Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PERCEPTRON INC/MI | v418495_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - PERCEPTRON INC/MI | v418495_ex99-1.htm |

Exhibit 99.2

Public Release 1 Cannacord Genuity Growth Conference Jeff Armstrong Chief Executive Officer August 12, 2015 NASDAQ : PRCP

Public Release 2 Safe Harbor Statement Cautionary Statement Certain statements made or incorporated by reference in this presentation reflect management’s estimates and beliefs and are intended to be, and are hereby identified as, “Forward - Looking Statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . These statements often include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, or similar expressions . These statements are based on certain assumptions that Perceptron has made in light of its experience in the industry as well as its perspective of historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances . Actual results may differ materially from the anticipated results because of risks and uncertainties . These risks and uncertainties are set forth in Perceptron’s Annual Report on Form 10 - K and other filings from time to time with the Securities and Exchange Commission . We disclaim any obligation to publicly update our forward - looking statements after the date of this presentation .

Public Release 3 Global metrology company offering best - in - class advanced manufacturing solutions • Founded in 1981 with headquarters in Michigan • 15 sales, service and support offices worldwide • 3D measurement and automated assembly • Solutions provide better quality and lower costs • Extensive intellectual property • Significant competitive advantages • Automotive segment market leader • New management team tasked to reinvigorate growth and increase shareholder value Transforming from a niche automotive market leader to a broad - based industrial metrology company

Public Release Organic Growth x New product launch campaign to expand our offerings x Targets 3D machine vision and automation markets x Markets are generally fragmented and low penetration x Offer strong value to customers while being accretive to gross margin x Expand our complete solution and full turnkey offerings Acquisition Growth x February 2015 - closed our first acquisitions in over 15 years x 25% top line revenue and significant addressable market increase x Technology innovation play in a very traditional product space x Market technical leader with low penetration Diversification x Diversify in automotive outside our niche x Diversify beyond the automotive segment x Acquisitions and new products will accelerate diversification 4 How Are We Transforming?

Public Release Served Market Segments 5 Industrial Metrology Robotic Automation Other 3D Scanning CMM - Automotive CMM - Aerospace CMM – Machine Shops CMM - Markets $5 Billion Served Market Our direct addressable market – just in automotive - has increased this year 7X to approximately $750M Based on Frost & Sullivan, IHS and management’s best estimates

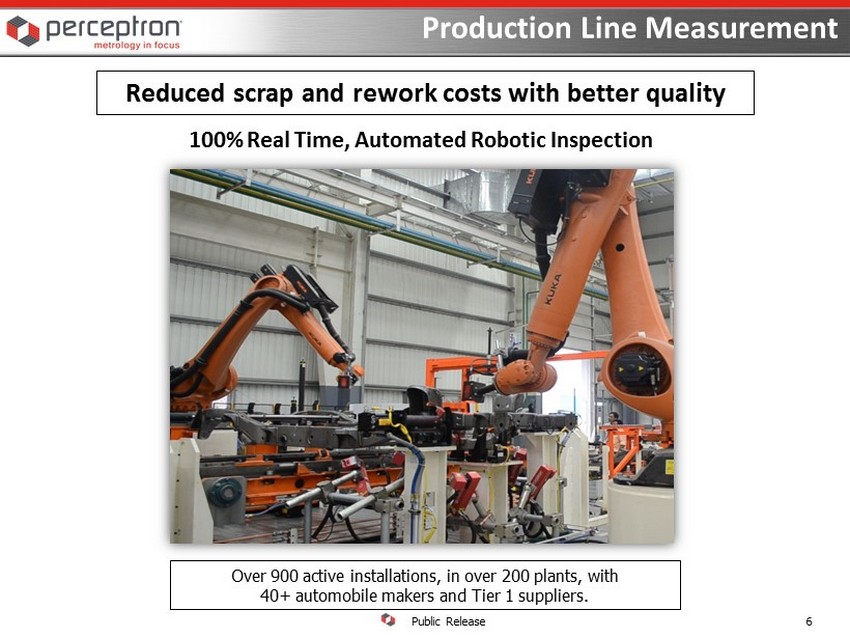

Public Release 6 100% Real Time, Automated Robotic Inspection Reduced scrap and rework costs with better quality Production Line Measurement Over 900 active installations, in over 200 plants, with 40+ automobile makers and Tier 1 suppliers.

