Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | kra0730158-k.htm |

Kraton Performance Polymers, Inc. Second Quarter 2015 Earnings Conference Call July 30, 2015

Forward Looking Statement Disclaimer 2 This presentation includes forward-looking statements that reflect our plans, beliefs, expectations and current views with respect to, among other things, future events and financial performance. Forward-looking statements are often characterized by the use of words such as “outlook,” “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions, including the matters described under the captions "On Track to Deliver $18 million in 2015 Cost Reductions" and “Selected 2015 Estimates.” All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in forward-looking statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission, and include, but are not limited to, risks related to: conditions in the global economy and capital markets; declines in raw material costs; our reliance on LyondellBasell Industries for the provision of significant operating and other services; the failure of our raw materials suppliers to perform their obligations under long- term supply agreements, or our inability to replace or renew these agreements when they expire; limitations in the availability of raw materials we need to produce our products in the amounts or at the prices necessary for us to effectively and profitably operate our business; competition from other producers of SBCs and from producers of products that can be substituted for our products; our ability to produce and commercialize technological innovations; our ability to protect our intellectual property, on which our business is substantially dependent; hazards inherent to the chemical manufacturing business; other risks, factors and uncertainties described in this presentation and our other reports and documents; and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to place undue reliance on our forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update such information in light of new information or future events. Kraton Second Quarter 2015 Earnings Call

GAAP Disclaimer 3 This presentation includes the use of both GAAP and non-GAAP financial measures. The non-GAAP financial measures are EBITDA, Adjusted EBITDA, Adjusted Gross Profit and Adjusted Net Income attributable to Kraton (or earnings per share). Tables included in this presentation and our earnings release reconcile each of these non-GAAP financial measures with the most directly comparable GAAP financial measure. For additional information on the impact of the spread between the FIFO basis of accounting and estimated current replacement cost (“ECRC”), see Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. We consider these non-GAAP financial measures to be important supplemental measures of our performance and believe they are frequently used by investors, securities analysts and other interested parties in the evaluation of our performance including period-to-period comparisons and/or that of other companies in our industry. Further, management uses these measures to evaluate operating performance, and our incentive compensation plan bases incentive compensation payments on our Adjusted EBITDA performance, along with other factors. These non-GAAP financial measures have limitations as analytical tools and in some cases can vary substantially from other measures of our performance. You should not consider them in isolation, or as a substitute for analysis of our results under GAAP in the United States. For EBITDA, these limitations include: EBITDA does not reflect the significant interest expense on our debt; EBITDA does not reflect the significant depreciation and amortization expense associated with our long-lived assets; EBITDA included herein should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements. The calculation of EBITDA in our debt agreements includes adjustments, such as extraordinary, non-recurring or one-time charges, proforma cost savings, certain non-cash items, turnaround costs, and other items included in the definition of EBITDA in our debt agreements; and other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC, but you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP; and Adjusted EBITDA may, and often will, vary significantly from EBITDA calculations under the terms of our debt agreements and should not be used for assessing compliance or non-compliance with financial covenants under our debt agreements. Because of these and other limitations, EBITDA and Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. As a measure of our performance, Adjusted Gross Profit is limited because it often will vary substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Finally, we prepare Adjusted Net Income attributable to Kraton by eliminating from net income the impact of a number of items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC. Our presentation of non-GAAP financial measures and the adjustments made therein should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items, and in the future we may incur expenses or charges similar to the adjustments made in the presentation of our non-GAAP financial measures. Kraton Second Quarter 2015 Earnings Call

Second Quarter 2015 Highlights ▪ Sales volume of 76.2 kilotons, a decline of 2.2 kilotons compared to 78.4 kilotons in Q2 2014 ▪ Revenue of $255.9 million, down $67.9 million compared to Q2 2014 primarily due to changes in foreign currency and lower raw material costs ▪ Adjusted EBITDA of $25.1 million, down $13.4 million from $38.6 million in Q2 2014 ▪ Operational issues negatively impacted adjusted gross profit and adjusted EBITDA by $7.5 million ▪ Turnaround costs in Q2 2015 were $5.7 million higher than Q2 2014 ▪ Adjusted EPS of $0.02 per share compared to $0.33 per share in Q2 2014 ▪ Headwinds of $0.46 per share resulting from operational issues ($0.24 per share), higher turnaround costs ($0.18 per share), and changes in currency ($0.04 per share) ▪ Net cash provided by operating activities of $50.7 million compared to $2.0 million in Q2 2014 See the appendix for a reconciliation of GAAP to non-GAAP financial measures. Kraton Second Quarter 2015 Earnings Call 4

