Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - Startek, Inc. | srt8-kainvestorpresentation.htm |

INVESTOR PRESENTATION OCTOBER 2015 There’s a Brand Warrior Behind Everything We Do

NYSE: SRTImportant Cautions Regarding Forward- Looking Statements 2 This presentation contains forward-looking statements, pursuant to the Safe Harbor provisions of the Federal Securities laws. These statements are subject to various risks and uncertainties and actual results may vary materially from these projections. STARTEK advises all recipients of these materials to review the 2014 Form 10-K, posted on their website, for a summary of these risks and uncertainties. STARTEK does not undertake the responsibility to update these projections. This presentation is copyright 2015 StarTek, Inc. All rights reserved.

NYSE: SRT Who We Are… • STARTEK is a provider of comprehensive business process outsourcing (BPO) and customer engagement agency (CEA) services • We are Brand Warriors – some of the world’s most prominent companies entrust us to uphold their reputation and safeguard their customers • Seven major industries served, including financial services, healthcare, technology, cable & media, telecom and retail • ~14,000 agents across the world provide services like customer care, receivables management and order processing 3 We are Brand Warriors!

NYSE: SRT We Address a Large & Growing BPO Market • We address a $64 billion BPO marketplace¹ • This market is projected to grow at a 6% CAGR through 2018¹ • BPO penetration is low but growing – only ~25% of companies outsource contact center services (up from 20%)² • BPO market has transformed from a labor arbitrage model to a focus on: • Value-added services • Customer experience • Omni-channel capabilities • These services align with our current capabilities 4 1)IDC, 2014 2)IDC, May 2012 $61B $64B $68B $72B $77B $81B 2013 2014E 2015E 2016E 2017E 2018E Customer Care BPO Market Size¹

NYSE: SRTBPO Market Moving from Pure Labor Model to Multi-Channel Value Add Services 5 49% of BPO buyers are here. The opportunity. 1st Gen LATE 90’S “Pioneers” 2nd Gen EARLY 00’S “Offshore” 3rd Gen MID-00’S “Opex” 4th Gen TODAY “Insight” 5th Gen NEAR FUTURE “On-Demand” 6th Gen FUTURE “Community” Deals Pioneering mega deals FTE-based focused on labor arbitrage FTE-based with some innovation Based on business outcomes to clients Business outcome- based; tech components Common & consistent in approach across clients Platforms Use client platform for 1:many Client owns platform Mostly client’s own the platform Providers adding analytics tools Building standard platforms Providers add collaboration & social media Client Objective Cost savings, transfer people & tech to providers Global capacity “Noiseless” delivery Industry depth, analytics, innovation Flexibility Community ~49% of BPO customers are no further than 3rd Gen buyers. To deliver higher value buyer expectations, engagements need to bring MORE expertise¹. 1)Accenture BPO research and STARTEK estimates.

NYSE: SRTWe Serve this Market with a Full Suite of Multi-Channel, High-Value Services 6 Voice: brand warriors handling all calls plus interactive voice response Back Office: complex order processing, receivables management and provisioning Online/Social CRM: social care and learning, hosted communities, online chat, email support, knowledge base Mobile: basic SMS/text, mobile web support, app support, integrated voice, text, web and social media support Optimization: lifecycle customer experience management, voice of the customer analysis, program and agent performance optimization

NYSE: SRT ACCENT Acquisition • Acquired ACCENT Marketing Services for $16.0M in May 2015 (~3.5x EBITDA) • Transaction accretive in Q4 2015 • ACCENT is a BPO company providing contact center and customer engagement agency (CEA) solutions to 18 marquee clients across several industries • Provides client diversification and enhances customer engagement through omni-channel offerings • Expands footprint with six locations across the U.S. and Jamaica • ACCENT’s CEA model builds upon our acquisition of Ideal Dialogue, utilizing data and analytics to develop and execute customer strategy • STARTEK will now have over 50 clients and 14,000 employees operating in five countries 7