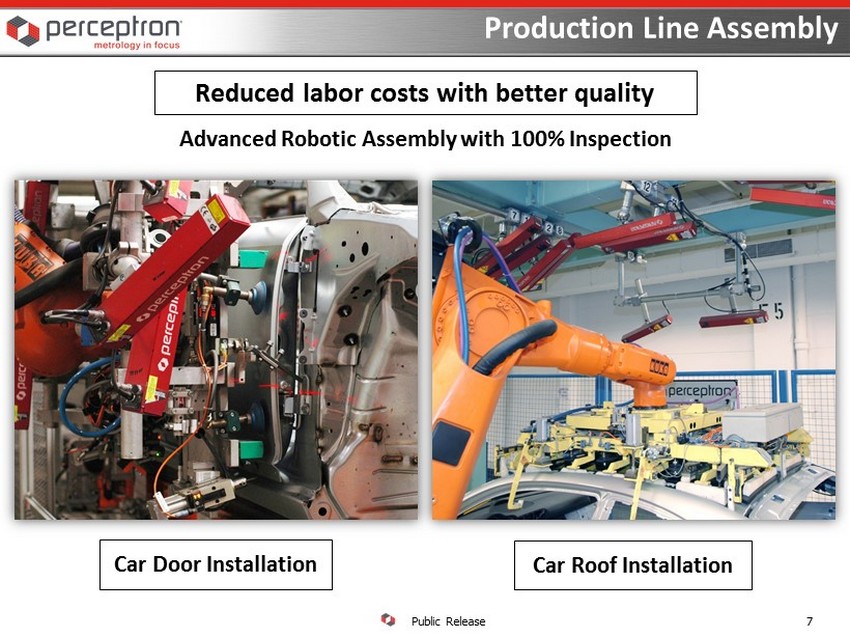

Public Release 7 Reduced labor costs with better quality Production Line Assembly Advanced Robotic Assembly with 100% Inspection Car Door Installation Car Roof Installation

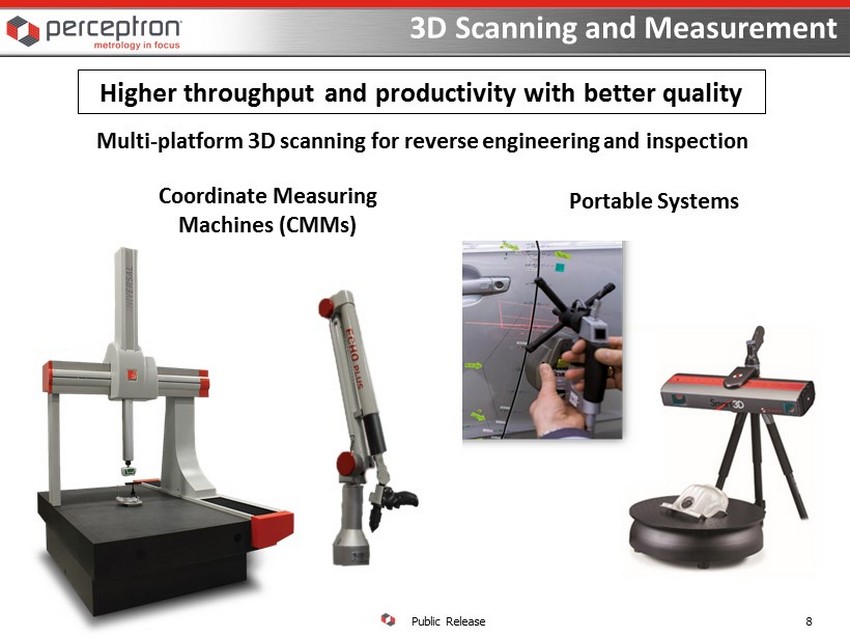

Public Release 8 3D Scanning and Measurement Portable Systems Coordinate Measuring Machines (CMMs) Multi - platform 3D scanning for reverse engineering and inspection Higher throughput and productivity with better quality

