Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPIRIT REALTY CAPITAL, INC. | coverinvestorpresentation1.htm |

NYSE:SRC Investor Presentation NOVEMBER 2015

NYSE:SRC TABLE OF CONTENTS 2 Executive Summary Spirit Overview Investment Strategy Portfolio Management Financial Overview Appendix www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC FORWARD-LOOKING STATEMENTS 3 Statements contained in these slides and any accompanying oral presentation by Spirit Realty Capital, Inc. (“Spirit” or the “Company”) that are not strictly historical are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements can be identified by the use of words such as “expects,” “plans,” “estimates,” “projects,” “intends,” “believes,” “guidance,” and similar expressions that do not relate to historical matters. These forward-looking statements are subject to known and unknown risks and uncertainties that can cause actual results to differ materially from those currently anticipated, due to a number of factors which include, but are not limited to, Spirit’s continued ability to source new investments, risks associated with using debt to fund Spirit’s business activities (including refinancing and interest rate risks, changes in interest rates and/or credit spreads and changes in the real estate markets), unknown liabilities acquired in connection with acquired properties, portfolios of properties, or interests in real-estate related entities, risks related to the relocation of our corporate headquarters to Dallas, Texas, general risks affecting the real estate industry (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition and operating performance, and competition from other developers, owners and operators of real estate), risks associated with our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended, and additional risks discussed in Spirit’s most recent filings with the Securities and Exchange Commission from time to time, including Spirit’s Annual Report on Form 10-K. Spirit expressly disclaims any responsibility to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC EXECUTIVE SUMMARY 4 Market Leader in the Net Lease Space Proven Management Team Disciplined Investment Strategy Proactive Portfolio Management Financial Focus Supports Prudent Growth Key Take-Aways www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015

SPIRIT OVERVIEW NYSE:SRC

NYSE:SRC PREMIER NET LEASE REIT 6 $8.3 Billion in Real Estate Investments Solely Focused on U.S. Markets (1) 2,634 Properties Across 49 States, Leased to 435 Tenants Across 27 Industries (1) Proven Single-Tenant Net Lease Retail Investment Strategy Disciplined Underwriting and Asset Management Management Team Has Decades of Real Estate Experience www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015 (1) Includes $106.9 million of commercial loan receivables secured by 145 properties or other related assets. All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

NYSE:SRC WELL-DIVERSIFIED PORTFOLIO 7 www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015 Over $8 billion in real estate investments solely focused on U.S. Markets State % of Normalized Rental Revenue Texas 11.7 % Illinois 6.6 % Georgia 5.9 % California 5.0 % Florida 4.9 % Wisconsin 4.6 % Ohio 4.3 % Tennessee 3.2 % Minnesota 2.9 % North Carolina 2.8 % Indiana 2.7 % Missouri 2.7 % South Carolina 2.6 % Michigan 2.6 % Alabama 2.5 % Virginia 2.5 % Pennsylvania 2.1 % Arizona 2.0 % Colorado 1.9 % Kansas 1.8 % New Mexico 1.7 % Nevada 1.6 % New York 1.5 % Kentucky 1.4 % Oregon 1.3 % State % of Normalized Rental Revenue Washington 1.3 % Massachusetts 1.2 % Iowa 1.2 % Nebraska 1.2 % Oklahoma 1.1 % Idaho 1.0 % Mississippi 1.0 % Utah 0.9 % Arkansas 0.8 % Louisiana 0.8 % New Hampshire 0.8 % Maryland 0.8 % Montana 0.8 % New Jersey 0.8 % West Virginia 0.7 % South Dakota 0.7 % North Dakota 0.5 % Connecticut 0.4 % Maine 0.4 % Wyoming 0.3 % Rhode Island 0.2 % Delaware 0.2 % Vermont 0.1 % Alaska -- Hawaii -- % OF TOTAL NORMALIZED REVENUES 0% - 1% 1% - 2% 2% - 3% 3% - 4% 4% - 5% >5% All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. % OF TOTAL NORMALIZED RENTAL REVENUE

NYSE:SRC Top 10 Tenants (1) Properties Normalized Revenues 153 9.9% 66 3.5% 108 2.9% 20 2.4% 199 2.2% Top 5 Total 546 20.9% 83 1.8% 6 1.8% 37 1.5% 13 1.4% 8 1.3% Top 10 Total 693 28.7% HIGH-QUALITY AND DIVERSE PORTFOLIO WWW.SPIRITREALTY.COM INVESTOR PRESENTATION | NOVEMBER 2015 8 (1)Tenant concentrations are measured by the legal entities ultimately responsible for obligations under lease agreements. Other tenants may operate the same or similar business concepts or brands set forth above. (2) Unit Level Rent Coverage is derived from THE most recent data of tenants who provide unit level financial reporting representing approximately 56% of our rental revenues as of 9/30/15. Spirit does not independently verify financial information provided by its tenants. (3) Includes $106.9 million of commercial loan receivables secured by 145 properties or other related assets. Unit Level Rent Coverage (2) All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. Weighted Average Remaining Lease Term (years) Weighted Average Unit Level Rent Coverage (2) Median Unit Level Rent Coverage 10.8 2.9x 2.3x Spirit Portfolio Properties (3) Occupancy States Tenants Industries 2,634 98.5% 49 435 27 Spirit’s Top 10 Tenants Weighted Average Remaining Lease Term (years) Weighted Average Unit Level Rent Coverage Median Unit Level Rent Coverage 12.1 2.5x 2.4x

NYSE:SRC PROVEN MANAGEMENT TEAM 9 www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015 Thomas H. Nolan, Jr. Chairman & CEO Phillip D. Joseph, Jr. Chief Financial Officer Gregg A. Seibert Chief Investment Officer Mark L. Manheimer EVP Asset Mgmt. 23+ years Real Estate Experience Over $35 Billion of Public and Private Capital Raised in Global Markets Capital Markets, FP&A and Stakeholder Engagement Expertise Finance and Banking Background Previously Global Treasurer of Prologis 27+ years Real Estate and Net Lease Experience Executive at FFCA for 7 years prior to sale to GE Capital Joined Spirit at Inception in 2003 Invested more than $5 billion since 2003 (excludes Cole II) Vast Net Lease Network 15+ years Banking & Real Estate Experience Joined Spirit in 2012 Investment management with strong strategic planning expertise Broad net lease REIT management experience Previously with Cole Real Estate Investments and Realty Income 30+ years Real Estate Investment and Portfolio Management Experience Actively Managed over $75 Billion of Real Estate Transactions Recognized Industry Leader in Portfolio and Risk Management Led Successful Restructuring of General Growth Properties Prior President of AEW Partners Private Real Estate Equity Funds