Medical 93% Industrial 7% CariflexTM 5 ▪ Sales volume increased 26.0%, largely driven by higher sales into surgical glove applications ▪ Excluding a $2.5 million negative effect from currency fluctuations, revenue growth of 22.0%, despite lower raw material costs ▪ Cariflex represents 13% of 6/30/2015 TTM revenue compared to 10% for the TTM period ended 6/30/2014 Revenue ($ millions) Q2'14 Q2'15 $29 $33 Kraton Second Quarter 2015 Earnings Call Revenue by Application 6/30/2015 TTM Revenue by Geography 6/30/2015 TTM Europe 9% Asia 89% North America 2% TTM June 2014 TTM June 2015 100% 100% Portfolio Composition Innovation & Differentiated

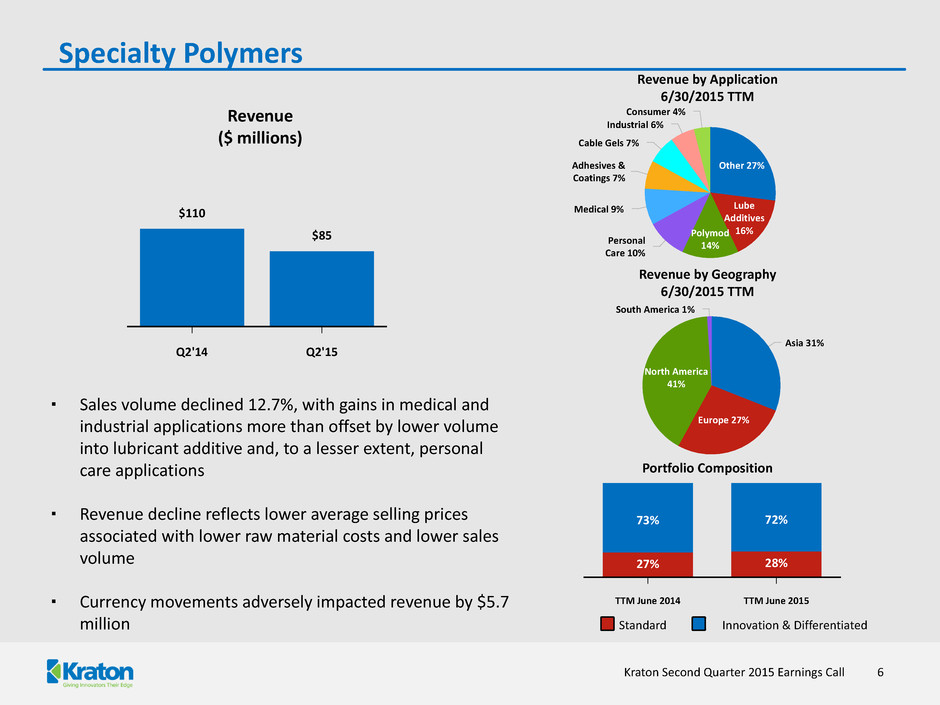

Specialty Polymers 6 ▪ Sales volume declined 12.7%, with gains in medical and industrial applications more than offset by lower volume into lubricant additive and, to a lesser extent, personal care applications ▪ Revenue decline reflects lower average selling prices associated with lower raw material costs and lower sales volume ▪ Currency movements adversely impacted revenue by $5.7 million Revenue ($ millions) Q2'14 Q2'15 $110 $85 Kraton Second Quarter 2015 Earnings Call Other 27% Lube Additives 16%Polymod 14%Personal Care 10% Medical 9% Adhesives & Coatings 7% Cable Gels 7% Industrial 6% Consumer 4% Revenue by Application 6/30/2015 TTM Asia 31% Europe 27% North America 41% South America 1% Revenue by Geography 6/30/2015 TTM TTM June 2014 TTM June 2015 27% 28% 73% 72% Portfolio Composition Standard Innovation & Differentiated

