Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - GLOBE SPECIALTY METALS INC | exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - GLOBE SPECIALTY METALS INC | exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - GLOBE SPECIALTY METALS INC | exhibit311.htm |

| EX-10.15 - EXHIBIT 10.15 - GLOBE SPECIALTY METALS INC | execcompplan.htm |

| EX-21.1 - EXHIBIT 21.1 - GLOBE SPECIALTY METALS INC | subsidiaries.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

|

(Mark One)

|

||

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended June 30, 2010

|

||

|

OR

|

||

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from to

|

||

Commission File Number 001-34420

Globe Specialty Metals, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-2055624

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

One Penn Plaza

250 West 34th Street, Suite 4125

New York, NY 10119

(Address of principal executive offices, including zip code)

(212) 798-8122

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|||

| Common stock, $0.0001 par value |

The NASDAQ Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer þ

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

As of September 27, 2010, the registrant had 74,866,374 shares of common stock outstanding. As of December 31, 2009 (the last business day of the Registrant's most recently completed second fiscal quarter), the aggregate market value of such shares held by non-affiliates of the Registrant was approximately $591,000,000.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive Proxy Statement relating to the 2010 Annual Meeting of Stockholders, filed with the Securities and Exchange Commission, are incorporated by reference in Part III, Items 10 - 14 of this Annual Report on Form 10-K as indicated herein.

Globe Specialty Metals, Inc.

|

Page

|

||||||

|

No.

|

||||||

|

PART I

|

||||||

|

Special Note Regarding Forward-Looking Statements

|

1

|

|||||

|

1

|

Business

|

1

|

||||

|

1A

|

Risk Factors

|

7

|

||||

|

1B

|

Unresolved Staff Comments

|

11

|

||||

|

2

|

Properties

|

11

|

||||

|

3

|

Legal Proceedings

|

11

|

||||

|

4

|

[Reserved]

|

11

|

||||

|

PART II

|

||||||

|

5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

12

|

||||

|

6

|

Selected Financial Data

|

13

|

||||

|

7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

14

|

||||

|

7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

25

|

||||

|

8

|

Financial Statements and Supplementary Data

|

26

|

||||

|

9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

26

|

||||

|

9A

|

Controls and Procedures

|

26

|

||||

|

9B

|

Other Information

|

26

|

||||

|

PART III

|

||||||

|

10

|

Directors, Executive Officers and Corporate Governance

|

27

|

||||

|

11

|

Executive Compensation

|

27

|

||||

|

12

|

Security Ownership of Certain Beneficial Owners and Managers and Related Stockholder Matters

|

27

|

||||

|

13

|

Certain Relationships and Related Transactions and Director Independence

|

27

|

||||

|

14

|

Principal Accountant Fees and Services

|

27

|

||||

|

PART IV

|

||||||

|

15

|

Exhibits and Financial Statement Schedules

|

28

|

||||

|

Signatures

|

29

|

|||||

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” as that term is used in the Private Securities Litigation Reform Act of 1995. The forward-looking statements are contained principally in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties, and other factors which may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward-looking statements include statements about:

|

|

•

|

the anticipated benefits and risks associated with our business strategy;

|

|

|

•

|

our future operating results and the future value of our common stock;

|

|

|

•

|

the anticipated size or trends of the markets in which we compete and the anticipated competition in those markets;

|

|

|

•

|

our ability to attract customers in a cost-efficient manner;

|

|

|

•

|

our ability to attract and retain qualified management personnel;

|

|

|

•

|

our future capital requirements and our ability to satisfy our capital needs;

|

|

|

•

|

the potential for additional issuances of our securities; and

|

|

|

•

|

the possibility of future acquisitions of businesses or assets.

|

Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties including, but not limited to:

|

|

•

|

the historic cyclicality of the metals industry and the attendant swings in market price and demand;

|

|

|

•

|

increases in energy costs and the effect on our cost of production;

|

|

|

•

|

disruptions in the supply of power;

|

|

|

•

|

availability of raw materials or transportation;

|

|

|

•

|

cost of raw material inputs and our ability to pass along those costs to customers;

|

|

|

•

|

the concentration of our sales to a limited number of customers and the potential loss of a portion of sales to those customers;

|

|

|

•

|

changes in laws protecting U.S. companies from foreign competition;

|

|

|

•

|

integration and development of prior and future acquisitions; and

|

|

|

•

|

other risks described from time to time in our filings with the United States Securities and Exchange Commission (SEC), including the risks discussed under the heading “Risk Factors” in this Annual Report.

|

Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date the statements are made. You should read this Annual Report on Form 10-K and the documents that we have filed as exhibits completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Overview

Globe Specialty Metals, Inc. and subsidiary companies (GSM, the Company, we, us, or our) is one of the world’s largest and most efficient producers of silicon metal and silicon-based alloys, with approximately 100,000 metric tons (MT) of silicon metal capacity (excluding Dow Corning Corporation’s portion of the capacity of our Alloy, West Virginia plant) and 120,000 MT of silicon-based alloys capacity. Silicon metal, our principal product, is used as a primary raw material in making silicone compounds, aluminum and polysilicon. Our silicon-based alloys are used as raw materials in making steel, automotive components and ductile iron. We control the supply of most of our raw materials, and we capture, recycle and sell most of the by-products generated in our production processes.

Our products are currently produced in six principal operating facilities located in the United States and Argentina. Additionally, we operate facilities in Poland and China. Our flexible manufacturing capabilities allow us to optimize production and focus on products that enhance profitability. We also benefit from the lowest average operating costs of any large Western World producer of silicon metal, according to CRU International Limited (CRU), a leading metals industry consultant. CRU defines “Western World” as all countries supplying or consuming silicon metal with the exception of China and the former republics of the Soviet Union, including Russia.

Fiscal year 2010 was a very active year for us. In addition to our July 2009 initial public offering on the NASDAQ Global Select Market, we completed an acquisition, a joint venture, a divestiture and the reopening of two plants. These events served to broaden our product mix, improve our profitability and position us for significant future growth. These major events are as follows:

|

·

|

On November 5, 2009, we closed two transactions with Dow Corning Corporation (Dow Corning), which provided us with approximately $135,000,000 of net after-tax proceeds that we intend to use to fund future acquisitions and other business development opportunities. We sold our Brazilian manufacturing operations (Globe Metais) to Dow Corning for net after-tax proceeds of approximately $65,000,000. We acquired these manufacturing operations in January 2007 and operated them profitably for three years. However, in the second half of calendar year 2009, operating costs had risen significantly as a result of the weakening of the U.S. dollar and higher local power rates, and we expected these unfavorable trends to continue. The sale of the Brazilian manufacturing operations eliminated the risk of declining future profits in Brazil and provided capital to continue our growth strategy. Also on November 5, 2009, we entered into a manufacturing joint venture with Dow Corning at our Alloy, West Virginia plant, which generated net after-tax proceeds for us of approximately $70,000,000. Under this joint venture agreement, Dow Corning acquired a 49% equity interest in WVA Manufacturing LLC (WVA LLC), the subsidiary that owns our Alloy plant. As we retained a controlling financial interest in WVA LLC, no gain has been recognized in net income on the sale of the 49% membership interest. This interest entitles Dow Corning to receive 49% of the plant’s production at cost. The tonnage that Dow Corning will receive under the joint venture agreement is approximately equal to the volume they received from us under an existing long-term supply agreement, which was set to expire at the end of calendar 2010. By entering into this joint venture agreement, we effectively monetized the existing long-term supply agreement with Dow Corning and secured a permanent commitment for production for the plant. The Alloy plant is our largest production facility and achieves significant cost benefits when consistently operating at full capacity.

