Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - SPIRIT REALTY CAPITAL, INC. | a2018q3exhibit322906ceocfo.htm |

| EX-32.1 - EXHIBIT 32.1 - SPIRIT REALTY CAPITAL, INC. | a2018q3exhibit321906ceocfo.htm |

| EX-31.4 - EXHIBIT 31.4 - SPIRIT REALTY CAPITAL, INC. | a2018q3exhibit314302cfosrlp.htm |

| EX-31.3 - EXHIBIT 31.3 - SPIRIT REALTY CAPITAL, INC. | a2018q3exhibit313302ceosrlp.htm |

| EX-31.2 - EXHIBIT 31.2 - SPIRIT REALTY CAPITAL, INC. | a2018q3exhibit312302cfosc.htm |

| EX-31.1 - EXHIBIT 31.1 - SPIRIT REALTY CAPITAL, INC. | a2018q3exhibit311302ceosc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2018

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

Spirit Realty Capital, Inc. 001-36004

Spirit Realty, L.P. 333-216815-01

___________________________________________________________

SPIRIT REALTY CAPITAL, INC.

SPIRIT REALTY, L.P.

(Exact name of registrant as specified in its charter)

_______________________________________________

Spirit Realty Capital, Inc. | Maryland | 20-1676382 | ||

Spirit Realty, L.P. | Delaware | 20-1127940 | ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |||

2727 North Harwood Street, Suite 300, Dallas, Texas 75201 | (972) 476-1900 | |||

(Address of principal executive offices; zip code) | (Registrant’s telephone number, including area code) | |||

(Former name, former address and former fiscal year, if changed since last report)

__________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Spirit Realty Capital, Inc. Yes x No o | Spirit Realty, L.P. Yes x No o |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Spirit Realty Capital, Inc. Yes x No o | Spirit Realty, L.P. Yes x No o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Spirit Realty Capital, Inc.

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o |

Smaller reporting company o | Emerging growth company o |

Spirit Realty, L.P.

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x |

Smaller reporting company o | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Spirit Realty Capital, Inc. o | Spirit Realty, L.P. o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Spirit Realty Capital, Inc. Yes o No x | Spirit Realty, L.P. Yes o No x |

As of November 7, 2018, there were 428,476,552 shares of common stock, par value $0.01, of Spirit Realty Capital, Inc. outstanding.

Explanatory Note

This report combines the quarterly reports on Form 10-Q for the three and nine months ended ended September 30, 2018 of Spirit Realty Capital, Inc., a Maryland corporation, and Spirit Realty, L.P., a Delaware limited partnership. Unless otherwise indicated or unless the context requires otherwise, all references in this report to “we,” “us,” “our,” or the “Company” refer to Spirit Realty Capital, Inc. together with its consolidated subsidiaries, including Spirit Realty, L.P. Unless otherwise indicated or unless the context requires otherwise, all references to the “Operating Partnership” refer to Spirit Realty, L.P. together with its consolidated subsidiaries.

Spirit General OP Holdings, LLC ("OP Holdings") is the sole general partner of the Operating Partnership. The Company is a real estate investment trust ("REIT") and the sole member of OP Holdings, as well as the special limited partner of the Operating Partnership. As sole member of the general partner of our Operating Partnership, our Company has the full, exclusive and complete responsibility for our Operating Partnership’s day-to-day management and control.

We believe combining the quarterly reports on Form 10-Q of our Company and Operating Partnership into a single report results in the following benefits:

• | enhancing investors’ understanding of our Company and Operating Partnership by enabling investors to view the business as a whole, reflective of how management views and operates the business; |

• | eliminating duplicative disclosure and providing a streamlined presentation as a substantial portion of the disclosures apply to both our Company and Operating Partnership; and |

• | creating time and cost efficiencies by preparing one combined report in lieu of two separate reports. |

There are a few differences between our Company and Operating Partnership, which are reflected in the disclosures in this report. We believe it is important to understand these differences in the context of how we operate as an interrelated, consolidated company. Our Company is a REIT, the only material assets of which are the partnership interests in our Operating Partnership. As a result, our Company does not conduct business itself, other than acting as the sole member of the general partner of our Operating Partnership, issuing equity from time to time and guaranteeing certain debt of our Operating Partnership. Our Operating Partnership holds substantially all the assets of our Company. Our Company issued convertible notes and guarantees some of the debt of our Operating Partnership. See Note 4 to the consolidated financial statements included herein for further discussion. Our Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for net proceeds from the issuance of convertible notes and equity issuances by our Company, which are generally contributed to our Operating Partnership in exchange for partnership units of our Operating Partnership, our Operating Partnership generates the capital required by our Company’s business through our Operating Partnership’s operations or our Operating Partnership’s incurrence of indebtedness.

The presentation of stockholders’ equity and partners’ capital are the main areas of difference between the consolidated financial statements of our Company and those of our Operating Partnership. The partnership units in our Operating Partnership are accounted for as partners’ capital in our Operating Partnership’s consolidated financial statements. There are no non-controlling interests in the Company or the Operating Partnership.

To help investors understand the significant differences between our Company and our Operating Partnership, this report presents the consolidated financial statements separately for our Company and our Operating Partnership. All other sections of this report, including “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Quantitative and Qualitative Disclosures About Market Risk,” are presented together for our Company and our Operating Partnership.

In order to establish that the Chief Executive Officer and the Chief Financial Officer of each entity have made the requisite certifications and that our Company and Operating Partnership are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934, or the Exchange Act, and 18 U.S.C. §1350, this report also includes separate “Item 4. Controls and Procedures” sections and separate Exhibit 31 and 32 certifications for each of our Company and our Operating Partnership.

SPIRIT REALTY CAPITAL, INC.

INDEX

Glossary | |

Item 1. Financial Statements (Unaudited) | |

2

GLOSSARY

2017 Tax Legislation | Tax Cuts and Jobs Act |

2019 Notes | $402.5 million convertible notes of the Corporation due in 2019 |

2021 Notes | $345.0 million convertible notes of the Corporation due in 2021 |

AFFO | Adjusted Funds From Operations. See definition in Management's Discussion and Analysis of Financial Condition and Results of Operations |

Amended Incentive Award Plan | Amended and Restated Spirit Realty Capital, Inc. and Spirit Realty, L.P. 2012 Incentive Award Plan |

ASC | Accounting Standards Codification |

Asset Management Agreement | Asset Management Agreement between Spirit Realty, L.P. and Spirit MTA REIT dated May 31, 2018 |

ASU | Accounting Standards Update |

ATM Program | At the Market equity distribution program, pursuant to which the Company may offer and sell registered shares of common stock from time to time |

CMBS | Commercial Mortgage-Backed Securities |

Code | Internal Revenue Code of 1986, as amended |

Collateral Pools | Pools of collateral assets that are pledged to the indenture trustee for the benefit of the noteholders and secure obligations of issuers under Master Trust 2013 and Master Trust 2014 |

Company | The Corporation and its consolidated subsidiaries |

Contractual Rent | Monthly contractual cash rent and earned income from direct financing leases, excluding percentage rents, from our properties owned fee-simple or ground leased, recognized during the final month of the reporting period, adjusted to exclude amounts received from properties sold during that period and adjusted to include a full month of contractual rent for properties acquired during that period. |

Convertible Notes | The 2019 Notes and 2021 Notes, together |

Corporation | Spirit Realty Capital, Inc., a Maryland corporation |

CPI | Consumer Price Index |

Credit Agreement | Revolving credit facility agreement between the Operating Partnership and certain lenders dated March 31, 2015, as amended or otherwise modified from time to time |

EBITDAre | EBITDAre is a non-GAAP financial measure and is computed in accordance with standards established by NAREIT. See definition in Management's Discussion and Analysis of Financial Condition and Results of Operations |

Exchange Act | Securities Exchange Act of 1934, as amended |

FASB | Financial Accounting Standards Board |

FFO | Funds From Operations. See definition in Management's Discussion and Analysis of Financial Condition and Results of Operations |

GAAP | Generally Accepted Accounting Principles in the United States |

LIBOR | London Interbank Offered Rate |

Master Trust 2013 | The net-lease mortgage securitization trust established in December 2013 |

Master Trust 2014 | The net-lease mortgage securitization trust established in 2005 and amended and restated in 2014 |

Master Trust Notes | Master Trust 2013 and Master Trust 2014 notes, together |

Master Trust Release | Proceeds from the sale of assets securing the Master Trust Notes held in restricted accounts until a qualifying substitution is made or until used for principal reduction |

Moody's | Moody's Investor Services |

NAREIT | National Association of Real Estate Investment Trusts |

OP Holdings | Spirit General OP Holdings, LLC |

Operating Partnership | Spirit Realty, L.P., a Delaware limited partnership |

3

Property Management and Servicing Agreement | Second amended and restated agreement governing the management services and special services provided to Master Trust 2014 by Spirit Realty, L.P., dated as of May 20, 2014, as amended, supplemented, amended and restated or otherwise modified |

