Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIPTREE INC. | a1116158-k.htm |

November 2015 Financial information as of September 30, 2015 NASDAQ: TIPT INVESTOR PRESENTATION - THIRD QUARTER 2015

1 LIMITATIONS ON THE USE OF INFOMRATION This presentation has been prepared by Tiptree Financial Inc. (“Tiptree Financial”) and Tiptree Operating Company, LLC (the “Company”) solely for informational purposes, and not for the purpose of updating any information or forecast with respect to Tiptree Financial, its subsidiaries or any of its affiliates or any other purpose. This information is subject to change without notice and should not be relied upon for any purpose. Neither Tiptree Financial nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information. In furnishing this information and making any oral statements, neither Tiptree Financial, its subsidiaries nor any of its affiliates undertakes any obligation to provide the recipient with access to any additional information or to update or correct such information. The information herein or in any oral statements (if any) are prepared as of the date hereof or as of such earlier dates as presented herein; neither the delivery of this document nor any other oral statements regarding the affairs of Tiptree Financial or its affiliates shall create any implication that the information contained herein or the affairs of Tiptree Financial, its subsidiaries or its affiliates have not changed since the date hereof or after the dates presented herein (as applicable); that such information is correct as of any time subsequent to its date; or that such information is an indication regarding the performance of Tiptree Financial or any of its affiliates since the time of Tiptree Financial’s latest public filings or disclosure. These materials and any related oral statements are not all-inclusive and shall not be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Tiptree Financial files public reports with the Securities and Exchange Commission (“SEC”) on EDGAR. The information contained herein should be read in conjunction with and is qualified by Tiptree Financial’s public filings. Performance information is historical and is not indicative of, nor does it guarantee future results. There can be no assurance that similar performance may be experienced in the future. Certain market data and industry data used in this presentation were obtained from reports of governmental agencies and industry publications and surveys. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. We believe the data from third-party sources to be reliable based upon our management’s knowledge of the industry, but have not independently verified such data and as such, make no guarantees as to its accuracy, completeness or timeliness. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS This document contains "forward-looking statements" which involve risks, uncertainties and contingencies, many of which are beyond Tiptree Financial's control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained herein that are not clearly historical in nature are forward-looking, and the words "anticipate," "believe," "estimate," "expect,“ “intend,” “may,” “might,” "plan," “project,” “should,” "target,“ “will,” or similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about Tiptree Financial's plans, objectives, expectations and intentions. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section entitled “Risk Factors” in Tiptree Financial’s Annual Report on Form 10-K, and as described in the Tiptree Financial’s other filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to update any forward- looking statements. NOT AN OFFER OR A SOLICIATION This document does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with Tiptree Financial, its subsidiaries or its affiliates. The information in this document is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. NON-U.S. GAAP MEASURES Management uses EBITDA and Adjusted EBITDA on a consolidated basis and for each segment, which are non-GAAP financial measures. We believe that consolidated EBITDA and Adjusted EBITDA provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period, to analyze a company’s ability to service its debt and to facilitate comparison among companies. We believe segment EBITDA and Adjusted EBITDA provides additional supplemental information to compare results among our segments. EBITDA and Adjusted EBITDA are not a measurement of financial performance or liquidity under GAAP; therefore, EBITDA and Adjusted EBITDA should not be considered as an alternative or substitute for GAAP. Our presentation of EBITDA and Adjusted EBITDA may differ from similarly titled non- GAAP financial measures used by other companies. We define EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income taxes and consolidated depreciation and amortization expense as presented in our financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt incurred in the ordinary course of our subsidiaries’ business operations, (ii) adjust for the effect of purchase accounting, (iii) add significant acquisition related costs and (iv) adjust for significant relocation costs. DISCLAIMER

OVERVIEW Key Highlights

3 Tiptree Financial Inc. Insurance and Insurance Services Specialty Finance Real Estate Asset Management Corporate and Other TIPTREE FINANCIAL INC. - THIRD QUARTER KEY HIGHLIGHTS • Growing demand for non-bank consumer finance continues to drive robust growth in credit protection products, underlying Fortegra's pre-tax earnings of $10.1 million for the third quarter of 2015. • Improvement in specialty products' contribution to results helped close the gap from continued competitive pressure in cell phone warranty products. • Home affordability and an improving economy drove mortgage origination volumes to $442.5 million for the third quarter 2015. • Improvements in mortgage margins were driven by the contributions of more FHA/VA and agency business from the Reliance acquisition. • Trends in small business borrowing and capital investment supported positive earnings growth at Siena. • Macro economic and demographic trends fueled investments at our Care subsidiary in the beginning of 2015. • The portfolio growth fueled revenue growth at Care for the year over year period ended September 30. • Contributed capital investment and property management activities to increase occupancy drove sequential quarter improvements in revenue and income in 3Q. • Invested $40 million in Telos 2015-7, Ltd. ("Telos 7") which entered into a warehouse credit facility in anticipation of launching a new CLO. • Market expectations of weakening credit, primarily driven by the energy sector, combined with an overhang of loans on bank balance sheets has slowed new CLO issuances. • Absent the launch of new CLOs, we will see a deterioration in our asset management fees year over year, partially offset by interest net income on the warehouse. • Grew principal investments in non- performing mortgage loans ("NPLs") with additional $20.9 million investment, bringing total investment in NPLs to $30.6 million. • Grew assets in the Credit Opportunities Fund managed by Telos for Tiptree to $79.1 million.

Three and Nine Months Ended September 30, 2015 FINANCIAL RESULTS

5 (1) The consolidated non-corporate and non-acquisition related interest expense subtracted from Adjusted EBITDA includes interest expense associated with asset-specific debt at subsidiaries in the insurance and insurance services, specialty finance, real estate and corporate and other segments. For an explanation of Adjusted EBITDA and reconciliation to GAAP Net Income, see the Appendix. Key Drivers of Consolidated Results: Net loss of $3.6 million in 3Q and $11.0 million for the first nine months primarily driven by: • Improved profitability from the addition of Fortegra’s results • Growth in Specialty Finance volumes and margins • Increased rental income at Care from a combination of investments in our portfolio and improving results at our existing properties More than offset by: • Higher depreciation and amortization on our real estate portfolio • Realized marks and lower distributions received on our CLO subordinated notes as a result of the sale in the first half of 2015 • Unrealized fair value marks on our CLO subordinated notes as market expectations of higher default rates drove down valuations • Higher corporate expenses associated with our efforts to improve our controls and financial reporting infrastructure Summary Consolidated Statements of Operations and Adjusted EBITDA (1) THIRD QUARTER AND NINE MONTHS HIGHLIGHTS - CONSOLIDATED (unaudited, $ in thousands) Three Months EndedSeptember 30, Nine Months Ended September 30, 2015 2014 2015 2014 Total revenue $ 119,089 $ 20,326 $ 306,278 $ 40,832 Total expense $ 121,225 $ 18,191 $ 318,512 $ 47,995 Net Income attributable to consolidated CLOs $ (1,423) $ 2,736 $ 1,235 $ 14,450 (Loss) income before taxes from continuing operations $ (3,559) $ 4,871 $ (10,999) $ 7,287 Less: Provision (benefit) for income taxes $ 2,829 $ (1,365) $ 962 $ (3,097) Discontinued operations, net — $ 1,807 $ 23,348 $ 5,283 Net income before non-controlling interests $ (6,388) $ 8,043 $ 11,387 $ 15,667 Less: net income attributable to noncontrolling interests $ (1,835) $ 3,758 $ 1,957 $ 7,717 Net income available to common stockholders $ (4,553) $ 4,285 $ 9,430 $ 7,950 Class A Shareholder Equity (as of September 30, 2015) $ 319,593 Class A Earnings per Share $ (0.13) $ 0.24 $ 0.29 $ 0.61 Adjusted EBITDA for Continuing Operations of the Company $ 4,944 $ 7,588 $ 16,755 $ 15,853 Adjusted EBITDA for Discontinued Operations of the Company — $ 7,434 $ 33,232 $ 21,118 Total Adjusted EBITDA of the Company $ 4,944 $ 15,022 $ 49,987 $ 36,971