INVESTMENT STRATEGY NYSE:SRC

NYSE:SRC 11 www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015 FRANCHISE VALUE REAL ESTATE EXPERTISE - Seasoned Acquisitions Team - Vast Deal Network - Salaried – No Commissions - Decades of Real Estate Experience DISCIPLINED UNDERWRITING - Target Non-Cyclical Industries - Target Unit Level Rent Coverage ≥ 2.0x - Target Investments within 10% of Market Rents TENANT FOCUS - Middle-Market Unrated Tenants - Operationally Essential Activities - Primarily Retail SUPERIOR RISK ADJUSTED RETURNS - Sale-Leaseback Transactions - Master Leases - Contractual Rent Escalations - Unit Level Reporting - Portfolio Risk Monitoring $2 Trillion Market Real Estate Underwriting/ Unit Performance Lease Credit Enhancement $2 Trillion Market * *Source: Estimates of the amount of U.S. real estate owned by corporate owner-occupiers, and therefore real estate potentially available for sale-leaseback transactions, range from $1.5 trillion to more than $2.0 trillion of the estimated $5.2 trillion of U.S. commercial real estate assets (by the U.S. Bureau of Economic Analysis). All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

NYSE:SRC DISCIPLINED UNDERWRITING 12 www.spiritrealty.com Speculative Equivalent Non- Investment Grade Investment Grade Small Companies Regional Companies <50 locations $10M - $100M in Annual Sales Middle Market Companies Regional & National Companies 50 – 500 locations $100M - $2B in Annual Sales Large Companies National Companies >500 Locations $2B+ Annual Sales ≤ CC+ B- to BB+ ≥ BBB- Key Investment Criteria Range Average (since 2011) Unit Level Coverage 2.00x to 3.00x 2.60x Lease Structure Master Lease or Spirit Form Lease 70% Rent Escalations 1.25% to 2.00% Annually 1.58% Annually Investment Size $5 to $30 million $12 million INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

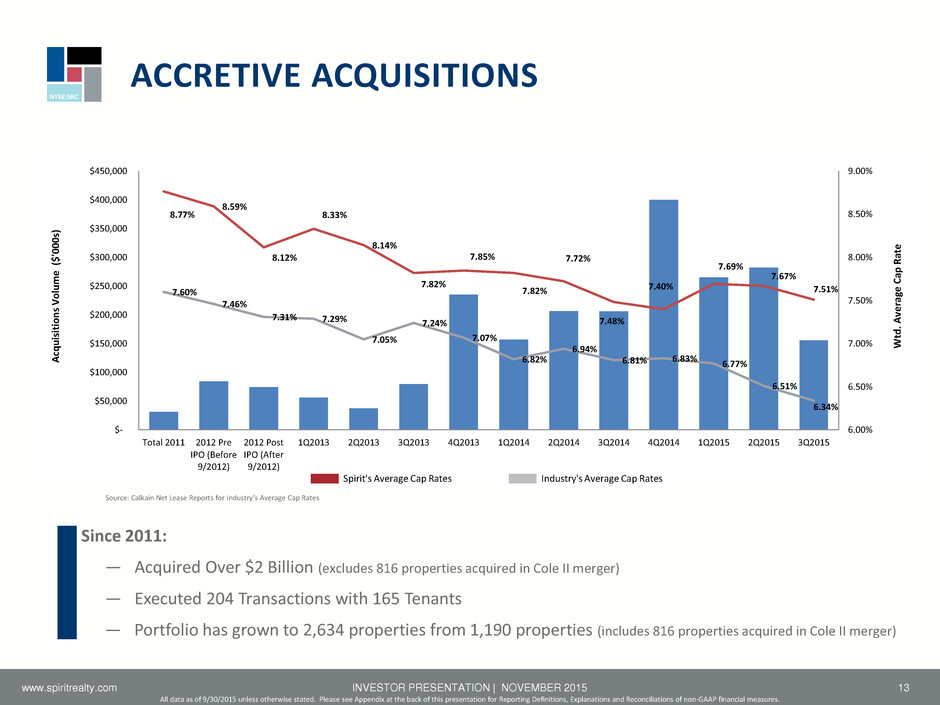

NYSE:SRC 8.77% 8.59% 8.12% 8.33% 8.14% 7.82% 7.85% 7.82% 7.72% 7.48% 7.40% 7.69% 7.67% 7.51%7.60% 7.46% 7.31% 7.29% 7.05% 7.24% 7.07% 6.82% 6.94% 6.81% 6.83% 6.77% 6.51% 6.34% 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% 9.00% $- $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 $450,000 Total 2011 2012 Pre IPO (Before 9/2012) 2012 Post IPO (After 9/2012) 1Q2013 2Q2013 3Q2013 4Q2013 1Q2014 2Q2014 3Q2014 4Q2014 1Q2015 2Q2015 3Q2015 Acq uisi tion s Vo lume ($'0 00s ) Wtd . Av era ge C ap Rat e ACCRETIVE ACQUISITIONS 13 www.spiritrealty.com Since 2011: — Acquired Over $2 Billion (excludes 816 properties acquired in Cole II merger) — Executed 204 Transactions with 165 Tenants — Portfolio has grown to 2,634 properties from 1,190 properties (includes 816 properties acquired in Cole II merger) Source: Calkain Net Lease Reports for Industry’s Average Cap Rates INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. Spirit's Average Cap Rates Industry's Average Cap Rates