Real Estate Investment Value | The gross acquisition cost, including capitalized transaction costs, plus improvements and less impairments, if any |

REIT | Real Estate Investment Trust |

Revolving Credit Facility | $800.0 million unsecured credit facility pursuant to the Credit Agreement |

S&P | Standard & Poor's Rating Services |

SEC | Securities and Exchange Commission |

Securities Act | Securities Act of 1933, as amended |

Senior Unsecured Notes | $300 million aggregate principal amount of senior notes issued in August 2016 |

Series A Preferred Stock | 6,900,000 shares of 6.000% Cumulative Redeemable Preferred Stock issued October 3, 2017, with a liquidation preference of $25.00 per share. |

Shopko | Specialty Retail Shops Holding Corp. and certain of its affiliates |

SMTA | Spirit MTA REIT, a Maryland real estate investment trust |

Spin-Off | Creation of an independent, publicly traded REIT, SMTA, through our contribution of properties leased to Shopko, assets that collateralize Master Trust 2014 and other additional assets to SMTA followed by the distribution by us to our stockholders of all of the common shares of beneficial interest in SMTA. |

SubREIT | Spirit MTA SubREIT, a wholly-owned subsidiary of SMTA |

Term Loan | $420.0 million senior unsecured term facility pursuant to the Term Loan Agreement |

Term Loan Agreement | Term loan agreement between the Operating Partnership and certain lenders dated November 3, 2015, as amended or otherwise modified from time to time |

TSR | Total Stockholder Return |

U.S. | United States |

Vacant | Owned properties which are not economically yielding |

Unless otherwise indicated or unless the context requires otherwise, all references to the "Company," "Spirit Realty Capital," "we," "us" or "our" refer to the Corporation and its consolidated subsidiaries, including the Operating Partnership. Unless otherwise indicated or unless the context requires otherwise, all references to the "Operating Partnership" refer to Spirit Realty, L.P. and its consolidated subsidiaries.

4

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

SPIRIT REALTY CAPITAL, INC.

Consolidated Balance Sheets

(In Thousands, Except Share and Per Share Data)

(Unaudited)

September 30, 2018 | December 31, 2017 | ||||||

Assets | |||||||

Investments: | |||||||

Real estate investments: | |||||||

Land and improvements | $ | 1,629,509 | $ | 1,598,355 | |||

Buildings and improvements | 3,100,749 | 2,989,451 | |||||

Total real estate investments | 4,730,258 | 4,587,806 | |||||

Less: accumulated depreciation | (589,599 | ) | (503,568 | ) | |||

4,140,659 | 4,084,238 | ||||||

Loans receivable, net | 52,001 | 78,466 | |||||

Intangible lease assets, net | 302,954 | 306,252 | |||||

Real estate assets under direct financing leases, net | 24,809 | 24,865 | |||||

Real estate assets held for sale, net | 43,601 | 20,469 | |||||

Net investments | 4,564,024 | 4,514,290 | |||||

Cash and cash equivalents | 7,578 | 8,792 | |||||

Deferred costs and other assets, net | 112,149 | 121,949 | |||||

Investment in Master Trust 2014 | 33,558 | — | |||||

Preferred equity investment in SMTA | 150,000 | — | |||||

Goodwill | 225,600 | 225,600 | |||||

Assets related to SMTA Spin-Off | — | 2,392,880 | |||||

Total assets | $ | 5,092,909 | $ | 7,263,511 | |||

Liabilities and stockholders’ equity | |||||||

Liabilities: | |||||||

Revolving Credit Facility | $ | 157,000 | $ | 112,000 | |||

Term Loan, net | 419,920 | — | |||||

Senior Unsecured Notes, net | 295,654 | 295,321 | |||||

Mortgages and notes payable, net | 465,433 | 589,644 | |||||

Convertible Notes, net | 726,261 | 715,881 | |||||

Total debt, net | 2,064,268 | 1,712,846 | |||||

Intangible lease liabilities, net | 123,613 | 130,574 | |||||

Accounts payable, accrued expenses and other liabilities | 99,670 | 131,642 | |||||

Liabilities related to SMTA Spin-Off | — | 1,968,840 | |||||

Total liabilities | 2,287,551 | 3,943,902 | |||||

Commitments and contingencies (see Note 6) | |||||||

Stockholders’ equity: | |||||||

Preferred stock and paid in capital, $0.01 par value, 20,000,000 shares authorized: 6,900,000 shares issued and outstanding at both September 30, 2018 and December 31, 2017 | 166,177 | 166,193 | |||||

Common stock, $0.01 par value, 750,000,000 shares authorized: 428,478,845 and 448,868,269 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | 4,285 | 4,489 | |||||

Capital in excess of common stock par value | 4,989,804 | 5,193,631 | |||||

Accumulated deficit | (2,354,908 | ) | (2,044,704 | ) | |||

Total stockholders’ equity | 2,805,358 | 3,319,609 | |||||

Total liabilities and stockholders’ equity | $ | 5,092,909 | $ | 7,263,511 | |||

See accompanying notes.

5

SPIRIT REALTY CAPITAL, INC.

Consolidated Statements of Operations and Comprehensive Income

(In Thousands, Except Share and Per Share Data)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Revenues: | |||||||||||||||

Rentals | $ | 97,311 | $ | 103,523 | $ | 290,549 | $ | 307,822 | |||||||

Interest income on loans receivable | 1,121 | 865 | 2,410 | 2,392 | |||||||||||

Earned income from direct financing leases | 465 | 483 | 1,395 | 1,613 | |||||||||||

Tenant reimbursement income | 3,516 | 3,270 | 10,021 | 10,922 | |||||||||||

Related party fee income | 6,750 | — | 8,969 | — | |||||||||||

Other income | 481 | 580 | 2,298 | 1,139 | |||||||||||

Total revenues | 109,644 | 108,721 | 315,642 | 323,888 | |||||||||||

Expenses: | |||||||||||||||

General and administrative | 11,033 | 12,712 | 39,843 | 46,789 | |||||||||||

Property costs (including reimbursable) | 5,172 | 5,180 | 15,529 | 19,193 | |||||||||||

Real estate acquisition costs | 26 | 177 | 143 | 851 | |||||||||||

Interest | 24,784 | 29,948 | 71,385 | 85,805 | |||||||||||

Depreciation and amortization | 40,379 | 43,318 | 121,015 | 130,634 | |||||||||||

Impairments | 1,279 | 22,301 | 6,254 | 60,258 | |||||||||||

Total expenses | 82,673 | 113,636 | 254,169 | 343,530 | |||||||||||

Income (loss) from continuing operations before other income and income tax expense | 26,971 | (4,915 | ) | 61,473 | (19,642 | ) | |||||||||

Other income: | |||||||||||||||

Gain on debt extinguishment | — | 1,792 | 27,092 | 1,769 | |||||||||||

Gain on disposition of assets | 436 | 10,089 | 827 | 21,986 | |||||||||||

Preferred dividend income from SMTA | 3,750 | — | 5,000 | — | |||||||||||

Total other income | 4,186 | 11,881 | 32,919 | 23,755 | |||||||||||

Income from continuing operations before income tax expense | 31,157 | 6,966 | 94,392 | 4,113 | |||||||||||

Income tax expense | (135 | ) | (144 | ) | (475 | ) | (421 | ) | |||||||

Income from continuing operations | 31,022 | 6,822 | 93,917 | 3,692 | |||||||||||

(Loss) income from discontinued operations | (966 | ) | (1,500 | ) | (15,979 | ) | 37,665 | ||||||||

Net income and total comprehensive income | $ | 30,056 | $ | 5,322 | $ | 77,938 | $ | 41,357 | |||||||

Dividends paid to preferred stockholders | (2,588 | ) | — | (7,764 | ) | — | |||||||||

Net income attributable to common stockholders | $ | 27,468 | $ | 5,322 | $ | 70,174 | $ | 41,357 | |||||||

Net income per share attributable to common stockholders - basic: | |||||||||||||||

Continuing operations | $ | 0.06 | $ | 0.01 | $ | 0.20 | $ | 0.01 | |||||||

Discontinued operations | — | — | (0.04 | ) | 0.08 | ||||||||||

Net income per share attributable to common stockholders - basic | $ | 0.06 | $ | 0.01 | $ | 0.16 | $ | 0.09 | |||||||

Net income per share attributable to common stockholders - diluted | |||||||||||||||

Continuing operations | $ | 0.06 | $ | 0.01 | $ | 0.20 | $ | 0.01 | |||||||

Discontinued operations | — | — | (0.04 | ) | 0.08 | ||||||||||

Net income per share attributable to common stockholders - diluted | $ | 0.06 | $ | 0.01 | $ | 0.16 | $ | 0.09 | |||||||

6

SPIRIT REALTY CAPITAL, INC.

