Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GLOBE SPECIALTY METALS INC | form8k4q2015.htm |

| EX-99.1 - PRESS RELEASE Q4 FY15 - GLOBE SPECIALTY METALS INC | pressrelease4q2015.htm |

August 26, 2015 4th Quarter 2015 Earnings Call

Disclaimer and Forward Looking Statements Forward-Looking Statements This communication may contain ''forward-looking statements'' within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as ''anticipates,'' ''intends,'' ''plans,'' ''seeks,'' ''believes,'' ''estimates,'' ''expects'' and similar references to future periods, or by the inclusion of forecasts or projections. Forward-looking statements are based on the current expectations and assumptions of Globe Specialty Metals, Inc. (the "Company“ or “Globe”) regarding its business, financial condition, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. The Company's actual results may differ materially from those contemplated by the forward-looking statements. The Company cautions you therefore that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions including, among others, changes in metals prices; increases in the cost of raw materials or energy; competition in the metals and foundry industries; environmental and regulatory risks; ability to identify liabilities associated with acquired properties prior to their acquisition; ability to manage price and operational risks including industrial accidents and natural disasters; ability to manage foreign operations; changes in technology; ability to acquire or renew permits and approvals; with respect to the proposed business combination with Grupo FerroAtlantica, the timing to complete the proposed transaction, the timing of or ability to satisfy the conditions to the completion of the proposed transaction, including the receipt of shareholder approval, and that regulatory approvals required for the proposed transaction may not be obtained on the terms expected or on the anticipated schedule; and other factors identified in the Company’s periodic reports filed with the SEC. Any forward-looking statement made by the Company or management in this communication speaks only as of the date on which it or they make it. Factors or events that could cause the Company's actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, unless otherwise required to do so under the law or the rules of the NASDAQ Global Market.

Disclaimer and Forward Looking Statements Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed transaction among Globe, Grupo Villar Mir, S.A.U., Grupo FerroAtlántica and VeloNewco. In connection with the proposed transaction, VeloNewco has filed with the SEC a registration statement on Form F-4, which includes a proxy statement of Globe that also constitutes a preliminary prospectus of VeloNewco. Investors and security holders are urged to read the definitive proxy statement/prospectus, which was filed with the SEC by Globe on August 12, 2015, together with all other relevant documents filed with the SEC, because they will contain important information about the proposed transaction. Investors and security holders are able to obtain the documents (once available) free of charge at the SEC’s website, http://www.sec.gov, or for free from Globe by contacting the Corporate Secretary, Globe Specialty Metals, 600 Brickell Avenue, Suite 3100, Miami, FL 33131, telephone: 786-509-6900 (for documents filed with the SEC by Globe) or from Grupo Villar Mir by contacting Investor Relations, Torre Espacio, Paseo de la Castellana, 259 D 49a, 28046 Madrid, Spain, +34 91 556 7347 (for documents filed with the SEC by Grupo Villar Mir, Grupo FerroAtlántica or VeloNewco). Participants in Solicitation Globe, Grupo Villar Mir, FerroAtlántica and VeloNewco and their directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of Globe common stock with respect to the proposed transaction. Information about Globe’s directors and executive officers is set forth in the proxy statement for Globe’s 2014 Annual Meeting of Stockholders, which was filed with the SEC on October 27, 2014. To the extent holdings of Globe securities have changed since the amounts contained in the proxy statement for Globe’s 2014 Annual Meeting of Stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the acquisition (once available). These documents (when available) may be obtained free of charge from the SEC’s website http://www.sec.gov, or from Globe and Grupo Villar Mir using the contact information above. Non-Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

