Attached files

| file | filename |

|---|---|

| S-1/A - FORM S-1/A - Help International, Inc | s101770_s-1a.htm |

| EX-99.2 - EXHIBIT 99.2 - Help International, Inc | s101770_ex99-2.htm |

| EX-99.3 - EXHIBIT 99.3 - Help International, Inc | s101770_ex99-3.htm |

| EX-23.1 - EXHIBIT 23.1 - Help International, Inc | s101770_ex23-1.htm |

Exhibit 99.1

Come Together: The Rise of Coalition Lite

While a national U.S. loyalty coalition has so far proven to be a pipe dream, marketers around the country are already adopting the coalition model on a more concentrated scale. Call it Coalition Lite, and call it the future of loyalty marketing. If you’re not already a player, you may be in danger of getting left behind.

By Rick Ferguson

Send This Article To A Friend!

On May 9, 2004, mothers across the United States will have more to look forward to than just breakfast in bed, a day off from the kids or brunch at a downtown bistro. In fact, life as Mom knows it might never be the same.

The reason? Club Mom, the coalition loyalty program and affinity club for three million registered American mothers with footprints in Baltimore, Cleveland, Detroit, Knoxville and Rochester, among other places, is planning an ambitious Mother’s Day national rollout. The rollout includes new major national sponsors, expanded soft benefits for mothers and a concerted membership drive. It’s enough to warm the heart of even the most harried working mom.

The Club’s loyalty component, Club Mom Rewards, allows moms to earn points for shopping at coalition partners including Farmer Jack, Safeway and Vons supermarkets; national retailers JCPenney, Nine West, Payless Shoe Source, Pier 1 Imports and Radio Shack; and a slew of regional partners in each geographic location. Mothers can redeem points for vacations, salon visits, romantic dinners for two, housecleaning services and gift certificates. On the soft benefit side, moms can avail themselves of a “Day of Indulgence” at a local spa, read tips for mothers in Club Mom magazine and share war stories with other mothers in the online forums.

Four-year-old loyalty coalition Club Mom plans an ambitious Mother’s Day 2004 expansion

Club Mom, you see, isn’t just some fly-by-night discount scheme designed to milk its partners for a few years and then blow town like an aluminum siding or vinyl phone book cover company. The four-year-old coalition counts among its founders Melrose Place actor Andrew Shue, The View talk-show host Meredith Vieira and CEO Michael Sanchez, a child chess prodigy who toured the globe as a top-ranked junior player and earned a draw with the number three-ranked player in the world.

“We were successful early on in bringing some of the best marketers in the country behind the idea,” says Sanchez. “Everybody was excited about this big affinity group that no one had succeeded in bringing together— it could have real value to moms, it would be great for companies, and it could have social import. We raised a lot of money and got a great group of people excited about the concept.”

The emotional connection with new mothers that’s hardwired into Club Mom makes the program a best-in-class example of the hottest new trend in U.S. loyalty marketing— the “lifestage” or “lifestyle”-themed multi-merchant coalition built around a particular demographic, geographic region or affinity group. You can call them micro-coalitions, or you can adopt our favorite new catch phrase, Coalition Lite. Whatever you call it, we’re not exaggerating when we call it the future of loyalty marketing. In fact, the future may already be here.

Here,

there and everywhere

In the summer of 1996, Provident Bancorp launched the first notable example of a regional coalition in Cincinnati, Ohio

with MeritValu. The program was handicapped from the start, however, by an uninspired cash-based value proposition that

dealt in pennies, and a “Dear Cardholder” letter announcing the program’s demise soon followed. Provident had

hoped to grow MeritValu into a national coalition. Sure, the discount-based value proposition was terminally flawed, but

the bank may simply have been both too ambitious and ahead of its time.

Today, it’s not just among American mothers that the coalition concept has taken root. Around the country, ambitious, entrepreneurial-minded marketers are piloting programs here, signing merchants there, and employing new technologies to capture the attention of consumers bound by age, lifestyle and region.

College savings programs Upromise and BabyMint are still alive and presumably well. The Student Crew Card, a chip card-based coalition program aimed at college and high school students, currently boasts over 500,000 student members and over 27,000 participating retail merchants. The Cure Card, a charity-based coalition loyalty program benefiting breast cancer research, recently reached over $1 million in sales with the help of 93,000 cardholders and 1,000 retailers nationwide.

