Attached files

| file | filename |

|---|---|

| S-1/A - FORM S-1/A - Help International, Inc | s101770_s-1a.htm |

| EX-99.2 - EXHIBIT 99.2 - Help International, Inc | s101770_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Help International, Inc | s101770_ex99-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Help International, Inc | s101770_ex23-1.htm |

Exhibit 99.3

| |

| THE ART AND SCIENCE OF CHANGING CUSTOMER BEHAVIOR | PAPER 02.06 / FEBRUARY 2006 |

| Trendtalk | |

|

You Say You Want a Revolution: Transform Your Loyalty Strategy

and

Rick Ferguson Editorial Director, COLLOQUY

|

| Published by: | |

|

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

| You Say You Want a Revolution: | |

| Three Evolutionary Trends That Will Transform Your Loyalty Strategy |

‘Come to the edge,’ he said.

They said, ‘We are afraid.’

‘Come to the edge,’ he said.

They came. He pushed them … and they flew.

—Guillaume Apollinaire

Introduction

Sometimes, innovation happens in the blink of an eye. In most cases, however, innovation occurs more as a continual evolution, in which those at the forefront of change push the boundaries out farther—from how we define “loyalty marketing” today to how we will define it tomorrow.

And while, on the surface at least, it may appear to jaded marketers that the true revolutionary events in loyalty marketing are well in our rear-view mirrors, the truth is that micro-revolutions in loyalty are happening everywhere— in retail, in financial services, in hospitality, and in every developed market around the globe. Taken as a whole, these individual instances of experimentation and innovation amount to a steady evolution of loyalty marketing into a holistic marketing discipline that can transform businesses from make-sell, internally focused enterprises into powerful, customer-focused marketing machines. The broad concepts of customer loyalty are well defined, it’s true. But in today’s hypercompetitive global marketplace, those concepts are more important than ever before.

So when COLLOQUY looks at the future of loyalty marketing and the trends that will shape our space, we see boundaries that will continue to expand outward. The very concept of “loyalty marketing” will encompass many more ideas, strategies and tactics than it has in the past. We can group these micro-revolutions into three macro trends that will affect the evolution of your own customer loyalty strategy. These shifts will allow marketers to unleash new loyalty-marketing strategies and tactics that will power profits and growth well into the 21st century.

Our three evolutionary trends for 2006 and beyond:

| • | The Power of Networks: In which customer-focused enterprises leverage virtual environments and tangible events to build niche communities of users united in their advocacy for the brand. | |

| • | The Power of Data: In which data-driven enterprises look beyond loyalty program return-on-investment (ROI) metrics and discover the true value of that data in its ability to fundamentally transform the customer experience. | |

| • | The Power of Convergence: In which the confluence of mega-mergers, new point-of-sale (POS) technologies and the next generation of Customer Relationship Management platforms launch the next generation of coalition loyalty programs around the globe. |

Now let’s examine each of these trends in detail.

| PAGE 2 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

| “We are in great haste to construct a magnetic telegraph from Maine to Texas; but Maine and Texas, it may be, have nothing important to communicate.” | |

| —Henry David | |

| Thoreau, Walden | |

I. The Power of the Network: Beyond Dialogue Marketing

Marketers have always understood the power of engaging in dialogue with their customers to better understand their needs, wants and desires. But those marketers pushing the boundaries of customer relationships also understand the power of communities of consumers— communities united in affinity for a brand or bound by geography, life stage or lifestyle. In the future, those companies that win in the marketplace will be those that best leverage the power of these network-building systems. The natural growth of these powerful consumer networks within existing loyalty systems is our first evolutionary trend.

In the loyalty game, facilitating the formation of customer groups bound by shared interests is a way to develop a sense of community around your brand. Communities have always evolved organically, without help from Marketing— but today, smart marketers are tinkering with the DNA of their customer base to push outward the boundaries of customer loyalty by creating unique soft benefits that allow members to connect with one another to share information, share tips and even swap sales leads.

Still, just as it isn’t possible for a fish to evolve into a land mammal in a single leap, so is it presumptuous for marketers to assume they can jump-start communities of engaged consumers without first building active, mature loyalty systems. To understand why, it’s first necessary to understand how networked systems evolve.

Networks are cool

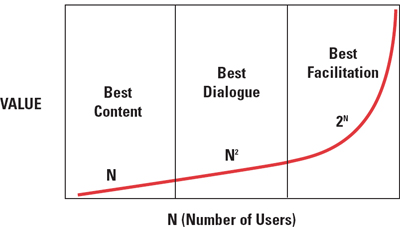

If you’re in the customer loyalty business, then you’ve heard of Metcalfe’s Law. Formulated by Ethernet pioneer and 3Com founder Robert Metcalfe in 1995, Metcalfe’s Law states that the usefulness or value of a networked system equals the square of the number of users of the system, or N2 (since a user can’t connect to itself, the actual calculation is N2 - N). The most common example used to illustrate Metcalfe’s Law is the telephone: a single telephone doesn’t do you much good, but the value of your telephone increases as the number of telephones on the network increases— purchasing a telephone makes other telephones more useful.