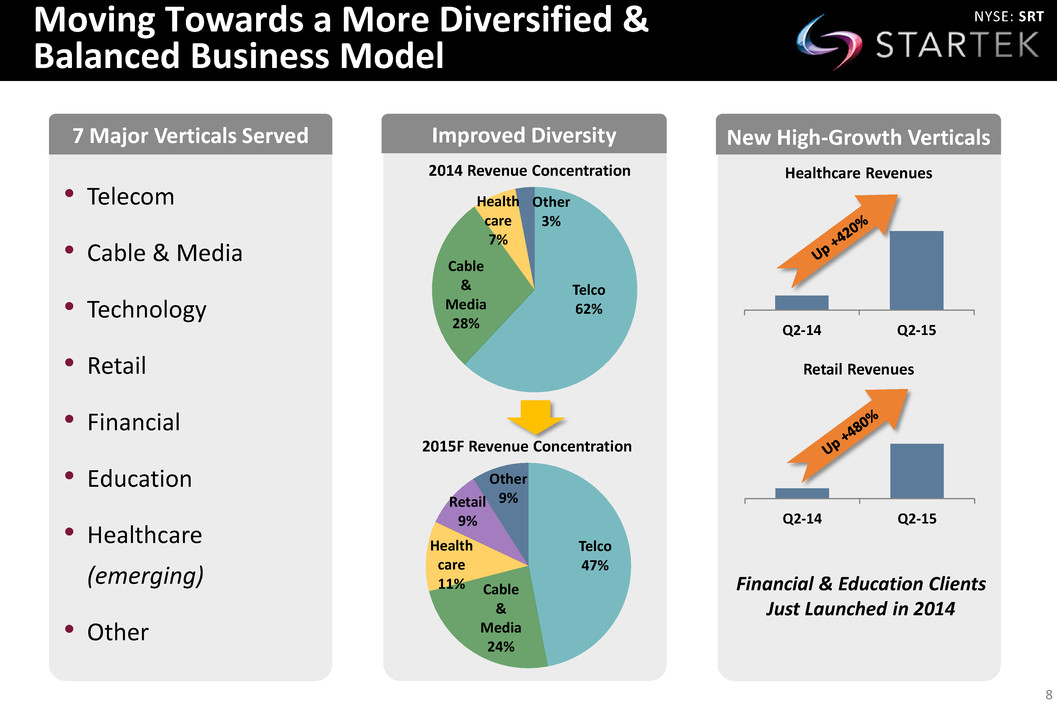

NYSE: SRTMoving Towards a More Diversified & Balanced Business Model 8 • Telecom • Cable & Media • Technology • Retail • Financial • Education • Healthcare (emerging) • Other 7 Major Verticals Served Improved Diversity New High-Growth Verticals 2015F Revenue Concentration Telco 47% Cable & Media 24% Health care 11% Retail 9% Other 9% 2014 Revenue Concentration Telco 62% Cable & Media 28% Health care 7% Other 3% Healthcare Revenues Q2-14 Q2-15 Retail Revenues Q2-14 Q2-15 Financial & Education Clients Just Launched in 2014

NYSE: SRT IT Transformation – STARTEK Connect 9 • STARTEK Connect is our cloud-based IT platform launched in Q2-15 • Variable cost model and “capital light” • Delivers virtualized applications & hardware • Enhances speed to market (value beyond cost) • Eliminates transition points • Reduced cost per seat by 40% since 2011 • Further scale is expected to continue this cost reduction trend $219M $198M $231M $250M 13.9% 14.4% 12.5% 11.9% 2011 2012 2013 2014 IT Costs to Continue Downward Trend Revenue Total IT as % Revenue