NYSE:SRC DIVERSE TENANT INDUSTRIES 14 www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. Industry Number of Properties Total Square Feet (in thousands) Percent of Normalized Rental Revenue General Merchandise 193 11,689 12.6% Restaurants - Casual Dining 399 2,489 10.3% Convenience Stores / Car Washes 272 998 7.4% Restaurants - Quick Service 543 1,429 7.2% Drug Stores / Pharmacies 129 1,663 6.4% Building Materials 169 6,261 5.7% Movie Theatres 48 2,389 5.1% Grocery 71 3,039 4.4% Medical / Other Office 111 1,098 4.2% Sporting Goods 26 2,947 3.9% Health and Fitness 33 1,294 3.3% Automotive Parts and Service 153 993 3.2% Education 50 1,133 2.7% Apparel 13 2,363 2.6% Home Furnishings 30 1,781 2.5% Automotive Dealers 22 680 2.3% Entertainment 16 874 2.3% Home Improvement 12 1,504 2.2% Distribution 13 1,082 1.6% Specialty Retail 22 675 1.6% Consumer Electronics 13 980 1.6% Manufacturing 23 3,664 1.4% Dollar Stores 83 857 1.3% Pet Supplies and Service 4 1,015 1.0% Wholesale Clubs 4 393 * Financial Services 5 390 * Office Supplies 20 464 * Miscellaneous 12 588 * Total 2,489 54,732 100.0% *Less than 1%

PORTFOLIO MANAGEMENT NYSE:SRC

NYSE:SRC PORTFOLIO MANAGEMENT 16 www.spiritrealty.com Probability of Default/Lease Expiration Corporate Performance Corporate EDF (1) (Expected Default Frequency) Probability of Termination Given Default/Expiration Unit Performance Unit Level Rent (2) Coverage Expected Loss on Re-let /Sale Expected Loss Comp Sales/Leases Results = High Occupancy = High Renewal Rate = Infrequent Defaults = Predictable Cash Flows MEASURE PERFORMANCE (1) EDF is calculated through use of Moody’s software based on the tenant’s corporate financials and estimates the probability of default/unrecovered lease expiration. (2) Derived from tenants who provide unit level financial reporting, which represents approximately 56% of our rental revenues as of 9/30/15. Spirit does not independently verify tenant financial information. Spirit’s Weighted Average Portfolio EDF equates to BB+ (1) Spirit’s Weighted Average Unit Level Rent Coverage is 2.9x (2) Spirit Targets Investments Within 10% of Market Rent Asset Management Conducts Site Inspections Prior To and Periodically After Acquisition INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

NYSE:SRC UNIT PERFORMANCE SINCE INCEPTION 17 www.spiritrealty.com Rent Coverage is #1 Indicator of Lease Performance, Lease Acceptance in Restructuring and Lease Renewal Upon Expiration Monitored Through Hold Period with Unit Level Reporting Requirement Enhanced with Master Lease Structure INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

NYSE:SRC MASTER LEASE ATTRIBUTES 18 Multiple Properties – One Lease Payment Greater Protection in Bankruptcy Tenant Must Assume Or Reject Entire Lease Prohibits Tenant From Rejecting Underperforming Properties www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

NYSE:SRC CAPITAL RECYCLING 19 www.spiritrealty.com Dispositions Completed Since IPO to Build a More Diverse, Quality Real Estate Portfolio: Entity Recycled Asset Type Lease Strength Industry Diversification Unit Performance Spirit Finance $509.6 Million Cole Credit Property Trust II $464.2 Million Spirit Realty Capital $ 17.6 Million (all assets sold identified upon portfolio acquisitions) INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. Portfolio Built Through Three Different Investment Philosophies Recycled Assets That Did Not Fit Spirit Realty Capital’s Investment Criteria

NYSE:SRC SUSTAINABLE LEASE PROFILE 20 www.spiritrealty.com Based on Normalized Rental Revenue, 89% of our leases provide for periodic escalations; and 45% of our leases are under Master Lease structures. Lease Expirations as a Percent of Annualized Normalized Rents Lease Escalations as a Percent of Normalized Rental Revenue (Excludes Multi-Tenant Properties) INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. 100% 100% 100% 100% 100% 99% 99% 96% 98% 99% 99% 98% 99% (10%) (8%) (6%) (4%) (2%) 0% 2% 4% 6% 8% 10% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q4-03 Q4-04 Q4-05 Q4-06 Q4-07 Q4-08 Q4-09 Q4-10 Q4-11 Q4-12 Q4-13 Q4-14 Q3-15 Historical Occupancy Rates vs. GDP Growth Rate Spirit Occupancy Rate GDP Growth Y o Y G D P G ro w th R a te S R C O c c u p a n c y R a te

NYSE:SRC HAGGEN UPDATE 21 www.spiritrealty.com The outlook for our portfolio remains constant as Haggen works through their bankruptcy. There is interest from other retail operators in the Spirit-owned units. Haggen has paid October and November rent under the Master Lease while marketing the stores. ― Haggen’s advisors solicited bids based on their own allocations of rent by property, which has hampered the bid process for some stores. INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. Potential Outcomes Likelihood Implications Haggen Assumes the Master Lease Extremely unlikely, as Haggen will not be operating in the footprint of many of the stores Master Lease would remain in place on current terms. Haggen/Spirit Restructure the Master Lease Possible – Relevant parties are in discussions and focused on a mutually beneficial outcome The 20 stores would be leased or sold to a combination of different operators (potentially including a restructured Haggen) identified by Haggen and Spirit. Haggen Rejects the Master Lease Likely if discussions break down This outcome would result in the most flexibility for Spirit to relet assets to tenants of Spirit’s choosing at market rent without need for a 3rd party’s cooperation. Short-term hurdles would include property vacancies and potential TI’s, but we are hopeful that we can quickly backfill the assets based upon the level of interest we have received.

