Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - FREEPORT-MCMORAN INC | q215exhibit101.htm |

| EX-15.1 - EXHIBIT 15.1 - FREEPORT-MCMORAN INC | q215exhibit151.htm |

| EX-31.2 - EXHIBIT 31.2 - FREEPORT-MCMORAN INC | q215exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - FREEPORT-MCMORAN INC | q215exhibit311.htm |

| EX-32.2 - EXHIBIT 32.2 - FREEPORT-MCMORAN INC | q215exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - FREEPORT-MCMORAN INC | q215exhibit321.htm |

| EX-95.1 - EXHIBIT 95.1 - FREEPORT-MCMORAN INC | q215exhibit951.htm |

UNITED STATES | ||

SECURITIES AND EXCHANGE COMMISSION | ||

Washington, D.C. 20549 | ||

FORM 10-Q | ||

(Mark One) | ||

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the quarterly period ended June 30, 2015 | ||

OR | ||

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from | to | |

Commission File Number: 001-11307-01 | ||

Freeport-McMoRan Inc.

(Exact name of registrant as specified in its charter)

Delaware | 74-2480931 |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) |

incorporation or organization) | |

333 North Central Avenue | |

Phoenix, AZ | 85004-2189 |

(Address of principal executive offices) | (Zip Code) |

(602) 366-8100 | |

(Registrant's telephone number, including area code) | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes þ No

On July 31, 2015, there were issued and outstanding 1,040,228,261 shares of the registrant’s common stock, par value $0.10 per share.

FREEPORT-McMoRan INC.

TABLE OF CONTENTS

Page | |

2

Part I. | FINANCIAL INFORMATION |

Item 1. | Financial Statements. |

FREEPORT-McMoRan INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

June 30, 2015 | December 31, 2014 | ||||||

(In millions) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 466 | $ | 464 | |||

Trade accounts receivable | 949 | 953 | |||||

Other accounts receivable | 1,323 | 1,610 | |||||

Inventories: | |||||||

Materials and supplies, net | 2,014 | 1,886 | |||||

Mill and leach stockpiles | 1,933 | 1,914 | |||||

Product | 1,484 | 1,561 | |||||

Other current assets | 528 | 657 | |||||

Total current assets | 8,697 | 9,045 | |||||

Property, plant, equipment and mining development costs, net | 27,095 | 26,220 | |||||

Oil and gas properties, net - full cost method | |||||||

Subject to amortization, less accumulated amortization | 4,649 | 9,187 | |||||

Not subject to amortization | 9,312 | 10,087 | |||||

Long-term mill and leach stockpiles | 2,277 | 2,179 | |||||

Other assets | 1,978 | 1,956 | |||||

Total assets | $ | 54,008 | $ | 58,674 | |||

LIABILITIES AND EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable and accrued liabilities | $ | 3,376 | $ | 3,653 | |||

Current portion of debt | 791 | 478 | |||||

Current portion of environmental and asset retirement obligations | 330 | 296 | |||||

Dividends payable | 175 | 335 | |||||

Accrued income taxes | 67 | 410 | |||||

Total current liabilities | 4,739 | 5,172 | |||||

Long-term debt, less current portion | 20,111 | 18,371 | |||||

Deferred income taxes | 4,870 | 6,398 | |||||

Environmental and asset retirement obligations, less current portion | 3,716 | 3,647 | |||||

Other liabilities | 1,760 | 1,861 | |||||

Total liabilities | 35,196 | 35,449 | |||||

Redeemable noncontrolling interest | 757 | 751 | |||||

Equity: | |||||||

Stockholders’ equity: | |||||||

Common stock | 117 | 117 | |||||

Capital in excess of par value | 22,330 | 22,281 | |||||

(Accumulated deficit) retained earnings | (4,417 | ) | 128 | ||||

Accumulated other comprehensive loss | (523 | ) | (544 | ) | |||

Common stock held in treasury | (3,702 | ) | (3,695 | ) | |||

Total stockholders’ equity | 13,805 | 18,287 | |||||

Noncontrolling interests | 4,250 | 4,187 | |||||

Total equity | 18,055 | 22,474 | |||||

Total liabilities and equity | $ | 54,008 | $ | 58,674 | |||

The accompanying notes are an integral part of these consolidated financial statements.

3

FREEPORT-McMoRan INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(In millions, except per share amounts) | |||||||||||||||

Revenues | $ | 4,248 | $ | 5,522 | $ | 8,401 | $ | 10,507 | |||||||

Cost of sales: | |||||||||||||||

Production and delivery | 2,848 | 3,082 | 5,760 | 5,819 | |||||||||||

Depreciation, depletion and amortization | 890 | 1,013 | 1,829 | 1,979 | |||||||||||

Impairment of oil and gas properties | 2,686 | — | 5,790 | — | |||||||||||

Total cost of sales | 6,424 | 4,095 | 13,379 | 7,798 | |||||||||||

Selling, general and administrative expenses | 151 | 164 | 305 | 299 | |||||||||||

Mining exploration and research expenses | 36 | 34 | 69 | 64 | |||||||||||

Environmental obligations and shutdown costs | 11 | 76 | 24 | 82 | |||||||||||

Net gain on sale of assets | — | — | (39 | ) | — | ||||||||||

Total costs and expenses | 6,622 | 4,369 | 13,738 | 8,243 | |||||||||||

Operating (loss) income | (2,374 | ) | 1,153 | (5,337 | ) | 2,264 | |||||||||

Interest expense, net | (149 | ) | (164 | ) | (295 | ) | (325 | ) | |||||||

Insurance and other third-party recoveries | 92 | — | 92 | — | |||||||||||

Net gain on early extinguishment of debt | — | 5 | — | 5 | |||||||||||

Other (expense) income, net | (55 | ) | (8 | ) | (48 | ) | 25 | ||||||||

(Loss) income before income taxes and equity in affiliated companies' net earnings | (2,486 | ) | 986 | (5,588 | ) | 1,969 | |||||||||

Benefit from (provision for) income taxes | 687 | (328 | ) | 1,382 | (685 | ) | |||||||||

Equity in affiliated companies’ net earnings | — | 2 | 1 | 2 | |||||||||||

Net (loss) income | (1,799 | ) | 660 | (4,205 | ) | 1,286 | |||||||||

Net income attributable to noncontrolling interests | (42 | ) | (168 | ) | (100 | ) | (274 | ) | |||||||

Preferred dividends attributable to redeemable noncontrolling interest | (10 | ) | (10 | ) | (20 | ) | (20 | ) | |||||||

Net (loss) income attributable to common stockholders | $ | (1,851 | ) | $ | 482 | $ | (4,325 | ) | $ | 992 | |||||

Net (loss) income per share attributable to common stockholders: | |||||||||||||||

Basic | $ | (1.78 | ) | $ | 0.46 | $ | (4.16 | ) | $ | 0.95 | |||||

Diluted | $ | (1.78 | ) | $ | 0.46 | $ | (4.16 | ) | $ | 0.95 | |||||

Weighted-average common shares outstanding: | |||||||||||||||

Basic | 1,040 | 1,039 | 1,040 | 1,039 | |||||||||||

Diluted | 1,040 | 1,045 | 1,040 | 1,045 | |||||||||||

Dividends declared per share of common stock | $ | 0.1605 | $ | 0.3125 | $ | 0.2105 | $ | 0.6250 | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

FREEPORT-McMoRan INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (Unaudited)

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

(In millions) | ||||||||||||||||

Net (loss) income | $ | (1,799 | ) | $ | 660 | $ | (4,205 | ) | $ | 1,286 | ||||||

Other comprehensive income, net of taxes: | ||||||||||||||||

Defined benefit plans: | ||||||||||||||||

Amortization of unrecognized amounts included in net periodic benefit costs | 8 | 4 | 16 | 7 | ||||||||||||

Foreign exchange gains (losses) | 1 | (3 | ) | 5 | (3 | ) | ||||||||||

Other comprehensive income | 9 | 1 | 21 | 4 | ||||||||||||

Total comprehensive (loss) income | (1,790 | ) | 661 | (4,184 | ) | 1,290 | ||||||||||

Total comprehensive income attributable to noncontrolling interests | (42 | ) | (168 | ) | (100 | ) | (274 | ) | ||||||||

Preferred dividends attributable to redeemable noncontrolling interest | (10 | ) | (10 | ) | (20 | ) | (20 | ) | ||||||||

Total comprehensive (loss) income attributable to common stockholders | $ | (1,842 | ) | $ | 483 | $ | (4,304 | ) | $ | 996 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

5

FREEPORT-McMoRan INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

Six Months Ended | ||||||||

June 30, | ||||||||

2015 | 2014 | |||||||

(In millions) | ||||||||

Cash flow from operating activities: | ||||||||

Net (loss) income | $ | (4,205 | ) | $ | 1,286 | |||

Adjustments to reconcile net (loss) income to net cash provided by operating activities: | ||||||||

Depreciation, depletion and amortization | 1,829 | 1,979 | ||||||

Impairment of oil and gas properties | 5,790 | — | ||||||

Lower of cost or market inventory adjustments | 63 | — | ||||||

Net gain on sale of assets | (39 | ) | — | |||||

Net (gains) losses on crude oil and natural gas derivative contracts | (58 | ) | 120 | |||||

Net charges for environmental and asset retirement obligations, including accretion | 109 | 97 | ||||||

Payments for environmental and asset retirement obligations | (81 | ) | (96 | ) | ||||

