Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION 9 16 15 - U.S. CONCRETE, INC. | a8-kinvestorpresentation91.htm |

September 2015 INVESTOR PRESENTATION

1 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Forward-Looking Statements Certain statements and information provided in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us and do not include the impact of future acquisitions. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially. The forward-looking statements speak only as of the date of this presentation. Investors are cautioned not to rely unduly upon these forward-looking statements. The Company undertakes no obligation to update these forward-looking statements, except as required by law. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, general economic and business conditions, which will, among other things, affect demand for new residential and commercial construction; our ability to successfully identify, manage, and integrate acquisitions; the cyclical nature of, and changes in, the real estate and construction markets, including pricing changes by our competitors; governmental requirements and initiatives, including those related to mortgage lending or mortgage financing, funding for public or infrastructure construction, land usage, and environmental, health, and safety matters; disruptions, uncertainties or volatility in the credit markets that may limit our, our suppliers' and our customers' access to capital; our ability to successfully implement our operating strategy; weather conditions; our substantial indebtedness and the restrictions imposed on us by the terms of our indebtedness; our ability to maintain favorable relationships with third parties who supply us with equipment and essential supplies; our ability to retain key personnel and maintain satisfactory labor relations; and product liability, property damage, and other claims and insurance coverage issues. For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see “Risk Factors” in our Form 10-K and our Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. All written and oral forward-looking statements in this presentation are expressly qualified by these “Risk Factors.”

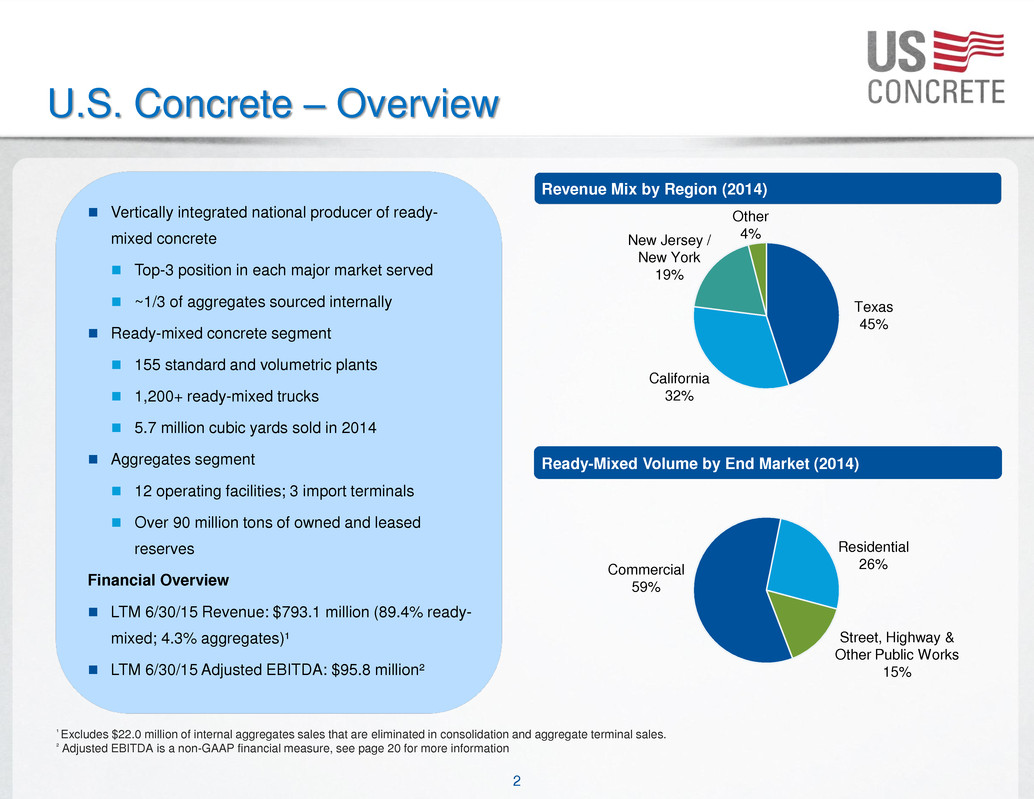

2 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 U.S. Concrete – Overview Vertically integrated national producer of ready- mixed concrete Top-3 position in each major market served ~1/3 of aggregates sourced internally Ready-mixed concrete segment 155 standard and volumetric plants 1,200+ ready-mixed trucks 5.7 million cubic yards sold in 2014 Aggregates segment 12 operating facilities; 3 import terminals Over 90 million tons of owned and leased reserves Financial Overview LTM 6/30/15 Revenue: $793.1 million (89.4% ready- mixed; 4.3% aggregates)¹ LTM 6/30/15 Adjusted EBITDA: $95.8 million² Texas 45% California 32% New Jersey / New York 19% Other 4% Ready-Mixed Volume by End Market (2014) Commercial 59% Residential 26% ¹ Excludes $22.0 million of internal aggregates sales that are eliminated in consolidation and aggregate terminal sales. ² Adjusted EBITDA is a non-GAAP financial measure, see page 20 for more information Revenue Mix by Region (2014) (2014A) Street, Highway & Other Public Works 15%

3 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Premier Position in Attractive Construction Material Categories Industry Leading Performance Top-3 Positions in Well-Structured Markets with Attractive Fundamentals Long-Term Diversified Customer Base Across Sectors and Regions Top Supplier to Commercial Projects with High Margins and Barriers to Entry Vertical Integration into Aggregates Enhances Value Chain Successful Track Record of Accretive Acquisitions with Significant Consolidation Pipeline Disciplined Pricing Mechanics Drive Superior Margin Performance Through the Cycle Strong Financial Performance, Conservative Balance Sheet and Solid Returns on Capital

