Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WireCo WorldGroup Inc. | q32015investorcallslides.htm |

WireCo WorldGroup Investor Call Q3 2015

2 Forward-Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements. It is important to note that the Company’s performance, and actual results, financial condition or business could differ materially from those expressed in such forward- looking statements. Forward-looking statements include those containing such words as “anticipates,” “believes”, “continues,” “estimates,” “expects,” “forecasts,” “intends,” “outlook,” “plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. Factors that could cause or contribute to such differences include, but are not limited to: the general economic conditions in markets and countries where we have operations; fluctuations in end market demand; risks associated with our non-U.S. operations; foreign currency exchange rate fluctuations; the competitive environment in which we operate; changes in the availability or cost of raw materials and energy; risks associated with our manufacturing activities; our ability to meet quality standards; our ability to protect our trade names; violations of laws and regulations; the impact of environmental issues and changes in environmental laws and regulations; our ability to successfully execute and integrate acquisitions; comparability of our specified scaled disclosure requirements applicable to emerging growth companies; labor disturbances, including any resulting from suspension or termination of our collective bargaining agreements; our significant indebtedness; covenant restrictions; the interests of our principal equity holder may not be aligned with the holders of our 9.5% Senior Notes; and credit-rating downgrades. More detailed information about factors that could affect future performance or results may be found in our filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2014 and subsequent reports. Forward-looking statements should not be relied upon as a guarantee of future performance or results, nor will they prove to be accurate indications of the times at or by which any such performance or results will be achieved. The Company undertakes no obligation to update forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial condition or business over time. Non-GAAP Financial Measures Some of the information included in this presentation is derived from our consolidated financial information but is not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Certain of these data are considered “Non-GAAP Financial Measures” under SEC rules. These Non-GAAP Financial Measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures can be found in the Appendix to this presentation. These Non-GAAP Financial Measures are provided as a means to enhance communications with security holders by providing additional information regarding our operating results and liquidity. Management uses these Non-GAAP Financial Measures in evaluating our performance and in determining debt covenant calculations. Any reference during the discussion today to EBITDA means Adjusted EBITDA for which we have provided a reconciliation in the Appendix. Cautionary Statements

3 WireCo Business Overview

4 WireCo Overview Steel (70%) Large diameter, highly engineered rope and electrical signal transmission cable Engineered specialty wire products used in industrial end markets Highly engineered, made-to-order synthetic ropes and technical products that have strength characteristics of steel but weigh significantly less Synthetic (30%) Highly engineered plastic molding from recycled materials used in a variety of industrial, structural and oil and gas applications Rope (72% of Sales) (1) Broad Product Offering Specialty Wire (17% of Sales) (1) Engineered Products (11% of Sales) (1) Rope: Diverse End Market Applications Oil & Gas Industrial and Infrastructure Fishing Maritime Mining (1) Percentages shown as % of Q3 2015 Sales.

5 WireCo Q3 2015 Performance

6 $16.2 $18.1 Q3'14 Q3'15 $217.1 $194.8 $171.4 Q3'14 Q3'14CC Q3'15 $39.0 $35.0 $27.5 $40.1 $36.1 $29.3 Q3'14 Q3'14CC Q3'15 Management proactive in challenging market conditions by reducing costs $6.5 million (Constant Currency(2)) Q3’15 versus Q3’14 as revenue declined $23.4 million (Constant Currency(2)) – Margin improved to 16.2% from low in Q1 of 15.2% Revenue decline from Q3’14 to Q3’15 of $23.4 million on a Constant Currency(2) basis – Oil & Gas slowdown driving lower sales in Onshore ropes and Engineered Products (mature Oil & Gas product portfolio of EP) – Additional slowdown in Global OEM Crane and Mining markets driving lower rope sales – Q3’15 in line with Q2’15 revenues; market stability seen for back to back quarters Resulting Adjusted EBITDA(1) of $27.5 million – FX impact of $4.0 million compared to Q3’14 Q3 cash generation driven by improved inventory days and disciplined capital expenditure management (while continuing to prudently invest in maintenance) Q3 Performance Summary Sales Adjusted EBITDA (1) (1) Adjusted EBITDA, Credit Agreement EBITDA, Free Cash Flow and Adjusted Working Capital are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures. (2) 2014 Constant Currency (CC) are 2014 actuals calculated at 2015 exchange rates for the same period. Free Cash Flow (1) (1) (1) (2) (2)