FINANCIAL OVERVIEW NYSE:SRC

NYSE:SRC KEY FOCUS AREAS 23 www.spiritrealty.com LONG-TERM TARGET IPO (09/30/2012) Third Qtr. (09/30/15) Progress Portfolio Quality and Diversification Top 10 Tenancy < 30% 51.7% 28.7% Unit Level Rent Coverage (1) > 2.5X 2.7x 2.9x Tenant Retention ≥ 75% 77% 75% Occupancy ≥ 98% 98% 99% Leverage and Capital Structure Unencumbered Assets as a % of Gross Assets > 40% 3% 36% Adjusted Debt / Annualized Adjusted EBITDA < 7.0x 7.3x 6.8x Adjusted Debt / Enterprise Value < 45% 60% 50% Fixed Charge Coverage Ratio > 2.5x 1.8x 2.9x Diversified Access To Capital Unsecured Debt (2) > 50% <1% 29% (1) Derived from tenants who provide unit level financial reporting, which represents approximately 56% of our rental revenues as of 9/30/15. Spirit does not independently verify tenant financial information. (2) Total committed and funded unsecured debt as a percent of total committed and funded debt. INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

NYSE:SRC FINANCIAL STRENGTH 24 www.spiritrealty.com (1) Includes $106.9 million of commercial loan receivables secured by 145 properties or other related assets. $6 million drawn on $600 million credit facility as of 11/15/2015 Targeting annual debt maturities < 15% of total debt $3.0 billion of unencumbered assets Adjusted Debt /Annualized Adjusted EBITDA of 6.8x Strong access to private and public capital markets ̶ $6.8 billion of capital markets transactions since IPO Fixed Charge Coverage of 2.9x 2,634 total properties with gross investments of $8.3 billion (1) Focus Mitigants Financial Strength Supported by: Market leading, geographically diverse net lease real estate platform High quality, middle market tenants with lease credit enhancements Seasoned investment and asset management disciplines support revenue stability Liquidity and Funding Leverage & Capital Structure Cash Flow INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

NYSE:SRC $96,783 $98,372 $2,307 $407 $1,642 $829 $94,000 $96,000 $98,000 $100,000 $102,000 AFFO GROWTH BUILDING BLOCKS $ in thousands, except per share amounts 25 www.spiritrealty.com (1) Notional AFFO Adjustments assume real estate investments, asset dispositions, and debt extinguished during 3Q-2015 occurred on July 1, 2015. (2) Quarterly contribution of the expected annual contractual cash rent escalations on leases active at September 30, 2015 that are not scheduled to mature on or before September 30, 2016. (3) Represents full quarter interest savings if debt scheduled to mature between July 1, 2015 and September 30, 2016 is refinanced with 4.5% coupon debt. INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. $0.21 $0.22 $0.23 $0.24 $0.2194 $0.2228 $0.2284 Notional AFFO Adjustments (1) Reported 3Q 2015 Notional 3Q 2015 Acquisitions Dispositions Interest Rent Escalations (2) Debt Refinancing (3) Embedded AFFO Growth in the Portfolio is ~4% Organic Growth Drivers • Contractual rent escalations • Refinance high coupon debt • Lower cost of capital External Growth Drivers • Acquisitions • Accretive capital recycling $(1,125) Organic and External Growth Drivers Offer Opportunity For Sustained Growth $0.20

NYSE:SRC 26 DEBT MATURITY PROFILE www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 Rem. 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Thereafter Line of Credit Unsecured Term Loan CMBS Debt Master Trust Convertible Notes NA 6.00% 5.80% 2.78% 3.00% 4.73% 4.56% 5.61% 5.37% NA 4.66% Target smoothing of debt maturities Represents outstanding principal balance of debt by year of maturity, Adjusted for $325M Term Loan issuance, two CMBS partial prepayments of $88 million, and a zero Line of Credit balance. 2015 excludes $80M principal balance outstanding (including $6.9M of capitalized interest) on four CMBS loans in default. Weighted average interest rates reflect the current hedged fixed rate on the variable rate loans, and excludes the default interest rates for the four CMBS loans in default. As of September 30, 2015, Adjusted $ in millions

NYSE:SRC KEY TAKE-AWAYS 27 Premier & Nationally Diverse Net Lease Platform Proven Management Team with Significant Net Lease and Real Estate Expertise Disciplined and Proven Investment and Portfolio Management Disciplines Notably Improved Financial Standing and Well Positioned for Prudent Growth www.spiritrealty.com INVESTOR PRESENTATION | NOVEMBER 2015 All data as of 9/30/2015 unless otherwise stated. Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures.

APPENDIX

NYSE:SRC About Spirit Spirit Realty Capital, Inc. (NYSE:SRC) is a premier net lease real estate investment trust (REIT) that invests in and manages a portfolio primarily of single-tenant, operationally essential real estate assets throughout the United States. Single-tenant, operationally essential real estate generally refers to free-standing, commercial real estate facilities where our tenants conduct business activities that are essential to the generation of their sales and profits. Our properties are frequently acquired through strategic sale- leaseback transactions and predominantly leased on a long-term, triple-net basis to high-quality tenants. Founded in 2003, we are an established net-lease REIT with a proven growth strategy and a seasoned management team focused on producing superior risk adjusted returns. As of September 30, 2015, our undepreciated gross real estate investment portfolio was approximately $8.3 billion, representing investments in 2,634 properties, including properties securing mortgage loans made by the Company. Our properties are leased to approximately 435 tenants who represent 27 diverse industries across 49 states. At September 30, 2015, Spirit’s leases had a weighted average remaining term of 10.8 years. In addition, approximately 45% of Spirit’s annual rental revenues were derived from master leases and approximately 89% of Spirit’s single tenant leases provided for periodic rent increases. www.spiritrealty.com 29 APPENDIX – CORPORATE OVERVIEW INVESTOR RELATIONS CONTACT Mary Jensen – Vice President Investor Relations (480) 315-6604 mjensen@spiritrealty.com All data as of 9/30/2015 unless otherwise stated. APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC INVESTMENT CASE STUDIES 30 www.spiritrealty.com YUM! Franchisee Tenant FQSR, LLC dba KBP Foods Industry Quick Service Restaurants Investment $45 million to acquire 46 KFC / Taco Bell locations in 2 transactions Lease Structure 32 assets with 20-Year Individual NNN Leases 10% escalations every 5 years Concept Taco Bell / KFC Since the time of the original acquisition, FQSR has grown from 69 stores to 278 stores, as of April 2015. Currently, FQSR has 54 new locations in its pipeline. FQSR recently led a buyout of its private equity owners, Boyne Capital, in April 2015. FQSR, LLC dba KBP Foods Revenue Units Time of Acquisition $73.9 M 69 Today $246.5 M 278 APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

