Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EDGEWATER TECHNOLOGY INC/DE/ | d86388d8k.htm |

Southwest IDEAS Investor Conference November 19, 2015 Exhibit 99.1 This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

Some of the statements in this presentation constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, growth, performance, tax consequences or achievements to be materially different from any future results, levels of activity, growth, performance, tax consequences or achievements expressed or implied by such forward-looking statements. Such factors include, among other things, those listed below. The forward-looking statements included in this presentation are related to future events or the Company's strategies or future financial performance, including statements concerning the Company's 2015 outlook, future revenue and growth, customer spending outlook, general economic trends, IT service demand, future revenue and revenue mix, utilization, new service offerings, significant customers, competitive and strategic initiatives, growth plans, potential stock repurchases, future results, tax consequences and liquidity needs. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "believe," "anticipate," "anticipated," "expectation," "continued," "future," "forward," "potential," "estimate," "estimated," "forecast," "project," "encourage," "opportunity," "goal," "objective," "could," "expect," "expected," "intend," "plan," "planned," "will," "predict," or the negative of such terms or comparable terminology. These forward-looking statements inherently involve certain risks and uncertainties, although they are based on the Company's current plans or assessments which are believed to be reasonable as of the date of this presentation. Factors that may cause actual results, goals, targets or objectives to differ materially from those contemplated, projected, forecasted, estimated, anticipated, planned or budgeted in such forward-looking statements include, among others, the following possibilities: (1) failure to obtain new customers or retain significant existing customers; (2) the loss of one or more key executives and/or employees; (3) changes in industry trends, such as a decline in the demand for Enterprise Resource Planning and Enterprise Performance Management solutions, custom development and system integration services and/or declines in industry-wide information technology spending, whether on a temporary or permanent basis and/or delays by customers in initiating new projects or existing project milestones; (4) inability to execute upon growth objectives, including new services and growth in entities acquired by the Company; (5) adverse developments and volatility involving geopolitical or technology market conditions; (6) unanticipated events or the occurrence of fluctuations or variability in the matters identified under "Critical Accounting Policies" in our 2014 Annual Report on Form 10-K; (7) delays in, or the failure of, the Company's sales pipeline being converted to billable work and recorded as revenue; (8) termination by clients of their contracts with the Company or inability or unwillingness of clients to pay for the Company's services, which may impact the Company's accounting assumptions; (9) inability to recruit and retain professionals with the high level of information technology skills and experience needed to provide the Company's services; (10) failure to expand outsourcing services to generate additional revenue; (11) any changes in ownership of the Company or otherwise that would result in a limitation of the net operating loss carry forward under applicable tax laws; (12) future proxy contests could be disruptive and costly, and the possibility that activist stockholders may wage proxy contests or gain representation on or control of the Board of Directors could cause disruption and/or uncertainty to the Company's business, customer relationships and employee retention; (13) the failure of the marketplace to embrace advisory and product-based consulting services; (14) changes in the Company's utilization levels; and/or (15) pending, threatened or future legal proceedings in connection with the unsolicited, all-stock proposal from AMERI Holdings, Inc. to acquire Edgewater for $8.50 per share. In evaluating these statements, you should specifically consider various factors described above as well as the risks outlined under Part I - Item IA "Risk Factors" in the Company's 2014 Annual Report on Form 10-K filed with the SEC on March 2, 2015. Safe Harbor Language This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

These factors may cause the Company's actual results to differ materially from those contemplated, projected, anticipated, planned or budgeted in any such forward-looking statements. Although the Company believes that the expectations in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, growth, earnings per share or achievements. However, neither the Company nor any other person assumes responsibility for the accuracy and completeness of such statements. Except as otherwise required, the Company undertakes no obligation to update any of the forward-looking statements after the date of this presentation to conform such statements to actual results. Additional Information In connection with the consent solicitation initiated by Lone Star Value Investors, LP, the Company will file a consent revocation statement and other documents regarding the Lone Star proposals with the SEC and will mail a consent revocation statement and a consent revocation card to each stockholder of record entitled to deliver a written consent with respect to the Lone Star proposals. STOCKHOLDERS ARE ENCOURAGED TO READ ANY CONSENT REVOCATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The final consent revocation statement will be mailed to stockholders. Investors and security holders will be able to obtain the documents free of charge at the SEC's website, www.sec.gov, from Edgewater at its website, www.edgewater.com, or 200 Harvard Mill Square, Suite 210, Wakefield, Massachusetts 01880, Attention: Corporate Secretary. Participants in Solicitation The Company and its directors and executive officers may be deemed to be participants in the solicitation of consent revocations in connection with the Lone Star proposals. Information concerning the Company's participants is set forth in the proxy statement, dated April 22, 2015, for its 2015 Annual Meeting of Stockholders as filed with the SEC on Schedule 14A. Additional information regarding the interests of participants of the Company in the solicitation of consent revocations in connection with the Lone Star proposals and other relevant materials will be filed with the SEC when they become available. Safe Harbor Language (Continued) This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