Asia 8% Europe 47% North America 36% South America 9% Paving 26% Roofing 18%Personal Care 20% Packaging & Industrial Adhesives 19% Other 10% Industrial 7% Performance Products 7 ▪ Sales volume essentially flat, with higher sales into roofing applications in Europe and North America and higher sales into paving applications in Asia more than offset by lower sales into paving applications in Europe ▪ Revenue decrease reflects lower average selling prices associated with lower raw material costs ▪ Currency movements adversely impacted revenue by $17.9 million Revenue by Application 6/30/2015 TTM Revenue ($ millions) Q2'14 Q2'15 $184 $138 TTM June 2014 TTM June 2015 64% 63% 36% 37% Revenue by Geography 6/30/2015 TTM Portfolio Composition Standard Innovation & Differentiated Kraton Second Quarter 2015 Earnings Call

Kraton Portfolio Overview 8 Revenue by Geography 6/30/2015 TTM Revenue by Product Group 6/30/2015 TTM Portfolio Composition TTM June 2014 TTM June 2015 46% 43% 54% 57% Cariflex 13% Specialty Polymers 33% Perf. Products 54% Standard Innovation & Differentiated Kraton Second Quarter 2015 Earnings Call Asia 27% Europe 35% North America 33% South America 5%

Second Quarter Revenue and Adjusted Gross Profit 9 ▪ 76.2 kilotons of sales volume in Q2 2015, down 2.2 kilotons from 78.4 kilotons in Q2 2014 ▪ Currency movements adversely impacted revenue by $26.1 million ▪ Revenue decrease also reflects the effect of lower raw material costs on average selling prices and lower sales volume ▪ Second quarter 2015 adjusted gross profit was $698 per ton and was negatively impacted by $221 per ton due to the following factors: ▪ Operational issues ($98 per ton) ▪ Turnaround costs ($75 per ton), and ▪ Currency ($48 per ton) See the appendix for a reconciliation of GAAP to non-GAAP financial measures. ($ in millions) Revenue Q2'14 Q2'15 $324 $256 Adjusted Gross Profit Q2'14 Q2'15 $68 $53 Kraton Second Quarter 2015 Earnings Call

Second Quarter Adjusted EBITDA and Adjusted EPS 10 ▪ EPS impact from Q2'15 turnaround costs and operational issues of $0.42 per share ▪ Currency negatively impacted adjusted EPS by $0.04 per share ($ in millions) See the appendix for a reconciliation of GAAP to non-GAAP financial measures. Adjusted EPS Q2'14 Q2'15 $0.33 $0.02 Kraton Second Quarter 2015 Earnings Call Adjusted EBITDA Q2'14 Operational Issues T/A FX All Other Q2'15 $38.6 $(7.5) $(5.7) $(2.3) $2.0 $25.1 ▪ Operational issues have been resolved ▪ Turnaround activity largely due to Berre site turnaround, last performed in 2009 ▪ Favorable business performance largely offset currency headwind

Sales Volume (kT) H1'14 H1'15 153 151 Year-to-date Sales Volume and Adjusted EBITDA 11 ▪ Operational issues reduced Q2'15 production and sales volume by 7 kilotons ▪ Excluding impact of operational issues, H1'15 pro-forma sales volume of 157.6 kilotons, up 3% compared to H1'14 ▪ Overall business dynamics provided $17 million of EBITDA growth, which was offset by second quarter headwinds See the appendix for a reconciliation of GAAP to non-GAAP financial measures. ($ in millions) Kraton Second Quarter 2015 Earnings Call Adjusted EBITDA H1'14 Operational Issues T/A F/X All Other H1'15 $76.1 $(7.5) $(6.6) $(4.7) $17.1 $74.4

On Track To Deliver $18 Million In 2015 Cost Reductions 12 2015 Target Status Manufacturing cost reductions $12 million þ SAR cost reductions $6 million þ Total 2015 cost reduction target $18 million þ Approximately $6.5 million realized in 1H 2015 Kraton Second Quarter 2015 Earnings Call