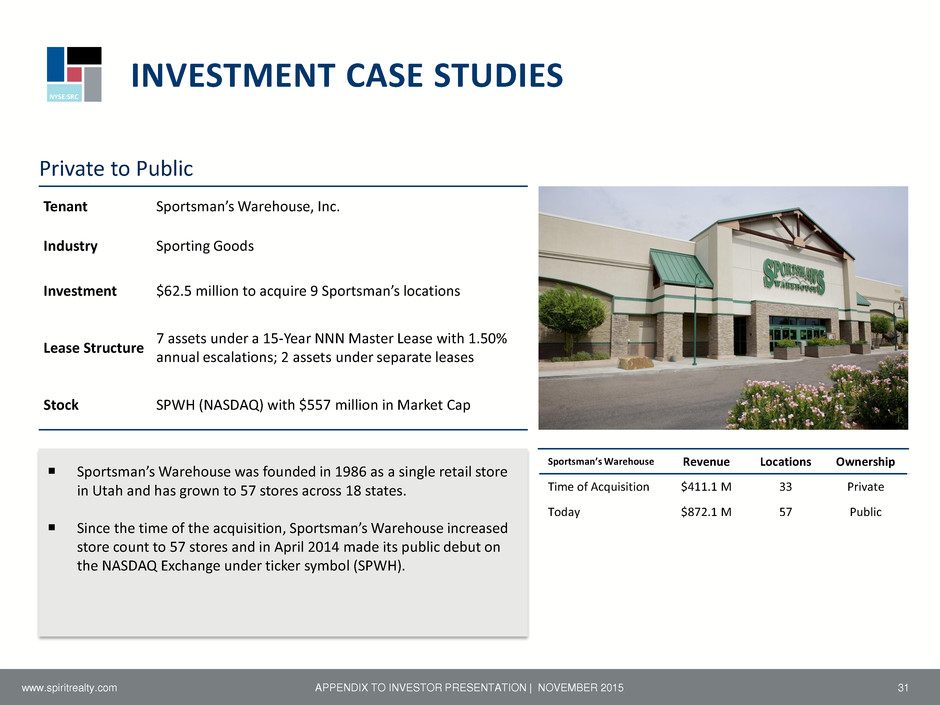

NYSE:SRC INVESTMENT CASE STUDIES 31 www.spiritrealty.com Private to Public Sportsman’s Warehouse was founded in 1986 as a single retail store in Utah and has grown to 57 stores across 18 states. Since the time of the acquisition, Sportsman’s Warehouse increased store count to 57 stores and in April 2014 made its public debut on the NASDAQ Exchange under ticker symbol (SPWH). Sportsman’s Warehouse Revenue Locations Ownership Time of Acquisition $411.1 M 33 Private Today $872.1 M 57 Public Tenant Sportsman’s Warehouse, Inc. Industry Sporting Goods Investment $62.5 million to acquire 9 Sportsman’s locations Lease Structure 7 assets under a 15-Year NNN Master Lease with 1.50% annual escalations; 2 assets under separate leases Stock SPWH (NASDAQ) with $557 million in Market Cap APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC INVESTMENT CASE STUDIES 32 www.spiritrealty.com Car Wash At the time of the acquisition, Mister Car Wash operated 105 car washes and 32 lube centers in nine states; today they operate 157 car washes and 32 lube centers in 18 states. In August 2014, ONCAP sold Mister Car Wash to Leonard Green & Partners, L.P. Car Wash Partners, Inc. is the largest car wash provider in the United States. Car Wash Partners Revenue Locations Ownership Time of Acquisition $162.3 M 137 ONCAP Today $236.7 M 189 Leonard Green & Partners Tenant Car Wash Partners, Inc. or affiliates Industry Car Wash Investment $71.4 million to acquire 17 car wash locations Lease Structure 14 properties 20-year NNN Master Leases with annual escalations of 1.5x CPI capped at 2.0% Concept Mister Car Wash APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

