Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Walgreens Boots Alliance, Inc. | d208289d8k.htm |

Walgreens Boots Alliance Investor Roadshow materials November 2015 Exhibit 99.1

Certain statements and projections of future results made in this presentation constitute forward-looking statements that are based on our current market, competitive and regulatory expectations and are subject to risks and uncertainties that could cause actual results to vary materially. Except to the extent required by the law, we undertake no obligation to update publicly any forward-looking statement after this presentation, whether as a result of new information, future events, changes in assumptions or otherwise. Please see our fiscal 2015 Form 10-K and subsequent filings, for a discussion of risk factors as they relate to forward-looking statements. This presentation includes certain non-GAAP financial measures, and we refer you to the Appendix to the presentation materials available on our investor relations website for reconciliations to the most directly comparable GAAP financial measures and related information. Safe Harbor and Non-GAAP

Walgreens Boots Alliance Agreement to acquire Rite Aid IR Roadshow - November 2015

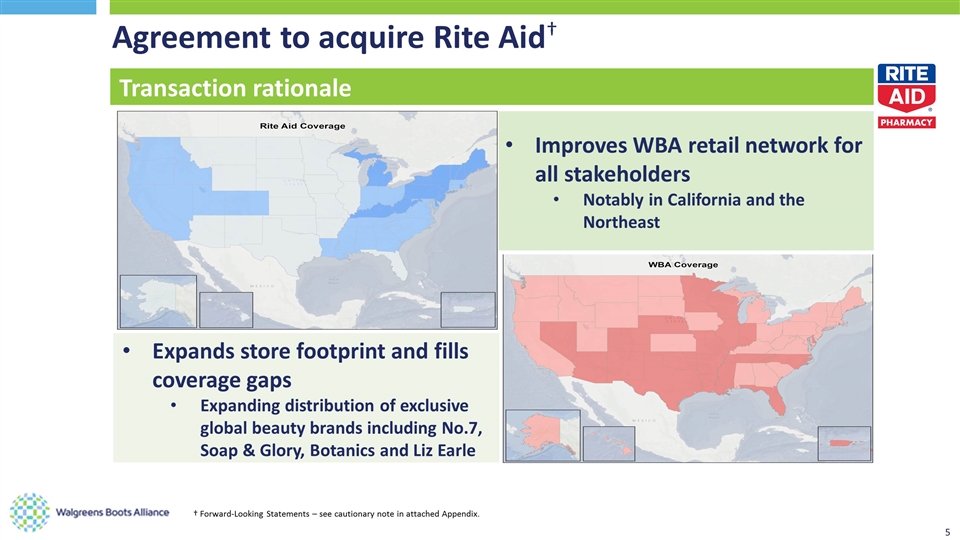

† Forward-Looking Statements – see cautionary note in attached Appendix. Economies of scale create efficiencies and cost savings Provides opportunity to develop the Rite Aid retail product offering Shift to improve category mix Expand distribution of exclusive global beauty brands including No.7, Soap & Glory, Botanics and Liz Earle Drive own brand penetration Positions WBA to better serve customers as U.S. healthcare market continues to evolve Attractive financial return† Transaction rationale Agreement to acquire Rite Aid† Complements Walgreens footprint, filling gaps in the Northeast and Southern California so WBA will cover the entire US

† Forward-Looking Statements – see cautionary note in attached Appendix. Transaction rationale Agreement to acquire Rite Aid† Expands store footprint and fills coverage gaps Expanding distribution of exclusive global beauty brands including No.7, Soap & Glory, Botanics and Liz Earle Improves WBA retail network for all stakeholders Notably in California and the Northeast

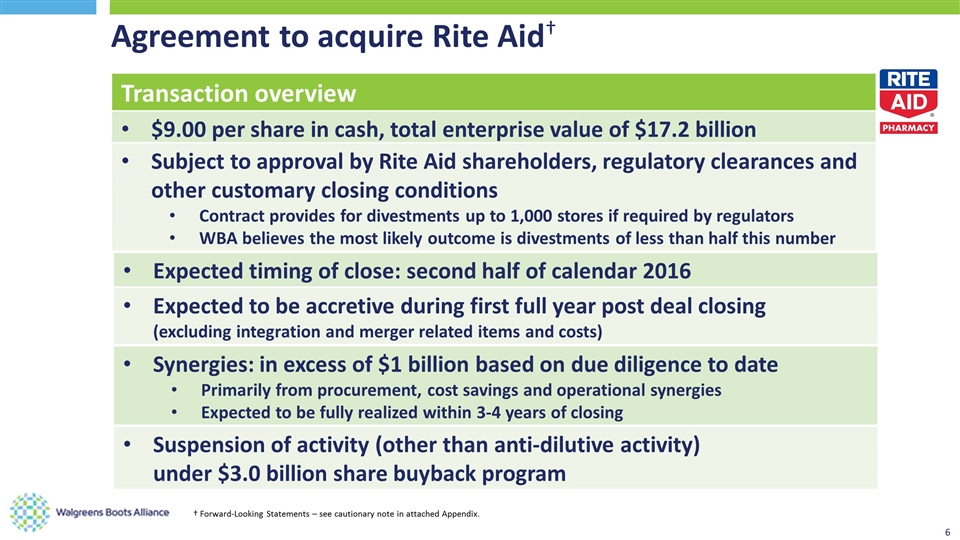

Agreement to acquire Rite Aid† † Forward-Looking Statements – see cautionary note in attached Appendix. Transaction overview $9.00 per share in cash, total enterprise value of $17.2 billion Subject to approval by Rite Aid shareholders, regulatory clearances and other customary closing conditions Contract provides for divestments up to 1,000 stores if required by regulators WBA believes the most likely outcome is divestments of less than half this number Expected timing of close: second half of calendar 2016 Expected to be accretive during first full year post deal closing (excluding integration and merger related items and costs) Synergies: in excess of $1 billion based on due diligence to date Primarily from procurement, cost savings and operational synergies Expected to be fully realized within 3-4 years of closing Suspension of activity (other than anti-dilutive activity) under $3.0 billion share buyback program