Even outside of the United States, the Coalition Lite concept has legs. Regional coalitions have appeared in cities as large as Shanghai, China and as small as the tiny U.K. hamlet of Diss. Coalitions built around sporting teams thrive in the U.K., South Africa and Australia. In France, Accor subsidiary Accentiv’ has launched a coalition called Mouvango designed for medium-spend French business travelers.

Name a hobby, age group, lifestyle orientation or region and chances are that a coalition concept is either in the planning stages or already running. The consumer appeal of affinity marketing is so strong that even the launch of the most basic program can quickly bear fruit in the form of behavior shift, incremental revenue and higher retention. If the program also includes a sophisticated loyalty component, then watch out— it may prove to be the most powerful form of marketing to come down the pike since the advent of frequent-flyer programs 23 years ago. Think we’re kidding? Let’s take a look.

The Hudson City Card: fixing a hole

The Hudson Gift Card issued by the Hudson, OH chamber of Commerce, has resulted in over $88,000 in partner transactions remaining in the downtown business district. Merchants are reporting a 16 percent lift in holiday sales in 2003. The card currently offers no reward component, but the Chamber may revisit that option in 2004.

Hudson, Ohio is a city of about 20,000, located in Summit County about halfway between Akron and Cleveland. Like most American cities, Hudson suffers from creeping economic homogenization; within a 15 minute drive in any direction from downtown, you can find a major shopping mall or retail strip center with every big box retailer and chain restaurant you’ll find 15 minutes away from every other downtown in America.

And just like every other downtown, Hudson was hemorrhaging both consumers and cash. Carolyn Konefal, director of the Hudson Chamber of Commerce, and her team decided to do something about it. Working with a local technology company, the Chamber created a reloadable private-label gift card and dubbed it the Hudson City Card. The idea: give consumers a convenient way to spend money in the downtown retail district while appealing to their civic pride, and siphon a few of those dollars away from the Wal-Mart district on the outskirts of town.

“The driving force behind this [program] was to create a mechanism that would protect and promote our downtown,” says Konefal. “We were presented with this idea a number of years ago, but from a cost and technical standpoint we didn’t think we would ever get the merchants to buy into it. So we pretty much shelved it. But a few years later, a Chamber member in the plastic card business reevaluated the technology and said it looked much more doable. So we went ahead with it.”

Konefal and her staff created a target list of 70 downtown merchants and then went door to door on a proselytizing mission. They pitched a magnetic-stripe stored value solution, which seemed simple enough. But the grab bag of credit card terminals and point-of-sale (POS) systems among their membership presented an immediate hurdle.

“A lot of people were interested but didn’t have a compatible terminal,” Konefal says. “In hindsight, that was probably our biggest obstacle.”

The Chamber approached the problem on a case-by-case basis. In some instances they installed new terminals sophisticated enough to process both credit and gift-card transactions. In others, they installed a splitter so the merchants could process the gift cards on a less expensive terminal. They also created a system whereby merchants could dial in the transactions over the phone, and even created a “virtual terminal” application that allowed PC-based systems to process the transactions over the Internet.

The end result was a Thanksgiving 2002 launch with 35 merchant partners on board. At that point, Konefal simply crossed her fingers and hoped for the best.

“When we went into this, we really had no idea what our goals or expectations were,” she says. “We could find no other programs anywhere like this one to give us any sense of what to expect in dollar value or the number of cards sold. In terms of trying to create any sort of plan or budget for it, it was like throwing a dart at a dartboard.”

Fortunately for Konefal, the response from both merchants and consumers was overwhelmingly positive. Without any sort of a rewards component— not even a standard discount offering at participating merchants to promote card usage— the Hudson City Card program accounted for over $88,000 in partner transactions between Christmas 2002 and 2003. Merchants also saw a 16 percent lift in holiday sales in 2003 over the previous year.

“We were very pleased with the numbers we ended up with,” Konefal said. “It’s been extremely well-received locally, and we’ve had a very positive response from people in the community. We’ve had some major employers in the area pick up the card as a year-end gift for their employees.”

But if results were so positive simply on the strength of stored-value convenience and consumer affinity for the downtown business community, how much more effective would the card be with a loyalty component? Konefal says that their options are as varied as the stored-value technology allows.

“We all felt that we at least wanted to get a year under our belts to see what kind of volume we were going to do and what sort of expiration we would see on the cards,” Konefal says. “As far as rewards options, there are so many different things we can do— points, cash back or even something that goes to a charitable organization. We just haven’t had the time or the information to make that decision. But it’s definitely something we’ll revisit this year.”

The

PowerCard: getting better all the time

If the Hudson City Card can change consumer behavior to the tune of $88,000 in a year’s time with no loyalty component,

what can the added incentive of recognition and reward do for a regional coalition program?