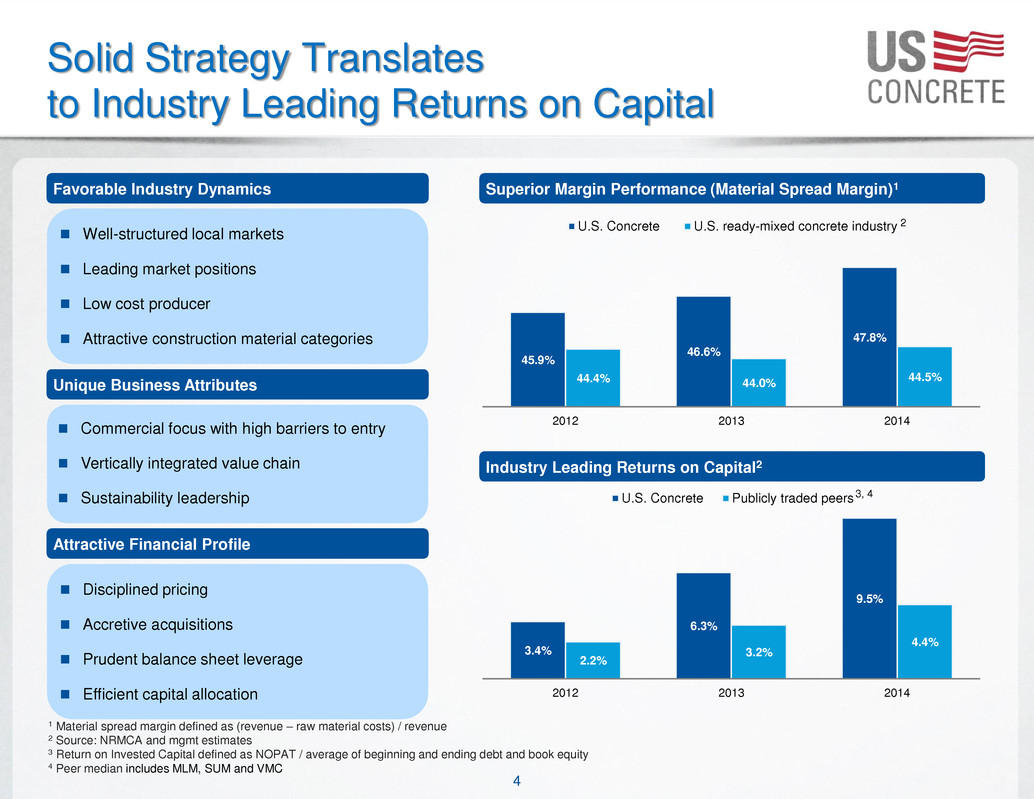

4 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Solid Strategy Translates to Industry Leading Returns on Capital 1 Material spread margin defined as (revenue – raw material costs) / revenue 2 Source: NRMCA and mgmt estimates 3 Return on Invested Capital defined as NOPAT / average of beginning and ending debt and book equity 4 Peer median includes MLM, SUM and VMC Favorable Industry Dynamics Well-structured local markets Leading market positions Low cost producer Attractive construction material categories Unique Business Attributes Commercial focus with high barriers to entry Vertically integrated value chain Sustainability leadership Attractive Financial Profile Disciplined pricing Accretive acquisitions Prudent balance sheet leverage Efficient capital allocation Superior Margin Performance (Material Spread Margin)1 45.9% 46.6% 47.8% 44.4% 44.0% 44.5% 2012 2013 2014 U.S. Concrete U.S. ready-mixed concrete industry 2 3.4% 6.3% 9.5% 2.2% 3.2% 4.4% 2012 2013 2014 U.S. Concrete Publicly traded peers Industry Leading Returns on Capital2 3, 4

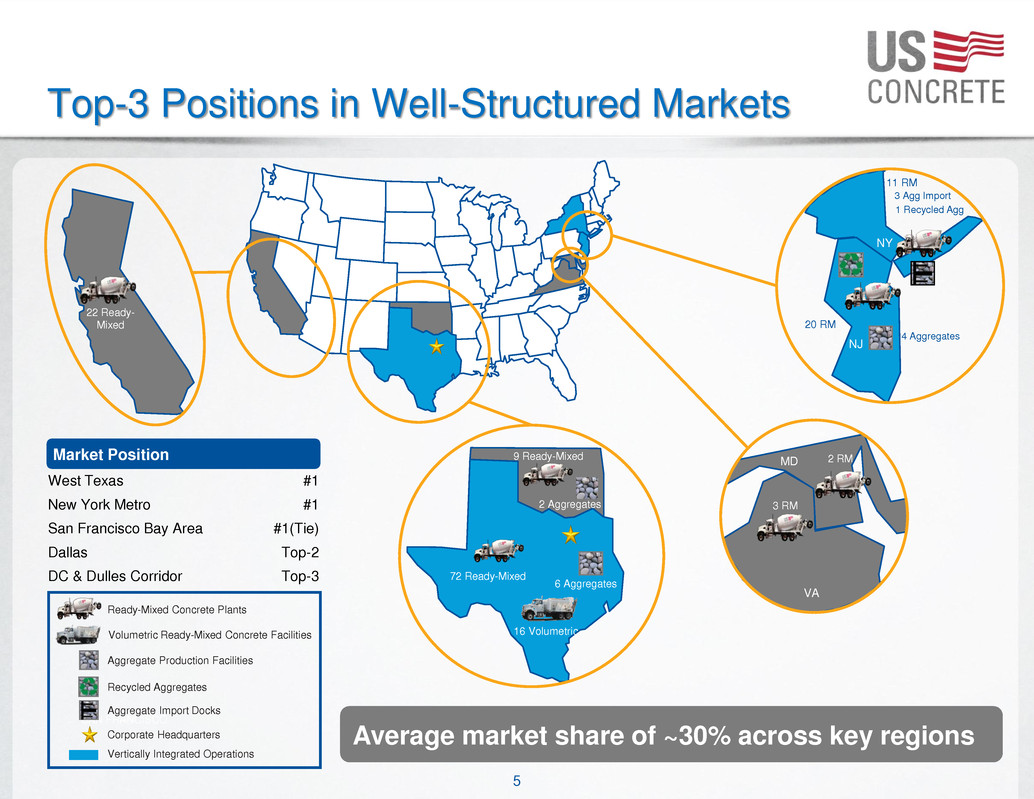

5 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Top-3 Positions in Well-Structured Markets NJ 20 RM 1 Recycled Agg NY 3 Agg Import 11 RM MD VA 3 RM 2 RM West Texas #1 New York Metro #1 San Francisco Bay Area #1(Tie) Dallas Top-2 DC & Dulles Corridor Top-3 SAN FRANCISCO Ready-Mixed Concrete Plants Aggregate Production Facilities Recycled Aggregates Corporate Headquarters Vertically Integrated Operations Volumetric Ready-Mixed Concrete Facilities Aggregate Import Docks 72 Ready-Mixed 6 Aggregates 16 Volumetric 9 Ready-Mixed 2 Aggregates 22 Ready- Mixed Market Position Average market share of ~30% across key regions 4 Aggregates