Metcalfe’s Law was a modification of Sarnoff’s Law, developed by broadcast radio pioneer David Sarnoff, the CEO of the Radio Corporation of America (RCA), who was instrumental in the development of broadcast television in the 1940s. Sarnoff’s Law stated that, for one-way broadcast communications, the value of the network rises proportionally to N, the number of users. In loyalty, the corollary is the mass-designed, one-size-fits-all program that dominated the space in the 1990s. Metcalfe modified Sarnoff’s Law to address the growing value of two-way communications networks— hence the value is equal to the square of the number of users. In loyalty, Metcalfe’s Law manifests itself in those programs already engaged in ongoing dialogue with their members about their preferences, needs and intentions.

In 1999, MIT adjunct professor David P. Reed took Metcalfe’s Law and turbocharged it. Reed stated that networks he called group-forming networks, which support the construction of communicating groups, create value that scales exponentially with network size— instead of N2, Reed said, the real value was 2N.

| MIT professor David P. Reed has argued that as networks grow in size, they move through dominant value regions, evolving from broadcast to transactional dialogue to community-forming regions. This evolution increases the economic value of the network. |

| PAGE 3 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

| “We take the ‘connection’ part very seriously in [the Customer Connection] program. To date, the interactive member events have been the number one feature. Customers tell us it’s why they stay engaged with us. The time constraints of their jobs are the only reason they don’t participate more.” |

| —Tiffany Tuell, Global |

| Customer Loyalty |

| Manager, HP |

| “Rain Bird is a strong brand, and we want to continue to strengthen that brand through everything we do. Rain Bird Rewards is a reflection of the brand, and we’re committed to having the best [loyalty] program in the industry and being the best business partner we can be to our customers. When embraced and used effectively in the market, a loyalty program can be a winner for manufacturers, contractors and distributors alike.” |

| —Dave Manger, |

| Marketing Manager, |

| Rain Bird |

Reed argued that as networks increase in size, they move through dominant value regions. In its infancy, a network most closely resembles the Sarnoff broadcast model in which content is king (think a broadcast or cable television network). It next evolves into a Metcalfe model, dominated by transactional exchanges of value (think an e-commerce site such as Amazon.com). In maturity, it evolves into a facilitation engine, or a Reed model, by which communities of users form that increase exponentially the total value of the network (think eBay).

In our view, Reed is right on. The most powerful networks are those that facilitate the growth of sub-communities of users. Within the universe of eBay buyers and sellers, you’ll find small communities of customers actively exchanging information on everything under the sun— from obscure 78 RPM jazz records to vintage typewriters to Beanie Babies, there’s a group of eBay users built around an affinity for these products and sharing tips and advice. Similar group-forming platforms exist at Yahoo!, Google and dozens of other portal web sites around the globe— and indeed, you can extrapolate the Internet itself as the biggest facilitation engine of them all. In loyalty, the parallel emerges in those innovative loyalty operators who add core soft benefits to their programs that go beyond dialogue and enable communities to form among the program’s membership base. The affinity facilitated by these virtual environments results in loyalty “glue” that cements customer relationships both within the community and with the parent brand.

This chart demonstrates how loyalty programs undergo a similar Reed-style evolution from broadcast to group-forming networks. Best customers who participate in these programs likewise evolve from deal-seekers to brand advocates.

| VALUE REGION 1 | VALUE REGION 2 | VALUE REGION 3 | |

| NETWORK THEORY |

Sarnoff’s Law (Broadcast) |

Metcalfe’s Law (Two-way dialogue) |

Reed’s Law (Community-forming) |

| PREMISE | One-way communications | Transactional value exchange | Facilitation engine |

| LOYALTY COUNTERPART |

Discount cards | Points and dialogue-driven programs | Communities of best customers form and interact |

The community evolution

What does this admittedly esoteric concept mean to loyalty innovators? It means moving beyond “spend a dollar, earn a point” loyalty programs. It means moving beyond mere dialogue platforms— standard direct mail offers and simple brochure-ware web sites— to build virtual environments in which customers can connect with each other to share insights and relevant information. Since you can’t force-feed communities on members where there is no real sense of commonality, your challenge is to search for those sub-segments within your customer base where common interests exist and member-to-member connection will be embraced. As always, consumers will drive this evolution.

This trend is currently emerging among loyalty programs designed for very specific, niche audiences. Here are just a few key examples:

HP Customer Connection: In our “Long Tail of Loyalty” cover story in COLLOQUY’s Summer 2005 issue, we documented the efforts of Hewlett-Packard’s enterprise software division to develop their HP Customer Connection program. This web portal-based loyalty program, designed for highly technical end-users of HP enterprise software, has created a thriving customer community where IT managers can share information, attend educational webinars and exchange problem-solving tips.

The value of this network, both to its members and to HP, has increased as the membership has grown and more IT managers are available to share ideas and promote HP software. As the network grows, HP is better able to understand the needs of these end-users and leverage the network to help meet those needs. The power of the information flowing between these network nodes has turbo-charged HP’s relationship with these crucial influencers and helped build brand affinity that the company’s competitors will be hard-pressed to match.

| PAGE 4 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

Rain Bird Rewards: In that same issue, we also introduced you to Glendora, Cal.-based Rain Bird Corp., one of the world’s leading irrigation equipment manufacturers. Rain Bird’s Rewards program is a business-to-business (B2B) loyalty program targeted to landscape contractors and designers who install irrigation equipment around private homes, golf courses and other locations. Within their customer base, Rain Bird noticed a segment of smaller contractors who, while individually smaller accounts, collectively represented an opportunity to consolidate a large share of market spending with Rain Bird.