That was the question that PowerCard CEO Kermit Austin and his team hoped to answer in Tucson, Arizona in January of 2002. Their goal: run a pilot coalition program in Tucson for a year in preparation for a national rollout. In 2000, the company had tried and failed to launch a full-fledged open earn and burn program with a $19.95 signup fee. Local restaurants and merchants used to offering simple two-for-one coupons through the Entertainment Book balked at a program that spread consumer loyalty across a merchant network. They wanted a program that built loyalty foremost to their own businesses.

“The response was pretty poor,” says Austin. “When I came to the forefront, I still believed in the vision, but I believed that it needed to be changed a little bit. So at that point I started revamping it.”

The PowerCard, which debuted in Tucson, AZ in the winter of 2002, allows merchant partners to design their own loyalty point programs and operate them through the PowerCard network. The card also offers a second program tier, PowerCard points, that can be earned at any partner and redeemed for higher-level rewards. The program has since expanded to other cities in Arizona, Colorado, North Carolina and Texas.

Austin’s solution was to introduce a two-tiered coalition program: one tier allowed merchants to design their own brand-specific points programs with in-kind rewards, and the second tier allowed consumers to pool the merchant points into PowerCard points that could be spent on experiential rewards like movie passes and concert tickets. It was a clever compromise between the needs of merchants, who wanted to market to their own best customers, and those of consumers, who wanted the broadest possible earning power.

“The merchants are a lot more receptive to it, because they feel like they’re still running their own unique rewards program,” says Austin. “The cardholders are still happy with it, because they only have to sign up once, and they’re enrolled in everyone’s loyalty program. [The second tier] just becomes more of a long-term thing with them. They know they’ll get rewarded quicker with the open earn structure.”

Like Konefal, Austin and his team struggled with POS integration. PowerCard’s remedy was to implement a three-pronged integration solution: proprietary dialup software for Verifone systems, with the terminals supplied to retailers who lacked a POS system; an integration solution for the Micros POS systems common in the restaurant and small retail sectors; and a new Windows application for PC-based systems. Every transaction passes in real time through the PowerCard servers.

Austin’s other major design change was to move the program from fee to free. The no-hassle card signup option at the merchant point-of-sale resulted in 35 charter merchant partners and 25,000 cardholders joining the program in Tucson over the next 16 months. Over 19,000 of those cardholders are still active. The card drives an average of about $1,500 a month in new business for its partners, and 87 percent of active members return to a member location within 90 days of receiving a reward.

Member businesses also love PowerCard’s Web-based reporting tools, which allow them to view member data in aggregate and in detail, and even send e-mail marketing messages to individual customers directly from the Web site. For many PowerCard retailers, the ability to identify best customers is a novel experience.

“Every business I’ve ever talked to says, ‘We know who our regular customers are,’“ says Austin. “But after the first or second month in the program, they look at their Top Ten Customers report and say, ‘I know this guy and this guy— but I don’t know these eight other people.’ But they probably should know them, because those customers are spending $300 a month at their business.”

PowerCard’s success in Tucson has allowed Austin to roll the program out to other markets, including Charlotte, Dallas, Phoenix, Sedona and Vail. The merchant network is likewise beginning to snowball; recent signees include a chain of 22 golf courses and a chain of 550 restaurants in 25 markets. The company also plans to institute a “Gold Level” tier with additional earn and burn opportunities for high-volume members.

“It’s really been working well,” says Austin, “and it’s about to get very fun.”

Club

Mom: your mother should know

What PowerCard demonstrates is that regional coalitions can work even without big anchor sponsors. Consumers want to demonstrate

loyalty to local merchants; give them a little recognition and reward for doing so, and they’ll blow your doors off. But

a sense of community doesn’t have to be confined to a geographic location. Appeal to the right demographic, and your community

can stretch as far as your marketing dollars and resources allow.

That brings us back to Club Mom. What makes this program the most promising Coalition Lite concept in the marketplace is that its designers understand the power of soft benefits and special recognition to drive behavior beyond the ability of the hard benefit rewards alone. Club Mom’s initial research revealed that, while the rewards program was critical to success, what mothers really craved was recognition— of both their value to their families, and their value as consumers.

“We went out and talked to a lot of different ‘mom’ segments,” says Alexandra Aleskovsky, Club Mom’s chief marketing officer, “including stay-at-home moms, working moms, and moms from different socio-economic levels. What we found is that moms have a 24-7 job. They’re always doing for others, and they’re never getting a moment for themselves. So the concept of being rewarded and celebrated resonated highly with them.”