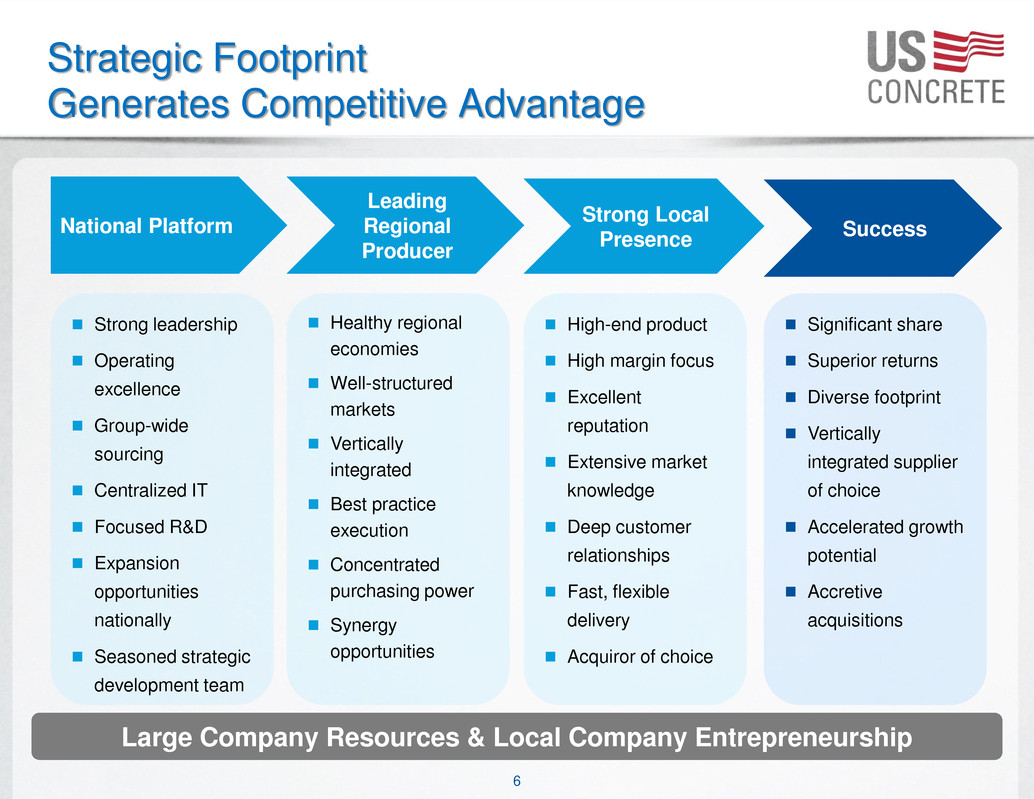

6 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Strategic Footprint Generates Competitive Advantage Strong leadership Operating excellence Group-wide sourcing Centralized IT Focused R&D Expansion opportunities nationally Seasoned strategic development team Healthy regional economies Well-structured markets Vertically integrated Best practice execution Concentrated purchasing power Synergy opportunities High-end product High margin focus Excellent reputation Extensive market knowledge Deep customer relationships Fast, flexible delivery Acquiror of choice Significant share Superior returns Diverse footprint Vertically integrated supplier of choice Accelerated growth potential Accretive acquisitions National Platform Leading Regional Producer Strong Local Presence Success Large Company Resources & Local Company Entrepreneurship

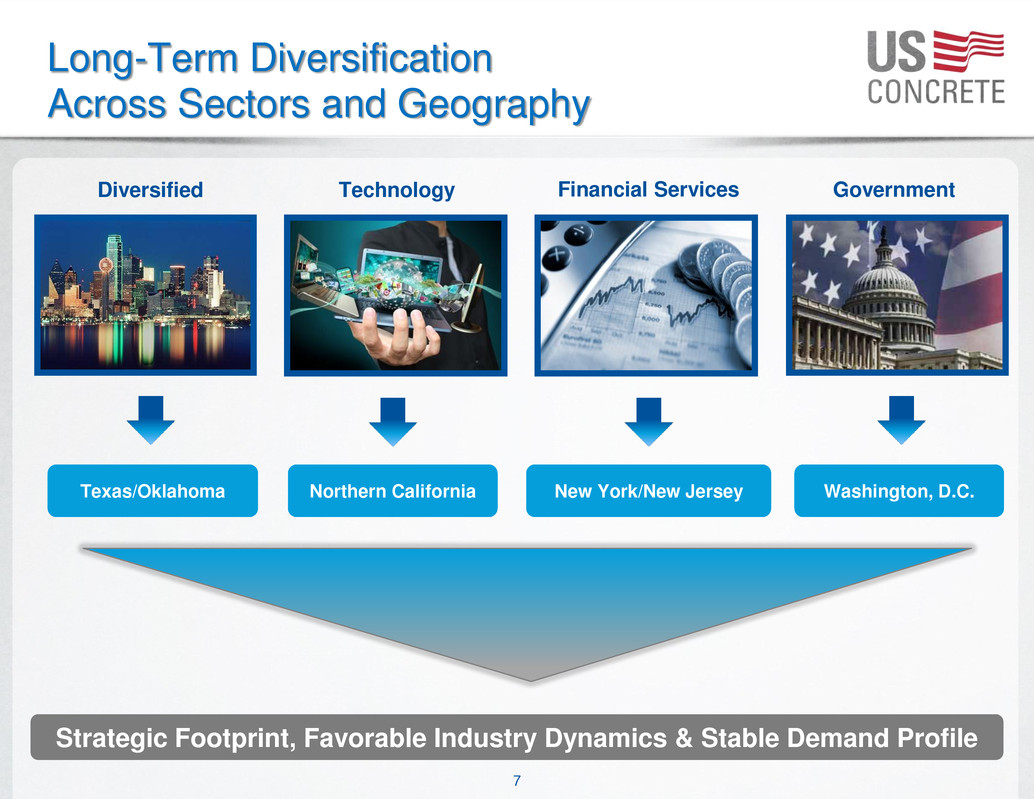

7 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Long-Term Diversification Across Sectors and Geography Texas/Oklahoma Northern California New York/New Jersey Washington, D.C. Diversified Technology Financial Services Government Strategic Footprint, Favorable Industry Dynamics & Stable Demand Profile

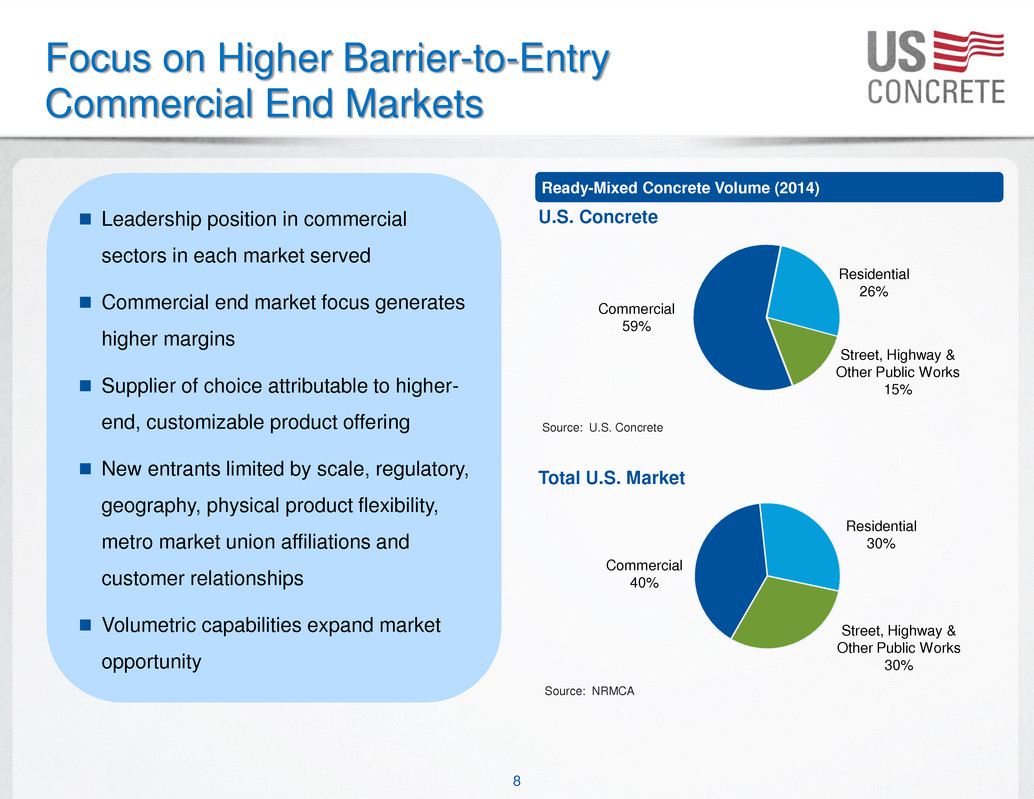

8 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Focus on Higher Barrier-to-Entry Commercial End Markets Leadership position in commercial sectors in each market served Commercial end market focus generates higher margins Supplier of choice attributable to higher- end, customizable product offering New entrants limited by scale, regulatory, geography, physical product flexibility, metro market union affiliations and customer relationships Volumetric capabilities expand market opportunity Ready-Mixed Concrete Volume (2014) U.S. Concrete Source: U.S. Concrete Total U.S. Market Commercial 59% Residential 26% Street, Highway & Other Public Works 15% Commercial 40% Residential 30% Street, Highway & Other Public Works 30% Source: NRMCA

