Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ANCHOR BANCORP WISCONSIN INC | d73327d8k.htm |

| EX-99.1 - EX-99.1 - ANCHOR BANCORP WISCONSIN INC | d73327dex991.htm |

Second

Quarter 2015 Earnings Presentation Exhibit 99.2

|

2 This presentation does not constitute an offer to sell, nor a solicitation of an offer to buy, any securities of Anchor BanCorp Wisconsin, Inc. (the “Company”) by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of the securities of Anchor or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense.

Except as otherwise indicated, this presentation speaks as of the date hereof. The

delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof. Market and other statistical data used in this presentation has been obtained from independent industry sources and publications as well as from

research reports prepared for other purposes. Industry publications and

surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Anchor has not independently verified the data obtained from these sources. Forward-looking information obtained from these sources is

subject to the same qualifications and the additional uncertainties

regarding the other forward-looking statements in this presentation.

From time to time, Anchor may make forward-looking statements that reflect the

Company’s views with respect to, among other things, future events and financial performance. Words such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will

likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,”

“would” and “outlook,” or the negative version of those words or other comparable words are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. These forward-looking statements are not historical facts, and are based on current expectations, estimates and

projections about the Company’s industry, management’s beliefs

and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Although the Company believes that the expectations reflected in such forward-looking statements are

reasonable as of the date made, actual results may prove to be materially

different from the expected results expressed or implied by such forward-looking statements. Any forward-looking statement speaks only as of the date on which it was made, and unless otherwise required by law, the Company does not undertake any obligation to update or review any forward-looking statements, whether as a result of new information, future developments or otherwise. This presentation includes certain non-GAAP financial measures. These non-GAAP financial measures should be considered only as

supplemental to, and not as superior to, financial measures prepared in

accordance with GAAP. Please refer to the Appendix of this presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking

Information and Non-GAAP Financial Information |

3 Continuing the Recovery & Executing Our Business Plan Continue Credit Improvement Execute Business Development Strategies Improve Efficiency Utilize the Value of the DTA¹ Normalize Excess Capital Building Shareholder Value 1) “DTA” refers to the Company’s deferred tax asset. |

4 2015 Q2 Financial Highlights Non-Interest Expense Non-Interest Income Net Interest Income Asset Quality • NPLs down $7.5 million during Q2 2015, and a YTD decline of 50%. • OREO down $3.4 million during Q2 2015, and a YTD decline of 23%. • De-provision of $0.6 million in Q2 2015, ALLL coverage is strong. • Net interest income of $17.4 million during Q2 2015, up $0.4 million or 2% Q-O-MRQ.

• Net Interest Margin stable at 3.43%. • Earning asset yields and cost of funds stable at 3.65% and 0.24% respectively. • Non-interest income increased $1.0 million Q-O-MRQ (includes the Appleton – Fox building and Viroqua branch sales). • Non-interest income increased $2.1 million, or 28%, over Q-Q2 2014. • Gain on sale of loans and loan fees up Q-O-Q2 2014 by $1.2 million or 127%.

• Deposit Service Fees higher Q-O-Q2 2014 by $73,000 or an increase of 3%.

• Excluding one-time costs of $2.3 million, non-interest expense of $21 million was flat Q-

O-MRQ. • Non-interest expense (exclusive of one-time charges) is lower by $1.9 million Q-O-Q2

2014, or a decrease of 8%.