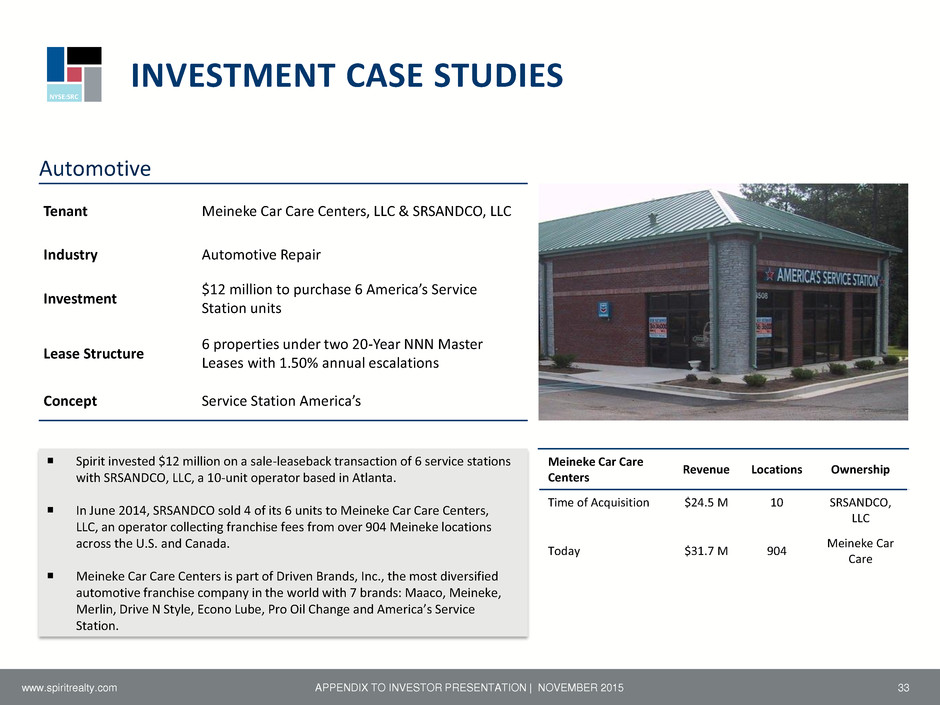

NYSE:SRC INVESTMENT CASE STUDIES 33 www.spiritrealty.com Automotive Spirit invested $12 million on a sale-leaseback transaction of 6 service stations with SRSANDCO, LLC, a 10-unit operator based in Atlanta. In June 2014, SRSANDCO sold 4 of its 6 units to Meineke Car Care Centers, LLC, an operator collecting franchise fees from over 904 Meineke locations across the U.S. and Canada. Meineke Car Care Centers is part of Driven Brands, Inc., the most diversified automotive franchise company in the world with 7 brands: Maaco, Meineke, Merlin, Drive N Style, Econo Lube, Pro Oil Change and America’s Service Station. Meineke Car Care Centers Revenue Locations Ownership Time of Acquisition $24.5 M 10 SRSANDCO, LLC Today $31.7 M 904 Meineke Car Care Tenant Meineke Car Care Centers, LLC & SRSANDCO, LLC Industry Automotive Repair Investment $12 million to purchase 6 America’s Service Station units Lease Structure 6 properties under two 20-Year NNN Master Leases with 1.50% annual escalations Concept Service Station America’s APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC INVESTMENT CASE STUDIES 34 www.spiritrealty.com Movie Theater Case Study Spirit invested $79.6 million on a sale-leaseback transaction of 9 theaters with Georgia Theatre Company Group, a 30-unit operator in Georgia, South Carolina, Virginia and Florida. In September 2015, Georgia Theatre sold 5 of the 9 Spirit-owned units to Regal Cinemas, Inc., a subsidiary of Regal Entertainment Group, the largest and most geographically diverse theater circuit in the United States, operating over 569 sites and generating $3.0 billion in annual revenue. Georgia Theatre Company Group Revenue Locations Ownership Time of Acquisition $69.1 M 30 Private Today $3.0 B 569 Public Tenant Regal Cinemas, Inc. & Georgia Theatre Company Group Industry Movie Theaters Investment $79.6 million to purchase 9 theaters Lease Structure 5 assets under two 15-Year NNN Master Leases with 1.25% annual escalations; 2 assets under separate leases Concept Georgia Theatres APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC APPENDIX – REPORTING DEFINITIONS AND EXPLANATIONS 35 www.spiritrealty.com Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO) We calculate FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts, or NAREIT. FFO represents net income (loss) attributable to common stockholders (computed in accordance with GAAP), excluding real estate-related depreciation and amortization, impairment charges and net losses (gains) from property dispositions. FFO is a supplemental non-GAAP financial measure. We use FFO as a supplemental performance measure because we believe that FFO is beneficial to investors as a starting point in measuring our operational performance. Specifically, in excluding real estate-related depreciation and amortization, gains and losses from property dispositions and impairment charges, which do not relate to or are not indicative of operating performance, FFO provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of the performance of equity REITs, FFO will be used by investors as a basis to compare our operating performance with that of other equity REITs. However, because FFO excludes depreciation and amortization and does not capture the changes in the value of our properties that result from use or market conditions, all of which have real economic effects and could materially impact our results from operations, the utility of FFO as a measure of our performance is limited. In addition, other equity REITs may not calculate FFO as we do, and, accordingly, our FFO may not be comparable to such other equity REITs’ FFO. Accordingly, FFO should be considered only as a supplement to net income (loss) attributable to common stockholders as a measure of our performance. AFFO is a non-GAAP financial measure of operating performance used by many companies in the REIT industry. We adjust FFO to eliminate the impact of certain items that we believe are not indicative of our core operating performance, including merger and finance restructuring costs, default interest on non-recourse mortgage indebtedness, debt extinguishment gains (losses), transaction costs incurred in connection with the acquisition of real estate investments subject to existing leases and certain non-cash items. These certain non-cash items include non-cash revenues (comprised of straight-line rents, amortization of above and below market rent on our leases, amortization of lease incentives, amortization of net premium (discount) on loans receivable and amortization of capitalized lease transaction costs), non-cash interest expense (comprised of amortization of deferred financing costs and amortization of net debt discount/premium) and non-cash compensation expense (stock-based compensation expense). In addition, other equity REITs may not calculate AFFO as we do, and, accordingly, our AFFO may not be comparable to such other equity REITs’ AFFO. AFFO does not represent cash generated from operating activities determined in accordance with GAAP, is not necessarily indicative of cash available to fund cash needs and should not be considered as an alternative to net income (determined in accordance with GAAP) as a performance measure. APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC APPENDIX – REPORTING DEFINITIONS AND EXPLANATIONS 36 www.spiritrealty.com Adjusted EBITDA represents EBITDA, or earnings before interest, taxes, depreciation and amortization, modified to include other adjustments to GAAP net income (loss) attributable to common stockholders for real estate acquisition costs, impairment losses, gains/losses from the sale of real estate and debt transactions and other items that we do not consider to be indicative of our on- going operating performance. We focus our business plans to enable us to sustain increasing shareholder value. Accordingly, we believe that excluding these items, which are not key drivers of our investment decisions and may cause short-term fluctuations in net income, provides a useful supplemental measure to investors and analysts in assessing the net earnings contribution of our real estate portfolio. Because these measures do not represent net income (loss) that is computed in accordance with GAAP, they should not be considered alternatives to net income (loss) or as an indicator of financial performance. Annualized Adjusted EBITDA is calculated by multiplying Adjusted EBITDA of a quarter by four. Our computation of Adjusted EBITDA and Annualized Adjusted EBITDA may differ from the methodology used by other equity REITs to calculate these measures, and, therefore, may not be comparable to such other REITs. A reconciliation of net income (loss) attributable to common stockholders (computed in accordance with GAAP) to EBITDA, Adjusted EBITDA and Annualized Adjusted EBITDA is included in the Appendix found at the end of this presentation. Adjusted Debt represents interest bearing debt (reported in accordance with GAAP) adjusted to exclude unamortized debt discount/premium and deferred financing costs, as further reduced by cash and cash equivalents as well as cash reserves on deposit with lenders as additional security. By excluding unamortized debt discount/premium and deferred financing costs, cash and cash equivalents, and cash reserves on deposit with lenders as additional security, the result provides an estimate of the