|

|

·

|

During the quarter ended December 31, 2009, we reopened our Niagara Falls, New York plant and began the process of reopening our Selma, Alabama plant. The Niagara Falls plant had been closed for six years and was reopened with a long-term power contract from the New York Power Authority. During fiscal year 2010, we incurred start-up costs of approximately $6,600,000 as the plant was being restarted and operations were being stabilized. We expect to incur additional start-up costs at this plant in the quarter ending September 30, 2010. The Selma plant was idled in April 2009 as a result of the global economic recession. We successfully renegotiated a power rate at the Selma plant comparable with our other domestic plants, which reduced the cost of production and made it more comparable with our other domestic plants. During fiscal year 2010, we incurred start-up costs of approximately $3,100,000 as the plant was being restarted and operations were being stabilized. We do not expect to incur any additional start-up costs at this plant.

|

1

|

·

|

On April 1, 2010, we purchased all of the ownership interests in Core Metals Group Holdings LLC (Core Metals), for approximately $52,000,000 in cash, including $15,329,000 borrowed under our senior revolving credit facility. Core Metals is a leading producer, marketer and distributor of ferrosilicon for the North American steel industry. The acquisition was made at an attractive valuation to strengthen our growing ferrosilicon business and expand the line of products we offer to the steel industry. On April 7, 2010, we sold Masterloy Products Company, an ancillary business included in the Core Metals acquisition, for $3,000,000.

|

Our business has improved to near pre-recession levels, with volumes shipped in fiscal year 2010 increasing more than 20% from our prior fiscal year, with approximately one-third of the increase in volume coming from the acquisition of Core Metals. We are presently running all of our furnaces at full capacity, subject to planned maintenance outages. Spot pricing for silicon metal, according to Metal Bulletin, has risen from approximately $1.20/LB at the beginning of calendar 2010 to approximately $1.55/LB in September 2010. Demand and pricing for silicon metal appears to be primarily driven by strong end user demand for silicones, which are additives to hundreds of products such as cosmetics, textiles, paints and coatings, and by growing demand for polysilicon, which is used to produce photovoltaic (solar) cells. Major silicone and polysilicon producers have announced a return to pre-recession levels and significant quarter-over-quarter and year-over-year increases in sales and profits.

Business segments

GMI

GMI currently operates five principal production facilities in the United States located in Beverly, Ohio, Alloy, West Virginia, Selma, Alabama, Niagara Falls, New York and Bridgeport, Alabama.

Globe Metais

Globe Metais is a distributor of silicon metal manufactured in Brazil. This segment includes the historical Brazilian manufacturing operations, comprised of a manufacturing plant in Breu Branco, mining operations and forest reserves, which were sold on November 5, 2009.

Globe Metales

Globe Metales operates a production facility in Mendoza, Argentina and a cored-wire fabrication facility in San Luis, Argentina. Globe Metales specializes in producing silicon-based alloy products, either in lump form or in cored-wire, a delivery method preferred by some manufacturers of steel, ductile iron, machine and auto parts and industrial pipe.

Solsil

Solsil is continuing to develop its technology to produce upgraded metallurgical grade silicon metal (UMG) manufactured through a proprietary metallurgical process, which is primarily used in silicon-based photovoltaic (solar) cells. Solsil is located in Beverly, Ohio and is currently focused on research and development projects and is not producing material for commercial sale. We own an 81% interest in Solsil, Inc. (Solsil).

Corporate

The corporate office, located in New York, New York, includes general expenses, investments, and related investment income.

Other

Ningxia Yonvey Coal Industrial Co., Ltd. (Yonvey). Yonvey produces carbon electrodes, an important input in our production process, at a production facility in Shizuishan in the Ningxia Hiu Autonomous Region of China. We currently consume internally the majority of Yonvey’s output of electrodes. We hold a 70% ownership interest in Yonvey.

Ultracore Polska Sp.z.o.o (UCP). UCP produces cored-wire silicon-based alloy products. The fabrication facility is located in Police in northern Poland.

See our June 30, 2010 consolidated financial statements for financial information with respect to our segments.

Products and Operations

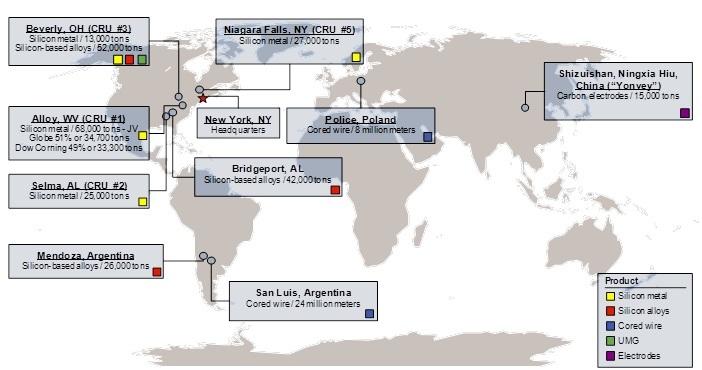

The following chart shows the location of our primary facilities, the products produced at each facility and each facility’s production capacity.

2

The following table details our shipments and average selling price per MT over the last eight quarters through June 30, 2010. See note 24 (Operating Segments) to our June 30, 2010 consolidated financial statements for additional information.

|

Quarter Ended

|

|||||||||||||||

|

June 30,

|

March 31,

|

December 31,

|

September 30,

|

June 30,

|

March 31,

|

December 31,

|

September 30,

|

||||||||

|

2010

|

2010

|

2009

|

2009

|

2009

|

2009

|

2008

|

2008

|

||||||||

|

(Unaudited)

|

|||||||||||||||

|

Shipments (MT) (a)

|

|||||||||||||||

|

Silicon metal

|

32,925

|

30,681

|

28,759

|

25,962

|

20,088

|

18,564

|

28,674

|

33,135

|

|||||||

|

Silicon-based alloys

|

29,282

|

17,003

|

15,749

|

14,110

|

12,094

|

9,729

|

15,605

|

22,126

|

|||||||

|

Total

|

62,207

|

47,684

|

44,508

|

40,072

|

32,182

|

28,293

|

44,279

|

55,261

|

|||||||

|

Average selling price ($/MT)

|

|||||||||||||||

|

Silicon metal

|

$2,435

|

2,380

|

2,580

|

2,673

|

2,594

|

2,563

|

2,539

|

2,567

|

|||||||

|

Silicon-based alloys

|

1,844

|

2,011

|

1,926

|

2,095

|

2,044

|

2,472

|

2,541

|

2,393

|

|||||||

|

Silicon metal and silicon-based alloys

|

2,157

|

2,248

|

2,348

|

2,470

|

2,388

|

2,532

|

2,540

|

2,497

|

|||||||

___________

|

|

(a)

|

Shipments and average selling price exclude silica fume, other by-products and electrodes.

|

During the year ended June 30, 2010, our customers engaged primarily in the manufacture of silicone chemicals and polysilicon (47% of revenue), foundry alloys (15% of revenue), aluminum (13% of revenue) and steel (13% of revenue). Our customer base is geographically diverse, and includes North America, Europe, South America and Asia, which for the year ended June 30, 2010, represented 73%, 18%, 5% and 3% of our revenue, respectively.