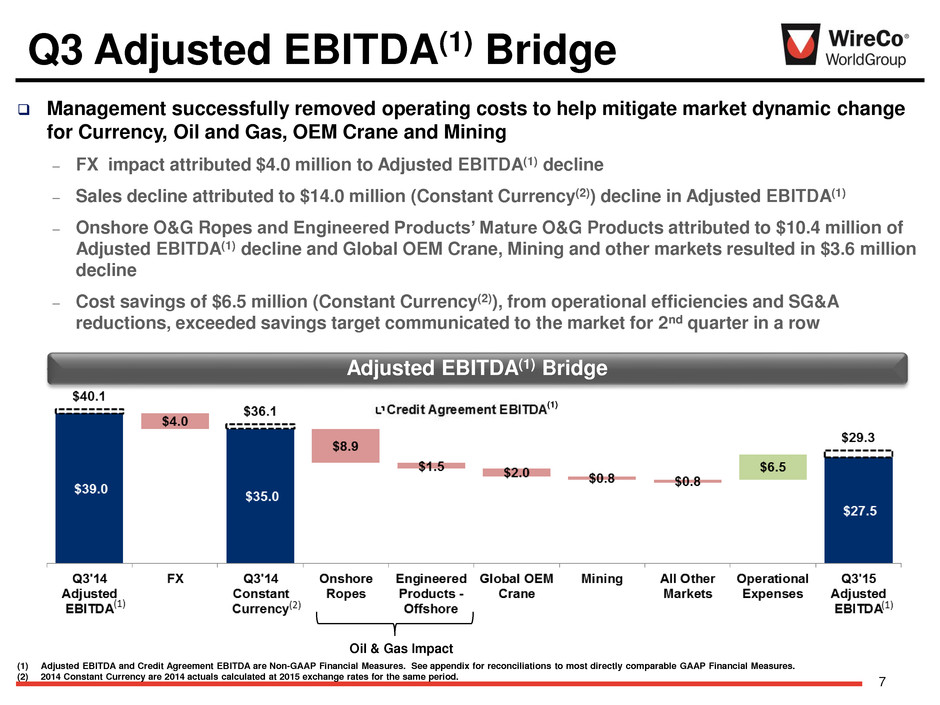

7 (1) Management successfully removed operating costs to help mitigate market dynamic change for Currency, Oil and Gas, OEM Crane and Mining – FX impact attributed $4.0 million to Adjusted EBITDA(1) decline – Sales decline attributed to $14.0 million (Constant Currency(2)) decline in Adjusted EBITDA(1) – Onshore O&G Ropes and Engineered Products’ Mature O&G Products attributed to $10.4 million of Adjusted EBITDA(1) decline and Global OEM Crane, Mining and other markets resulted in $3.6 million decline – Cost savings of $6.5 million (Constant Currency(2)), from operational efficiencies and SG&A reductions, exceeded savings target communicated to the market for 2nd quarter in a row Q3 Adjusted EBITDA(1) Bridge Adjusted EBITDA(1) Bridge Oil & Gas Impact (1) Adjusted EBITDA and Credit Agreement EBITDA are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures. (2) 2014 Constant Currency are 2014 actuals calculated at 2015 exchange rates for the same period.

8 Initiative Description Plant / Other Operational Plant savings offset by lower absorption driven by inventory reduction targets Includes savings related to Distribution Centers and Freight Procurement Resin price reductions and continued progress on Procurement initiative efforts SG&A Favorable from headcount reductions, hire deferrals, disciplined travel and entertainment expense management and 3rd party consultant management Operational Initiatives Update Management’s operational initiatives generated savings in excess of the implied quarterly savings communicated during Q1 investor call Commentary (1) Implied quarterly savings based on full year 2015E savings communicated on Q1 Investor call. Plants / Other Total ($ in millions) Operational Procurement SG&A Savings Total 2015 Estimated Savings $ 5.6 $ 7.1 $ 5.0 $ 17.7 YTD 2015 Estimated Savings 4.1 4.9 3.5 12.5 Q1 Actual Savings 0.9 0.5 0.5 1.9 Q2 Actual Savings 2.0 1.6 2.8 6.4 Q3 Actual Savings 0.8 3.2 2.6 6.5 Total YTD'15 Savings $ 3.6 $ 5.2 $ 5.9 $ 14.8 YTD vs. Original Estimate (0.5) 0.3 2.4 2.3