contractual amount of borrowed capital to be repaid, net of cash available to repay it. We believe this calculation constitutes a beneficial supplemental non-GAAP financial disclosure to investors in understanding our financial condition. Adjusted Debt to Annualized Adjusted EBITDA is a supplemental non-GAAP financial measure we use to evaluate the level of borrowed capital being used to increase the potential return of our real estate investments, and a proxy for a measure we believe is used by many lenders and ratings agencies to evaluate our ability to repay and service our debt obligations over time. We believe this ratio is a beneficial disclosure to investors as a supplemental means of evaluating our ability to meet obligations senior to those of our equity holders. Our computation of this ratio may differ from the methodology used by other equity REITs, and, therefore, may not be comparable to such other REITs. A reconciliation of interest bearing debt (reported in accordance with GAAP) to Adjusted Debt is included in the Appendix found at the end of this presentation. Annualized Rents represents the annualized monthly contractual cash rent of a lease at a specified period. Capitalization Rate represents the Annualized Rent on the date of a property disposition divided by the gross sales price. For Multi-Tenant properties, non- reimbursable property costs are deducted from the Annualized Rent prior to computing the disposition Capitalization Rate. Convertible Notes are those $402.5 million convertible notes of the Company due in 2019 and the $345.0 million convertible notes of the Company due in 2021, together. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. CMBS are those notes secured by commercial real estate and rents therefrom under which certain indirect special purpose entity subsidiaries of the Company are the borrower. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC APPENDIX – REPORTING DEFINITIONS AND EXPLANATIONS 37 www.spiritrealty.com Enterprise Value represents Total Market Capitalization less cash and cash equivalents as of the date indicated. Equity Market Capitalization is calculated by multiplying the number of shares outstanding by the closing share price of the Company’s common stock as of the date indicated. Fixed Charge Coverage Ratio (FCCR) is the ratio of Annualized Adjusted EBITDA to Annualized Fixed Charges, a ratio derived from non-GAAP measures that we use to evaluate our liquidity and ability to obtain financing. Fixed charges consist of interest expense, reported in accordance with GAAP, less non-cash interest expense. Annualized fixed charges is calculated by multiplying fixed charges for the quarter by four. Initial Cash Yield from properties is calculated by dividing the first twelve months of contractual cash rent (excluding any future rent escalations provided subsequently in the lease) by the Gross Investment in the related properties. Initial cash yield is a measure (expressed as a percentage) of the contractual cash rent expected to be earned on an acquired property in the first year. Because it excludes any future rent increases or additional rent that may be contractually provided for in the lease, as well as any other income or fees that may be earned from lease modifications or asset dispositions, Initial Cash Yield does not represent the annualized investment rate of return of our acquired properties. Additionally, actual contractual cash rent earned from the properties acquired may differ from the Initial Cash Yield based on other factors, including difficulties collecting anticipated rental revenues and unanticipated expenses at these properties that we cannot pass on to tenants, as well as the risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2014. Lease Expiration is the end of the initial term under a lease and does not account for extension periods under the lease. Master Trust Notes are those net-lease mortgage notes issued under the Spirit Master Funding Program and the securitization trusts established thereunder. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. Normalized Revenue, Normalized Rental Revenue, and Portfolio Composition Calculations represent Spirit's portfolio composition metrics, which are calculated based upon the assets held on the referenced date. Normalized Revenue percentages are calculated based on total revenue during the referenced quarterly period, adjusted to exclude revenues derived from properties sold during that period. Normalized Rental Revenue percentages are calculated based on total rental revenue during the referenced monthly period, adjusted to exclude rental revenues derived from properties sold during that period. We use these numbers to evaluate the diversity of our asset portfolio and to assist us in assessing and managing credit, asset type, industry and geographic risk. Occupancy is calculated by dividing the number of occupied, owned properties in the portfolio as of the measurement date by the number of total owned properties on said date. Owned Properties refers to properties owned in fee or ground leased by Company subsidiaries as lessee. Revolving Credit Facilities include (a) the $600 million unsecured credit facility which matures on March 31, 2019 (“2015 Credit Facility”), and (b) a $40 million secured revolving line of credit which expires on March 31, 2016 (“Line of Credit”). The 2015 Credit Facility includes sublimits for swingline loans and letter of credit issuances. Swingline loans and letters of credit reduce availability under the 2015 Credit Facility. The ability to borrow under these Revolving Credit Facilities is subject to the ongoing compliance with customary financial covenants. APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC APPENDIX – REPORTING DEFINITIONS AND EXPLANATIONS 38 www.spiritrealty.com Total Market Capitalization represents Equity Market Capitalization plus Total Debt as of the date indicated. Total Debt represents the sum of the principal balances outstanding on interest-bearing debt on the Company’s balance sheet as of the date indicated. Unencumbered Assets represents the assets in our portfolio that are not subject to mortgage indebtedness, which we use to evaluate our potential access to capital and in our management of financial risk. The asset value attributed to these assets is the Real Estate Investment. Unsecured Debt represents components of Total Debt that are not secured by liens, mortgages or deeds of trust on Company assets. Unit Level Rent Coverage is used as an indicator of individual asset profitability, as well as signaling the property’s importance to our tenants’ financial viability. We calculate this ratio by dividing our reporting tenants’ trailing 12-month EBITDAR (earnings before interest, tax, depreciation, amortization and rent) by annual contractual rent. Weighted Average Remaining Lease Term is calculated by dividing the sum product of (a) a stated revenue or sales price component and (b) the lease term for each lease by (c) the sum of the total revenue or sale price components for all leases within the sample. Weighted Average Stated Interest Rate is calculated by dividing the sum product of (a) coupon interest rate of each note and (b) the principal balance outstanding of each note by (c) the sum of the total principal balances outstanding for all notes in the sample. APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015