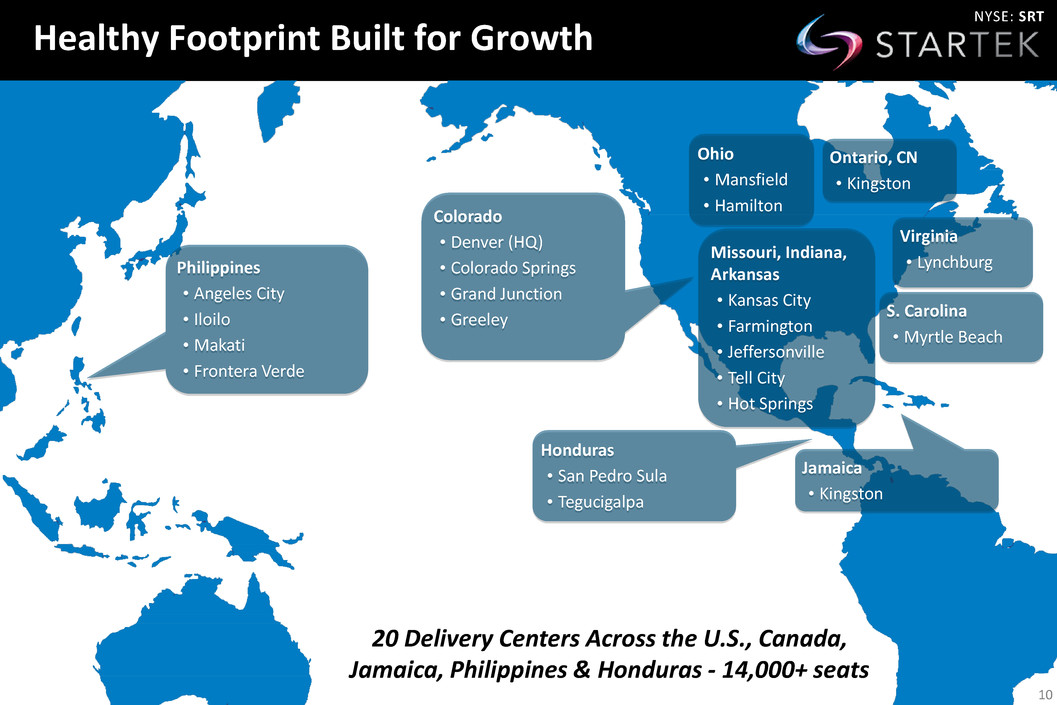

NYSE: SRT Healthy Footprint Built for Growth 10 20 Delivery Centers Across the U.S., Canada, Jamaica, Philippines & Honduras - 14,000+ seats Philippines • Angeles City • Iloilo • Makati • Frontera Verde Colorado • Denver (HQ) • Colorado Springs • Grand Junction • Greeley Ohio • Mansfield • Hamilton S. Carolina • Myrtle Beach Virginia • Lynchburg Ontario, CN • Kingston Honduras • San Pedro Sula • Tegucigalpa Jamaica • Kingston Missouri, Indiana, Arkansas • Kansas City • Farmington • Jeffersonville • Tell City • Hot Springs

NYSE: SRT Competitive Landscape 11 • The industry has undergone recent consolidation, with the larger players acquiring smaller firms • Highly fragmented industry – five largest companies represent <20% of the market • Unique STARTEK differentiators • Trusted sourcing enables client acquisition and retention • Focus on customer experience • CEA model aligns omni-channel capabilities and creates new revenue opportunities for clients Competitive Landscape

NYSE: SRTWhy Companies Choose Us – The STARTEK Advantage System 12 Trusted Partnership Optimized Performance Continuous Improvement Customized Solutions STARTEK’s Unique Culture STARTEK Operating Platform

NYSE: SRT Smart Seat Capacity Growth Multiple Avenues for Growth 13 Increase Utilization Healthcare Vertical Customer Engagement Emerging Services 3,394 3,630 4,340 5,850 4,168 4,847 5,684 5,4351,683 1,617 1,599 2,115 2012 2013 2014 June 2015 Domestic Offshore Nearshore 9,245 10,094 11,623 13,400 • Recently expanded capacity: • 1,500 net new seats added in 2014 • 2,000 seats and six new facilities added with acquisition of ACCENT in May 2015 • Maximizing utilization by converting our large new business pipeline • Added 15 new clients in 2014, six clients in 2015 YTD and an additional 18 new clients from ACCENT • 50+ clients now supported by our 14,000 Brand Warriors • For calendar 2015, expecting ~$9M in CapEx, which includes $2.5M to support growth at new sites