6 SEGMENT TOTAL REVENUE CONTRIBUTION YTD September 30, 2015 Insurance and insurance services (Fortegra) $238,891 67.3% Specialty finance $33,583 9.5% Real estate $33,334 9.4% Asset management $8,307 2.3% Corporate and other $382 0.1% Insurance and insurance services (PFG) $40,459 11.4% Specialty finance $10,172 9.4% Real estate $22,754 21.1% Asset management $9,212 8.5% Corporate and other $7,682 7.1% Insurance and insurance services (PFG) $58,226 53.9% (1) For comparative purposes, total revenues as shown in the charts include the results of PFG as well as income attributable to the consolidated CLOs. The nine month 2014 and first half 2015 results of PFG were reported in Discontinued Operations. (2) Consists of total revenues of PFG for the first half of 2015, which were reported in Discontinued Operations. PFG was sold on June 30, 2015. ($ in thousands) Tiptree's revenues grew substantially in 2015, with the key drivers being: • Addition of Fortegra more than offsetting the sale of PFG • Improvement in volume and margins in Specialty Finance with the expansion of FHA/VA and agency products combined with the improvement of overall lending industry health • Increased rental revenue off our expanded portfolio of Care The expanded revenue pie was dampened somewhat by a combination of: • Reduction in asset management fees as our older CLOs amortize. Asset management fees are expected to increase after the launch of Telos 7 • Realized and unrealized fair value losses on our CLO investments • The one-time gain of $7.9 million at Care in 2014, which impacted year over year comparisons (2) Total Revenue: $355 million(1) Total Revenue: $108 million(1) YTD September 30, 2014

7 SEGMENT ADJUSTED EBITDA From Continuing Operations Adjusted EBITDA also grew year over year, while the segment contributions to the metric shifted • Excluding a $7.9 million one time gain of Care in 2014, growth in Adjusted EBITDA was driven by Care and Specialty Finance, along with strong contributions from Fortegra, contributing to the improved results. • The dampening effects were driven by higher corporate expenses and the fair value marks on our Principal Investments. Insurance and insurance services Specialty finance Real estate Asset management Principal investments Other Total Adjusted EBITDA Nine Months Ended September 30, 2015 $45 $25 $5 $-15 $-35 $ (M ill io ns ) Segments Corp. & others Total $30.5 $2.9 $3.9 $6.7 $44.0 $(7.3) $(19.8) $-27.1 $16.8 Nine Months Ended September 30, 2014 $45 $25 $5 $-15 $-35 Segments Corp. & others Total $(1.8) $10.2 $7.2 $15.6 $10.5 $0.2 $(10.3) $15.9 (1) (2) (1) Represents our investments in CLOs, tax exempt securities and credit investment portfolio. (2) Represents our corporate expenses, including interest expense on the Fortress credit facility, head office payroll, depreciation and amortization expenses and other expenses.

Tiptree Operating Company and Tiptree Financial OPPORTUNITIES FOR GROWTH

9 Sources: (a) US. Bureau of Economic Analysis, (b) Surveys of Consumers University of Michigan; (c) Federal Reserve Bank of St. Louis IMPROVING US ECONOMIC FUNDAMENTALS DRIVE GROWTH TRAJECTORY FOR TIPTREE •The US economy has stabilized and has been showing signs of improving growth fundamentals. •US consumer confidence index is up year over year. •GDP has continued to gradually expand. •Based on the improving jobs picture, combined with some signs of wage growth, we believe it is likely that the Fed will raise interest rates in December and that rates will only increase gradually. •Tiptree’s businesses are positively leveraged to wage growth and a more confident consumer, improving business confidence and increased investment, and an expanding US economy. US Gross Domestic Product 18,500 18,000 17,500 17,000 16,500 16,000 15,500 Bi l. $ Ja n 20 13 Ap r2 01 3 Ju l2 01 3 O ct 20 13 Ja n 20 14 Ap r2 01 4 Ju l2 01 4 O ct 20 14 Ja n 20 15 Ap r2 01 5 Ju l2 01 5 Consumer Sentiment Three Month Moving Average 120 100 80 60 40 20 0 In de x Ja n 20 13 M ar 20 13 M ay 20 13 Ju l2 01 3 Se p 20 13 N ov 20 13 Ja n 20 14 M ar 20 14 M ay 20 14 Ju l2 01 4 Se p 20 14 N ov 20 14 Ja n 20 15 M ar 20 15 M ay 20 15 Ju l2 01 5 Se p 20 15 US Civilian Unemployment Rate 9.0 8.0 7.0 6.0 5.0 4.0 3.0 Pe rc en t Ja n 20 13 M ar 20 13 M ay 20 13 Ju l2 01 3 Se p 20 13 N ov 20 13 Ja n 20 14 M ar 20 14 M ay 20 14 Ju l2 01 4 Se p 20 14 N ov 20 14 Ja n 20 15 M ar 20 15 M ay 20 15 Ju l2 01 5 Se p 20 15 a b c