• Efficiency initiatives projected to lower expense by $5.4 million annually. Income • Net income of $107.5 million or $11.37 per diluted share. • Includes one-time tax benefit of $103.0 million or $10.89 per share related to reversal of

substantially all of the Company’s deferred tax asset valuation

allowance. •

Pre-tax income of $4.5 million or $0.48 per share includes one-time gains and

costs associated with previously announced efficiency

initiatives. |

5 DTA Valuation Allowance Recapture DTA Valuation Allowance Reversal Update • Reversed substantially all of the DTA valuation allowance ($5.9 million state NOL DTA remains)

• Recognized $103.0 million of income tax benefit, net of current year provision, in Q2

• Evidence considered by management in supporting the reversal included: • Eight consecutive quarters of pre-tax earnings; • A three-year cumulative pre-tax book income position; • Significant reductions in the level of non-performing assets; • Successful execution of operational initiatives *Full Valuation Allowance Prior to 6/30/2015 Current Trading View on Tangible Book Value and Adjusted Tangible Book Value Basis

$ in Thousands $ Per Share $ in Thousands $ Per Share $ in Thousands $ Per Share Tangible Book Value $227,663 $23.85 $236,857 $24.66 $342,620 $35.68 Deferred Tax Assets* $113,099 $11.85 $109,452 $11.39 $5,900 $0.61 Tangible Book Value Including DTA $340,762 $35.70 $346,309 $36.05 $348,520 $36.30 Closing Stock Price $34.44 $34.73 $37.98 Stock Price Multiple to Tangible Book 144% 141% 106% Stock Price Multiple to Tangible Book Including DTA 96% 96% 105% 12/31/2014 3/31/2015 6/30/2015 |

6 Net Interest Income * All data in millions 3.89% 3.77% 3.68% 3.64% 3.63% 3.65% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Yield on Interest-earning Assets 0.25% 0.23% 0.22% 0.22% 0.23% 0.24% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Cost of Interest-bearing Liabilities $18.3 $17.9 $17.6 $17.5 $17.1 $17.4 3.66% 3.55% 3.47% 3.43% 3.42% 3.43% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Net Interest Income - Net Interest Margin (%) |

7 Non-Interest Income 2 Other Non-interest Income includes investment and insurance commissions, gains/losses on sale of investment securities, other than temporary impairment of investment securities, gains/losses on sale of OREO, and other miscellaneous items 1 Includes $0.4 million and $1.4 million for Viroqua branch and Appleton – Fox facility sales * All data in millions $5.9 $7.6 $8.0 $9.0 $8.7 $9.7 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Total Non-interest Income 1 |