Cash Flow and Other Financial Highlights 13 ▪ Operating cash flow exceeded Q2 2014 by $48.7 million ▪ $1.2 million used to repurchase 61,918 additional shares in Q2 2015 ▪ KRA ABL availability at June 30, 2015 of $168.2 million and KRA total liquidity (defined as ABL availability plus KRA cash) of $215.5 million ▪ Consolidated net debt to TTM Adjusted EBITDA of 2.3x at June 30, 2015 ▪ KFPC debt is 50% guaranteed by Kraton Polymers, LLC and 50% guaranteed by Formosa Petrochemical Corporation ($ in millions) Six Months Ended June 30, 2015 Kraton KFPC Consolidated Operating activities $ 48.0 $ (3.8) $ 44.2 Investing activities (29.2) (34.2) (63.4) Financing activities (13.7) 42.8 29.1 Foreign currency impact (3.6) 0.1 (3.5) Change in cash 1.5 4.9 6.4 Beginning cash 45.8 8.0 53.8 Ending cash 47.3 12.9 60.2 Debt 352.5 43.0 395.5 Net Debt $ 305.2 $ 30.1 $ 335.3 Kraton Second Quarter 2015 Earnings Call

Selected 2015 Estimates 14 ($ in millions) SG&A (non-GAAP) Excludes non-cash compensation costs and other items $87 R&D (non-GAAP) Excludes non-cash compensation costs and other items $31 Non-cash compensation expense $8 Depreciation and amortization $63 Turnaround costs Full-year 2014 full-year turnaround costs were $10 million. 2015 costs by quarter; Q1 - $1.8 million, Q2 - $7.0 million, Q3 - $1.6 million, Q4 - $0.7 million $11 Interest expense $25 Income tax expense $7 Full-year negative effect on Adjusted EBITDA due to currency $14 Full-year Adjusted Gross Profit per ton $900 - $925 Q3 2015 spread between FIFO and ECRC Minimal Capex Excludes KFPC capex of $130 - $140 million Excludes capitalized interest of $6 million $60 - $65 Non-cash compensation expense is excluded in determining Adjusted EBITDA and included in determining Adjusted EPS. See the appendix for a reconciliation of GAAP to non-GAAP financial measures. Kraton Second Quarter 2015 Earnings Call

Appendix July 30, 2015 15Kraton Second Quarter 2015 Earnings Call

Monomer Volatility ($ in millions, except per ton information) 16 Quarterly Difference Between Inventory Valuation at FIFO and at ECRC Adjusted Gross Profit per Ton Annual Difference Between Inventory Valuation at FIFO and at ECRC Kraton Second Quarter 2015 Earnings Call Q1'12 Q2'12 Q3'12 Q4’12 Q1’13 Q2’13 Q3’13 Q4’13 Q1'14 Q2'14 Q3'14 Q4’14 Q1’15 Q2’15 $792 $820 $1,010 $743 $772 $804 $860 $890 $890 $867 $803 $817 $1,075 $698 Q1'12 Q2'12 Q3'12 Q4’12 Q1’13 Q2’13 Q3’13 Q4’13 Q1'14 Q2'14 Q3'14 Q4’14 Q1’15 Q2’15 $3.4 $14.0 $(37.6) $(10.2) $(0.5) $(2.3) $(20.7) $(7.3) $4.0 $4.3 $(1.8) $(15.8) $(33.4) $(5.8) 2010 2011 2012 2013 2014 $12.1 $66.3 $(30.5) $(30.7) $(9.3)

