Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BAY BANKS OF VIRGINIA INC | v421239_8k.htm |

Exhibit 99.1

1

Forward Looking Statements This report contains statements concerning the Company’s expectations, plans, objectives, future financial performance and other statements that are not historical facts. These statements may constitute “forward - looking statements” as defined by federal securities laws. These statements may address issues that involve estimates and assumptions made by management, risks and uncertainties, and actual results could differ materially from historical results or those anticipated by such statements. Factors that could have a material adverse effect on the operations and future prospects of the Company include, but are not limited to, changes in: interest rates, general economic conditions, the legislative/regularity climate, monetary and fiscal policies of the U. S. Government, including policies of the U. S. Treasury and Federal Reserve Board, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, acquisitions and dispositions, and accounting principles, polices and guidelines. These risks and uncertainties should be considered in evaluating the forward - looking statements contained herein, and readers are cautioned not to place undue reliance on such statements, which speak only as of the date they are made. 2

Company Overview The history of Bay Banks of Virginia, Inc. begins in 1930 when, in the midst of the Great Depression, a group of financial visionaries in Kilmarnock, Virginia took a bold step and founded a new bank, Bank of Lancaster. Over the years, Bank of Lancaster grew and prospered because it adhered to its founders’ commitment to provide customers with friendly, personal service, a safe haven for their savings and investments, and a sound line of financial products and services to help them build and buy homes, establish businesses and improve the quality of their lives. In 1997, after nearly 70 years of solid growth and customer satisfaction, Bank of Lancaster underwent a corporate reorganization. Bay Banks of Virginia was formed as a bank holding company and assumed ownership of 100% of the stock of Bank of Lancaster. Two years later, Bay Banks of Virginia created a second subsidiary, Bay Trust Company, to purchase the assets of the Bank of Lancaster Trust Department. The sale and transfer of assets was completed on December 31, 1999, at which time Bay Trust Company began operations as a subsidiary of Bay Banks of Virginia. Today, Bay Banks of Virginia conducts substantially all of its operations through its two subsidiaries, Bank of Lancaster and Bay Trust Company. As of June 30, 2015, Bay Banks of Virginia and its subsidiaries had 128 full time equivalent employees, 630 stockholders of record and assets of approximately $422 million. 3

Branching Network Seven branch offices in the Northern Neck Region of Virginia, approximately 75 miles south of Washington, D.C. and 55 miles northeast of Richmond, Virginia Three branch offices in Richmond One branch office in the Middle Peninsula 4

Accomplishments Converted Paragon Place LPO to Branch Formalized Treasury Management Function Opened Patterson Avenue Branch (now our second largest branch) Opened Robious Road Branch Closed North Side Branch Converted Hartfield LPO to Branch Launched Extreme Banking Program Restructured Lending Operations Richmond Deposits Now Account For More Than 17% of the Bank 5

Financial Highlights 6 *$ (000) except per share data 12/31/11 12/31/12 12/31/13 12/31/14 6/30/15 Balance Sheet Total Assets $315,212 $334,798 $331,135 $390,486 $421,727 Gross Loans $236,690 $239,238 $250,837 $298,447 $316,881 Deposits $265,132 $275,175 $268,347 $307,485 $333,601 Loans/Deposits 89.14% 86.94% 93.50% 97.06% 95.00% Capital Common Equity $28,015 $36,585 $37,136 $39,238 $39,587 TARP / Preferred $0 $0 $0 $0 $0 Total Equity/Assets 8.89% 10.93% 11.21% 10.05% 9.39% Tang. Common Equity/Tang. Assets 8.07% 10.17% 10.46% 9.56% 8.92% Leverage Ratio 7.97% 10.93% 10.93% 10.37% 9.52% Profitability Measures Net Interest Margin (FTE) 3.46% 3.61% 3.53% 3.85% 3.59% Earnings Per Share $0.13 $0.27 $0.25 $0.38 $0.14 Efficiency Ratio 88.96% 81.72% 81.27% 78.70% 85.17% ROAA 0.11% 0.22% 0.37% 0.53% 0.34% ROAE 1.25% 2.43% 3.34% 4.76% 3.44% Net Income (YTD) $350 $698 $1,222 $1,830 $675

Loan Growth 6/30/15 loan portfolio balance: $316.9 million Portfolio composition as of June 30: $26.4 million C&I $88.3 million Commercial Real Estate $192.2 million Consumer Real Estate $10.0 million Consumer/Other 6/30/15 average yield on loans: 4.83% Loan growth of $47.6 million or 19.0% in 2014 Loan growth of $28.2 million or 9.5 % through August 2015 7

$19.8 million of 2015 growth has been in consumer real estate $6.5 million of 2015 growth has been in CRE $13.6 million of 2015 growth has come from Richmond Net interest income of $6.6 million for first six months of 2015; $832,000 higher than $5.7 million for first six months of 2014 6/30/15 ALLL of $3.44 million: ▪ 1.09% of total loans ▪ 71% of non - performing loans 8