IR Roadshow - November 2015 Walgreens Boots Alliance Full Year 2015 / 4th Quarter 2015 Earnings

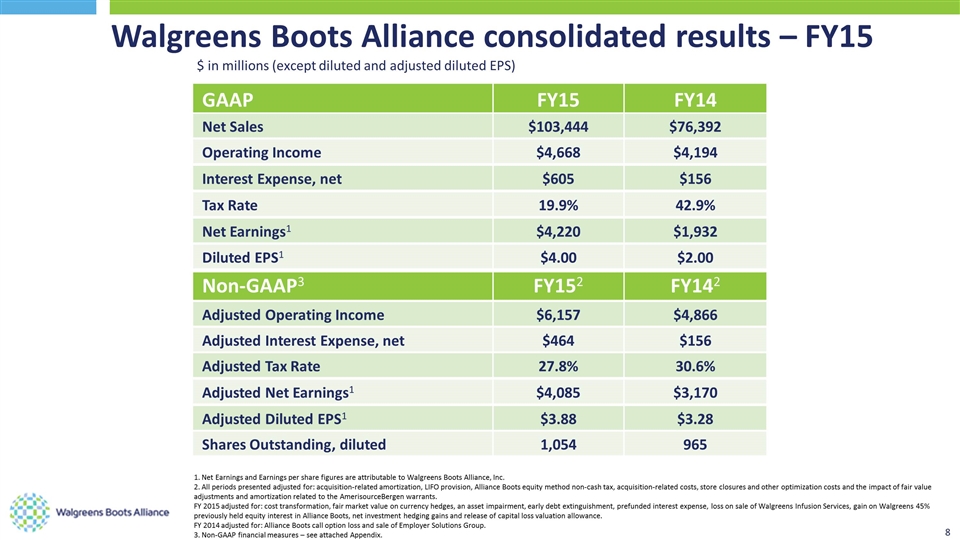

$ in millions (except diluted and adjusted diluted EPS) Walgreens Boots Alliance consolidated results – FY15 1. Net Earnings and Earnings per share figures are attributable to Walgreens Boots Alliance, Inc. 2. All periods presented adjusted for: acquisition-related amortization, LIFO provision, Alliance Boots equity method non-cash tax, acquisition-related costs, store closures and other optimization costs and the impact of fair value adjustments and amortization related to the AmerisourceBergen warrants. FY 2015 adjusted for: cost transformation, fair market value on currency hedges, an asset impairment, early debt extinguishment, prefunded interest expense, loss on sale of Walgreens Infusion Services, gain on Walgreens 45% previously held equity interest in Alliance Boots, net investment hedging gains and release of capital loss valuation allowance. FY 2014 adjusted for: Alliance Boots call option loss and sale of Employer Solutions Group. 3. Non-GAAP financial measures – see attached Appendix. GAAP FY15 FY14 Net Sales $103,444 $76,392 Operating Income $4,668 $4,194 Interest Expense, net $605 $156 Tax Rate 19.9% 42.9% Net Earnings1 $4,220 $1,932 Non-GAAP3 FY152 FY142 Adjusted Operating Income $6,157 $4,866 Adjusted Interest Expense, net $464 $156 Diluted EPS1 $4.00 $2.00 Adjusted Tax Rate 27.8% 30.6% Adjusted Net Earnings1 $4,085 $3,170 Adjusted Diluted EPS1 $3.88 $3.28 Shares Outstanding, diluted 1,054 965

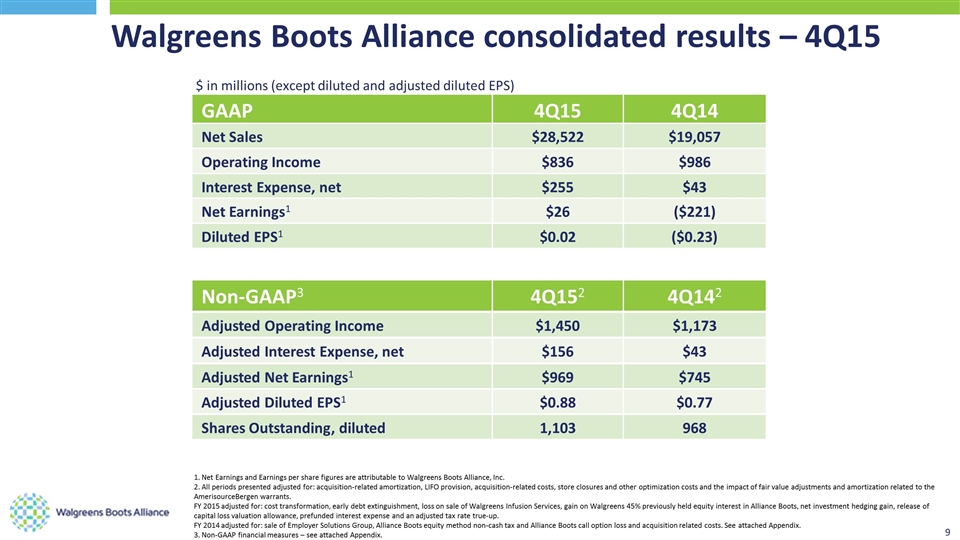

$ in millions (except diluted and adjusted diluted EPS) Walgreens Boots Alliance consolidated results – 4Q15 GAAP 4Q15 4Q14 Net Sales $28,522 $19,057 Operating Income $836 $986 Interest Expense, net $255 $43 Net Earnings1 $26 ($221) Diluted EPS1 $0.02 ($0.23) Non-GAAP3 4Q152 4Q142 Adjusted Operating Income $1,450 $1,173 Adjusted Interest Expense, net $156 $43 Adjusted Net Earnings1 $969 $745 Adjusted Diluted EPS1 $0.88 $0.77 Shares Outstanding, diluted 1,103 968 1. Net Earnings and Earnings per share figures are attributable to Walgreens Boots Alliance, Inc. 2. All periods presented adjusted for: acquisition-related amortization, LIFO provision, acquisition-related costs, store closures and other optimization costs and the impact of fair value adjustments and amortization related to the AmerisourceBergen warrants. FY 2015 adjusted for: cost transformation, early debt extinguishment, loss on sale of Walgreens Infusion Services, gain on Walgreens 45% previously held equity interest in Alliance Boots, net investment hedging gain, release of capital loss valuation allowance, prefunded interest expense and an adjusted tax rate true-up. FY 2014 adjusted for: sale of Employer Solutions Group, Alliance Boots equity method non-cash tax and Alliance Boots call option loss and acquisition related costs. See attached Appendix. 3. Non-GAAP financial measures – see attached Appendix.