Consolidated Statements of Operations and Comprehensive Income

(In Thousands, Except Share and Per Share Data)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Weighted average shares of common stock outstanding: | |||||||||||||||

Basic | 426,678,579 | 456,671,617 | 433,162,760 | 472,698,692 | |||||||||||

Diluted | 427,890,152 | 456,671,617 | 433,940,701 | 472,698,692 | |||||||||||

Dividends declared per common share issued | $ | 0.1250 | $ | 0.1800 | $ | 0.4850 | $ | 0.5400 | |||||||

See accompanying notes.

7

SPIRIT REALTY CAPITAL, INC.

Consolidated Statement of Stockholders’ Equity

(In Thousands, Except Share Data)

(Unaudited)

Preferred Stock | Common Stock | ||||||||||||||||||||||||

Shares | Par Value and Capital in Excess of Par Value | Shares | Par Value | Capital in Excess of Par Value | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||

Balances, December 31, 2017 | 6,900,000 | $ | 166,193 | 448,868,269 | $ | 4,489 | $ | 5,193,631 | $ | (2,044,704 | ) | $ | 3,319,609 | ||||||||||||

Net income | — | — | — | — | — | 77,938 | 77,938 | ||||||||||||||||||

Dividends declared on preferred stock | — | — | — | — | — | (7,764 | ) | (7,764 | ) | ||||||||||||||||

Net income available to common stockholders | — | — | — | 70,174 | 70,174 | ||||||||||||||||||||

Dividends declared on common stock | — | — | — | — | — | (209,270 | ) | (209,270 | ) | ||||||||||||||||

Tax withholdings related to net stock settlements | — | — | (285,378 | ) | (3 | ) | — | (2,344 | ) | (2,347 | ) | ||||||||||||||

Repurchase of common shares | — | — | (21,222,257 | ) | (212 | ) | — | (167,953 | ) | (168,165 | ) | ||||||||||||||

SMTA dividend distribution | — | — | — | — | (216,005 | ) | — | (216,005 | ) | ||||||||||||||||

Issuance of preferred shares, net | — | (16 | ) | — | — | — | — | (16 | ) | ||||||||||||||||

Stock-based compensation, net | — | — | 1,118,211 | 11 | 12,178 | (811 | ) | 11,378 | |||||||||||||||||

Balances, September 30, 2018 | 6,900,000 | $ | 166,177 | 428,478,845 | $ | 4,285 | $ | 4,989,804 | $ | (2,354,908 | ) | $ | 2,805,358 | ||||||||||||

See accompanying notes.

8

SPIRIT REALTY CAPITAL, INC.

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

Nine Months Ended September 30, | |||||||

2018 | 2017 | ||||||

Operating activities | |||||||

Net income | $ | 77,938 | $ | 41,357 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 156,476 | 192,887 | |||||

Impairments | 17,197 | 88,109 | |||||

Amortization of deferred financing costs | 7,442 | 7,274 | |||||

Amortization of debt discounts | 10,888 | 9,663 | |||||

Stock-based compensation expense | 12,189 | 13,778 | |||||

Gain on debt extinguishment | (26,729 | ) | (1,770 | ) | |||

Gain on dispositions of real estate and other assets | (553 | ) | (40,197 | ) | |||

Non-cash revenue | (14,239 | ) | (20,642 | ) | |||

Bad debt expense and other | 1,596 | 4,902 | |||||

Changes in operating assets and liabilities: | |||||||

Deferred costs and other assets, net | (5,681 | ) | (1,684 | ) | |||

Accounts payable, accrued expenses and other liabilities | (2,712 | ) | 5,726 | ||||

Net cash provided by operating activities | 233,812 | 299,403 | |||||

Investing activities | |||||||

Acquisitions of real estate | (242,491 | ) | (278,470 | ) | |||

Capitalized real estate expenditures | (26,769 | ) | (34,939 | ) | |||

Investments in notes receivable | (35,450 | ) | (4,995 | ) | |||

Collections of principal on loans receivable and real estate assets under direct financing leases | 25,858 | 7,817 | |||||

Proceeds from dispositions of real estate and other assets, net | 41,461 | 342,032 | |||||

Net cash (used in) provided by investing activities | (237,391 | ) | 31,445 | ||||

9

Nine Months Ended September 30, | |||||||

2018 | 2017 | ||||||

Financing activities | |||||||

Borrowings under Revolving Credit Facility | 737,800 | 781,200 | |||||

Repayments under Revolving Credit Facility | (692,800 | ) | (481,200 | ) | |||

Borrowings under mortgages and notes payable | 104,247 | — | |||||

Repayments under mortgages and notes payable | (167,671 | ) | (76,403 | ) | |||

Borrowings under Term Loan | 420,000 | — | |||||

Debt extinguishment costs | (2,968 | ) | — | ||||

Deferred financing costs | (1,417 | ) | (192 | ) | |||

Cash, cash equivalents and restricted cash held by SMTA at Spin-Off | (73,081 | ) | — | ||||

Sale of SubREIT preferred shares | 5,000 | — | |||||

Repurchase of shares of common stock | (170,512 | ) | (225,748 | ) | |||

Preferred stock dividends paid | (7,764 | ) | — | ||||

Common stock dividends paid | (236,663 | ) | (257,112 | ) | |||

Net cash used in financing activities | (85,829 | ) | (259,455 | ) | |||

Net (decrease) increase in cash, cash equivalents and restricted cash | (89,408 | ) | 71,393 | ||||

Cash, cash equivalents and restricted cash, beginning of period | 114,707 | 36,898 | |||||

Cash, cash equivalents and restricted cash, end of period | $ | 25,299 | $ | 108,291 | |||

See accompanying notes.

10

SPIRIT REALTY, L.P.

Consolidated Balance Sheets

(In Thousands, Except Unit and Per Unit Data)

(Unaudited)

September 30, 2018 | December 31, 2017 | ||||||

Assets | |||||||

Investments: | |||||||

Real estate investments: | |||||||

Land and improvements | $ | 1,629,509 | $ | 1,598,355 | |||

Buildings and improvements | 3,100,749 | 2,989,451 | |||||

Total real estate investments | 4,730,258 | 4,587,806 | |||||

Less: accumulated depreciation | (589,599 | ) | (503,568 | ) | |||

4,140,659 | 4,084,238 | ||||||

Loans receivable, net | 52,001 | 78,466 | |||||

Intangible lease assets, net | 302,954 | 306,252 | |||||

Real estate assets under direct financing leases, net | 24,809 | 24,865 | |||||

Real estate assets held for sale, net | 43,601 | 20,469 | |||||

Net investments | 4,564,024 | 4,514,290 | |||||

Cash and cash equivalents | 7,578 | 8,792 | |||||

Deferred costs and other assets, net | 112,149 | 121,949 | |||||

Investment in Master Trust 2014 | 33,558 | — | |||||

Preferred equity investment in SMTA | 150,000 | — | |||||

Goodwill | 225,600 | 225,600 | |||||

Assets related to SMTA Spin-Off | — | 2,392,880 | |||||

Total assets | $ | 5,092,909 | $ | 7,263,511 | |||

Liabilities and partners' capital | |||||||

Liabilities: | |||||||

Revolving Credit Facility | $ | 157,000 | $ | 112,000 | |||

Term Loan, net | 419,920 | — | |||||

Senior Unsecured Notes, net | 295,654 | 295,321 | |||||

Notes payable to Spirit Realty Capital, Inc., net | 465,433 | 589,644 | |||||

Convertible Notes, net | 726,261 | 715,881 | |||||

Total debt, net | 2,064,268 | 1,712,846 | |||||

Intangible lease liabilities, net | 123,613 | 130,574 | |||||

Accounts payable, accrued expenses and other liabilities | 99,670 | 131,642 | |||||

Liabilities related to SMTA Spin-Off | — | 1,968,840 | |||||

Total liabilities | 2,287,551 | 3,943,902 | |||||

Commitments and contingencies (see Note 6) | |||||||

Partners' capital: | |||||||

Partnership units | |||||||

General partner's capital: 3,988,218 units issued and outstanding as of both September 30, 2018 and December 31, 2017 | 23,151 | 24,426 | |||||

Limited partners' preferred capital: 6,900,000 units issued and outstanding as of both September 30, 2018 and December 31, 2017 | 166,177 | 166,193 | |||||

Limited partners' capital: 424,490,627 and 444,880,051 units issued and outstanding as of September 30, 2018 and December 31, 2017, respectively | 2,616,030 | 3,128,990 | |||||

Total partners' capital | 2,805,358 | 3,319,609 | |||||

Total liabilities and partners' capital | $ | 5,092,909 | $ | 7,263,511 | |||

See accompanying notes.