Net gain on early extinguishment of debt | — | (5 | ) | |||||

Deferred income taxes | (1,432 | ) | 37 | |||||

Increase in long-term mill and leach stockpiles | (104 | ) | (131 | ) | ||||

Other, net | 104 | 77 | ||||||

Changes in working capital and other tax payments, excluding amounts from acquisitions and disposition: | ||||||||

Accounts receivable | 493 | (243 | ) | |||||

Inventories | 8 | (230 | ) | |||||

Other current assets | (1 | ) | 35 | |||||

Accounts payable and accrued liabilities | (205 | ) | (186 | ) | ||||

Accrued income taxes and changes in other tax payments | (485 | ) | (153 | ) | ||||

Net cash provided by operating activities | 1,786 | 2,587 | ||||||

Cash flow from investing activities: | ||||||||

Capital expenditures: | ||||||||

North America copper mines | (214 | ) | (627 | ) | ||||

South America | (902 | ) | (839 | ) | ||||

Indonesia | (438 | ) | (479 | ) | ||||

Africa | (97 | ) | (60 | ) | ||||

Molybdenum mines | (7 | ) | (33 | ) | ||||

United States oil and gas operations | (1,795 | ) | (1,484 | ) | ||||

Other | (75 | ) | (40 | ) | ||||

Acquisition of Deepwater Gulf of Mexico interests | — | (925 | ) | |||||

Net proceeds from sale of Eagle Ford shale assets | — | 3,009 | ||||||

Other, net | 136 | (363 | ) | |||||

Net cash used in investing activities | (3,392 | ) | (1,841 | ) | ||||

Cash flow from financing activities: | ||||||||

Proceeds from debt | 4,422 | 1,248 | ||||||

Repayments of debt | (2,360 | ) | (1,611 | ) | ||||

Cash dividends and distributions paid: | ||||||||

Common stock | (380 | ) | (653 | ) | ||||

Noncontrolling interests | (60 | ) | (250 | ) | ||||

Stock-based awards net (payments) proceeds, including excess tax benefit | (7 | ) | 3 | |||||

Debt financing costs and other, net | (7 | ) | (10 | ) | ||||

Net cash provided by (used in) financing activities | 1,608 | (1,273 | ) | |||||

Net increase (decrease) in cash and cash equivalents | 2 | (527 | ) | |||||

Cash and cash equivalents at beginning of year | 464 | 1,985 | ||||||

Cash and cash equivalents at end of period | $ | 466 | $ | 1,458 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

6

FREEPORT-McMoRan INC.

CONSOLIDATED STATEMENT OF EQUITY (Unaudited)

Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||

Common Stock | Retained Earnings(Accum-ulated Deficit) | Accumu- lated Other Compre- hensive Loss | Common Stock Held in Treasury | Total Stock-holders' Equity | |||||||||||||||||||||||||||||||||

Number of Shares | At Par Value | Capital in Excess of Par Value | Number of Shares | At Cost | Non- controlling Interests | Total Equity | |||||||||||||||||||||||||||||||

(In millions) | |||||||||||||||||||||||||||||||||||||

Balance at December 31, 2014 | 1,167 | $ | 117 | $ | 22,281 | $ | 128 | $ | (544 | ) | 128 | $ | (3,695 | ) | $ | 18,287 | $ | 4,187 | $ | 22,474 | |||||||||||||||||

Exercised and issued stock-based awards | 1 | — | 3 | — | — | — | — | 3 | — | 3 | |||||||||||||||||||||||||||

Stock-based compensation | — | — | 50 | — | — | — | — | 50 | 7 | 57 | |||||||||||||||||||||||||||

Reserve of tax benefit for stock-based awards | — | — | (2 | ) | — | — | — | — | (2 | ) | — | (2 | ) | ||||||||||||||||||||||||

Tender of shares for stock-based awards | — | — | — | — | — | — | (7 | ) | (7 | ) | — | (7 | ) | ||||||||||||||||||||||||

Dividends on common stock | — | — | — | (220 | ) | — | — | — | (220 | ) | — | (220 | ) | ||||||||||||||||||||||||

Dividends to noncontrolling interests | — | — | — | — | — | — | — | — | (46 | ) | (46 | ) | |||||||||||||||||||||||||

Noncontrolling interests' share of contributed capital in subsidiary | — | — | (2 | ) | — | — | — | — | (2 | ) | 2 | — | |||||||||||||||||||||||||

Net loss attributable to common stockholders | — | — | — | (4,325 | ) | — | — | — | (4,325 | ) | — | (4,325 | ) | ||||||||||||||||||||||||

Net income attributable to noncontrolling interests | — | — | — | — | — | — | — | — | 100 | 100 | |||||||||||||||||||||||||||

Other comprehensive income | — | — | — | — | 21 | — | — | 21 | — | 21 | |||||||||||||||||||||||||||

Balance at June 30, 2015 | 1,168 | $ | 117 | $ | 22,330 | $ | (4,417 | ) | $ | (523 | ) | 128 | $ | (3,702 | ) | $ | 13,805 | $ | 4,250 | $ | 18,055 | ||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

7

FREEPORT-McMoRan INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

NOTE 1. GENERAL INFORMATION

The accompanying unaudited consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all information and disclosures required by generally accepted accounting principles (GAAP) in the United States (U.S.). Therefore, this information should be read in conjunction with Freeport-McMoRan Inc.'s (FCX) consolidated financial statements and notes contained in its annual report on Form 10-K for the year ended December 31, 2014. The information furnished herein reflects all adjustments that are, in the opinion of management, necessary for a fair statement of the results for the interim periods reported. With the exception of the oil and gas properties impairment discussed below and the related tax charge to establish a deferred tax valuation allowance, all such adjustments are, in the opinion of management, of a normal recurring nature. Operating results for the quarter and six months ended June 30, 2015, are not necessarily indicative of the results that may be expected for the year ending December 31, 2015.

Oil and Gas Properties. Under the U.S. Securities and Exchange Commission's (SEC) full cost accounting rules, FCX reviews the carrying value of its oil and gas properties each quarter on a country-by-country basis. Under these rules, capitalized costs of oil and gas properties (net of accumulated depreciation, depletion, amortization and impairment, and related deferred income taxes) for each cost center may not exceed a “ceiling” equal to:

• | the present value, discounted at 10 percent, of estimated future net cash flows from the related proved oil and natural gas reserves, net of estimated future income taxes; plus |

• | the cost of the related unproved properties not being amortized; plus |

• | the lower of cost or estimated fair value of the related unproved properties included in the costs being amortized (net of related tax effects). |

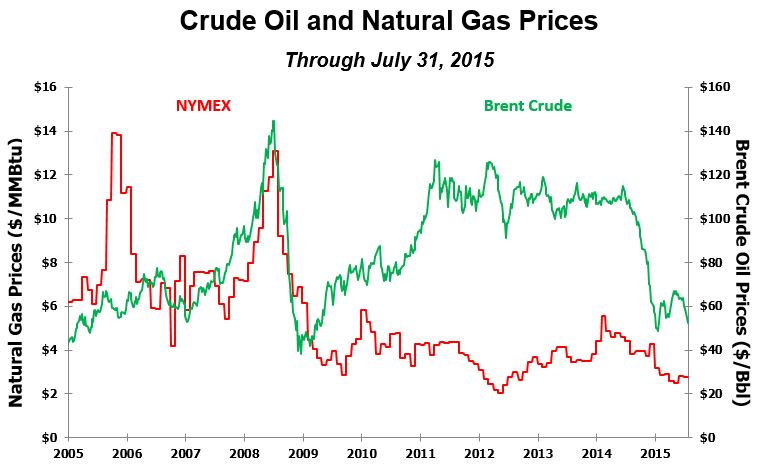

These rules require that FCX price its future oil and gas production at the twelve-month average of the first-day-of-the-month historical reference prices as adjusted for location and quality differentials. FCX's reference prices are West Texas Intermediate (WTI) for oil and the Henry Hub spot price for natural gas. Such prices are utilized except where different prices are fixed and determinable from applicable contracts for the remaining term of those contracts. The reserve estimates exclude the effect of any crude oil derivatives FCX has in place. The estimated future net cash flows also exclude future cash outflows associated with settling asset retirement obligations included in the net book value of the oil and gas properties. The rules require an impairment if the capitalized costs exceed this “ceiling.”

At June 30, 2015, and March 31, 2015, net capitalized costs with respect to FCX's proved U.S. oil and gas properties exceeded the related ceiling test limitation; therefore, impairment charges of $2.7 billion were recorded in second-quarter 2015 and $5.8 billion for the first six months of 2015, primarily because of the lower twelve-month average of the first-day-of-the-month historical reference oil price and higher capitalized costs at such dates. The SEC requires that the twelve-month average of the first-day-of-the-month historical reference oil price be used in determining the ceiling amount under its full cost accounting rules. This price (using WTI as the reference oil price) was $71.68 per barrel at June 30, 2015 (the twelve-month average was $82.72 per barrel at March 31, 2015).

NOTE 2. ACQUISITIONS AND DISPOSITIONS

Eagle Ford Disposition. On June 20, 2014, FCX completed the sale of its Eagle Ford shale assets to a subsidiary of Encana Corporation for cash consideration of $3.1 billion, before closing adjustments from the April 1, 2014, effective date. Under full cost accounting rules, the proceeds were recorded as a reduction of capitalized oil and gas properties, with no gain or loss recognition, except for $58 million of deferred tax expense recorded in connection with the allocation of $221 million of goodwill (for which deferred taxes were not previously provided) to the Eagle Ford shale assets. Approximately $1.3 billion of proceeds from this transaction was placed in a like-kind exchange escrow and was used to reinvest in additional Deepwater Gulf of Mexico (GOM) oil and gas interests, as discussed below and in Note 2 of FCX's annual report on Form 10-K for the year ended December 31, 2014. The remaining proceeds were used to repay debt.