Insurance and Insurance Services OPPORTUNITIES FOR GROWTH

11 (a) Does not include Mortgage, home equity revolving, auto nor student loan debt. (b) The index is set at 100 at December 2012 for comparative purposes. Sources: (c) Federal Reserve Bank of New York Quarterly Report on Household Debt and Credit - August 2015; (d) Federal Reserve Bank of St. Louis INSURANCE AND INSURANCE SERVICES - GROWTH OPPORTUNITY DRIVERS •Consumer confidence and improving jobs outlook has supported growth in the demand for consumer credit. •Trends in bank regulation have driven the growth to non-bank providers for lower wage earners. •Credit life insurance products support these consumers’ access to credit. •These products have been the steady growth engine supporting quarter over quarter improvement in Fortegra’s earnings. •Growth in auto and auto warranty products as well as warranty products for consumer durables and electronics are providing new product opportunities, offsetting continued competitive pressure in the cell phone warranty business. Industrial Production: Durable Goods: Appliances, Furniture & Carpeting 120 115 110 105 100 95 90 In de x De c 20 12 M ar 20 13 Ju n 20 13 Se p 20 13 De c 20 13 M ar 20 14 Ju n 20 14 Se p 20 14 De c 20 14 M ar 20 15 Ju n 20 15 Se p 20 15 US Mobile Cellular Subscriptions 100 98 96 94 92 90 Pe r1 00 Pe op le Jan 2011 Jan 2012 Jan 2013 Jan 2014 94.4 96.0 97.1 98.4 Credit Other Household Debt - Credit & Other Debt 1.2 1.0 0.8 0.6 0.4 0.2 0.0 Pe rc en ts 2012 2013 2014 13:Q2 14:Q2 15:Q2 0.68 0.68 0.70 0.67 0.67 0.70 0.32 0.32 0.34 0.30 0.32 0.34 a, c b, d d

12 3Q 2015 QTD Net Revenue 35.0 30.0 25.0 Q3 2 014 Cred it Pro tectio n Warr anty/ Auto Spec ialty Prod ucts Servi ces & Othe r Q3 2 015 28.6 1.5 0.7 0.5 (1.2) 30.1 YTD 9 Months 2015 Net Revenue 90.0 85.0 80.0 75.0 YTD 9 /201 4 Cred it Pro tectio n Warr anty/ Auto Spec ialty Prod ucts Servi ces & Othe r YTD 9 /201 5 84.9 1.6 (1.5) 2.0 (1.9) 85.1 (1) Excludes the value of the business acquired which represent adjustments including setting deferred cost assets to a fair value of zero, modifying deferred revenue liabilities to their respective fair values and recording a substantial intangible asset. FORTEGRA REVENUE BRIDGE • Year over year net revenues at Fortegra were up 5.1% in the third quarter and flat for the nine months • Driven by a 10% increase in Credit Protection on the quarter and 3% YTD, as organic growth remains robust • Specialty Products increased $0.5M for the quarter and $2.0M YTD, primarily due to non- standard auto program business • While Warranty grew $0.7M, or 8% in the quarter, but were down $1.5M YTD, ProtectCell, Fortegra’s mobile device product experienced weaker than expected results • Services and Other were off by $1.2M and $1.9M YTD, impacted principally by anticipated run-off of Consecta administration services (1) (1)

13 FORTEGRA UNAUDITED PRO FORMA 2015 FINANCIAL INFORMATION Tiptree is presenting the following unaudited proforma financial information of Fortegra for the three and nine months ended September 30, 2015 to allow Tiptree investors to compare Fortegra's performance without the purchase price allocations reflected in Tiptree's consolidated financial statements. (Unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2015 2014 2015 2014 Actual Adjustments Proforma Actual Actual Adjustments Proforma Actual Net revenues 34,197 (4,350) 29,847 28,627 103,447 (19,413) 84,034 84,878 Total operating expenses 24,074 (2,742) 21,332 23,842 82,998 (15,492) 67,506 68,758 Income before taxes from continuing operations $ 10,123 $ (1,608) $ 8,515 $ 4,785 $ 20,449 $ (3,921) $ 16,528 $ 16,120 Adjusted EBITDA(1)(2) $ 13,171 $ 30,479 •The quarter over quarter improvement in net income and adjusted EBITDA was largely attributable to: •Improvements in revenue discussed on the previous slide. •A disciplined approach to expense management. •While year over year results were flat, the expense management and continued revenue contributions from credit products are expected to continue to drive growth into the fourth quarter. •Growth in consumer finance in the US combined with strong sales in auto, auto warranty products and consumer electronics and durable goods has provided strong underlying support to Fortegra’s results. (1) Fortegra's 2014 Adjusted EBITDA is not comparable and therefore not shown. (2)The consolidated non-corporate and non-acquisition related interest expense subtracted from Adjusted EBITDA includes interest expense associated with asset-specific debt, which for the insurance and insurance services segment was $76 thousand and $0.2 million for the three and nine months ended September 30, 2015, respectively.

Specialty Finance OPPORTUNITIES FOR GROWTH

15 (a) Measures whether a family earning median family income could qualify for a mortgage loan on a typical home defined as a national median-priced, existing single-family home. An index value of 100 means that a median income family has exactly enough to qualify while an index value of greater than 100 indicates that a median income family has more than enough income to qualify for a mortgage. Sources: (b)Thomson Reuters/PayNet; (c) Federal Reserve Bank of St. Louis (d) Fannie Mae Housing Forecast: October 2015 SPECIALTY FINANCE • Siena Lending Group (“Siena”) • Improvement in the US economy driving small and mid-size businesses to borrow and invest. • Industry trends supported Siena loan balance growth of 61% and improved earnings profile. • Mortgage Business • Home affordability continues to be attractive, with near term interest rate increases still expected to keep rates low by historic standards • Improving job prospects combined with home price improvement in many areas of the country are driving positive growth in home sales and the mortgage market Composite Housing Affordability Index 250.0 200.0 150.0 100.0 50.0 0.0 In de x Ja n- 00 Ja n- 01 Ja n- 02 Ja n- 03 Ja n- 04 Ja n- 05 Ja n- 06 Ja n- 07 Ja n- 08 Ja n- 09 Ja n- 10 Ja n- 11 Ja n- 12 Ja n- 13 Ja n- 14 Ja n- 15 Single Family Multifamily Housing Starts 1,400 1,200 1,000 800 600 400 200 0 Th ou s. U ni ts 2014 2015(P) 2016(P) 648 711 827 355 397 398 Small Business Lending Index (SBLI) 150 140 130 120 110 100 90 80 70 60 In de x Ju n- 12 Au g- 12 O ct -1 2 De c- 12 Fe b- 13 Ap r- 13 Ju n- 13 Au g- 13 O ct -1 3 De c- 13 Fe b- 14 Ap r- 14 Ju n- 14 Au g- 14 O ct -1 4 De c- 14 Fe b- 15 Ap r- 15 Ju n- 15 Au g- 15 b a, c d

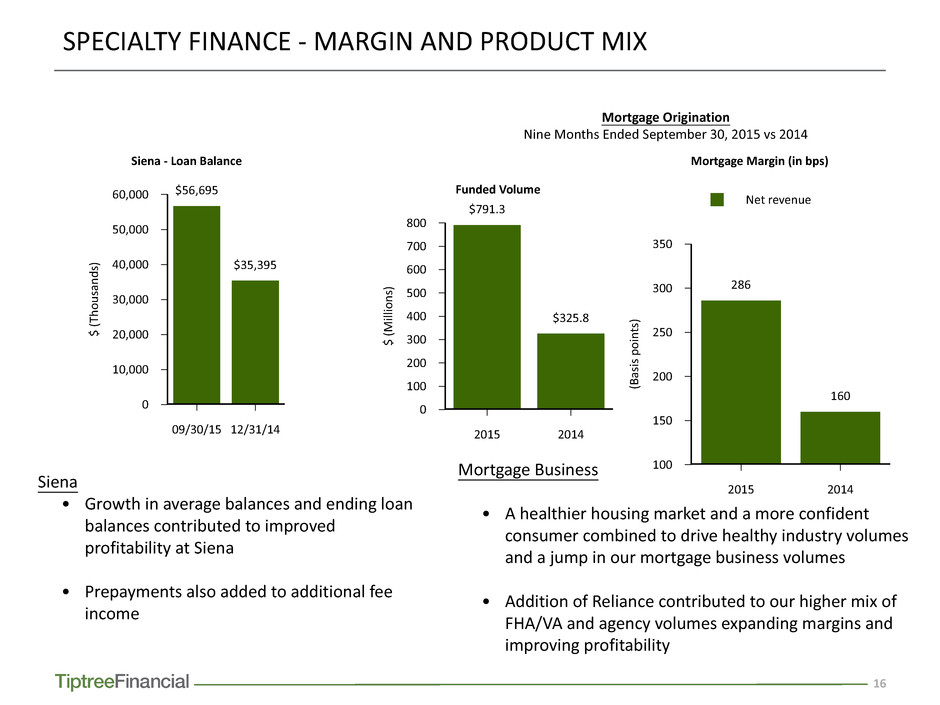

16 Net revenue Mortgage Margin (in bps) 350 300 250 200 150 100 (B as is po in ts ) 2015 2014 286 160 SPECIALTY FINANCE - MARGIN AND PRODUCT MIX Funded Volume 800 700 600 500 400 300 200 100 0 $ (M ill io ns ) 2015 2014 $791.3 $325.8 Mortgage Origination Nine Months Ended September 30, 2015 vs 2014 Siena - Loan Balance 60,000 50,000 40,000 30,000 20,000 10,000 0 $ (T ho us an ds ) 09/30/15 12/31/14 $56,695 $35,395 Mortgage Business • A healthier housing market and a more confident consumer combined to drive healthy industry volumes and a jump in our mortgage business volumes • Addition of Reliance contributed to our higher mix of FHA/VA and agency volumes expanding margins and improving profitability Siena • Growth in average balances and ending loan balances contributed to improved profitability at Siena • Prepayments also added to additional fee income

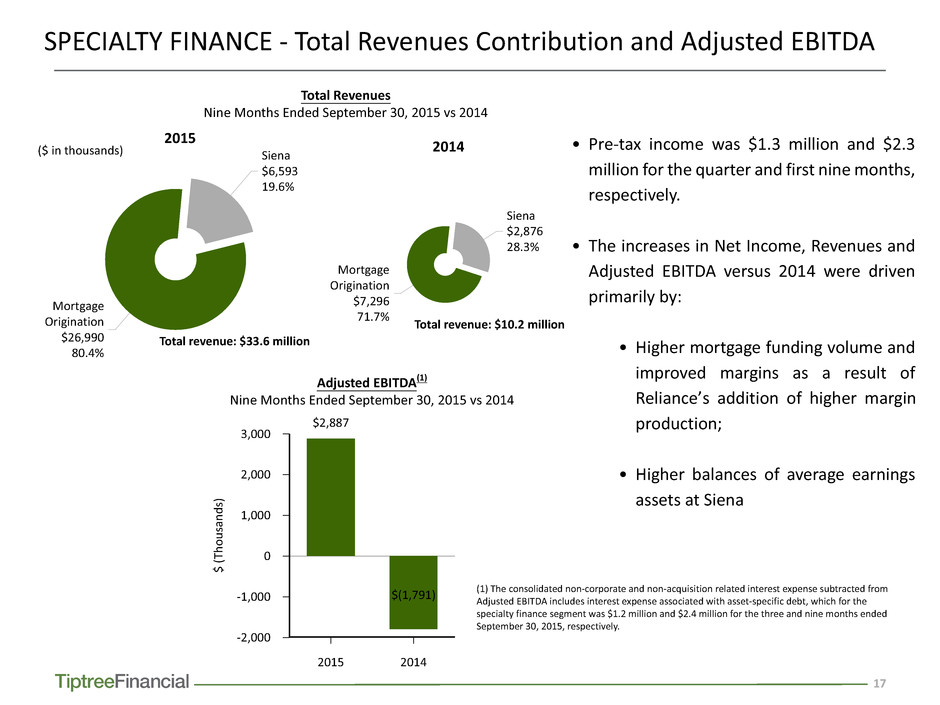

17 SPECIALTY FINANCE - Total Revenues Contribution and Adjusted EBITDA • Pre-tax income was $1.3 million and $2.3 million for the quarter and first nine months, respectively. • The increases in Net Income, Revenues and Adjusted EBITDA versus 2014 were driven primarily by: • Higher mortgage funding volume and improved margins as a result of Reliance’s addition of higher margin production; • Higher balances of average earnings assets at Siena Total Revenues Nine Months Ended September 30, 2015 vs 2014 2015 Mortgage Origination $26,990 80.4% Siena $6,593 19.6% 2014 Mortgage Origination $7,296 71.7% Siena $2,876 28.3% ($ in thousands) 3,000 2,000 1,000 0 -1,000 -2,000 $ (T ho us an ds ) 2015 2014 $2,887 $(1,791) Adjusted EBITDA(1) Nine Months Ended September 30, 2015 vs 2014 (1) The consolidated non-corporate and non-acquisition related interest expense subtracted from Adjusted EBITDA includes interest expense associated with asset-specific debt, which for the specialty finance segment was $1.2 million and $2.4 million for the three and nine months ended September 30, 2015, respectively. Total revenue: $10.2 million Total revenue: $33.6 million

Real estate OPPORTUNITIES FOR GROWTH

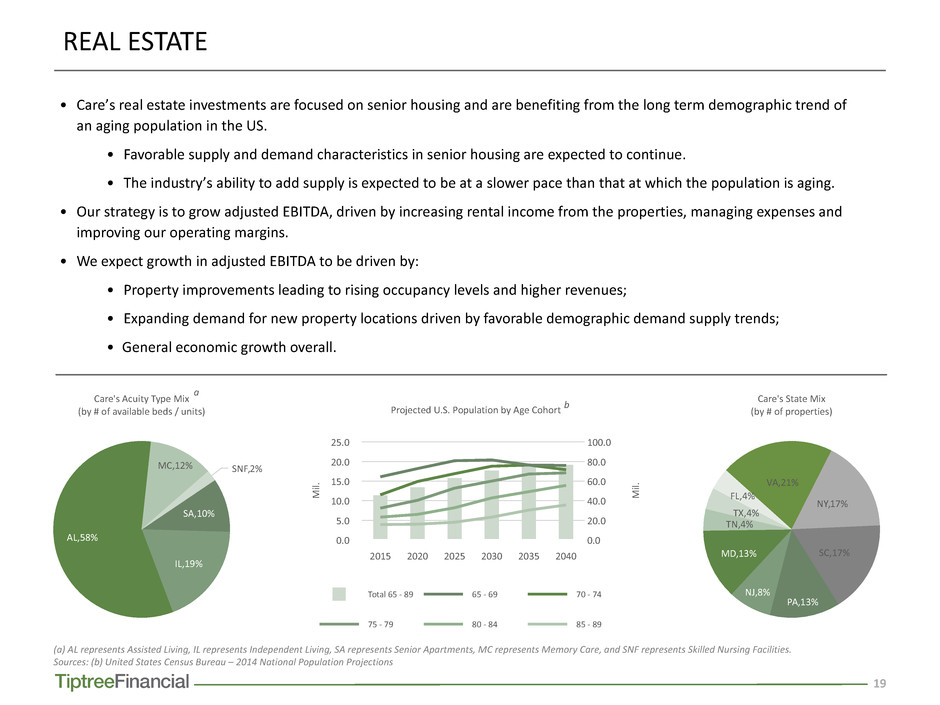

19 (a) AL represents Assisted Living, IL represents Independent Living, SA represents Senior Apartments, MC represents Memory Care, and SNF represents Skilled Nursing Facilities. Sources: (b) United States Census Bureau – 2014 National Population Projections REAL ESTATE • Care’s real estate investments are focused on senior housing and are benefiting from the long term demographic trend of an aging population in the US. • Favorable supply and demand characteristics in senior housing are expected to continue. • The industry’s ability to add supply is expected to be at a slower pace than that at which the population is aging. • Our strategy is to grow adjusted EBITDA, driven by increasing rental income from the properties, managing expenses and improving our operating margins. • We expect growth in adjusted EBITDA to be driven by: • Property improvements leading to rising occupancy levels and higher revenues; • Expanding demand for new property locations driven by favorable demographic demand supply trends; • General economic growth overall. Care's Acuity Type Mix (by # of available beds / units) SA,10% IL,19% AL,58% MC,12% SNF,2% Total 65 - 89 65 - 69 70 - 74 75 - 79 80 - 84 85 - 89 Projected U.S. Population by Age Cohort 25.0 20.0 15.0 10.0 5.0 0.0 M il. 100.0 80.0 60.0 40.0 20.0 0.0 M il. 2015 2020 2025 2030 2035 2040 Care's State Mix (by # of properties) VA,21% NY,17% SC,17% PA,13% NJ,8% MD,13% TN,4% TX,4% FL,4% a b

20 2013 and prior 2014 and after Portfolio Growth $250 $225 $200 $175 $150 $125 $100 $75 $50 $25 $0 To ta lP ur ch as e Pr ic e ($ m m ) $109.1 $123.8 $232.9 REAL ESTATE PORTFOLIO SNAPSHOT (1) Represents total purchase price of the portfolios, which includes amounts contributed by non-controlling interests and intangible assets. Total purchase price does not include subsequent depreciation and amortization or amounts reserved for additional capital expenditures. (2) Belle Reve property was acquired in December 2014. Property Acquisition Date Type Number of Facilities Number of Units Greenfield I 09/2011 NNN 3 120 Calamar 02/2013 JV 2 202 Premier 08/2013 NNN 2 99 Heritage (2) 11/2013 JV 3 349 Greenfield JV 10/2014 JV 3 360 Royal 02/2015 JV 5 282 Greenfield II 03/2015 Hybrid 6 299 Total Portfolio 24 1,711 Acquisition History • Growth in rental revenue at Care has been driven by two factors - recent acquisitions and increase in occupancy. • 14 out of our 24 facilities, representing 53% of our real estate portfolio by purchase price, were acquired at the end of 2014 and beginning of 2015. • At 13 of the 14 recent acquisition properties, Care replaced the prior manager and initiated comprehensive capital expenditure plans designed grow revenues and drive efficiencies (1)

21 SEGMENT RESULTS - REAL ESTATE 33,000 27,500 22,000 16,500 11,000 5,500 0 $ (T ho us an ds ) 2015 2014 $33,334 $14,854 $7,900 $22,754 15,000 12,500 10,000 7,500 5,000 2,500 0 $ (T ho us an ds ) 2015 2014 $3,852 $2,272 $7,900 $10,172 Nine Months Ended September 30, 2015 vs 2014 Westside loan Total Revenues Adjusted EBITDA(1) (1) Adjusted EBITDA excludes depreciation and amortization expense. The consolidated non-corporate and non-acquisition related interest expense subtracted from Adjusted EBITDA includes interest expense associated with asset-specific debt, which for the real estate segment was $1.8 million and $5.0 million for the three and nine months ended September 30, 2015, respectively. • New investments lead to higher revenues and fee income in the first nine months of 2015 vs. the same period in 2014. • Revenue and Adjusted EBITDA grew 125% and 70%, respectively, in the first nine months of 2015 vs. the same period in 2014 after adjusting for a $7.9 million one-time gain recorded by Care in 2014 attributable to the repayment in full of the Westside loan that Care had acquired at a discount.

Asset Management and Principal Investments OPPORTUNITIES FOR GROWTH

23 Sources: (a) Federal Reserve Bank of St. Louis; (b) Federal Reserve Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, September 2015. ASSET MANAGEMENT AND PRINCIPAL INVESTMENTS - OPPORTUNITIES FOR GROWTH •Growth in assets under management (“AUM”) will benefit from a growing demand for business credit. •Demand for business credit has generally improved with the improvement in the economy and a growing confidence in and willingness to invest. •As of September 30, 2015, Telos had $1.77 billion of AUM primarily related to six match-funded CLOs. •Invested $40 million into Telos 2015-7 ("Telos 7") to establish a warehouse credit facility in anticipation of launching a new CLO and $25 million in Telos Credit Opportunities Fund, L.P. ("Telos COF") to take advantage of this trend. ◦ When combined with leverage, the two investments added $239.2 million to AUM. PMI Composite Index 60.0 55.0 50.0 45.0 40.0 In de x Ju l-1 2 O ct -1 2 Ja n- 13 Ap r- 13 Ju l-1 3 O ct -1 3 Ja n- 14 Ap r- 14 Ju l-1 4 O ct -1 4 Ja n- 15 Ap r- 15 Ju l-1 5 O ct -1 5 Fed. Reserve Projected Change in Real GDP, Central Tendency (% Range) 3.0 2.5 2.0 1.5 1.0 0.5 0.0 % Gr ow th 2015 2016 2017 2018 Longer Run a b aNonfinancial Corporate Business; Credit Market Instruments 10,000.0 8,000.0 6,000.0 4,000.0 2,000.0 0.0 Bi l. $ Ap r- 00 Ap r- 01 Ap r- 02 Ap r- 03 Ap r- 04 Ap r- 05 Ap r- 06 Ap r- 07 Ap r- 08 Ap r- 09 Ap r- 10 Ap r- 11 Ap r- 12 Ap r- 13 Ap r- 14 Ap r- 15

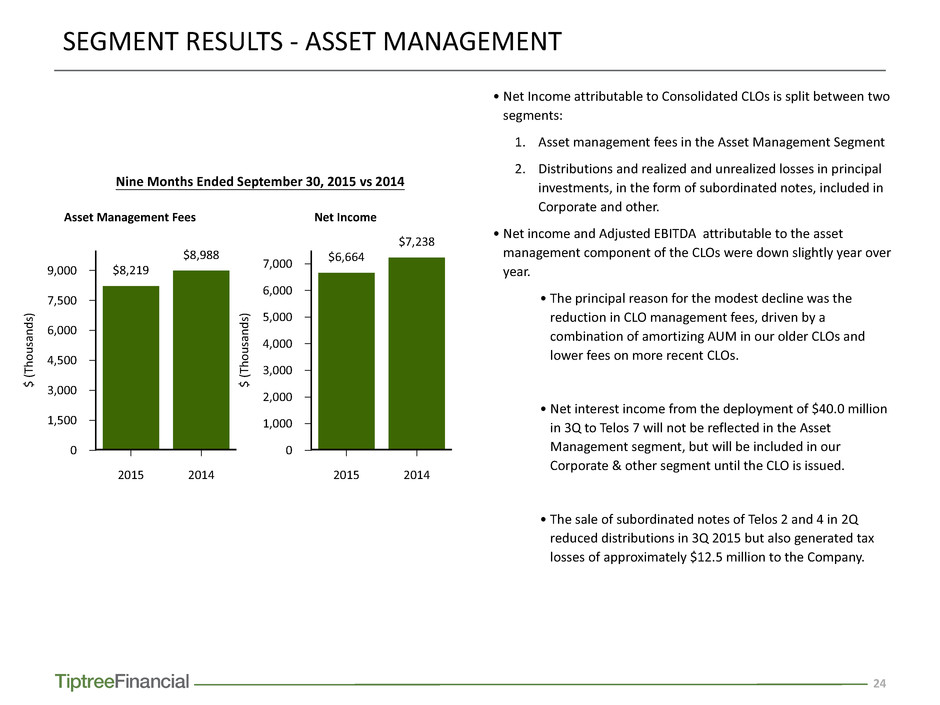

24 SEGMENT RESULTS - ASSET MANAGEMENT • Net Income attributable to Consolidated CLOs is split between two segments: 1. Asset management fees in the Asset Management Segment 2. Distributions and realized and unrealized losses in principal investments, in the form of subordinated notes, included in Corporate and other. • Net income and Adjusted EBITDA attributable to the asset management component of the CLOs were down slightly year over year. • The principal reason for the modest decline was the reduction in CLO management fees, driven by a combination of amortizing AUM in our older CLOs and lower fees on more recent CLOs. • Net interest income from the deployment of $40.0 million in 3Q to Telos 7 will not be reflected in the Asset Management segment, but will be included in our Corporate & other segment until the CLO is issued. • The sale of subordinated notes of Telos 2 and 4 in 2Q reduced distributions in 3Q 2015 but also generated tax losses of approximately $12.5 million to the Company. Asset Management Fees 9,000 7,500 6,000 4,500 3,000 1,500 0 $ (T ho us an ds ) 2015 2014 $8,219 $8,988 Net Income 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 $ (T ho us an ds ) 2015 2014 $6,664 $7,238 Nine Months Ended September 30, 2015 vs 2014

25 SEGMENT RESULTS - CORPORATE AND OTHER • Incorporates revenues from the Company’s principal investment activities and expenses including interest expense on the Fortress credit facility, head office payroll and other expenses, such as audit fees. • Pre-tax loss for the third quarter 2015 of $14.5 million and for the nine months ended September 30, 2015 of $31.6 million was primarily driven by realized and unrealized net losses of $18.8 million on CLO subordinated notes. ◦ Market expectations of deteriorating credit, combined with an overhang of loan assets for sale on bank balance sheets, drove the unrealized marks on the CLOs in the third quarter. • Corporate and other results were also impacted by our continued investment in controls and reporting infrastructure. Barclays US Corporate High Yield Average OAS 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 Yi el d Ja n- 14 Fe b- 14 M ar -1 4 M ay -1 4 Ju n- 14 Au g- 14 Se p- 14 N ov -1 4 De c- 14 Fe b- 15 M ar -1 5 Ap r- 15 Ju n- 15 Ju l-1 5 Se p- 15 O ct -1 5

26 WELL POSITIONED FOR THE REMAINDER OF 2015 AND BEYOND • As we move into the fourth quarter of 2015 and look forward to 2016, we are well positioned to take advantage of any improvements in the US economy. • Adjusted EBITDA growth is expected to benefit from: • Continued revenue growth of Fortegra, combined with disciplined expense management, driving positive improvements; • Growth in specialty finance volumes and margins from industry expansion and improving product mix and the resultant increased margins in mortgage originations; • Growing rental income from our real estate portfolio combined with investments to increase occupancy stabilize income; and • While the fair value marks on our CLOs were impacted by credit market conditions in 3Q, we expect this component of our business model to continue to improve into 2016. • We are confident that our strategic direction to take advantage of positive economic trends puts the Company in a strong position to drive long term shareholder value.

APPENDIX

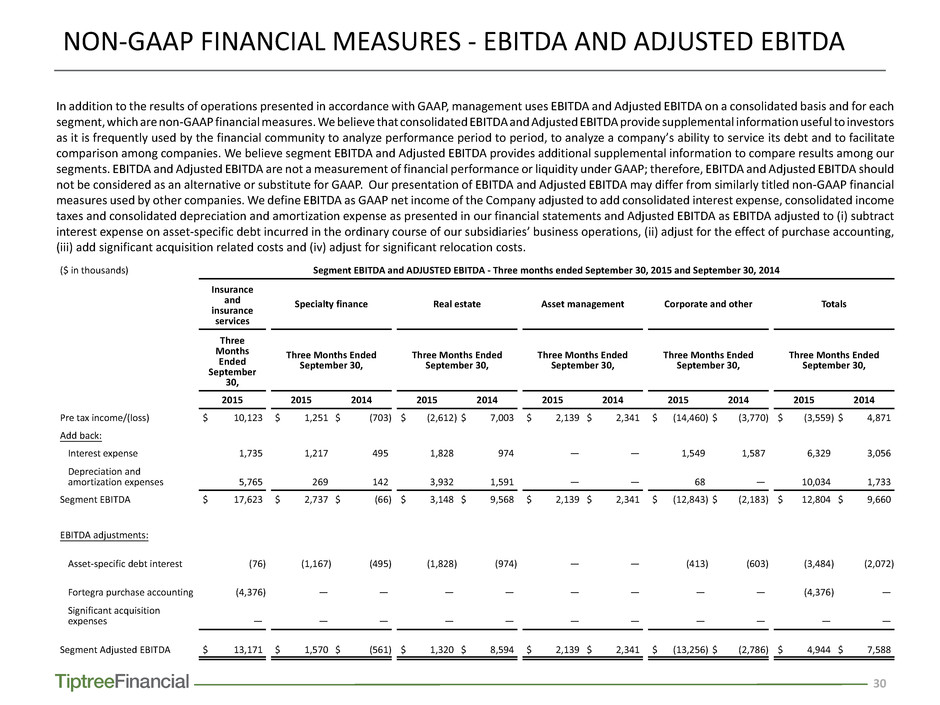

28 In addition to the results of operations presented in accordance with GAAP, management uses EBITDA and Adjusted EBITDA on a consolidated basis and for each segment, which are non-GAAP financial measures. We believe that consolidated EBITDA and Adjusted EBITDA provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period, to analyze a company’s ability to service its debt and to facilitate comparison among companies. We believe segment EBITDA and Adjusted EBITDA provides additional supplemental information to compare results among our segments. EBITDA and Adjusted EBITDA are not a measurement of financial performance or liquidity under GAAP; therefore, EBITDA and Adjusted EBITDA should not be considered as an alternative or substitute for GAAP. Our presentation of EBITDA and Adjusted EBITDA may differ from similarly titled non-GAAP financial measures used by other companies. We define EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income taxes and consolidated depreciation and amortization expense as presented in our financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt incurred in the ordinary course of our subsidiaries’ business operations, (ii) adjust for the effect of purchase accounting, (iii) add significant acquisition related costs and (iv) adjust for significant relocation costs. NON-GAAP FINANCIAL MEASURES - EBITDA AND ADJUSTED EBITDA Reconciliation from the Company’s GAAP net income to Non-GAAP financial measures - EBITDA and Adjusted EBITDA (Unaudited) (in thousands) Three Months Ended September 30, Nine Months Ended September 30, Year ended 2015 2014 2015 2014 2014 Net income (loss) available to Class A common stockholders $ (4,553) $ 4,285 $ 9,430 $ 7,950 $ (1,710) Add: net income attributable to noncontrolling interests - Tiptree Financial Partners, L.P. (1,661) 3,908 2,214 8,459 6,791 Add: net income (loss) attributable to noncontrolling interests - Other (174) (150) (257) (742) (497) Less: net income from discontinued operations — 1,807 23,348 5,283 (7,937) (Loss) from Continuing Operations of the Company $ (6,388) $ 6,236 $ (11,961) $ 10,384 $ (3,353) Consolidated interest expense 6,329 3,056 17,652 8,513 12,541 Consolidated income taxes 2,829 (1,365) 962 (3,097) 4,141 Consolidated depreciation and amortization expense 10,034 1,733 36,857 5,063 11,945 EBITDA for Continuing Operations $ 12,804 $ 9,660 $ 43,510 $ 20,863 $ 25,274 Consolidated non-corporate and non-acquisition related interest expense(1) (3,484) (2,072) (8,127) (5,010) (7,236) Effects of Purchase Accounting related to the Fortegra acquisition(2) (4,376) — (19,977) — (4,168) Significant acquisition related costs(3) — — 1,349 — 6,121 Subtotal Adjusted EBITDA for Continuing Operations of the Company $ 4,944 $ 7,588 $ 16,755 $ 15,853 $ 19,991 Income from Discontinued Operations of the Company(4) $ — $ 1,807 $ 23,348 $ 5,283 $ 7,937 Consolidated interest expense — 2,873 5,226 8,683 11,475 Consolidated income taxes — 1,345 3,796 4,003 5,525 Consolidated depreciation and amortization expense — 1,409 862 3,149 4,379 EBITDA for Discontinued Operations $ — $ 7,434 $ 33,232 $ 21,118 $ 29,316 Significant relocation costs(5) — — — — 5,477 Subtotal Adjusted EBITDA for Discontinued Operations of the Company $ — $ 7,434 $ 33,232 $ 21,118 $ 34,793 Total Adjusted EBITDA of the Company $ 4,944 $ 15,022 $ 49,987 $ 36,971 $ 54,784

29 Notes: (1) The consolidated non-corporate and non-acquisition related interest expense subtracted from Adjusted EBITDA includes interest expense associated with asset-specific debt at subsidiaries in the insurance and insurance services, specialty finance, real estate and corporate and other segments. For the quarter ended September 30, 2015, interest expense for the asset-specific debt was $76.0 thousand for insurance and insurance services, $1.2 million for specialty finance, $1.8 million for real estate and $0.4 million for corporate and other, totaling $3.5 million. For the quarter ended September 30, 2014, interest expense for the asset-specific debt was $0.5 million for specialty finance, $1.0 million for real estate and $0.6 million for corporate and other, totaling $2.1 million. For the nine months ended September 30, 2015, interest expense for the asset-specific debt was $0.2 million for insurance and insurance services, $2.4 million for specialty finance, $5.0 million for real estate and $0.5 million for corporate and other, totaling $8.1 million. For the nine months ended September 30, 2014, interest expense for the asset-specific debt was $1.0 million for specialty finance, $2.9 million for real estate, and $1.1 million for corporate and other segments, totaling $5.0 million. (2) Tiptree’s purchase of Fortegra resulted in a number of purchase accounting adjustments being made as of the date of acquisition, which included setting deferred cost assets to a fair value of zero, modifying deferred revenue liabilities to their respective fair values, and recording a substantial intangible asset representing the value of the acquired insurance policies and contracts. Following the purchase accounting adjustments, for the quarter ended September 30, 2015, expenses associated with deferred costs were more favorably stated by $1.1 million and current period income associated with deferred revenues were less favorably stated by $5.5 million. For the nine months ended September 30, 2015, expenses associated with deferred costs were more favorably stated by $5.7 million and current period income associated with deferred revenues were less favorably stated by $25.7 million.Thus, the purchase accounting effect increased EBITDA by $4.3 million and $20.0 million in the quarter ended September 30, 2015 and the nine months ended September 30, 2015, respectively, above what the historical basis of accounting would have generated. The impact of purchase accounting has been reversed to reflect an adjusted EBITDA without the purchase accounting effect. (3) Significant acquisition related costs in connection with Care’s acquisition of the Royal Portfolio and Greenfield II Portfolio properties included taxes of $504 thousand, legal costs of $414 thousand and $431 thousand of other property acquisition expenses. (4) See Note 5—Dispositions, Asset Held for Sale and Discontinued Operations, in the accompanying consolidated financial statements contained in Tiptree Financial’s form 10-Q for the quarter ended September 30, 2015, for further discussion of discontinued operations. (5) Significant relocation costs for discontinued operations included expenses incurred in connection with the move of PFAS’s physical location from New Jersey to Philadelphia for the year ended December 31, 2014. NON-GAAP FINANCIAL MEASURES - EBITDA AND ADJUSTED EBITDA (CONT.)