NYSE: SRT Multiple Avenues for Growth 14 Emerging Services Healthcare Vertical Customer Engagement Expand Capacity • Leverage Ideal Dialogue and ACCENT to enhance customer experience and business analytics • Receivables management • Back office (non-voice) • CCaaS (Contact Center as a Service) • BPaaS (Business Process as a Service) • Healthcare vertical • These services generate higher margins than our core business and command higher multiples Emerging Services Revenue¹ $43.4M $62.3M $12.7M $18.8M FY-13 FY-14 Q2-14 Q2-15 1)Emerging Services revenues include the Healthcare vertical, receivables management, IT, IDC and back office. % of Revs 19% 25% 21% 30%

NYSE: SRT Multiple Avenues for Growth 15 Healthcare Vertical Customer Engagement Expand Capacity Emerging Services • Expanding regional focus to provide multiple solutions for our clients • Clinicians providing tele health services: • Post-discharge management • Emergency room triage • Remote patient monitoring • Serving the needs of providers, med device and pharma companies, as well as payers At 53%, Healthcare BPO Market Expected to Outgrow All Other Verticals $1B $3B $5B $7B $9B '12 '13 '14 '15 '16 '17 '18 Telco, 31% Retail, 29% Media, 27% Utilities, 27% Healthcare, 53% Education, 23%

NYSE: SRT Multiple Avenues for Growth 16 Customer Engagement • Our acquisitions of Ideal Dialogue and ACCENT have created a robust Customer Engagement Agency (CEA) platform that fuels our growth • CEA goes beyond operational services provided by traditional BPOs and call centers • We serve as a strategic partner for our clients, offering valuable insight about their customers through omni-channel analytics • We teach our clients how to proactively engage with their customers and create new revenue opportunities Expand Capacity Emerging Services Healthcare Vertical “Customers expect a personalized experience that is seamless and consistent across all touch points”