NYSE:SRC 39 APPENDIX – NON-GAAP RECONCILIATIONS $ in thousands www.spiritrealty.com APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015 Adjusted Debt, Adjusted EBITDA, Annualized Adjusted EBITDA Q1 2015 Q2 2015 Q3 2015 Revolving Credit Facilities, net $185,022 $20,000 $75,000 Mortgage and notes payable, net 3,456,609 3,291,679 3,242,922 Convertible Notes, net 681,109 684,066 687,062 Total Debt, net 4,322,740 3,995,745 4,004,984 Add / (less): Preferred stock — — — Unamortized debt (premium) discount, net 54,574 54,247 54,181 Unamortized deferred financing costs 44,995 42,870 41,183 Cash and cash equivalents (108,134 ) (39,674 ) (28,210 ) Cash reserves on deposit with lenders classified as other assets (45,010 ) (23,716 ) (24,578 ) Total Adjustments (53,575 ) 33,727 42,576 Adjusted Debt $4,269,165 $4,029,472 $4,047,560 Net income attributable to common stockholders $25,324 $60,891 $17,167 Add / (less): Interest 57,914 56,167 54,673 Depreciation and amortization 66,296 64,671 64,493 Income tax expense 362 161 184 Total Adjustments 124,572 120,999 119,350 EBITDA 149,896 181,890 136,517 Add / (less): Real estate acquisition costs 1,093 453 576 Impairments 1,555 33,775 20,434 Gains on sales of real estate assets (11,338 ) (63,278 ) (7,962 ) Losses (gains) on debt extinguishment 1,230 (3,377 ) (342 ) Total Adjustments (7,460 ) (32,427 ) 12,706 Adjusted EBITDA 142,436 149,463 149,223 Annualized Adjusted EBITDA $569,744 $597,852 $596,892 Adjusted Debt / Annualized Adjusted EBITDA 7.5x 6.7x 6.8 x Enterprise Value $9,368,460 $8,322,618 $8,106,635 Adjusted Debt / Enterprise Value 45.6 % 48.4 % 49.9 % Fixed Charge Coverage Ratio (FCCR) Q1 2015 Q2 2015 Q3 2015 Annualized Adjusted EBITDA $569,744 $597,852 $596,892 Interest Expense 57,914 56,167 54,673 Less: Non-cash interest (2,576 ) (2,590 ) 2,478 Fixed charges $55,338 $53,577 $52,195 Annualized Fixed Charges $221,352 $214,308 $208,780 Fixed Charge Coverage Ratio 2.6 x 2.8 x 2.9 x Unencumbered Assets to Unsecured Debt Q1 2015 Q2 2015 Q3 2015 Unsecured Debt: Credit Facilities $170,000 $20,000 $75,000 Convertible Notes 747,500 747,500 747,500 Other Unsecured Note 1,269 1,232 — Total Unsecured Debt $918,769 $768,732 $822,500 Unencumbered Assets $2,527,449 $2,838,515 $2,970,913 Unencumbered Assets / Unsecured Debt 2.8 x 3.7 x 3.6 x Notice Regarding Non-GAAP Financial Measures In addition to U.S. GAAP financial measures, this presentation contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this Appendix if the reconciliation is not presented on the page in which the measure is published.

NYSE:SRC 40 APPENDIX – NON-GAAP RECONCILIATIONS $ in thousands, except per share amounts www.spiritrealty.com APPENDIX TO INVESTOR PRESENTATION | NOVEMBER 2015 FUNDS AND ADJUSTED FUNDS FROM OPERATIONS (FFO/AFFO) (Unaudited) THREE MONTHS ENDED SEPTEMBER 30, NINE MONTHS ENDED SEPTEMBER 30, 2015 2014 2015 2014 Net Income (Loss) Attributable to Common Stockholders $17,167 $7,670 $103,382 ($67,912 ) Portfolio Depreciation and Amortization - Continuing Operations 64,399 61,973 195,178 184,302 Portfolio Impairments - Continuing Operations 20,434 12,727 55,730 42,061 Portfolio Impairments - Discontinued Operations — — 34 — Realized Gains on Sales of Real Estate (1) (7,962 ) (1,654 ) (82,578 ) (2,171 ) Funds From Operations $94,038 $80,716 $271,746 $156,280 (Gain) Loss on Debt Extinguishment (342 ) (212 ) (2,489 ) 64,496 Master Trust Exchange Costs — (11 ) — 13,022 Real Estate Acquisition Costs 576 865 2,122 2,372 Non-Cash Interest Expense 2,478 2,042 7,644 3,362 Accrued Interest on Defaulted Loans 1,960 1,217 5,412 1,217 Non-Cash Revenues (5,396 ) (4,533 ) (15,947 ) (12,877 ) Non-Cash Compensation Expense 3,469 3,019 10,757 8,503 Adjusted Funds From Operations $96,783 $83,103 $279,245 $236,375 Dividends Declared to Common Stockholders $75,040 $66,262 $221,225 $194,199 Net Income (Loss) Per Share of Common Stock Basic (3) $0.04 $0.02 $0.24 ($0.18 ) Diluted (2) (3) $0.04 $0.02 $0.24 ($0.18 ) FFO Per Share of Common Stock - Diluted Diluted (2) (3) $0.21 $0.20 $0.63 $0.41 AFFO Per Share of Common Stock - Diluted Diluted (2) (3) $0.22 $0.21 $0.65 $0.61 Weighted Average Shares of Common Stock Outstanding: Basic 440,205,348 396,807,656 429,387,707 382,525,614 Diluted 440,353,965 397,613,583 429,738,776 383,266,751 (1) Realized Gains on Sales of Real Estate include amounts related to discontinued operations. (2) Assumes the issuance of potentially issuable shares unless the result would be anti-dilutive. (3) For the three months ended September 30, 2015 and 2014, dividends paid to unvested restricted shareholders of $0.1 million and $0.2 million, respectively, and for the nine months ended September 30, 2015 and 2014, dividends paid to unvested restricted shareholders of $0.6 million and $0.9 million, respectively, are deducted from Net Income, FFO and AFFO attributable to common stockholders in the computation of per share amounts. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements.