Attached files

| file | filename |

|---|---|

| 8-K - 8-K - R1 RCM INC. | a8kpressrelease11915q32015.htm |

| EX-99.1 - EXHIBIT 99.1 - R1 RCM INC. | exhibit991-q3pressrelease.htm |

©2015 Accretive Health Inc.1 Financial Results Conference Call Exhibit 99.2 EDITABLE CONTENT November 9, 2015

©2015 Accretive Health Inc.2 Safe Harbor This presentation contains forward-looking statements, including statements regarding the Company’s strategic review process and its ability to generate specified levels of cash from contracting activities. All forward-looking statements contained in this presentation involve risks and uncertainties. The Company’s actual results and outcomes could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the factors set forth under the heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on June 23, 2015, and its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2015, filed with the SEC on November 9, 2015. The words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “vision,” “would,” and similar expressions are intended to identify forward- looking statements, although not all forward-looking statements contain these identifying words. The Company has based these forward-looking statements on its current expectations and projections about future events. Although the Company believes that the expectations underlying any of its forward-looking statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections, or expectations prove incorrect, actual results, performance, financial condition, or events may vary materially and adversely from those anticipated, estimated, or expected. All forward-looking statements included in this presentation are expressly qualified in their entirety by these cautionary statements. The Company cautions readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described above, as well as others that the Company may consider immaterial or does not anticipate at this time. Although the Company believes that the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations may prove correct. The Company’s expectations reflected in its forward-looking statements can be affected by inaccurate assumptions it might make or by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not exclusive, and further information concerning the Company and its business, including factors that potentially could materially affect its financial results or condition or relationships with customers and potential customers, may emerge from time to time. The Company assumes no, and it specifically disclaims any, obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. The Company advises investors, however, to consult any further disclosures it makes on related subjects in our periodic reports that it files with or furnishes to the SEC.

©2015 Accretive Health Inc.3 Emad Rizk, M.D. President & CEO

©2015 Accretive Health Inc.4 Executive Summary square4 Overview of third quarter results square4 Signed first RCM customer in over two years square4 4 Hospitals, ~$700 million in net patient revenue square4 Competitive process, 9-month selling cycle square4 Signed sizable PAS customer square4 Health system with $2 billion in net patient revenue square4 Market demand for RCM services remains robust; we have an active sales effort and continue to grow the pipeline square4 Operational execution on track square4 Onboarded new business into Southfield shared services center square4 Operating metrics which directly correlate to hospitals’ financial performance continue to improve square4 Strategic review process is ongoing

©2015 Accretive Health Inc.5 Peter Csapo Chief Financial Officer & Treasurer

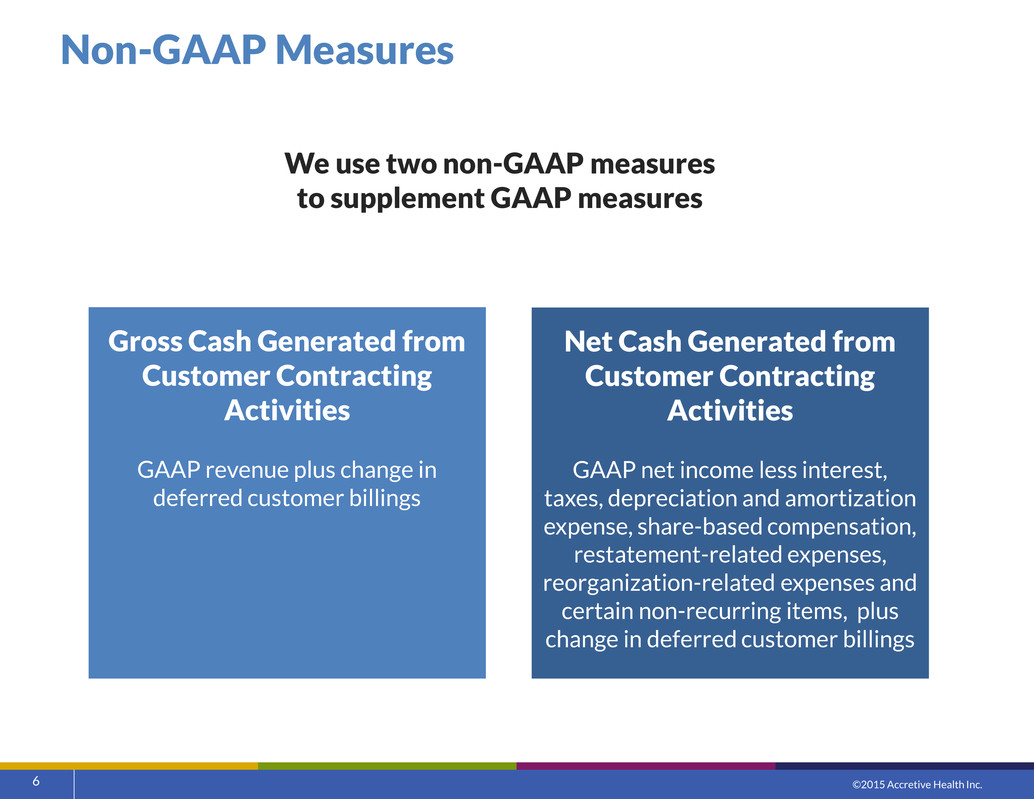

©2015 Accretive Health Inc.6 Non-GAAP Measures Gross Cash Generated from Customer Contracting Activities GAAP revenue plus change in deferred customer billings Net Cash Generated from Customer Contracting Activities GAAP net income less interest, taxes, depreciation and amortization expense, share-based compensation, restatement-related expenses, reorganization-related expenses and certain non-recurring items, plus change in deferred customer billings We use two non-GAAP measures to supplement GAAP measures

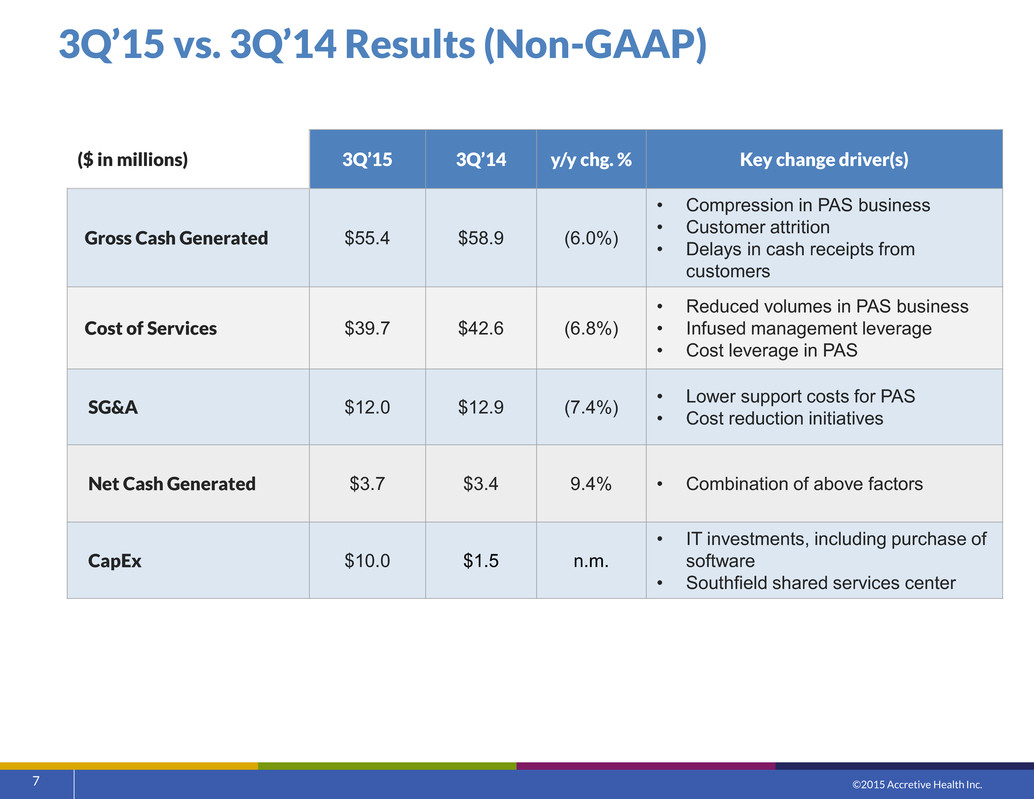

©2015 Accretive Health Inc.7 3Q’15 vs. 3Q’14 Results (Non-GAAP) ($ in millions) 3Q’15 3Q’14 y/y chg. % Key change driver(s) Gross Cash Generated $55.4 $58.9 (6.0%) • Compression in PAS business • Customer attrition • Delays in cash receipts from customers Cost of Services $39.7 $42.6 (6.8%) • Reduced volumes in PAS business • Infused management leverage • Cost leverage in PAS SG&A $12.0 $12.9 (7.4%) • Lower support costs for PAS• Cost reduction initiatives Net Cash Generated $3.7 $3.4 9.4% • Combination of above factors CapEx $10.0 $1.5 n.m. • IT investments, including purchase of software • Southfield shared services center

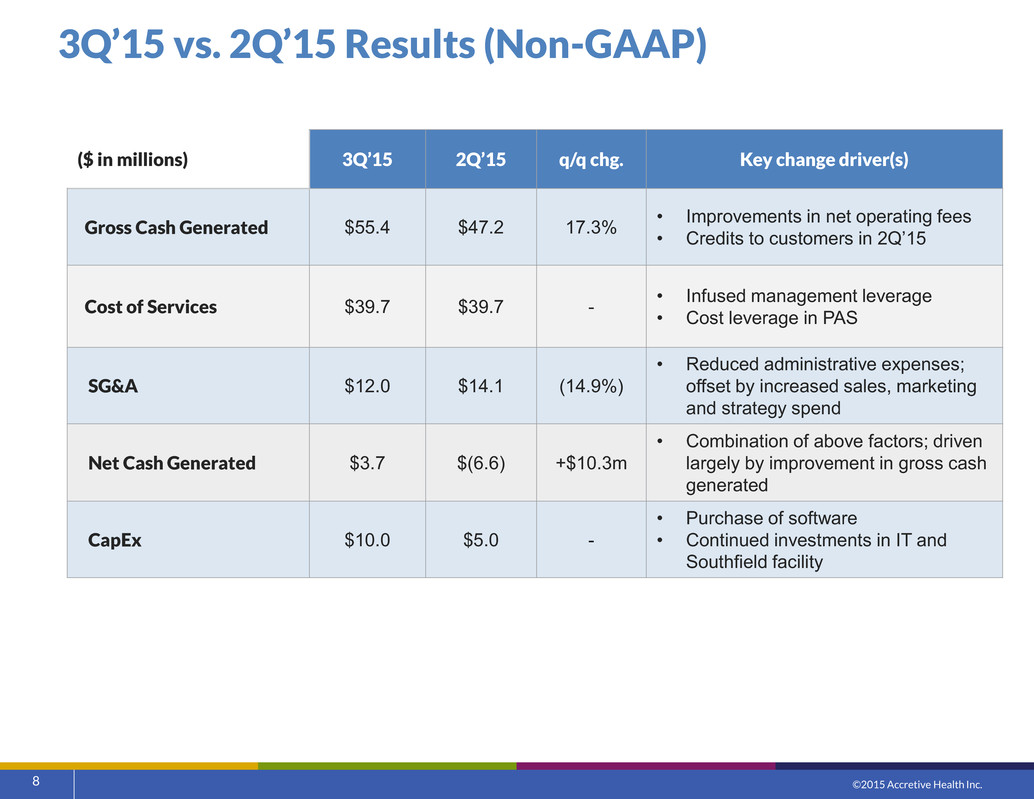

©2015 Accretive Health Inc.8 3Q’15 vs. 2Q’15 Results (Non-GAAP) ($ in millions) 3Q’15 2Q’15 q/q chg. Key change driver(s) Gross Cash Generated $55.4 $47.2 17.3% • Improvements in net operating fees• Credits to customers in 2Q’15 Cost of Services $39.7 $39.7 - • Infused management leverage• Cost leverage in PAS SG&A $12.0 $14.1 (14.9%) • Reduced administrative expenses; offset by increased sales, marketing and strategy spend Net Cash Generated $3.7 $(6.6) +$10.3m • Combination of above factors; driven largely by improvement in gross cash generated CapEx $10.0 $5.0 - • Purchase of software • Continued investments in IT and Southfield facility

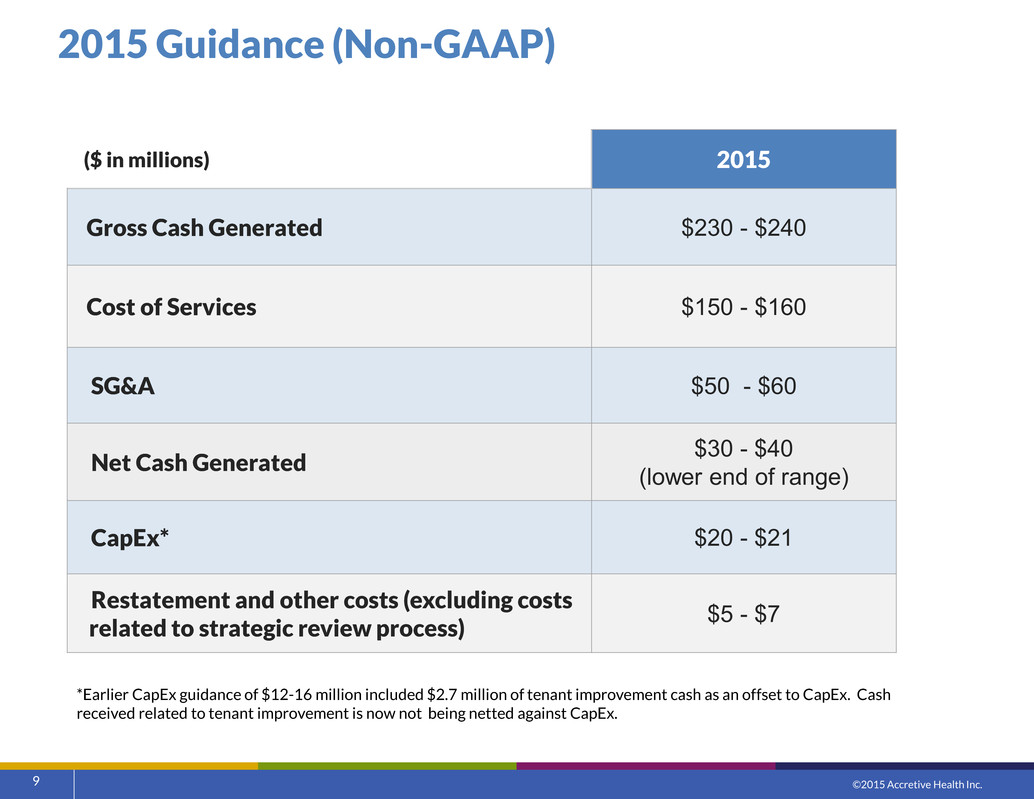

©2015 Accretive Health Inc.9 2015 Guidance (Non-GAAP) ($ in millions) 2015 Gross Cash Generated $230 - $240 Cost of Services $150 - $160 SG&A $50 - $60 Net Cash Generated $30 - $40(lower end of range) CapEx* $20 - $21 Restatement and other costs (excluding costs related to strategic review process) $5 - $7 *Earlier CapEx guidance of $12-16 million included $2.7 million of tenant improvement cash as an offset to CapEx. Cash received related to tenant improvement is now not being netted against CapEx.