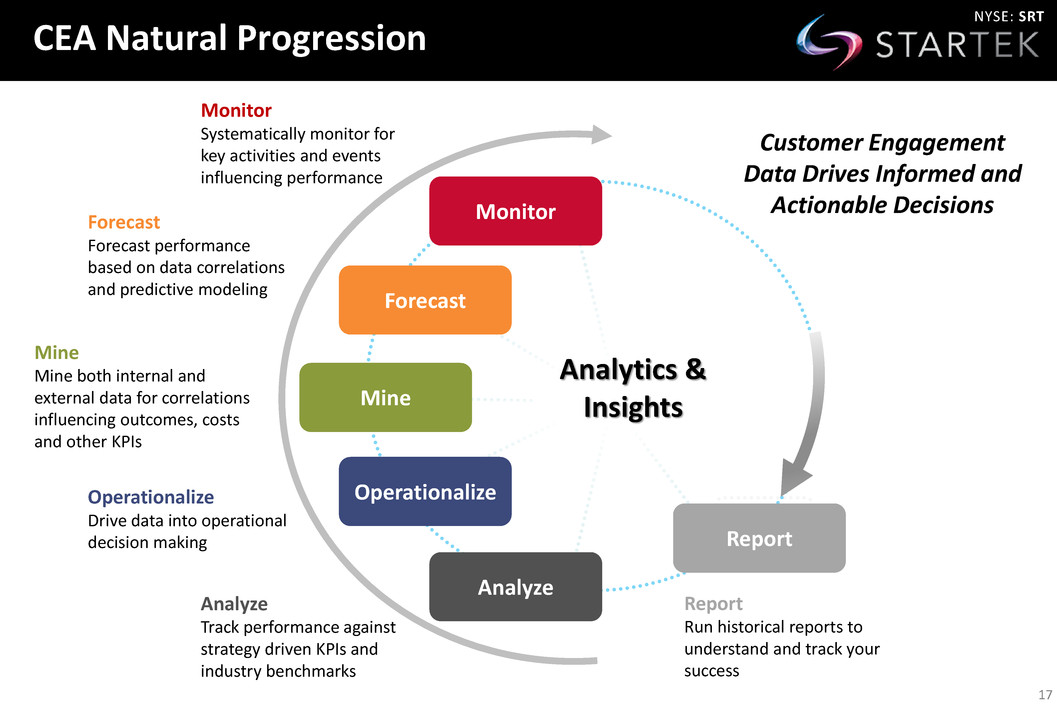

NYSE: SRT CEA Natural Progression 17 Monitor Forecast Mine Operationalize Analyze Report Analytics & Insights Monitor Systematically monitor for key activities and events influencing performance Forecast Forecast performance based on data correlations and predictive modeling Mine Mine both internal and external data for correlations influencing outcomes, costs and other KPIs Operationalize Drive data into operational decision making Analyze Track performance against strategy driven KPIs and industry benchmarks Report Run historical reports to understand and track your success Customer Engagement Data Drives Informed and Actionable Decisions