11

SPIRIT REALTY, L.P.

Consolidated Statements of Operations and Comprehensive Income

(In Thousands, Except Unit and Per Unit Data)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Revenues: | |||||||||||||||

Rentals | $ | 97,311 | $ | 103,523 | $ | 290,549 | $ | 307,822 | |||||||

Interest income on loans receivable | 1,121 | 865 | 2,410 | 2,392 | |||||||||||

Earned income from direct financing leases | 465 | 483 | 1,395 | 1,613 | |||||||||||

Tenant reimbursement income | 3,516 | 3,270 | 10,021 | 10,922 | |||||||||||

Related party fee income | 6,750 | — | 8,969 | — | |||||||||||

Other income | 481 | 580 | 2,298 | 1,139 | |||||||||||

Total revenues | 109,644 | 108,721 | 315,642 | 323,888 | |||||||||||

Expenses: | |||||||||||||||

General and administrative | 11,033 | 12,712 | 39,843 | 46,789 | |||||||||||

Property costs (including reimbursable) | 5,172 | 5,180 | 15,529 | 19,193 | |||||||||||

Real estate acquisition costs | 26 | 177 | 143 | 851 | |||||||||||

Interest | 24,784 | 29,948 | 71,385 | 85,805 | |||||||||||

Depreciation and amortization | 40,379 | 43,318 | 121,015 | 130,634 | |||||||||||

Impairments | 1,279 | 22,301 | 6,254 | 60,258 | |||||||||||

Total expenses | 82,673 | 113,636 | 254,169 | 343,530 | |||||||||||

Income (loss) from continuing operations before other income and income tax expense | 26,971 | (4,915 | ) | 61,473 | (19,642 | ) | |||||||||

Other income: | |||||||||||||||

Gain on debt extinguishment | — | 1,792 | 27,092 | 1,769 | |||||||||||

Gain on disposition of assets | 436 | 10,089 | 827 | 21,986 | |||||||||||

Preferred dividend income from SMTA | 3,750 | — | 5,000 | — | |||||||||||

Total other income | 4,186 | 11,881 | 32,919 | 23,755 | |||||||||||

Income from continuing operations before income tax expense | 31,157 | 6,966 | 94,392 | 4,113 | |||||||||||

Income tax expense | (135 | ) | (144 | ) | (475 | ) | (421 | ) | |||||||

Income from continuing operations | 31,022 | 6,822 | 93,917 | 3,692 | |||||||||||

(Loss) income from discontinued operations | (966 | ) | (1,500 | ) | (15,979 | ) | 37,665 | ||||||||

Net income and total comprehensive income | $ | 30,056 | $ | 5,322 | $ | 77,938 | $ | 41,357 | |||||||

Preferred distributions | (2,588 | ) | — | (7,764 | ) | — | |||||||||

Net income after preferred distributions | $ | 27,468 | $ | 5,322 | $ | 70,174 | $ | 41,357 | |||||||

Net income attributable to the general partner | |||||||||||||||

Continuing operations | $ | 313 | $ | 56 | $ | 789 | $ | 29 | |||||||

Discontinued operations | (32 | ) | (12 | ) | (146 | ) | 315 | ||||||||

Net income attributable to the general partner | $ | 281 | $ | 44 | $ | 643 | $ | 344 | |||||||

Net income attributable to the limited partners | |||||||||||||||

Continuing operations | $ | 28,121 | $ | 6,766 | $ | 85,364 | $ | 3,663 | |||||||

Discontinued operations | (934 | ) | (1,488 | ) | (15,833 | ) | 37,350 | ||||||||

Net income attributable to the limited partners | $ | 27,187 | $ | 5,278 | $ | 69,531 | $ | 41,013 | |||||||

12

SPIRIT REALTY, L.P.

Consolidated Statements of Operations and Comprehensive Income

(In Thousands, Except Unit and Per Unit Data)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Net income per partnership unit - basic | |||||||||||||||

Continuing operations | $ | 0.06 | $ | 0.01 | $ | 0.20 | $ | 0.01 | |||||||

Discontinued operations | — | — | (0.04 | ) | 0.08 | ||||||||||

Net income per partnership unit - basic | $ | 0.06 | $ | 0.01 | $ | 0.16 | $ | 0.09 | |||||||

Net income per partnership unit - diluted | |||||||||||||||

Continuing operations | $ | 0.06 | $ | 0.01 | $ | 0.20 | $ | 0.01 | |||||||

Discontinued operations | — | — | (0.04 | ) | 0.08 | ||||||||||

Net income per partnership unit - diluted | $ | 0.06 | $ | 0.01 | $ | 0.16 | $ | 0.09 | |||||||

Weighted average partnership units outstanding: | |||||||||||||||

Basic | 426,678,579 | 456,671,617 | 433,162,760 | 472,698,692 | |||||||||||

Diluted | 427,890,152 | 456,671,617 | 433,940,701 | 472,698,692 | |||||||||||

Distributions declared per partnership unit issued | $ | 0.1250 | $ | 0.1800 | $ | 0.4850 | $ | 0.5400 | |||||||

See accompanying notes.

13

SPIRIT REALTY, L.P.

Consolidated Statements of Partners' Capital

(In Thousands, Except Unit Data)

(Unaudited)

Preferred Units | Common Units | Total Partnership Capital | ||||||||||||||||||||||

Limited Partners' Capital (1) | General Partner's Capital (2) | Limited Partners' Capital (1) | ||||||||||||||||||||||

Units | Amount | Units | Amount | Units | Amount | |||||||||||||||||||

Balances, December 31, 2017 | 6,900,000 | $ | 166,193 | 3,988,218 | $ | 24,426 | 444,880,051 | $ | 3,128,990 | $ | 3,319,609 | |||||||||||||

Net income and total comprehensive income (3) | — | 7,764 | — | 643 | — | 69,531 | 77,938 | |||||||||||||||||

Partnership distributions declared on preferred units | — | (7,764 | ) | — | — | — | — | (7,764 | ) | |||||||||||||||

Net income after preferred distributions | — | 643 | 69,531 | 70,174 | ||||||||||||||||||||

Partnership distributions declared on common units | — | — | — | (1,918 | ) | — | (207,352 | ) | (209,270 | ) | ||||||||||||||

Tax withholdings related to net partnership unit settlements | — | — | — | — | (285,378 | ) | (2,347 | ) | (2,347 | ) | ||||||||||||||

Repurchase of partnership units | — | — | — | — | (21,222,257 | ) | (168,165 | ) | (168,165 | ) | ||||||||||||||

SMTA dividend distribution | — | — | — | — | — | (216,005 | ) | (216,005 | ) | |||||||||||||||

Issuance of preferred partnership units | — | (16 | ) | — | — | — | — | (16 | ) | |||||||||||||||

Stock-based compensation, net | — | — | — | — | 1,118,211 | 11,378 | 11,378 | |||||||||||||||||

Balances, September 30, 2018 | 6,900,000 | $ | 166,177 | 3,988,218 | $ | 23,151 | 424,490,627 | $ | 2,616,030 | $ | 2,805,358 | |||||||||||||

(1) Consists of limited partnership interests held by the Corporation and Spirit Notes Partner, LLC.

(2) Consists of general partnership interests held by OP Holdings.

(3) Net income and total comprehensive income is allocated first to the preferred unitholders, with income after the preferred distributions allocated to the common units on a pro rata basis.

See accompanying notes.

14

SPIRIT REALTY, L.P.