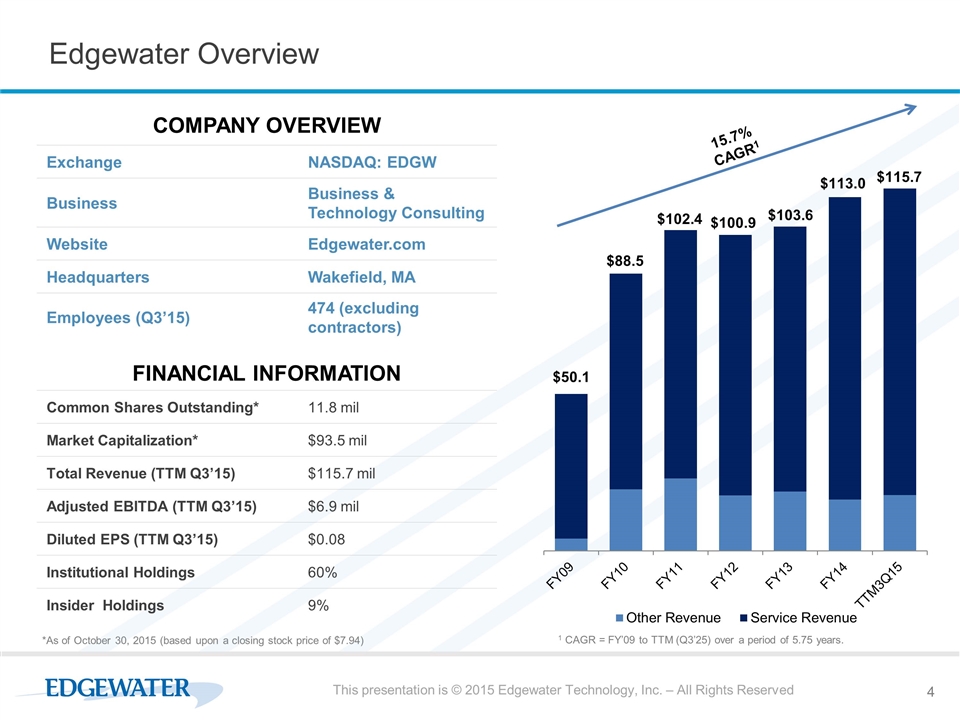

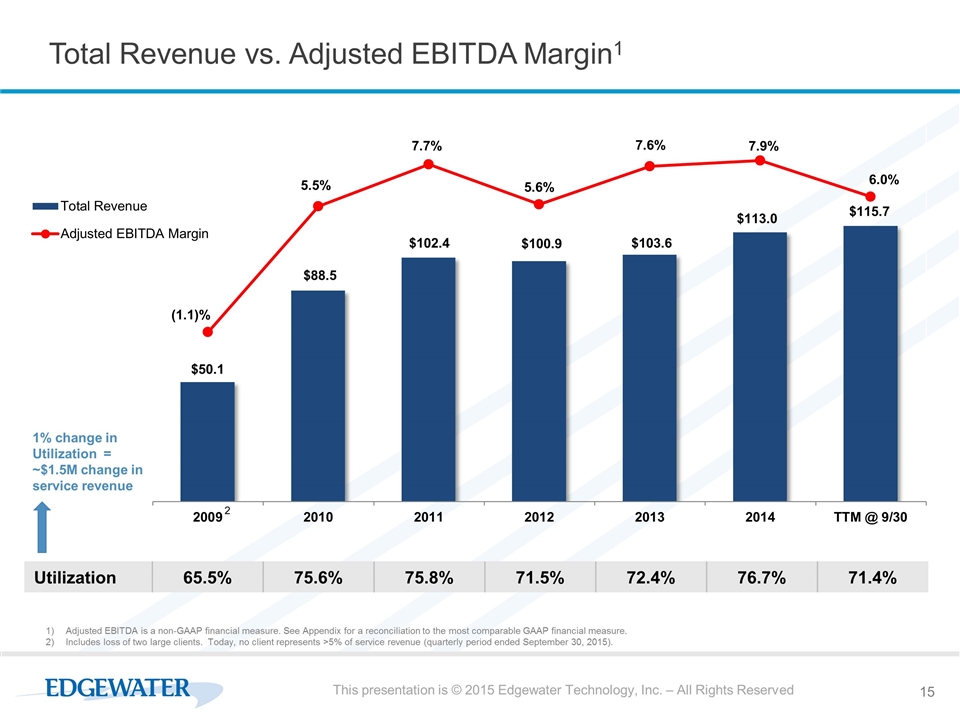

*As of October 30, 2015 (based upon a closing stock price of $7.94) $50.1 $88.5 $102.4 $103.6 $115.7 15.7% CAGR1 COMPANY OVERVIEW Exchange NASDAQ: EDGW Business Business & Technology Consulting Website Edgewater.com Headquarters Wakefield, MA Employees (Q3’15) 474 (excluding contractors) FINANCIAL INFORMATION Common Shares Outstanding* 11.8 mil Market Capitalization* $93.5 mil Total Revenue (TTM Q3’15) $115.7 mil Adjusted EBITDA (TTM Q3’15) $6.9 mil Diluted EPS (TTM Q3’15) $0.08 Institutional Holdings 60% Insider Holdings 9% Edgewater Overview $100.9 1 CAGR = FY’09 to TTM (Q3’25) over a period of 5.75 years. This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