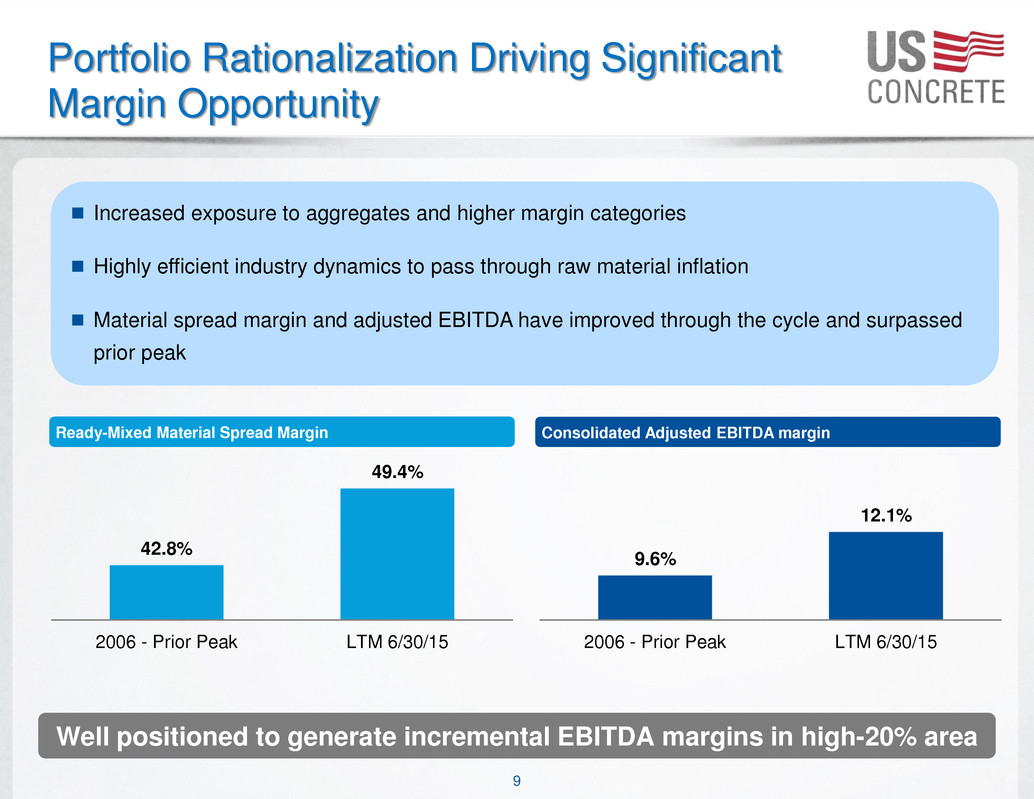

9 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Portfolio Rationalization Driving Significant Margin Opportunity Increased exposure to aggregates and higher margin categories Highly efficient industry dynamics to pass through raw material inflation Material spread margin and adjusted EBITDA have improved through the cycle and surpassed prior peak 42.8% 49.4% 2006 - Prior Peak LTM 6/30/15 9.6% 12.1% 2006 - Prior Peak LTM 6/30/15 Consolidated Adjusted EBITDA margin Ready-Mixed Material Spread Margin Well positioned to generate incremental EBITDA margins in high-20% area

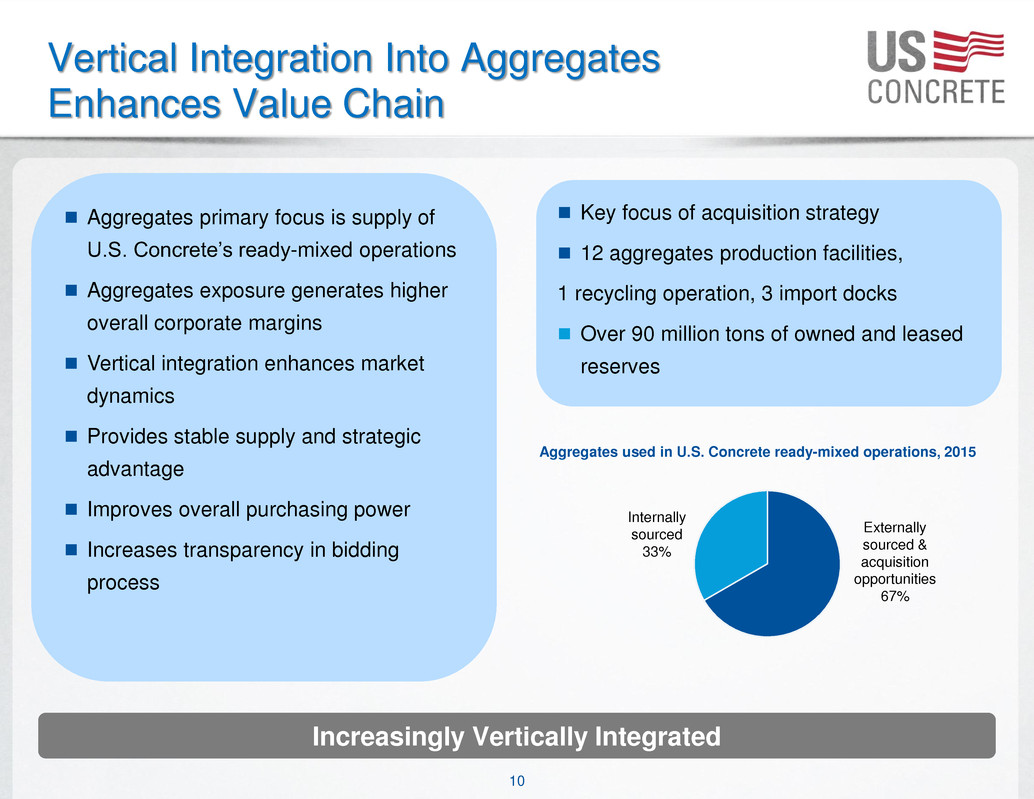

10 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Vertical Integration Into Aggregates Enhances Value Chain Aggregates primary focus is supply of U.S. Concrete’s ready-mixed operations Aggregates exposure generates higher overall corporate margins Vertical integration enhances market dynamics Provides stable supply and strategic advantage Improves overall purchasing power Increases transparency in bidding process Aggregates used in U.S. Concrete ready-mixed operations, 2015 Externally sourced & acquisition opportunities 67% Internally sourced 33% Key focus of acquisition strategy 12 aggregates production facilities, 1 recycling operation, 3 import docks Over 90 million tons of owned and leased reserves Increasingly Vertically Integrated