9 Cash generation of $18.1 million in Q3’15 driven by effective management of inventory and disciplined capital spending Decreased inventory from Q2’15 by 6 days Ending Net Debt of $808.1 million (down from $816.8 million in Q4’14) Working Capital & Cash Management Key Working Capital Statistics Cash Flow ($ in mil.) Metrics in Days Q1'15 Q2'15 Q3'15 A/R 62 63 64 Inventory 134 138 132 A/P 51 52 46 Working Capital as % of Sales 34.8% 35.7% 36.2% (1) Adjusted EBITDA and Free Cash Flow are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures. ($ in mil.) Q3'15 Q3'15 YTD Adjusted EBITDA (1) $27.5 $81.9 Interest (5.8) (39.7) Tax (1.5) (4.4) Inventory 8.0 18.4 A/R (2.5) 11.1 Payable & Other (1.1) (23.5) Change in NWC $4.4 $5.9 Other (1.1) (9.9) Capex (5.4) (22.8) Cash Flow - Pre Advisory/Amendment $18.1 $11.0 Advisory/Amendment Fees - (2.2) Free Cash Flow (1) $18.1 $8.8

10 $35.0 $36.5 $41.3 $39.0 $34.3 $27.3 $27.1 $27.5 $36.1 $37.6 $42.5 $40.1 $36.2 $32.4 $29.3 $29.3 17.1% 17.3% 18.2% 17.9% 16.9% 15.2% 15.6% 16.1% $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Quarterly Performance Trends Sales Adjusted EBITDA (1) Free Cash Flow (1) (1) Adjusted EBITDA, Credit Agreement EBITDA, Adjusted Working Capital and Free Cash Flow are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures. Adjusted Working Capital (1) $204.9 $210.5 $226.5 $217.1 $202.7 $180.4 $173.8 $171.4 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 $301 $311 $313.2 $286.7 $263.5 $251.3 $248.2 $247.8 36.7% 36.9% 34.6% 33.0% 32.5% 34.8% 35.7% 36.2% Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 $10.7 $12.3 $(0.5) $16.2 $0.5 $(0.1) $(9.2) $18.1 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 (1) (1)

11 Net Debt(1) decreased compared to Q2 2015 – Swap Adjusted Net Debt assumes unrealized gain from swap Total debt of $844.3 million; Total cash of $36.2 million – Approximately $31 million of cash is unrestricted and can be repatriated on tax free basis however, given inability for foreign entities to draw direct on revolver those entities keep cash on balance sheet for working capital purposes Capital investments in Brazil completed and fully utilized; expansion in Poland nearing completion Net Debt (1) Levels (1) Net Debt is a Non-GAAP Financial Measure. See appendix for reconciliation to most directly comparable GAAP Financial Measure. (2) Calculated per Credit Agreement definition. Net Debt (1) and Swap Adjusted Net Debt Trend (2) (2)

12 Market Outlook

13 Short-Term Market Outlook & Trends Oil & Gas ST Market Outlook ST WireCo Sales Outlook Sales Results ($ millions) LTM Rope Sales: $530.0 Industrial and Infrastructure Mining Fishing Maritime Rope Update ─ Rig count resumed decline on continued production over supply ─ Stability in Brazil offshore business ─ Planned Portugal changeover for contract transition ─ Europe business benefitting from weaker euro and continued quantitative easing ─ US stagnant on weak OEM backlog ─ China continues to be slow amidst financial market turmoil and manufacturing slowdown ─ Continued pressure on commodity prices and decline in coal tons mined in US driving lower sales ─ Gaining traction in new markets – Africa, South America & Russia ─ Continued strength in tuna netting business ─ Rest of business experiencing stability on steady market production ─ Trading business under pressure due to slow O&G related activity ─ Steady and growing demand for new build vessels ─ Weakness in Australia $149.5 $130.0 $126.5 $124.0 Q4 '14 Q1 '15 Q2 '15 Q3 '15

14 LTM Wire Sales: $126.8 Sales Results Specialty Wire ($ millions) ST WireCo Sales Outlook Engineered Products ($ millions) LTM Engineered Products Sales: $71.4 ST Market Outlook Specialty Wire and Engineered Products – Developing buoyancy portfolio, two orders qualified in Q3 – Continued weakness in mature offshore portfolio. – Rest of EP portfolio showing stability – Public Infrastructure projects in Mexico continue to be delayed – Strong activity in automotive sector in Mexico as well as Poland. – US infrastructure sector showing signs of slowing down, impacting PC Wire business in the US. $33.4 $32.9 $30.9 $29.6 Q4 '14 Q1 '15 Q2 '15 Q3 '15 $19.8 $17.4 $16.4 $17.8 Q4 '14 Q1 '15 Q2 '15 Q3 '15