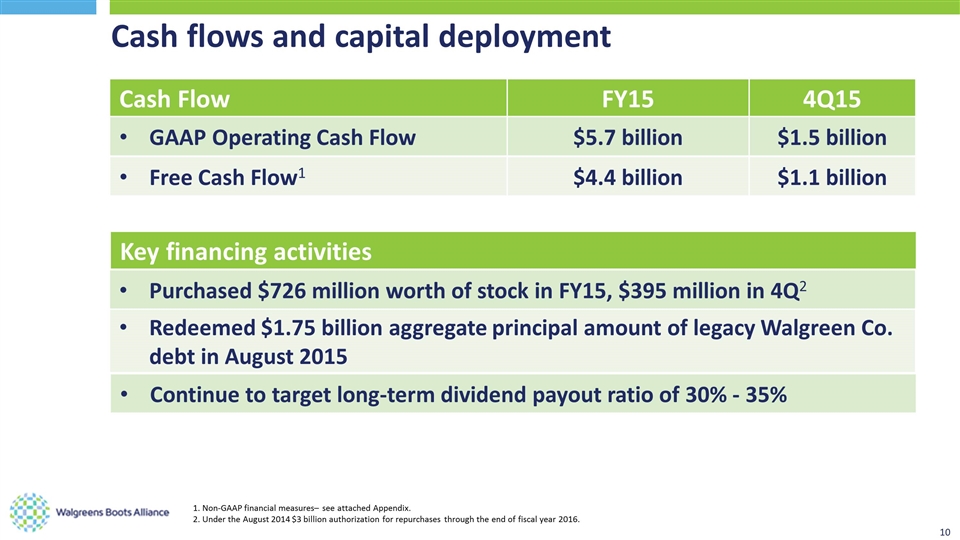

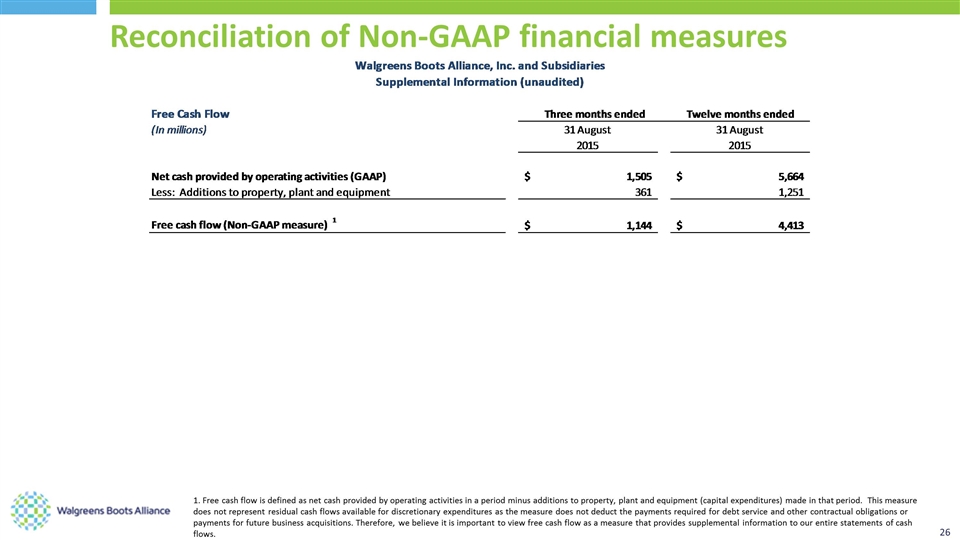

Cash flows and capital deployment 1. Non-GAAP financial measures– see attached Appendix. 2. Under the August 2014 $3 billion authorization for repurchases through the end of fiscal year 2016. Cash Flow FY15 4Q15 GAAP Operating Cash Flow $5.7 billion $1.5 billion Key financing activities Free Cash Flow1 $4.4 billion $1.1 billion Purchased $726 million worth of stock in FY15, $395 million in 4Q2 Redeemed $1.75 billion aggregate principal amount of legacy Walgreen Co. debt in August 2015 Continue to target long-term dividend payout ratio of 30% - 35%