Reconciliation of Gross Profit to Adjusted Gross Profit ($ in millions) 17 Q1'12 Q2'12 Q3'12 Q4’12 Q1’13 Q2’13 Q3’13 Q4’13 Q1'14 Q2'14 Q3'14 Q4’14 Q1’15 Q2’15 Gross Profit @ FIFO $ 75.5 $ 73.5 $ 42.8 $ 39.7 $ 59.9 $ 59.9 $ 47.5 $ 58.6 $ 57.1 $ 72.1 $ 63.8 $ 44.1 $ 46.6 $ 47.4 FIFO to ECRC (3.4) (14.0) 37.6 10.2 0.5 2.3 20.7 7.3 (4.0) (4.3) 1.8 15.8 33.4 5.8 Restructuring and other charges — 1.0 — — — — 0.1 0.1 0.5 0.1 — 0.1 — 0.1 Production downtime — — — — — — 3.5 — 12.4 — (1.0) (1.5) (0.2) (0.2) Impairment of spare parts inventory — — — — — — — — — — — 0.4 — — Storm related charges — 2.8 (0.3) — — — — — — — — — — — Property tax dispute 5.6 — — — — — — — — — — — — — Settlement loss (6.8) — — — — — — — — — — — — — Non-cash compensation expense — — — — — 0.1 0.1 0.1 0.2 0.2 0.1 0.1 0.2 0.1 Adjusted Gross Profit $ 71.0 $ 63.3 $ 80.1 $ 49.9 $ 60.4 $ 62.3 $ 71.8 $ 66.1 $ 66.2 $ 68.0 $ 64.8 $ 59.0 $ 80.0 $ 53.2 Sales Volume (Kilotons) 89.6 77.2 79.3 67.2 78.2 77.5 83.5 74.3 74.4 78.4 80.7 72.2 74.4 76.2 Adjusted Gross Profit per ton $ 792 $ 820 $ 1,010 $ 743 $ 772 $ 804 $ 860 $ 890 $ 890 $ 867 $ 803 $ 817 $ 1,075 $ 698 Columns may not foot due to rounding. Kraton Second Quarter 2015 Earnings Call

GAAP and Non-GAAP Statement of Operations – Q2 2015 ($ in thousands, except per share amounts) 18 Three Months Ended June 30, 2015 As Reported Other Adjustments FIFO TO ECRC Adjustment Adjusted Revenue $ 255,908 $ — $ — $ 255,908 Cost of goods sold 208,472 119 (a) (5,810) 202,781 Gross profit 47,436 (119) 5,810 53,127 Operating expenses: Research and development 7,801 — — 7,801 Selling, general and administrative 23,622 (1,365) (b) — 22,257 Depreciation and amortization 15,411 — — 15,411 Total operating expenses 46,834 (1,365) — 45,469 Earnings of unconsolidated joint venture 102 — — 102 Interest expense, net 5,704 — — 5,704 Income (loss) before income taxes (5,000) 1,246 5,810 2,056 Income tax expense 993 144 (c) 328 1,465 Consolidated net income (loss) (5,993) 1,102 5,482 591 Net loss attributable to noncontrolling (429) 290 (d) — (139) Net income (loss) attributable to Kraton $ (5,564) $ 812 $ 5,482 $ 730 Earnings (loss) per common share: Basic $ (0.18) $ 0.03 $ 0.17 $ 0.02 Diluted $ (0.18) $ 0.03 $ 0.17 $ 0.02 Weighted average common shares outstanding: Basic 30,772 30,772 30,772 30,772 Diluted 30,772 31,149 31,149 31,149 (a) $0.2 million reduction of costs related to additional insurance recoveries associated with the first quarter 2014 production downtime at our Belpre, Ohio, and Berre, France, facilities, partially offset by $0.1 million of restructuring and other charges. (b) $0.1 million of restructuring and other charges, $0.5 million of transaction related costs, $0.1 million of production downtime costs and $0.7 million of KFPC startup costs. (c) Tax effect of other adjustments. (d) Portion of the adjustment associated with the KFPC startup costs which is attributed to the non-controlling interest. Kraton Second Quarter 2015 Earnings Call