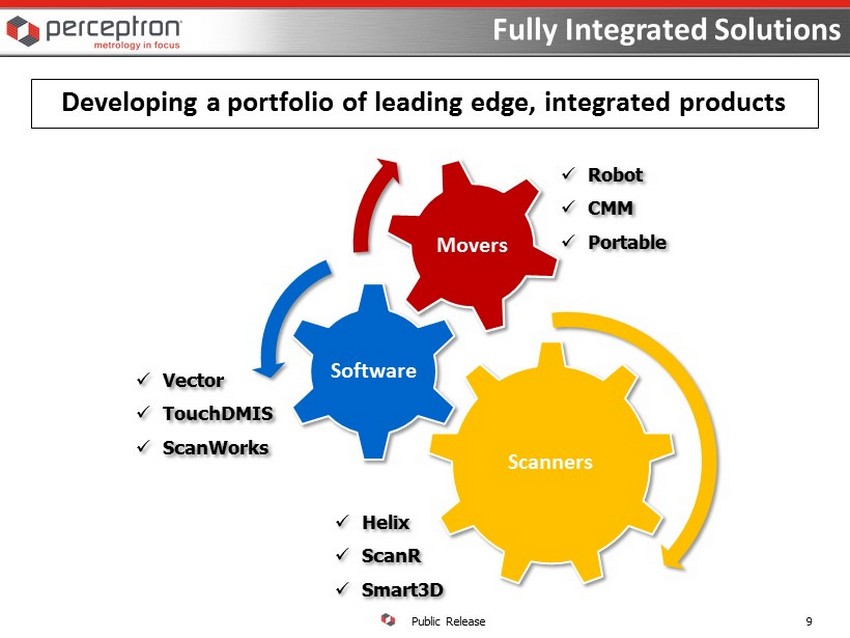

Public Release Fully Integrated Solutions 9 Developing a portfolio of leading edge, integrated products Scanners Software Movers x Helix x ScanR x Smart3D x Robot x CMM x Portable x Vector x TouchDMIS x ScanWorks

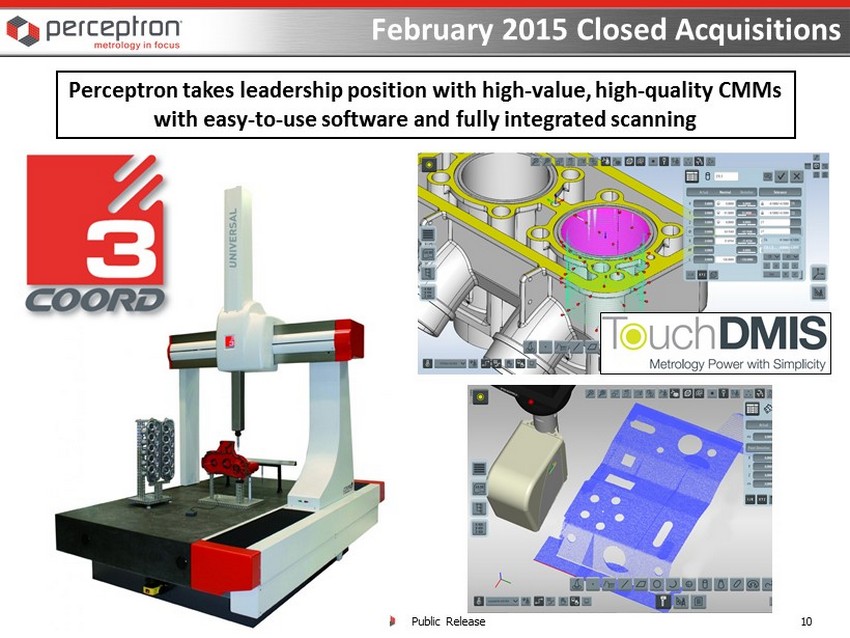

Public Release February 2015 Closed Acquisitions 10 Perceptron takes leadership position with high - value, high - quality CMMs with easy - to - u se software and fully i ntegrated scanning