Compelling Investment Opportunity Industry leading position, compelling growth prospects and strong financial profile drive shareholder value Leading Provider of Technology Services and Specialized Product- Based Solutions Uniquely positioned as a strategic and IT consultancy specializing in business advisory, Big Data and Analytics, Enterprise Performance Management (EPM), ERP and CRM systems integration and Cloud technologies Significant service component provides compelling annuity-like revenue stream Value-added client expertise supports higher revenue per consultant Well Positioned to Capitalize on Attractive Industry Dynamics Unprecedented, disruptive change is driving demand for strategic expertise Digitization of entire industries Global increase in the flow of goods, information and capital Stricter regulatory environments Experts with skill-sets in data and analytics, mobility and digitization and cloud computing are rare and highly sought-after Strong Existing Platform and Compelling Growth Opportunities Long-standing relationships with powerhouse channel partners – Microsoft and Oracle Successful acquisition strategy, including recent acquisitions of Branchbird and Zero2Ten, has contributed to recent expansion Opportunity to drive incremental growth through disciplined acquisitions Strong Financial Profile History of revenue growth and margin expansion Strong cash flow and balance sheet with disciplined approach to capital allocation This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

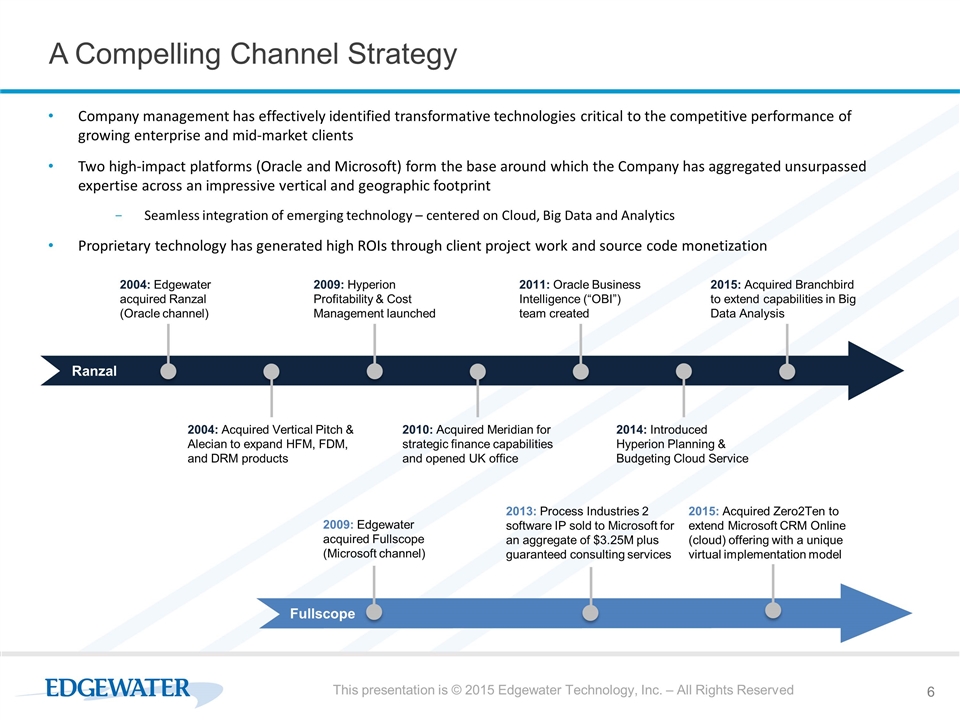

Company management has effectively identified transformative technologies critical to the competitive performance of growing enterprise and mid-market clients Two high-impact platforms (Oracle and Microsoft) form the base around which the Company has aggregated unsurpassed expertise across an impressive vertical and geographic footprint Seamless integration of emerging technology – centered on Cloud, Big Data and Analytics Proprietary technology has generated high ROIs through client project work and source code monetization A Compelling Channel Strategy Ranzal 2004: Edgewater acquired Ranzal (Oracle channel) 2004: Acquired Vertical Pitch & Alecian to expand HFM, FDM, and DRM products 2009: Hyperion Profitability & Cost Management launched 2010: Acquired Meridian for strategic finance capabilities and opened UK office 2014: Introduced Hyperion Planning & Budgeting Cloud Service 2011: Oracle Business Intelligence (“OBI”) team created 2015: Acquired Branchbird to extend capabilities in Big Data Analysis Fullscope 2009: Edgewater acquired Fullscope (Microsoft channel) 2013: Process Industries 2 software IP sold to Microsoft for an aggregate of $3.25M plus guaranteed consulting services 2015: Acquired Zero2Ten to extend Microsoft CRM Online (cloud) offering with a unique virtual implementation model This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