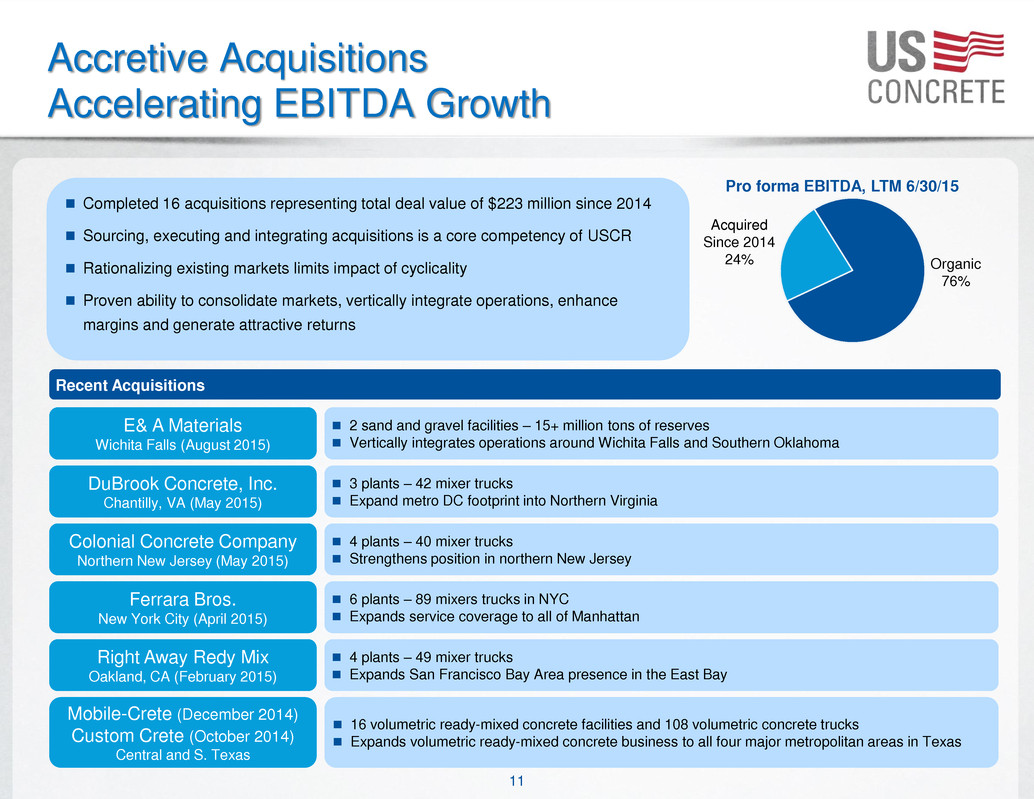

11 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Accretive Acquisitions Accelerating EBITDA Growth Completed 16 acquisitions representing total deal value of $223 million since 2014 Sourcing, executing and integrating acquisitions is a core competency of USCR Rationalizing existing markets limits impact of cyclicality Proven ability to consolidate markets, vertically integrate operations, enhance margins and generate attractive returns Mobile-Crete (December 2014) Custom Crete (October 2014) Central and S. Texas 3 plants – 42 mixer trucks Expand metro DC footprint into Northern Virginia DuBrook Concrete, Inc. Chantilly, VA (May 2015) Colonial Concrete Company Northern New Jersey (May 2015) 6 plants – 89 mixers trucks in NYC Expands service coverage to all of Manhattan Ferrara Bros. New York City (April 2015) 4 plants – 49 mixer trucks Expands San Francisco Bay Area presence in the East Bay Right Away Redy Mix Oakland, CA (February 2015) 16 volumetric ready-mixed concrete facilities and 108 volumetric concrete trucks Expands volumetric ready-mixed concrete business to all four major metropolitan areas in Texas 2 sand and gravel facilities – 15+ million tons of reserves Vertically integrates operations around Wichita Falls and Southern Oklahoma E& A Materials Wichita Falls (August 2015) 4 plants – 40 mixer trucks Strengthens position in northern New Jersey Recent Acquisitions Acquired Since 2014 24% Organic 76% Pro forma EBITDA, LTM 6/30/15

12 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Significant Industry Consolidation Opportunities Ready-Mixed Concrete Market Size Deal opportunities remain robust in a largely unconsolidated landscape outside of U.S. Concrete’s current regions U.S. Concrete is an acquiror of choice in established markets through decades long relationships amongst local and national management teams Aggregates provide additional expansion opportunities and strengthen vertically integrated capabilities Increasing vertical integration among cement, aggregates and concrete producers represents favorable market dynamic Annual Revenue $30.0 B Ready-Mixed Concrete Producers 2,000 Ready-Mixed Concrete Plants 5,500 Source: National Ready-Mixed Concrete Association

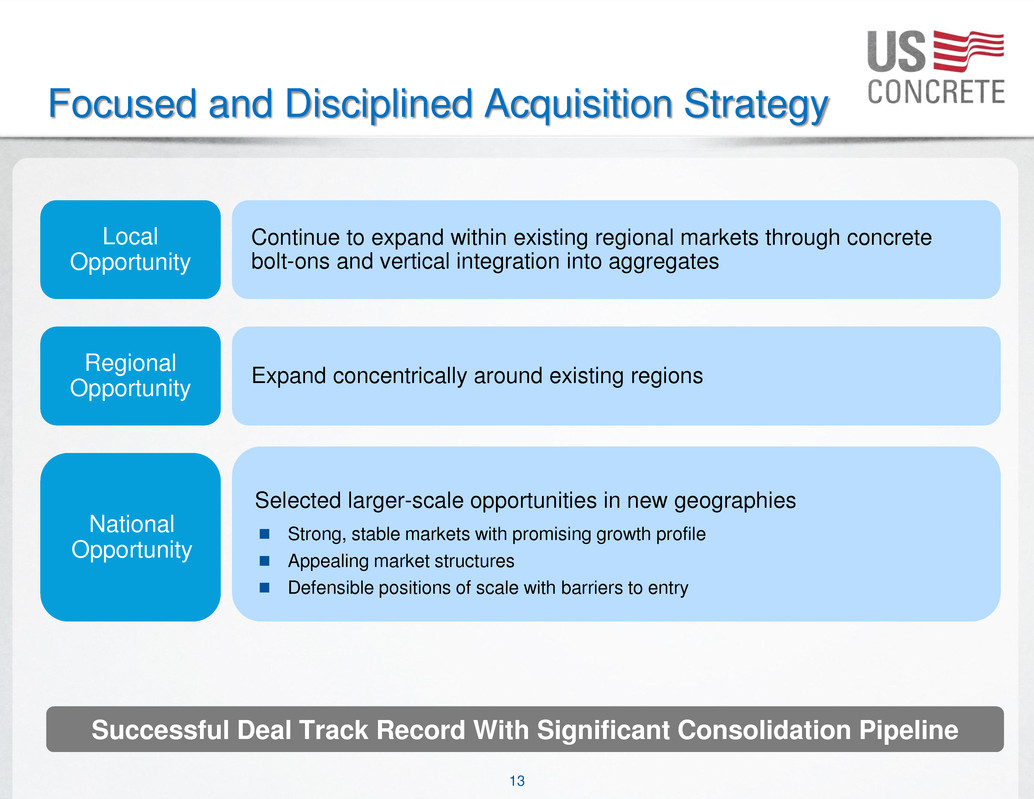

13 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Focused and Disciplined Acquisition Strategy Continue to expand within existing regional markets through concrete bolt-ons and vertical integration into aggregates Local Opportunity Expand concentrically around existing regions Regional Opportunity Selected larger-scale opportunities in new geographies National Opportunity Strong, stable markets with promising growth profile Appealing market structures Defensible positions of scale with barriers to entry Successful Deal Track Record With Significant Consolidation Pipeline