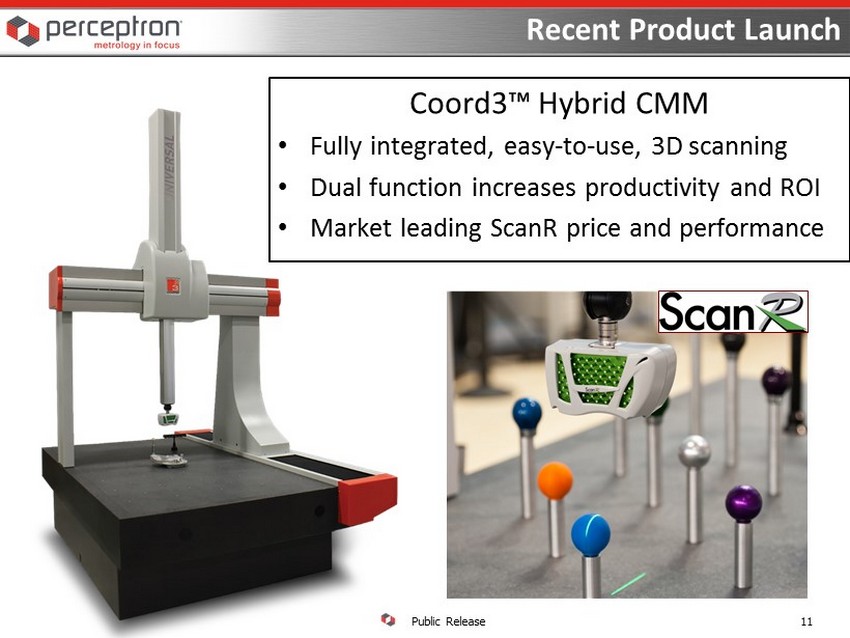

Public Release Coord3™ Hybrid CMM • Fully integrated, easy - to - use, 3D scanning • Dual function increases productivity and ROI • Market leading ScanR price and performance Recent Product Launch 11

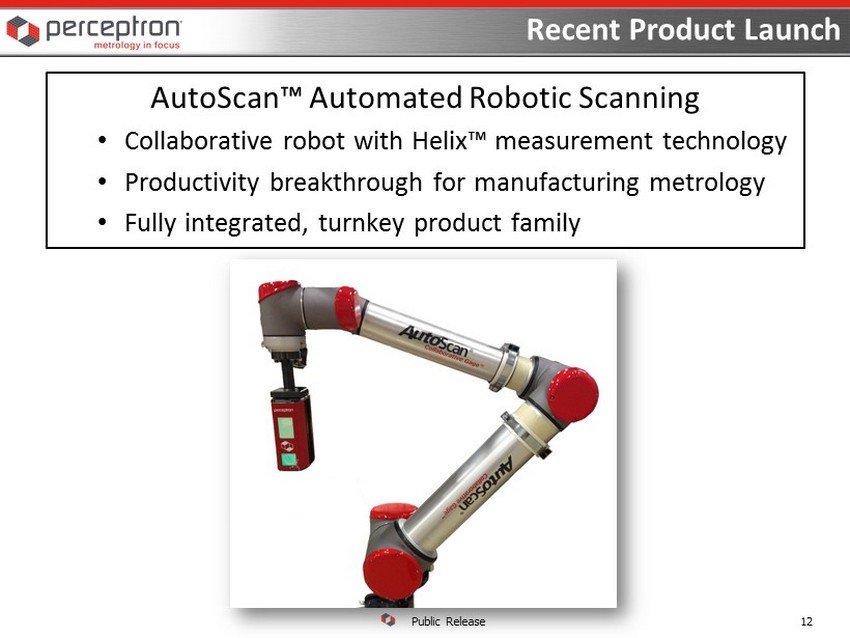

Public Release AutoScan™ Automated Robotic Scanning • Collaborative robot with Helix ™ measurement technology • Productivity breakthrough for manufacturing metrology • Fully integrated, turnkey product family Recent Product Launch 12