Credit Quality 9

10

Net Interest Income YTD 6/30/15 vs YTD 6/30/14 Interest income grew by $1,039,000 Yield on earning assets declined to 4.29% from 4.60% Interest expense grew by $207,000 Cost of funds declined to 0.73% from 0.76% N ET I NTEREST I NCOME G REW B Y $832,000 11

Interest Rate Sensitivity It only takes $3 million of loan growth to make the net interest income line positive. 12

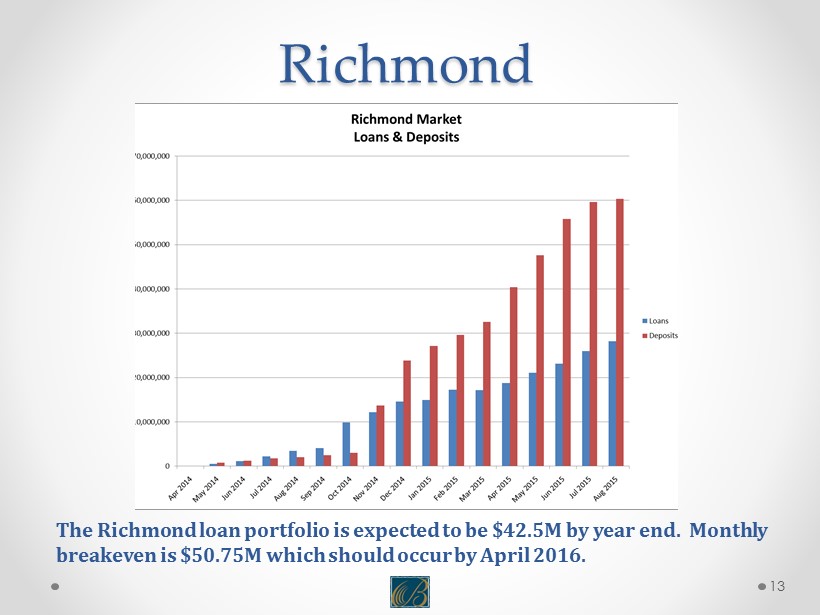

Richmond The Richmond loan portfolio is expected to be $42.5M by year end. Monthly breakeven is $50.75M which should occur by April 2016. 13

