Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EMMIS COMMUNICATIONS CORP | a8kjuly92015.htm |

| EX-99.1 - EXHIBIT 99.1 - EMMIS COMMUNICATIONS CORP | a8kjuly92015ex991.htm |

Emmis Communications Annual Meeting of Shareholders July 9, 2015 11:00 a.m.

2 • Note: Certain statements in this presentation constitute “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Reference is made to the company’s Annual Report on Form 10-K and other public documents filed with the Securities and Exchange Commission for additional information concerning such risks and uncertainties. • Additional disclosure related to non-GAAP financial measures can be found under the Investors tab on our website, www.emmis.com.

3 Emmis Overview Headquartered in Indianapolis, IN, Emmis is a publicly traded radio broadcasting communications company (NASDAQ: EMMS). The Company was incorporated in 1979 and went public in 1994 Emmis operates one of the 10 largest radio portfolios in the US (based on number of listeners) - Owns 19 FM and 4 AM radio stations in New York, Los Angeles, St. Louis, Austin (has 50.1% controlling interest) Indianapolis and Terre Haute, IN Includes 2 largest hip-hop stations in the world based in New York City (Hot 97) and Los Angeles (Power 106) Includes WBLS, the most listened to urban station in the US - One of the FM radio stations in New York is operated pursuant to a Local Marketing Agreement (“LMA”) with ESPN / Disney The radio division of Emmis accounts for approximately 70% of revenues and substantially all of the Company’s station operating income In addition to owning and operating radio stations, the Company owns NextRadio®, leading city / regional publications and is majority owner of a dynamic pricing business (Digonex) Company overview Radio market statistics Publishing portfolio summary Source: Miller Kaplan; Terre Haute revenue share is Company estimate Note: One of the above stations in New York is operated under LMA with ESPN Source: Publisher’s Statement as of 12/31/2014 Revenue share AM FM Total Los Angeles, CA 1 6% - 1 1 New York, NY 2 10% 1 3 4 St. Louis, MO 20 21% - 4 4 Austin, TX 33 42% 1 5 6 Indianapolis, IN 38 31% 1 3 4 Terre Haute, IN 227 70% 1 3 4 Total 4 19 23 Market name Market rank Stations Monthly Paid & Verified Circulation Monthly Paid & Verified Circulation Texas Monthly 300,600 Orange Coast 48,460 Los Angeles 142,680 Indianapolis Monthly 40,280 Atlanta 70,130 Cincinnati 35,340 Total 637,490

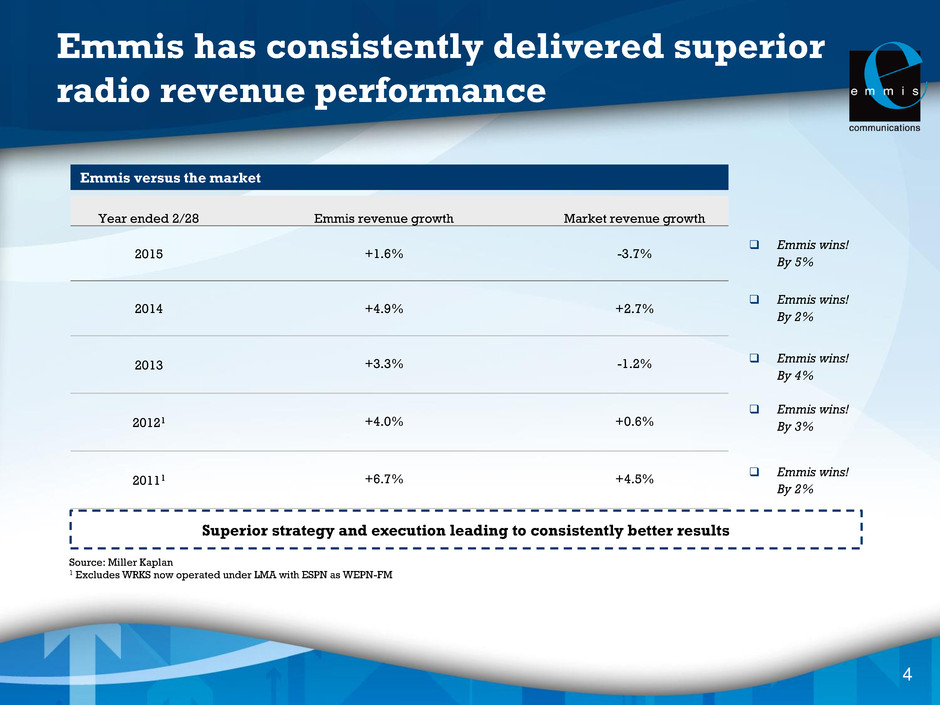

4 Emmis has consistently delivered superior radio revenue performance Year ended 2/28 Emmis revenue growth Market revenue growth 2015 +1.6% -3.7% 2014 +4.9% +2.7% 2013 +3.3% -1.2% 20121 +4.0% +0.6% 20111 +6.7% +4.5% Emmis versus the market Emmis wins! By 2% Emmis wins! By 4% Emmis wins! By 3% Emmis wins! By 2% Superior strategy and execution leading to consistently better results Source: Miller Kaplan 1 Excludes WRKS now operated under LMA with ESPN as WEPN-FM Emmis wins! By 5%