For the year ended June 30, 2010, two customers accounted for more than 10% of revenues: Dow Corning, which represented approximately 30% of revenues (approximately one-third of which was a result of the manufacturing joint venture at our Alloy, West Virginia plant), and Wacker Chemie AG, which represented approximately 13% of revenues. Our ten largest customers account for approximately 60% of our net sales. These percentages include sales made under our joint venture agreement to Dow Corning.

Silicon Metal

We are among the world’s largest and most efficient producers of silicon metal. Silicon-based products are classified by the approximate percentage of silicon contained in the material and the levels of trace impurities. We produce specialty-grade, high quality silicon metal with silicon content generally greater than 99.25%. We produce the majority of this high-grade silicon metal for three industries: (i) the aluminum industry; (ii) the chemical industry; and (iii) polysilicon producers in the photovoltaic (solar)/semiconductor industry. We also continue to develop our technology to produce UMG for photovoltaic (solar) applications.

We market to primary aluminum producers who require silicon metal with certain purity requirements for use as an alloy, as well as to the secondary aluminum industry where specifications are not as stringent. Aluminum is used to manufacture a variety of automobile and truck components, including engine pistons, housings, and cast aluminum wheels and trim, as well as uses in high tension electrical wire, aircraft parts, beverage containers and other products which require optimal aluminum properties. The addition of silicon metal reduces shrinkage and the hot cracking tendencies of cast aluminum and improves the castability, hardness, corrosion resistance, tensile strength, wear resistance and weldability of the end products.

Purity and quality control are important. For instance, the presence of iron in aluminum alloys, in even small quantities, tends to reduce its beneficial mechanical properties as well as reduce its lustrous appearance, an important consideration when producing alloys for aluminum wheels and other automotive trim. We have the ability to produce silicon metal with especially low iron content as a result of our precisely controlled production processes.

We market to all the major silicone chemical producers. Silicone chemicals are used in a broad range of applications, including personal care items, construction-related products, health care products and electronics. In construction and equipment applications, silicones promote adhesion, act as a sealer and have insulating properties. In personal care and health care products, silicones add a smooth texture, prevent against ultra violet rays and provide moisturizing and cleansing properties. Silicon metal is an essential component of the manufacture of silicones, accounting for approximately 20% of raw materials used.

We market to producers of silicon wafers and solar cells who utilize silicon metal as the core ingredient of their product. These manufacturers employ processes to further purify the silicon metal and then use the material to grow crystals. These crystals are then cut into wafers, which are capable of converting sun light to electricity. The individual wafers are then soldered together to make solar cells.

We enter into multi-year, annual, semi-annual or quarterly contracts for a majority of our silicon metal production.

Silicon-Based Alloy Products

We make ferrosilicon by combining silicon dioxide (quartzite) with iron in the form of scrap steel and iron oxides. To produce our high-grade silicon-based alloys, we combine ferrosilicon with other additions that can include precise measured quantities of other metals and rare earths to create alloys with specific metallurgical characteristics. Our silicon-based alloy products can be divided into four general categories: (i) ferrosilicon, (ii) magnesium-ferrosilicon-based alloys, (iii) ferrosilicon-based alloys and (iv) calcium silicon.

Magnesium-ferrosilicon-based alloys are known as “nodularizers” because, when combined with molten grey iron, they change the graphite flakes in the iron into spheroid particles, or “nodules,” thereby increasing the iron’s strength and resilience. The resulting product is commonly known as ductile iron. Ductile iron is employed in numerous applications, such as the manufacture of automobile crankshafts and camshafts, exhaust manifolds, hydraulic valve bodies and cylinders, couplings, sprockets and machine frames, as well as in commercial water pipes. Ductile iron is lighter than steel and provides better castability (i.e., intricate shapes are more easily produced) than untreated iron.

Ferrosilicon-based alloys (without or with very low concentrations of magnesium) are known as “inoculants” and can contain any of a large number of combinations of metallic elements. Inoculants act to evenly distribute the graphite particles found in both grey and ductile iron and refine other microscopic structures, resulting in a product with greater strength and improved casting and machining properties.

Calcium silicon alloys are widely used to improve the quality, castability and machinability of steel. Calcium is a powerful modifier of oxides and sulfides. It improves the castability of the steel in a continuous casting process by keeping nozzles from clogging. Calcium also improves the machinability of steel, increasing the life of cutting tools.

We believe that we distinguish ourselves from our competitors by providing technical advice and service to our silicon-based alloy customers and by tailoring the chemical composition of our alloys to the specific requirements of each customer’s product line and foundry process. Silicon-based alloy customers are extremely quality conscious. We have intensive quality control measures at each stage of the manufacturing process to ensure that our customers’ specifications are met.

Our silicon-based alloys are sold to a diverse base of customers worldwide. Silicon-based alloys are typically sold on quarterly contracts or on a spot basis. We have evergreen year-to-year contracts with many of our customers for the purchase of our magnesium-ferrosilicon-based products, while foundry ferrosilicon alloys are typically purchased in smaller quantities for delivery within 30 days.

By-Products

We capture, recycle and sell most of the by-products generated in our production processes. The largest volume by-product not recycled into the manufacturing process is silica fume (also known as microsilica). This dust-like material, collected in our air filtration systems, is sold to our 50%-owned affiliate, Norchem Inc., and other companies which process, package and market it for use as a concrete additive, refractory material or oil well conditioner. The other major by-products of our manufacturing processes are “fines,” the fine material resulting from crushing, and dross, which results from the purification process during smelting. The fines and dross that are not recycled into our own production processes are generally sold to customers who utilize these products in other manufacturing processes, including steel production.

