal lacks presence

Expanded North American Geographical Footprint M2 Edgewater Ranzal

Transaction Overview Asset Purchase (M2 Dynamics is an S-Corp) $16.1 million Up Front Purchase Price Consideration ~1.4X multiple of Unaudited LTM revenue (excluding expenses) ~5.0X multiple of Unaudited LTM Adjusted EBITDA* All cash consideration / No stock component Subject to a Net Working Capital adjustment One-Year Earnout Agreement 12 months in length beginning the day of close Based upon Revenue (30%)/EBITDA (70%) generated through operations Maximum Revenue & EBITDA payout thresholds require growth during earnout period Earnout consideration capped at $6.6 million Payable in cash / No stock component * - LTM Q3’15 Adjusted EBITDA excludes certain owner compensation-related expenses, owner expense reimbursements and general and administrative-related salaries and wages.

Transaction Overview Standard Indemnity Escrow 10% of Upfront Purchase Price Non-Compete Agreements (Key Management) 5-Year for principal owners

Financial Highlights (Unaudited) LTM Q3’15 service revenue of ~ $11.5 million Low overhead = Strong operating profit leverage Light SG&A expense framework Adjusted EBITDA in a range of 20% - 25% Average bill rates are in alignment with current Edgewater EPM-related bill rates Healthy backlog of signed engagements Anticipated to be accretive on a GAAP EPS basis in 2016 * - Adjusted EBITDA excludes certain owner compensation-related expenses, owner expense reimbursements and general and administrative-related salaries and wages.

Contact Information Edgewater Technology, Inc. 200 Harvard Mill Square, Suite 210 Wakefield, MA 01880 Tel (781) 246-3343 Company Contact Timothy R. Oakes, CFO Investor Relations Three Part Advisors Steven Hooser Tel (214) 872-2710 shooser@threepa.com