Deepwater GOM Acquisition. On June 30, 2014, FCX completed the acquisition of interests in the Deepwater GOM from a subsidiary of Apache Corporation, including interests in the Lucius and Heidelberg oil fields and several exploration leases, for $918 million ($451 million for oil and gas properties subject to amortization and $477 million for costs not subject to amortization, including transaction costs and $10 million of asset retirement costs). The Deepwater GOM acquisition was funded by the like-kind exchange escrow.

8

NOTE 3. EARNINGS PER SHARE

FCX’s basic net (loss) income per share of common stock was computed by dividing net (loss) income attributable to common stockholders by the weighted-average shares of common stock outstanding during the period. Diluted net income per share of common stock was computed using the most dilutive of (a) the two-class method or (b) the treasury stock method. Under the two-class method, net income is allocated to each class of common stock and participating securities as if all of the earnings for the period had been distributed. FCX’s participating securities consist of vested restricted stock units (RSUs) for which the underlying common shares are not yet issued and entitle holders to non-forfeitable dividends.

A reconciliation of net (loss) income and weighted-average shares of common stock outstanding for purposes of calculating basic and diluted net (loss) income per share follows (in millions, except per share amounts):

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

Net (loss) income | $ | (1,799 | ) | $ | 660 | $ | (4,205 | ) | $ | 1,286 | ||||||

Net income attributable to noncontrolling interests | (42 | ) | (168 | ) | (100 | ) | (274 | ) | ||||||||

Preferred dividends on redeemable noncontrolling interest | (10 | ) | (10 | ) | (20 | ) | (20 | ) | ||||||||

Undistributed earnings allocable to participating securities | (3 | ) | (2 | ) | (3 | ) | (3 | ) | ||||||||

Net (loss) income allocable to common stockholders | $ | (1,854 | ) | $ | 480 | $ | (4,328 | ) | $ | 989 | ||||||

Basic weighted-average shares of common stock outstanding | 1,040 | 1,039 | 1,040 | 1,039 | ||||||||||||

Add shares issuable upon exercise or vesting of dilutive stock options and RSUs | — | a | 6 | a | — | a | 6 | a | ||||||||

Diluted weighted-average shares of common stock outstanding | 1,040 | 1,045 | 1,040 | 1,045 | ||||||||||||

Basic net (loss) income per share attributable to common stockholders | $ | (1.78 | ) | $ | 0.46 | $ | (4.16 | ) | $ | 0.95 | ||||||

Diluted net (loss) income per share attributable to common stockholders | $ | (1.78 | ) | $ | 0.46 | $ | (4.16 | ) | $ | 0.95 | ||||||

a. | Excludes approximately four million shares of common stock for both the quarter and six months ended June 30, 2015, and three million shares of common stock for both the quarter and six months ended June 30, 2014, associated with outstanding stock options with exercise prices less than the average market price of FCX's common stock and RSUs that were anti-dilutive. |

Outstanding stock options with exercise prices greater than the average market price of FCX’s common stock during the period are excluded from the computation of diluted net income per share of common stock. Excluded stock options totaled 40 million for both the quarter and six months ended June 30, 2015, and 30 million for both the quarter and six months ended June 30, 2014.

9

NOTE 4. INVENTORIES, INCLUDING LONG-TERM MILL AND LEACH STOCKPILES

The components of inventories follow (in millions):

June 30, 2015 | December 31, 2014 | |||||||

Current inventories: | ||||||||

Mill stockpiles | $ | 130 | $ | 86 | ||||

Leach stockpiles | 1,803 | 1,828 | ||||||

Total current mill and leach stockpiles | $ | 1,933 | $ | 1,914 | ||||

Total materials and supplies, neta | $ | 2,014 | $ | 1,886 | ||||

Raw materials (primarily concentrates) | $ | 306 | $ | 288 | ||||

Work-in-process | 155 | 174 | ||||||

Finished goods | 1,023 | 1,099 | ||||||

Total product inventories | $ | 1,484 | $ | 1,561 | ||||

Long-term inventories: | ||||||||

Mill stockpiles | $ | 361 | $ | 360 | ||||

Leach stockpiles | 1,916 | 1,819 | ||||||

Total long-term mill and leach stockpilesb | $ | 2,277 | $ | 2,179 | ||||

a. | Materials and supplies inventory was net of obsolescence reserves totaling $25 million at June 30, 2015, and $20 million at December 31, 2014. |

b. | Estimated metals in stockpiles not expected to be recovered within the next 12 months. |

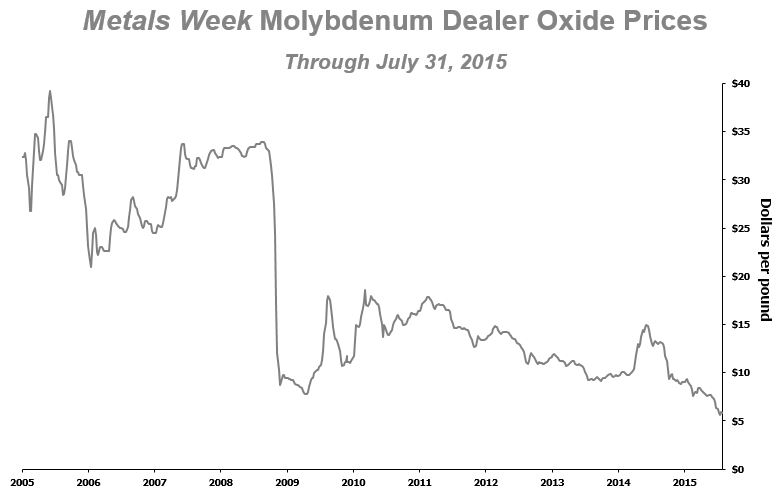

FCX recorded charges for lower of cost or market (LCM) inventory adjustments of $59 million ($48 million for molybdenum inventories and $11 million for copper inventories) for second-quarter 2015 and $63 million ($52 million for molybdenum inventories and $11 million for copper inventories) for the first six months of 2015, primarily because of lower molybdenum and copper prices.

NOTE 5. INCOME TAXES

Variations in the relative proportions of jurisdictional income result in fluctuations to FCX's consolidated effective income tax rate. FCX’s consolidated effective income tax rate was 25 percent for the first six months of 2015 and 35 percent for the first six months of 2014. Geographic sources of FCX's (benefit from) provision for income taxes follow (in millions):

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

U.S. operations | $ | (829 | ) | a | $ | 149 | b | $ | (1,664 | ) | a | $ | 285 | b | ||

International operations | 142 | 179 | 282 | 400 | ||||||||||||

Total | $ | (687 | ) | $ | 328 | $ | (1,382 | ) | $ | 685 | ||||||

a. | As a result of the impairment to oil and gas properties, FCX recorded tax charges of $305 million for second-quarter 2015 and $763 million for the first six months of 2015 to establish a valuation allowance primarily against U.S. federal alternative minimum tax credits. Excluding this charge, FCX's consolidated effective income tax rate was 38 percent for the first six months of 2015. |

b. | FCX recognized a $58 million charge for deferred taxes recorded in connection with the allocation of goodwill to the sale of Eagle Ford shale assets. |

10

NOTE 6. DEBT AND EQUITY TRANSACTIONS

Debt Transactions. At June 30, 2015, FCX had $20.9 billion in debt, which included additions for unamortized fair value adjustments of $225 million (primarily from the oil and gas acquisitions in 2013), and is net of reductions attributable to unamortized net discounts of $21 million and unamortized debt issuance costs of $116 million. Refer to Note 12 for discussion of a change in the presentation of debt issuance costs.

In February 2015, FCX's unsecured revolving credit facility and $4.0 billion bank term loan (Term Loan) were modified to amend the maximum total leverage ratio. In addition, the Term Loan amortization schedule was extended such that, as amended, the Term Loan’s scheduled payments total $205 million in 2016, $272 million in 2017, $1.0 billion in 2018, $313 million in 2019 and $1.3 billion in 2020, compared with the previous amortization schedule of $650 million in 2016, $200 million in 2017 and $2.2 billion in 2018.

At June 30, 2015, $985 million was outstanding and $42 million of letters of credit were issued under FCX's revolving credit facility, resulting in availability of approximately $3.0 billion, of which approximately $1.5 billion could be used for additional letters of credit.

At June 30, 2015, $1.3 billion was outstanding and no letters of credit were issued under Sociedad Minera Cerro Verde S.A.A.'s (Cerro Verde, FCX's mining subsidiary in Peru) credit facility, resulting in availability of $531 million. Cerro Verde's five-year, $1.8 billion senior unsecured credit facility is nonrecourse to FCX and the other shareholders of Cerro Verde.

In April 2014, FCX redeemed $210 million of the aggregate principal amount of FCX Oil & Gas Inc.'s (FM O&G, FCX's oil and gas subsidiary) outstanding 6.625% Senior Notes due 2021. In accordance with the terms of the senior notes, the redemption was funded with cash contributions to FM O&G by FCX in exchange for additional equity, which is eliminated in the consolidated financial statements. Holders of these senior notes received the principal amount together with the redemption premium and accrued and unpaid interest to the redemption date. As a result of the redemption, FCX recorded a gain on early extinguishment of debt of $6 million in second-quarter 2014.