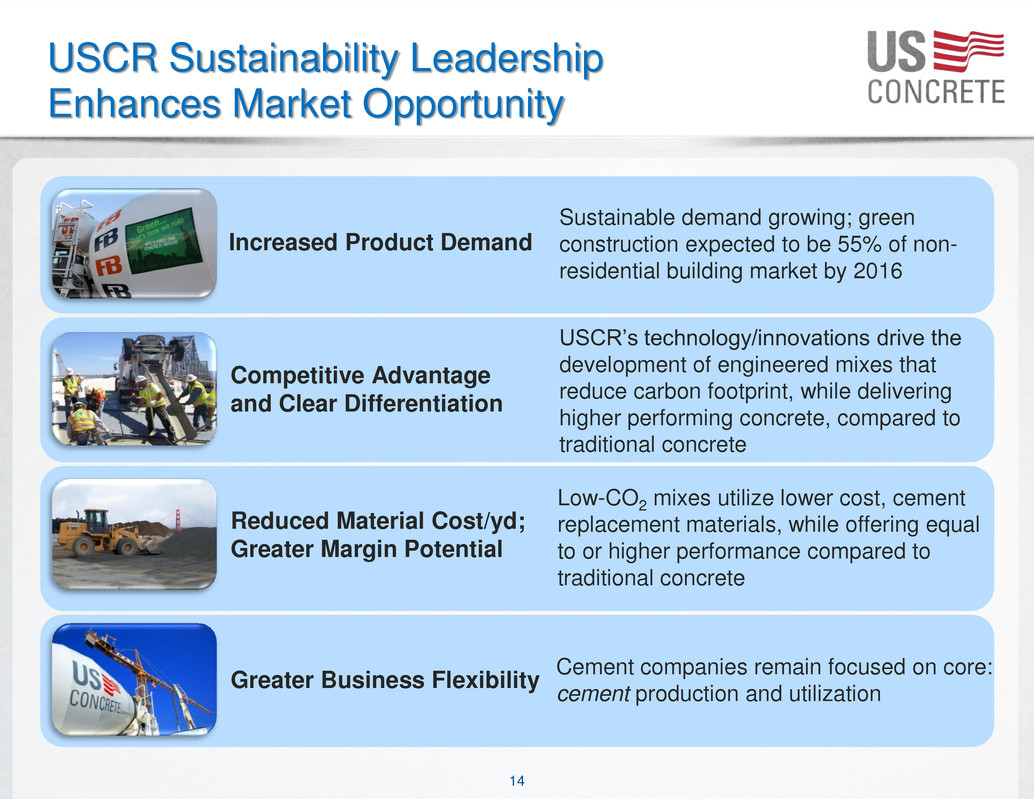

14 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 USCR Sustainability Leadership Enhances Market Opportunity Sustainable demand growing; green construction expected to be 55% of non- residential building market by 2016 Increased Product Demand USCR’s technology/innovations drive the development of engineered mixes that reduce carbon footprint, while delivering higher performing concrete, compared to traditional concrete Competitive Advantage and Clear Differentiation Low-CO2 mixes utilize lower cost, cement replacement materials, while offering equal to or higher performance compared to traditional concrete Reduced Material Cost/yd; Greater Margin Potential Cement companies remain focused on core: cement production and utilization Greater Business Flexibility

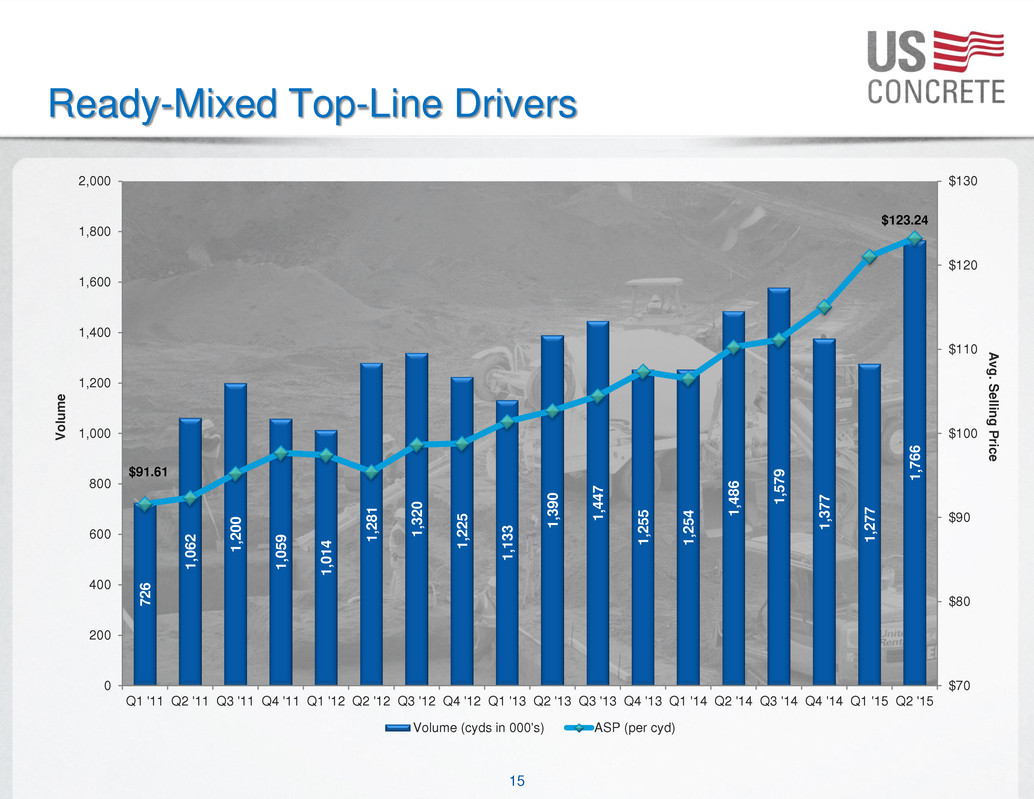

15 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Ready-Mixed Top-Line Drivers 7 2 6 1,06 2 1,20 0 1,05 9 1,01 4 1,28 1 1,32 0 1,22 5 1,13 3 1,39 0 1,44 7 1,25 5 1,25 4 1,48 6 1,57 9 1,37 7 1,27 7 1,76 6 $91.61 $123.24 $70 $80 $90 $100 $110 $120 $130 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 A v g . S el lin g P ric e V o lu m e Volume (cyds in 000's) ASP (per cyd)