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

Nine Months Ended September 30, | |||||||

2018 | 2017 | ||||||

Operating activities | |||||||

Net income attributable to partners | $ | 77,938 | $ | 41,357 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 156,476 | 192,887 | |||||

Impairments | 17,197 | 88,109 | |||||

Amortization of deferred financing costs | 7,442 | 7,274 | |||||

Amortization of debt discounts | 10,888 | 9,663 | |||||

Stock-based compensation expense | 12,189 | 13,778 | |||||

Gain on debt extinguishment | (26,729 | ) | (1,770 | ) | |||

Gain on dispositions of real estate and other assets | (553 | ) | (40,197 | ) | |||

Non-cash revenue | (14,239 | ) | (20,642 | ) | |||

Bad debt expense and other | 1,596 | 4,902 | |||||

Changes in operating assets and liabilities: | |||||||

Deferred costs and other assets, net | (5,681 | ) | (1,684 | ) | |||

Accounts payable, accrued expenses and other liabilities | (2,712 | ) | 5,726 | ||||

Net cash provided by operating activities | 233,812 | 299,403 | |||||

Investing activities | |||||||

Acquisitions of real estate | (242,491 | ) | (278,470 | ) | |||

Capitalized real estate expenditures | (26,769 | ) | (34,939 | ) | |||

Investments in notes receivable | (35,450 | ) | (4,995 | ) | |||

Collections of principal on loans receivable and real estate assets under direct financing leases | 25,858 | 7,817 | |||||

Proceeds from dispositions of real estate and other assets, net | 41,461 | 342,032 | |||||

Net cash (used in) provided by investing activities | (237,391 | ) | 31,445 | ||||

15

Nine Months Ended September 30, | |||||||

2018 | 2017 | ||||||

Financing activities | |||||||

Borrowings under Revolving Credit Facility | 737,800 | 781,200 | |||||

Repayments under Revolving Credit Facility | (692,800 | ) | (481,200 | ) | |||

Borrowings under mortgages and notes payable | 104,247 | — | |||||

Repayments under mortgages and notes payable | (167,671 | ) | (76,403 | ) | |||

Borrowings under Term Loan | 420,000 | — | |||||

Debt extinguishment costs | (2,968 | ) | — | ||||

Deferred financing costs | (1,417 | ) | (192 | ) | |||

Cash, cash equivalents and restricted cash held by SMTA at Spin-Off | (73,081 | ) | — | ||||

Sale of SubREIT preferred shares | 5,000 | — | |||||

Repurchase of partnership units | (170,512 | ) | (225,748 | ) | |||

Preferred distributions paid | (7,764 | ) | — | ||||

Common distributions paid | (236,663 | ) | (257,112 | ) | |||

Net cash used in financing activities | (85,829 | ) | (259,455 | ) | |||

Net (decrease) increase in cash, cash equivalents and restricted cash | (89,408 | ) | 71,393 | ||||

Cash, cash equivalents and restricted cash, beginning of period | 114,707 | 36,898 | |||||

Cash, cash equivalents and restricted cash, end of period | $ | 25,299 | $ | 108,291 | |||

See accompanying notes.

16

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements

September 30, 2018

(Unaudited)

Note 1. Organization

Company Organization and Operations

Spirit Realty Capital, Inc. (the "Corporation" or "Spirit" or, with its consolidated subsidiaries, the "Company") operates as a self-administered and self-managed REIT that seeks to generate and deliver sustainable and attractive returns for stockholders by primarily investing in and managing a portfolio of single-tenant, operationally essential real estate throughout the U.S. that is generally leased on a long-term, triple-net basis to tenants operating within retail, office, industrial and data center property types. Single tenant, operationally essential real estate generally refers to free-standing, commercial real estate facilities where tenants conduct activities that are essential to the generation of their sales and profits.The Company began operations through a predecessor legal entity in 2003.

The Company’s operations are generally carried out through Spirit Realty, L.P. (the "Operating Partnership") and its subsidiaries. Spirit General OP Holdings, LLC ("OP Holdings"), one of the Company's wholly-owned subsidiaries, is the sole general partner and owns approximately 1% of the Operating Partnership. The Corporation and a wholly-owned subsidiary ("Spirit Notes Partner, LLC") are the only limited partners and together own the remaining 99% of the Operating Partnership.

On May 31, 2018, (the "Distribution Date"), Spirit completed the previously announced spin-off (the "Spin-Off") of the assets that collateralize Master Trust 2014, properties leased to Shopko, and certain other assets into an independent, publicly traded REIT, Spirit MTA REIT ("SMTA"). Beginning in the second quarter of 2018, the historical financial results of SMTA are reflected in our consolidated financial statements as discontinued operations for all periods presented.

Note 2. Summary of Significant Accounting Policies

Basis of Accounting and Principles of Consolidation

The accompanying consolidated financial statements of the Company and the Operating Partnership have been prepared pursuant to the rules and regulations of the SEC. In the opinion of management, the consolidated financial statements include the normal, recurring adjustments necessary for a fair statement of the information required to be set forth therein. The results for interim periods are not necessarily indicative of the results for the entire year. Certain information and note disclosures, normally included in financial statements prepared in accordance with GAAP, have been condensed or omitted from these statements pursuant to SEC rules and regulations and, accordingly, these financial statements should be read in conjunction with the Company’s audited consolidated financial statements as filed with the SEC in its Annual Report on Form 10-K for the year ended December 31, 2017 and its Current Report on Form 8-K dated September 20, 2018.

The consolidated financial statements include the accounts of the Corporation and its wholly-owned subsidiaries. The consolidated financial statements of the Operating Partnership include the accounts of the Operating Partnership and its wholly-owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

All expenses incurred by the Company have been allocated to the Operating Partnership in accordance with the Operating Partnership's first amended and restated agreement of limited partnership, which management determined to be a reasonable method of allocation. Therefore, expenses incurred would not be materially different if the Operating Partnership had operated as an unaffiliated entity.

The Company has formed multiple special purpose entities to acquire and hold real estate encumbered by indebtedness (see Note 4). Each special purpose entity is a separate legal entity and is the sole owner of its assets and responsible for its liabilities. The assets of these special purpose entities are not available to pay, or otherwise satisfy obligations to, the creditors of any affiliate or owner of another entity unless the special purpose entities have expressly agreed and are permitted to do so under their governing documents. As of September 30, 2018 and December 31, 2017, net assets totaling $0.90 billion and $2.78 billion, respectively, were held, and net liabilities totaling $0.48 billion and $2.63 billion, respectively, were owed by these encumbered special purpose entities and are included in the accompanying consolidated balance sheets.

17

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements - (continued)

September 30, 2018

(Unaudited)

Discontinued Operations

A discontinued operation represents: (i) a component of an entity or group of components that has been disposed of or is classified as held for sale in a single transaction and represents a strategic shift that has or will have a major effect on the Company’s operations and financial results or (ii) an acquired business that is classified as held for sale on the date of acquisition. Examples of a strategic shift include disposing of: (i) a separate major line of business, (ii) a separate major geographic area of operations, or (iii) other major parts of the Company. The Company determined that the Spin-Off represented a strategic shift that has a major effect on the Company's results and, therefore, SMTA's operations qualify as discontinued operations. See Note 8 for further discussion on discontinued operations.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Although management believes its estimates are reasonable, actual results could differ from those estimates.

Segment Reporting

The Company views its operations as one segment, which consists of net leasing operations. The Company has no other reportable segments.

Allowance for Doubtful Accounts

The Company reviews its rent and other tenant receivables for collectability on a regular basis, taking into consideration changes in factors such as the tenant’s payment history, the financial condition of the tenant, business conditions in the industry in which the tenant operates, and economic conditions in the area in which the tenant operates. If the collectability of a receivable with respect to any tenant is in doubt, a provision for uncollectible amounts will be established or a direct write-off of the specific receivable will be made. The Company's reserves for uncollectible amounts totaled $4.2 million and $12.4 million as of September 30, 2018 and December 31, 2017, respectively, against accounts receivable balances of $14.7 million and $27.2 million, respectively. Receivables are recorded within deferred costs and other assets, net in the accompanying consolidated balance sheets. Receivables are written off against the reserves for uncollectible amounts when all possible means of collection have been exhausted.

For rental revenues related to the straight-line method of reporting rental revenue, the collectability review includes management’s estimates of amounts that will not be realized based on an assessment of the risks inherent in the portfolio, considering historical experience. The Company established a reserve for losses of $0.5 million and $1.8 million as of September 30, 2018 and December 31, 2017, respectively, against straight-line rental revenue receivables of $66.4 million and $81.6 million, respectively. These receivables are recorded within deferred costs and other assets, net in the accompanying consolidated balance sheets.

Goodwill

Goodwill arises from business combinations and represents the excess of the cost of an acquired entity over the net fair value amounts that were assigned to the identifiable assets acquired and the liabilities assumed. Goodwill is tested for impairment at the reporting unit level on an annual basis and between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of the reporting unit below its carrying value. No impairment was recorded for the periods presented.

18

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements - (continued)

September 30, 2018

(Unaudited)

Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include cash and highly liquid investment securities with maturities at acquisition of three months or less. The Company invests cash primarily in money market funds of major financial institutions with fund investments consisting of highly-rated money market instruments and other short-term investments. Restricted cash is classified within deferred costs and other assets, net in the accompanying consolidated balance sheets. Cash, cash equivalents and restricted cash consisted of the following (in thousands):

September 30, 2018 | December 31, 2017 | September 30, 2017 | |||||||||

Cash and cash equivalents | $ | 7,578 | $ | 8,798 | $ | 11,947 | |||||

Restricted cash: | |||||||||||

Collateral deposits (1) | 423 | 1,751 | 1,229 | ||||||||

Tenant improvements, repairs, and leasing commissions (2) | 8,898 | 8,257 | 7,988 | ||||||||

Master Trust Release (3) | 7,410 | 85,703 | 79,353 | ||||||||

Liquidity reserve (4) | — | 5,503 | — | ||||||||

Other (5) | 990 | 4,695 | 7,774 | ||||||||

Total cash, cash equivalents and restricted cash | $ | 25,299 | $ | 114,707 | $ | 108,291 | |||||

(1) Funds held in lender controlled accounts generally used to meet future debt service or certain property operating expenses.