To facilitate the growth of this network, the company revamped its Rewards program with an extra layer of soft benefits for smaller contractors who consolidated 100 percent of their spending with Rain Bird: a members-only web site and toll-free number; a quarterly newsletter; access to advertising and marketing tools and training; annual conferences in Cancun and Hawaii; a contractor referral program; and even access to business development funds. As this network grows, Rain Bird will be able to capture increased share of market through their loyalty strategy— and build a community of Rain Bird loyalists for life.

British-American Tobacco: Regardless of your personal feelings about cigarettes, there’s no doubt that cigarette sales provide the backbone of profits for many retailers around the world. In South Africa, U.K.-based British-American Tobacco has developed a B2B dialogue-marketing program, called Link Up, which allows convenience store operators and retailers carrying British-American Tobacco products to talk to one another, attend networking events and share information about how to grow and market their businesses.

Harley-Davidson Owners’ Group (HOG): This venerable affinity program, launched in 1983 and first covered in COLLOQUY in January 1991, has long enjoyed the support of one of the most recognizable brands in the world. But the HOG program operators haven’t allowed the program to rest on its laurels. In recent years, they have developed such network-building initiatives as an online portal and virtual workshops to facilitate the sharing of information and associate that dialogue with the corporate brand.

Finance House: Sometimes, networks can form over simple financial incentives. In Dubai, United Arab Emirates, financial services provider Finance House this year launched a co-branded MasterCard with a devilishly simple value proposition: refer a friend and receive 1 percent of that cardholder’s spend as a cash reward for the life of the cardholder. We envision a sort of card-based pyramid scheme through which the top of the pyramid is earning lavishly while the bottom attempts to expand through mass referrals. Of course, the cardholder who refers Bill Gates or Warren Buffet is set for life.

Huggies Baby Network program: We’ve talked about such Coalition Lite programs as Club Mom that build loyalty to mothers of young children and facilitate dialogue between those mothers and complementary brands. The Huggies Baby Network program follows a similar path, but is designed to build a community of mothers who support one another through a portal web site that allows them to share information about children and pregnancy. New mothers can design a virtual nursery, access games for their infants to help them learn and receive advice from child-rearing experts and authors. By helping mothers talk to one another about issues they face in their everyday lives, Huggies can enjoy the “halo effect” of promoting this dialogue while leveraging the collected data to ensure more relevant communications to their customers.

These examples are just a few of the many companies around the world harnessing the power of networks through their loyalty and dialogue strategies. Loyalty programs that serve a broad customer base may not be immediately ripe for such networking soft benefits. Look for niche groups already forming naturally around your brand— in those instances, members will demand that you develop specialized content to serve them and provide the tools and information required to allow these communities to flourish.

| PAGE 5 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

Tips on leveraging the power of networks

By exploring networked loyalty systems as developed by these three pioneers, the fundamental rules of engagement for leveraging the power of networks come into focus:

1. Know thy member base: If your loyalty program serves a member base with highly specialized needs, then enabling members to connect to each other can build value. For larger organizations with programs that serve a larger, diverse audience, a question begs: what niche segments within your base can you better serve? Which niche segments have the most potential value?

In either case, your starting point is the analysis of existing customer behavior patterns. Clustering techniques can adeptly segment customers for further exploration. Your next step is to research the underlying motivations of customer behavior. Why are your customers switching to the competition? Why did they choose you in the first place?

By applying a disciplined analysis of what customers desire from their relationship with your brand, you can identify the relevant economic and emotional issues that can form the basis of community growth within your existing loyalty system. HP’s three years of research into the needs of their enterprise software end-users, for example, led directly to the creation of their Customer Connection portal.

2. Create virtual sharing environments: The growth of the Internet, with its inherent cost efficiencies, is the primary driver behind the evolution of community-forming networks. As you evolve your own loyalty strategy, you’ll build your own virtual communities for users.

Web-based communities have value when you create specialized, relevant content. Interactive tools such as the virtual nursery room creator at the Huggies Baby Network site are critical. Member event summaries, such as the HOG event photo albums on the Harley-Davidson web site, build community. Dialogue platforms such as HP’s “IT Hero of the Month” and the Huggies “Sharing Space” allow members to share tips and information directly with one another.

Truly, your virtual community environment is limited only by your resources and imagination. Message boards, questions archived by category, “Ask the Expert” access, blogs, members-only content posting features and photo libraries all contribute to the development of affiliate communities of brand loyalists.

3. Build community through tangible access: As compelling and necessary as virtual network portals can be, there’s no substitute for human interaction. You can build emotional attachment to your network and your brand by creating access to members-only events within your loyalty strategy.