3

Raw Material Supply

We control the supply of most of our raw materials. We have mining operations located in Billingsley, Alabama. These mines supply our U.S. operations with a substantial portion of our requirements for quartzite, the principal raw material used in the manufacturing of all of our products. We believe that these mines, together with additional leasing opportunities in the vicinity, should cover our needs well into the future. We also obtain quartzite from other sources in the U.S. The gravel is mined, washed and screened to our specifications by our suppliers. All of our products also require coal or charcoal and woodchips in their manufacture. We source our low ash metallurgical-grade coal mainly from the midwest region of the U.S., mostly under long-term fixed price contracts, for our U.S. operations, and we use charcoal from local suppliers for our Argentine operations. Woodchips are sourced locally by each plant, and we maintain a wood chipping operation at our Alloy, West Virginia plant, which allows us to either buy logs or chips based on market pricing and availability. Carbon electrodes are supplied by Yonvey and are also purchased from several other suppliers on annual contracts and spot purchases. Most of our metal purchases are made on the spot market or from scrap dealers, with the exception of magnesium, which is purchased under a fixed duration contract for our U.S. business. Our principal iron source for producing ferrosilicon-based alloys has been scrap steel. Magnesium and other additives are obtained from a variety of sources producing or dealing in these products. We also obtain raw materials from a variety of other sources. Rail is the principal transportation method for gravel and coal. We have rail spurs at all of our plants. Other materials arrive primarily by truck. We require our suppliers, whenever feasible, to use statistical process control procedures in their production processes to conform to our own processes.

We believe that we have a cost advantage in most of our long-term power supply contracts. Our power supply contracts result in stable, favorably priced, long-term commitments of power at reasonable rates. In Argentina, our power contract with the province of Mendoza to provide power at a discount to the local market price expired in October 2009, and we are currently paying a month-to-month rate. We are in negotiations to enter into a new long-term contract. In West Virginia, we have a contract with Brookfield Energy to provide approximately 45% of our power needs at a fixed rate through December 2021. The remainder of our power needs in West Virginia, Ohio and Alabama are sourced through contracts that provide tariff rates at historically competitive levels. In connection with the reopening of our Niagara Falls, New York plant, and as an incentive to reopen the plant, we obtained a public-sector package including 40 megawatts of hydropower through 2013, with a potential seven year extension. We entered into a power hedge agreement, for a term of 24 months ending in June 2012, for approximately 20% of the total power required by our Niagara Falls, New York plant. This hedge covers our expected needs not supplied by the long-term power contract over the term of the hedge agreement.

Sales and Marketing Activities

Our silicon metal is typically sold through contracts which are between three months and several years in length and serve to lock in volumes and prices. Our multi-year contracts have historically represented a meaningful portion of our silicon metal sales; however, substantially all silicon metal contracts expire at the end of calendar 2010.

Our marketing strategy is to maximize profitability by varying the balance of our product mix among the various silicon-based alloys and silicon metal. Our products are marketed directly by our own marketing staff located in Buenos Aires, Argentina, Police, Poland, and at various locations in the United States and who work together to optimize the marketing efforts. The marketing staff is supported by our Technical Services Manager, who supports the sales representatives by advising foundry customers on how to improve their processes using our products.

We also employ customer service representatives. Order receiving, entry, shipment coordination and customer service is handled primarily from the Beverly, Ohio facility for our U.S. operations, and in Buenos Aires, Argentina, and Police, Poland for our non U.S. operations. In addition to our direct sales force, we sell through distributors in various U.S. regions, Canada, Southern and Northern Mexico, Australia, South America and Europe.

We maintain credit insurance for the majority of our customer receivables to mitigate collection risk.

Competition

The silicon metal and silicon-based alloy markets are capital intensive and competitive. Our primary competitors are Elkem AS, owned by Orkla ASA, and Grupo Ferroatlantica S.L. In addition, we also face competition from other companies, such as, Becancour Silicon, Inc., Rima Industrial SA and Ligas de Alumino SA, as well as producers in China and the former republics of the Soviet Union. We have historically proven to be a highly efficient, low cost producer, with competitive pricing and manufacturing processes that capture most of our production by-products for reuse or resale. We also have the flexibility to adapt to current market demands by switching between silicon-based alloy and silicon metal production with reasonable switching costs. We face continual threats from existing and new competition. Nonetheless, certain factors can affect the ability of competition to enter or expand. These factors include (i) lead time of three to five years to obtain the necessary governmental approvals and construction completion; (ii) construction costs; (iii) the need to situate a manufacturing facility proximate to raw material sources, and (iv) energy supply for manufacturing purposes.

Competitive Strengths

We believe that we possess a number of competitive strengths that position us well to continue as one of the leading global suppliers of silicon metal and silicon-based alloys.

|

|

•

|

Leading Market Positions. We hold leading market shares in a majority of our products. Our silicon metal capacity of approximately 100,000 MT annually (excluding Dow Corning’s portion of the capacity of our Alloy, West Virginia plant), represents approximately 9% total Western World capacity, including 41% capacity in North America. We estimate that we have approximately 20% Western World capacity for magnesium ferrosilicon, including 50% capacity in North America and are one of only six suppliers of calcium silicon in the Western World (with estimated 18% capacity).

|

|

|

•

|

Low Cost Producer. We have been recognized by CRU as the lowest average operating cost large silicon metal producer in the Western World. Currently, CRU lists our four silicon metal manufacturing facilities as being among CRU’s five most cost efficient silicon metal manufacturing facilities in the Western World, including the three lowest cost facilities. Our Niagara Falls, New York plant is included in the CRU analysis at its normalized expected production costs.

|

|

|

•

|

Highly Variable Cost Structure. We operate with a largely variable cost of production and have the ability to rapidly turn furnaces on and off to react to changes in customer demand. During the global economic recession, we were able to quickly idle certain furnaces as demand declined and then quickly re-start them at minimal cost as demand returned.

|

|

|

•

|

Long-Term Power Contracts. We also believe that we have a cost advantage in our long-term power supply contracts, which provide a significant portion of our power needs. These power supply contracts result in stable, favorably priced, long-term commitments of power at reasonable rates.

|

|

|

•

|

Stable Raw Material Supply Through Captive Mines. We have quartz mining operations, located in Billingsley, Alabama, for which we currently possess long-term lease mining rights. These mines supply our U.S. plants with a majority of our requirements for quartzite, the principal raw material used in the manufacturing of our products. We believe that these mines, taken together with additional leasing opportunities in the vicinity should cover our needs well into the future. We have also obtained a captive supply of electrodes, an important input in our manufacturing process, through our ownership in Yonvey.

|

|

|

•

|

Efficient and Environmentally Sensitive By-Product Usage. We utilize or sell most of our manufacturing processes’ by-products, which reduces costs and limits environmental impact.

|

|

|

•

|

Diverse Products and Markets. We sell our products to a wide variety of industries and to companies in over 30 countries. We believe that our diverse product and geographic end-market profile provides us with numerous growth opportunities and should help insulate us from economic downturns occurring in any individual industry or geographic region, however global macroeconomic factors will impact the effectiveness of our industrial and geographical diversity strategy. See note 24 (Operating Segments) to our June 30, 2010 consolidated financial statements for additional information.