GAAP and Non-GAAP Statement of Operations – Q2 2014 ($ in thousands, except per share amounts) 19 Three Months Ended June 30, 2014 As Reported Other Adjustments FIFO TO ECRC Adjustment Adjusted Revenue $ 323,767 $ — $ — $ 323,767 Cost of goods sold 251,687 (67) (a) 4,300 255,920 Gross profit 72,080 67 (4,300) 67,847 Operating expenses: Research and development 7,999 — — 7,999 Selling, general and administrative 28,280 (4,305) (b) — 23,975 Depreciation and amortization 16,669 — — 16,669 Total operating expenses 52,948 (4,305) — 48,643 Earnings of unconsolidated joint venture 127 — — 127 Interest expense, net 6,230 — — 6,230 Income before income taxes 13,029 4,372 (4,300) 13,101 Income tax expense 2,161 95 (c) (15) 2,241 Consolidated net income 10,868 4,277 (4,285) 10,860 Net loss attributable to noncontrolling interest (275) 180 (d) — (95) Net income attributable to Kraton $ 11,143 $ 4,097 $ (4,285) $ 10,955 Earnings per common share: Basic $ 0.34 $ 0.12 $ (0.13) $ 0.33 Diluted $ 0.33 $ 0.12 $ (0.12) $ 0.33 Weighted average common shares outstanding: Basic 32,268 32,268 32,268 32,268 Diluted 32,777 32,777 32,777 32,777 (a) $0.1 million of restructuring and other charges. (b) $3.8 million of transaction related costs, $0.4 million of KFPC startup costs, and $0.1 million of restructuring and other charges. (c) Tax effect of other adjustments. (d) Portion of the adjustment associated with the KFPC startup costs which is attributed to the non-controlling interest. Kraton Second Quarter 2015 Earnings Call

20 Six Months Ended June 30, 2015 As Reported Other Adjustments FIFO TO ECRC Adjustment Adjusted Revenue $ 517,337 $ — $ — $ 517,337 Cost of goods sold 423,340 247 (a) (39,218) 384,369 Gross profit 93,997 (247) 39,218 132,968 Operating expenses: Research and development 15,748 — — 15,748 Selling, general and administrative 50,571 (2,984) (b) — 47,587 Depreciation and amortization 30,707 — — 30,707 Total operating expenses 97,026 (2,984) — 94,042 Earnings of unconsolidated joint venture 178 — — 178 Interest expense, net 11,824 — — 11,824 Income (loss) before income taxes (14,675) 2,737 39,218 27,280 Income tax expense 1,059 253 (c) 1,313 2,625 Consolidated net income (loss) (15,734) 2,484 37,905 24,655 Net loss attributable to noncontrolling interest (714) 477 (d) — (237) Net income (loss) attributable to Kraton $ (15,020) $ 2,007 $ 37,905 $ 24,892 Earnings (loss) per common share: Basic $ (0.48) $ 0.06 $ 1.21 $ 0.79 Diluted $ (0.48) $ 0.06 $ 1.20 $ 0.78 Weighted average common shares outstanding: Basic 30,919 30,919 30,919 30,919 Diluted 30,919 31,260 31,260 31,260 (a) $0.3 million reduction of costs related to additional insurance recoveries associated with the first quarter 2014 production downtime at our Belpre, Ohio, and Berre, France, facilities, partially offset by $0.1 million of restructuring and other charges. (b) $0.9 million of transaction restructuring and other charges, $0.8 million of transaction related costs, $0.1 million of production downtime costs, and $1.2 million of KFPC startup costs. (c) Tax effect of other adjustments. (d) Portion of the adjustment associated with the KFPC startup costs which is attributed to the non-controlling interest. GAAP and Non-GAAP Statement of Operations – YTD 2015 ($ in thousands, except per share amounts) Kraton Second Quarter 2015 Earnings Call