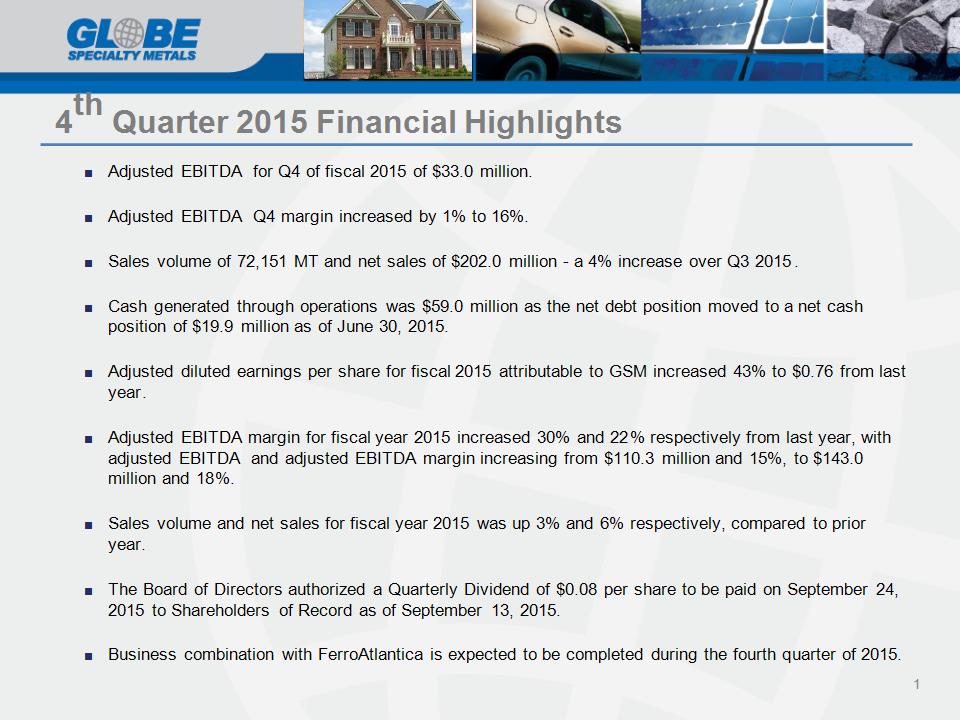

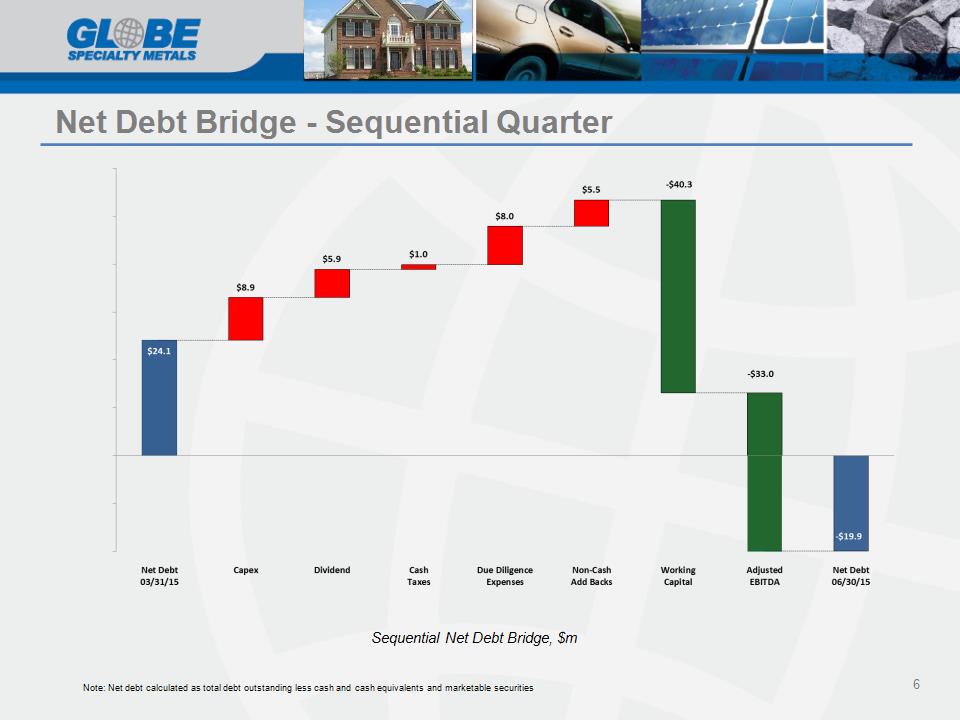

4th Quarter 2015 Financial Highlights 1 Adjusted EBITDA for Q4 of fiscal 2015 of $33.0 million. Adjusted EBITDA Q4 margin increased by 1% to 16%. Sales volume of 72,151 MT and net sales of $202.0 million – a 4% increase over Q3 2015. Cash generated through operations was $59.0 million as the net debt position moved to a net cash position of $19.9 million as of June 30, 2015. Adjusted diluted earnings per share for fiscal 2015 attributable to GSM increased 43% to $0.76 from last year. Adjusted EBITDA margin for fiscal year 2015 increased 30% and 22% respectively from last year, with adjusted EBITDA and adjusted EBITDA margin increasing from $110.3 million and 15%, to $143.0 million and 18%. Sales volume and net sales for fiscal year 2015 was up 3% and 6% respectively, compared to prior year. The Board of Directors authorized a Quarterly Dividend of $0.08 per share to be paid on September 24, 2015 to Shareholders of Record as of September 13, 2015. Business combination with FerroAtlantica is expected to be completed during the fourth quarter of 2015.