Consolidated interest expense (excluding capitalized interest) totaled $215 million in second-quarter 2015, $225 million in second-quarter 2014, $425 million for the first six months of 2015 and $449 million for the first six months of 2014. Capitalized interest added to property, plant, equipment and mining development costs, net, totaled $47 million in second-quarter 2015, $39 million in second-quarter 2014, $92 million for the first six months of 2015 and $79 million for the first six months of 2014. Capitalized interest added to oil and gas properties not subject to amortization totaled $19 million in second-quarter 2015, $22 million in second-quarter 2014, $38 million for the first six months of 2015 and $45 million for the first six months of 2014.

Equity Transactions. On June 24, 2015, FCX's Board of Directors (the Board) declared a dividend of $0.1605 per share, which was paid on August 3, 2015, to common shareholders of record at the close of business on July 15, 2015. This common stock dividend consisted of $0.05 per share for FCX's regular quarterly dividend and $0.1105 per share as a one-time special dividend related to the settlement of the shareholder derivative litigation (refer to Note 9 for further discussion).

11

NOTE 7. FINANCIAL INSTRUMENTS

FCX does not purchase, hold or sell derivative financial instruments unless there is an existing asset or obligation, or it anticipates a future activity that is likely to occur and will result in exposure to market risks, which FCX intends to offset or mitigate. FCX does not enter into any derivative financial instruments for speculative purposes, but has entered into derivative financial instruments in limited instances to achieve specific objectives. These objectives principally relate to managing risks associated with commodity price changes, foreign currency exchange rates and interest rates.

Commodity Contracts. From time to time, FCX has entered into derivative contracts to hedge the market risk associated with fluctuations in the prices of commodities it purchases and sells. As a result of the acquisition of the oil and gas business in 2013, FCX assumed a variety of crude oil and natural gas commodity derivatives to hedge the exposure to the volatility of crude oil and natural gas commodity prices. Derivative financial instruments used by FCX to manage its risks do not contain credit risk-related contingent provisions. As of June 30, 2015, and December 31, 2014, FCX had no price protection contracts relating to its mine production. A discussion of FCX’s derivative contracts and programs follows.

Derivatives Designated as Hedging Instruments – Fair Value Hedges

Copper Futures and Swap Contracts. Some of FCX’s U.S. copper rod customers request a fixed market price instead of the Commodity Exchange Inc. (COMEX), a division of the New York Mercantile Exchange, average copper price in the month of shipment. FCX hedges this price exposure in a manner that allows it to receive the COMEX average price in the month of shipment while the customers pay the fixed price they requested. FCX accomplishes this by entering into copper futures or swap contracts. Hedging gains or losses from these copper futures and swap contracts are recorded in revenues. FCX did not have any significant gains or losses during the three-month or six-month periods ended June 30, 2015 and 2014, resulting from hedge ineffectiveness. At June 30, 2015, FCX held copper futures and swap contracts that qualified for hedge accounting for 51 million pounds at an average contract price of $2.71 per pound, with maturities through May 2017.

A summary of gains (losses) recognized in revenues for derivative financial instruments related to commodity contracts that are designated and qualify as fair value hedge transactions, along with the unrealized gains (losses) on the related hedged item follows (in millions):

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Copper futures and swap contracts: | |||||||||||||||

Unrealized gains (losses): | |||||||||||||||

Derivative financial instruments | $ | (4 | ) | $ | 12 | $ | 2 | $ | — | ||||||

Hedged item – firm sales commitments | 4 | (12 | ) | (2 | ) | — | |||||||||

Realized (losses) gains: | |||||||||||||||

Matured derivative financial instruments | (1 | ) | (2 | ) | (11 | ) | (4 | ) | |||||||

Derivatives Not Designated as Hedging Instruments

Embedded Derivatives. As described in Note 1 to FCX's annual report on Form 10-K for the year ended December 31, 2014, under “Revenue Recognition,” certain FCX copper concentrate, copper cathode and gold sales contracts provide for provisional pricing primarily based on the London Metal Exchange (LME) copper price or the COMEX copper price and the London Bullion Market Association (London) gold price at the time of shipment as specified in the contract. Similarly, FCX purchases copper under contracts that provide for provisional pricing. FCX applies the normal purchases and normal sales scope exception in accordance with derivatives and hedge accounting guidance to the host sales agreements since the contracts do not allow for net settlement and always result in physical delivery. Sales and purchases with a provisional sales price contain an embedded derivative (i.e., the price settlement mechanism is settled after the time of delivery) that is required to be bifurcated from the host contract. The host contract is the sale or purchase of the metals contained in the concentrates or cathodes at the then-current LME or COMEX copper price or the London gold price as defined in the contract. Mark-to-market price fluctuations from these embedded derivatives are recorded through the settlement date and are reflected in revenues for sales contracts and in cost of sales as production and delivery costs for purchase contracts.

12

A summary of FCX’s embedded commodity derivatives at June 30, 2015, follows:

Open Positions | Average Price Per Unit | Maturities Through | ||||||||||

Contract | Market | |||||||||||

Embedded derivatives in provisional sales contracts: | ||||||||||||

Copper (millions of pounds) | 572 | $ | 2.68 | $ | 2.58 | November 2015 | ||||||

Gold (thousands of ounces) | 229 | 1,189 | 1,174 | September 2015 | ||||||||

Embedded derivatives in provisional purchase contracts: | ||||||||||||

Copper (millions of pounds) | 134 | 2.75 | 2.61 | October 2015 | ||||||||

Crude Oil Contracts. As a result of the acquisition of the oil and gas business, FCX has derivative contracts extending through 2015 that consist of crude oil options. These crude oil derivatives are not designated as hedging instruments and are recorded at fair value with the mark-to-market gains and losses recorded in revenues.

The crude oil options were entered into by the oil and gas business to protect the realized price of a portion of expected future sales in order to limit the effects of crude oil price decreases. At June 30, 2015, these contracts are composed of crude oil put spreads consisting of put options with a floor limit. The premiums associated with put options are deferred until the settlement period. At June 30, 2015, the deferred option premiums and accrued interest associated with the crude oil option contracts totaled $106 million, which was included as a component of the fair value of the crude oil options contracts. At June 30, 2015, the outstanding 2015 crude oil option contracts, which settle monthly and cover approximately 15.5 million barrels over the remainder of 2015, follow:

Daily Volumes (thousand barrels) | Average Strike Price (per barrel)a | Weighted-Average Deferred Premium (per barrel) | |||||||||||||||||

2015 Period | Instrument Type | Floor | Floor Limit | Index | |||||||||||||||

July - December | Put optionsb | 84 | $ | 90 | $ | 70 | $ | 6.89 | Brent | ||||||||||

a. | The average strike prices do not reflect any premiums to purchase the put options. |

b. | If the index price is less than the per barrel floor, FCX receives the difference between the per barrel floor and the index price up to a maximum of $20 per barrel less the option premium. If the index price is at or above the per barrel floor, FCX pays the option premium and no cash settlement is received. |

Copper Forward Contracts. Atlantic Copper, FCX's wholly owned smelting and refining unit in Spain, enters into copper forward contracts designed to hedge its copper price risk whenever its physical purchases and sales pricing periods do not match. These economic hedge transactions are intended to hedge against changes in copper prices, with the mark-to-market hedging gains or losses recorded in cost of sales. At June 30, 2015, Atlantic Copper held net copper forward purchase contracts for 31 million pounds at an average contract price of $2.65 per pound, with maturities through August 2015.

13

Summary of (Losses) Gains. A summary of the realized and unrealized (losses) gains recognized in (loss) income before income taxes and equity in affiliated companies’ net earnings for commodity contracts that do not qualify as hedge transactions, including embedded derivatives, follows (in millions):

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Embedded derivatives in provisional copper and gold | |||||||||||||||

sales contractsa | $ | (78 | ) | $ | 84 | $ | (150 | ) | $ | (85 | ) | ||||

Crude oil optionsa | 6 | (68 | ) | 58 | (104 | ) | |||||||||

Natural gas swapsa | — | (2 | ) | — | (16 | ) | |||||||||

Copper forward contractsb | (6 | ) | 4 | (7 | ) | 5 | |||||||||

a. | Amounts recorded in revenues. |

b. | Amounts recorded in cost of sales as production and delivery costs. |

Unsettled Derivative Financial Instruments

A summary of the fair values of unsettled commodity derivative financial instruments follows (in millions):

June 30, 2015 | December 31, 2014 | |||||||

Commodity Derivative Assets: | ||||||||

Derivatives not designated as hedging instruments: | ||||||||

Embedded derivatives in provisional copper and gold | ||||||||

sales/purchase contracts | $ | 21 | $ | 15 | ||||

Crude oil optionsa | 174 | 316 | ||||||

Total derivative assets | $ | 195 | $ | 331 | ||||

Commodity Derivative Liabilities: | ||||||||

Derivatives designated as hedging instruments: | ||||||||

Copper futures and swap contractsb | $ | 5 | $ | 7 | ||||

Derivatives not designated as hedging instruments: | ||||||||

Embedded derivatives in provisional copper and gold | ||||||||

sales/purchase contracts | 65 | 93 | ||||||

Copper forward contracts | 1 | — | ||||||

Total derivative liabilities | $ | 71 | $ | 100 | ||||

a. | Amounts are net of $106 million at June 30, 2015, and $210 million at December 31, 2014, for deferred premiums and accrued interest. |

b. | FCX paid $9 million to brokers at June 30, 2015, and $10 million at December 31, 2014, for margin requirements (recorded in other current assets). |

14

FCX's commodity contracts have netting arrangements with counterparties with which the right of offset exists, and it is FCX's policy to offset balances by counterparty on the balance sheet. FCX's embedded derivatives on provisional sales/purchases are netted with the corresponding outstanding receivable/payable balances. A summary of these unsettled commodity contracts that are offset in the balance sheet follows (in millions):