IR Roadshow - November 2015 Walgreens Boots Alliance Outlook

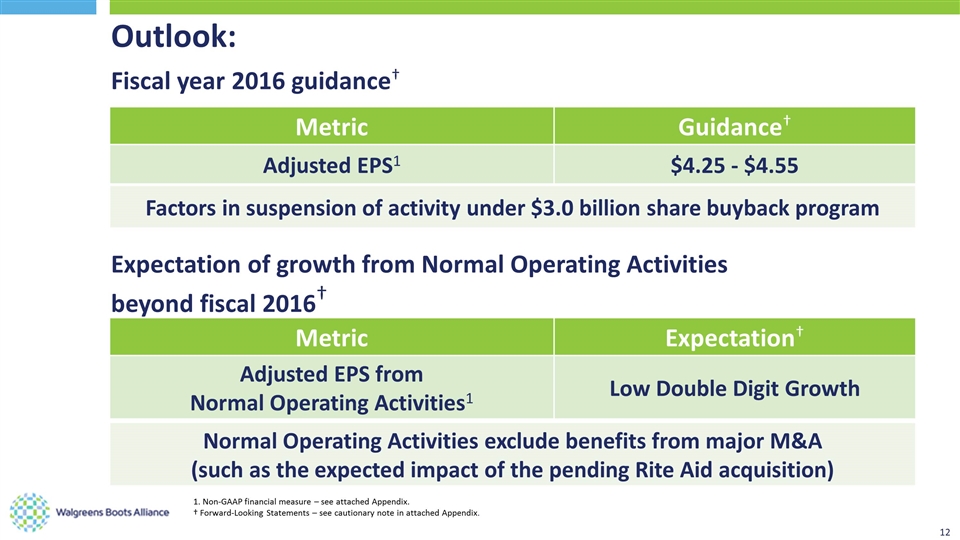

Outlook: Fiscal year 2016 guidance† 1. Non-GAAP financial measure – see attached Appendix. † Forward-Looking Statements – see cautionary note in attached Appendix. Metric Guidance† Adjusted EPS1 $4.25 - $4.55 Factors in suspension of activity under $3.0 billion share buyback program Expectation of growth from Normal Operating Activities beyond fiscal 2016† Metric Expectation† Adjusted EPS from Normal Operating Activities1 Low Double Digit Growth Normal Operating Activities exclude benefits from major M&A (such as the expected impact of the pending Rite Aid acquisition)