(2) Deposits held as additional collateral support by lenders to fund improvements, repairs and leasing commissions incurred to secure a new tenant.

(3) Proceeds from the sale of assets pledged as collateral under either Master Trust 2013 or Master Trust 2014, which are held on deposit until a qualifying substitution is made or the funds are applied as prepayment of principal.

(4) Liquidity reserve cash was placed on deposit for Master Trust 2014 and is held until there is a cashflow shortfall or upon achieving certain performance criteria, as defined in the agreements governing Master Trust 2014, or a liquidation of Master Trust 2014 occurs.

(5) Funds held in lender controlled accounts released after scheduled debt service requirements are met.

Income Taxes

The Company has elected to be taxed as a REIT under the Code. As a REIT, the Company generally will not be subject to federal income tax provided it continues to satisfy certain tests concerning the Company’s sources of income, the nature of its assets, the amounts distributed to its stockholders and the ownership of Company stock. Management believes the Company has qualified and will continue to qualify as a REIT and therefore, no provision has been made for federal income taxes in the accompanying consolidated financial statements. Even if the Company qualifies for taxation as a REIT, it may be subject to state and local income and franchise taxes, and to federal income tax and excise tax on its undistributed income. Taxable income from non-REIT activities managed through any of the Company's taxable REIT subsidiaries is subject to federal, state, and local taxes, which are not material.

The Operating Partnership is a partnership for federal income tax purposes. Partnerships are pass-through entities and are not subject to U.S. federal income taxes, therefore no provision has been made for federal income taxes in the accompanying financial statements. Although most states and cities where the Operating Partnership operates follow the U.S. federal income tax treatment, there are certain jurisdictions such as Texas, Tennessee and Ohio that impose income or franchise taxes on a partnership.

Franchise taxes are included in general and administrative expenses on the accompanying consolidated statements of operations and comprehensive income.

On May 31, 2018, the Company completed the Spin-Off of Spirit MTA REIT through a distribution of shares in SMTA to the Company’s shareholders. The distribution resulted in a deemed sale of assets and recognition of taxable gain by the Company, which is entitled to a dividends paid deduction equal to the value of the shares in SMTA that it distributed. The Company believes that its dividends paid deduction for 2018, including the value of the SMTA shares distributed, will equal or exceed its taxable income, including the gain recognized. As a result, the Company does not expect the distribution to result in current tax other than an immaterial amount of state and local tax which has been recognized in the accompanying financial statements.

19

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements - (continued)

September 30, 2018

(Unaudited)

New Accounting Pronouncements

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers: Topic 606. This new guidance establishes a principles-based approach for accounting for revenue from contracts with customers and is effective for annual reporting periods beginning after December 15, 2017, with early application permitted for annual reporting periods beginning after December 15, 2016. The Company adopted the new revenue recognition standard effective January 1, 2018 under the modified retrospective method, and elected to apply the standard only to contracts that were not completed as of the date of adoption (i.e. January 1, 2018). In evaluating the impact of this new standard, the Company identified that lease contracts covered by Leases (Topic 840) are excluded from the scope of this new guidance. As such, this ASU had no material impact on the Company's reported revenues, results of operations, financial position, cash flows and disclosures.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which supersedes the existing guidance for lease accounting Leases (Topic 840). ASU 2016-02 requires lessees to recognize leases on their balance sheets, and leaves lessor accounting largely unchanged. Leases pursuant to which the Company is the lessee primarily consist of its corporate office, ground leases and equipment leases. The amendments in this ASU are effective for the fiscal years beginning after December 15, 2018 and interim periods within those fiscal years. Early application is permitted for all entities. ASU 2016-02 requires a modified retrospective approach for all leases existing at, or entered into after, the date of initial application, with an option to elect to use certain transition relief. The Company has elected to use all of the practical expedients available for adoption of this ASU except for the hindsight expedient, which would require the re-evaluation of the lease term on all leases using current facts and circumstances. The Company has begun implementation of the ASU and is currently evaluating the overall impact of this ASU on its consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments, which requires more timely recognition of credit losses associated with financial assets. ASU 2016-13 requires financial assets (or a group of financial assets) measured at an amortized cost basis to be presented at the net amount expected to be collected. ASU 2016-13 is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Early adoption is permitted for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The Company is currently evaluating the impact of this ASU on its consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments, which addresses specific cash flow issues with the objective of reducing the existing diversity in practice. ASU 2016-15 is effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years, and requires retrospective adoption unless it is impracticable to apply, in which case it is to be applied prospectively as of the earliest date practicable. The Company adopted ASU 2016-15 effective January 1, 2018 and has applied it retrospectively. As a result of adoption, debt prepayment and debt extinguishment costs, previously presented in operating activities, are now presented in financing activities in the consolidated statement of cash flows. There was no impact on the statements of cash flows for the Company for other types of transactions.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. This guidance requires entities to include restricted cash and restricted cash equivalents within the cash and cash equivalents balances presented in the statement of cash flows. The new guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted, and the new guidance is to be applied retrospectively. The Company adopted ASU 2016-18 effective January 1, 2018 and applied it retrospectively. As a result, restricted cash and restricted cash equivalents are included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the consolidated statements of cash flows.

Note 3. Investments

Real Estate Investments

As of September 30, 2018, the Company's gross investment in real estate properties and loans totaled approximately $5.1 billion, representing investments in 1,523 properties, including 53 properties securing mortgage loans. The gross

20

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements

September 30, 2018

(Unaudited)

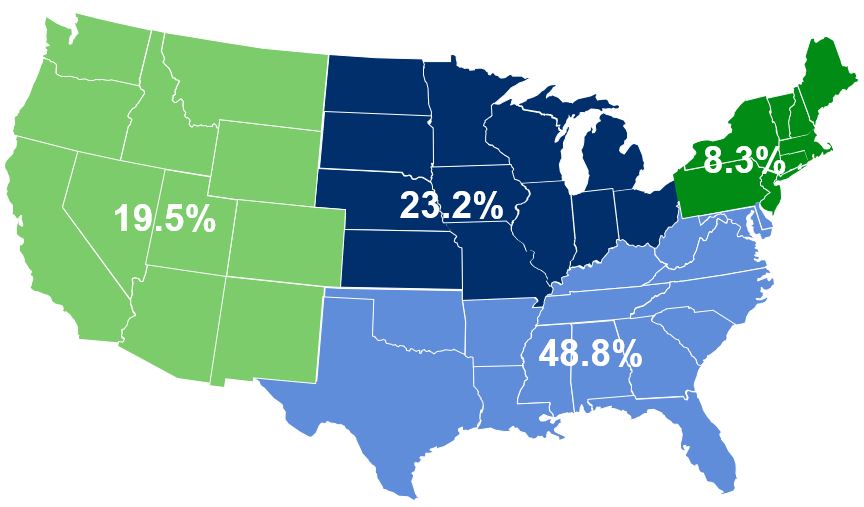

investment is comprised of land, buildings, lease intangible assets and lease intangible liabilities, as adjusted for any impairment, and the carrying amount of loans receivable, real estate assets held under direct financing leases and real estate assets held for sale. The portfolio is geographically dispersed throughout 49 states with Texas, at 11.9%, as the only state with a Real Estate Investment Value greater than 10% of the Real Estate Investment Value of the Company's entire portfolio.

During the nine months ended September 30, 2018, the Company had the following real estate and loan activity, net of accumulated depreciation and amortization:

Number of Properties | Dollar Amount of Investments | |||||||||||||||||||

Owned | Financed | Total | Owned | Financed | Total | |||||||||||||||

(In Thousands) | ||||||||||||||||||||

Gross balance, December 31, 2017 | 2,392 | 88 | 2,480 | $ | 7,823,058 | $ | 79,967 | $ | 7,903,025 | |||||||||||

Acquisitions/improvements (1) | 18 | 2 | 20 | 269,260 | 37,888 | 307,148 | ||||||||||||||

Dispositions of real estate (2)(3)(4) | (41 | ) | (5 | ) | (46 | ) | (83,338 | ) | — | (83,338 | ) | |||||||||

Principal payments and payoffs | — | (30 | ) | (30 | ) | — | (26,316 | ) | (26,316 | ) | ||||||||||

Impairments | — | — | — | (17,197 | ) | — | (17,197 | ) | ||||||||||||

Write-off of gross lease intangibles | — | — | — | (50,505 | ) | — | (50,505 | ) | ||||||||||||

Loan premium amortization and other | — | — | — | (886 | ) | (1,650 | ) | (2,536 | ) | |||||||||||

Spin-off to SMTA | (899 | ) | (2 | ) | (901 | ) | (2,855,052 | ) | (37,888 | ) | (2,892,940 | ) | ||||||||

Gross balance, September 30, 2018 | 1,470 | 53 | 1,523 | 5,085,340 | 52,001 | 5,137,341 | ||||||||||||||

Accumulated depreciation and amortization | (696,930 | ) | — | (696,930 | ) | |||||||||||||||

Net balance, September 30, 2018 | $ | 4,388,410 | $ | 52,001 | $ | 4,440,411 | ||||||||||||||

(1) Includes investments of $23.1 million in revenue producing capitalized expenditures, as well as $4.3 million of non-revenue producing capitalized expenditures as of September 30, 2018.