Assets | Liabilities | |||||||||||||||

June 30, 2015 | December 31, 2014 | June 30, 2015 | December 31, 2014 | |||||||||||||

Gross amounts recognized: | ||||||||||||||||

Commodity contracts: | ||||||||||||||||

Embedded derivatives in provisional | ||||||||||||||||

sales/purchase contracts | $ | 21 | $ | 15 | $ | 65 | $ | 93 | ||||||||

Crude oil derivatives | 174 | 316 | — | — | ||||||||||||

Copper derivatives | — | — | 6 | 7 | ||||||||||||

195 | 331 | 71 | 100 | |||||||||||||

Less gross amounts of offset: | ||||||||||||||||

Commodity contracts: | ||||||||||||||||

Embedded derivatives in provisional | ||||||||||||||||

sales/purchase contracts | 1 | 1 | 1 | 1 | ||||||||||||

Copper derivatives | — | — | — | — | ||||||||||||

1 | 1 | 1 | 1 | |||||||||||||

Net amounts presented in balance sheet: | ||||||||||||||||

Commodity contracts: | ||||||||||||||||

Embedded derivatives in provisional | ||||||||||||||||

sales/purchase contracts | 20 | 14 | 64 | 92 | ||||||||||||

Crude oil derivatives | 174 | 316 | — | — | ||||||||||||

Copper derivatives | — | — | 6 | 7 | ||||||||||||

$ | 194 | $ | 330 | $ | 70 | $ | 99 | |||||||||

Balance sheet classification: | ||||||||||||||||

Trade accounts receivable | $ | 3 | $ | 5 | $ | 53 | $ | 56 | ||||||||

Other current assets | 174 | 316 | — | — | ||||||||||||

Accounts payable and accrued liabilities | 17 | 9 | 17 | 43 | ||||||||||||

$ | 194 | $ | 330 | $ | 70 | $ | 99 | |||||||||

Credit Risk. FCX is exposed to credit loss when financial institutions with which FCX has entered into derivative transactions (commodity, foreign exchange and interest rate swaps) are unable to pay. To minimize the risk of such losses, FCX uses counterparties that meet certain credit requirements and periodically reviews the creditworthiness of these counterparties. FCX does not anticipate that any of the counterparties it deals with will default on their obligations. As of June 30, 2015, the maximum amount of credit exposure associated with derivative transactions was $226 million.

Other Financial Instruments. Other financial instruments include cash and cash equivalents, accounts receivable, restricted cash, investment securities, legally restricted funds, accounts payable and accrued liabilities, dividends payable and long-term debt. The carrying value for cash and cash equivalents (which included time deposits of $27 million at June 30, 2015, and $48 million at December 31, 2014), accounts receivable, restricted cash, accounts payable and accrued liabilities, and dividends payable approximates fair value because of their short-term nature and generally negligible credit losses (refer to Note 8 for the fair values of investment securities, legally restricted funds and long-term debt).

15

NOTE 8. FAIR VALUE MEASUREMENT

Fair value accounting guidance includes a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 inputs) and the lowest priority to unobservable inputs (Level 3 inputs).

FCX recognizes transfers between levels at the end of the reporting period. FCX did not have any significant transfers in or out of Level 1, 2 or 3 for second-quarter 2015. A summary of the carrying amount and fair value of FCX’s financial instruments, other than cash and cash equivalents, accounts receivable, restricted cash, accounts payable and accrued liabilities, and dividends payable (refer to Note 7), follows (in millions):

At June 30, 2015 | |||||||||||||||||||

Carrying | Fair Value | ||||||||||||||||||

Amount | Total | Level 1 | Level 2 | Level 3 | |||||||||||||||

Assets | |||||||||||||||||||

Investment securities:a,b | |||||||||||||||||||

U.S. core fixed income fund | $ | 23 | $ | 23 | $ | — | $ | 23 | $ | — | |||||||||

Money market funds | 22 | 22 | 22 | — | — | ||||||||||||||

Equity securities | 3 | 3 | 3 | — | — | ||||||||||||||

Total | 48 | 48 | 25 | 23 | — | ||||||||||||||

Legally restricted funds:a,b,c,d | |||||||||||||||||||

U.S. core fixed income fund | 51 | 51 | — | 51 | — | ||||||||||||||

Government bonds and notes | 35 | 35 | — | 35 | — | ||||||||||||||

Corporate bonds | 28 | 28 | — | 28 | — | ||||||||||||||

Government mortgage-backed securities | 24 | 24 | — | 24 | — | ||||||||||||||

Asset-backed securities | 14 | 14 | — | 14 | — | ||||||||||||||

Money market funds | 9 | 9 | 9 | — | — | ||||||||||||||

Collateralized mortgage-backed securities | 8 | 8 | — | 8 | — | ||||||||||||||

Municipal bonds | 1 | 1 | — | 1 | — | ||||||||||||||

Total | 170 | 170 | 9 | 161 | — | ||||||||||||||

Derivatives:a,e | |||||||||||||||||||

Embedded derivatives in provisional sales/purchase | |||||||||||||||||||

contracts in a gross asset position | 21 | 21 | — | 21 | — | ||||||||||||||

Crude oil options | 174 | 174 | — | — | 174 | ||||||||||||||

Total | 195 | 195 | — | 21 | 174 | ||||||||||||||

Total assets | $ | 413 | $ | 34 | $ | 205 | $ | 174 | |||||||||||

Liabilities | |||||||||||||||||||

Derivatives:a,e | |||||||||||||||||||

Embedded derivatives in provisional sales/purchase | |||||||||||||||||||

contracts in a gross liability position | $ | 65 | $ | 65 | $ | — | $ | 65 | $ | — | |||||||||

Copper futures and swap contracts | 5 | 5 | 5 | — | — | ||||||||||||||

Copper forward contracts | 1 | 1 | — | 1 | — | ||||||||||||||

Total | 71 | 71 | 5 | 66 | — | ||||||||||||||

Long-term debt, including current portionf | 20,902 | 20,191 | — | 20,191 | — | ||||||||||||||

Total liabilities | $ | 20,262 | $ | 5 | $ | 20,257 | $ | — | |||||||||||

16

At December 31, 2014 | |||||||||||||||||||

Carrying | Fair Value | ||||||||||||||||||

Amount | Total | Level 1 | Level 2 | Level 3 | |||||||||||||||

Assets | |||||||||||||||||||

Investment securities:a,b | |||||||||||||||||||

U.S. core fixed income fund | $ | 23 | $ | 23 | $ | — | $ | 23 | $ | — | |||||||||

Money market funds | 20 | 20 | 20 | — | — | ||||||||||||||

Equity securities | 3 | 3 | 3 | — | — | ||||||||||||||

Total | 46 | 46 | 23 | 23 | — | ||||||||||||||

Legally restricted funds:a,b,c,d | |||||||||||||||||||

U.S. core fixed income fund | 52 | 52 | — | 52 | — | ||||||||||||||

Government bonds and notes | 39 | 39 | — | 39 | — | ||||||||||||||

Corporate bonds | 27 | 27 | — | 27 | — | ||||||||||||||

Government mortgage-backed securities | 19 | 19 | — | 19 | — | ||||||||||||||

Asset-backed securities | 17 | 17 | — | 17 | — | ||||||||||||||

Money market funds | 11 | 11 | 11 | — | — | ||||||||||||||

Collateralized mortgage-backed securities | 6 | 6 | — | 6 | — | ||||||||||||||

Municipal bonds | 1 | 1 | — | 1 | — | ||||||||||||||

Total | 172 | 172 | 11 | 161 | — | ||||||||||||||

Derivatives:a,e | |||||||||||||||||||

Embedded derivatives in provisional sales/purchase | |||||||||||||||||||

contracts in a gross asset position | 15 | 15 | — | 15 | — | ||||||||||||||

Crude oil options | 316 | 316 | — | — | 316 | ||||||||||||||

Total | 331 | 331 | — | 15 | 316 | ||||||||||||||

Total assets | $ | 549 | $ | 34 | $ | 199 | $ | 316 | |||||||||||

Liabilities | |||||||||||||||||||

Derivatives:a,e | |||||||||||||||||||

Embedded derivatives in provisional sales/purchase | |||||||||||||||||||

contracts in a gross liability position | $ | 93 | $ | 93 | $ | — | $ | 93 | $ | — | |||||||||

Copper futures and swap contracts | 7 | 7 | 6 | 1 | — | ||||||||||||||

Total | 100 | 100 | 6 | 94 | — | ||||||||||||||

Long-term debt, including current portionf | 18,849 | 18,735 | — | 18,735 | — | ||||||||||||||

Total liabilities | $ | 18,835 | $ | 6 | $ | 18,829 | $ | — | |||||||||||

a. | Recorded at fair value. |

b. | Current portion included in other current assets and long-term portion included in other assets. |

c. | Excludes time deposits (which approximated fair value) included in other assets of $117 million at June 30, 2015, and $115 million at December 31, 2014, associated with an assurance bond to support PT Freeport Indonesia's (PT-FI) commitment for smelter development in Indonesia. |

d. | Excludes time deposits (which approximated fair value) included in other current assets of $10 million at June 30, 2015, and $8 million at December 31, 2014, associated with a reclamation guarantee at PT-FI. Also, excludes a time deposit of $9 million at December 31, 2014, associated with a customs audit assessment. |

e. | Refer to Note 7 for further discussion and balance sheet classifications. Crude oil options are net of $106 million at June 30, 2015, and $210 million at December 31, 2014, for deferred premiums and accrued interest. |

f. | Recorded at cost except for debt assumed in acquisitions, which were recorded at fair value at the respective acquisition dates. |

17

Valuation Techniques

Money market funds are classified within Level 1 of the fair value hierarchy because they are valued using quoted market prices in active markets.