Make it worthwhile to recruit friends and colleagues into the network, as Finance House did with their 1 percent referral program. B2B marketers can share their referrals and leads with their network, as Rain Bird has done with their Rewards contractor members. Create entertaining events to draw customers in person as British-American Tobacco did with their Link Up events for convenience store operators. Customers who build relationships through brand-sponsored gatherings will strengthen those relationships online.

4. Networks are a means to an end: In nearly every case we’ve documented thus far, leveraging the power of the network is just one element of the brand’s overall value proposition. Access to communities is a meaningful recognition benefit, and one that you can and should add to a well-balanced diet of hard and soft benefits.

Remember also a fundamental rule for loyalty marketers: just as all customers are not created equal, so are all communities not created equal. Unless united by common interests and relevant dialogue, member communities will wither on the vine. By creating both virtual and tangible environments where like-minded members can assemble and share ideas, and then nurturing these communities so they flourish, loyalty marketers can build a core soft benefit around which their brands can develop a pristine oasis of customer relevance and advocacy.

| PAGE 6 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

| “We are using data from Reward Zone and our Customer Centricity tests to take a fresh look at how we serve our customers in the store... and throughout our enterprise.” |

| —Brad Anderson, Chief Executive Officer, Best Buy |

II. The Power of Data: Beyond ROI

It’s a hoary old truism: information is power. But loyalty operators are finally taking this truism to the next level. For years, the debate has raged, particularly in the retail sector: are we running loyalty programs for the bottom-line return on investment, or are we running them to acquire customer data that drives benefits back into the core business model?

At COLLOQUY, we think the answer to this question is a no-brainer: the former depends on the latter. Without the data, you can’t get the ROI. Yes, you can do basic loyalty data analysis that translates into the fundamental financial benefits of lift, shift and retain. But that’s the least you should be doing with your loyalty data. You should be analyzing all the data from your loyalty program, and translating that analysis into marketing insight to make your program more effective. That’s how you increase the ROI. We want every operator reading this to do just that. But if you haven’t already boarded the data bus, then you’d better get on at the next stop— because basic loyalty ROI is just the starting point.

Our next evolutionary trend in loyalty will see companies leveraging loyalty data to enhance their core value proposition through personalization and customer experience management. Particularly in the retail space, loyalty programs will play a pivotal role in the ability to identify customers coming into the stores and harness data to change how they shop, how they experience the store and what benefits you give them while they’re in the store.

Where have we seen this trend emerging? We’ve seen evidence that customer data is driving the core business models of a handful of companies that understand that the customer experience drives their success. But perhaps nowhere have we seen more tangible evidence of this philosophy than the actions of a Minneapolis-based retailer of consumer electronics and entertainment that has transformed its entire business model around its key customer segments.

Case study: Best Buy

At the Stores 2005 conference in Toronto, Canada, Best Buy CEO Brad Anderson stated that it was now time to take the data collected from the company’s Reward Zone loyalty program to the next level by blending it with their Customer Centricity initiative to create a fundamentally different experience in their stores.

“We are using data from Reward Zone and our Customer Centricity tests to take a fresh look at how we serve our customers in the store…and throughout our enterprise,” Anderson said.

Launched in July of 2002 as a pilot program in 50 Southern California stores, Reward Zone delivers all of the bottom-line benefit that you’d expect from a successful loyalty program. Metrics of program success include plenty of hard numbers: the number and size of incremental sales attributable to the program, the membership goals and the bottom-line profit of the program.

“We maintain a control group,” Karen Maurice, Director of Relationship Marketing for Best Buy, told COLLOQUY in 2004, “and we see that members shop twice as often as non-members, and they spend twice as much. That’s a direct result of the program. Reward Zone is driving customer behavior.”

In 2004, Best Buy began their Customer Centricity initiative as a test in 32 stores. The initiative was designed to build individual stores around specific customer segments and manage the in-store experience to unprecedented levels. The company identified five customer segments that it believed represented some of their most profitable customers. The segments included affluent professionals, active young males, family men, busy suburban moms and small-business customers. Each of the test stores was adapted to serve one or more of those core customer segments; the company altered store designs, changed product mixes and taught store employees to focus on specific customers rather than just product categories— in short, they executed a 180-degree shift from product-channel to customer-focused retailing.

Best Buy judged the results of these investments by measuring growth in segment revenue and return on invested capital. The results? Fourth-quarter comparable store sales gains averaged 7 percent higher compared with other Best Buy stores. Close rates (the percentage of shoppers who make a purchase) rose by 6 percent. Those numbers prompted the company to announce the rollout of Customer Centricity to an additional 110 stores in 2005. Wall Street also took notice: a September 2005 Wall Street Journal article declared, “Analysts are upbeat on Best Buy, which has been enjoying impressive profit margins…traffic and margins will benefit from the November release of Xbox 360, continued rollout of Customer Centricity, expanding higher-margin services, and accelerated adoption of new technology.”

| PAGE 7 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

| “The area where we do work, and where we are creating breakthrough, is in identifying specific sets of shoppers that behave in a certain way. For example, innovators—people that are always into new things. That can be in skin, in home care or people who buy gadgets. How do you identify those people, and how do we keep the communication lines open with them?” |

| — Claudia Magielsen, |

| Business Manager, |

| Tesco UK |

It was only a matter of time before Reward Zone transactional data merged with Customer Centricity—and Anderson’s Stores keynote speech signaled that the merger was on. Anderson explained that the company would overlay the transactional data collected from Reward Zone and blend it with their existing Customer Centricity segments. The combination, he said, would strengthen their customer insights, allow them to create sub-segments within their core segments and score the other 50 percent of their customers that they couldn’t categorize using their primary segmentation methodology.