|

|

|

•

|

Experienced, Highly Qualified Management Team. We have assembled a highly qualified management team with over 50 years of combined experience in the metals industry among our top four executives. Alan Kestenbaum, our Executive Chairman, Jeff Bradley, our Chief Executive Officer, Malcolm Appelbaum, our Chief Financial Officer, and Stephen Lebowitz, our Chief Legal Officer, have over 20, 25, 5 and 7 years of experience, respectively, in metals industries. We believe that our management team has the operational and technical skill to continue to operate our business at world class levels of efficiency and to consistently produce silicon metal and silicon-based alloys.

|

4

Business Strategy

|

|

•

|

Focus on Core Businesses. We differentiate ourselves on the basis of our technical expertise and high product quality and use these capabilities to retain existing accounts and cultivate new business. As part of this strategy, we are focusing our production and sales efforts on our silicon metals and silicon-based alloys to end markets where we may achieve the highest profitability. We continue to evaluate our core business strategy and may divest certain non-core and lower margin businesses to improve our financial and operational results.

|

|

|

•

|

Continue to Rationalize Costs to Meet Current Levels of Demand. We are focused on operating in a cost effective manner and continue to focus on cost control in order to improve our profitability. Our largely variable cost of production should allow us to remain profitable during periods of reduced demand.

|

|

|

•

|

Capitalize on Market Conditions. In fiscal year 2010, we reopened our Niagara Falls, New York and Selma, Alabama plants and are currently running all furnaces at full capacity, other than planned maintenance outages. We remain focused on improving furnace uptime and production output.

|

|

|

•

|

Maintain Low Cost Position While Controlling Inputs. We intend to maintain our position as one of the most cost-efficient producers of silicon metal in the world by continuing to control the cost of the process inputs through our captive sources and long-term supply contracts. We continue to focus on reducing our fixed costs in order to reduce costs per MT of silicon metal and silicon-based alloy sold.

|

|

|

•

|

Continue Pursuing Strategic Acquisition Opportunities. We continue to pursue complementary acquisitions at appropriate valuations. We are actively reviewing several possible transactions to expand our strategic capabilities and leverage our products and operations. We intend to build on our history of successful acquisitions by continuing to evaluate attractive acquisition opportunities for the purpose of increasing our capacity, increasing our access to raw materials and other inputs and acquiring further refined products for our customers. Our focus is on investing globally in companies, technologies or products that complement and/or diversify our business or product offerings. In particular, we will consider acquisitions or investments that will enable us to leverage our expertise in silicon metal and silicon-based alloy products and to grow in these markets, as well as enable us to enter new markets or sell new products. We believe our overall metallurgical expertise and skills in lean production technologies position us well for future growth.

|

|

|

•

|

Leverage Flexible Manufacturing and Expand Other Lines of Business. We will leverage our flexible manufacturing capabilities to optimize the product mix produced while expanding the products we offer. Additionally, we can leverage our broad geographic manufacturing reach to ensure that production of specific metals is in the most appropriate facility/region. Besides our principal silicon metal products, we have the capability to produce silicon-based alloys, such as ferrosilicon and silicomanganese, using the same facilities. Our business philosophy is to allocate our furnace capacity to the products which we expect will improve profitability.

|

|

|

•

|

Leverage Synergies Among Units. According to CRU, we currently have the three lowest cost, and four of the five lowest cost silicon metal manufacturing facilities in the Western World. Additionally, according to CRU, the average operating cost of our four silicon metal production facilities is approximately 16.8% lower than the Western World weighted average cost. Our Niagara Falls, New York plant is included in the CRU analysis at its normalized expected production costs. We seek to leverage each of our facilities’ best practices and apply them across our system.

|

Employees

As of June 30, 2010, we had 1,136 employees. We have 770 employees in the United States, 137 employees in Argentina, 24 employees in Poland and 205 employees in China. Our total employees consist of 464 salaried employees and 672 hourly employees and include 469 unionized workers. This compares to 828 employees at June 30, 2009, which represented a 35% headcount reduction from levels at June 30, 2008 due to the global economic recession. The 1,283 employees at June 30, 2008 included 307 employees related to our Brazilian manufacturing operations, which were sold in November 2009, and excluded 98 employees from Core Metals, which was acquired in April 2010, and 97 employees from our Niagara Falls, New York plant, which restarted during fiscal year 2010.

We have not experienced any work stoppages and consider our relations with our employees to be good. Our hourly employees at our Selma, Alabama facility are covered by a collective bargaining agreement with the Industrial Division of the Communications Workers of America, under a contract running through July 31, 2013. Our hourly employees at our Alloy, West Virginia, Niagara Falls, New York and Bridgeport, Alabama facilities are covered by collective bargaining agreements with The United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union under contracts running through April 24, 2011, July 30, 2011, and March 31, 2012, respectively. Union employees in Argentina are working under a contract running through April 30, 2011. Our operations in Poland and China are not unionized.

Research and Development

Our primary research and development activities are concentrated in our Solsil business unit. Solsil is continuing to develop its technology to produce upgraded metallurgical grade silicon manufactured through a proprietary metallurgical process and which is primarily used in silicon-based photovoltaic (solar) cells. Solsil conducts research and development activities designed to improve the purity of its silicon. The business performs experiments, including continuous batch modifications with the goal of improving efficiencies, lowering costs and developing new products that we expect will meet the needs of the photovoltaic (solar) industry. These activities are performed at Solsil’s operations, which are currently located within our facility at Beverly, Ohio. Our success in producing UMG for the solar industry is expected to help lower the production cost of photovoltaic (solar) cells and increase the overall affordability of the technology.

Proprietary Rights and Licensing

The majority of our intellectual property relates to process design and proprietary know-how. Our intellectual property strategy is focused on developing and protecting proprietary know-how and trade secrets, which are maintained through employee and third-party confidentiality agreements and physical security measures. Although we have some patented technology, our businesses or profitability does not rely fundamentally upon such technology.

Regulatory Matters

We operate facilities in the U.S. and abroad, which are subject to foreign, federal, national, state, provincial and local environmental, health and safety laws and regulations, including, among others, those governing the discharge of materials into the environment, hazardous substances, land use, reclamation and remediation and the health and safety of our employees. These laws and regulations require us to obtain from governmental authorities permits to conduct certain regulated activities, which permits may be subject to modification or revocation by such authorities.

We are subject to the risk that we have not been or will not be at all times in complete compliance with such laws, regulations and permits. Failure to comply with these laws, regulations and permits may result in the assessment of administrative, civil and criminal penalties or other sanctions by regulators, the imposition of remedial obligations, the issuance of injunctions limiting or preventing our activities and other liabilities. Under these laws, regulations and permits, we could also be held liable for any and all consequences arising out of human exposure to hazardous substances or environmental damage we may cause or that relates to our operations or properties. Environmental, health and safety laws are likely to become more stringent in the future. Our costs of complying with current and future environmental, health and safety laws, and our liabilities arising from past or future releases of, or exposure to, hazardous substances, may adversely affect our business, results of operations and financial condition.