The U.S. core fixed income fund is valued at net asset value. The fund strategy seeks total return consisting of income and capital appreciation primarily by investing in a broad range of investment-grade debt securities, including U.S. government obligations, corporate bonds, mortgage-backed securities, asset-backed securities and money market instruments. There are no restrictions on redemptions (usually within one business day of notice) and, as such, this fund is classified within Level 2 of the fair value hierarchy.

Fixed income securities (government securities, corporate bonds, asset-backed securities, collateralized mortgage-backed securities and municipal bonds) are valued using a bid evaluation price or a mid-evaluation price. A bid evaluation price is an estimated price at which a dealer would pay for a security. A mid-evaluation price is the average of the estimated price at which a dealer would sell a security and the estimated price at which a dealer would pay for a security. These evaluations are based on quoted prices, if available, or models that use observable inputs and, as such, are classified within Level 2 of the fair value hierarchy.

Equity securities are valued at the closing price reported on the active market on which the individual securities are traded and, as such, are classified within Level 1 of the fair value hierarchy.

FCX’s embedded derivatives on provisional copper concentrate, copper cathode and gold purchases and sales are valued using quoted monthly LME or COMEX copper forward prices and the London gold forward price at each reporting date based on the month of maturity (refer to Note 7 for further discussion); however, FCX's contracts themselves are not traded on an exchange. As a result, these derivatives are classified within Level 2 of the fair value hierarchy.

FCX's derivative financial instruments for crude oil options are valued using an option pricing model, which uses various inputs including Intercontinental Exchange Holdings, Inc. crude oil prices, volatilities, interest rates and contract terms. Valuations are adjusted for credit quality, using the counterparties' credit quality for asset balances and FCX's credit quality for liability balances (which considers the impact of netting agreements on counterparty credit risk, including whether the position with the counterparty is a net asset or net liability). For asset balances, FCX uses the credit default swap value for counterparties when available or the spread between the risk-free interest rate and the yield rate on the counterparties' publicly traded debt for similar instruments. The crude oil options are classified within Level 3 of the fair value hierarchy because the inputs used in the valuation models are not observable for the full term of the instruments. The significant unobservable inputs used in the fair value measurement of the crude oil options are implied volatilities and deferred premiums. Significant increases (decreases) in implied volatilities in isolation would result in a significantly higher (lower) fair value measurement. The implied volatilities ranged from 28 percent to 41 percent, with a weighted average of 32 percent. The weighted-average cost of deferred premiums totals $6.89 per barrel at June 30, 2015. Refer to Note 7 for further discussion of these derivative financial instruments.

FCX’s derivative financial instruments for copper futures and swap contracts and copper forward contracts that are traded on the respective exchanges are classified within Level 1 of the fair value hierarchy because they are valued using quoted monthly COMEX or LME prices at each reporting date based on the month of maturity (refer to Note 7 for further discussion). Certain of these contracts are traded on the over-the-counter market and are classified within Level 2 of the fair value hierarchy based on COMEX and LME forward prices.

Long-term debt, including the current portion, is not actively traded and is valued using prices obtained from a readily available pricing source and, as such, is classified within Level 2 of the fair value hierarchy.

The techniques described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while FCX believes its valuation techniques are appropriate and consistent with other market participants, the use of different techniques or assumptions to determine fair value of certain financial instruments could result in a different fair value measurement at the reporting date. There have been no changes in the techniques used at June 30, 2015.

18

A summary of the changes in the fair value of FCX's most significant Level 3 instruments, crude oil options, follows (in millions):

Crude Oil | ||||

Options | ||||

Fair value at December 31, 2014 | $ | 316 | ||

Net realized gains | 21 | |||

Net unrealized gains included in earnings related to assets and liabilities still held at the end of the period | 36 | a | ||

Net settlement receipts | (199 | ) | b | |

Fair value at June 30, 2015 | $ | 174 | ||

a. | Includes net unrealized gains of $37 million, partially offset by $1 million of interest expense associated with the deferred premiums. |

b. | Includes interest payments of $2 million. |

NOTE 9. CONTINGENCIES AND COMMITMENTS

Litigation. The following information includes a discussion of updates to previously reported legal proceedings included in Note 12 of FCX's annual report on Form 10-K for the year ended December 31, 2014, as updated in Note 8 of FCX's quarterly report on Form 10-Q for the quarterly period ended March 31, 2015.

Shareholder Litigation. On April 7, 2015, the Delaware Court of Chancery approved the settlement of FCX’s consolidated stockholder derivative litigation captioned In Re Freeport-McMoRan Copper & Gold Inc. Derivative Litigation, No. 8145-VCN, and awarded the plaintiffs legal fees and expenses. This settlement resolved all pending derivative claims against directors and officers of FCX challenging FCX's 2013 acquisitions of Plains Exploration & Production Company and McMoRan Exploration Co. During first-quarter 2015, insurers under FCX’s directors and officers liability insurance policies and other third parties funded an escrow account with the $125 million settlement amount, from which the proceeds, net of plaintiffs’ legal fees and expenses totaling $33 million, were released to FCX in May 2015. Upon the release of funds, FCX recognized a gain of $92 million in second-quarter 2015. As a result and in accordance with the approved settlement terms, FCX's Board declared a special dividend that was paid on August 3, 2015, together with the regular quarterly dividend paid on the same day (refer to Note 6 for further discussion).

Tax and Other Matters. There were no significant changes to the Cerro Verde royalty dispute or other Peruvian tax matters during the second quarter of 2015 (refer to Note 12 of FCX’s annual report on Form 10-K for the year ended December 31, 2014, for further discussion of these matters).

Indonesia Tax Matters. The following information includes a discussion of updates to previously reported Indonesia tax matters included in Note 12 of FCX’s annual report on Form 10-K for the year ended December 31, 2014, as updated in Note 8 of FCX's quarterly report on Form 10-Q for the quarterly period ended March 31, 2015.

PT-FI received assessments from the local regional tax authority in Papua, Indonesia, for additional taxes and penalties related to water rights tax payments for the period from January 2011 through June 2015. PT-FI has filed or will file objections to these assessments. In March 2015, the local government of Papua rejected PT-FI’s objections to the assessments related to the period from January 2011 through December 2014, and in April 2015, PT-FI filed appeals with the Indonesian tax court. The aggregate amount of all assessments received through August 3, 2015, including penalties, was 2.5 trillion Indonesian rupiah ($190 million based on exchange rates at June 30, 2015). Additional penalties, which could be significant, may be assessed depending on the outcome of the appeals process. No amounts have been accrued for these assessments as of June 30, 2015, because PT-FI believes its Contract of Work (COW) exempts it from these payments and that it has the right to contest these assessments in the tax court and ultimately the Indonesian Supreme Court.

19

NOTE 10. BUSINESS SEGMENTS

FCX has organized its mining operations into five primary divisions – North America copper mines, South America mining, Indonesia mining, Africa mining and Molybdenum mines. Notwithstanding this structure, FCX internally reports information on a mine-by-mine basis for its mining operations. Therefore, FCX concluded that its operating segments include individual mines or operations relative to its mining operations. For oil and gas operations, FCX determines its operating segments on a country-by-country basis. Operating segments that meet certain thresholds are reportable segments, which are separately disclosed in the following table.

Intersegment Sales. Intersegment sales between FCX’s mining operations are based on similar arms-length transactions with third parties at the time of the sale. Intersegment sales may not be reflective of the actual prices ultimately realized because of a variety of factors, including additional processing, timing of sales to unaffiliated customers and transportation premiums.

FCX defers recognizing profits on sales from its mines to other divisions, including Atlantic Copper (FCX's wholly owned smelter and refinery in Spain) and on 25 percent of PT-FI's sales to PT Smelting (FCX's 25 percent-owned smelter and refinery in Indonesia), until final sales to third parties occur. Quarterly variations in ore grades, the timing of intercompany shipments and changes in product prices result in variability in FCX's net deferred profits and quarterly earnings.

Allocations. FCX allocates certain operating costs, expenses and capital expenditures to its operating divisions and individual segments. However, not all costs and expenses applicable to an operation are allocated. U.S. federal and state income taxes are recorded and managed at the corporate level (included in corporate, other & eliminations), whereas foreign income taxes are recorded and managed at the applicable country level. In addition, most mining exploration and research activities are managed on a consolidated basis, and those costs along with some selling, general and administrative costs are not allocated to the operating divisions or individual segments. Accordingly, the following segment information reflects management determinations that may not be indicative of what the actual financial performance of each operating division or segment would be if it was an independent entity.