Well Positioned for the Future

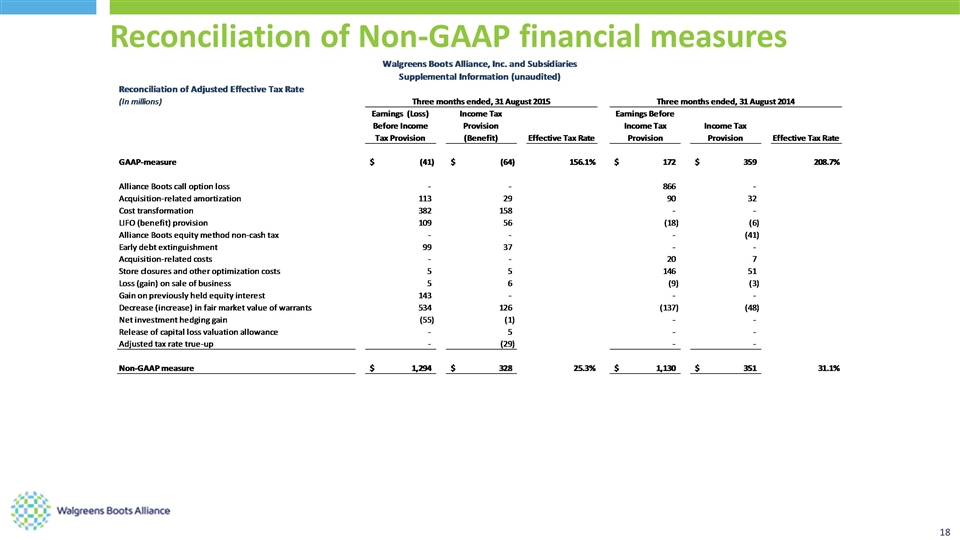

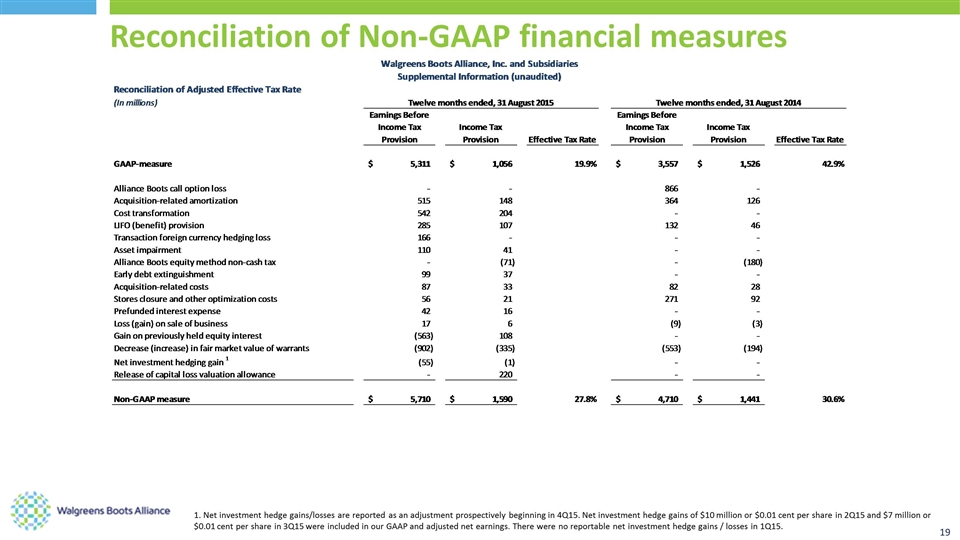

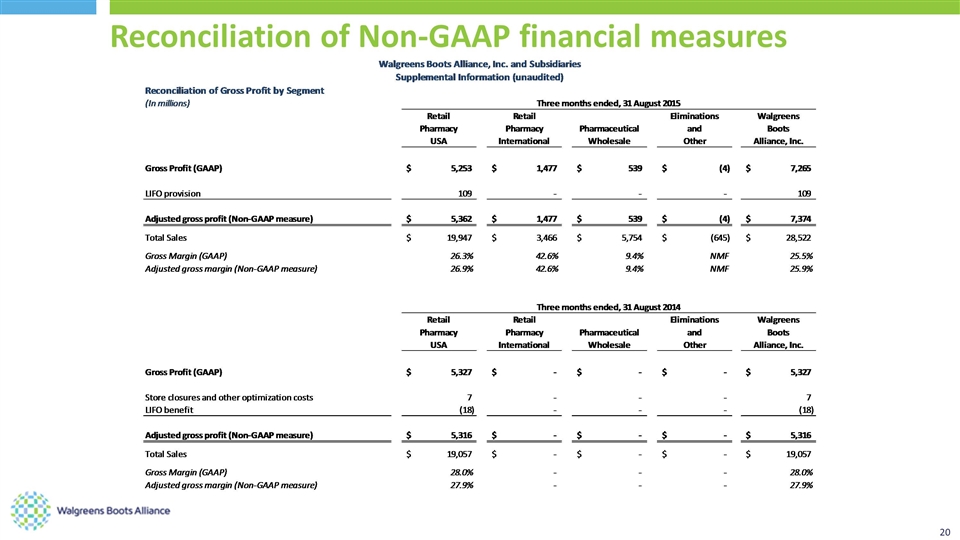

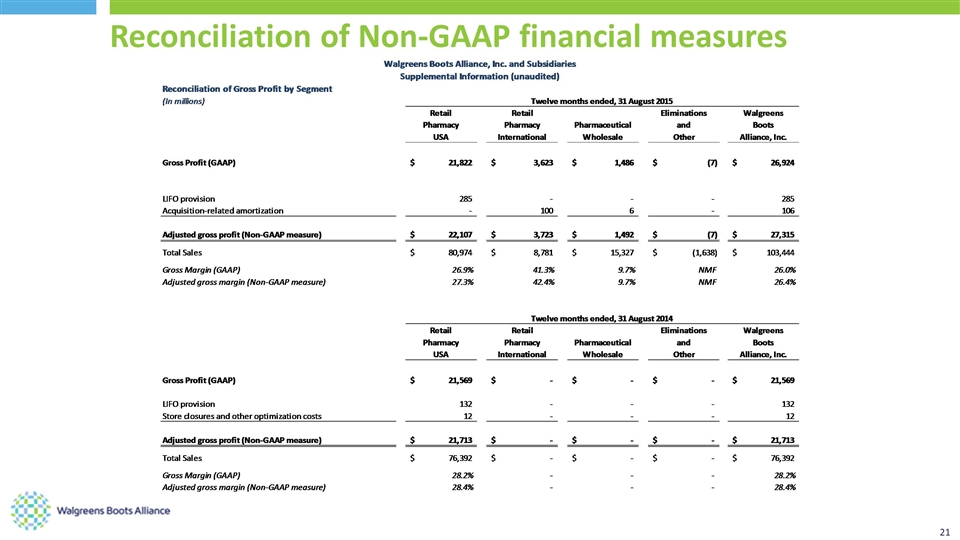

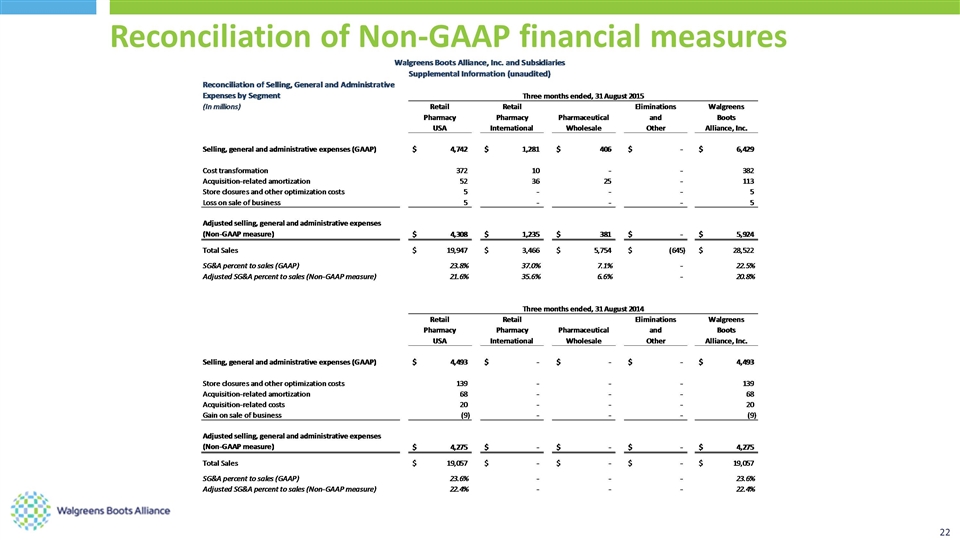

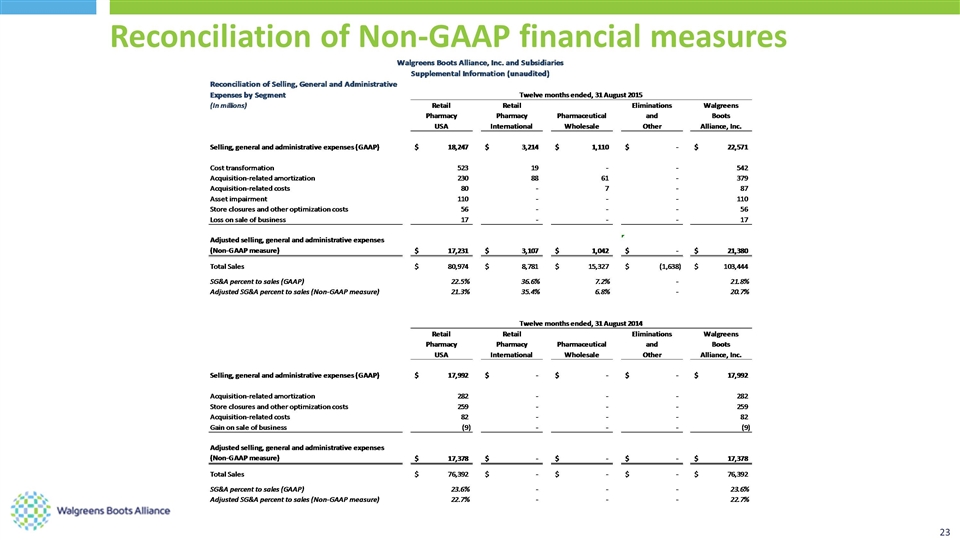

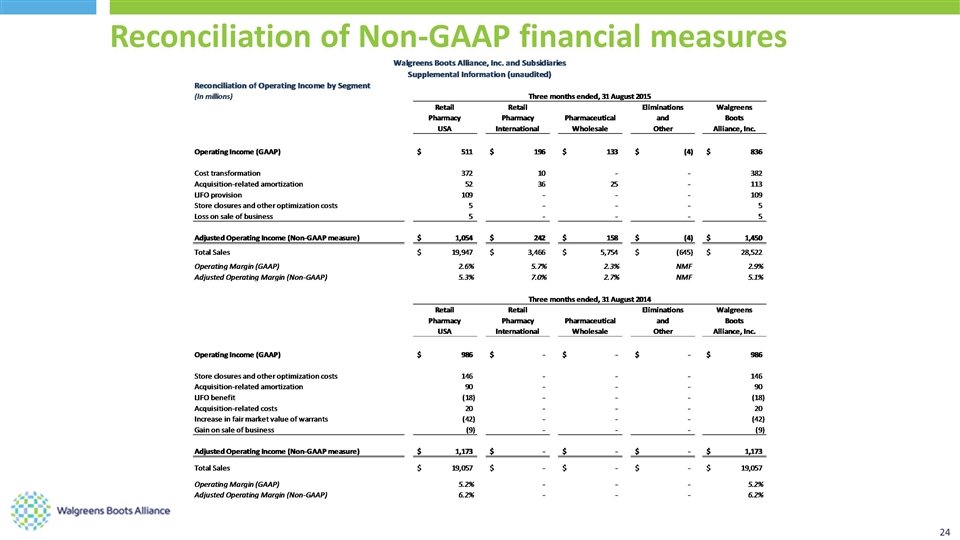

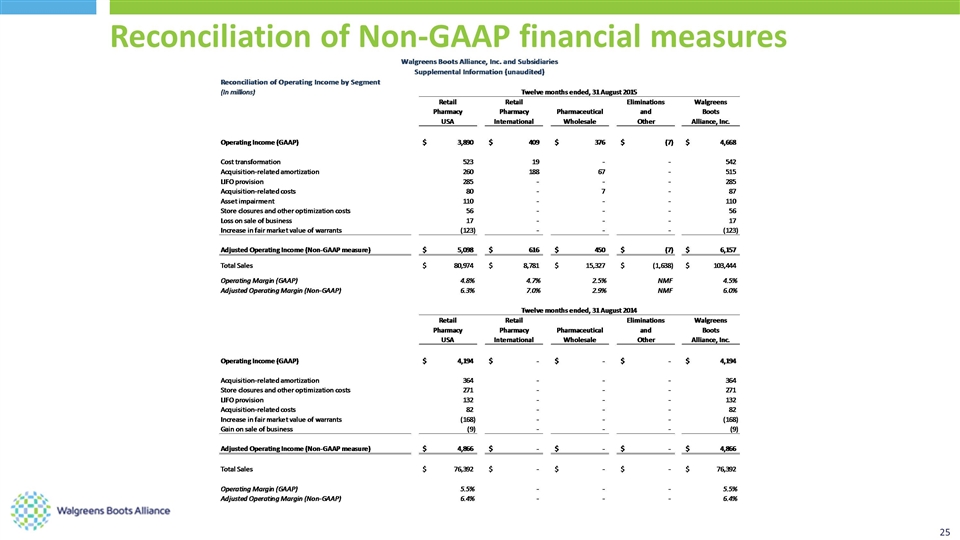

The following information provides reconciliations of the supplemental non-GAAP financial measures, as defined under SEC rules, presented in this presentation to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles in the United States (GAAP). The company has provided these non-GAAP financial measures in the presentation, which are not calculated or presented in accordance with GAAP, as supplemental information in addition to the financial measures that are calculated and presented in accordance with GAAP. These supplemental non-GAAP financial measures are presented because management has evaluated the company’s financial results both including and excluding the adjusted items and believes that the