15 Disciplined management of cash – Generated $18.1 million in cash in Q3; $8.8 million YTD – Continuing to reduce inventory during challenging market generating Continue to monitor markets closely and react as needed to changing market conditions – Expense reductions continue in excess of initial guidance; $14.8 million YTD – Q3’15 Adjusted EBITDA(1) increased $0.4 million over Q2’15 – Q3’15 in line with Q2’15 revenues; market stability seen for back to back quarters (however, onshore oil and gas rig count recently resumed decline) As discussed last earnings call, we continue to proactively consider refinancing alternatives and remain focused on opportunistically extending the maturities of our capital structure at the appropriate time – We are in active dialogue with various banks and financing sources and expect to be in market at appropriate time well ahead of these maturities Conclusion (1) Adjusted EBITDA is a Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measure.

16 Appendix

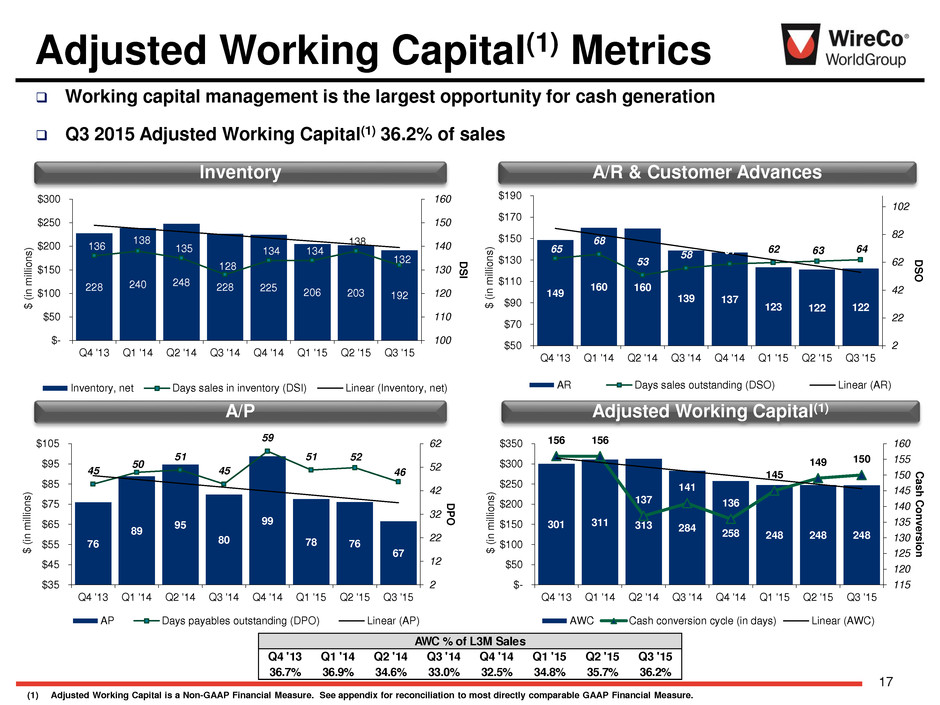

17 Adjusted Working Capital(1) Metrics A/P Working capital management is the largest opportunity for cash generation Q3 2015 Adjusted Working Capital(1) 36.2% of sales Adjusted Working Capital(1) A/R & Customer Advances Inventory (1) Adjusted Working Capital is a Non-GAAP Financial Measure. See appendix for reconciliation to most directly comparable GAAP Financial Measure. 228 240 248 228 225 206 203 192 136 138 135 128 134 134 138 132 100 110 120 130 140 150 160 $- $50 $100 $150 $200 $250 $300 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 D S I $ ( in m ill io n s ) Inventory, net Days sales in inventory (DSI) Linear (Inventory, net) 149 160 160 139 137 123 122 122 65 68 53 58 61 62 63 64 2 22 42 62 82 102 $50 $70 $90 $110 $130 $150 $170 $190 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 D S O $ ( in m ill io n s ) AR Days sales outstanding (DSO) Linear (AR) 76 89 95 80 99 78 76 67 45 50 51 45 59 51 52 46 2 12 22 32 42 52 62 $35 $45 $55 $65 $75 $85 $95 $105 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 D P O $ ( in m ill io n s ) AP Days payables outstanding (DPO) Linear (AP) 301 311 313 284 258 248 248 248 156 156 137 141 136 145 149 150 115 120 125 130 135 140 145 150 155 160 $- $50 $100 $150 $200 $250 $300 $350 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 C a s h C onv e rs io n $ ( in m ill io n s ) AWC Cash conversion cycle (in days) Linear (AWC) AWC % of L3M Sales Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 36.7% 36.9% 34.6% 3 .0% 32.5% 34.8% 35.7% 36.2%