There are a variety of laws and regulations in place or being considered at the international, federal, regional, state and local levels of government that restrict or are reasonably likely to restrict the emission of carbon dioxide and other greenhouse gases. These legislative and regulatory developments may cause us to incur material costs to reduce the greenhouse gas emissions from our operations (through additional environmental control equipment or retiring and replacing existing equipment) or to obtain emission allowance credits, or result in the incurrence of material taxes, fees or other governmental impositions on account of such emissions. In addition, such developments may have indirect impacts on our operations, which could be material. For example, they may impose significant additional costs or limitations on electricity generators, which could result in a material increase in our energy costs.

Certain environmental laws assess liability on current or previous owners or operators of real property for the cost of removal or remediation of hazardous substances. In addition to cleanup, cost recovery or compensatory actions brought by federal, state and local agencies, neighbors, employees or other third parties could make personal injury, property damage or other private claims relating to the presence or release of hazardous substances. Environmental laws often impose liability even if the owner or operator did not know of, or was not responsible for, the release of hazardous substances. Persons who arrange for the disposal or treatment of hazardous substances also may be responsible for the cost of removal or remediation of these substances. Such persons can be responsible for removal and remediation costs even if they never owned or operated the disposal or treatment facility. In addition, such owners or operators of real property and persons who arrange for the disposal or treatment of hazardous substances can be held responsible for damages to natural resources.

Soil or groundwater contamination resulting from historical, ongoing or nearby activities is present at certain of our current and historical properties, and additional contamination may be discovered at such properties in the future. Based on currently available information, we do not believe that any costs or liabilities relating to such contamination will have a material adverse effect on our financial condition, results of operations or liquidity.

5

Other Information

Globe Specialty Metals, Inc. was incorporated in December 2004 pursuant to the laws of the State of Delaware under the name “International Metal Enterprises, Inc.” for the initial purpose to serve as a vehicle for the acquisition of companies operating in the metals and mining industries. In November 2006, we changed our name to “Globe Specialty Metals, Inc.”

Our internet website address is www.glbsm.com. Copies of the following reports are available free of charge through the internet website, as soon as reasonably practicable after they have been filed with or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended: the Annual Report on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; any amendments to such reports; and proxy statements. Information on the website does not constitute part of this or any other report filed with or furnished to the SEC.

6

|

Item 1A.

|

Risk Factors

|

You should consider and read carefully all of the risks and uncertainties described below, together with all of the other information contained in this Annual Report on Form 10-K, including the consolidated financial statements and the related notes to consolidated financial statements. If any of the following events actually occur, our business, business prospects, financial condition, results of operations or cash flows could be materially affected. In any such case, the trading price of our common stock could decline, and you could lose all or part of your investment.

The metals industry, including silicon-based metals, is cyclical and has been subject in the past to swings in market price and demand which could lead to volatility in our revenues.

Our business has historically been subject to fluctuations in the price of our products and market demand for them, caused by general and regional economic cycles, raw material and energy price fluctuations, competition and other factors. Historically, our subsidiary, Globe Metallurgical, Inc., has been particularly affected by recessionary conditions in the end-markets for its products. In April 2003, Globe Metallurgical, Inc. sought protection under Chapter 11 of the United States Bankruptcy Code following its inability to restructure or refinance its indebtedness in light of the confluence of several negative economic and other factors, including an influx of low-priced, dumped imports, which caused it to default on then-outstanding indebtedness. A recurrence of such economic factors could have a material adverse effect on our business prospects, condition (financial or otherwise) and results of operations.

In calendar 2009, the global silicon metal industry suffered from unfavorable market conditions. The weakened economic environment of national and international metals markets that occurred during that time may return; any decline could have a material adverse effect on our business prospects, condition (financial or otherwise), and results of operations. In addition, our business is directly related to the production levels of our customers, whose businesses are dependent on highly cyclical markets, such as the automotive, residential and nonresidential construction, consumer durables, polysilicon, and chemical markets. In response to unfavorable market conditions, customers may request delays in contract shipment dates or other contract modifications. If we grant modifications, they could adversely affect our anticipated revenues and results of operations. Also, many of our products are internationally traded products with prices that are significantly affected by worldwide supply and demand. Consequently, our financial performance will fluctuate with the general economic cycle, which could have a material adverse effect on our business prospects, condition (financial or otherwise) and results of operations.

Our business is particularly sensitive to increases in energy costs, which could materially increase our cost of production.

Electricity is one of our largest production cost components, comprising approximately 25% of cost of goods sold. The level of power consumption of our submerged electric arc furnaces is highly dependent on which products are being produced and typically fall in the following ranges: (i) silicon-based alloys require between 3.5 and 8 megawatt hours to produce one MT of product and (ii) silicon metal requires approximately 11 megawatt hours to produce one MT of product. Accordingly, consistent access to low cost, reliable sources of electricity is essential to our business.

Electrical power to our U.S. facilities is supplied mostly by AEP, Alabama Power, Brookfield Power, Tennessee Valley Authority and Niagara Mohawk Power Corporation through dedicated lines. Our Alloy, West Virginia facility obtains approximately 45% of its power needs under a 15-year fixed-price contract with a nearby hydroelectric facility. This facility is over 70 years old and any breakdown could result in the Alloy facility having to pay much higher rates for electric power from third parties. Our energy supply for our facilities located in Argentina is supplied through the Edemsa hydroelectric facilities located in Mendoza, Argentina. Our contract expired in October 2009; we are currently operating under a month-to-month arrangement and are negotiating a new contract. Because energy constitutes such a high percentage of our production costs, we are particularly vulnerable to cost fluctuations in the energy industry. Accordingly, the termination or non-renewal of any of our energy contracts, or an increase in the price of energy could materially adversely affect our future earnings, if any, and may prevent us from effectively competing in our markets.

Losses caused by disruptions in the supply of power would reduce our profitability.

Our operations are heavily dependent upon a reliable supply of electrical power. We may incur losses due to a temporary or prolonged interruption of the supply of electrical power to our facilities, which can be caused by unusually high demand, blackouts, equipment failure, natural disasters or other catastrophic events, including failure of the hydroelectric facilities that currently provide power under contract to our West Virginia, New York and Argentina facilities. Large amounts of electricity are used to produce silicon metal and silicon-based alloys, and any interruption or reduction in the supply of electrical power would adversely affect production levels and result in reduced profitability. Our insurance coverage may not be sufficient to cover any or all losses, and such policies do not cover all events. Certain of our insurance policies will not cover any losses that may be incurred if our suppliers are unable to provide power during periods of unusually high demand.

Investments in Argentina’s electricity generation and transmission systems have been lower than the increase in demand in recent years. If this trend is not reversed, there could be electricity supply shortages as the result of inadequate generation and transmission capacity. Given the heavy dependence on electricity of our manufacturing operations, any electricity shortages could adversely affect our financial results.