Public Release Smart3D™ Portable Laser Scanning • Automated, easy - to - use scanning for reverse engineering, modeling and inspection • Planned family of solutions from basic to advanced Recent Product Launch 13

Public Release 14 Financial Overview Revenue Income from Continuing Operations $54,307 $38,287 $40,199 $50,847 $57,379 $60,886 $59,612 2008 2009 2010 2011 2012 2013 2014 $(1,345) $(6,595) $70 $2,650 $2,827 $6,130 $2,427 2008 2009 2010 2011 2012 2013 2014 2014 Revenue Profile Americas Europe Asia $ 18.3 Mil. $ 27.8 Mil. $13.5 Mil. 46% 31% 23% 14

Public Release • Profitable Organic Growth • Industry Diversification • Broaden and Extend Our Technical Leadership • Maintain Operational Excellence and Fiscal Discipline 15 Strategic Roadmap for Success Commitment to Growth and Increasing Shareholder Value

Public Release • ‘In Line’ automotive market - forecast 10% CAGR o Gain new customers (Tier 1 suppliers, agricultural, etc.) o Leverage new products and CMMs with our existing automotive customer base • 3D scanning market - forecast 8 - 11 % CAGR o Deliver new, innovative, high - value products o Grow our direct and reseller channels to market • Scanning CMM market - forecast 15% CAGR o Deliver easy - to - use, fully integrated, high - value products o Enable Coord3’s continued growth o Shared sales channels with 3D Scanning products 16 Profitable Organic Growth

Public Release 17 Industry Diversification • Target 30% diversification by the end of FY17 – Currently 20% non - automotive • Pursue while the automotive cycle is favorable • CMM growth provides diversification into aerospace , machinery, and energy segments • 3D Scanning growth provides broad diversification • Capitalize on our worldwide sales, support, and relationships • We will push to lead the automotive metrology market where we have strong growth opportunities

Public Release • Target R&D on adjacent and transformational products • Continue software ease - of - use initiatives targeted toward a much broader market with lower skill levels • Increase our competitive advantages through partnerships • Maintain leading - edge sensor performance • Focus on low - cost, quick - feedback, lean start - up activities • We are delivering more new products in one year than at any similar period in our history. 18 Extend Technical Leadership

Public Release • Focus on profitable top line growth • Target our product mix for higher gross margins: – Maintain a 45% gross margin benchmark – CMMs will initially be lower GM and 3Ds will be higher GM • Reduce SG&A costs and increase operating income: – Drive operational efficiencies as we grow the top line • Maintain operational excellence: – Focus on continued high customer satisfaction • Prudent capital allocation: – Wise use of cash to maximize shareholder value – Maintain a strong balance sheet 19 Maintain Fiscal Discipline

Public Release x Technological – Best in industry laser optical scanners – Fully integrated software with extensive analysis tools and ease of setup – Significant, ongoing R&D to develop innovative solutions – Patents covering hardware and software intellectual property x Customer focus – Training, service, and support from company locations worldwide – Able to deliver turnkey, fully integrated solutions – Software and documentation published in 13 languages – Deep experience = lowest financial, schedule and performance risk x Extensive industry knowledge: – Automotive market and technical leader – Global standard for several OEMs with ~ 60% in - line market penetration – Solutions for a wide range of industry needs – Strong relations with robot makers, line builders and integrators Competitive Advantages 20

Public Release x On path for growth and increased shareholder value x Industry - leading metrology technology x Global infrastructure base to leverage x Strong and growing automotive base to leverage x Large and growing adjacent markets x Top - line growth will enable profit expansion x Financially strong with solid cash flow x On track to achieve fiscal 2015 growth objectives x Very low multiples compared to peers Investment Proposition 21

Public Release Thank you for your time and interest. Questions? 22