18 Income Statement Results 2014 2015 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Sales $210.5 $226.5 $217.1 $202.7 $856.8 $180.4 $173.8 $171.4 Adj. EBITDA (1) $36.5 $41.3 $39.0 $34.3 $151.0 $27.3 $27.1 $27.5 Adj. EBITDA Margin 17.3% 18.2% 17.9% 16.9% 17.6% 15.2% 15.6% 16.1% Credit Agreement EBITDA (1) $37.6 $42.5 $40.1 $36.2 $156.5 $32.4 $29.3 $29.3 Sales Var. QoQ 2.7% 7.6% (4.2%) (6.6%) (11.0%) (3.6%) (1.4%) Adj. EBITDA Var. QoQ 4.3% 13.2% (5.6%) (12.3%) (20.2%) (0.7%) 1.7% Sales Var. YoY (5.5%) 19.3% 6.5% (1.1%) (14.3%) (23.3%) (21.1%) Adj. EBITDA Var. YoY (2.9%) 33.2% 9.2% (2.3%) (25.2%) (34.4%) (29.4%) (1) Adjusted EBITDA and Credit Agreement EBITDA are Non-GAAP Financial Measures. See appendix for reconciliation to most directly comparable GAAP Financial Measure.

19 2014 2015 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Free Cash Flow (1) $12 ($1) $16 $1 $0 ($9) $18 Interest Paid $5 $31 $6 $28 $6 $28 $6 CapEx $3 $6 $7 $9 $9 $8 $6 Cash Flow (1) Free Cash Flow, Adjusted Working Capital and Net Debt are Non-GAAP Financial Measures. See appendix for reconciliations to most directly comparable GAAP Financial Measures. Adjusted Working Capital (AWC) (1) $311 $313 $287 $264 $251 $248 $248 AWC % of Sales 36.9% 34.6% 33.0% 32.5% 34.8% 35.7% 36.2% Net Debt (1) $833 $834 $817 $817 $817 $826 $808 Net Leverage 5.9X 5.5x 5.5x 5.2x 5.4x 6.0x 6.4x Balance Sheet Cash Flow and Balance Sheet Results ($ millions)

20 Adjusted EBITDA Reconciliation ($000s) Non-GAAP Reconciliations Q4 2013 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 2014 Q1 2015 Q2 2015 Q3 2015 Net Loss (GAAP) (1,554)$ (27,004)$ (43)$ (2,097)$ (35,192)$ 8,559$ (28,773)$ (4,068)$ (15,045)$ (5,192)$ Plus: Interest expense, net 20,382 80,830 19,858 20,116 19,603 18,900 78,477 18,988 16,637 19,597 Income tax expense (benefit) 3,556 10,541 658 2,704 (4,540) (14,463) (15,641) (7,561) 6,709 1,446 Depreciation and amortization 15,779 58,534 13,035 12,913 12,192 12,418 50,558 11,375 11,138 11,232 Foreign currency exchange losses (gains), net (9,185) (13,584) (950) 4,045 31,816 1,387 36,298 4,278 2,689 (5,626) Share-based compensation 2,251 5,969 1,762 1,808 1,969 2,277 7,816 1,926 1,926 1,926 Other expense (income), net 183 635 (755) 176 (125) 680 (24) 309 (80) 169 Loss on extinguishment of debt - - - - 617 - 617 - - - Acquisition costs (1) 369 12 334 - 1,107 1,453 - - - Purchase accounting (inventory step-up and other) 37 2,191 - - - - - - - - Advisory fees 997 4,551 952 947 2,001 1,497 5,397 984 991 953 Reorganization and restructuring charges 1,992 9,548 987 147 832 268 2,234 759 1,498 2,956 Effect of inventory optimization program - 2,970 - - 9,244 - 9,244 - - - Non-cash impairment of fixed assets - - 598 - 246 300 1,144 - - - Other adjustments 532 3,643 356 230 289 1,334 2,209 352 587 58 Adjusted EBITDA (Non-GAAP) 34,969$ 139,193$ 36,470$ 41,323$ 38,952$ 34,264$ 151,009$ 27,342$ 27,050$ 27,519$ Plus: Additional reorganization and restructuring charges - - - - - 300 300 89 172 - Additional effect of Inventory Optimization Program - - - - - - - - - 143 Production curtailment - - - - - - - 633 491 737 Impact of nonrecurring resin procurement costs - - - - - - - - - 920 Impact of nonrecurring and unusual items in Brazil - - - - - - - 2,609 1,136 - Pro forma expense savings 1,175 4,700 1,175 1,175 1,175 1,175 4,700 1,525 475 - Additional other adjustments - - - - - 500 500 202 - - Credit Agreement EBITDA (Non-GAAP) 36,144$ 143,893$ 37,645$ 42,498$ 40,127$ 36,239$ 156,509$ 32,400$ 29,324$ 29,319$ (1) (1) (1) Reflects correction of an error of $3,051 in unrealized foreign currency gains which were previously excluded from net loss.