Government regulations of electricity in Argentina give priority access of hydroelectric power to residential users and subject violators of these restrictions to significant penalties. This preference is particularly acute during Argentina’s winter months due to a lack of natural gas. We have previously successfully petitioned the government to exempt us from these restrictions given the demands of our business for continuous supply of electric power. If we are unsuccessful in our petitions or in any action we take to ensure a stable supply of electricity, our production levels may be adversely affected and our profitability reduced.

Any decrease in the availability, or increase in the cost, of raw materials or transportation could materially increase our costs.

Principal components in the production of silicon metal and silicon-based alloys include metallurgical-grade coal, charcoal, carbon electrodes, quartzite, wood chips, steel scrap, and other metals, such as magnesium. We buy some raw materials on a spot basis. We are dependent on certain suppliers of these products, their labor union relationships, mining and lumbering regulations and output and general local economic conditions in order to obtain raw materials in a cost efficient and timely manner. An increase in costs of raw materials or transportation, or the decrease in their production or deliverability in a timely fashion, or other disruptions in production, could result in increased costs to us and lower productivity levels. We may not be able to obtain adequate supplies of raw materials from alternative sources on terms as favorable as our current arrangements or at all. Any increases in the price or shortfall in the production and delivery of raw materials, could materially adversely affect our business prospects, condition (financial or otherwise) or results of operation.

Cost increases in raw material inputs may not be passed on to our customers, which could negatively impact our profitability.

The availability and prices of raw material inputs may be influenced by supply and demand, changes in world politics, unstable governments in exporting nations and inflation. The market prices of our products and raw material inputs are subject to change. We may not be able to pass a significant amount of increased input costs on to our customers. Additionally, we may not be able to obtain lower prices from our suppliers should our sale prices decrease.

Compliance with and changes in environmental laws, including proposed climate change laws and regulations, could adversely affect our performance.

The principal environmental risks associated with our operations are emissions into the air and releases into the soil, surface water, or groundwater. Our operations are subject to extensive federal, state, and local environmental laws and regulations, including those relating to the discharge of materials into the environment, waste management, pollution prevention measures and greenhouse gas emissions. If we violate or fail to comply with these laws and regulations, we could be fined or otherwise sanctioned. Because environmental laws and regulations are becoming more stringent and new environmental laws and regulations are continuously being enacted or proposed, such as those relating to greenhouse gas emissions and climate change, the level of expenditures required for environmental matters could increase in the future. Future legislative action and regulatory initiatives could result in changes to operating permits, additional remedial actions, material changes in operations, increased capital expenditures and operating costs, increased costs of the goods we sell, and decreased demand for our products that cannot be assessed with certainty at this time.

Some of the proposed federal cap-and-trade legislation would require businesses that emit greenhouse gases to buy emission credits from the government, other businesses, or through an auction process. As a result of such a program, we may be required to purchase emission credits for greenhouse gas emissions resulting from our operations. Although it is not possible at this time to predict the final form of a cap-and-trade bill (or whether such a bill will be passed), any new federal restrictions on greenhouse gas emissions – including a cap-and-trade program – could result in material increased compliance costs, additional operating restrictions for our business, and an increase in the cost of the products we produce, which could have a material adverse effect on our financial position, results of operations, and liquidity.

We make a significant portion of our sales to a limited number of customers, and the loss of a portion of the sales to these customers could have a material adverse effect on our revenues and profits.

In the year ended June 30, 2010, we made approximately 60% of our consolidated net sales to our top ten customers and approximately 43% to our top two customers. These percentages include sales made under our joint venture agreement to Dow Corning. We expect that we will continue to derive a significant portion of our business from sales to these customers. If we were to experience a significant reduction in the amount of sales we make to some or all of these customers and could not replace these sales with sales to other customers, it could have a material adverse effect on our revenues and profits.

7

Our U.S.-based businesses benefit from U.S. antidumping duties and laws that protect U.S. companies by taxing imports from foreign companies. If these laws change, foreign companies will be able to compete more effectively with us. Conversely, our foreign operations are adversely affected by these U.S. duties and laws.

Antidumping duties are currently in place covering silicon metal imports from China and Russia. The orders imposing these duties benefit our U.S. operations by constraining supply and increasing U.S. market prices and sales of domestic silicon metal. Rates of duty can change as a result of “administrative reviews” and “new shipper reviews” of antidumping orders. These orders can also be revoked as a result of periodic “sunset reviews,” which determine whether the orders will continue to apply to imports from particular countries. A sunset review of the order covering imports from China will be initiated in 2011. Thus, the current orders may not remain in effect and continue to be enforced from year to year, the goods and countries now covered by antidumping orders may no longer be covered, and duties may not continue to be assessed at the same rates. Changes in any of these factors could adversely affect our business and profitability. Finally, at times, in filing trade actions, we find ourselves acting against the interests of our customers. Some of our customers may not continue to do business with us because of our having filed a trade action. Antidumping rules may, conversely, also adversely impact our foreign operations.

The European Union, like the U.S., maintains an antidumping duty covering silicon metal imports from China. The duty was reduced in May 2010.

We may be unable to successfully integrate and develop our prior and future acquisitions.

We acquired five private companies between November 2006 and April 2010, and entered into a business combination in May 2008 and a joint venture agreement in November 2009. We expect to acquire additional companies in the future. Integration of our prior and future acquisitions with our existing business is a complex, time-consuming and costly process requiring the employment of additional personnel, including key management and accounting personnel. Additionally, the integration of these acquisitions with our existing business may require significant financial resources that would otherwise be available for the ongoing development or expansion of existing operations. Unanticipated problems, delays, costs or liabilities may also be encountered in the development of these acquisitions. Failure to successfully and fully integrate and develop these businesses and operations may have a material adverse effect on our business, financial condition, results of operations and cash flows. The difficulties of combining the acquired operations include, among other things:

|

|

•

|

operating a significantly larger combined organization;

|

|

|

•

|

coordinating geographically disparate organizations, systems and facilities;

|

|

•

|

consolidating corporate technological and administrative functions;

|

|

|

•

|

integrating internal controls and other corporate governance matters;

|

|

|

•

|

the diversion of management’s attention from other business concerns;

|

|

|

•

|

unexpected customer or key employee loss from the acquired businesses;

|

|

|

•

|

hiring additional management and other critical personnel;

|

|

|

•

|

negotiating with labor unions;

|

|

|

•

|

a significant increase in our indebtedness; and

|

|

|

•

|

potential environmental or regulatory liabilities and title problems.

|

In addition, we may not realize all of the anticipated benefits from any prior and future acquisitions, such as increased earnings, cost savings and revenue enhancements, for various reasons, including difficulties integrating operations and personnel, higher and unexpected acquisition and operating costs, unknown liabilities, inaccurate reserve estimates and fluctuations in markets. If these benefits do not meet the expectations of financial or industry analysts, the market price of our shares may decline.

We are subject to the risk of union disputes and work stoppages at our facilities, which could have a material adverse effect on our business.