©2015 Accretive Health Inc.10 Questions and Answers

©2015 Accretive Health Inc.11 Appendix

©2015 Accretive Health Inc.12 Use of Non-GAAP Financial Measures In order to provide a more comprehensive understanding of the information used by Accretive Health’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial measures, which are included in this presentation. These include gross and net cash generated from customer contracting activities, and adjusted EBITDA. Our Board and management team use these non-GAAP measures as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations; and (ii) as a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation plans for employees. Gross cash generated from customer contracting activities is defined as GAAP net services revenue, plus the change in deferred customer billings. Accordingly, gross cash generated from customer contracting activities is the sum of (i) invoiced or accrued net operating fees, (ii) cash collections on incentive fees and (iii) other services fees. Net cash generated from customer contracting activities reflects non-GAAP adjusted EBITDA and the change in deferred customer billings. Adjusted EBITDA is defined as net income before net interest income (expense), income tax provision, depreciation and amortization expense, share-based compensation, restatement-related expense, reorganization-related expense and certain non-recurring items. The use of adjusted EBITDA to measure operating and financial performance is limited by our revenue recognition criteria, pursuant to which GAAP net services revenue is recognized at the end of a contract or other contractual agreement event. Adjusted EBITDA does not adequately match corresponding cash flows from customer contracting activities. As a result, the Company uses gross cash and net cash generated from customer contracting activities to better compare cash flows to operating performance. Deferred customer billings include the portion of both (i) invoiced or accrued net operating fees and (ii) cash collections of incentive fees, in each case, that have not met our revenue recognition criteria. Deferred customer billings are included in the detail of our customer liabilities balance in the consolidated balance sheet available in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014. Slide 14 presents a reconciliation of GAAP revenue to gross cash generated from customer contracting activities, and slide 15 presents a reconciliation of GAAP net income (loss), the most comparable GAAP measure, to adjusted EBITDA and net cash generated from customer contracting activities, in each case, for each of the periods indicated. These adjusted measures are non-GAAP and should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP.