Thus the program celebrates moms in every aspect of both the value proposition and the communications stream. The relationship with moms doesn’t stop at registration. Moms receive invitations to special events such as massages, mini-facials and gourmet food tastings. Most popular is the Day of Indulgence, a service free to members whereby moms can come into a local Club Mom spa partner for a day of pampering.

“The comments we get from moms tell us that this is better than Mother’s Day,” says Aleskovsky.

On the merchant partner side of the equation, Club Mom employs state-of-the-art loyalty database technology, program financial modeling, testing and control to drive results for their partners. Back in 2000, when investment capital flowed more freely, the company designed a proprietary loyalty platform that allows them to segment members and send targeted offers based on purchasing behaviors down to the SKU level. In addition, the company provides rigorous analytics around the incrementality of the business. They establish a control group of customers to whom they can compare member behavior, and every 12 weeks the sponsors receive an ROI analysis broken down by deciles, offers and total basket, among other metrics.

“We’ve really turned this into a core competency,” says Sanchez. “With every major partner we have, we have been able to establish that existing customers are spending more [through Club Mom]. Two and a half years in, we’re still seeing a 10 percent lift at the household level.”

On the communications end, moms receive regular statements with targeted messages such as double or triple points offers for shopping at a particular time or buying a particular product. They also receive holiday greeting cards, local market news, recipes and community information and redemption threshold reminders. They even get a custom publication, Club Mom magazine, to enhance the sense of community.

If the program’s upcoming Mother’s Day blitzkrieg is any indication, mothers may soon feel that sense of community on a national level. While Club Mom probably needs at least one more major “everyday spend” category partner to achieve critical mass, its aggressive expansion in the grocery sector has already impressively enhanced its velocity of earning. They’re looking for a gasoline partner, and they have a co-branded credit card on the drawing board. Their entrenched first-mover advantage means that any marketer attempting to plug into the same demographic will face a tortuous uphill climb.

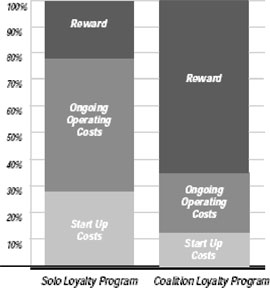

The strategic advantage of a coalition loyalty play over a proprietary program ist hat you share startup and operational costs aross the partner network, which allows you to allocate a higher percentage of your program budget to the customer value proposition. Customers earn more rewards faster, which accelerates your return on investment and makes the program more lucrative for everyone involved.

“The honest assessment for the rewards part of our business is that it works,” says Sanchez. “If you tell moms that you care about them, that you can deliver value to them, then they’ll spend more. From our perspective, that’s been proven. It’s been a blessing to build a good operation where we can execute well and prove the ROI of the program.”

All

you need is love

For all their inherent appeal, micro-coalitions must overcome the same challenges that beset large, national coalitions: raising

capital, building an infrastructure and convincing partners to set aside selfish short-term interests for the long-term common

good. Likewise, the best practices rules that apply on the macro-scale apply on the micro level as well— always move first

when possible, look to secure exclusive partnerships in “everyday spend” categories, and always seek to deliver as

much value to members as you can afford.

If there is a common thread among these three examples of successful micro-coalitions, however, it’s that each of these programs has at its core an emotional connection with its membership base. Hudson City Card cardholders know that they’re helping to protect their downtown core; the stored value card is simply a physical reminder of that connection. PowerCard members can likewise patronize locally owned businesses while feeling rewarded for their troubles. And Club Mom showers a demographic deeply in need of special privilege and recognition by uniting them with merchant partners eager to cater to their every whim.

In fact, the single greatest advantage to the Coalition Lite concept— whether built around downtown shoppers, moms, students, senior citizens, small business owners or sports fans— is that no other marketing mechanism is better equipped to tap into consumers’ deepest and most heartfelt dreams and their sense of worth as individuals. A proprietary loyalty program can do a fantastic job of building loyalty to a brand. But an expertly designed and executed micro-coalition can earn more than loyalty— it can earn love.

“If

you can build the right affinity and emotional resonance with the consumer, and it’s deep enough, then it really makes sense

for a coalition program,” says Sanchez. “We’ve had very good measurable success with our partners to date, and

the reason is the emotional connection we have with moms. Once that relationship exists, they feel much more engaged with the

program. That’s how we’re able to get these results.”

Rick Ferguson is the Editorial Director for COLLOQUY.

Volume 12, Issue 1, 2004.