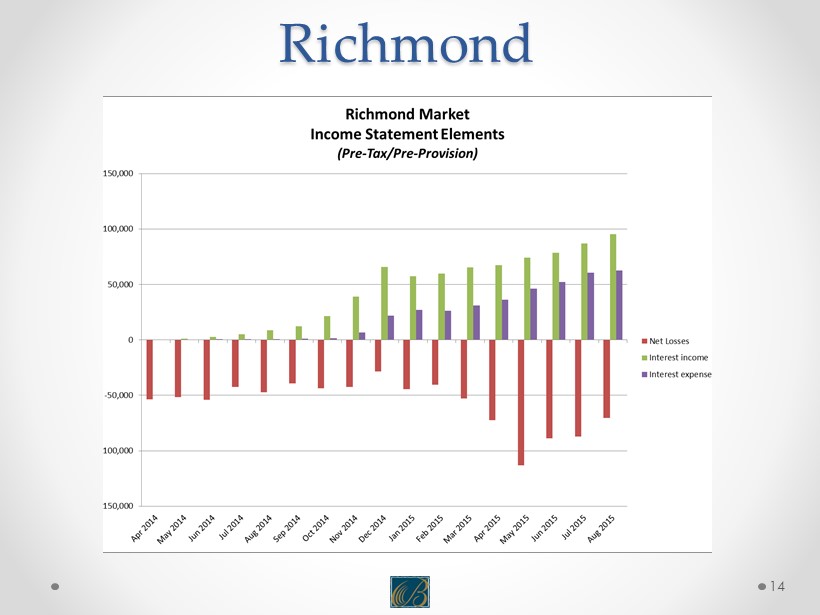

Richmond 14

Executive Management 15

Randal R. Greene Randal “Randy” Greene is president and chief executive officer of Bay Banks of Virginia (the “Company”) and Bank of Lancaster (t he “Bank”), the Company’s wholly - owned, community bank subsidiary. He is a member of both the Bay Banks of Virginia Board of Directors and the Bank of Lancaster Board of Directors, and serves as vice chairman of the board for Bay Trust Company, a who lly - owned subsidiary of the Company. Greene joined the Company and the Bank in fall 2011 , and since that time has led the Company’s efforts in developing and implementing a turnaround strategy . The strategy, implemented in 2012 , included 12 revenue - enhancing and cost - cutting initiatives exceeding $ 2 . 5 million in value for the Company . Asset quality improvements, a branch consolidation, and a workforce reduction improved the Company’s earnings, allowing it to complete a $ 9 . 4 million private placement of its common stock — a significant achievement in light of a continued challenging economy and difficult banking industry environment . Following the successful capital raise and under Greene’s guidance, the Company expanded by opening a residential mortgage loan production office in Middlesex County, just to the south of the Bank’s primary market area of Virginia’s Northern Neck, and created a Wealth Management Group that enjoyed a successful year in 2013 . With the improvements and enhancements in place, Company profits increased 75 % in 2013 over 2012 , resulting in its most profitable year since 2009 . Through his efforts, new leadership was put in place for the Residential Mortgage operations of the Bank, and both volume and profits tripled for 2013 . In 2014 , Greene recruited an experienced banker to lead the Bank’s entry into Richmond, the capital of Virginia and a key banking market, and opened a loan production office with plans to open a full - service office in the near future . Greene received his bachelor of Business Administration from East Tennessee State University, Johnson City, Tenn . , in 1982 . He began his banking career in 1984 and brings nearly thirty years of community banking and management experience to his role with the Company . Prior to joining the Company, he was a regional president of State of Franklin Bank, a division of Jefferson Federal Bank in Johnson City, Tennessee . From 1996 to 2008 , he was president, chief executive officer, director and founder of State of Franklin Savings Bank and chairman of its executive committee . He was president of State of Franklin Real Estate from 1997 to 2008 , growing the company to 100 agents and to number 2 in market share . In addition, he served as president of State of Franklin Leasing Company . 16

Douglas F. Jenkins, Jr. Doug is Bank of Lancaster’s Executive Vice President and Chief Banking Officer. As second in command of the Bank, his responsibilities include oversight of lending and retail delivery. Doug joined the Bank in April 2006 as Vice President, Business Development Officer. In May 2008, he was promoted to Senior Lending Officer, responsible for supervising all lending areas of the Bank – residential, consumer and commercial. In December, 2009, Doug was promoted to Senior Vice President. He assumed responsibility for Retail Delivery in June of 2011 and in December of 2011 was elected by the Bank’s Board to the position of Executive Vice President. Jenkins was named Chief Lending Officer in April 2013 and Chief Banking Officer in September of 2015. Doug began his banking career in 1985, as a Financial Accountant with United Virginia Bank, which subsequently became Crestar Bank. In 1987, he joined Crestar’s Investment Banking Division as an Assistant Vice President, providing analytical support and investment counseling to Crestar’s correspondent banks. Later he joined Crestar’s internal Mergers and Acquisitions Department, where he was promoted to Vice President and worked on a number of transactions for Crestar. In 1994, Doug joined Crestar’s Correspondent Banking Division, where he was responsible for managing relationships of Crestar’s correspondent banks. Crestar was acquired by SunTrust Bank in 1998, at which time the Correspondent Banking Department was renamed the Financial Institutions Group and became a part of SunTrust’s Corporate and Investment Banking Group. Doug continued with the Financial Institutions Group of SunTrust until April of 2006. He received his BS in Finance from the University of Virginia’s McIntire School of Commerce in May of 1982. He recently completed a term serving as a Director of the Virginia Association of Community Banks. 17

Deborah M. Evans Deb is Treasurer and Chief Financial Officer for Bay Banks of Virginia, Inc. She is also a Senior Vice President and the Chi ef Financial Officer of Bank of Lancaster and Treasurer of Bay Trust Company. Deb joined the Company in September 1999 as the Bank’s Regulatory Accountant and by 2005 had assumed responsibility as acting Chief Financial Officer for the Bank and Treasurer and Principal Financial and Accounting Officer for Bay Banks. In 2010, she earned the official title as Chief Financial Officer for the Bank, then Chief Financial Officer for Bay Banks in 2011. She is responsible for financial reporting, planning and controls. She is a key member of the Asset - Liability Committee, chairs the Pricing Committee and is a member of the Investment Committee and the Employee Stock Ownership Plan Committee. She develops and oversees related policies, programs and procedures and provides counsel to the CEO/President and Boards of Directors regarding financial performance, external reporting to banking regulators and the public via the Securities and Exchange Commission. Deb holds a Bachelor’s of Science degree in Mechanical Engineering from General Motors Institute, now Kettering University, and a Masters in Business Administration from Yale University’s School of Organization and Management. She holds a certificate in Bank Management from the Graduate School of Banking at the University of Colorado and was part of the inaugural class of the Virginia Bankers Leadership Institute program. She is a member of the Virginia Bankers Association’s CFO Committee, which plans the VBA’s annual CFO Conference. She is also a member of the American Bankers Association’s Accounting Administrative Committee, which advocates for banking industry accounting practices to the U.S. Congress, banking regulators, the Public Company Accounting Oversight Board, and the Financial Accounting Standards Board. She also chairs the American Bankers Association’s annual CFO Exchange Conference and is a member of its Advisory Committee. 18