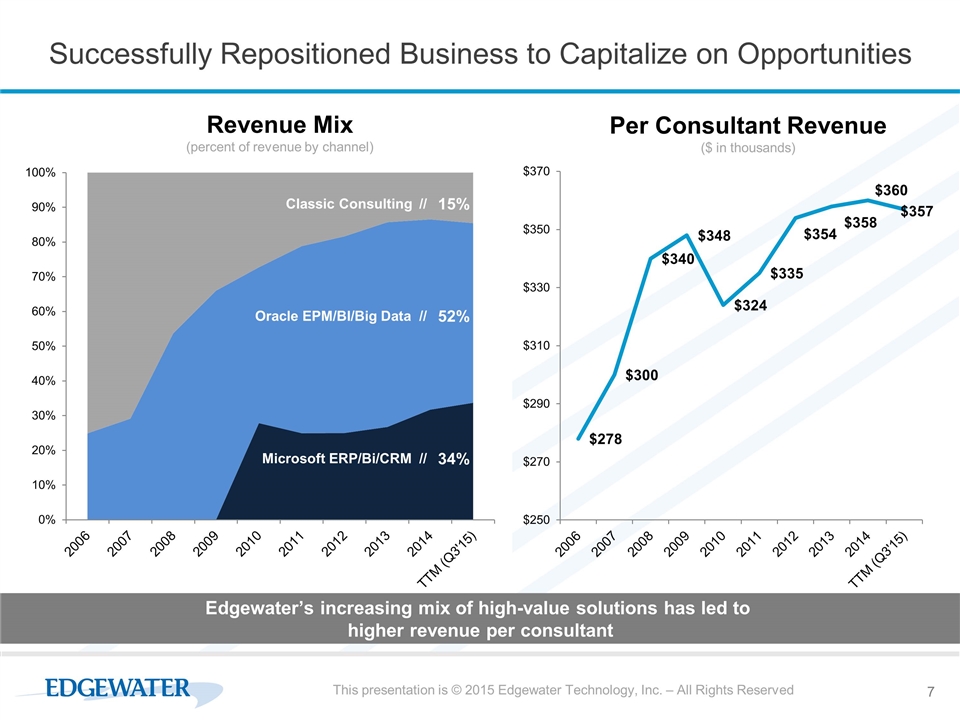

Successfully Repositioned Business to Capitalize on Opportunities Microsoft ERP/Bi/CRM // Revenue Mix (percent of revenue by channel) Per Consultant Revenue ($ in thousands) Edgewater’s increasing mix of high-value solutions has led to higher revenue per consultant Oracle EPM/BI/Big Data // Classic Consulting // This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

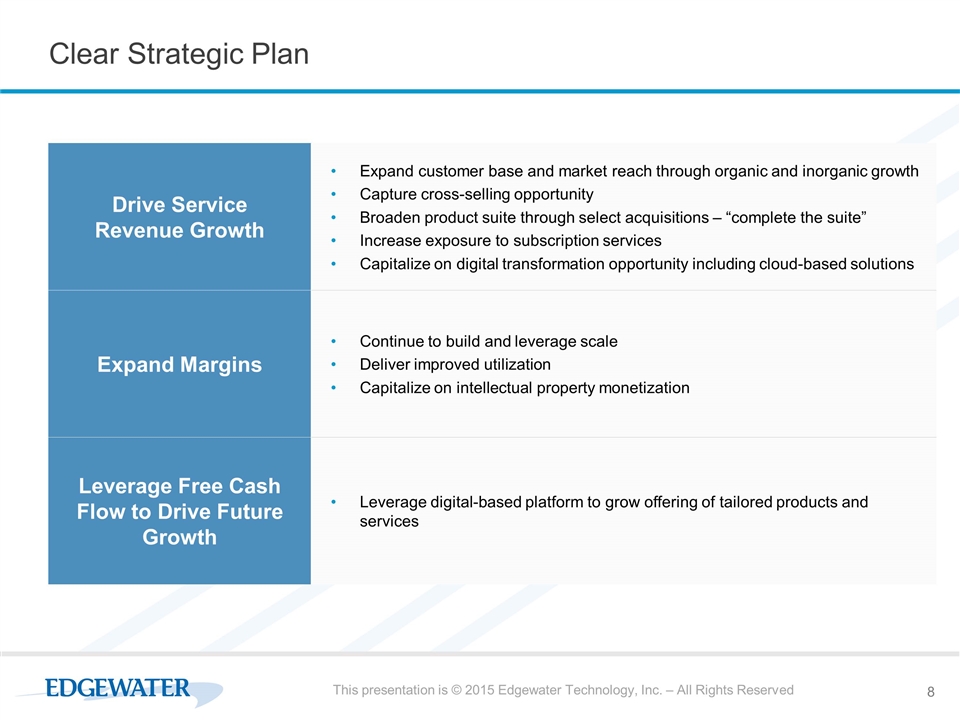

Clear Strategic Plan Drive Service Revenue Growth Expand customer base and market reach through organic and inorganic growth Capture cross-selling opportunity Broaden product suite through select acquisitions – “complete the suite” Increase exposure to subscription services Capitalize on digital transformation opportunity including cloud-based solutions Expand Margins Continue to build and leverage scale Deliver improved utilization Capitalize on intellectual property monetization Leverage Free Cash Flow to Drive Future Growth Leverage digital-based platform to grow offering of tailored products and services This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