FINANCIAL HIGHLIGHTS

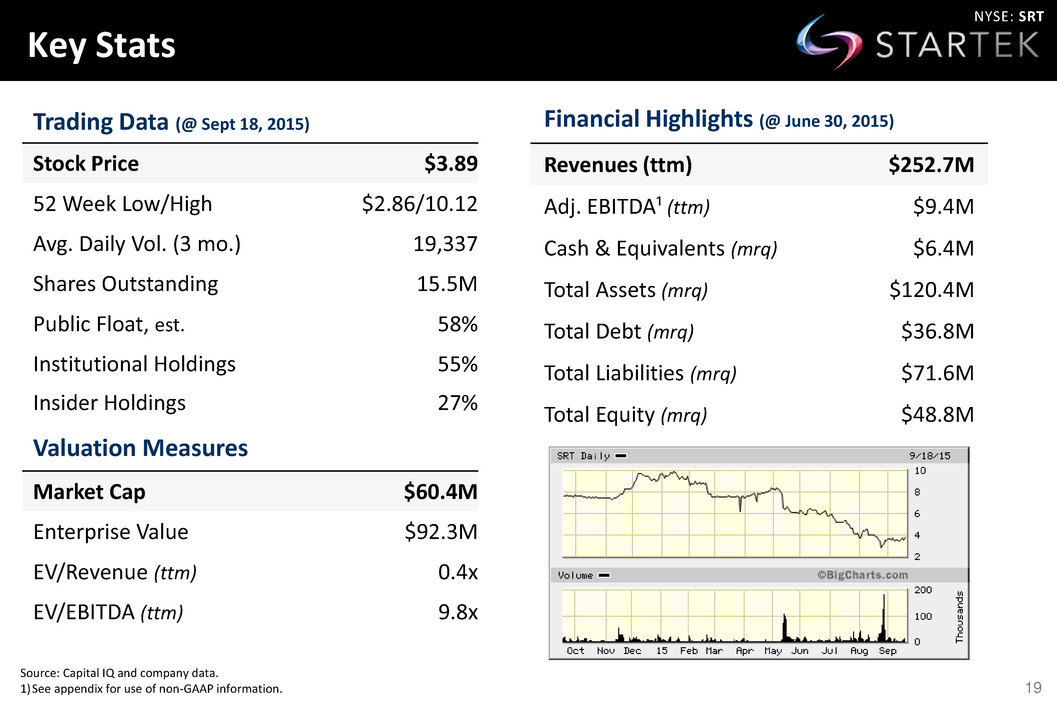

NYSE: SRT Key Stats Trading Data (@ Sept 18, 2015) Stock Price $3.89 52 Week Low/High $2.86/10.12 Avg. Daily Vol. (3 mo.) 19,337 Shares Outstanding 15.5M Public Float, est. 58% Institutional Holdings 55% Insider Holdings 27% Valuation Measures Market Cap $60.4M Enterprise Value $92.3M EV/Revenue (ttm) 0.4x EV/EBITDA (ttm) 9.8x Financial Highlights (@ June 30, 2015) Revenues (ttm) $252.7M Adj. EBITDA¹ (ttm) $9.4M Cash & Equivalents (mrq) $6.4M Total Assets (mrq) $120.4M Total Debt (mrq) $36.8M Total Liabilities (mrq) $71.6M Total Equity (mrq) $48.8M Source: Capital IQ and company data. 1)See appendix for use of non-GAAP information. 19

NYSE: SRT Turnaround Complete, Returning to Growth 20 $265.4M $219.5M $198.1M $231.3M $250.1M $252.7M 16.0% 17.0% 15.0% 12.4% 12.5% 12.9% 2010 2011 2012 2013 2014 TTM@ Jun-15 Revenue and SG&A % Adjusted Gross Margin 10.4% 10.5% 11.6% 10.5% 14.7%¹ 13.3% 2011: Embarked on strategy to close underperforming sites, improve utilization, control costs & diversify 1)2014 excludes 280 basis points for client start-up and capacity expansion expenses.

NYSE: SRT Domestic Offshore Nearshore Revenue & Gross Margin by Region 21 $157M $100M $121M $131M $139M 2011 2012 2013 2014 TTM@ Jun-15 $55M $80M $81M $86M $82M 2011 2012 2013 2014 TTM@ Jun-15 $8M $19M $29M $34M $32M 2011 2012 2013 2014 TTM@ Jun-15 Gross Margin 7.1% 7.4% 11.0% 9.9% 7.5% Gross Margin 14.8% 20.7% 12.3% 17.7% 16.2% Capacity investments muting revenue & margin growth near-term Operational efficiencies driving improved utilization Capacity improvements & labor efficiencies offset by ‘14 Costa Rica closure Gross Margin N/A N/A 3.6% 6.9% 13.7%

NYSE: SRT Cash Flow Trends Improving 22 $23.8M $3.9M -$3.8M $7.9M $9.6M $11.5M $9.4M 2009 2010 2011 2012 2013 2014 TTM@ Jun-15 Adjusted EBITDA Adjusted EBITDA Margin 8.2% 1.5% N/A 4.0% 4.2% 4.6% 3.7%