(2) The total accumulated depreciation and amortization associated with dispositions of real estate was $14.4 million as of September 30, 2018.

(3) For the nine months ended September 30, 2018, the total (loss) gain on disposal of assets for properties held in use and held for sale was $(2.6) million and $3.2 million, respectively.

(4) Includes six deed-in-lieu properties with a real estate investment of $28.5 million that were transferred to the lender during the nine months ended September 30, 2018.

Scheduled minimum future contractual rent to be received under the remaining non-cancelable term of the operating leases (including contractual fixed rent increases occurring on or after October 1, 2018) at September 30, 2018 (in thousands):

September 30, 2018 | |||

Remainder of 2018 | $ | 95,355 | |

2019 | 379,441 | ||

2020 | 373,089 | ||

2021 | 353,153 | ||

2022 | 330,083 | ||

Thereafter | 2,473,691 | ||

Total future minimum rentals | $ | 4,004,812 | |

Because lease renewal periods are exercisable at the option of the lessee, the preceding table presents future minimum lease payments due during the initial lease term only. In addition, the future minimum rentals do not include any contingent rent based on a percentage of the lessees' gross sales or lease escalations based on future changes in the CPI or other stipulated reference rate.

21

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements

September 30, 2018

(Unaudited)

Loans Receivable

The following table details loans receivable, net of premiums, discounts and allowance for loan losses (in thousands):

September 30, 2018 | December 31, 2017 | ||||||

Mortgage loans - principal | $ | 43,900 | $ | 69,963 | |||

Mortgage loans - premiums, net of amortization | 2,954 | 5,038 | |||||

Allowance for loan losses | — | (389 | ) | ||||

Mortgages loans, net | 46,854 | 74,612 | |||||

Other notes receivable - principal | 5,388 | 5,355 | |||||

Other notes receivable - discounts, net of amortization | (241 | ) | — | ||||

Allowance for loan losses | — | — | |||||

Other notes receivable, net | 5,147 | 5,355 | |||||

Total loans receivable, net | $ | 52,001 | $ | 79,967 | |||

The mortgage loans are secured by single-tenant commercial properties and generally have fixed interest rates over the term of the loans. There are three other notes receivable included within loans receivable, as of September 30, 2018, of which two notes totaling $3.4 million are secured by tenant assets and stock and the remaining note, with a balance of $1.7 million, is unsecured. As of December 31, 2017, there were three other notes receivable included within loans receivable, of which one $3.5 million note was secured by tenant assets and stock and the other two were unsecured.

Lease Intangibles, Net

The following table details lease intangible assets and liabilities, net of accumulated amortization (in thousands):

September 30, 2018 | December 31, 2017 | ||||||

In-place leases | $ | 385,936 | $ | 591,551 | |||

Above-market leases | 62,822 | 89,640 | |||||

Less: accumulated amortization | (145,804 | ) | (271,288 | ) | |||

Intangible lease assets, net | $ | 302,954 | $ | 409,903 | |||

Below-market leases | $ | 168,485 | $ | 216,642 | |||

Less: accumulated amortization | (44,872 | ) | (61,339 | ) | |||

Intangible lease liabilities, net | $ | 123,613 | $ | 155,303 | |||

The amounts amortized as a net increase to rental revenue for capitalized above and below-market leases were $1.3 million and $1.5 million for the three months ended September 30, 2018 and 2017, respectively, and $4.2 million and $4.9 million for the nine months ended September 30, 2018 and 2017, respectively. The value of in place leases amortized and included in depreciation and amortization expense was $7.0 million and $10.8 million for the three months ended September 30, 2018 and 2017, respectively, and $25.7 million and $33.0 million for the nine months ended September 30, 2018 and 2017, respectively.

22

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements

September 30, 2018

(Unaudited)

Real Estate Assets Under Direct Financing Leases

The components of real estate investments held under direct financing leases were as follows (in thousands):

September 30, 2018 | December 31, 2017 | ||||||

Minimum lease payments receivable | $ | 5,874 | $ | 7,325 | |||

Estimated residual value of leased assets | 24,552 | 24,552 | |||||

Unearned income | (5,617 | ) | (7,012 | ) | |||

Real estate assets under direct financing leases, net | $ | 24,809 | $ | 24,865 | |||

Real Estate Assets Held for Sale

The following table shows the activity in real estate assets held for sale for the nine months ended September 30, 2018 (dollars in thousands):

Number of Properties | Carrying Value | |||||

Balance, December 31, 2017 | 15 | $ | 48,929 | |||

Transfers from real estate investments held and used | 9 | 39,487 | ||||

Sales | (6 | ) | (10,257 | ) | ||

Transfers to real estate investments held in use | (7 | ) | (25,715 | ) | ||

Transfers to SMTA | (5 | ) | (7,853 | ) | ||

Impairments | — | (990 | ) | |||

Balance, September 30, 2018 | 6 | $ | 43,601 | |||

Impairments

The following table summarizes total impairment losses recognized on the accompanying consolidated statements of operations and comprehensive income (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Real estate and intangible asset impairment | $ | 1,113 | $ | 32,676 | $ | 16,737 | $ | 82,553 | |||||||

Write-off of lease intangibles, net | 166 | 5,061 | 477 | 5,556 | |||||||||||

Recovery of loans receivable, previously impaired | — | — | (17 | ) | — | ||||||||||

Total impairment loss | $ | 1,279 | $ | 37,737 | $ | 17,197 | $ | 88,109 | |||||||

Impairments for the three months ended September 30, 2018 and 2017, were comprised of $0.7 million and $32.9 million on properties classified as held and used, respectively, and $0.6 million and $4.8 million on properties classified as held for sale for the three months ended September 30, 2018 and 2017.

Impairments for the nine months ended September 30, 2018 and 2017, were comprised of $16.2 million and $65.5 million on properties classified as held and used, respectively, and $1.0 million and $22.6 million on properties classified as held for sale, respectively.

23

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements - (continued)

September 30, 2018

(Unaudited)

Note 4. Debt

The debt of the Company and the Operating Partnership are the same, except for the presentation of the Convertible Notes which were issued by the Company. Subsequently, an intercompany note between the Company and the Operating Partnership was executed with terms identical to those of the Convertible Notes. Therefore, in the consolidated balance sheet of the Operating Partnership, the amounts related to the Convertible Notes are reflected as notes payable to Spirit Realty Capital, Inc., net. The Company's debt is summarized below:

Weighted Average Effective Interest Rates (1) | Weighted Average Stated Rates (2) | Weighted Average Maturity (3) | September 30, 2018 | December 31, 2017 | |||||||||||

(in Years) | (In Thousands) | ||||||||||||||

Revolving Credit Facility | 5.42 | % | 3.37 | % | 0.5 | $ | 157,000 | $ | 112,000 | ||||||

Term Loan | 3.78 | % | 3.57 | % | 0.1 | 420,000 | — | ||||||||

Master Trust Notes | 5.89 | % | 5.27 | % | 5.2 | 169,012 | 2,248,504 | ||||||||

CMBS | 5.90 | % | 5.51 | % | 4.7 | 275,460 | 332,647 | ||||||||

Related Party Notes Payable | 1.00 | % | 1.00 | % | 9.5 | 28,630 | — | ||||||||

Convertible Notes | 5.31 | % | 3.28 | % | 1.5 | 747,500 | 747,500 | ||||||||

Senior Unsecured Notes | 4.60 | % | 4.45 | % | 8.0 | 300,000 | 300,000 | ||||||||

Total debt | 5.04 | % | 3.93 | % | 2.9 | 2,097,602 | 3,740,651 | ||||||||

Debt discount, net | (17,406 | ) | (61,399 | ) | |||||||||||

Deferred financing costs, net (4) | (15,928 | ) | (39,572 | ) | |||||||||||

Total debt, net | $ | 2,064,268 | $ | 3,639,680 | |||||||||||

(1) The effective interest rates include amortization of debt discount/premium, amortization of deferred financing costs, facility fees, and non-utilization fees, where applicable, calculated for the three months ended September 30, 2018 and based on the average principal balance outstanding during the period.