30 In addition to the results of operations presented in accordance with GAAP, management uses EBITDA and Adjusted EBITDA on a consolidated basis and for each segment, which are non-GAAP financial measures. We believe that consolidated EBITDA and Adjusted EBITDA provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period, to analyze a company’s ability to service its debt and to facilitate comparison among companies. We believe segment EBITDA and Adjusted EBITDA provides additional supplemental information to compare results among our segments. EBITDA and Adjusted EBITDA are not a measurement of financial performance or liquidity under GAAP; therefore, EBITDA and Adjusted EBITDA should not be considered as an alternative or substitute for GAAP. Our presentation of EBITDA and Adjusted EBITDA may differ from similarly titled non-GAAP financial measures used by other companies. We define EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income taxes and consolidated depreciation and amortization expense as presented in our financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt incurred in the ordinary course of our subsidiaries’ business operations, (ii) adjust for the effect of purchase accounting, (iii) add significant acquisition related costs and (iv) adjust for significant relocation costs. NON-GAAP FINANCIAL MEASURES - EBITDA AND ADJUSTED EBITDA ($ in thousands) Segment EBITDA and ADJUSTED EBITDA - Three months ended September 30, 2015 and September 30, 2014 Insurance and insurance services Specialty finance Real estate Asset management Corporate and other Totals Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, 2015 2015 2014 2015 2014 2015 2014 2015 2014 2015 2014 Pre tax income/(loss) $ 10,123 $ 1,251 $ (703) $ (2,612) $ 7,003 $ 2,139 $ 2,341 $ (14,460) $ (3,770) $ (3,559) $ 4,871 Add back: Interest expense 1,735 1,217 495 1,828 974 — — 1,549 1,587 6,329 3,056 Depreciation and amortization expenses 5,765 269 142 3,932 1,591 — — 68 — 10,034 1,733 Segment EBITDA $ 17,623 $ 2,737 $ (66) $ 3,148 $ 9,568 $ 2,139 $ 2,341 $ (12,843) $ (2,183) $ 12,804 $ 9,660 EBITDA adjustments: Asset-specific debt interest (76) (1,167) (495) (1,828) (974) — — (413) (603) (3,484) (2,072) Fortegra purchase accounting (4,376) — — — — — — — — (4,376) — Significant acquisition expenses — — — — — — — — — — — Segment Adjusted EBITDA $ 13,171 $ 1,570 $ (561) $ 1,320 $ 8,594 $ 2,139 $ 2,341 $ (13,256) $ (2,786) $ 4,944 $ 7,588

31 In addition to the results of operations presented in accordance with GAAP, management uses EBITDA and Adjusted EBITDA on a consolidated basis and for each segment, which are non-GAAP financial measures. We believe that consolidated EBITDA and Adjusted EBITDA provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period, to analyze a company’s ability to service its debt and to facilitate comparison among companies. We believe segment EBITDA and Adjusted EBITDA provides additional supplemental information to compare results among our segments. EBITDA and Adjusted EBITDA are not a measurement of financial performance or liquidity under GAAP; therefore, EBITDA and Adjusted EBITDA should not be considered as an alternative or substitute for GAAP. Our presentation of EBITDA and Adjusted EBITDA may differ from similarly titled non-GAAP financial measures used by other companies. We define EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income taxes and consolidated depreciation and amortization expense as presented in our financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt incurred in the ordinary course of our subsidiaries’ business operations, (ii) adjust for the effect of purchase accounting, (iii) add significant acquisition related costs and (iv) adjust for significant relocation costs. NON-GAAP FINANCIAL MEASURES - EBITDA AND ADJUSTED EBITDA ($ in thousands) Segment EBITDA and ADJUSTED EBITDA - Nine months ended September 30, 2015 and September 30, 2014 Insurance and insurance services Specialty finance Real estate Asset management Corporate and other Totals Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, 2015 2015 2014 2015 2014 2015 2014 2015 2014 2015 2014 Pre tax income/(loss) $ 20,449 $ 2,254 $ (2,170) $ (8,762) $ 5,488 $ 6,664 $ 7,238 $ (31,604) $ (3,269) $ (10,999) $ 7,287 Add back: Interest expense 5,249 2,562 950 4,968 2,930 — — 4,873 4,633 17,652 8,513 Depreciation and amortization expenses 24,977 515 379 11,265 4,684 — — 100 — 36,857 5,063 Segment EBITDA $ 50,675 $ 5,331 $ (841) $ 7,471 $ 13,102 $ 6,664 $ 7,238 $ (26,631) $ 1,364 $ 43,510 $ 20,863 EBITDA adjustments: Asset-specific debt interest (219) (2,444) (950) (4,968) (2,930) — — (496) (1,130) (8,127) (5,010) Fortegra purchase accounting (19,977) — — — — — — — — (19,977) — Significant acquisition expenses — — — 1,349 — — — — — 1,349 — Segment Adjusted EBITDA $ 30,479 $ 2,887 $ (1,791) $ 3,852 $ 10,172 $ 6,664 $ 7,238 $ (27,127) $ 234 $ 16,755 $ 15,853

32 TIPTREE FINANCIAL INC. AND THE COMPANY - BOOK VALUE PER SHARE Tiptree Financial’s book value per share was $9.12 as of September 30, 2015 compared with $8.94 as of December 31, 2014. Total stockholders' equity for the Company was $398.1 million as of September 30, 2015, which comprised total stockholders' equity of $406.8 million adjusted for $15.2 million attributable to non-controlling interest at subsidiaries that are not wholly owned by the Company, such as Siena, Luxury and Care, and net liabilities of $6.6 million wholly owned by Tiptree Financial Inc. Total stockholders' equity for the Company was $381.3 million as of December 31, 2014, which comprised total stockholders' equity of $401.7 million adjusted for $27.1 million attributable to non-controlling interest at subsidiaries that are not wholly owned by the Company and net liabilities of $6.7 million wholly owned by Tiptree Financial Inc. Additionally, the Company’s book value per share is based upon Class A common shares outstanding, plus Class A common stock issuable upon exchange of partnership units of TFP. The total shares as of September 30, 2015 and December 31, 2014 were 43.1 million and 41.6 million, respectively. Tiptree Financial’s Class A book value per common share and the Company’s book value per share are presented below. Book value per share - Tiptree Financial (in thousands, except per share data) September 30, 2015 December 31, 2014 Total stockholders’ equity of Tiptree Financial $ 319,593 $ 284,462 Class A common stock outstanding 35,039 31,830 Class A book value per common share(1) $ 9.12 $ 8.94 Book value per share - the Company Total stockholders’ equity of the Company $ 398,113 $ 381,300 Class A common stock outstanding 35,039 31,830 Class A common stock issuable upon exchange of partnership units of TFP 8,055 9,770 Total shares 43,094 41,600 Company book value per share $ 9.24 $ 9.17 Notes: (1) See Note 24—Earnings per Share, in the Form 10-Q for the quarter ended September 30, 2015, for further discussion of potential dilution from warrants.