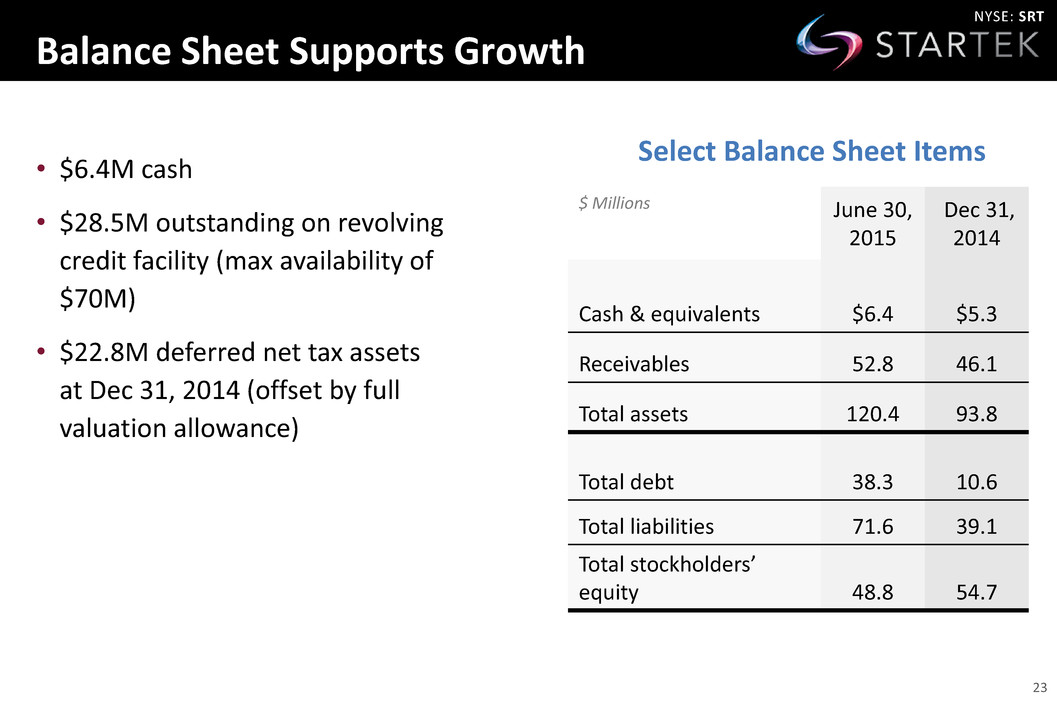

NYSE: SRT Balance Sheet Supports Growth 23 • $6.4M cash • $28.5M outstanding on revolving credit facility (max availability of $70M) • $22.8M deferred net tax assets at Dec 31, 2014 (offset by full valuation allowance) Select Balance Sheet Items $ Millions June 30, 2015 Dec 31, 2014 Cash & equivalents $6.4 $5.3 Receivables 52.8 46.1 Total assets 120.4 93.8 Total debt 38.3 10.6 Total liabilities 71.6 39.1 Total stockholders’ equity 48.8 54.7

NYSE: SRT Targeted Financial Model 24 Revenue $250.1 $350.0 $450.0 Adjusted EBITDA $11.5 $35.0 $54.0 AEBITDA Margin 5% 10% 12% AR (Increase)/Decrease ($2.4) ($16.7) ($17.9) Other Working Capital Change¹: ($4.6) ($3.5) ($4.5) Operating Cash (Use)/Source $4.5 $21.8 $40.6 CAPEX ($11.7) ($5.0) ($5.0) Free Cash Flow ($7.2) $16.8 $35.6 AR Balance $46.1 $62.8 $80.8 DSO 66 66 66 Potential Financial Model*FY 2014 1$ Millions Key Takeaways • Expect double digit revenue growth • AEBITDA margin expansion through emerging services and CEA engagements • A/R will continue to grow as revenues grow • Working capital and capex normalize going forward *For illustrative purposes only. 1) Other working capital includes cash payments for accrued liabilities, including payroll & restructuring costs

NYSE: SRT SRT Key Takeaways • Omni-channel value-add services. A fresh approach in the BPO industry through CEA should drive higher value engagements. • Strategic investments advancing scale. Capacity and improved IT platform supports future growth and profitability. • Improved diversity. Emerging BPO sectors command higher margins, support higher multiples. • Return to growth and profitability. Right-sizing the organization with a focus on utilization and diversified revenue to drive free cash flow and pay down debt. 25 $265 $219 $198 $231 $250 $253 $4 ($4) $8 $10 $12 $9 2010 2011 2012 2013 2014 TTM@ Jun-15 Revenue Adj. EBITDA¹ 1) See Appendix for a reconciliation of Adj. EBITDA. $ Millions

STARTEK 8200 E. Maplewood Ave, Suite 100 Greenwood Village, CO 80111 INVESTOR RELATIONS Liolios Group Cody Slach or Sean Mansouri 949-574-3860 Investor@STARTEK.com 26