non-GAAP financial measures presented provide additional perspective and insights when analyzing the core operating performance of the Company’s business from period to period and trends in the company’s historical operating results. The company does not provide a non-GAAP reconciliation for non-GAAP estimates on a forward-looking basis where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. The supplemental non-GAAP financial measures presented should not be considered superior to, as a substitute for or as an alternative to, and should be considered in conjunction with, the GAAP financial measures presented in the presentation. Appendix

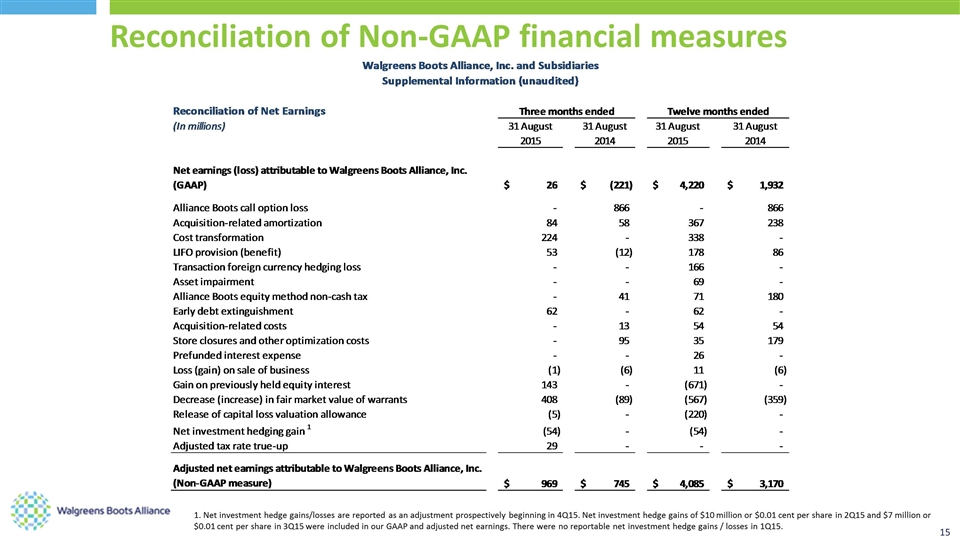

Reconciliation of Non-GAAP financial measures 1. Net investment hedge gains/losses are reported as an adjustment prospectively beginning in 4Q15. Net investment hedge gains of $10 million or $0.01 cent per share in 2Q15 and $7 million or $0.01 cent per share in 3Q15 were included in our GAAP and adjusted net earnings. There were no reportable net investment hedge gains / losses in 1Q15.