21 Adjusted Working Capital Non-GAAP Reconciliations ($000s) Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Accounts receivable, net 148,564$ 160,427$ 159,652$ 141,982$ 143,068$ 126,549$ 131,707$ 134,297$ Inventories, net 228,245 239,831 248,400 227,590 225,075 205,567 202,889 192,211 Account payable (76,181) (88,950) (94,821) (80,026) (98,914) (77,656) (76,182) (66,738) Customer advances - - - (2,886) (5,716) (3,128) (10,204) (11,964) Adjusted Working Capital (Non-GAAP) 300,628 311,308 313,231 286,660 263,513 251,332 248,210 247,806 Plus: All other current assets 55,999 62,770 62,898 73,034 78,908 70,454 60,762 53,049 Less: All other current liabilities (56,539) (71,603) (60,072) (73,067) (59,320) (66,164) (42,757) (57,331) Working capital (GAAP) 300,088$ 302,475$ 316,057$ 286,627$ 283,101$ 255,622$ 266,215$ 243,524$

22 Free Cash Flow Reconciliation ($000s) Non-GAAP Reconciliations Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Net cash provided by (used in) operating activities (GAAP) 16,145$ 15,650$ 10,072$ 22,704$ 10,992$ 12,600$ (896)$ 24,299$ Less: capital expenditures (6,839) (3,200) (6,424) (6,589) (8,659) (9,212) (8,250) (5,367)$ Less: acquisition of business and other investing activities - - (4,573) 1,951 - - - -$ Effect of exchange rates on cash and cash equivalents 686 46 26 (1,978) (1,945) (4,460) 608 (547)$ Other items 670 (187) 352 147 98 940 (700) (263)$ Free Cash Flow (Non-GAAP) 10,662$ 12,309$ (547)$ 16,235$ 486$ (132)$ (9,238)$ 18,122$

23 Net Debt Reconciliation ($000s) Non-GAAP Reconciliations Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Borrowings under Revolving Loan Facility 32,000$ 18,500$ 27,250$ 44,050$ 68,750$ 57,650$ 75,600$ 54,570$ Polish Debt due 2014 8,860 8,810 8,756 8,029 - - - - Term Loan due 2017 330,813 329,975 326,021 325,192 324,362 323,532 308,038 307,246 9.00% Senior Notes due 2017 (formerly 11.75% Senior Notes) 82,500 82,500 82,500 56,000 56,000 56,000 56,000 56,000 9.50% Senior Notes due 2017 425,000 425,000 425,000 425,000 425,000 425,000 425,000 425,000 Other indebtedness 688 491 594 188 157 - - - Capit l lease obligations 3,333 3,659 2,869 2,455 2,328 1,050 1,246 1,460 Total debt at face value plus capital lease obligations (GAAP) 883,194 868,935 872,990 860,914 876,597 863,232 865,884 844,276 Less: Cash and cash equivalents (34,987) (33,373) (37,003) (41,718) (58,195) (45,193) (38,044) (34,607) Less: Restricted cash (2,887) (2,551) (2,429) (1,873) (1,565) (1,070) (1,633) (1,584) Net Debt (Non-GAAP) 845,320$ 833,011$ 833,558$ 817,323$ 816,837$ 816,969$ 826,207$ 808,085$