APPENDIX

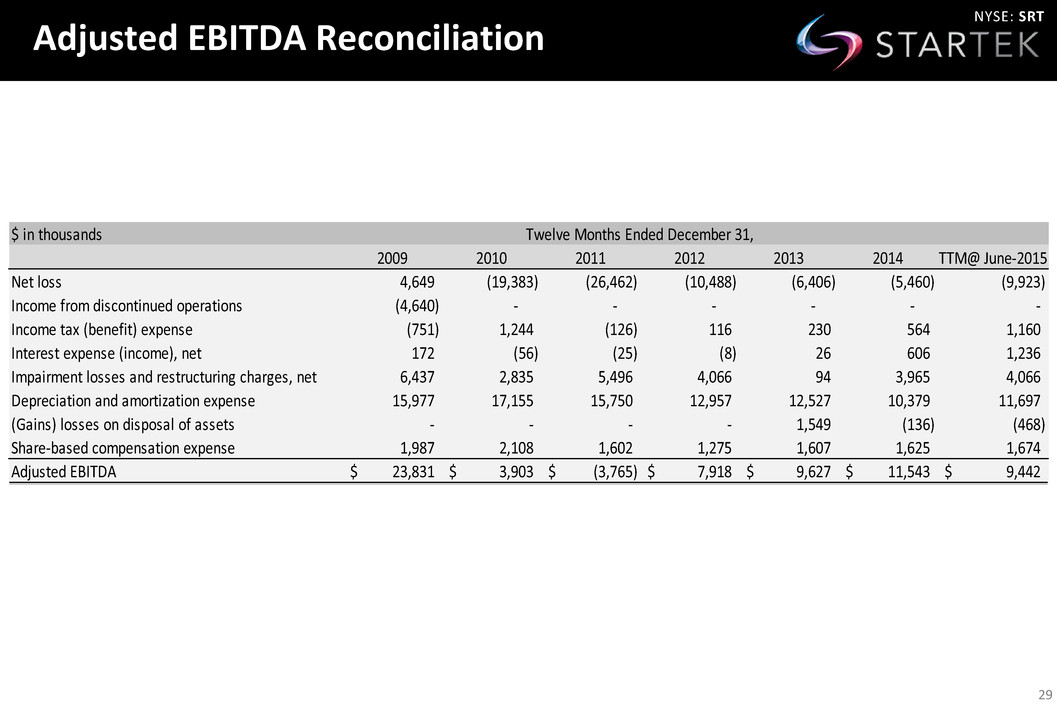

NYSE: SRT Non-GAAP Measures 28 This presentation may contain certain non-GAAP financial measures including Adjusted EBITDA. A reconciliation of this non-GAAP measure to its comparable GAAP measure is included in this presentation. This non-GAAP information should not be construed as an alternative to the reported results determined in accordance with GAAP. It is provided solely to assist in an investor’s understanding of these items on the comparability of the Company’s operations. The Company defines non-GAAP Adjusted EBITDA as net income (loss) plus income tax expense (benefit), interest expense (income), impairment losses and restructuring charges, depreciation and amortization expense, (gains) losses on disposal of assets and share-based compensation expense. Management uses Adjusted EBITDA as a performance measure to analyze the performance of our business. Management believes that excluding these non-cash and other non-recurring items helps investors and analysts assess the strength and performance of our ongoing operations. Management believes that the measures that exclude impairment losses and restructuring charges or other non-recurring items permit a more meaningful comparison and understanding of our operating performance for the current, past or future periods.

NYSE: SRT Adjusted EBITDA Reconciliation 29 $ in thousands 2009 2010 2011 2012 2013 2014 TTM@ June-2015 Net loss 4,649 (19,383) (26,462) (10,488) (6,406) (5,460) (9,923) Income from discontinued operations (4,640) - - - - - - Income tax (benefit) expense (751) 1,244 (126) 116 230 564 1,160 Interest expense (income), net 172 (56) (25) (8) 26 606 1,236 Impairment losses and restructuring charges, net 6,437 2,835 5,496 4,066 94 3,965 4,066 Depreciation and amortization expense 15,977 17,155 15,750 12,957 12,527 10,379 11,697 (Gains) losses on disposal of assets - - - - 1,549 (136) (468) Share-based compensation expense 1,987 2,108 1,602 1,275 1,607 1,625 1,674 Adjusted EBITDA 23,831$ 3,903$ (3,765)$ 7,918$ 9,627$ 11,543$ 9,442$ Twelve Months Ended December 31,