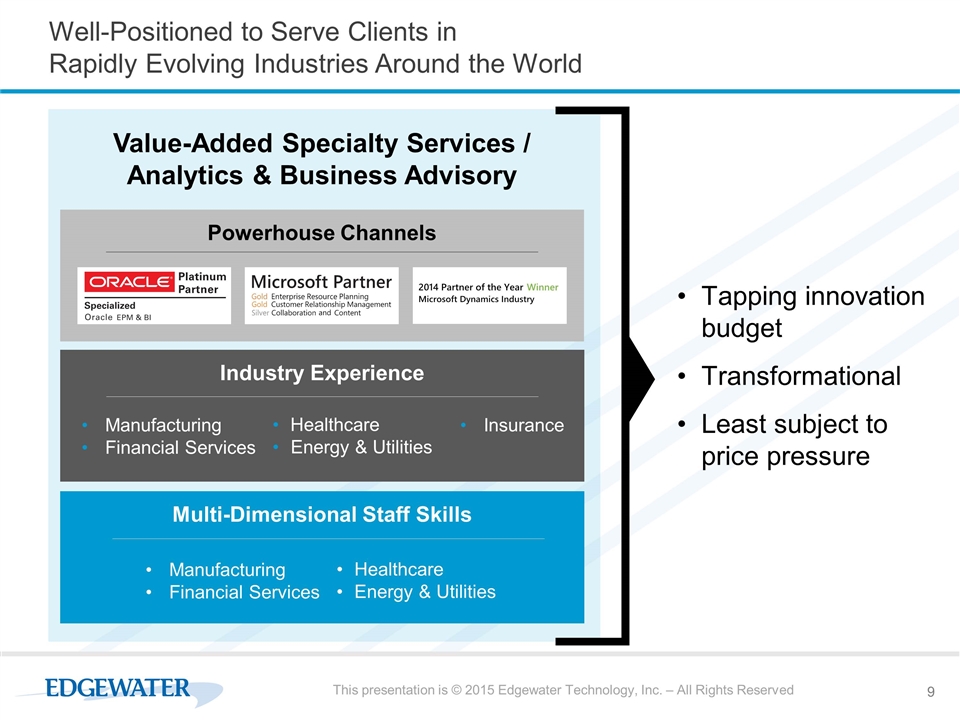

Well-Positioned to Serve Clients in Rapidly Evolving Industries Around the World Value-Added Specialty Services / Analytics & Business Advisory Tapping innovation budget Transformational Least subject to price pressure Powerhouse Channels Industry Experience Manufacturing Financial Services Healthcare Energy & Utilities Insurance Multi-Dimensional Staff Skills Manufacturing Financial Services Healthcare Energy & Utilities This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

Attractive Product Offering and Client Base Department Office of the CFO IT Department Line Business C- Suite Product Offering ERP EPM Planning Budgeting Financial Close Strategic Finance Leverage/Retool Legacy IT Systems Technology Roadmaps Cloud Big Data Web Services and Analytics Business Intelligence Business Advisory Digital Transformation Product Selection and Implementations Data and Analytics CRM Business Advisory Business Process Domain Expertise Digital Transformation Big Data and Analytics Custom Development/ System Integration This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

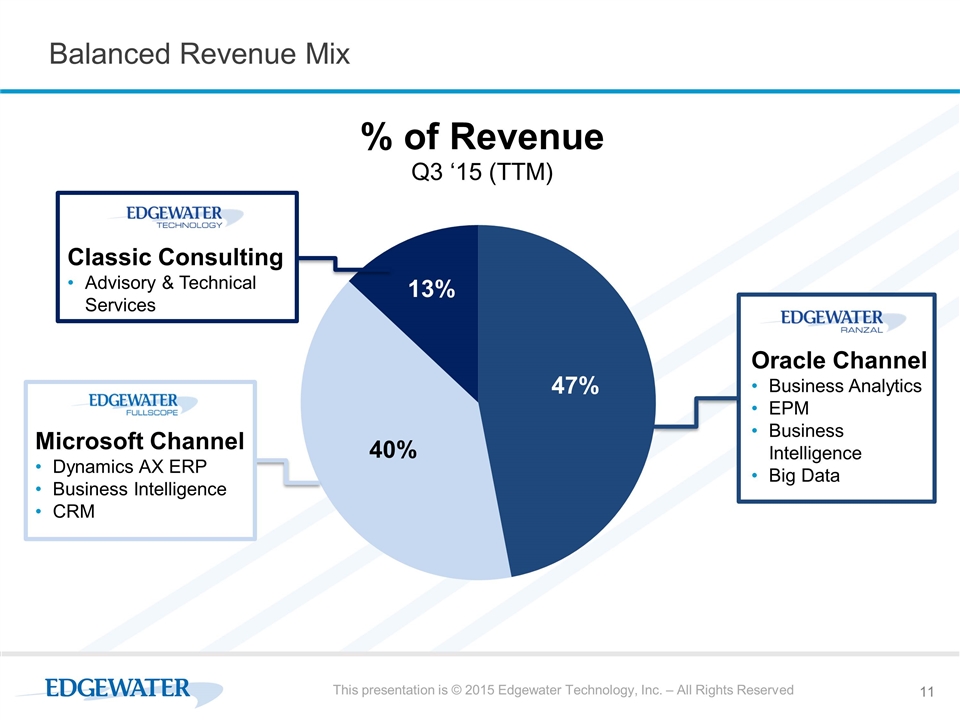

Balanced Revenue Mix Oracle Channel Business Analytics EPM Business Intelligence Big Data Microsoft Channel Dynamics AX ERP Business Intelligence CRM Classic Consulting Advisory & Technical Services This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