“We are in the midst of a strategic transformation to put the customer at the center of all that we do,” said Brad Anderson. “We see additional opportunities to connect more closely with our customers, to increase our competitive advantages, to boost our market share and to deliver superior financial results.”

The data evolution

Like Anderson, marketing executives at the uppermost levels have come to understand the critical importance of loyalty data to their fundamental business models. Yes, they still want their loyalty programs to deliver incremental behavior shifts that lead to measurable return on investment. But they also see that, when it comes to leveraging program data, most companies have barely scratched the surface of opportunity.

So what companies are building foundations of solid data analysis in the global loyalty landscape? Here are just a few examples.

Tesco: Loyalty gurus around the world hold up U.K. grocer Tesco as the gold standard of companies leveraging loyalty data to fundamentally change the way they do business. Launched in 1994, Tesco’s Club Card helped move Tesco’s market position in the U.K. from third to first; today, over 40 percent of U.K. households are members.

Tesco segments their Club Card shoppers into six behavior categories: price-sensitive, traditional, mainstream, healthy, convenience and fine-foods. Every aspect of their in-store and direct mail marketing is geared toward delivering relevant offers to specific sets of shoppers who behave in different ways. As a result of these efforts, they send 5 million to 6 million unique mailings to their 10 million members annually, and enjoy a 20 to 40 percent redemption rate. For example, the company uses Club Card data to identify new pet owners who buy into the premium pet food segment, and then sends them a mailer containing information on caring for new pets and an offer for Iams pet food. In their use of loyalty data, Tesco is among the global leaders in innovation.

M&M Meats: This Canadian food retailer with 340 stores has evolved its loyalty program from a player model to the proprietary M&M MAX program, through which the company has succeeded in getting 96 percent of their customers to raise their hands and identify themselves. Best of all, they’ve used program data to fundamentally change the way their franchisees interact with the brand and their customers in their day-to-day operations.

On a recent Valentine’s Day, the company pushed out a list of each franchisee’s top 50 customers and invited them to issue a Valentine’s Day thank-you to each customer on the list that included a hand-written “Thank you” note, a single red rose and a cherry cheesecake. Of course, the reports back from the franchisees about customer response to this surprise-and-delight tactic were glowing. It’s a simple way to enhance the consumer experience through effective loyalty data usage.

Jaguar: For several years now, the Jaguar Marketing team has been collecting self-reported owner data through a series of exclusive meet-and-greet events. For example, a recent invitation found Jaguar owners gathering at the Philadelphia Museum of Art for a Jaguar-sponsored preview of a Salvador Dali display. At the event, the Jaguar team collected such owner information as the model owned, place and time of purchase.

That data, collected through a soft-benefit experiential reward, has dramatically improved the way Jaguar communicates with those owners. As opposed to the typical barrage of generic communications designed to keep the Jaguar brand in front of customers, the company uses predictive modeling to design a series of event-triggered communications to deliver messages about the right Jaguar model to the right customer at the right time. Leveraging the data has helped them change the way they interact both with their customer base and their dealership network.

| PAGE 8 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

| “One of the things that makes us unique as a company is that we’ve really integrated our loyalty program in our operations. We use our program as a core part of our marketing strategy. We don’t spend a great deal of time in our organization trying to justify the value, because it’s so deeply embedded in our company, our operations and how we go to market, that there is no debate about it.” |

| — Uwe Stueckman, |

|

Vice President |

| Marketing and CRM, |

| Shoppers Drug Mart |

Shoppers Drug Mart: This Canadian health and beauty retailer has restructured its entire organization around its Shoppers Optimum loyalty program. The company has taken the collected loyalty program data and driven it back into the business in surprising new ways.

For example, take their private-label health and beauty magazine, Glow, launched a few years ago in partnership with Rogers Communications. Using Shoppers Optimum data, the company versions the magazine editorial with articles geared to transactional behavior and special targeted offers from delighted packaged goods manufacturers. In addition, the company has developed the HealthWatch Refill program, which is designed to use loyalty program data to alert pharmacy customers when their prescription medications are in danger of negative interactions with over-the-counter cold or allergy medications they recently purchased. In this case, Shoppers Drug Mart has unleashed the power of the data to offer real, differentiated public service to their customers.

| Canadian health and beauty retailer Shoppers Drug Mart has used data from their Shoppers Optimum loyalty program to build relevant, personalized communications platforms for their best customers. |

|

| PAGE 9 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

Tips for leveraging the power of the data:

How can marketers begin to leverage the power of data in their own enterprises? Each of the companies profiled above is known for their analytical prowess. And indeed, before the loyalty program information can really be leveraged to enhance your core product, you must understand what insights you can glean from your available data. Consider these best practices:

| 1. | Cast a wide net: Simply put, you can’t manage a relationship or enhance the in-store experience if you don’t know who your customers are. The starting point for Tesco, Shoppers Drug Mart, Best Buy and M&M Meats was a sound loyalty program with broad appeal. The first step down this path is to put forth a value proposition that encourages customers to raise their hands and ask to be identified. Sophisticated application of recognition and reward is the foundation of your enterprise loyalty strategy. |

| 2. | Understand customer value: You can start with a simple question: which of your customers are the most valuable? Yes, the basic insight of which customers make up most of your sales will always be relevant. M&M Meats started simply: 1 percent of their customers account for 10 percent of their sales; 10 percent of their customers account for 43 percent of their sales. That simple insight was the starting point for giving the franchisees of their 340 stores a better way to cultivate loyalty, one customer at a time. |

| 3. | Blend approaches: Combine transactional and demographic data to enhance understanding of your customer base— just as Best Buy plans to combine their Reward Zone data with Customer Centricity to better understand specific customer segments, their value and their varying needs for a different in-store experience. |

| 4. | Target offers: Use market basket analysis to target offers and identify new product opportunities, much as Tesco uses Club Card data to say hello to those new pet owners. Likewise, M&M Meats offers a “tool kit” for franchisees that includes data and information to hold a Holiday Open House for their best customers, target appropriate e-mail offers and drive special surprise-and-delight thank-you’s. |

| 5. | Personalization drives relevance: Shoppers Drug Mart’s Glow magazine and Jaguar’s event-driven communications illustrate the importance the big boys place on relevance. With customer value detectors as sharp as they’ve ever been, and the din of noise in available communications channels increasing every year, your communications to members should serve as a safe harbor of pristine, relevant and value-added communications. |

| 6. | The spoils go to the innovators: Just take a look at Tesco’s market share, Best Buy’s stock price and Jaguar’s brand cache, and this should be obvious. Innovation breeds success. The followers can only devote their time to playing catch-up. |

| PAGE 10 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

| “Innovation is happening much faster and defuses much more rapidly into our everyday lives. EBay didn’t happen just because of the Internet. [The eBay innovation] was through the intersection of the Internet, secure online transaction systems, reliable overnight delivery services and the emergence of virtual communities.” |

| — Sam Palmisiano, |

|

Chairman and Chief |

| Executive Officer, IBM |

| “The U.K. is probably the most mature loyalty market in the world, and, prior to the launch of Nectar, most retailers had some type of standalone program. As a result, consumers were quite tired of loyalty programs. They had five loyalty cards in their wallets, they earned a small number of points in any given program, and they really didn’t see much value in them. So from the consumer perspective, Nectar was a pretty easy sell. They get one card and earn one currency in one account.” |

| — Robert Gierkink, |

|

Chief Executive Officer, |

| Loyalty Management |

| U.K. |

III. The Power of Convergence: Beyond Coalitions

Returning to eBay as a metaphor for loyalty innovation, we’ll turn now to IBM Chairman and CEO Samuel J. Palmisiano, who recently discussed the idea of technological innovation using the Internet-based auctioneer as an example. Palmisiano pointed out that eBay’s success didn’t come just through leveraging the power of the Internet. Its success was really due to the convergence of three complementary factors: the development of secure online transaction systems that customers can trust; the rise of reliable overnight delivery services that move items quickly from one customer to another, allowing the instant gratification that comes from winning a bid on an item and receiving it within a few days; and the emergence of virtual communities, enabled by technology, with shared interests and common issues.

Thus the concept of convergence, which powers our third evolutionary trend. In mathematics, convergence describes limiting behavior— given an infinite sequence or series of values or events, those values or events will eventually converge toward some limit, which may be itself unknown. In technological terms, convergence occurs when different technologies evolve independently to perform similar tasks. Consider, for example, the convergence of telephones (voice communications), computers (data communications) and video (picture communications) onto a single broadband communications network. Technologies that were created to perform very specific tasks have now converged to share resources and create new efficiencies. We can view the broadband communications platform as the limit to which these technologies have evolved.

Which brings us back to loyalty. Could a similar convergence of differing technologies and marketing trends give rise to a new generation of loyalty programs? If so, is the limit knowable, or ultimately unknown?

The coalition limit

COLLOQUY has long debated the inevitability of coalition loyalty programs in the U.S. In most of the developed world, multi-merchant loyalty coalitions are de rigueur; AIR MILES in Canada, Nectar in the U.K., Payback in Germany and FlyBuys in Australia and New Zealand are each a long-standing, successful, profitable coalition that delivers value to consumers, merchant sponsors and stakeholders alike. The efficiencies inherent in coalition loyalty models— the shared marketing, operational and infrastructure costs, the cross-selling opportunities and the increased earn velocity— make coalitions the natural end-game for loyalty evolution.

In the developed world, coalitions typically form through entrepreneurship: a would-be coalition operator establishes a stable of “everyday spend” partners that includes some combination of a grocer, a fuel retailer, a credit card issuer, a telecom and a host of smaller retailers. The operator then takes the value proposition to market and asks customers to enroll. Such is the genesis of the world’s most successful coalition programs.

| Coalition loyalty programs typically form through entrepreneurship: a coalition operator establishes a stable of everyday-spend partners, then takes the value proposition to market and asks customers to enroll. |

|

But what about the U.S.? For the past 10 years or so, haven’t we all been wondering when and how a national coalition would launch? O.K., so maybe it’s mostly been COLLOQUY doing the wondering—but that’s our job.