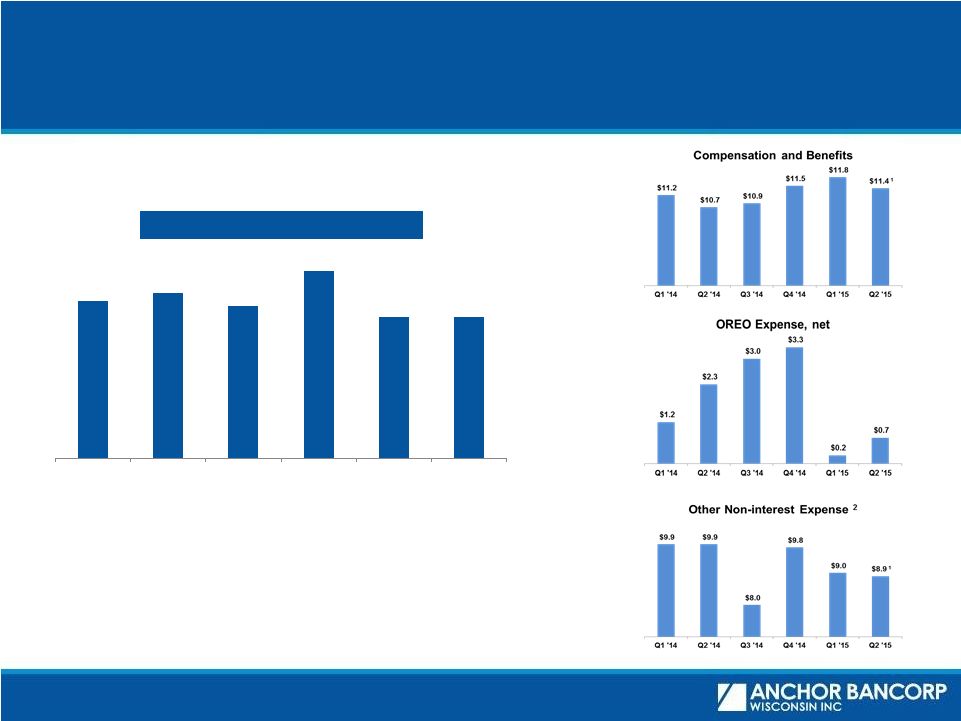

8 Non-Interest Expense 2 Other Non-interest Expense includes occupancy, FDIC insurance, furniture and equipment, data processing, marketing, MSR impairment/recovery, provision for unfunded commitments, and other miscellaneous items 1 Excludes $2.3 million of one-time changes ($2 million of compensation and $0.3 million of occupancy cost). Exclusive of one-time changes, non-interest expense was flat. * All data in millions $22.3 $22.9 $21.9 $24.6 $21.0 $21.0 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Total Non-interest Expense 1 |

9 Summary of Recent Initiatives Branch Rationalization Compensation & Benefits Occupancy Universal Banker Branch Staffing Model • 2014 Q4 – sold Richland Center Branch to Peoples Community Bank of Mazomanie • 2015 Q2 –sold Viroqua branch to Royal Bank of Elroy, announced sale of the

Winneconne branch to Premier Community Bank (settlement - September 2015) • 2015 Q2 – consolidating 6 branches in the Wisconsin communities of Appleton, Menasha, Oshkosh, Janesville, Franklin, and Madison, all with other branches within 5

miles • Expanded the Appleton Commercial facility for Retail Bank business • 2015 Q2 – New Universal Banker Branch staffing model – the majority of staff will be able to open new accounts and perform most branch transactions for customers improving branch efficiency and providing customers with strong customer service

• 2015 Q2 – Voluntary Separation Plan packages accepted by 78 of 140 eligible employees providing a variety of benefits including additional compensation, subsidized

COBRA health benefits, and optional job placement services

• 2015 Q1 - purchased new City View Madison Support Center consolidated various operational teams • 2015 Q2 – sold Appleton Fox facility for $1.4 million gain |

10 Loan Portfolio & Yields Ending portfolio loan balances (1) are up Q-O-MRQ (March 2015) and Q-O-Q2 2014 (June 2014). Commercial and

Industrial loans and Commercial Real Estate loans are up 43% and 6% respectively since

June 2014. (1)

Loan balances reported per SEC categories gross of LIP, deferred fees, unearned

interest and ALLL Originated $216 million of portfolio loans in the

first and second quarters of 2015, and $429

million over the last 12 months, demonstrating

customer confidence in the Company. |

Deposit

Mix Business Deposits Balances Trending Higher…

…Driven by Business Checking Growth

Business deposit data - monthly average balances 2015 Q2 Deposit Mix 2015 YTD Deposit Growth of $6.6 million includes the negative impact of branch deposit sales.

Adjusting for branch sales, deposits grew $17.8 million or 1%.

11 Attractive core deposit base with growing emphasis on relationship based commercial deposits driving low cost of funds. |

Significantly Improved Asset Quality

Non-performing Asset Levels ($ millions)

¹ Non-performing loans and assets exclude troubled debt restructurings that are

now accruing. Source: Anchor SEC filings.