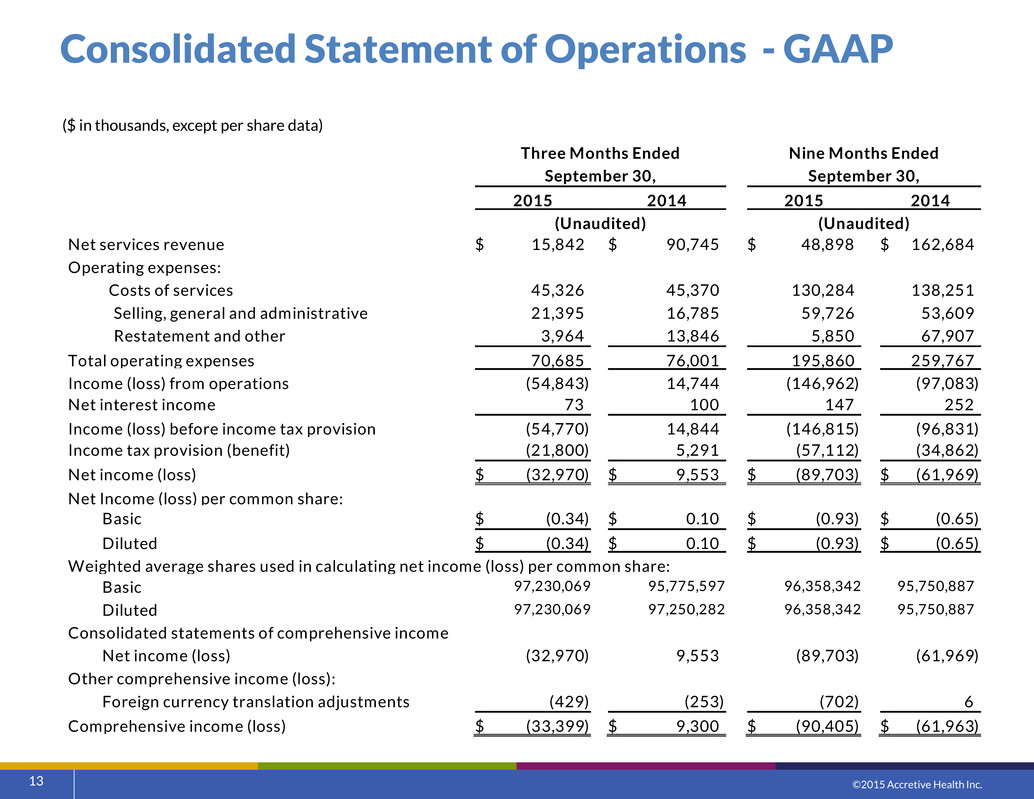

©2015 Accretive Health Inc.13 Consolidated Statement of Operations - GAAP ($ in thousands, except per share data) Three Months Ended Nine Months Ended September 30, September 30, 2015 2014 2015 2014 (Unaudited) (Unaudited) Net services revenue $ 15,842 $ 90,745 $ 48,898 $ 162,684 Operating expenses: Costs of services 45,326 45,370 130,284 138,251 Selling, general and administrative 21,395 16,785 59,726 53,609 Restatement and other 3,964 13,846 5,850 67,907 Total operating expenses 70,685 76,001 195,860 259,767 Income (loss) from operations (54,843) 14,744 (146,962) (97,083) Net interest income 73 100 147 252 Income (loss) before income tax provision (54,770) 14,844 (146,815) (96,831) Income tax provision (benefit) (21,800) 5,291 (57,112) (34,862) Net income (loss) $ (32,970) $ 9,553 $ (89,703) $ (61,969) Net Income (loss) per common share: Basic $ (0.34) $ 0.10 $ (0.93) $ (0.65) Diluted $ (0.34) $ 0.10 $ (0.93) $ (0.65) Weighted average shares used in calculating net income (loss) per common share: Basic 97,230,069 95,775,597 96,358,342 95,750,887 Diluted 97,230,069 97,250,282 96,358,342 95,750,887 Consolidated statements of comprehensive income Net income (loss) (32,970) 9,553 (89,703) (61,969) Other comprehensive income (loss): Foreign currency translation adjustments (429) (253) (702) 6 Comprehensive income (loss) $ (33,399) $ 9,300 $ (90,405) $ (61,963)

©2015 Accretive Health Inc.14 Reconciliation of GAAP revenue to Gross Cash Generated from Customer Contracting Activities ($ in thousands) 2015 2014 Amount % 2015 2014 Amount % GAAP Net S ervices Revenue: RCM services : net operating fee $ 6,232 $ 37,861 $ (31,629) (83.5)% $ 19,402 $ 62,817 $ (43,415) (69.1)% RCM services : incentive fee 1,017 45,970 (44,953) (97.8)% 9,022 75,076 (66,054) (88.0)% RCM services : other 5,359 1,858 3,501 n.m. 9,591 5,787 3,804 65.7% Other service fee 3,234 5,056 (1,822) (36.0)% 10,883 19,004 (8,121) (42.7)% Net services revenue (GAAP basis ) 15,842 90,745 (74,903) (82.5)% 48,898 162,684 (113,786) (69.9)% Change in deferred customer billings 39,541 (31,821) 71,362 n.m 108,601 10,189 98,412 n.m Gross cash generated from customer contracting activities $ 55,383 $ 58,924 $ (3,541) (6.0)% $ 157,499 $ 172,873 $ (15,374) (8.9)% Components of Gross Cash Generated from Customer Contracting Activities: RCM services : net operating fee $ 31,522 $ 26,454 $ 5,068 19.2% $ 88,761 $ 90,684 $ (1,923) (2.1)% RCM services : incentive fee 14,859 25,556 (10,697) (41.9)% 47,501 57,398 (9,897) (17.2)% RCM services : other 5,768 1,218 4,550 n.m 10,354 4,147 6,207 n.m. Total RCM services fees 52,149 53,228 (1,079) (2.0)% 146,616 152,229 (5,613) (3.7)% Other service fees 3,234 5,696 (2,462) (43.2)% 10,883 20,644 (9,761) (47.3)% Gross cash generated from customer contracting activities $ 55,383 $ 58,924 $ (3,541) (6.0)% $ 157,499 $ 172,873 $ (15,374) (8.9)% Three Months Ended S eptember 30, 2015 vs. 2014 Change Nine Months Ended S eptember 30, 2015 vs. 2014 Change *n.m. – not meaningful