In our last Loyalty Trends white paper, COLLOQUY predicted the continuing rise of Coalition Light: niche multi-merchant loyalty programs built around geographical regions or lifestyle affinity. The original Coalition Lite programs are still around, including the college education savings program Upromise, and regional coalitions such as the Idaho-based fuel-retail coalition KickBack Points continue to launch and expand. In the U.S., we’ll continue to see Coalition Lite programs lead the way in coalition marketing.

| PAGE 11 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

| “While would-be entrepreneurs have historically encountered significant obstacles to launching coalition programs in the U.S., it’s only a matter of time until someone puts together the ‘magic mosaic’ whereby all the pieces would actually fit together to create a network of players who would operate collectively for the common good.” |

| — Bryan Pearson, |

|

President, AIR MILES |

| Reward Program |

So perhaps the end-game will see a patchwork quilt of Coalition Lite programs spread throughout the U.S. Or could a national coalition program launch by unconventional means? Could converging factors in the marketplace still conspire to make a national U.S. coalition the inevitable limit of loyalty marketing? The answer to this question is up for debate. Still, we see convergence in the loyalty space arising through three major trends:

Corporate convergence: In the U.S., mega-corporations continue to gobble up one another. Bank of America attempts to purchase MBNA. Chase purchases Bank One. ChevronTexaco acquires Unocal. Federated Department Stores acquires May Department Stores. Through consolidation in the financial service, fuel-convenience and retail sectors, among others, corporations continue to grow, and the size of their corresponding customer bases becomes more astounding every day— with some of these companies reaching 60 or 70 million customers, that’s a lot of baked-in opportunity.

CRM convergence: Because of this consolidation and growth, these companies are developing a renewed interest in Customer Relationship Management technology; in many ways, the acronym CRM has come full circle. Where the phrase had once been discredited because of the many expensive false starts and failures in CRM implementations that occurred in the marketplace in the past decade, we now see renewed interest among these corporations in leveraging the power of customer data throughout their enterprises. The next generation of CRM technologies will help companies organize every aspect of their businesses around customer segments; they will use the resulting data to allocate resources effectively to influence and retain their high-profit and high-potential segments. This convergence of scalable technology and customer-focused enterprises will lay the groundwork for a renaissance in true customer relationship management.

POS technology convergence: In retail, we’ll also see convergence continue through the constant barrage of point-of-sale (POS) innovations: contactless RFID, smart cards, biometric payment systems, intelligent web-enabled POS systems, cellular phones that double as payment devices— all of these payment and identification innovations will eventually collide and converge in their ability to enable sustainable brand-customer relationships. All of this waving, tapping and blinking by these hoards of customers belonging to just one company means they’ll be able to interact seamlessly at the POS within a broad loyalty program.

How will U.S. corporations take advantage of this convergence to build the next generation of loyalty coalitions? Instead of the old model of third-party operators scrounging for those everyday-spend sponsors, could we see a proprietary loyalty program, run by one of these new mega-corporations, evolve into a U.S. national coalition?

| In the convergence model of coalition creation, a U.S. mega-corporation with an existing proprietary loyalty program, made up of millions of members, signs complementary everyday-spend partners and evolves the program naturally into a coalition. |

|

Here’s our prediction: by leveraging new CRM technologies to move data swiftly through the enterprise, and by utilizing new payment and identification systems that will make consumer participation a snap, a major U.S. corporation will launch a national coalition program. With the ability to reach tens of millions of their own customers, better CRM and cutting-edge POS capabilities at their disposal, this company will be able to sign major players in the grocery, telecom and fuel sectors who crave access to that mass of consumers. There are already several corporations poised to take this leap: Citi’s ThankYou network; American Express’s Membership Rewards or the Kroger 1-2-3 Rewards Card program could all pull it off. Convergence makes such evolution from a proprietary model to a coalition possible, if not inevitable, and the first corporation to do so will enjoy considerable first-mover advantage.

| PAGE 12 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

TRENDTALK

Tips for leveraging the power of convergence

If you’re a smaller player in the marketplace, looking up at these monolithic mega-corporations with a combination of hope and trepidation, how should you prepare for a major player to evolve their program to a coalition program? And more importantly, why should you care? When you are approached to join a coalition program, here are a few important considerations to bear in mind:

| 1. | WIIFM? Short for “What’s in it for me?” A coalition means your customers can earn rewards and benefits even faster. In return, the increased earning velocity of coalitions drives behavior shifts in ways that operators of proprietary loyalty programs can only dream of. The power of earning lots of currency quickly, at a variety of partner brands, makes a loyalty coalition a strong ally— or a formidable opponent. |

| 2. | The acquisition effect: The “collector” mentality created by a well-formed coalition has a significant benefit: increased rates of acquiring customers from other sponsors in the program. This acquisition effect will leave competitors on the outside, looking in. Of the three basic building blocks for generating ROI in your loyalty program— shift, lift and retain— the coalition model excels at the “shift” part of the equation. But once you’re in a coalition, remember that you’re in it for the long haul— because the acquisition effect can also work against you if you leave the coalition and a competitor steps in to take your slot. |