5 Emmis’ Radio Strategy Strategy based on smarts and speed; primary competitors focused on scale

6 Emmis Radio Market Summary FY15 Net Revenues 100% = $149.5 million FY15 Station Operating Income 100% = $44.2 million Note: Excludes 98.7FM in NY. Reflects 50% of Austin radio stations New York + Los Angeles represent approximately 57% of our radio net revenues and 70% of our radio SOI 35% 22% 11% 16% 14% 2% 0% 5% 10% 15% 20% 25% 30% 35% 40% NY LA Austin Ind STL TH 36% 34% 14% 10% 7% 0% 0% 5% 10% 15% 20% 25% 30% 35% 40% NY LA Austin Ind STL TH

7 Emmis facing challenges in its two largest markets New York: Market softness Los Angeles: New direct competitor • For the twelve months ended 2/28/2015, the New York radio market was down 7%. Emmis’ stations in New York for the same period were down 5% • Wireless and beverage categories were exceptionally weak • Weakness continued in Q1FY16, but market appears to be improving in Q2 • Power 106 has been Emmis’ top performing station for several years while facing limited direct competition • New direct competitor from iHeart was launched in February 2015 • Competitive situation is stabilizing. Highly focused management team in LA is responding effectively

8 Summary of publishing division performance Emmis achieved publishing division revenue growth of 2.3% in FYE 2015 $23.2 $12.4 $7.8 $5.4 $5.0 $3.1 Texas Los Angeles Atlanta Indianapolis Cincinnati Orange Coast Publishing division net revenues for fiscal year ended 2/28/2015 ($ millions) +7.9% -7.8% +9.6% +9.7% +12.6% -3.4% % Change in net revenue compared to prior year

9 Offers dynamic pricing solutions to help clients optimize revenues given supply and demand conditions Emmis acquired majority control in June 2014 Clients include the Indianapolis Zoo, Lids, Broadway shows and sports teams Emerging Technologies: NextRadio and Digonex Emmis intellectual property core to NextRadio smartphone application Agreement in place with Sprint for FM-enabled smartphones and other wireless devices; recently added Amazon platform with others coming soon NextRadio has the potential to reinvigorate radio industry growth rates - Emmis would benefit both as a radio operator and as owner of NextRadio intellectual property

10 NextRadio Product NextRadio is… FM Radio on your Smartphone NOT Internet Streaming Intuitive Live Guide Artist/program/commercial visuals Station feedback Real-time interactivity Enabled by TagStation® – cloud- based content delivery application software for broadcasters

11 Consumers Carriers Broadcasters Free, unlimited audio entertainment from familiar, local radio stations without the data costs associated with streaming 3x longer battery life Ability to seamlessly interact with familiar local radio stations Revenue opportunity through partnership with broadcasters Relieve data congestion Product differentiation Expand distribution of FM to smartphones Reach of mass market FM fully integrated with one-to-one smartphone interaction Enables more meaningful participation in digital ad pie Much lower content costs compared to streaming NextRadio Economic Opportunities Interactive, mobile platform provides point-of-purchase opportunity for advertisers to connect with radio’s listeners SMS Website Location Coupon

12 Near-term Actions to Deliver Shareholder Value Stabilize Core Operations Build Future Growth Engines in Related Businesses Increase Free Cash Flow from Core Operations

13 Compelling free cash flow yield valuation The summary below excludes the operations of 98.7FM in New York, which is operated pursuant to an LMA with Disney/ESPN FY15 EBITDA (See appendix for reconciliation) 29,286 Less: Capital expenditures (3,514) Less: Interest expense (13,863) FY15 Free Cash Flow 11,909 Diluted shares outstanding 49,127 Free cash flow/share 0.24$ Price 7/2/2015 1.09$ FCF Yield 22.2%

Appendix

15 EBITDA Reconciliation LTM 2/28/2015 Trailing twelve-months operating income from continuing operations (34,063)$ Plus: Depreciation and amortization 5,926 Plus: Hungary litigation expenses and related costs 521 Plus: No cash compensation 2,813 Plus: LMA fees 4,208 Plus: Impairment loss 67,915 Less: Gain on contract settlement (2,500) Less: 49.9% of Austin radio EBITDA (Minority Interest) (6,205) EBITDA, including New York SPV EBITDA 38,615$ Less: 98.7FM New York LMA LTM EBITDA (9,329) EBITDA, excluding New York SPV EBITDA 29,286$

Emmis Communications Annual Meeting of Shareholders July 9, 2015 11:00 a.m.