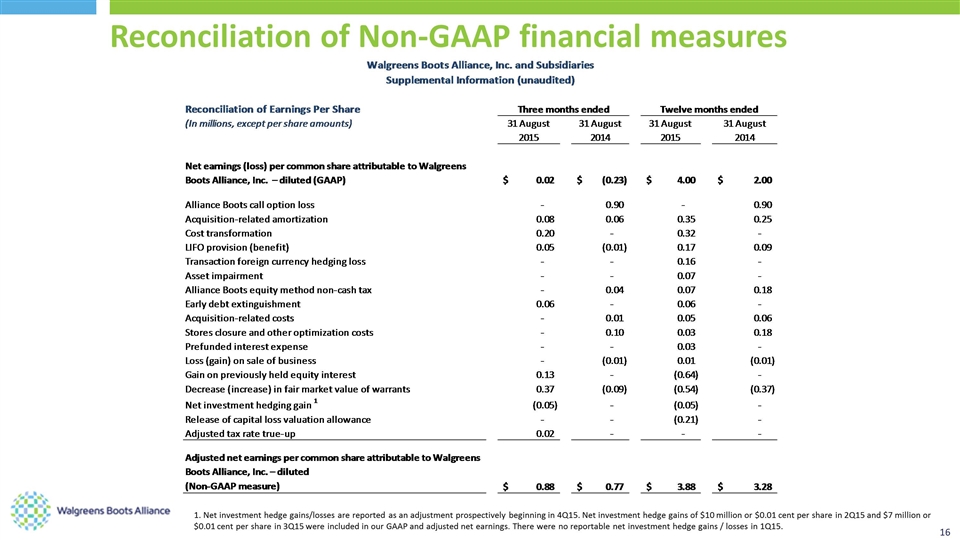

Reconciliation of Non-GAAP financial measures 1. Net investment hedge gains/losses are reported as an adjustment prospectively beginning in 4Q15. Net investment hedge gains of $10 million or $0.01 cent per share in 2Q15 and $7 million or $0.01 cent per share in 3Q15 were included in our GAAP and adjusted net earnings. There were no reportable net investment hedge gains / losses in 1Q15.

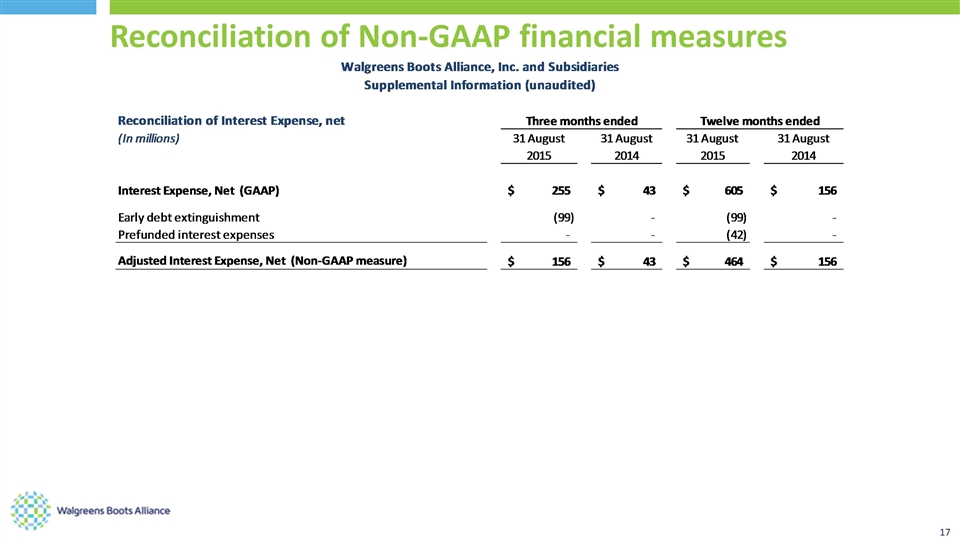

Reconciliation of Non-GAAP financial measures

Reconciliation of Non-GAAP financial measures

Reconciliation of Non-GAAP financial measures 1. Net investment hedge gains/losses are reported as an adjustment prospectively beginning in 4Q15. Net investment hedge gains of $10 million or $0.01 cent per share in 2Q15 and $7 million or $0.01 cent per share in 3Q15 were included in our GAAP and adjusted net earnings. There were no reportable net investment hedge gains / losses in 1Q15.

Reconciliation of Non-GAAP financial measures

Reconciliation of Non-GAAP financial measures

Reconciliation of Non-GAAP financial measures

Reconciliation of Non-GAAP financial measures

Reconciliation of Non-GAAP financial measures

Reconciliation of Non-GAAP financial measures

1. Free cash flow is defined as net cash provided by operating activities in a period minus additions to property, plant and equipment (capital expenditures) made in that period. This measure does not represent residual cash flows available for discretionary expenditures as the measure does not deduct the payments required for debt service and other contractual obligations or payments for future business acquisitions. Therefore, we believe it is important to view free cash flow as a measure that provides supplemental information to our entire statements of cash flows. Reconciliation of Non-GAAP financial measures