| 3. | Share of mind: One of the subtler strengths of coalition loyalty programs lies in their ability to influence share of mind in participating members. When a member produces her coalition card at the point-of-sale several times per week at the grocer, the fuel retailer and the bank, the repetition reinforces the strength of the coalition brand as an integral part of the consumer’s life— particularly if this “swiping power” is combined with accelerated earning velocity. This ability means that the first-movers in a new coalition will enjoy a considerable advantage. |

| 4. | Brand alignment: The ability to align your brand with other top-tier brands within a loyalty coalition is one of the strongest arguments for joining one. If you’re a grocer approached to join a coalition, ask about your potential partners in other high-velocity sectors such as fuel retail and financial services. If you have the chance to join top-tier players in complementary sectors, jump at it. The move could quickly vault you from also-ran to leader in your sector. |

The power of convergence will necessitate a strategy for evaluating whether an emerging coalition is the right one for you. Whether you help launch, join or respond to a coalition program, the last position you want to find yourself in is caught with your proverbial pants down. The stakes are simply too high.

Chart your own evolutionary path

Whenever the COLLOQUY brain trust gathers together to discuss loyalty trends, we inevitably ask ourselves if we’ve left the land of the practical to dwell in the airy clouds of esoteric daydreaming. While discussion of marketplace trends inevitably takes the 30,000-foot view, we’ve tried to ground our discussion in reality by basing our trend analysis closely on real-world examples we’ve observed in the marketplace. Each of our three evolutionary trends has already happened— all that remains to be seen is whether these trends have staying power. We think they do.

If you’re on board, then it’s time to look in the mirror. Do your loyalty and relationship marketing initiatives currently leverage the power of networks, your customer data and technology and corporate convergence? Are you paying as much attention to the smaller, more nimble innovators in the marketplace as you are to the big boys?

COLLOQUY revels in the continual innovation in the loyalty industry, whether that innovation comes through evolution or revolution. We’ll be here to report on that innovation, separate the winners from the also-rans and continue to challenge marketers to push the boundaries of their own customer strategies. It’s always better to ride a wave of marketplace innovation rather than be swallowed up by it. You say you want a revolution? Well, there are revolutions in customer-centric marketing happening all over the world. Join in the fun— and consider us your own loyalty bullhorn.

| PAGE 13 |

| COLLOQUYtalk / 02.06 | WWW.COLLOQUY.COM |

THE AUTHORS

The Authors

As Director of COLLOQUY, Kelly Hlavinka directs all strategic consulting, publishing, education and research projects. Kelly established COLLOQUY’s Consulting group in 2003 and under her direction it has grown to a team of internationally recognized practitioners, working with such notable clients as MGM MIRAGE, Eddie Bauer, Best Buy, HP Software, and VISA International.

An acknowledged expert in the theory and practice of loyalty marketing, Kelly’s bylined articles have been published by DM News, The DMA Insider, DIRECT and COLLOQUY and she is often quoted by publications including Newsweek, Advertising Age, CMO, Cards & Payments, Smart Money and 1to1 Magazine. Kelly has been a featured presenter at industry conferences sponsored by the DMA, FTMA, IIR and Source Media and she leads COLLOQUY’s faculty in teaching a series of Loyalty Marketing Workshops and webinars around the world.

As Editorial Director for COLLOQUY, Rick Ferguson is responsible for all COLLOQUY publishing, educational and research projects. An acknowledged expert in the theory and practice of loyalty marketing, Rick has published numerous articles and white papers describing the characteristics of marketing programs which seek to change customer behavior. He has been quoted as a loyalty expert in the Wall Street Journal, Guardian UK, Fast Company and the Dallas Morning News, serves as a contributor to The Journal of Consumer Marketing and writes a monthly column for NACS magazine. Rick has been a featured presenter at industry conferences sponsored by the DMA, NACS, FTMA and Terrapinn. As a key member of the COLLOQUY faculty, he has delivered educational workshops and webinars on the principles, practices and technologies of loyalty marketing in the U.S., U.K. and Singapore.

THE PUBLISHER

The Publisher

COLLOQUY comprises a collection of resources devoted to the global loyalty-marketing industry. The flagship resources are COLLOQUY Consulting, our loyalty consulting practice, COLLOQUY®, a quarterly publication serving the loyalty-marketing industry since 1990, Colloquy.com, the most comprehensive loyalty web site in the world, COLLOQUY’s Research and Education divisions, and the COLLOQUY Network, a global network of consultants certified in COLLOQUY’s consulting methodology. Together, they provide a worldwide audience of 25,000+ marketers with consulting services, news, editorial, educational and research services across all verticals and around the globe. COLLOQUY magazine subscriptions are available at no cost to qualified persons at www.colloquy.com/register.asp or by calling 513.248.5918.

1000 Summit Drive, Suite 200

Milford, Ohio 45150

513.248.2882

e-mail: info@colloquy.com

www.colloquy.com

© 2006 LoyaltyOne, Inc.

COLLOQUY is a registered trademark of LoyaltyOne, Inc. All rights reserved.

| PAGE 14 |