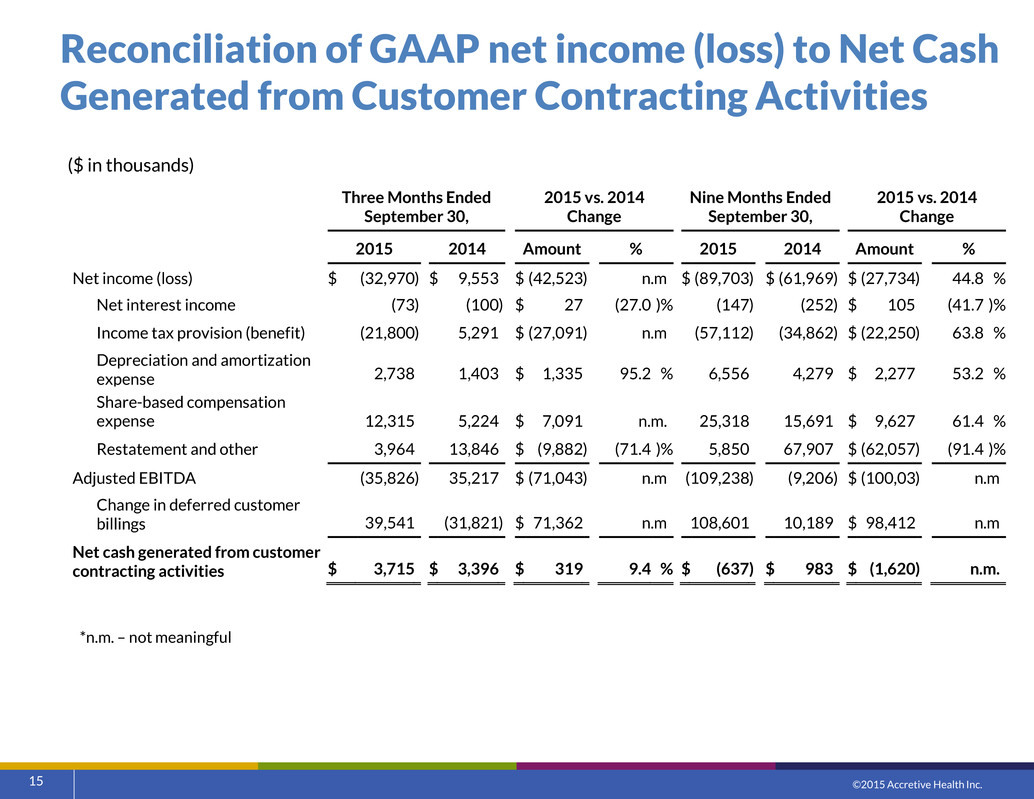

©2015 Accretive Health Inc.15 Reconciliation of GAAP net income (loss) to Net Cash Generated from Customer Contracting Activities ($ in thousands) *n.m. – not meaningful Three Months Ended September 30, 2015 vs. 2014 Change Nine Months Ended September 30, 2015 vs. 2014 Change 2015 2014 Amount % 2015 2014 Amount % Net income (loss) $ (32,970) $ 9,553 $ (42,523) n.m $ (89,703 ) $ (61,969 ) $ (27,734) 44.8 % Net interest income (73) (100) $ 27 (27.0 )% (147) (252) $ 105 (41.7 )% Income tax provision (benefit) (21,800) 5,291 $ (27,091) n.m (57,112) (34,862) $ (22,250) 63.8 % Depreciation and amortization expense 2,738 1,403 $ 1,335 95.2 % 6,556 4,279 $ 2,277 53.2 % Share-based compensation expense 12,315 5,224 $ 7,091 n.m. 25,318 15,691 $ 9,627 61.4 % Restatement and other 3,964 13,846 $ (9,882) (71.4 )% 5,850 67,907 $ (62,057) (91.4 )% Adjusted EBITDA (35,826) 35,217 $ (71,043) n.m (109,238) (9,206) $ (100,03 2 ) n.m Change in deferred customer billings 39,541 (31,821) $ 71,362 n.m 108,601 10,189 $ 98,412 n.m Net cash generated from customer contracting activities $ 3,715 $ 3,396 $ 319 9.4 % $ (637 ) $ 983 $ (1,620) n.m.