($000s) As of 12/31/2013 12/31/2014 6/30/2015 Nonaccrual loans $39,151 $18,632 $8,959 Troubled debt restructurings¹ 29,346 16,483 8,591 OREO 63,460 35,491 27,255 Total nonperforming assets $131,957 $70,606 $44,805 NPLs / Gross Loans 4.22% 2.22% 1.11% NPAs / Assets 6.25 3.39 2.03 ALLL / Gross Loans 4.02 2.97 2.97 ALLL / NPLs 95.16 133.95 268.02 12 Credit Quality Overview |

Strong

Loan Loss Reserves Allowance to Total Loans

Held-for-Investment 1

Anchor peer group represents all Wisconsin banks and thrifts with total assets greater

than $500 million as of March 31, 2015. Note: Anchor data reflects

consolidated entity. Source: SNL Financial and Anchor SEC

filings. Anchor’s reserves are strong and sufficient to cover potential

credit losses. The ALLL to total NPLs was 268% at June 30, 2015, an

increase from 95% at December 31, 2013. Four consecutive quarters of de-provision. 13 |

Strong

Capital Being strong and well capitalized allows Anchor to seek

opportunities to increase earnings and profitably grow our

company. Bank Tier 1 Core/Leverage Ratio

Bank Total Risk Based Capital Ratio

1 1 Capital ratios are reported for AnchorBank, fsb and calculated utilizing Basel III regulatory requirements effective

January 1, 2015 14 1 1 |

15 ABCW Recent Market Performance Strong ABCW stock price performance since the public offering. Anchor committed to continued focus on building shareholder value. Volume (Shares) Stock Price Public Offering Russell Index Inclusion Russell Index Rebalancing 2015 Q1 Earnings Efficiency Initiatives 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 $25.00 $30.00 $35.00 $40.00 $45.00 |

16 Highlights Delivered improved operating results Positive pre-tax net income since the recapitalization First quarter 2015 pre-tax income of $6.2 million, 220% increase over Q1 2014

Second quarter pre-tax income of $4.5 million, a 74% increase over Q2

2014 Maintaining attractive core deposits and low cost of

funds Rationalized

cost structure – lowering annual expense by an estimated $5.4 million Business plan execution and growth in loans Emphasis on growing C&I business – 43% loan growth in last 12 months - hired strong, experienced talent CRE lending remains strong and high quality Mortgage business transformation resulting in significant increase in production and

gain on sale year-over-year

Retail Bank branch rationalization and Universal Banker model allow for leveraging

sales and service culture and digital business delivery

Credit quality improved

NPAs decreased $25.8 million or 37% in 2015

OREO decreased $8.2 million or 23% in 2015

NPA/Total Assets improved from 3.39% to 2.03% during 2015

|

17 Reconciliation of Non-GAAP Measures Non-GAAP Financial Measures¹ 1 Tangible common equity to tangible assets (the “tangible common equity ratio”) is a non-GAAP financial measure. The Company

calculates the tangible common equity ratio by excluding the balance of

preferred equity, goodwill and other intangible assets from common shareholders’ equity and assets. The Company considers this information important to shareholders as tangible equity is a measure that is consistent with the calculation of capital for bank regulatory purposes, which excludes intangible assets

from the calculation of risk-based ratios. This disclosure should not

be viewed as a substitute for results determined to be in accordance with GAAP, nor is it necessarily comparable to non-GAAP performance measures presented by other companies. ($000s) 12/31/2013 03/31/2014 06/30/2014 09/30/2014 12/31/2014 03/31/2015 06/30/2015 Total GAAP Equity / (Deficit) $202,198 $206,708 $211,507 $214,709 $227,663 $236,856 $342,620 Less: Preferred Equity - - - - - - - Less: Goodwill and Other Intangibles

- - - - - - - Tangible Common Equity

$202,198 $206,708 $211,507 $214,709 $227,663 $236,856 $342,620 Total GAAP Assets $2,112,474 $2,109,824 $2,121,249 $2,106,521 $2,082,379 $2,094,161 $2,205,595 Less: Goodwill and Other Intangibles - - - - - - - Tangible Assets

$2,112,474 $2,109,824 $2,121,249 $2,106,521 $2,082,379 $2,094,161 $2,205,595 Tang. Common Equity / Tang. Assets 9.57% 9.80% 9.97% 10.19% 10.93% 11.31% 15.53% As of, |