(2) Represents the weighted average stated interest rate based on the outstanding principal balance as of September 30, 2018.

(3) Represents the weighted average maturity based on the outstanding principal balance as of September 30, 2018.

(4) The Company records deferred financing costs for its Revolving Credit Facility in deferred costs and other assets, net on its consolidated balance sheets.

Revolving Credit Facility

The Company has access to an unsecured credit facility, the Revolving Credit Facility, which matures on March 31, 2019 (extendable at the Operating Partnership's option to March 31, 2020, subject to satisfaction of certain requirements) and includes an accordion feature to increase the committed facility size up to $1.0 billion, subject to satisfying certain requirements and obtaining additional lender commitments. The Operating Partnership may voluntarily prepay the Revolving Credit Facility, in whole or in part, at any time without premium or penalty, but subject to applicable LIBOR breakage fees, if any.

Borrowings bear interest at 1-Month LIBOR plus 0.875% to 1.55% per annum and require a facility fee in an amount equal to the aggregate revolving credit commitments (whether or not utilized) multiplied by a rate equal to 0.125% to 0.30% per annum. As of September 30, 2018, the Revolving Credit Facility bore interest at 1-Month LIBOR plus 1.25% and incurred a facility fee of 0.25% per annum.

In connection with placement and use of the Revolving Credit Facility, the Company has incurred costs of $4.8 million. These deferred financing costs are being amortized to interest expense over the remaining initial term of the Revolving Credit Facility. The unamortized deferred financing costs relating to the Revolving Credit Facility were $0.7 million and $1.6 million as of September 30, 2018 and December 31, 2017, respectively, and recorded in deferred costs and other assets, net on the accompanying consolidated balance sheets.

As of September 30, 2018, $157.0 million was outstanding and $643.0 million of borrowing capacity was available under the Revolving Credit Facility. The Operating Partnership's ability to borrow under the Revolving Credit Facility is subject to ongoing compliance with a number of customary financial covenants and other customary affirmative and

24

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements - (continued)

September 30, 2018

(Unaudited)

negative covenants. As of September 30, 2018, the Company and the Operating Partnership were in compliance with these financial covenants.

Term Loan

On November 3, 2015, the Company entered into a Term Loan Agreement with an initial maturity date of November 2, 2018, which may be extended at the Company's option pursuant to two one-year extension options, subject to the satisfaction of certain conditions and payment of an extension fee. In addition, an accordion feature allows the facility to be increased from $420.0 million up to $600.0 million, subject to obtaining additional lender commitments. Borrowings may be repaid without premium or penalty, and may be re-borrowed within 30 days up to the then available loan commitment and subject to occurrence limitations within any twelve-month period. The Company elected to exercise its option to extend the Term Loan, see Note 13 for further discussion.

The Term Loan Agreement provides that outstanding borrowings bear interest at 1-Month LIBOR plus 0.90% to 1.75% per annum, depending on the Company’s credit ratings. As of September 30, 2018, the Term Loan bore interest at 1-Month LIBOR plus 1.35%.

As a result of entering into the Term Loan, the Company incurred origination costs of $2.4 million. These deferred financing costs are being amortized to interest expense over the remaining initial term of the Term Loan. As of September 30, 2018 and December 31, 2017, the unamortized deferred financing costs relating to the Term Loan were $0.1 million and $0.7 million, respectively, and were recorded net against the principal balance of mortgages and notes payable as of September 30, 2018 and December 31, 2017, on the accompanying consolidated balance sheets.

As of September 30, 2018, the Term Loan had a $420.0 million outstanding balance and no available borrowing capacity. The Operating Partnership's ability to borrow under the Term Loan is subject to ongoing compliance with a number of customary financial covenants and other customary affirmative and negative covenants. The Corporation has unconditionally guaranteed all obligations of the Operating Partnership under the Term Loan Agreement. As of September 30, 2018, the Corporation and the Operating Partnership were in compliance with these financial covenants.

Senior Unsecured Notes

On August 18, 2016, the Operating Partnership completed a private placement of $300.0 million aggregate principal amount of senior notes, which are guaranteed by the Company. The Senior Unsecured Notes were issued at 99.378% of their principal face amount, resulting in net proceeds of $296.2 million, after deducting transaction fees and expenses. The Senior Unsecured Notes accrue interest at a rate of 4.45% per annum, payable on March 15 and September 15 of each year, and mature on September 15, 2026. The Company filed a registration statement with the SEC to exchange the private Senior Unsecured Notes for registered Senior Unsecured Notes with substantially identical terms, which became effective on April 14, 2017. All $300.0 million aggregate principal amount of private Senior Unsecured Notes were tendered in the exchange for registered Senior Unsecured Notes.

The Senior Unsecured Notes are redeemable in whole at any time or in part from time to time, at the Operating Partnership’s option, at a redemption price equal to the sum of: an amount equal to 100% of the principal amount of the Senior Unsecured Notes to be redeemed plus accrued and unpaid interest and liquidated damages, if any, up to, but not including, the redemption date; and a make-whole premium calculated in accordance with the indenture. Notwithstanding the foregoing, if any of the Senior Unsecured Notes are redeemed on or after June 15, 2026 (three months prior to the maturity date of the Senior Unsecured Notes), the redemption price will not include a make-whole premium.

In connection with the offering, the Operating Partnership incurred $3.4 million in deferred financing costs and an offering discount of $1.9 million. These amounts are being amortized to interest expense over the life of the Senior Unsecured Notes. As of September 30, 2018 and December 31, 2017, the unamortized deferred financing costs relating to the Senior Unsecured Notes were $2.8 million and $3.0 million, respectively, and the unamortized discount was $1.5 million and $1.7 million, respectively, with both the deferred financing costs and offering discount recorded net against the Senior Unsecured Notes principal balance on the accompanying consolidated balance sheets.

In connection with the issuance of the Senior Unsecured Notes, the Company and Operating Partnership are subject to ongoing compliance with a number of customary financial covenants and other customary affirmative and negative

25

SPIRIT REALTY CAPITAL, INC. and SPIRIT REALTY, L.P.

Notes to Consolidated Financial Statements - (continued)

September 30, 2018

(Unaudited)

covenants. As of September 30, 2018, the Company and the Operating Partnership were in compliance with these financial covenants.

Master Trust Notes

Master Trust 2013 and Master Trust 2014 are asset-backed securitization platforms through which the Company has raised capital through the issuance of non-recourse net-lease mortgage notes collateralized by commercial real estate, net-leases and mortgage loans.

On January 23, 2018, the Company re-priced a private offering of the Master Trust 2014 Series 2017-1 notes with $674.2 million aggregate principal amount. As a result, the interest rate on the Class B Notes was reduced from 6.35% to 5.49%, while the other terms of the Class B Notes remained unchanged. The terms of the Class A Notes were unaffected by the repricing. In connection with the re-pricing, the Company received $8.2 million in additional proceeds, that reduced the discount on the underlying debt.

On February 2, 2018, the Operating Partnership sold its holding of Master Trust 2014 Series 2014-2 notes with a principal balance of $11.6 million to a third-party. This transaction resulted in an increase in the Company's mortgages and notes payable, net balance as shown in the balance sheet.

On May 21, 2018, the Company retired $123.1 million of Master Trust 2013 Series 2013-1 Class A notes. There was no make-whole payment associated with the redemption of these notes. During the nine months ended September 30, 2018 there were $15.2 million in prepayments on Master Trust 2013 Series 2013-2 Class A notes with $934 thousand in associated make-whole payments.

On May 31, 2018, in conjunction with the Spin-Off, the Company contributed Master Trust 2014, which is included in liabilities related to SMTA Spin-Off in our December 31, 2017 consolidated balance sheet.

The Master Trust Notes are summarized below:

Stated Rate | Maturity | September 30, 2018 | December 31, 2017 | ||||||||||

(in Years) | (in Thousands) | ||||||||||||

Series 2014-1 Class A2 | $ | — | $ | 252,437 | |||||||||

Series 2014-2 | — | 222,683 | |||||||||||

Series 2014-3 | — | 311,336 | |||||||||||

Series 2014-4 Class A1 | — | 150,000 | |||||||||||

Series 2014-4 Class A2 | — | 358,664 | |||||||||||

Series 2017-1 Class A | — | 515,280 | |||||||||||

Series 2017-1 Class B | — | 125,400 | |||||||||||

Total Master Trust 2014 notes | — | 1,935,800 | |||||||||||

Series 2013-1 Class A | — | 125,000 | |||||||||||

Series 2013-2 Class A | 5.3 | % | 5.2 | 169,012 | 187,704 | ||||||||

Total Master Trust 2013 notes | 5.3 | % | 5.2 | 169,012 | 312,704 | ||||||||

Debt discount, net | — | (36,188 | ) | ||||||||||