Compelling Investment Opportunity Industry leading position, compelling growth prospects and strong financial profile drive long-term shareholder value Leading Provider of Technology Services and Specialized Product- Based Solutions Uniquely positioned as a strategic and IT consultancy specializing in business advisory, Big Data and Analytics, Enterprise Performance Management (EPM), ERP and CRM systems integration, and Cloud technologies Significant service component provides compelling annuity-like revenue stream Value-added client expertise supports higher revenue per consultant Well Positioned to Capitalize on Attractive Industry Dynamics Unprecedented, disruptive change is driving demand for strategic expertise Digitization of entire industries Global increase in the flow of goods, information and capital Stricter regulatory environments Experts with skill-sets in data and analytics, mobility and digitization and cloud computing are rare and highly sought-after Strong Existing Platform and Compelling Growth Opportunities Long-standing relationships with powerhouse channel partners – Microsoft and Oracle Successful acquisition strategy, including recent acquisitions of Branchbird and Zero2Ten, has driven recent expansion Opportunity to drive incremental growth through disciplined acquisitions Strong Financial Profile History of revenue growth and margin expansion Strong cash flow and balance sheet with disciplined approach to capital allocation This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

Contact Information Edgewater Technology, Inc. 200 Harvard Mill Square, Suite 210 Wakefield, MA 01880 Tel (781) 246-3343 Company Contact Timothy R. Oakes, CFO Investor Relations Three Part Advisors Steven Hooser Tel (214) 872-2710 shooser@threepa.com This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

Financial Slides Appendix

Total Revenue vs. Adjusted EBITDA Margin1 Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation to the most comparable GAAP financial measure. Includes loss of two large clients. Today, no client represents >5% of service revenue (quarterly period ended September 30, 2015). Utilization 65.5% 75.6% 75.8% 71.5% 72.4% 76.7% 71.4% 1% change in Utilization = ~$1.5M change in service revenue 2 This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