Certain definitions and assumptions Certain Assumptions: Unless the context otherwise indicates or requires: This presentation assumes constant currency exchange rates after the date hereof based on current rates; All financial estimates and goals assume constant currency exchange rates after the date hereof based on current rates and no major mergers, acquisitions, divestitures or strategic transactions. Holding Company Reorganization. On December 31, 2014, Walgreens Boots Alliance, Inc. became the successor of Walgreen Co. pursuant to a merger to effect a reorganization of Walgreen Co. into a holding company structure (the “Reorganization”), with Walgreens Boots Alliance, Inc. becoming the parent holding company. References in this presentation to the “Company,” “we,” “us” or “our” refer to Walgreens Boots Alliance, Inc. and its subsidiaries from and after the effective time of the Reorganization on December 31, 2014 and, prior to that time, to the predecessor registrant Walgreen Co. and its subsidiaries, and in each case do not include unconsolidated partially-owned entities, except as otherwise indicated or the context otherwise requires. Our fiscal year ends on August 31, and references herein to “fiscal 2015” refer to our fiscal year ended August 31, 2015. Historical Alliance Boots Financial Information. On December 31, 2014, Alliance Boots became a consolidated subsidiary and ceased being accounted for under the equity method. Please refer to Exhibits 99.1 and 99.2, respectively, to our fiscal 2015 Form 10-K, when filed, for (1) Alliance Boots GmbH audited consolidated financial statements and accompanying notes (prepared in accordance with IFRS and audited in accordance with U.S. GAAS), including the statements of financial position at March 31, 2014 and 2013 of Alliance Boots and its subsidiaries (the Group) and the related Group income statements, Group statements of comprehensive income, Group statements of changes in equity and Group statements of cash flows for each of the years in the three-year period ended March 31, 2014 and (2) Alliance Boots GmbH unaudited interim condensed consolidated financial statements and accompanying notes (prepared in accordance with IFRS) including the Group statements of financial position at December 31, 2014 and 2013, and the related Group income statements, Group statements of comprehensive income, Group statements of changes in equity and Group statements of cash flows for each of the nine month periods then ended. All descriptions of the Company’s agreements relating to Alliance Boots and the arrangements and transactions contemplated thereby in this presentation are qualified in their entirety by reference to the full text of the agreements, copies of which have been filed with the SEC. AmerisourceBergen Information. All descriptions in this presentation of the agreements relating to the strategic long-term relationship with AmerisourceBergen announced by the Company and Alliance Boots on March 18, 2013 and the arrangements and transactions contemplated thereby are qualified in their entirety by reference to the description and the full text of the agreements in the Company’s Form 8-K filing on March 20, 2013 and Schedule 13D filing on April 15, 2014, as amended on January 16, 2015. We adjust for fluctuations in the fair value of our warrants to acquire AmerisourceBergen common stock in determining adjusted net earnings (non-GAAP). The initial tranche of these warrants are exercisable during a six month period beginning on March 18, 2016. If that tranche were to be exercised in full, we would anticipate beginning to account for our investment in AmerisourceBergen common stock using the equity method of accounting.

Cautionary note regarding forward-looking statements Cautionary Note Regarding Forward-Looking Statements: All statements in these materials and the related presentation that are not historical including, without limitation, estimates of and goals for future financial and operating performance, the expected execution and effect of our business strategies, our cost-savings and growth initiatives and restructuring activities and the amounts and timing of their expected impact, and our pending agreement with Rite Aid and the transactions contemplated thereby and their possible effects, are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as "expect," "likely," "outlook," "forecast," “preliminary,” "would," "could," "should," "can," "will," "project," "intend," "plan," "goal," “guidance,” "target," "continue," "sustain," "synergy," "on track," "believe," "seek," "estimate," "anticipate," "may," "possible," "assume," and variations of such words and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that could cause actual results to vary materially from those indicated, including, but not limited to, those relating to the impact of private and public third-party payers’ efforts to reduce prescription drug reimbursements, the impact of generic prescription drug inflation, the timing and magnitude of the impact of branded to generic drug conversions, our ability to realize anticipated synergies and achieve anticipated financial, tax and operating results in the amounts and at the times anticipated, supply arrangements including our commercial agreement with AmerisourceBergen Corporation, the arrangements and transactions contemplated by our framework agreement with AmerisourceBergen and their possible effects, the risks associated with equity investments in AmerisourceBergen including whether the warrants to invest in AmerisourceBergen will be exercised and the ramifications thereof, the occurrence of any event, change or other circumstance that could give rise to the termination, cross-termination or modification of any of our contractual obligations, the amount of costs, fees, expenses and charges incurred in connection with strategic transactions, whether the actual costs associated with restructuring activities will exceed estimates, our ability to realize expected savings and benefits from cost-savings initiatives, restructuring activities and acquisitions in the amounts and at the times anticipated, the timing and amount of any impairment or other charges, changes in management’s assumptions, the risks associated with governance and control matters, the ability to retain key personnel, changes in economic and business conditions generally or in the markets in which we participate, changes in financial markets, interest rates and foreign currency exchange rates, the risks associated with international business operations, the risk of unexpected costs, liabilities or delays, changes in vendor, customer and payer relationships and terms, including changes in network participation and reimbursement terms, risks of inflation in the cost of goods, risks associated with the operation and growth of our customer loyalty programs, risks associated with acquisitions, divestitures, joint ventures and strategic investments, including our ability to satisfy the closing conditions and consummate the pending acquisition of Rite Aid and related financing matters on a timely basis or at all, the risks associated with the integration of complex businesses, subsequent adjustments to preliminary purchase accounting determinations, outcomes of legal and regulatory matters, including with respect to regulatory review and actions in connection with the pending acquisition of Rite Aid, and changes in legislation, regulations or interpretations thereof. These and other risks, assumptions and uncertainties are described in Item 1A (Risk Factors) of our Report on Form 10-K for the fiscal year ended August 31, 2015, which is incorporated herein by reference, and in other documents that we file or furnish with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Except to the extent required by law, we do not undertake, and expressly disclaim, any duty or obligation to update publicly any forward-looking statement after the date of publication of this presentation, whether as a result of new information, future events, changes in assumptions or otherwise.