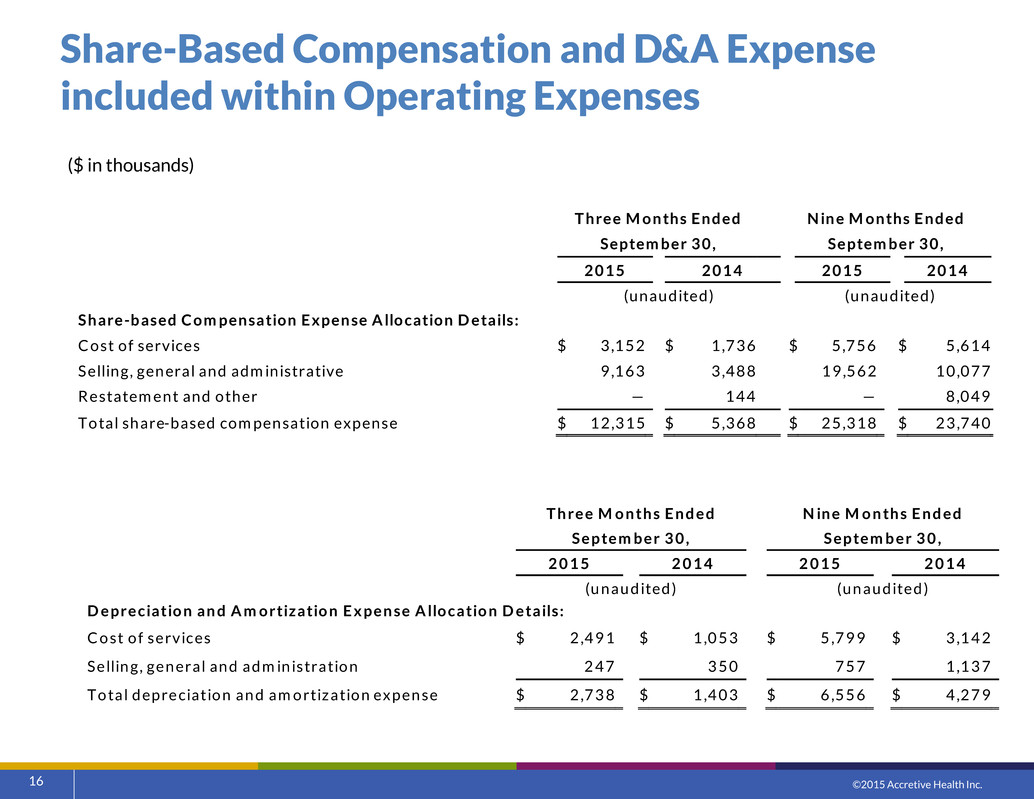

©2015 Accretive Health Inc.16 Share-Based Compensation and D&A Expense included within Operating Expenses ($ in thousands) Three Months Ended Nine Months Ended September 30, September 30, 2015 2014 2015 2014 (unaudited) (unaudited) Share-based Compensation Expense Allocation Details: Cost of services $ 3,152 $ 1,736 $ 5,756 $ 5,614 Selling, general and adm inistrative 9 ,163 3,488 19,562 10,077 Restatement and other — 144 — 8,049 Total share-based compensation expense $ 12,315 $ 5,368 $ 25,318 $ 23,740 Three M onths Ended N ine M onths Ended September 30 , September 30 , 2015 2014 2015 2014 (unaudited) (unaudited) Depreciation and Amortization Expense A llocation Details: Cost o f services $ 2 ,491 $ 1 ,053 $ 5 ,799 $ 3 ,142 Selling, general and adm in istration 247 350 757 1 ,137 Total depreciation and amortization expense $ 2 ,738 $ 1 ,403 $ 6 ,556 $ 4 ,279