21 Six Months Ended June 30, 2014 As Reported Other Adjustments FIFO TO ECRC Adjustment Adjusted Revenue $ 635,423 $ — $ — $ 635,423 Cost of goods sold 506,270 (12,971) (a) 8,324 501,623 Gross profit 129,153 12,971 (8,324) 133,800 Operating expenses: Research and development 16,296 — — 16,296 Selling, general and administrative 62,498 (14,630) (b) — 47,868 Depreciation and amortization 33,078 — — 33,078 Total operating expenses 111,872 (14,630) — 97,242 Earnings of unconsolidated joint venture 244 — — 244 Interest expense, net 12,568 — — 12,568 Income before income taxes 4,957 27,601 (8,324) 24,234 Income tax expense 2,283 273 (c) (48) 2,508 Consolidated net income 2,674 27,328 (8,276) 21,726 Net loss attributable to noncontrolling interest (560) 370 (d) — (190) Net income attributable to Kraton $ 3,234 $ 26,958 $ (8,276) $ 21,916 Earnings per common share: Basic $ 0.10 $ 0.82 $ (0.25) $ 0.67 Diluted $ 0.10 $ 0.81 $ (0.25) $ 0.66 Weighted average common shares outstanding: Basic 32,215 32,215 32,215 32,215 Diluted 32,690 32,690 32,690 32,690 (a) $12.4 million of production downtime at our Belpre, Ohio, and Berre, France, facilities, and $0.6 million of restructuring and other charges. (b) $13.0 million of transaction related costs, $0.9 million of KFPC startup costs, $0.6 million of production downtime at our Belpre, Ohio, and Berre, France, facilities, and $0.1 million of restructuring and other charges. (c) Tax effect of other adjustments. (d) Portion of the adjustment associated with the KFPC startup costs which is attributed to the non-controlling interest. GAAP and Non-GAAP Statement of Operations – YTD 2014 ($ in thousands, except per share amounts) Kraton Second Quarter 2015 Earnings Call

Reconciliation of Net Income and EPS to Adjusted Net Income and EPS ($ in thousands, except per share amounts) 22 Three Months Ended June 30, 2015 Three Months Ended June 30, 2014 Income (Loss) Before Income Tax Income Taxes Noncontrolling Interest Diluted EPS Income Before Income Tax Income Taxes Noncontrolling Interest Diluted EPS GAAP Earnings (Loss) $ (5,000) $ 993 $ (429) $ (0.18) $ 13,029 $ 2,161 $ (275) $ 0.33 Restructuring and other charges (a) 147 19 — — 132 22 — — Transaction and acquisition related costs (b) 502 10 — 0.02 3,807 — — 0.11 Production downtime (c) (101) (3) — — — — — — KFPC startup costs (d) 698 118 290 0.01 433 73 180 0.01 Spread between FIFO and ECRC 5,810 328 — 0.17 (4,300) (15) — (0.12) Adjusted Earnings $ 2,056 $ 1,465 $ (139) $ 0.02 $ 13,101 $ 2,241 $ (95) $ 0.33 (a) Severance expenses, professional fees and other restructuring related charges which are primarily recorded in selling, general and administrative expenses in 2015 and primarily in cost of goods sold in 2014. (b) Charges related to the evaluation of acquisition transactions which are recorded in selling, general and administrative expenses. In 2014, primarily professional fees related to the terminated Combination Agreement with LCY. (c) Weather-related production downtime at our Belpre, Ohio, facility and an operating disruption from a small fire at our Berre, France, facility. In 2014, $12.4 million is recorded in cost of goods sold and $0.6 million is recorded in selling, general and administrative expenses. In 2015, the reduction in costs is due to additional insurance recoveries related to the Belpre production downtime, which are recorded in cost of goods sold. (d) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general and administrative expenses. Kraton Second Quarter 2015 Earnings Call Six Months Ended June 30, 2015 Six Months Ended June 30, 2014 Income (Loss) Before Income Tax Income Taxes Noncontrolling Interest Diluted EPS Income Before Income Tax Income Taxes Noncontrolling Interest Diluted EPS GAAP Earnings (Loss) $ (14,675) $ 1,059 $ (714) $ (0.48) $ 4,957 $ 2,283 $ (560) $ 0.1 Restructuring and other charges (a) 966 45 — 0.03 653 121 — 0.02 Transaction and acquisition related costs (b) 830 17 — 0.03 13,043 — — 0.39 Production downtime (c) (209) (5) — (0.01) 13,013 — — 0.39 KFPC startup costs (d) 1,150 196 477 0.01 892 152 370 0.01 Spread between FIFO and ECRC 39,218 1,313 — 1.2 (8,324) (48) — (0.25) Adjusted Earnings $ 27,280 $ 2,625 $ (237) $ 0.78 $ 24,234 $ 2,508 $ (190) $ 0.66