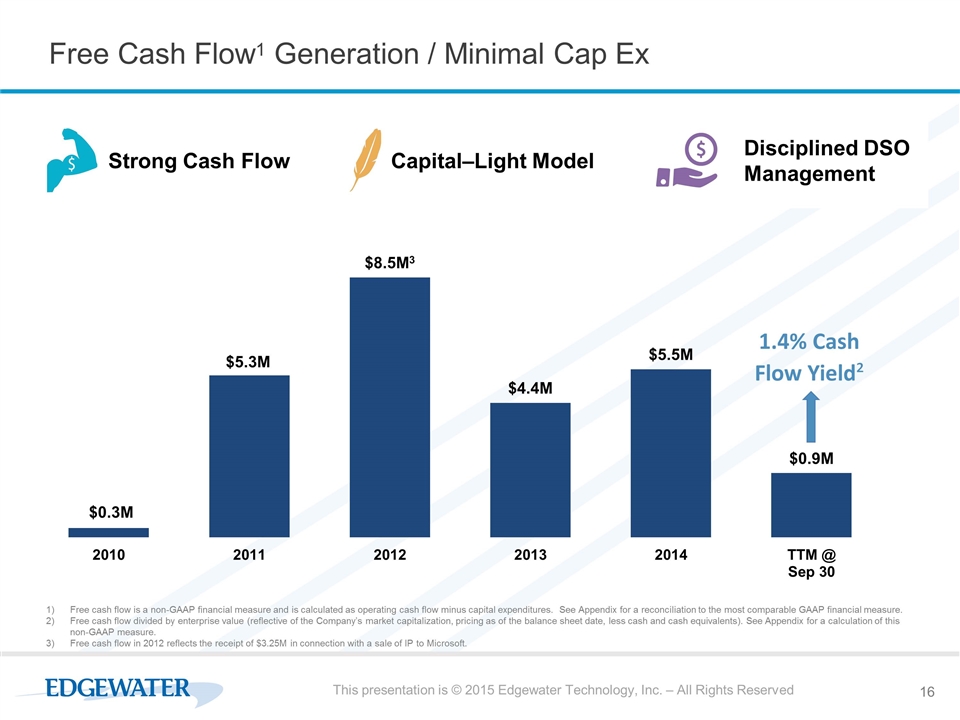

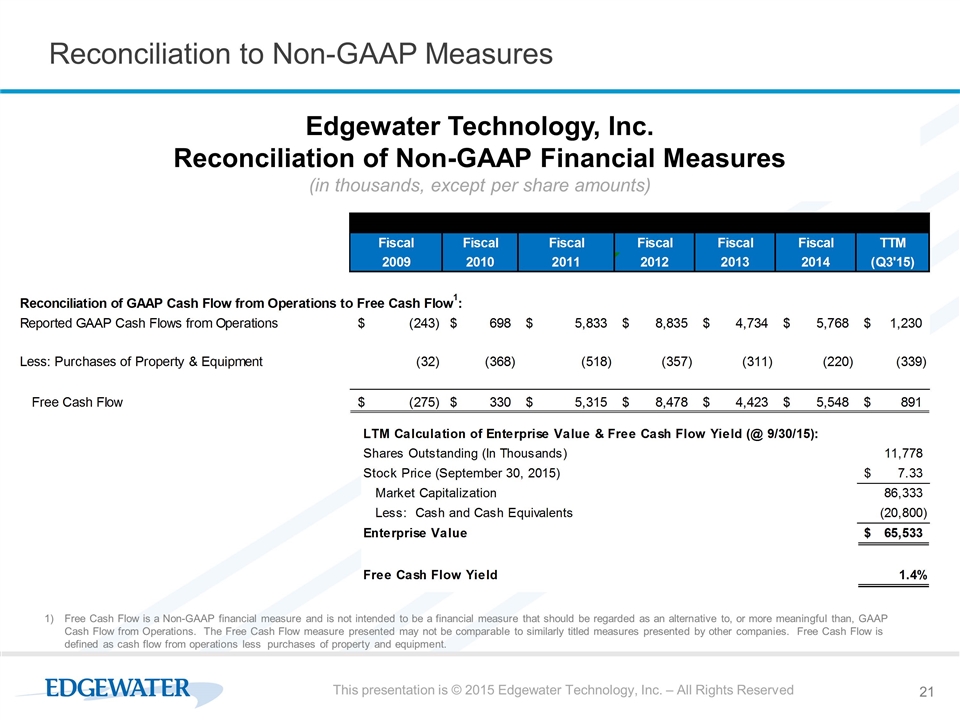

Free Cash Flow1 Generation / Minimal Cap Ex Strong Cash Flow Free cash flow is a non-GAAP financial measure and is calculated as operating cash flow minus capital expenditures. See Appendix for a reconciliation to the most comparable GAAP financial measure. Free cash flow divided by enterprise value (reflective of the Company’s market capitalization, pricing as of the balance sheet date, less cash and cash equivalents). See Appendix for a calculation of this non-GAAP measure. Free cash flow in 2012 reflects the receipt of $3.25M in connection with a sale of IP to Microsoft. 1.4% Cash Flow Yield² Capital–Light Model Disciplined DSO Management This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

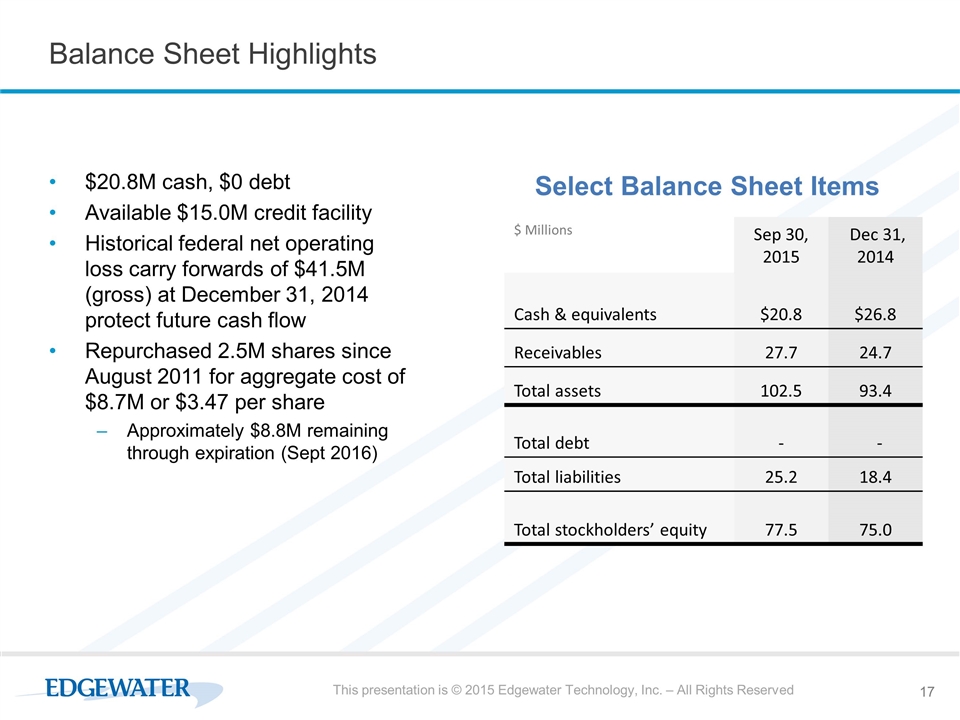

$20.8M cash, $0 debt Available $15.0M credit facility Historical federal net operating loss carry forwards of $41.5M (gross) at December 31, 2014 protect future cash flow Repurchased 2.5M shares since August 2011 for aggregate cost of $8.7M or $3.47 per share Approximately $8.8M remaining through expiration (Sept 2016) Balance Sheet Highlights $ Millions Sep 30, 2015 Dec 31, 2014 Cash & equivalents $20.8 $26.8 Receivables 27.7 24.7 Total assets 102.5 93.4 Total debt - - Total liabilities 25.2 18.4 Total stockholders’ equity 77.5 75.0 Select Balance Sheet Items This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

Edgewater reports its financial results in accordance with generally accepted accounting principles (“GAAP”). Management believes, however, that certain non-GAAP financial measures used in managing the Company’s business may provide users of this financial information with additional meaningful comparisons between current results and prior reported results. Certain of the information set forth herein and certain of the information presented by the Company from time to time may constitute non-GAAP financial measures within the meaning of Regulation G adopted by the Securities and Exchange Commission. We have presented herein a reconciliation of these measures to the most directly comparable GAAP financial measure. The non-GAAP measures presented herein may not be comparable to similarly titled measures presented by other companies. As noted below, the foregoing measures have limitations and do not serve as a substitute and should not be construed as a substitute for GAAP performance, but provide supplemental information concerning our performance that our investors and we find useful. Edgewater views Adjusted EBITDA and Free Cash Flow as important indicators of performance, consistent with the manner in which management measures and forecasts the Company’s performance. We believe Adjusted EBITDA measures are important performance metrics because they facilitate the analysis of our results, exclusive of certain non-cash items, including items which do not directly correlate to our existing business, providing specialty IT services. For instance, the exit of our former significant unrelated operations in 2000 and 2001 created significant net operating loss carry-forwards and deferred tax assets, and the tax provisions that we take under GAAP, for which there is no corresponding federal tax payment obligation for us, and the adjustments that we make to our deferred tax asset, based on the prospects and anticipated future profitability of our ongoing operations, can be significant and can obscure, either significantly, or in part, period-to-period changes in our core operating results. Likewise, we incur direct transaction costs related to acquisitions which are expensed in our GAAP financial statements. Our Adjusted EBITDA calculation excludes the effects of direct acquisition-related costs to facilitate an understanding of comparative period-to-period changes in our core operating results. Similarly, we incurred, and have excluded from our Adjusted EBITDA calculation, costs associated with the Fullscope Embezzlement Issue as we believe that the non-recurring nature of the costs associated with this issue makes comparison of our current and historical financial results difficult. Non-GAAP Financial Measures This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