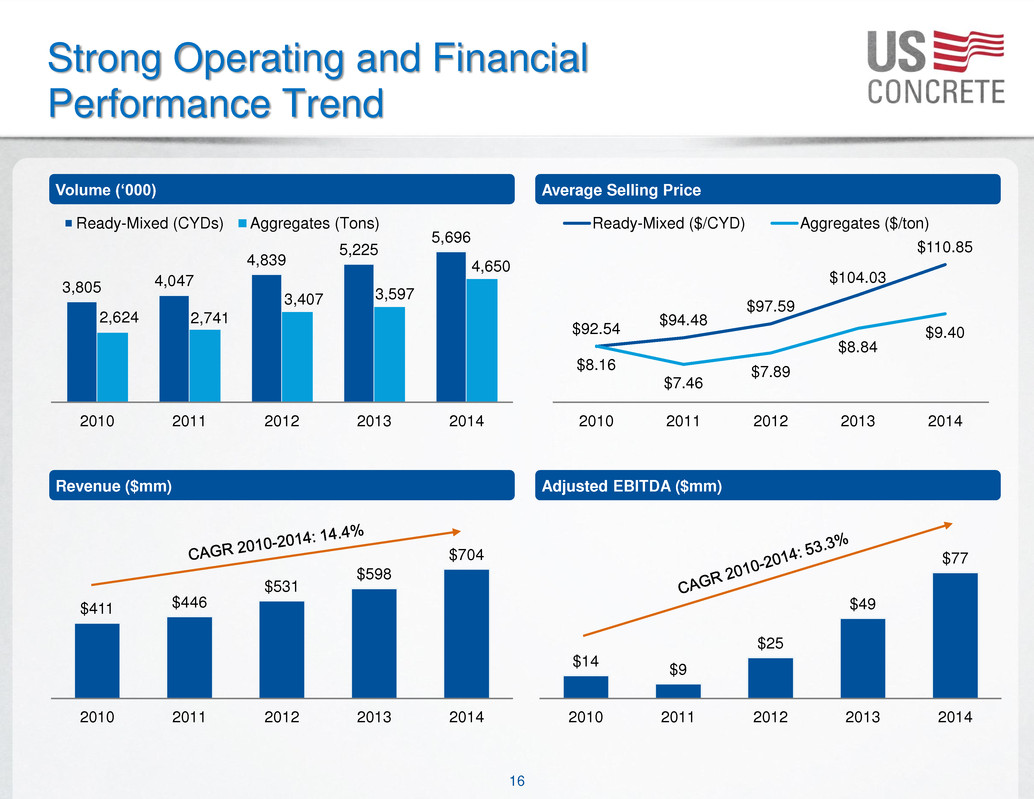

16 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Strong Operating and Financial Performance Trend Average Selling Price Volume (‘000) 3,805 4,047 4,839 5,225 5,696 2,624 2,741 3,407 3,597 4,650 2010 2011 2012 2013 2014 Ready-Mixed (CYDs) Aggregates (Tons) $92.54 $94.48 $97.59 $104.03 $110.85 $8.16 $7.46 $7.89 $8.84 $9.40 2010 2011 2012 2013 2014 Ready-Mixed ($/CYD) Aggregates ($/ton) Adjusted EBITDA ($mm) Revenue ($mm) $411 $446 $531 $598 $704 2010 2011 2012 2013 2014 $14 $9 $25 $49 $77 2010 2011 2012 2013 2014

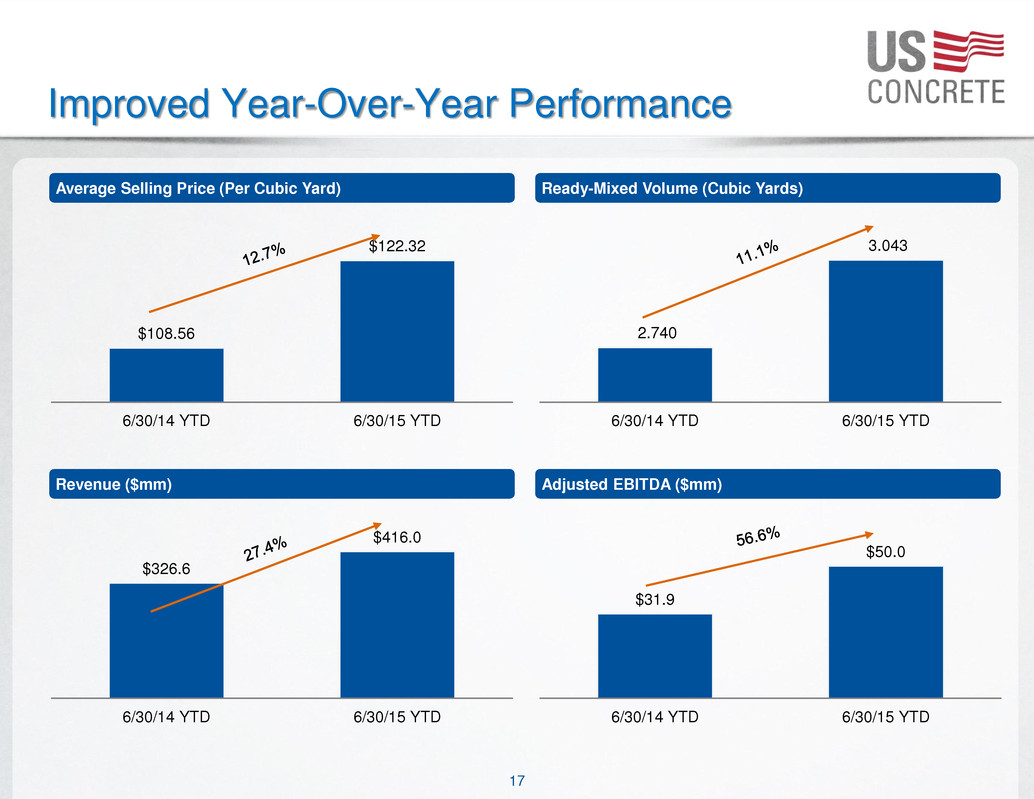

17 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Improved Year-Over-Year Performance Ready-Mixed Volume (Cubic Yards) Average Selling Price (Per Cubic Yard) $326.6 $416.0 6/30/14 YTD 6/30/15 YTD Adjusted EBITDA ($mm) Revenue ($mm) 2.740 3.043 6/30/14 YTD 6/30/15 YTD $31.9 $50.0 6/30/14 YTD 6/30/15 YTD $108.56 $122.32 6/30/14 YTD 6/30/15 YTD