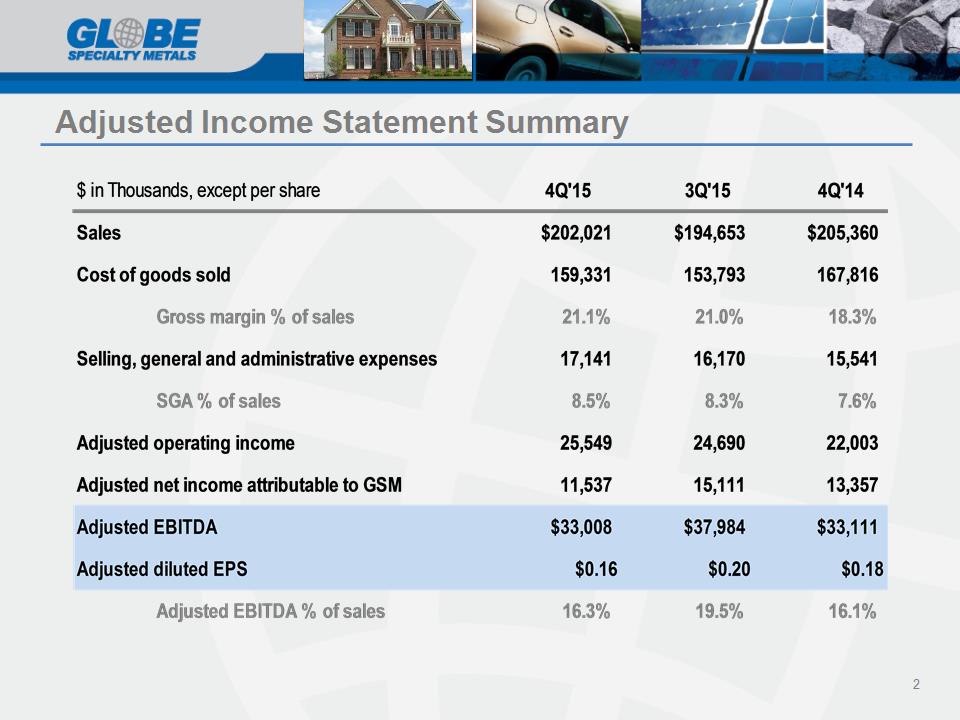

Adjusted Income Statement Summary 2

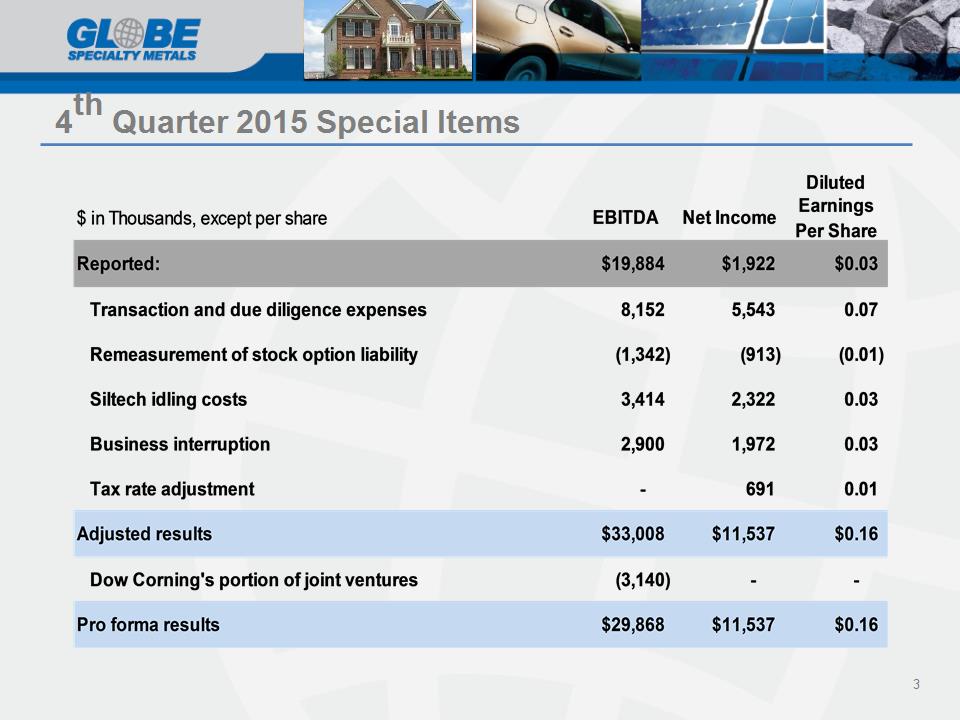

4th Quarter 2015 Special Items 3

4th Quarter 2015 Reported Results 4

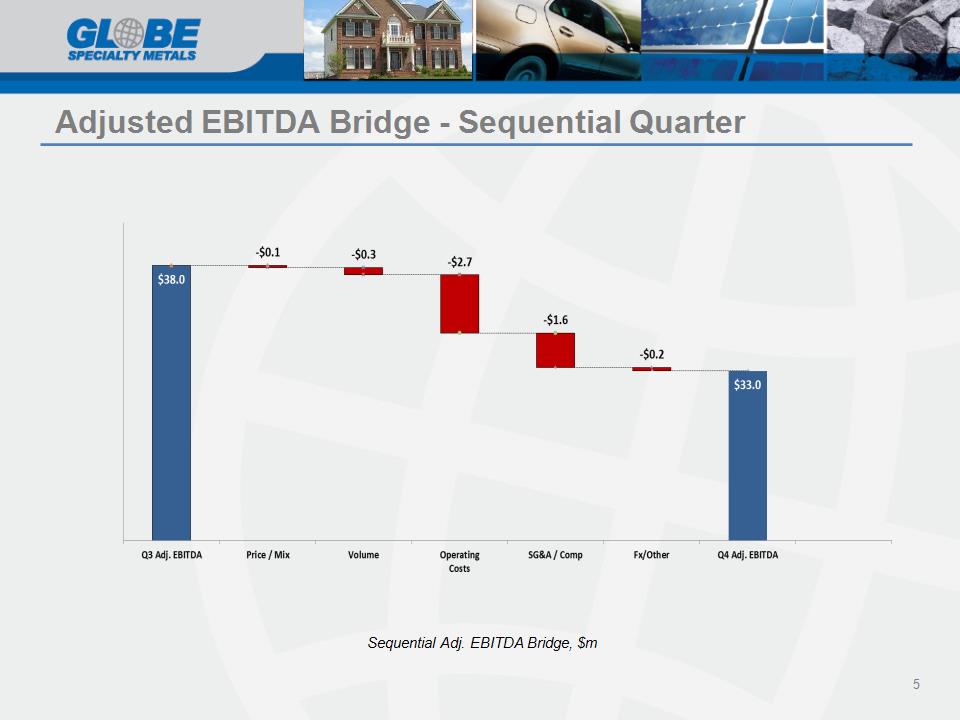

5 Sequential Adj. EBITDA Bridge, $m Adjusted EBITDA Bridge – Sequential Quarter

6 Net Debt Bridge – Sequential Quarter Sequential Net Debt Bridge, $m Note: Net debt calculated as total debt outstanding less cash and cash equivalents and marketable securities

August 26, 2015 4th Quarter 2015 Earnings Call