We believe Free Cash Flow measures are important performance metrics because they provide us with a useful assessment of our liquidity and capital resources. The GAAP measure most directly comparable to Free Cash Flow is cash flow from operations. We use Free Cash Flow for the purpose of determining the amount of cash available for investment in our business, funding strategic acquisitions, repurchasing stock and other purposes. Our Free Cash Flow calculation is the result of cash flow from operations, less purchases of property and equipment. Because Free Cash Flow addresses the effect of capital expenditures that are not reflected in GAAP cash flow from operations, we believes that Free Cash Flow provides a useful assessment of our liquidity and capital resources. We believe that Adjusted EBITDA and Free Cash Flow metrics provide qualitative insight into our current performance; we use these measures to evaluate our results, performance of our management team and our management’s entitlement to incentive compensation (with respect to Adjusted EBITDA); and we believe that making this information available to investors enables them to view our performance the way that we view our performance and thereby gain a meaningful understanding of our core operating results, in general, and from period to period. Non-GAAP Financial Measures (Continued) This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

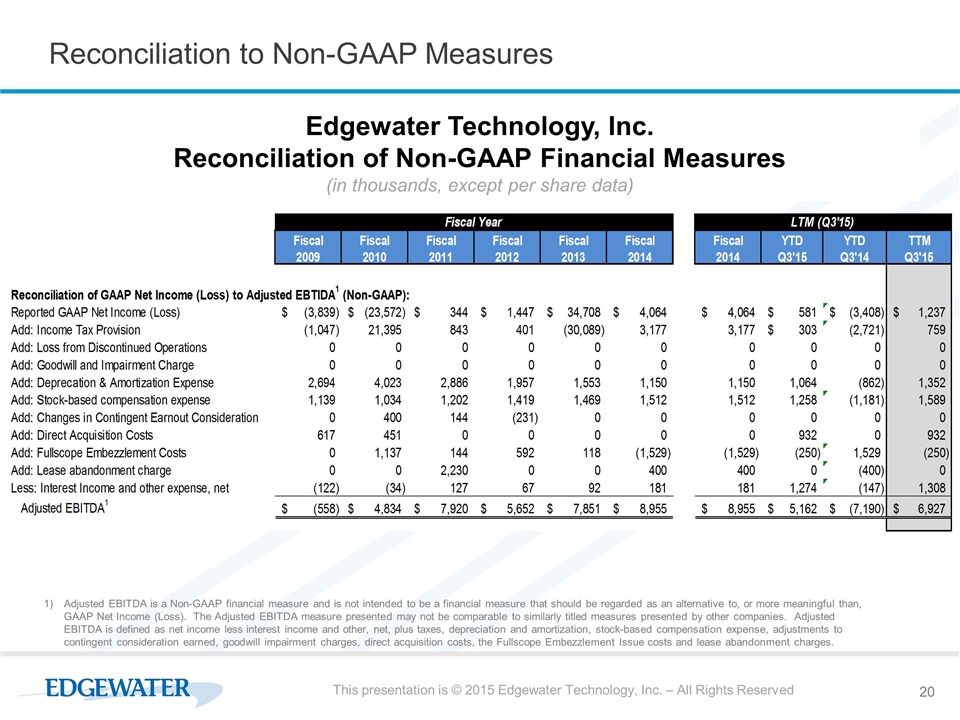

Reconciliation to Non-GAAP Measures Adjusted EBITDA is a Non-GAAP financial measure and is not intended to be a financial measure that should be regarded as an alternative to, or more meaningful than, GAAP Net Income (Loss). The Adjusted EBITDA measure presented may not be comparable to similarly titled measures presented by other companies. Adjusted EBITDA is defined as net income less interest income and other, net, plus taxes, depreciation and amortization, stock-based compensation expense, adjustments to contingent consideration earned, goodwill impairment charges, direct acquisition costs, the Fullscope Embezzlement Issue costs and lease abandonment charges. Edgewater Technology, Inc. Reconciliation of Non-GAAP Financial Measures (in thousands, except per share data) This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved

Reconciliation to Non-GAAP Measures Free Cash Flow is a Non-GAAP financial measure and is not intended to be a financial measure that should be regarded as an alternative to, or more meaningful than, GAAP Cash Flow from Operations. The Free Cash Flow measure presented may not be comparable to similarly titled measures presented by other companies. Free Cash Flow is defined as cash flow from operations less purchases of property and equipment. Edgewater Technology, Inc. Reconciliation of Non-GAAP Financial Measures (in thousands, except per share amounts) This presentation is © 2015 Edgewater Technology, Inc. – All Rights Reserved