20

Financial Information by Business Segments

(In millions) | Mining Operations | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

North America Copper Mines | South America | Indonesia | Africa | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Atlantic | Other | Corporate, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Molyb- | Copper | Mining | U.S. | Other | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other | Cerro | Other | denum | Rod & | Smelting | & Elimi- | Total | Oil & Gas | & Elimi- | FCX | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Morenci | Mines | Total | Verde | Minesa | Total | Grasberg | Tenke | Mines | Refining | & Refining | nations | Mining | Operationsb | nations | Total | ||||||||||||||||||||||||||||||||||||||||||||||||

Three Months Ended June 30, 2015 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unaffiliated customers | $ | 180 | $ | 92 | $ | 272 | $ | 195 | $ | 221 | $ | 416 | $ | 792 | c | $ | 310 | $ | — | $ | 1,089 | $ | 495 | $ | 305 | d | $ | 3,679 | $ | 569 | e | $ | — | $ | 4,248 | ||||||||||||||||||||||||||||

Intersegment | 427 | 706 | 1,133 | 37 | — | 37 | (2 | ) | f | 41 | 102 | 8 | 5 | (1,324 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

Production and delivery | 386 | 576 | g | 962 | 165 | 150 | 315 | 455 | 190 | 84 | g | 1,088 | 468 | (997 | ) | g | 2,565 | 281 | 2 | 2,848 | |||||||||||||||||||||||||||||||||||||||||||

Depreciation, depletion and amortization | 55 | 84 | 139 | 40 | 32 | 72 | 78 | 57 | 25 | 3 | 9 | 19 | 402 | 485 | 3 | 890 | |||||||||||||||||||||||||||||||||||||||||||||||

Impairment of oil and gas properties | — | — | — | — | — | — | — | — | — | — | — | — | — | 2,686 | — | 2,686 | |||||||||||||||||||||||||||||||||||||||||||||||

Selling, general and administrative expenses | — | 2 | 2 | — | 1 | 1 | 25 | 3 | — | — | 4 | 5 | 40 | 49 | 62 | 151 | |||||||||||||||||||||||||||||||||||||||||||||||

Mining exploration and research expenses | — | 2 | 2 | — | — | — | — | — | — | — | — | 34 | 36 | — | — | 36 | |||||||||||||||||||||||||||||||||||||||||||||||

Environmental obligations and shutdown costs | — | — | — | — | — | — | — | — | — | — | — | 11 | 11 | — | — | 11 | |||||||||||||||||||||||||||||||||||||||||||||||

Operating income (loss) | 166 | 134 | 300 | 27 | 38 | 65 | 232 | 101 | (7 | ) | 6 | 19 | (91 | ) | 625 | (2,932 | ) | (67 | ) | (2,374 | ) | ||||||||||||||||||||||||||||||||||||||||||

Interest expense, net | — | 1 | 1 | — | — | — | — | — | — | — | 2 | 39 | 42 | 41 | 66 | 149 | |||||||||||||||||||||||||||||||||||||||||||||||

Provision for (benefit from) income taxes | — | — | — | (5 | ) | 11 | 6 | 95 | 27 | — | — | — | — | 128 | — | (815 | ) | (687 | ) | ||||||||||||||||||||||||||||||||||||||||||||

Total assets at June 30, 2015 | 3,806 | 5,582 | 9,388 | 8,567 | 1,935 | 10,502 | 8,959 | 5,125 | 2,052 | 286 | 786 | 1,336 | 38,434 | 15,393 | 181 | 54,008 | |||||||||||||||||||||||||||||||||||||||||||||||

Capital expenditures | 79 | 28 | 107 | 444 | 13 | 457 | 213 | 58 | 4 | — | 4 | 11 | 854 | 777 | 30 | 1,661 | |||||||||||||||||||||||||||||||||||||||||||||||

Three Months Ended June 30, 2014 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unaffiliated customers | $ | 52 | $ | 55 | $ | 107 | $ | 421 | $ | 524 | $ | 945 | $ | 523 | c | $ | 386 | $ | — | $ | 1,234 | $ | 623 | $ | 468 | d | $ | 4,286 | $ | 1,236 | e | $ | — | $ | 5,522 | ||||||||||||||||||||||||||||

Intersegment | 474 | 888 | 1,362 | 23 | 63 | 86 | — | 32 | 170 | 8 | 6 | (1,664 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

Production and delivery | 312 | 558 | 870 | 195 | 335 | 530 | 511 | 198 | 81 | 1,233 | 618 | (1,287 | ) | 2,754 | 329 | (1 | ) | 3,082 | |||||||||||||||||||||||||||||||||||||||||||||

Depreciation, depletion and amortization | 43 | 85 | 128 | 43 | 52 | 95 | 54 | 63 | 24 | 3 | 10 | 17 | 394 | 616 | 3 | 1,013 | |||||||||||||||||||||||||||||||||||||||||||||||

Selling, general and administrative expenses | 1 | — | 1 | 1 | 1 | 2 | 25 | 3 | — | — | 5 | 6 | 42 | 59 | 63 | 164 | |||||||||||||||||||||||||||||||||||||||||||||||

Mining exploration and research expenses | — | 2 | 2 | — | — | — | — | — | — | — | — | 32 | 34 | — | — | 34 | |||||||||||||||||||||||||||||||||||||||||||||||

Environmental obligations and shutdown costs | — | — | — | — | — | — | — | — | — | — | — | 76 | 76 | — | — | 76 | |||||||||||||||||||||||||||||||||||||||||||||||

Operating income (loss) | 170 | 298 | 468 | 205 | 199 | 404 | (67 | ) | 154 | 65 | 6 | (4 | ) | (40 | ) | 986 | 232 | (65 | ) | 1,153 | |||||||||||||||||||||||||||||||||||||||||||

Interest expense, net | — | 1 | 1 | — | — | — | — | — | — | — | 3 | 18 | 22 | 74 | 68 | 164 | |||||||||||||||||||||||||||||||||||||||||||||||

Provision for (benefit from) income taxes | — | — | — | 73 | 67 | 140 | (33 | ) | 33 | — | — | — | — | 140 | — | 188 | 328 | ||||||||||||||||||||||||||||||||||||||||||||||

Total assets at June 30, 2014 | 3,675 | 5,822 | 9,497 | 6,876 | 3,791 | 10,667 | 7,972 | 4,952 | 2,095 | 299 | 882 | 1,127 | 37,491 | 25,293 | 1,119 | 63,903 | |||||||||||||||||||||||||||||||||||||||||||||||

Capital expenditures | 289 | 35 | 324 | 391 | 25 | 416 | 243 | 29 | 14 | 1 | 5 | 17 | 1,049 | 903 | (2 | ) | 1,950 | ||||||||||||||||||||||||||||||||||||||||||||||

a. | Second-quarter 2014 includes the results of the Candelaria and Ojos del Salado mining operations, which were sold in November 2014. |

b. | Second-quarter 2014 includes the results from Eagle Ford, which was sold in June 2014. |

c. | Includes PT-FI’s sales to PT Smelting totaling $293 million in second-quarter 2015 and $540 million in second-quarter 2014. |

d. | Includes revenues from FCX's molybdenum sales company, which includes sales of molybdenum produced by the Molybdenum mines and by certain of the North and South America copper mines. |

e. | Includes net mark-to-market gains (losses) associated with crude oil and natural gas derivative contracts totaling $6 million in second-quarter 2015 and $(70) million in second-quarter 2014. |

f. | Amounts include net reductions for provisional pricing adjustments to prior period open sales. There were no intersegment sales from Grasberg in second-quarter 2015. |

g. | Includes LCM inventory adjustments totaling $11 million at other North America copper mines, $3 million at Molybdenum mines and $45 million at other mining & eliminations (see Note 4). |

21

(In millions) | Mining Operations | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

North America Copper Mines | South America | Indonesia | Africa | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Atlantic | Other | Corporate, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Molyb- | Copper | Mining | U.S. | Other | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other | Cerro | Other | denum | Rod & | Smelting | & Elimi- | Total | Oil & Gas | & Elimi- | FCX | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Morenci | Mines | Total | Verde | Minesa | Total | Grasberg | Tenke | Mines | Refining | & Refining | nations | Mining | Operationsb | nations | Total | ||||||||||||||||||||||||||||||||||||||||||||||||

Six Months Ended June 30, 2015 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unaffiliated customers | $ | 286 | $ | 207 | $ | 493 | $ | 443 | $ | 452 | $ | 895 | $ | 1,413 | c | $ | 692 | $ | — | $ | 2,151 | $ | 1,035 | $ | 653 | d | $ | 7,332 | $ | 1,069 | e | $ | — | $ | 8,401 | ||||||||||||||||||||||||||||

Intersegment | 877 | 1,370 | 2,247 | 51 | (7 | ) | f | 44 | (16 | ) | f | 69 | 215 | 15 | 11 | (2,585 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Production and delivery | 760 | 1,145 | g | 1,905 | 363 | 297 | 660 | 894 | 425 | 167 | g | 2,151 | 987 | (1,998 | ) | g | 5,191 | 564 | 5 | 5,760 | |||||||||||||||||||||||||||||||||||||||||||

Depreciation, depletion and amortization | 106 | 166 | 272 | 77 | 70 | 147 | 148 | 130 | 51 | 5 | 19 | 35 | 807 | 1,015 | 7 | 1,829 | |||||||||||||||||||||||||||||||||||||||||||||||

Impairment of oil and gas properties | — | — | — | — | — | — | — | — | — | — | — | — | — | 5,790 | — | 5,790 | |||||||||||||||||||||||||||||||||||||||||||||||

Selling, general and administrative expenses | 1 | 2 | 3 | 1 | 1 | 2 | 50 | 6 | — | — | 9 | 11 | 81 | 103 | 121 | 305 | |||||||||||||||||||||||||||||||||||||||||||||||

Mining exploration and research expenses | — | 5 | 5 | — | — | — | — | — | — | — | — | 64 | 69 | — | — | 69 | |||||||||||||||||||||||||||||||||||||||||||||||

Environmental obligations and shutdown costs | — | — | — | — | — | — | — | — | — | — | — | 24 | 24 | — | — | 24 | |||||||||||||||||||||||||||||||||||||||||||||||

Net gain on sales of assets | — | (39 | ) | (39 | ) | — | — | — | — | — | — | — | — | — | (39 | ) | — | — | (39 | ) | |||||||||||||||||||||||||||||||||||||||||||