Reconciliation of Net Income to EBITDA and Adjusted EBITDA ($ in thousands) 23 (a) Severance expenses, professional fees and other restructuring related charges which are primarily recorded in selling, general and administrative expenses in 2015 and primarily in cost of goods sold in 2014. (b) Charges related to the evaluation of acquisition transactions which are recorded in selling, general and administrative expenses. In 2014, primarily professional fees related to the terminated Combination Agreement with LCY. (c) Weather-related production downtime at our Belpre, Ohio, facility and an operating disruption from a small fire at our Berre, France, facility. In 2014, $12.4 million is recorded in cost of goods sold and $0.6 million is recorded in selling, general and administrative expenses. In 2015, the reduction in costs is due to additional insurance recoveries related to the Belpre production downtime, which are primarily recorded in cost of goods sold. (d) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general and administrative expenses. (e) For the three months ended June 30, 2015 and 2014, respectively, $1.7 million and $2.2 million is recorded in selling, general and administrative expenses, $0.2 million and $0.2 million is recorded in research and development expenses, and $0.1 million and $0.2 million is recorded in cost of goods sold. For the six months ended June 30, 2015 and 2014, respectively, $3.9 million and $5.3 million is recorded in selling, general and administrative expenses, $0.4 million and $0.5 million is recorded in research and development expenses, and $0.3 million and $0.4 million is recorded in cost of goods sold. Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 Net income (loss) attributable to Kraton $ (5,564) $ 11,143 $ (15,020) $ 3,234 Net loss attributable to noncontrolling interest (429) (275) (714) (560) Consolidated net income (loss) (5,993) 10,868 (15,734) 2,674 Add: Interest expense, net 5,704 6,230 11,824 12,568 Income tax expense 993 2,161 1,059 2,283 Depreciation and amortization 15,411 16,669 30,707 33,078 EBITDA 16,115 35,928 27,856 50,603 Add (deduct): Restructuring and other charges (a) 147 132 966 653 Transaction and acquisition related costs (b) 502 3,807 830 13,043 Production downtime (c) (101) — (209) 13,013 KFPC startup costs (d) 698 433 1,150 892 Non-cash compensation expense (e) 1,960 2,580 4,569 6,194 Spread between FIFO and ECRC 5,810 (4,300) 39,218 (8,324) Adjusted EBITDA $ 25,131 $ 38,580 $ 74,380 $ 76,074 Kraton Second Quarter 2015 Earnings Call

Historical Revenue by Product Group ($ in thousands) 24 Q1 2013 Q2 2013 Q3 2013 Q4 2013 FY 2013 Performance Products $ 199,484 $ 194,951 $ 195,533 $ 172,971 $ 762,939 Specialty Polymers 113,287 110,073 102,940 85,709 412,009 Cariflex 27,029 29,244 28,231 31,499 116,003 Other 307 275 405 183 1,170 Total $ 340,107 $ 334,543 $ 327,109 $ 290,362 $1,292,121 Q1 2012 Q2 2012 Q3 2012 Q4 2012 FY 2012 Performance Products $ 245,636 $ 221,131 $ 210,624 $ 173,371 $ 850,762 Specialty Polymers 138,380 124,588 107,580 93,712 464,260 Cariflex 22,645 29,805 24,193 29,255 105,898 Other 1,652 232 238 80 2,202 Total $ 408,313 $ 375,756 $ 342,635 $ 296,418 $1,423,122 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Performance Products $ 167,852 $ 183,974 $ 180,122 $ 146,982 $ 678,930 Specialty Polymers 108,346 110,463 98,742 94,884 412,435 Cariflex 35,363 29,242 39,959 34,032 138,596 Other 95 88 148 141 472 Total $ 311,656 $ 323,767 $ 318,971 $ 276,039 $1,230,433 Q1 2015 Q2 2015 YTD 2015 Performance Products $ 134,768 $ 138,134 $ 272,902 Specialty Polymers 91,674 84,580 176,254 Cariflex 34,837 33,188 68,025 Other 150 6 156 Total $ 261,429 $ 255,908 $ 517,337 Kraton Second Quarter 2015 Earnings Call

Kraton Performance Polymers, Inc. Second Quarter 2015 Earnings Conference Call July 30, 2015