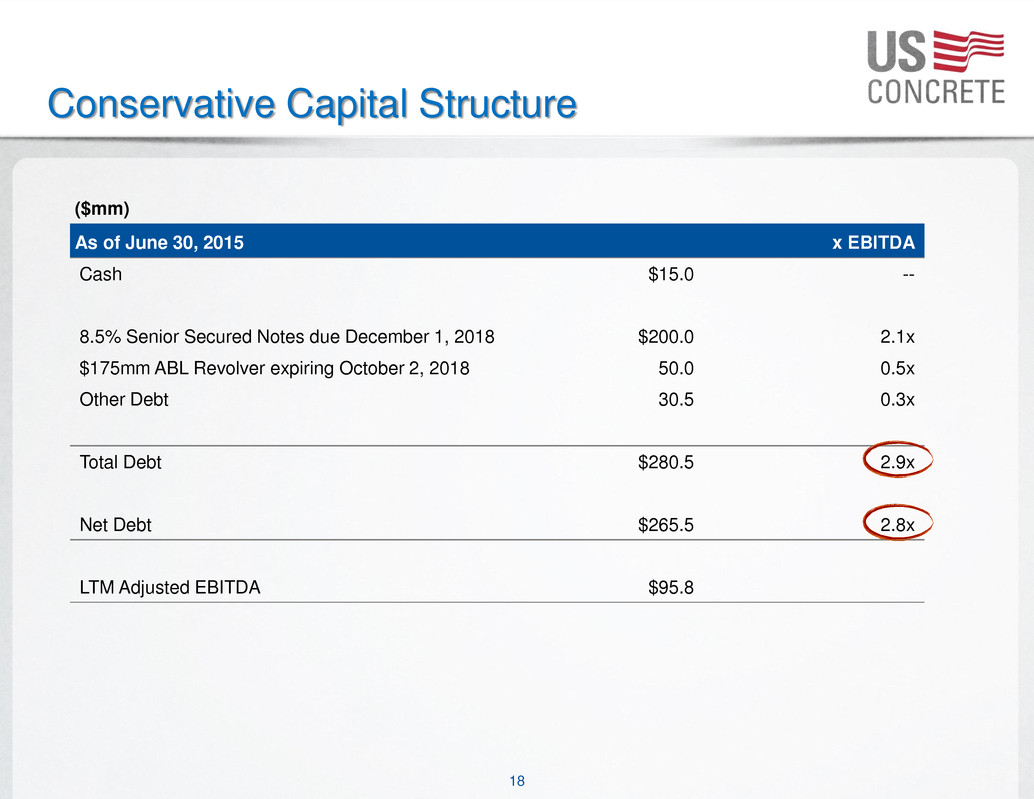

18 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Conservative Capital Structure ($mm) As of June 30, 2015 x EBITDA Cash $15.0 -- 8.5% Senior Secured Notes due December 1, 2018 $200.0 2.1x $175mm ABL Revolver expiring October 2, 2018 50.0 0.5x Other Debt 30.5 0.3x Total Debt $280.5 2.9x Net Debt $265.5 2.8x LTM Adjusted EBITDA $95.8

Appendix

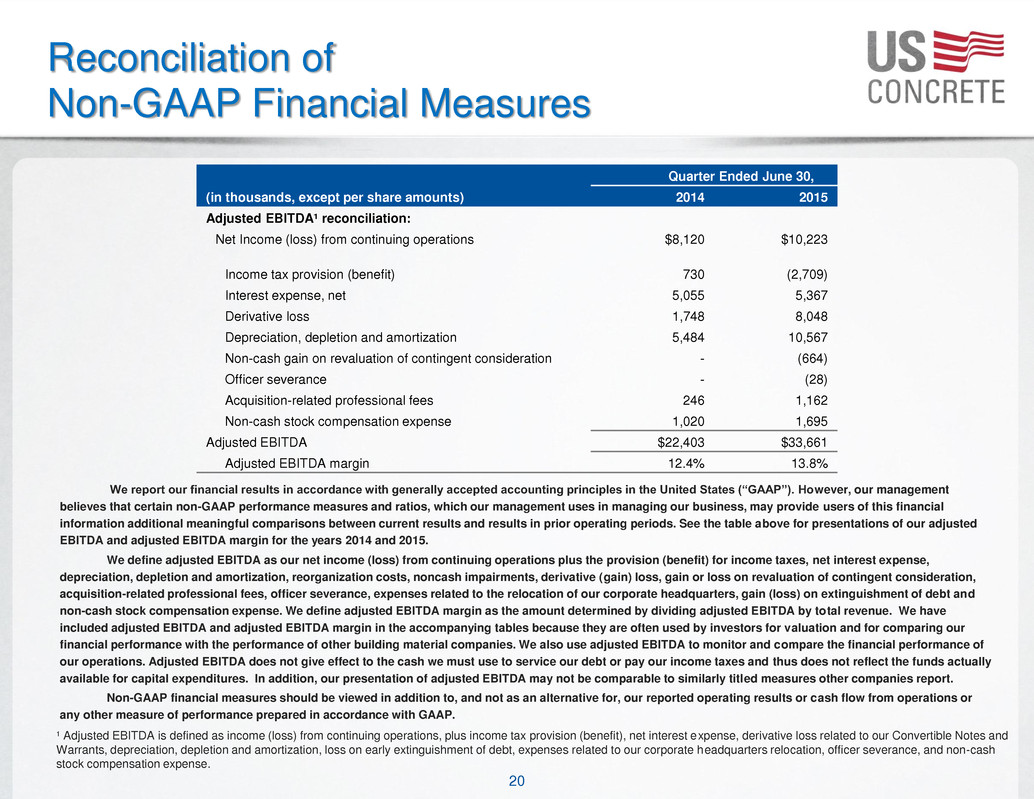

20 113.156.53 0.81.155 53.156.147 5.158.219 124.124.124 242.112.109 219.104.11 250.166.25 Reconciliation of Non-GAAP Financial Measures Quarter Ended June 30, (in thousands, except per share amounts) 2014 2015 Adjusted EBITDA¹ reconciliation: Net Income (loss) from continuing operations $8,120 $10,223 Income tax provision (benefit) 730 (2,709) Interest expense, net 5,055 5,367 Derivative loss 1,748 8,048 Depreciation, depletion and amortization 5,484 10,567 Non-cash gain on revaluation of contingent consideration - (664) Officer severance - (28) Acquisition-related professional fees 246 1,162 Non-cash stock compensation expense 1,020 1,695 Adjusted EBITDA $22,403 $33,661 Adjusted EBITDA margin 12.4% 13.8% We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the table above for presentations of our adjusted EBITDA and adjusted EBITDA margin for the years 2014 and 2015. We define adjusted EBITDA as our net income (loss) from continuing operations plus the provision (benefit) for income taxes, net interest expense, depreciation, depletion and amortization, reorganization costs, noncash impairments, derivative (gain) loss, gain or loss on revaluation of contingent consideration, acquisition-related professional fees, officer severance, expenses related to the relocation of our corporate headquarters, gain (loss) on extinguishment of debt and non-cash stock compensation expense. We define adjusted EBITDA margin as the amount determined by dividing adjusted EBITDA by total revenue. We have included adjusted EBITDA and adjusted EBITDA margin in the accompanying tables because they are often used by investors for valuation and for comparing our financial performance with the performance of other building material companies. We also use adjusted EBITDA to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of adjusted EBITDA may not be comparable to similarly titled measures other companies report. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP. ¹ Adjusted EBITDA is defined as income (loss) from continuing operations, plus income tax provision (benefit), net interest expense, derivative loss related to our Convertible Notes and Warrants, depreciation, depletion and amortization, loss on early extinguishment of debt, expenses related to our corporate headquarters relocation, officer severance, and non-cash stock compensation expense.