Operating income (loss) | 296 | 298 | 594 | 53 | 77 | 130 | 305 | 200 | (3 | ) | 10 | 31 | (68 | ) | 1,199 | (6,403 | ) | (133 | ) | (5,337 | ) | ||||||||||||||||||||||||||||||||||||||||||

Interest expense, net | 1 | 1 | 2 | 1 | — | 1 | — | — | — | — | 5 | 79 | 87 | 78 | 130 | 295 | |||||||||||||||||||||||||||||||||||||||||||||||

Provision for (benefit from) income taxes | — | — | — | — | 30 | 30 | 124 | 53 | — | — | — | — | 207 | — | (1,589 | ) | (1,382 | ) | |||||||||||||||||||||||||||||||||||||||||||||

Capital expenditures | 163 | 51 | 214 | 875 | 27 | 902 | 438 | 97 | 7 | 1 | 8 | 27 | 1,694 | 1,795 | 39 | 3,528 | |||||||||||||||||||||||||||||||||||||||||||||||

Six Months Ended June 30, 2014 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unaffiliated customers | $ | 75 | $ | 116 | $ | 191 | $ | 701 | $ | 946 | $ | 1,647 | $ | 985 | c | $ | 692 | $ | — | $ | 2,380 | $ | 1,211 | $ | 904 | d | $ | 8,010 | $ | 2,497 | e | $ | — | $ | 10,507 | ||||||||||||||||||||||||||||

Intersegment | 918 | 1,646 | 2,564 | 87 | 195 | 282 | 8 | 53 | 296 | 16 | 11 | (3,230 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

Production and delivery | 595 | 1,061 | 1,656 | 360 | 646 | 1,006 | 894 | 350 | 157 | 2,381 | 1,206 | (2,470 | ) | 5,180 | 640 | (1 | ) | 5,819 | |||||||||||||||||||||||||||||||||||||||||||||

Depreciation, depletion and amortization | 77 | 158 | 235 | 79 | 103 | 182 | 102 | 114 | 46 | 5 | 20 | 36 | 740 | 1,232 | 7 | 1,979 | |||||||||||||||||||||||||||||||||||||||||||||||

Selling, general and administrative expenses | 1 | 1 | 2 | 2 | 2 | 4 | 46 | 6 | — | — | 9 | 13 | 80 | 116 | 103 | 299 | |||||||||||||||||||||||||||||||||||||||||||||||

Mining exploration and research expenses | — | 4 | 4 | — | — | — | — | — | — | — | — | 60 | 64 | — | — | 64 | |||||||||||||||||||||||||||||||||||||||||||||||

Environmental obligations and shutdown costs | — | — | — | — | — | — | — | — | — | — | — | 82 | 82 | — | — | 82 | |||||||||||||||||||||||||||||||||||||||||||||||

Operating income (loss) | 320 | 538 | 858 | 347 | 390 | 737 | (49 | ) | 275 | 93 | 10 | (13 | ) | (47 | ) | 1,864 | 509 | (109 | ) | 2,264 | |||||||||||||||||||||||||||||||||||||||||||

Interest expense, net | 1 | 1 | 2 | — | — | — | — | — | — | — | 7 | 36 | 45 | 150 | 130 | 325 | |||||||||||||||||||||||||||||||||||||||||||||||

Provision for (benefit from) income taxes | — | — | — | 130 | 137 | 267 | (15 | ) | 57 | — | — | — | — | 309 | — | 376 | 685 | ||||||||||||||||||||||||||||||||||||||||||||||

Capital expenditures | 533 | 94 | 627 | 791 | 48 | 839 | 479 | 60 | 33 | 2 | 6 | 27 | 2,073 | 1,484 | 5 | 3,562 | |||||||||||||||||||||||||||||||||||||||||||||||

a. | The first six months of 2014 include the results of the Candelaria and Ojos del Salado mining operations, which were sold in November 2014. |

b. | The first six months of 2014 include the results from Eagle Ford, which was sold in June 2014. |

c. | Includes PT-FI’s sales to PT Smelting totaling $643 million for the first six months of 2015 and $913 million for the first six months of 2014. |

d. | Includes revenues from FCX's molybdenum sales company, which includes sales of molybdenum produced by the Molybdenum mines and by certain of the North and South America copper mines. |

e. | Includes net mark-to-market gains (losses) associated with crude oil and natural gas derivative contracts totaling $58 million for the first six months 2015 and $(120) million for the first six months of 2014. |

f. | Amounts include net reductions for provisional pricing adjustments to prior period open sales. There were no intersegment sales from El Abra or Grasberg for the first six months of 2015. |

g. | Includes LCM inventory adjustments totaling $11 million at other North America copper mines, $3 million at Molybdenum mines and $49 million at other mining & eliminations (see Note 4). |

22

NOTE 11. GUARANTOR FINANCIAL STATEMENTS

All of the senior notes issued by FCX are fully and unconditionally guaranteed on a senior basis jointly and severally by Freeport-McMoRan Oil & Gas LLC (FM O&G LLC), as guarantor, which is a 100 percent owned subsidiary of FM O&G and FCX. The guarantee is an unsecured obligation of the guarantor and ranks equal in right of payment with all existing and future indebtedness of FM O&G LLC, including indebtedness under the revolving credit facility. The guarantee ranks senior in right of payment with all of FM O&G LLC's future subordinated obligations and is effectively subordinated in right of payment to any debt of FM O&G LLC's subsidiaries. The indentures provide that FM O&G LLC's guarantee may be released or terminated for certain obligations under the following circumstances: (i) all or substantially all of the equity interests or assets of FM O&G LLC are sold to a third party; or (ii) FM O&G LLC no longer has any obligations under any FM O&G senior notes or any refinancing thereof and no longer guarantees any obligations of FCX under the revolver, the Term Loan or any other senior debt.

The following condensed consolidating financial information includes information regarding FCX, as issuer, FM O&G LLC, as guarantor, and all other non-guarantor subsidiaries of FCX. Included are the condensed consolidating balance sheets at June 30, 2015, and December 31, 2014, and the related condensed consolidating statements of comprehensive (loss) income for the three and six months ended June 30, 2015 and 2014, and condensed consolidating statements of cash flows for the six months ended June 30, 2015 and 2014 (in millions), which should be read in conjunction with FCX's notes to the consolidated financial statements.

CONDENSED CONSOLIDATING BALANCE SHEET

June 30, 2015

FCX | FM O&G LLC | Non-guarantor | Consolidated | ||||||||||||||||

Issuer | Guarantor | Subsidiaries | Eliminations | FCX | |||||||||||||||

ASSETS | |||||||||||||||||||

Current assets | $ | 257 | $ | 2,900 | $ | 9,665 | $ | (4,125 | ) | $ | 8,697 | ||||||||

Property, plant, equipment and mining development costs, net | 20 | 51 | 27,024 | — | 27,095 | ||||||||||||||

Oil and gas properties, net - full cost method: | |||||||||||||||||||

Subject to amortization, less accumulated amortization | — | 1,507 | 3,142 | — | 4,649 | ||||||||||||||

Not subject to amortization | — | 2,649 | 6,659 | 4 | 9,312 | ||||||||||||||

Investments in consolidated subsidiaries | 24,153 | 2,216 | 4,019 | (30,388 | ) | — | |||||||||||||

Other assets | 9,991 | 4,703 | 4,179 | (14,618 | ) | 4,255 | |||||||||||||

Total assets | $ | 34,421 | $ | 14,026 | $ | 54,688 | $ | (49,127 | ) | $ | 54,008 | ||||||||

LIABILITIES AND EQUITY | |||||||||||||||||||

Current liabilities | $ | 3,106 | $ | 433 | $ | 5,325 | $ | (4,125 | ) | $ | 4,739 | ||||||||

Long-term debt, less current portion | 15,841 | 5,181 | 10,221 | (11,132 | ) | 20,111 | |||||||||||||

Deferred income taxes | 1,613 | a | — | 3,257 | — | 4,870 | |||||||||||||

Environmental and asset retirement obligations, less current portion | — | 307 | 3,409 | — | 3,716 | ||||||||||||||

Other liabilities | 56 | 3,361 | 1,829 | (3,486 | ) | 1,760 | |||||||||||||

Total liabilities | 20,616 | 9,282 | 24,041 | (18,743 | ) | 35,196 | |||||||||||||

Redeemable noncontrolling interest | — | — | 757 | — | 757 | ||||||||||||||

Equity: | |||||||||||||||||||

Stockholders' equity | 13,805 | 4,744 | 26,173 | (30,917 | ) | 13,805 | |||||||||||||

Noncontrolling interests | — | — | 3,717 | 533 | 4,250 | ||||||||||||||

Total equity | 13,805 | 4,744 | 29,890 | (30,384 | ) | 18,055 | |||||||||||||

Total liabilities and equity | $ | 34,421 | $ | 14,026 | $ | 54,688 | $ | (49,127 | ) | $ | 54,008 | ||||||||

a. | All U.S. related deferred income taxes are recorded at the parent company. |

23

CONDENSED CONSOLIDATING BALANCE SHEET

December 31, 2014

FCX | FM O&G LLC | Non-guarantor | Consolidated | ||||||||||||||||

Issuer | Guarantor | Subsidiaries | Eliminations | FCX | |||||||||||||||

ASSETS | |||||||||||||||||||

Current assets | $ | 323 | $ | 2,635 | $ | 8,659 | $ | (2,572 | ) | $ | 9,045 | ||||||||

Property, plant, equipment and mining development costs, net | 22 | 46 | 26,152 | — | 26,220 | ||||||||||||||

Oil and gas properties, net - full cost method: | |||||||||||||||||||