Hourly workers at our Selma, Alabama facility are covered by a collective bargaining agreement with the Industrial Division of the Communications Workers of America, under a contract running through July 31, 2013. Hourly employees at our Alloy, West Virginia, Niagara Falls, New York and Bridgeport, Alabama facilities are covered by collective bargaining agreements with The United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union under contracts running through April 24, 2011, July 30, 2011, and March 31, 2012, respectively. Our union employees in Argentina are working under a contract running through April 30, 2011. New labor contracts will have to be negotiated to replace expiring contracts from time to time. If we are unable to satisfactorily renegotiate those labor contracts on terms acceptable to us or without a strike or work stoppage, the effects on our business could be materially adverse. Any strike or work stoppage could disrupt production schedules and delivery times, adversely affecting sales. In addition, existing labor contracts may not prevent a strike or work stoppage, and any such work stoppage could have a material adverse effect on our business.

We are dependent on key personnel.

Our operations depend to a significant degree on the continued employment of our core senior management team. In particular, we are dependent on the skills, knowledge and experience of Alan Kestenbaum, our Executive Chairman, Jeff Bradley, our Chief Executive Officer, Malcolm Appelbaum, our Chief Financial Officer, and Stephen Lebowitz, our Chief Legal Officer. If these employees are unable to continue in their respective roles, or if we are unable to attract and retain other skilled employees, our results of operations and financial condition could be adversely affected. We currently have employment agreements with Alan Kestenbaum, Jeff Bradley, Malcolm Appelbaum and Stephen Lebowitz, each of which contains non-compete provisions. Such provisions may not be enforceable by us. Additionally, we are substantially dependent upon key personnel in our financial and information technology staff who enable us to meet our regulatory and contractual financial reporting obligations, including reporting requirements under our credit facilities.

Metals manufacturing is an inherently dangerous activity.

Metals manufacturing generally, and smelting, in particular, is inherently dangerous and subject to fire, explosion and sudden major equipment failure. This can and has resulted in accidents resulting in the serious injury or death of production personnel and prolonged production shutdowns. We have experienced fatal accidents and equipment malfunctions in our manufacturing facilities in recent years and may experience fatal accidents or equipment malfunctions again, which could materially affect our business and operations.

Unexpected equipment failures may lead to production curtailments or shutdowns.

Many of our business activities are characterized by substantial investments in complex production facilities and manufacturing equipment. Because of the complex nature of our production facilities, any interruption in manufacturing resulting from fire, explosion, industrial accidents, natural disaster, equipment failures or otherwise could cause significant losses in operational capacity and could materially and adversely affect our business and operations.

We depend on proprietary manufacturing processes and software. These processes may not yield the cost savings that we anticipate and our proprietary technology may be challenged.

We rely on proprietary technologies and technical capabilities in order to compete effectively and produce high quality silicon metals and silicon-based alloys. Some of these proprietary technologies that we rely on are:

|

|

•

|

computerized technology that monitors and controls production furnaces;

|

|

|

•

|

production software that monitors the introduction of additives to alloys, allowing the precise formulation of the chemical composition of products; and

|

|

|

•

|

flowcaster equipment, which maintains certain characteristics of silicon-based alloys as they are cast.

|

8

We are subject to a risk that:

|

|

•

|

we may not have sufficient funds to develop new technology and to implement effectively our technologies as competitors improve their processes;

|

|

|

•

|

if implemented, our technologies may not work as planned; and

|

|

|

•

|

our proprietary technologies may be challenged and we may not be able to protect our rights to these technologies.

|

Patent or other intellectual property infringement claims may be asserted against us by a competitor or others. Our intellectual property may not be enforceable, and it may not prevent others from developing and marketing competitive products or methods. An infringement action against us may require the diversion of substantial funds from our operations and may require management to expend efforts that might otherwise be devoted to operations. A successful challenge to the validity of any of our proprietary intellectual property may subject us to a significant award of damages, or we may be enjoined from using our proprietary intellectual property, which could have a material adverse effect on our operations.

We also rely on trade secrets, know-how and continuing technological advancement to maintain our competitive position. We may not be able to effectively protect our rights to unpatented trade secrets and know-how.

We are subject to environmental, health and safety regulations, including laws that impose substantial costs and the risk of material liabilities.

We are subject to extensive foreign, federal, national, state, provincial and local environmental, health and safety laws and regulations governing, among other things, the generation, discharge, emission, storage, handling, transportation, use, treatment and disposal of hazardous substances; land use, reclamation and remediation; and the health and safety of our employees. We are also required to obtain permits from governmental authorities for certain operations. We may not have been and may not be at all times in complete compliance with such laws, regulations and permits. If we violate or fail to comply with these laws, regulations or permits, we could be subject to penalties, fines, restrictions on operations or other sanctions. Under these laws, regulations and permits, we could also be held liable for any and all consequences arising out of human exposure to hazardous substances or environmental damage we may cause or that relates to our operations or properties.

Under certain environmental laws, we could be required to remediate or be held responsible for all of the costs relating to any contamination at our or our predecessors’ past or present facilities and at third party waste disposal sites. We could also be held liable under these environmental laws for sending or arranging for hazardous substances to be sent to third party disposal or treatment facilities if such facilities are found to be contaminated. Under these laws we could be held liable even if we did not know of, or were not responsible for, such contamination, or even if we never owned or operated the contaminated disposal or treatment facility.

There are a variety of laws and regulations in place or being considered at the international, federal, regional, state and local levels of government that restrict or are reasonably likely to restrict the emission of carbon dioxide and other greenhouse gases. These legislative and regulatory developments may cause us to incur material costs if we are required to reduce or offset greenhouse gas emissions and may result in a material increase in our energy costs due to additional regulation of power generators.

Environmental laws are complex, change frequently and are likely to become more stringent in the future. Therefore, our costs of complying with current and future environmental laws, and our liabilities arising from past or future releases of, or exposure to, hazardous substances may adversely affect our business, results of operations and financial condition.

We operate in a highly competitive industry.

The silicon-based alloy and silicon metal markets are capital intensive and competitive. Our primary competitors are Elkem AS, owned by Orkla ASA, a large Norwegian public company, Grupo Ferroatlantica S.L. and various producers in China. Our competitors may have greater financial resources, as well as other strategic advantages to maintain, improve and possibly expand their facilities; and as a result, they may be better positioned to adapt to changes in the industry or the global economy. The advantages that our competitors have over us could have a material adverse effect on our business. In addition, new entrants may increase competition in our industry, which could materially adversely affect our business. An increase in the use of substitutes for certain of our products also could have a material adverse effect on our financial condition and operations.

We have historically operated at near the maximum capacity of our operating facilities. Because the cost of increasing capacity may be prohibitively expensive, we may have difficulty increasing our production and profits.

Our facilities are able to manufacture, collectively, approximately 100,000 MT of silicon metal (excluding Dow Corning’s portion of the capacity of our Alloy, West Virginia plant) and 120,000 MT of silicon-based alloys on an annual basis. Our ability to increase production and revenues will depend on expanding existing facilities or opening new ones. Increasing capacity is difficult because:

|

|

•

|